Practice Aid

Accounting and Financial Reporting

Guidelines for Cash- and Tax-Basis

Financial Statements

PA_Cover_Series.indd 2 5/17/18 3:03 PM

© 2018 Association of International Certified Professional Accountants. All rights reserved.

For other uses of this work, please email [email protected] with your request or write to us at 220 Leigh Farm

Road, Durham, NC 27707-8110 USA.

PA-CBT-Front Matter.indd 2 9/21/15 3:42 PM

This document was created by the Association of International Certified Professional Accountants as a free member

benefit which may be freely used and shared by members for personal use. All copyright statements should be

maintained.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.1

Preface

BecauseofthecomplexitiesofaccountingprinciplesgenerallyacceptedintheUnitedStatesofAmerica(GAAP),

manysmallerentitieshavedeterminedthatfinancialstatements preparedbyapplyingthecash‐ortax‐basisof

accountingmoreappropriatelysuittheirneeds.UnlikeGAAP,littleauthoritativeguidanceisavailablewithre‐

specttothe

preparationoffinancialstatementswhenapplyingthecash‐ortax‐basisofaccounting.Financial

statementspreparedwhenapplyingthecash‐ortax‐basisofaccountingneedtohavealevelofconsistencyso

thattheyareusefulandnotmisleadingtousersofthefinancialstatements.Additionally,becausefinancial

statements

preparedwhenapplyingthecash‐ortax‐basisofaccountingarenotconsideredappropriateinform

unlessthefinancialstatementsincludeinformativedisclosuressimilartothoserequiredbyGAAPifthefinancial

statementscontainitemsthatarethesameas,orsimilarto,thoseinfinancialstatementspreparedinaccord‐

ance

withGAAP,preparersoffulldisclosurefinancialstatementspreparedwhenapplyingthecash‐ortax‐basis

ofaccountingareoftenfacedwithdifficultquestions.

Thispracticeaidisintendedtoprovidepreparersofcash‐andtax‐basisfinancialstatementswithguidelinesand

bestpracticestopromoteconsistencyandforresolving

theoftendifficultquestionsregardingthepreparation

ofsuchfinancialstatements.Althoughthispracticeaidisthebestsourceforsuchguidance,itisnonauthorita‐

tiveandshouldnotbeusedasasubstituteforthepreparer’sprofessionaljudgment.Thispracticeaidhasnot

beenapproved,disapproved,orotherwiseactedupon

byanyseniorcommitteeoftheAICPA.

Thispracticeaiddoesnotcontainguidancewithrespecttoperforminganaudit,review,orcompilationoffinan‐

cialstatementspreparedwhenapplyingthecash‐ortax‐basisofaccounting.Practitionersengagedtoauditsuch

financialstatementsshouldrefertoStatementsonAuditing

Standards,includingAU‐Csection800,SpecialCon‐

siderations—AuditsofFinancialStatementsPreparedinAccordanceWithSpecialPurposeFrameworks(AICPA,

ProfessionalStandards).PractitionersengagedtoperformarevieworcompilationshouldrefertoStatements

onStandardsforAccountingandReviewServices(SSARSs).Likewise,CPAsinpublicpracticewhopreparefinan‐

cialstatementsforclientsbutarenotengagedtoperformanaudit,review,orcompilationofsuchfinancial

statementsshouldrefertoSSARSs.

PreparedbyMichaelP.Glynn

SeniorTechnicalManager

AuditandAttestStandardsTeam

EditedbyKellyG.McAuliffe

TechnicalManager

MemberLear ning andCompetency

2©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Acknowledgments

In1998,theAICPApublishedthePracticeAidPreparingandReportingonCash‐andTax‐BasisFinancialState‐

ments.ThatpublicationwaswrittenbyMichaelJ.Ramos,CPA,andeditedbytheAICPAAccountingandPublica‐

tionsTeam.Thatpublicationservedasabasisforthepreparationoftheoriginal

editionofthispracticeaid.

Inadditiontothispracti ceaid,theAICPAhasalsopublishedaseparatepracticeaid,ApplyingOCBOAinState

andLocalGovernmentFinancialStatements,authoredbyMichaelA.(Mike)Crawford,CPA.Mikeservedasan

invaluableresourceinthepreparationoftheoriginaleditionof

thispracticeaid.

TheAICPAalsogreatlyappreciatestheinvaluableinputprovidedbythelateDr.ThomasA.Ratcliffeinthede‐

velopmentofthepreviouseditionofthispracticeaid.

Finally,theAICPAwouldliketothankthe2011/12membersoftheAccountingandReviewServicesCommittee

andthe2011/12

membersoftheAICPAPCPSTechnicalIssuesCommittee,whoprovidedinvaluablei nputre‐

gardingthecontentoftheoriginaleditionofthispracticeaid.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.3

4©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Chapter1

OverviewofCash‐andTax‐BasisFinancialStatements

Introduction

Financialstatements,includingrelatednotes,areastructuredrepresentationofhistoricalfinancialinformation

intendedtocommunicateanentity’seconomicresourcesandobligationsatapointintimeorthechanges

thereinforaperiodoftimeinaccordancewithafinancialreportingframework.

fn1

Allfinancialstatementsare

preparedinaccordancewithafinancialreportingframework.Thetermfinanc ialreportingframeworkisdefined

as“asetofcriteriausedtodeterminemeasurement,recognition,presentation,anddisclosureofallmaterial

itemsappearinginthefinancialstatements.”

fn2

Examplesoffinancialreportingframeworksareaccounting

principlesgenerallyacceptedintheUnitedStatesofAmerica(GAAP),InternationalFinancialReportingStand‐

ardspromulgatedbytheInternationalAccountingStandardsBoard,andspecialpurposeframeworkssuchasthe

cash‐,tax,regulatory‐,contractual‐,andotherbasesthatuseadefinitive

setoflogical,reasonablecriteriathatis

appliedtoallmaterialitemsappearinginthefinancialstatements.Thecash‐,tax‐,regulatory‐,andother‐basis

ofaccountingarecommonlyreferredtoasothercomprehensivebasesofaccounting.

AsGAAPbecomesincreasinglycomplexandlesscostbeneficialforprivate

companies,suchcompaniesconsider

issuingcash‐andtax‐basisfinancialstatementsascost‐effectiveandusefulalternatives.Manyoftheseprivate

companiesaresmallandmedium‐sizedentitiesthatreport toanarrowrangeoffinancialstatementusers.

Thoseusers,unlikeusersofpubliccompanyfinancialstatements,typicallyhaveaccessto

companymanagement

andadditionalfinancialinformationbeyondthatprovidedinthefinancialstatements.

Cash‐ortax‐basisfinancialstatementsmaybeappropriatewhenevertheentityisnotcontractuallyorotherwise

requiredtoissueGAAPfinancialstatements.Thefollowing conditionsmayindicatethatfinancialstatements

preparedwhenapplyingthecash‐or

tax‐basisofaccountingisappropriate:

Theusersofthefinancialstatements—bothinternalandexternaltotheentity—understandacash‐or

tax‐basispresentationandfinditrelevantfortheirneeds.

Itiscost‐effectivetopreparecash‐ortax‐basisfinancialstatements.

Theoperationsoftheentity

areconducivetoacash‐ortax‐basispresentation.

Preparingcash‐ortax‐basisfinancialstatementshasmanybenefits.Asignificantbenefitisduetothefactthat

manysmallerentitiesmaintaintheiraccountingrecordsonacash‐ortax‐basis.Often,accountingandfinance

personnelresponsibleformaintainingthe

booksandrecordscanmoreeasilyunderstandtheconceptsofcashin

fn1

Paragraph.05ofAR‐Csection90,ReviewofFinancialStatements(AICPA,ProfessionalStandards),andparagraph.13ofAU‐C

section200,OverallObjectivesoftheIndependentAuditorandConductofanAuditinAccordanceWithGenerallyAcceptedAuditing

Standards(AICPA,ProfessionalStandards).

fn2

Seefootnote1.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.5

andoutaswellastaxreportingcomparedtoGAAP.Becausetheinternalrecordsareoftenmaintainedonthe

cash‐ortax‐basisofaccounting,itiseasiertopreparethefinancial statementswhenapplyingthatsamebasis.If

thefinancialstatementsarepreparedinaccordancewithGAAP,theaccountingand

financepersonnelwould

“true‐up”thefinancialinformationthrougha seriesofjournalentries.Additionally,manyusersofsmallerentity

financialstatementsfindcash‐ortax‐basisfinancialstatementstobemoreunderstandablethanfinancial

statementspreparedinaccordancewithGAAPbecausethoseusersareoftenaccustomedtopreparingand

con‐

sideringbudgetsonacash‐basisandunderstandtaxissues.

Becausemanysmallerentitiesareappropriatelyconcernedwithminimizingcostsandmaximizing theresources

thatareavailabletofundtheoperationsofthebusiness,resourcesallocatedtoaccountingandfinancialreport‐

ingareoftennotsufficienttomaintainGAAP basis

accountingrecordsandtopreparefinancialstatementsinac‐

cordancewithGAAP.Preparingfinancialstatementswhenapplyingthecash‐ortax‐basis ofaccountinggeneral‐

lyislesscostlythanpreparingGAAPfinancialstatementsbecauseofthefollowing:

Lesscomplexmeasurementrequirements.Financialstatementspreparedwhenapplyingthecash‐

basis

ofaccountingreflecttransactionsresultingfromcashreceiptanddisbursementtransactionsorevents.

Financialstatementspreparedwhenapplyingthetax‐basisofaccountingreflecttransactionsinthe

samemannerasthosetransactionsarereflectedintheentity’staxreturn.

Lessextensivedisclosurerequirements.Financialstatementspreparedwhenapplyingthe

cash‐ortax‐

basisofaccountingdonotrequire alloftheextensivedisclosuresrequiredofGAAPstatementsbecause

thestatementsdonotincludesomeoftheitems,events,andtransactionsthataretypicallyincludedin

GAAPbasisfinancialstatements.

ObservationsandSuggestions

Often,preparersofcash‐andtax‐basisfinancialstatementselecttoomitsubstantiallyalldisclosuresrequiredby

thecash‐ortax‐basisofaccounting.Theomissionofdisclosuresisadeparturefromthecash‐ortax‐basisofac‐

countingand,ifsuchdisclosureswereincludedinthefinancialstatements,theymightinfluencetheuser’scon‐

clusionsabouttheentity’sfinancialposition,resultsofoperations,andcashflows.However,theomissionmay

notnecessarilyresultinmisleadingfinancialstatementsprovidedthattheintendedusersareinformedabout

suchmatters.

Abilitytopreparetaxreturnsandfinancialstatementsfromthesameinformation.Whentax‐basisfinan‐

cialstatementsareissued,asignificantportionofthecostcanbeabsorbedbythepreparationofthetax

return.Additionally,theentity isnotrequiredtomaintaintwosetsofaccountingrecordsto

accountfor

itemssuchasdepreciation,baddebts,andconsolidationmatters.

However,inadditiontothebenefitsoffinancialstatements preparedwhenapplyingacash‐ortax‐basisofac‐

counting,financialstatementpreparersshouldalsobeawareofthelimitationsofsuchfinancial statements.For

example,financialstatementsprepared

whenapplyingthecash‐ortax‐basisofaccountingmaynotmeetthe

needsofcertainuserssuchasregulatorsandcertainlenders.Inaddition,thecash‐basisofaccountingcanbe

easilymanipulatedbyacceleratingordelayingthetimingofthereceiptordisbursementofcashandtherefore

maynot

beacomprehensivemeasureoftheentity’scompleteeco nomiccondition.

Inpractice,themosttypicalindustriesinwhichcash‐ortax‐basisfinancialstatementsareissuedincludethefol‐

lowing:

Professionalservices

6©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Medical

Retail

Realestate

Farming/agricultural

Construction

Not‐for‐profit

Cash‐BasisofAccounting

Thecash‐basisofaccountingisabasisofaccountingthattheentityusestorecordcashreceiptsanddisburse‐

ments.Whenapplyingthecash‐basisofaccounting,transactionsarerecognizedbasedonthetimingofcashre‐

ceiptsanddisbursements.Asaresult,

revenuesarerecognizedonlywhencash

isreceivedratherthanwhenearned,and

expensesarerecognizedonlywhencashispaidratherthanwhentheobligationisincurred.

Whenapplyingthecash‐basis,cashoutflowstopurchasean“asset”arenotcapitalizedbutinsteadarerecorded

asadisbursementasofthedateofpurchase,

sothereisnodepreciationoramortization.Accrualsarenotmade

andprepaidassetsarenotrecorded.

Thecash‐basisofaccountinginitspurestformisrarelyusedbutmaybeappropriatewhenevertheentity

isinterestedprimarilyinsourcesandusesofcash.

hasalimitednumber

offinancialstatementusers.

hasrelativelysimpleoperationsengagedinoneprimaryactivity.

doesnothavesignificantamountsofdebt,capitalassets,orotheritemsthatwouldberecognizedinac‐

cordancewiththeaccrualbasis.

Examplesofsomeentitiesthatmayusethecash‐basisofaccounting

includethefollowing:

Estates

Trusts

Civicventures

Studentactivityfunds

Politicalcampaignsandcommittees

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.7

Whenapplyingthecash‐basisofaccounting,becausetheonlyassetsoftheentitywouldbecashandcash

equivalentsandtherewouldbenoliabilities,abalancesheetequivalentisoftennotpresented.Theincome

statementequivalentwouldreportcashreceiptsanddisbursementsandotherchangesincashandcash

equiva‐

lentsanddiscloseanyrestrictionsonendingcashandcashequivalents.

Anydeparturefromthepresentationofcashandcashequivalentbalancesandchangesinsuchbalances,such

asthereportingoflong‐termdebtarisingfromcashtransactions,thecapitalizationanddepreciationofcapital

assetsacquiredwithcash,

orthereportingofinvestmentsorreceivablesandpayablesresultingfromcash

transactions,shouldbeconsideredamodificationtothecash‐basisofaccounting.Suchdeviationsrequireeval‐

uationregardingwhethertheyareappropriatemodificationsofthecash‐basisofaccounting.Appropriatemodi‐

ficationsofthecash‐basisofaccountingare

discussedinthesubsequentsection.

In‐SubstanceTwo‐StepTransactionsorEventsintheCash‐BasisofAccounting

Thepreparerofcash‐basisfinancialstatementsmayencountersingle‐steptransactionsoreventsthatmaynot

directlyinvolveacashinfloworoutflowbutmayneverthelessberecordedasanin‐substancetwo‐stepcash

transactionoreventwhenapplyingthecash‐basisofaccounting.Forexample,managementofan

entitymay

signanotefromabankinordertopurchaseequipment.Thebankmaythendirectlypaythevendorforthepur‐

chaseoftheequipment.Becausetherewasnocashtransaction,theentitymaynotrecordthesingle‐steptrans‐

actioninthefinancialstatements.However,so

asnottobemisleadingtousersofthefinancialstatements,the

preparermaychoosetorecordthetransactionasanin‐substancetwo‐steptransaction.Inaccordancewiththat

treatment,thejournalentriesmaylookasfollows:

CashXX,XXX

NoteProceeds(Revenue) XX,XXX

(Torecordnoteproceedsthatwere

paiddirectlytothevendor)

Capitalexpenditure XX,XXX

CashXX,XXX

(Torecordpurchaseofequipment)

Then,subsequentpaymentsonthenotewouldberecordedasfollows:

Debtserviceexpenditure XXX

CashXXX

(Torecordprincipalandinterestpaymentonnotepayable)

ModifiedCash‐BasisofAcc ounting

Themodifiedcash‐basisofaccountinginvolveslogicalandconsistentmodificationstotransactionsorevents

thatarederivedfromcashreceiptsorcashdisbursements.Forexample,amodi ficationtothecash‐basisofac‐

countingtoreportcapitalassetsshouldinvolverecordinganddepreciatingonlythosecapitalassetsthatresult

from

cashtransactionsorevents.Themodificationshouldnotinvolvetherecordinganddepreciatingofdonated

capitalassetsbecausethesetransactionsoreventsdonotinvolveaninfloworoutflowofcash.Oncedeprecia‐

blecapitalassetsarisingfromcashtransactionsoreventsarerecordedwhenapplyingamodifiedcash‐basis

of

accounting,suchassetsshouldalsobedepreciatedovertheirestimatedusefullives.Depreciatingcapitalassets

thatwereacquiredwithcashisalogicalallocationofthecash‐basisassets’costsovertheassets’usefullives.

8©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Aneasywaytolookatwhetheramodificationisappropriateistoconsiderwhetherthetransactionorevent

wouldhavebeenrecordediftheentitywaspreparingthecash‐ba sisfinancialstatements.Forexample,ifanen‐

titypurchasedacapitalassetandwaspreparingcash‐basisfinancia lstatements,the

journalentrywouldlook

likethis:

Capitalexpenditure XXXX

CashXXXX

(Torecordpurchaseofcapitalasset)

Becausecashispartofthejournalentry,itwouldbeanappropriatemodificationtocapitaliz e theassetandde‐

preciatethecostovertheestimateduseful lifeoftheasset.

Onthe

otherhand,therecordingoftradeaccountsreceivablearisingfromservicesprovidedorgoodssold

wouldnotbeanappropriatemodificationofthecash‐basisofaccountingassumingcashwasnotreceivedatthe

timetheserviceswereprovidedorgoodsweresold.

Modificationstothecash‐basisofaccounting

generallyresultwhencashreceiptsorcashdisbursementsprovide

abenefitoranobligationthatcoversmultiplereportingperiods.Forexample,apreparermayconcludethatfi‐

nancialstatementuserswouldbemisledifcashpurchasesofcapitalassetsarerecordedasdisbursementsor

expendituresintheperiodinwhichthe

assetsarepurchased.Instead,theprep arermayele cttomodifythe

cash‐basisofaccountingtorecordtheassetonthebalancesheetequivalentanddepreciateitovertheestimat‐

edusefullifeoftheasset,thereby,ineffect,spreadingthebenefitofthecashoutflowovermultiplereporting

periods

inamannerthathassubstantialsupportandislogicalandconsistent.

Questionsoftenariseintheapplicationofamodifiedcash‐basisofaccountingregardingwhetherreportedas‐

setsandliabilitiesderivedfromcashtransactionsoreventsshouldeverbewrittendownorwrittenoffonce

theyarerecordedat

theiroriginalcashvalue.Temporarychangesinthefairvalueofanassetorliabilityshould

notberecognizedinapplyingamodifi ed cash‐basisofaccountingandallrecognizedassetsandliabilities should

bemeasuredandreportedattheiroriginalcashvalue(netofanyaccumulateddepreciationoramortization,

if

applicable).Ifanassetorliabilityhasbeenpermanentlyimpairedandhasnofuturecashvalueorrepresentsno

futureobligationagainstcash,itwouldbeappropriatetowrite‐downorwrite‐offsuchamountsinmodified

cash‐basisfinancialstatements.

Asignificantchallengetopreparingfinancialstatementswhenapplying

amodifiedcash‐basisofaccounting is

developingtheappropriateaccountingpolicythatresultsinfinancialstatementsthatmeettheneedsofthe

primaryusersofthestatementsandconsistentlyapplyingthatpolicytocashtransactionsandeventsinorderto

keepthefinancialstatementsfrombeingmisleadingforthe

purposesforwhichtheyareintended.Thepreparer

mayfindbenefitinspellingoutthelogicbehindthecash‐basismodificationsanddocumentingtheaccounting

policypriortopreparationofthebasicfinancialstatements.

Althoughthereisnosingleacceptedmethodofapplyingamodifiedcash‐basis ofaccounting,modifiedcash

‐

basisfinancialstatementscanbemoremeaningfuliftheyarecomparablewithsimilarfinancialstatements.

Somepreparershaveinappropriatelyconsideredthemodifiedcash‐basisofaccountingasa“free‐for‐all”propo‐

sitioninwhichtheycanunilaterallyandarbitrarilychoosethemodificationsthattheywillapply.Forexample,a

preparermayinappropriatelydecidetopreparefina ncialstatementsapplyingamodifiedcas h‐basis ofaccount‐

ingthatrecordsassetsarisingfromcashtransactionsorevents,including investments,inventories,andcapital

assetsbutdoesnotrecordshort‐termandlong‐termliabilitiesandotherobligationsarisingfromcashtransac‐

tions.Inconsistentuses

ofamodifiedcash‐basisframeworkshouldbeavoidedingeneralusefinancialstate‐

mentsbecausesuchinconsistencieswillnormallyresultinfinancialstatementsthataremisleadingforgeneral

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.9

use.Financialstatementsthatarepreparedusinginconsistentmodificationsmaybeappropriateforspecialpur‐

posesinvolvinglimitedusersbutshouldbelabeledassuchwithcleardisclosureanduseofdescriptiveheadings.

Withtheneedsoftheprimaryfinancialstatementusersinmind,whenpreparingfinancialstatementsapplyinga

modified

cash‐basisofaccounting,thepreparershouldconsidermodifyingthefollowingcashtransactionsor

events,amongothers,bytherecordingofthefollowing:

Receivablesresultingfromanoutflowofcash,suchasacashadvancetoanemployee

Investmentsinmarketablesecuritiesacquiredwithcash

Inventoriesacquired

withcash

Capitalassetsarisingfromcashtransactionsanddepreciatingtheassetswhereappropriate

Deferredrevenueresultingfromcashreceipts

Liabilitiesresultingfromshort‐termcashborrowings

Long‐termnotesandotherdebtarisingfromcashtransactionsorevents

Anyothermaterialassets,liabilities,revenues,and

expensesresultingfromcashtransactionsorevents

Ifthefinancialstatementsarepreparedwhenapplyingamodifiedcash‐basisaccountingpolicyinwhichoneor

moreofthepreceding—butnotall—arerecorded,thepreparershouldbepreparedtodefendhowthedecision

tomodifyornotmodifyisalogical

andconsistentapplicationoftheaccountingpolicyanddoesnotresultin

misleadingfinancialstatementsforthepurposesfor whichtheyareintended.

Anumberoftransactionsoreventsarenotappropriatemodificationstothecash‐basisofaccounting.Generally,

thesetransactionsoreventsshouldnotberecordedwhenapplyinga

modifiedcash‐basisofaccountingbecause

theydonotinvolvecashinflowsoroutflows,areillogical,orarenotsubstantiallysupportedintheaccounting

literature.Commontransactionsoreventsthatshouldnotbereportedinfinancialstatementspreparedwhen

applyingamodifiedcash‐basisofaccounting includetherecordingor

adjustingofthefollowing:

Capitalassetsarisingfromcashtransactionsorevents,butnotrecordingdepreciationwhereappropri‐

ate

Donatedcapitalassetswherecashoutflowswerenotinvolved

Accountsreceivablefromservicesprovidedorgoodssoldandotheraccruedreceivables

Pledgesreceivableorotherreceivableswherecash

outflowswerenotinvolved

Investmentsforwhichcashoutflowswerenotinvolved

Accountspayableforgoodsorservicesreceivedwherenocashoutflowwasinvolved

Accruedincometaxes,accruedinterestexpense,otheraccruedliabilitieswherenocashoutflowwasin‐

volved

10©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Subsequentwriteupsorwritedownstofairvaluetorecognizeunrealizedgainsandlossesonmarketa‐

bleinvestments

Derivativeinstrumentswherecashinflowsoroutflowswerenotinvolvedaswellasthemarktomarket

forfairvaluechanges

Becausemodifiedcash‐basisframeworksdonotinvolvefinancial

statementelementsresultingfromaccruals

andnoncashtransactionsorevents,itisunlikelythatanacceptablemodifiedcash‐basisframeworkwouldever

bemateriallyequivalenttoGAAP.However,itisimportantforfinancialstatementpreparerstoavoidattempting

tomakecertainmodificationstoGAAPfinancialstatementsandthenref erringto

thosefinancialstatementsas

modifiedcash‐basisfinancialstatements.Forexample, financialstatementsthatarepresentedinconformity

withGAAP,exceptthatmaterialleasesarenotcapitalized,arenotconsideredmodifiedcash‐basisfinancial

statements.SuchfinancialstatementsareconsideredGAAPfi nancialstatementswithamaterialdeparturedue

tothefailure

tocapitalizematerialleases.Thepreparerwillneed tousejudgmentindeterminingifmodified

“cash‐basis”statementsaretantamounttofinancialstatementspurportedtobepreparedinaccordancewith

GAAPwithmaterialdeparturestherefrom.

Tax‐BasisofAccounting

Thetax‐basisisabasisofaccountingthattheentityusestofileitsfederalincometaxorfederalinformationre‐

turnfortheperiodcoveredbythefinancialstatements.

Thetax‐basisofaccountingisbasedontheprinciplesandrulesforaccountingfortransactionsunderthefederal

income

taxlawsandregulations.Fewnewmeasurementguidelinesneedtobeestablishedbecausethemethod

isbasedontaxlaws.Thetax‐basisofaccountingcoversarangeofalternativebases,fromcashtofullaccrual,

dependingonthenatureofthetaxpayer,andinsomecircumstances,thetaxpayer’selections.

Anentityneednotbeataxableentitytopreparetax‐basis financialstatements.Anyentitythatfilesareturn

withtheIRS,eitheranincometaxreturnoraninformationreturn,maypreparetax‐basisfinancialstatements.

Therefore,not‐for‐profitorganizations,Ccorporations,Scorporations,partnerships,limi tedliabilitypartner

‐

ships,limitedliabilitycompanies,andsoleproprietorsmayallusethetax‐basisofaccounting.

Thetax‐basisofaccountingismostusefulforsmall,nonpublicentitieswhosefinancialstatementusersarein‐

terestedprimarilyinthetaxaspectsoftheirrelationshipwiththeentity.Forexample,investorsintax‐

driven

partnerships,suchasthosecommonlyemployedintherealestateindustry,maybeprimarilyinterestedinthe

taxconsequencesoftransactions.However,theymaywantmoreinformationthanwouldbeprovidedbyatax

return.

De term iningWhethertoPrepareandIssueCash‐orTax‐BasisFinancialSta t ements

Aslongastheentityisnotcontractuallyorotherwiserequiredtoissuefinancialstatementspreparedinaccord‐

ancewithGAAPoraregulatoryorcontractualbasisofaccounting,theentitymayprepareandissuecash‐ortax‐

basisfinancialstatements.Understa ndingtheneedsofthefinancialstatementusersisan

importantstepinde‐

terminingwhethertoprep areandissuecash‐ortax‐basisfinancialstatements.Iftheusersofthefinancial

statementsunderstandthepresentatio n, andiftheinformationpresentedwhenapplyingthatbasisofaccount‐

ingisrelevanttotheirneeds,thenthepreparermaydeterminethatit

isusefulandappropriatetoprepareand

issuecash‐ortax‐basisfinancialstatements.Thefollowingarecharacteristicsofentitiesthatgenerallyaregood

candidatestopreparecash ‐ortax‐basisfinancialstatements:

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.11

a. Theentity’screditorsdonotneedorrequirefinancialstatementspreparedinaccordancewithGAAP.

b. ThecostofcomplyingwithGAAPwouldexceedthebenefits(forexample,asmallconstructioncontrac‐

torwhowouldberequiredtoaccountforlongtermcontractsusingthepercentageofcompletion

methodand

wouldberequiredtocomputedeferredtaxes).

c. Theownersarecloselyinvolvedintheday‐to‐dayoperationsofthebusinessandhaveafairlyaccurate

pictureoftheentity’sfinancialposition.

d. Theownersareprimarilyinterestedincashflows(forexample,aprofessionalcorporationofphysicians

that

distributesitscash‐basisearningsthroughsalaries, bonuses,andretirementplancontributions).

e. Theownersareprimarilyinterestedinthetaximplicationsoftransactions(forexample,partnersin a

partnershipwhoareconcernedabouttheeffectsoftransactionsontheirpersonaltaxreturns).

f. Itmaynotbeappropriatetoprepare

andissuecash‐ortax‐basisfinancialstatementsiftheentityisor

soonwillberequiredtoissueGAAP‐basisfinancial statements.Forexample,managementof acompany

thatisanticipatingsellingitsbusinessmayberequiredtoissuefinancialstatementspreparedinaccord‐

ancewithGAAP.

Additionally,financial

statementspreparedwhenapplyingthecash‐ortax‐basisofaccountingshouldnotbeis‐

suediftheresultsaremisleading.Cash‐andtax‐basisfinancialstatementsareintendedtobeacost‐effectiveal‐

ternativetoGAAP,notawaytodeliberatelymisleadfinancialstatementusers.

Example

SituationInWhichitMayNotBePrudenttoIssueTax‐BasisFinancialStatements

LongStreetPartnershastypicallyissuedtax‐basisfinancialstatements becausethepartnersaremore

interestedinthetaxtreatmentofpartnershiptransactions.Outsidecreditorshavealsoacceptedthe

tax‐basisfinancialstatementsassuitablefor

theirneeds.Duringthecurrentyear,twoeventsoccurthat

significantlyaffectthepartnership:Severallargecustomersexperiencefinancialdifficultyandthepart‐

nership’sreceivablesfromthecustomersareindangerofnotbeingcollected.Ifthefinancialstatements

werepreparedinaccordancewithGAAP ,thepartnershipwouldberequired

torecordavaluational‐

lowanceandrecognizeabaddebtexpense.Underthetaxrules,thepartnershipusesthedirectwrite‐off

method,soataxdeductionmaynotbeallowedinthecurrentyear.

Thepartnershiphasacknowledgedthatitisobligatedtoperformanenvironmentalremediationat

one

ofitssites.IfthefinancialstatementswerepreparedinaccordancewithGAAP,thepartnershipwould

berequiredtorecognizetheliabilityandaloss.Althoughtheentitymaydisclosetheinformationina

risksanduncertaintiesnote,underthetaxrules,thedeductionisnotalloweduntilthe

amountispaid

andthereforewouldnotbeincludedintheincomestatementequivalent.

Priortopreparingandissuingtax‐basisfinancialstatements,indeterminingwhethertheproposedfi‐

nancialreportingframeworkisappropriate,thepreparermayconsiderthefollowing:

— Whetherthetax‐basisfinancialstatementscontinuetobe

suitablefortheusers’needs.Inthe

example,theentityhadalonghistoryofissuingtax‐basisfinancialstatements,whichweresuit‐

12©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

ablefortheneedsoftheusers.Theeventsinthecurrentyearmerelyillustratethelimitationsof

tax‐basisfinancialstatements.

— Appropriatenessofdisclosure.Thepreparermaydeterminetoexpandonthei nformationin‐

cludedinthenotestothefinancialstatementsaboutthesetwoevents.Forexample,the

part‐

nershipmightdisclosethenatureoftheenvironmentalremediationliabilityandtheamounts

involved.

— Recognitionmaybeappropriate.Depending onthenatureandmagnitudeoftheitem,itmaybe

appropriatetorecognizeitinthefinancialstatements.Inthisexample,thepartnershipmight

decidetoaccountfor

baddebtsusingtheallowancemethodandtorecognizeacontingentlia‐

bilityfortheremediationobligation.Thiswouldbeadeparturefromthetax‐basisofaccounting

andthemanagementoftheentitymay determinethat,inthecir cumstances,itmaybemore

appropriatetoprepareitsfinancialstatementsin

accordancewithGAAP.

— ConsiderGAAPfinancials.Asaresultofthechangedcircumstances,financialstatementspre‐

paredwhenapplyingthecash‐ortax‐basisofaccountingmaynolongerbeappropriate,andthe

managementoftheentitymaydecidetoprepareitsfinancialstatementsinaccordancewith

GAAP.

DecidingBetweenModifiedCash‐orA ccrualTax‐BasisFinancialSta t emen ts

Insomesituationsitmaybedifficulttodeterminewhethertoissuemodifiedcash‐oraccrualtax‐basisfinancial

statements.Eachbasishasitsowndistinctadvantagesanddisadvantages.

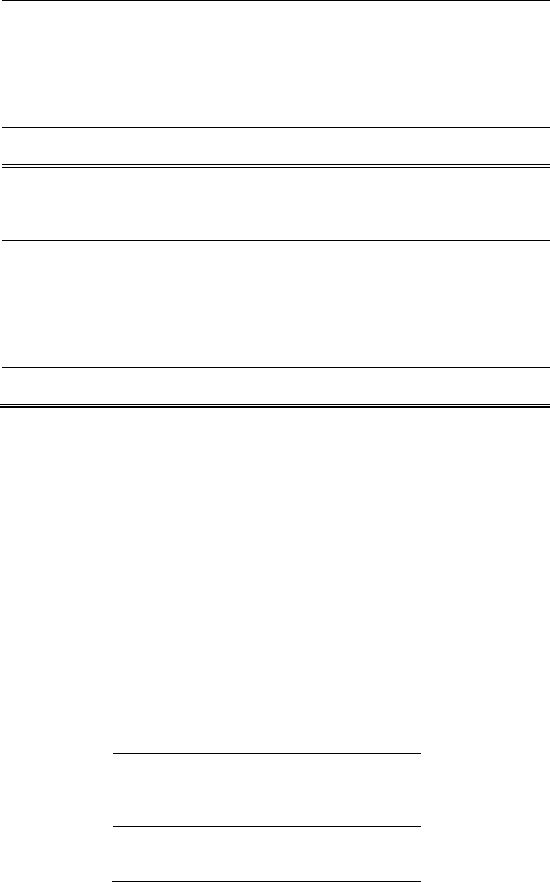

ModifiedCash‐orAccrualTax‐Basis

AdvantagesandDisadvantagesofEach

Advantages Disadvantages

ModifiedCash‐Basis

Canbesimplertopreparethantax‐

basis

Notaffectedbychangesintaxlaws

Interimfinancialstatementsareeasy

toprepare

Recognitionandmeasurementprin‐

ciplesarenotwell‐defined

Notwell‐suitedforentitiesthathave

inventoryorcomplexoperations

Accrual

Tax‐Basis

Better‐suitedforentitieswithinven‐

toryorcomplexoperations

Well‐definedrecognitionandmeas‐

urementcriteria

Decisionsmadefortaxreporting

purposesmayhaveunintendedfi‐

nancialreportingeffects

Accountingtreatmentsareaffected

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.13

Advantages Disadvantages

bychangesintaxlaws

14©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Chapter2

RecognitionandMeasurementIssuesinFinancialStatementsPreparedWhen

ApplyingtheCash‐orTax‐BasisofAccounting

Thedeterminationofwhatinformationshouldbereportedinthefinancialstatements andwhentorecognize

transactionsorevents(recognition),andhowtorecordtransactionsoreventsandatwhatamounts(measure‐

ment)variesdependingonthetypeofframeworkusedtopreparethefinancialstatements.Thischapterin‐

cludesa

discussionofrecognitionandmeasurementissuesforcash‐,modifiedcash‐,andtax‐basisfinancial

statements.

Cash‐BasisandModifiedCash‐Basis

ObservationsandSuggestions

InaccordancewiththemasterglossaryincludedintheFASBAccountingStandardsCodification

®

,cashequiva‐

lentsareshort‐term,highlyliquidinvestmentsthathavebothofthefollowingcharacteristics:

a. Readilyconvertibletoknownamountsofcash

b. Soneartheirmaturitythattheypresentinsignificantrisksofchangesinvaluebecauseofchangesinin‐

terestrates

Generally,onlyinvestmentswithoriginalmaturitiesofthreemonthsorlessqualifyunderthatdefinition.Origi‐

nalmaturitymeansoriginalmaturitytotheentityholdingtheinvestment.Forexample,bothathree‐monthU.S.

Treasurybillandathree‐yearU.S.Treasurynotepurchasedthreemonthsfrommaturityqualifyascashequiva‐

lents.However,aTreasurynotepurchasedthreeyearsagodoesnotbecomeacashequivalentwhenitsremain‐

ingmaturityisthreemonths.ExamplesofitemscommonlyconsideredtobecashequivalentsareTreasurybills,

commercialpaper,moneymarketfunds,andfederalfundssold(foranentitywithbankingoperations).

Thefollowingrepresentscertainsignificantmeasurementandrecognitionissueswithrespecttothecash‐and

modified‐cashbasesofaccounting.

Investments

Inaccordancewiththecash‐basisofaccounting,entitieswouldreflectpurchasesofinvestmentsascashdis‐

bursementsandsalesofinvestmentsascashreceiptsintheperiodthatthecashisdisbursedorreceived.In‐

vestmentsacquiredvianoncashtransactionsshouldnotberecordedandunrealizedgainsandlossesshould

not

berecognized.

Acommonmodificationtothecash‐basisofaccountingistorecordinvestmentsinmarketablesecuritiesasas‐

sets.Iftheentityprepareditsfinancialstatementsinaccordancewithaccountingprinciplesgenerallyaccepted

intheUnitedStatesofAm erica (GAAP),theinvestments wouldbereflectedinthe

balancesheet.Assuch,the

investmentswouldbeinitially recordedatcostandsubsequentunrealizedchangesinvaluewouldberecorded

toreflectthefairvalueoftheinvestments.Becauseunrealizedgainsandlossesarenottheresultofacash

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.15

transactionorevent,suchunrealizedgainsandlossesshouldnotberecordedinfinancialstatementswhenap‐

plyingamodifiedcash‐basisofaccounting.Instead,theinvestmentswouldremainonthebalancesheetequiva‐

lentatcostunlessanduntiltheybecomeworthlessoraresold.

Receivables

Receivablesshouldnotberecognizedinfinancialstatementspreparedwhenapplyingthecashbasisofaccount‐

ingunlessthereceivablesresultfromanoutflowofcash.Otherreceivablessuchasthosearisingfromsales

transactionsmadeoncreditshouldnotberecorded.

PropertyandEquipment

Underthecash‐basisofaccounting,purchasesofpropertyandequipmentwouldbereflectedinthefinancial

statementsascashdisbursementsintheperiodthetransactionoccurred.Theassetswouldnotbecapitalized

anddepreciationwouldnotberecorded.

Acommonmodificationtothecash‐basisofaccountingistorecord

propertyandequipmentarisingfromcash

transactionsasassets.Oncethemodificationismade,theentityshouldadoptandconsistentlyapplyanalloca‐

tionpolicy(depreciationoramortization)thathassubstantialsupportintheaccountinglitera tureandislogical.

Suchpolicyshouldalsoincluderecordinganyfinancingarrangementsthatare

partofacashtransaction.Aspart

ofthispolicy,managementoftheentityshouldconsiderhowitwouldaddresssingle‐steptransactionsorevents

thatmaynotdirectlyinvolveacashinfloworoutflowbutmayneverthelessberecordedasanin‐substancetwo‐

stepcashtransactionorevent.See

chapter1,“OverviewofCash‐andTax‐BasisFinancialStatements,”fordis‐

cussionofin‐substancetwo‐steptransactions.

Donatedassetsshouldnotberecognizedas“assets”becausetheyarenotderivedfromtheuseofcashorcash

equivalents.

Itwouldbeappropriatetowriteoffany remainingcarrying

valueofpropertyandequipmentoncetheassetsare

nolongerinuseorhavebeenpermanentlyimpaired.

BankOverdrafts

Bankoverdraftsmaybenettedwithothercashbalancesfromthesamebank.Bankoverdraftsshouldnotbe

nettedagainstfundsheldatanotherfinancialinstitution.Iftheentityhasanoverallnegativecashbalancefrom

afinancialinstitution,whenapplyingthecash‐basisofaccounting,thenegativecashbalancewould

beshownas

aliabilityonthebalancesheetequivalent,ifoneis presented.Forexample,ifthenetbalanceinBankAis

$(1,000)andthenetbalanceinBankBis$5,000,thebalancesheetequivalentwouldshowacashassetof

$5,000andthe$(1,000)overdraftas

aliability.Iftheentityhasanoverallglobalnegativecashbalance,theneg‐

ativecashbalancewouldbeshownasnegativecashonhandattheendoftheperiodonthestatementofcash

receiptsanddisbursements.

Borrowings

Whenapplyingthecash‐basisofaccounting,theentityshouldrecordallproceedsfromborrowingsascashre‐

ceiptswhenreceivedandthenreflecttheprincipalrepaidandassociatedinterestascashdisbursementswhen

paid.Ifaloanprovidesdirectfinancingofanasset,neithertheloannortheassetshould

berecorded.However,

16©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

theprincipalandinterestpaymentswouldbereflectedascashdisbursementswhenpaid.Seechapter1fordis‐

cussionofin‐substancetwo‐steptransactions.

Tax‐Basis

Intax‐basisfinancialstatements,transactionsarerecognized andmeasuredinthesamemannerastheyarein

theentity’sfederaltaxreturn.Therefore,theprepareroffinancial statementswhenapplyingthetax‐basisofac‐

countingisrequiredtounderstandthefederaltaxlawsapplicabletotheparticularentity.Although

thischapter

highlightscertaincommonmeasurementandrecognitionissueswithrespecttothetax‐basisofaccounting,itis

notasubstituteforunderstandingthefederaltaxlawsapplicabletotheparticularentity.

Additionally,althoughtheIRSpermitsallentitiestousetheaccrualme thodofa ccountingfortaxpurposes,

manysmallerentitiescaninsteadelecttousethecashmethodofaccountingfortaxpurposes.Entitieswithin‐

ventoriesarerequiredtousetheaccrualmethodforsalesandpur chasesofinventory.

NontaxableRevenuesandNondeductibleExpenses

Underfederalincometaxlaws,certainrevenueisnottaxableandcertainexpensesarenotdeductible.Forex‐

ample,receiptssuchasinterestonobligationsofstateandlocalgovernmentsandproceedsfromlifeinsurance

policiesarenottaxable.Costssuchaspremiumspaidonofficers’lifeinsurancepolicies arenot

deductible.

Whenpresentingtax‐basisfinancialstatements,inordertobetransparent,preparersoftax‐basisfinancial

statementsmayrecognizenontaxablerevenuesandnondeductibleexpensesoutsideoftaxableincome.

Nontaxablerevenuesshouldberecognizedwhenreceived(cash‐basis)orwhenearned(accrualbasis).Nonde‐

ductibleexpensesshouldbereportedand

chargedtoexpenseintheperiodpaid(cash‐basis)orwhenincurred

(accrualbasis).

AdditionalIncomeTaxesforPriorYears

AnIRSexammayresultinadditionalincometaxesbeingassessedforprioryears.Twoalternativemethodsmay

beusedtoaccountforadditionaltaxesforprioryears.

Theamountmaybechargedtoexpenseinthecurrentperiodiftherearenocorrespondingadjustments

tothebalancesheetequivalent

forexpensescapitalizedorrevenuerecognized.

Theamountmaybetreatedasapriorperiodadjustment and chargedtoretainedearningsinamanner

thatislogicalandconsistentwiththee quivalentofapresentationinaccordancewithGAAP.

TheIRSmaydisallowamountschargedtoexpenseinprior

yearsandrequirethoseamountstobecapitalized

andamortizedormayrequirerecognitionofpreviouslyunreportedrevenue.Sucha mounts,netofincometax

adjustments,shouldbetreatedaspriorperiodadjustments.Otherwise,eitheroftheprecedingmethodsiscon‐

sideredacceptable.Themethodusedandtheamountofadditionaltaxes

shouldbedisclosedinthenotestothe

financialstatements.

AccountingChangesforTaxPurposes

Fortaxpurposes,theeffectsofanaccountingchangemayberecognizedprospectivelyoveraspecifiednumber

ofyears.Accountingchangesshouldbetreatedinthesamemannerastheyaretreatedinthetaxreturn.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.17

SCorporations

IncomeofanScorporationistaxabletoitsshareholders.Consequently,suchacorporationmayberequiredto

maintaininformationondistinctclassesofretainedearnings.However,intax‐basisfinancialstatements,Scor‐

porationsusuallyreportretainedearningsasasingleamountandshouldreportdistributionstostockholders.

SignificantDifferencesBetweenGAAPandTax‐Basis

TherearemanydifferencesbetweenthewayitemsareaccountedforinaccordancewithGAAPandtheway

theyaretreatedunderthetaxrules.Someofthemorecommonincludethefollowing:

Baddebtlossesonuncollectiblereceivables

Inventorycapitalizationandvaluation

Unrealizedgainsoninvestmentsecurities

Depreciationandimpairmentofcapitalassets

Fairvaluemeasurements

Consolidation

18©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Chapter3

PresentationandDisclosureIssuesinFinancialStatementsPreparedWhenAp‐

plyingtheCash‐orTax‐BasisofAccounting

Thedeterminationoftheformandcontentofthefinancialstatementsorwhichfinancialstatementstopresent

andwhattoinclude(presentationanddisclosure)variesdependingonthefinancialreportingframeworkap‐

plied.

Financialstatementspreparedwhenapplyingthecash‐ortax‐basisofaccountingmayprovidelesscomplexand

more

understandablealternativestofinancialstatementspreparedinaccordancewithaccountingprinciples

generallyacceptedintheUnitedStatesofAmerica(GAAP).However,preparersmustbeknowledgeableofGAAP

disclosurerequirementsbecausecash‐andtax‐basisfinancial statementsshouldincludeinformativedisclosures

similartothoserequiredbyGAAPifthefinancialstatements

containitemsthatarethesameas,orsimilarto,

thoseinfinancialstatementspreparedinaccordancewithGAAP.

ObservationsandSuggestions

Often,preparersofcash‐andtax‐basisfinancialstatementselecttoomitsubstantiallyalldisclosuresrequiredby

thecash‐ortax‐basisofaccounting.Theomissionofdisclosuresisadeparturefromthecash‐ortax‐basisofac‐

countingand,ifsuchdisclosureswereincludedinthefinancialstatements,theymightinfluencetheuser’scon‐

clusionsabouttheentity’sfinancialposition,resultsofoperations,andcashflows.However,theomissionmay

notnecessarilyresultinmisleadingfinancialstatementsprovidedthattheintendedusersareinformedabout

suchmatters.

Ifcash‐ortax‐basisfinancialstatementscontainitemsforwhichGAAPwouldrequiredisclosure,thefinancial

statementsmayeitherprovidetherelevantdisclosurethatwouldberequiredforthoseitemsinaGAAPpresen‐

tationorprovideinformationthatcommunicatesthesubstanceofthatdisclosure.Thismayresultinsubstitut

‐

ingqualitativeinformationforsomeofthequantitativeinformationrequiredfo rGAAPpresentations.Forexam‐

ple,

disclosureoftherepaymenttermsofsignificantlong‐termborrowingsmaysufficientlycommunicatein‐

formationaboutfutureprincipalreductionwithoutprovidingthesummaryofprincipalreductionduring

eachofthenextfiveyears.

informationabouttheeffectsofaccountingchanges,discontinuedoperations, andextraordinaryitems

couldbedisclosedinanotetothefinancialstatementswithoutfollowingtheGAAPpresenta tionre‐

quirementsintheincomestatementequivalentordisclosingnet‐of‐taxeffects.

insteadofshowingexpensesbytheirfunctionalclassificationswith

respecttothefinancialstatements

ofanot‐for‐profitorganization,astatementofactivitiescouldpresentexpensesaccordingtotheirnatu‐

ralclassifications,andanotetothefina ncialstatementscoulduseestimatedpercentagestocommuni‐

cateinformationaboutexpensesincurredbythemajorprogramandsupportingservices.

insteadofshowingtheamountsof,andchangesin,theunrestrictedandtemporarilyandpermanently

restrictedclassesofnetassetswithrespecttothefinancialstatementsofanot‐for‐profitorganization,a

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.19

statementofassets,liabilities,andnetassetscouldreporttotalnetassetsorfundbalances,arelated

statementofactivitiescouldreportchangesinthosetotals,andanotetothefinancialstatementscould

provideinformation,usingestimatedoractualamountsorpercentages,abouttherestrictionsonthose

amountsandon

anydeferredrestrictedamounts,describethemajorrestrictions,andprovideinfor‐

mationaboutsignificantchangesinrestrictedamounts.

Forfinancialstatementspreparedwhenapplyingthecash‐ortax‐basisofaccounting,GAAPdisclosurerequire‐

mentsthatarenotrelevanttothemeasurementoftheitemneednotbeconsidered.To

illustrate,

fairvaluedisclosuresforinvestmentsindebtandequitysecuritieswouldnotberelevantwhenthebasis

ofpresentationdoesnotadjustthecostofsuchsecuritiestotheirfairvalue.

disclosuresrelatedtoactuarialcalculationsforcontributionstodefinedbenefitplanswouldnotberele‐

vantin

financialstatementspreparedwhenapplyingthecash‐ortax‐basisofaccounting.

disclosuresrelatedtotheuseofestimateswouldnotberelevantinapresentationthathasnoesti‐

mates,suchasthecash‐ormodifiedcash‐basisofaccounting.

Financialstatementspreparedwhenapplyingthecash‐basis

ofaccountinggenerallydonotincludeastatement

ofcashflows.However,dependingontheuser’srequirements,financialstatementspreparedwhenapplyinga

modifiedcash‐orthetax‐basisofaccountingmayincludeastatementofcashflows.Forexample,itmaybe

challengingforuserstoobtainaccurateinformationon

operating,investing,andfinancingactivitiesinsingle‐

yearfinancialstatementspreparedwhenapplyingthetax‐basisofaccounting unlessastatementofcashflowsis

presented.

SimilartofinancialstatementspreparedinaccordancewithGAAP,inordertoachievefairpresentation,financial

statementspreparedwhenapplyingthecash‐ortax‐

basisofaccountingshouldincludeallinformativedisclo‐

suresthatareappropriatefortheapplicablefinancialreportingframework,includingallsignificantmattersthat

materiallyaffectthefinancialstatements’use,understanding,andinterpretation.

Additionally,becausefinancialstatementspreparedwhenapplyingthecash‐ortax‐basisofaccountinghave

certaininherentpresentationand

disclosurelimitations,inordertoenhancethevalueandusefulnessofsuchfi‐

nancialstatements,thepreparermaydiscloseadditionalinformationinthenotestothefinancialstatements.

Forexample,donatedcapitalassetswouldnotbeincluded inthebalancesheetequivalentinfinancialstate‐

mentspreparedwhenapplyinga

modifiedcash‐basisofaccounting—evenifthemodificationtothecash‐basis

ofaccountingistorecordcapitalexpendituresasassetsanddepreciatethemovertheirestimatedusefullives.

Thepreparermayelecttodisclosethevalueofsuchdonatedcapitalassetsinthenotestothefinancialstate‐

ments.

Pr esen t a tion— Cash‐BasisFinancialStat ements

Becauseabalancesheetequivalentwouldsimplyshowthecashbalance andacorrespondingequityaccount,

andastatementofcashflowswouldberepetitiveofthestatementofcashreceiptsanddisbursements,finan‐

cialstatementspreparedwhenapplyingthecash‐basisofaccountingmayconsistonlyofastatementof

cashre‐

ceiptsanddisbursements.Althoughasinglestatementmaybepresented,info rmativedisclosures arestillnec‐

essary.Additionally,restrictionsoncashbalancesshouldeitherbepresentedonthefaceofthestatementof

cashreceiptsanddisbursementsorshouldbedisclosedinthenotestothefinancialstatements.

20©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

BasisofAcc oun ting

Arequireddisclosureforallcash‐andtax‐basisfinancialstatementsisthedescriptionofthebasisofaccounting

(financialreportingframework),includinghowthatbasisofaccountingdiffersfromGAAP.Althoughthesedif‐

ferencesfromGAAPshouldbequalitativelydescribed,theyneednotbequantified.Thisdescription isimportant

in

financialstatementspreparedwhenapplyingamodifiedcash‐basisofaccountingbecausesuchfinancial

statementsmayvarydependingonthemodificationstothecash‐basisthatweremade.Thedescriptionthere‐

forebecomesessentialtotheuser’sunderstandingofthefinancialstatements.

Thedescriptionofthebasisofaccountingis

usuallypresentedinthesummary ofsignifi cantaccountingpolicies

sectionofthenotestothefinancialstatementswithaheadingsuchas“BasisofAccounting.”Thefollowingex‐

amplesrepresenthowthebasisofaccountingmaybedisclosedinthenotestofinancialstatementsprepared

whenapplyingthecash‐,a

modifiedcash‐,andthetax‐basisofaccounting.

Example:BasisofAccountingNote—Cash‐BasisofAccounting

BasisofAccounting

ThefinancialstatementsofCompanyXhavebeenpreparedonthecash‐basisofaccounting,whichisacompre‐

hensivebasisofaccountingotherthanaccountingprinciplesgenerallyacceptedintheUnitedStatesofAmerica

(GAAP).Thecash‐basisofaccountingdiffersfromGAAPprimarilybecauserevenuesarerecognizedwhenre

‐

ceivedratherthanwhenearnedandexpensesarerecordedwhenpaidratherthanwhenincurred.Thefinancial

statementsthereforepresentonlycashandcashequivalentsandchangesthereinintheformofcashreceipts

anddisbursements.

Example:BasisofAccountingNote—ModifiedCash‐BasisofAccounting

BasisofAccounting

ThefinancialstatementsofCompanyXhavebeenpreparedonthecash‐basisofaccounting,modifiedtorecord

assetsorliabilitieswithrespecttocashtransactionsandeventsthatprovideabenefitorresultinanobligation

thatcoversaperiodgreaterthantheperiodinwhichthecashtransactionor

eventoccurred.Themodifications

resultintherecordingofinvestments,inventories,capitalassets,andrelatedshort‐termandlong‐termobliga‐

tionsonthestatementoffinancialposition.Thismethodofaccountingrepresentsacomprehensivebasisofac‐

countingotherthanaccountingprinciplesgenerallyacceptedintheUnitedStatesof

America(GAAP).Thisbasis

ofaccountingdiffersfromGAAPprimarilybecausecertainrevenueandrelatedassets(suchasaccountsreceiva‐

bleandrevenueforbilledorprovidedservicesnotyetcollected,andotheraccruedrevenueandreceivables)

havebeenrecognizedwhenreceivedratherthanwhenearnedandcertainexpensesandrelated

liabilities(such

asaccountspayableandexpensesforgoodsorservicesreceivedbutnotyetpaid,andotheraccruedliabilities

andexpenses)havebeenrecognizedwhenpaidratherthanwhentheobligationswereincurred.

Example:BasisofAccountingNote—Tax‐BasisofAccounting

BasisofAccounting

ThefinancialstatementsofCompanyXhavebeenpreparedontheaccrualbasisofaccountingthattheCompany

usesforfilingitsfederalincometaxreturn,whichisacomprehensivebasisofaccountingotherthanaccounting

principlesgenerallyacceptedintheUnitedStatesofAmerica(GAAP).ThisbasisdiffersfromGAAP

primarilybe‐

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.21

causetheCompanyexpensesthecostofcertaintypesofassetsinaccordancewithIRCSection179.GAAPre‐

quiresthatsuchassetsbecapitalizedandexpensedovertheirestimatedusefullives.

SummaryofSignificantAcc ountingPolicies

FASBAccountingStandardsCodification(ASC)235,NotestoFinancialStatements,requiresthatfinancialstate‐

mentspreparedinaccordancewithGAAPincludeasummaryofsignificantaccountingpoliciesinthenotesto

thefinancialstatements.Accordingly,cash‐andtax‐basisfinancialstatementsshouldincludeasummaryofsig‐

nificantaccountingpolicies

inthenotestothefinancialstatements.

Inadditiontothebasisofaccountingdiscussedpreviously,thenoteshouldincludedisclosureofthesignificant

accountingpoliciesusedtopreparethefinancialstatements,includingpoliciesthatinvolvethefollowing:

Aselectionfromexistingacceptablealternatives

Industryspecificapplications

Unusual

orinnovativeapplicationsofaccountingprinciples

Becausethecash‐basisofaccountingdoesnotincludetherecognitionofnoncashassets,liabilities,andnoncash

transactions,elaborateaccountingpolicydisclosuresareusuallyunnecessary.Infinancialstatementsprepared

whenapplyingamodifiedcash‐basisofaccounting,suchdisclosuresmayincludeinformationaboutthe

follow‐

ing:

Investments

Inventory

Propertyandequipment

Incometaxes

Consolidation

Relatedpartiesandrelatedpartytransactions

Commitmentsandcontingencies

Uncertainties

Subsequentevents

Assetimpairments

Thesignificantaccountingpoliciesnotefortax‐basisfinancialstatementsshouldincludedisclosureofthefollow‐

ing:

Whetherthebasicmethodofaccountingiscashoraccrual

22©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Thetaxfilingstatusoftheentity,ifotherthanataxablecorporation(thatis,aCcorporation)

Thatrevenuesandrelatedassetsandexpensesandrelatedobligationsarerecognizedonlywhenthey

arereportedordeductedforfederalincometaxpurposes

Thatnontaxableincomeandnondeductibleexpenses

areincludedinthedeterminationoftheequiva‐

lentofoperatingresultsor“netincome”

Thenatureofanyoptionaltaxmethodsofaccountingfollowed

Thenatureofanyimportantjudgmentsorpolicies necessaryforanunderstandingof themethodsof

recognizingrevenueandallocatingcoststocurrent

andfutureperiods

Taxuncertaintiesincludingopentaxyears

Also,taxuncertaintiesshouldbeaddressedinfinancialstatementspreparedwhenapplyingthecash‐ortax‐

basisofaccounting.FASBASC740‐10‐50‐15requiresthatopentaxyearsbedis closed—evenifthereportingen‐

tityisapass‐through

entityoranot‐for‐profitorganization.

Inaddition,infinancialstatementspreparedwhenapplyingthetax‐basisofaccounting,disclosuresregarding

significantaccountingpoliciesmay includeinformationaboutreceivables.

Thefollowingrepresentsguidanceoncertainothercommonpresentationanddisclosureissueswithrespectto

cash‐andtax‐basisfinancial

statements.

SubsequentEvents

FASBASC855,SubsequentEvents,setsforthgeneralstandardsofaccountingforanddisclosureofeventsthat

occurafterthebalancesheetdatebutbeforethefinancialstatementsareissuedorareavailabletobeissued.

Thepreparershoulddisclosethedatethroughwhichsubsequentevents have beenevaluated,which

isthedate

thefinancialstatementsareavailabletobeissued.Whenfinancialstatementspreparedwhenapplyingthecash‐

ortax‐basisofaccountingcontainitemsthatarethesameas,orsimilarto,thoseinfinancialstatementspre‐

paredinaccordancewithGAAP,suchfinancialstatementsshouldcontainthedisclosures

requiredbyFASBASC

855.

RelatedPartyTransactions

Theexistenceofrelatedparty transactionsthatarematerialindividuallyorintheaggregateandthenatureand

amountsofthetransactionsandbalancesshouldbedisclosed.Notethatthetaxrules maydefine“relatedpar‐

ty”differentlythanhowitisdefinedinaccordancewithGAAP.Toavoidconfusionon

thepartofusersofthe

tax‐basisfinancialstatements,theGAAPdefinitionofrelatedpartyshouldbeconsideredforallfinancialreport‐

ingpurposes.

CommitmentsandContingencies

Theexistenceandnatureofmaterialcommitmentsandcontingenciesshouldbedisclosedinthenotestofinan‐

cialstatementspreparedwhenapplyingthecash‐ortax‐basisofaccounting.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.23

PensionPlans

Theexistenceandnatureofapensionplanshouldbedisclosedinthenotestofinancialstatements whenapply‐

ingthecash‐ortax‐basisofaccounting.

AssetsandLiabilities

Informationdisclosedforassetsandliabilitiescommonlyincludesthefollowingitems:

Restrictedcash,segregatedfromcashavailableforcurrentoperations,withadescriptionofthenature

oftherestriction

Theaggregatefairvalueofinvestmentsinmarketablesecurities

Accountsandnotesreceiv ablefromofficers,employees,andaffiliates,presented

separatelywithdisclo‐

sureoftheeffectiveinterestrateonnotesreceivable,andinterestincomefortheperiod

Themajorclassesofproperty,plant,andequipment;depreciationexpensefortheperiod;themeth‐

od(s)usedincomputingdepreciation;andtheaggregate,accumulateddepreciation

Themethodofdetermininginventory

cost(forexample,lastin,firstoutandfirstin,firstout)

Owners’Equity

Thefinancialstatementsoftenincludedisclosuresregardinginformationonowners’equityasfollows:

Foreachclassofstock,thenumberofsharesauthor ized,issued,andoutstanding;theparorstatedval‐

ue;and,insummaryform,thepertinentrightsandprivilegesofeachoutstandingclass(ifmorethanone

class

isoutstanding)

Theexistenceofstockoptionandstockpurchaseplans

Restrictionsonthepaymentofdividends

Changesfortheperiodintheseparatecomponentsofowners’equity

Anotetothefinancialstatementsofavo luntary healthandwelfareorganizationthatpreparestax‐basisfinan‐

cial

statementscouldprovideinformation,usingestimatedoractualamountsorpercentages,aboutthere‐

strictionsontotalnetassetsorfundbalancesandonanydeferredrestrictedamounts,describethemajorre‐

strictions,andprovideinformationaboutsignificantchangesinrestrictedamounts.

RisksandUncertainties

FinancialstatementspreparedinaccordancewithGAAParerequiredtoincludeanumberofdisclosureswithre‐

specttorisksanduncertainties.

ThefollowingtablesummarizesthesedisclosuresandhowGAAPrequirementsfordisclosingrisksanduncer‐

taintiesshouldbeaddressedincash‐andtax‐basisfinancialstatements.Thetableis

notmeanttobeall‐

inclusive.

24©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

ObservationsandSuggestions

Often,preparersofcash‐andtax‐basisfinancialstatementselecttoomitsubstantiallyalldisclosuresrequiredby

thecash‐ortax‐basisofaccounting.Theomissionofdisclosuresisadeparturefromthecash‐ortax‐basisofac‐

countingand,ifsuchdisclosureswereincludedinthefinancialstatements,theymightinfluencetheuser’scon‐

clusionsabouttheentity’sfinancialposition,resultsofoperations,andcashflows.However,theomissionmay

notnecessarilyresultinmisleadingfinancialstatementsprovidedthattheintendedusersareinformedabout

suchmatters.

GAAPRequirement SummaryofRequiredDisclosures

ApplicabilitytoCash‐orTax‐

BasisofAccounting

NatureofOperations Entitiesshoulddiscloseade‐

scriptionofthemajorproducts

orservicesthereportingentity

sellsorprovidesanditsprincipal

markets.Thisinformationisuse‐

fulbecauseithelpsfinancial

statementusersunderstandthe

natureoftheentity’sbusiness

andtheriskscommontothat

business.

This

disclosureisrelevanttoall

financialstatementspreparedin

accordancewiththecash‐ortax‐

basisofaccountingandshould

bemade.

UseofEstimates Financialstatementsshouldin‐

cludeanexplanationthatthe

preparationoffinancialstate‐

mentsinaccordancewithGAAP

requirestheuseofmanage‐

ment’sestimates.

Thisdisclosuremaynotberele‐

vanttosomefinancialstate‐

mentspreparedinaccordance

withthecash‐ortax‐basisof

accounting;

forexample,finan‐

cialstatementspreparedonthe

cash‐basisthatdonotinclude

estimatedamounts.

CertainSignificantEstimates Ifcertaincriteriaaremet,the

entityisrequiredtodisclosethe

natureofanuncertaintyifitisat

leastreasonablypossiblethata

changeinanestimatewilloccur

inthenearterm.Thepurposeof

thedisclosureistocommunicate

tofinancialstatementusersthat

thereisareasonablepossibility

thatcertainestimatedamounts

inthecurrentyearfinancial

statementswillchangesignifi‐

cantlyandaffectthesubsequent

years’financialstatements.

IftheGAAPdisclosurecriteria

aremet,thefinancialstatements

shouldincludedisclosureofthe

informationrequiredbyGAAP.

VulnerabilityDuetoConcentra‐ Ifcertaincriteriaaremet,the IftheGAAPdisclosurecriteria

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.25

GAAPRequirement SummaryofRequiredDisclosures

ApplicabilitytoCash‐orTax‐

BasisofAccounting

tions financialstatementsarere‐

quiredtoincludedisclosurein‐

formationaboutitsvulnerability

duetoconcentrations;forex‐

ample,significantvolumeof

businessconductedwithone

customer.

aremet,thepreparershould

disclosetheinformationre‐

quiredbyGAAP.

GoingConcern Abasicpremiseunderlyingfi‐

nancialreportingisthatauserof

thefinancialstatementscanas‐

sumethattheentitywillcontin‐

ueasagoingconcernforarea‐

sonableperiodoftime.Ifthe

preparerconcludesthatmaterial

uncertaintiesexistsuchthatthe

entitymaynot

continueasago‐

ingconcernforareasonablepe‐

riodoftime,thefinancialstate‐

mentsshouldincludedisclosure

ofsuchuncertainty.

Ifthepreparerconcludesthat

thereissubstantialdoubtabout

theentity’sabilitytocontinueas

agoingconcernforareasonable

periodoftime(generallyone

yearfromthedateofthebal‐

ancesheetequivalent),thepre‐

parershoulddisclosethegoing

concernconsiderationsinanote

tothefinancialstatements.

TerminologyforCash‐andTax‐BasisFinancialSt a t emen ts

Thereisnorequirementtomodifyfinancialstatementtitlesincash‐ortax‐basisfinancialstatements.However,

usersofsuchfinancialstatementsshouldbeable toreadilyidentifythebasisofaccountingusedtopreparethe

financialstatements.Acommonandconvenien tway ofidentifyingthebasisofaccountingisthrough

thefinan‐

cialstatementtitlesbyadding“cash‐basis,”“modifiedcash‐basis,”or“tax‐basis”afterthefinancialstatementti‐

tle.

Cash‐basisfinancialstatementsmightbetitled,forexample,

StatementofAssetsandLiabilitiesArisingfromCashTransactions;

StatementofRevenueCollecte dandExpensesPaid;

Statement

ofRevenueandExpenses—Cash‐Basis;or

StatementofCashReceiptsandDisbursemen ts.

Modifiedcash‐basisfinancialstatementsmightbetitled,forexample,

StatementofAssetsandNetAssets—ModifiedCash‐Basis;or

StatementofRevenue,ExpensesandChangesinNetAssets—ModifiedCash‐Basis.

Tax‐basisfinancialstatementsmightbe

titled,forexample,

26©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

StatementofAssets,Liabilities,andCapital—Tax‐Basis;

StatementofOperations—Tax‐Basis;or

StatementofRevenueandExpenses—Tax‐Basis.

Theprecedingexamplesarenotmeanttobeall‐inclusiveandarenottheonlyacceptabletitles.

Withrespecttothecaptionstobeusedwiththecash‐,modified

cash‐,ortax‐basisfinancialstatements,thereis

norequirementtomodify thestandardGAAPfinancialstatementcaptions.Therefore,captionssuchas“netin‐

come,”“netloss,”and“retainedearnings”areacceptable.However,ifmodificationsaredesired(whichmany

preparerspreferasameansofadditionalemphasis thatthe

financialstatementsarenotpreparedinaccordance

withGAAP),commonexamplesforcash‐basisfinancialstatementsareexcessofrevenuecollectedover expenses

paidandexcessofexpensespaidoverrevenuecollected.Forfinancialstatementspreparedwhenapplyinga

modifiedcash‐basisofaccounting,commonmodificationsareexcessofrevenue

overexpensesandexcessofex‐

pensesoverrevenue.Withrespecttotax‐basisfinancialstatements,modificationswithrespecttofinancial

statementcaptionsarerarelymade.However,modifications, ifmade,mayincluderetainedearnings—tax‐basis

andnetincome—tax‐basis.

Consolid ation Accoun ting

Professionaljudgmentshouldbeappliedtodeterminewhichpresentation—consolidated,unconsolidated,or

combined—providesthemostmeaningfulandrelevantinformation.Apreparershouldnotconsolidateentities

unlessallentitiestobeconsolidatedusethesamebasis ofaccounting.Forexample,itwould notbeappropriate

toconsolidateanentitythatpreparesitsfinancial

statementsusingamodifiedcash‐basisofaccountingwithits

parentwhomaintainsitsbooksandrecordsinaccordancewiththetax‐basisofaccounting.Ifthemodifie dcash‐

basisofaccountingisused,thenallconsolidatedentitiesshouldutilizethesamemodificationstothecash‐basis

ofaccounting.

With

respecttofinancialstatementspreparedwhenapplyingthetax‐basisofaccounting,consolidationisbased

ontheIRC.Therefore,theconsolidationrequirementsofFASBASC810,Consolidation,donotapply.However,if

theentityfilesaconsolidatedtaxreturn,itshouldreportconsolidatedresultsonitstax‐basisfinancialstate‐

ments.Inthecaseofbrother‐sistercorporations inwhicheachentitymaintainsitsbooksandrecordsonthe

tax‐basisofaccounting,butaconsolidatedtaxreturnisnotfiled,thepreparermaypreparecombinedfinancial

statementsbecausesuchfinancialstatementsmaybemoreusefultousersthanindividualuncombined

financial

statements.

Althoughthetaxconsolidationrulesarefollowed,additionaldisclosures maybenecessarytolessenthechance

thatthefinancialstatementsarenotmisleading.Consider,forexample,a60 percentownedsubsidiarythat

wouldbeconsolidatedinfinancialstatementsprepar edin accordancewithGAAPbutisnotconsolidatedin

fi‐

nancialstatementspreparedwhenapplyingthetax‐basisofaccountingbecausethethresholdforconsolidation

undertheIRCis80percentownership.Eventhoughthesubsidiaryisnotconsolidated,thepreparershouldcon‐

siderwhichdisclosuresareappropriaterelativetothe60percentownedsubsidiary.Examplesofmattersthat

might

requiredisclosurearetheownershipandrelationshipwiththesubsidiary,relatedpartytransactions,

guarantees,andcommitments.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.27

ChangeFr om GAAPtoCash‐orTax‐Basis

AchangefromGAAPtocash‐ortax‐basisstatements(orviceversa)doesnotrepresentachangeinaccounting

principlesasdescribedin FASBASC250,AccountingChangesandErrorCorrections.Therefore,nojustification

forthechangeisrequired,andacumulativeeffectadjustmentisunnecessary.Whenonlythe

currentyear’s

cash‐ortax‐basisstatementsarepresented,therearethreewaysofpresentingopeningequity:

ShowopeningequityaspreviouslyreportedinaccordancewithGAAP,withanadjustmenttoconvertto

thecash‐ortax‐basis.

Showopeningequityontheas‐adjustedcash‐ortax‐basis.

Showtheeffectsoftheadjustmenttoconvertasacumulative‐effectadjustmentintheincomestate‐

mentequivalent.

Ifcomparativefinancialstatementsarepresented,thepriorperiodsshouldberestatedandpresentedonthe

basistowhichthecompanyhaschanged.Restatementisnecessarytoensurecomparabilitybetween

allperiods

presented.

Inallcases,thechangeinaccountingbasisshouldbedisclosedinthenotestothefinancial statements.Thefol‐

lowingisanexampleofhowsuchachangeinaccountingbasiscouldbedisclosedinthenotestothefinancial

statements:

In20X1,managementadoptedapolicy

ofpreparingitsfinancialstatementsonthebasisofaccounting

thatitusestofileitsfederalincometaxreturn.Priorto20X1,theCompany’sfinancialstatementswere

preparedinaccordancewithaccountingprinciplesge nerallyacceptedintheUnitedStatesofAmerica.

Managementbelievesthatthischangeresultsinmore

relevantfinancialreportingthatiseasierandless

costlytounderstand,apply,anduseintheCompany’scircumstancesandconsideringtheneedsofthe

usersofthefinancialstatements.The20X1financialstatementshavebeenrestatedtobeonthetax‐

basisofaccounting.

28©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Appendix

IllustrativeCash‐andTax‐BasisFinancialStatements

Thisappendixcontainsillustrativeexamplesoffinancialstatementspreparedwhenapplyingthecash‐,modified

cash‐,ortax‐basisofaccountingfordifferenttypesofentities.Thesefinancialstatementsareintendedtoillus‐

tratethesignificantdiscussionpointsinchapters1–3ofthispracti ceaid.Eachfinancialstatementhasbeen

an‐

notatedtohighlightthesekeypoints.

NameofEntity TypeofEntity BasisofPreparation

CeolainnClub Not‐for‐profit Cash

Mickey’sCenter Not‐for‐profit ModifiedCash

Donnelly&Oates LimitedLiabilityPartnership Tax(AccrualBasis)

CharltonContractors,Inc. ConstructionContractor Tax(AccrualBasis)

MargaretRose1964IrrevocableTrust Trust Tax(AccrualBasis)

CEOLAINNCLUB

FINANCIALSTATEMENTS

FORTHEYEARSENDED

JUNE30,20X2AND20X1

Circumstancesincludethefollowing:

Thefinancialstatementsareforanot‐for‐profitmembershipclub.

Thefinancialstatementsarepreparedonthecash‐basisofaccounting.

ThefinancialstatementsarecomparativefortheyearsendedJune30,20X2,and20X1.

Thefinancialstatementsillustratethefollowing:

The

financialstatementsincludeastatementoffunctionalexpenses,whichisrequiredbyaccounting

principlesgenerallyacceptedintheUnitedStatesofAmerica(GAAP).Financialstatementsprepared

whenapplyingthecash‐basisofaccountingarenotrequiredtoincludesuchastatement,butmayin‐

steadcommunicatethesubstanceofthat

requirement.

GAAPrequiresnot‐for‐profitorganizationstoreporttheamountofunrestricted,temporarilyrestricted,

andpermanentlyrestrictednetassetsonthefaceofthestatementoffinancialposition.Becausea

statementoffinancialpositionequivalentisnotpresented,theillustrativefinancialstatementscom‐

municatethesubstanceoftheGAAP

requirementinthenotestothefinancialstatements.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.29

CeoliannClub

StatementsofCashReceiptsandDisbursements

FortheYearsEndedJune30,20X2and20X1

June30,

20X2

June30,

20X1

Cashreceivedfromsupportactivities:

Membershipdues $49,899 $46,759

Donations 996 1,125

Programs 7,495 10,645

Totalcashreceivedfromsupportactivities 58,390 58,529

Cashreceivedfromothersources:

Interestincome 19 30

Other 300 3,720

Totalcashreceivedfromothersources 319 3,750

TOTALCASHRECEIVED $58,709 $62,279

Cashdisbursed:

Programservices $29,110 $29,484

Supportingservices 19,783 19,113

Fundraising 6,288 8,803

TOTALCASHDISBURSED $55,181 $57,400

Excessofrevenuecollectedoverexpensespaid 3,528 4,879

Cashandcashequivalents,beginningofyear 39,046 34,167

Cashandcashequivalents,endofyear $42,574 $39,046

Seeaccompanyingnotestofinancialstatements.

30©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

TheCeoliannClub

StatementsofFunctionalExpensesCash‐Basis

FortheYearsEndedJune30,20X2and20X1

Program

Services

Supporting

Services Fundraising

Total

June30,

20X2

Program

Services

Supporting

Services Fundraising

Total

June30,

20X1

Salariesand

benefits

$23,333 $16,440 $4,241 $44,014 $23,633 $15,876 $5,937 $45,446

Events—special

1,795 1,795

2,513 2,513

Legalandac‐

counting

2,320

2,320

2,500

2,500

Insurance 313 51 45 409 317 49 63 429

Postage/printing 3,477

3,477 3,398

3,398

Licenses/fees

114

114

464

464

Officeexpense 612 232 207 1.051 620 224 290 1,134

Miscellaneous 1,375 626

2,001 1,516

1,516

$29,110 $19,783 $6,288 $55,181 $29,484 $19,113 $8,803 $57,400

53% 36% 11%

52% 33% 15%

Seeaccompanyingnotestofinancialstatements.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.31

CeolainnClub

NotestoFinancialStatements

Cash‐Basis

FortheYearsEndedJune30,20X2and20X1

Note1—SummaryofSignificantAccountingPolicies

NatureofActivities

TheCeolainnClub(theClub)isaNewYorknot‐for‐profitorganization.TheClub’smissionistopromotesafeso‐

cialprogramsforyoungadults.

BasisofAccounting

TheClub’sfinancialstatementshavebeenpreparedonthecash‐basisof

accounting,whichisacomprehensive

basisofaccountingotherthanaccountingprinciplesgenerallyacceptedintheUnitedStatesofAmerica(GAAP).

Thecash‐basisofaccountingdiffersfromGAAPpri marilybecauserevenuesarerecognizedwhenreceivedrather

thanwhenearnedandexpensesarerecordedwhenpaidratherthanwhenincurred.The

financialstatements

thereforepresentonlycashandcashequivalentsandchangesthereinintheformofcashreceiptsanddis‐

bursements.

CashandCashEquivalents

TheClubconsidersallhighlyliquidinvestmentsavailableforcurrentusewithaninitialmaturityofthreemonths

orlesstobecashequivalents.As

ofJune30,20X2,and20X1,cashandcashequivalentsconsistedentirelyofthe

adjustedbookbalanceintheClub’scheckingaccount.

NetAssets

AsofJune30,20X2,and20X1,alloftheClub’snetassetswereunrestricted.

IncomeTaxes

TheClubisexemptfromfederalandstateincometaxes

underInternalRevenueCodeSection501(c)(7).Accord‐

ingly,noprovisionforincometaxeshasbeenmadeinthefinancialstatements.

UncertainTaxPositions

Federalandstateincometaxreturnsfortheyears20X0todatearesubjecttoexaminationbytaxingauthorities.

SubsequentEvents

Managementhasevaluatedsubsequent eventsthrough

August28,20X2,whichisthedatethefinancialstate‐

mentswereavailabletobeissued.

32©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

MICKEY’SCENTER

FINANCIALSTATEMENTS

ASOFANDFORTHEYEARENDED

AUGUST31,20X2

Circumstancesincludethefollowing:

Thefinancialstatementsareforanot‐for‐profitcharity.

Thefinancialstatementsarepreparedonamodifiedcash‐basisofaccounting.Thecash‐basisofac‐

countingwasmodifiedtoaccruecashtransactionsandeventsthatprovideabenefitorresultinanobli

‐

gationthatcoversaperiodgreaterthantheperiodinwhichthecashtransactionsoreventsoccurred.

Suchaccrualsresultedintherecordingofpropertyandequipmentasassetsonthestatementofassets

andnetassetsandsubsequentdepreciationofthoseassetsovertheirestimateduseful live s .

The

financialstatementsareasofAugust31,20X2,andfortheyearthenended.

Thefinancialstatementsillustratethefollowing:

Thefinancialstatementsincludeastatementoffunctionalexpenses,whichisrequiredbyaccounting

principlesgenerallyacceptedintheUnitedStatesofAmerica(GAAP).Financialstatementsprepared

whenapplyinga

modifiedcash‐basisofaccountingarenotrequiredtoincludesuch astatement, but

mayinsteadcommunicatethesubstanceofthatre quirement.

GAAPrequiresnot‐for‐profitorganizationstoreporttheamountofunrestricted,temporarilyrestricted,

andpermanentlyrestrictednetassetsonthefaceofthebalancesheet(in

thecaseoftheillustrativefi‐

nancialstatementspreparedonamodifiedcash‐basisofaccounting,suchpointintimestatementisre‐

ferredtoasthestatementofassetsandnetassets).Theillustrativefinancialstatementsdonotfollow

thosepresentationrequirementsbutinstead,communicatetheirsubstan cebyprovidingrelevant

in‐

formationinthenotestothefinancials tatements.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.33

Mickey’sCenter

StatementofAssetsandNetAssets

ModifiedCash‐Basis

August31,20X2

Assets

Cashandcashequivalents $316,258

Restrictedcash(Note2) 108,084

Propertyandequipment(netofaccumulatedde‐

preciationof$35,565)

9,018

$433,360

NetAssets

Unrestrictednetassets(Note5) 433,360

Netassets $433,360

Seeaccompanyingnotestofinancialstatements.

34©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Mickey’sCenter

StatementofRevenue,ExpensesandChangesinNetAssets

ModifiedCash‐Basis

FortheYearEndedAugust31,20X2

Revenue

Corporateandfoundationcontributions $536,134

Othercontributions 235,920

Exchangeclubprojects 105,302

Unsolicitedandotherdonations 69,754

Totalrevenue 947,110

Expenses

Programservices 769,426

Managementandgeneral 100,718

Fundraising 55,264

155,982

Totalexpenses 925,408

Increaseinnetassets 21,702

Netassets,beginningofyear 411,658

Netassets,endofyear $433,360

Seeaccompanyingnotestofinancialstatements.

©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.35

Mickey’sCenter

StatementofFunctionalExpenses

ModifiedCash‐Basis

FortheYearEndedAugust31,20X2

ProgramServices Managementand

General

Fundraising Total

Salariesandbene‐

fits

$451,675 $76,781 $38,041 $566,497

Grantexpense 41,291

41,291

Specialevents 77,790

13,233 91,023

Training 16,029

16,029

Professionalser‐

vices

16,810

16,810

Telephone 14,782 720 428 15,930

Postage/printing 6,176 301 178 6,655

Officesupplies 16,597 809 481 17,887

Programmaterials 16,279

16,279

Depreciation 8,917 435 259 9,611

Rent 58,084 2,831 1,683 62,598

Miscellaneous 61,806 2,031 961 64,798

$769,426 $100,718 $55,264 $925,408

83% 11% 6%

Seeaccompanyingnotestofinancialstatements.

36©2018AssociationofInternationalCertifiedProfessionalAccountants.Allrightsreserved.

Mickey’sCenter

NotestoFinancialStatements

ModifiedCash‐Basis

August31,20X2

Note1—SummaryofSignificantAccountingPolicies

NatureofActivities

Mickey’sCenter(theCenter)isanonprofitcorporationincorporatedundertheTexasNon‐ProfitCorporation

Act.ThepurposeoftheCenteristouseitsfundsexclusivelyforcharitable,scientific,andeducationalpurposes,

especiallythepreventionofchildabuse.

Basisof

Accounting

ThefinancialstatementsoftheCenterhavebeenpreparedonthecash‐basisofaccounting,modifiedtorecord

assetsorliabilitieswithrespecttocashtransactionsandeventsthatprovideabenefitorresultinanobligation

thatcoversaperiodgreaterthantheperiodinwhichthecashtransactions

oreventsoccurred.Themodifica‐

tionsresultintherecordingofcapitalassetsonthestatementofassetsandnetassets.Exceptfordepreciation,

alltransactionsarerecognizedaseitherrevenueorexpenseswhenreceivedorpaidincash.Exceptfordeprecia‐

tion,noncashtransactionsarenotrecognized.Thisbasis

ofaccountingrepresentsacomprehensivebasisofac‐

countingotherthanaccountingprinciplesgenerallyacceptedintheUnitedStatesofAmerica(GAAP).Thisbasis

ofaccountingdiffersfromGAAPprimarilybecausecertainrevenueandrelatedassetshavebeenrecognized

whenreceivedratherthanwhenearnedandcertainexpensesandrelatedliabilities

havebeenrecognizedwhen

paidratherthanwhentheobligationswereincurred.

PropertyandEquipment

Propertyandequipmentarerecordedatcostandconsistoftheofficebuildingandequipment.Depreciationis

computedonthestraight‐linemethodbasedonestimatedusefullivesof30yearsand5yearsfor