ESCB/European banking

supervision response to

the European

Commission’s public

consultation on a new

digital finance strategy for

Europe/FinTech action plan

August 2020

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

1

Contents

Executive summary 2

Introduction 5

1 Digital finance in the context of the pandemic crisis 7

2 The ECB’s general approach to digital finance 9

3 The ECB’s views on the priority areas identified by the Commission 11

3.1 The ECB’s views on Commission priority 1: ensuring that the

EU financial services regulatory framework is fit for the digital

age 11

3.2 The ECB’s views on Commission priority 2: enabling consumers

and firms to reap the opportunities offered by the EU-wide

Single Market for digital financial services by removing

fragmentation 12

3.3 The ECB’s views on Commission priority 3: promoting a

well-regulated data-driven financial sector for the benefit of EU

consumers and firms 14

ANNEX: The ECB’s response to the European Commission’s

questionnaire 15

General questions 15

1 Ensuring a technology-neutral and innovation friendly EU financial

services regulatory framework 18

2 Removing fragmentation in the single market for digital financial services 32

3 Promote a well-regulated data-driven financial sector 42

4 Broader issues 61

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

2

Executive summary

This European System of Central Banks (ESCB)/European banking supervision

1

response (hereafter referred to as “the ECB response”) has been approved by the

Governing Council of the European Central Bank (ECB) and was prepared with the

assistance of national central banks (NCBs) and national competent authorities

(NCAs) and in consultation with the Supervisory Board of the ECB. A separate ESCB

response has addressed considerations regarding payments in the context of a

specific consultation of the European Commission on a retail payments strategy for

the European Union (EU), launched on the same day as this consultation.

The ECB broadly supports the priority areas identified by the European

Commission in the consultation document to foster the development of digital

finance in the EU, which have gained further in importance in the light of the recent

coronavirus (COVID-19) pandemic crisis, namely: (1) ensuring that the EU financial

services regulatory framework is fit for the digital age; (2) enabling consumers and

firms to reap the opportunities offered by the EU-wide Single Market for digital financial

services by removing fragmentation; (3) promoting a well-regulated data-driven

financial sector for the benefit of EU consumers and firms; and (4) enhancing the

digital operational resilience framework for financial services. As regards the latter

priority, the ECB has provided a separate contribution in the context of the specific

consultation launched by the Commission on this matter.

While the ECB recognises that financial technology (“fintech”) and innovation

may bring significant benefits for financial institutions, their customers, the

financial system and the broader economy, the digital transformation of the

banking sector has to be performed taking due account of the risks related to

the use of innovative technologies. The pandemic crisis has acted as a catalyst to

accelerate the already planned digitalisation efforts of the financial sector as well as

the further transformation of their business models, and has also highlighted additional

challenges and risks for financial institutions.

The ECB follows a technology-neutral approach to its areas of competence,

including banking supervision and the oversight of payment systems, in accordance

with the SSM Regulation and the Treaty on the Functioning of the European Union.

The ECB’s role is to ensure the safety and soundness of the banking sector,

maintaining a high standard of prudential supervision and oversight of payment

systems, schemes and instruments, irrespective of the particular business model or

the application of any particular technological solution. The ECB aims to maintain a

level playing field for banking services, and follows the guiding principle of “same

activity, same risks, same supervision and regulation”. In its role as catalyst in the field

of payments, the ECB fosters an innovative market for euro payments in cooperation

with the relevant stakeholders and pursues the objectives of strategic autonomy and

resilience.

1

“European banking supervision” refers to the Single Supervisory Mechanism (SSM) in view of the NCA

involvement in the preparation of this response.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

3

The ECB has responded to the evolving challenges and risks arising from

financial innovation on multiple fronts. On the central banking side, consistent with

its mandate to ensure financial stability and the smooth functioning of payment

systems, the ECB is monitoring and assessing the implications of fintech and actively

exploring new technologies that may prove useful in supporting the ECB’s functions.

On the banking supervision side, the ECB is assessing the evolving business models

and looking into the related new risks and challenges that banks are facing due to

innovation and digitalisation, and is closely monitoring banks’ related risk

management practices and internal governance also in the light of the current

pandemic crisis. In the same vein, the Eurosystem is also currently reviewing its

oversight frameworks for payment instruments.

One important challenge in relation to digital finance will be to reassess the

dependence of European financial service providers on non-EU providers of

critical services and technical infrastructures (e.g. the “cloud”), while EU-based

global players have struggled to emerge. This could lead to banks’ reliance on a few

non-EU service providers and possible concentration issues at both entity and

systemic levels.

In the context of the current regulatory framework, different entities which could

perform to a certain extent similar activities, such as credit institutions, e-money

institutions and payment institutions, are subject to various regulatory and supervisory

frameworks, either at national or European level. As this trend is accelerated by

innovation and digitalisation, this framework may need to be reviewed to ensure a

level playing field and maintain the principle of “same activity, same risks, same

supervision and regulation”. Moreover, as part of its oversight role over payment

systems, instruments and schemes, the ECB envisages enhancing its cooperation

with national authorities supervising payment service providers (PSPs).

As regards the above-mentioned priorities of the European Commission, the ECB

considers that:

• While the current EU financial services regulatory framework is already

broadly technology neutral, it should support fair competition and ensure

a level playing field in digital financial services, while addressing

associated risks and also reinforcing the need to develop strong risk

management at the firm level. Important areas for improvement would be to

enhance clarity on the application of existing laws and regulations to innovative

technologies and related business models, and to diminish the fragmentation

resulting from different legal and regulatory frameworks and industry standards

across EU Member States, in order to foster the Internal Market, the

pan-European application of standards and a level playing field.

• With regard to facilitating the use of digital financial identities throughout the EU,

the ECB fully endorses the mandatory use of unique identifiers, based on

internationally recognised global standards including legal entity identifiers

(LEIs), unique transaction identifiers (UTIs) and unique product identifiers (UPIs).

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

4

• The ECB supports the need for enhanced cooperation throughout the EU

on different schemes such as regulatory sandboxes and innovation hubs,

and acknowledges the benefits of fostering an open dialogue between

supervisors and supervised entities. This may encourage banks (and other

financial entities) to launch innovative solutions, while being able to monitor the

accompanying risks in a controlled environment.

• The ECB considers that open finance can have implications for the

supervised banks, at both entity and systemic levels and also as regards the

nature of the cooperation between these banks and new potential actors, such as

third-party providers. In this respect, the ECB is adapting its supervisory

approach towards the regulated entities to the new landscape that the revised

Payment Services Directive (PSD2) has enabled, also in anticipation of the next

developments. While open finance and the use of alternative data (such as data

from public sources) can enable the modernisation of banks’ internal processes,

it should however be ensured that customer data sharing, also with third-party

providers, meets clear legal requirements and fulfils security standards.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

5

Introduction

On 3 April 2020, the European Commission launched a public consultation covering a

range of issues that fall under the umbrella term “digital finance”, aiming to contribute

to the new EU FinTech action plan to be published later this year.

2

The Commission

seeks to identify if there is a need to adapt the current regulatory framework or to

launch new initiatives, against the backdrop of a rapidly evolving financial landscape,

driven by a fast uptake of technologies by incumbent firms and the entrance into the

market of new players (including technology companies).

The ECB welcomes this consultation in view of the key relevance of digital finance for

the entire financial sector. Enhanced technological possibilities and changing

customer demands have affected markets and businesses worldwide, including the

European financial sector. In line with the European Commission’s objectives, the

ECB considers that it is essential for Europe to manage, regulate and supervise the

financial system in a way that promotes and protects Europe’s values and financial

stability.

Against this background, this ECB response, which has been approved by the

Governing Council of the ECB, was prepared with the assistance of ESCB committees

and of NCAs through the internal structures of the ECB and in consultation with the

Supervisory Board of the ECB. The Annex specifies the views of the ECB regarding

various questions raised by the European Commission in its consultation

questionnaire. The ECB has focused its response on the questions falling within its

central banking and banking supervision tasks and has not expressed views on

aspects which do not relate to its mandate (e.g. consumer protection). In order to

ensure consistency, the term “ECB” will be used throughout the response to express

these views.

The European Commission has identified the following priorities:

1. ensuring that the EU financial services regulatory framework is fit for the digital

age, i.e. technology neutral and innovation friendly;

2. enabling consumers and firms to reap the opportunities offered by the EU-wide

Single Market for digital financial services by removing fragmentation;

3. promoting a well-regulated data-driven financial sector for the benefit of EU

consumers and firms;

4. enhancing the digital operational resilience framework for financial services.

Priority 4 is not covered in this ECB response since this priority and related questions

were covered in a previous European Commission public consultation launched in

2

The current consultation follows two previous European Commission public consultations launched in

December 2019, focusing on crypto-assets and digital operational resilience respectively. The

Commission has also launched a specific consultation on a retail payments strategy for the EU, in parallel

to the present one. All four consultations contribute to informing the European Commission in view of a

new digital finance strategy for Europe/FinTech action plan to be published in the third quarter of 2020.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

6

December 2019 on digital operational resilience for which the ECB has provided a

separate contribution.

Furthermore, considerations regarding payments are addressed in a specific

consultation of the European Commission on a retail payments strategy for the EU

launched on the same day as the present consultation and for which a specific ESCB

response has been submitted.

3

The ESCB response identifies a need for coordinated

action on multiple fronts to reinforce the EU’s independence and competitiveness in

the field of payments. In this respect, the successful roll-out of instant payments is a

strategic priority that could benefit to an equal degree from mandatory adherence to

the SEPA Instant Credit Transfer scheme and from adding instant credit transfers to

the list of services of the Payment Accounts Directive

4

, under certain conditions. The

ESCB response also encourages the Commission to revise the Settlement Finality

Directive (SFD)

5

so that adequately supervised or overseen entities (e.g. e-money

and payment institutions) become eligible to directly access SFD-designated payment

systems, while at the same time avoiding the creation of undue risks for payment

systems. Similarly, the ESCB supports taking regulatory action to ensure open access

to key technical infrastructure services (e.g. mobile device capabilities) based on

transparent, objective and non-discriminatory criteria that take into account security

standards, oversight and supervisory requirements. The ESCB response stresses the

importance of satisfying the needs of all EU citizens by preserving access to, and

acceptance of, cash at the point of sale.

3

See the “European System of Central Banks response to the European Commission’s consultation on a

retail payments strategy for the EU” on the ECB website.

4

Directive 2014/92/EU of the European Parliament and of the Council of 23 July 2014 on the comparability

of fees related to payment accounts, payment account switching and access to payment accounts with

basic features (OJ L 257, 28.8.2014, p. 214).

5

Directive 98/26/EC of the European Parliament and of the Council of 19 May 1998 on settlement finality

in payment and securities settlement systems (OJ L 166, 11.6.1998, p. 45).

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

7

1 Digital finance in the context of the pandemic crisis

Financial technology (“fintech”)

6

may bring significant benefits for financial

institutions, their customers, the financial system and the broader economy.

The emergence of fintech has led to changes in their business models. Fintech can

improve the customer experience, enabling for example digital onboarding, the use of

online customer interfaces, and the roll-out of services and products in a more

affordable and efficient manner. The application of artificial intelligence (AI), coupled

with the large volumes of data now available, can also help financial institutions

improve many of their back-office functions. More generally, fintech has a significant

potential to enhance the competitiveness of the EU financial sector by deepening the

Internal Market and fostering the capital markets union. As pointed out by the

European Commission

7

, strong and innovative digital capacities in the financial sector

will help improve the EU’s ability to deal with emergencies such as the COVID-19

outbreak. On the other hand, this digital transformation has to be performed taking due

account of the risks related to the use of innovative technologies.

The pandemic crisis has highlighted the need for banks

8

and financial market

infrastructures (FMIs) to avail of mature digital capabilities to deliver products

and services. In this respect, banks have adjusted their operations, ensuring

business continuity and enabling them to continue to provide services on a

cross-border basis.

9

These are not new phenomena for the banking sector, but the

crisis is acting as a catalyst to accelerate the already planned digitalisation efforts of

banks as well as the further transformation of their business models.

It is still too early to tell how the post-pandemic landscape will look.

Nevertheless, this crisis has also highlighted additional challenges and risks for banks,

PSPs and FMIs. As they transfer their processes to contingency environments, their

exposure to cyber threats increases, as does the risk of IT failures. Banks’ IT systems

must be resilient enough to withstand the current heavy reliance on remote working

and servicing. Furthermore, digitalisation strategies require sufficient means, a due

implementation supported by knowledgeable staff, measured by financial and

non-financial risk metrics, and adequate governance procedures. Finally, updating or

even replacing legacy IT systems may require significant efforts, especially if banks

use multiple IT systems which are linked together.

The euro area central banks and supervisors are closely monitoring how technological

changes and innovation affect financial markets and banks. As further explained

below, the ECB will continue to engage with the banking industry, in order to

adequately tailor its supervisory approach and its approach to oversight, also with a

6

Fintech is a term used throughout the response to refer to financial technology – in the ECB’s view an

umbrella term for any kind of technological innovation used to support or provide financial services that

could result in changes to business models, applications, processes or products.

7

See the consultation document (page 8) on the European Commission’s website.

8

The terms “bank” and “credit institution”, as defined in Article 4(1) of Regulation (EU) No 575/2013 of the

European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions

and investment firms, are used interchangeably.

9

See also the blog post by Pentti Hakkarainen, Member of the Supervisory Board of the ECB, entitled “The

first lesson from the pandemic: state-of-the-art technology is vital”, 8 May 2020.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

8

view to ensuring that the euro area banking sector is in a position to face the

challenges of the new post-pandemic environment.

10

It is up to banks however to face this new reality, shift to greater digitalisation and step

up their innovation efforts, in order to meet changing customer demands, with

adequate risk management procedures in place. If banks adopt an agile, responsible

and risk-based approach towards innovation, they could face the increased

competition in the financial sector and amend their value proposition, streamline their

internal processes and become more cost efficient, ensuring the sustainability of their

business models.

10

For further information, see Box 4 of the “ECB Annual Report 2019”.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

9

2 The ECB’s general approach to digital finance

Regarding innovation and technology in the digital finance area – and in line

with its principles – the ECB follows a technology-neutral approach to

supervision and oversight. The ECB’s role is to ensure the safety and soundness of

the banking sector, maintaining a high standard of prudential supervision, irrespective

of the application of any particular technological solution. With regard to its oversight

role

11

, the ECB is currently revising its harmonised oversight approach, which sets

common oversight standards for payment instruments and schemes. The new

framework includes, besides payment schemes, the assessment of payment

arrangements providing different technological solutions. The aim is to evaluate the

associated risks and mitigate them regardless of technological implementation.

The ECB has responded to the evolving challenges and risks arising from

financial innovation on multiple fronts. On the central banking side, consistent

with its mandate to ensure financial stability and the smooth functioning of payment

systems, the ECB is monitoring and assessing the implications of fintech and actively

exploring new technologies that may prove useful in supporting the ECB’s functions.

Profitability pressures stemming from competition with technology companies are

being amplified by banks’ needs for investment in digitalisation, which requires time to

yield net benefits. Growing interlinkages with firms could mean that any disruptions

might have systemic implications for the financial system unless adequate safeguards

are put in place. Another important challenge in relation to digital finance will be to

reassess the dependence of financial institutions on non-EU providers of critical

services and technical infrastructures (e.g. the cloud), while EU-based global players

have struggled to emerge. This could lead to banks’ reliance on a few non-EU service

providers at both the entity and systemic levels. On the banking supervision side,

the ECB is looking into the new risks and challenges that banks are facing due to

innovation and is closely monitoring their risk management practices, also in light of

the current pandemic crisis. The risks associated with the use of fintech are not limited

to IT. The ECB is therefore adapting its methodological toolbox, reflecting on the

technologies used and providing supervisory recommendations across all prudential

risk categories, including governance, business model and operational risk.

The ECB’s ongoing work within the euro area aims to foster a common approach to

fintech-related risks, ensure a consistent supervisory approach across the euro area

and open a dialogue with the industry

12

, also in view of its mandate in relation to the

authorisation and supervision of banks in the euro area.

13

The ECB aims to maintain a

level playing field for banking services and financial services more generally, and

11

According to the

Eurosystem oversight policy framework, the Eurosystem pursues three complementary

approaches to promote the safety and efficiency of FMIs, namely: (i) owning and operating FMIs;

(ii) conducting oversight activities; and (iii) acting as a catalyst. The term “FMI” encompasses, inter alia,

payment systems, and clearing and settlement systems. Furthermore, as payment instruments and

payment schemes are an integral part of payment systems, the Eurosystem includes these in central

bank oversight of payment systems.

12

See the ECB Banking Supervision website.

13

In accordance with Council Regulation (EU) No 1024/2013 of 15 October 2013 conferring specific tasks

on the European Central Bank concerning policies relating to the prudential supervision of credit

institutions, the ECB has the tasks to, amongst others, decide on common procedures for credit

institutions in the euro area, perform direct supervision of significant institutions in the euro area and

oversee the functioning of the system.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

10

follows the guiding principle of “same activity, same risks, same supervision”

14

and

regulation. This means that similar activities that generate similar risks require the

same regulatory treatment and supervisory approach, in order to ensure consistency.

This has also been reflected in the regulatory framework and supervisory approach

further specified in the SSM Supervisory Manual. While the ECB does not prescribe

how banks should conduct their business, supervisors look into the risks related to the

bank’s activities and if they are adequately managed. In this regard, the ECB is

proactively engaging with banks to gain knowledge of their transformation process

and take-up of innovative technological solutions. This work in relation to digital

transformation and the use of innovative technologies is conducted by assessing

banks’ business model changes and related risks. The work on fintech supervision has

also been made part of the SSM supervisory priorities for 2020

15

to assess banks’

business models in the light of increasing digitalisation and related risks such as IT

and cyber risks.

Therefore, it is of utmost importance to assess the risks and benefits arising from new

technologies in the increasingly digital and changing landscape. The ECB is

continuously adapting its supervisory (and oversight) approach vis-à-vis fintech,

leveraging on knowledge gained through industry dialogues and exchanges with other

authorities. In this regard, the ECB’s supervisory approach will benefit from the

support of legislation that is technology neutral and addresses the new landscape and

risks related to digitalisation and innovation.

In the context of the current regulatory framework, different entities which could

perform to a certain extent similar activities, such as credit institutions, e-money

institutions and payment institutions, are subject to varying regulatory and supervisory

frameworks, either at national or European level. As this trend is accelerated by

innovation and digitalisation, this framework may need to be reviewed to ensure a

level playing field and maintain the principle of “same activity, same risks, same

supervision and regulation”. Moreover, as part of its oversight role over payment

systems, schemes and instruments, the ECB envisages enhancing its cooperation

with national authorities supervising PSPs.

14

See the speech entitled “A binary future? How digitalisation might change banking” by Andrea Enria,

Chair of the Supervisory Board of the ECB, at the banking seminar organised by De Nederlandsche

Bank, Amsterdam, 11 March 2019.

15

See the “SSM Supervisory Priorities 2020” on the ECB Banking Supervision website.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

11

3 The ECB’s views on the priority areas identified by the

Commission

As mentioned above, the ECB broadly supports the priority areas identified by the

Commission in relation to digital finance and the related policy work to spur the

development of digital finance in the EU. Indeed, this is in line with the ECB’s priority to

remain technology neutral, while taking into account new benefits and risks related to

innovation and digitalisation. The ECB’s views on the consultation’s questions in

relation to the three priorities in question are further specified below.

3.1 The ECB’s views on Commission priority 1: ensuring that the EU

financial services regulatory framework is fit for the digital age

In the ECB’s view, the European Commission’s priority appears to be in line

with the current EU financial services regulatory framework, which is already

broadly technology neutral. However, in matters of regulation, technological neutrality

is not a means in itself: it needs to be balanced against the risks that the free use of

technological innovation may entail. The EU financial services regulatory framework

should support fair competition in digital financial services, while addressing

associated risks and also reinforcing the need to develop strong risk management at

the firm level. Furthermore, the development of digital finance should take into

consideration wide accessibility of basic financial services and the technologies that

underpin them.

The ECB supports a technology-neutral approach to regulation, supervision

and oversight.

16

While remaining mindful that new technologies do not undermine

common standards and interoperability, the ECB does not attempt to steer the market

in one direction or the other when it comes to the use of particular technologies.

17

Recent developments in technologies and financial market players suggest that the

regulatory framework should be further clarified and adapted to the new digital reality

to preserve and enhance the level playing field of the EU financial system in the

evolving landscape. For example, the entrance of technology companies into the

financial services sector, big technology (“big tech”) companies in particular,

has raised concerns that the principle of “same activity, same risks, same

supervision” and regulation could be undermined.

18

Should big tech companies

decide to enter financial services on a large scale, and especially into the retail market,

it has to be ensured that risks associated with their activities are appropriately

captured and addressed in the regulatory framework.

16

See also the panel remarks “On supervisory architecture” by Andrea Enria, Chair of the Supervisory

Board of the ECB, at the Financial Stability Institute 20th anniversary conference, Basel, 12 March 2019.

17

See also the speech entitled “A binary future? How digitalisation might change banking” by Andrea Enria,

Chair of the Supervisory Board of the ECB, at the banking seminar organised by De Nederlandsche

Bank, Amsterdam, 11 March 2019.

18

Ibid.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

12

Through the licensing process

19

and the ongoing supervision of banks in the euro

area (both significant and less significant institutions), it can be observed that certain

aspects of the supervision of banks’ use of innovative technologies and

digitalisation strategies require enhanced attention, touching on various topics.

These topics include: (i) the increased use of cloud service providers, leading to

concentration (both idiosyncratic and systemic) among a few providers, including big

tech companies; (ii) the use of AI for a range of functions, e.g. credit scoring and

robo-advice, to ensure the performance of the models and also prevent bias; (iii) the

move towards an open banking model to enhance the effective and safe use of

available data; (iv) the use of distributed ledger technology (DLT) for certain activities,

such as trade finance, requiring a good governance of the platforms and an

understanding of the technologies; and (v) regulatory technology (regtech), for the

purpose of meeting regulatory requirements, reporting, supporting compliance and

enhancing risk management in a credit institution.

The ECB is continuously adapting its supervisory approach to banks’ use of

innovative technologies, leveraging on knowledge gained through its own

experience with advanced technologies, industry dialogues and exchanges

with other authorities in the European and global fora. The ECB’s objective is to

promote a common understanding of fintech-related risks and ensure that they are

assessed in a consistent manner across the euro area.

Overall, the ECB considers that important areas for improvement would be to

enhance clarity on the application of existing laws and regulations to innovative

technologies and related business models, and to diminish the fragmentation resulting

from different legal and regulatory frameworks and industry standards across EU

Member States, in order to foster the Internal Market, the pan-European application of

standards and a level playing field. In this regard, targeted amendments to

legislation, interpretative guidance and a periodic review of existing rules would

be useful to ensure that the EU framework remains effective and technology neutral.

While the ECB sees some benefits in bespoke regimes for nascent technologies, such

as DLT, these will have to be balanced against the risks of their leading to a complex

and potentially inconsistent regulatory framework.

3.2 The ECB’s views on Commission priority 2: enabling consumers and

firms to reap the opportunities offered by the EU-wide Single Market

for digital financial services by removing fragmentation

A level playing field is of utmost importance to fully reap the opportunities of an

EU-wide Single Market for digital financial services. This requires, among other things,

building up reliable legal and monitoring frameworks. An important step in that

direction would be a generally accessible real-time European business register,

whether centrally managed or as a digitally linked network of national registers. Such a

19

See “Guide to assessments of fintech credit institution licence applications”, ECB Banking Supervision,

September 2017.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

13

register should contain unique entity identifiers and information on the structure of

institutions, preferably LEIs.

In this context and with regard to facilitating the use of digital financial identities

throughout the EU, the ECB fully endorses the mandatory use of different

identifiers, based on internationally recognised global standards including LEIs, UTIs

and UPIs, which is crucial to reap the benefits of and speed up the comprehensive

digitalisation and automation of processes in financial services. With regard to the LEI,

the ECB considers that it is a key and indispensable element of digital financial

identities, and that it should be leveraged and used to the greatest extent possible. In

that context, it should be noted that the European Systemic Risk Board has set up a

task force to prepare a recommendation on the establishment of an EU legislative

framework for greater adoption of LEIs across the EU, requiring all legal entities in the

EU to have an LEI and that each entity’s LEI is also mandatory for financial transaction

and public reporting. The ECB is of the view that the various aspects of the European

Commission’s identified framework, in relation to providing rules and guidance at an

EU level, are relevant and justified, and can create greater efficiency of such

frameworks.

In addition, the ECB supports the need for enhanced cooperation throughout the

EU on different schemes such as regulatory sandboxes and innovation hubs,

and acknowledges the benefits of fostering an open dialogue between supervisors

and supervised entities. The ECB notes that regulatory sandboxes are under

development in various Member States. While the setting-up of an EU-wide

sandbox would be a task for the legislator to decide on, such an initiative, as well

as national initiatives, would need to be in line with the European regulatory framework

and the division of competences contained therein, as well as the ECB’s mandate for

licensing credit institutions and supervising credit institutions.

20

Therefore, the ECB

welcomes the European Commission’s initiatives to address cross-border aspects

when European entities operate in such schemes, in order to ensure a harmonised

approach and foster a level playing field.

With regard to the use of passporting to scale up activities across the Member States,

the ECB welcomes the work of the European Banking Authority (EBA) on potential

impediments to the cross-border provision of banking and payment services.

21

The

ECB supports further work by the Commission/EBA on the cross-border

provision of services, which is especially relevant for digital finance. Currently,

only some Member States have defined a framework for credit institutions to provide

cross-border financial services using intermediaries (e.g. branches) in another

Member State and the respective notification process. The ECB is of the view that

additional clarity could be helpful in this area to ensure a consistent approach

throughout the EU and foster the ease of cross-border operations which are especially

relevant for digitally operating credit institutions.

20

See also the speech entitled “Innovation and digitalisation in payment services” by Yves Mersch, Member

of the Executive Board of the ECB, at the Second Annual Conference on “Fintech and Digital Innovation:

Regulation at the European level and beyond”, Brussels, 27 February 2018.

21

“Report on potential impediments to the cross-border provision of banking and payment services”,

European Banking Authority, 29 October 2019.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

14

Finally, taking a broader perspective, the ECB supports the cooperation throughout

the EU in the context of other initiatives, e.g. those aiming to monitor the fintech

phenomenon in Europe and related statistical initiatives.

22

3.3 The ECB’s views on Commission priority 3: promoting a

well-regulated data-driven financial sector for the benefit of EU

consumers and firms

The ECB considers that open finance can have implications for the supervised

banks, at both the entity and systemic levels and also as regards the nature of the

cooperation between these banks and new potential actors, such as third-party

providers. The revised Payment Services Directive (PSD2)

23

has created a new

environment for access to payment account data, as well as the potential for

added-value services. These data can now be shared with competitors, including

non-banks. At the same time, technological developments have made big data, cloud

services and AI algorithms more accessible, increasing the value of data for banks.

Against this background, the ECB is adapting its supervisory approach towards the

regulated entities to the new landscape that PSD2 has enabled, also in anticipation of

the next developments.

With respect to consent-based access to personal data and data sharing in the

financial sector, in the ECB’s view, alternative data sources such as public data

could be useful in providing insights, even though supervisory decisions or actions

cannot be taken based directly and solely on such data, also in view of data quality

issues. However, data generated by means of advanced technologies can

complement the data collected by traditional means. For instance, alternative data

from the news and social media can be used for sentiment analysis. Some alternative

data sources are public and, in this sense, bring the benefit that they are widely

accessible with limited or no confidentiality restrictions.

22

See, for example, “IFC Report on central banks and fintech data issues”, Bank for International

Settlements, February 2020.

23

Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on

payment services in the internal market (OJ L 337, 23.12.2015, p. 35).

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

15

ANNEX:

The ECB’s response to the European

Commission’s questionnaire

General questions

Question 1

What are the main obstacles to fully reap the opportunities of innovative technologies

in the European financial sector (please mention no more than 4)?

Please also take into account the analysis of the Expert Group on Regulatory

Obstacles to Financial Innovation

24

in that respect.

The ECB considers the following to be the most important areas for improvement, so

that European financial service providers can fully reap the opportunities that have

arisen from the emergence of innovative technologies:

1. Enhance clarity on the application of existing laws and regulation to innovative

technologies and related business models. Some technological innovations

entail a degree of legal uncertainty, which could hinder the uptake of innovation

by financial service providers. The uncertainty stemming from the lack of a stable

legal taxonomy in this area, taking into account new innovative applications in the

financial sector for the performance of financial activities and for the delivery of

products and services, as well as the specific requirements related to the use of

innovative technologies, could subsequently lead to uncertainty as to the

regulatory and supervisory regime applicable to newcomers as well as

incumbents, including with regard to anti-money laundering (AML) and

know-your-customer (KYC) requirements. For instance, regarding the General

Data Protection Regulation (GDPR) and other relevant legislation, guidance

would be needed on the application of the requirement for erasure in DLT

platforms, as well as on the issue of specificity of user consent in AI models.

2. Diminish the fragmentation due to different legal and regulatory frameworks

and industry standards across EU Member States, in order to foster the Internal

Market, the pan-European application of standards and a level playing field.

3. Reassess the dependence of financial institutions on providers of critical digital

services (e.g. cloud-based services) and technical infrastructures, which are

mostly non-EU providers. At the same time, EU-based global players have

struggled to emerge.

24

“Final report of the Expert Group on Regulatory Obstacles to Financial Innovation: 30 recommendations

on regulation, innovation and finance”, European Commission, 13 December 2019.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

16

4. Enhance the assessment of risks and benefits arising from new

technologies, in view of the increasingly digital and changing landscape.

The ECB is continuously adapting its supervisory and oversight approach to

fintech, leveraging on knowledge gained through its own experience in applying

advanced technology, industry dialogues, exchanges with other authorities and

participation in fora focused on innovation, such as the European Forum for

Innovation Facilitators (EFIF). The objective is to promote a common

understanding of fintech-related risks among supervisors and legislators and to

ensure that they are assessed in a consistent manner within the EU.

Question 2

What are the key advantages and challenges consumers are facing with the

increasing digitalisation of the financial sector (please mention no more than 4)?

For each of them, what if any are the initiatives that should be taken at EU level?

The ECB refrains from answering questions in relation to consumer protection.

Building on previous policy and legislative work, and taking into account the

contribution digital finance can make to deal with the COVID-19 emergency and its

consequences, the Commission services are considering four key priority areas for

policy action to spur the development of digital finance:

1. ensuring that the EU financial services regulatory framework is

technology-neutral and innovation friendly;

2. reaping the opportunities offered by the EU-wide Single Market for digital

financial services for consumers and firms;

3. promoting a data-driven financial sector for the benefit of EU consumers and

firms; and

4. enhancing the operational resilience of the financial sector.

Question 3

Do you agree with the choice of these priority areas?

Yes

No

Don’t know / no opinion / not relevant

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

17

Question 3.1

Please explain your answer to question 3 and specify if you see other areas that would

merit further attention from the Commission:

Subject to the following remarks, the ECB supports the European Commission’s

choice of priority areas, which appear to be broadly justified and consistent with the

legal framework related to EU financial services regulation.

Specifically, the EU financial services regulatory framework is already broadly

technology neutral. Looking at the legal framework governing the banking sector, the

Capital Requirements Regulation and Directive (CRR/CRD)

25

package does not

include any provisions regarding preferential treatment in relation to banks using

innovative technologies. In addition, the revised Markets in Financial Instruments

Directive (MiFID II)

26

speaks of a “system” in the context of defining regulated

markets, multilateral trading facilities (MTFs) or organised trading facilities (OTFs)

without distinguishing in terms of the technology they deploy. Equally, from a

payments and post-trading perspective, the revised Payment Services Directive

(PSD2)

27

, the Settlement Finality Directive (SFD)

28

, the Systemically Important

Payment Systems Regulation (SIPSR)

29

, the European Market Infrastructure

Regulation (EMIR)

30

and the Centralised Securities Depository Regulation (CSDR)

31

describe a “system” in contractual rather than technological terms. As a regulatory

focus, technological neutrality – especially in an open market economy with free

competition, such as the Single Market – is conducive to innovation-friendly regulatory

outcomes.

However, in matters of regulation, technological neutrality should not be viewed in

isolation; instead, it needs to be balanced against the risks that the free use of

technological innovation may entail. There are several examples where the EU

legislator regulated technological developments differently due to their novel risks. For

instance, MiFID II seeks to ensure that algorithmic trading or high-frequency

algorithmic trading techniques do not create a disorderly market and cannot be used

for abusive purposes. Similarly, while the GDPR

32

acknowledges that the increased

25

Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on

prudential requirements for credit institutions and investment firms (OJ L 176, 27.6.2013, p. 1) and

Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the

activity of credit institutions and the prudential supervision of credit institutions and investment firms

(OJ L 176, 27.6.2013, p. 338).

26

Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in

financial instruments (OJ L 173, 12.6.2014, p. 349).

27

Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on

payment services in the internal market (OJ L 337, 23.12.2015, p. 35).

28

Directive 98/26/EC of the European Parliament and of the Council of 19 May 1998 on settlement finality

in payment and securities settlement systems (OJ L 166, 11.6.1998, p. 45).

29

Regulation of the European Central Bank (EU) No 795/2014 of 3 July 2014 on oversight requirements for

systemically important payment systems (ECB/2014/28) (OJ L 217, 23.7.2014, p. 16).

30

Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC

derivatives, central counterparties and trade repositories (OJ L 201, 27.7.2012, p. 1).

31

Regulation (EU) No 909/2014 of the European Parliament and of the Council of 23 July 2014 on

improving securities settlement in the European Union and on central securities depositories (OJ L 257,

28.8.2014, p. 1).

32

Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the

protection of natural persons with regard to the processing of personal data and on the free movement of

such data (OJ L 119, 4.5.2016, p. 1).

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

18

scale of collection and sharing of consumers’ personal data due to technological

developments brings new challenges for the protection of personal data (e.g. in

relation to DLT and erasure), it calls upon technology to facilitate the free flow of

personal data within the EU and to ensure a high level of data protection. Therefore,

the European Commission’s consultation paper identifies priority areas which are in

line with technological neutrality and innovation friendliness.

In addition, EU regulation should support fair competition in digital financial services.

Technology-neutral regulation also serves this objective. Furthermore, the

development of digital finance should take into consideration wide accessibility of

basic financial services and the technologies that underpin them.

A further priority area could be to harmonise substantive rules related to digital finance

(e.g. formation of digital contracts, transfer of crypto-assets, whether outright or by

way of collateral, cross-border technical acceptance of eID/eSignature solutions, legal

validity of smart contracts and blockchain-registered transactions). Considering the

likely challenges, an incremental approach would seem more advisable, placing the

emphasis on the regulation of the cross-border aspects of digital finance activities.

The accessibility of basic financial services by all user groups (including vulnerable

groups) should also be considered as a relevant issue, as well as digital inclusion,

because increased digitalisation of financial services requires new skills of users and

adequate access to technologies.

1 Ensuring a technology-neutral and innovation friendly EU

financial services regulatory framework

Question 4

Do you consider the existing EU financial services regulatory framework to be

technology neutral and innovation friendly?

Yes

No

Don’t know / no opinion / not relevant

Question 4.1

If not, please provide specific examples of provisions and requirements that are not

technologically neutral or hinder innovation:

Overall, the ECB considers that the current EU framework is technologically neutral,

as banks need to fulfil the same requirements depending on the specificities of their

business model and risk profile, while on this basis proportionality can also be applied

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

19

(for specific examples that this may not be the case, please refer to the report of the

Expert Group on Regulatory Obstacles to Financial Innovation).

33

In line with the above-mentioned report, it should be analysed to what extent the

current framework for financial services is technology neutral and able to

accommodate fintech innovation and whether it needs to be adapted, also with a view

to making the framework suitable for further innovations within the financial sector.

The ECB is of the view that interpretative guidance, targeted amendments and a

periodic review of existing rules would be useful to ensure that the EU framework

remains technology neutral also going forward, given the change of the nature of

banks’ business models as a result of innovation and digitalisation.

Question 5

Do you consider that the current level of consumer protection for the retail financial

products and services established by the EU regulatory framework is technology

neutral and should be also applied to innovative ones using new technologies,

although adapted to the features of these products and to the distribution models?

Yes

No

Don’t know / no opinion / not relevant

Question 5.1

Please explain your reasoning on your answer to question 5, and where relevant

explain the necessary adaptations:

The ECB expresses no views on this question.

33

“Final report of the Expert Group on Regulatory Obstacles to Financial Innovation: 30 recommendations

on regulation, innovation and finance”, European Commission, 13 December 2019.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

20

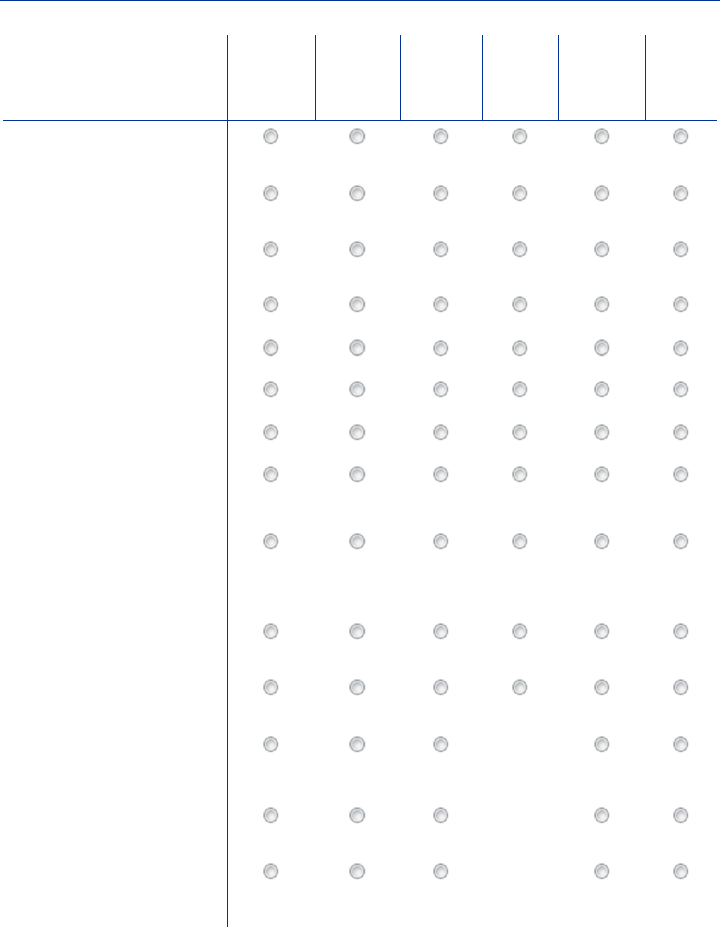

Identifying areas where the financial services regulatory framework

may need to be adapted

Question 6

In your opinion, is the use for financial services of the new technologies listed below

limited due to obstacles stemming from the EU financial services regulatory

framework or other EU level regulatory requirements that also apply to financial

services providers?

Please rate each proposal from 1 to 5:

1

(irrelevant)

2

(rather not

relevant)

3

(neutral)

4

(rather

relevant)

5

(fully

relevant) N.A.

Distributed Ledger

Technology (except crypto-

assets)

X

Cloud computing

X

Artificial Intelligence/

Machine learning

X

Internet Of Things (IoT)

Biometrics

Quantum computing

Other

If you see other technologies whose use would be limited in the financial services due

to obstacles stemming from the EU financial services legislative framework, please

specify and explain:

In terms of other technologies, the ECB believes that application programming

interfaces (APIs) provide advantages for banks, including potential improvements to

efficiency, data standardisation, privacy, as well as data protection, in comparison to

other techniques (e.g. screen scraping). Banks have been internally relying on APIs

for many years. They traditionally maintain multiple systems to run their operations

and APIs enable the communication among these. Recently, the focus has turned to

external APIs. The use of APIs, in the context of PSD2 but also beyond, is increasing

in banks, especially those that intend to monetise their APIs via different models. To

achieve interoperability of external APIs, the ECB considers that a clear and

consistent regulatory framework for APIs, as well as their standardisation, where

possible, would be beneficial. In this context, further discussions also including

relevant stakeholders may be necessary.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

21

Question 6.1

Please explain your answer to question 6, specify the specific provisions and

legislation you are referring to and indicate your views on how it should be addressed:

Regarding DLT (except crypto-assets), the ECB believes that the existence of

harmonised definitions, legal clarity (e.g. on the governance of the platform and

applicable law) and standardisation, where possible, would be beneficial for the

expansion of DLTs in banking solutions and FMIs.

At the beginning of 2019, the EBA published a guideline on outsourcing

arrangements.

34

This guideline also integrated the 2017 EBA recommendations on

outsourcing to cloud service providers. The ECB has actively contributed to the

elaboration of this guideline. It contains no significant restrictions on the usage of

cloud services. Nevertheless, further action could be taken to strengthen the legal

certainty for industry participants on the use of cloud computing in the financial sector

and its effective supervision, in particular in the area of standardisation of services and

contracts, and requirements in relation to the location of data, as well as the providers’

facilities.

34

“Final Report on EBA Guidelines on outsourcing arrangements”, European Banking Authority,

25 February 2019.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

22

Question 7

Building on your experience, what are the best ways (regulatory and non-regulatory

measures) for the EU to support the uptake of nascent technologies and business

models relying on them while also mitigating the risks they may pose?

Please rate each proposal from 1 to 5:

1

(irrelevant)

2

(rather

not

relevant)

3

(neutral)

4

(rather

relevant)

5

(fully

relevant) N.A.

Setting up dedicated

observatories to monitor

technological and market trends

(e.g. EU Block chain Observatory

& Forum; Platform Observatory)

X

Funding experimentation on

certain applications of new

technologies in finance (e.g. block

chain use cases)

Promoting supervisory innovation

hubs and sandboxes

X

Supporting industry codes of

conduct on certain applications of

new technologies in finance

Enhancing legal clarity through

guidance at EU level for specific

technologies and/or use cases

X

Creating bespoke EU regimes

adapted to nascent markets,

possibly on a temporary basis

X

Other

Please specify what are the other ways the EU could support the uptake of nascent

technologies and business models relying on them while also mitigating the risks they

may pose:

While the ECB sees some benefits in bespoke regimes for nascent technologies (such

as the use of blockchain), there are also risks of their leading to a complex and

possibly inconsistent regulatory structure and provisions in different EU Member

States. Similarly, the creation of regimes applicable on a temporary basis may be

relevant for nascent markets, but could also increase regulatory uncertainty in relation

to provisions related to nascent markets (e.g. new innovative players in the field of

lending, wealth management). Therefore, enhancement of the European regulatory

framework may be necessary to ensure a level playing field.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

23

Assessing the need for adapting the existing prudential frameworks

to the new financial ecosystem, also to ensure a level playing field

Question 8

In which financial services do you expect technology companies which have their main

business outside the financial sector (individually or collectively) to gain significant

market share in the EU in the five upcoming years?

Please rate each proposal from 1 to 5:

1

(very low

market

share

below 1%)

2

(low

market

share

3

(neutral)

4

(significant

market

share)

5

(very

significant

market

share above

25%)

N.A.

Intra-European retail payments

Intra-European wholesale

payments

Consumer credit provision to

households with risk taking

Consumer credit distribution to

households with partner

institution(s)

Mortgage credit provision to

households with risk taking

Mortgage credit distribution to

households with partner

institution(s)

Credit provision to SMEs with risk

taking

Credit distribution to SMEs with

partner institution(s)

Credit provision to large

corporates with risk taking

Syndicated lending services with

risk taking

Risk-taking activities in Life

insurance products

Risk-taking activities in Non-life

insurance products

Risk-taking activities in pension

products

Intermediation / Distribution of

life insurance products

Intermediation / Distribution of

non- life insurance products

Intermediation / Distribution of

pension products

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

24

Other insurance related activities,

e.g. claims management

Re-insurance services

Investment products distribution

Asset management

Others

Please specify in which other financial services you expect technology companies to

gain significant market share in the EU in the five upcoming years:

It should be examined to what extent fintech ecosystem companies and financial

services platforms might start gaining additional market share in the next years as a

result of their offering and a combination of various aforementioned financial services.

Question 8.1

Please explain your answer to question 8 and, if necessary, describe how you expect

technology companies to enter and advance in the various financial services markets

in the EU Member States:

Technology companies could deploy various strategies to become more active in the

payments market. They could build on existing payment infrastructure, cooperate with

existing PSPs, or choose to offer their own payment solutions on a newly developed

proprietary or third-party infrastructure. In the latter case, new solutions may also have

a negative impact on market integration. Technology companies could also enter new

markets by taking over successful start-up companies. In Europe, for the most part,

technology companies offer technical services to banks and PSPs both at the front

end (e.g. electronic wallets) and back end (e.g. cloud services) of the payments value

chain. The ECB believes that technology companies could pursue a more prominent

role in payment service provision. Large technology companies with cross-border user

bases may develop new global payment schemes/arrangements by using new and

innovative technologies/assets. Technology companies’ strategies could be potentially

broader than the provision of new payment instruments/arrangements (e.g. extending

to eID solutions). However, at this stage, it is not possible to estimate these

companies’ market share in five years’ time. Ultimately, the technology companies’

expansion in financial services would depend on the underlying business model of the

technology company.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

25

Question 9

Do you see specific financial services areas where the principle of “same activity

creating the same risks should be regulated in the same way” is not respected?

Yes

No

Don’t know / no opinion / not relevant

Question 9.1

Please explain your answer to question 9 and provide examples if needed:

In relation to the banking sector:

Any entity in the euro area that accepts deposits and offers loans to the public is

supervised as a credit institution and hence must adhere to the applicable regulation.

Only the ECB can grant licences to such institutions.

35

The entrance of service providers such as technology companies into the financial

services sector, more specifically big tech companies, has raised concerns that the

principle of “same activity, same risks, same supervision and regulation” could be

undermined. Should big tech companies decide to start providing financial services on

a large scale, and especially in the retail market, this could significantly transform the

financial landscape. Big tech companies provide services to a large customer base

and can leverage on economies of scale and their presence on multiple markets to

offer financial services to both consumers and merchants, as well as gaining access to

large amounts of user data that can be exploited for credit rating purposes and

targeted marketing. At the same time, these service providers could deliberately

choose their product characteristics to circumvent the existing regulation, potentially

undermining the applicability of the “same activity, same risks, same supervision and

regulation” principle.

36

At the current juncture, in the euro area at least, the ECB witnesses that big tech

companies are partnering with banks or providing ancillary services. Examples of the

former include Google Pay and Apple Pay, services which are being rolled out across

the EU with benefits for the participating banks, but also for the big tech companies

that would not need to meet the regulatory requirements themselves, and of course for

consumers. Some big tech companies are also key providers of cloud services for

banks.

Nevertheless, as mentioned elsewhere in the ECB’s answers (see, for example,

Question 10 and Question 12), it is important that we remain vigilant in this respect

35

In line with its mandate in Council Regulation (EU) No 1024/2013 of 15 October 2013 conferring specific

tasks on the European Central Bank concerning policies relating to the prudential supervision of credit

institutions (OJ L 287, 29.10.2013, p. 63).

36

See also the speech entitled “A binary future? How digitalisation might change banking” by Andrea Enria,

Chair of the Supervisory Board of the ECB, at the banking seminar organised by De Nederlandsche

Bank, Amsterdam, 11 March 2019.

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

26

and are prepared at an EU level to consider adjusting the regulatory perimeter if and

when big tech companies should increasingly offer banking services, such as lending

to consumers and/or small and medium-sized enterprises (SMEs), to ensure that the

risks related to these services are adequately addressed (including concentration

risks), and in a similar manner across the various institutions providing those services,

as well as in the various European jurisdictions.

Question 10

Which prudential and conduct risks do you expect to change with technology

companies gaining significant market share in financial services in the EU in the five

upcoming years?

Please rate each proposal from 1 to 5:

1

(significant

reduction

in risks)

2

(reduction

in risks)

3

(neutral)

4

(increase

in risks)

5

(significant

increase in

risks) N.A.

Liquidity risk in interbank

market (e.g. increased volatility)

Liquidity risk for particular

credit institutions

Liquidity risk for asset

management companies

Credit risk: household lending

Credit risk: SME lending

Credit risk: corporate lending

Pro-cyclical credit provision

Concentration risk for funds

collected and invested (e.g. lack

of diversification)

Concentration risk for holders

of funds (e.g. large deposits or

investments held in a bank or

fund)

Undertaken insurance risk in

life insurance

Undertaken insurance risk in

non-life insurance

Operational risks for

technology companies and

platforms

X

Operational risk for incumbent

financial service providers

X

Systemic risks (e.g. technology

companies and platforms

become too big, too

interconnected to fail)

X

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

27

Please specify which other prudential and conduct risk(s) you expect to change with

technology companies gaining significant market share in financial services in the EU

in the five upcoming years:

The ECB does not provide any views on this matter.

Question 10.1

Please explain your answer to question 10 and, if necessary, please describe how the

risks would emerge, decrease or increase with the higher activity of technology

companies in financial services and which market participants would face these

increased risks:

The ECB notes that consideration should be given to the possible entrance of big tech

companies into the financial services market. They can draw upon the vast amounts of

data from their wide customer base and combine this with their extensive use of

innovative technologies to better tailor their product offering. Big tech companies have

the potential to quickly gain a significant market share, which could lead to significant

concentration risks and, in the event of operational failures and targeted cyberattacks,

could have a systemic impact on the financial system as a whole, thus increasing

financial stability risks.

Incumbent financial institutions are reacting to this changing environment by

transforming their business models. This could imply, for instance, transforming the

bank itself into a fully fledged digital institution, establishing a stand-alone digital bank

or partnering with non-bank fintech or big tech companies to deliver certain products,

creating ecosystems where financial institutions, fintech start-ups and service

providers cooperate. In relation to its oversight and supervisory mandates, the ECB

does not attempt to steer the market in one direction or the other. Our aim is to

maintain a level playing field in financial services. Our guiding principle is “same

activity, same risks, same supervision and regulation”.

37

Therefore, the evolving

business models and the application of new technologies are being monitored with

regard to the related risks and banks’ risk management processes.

The security and operational resilience of the financial sector can be affected in a

number of ways by the increased use of new technologies. Overall, it can be expected

that the increased presence of technology companies will create more operational

complexity and add intermediaries in the financial sector, also increasing third-party

37

See also the speech entitled “A binary future? How digitalisation might change banking” by Andrea Enria,

Chair of the Supervisory Board of the ECB, at the banking seminar organised by De Nederlandsche

Bank, Amsterdam, 11 March 2019.

Money-laundering and

terrorism financing risk

Other

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

28

dependencies. This may raise systemic risk, as operational problems that arise in one

country may spread to other countries. A complicating factor in this respect may be

that the presence of such companies in many countries may reduce the insight of

national overseers and prudential supervisors into the type and scale of financial

activities taking place within their jurisdictions. As the pace of technological innovation

increases, the financial sector will see more often the introduction of innovative

technology which has not been intensively market-tested and is therefore inherently

more risky from an operational point of view. At the same time, the accelerated

adoption of new technologies could also enhance the resiliency of the sector. For

example, the use of cloud services could, under certain conditions, improve

operational systems’ availability, scalability and resilience compared with what can be

achieved with on-premises data centres.

A competitive attitude of market players should not result in a deterioration of business

operating conditions which could increase operational risks due to underinvestment in

IT security.

The reliance on external technology providers increases the surface of attack, thereby

potentially facilitating the propagation of disruptions. However, some specialised

technology companies have a strong interest in ensuring a high level of cyber and

operational resilience, as the provision of technology services is their core business.

Lastly, when EU financial service providers increasingly rely on (critical) services

offered to them by non-EU technology firms, EU sovereignty with regard to those

services (e.g. the ability to regulate and supervise those non-EU service providers)

decreases. The same applies when non-EU technology firms replace EU financial

service providers for services to EU citizens and businesses (for example, when

non-EU big tech companies’ market share in offering retail payment services

increases).

ESCB/European banking supervision response to the European Commission’s public

consultation on a new digital finance strategy for Europe/FinTech action plan

29

Question 11

Which consumer risks do you expect to change when technology companies gain

significant market share in financial services in the EU in the five upcoming years?

Please rate each proposal from 1 to 5:

1

(significant

reduction in

risks)

2

(reduction

in risks)

3

(neutral)

4

(increase

in risks)

5

(significant

increase in

risks N.A.

Default risk for funds

held in non-banks and

not protected by Deposit

Guarantee Scheme

Liquidity risk

Misselling of insurance

products

Misselling of investment

products

Misselling of credit

products

Misselling of pension

products

Inadequate provision of

information

Inadequate complaint

and redress process and

management

Use/abuse of personal

data for financial

commercial purposes

Discrimination e.g.

based on profiles

Operational risk e.g.

interrupted service, loss

of data

Other

Please specify which other consumer risk(s) you expect to change when technology

companies gain significant market share in financial services in the EU in the five