Annual Report

For the Period Ended

December 31, 2020

TABLE OF CONTENTS

PART I

Pag e

Special Note Regarding Forward-Looking Statements

Introduction

Glossary of Selected Terms

Item 1.

Identity of Directors, Senior Management and Advisers

1

Item 2.

Offer Statistics and Expected Timetable

1

Item 3.

Key Information

1

Item 4.

Information on the Company

38

Item 4A.

Unresolved Staff Comments

131

Item 5.

Operating and Financial Review and Prospects

132

Item 6.

Directors, Senior Management and Employees

167

Item 7.

Major Shareholders and Related Party Transactions

188

Item 8.

Financial Information

197

Item 9.

The Offer and Listing

201

Item 10.

Additional Information

201

Item 11.

Quantitative and Qualitative Disclosures About Market Risk

210

Item 12.

Description of Securities Other than Equity Securities

219

PART II

Item 13.

Defaults, Dividend Arrangements and Delinquencies

219

Item 14.

Material Modifications to the Rights of Security Holders and Use of Proceeds

219

Item 15.

Controls and Procedures

220

Item 16A.

Audit and Accounting Committee Financial Expert

221

Item 16B.

Code of Ethics

221

Item 16C.

Principal Accountant Fees and Services

222

Item 16D.

Exemptions from the Listing Standards for Audit Committees

222

Item 16E.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

222

Item 16F.

Change in Registrant’s Certifying Accountant

223

Item 16G.

Corporate Governance

223

Item16H.

Mine Safety Disclosure

225

Item 17.

Financial Statements

225

Item 18.

Financial Statements

225

Item 19.

Exhibits

225

FS-1

S P ECIAL N OTE R EGARDIN G F ORW ARD -LOOKING STAT EMENTS

Th is A n n u al Report con t ain s st at e me nts t h at con st it ut e “forward - lookin g st at e me nt s,” ma ny of

wh ich can be ident ified by t he use of forward- lookin g words su ch as “an ticipate,” “b elieve,” “cou ld,”

“expect ,” “sh ou ld ,” “plan ,” “ in t en d,” “e stima t e”, "st rive ", "forecast", "t arg et s" a n d “pot e ntial,” among

ot h er s.

For ward - lookin g st a tement s appear in a n u mb er of pla ce s in t his A n nu a l Repor t an d in clu de, but

are n ot limit ed t o, st atemen ts r egardin g ou r in tent, b elie f or cu rren t e xpecta tion s. Forward- looking

st at emen ts are b ased on ou r man age me nt’s b eliefs an d a ssu mpt ion s a nd on in format ion cu rrently

availa b le to ou r ma nage ment. Su ch st at eme nt s are subje ct to risks an d un certaint ies, and th e a ctual

resu lt s may d iffer materially from t h ose expre ssed or implied in t he forwar d-lookin g st at eme nts due

to va riou s fa ct ors, in clu d in g , b u t n ot limit ed t o, t hose id en t ified in “I t em 3 - Key I nfor mat ion — D.

Risk Fact ors” in t his A nn ual Re port. Th ese risks an d u ncert ain ties in clud e factor s relating to:

Loss or impa irment of b u sin ess licen se s or min era l e xt ra ct ion s permit s or con cessions; vola t ilit y of

su pply a nd d eman d an d t he impact of compet it ion ; the d ifference between act ual reserve s an d our

rese rve est imates; n at ural d isast ers; fa ilur e to "h arvest" salt wh ich cou ld le ad to a ccumu lation of salt

at t h e b ot t om of t h e evapor ation Pond 5 in t h e Dead Sea ; con st ruct ion of a n ew pu mpin g st at ion;

d isr u pt ion s at ou r seaport sh ippin g facilit ies or reg ulatory rest rict ions affectin g ou r abilit y to export

ou r prod u ct s over seas; g en e ral mar ket, polit ical or econ omic con d it ion s in t h e cou n t ries in wh ich

we opera t e; price in cr eases or sh or t ag es wit h r espe ct to ou r prin cipa l raw ma t erials; d elays in the

complet ion of ma jor pr oject s by t h ird par t y con t r actor s an d /or t er min at ion of eng age me nts with

con t ract or s an d /or g overnme ntal ob lig a tion s; t h e in flow of sig n ifican t amou n ts of wat er in t o t he

De ad Se a cou ld ad verse ly a ffect prod u ct ion at ou r plan t s; lab or d ispu t es, slowd own s an d st rike s

in volvin g ou r employee s; pe nsion and he alt h in sur ance liab ilit ies; t h e on g oin g CO VI D-19 pan demic,

wh ich h as impact ed , an d ma y con t in u e to impact ou r sa le s, operat in g resu lt s a n d b u sin ess

operat ion s by d isr upt ing our a bilit y to pu rchase raw mat erials, by n eg at ive ly impa ctin g t he demand

an d pr icin g for some of ou r prod u ct s, by d isr u pt in g ou r ab ilit y to se ll an d / or d ist r ib ute pr od u cts,

impa ct in g cu st omers' ab ilit y to pay us for pa st or fu t u r e pu rcha ses a nd /or t emporarily closin g our

facilit ies or t h e fa cilit ies of ou r su pplier s or cu st omers and t h eir con t ract man u fa ct ur ers, or

rest r ict in g ou r a b ilit y to t ravel to su pport ou r sit es or ou r cu st omers ar ou nd t h e world ; ch an ges to

governmen t a l in cent ive prog rams or t a x b en efit s, crea t ion of n ew fiscal or t ax re lat ed leg isla tion;

ch an g es in ou r eva lu ation s and estimates, which se rve as a ba sis for t he r ecog nit ion a nd manner of

me asu re men t of asset s a nd liab ilit ies; h ig h er t ax liab ilit ies; failu re to int eg rate or re alize expected

b en efit s from mer ge rs a nd acqu isit ion s, org aniza t ion al rest ructu rin g an d join t ven t u res; cu rrency

rat e flu ct u at ions; risin g in t e rest ra tes; g ove rnmen t examin ation s or in ve st iga tion s; d isru ption of ou r,

or ou r ser vice provid e rs', in format ion t echn olog y syst ems or b rea ch es of ou r , or ou r ser vice

provid e rs', d at a secu rit y; failu re to r etain a nd/or recruit ke y per son nel; inabilit y to r ealize e xpected

b en efit s from ou r cost red u ct ion program accord ing to t he e xpe ct ed t imet a ble; in abilit y to a cce ss

capit al market s on fa vorab le t er ms; cyclica lit y of ou r b u sin esses; chan ges in d emand for ou r fe rt ilizer

prod u ct s d u e to a d eclin e in a gricultu ral produ ct prices, la ck of available credit , weather cond itions,

governmen t policies or ot h er fact ors b eyon d ou r con t rol; sa les of ou r mag n esiu m prod u ct s b eing

affect e d by var iou s fact or s t ha t are n ot wit hin ou r con t rol; ou r ab ilit y to se cu re approvals and

permit s fr om t he au t h orit ies in I srael to con t in u e ou r ph osph at e min in g oper at ion s in Rot em;

volat ilit y or cr ises in t he fin an cial mar ket s; u n ce rtaintie s su rr oun din g t h e pr opose d wit h d ra wal of

t he Unit e d Kin g d om from the Eu ropea n Un ion ; hazard s in he ren t to min in g and che mica l

ma nu fact u rin g; t h e fa ilu re to en su re t h e safet y of ou r wor kers a n d proce sse s; cost of complian ce

wit h e n viron me ntal regu lat ory leg islative an d lice nsin g r est rict ions; laws a nd regu lat ions re lated to,

an d ph ysical impact s of climat e ch an g e and g r eenh ouse g a s e mission s; lit ig at ion , ar b it r ation and

reg u lat ory proceedin gs; e xposu re to t hir d par ty and pr od uct liabilit y claims; prod uct r ecalls or other

liab ilit y claims as a r esu lt of food safet y and food - b orn e illn e ss con ce rn s; in sufficien cy of in su rance

cove rag e; closin g of t ransa ction s, mer g ers a nd acqu isit ion s; war or act s of t er ror an d / or polit ical,

econ omic a nd milit ary in stabilit y in Israel and it s r eg ion; filin g of cla ss action s and derivat ive actions

ag ain st t h e Compan y, it s exe cu tives a n d B oa rd memb ers; The Compan y is e xposed to risks relat ing

to it s cu r ren t a n d fu tu re a ctivit y in emer g ing mar ket s; and ot h er risk fact ors d iscussed u n der ”Item

3 - Key I nformat ion — D. Risk Fa ct ors".

For ward - lookin g st ate ments speak on ly as at t he d ate th ey are ma de, a nd we do not u nde rt ake any

ob ligat ion to u pd ate th em in lig h t of n ew in formation or futu re development s or to relea se pub licly

an y revision s to t h ese st a t ements in ord e r to reflect la t er e ve nt s or circu mst a nces or to r eflect the

occu rr en ce of u n anticipat ed events.

I N T RODUCT IO N

Th e fin an cial in format ion inclu ded in this A n nu al Report h as been prepa red in accordance with the

In t e rn ation al Fin an cial Re port in g St an dard s ( “I FRS”), as issu ed b y t h e In t e rnation al A ccou n ting

St an d a rds B oar d ( “IASB ”). Non e of t h e fin an cial in formation in t h is A n nual Report h as b een pr epared

in accord a nce wit h a ccou nt ing principle s g enerally a ccept ed in t h e Un ite d St at es.

Th is A n n u al Report con tains t ranslat ions of ce rt ain currencies amou nt s in to U.S. d ollar s at specified

rat e s solely for you r con ven ie n ce. Un less ot h erwise in d icate d, we h ave t r an slated NIS amou n ts as

at Decemb er 31, 2020, in t o U.S. d olla rs at an excha ng e rat e of NI S 3.215 to $1.00, the d a ily

repre se n t at ive e xchang e ra te reported by t he B an k of I sr ael for Decemb er 31, 2020. Eu ro amou nts

wer e t ran slated in to U.S. d ollar s at an exchan ge rat e of €0.815 to $1.00.

Ma rket d at a and cert ain in d u stry d at a u se d in t h is A n n u al Repor t were ob t ain ed from in t er nal

report s an d st u d ies, wh ere appropriat e, as we ll as est imat es, marke t rese arch, pu b licly a vailable

in format ion an d in d u st r y pu b licat ion s, in clu d in g pu b licat ion s, r eport s or relea ses of t he

In t e rn ation al Mon et a ry F u nd ( “I MF”), t h e U.S. Cen su s B u re au , t h e Food an d A g ricu lt ure

Org aniza tion of t he Unit e d Nat ion s ( “FAO”), t h e In tern ation al Fe rtiliz ers A ssociat ion ( “I FA ”), the

Unit ed St at es Depart ment of A g ricu lt ure ( “USDA ”), t h e Un it e d St at es Geolog ical Su rvey, t he CRU

Grou p ( "CRU") an d Fer t econ , t he Fer t iliz er A ssocia t ion of In d ia (“F A I”). I n d u st ry pu b licat ions

gen era lly st at e t h at t he in formation t h ey in clu d e h as b e en ob t ain ed from sou r ces b elie ved to be

reliab le, b u t t ha t t h e a ccu r acy a n d complet ene ss of su ch in format ion is n ot g u a ran teed . Similarly,

in t er n al repor t s an d st u die s, e st imat es and ma rket rese arch, which we b elieve to be reliab le and

accu rat ely ext racted by us for u se in t his Ann u a l Report , h ave n ot b een in d epen dently ver ified.

Howe ve r, we b elieve su ch d at a is a ccu r at e. T here is on ly a limit e d amou n t of in d e pen d e nt d ata

availa b le ab ou t cert ain aspect s of ou r in du stry, market and competit ive posit ion . As a re sult, ce rtain

d at a a n d in format ion ab ou t ou r market ran king s in cer t ain prod u ct areas are b a se d on ou r g ood

fait h est imat es, which are d erived from ou r review of in t er nal d at a a n d in format ion , in format ion

t hat we ob tain from ou r cu stome rs, and other thir d- pa rty sou rces. We be lieve th ese in ternal su rveys

an d ma nag emen t e st imat e s are r elia b le ; h owever, no in d epen d en t sou rces h ave verified su ch

su rveys an d e st imates.

In pr esen t in g an d d iscu ssin g ou r fin an cial posit ion , operat in g re su lt s and net in come r esu lt s, the

ma na g emen t u ses cert a in n on -IFRS fin an cial measu res. T h ese n on -IFRS fin an cial mea su res sh ould

not be vie wed in isolat ion or as alt ernatives to t he e quivalent IFRS me asur es and sh ou ld be used in

con ju n ct ion wit h t h e most d ire ct ly compa rab le IF RS mea su r es. A d iscu ssion of n on - IFRS measu res

in clu d e d in t h is A n n u al Repor t an d a recon cilia t ion of su ch measu res to t he most d ir ect ly

compar ab le I FRS mea su res are con t ain ed in t h is A n nu al Repor t u n d er “I te m 5 – Oper at in g and

Fin a ncia l Review an d Prospect s— A. O peratin g Resu lts”.

In t h is A n nual Report , u n less ot herwise in d icated or t h e con t ext ot he rwise requ ires, a ll refere nces

to “I CL,” t h e “Grou p,” t h e “Company,” “we,” “ou r ,” “ou rs,” “u s” or similar t erms re fer to ICL Gr ou p

Lt d ., t og et he r wit h it s con solid at ed su b sidiarie s. W h en we refer to ou r “pare nt Compan y” or to

“Isr ael Cor porat ion ,” we refer to ou r con t rollin g sh areh old er, I sr ael Corpor at ion Lt d . Un less

ot h er wise in d icated or th e con te xt ot her wise requir es, references in th is A nnu al Repor t to “NI S” are

to t h e leg al cu rre ncy of Isr ael, “U.S. d ollars”, “$” or “d ollars” are to Un it e d St a tes d olla rs, “eu ro” or

“€” are to th e Eu ro, t h e le g al cu rr en cy of cert ain cou n tries of t h e Eu rope an Un ion , an d “B ritish

pou n d ” or “£” are to t he lega l cu rre n cy of t h e Un it e d Kin g d om. Se e “I t em 4 - I n for ma t ion on t he

Compan y— A. Hist or y an d Developmen t of t h e Compa ny”. We own or h ave rig hts to t rad emarks or

t rad e n ames t hat we u se in con ju nction wit h t he operat ion of ou r b usin ess. Solely for con ven ie nce,

t rad emarks an d t ra de n ames r efe rred to in t h is A n n u al Report may appe ar wit h ou t t he ® or ™

symb ols, bu t su ch r efe rences are n ot in t e nded to ind icat e , in an y wa y, t h at we will n ot asser t , to

t he fu lle st ext e nt of t h e law, ou r rig ht s or t he rig hts of t h e a pplica b le lice n sor to t hese t rademarks

an d t ra d e n ames. In t h is A n n u al Repor t , we a lso r efe r to prod u ct n ames, t rad e ma rks, and t rade

name s t h at are t h e prope rty of ot he r compa nies. Each of t h e t rade ma rks a nd t rad e n ames of ot her

compan ies appear in g in t h is An n u al Re port b elongs to it s own ers. Ou r u se or display of ot h er

compan ies’ prod u ct n ames, t rad emarks, or t ra d e n ames is n ot in t e nd ed to a n d does n ot imply a

relat ion sh ip wit h , or end orse me nt or spon sor ship by us of, t he prod u ct , t rademark, or t ra d e n ame

owner, u n le ss we ot h erwise in dicate.

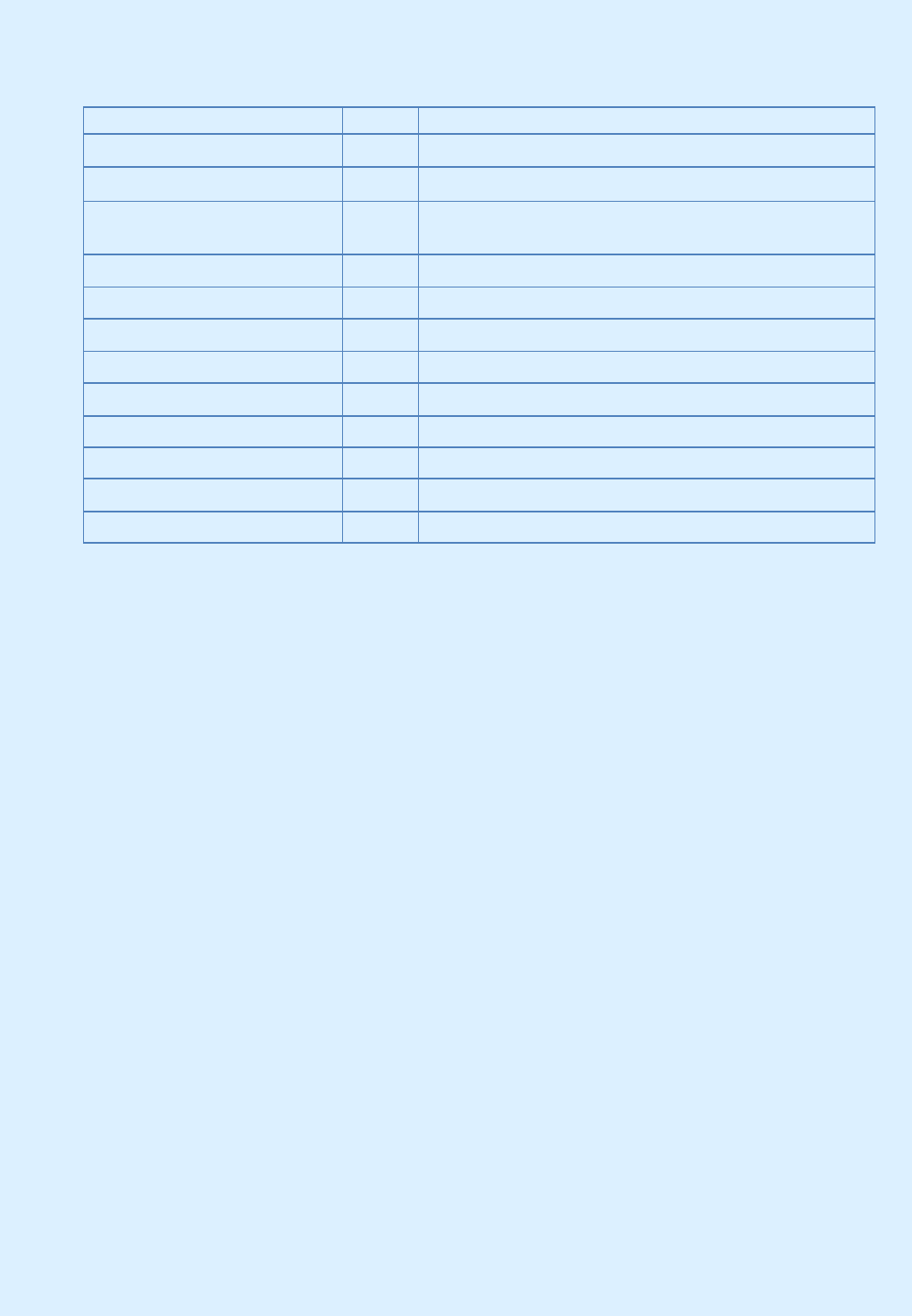

G L O SSARY OF SELECTED TERMS

Th e followin g is a g lossary of se lect ed t er ms u sed in this A nn ual Re port.

Bromine

A chemical element used as a basis for a wide variety of uses and

compounds, and mainly as a component in flame retardants or fire

prevention substances. Unless otherwise stated, the term “bromine”

refers to elemental bromine.

CDP

Carbon Disclosure Project - A non-profit leading organization in the

greenhouse gas emissions reporting field.

CFR

Cost and freight. In a CFR transaction, the prices of goods to the

customer includes, in addition to FOB expenses, marine shipping costs

and all other costs that arise after the goods leave the seller’s factory

gates and up to the destination port.

CLP

Classification, Labeling and Packaging of Substances and Mixtures– EU

regulation.

CPI

The Consumer Price Index, as published by the Israeli Central Bureau of

Statistics.

CRU

Intelligence Company providing information on global mining, metal and

fertilizers market.

Dead Sea Bromine Company

Dead Sea Bromine Company Ltd., included in Industrial Products

segment.

DAP

Diammonium Phosphate - a fertilizer containing nitrate and phosphorus

oxide.

EPA

US Environmental Protection Agency.

FAO

The Food and Agriculture Organization of the United Nations.

FOB

Free on-board expenses are expenses for overland transportation,

loading costs and other costs, up to and including the port of origin. In

an FOB transaction, the seller pays the FOB expenses and the buyer pays

the other costs from the port of origin onwards.

ICL Haifa (Fertilizers &

Chemicals)

Fertilizers and Chemicals Ltd., included in Innovative Ag Solutions

segment.

GHG

Greenhouse gases – air emissions contributing to climate change.

Granular

Fertilizer having granular particles.

ICL Boulby

A United Kingdom Company included in the Potash segment.

ICL Iberia (Iberpotash)

Iberpotash S.A., a Spanish Company included in Potash segment.

IC

Israel Corporation Ltd.

ICL Dead Sea (DSW)

Dead Sea Works Ltd., included in Potash segment.

ICL Dead Sea Magnesium (DSM)

Dead Sea Magnesium Ltd., included in Potash segment.

ICL Neot Hovav

Subsidiaries in the Neot Hovav area in the south of Israel, including

facilities of Bromine Compounds Ltd. Included in Industrial Products

segment.

ICL Rotem

Rotem Amfert Negev Ltd., included in Phosphate Solutions segment.

IFA

The International Fertilizers Industry Association, an international

association of fertilizers manufacturers.

ILA

Israel Land Authority.

IMF

International Monetary Fund.

K

The element potassium, one of the three main plant nutrients.

KNO

3

Potassium Nitrate, soluble fertilizer containing N&P used as a stand-alone

product or as a key component of some water-soluble blends.

KOH

Potassium hydroxide 50% liquid.

MGA

Merchant grade phosphoric acid.

MoEP

Israel Ministry of Environmental Protection.

N

The element nitrogen, one of the three main plant nutrients.

NPK

Complex fertilizer comprised primarily of 3 primary nutrients (N,P,K).

NYSE

The New York Stock Exchange.

P

The element phosphorus, one of the three main plant nutrients, which is

also used as a raw material in industry.

Phosphate

Phosphate rock that contains the element phosphorus. Its concentration

is measured in units of P

2

O

5

.

Po lyhalite

A mineral marketed by ICL under the brand name Polysulphate™,

composed of potash, sulphur, calcium, and magnesium. Used in its

natural form as a fully soluble and natural fertilizer, which is also used for

organic agriculture and as a raw material for production of fertilizers.

Polymer

A chemical compound containing a long chain of repeating units linked

by a chemical bond and created by polymerization.

Po tash

Potassium chloride (KCl), used as a plant’s main source of potassium.

P

2

O

5

Phosphorus pentoxide.

P

2

S

5

Phosphorus pentasulfide.

REACH

Registration, Evaluation, Authorization and Restriction of Chemicals, a

framework within the European Union.

Salt

Unless otherwise specified, sodium chloride (NaCl).

S

Sulphur – a chemical used for the production of sulfuric acid for sulfate

and phosphate fertilizers, and other chemical processes.

Soluble NPK

Soluble fertilizer containing the three basic elements for plant

development (nitrogen, phosphorus and potash).

Standard

Fertilizer having small particles.

Tami

Tami (IMI) Research and Development Institute Ltd., the central research

institute of ICL.

TASE

Tel Aviv Stock Exchange, Ltd.

USDA

United States Department of Agriculture.

WPA

White Phosphoric Acid, purified from MGA.

Ur ea

A white granular or prill solid fertilizer containing 46% nitrogen.

YTH/YPC

The Chinese partner in the Company’s joint venture YPH in China.

4D

Clean green phosphoric acid, used as a raw material for purification

processes.

PM

Particular matter

1 ICL Group Limited

Item 1 – IDENTITY OF DIRECTORS, SENIOR MANAGEMENT

AND ADVISORS

Not A pplicab le.

Item 2 – OFFER STATISTICS AND EXPECTED TIMETABLE

Not A pplicab le.

Item 3 – KEY INFORMATION

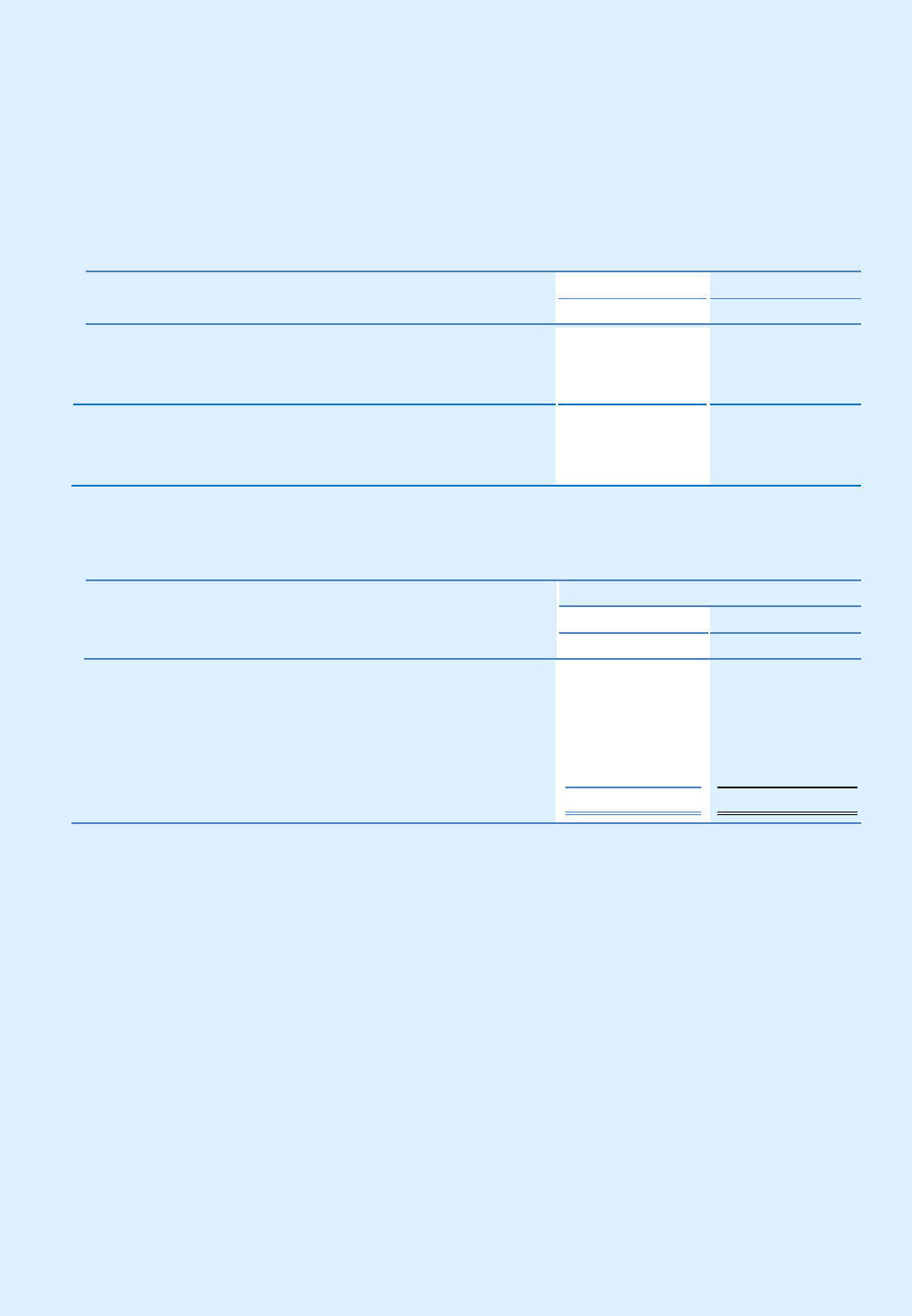

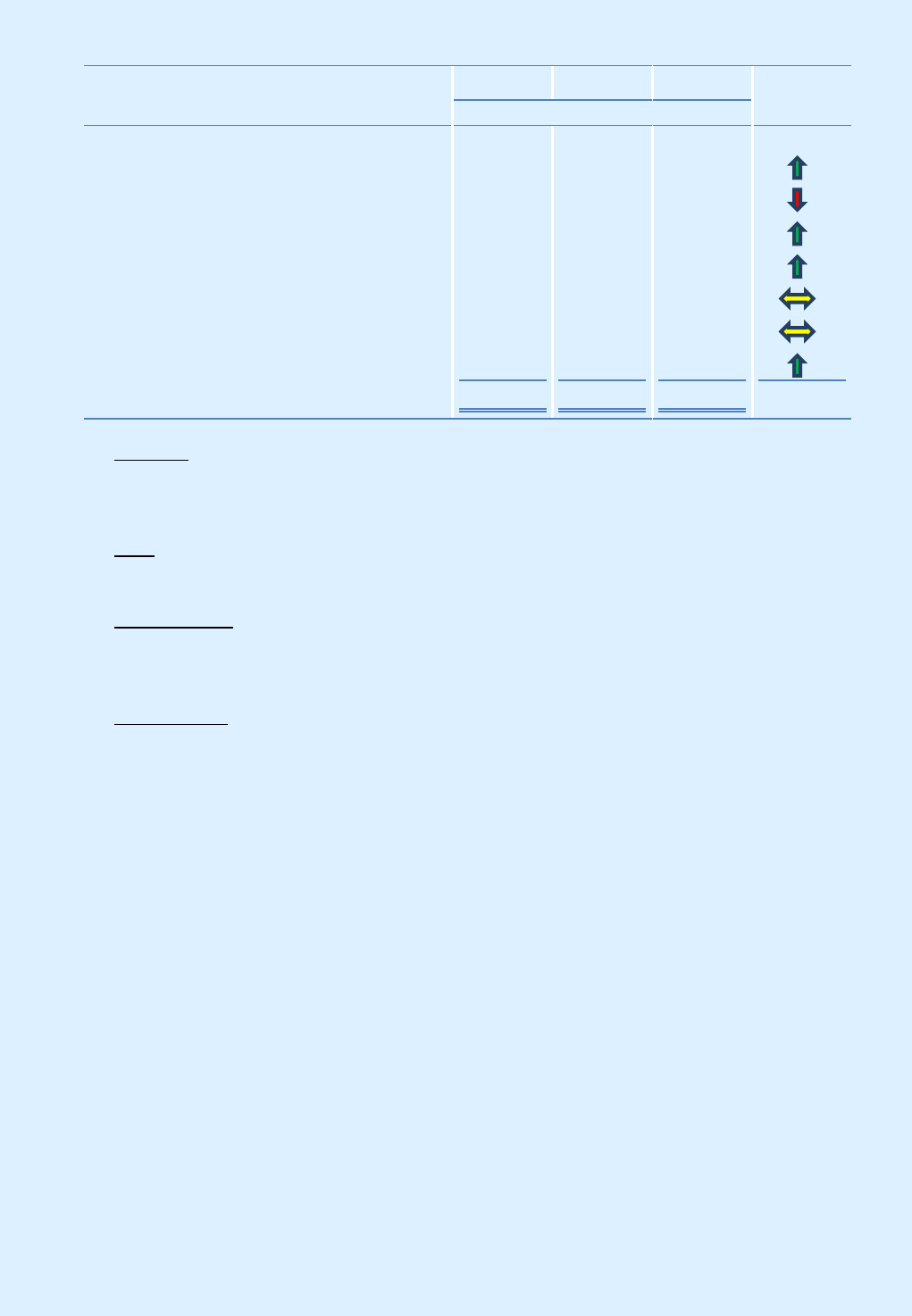

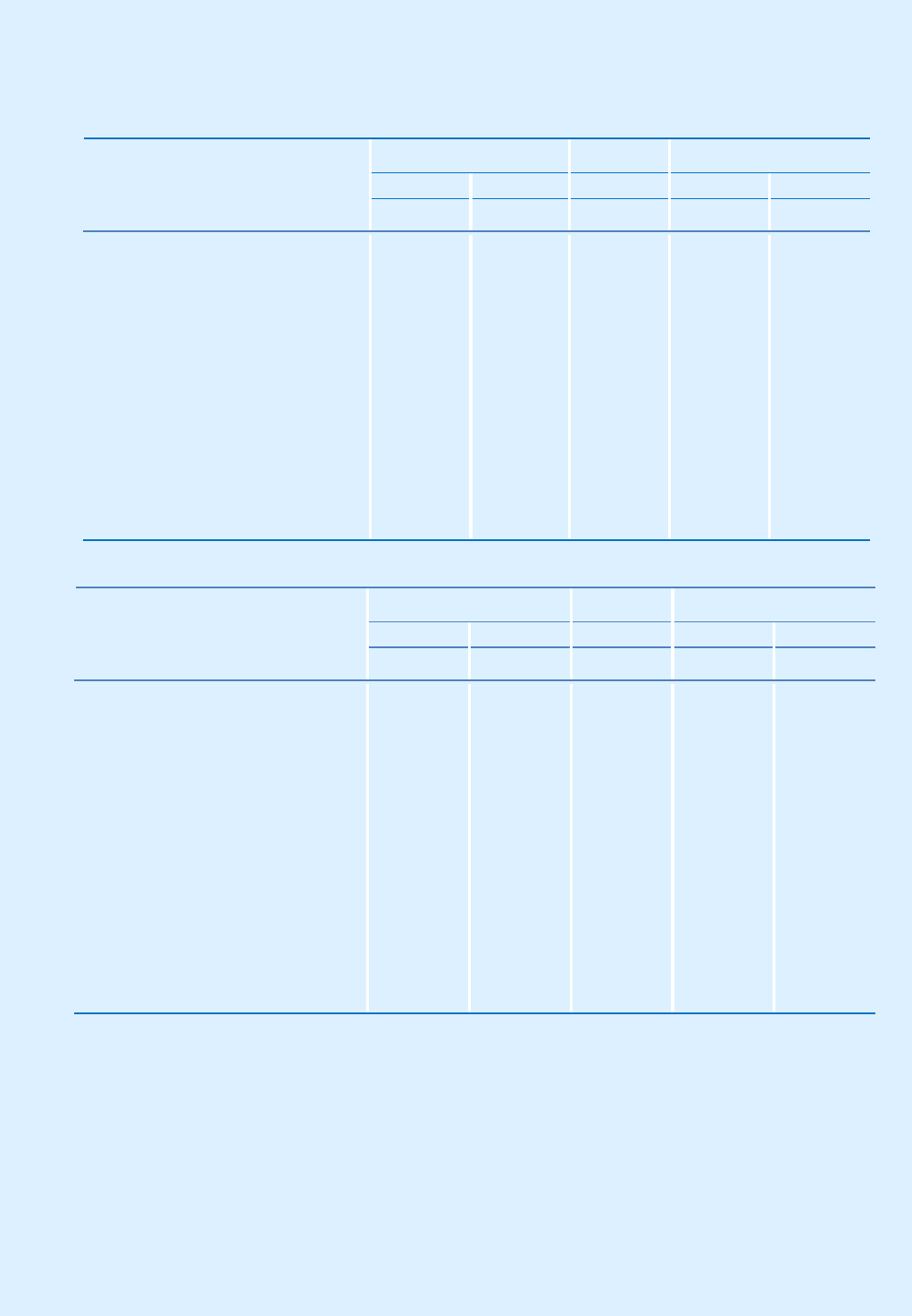

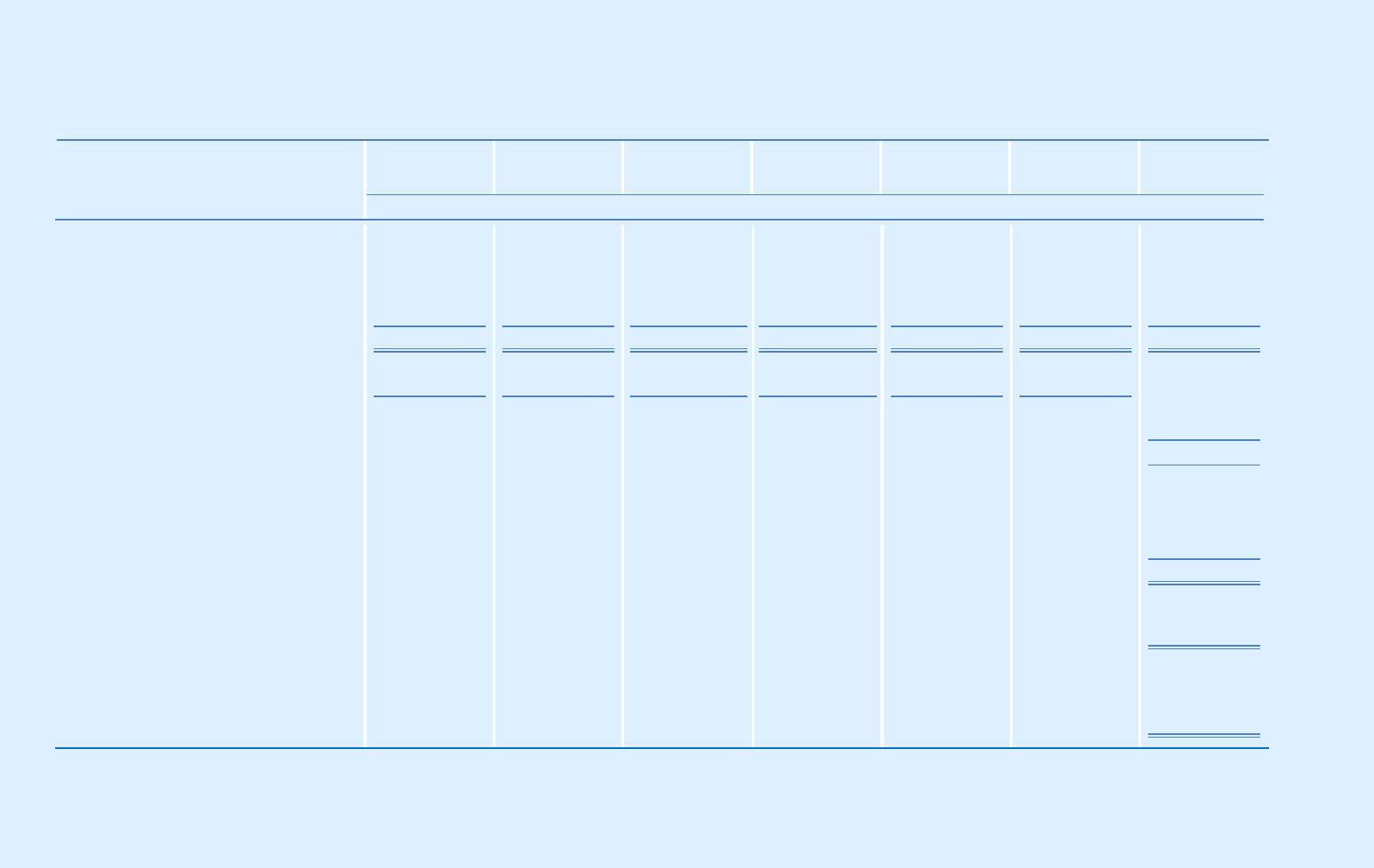

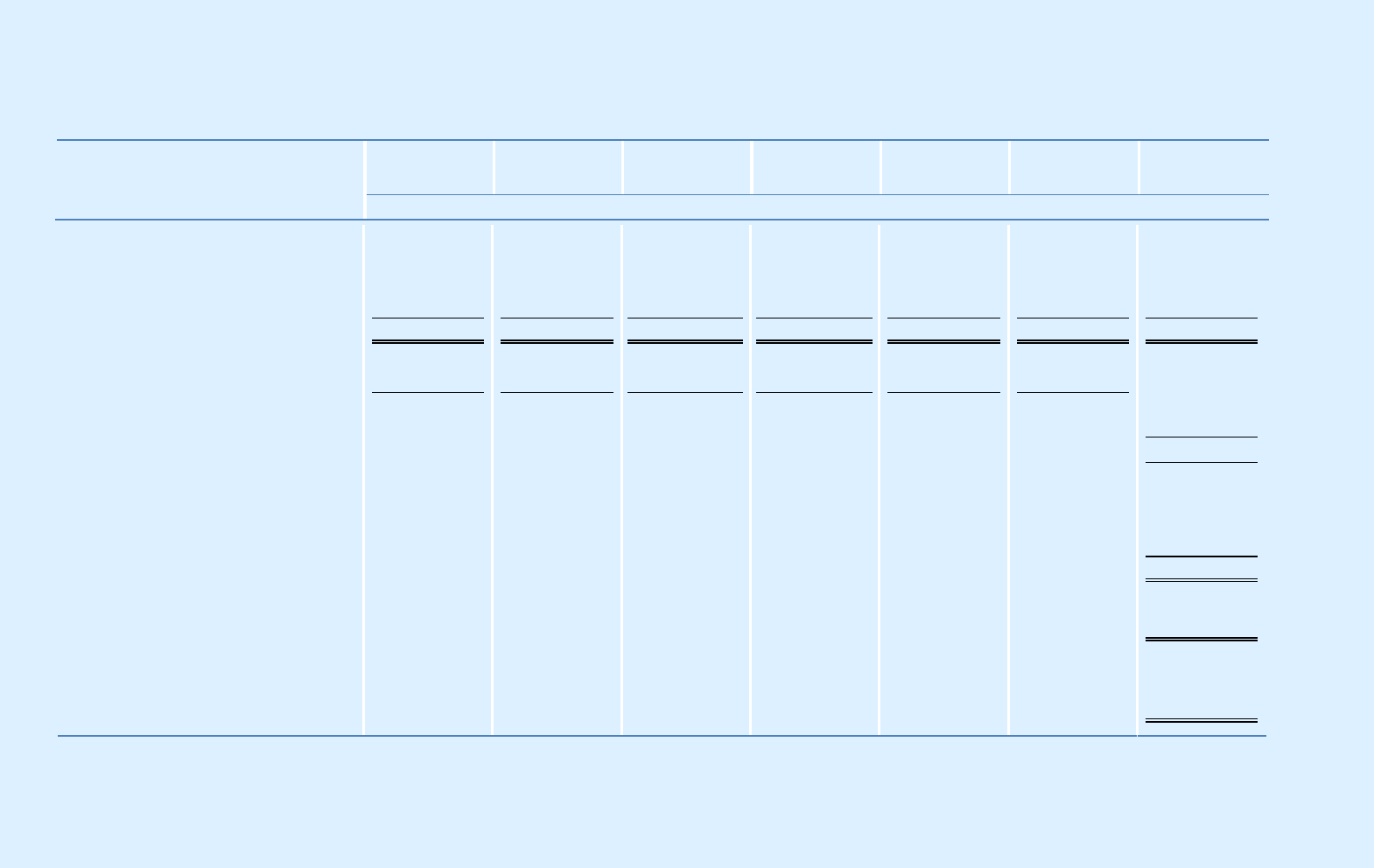

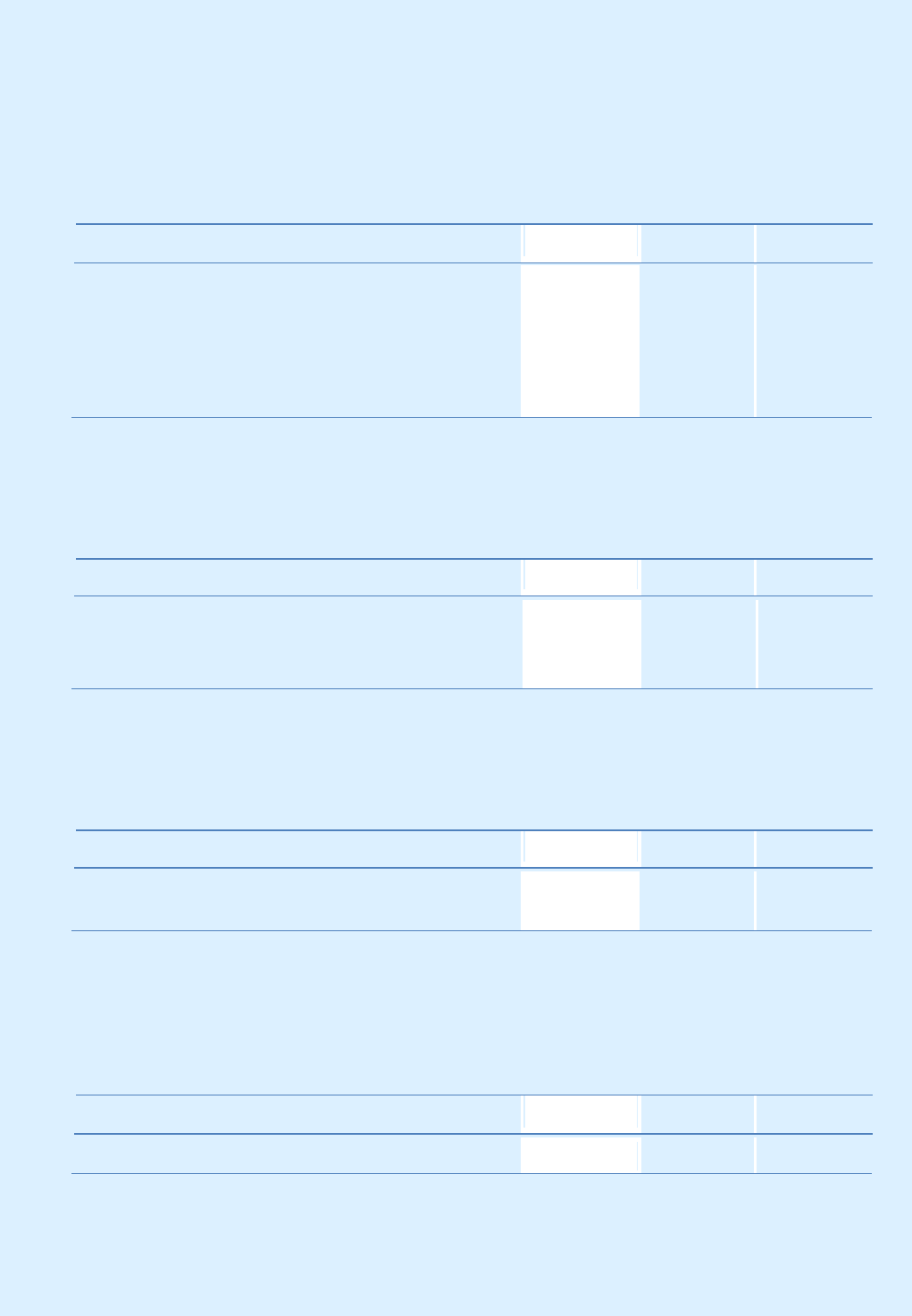

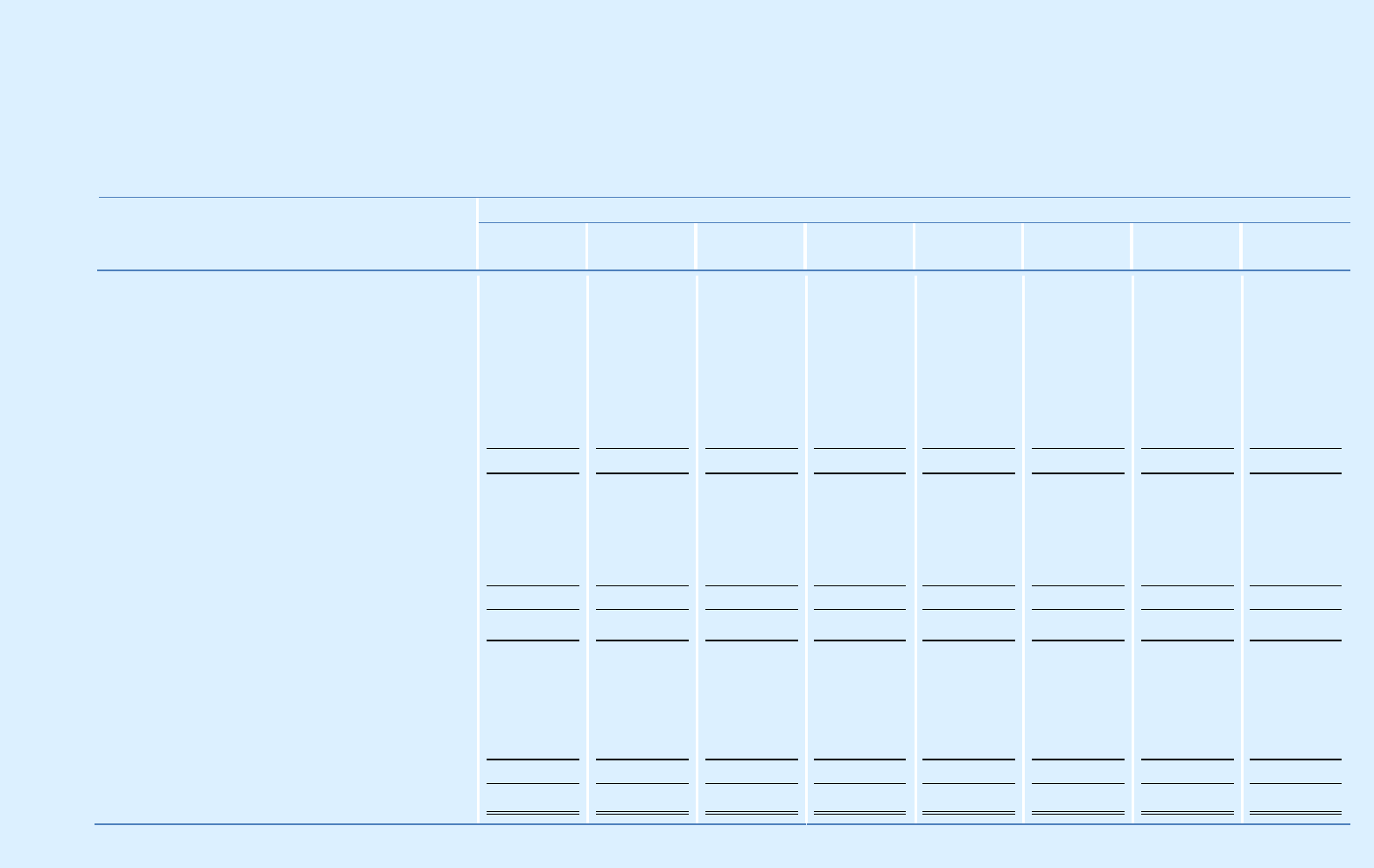

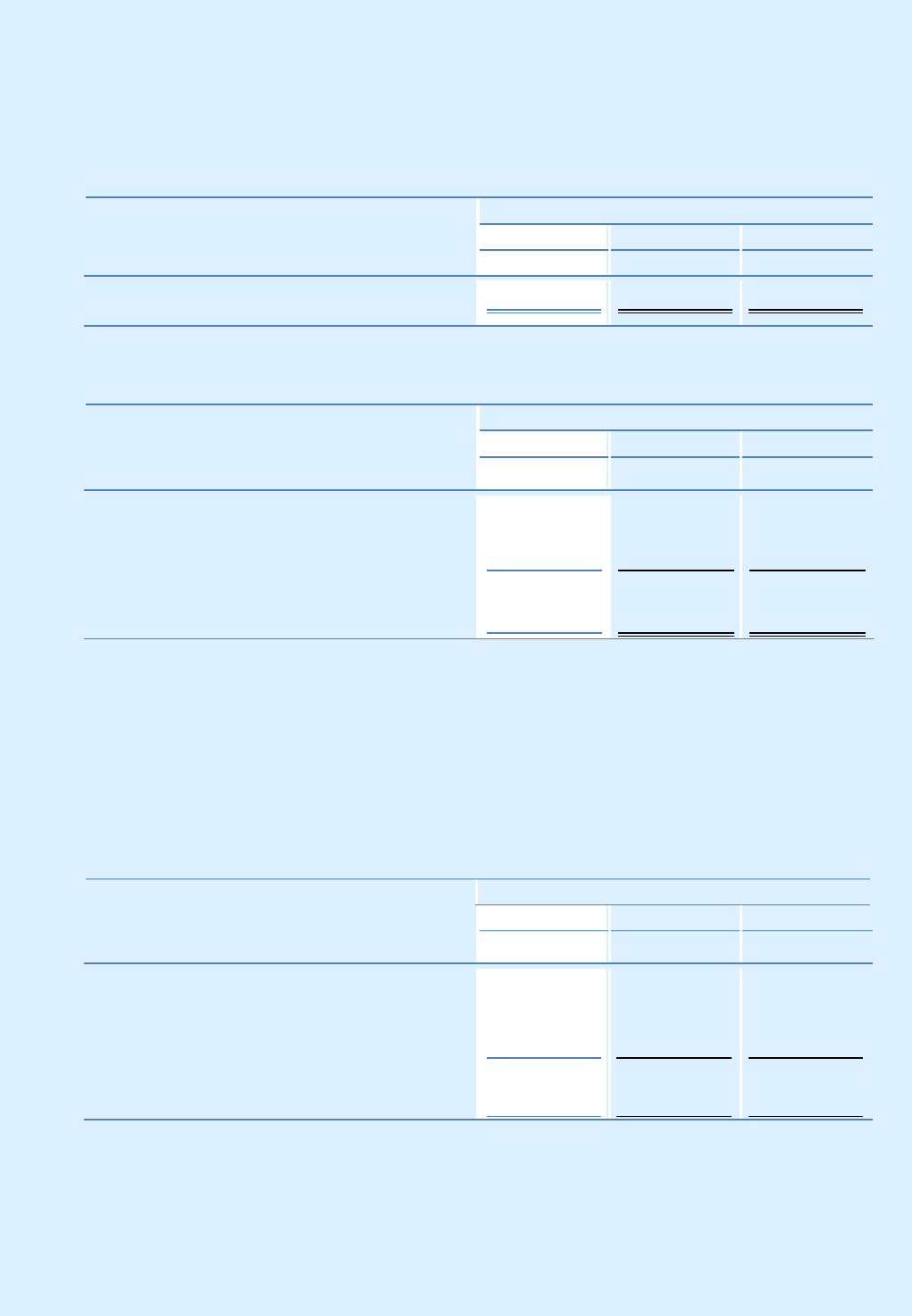

A. SELECTED FINANCIAL DATA

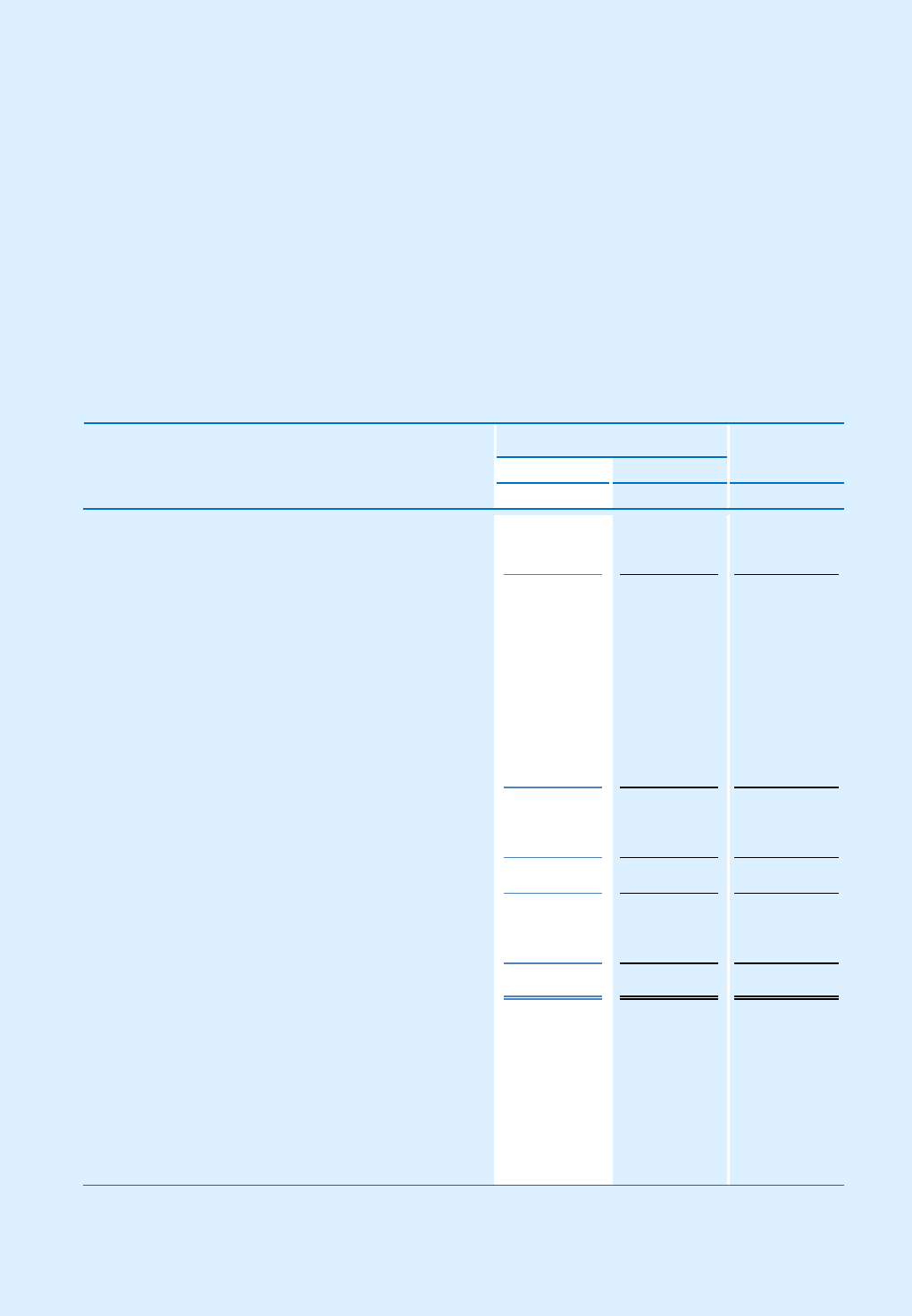

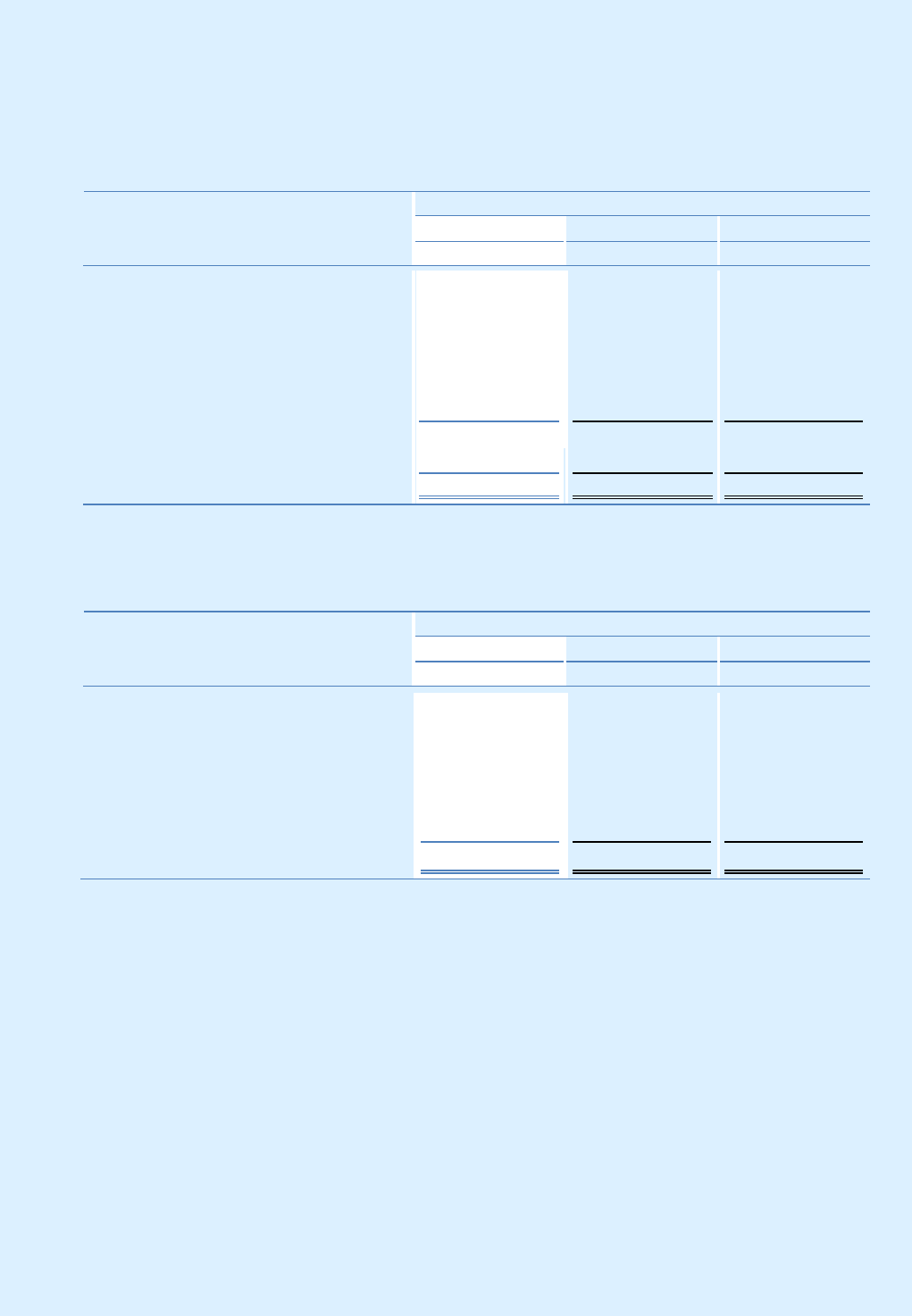

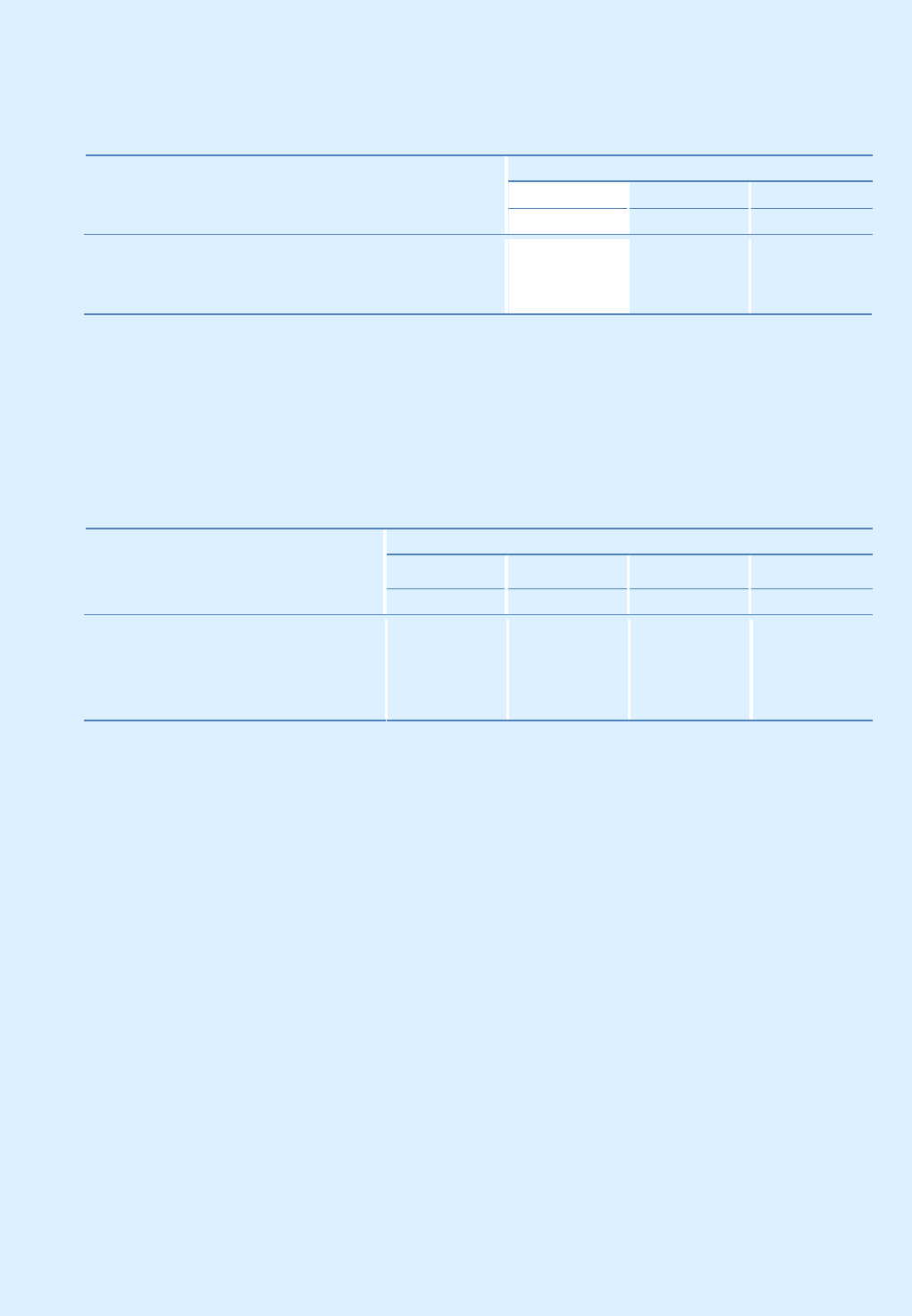

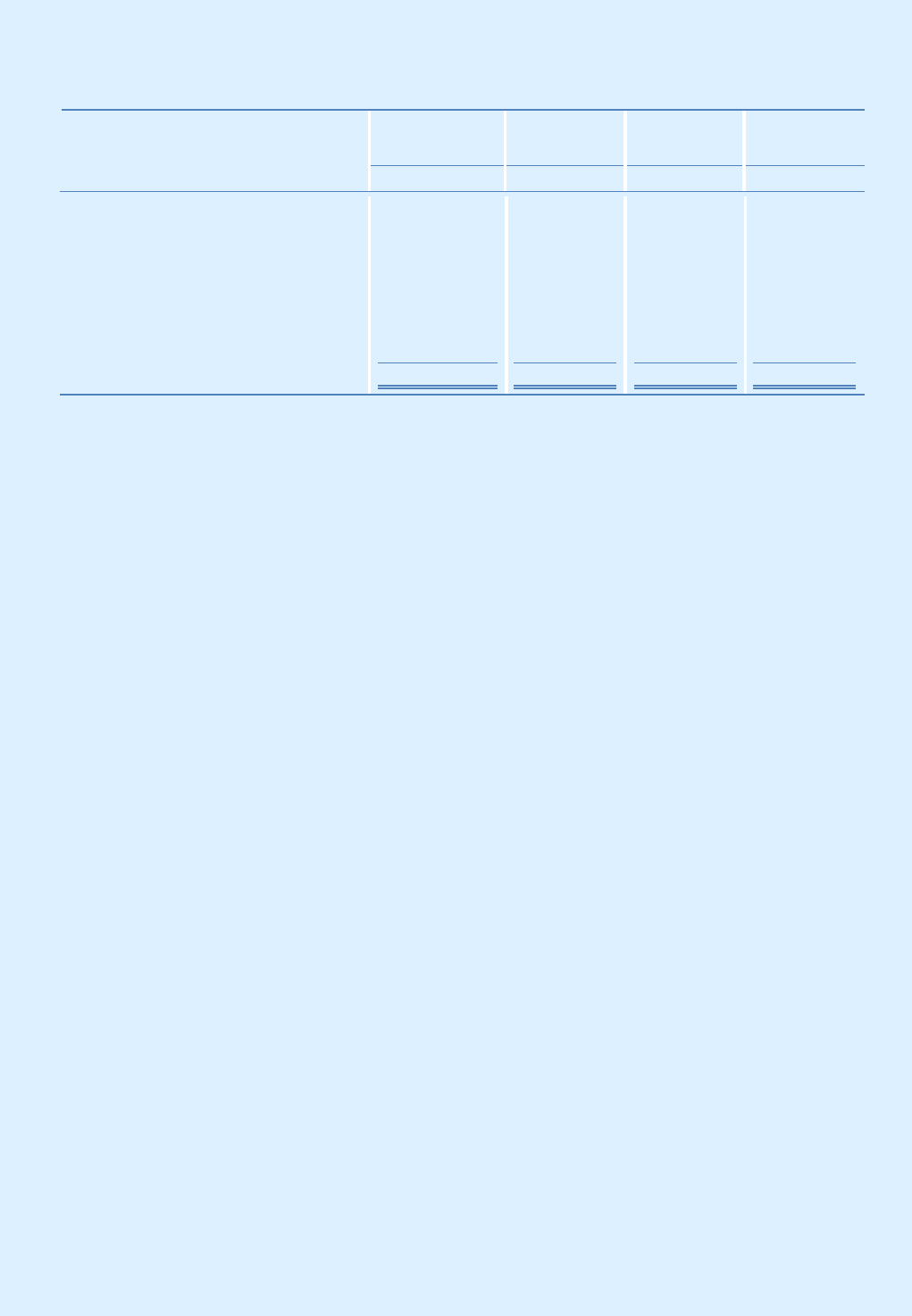

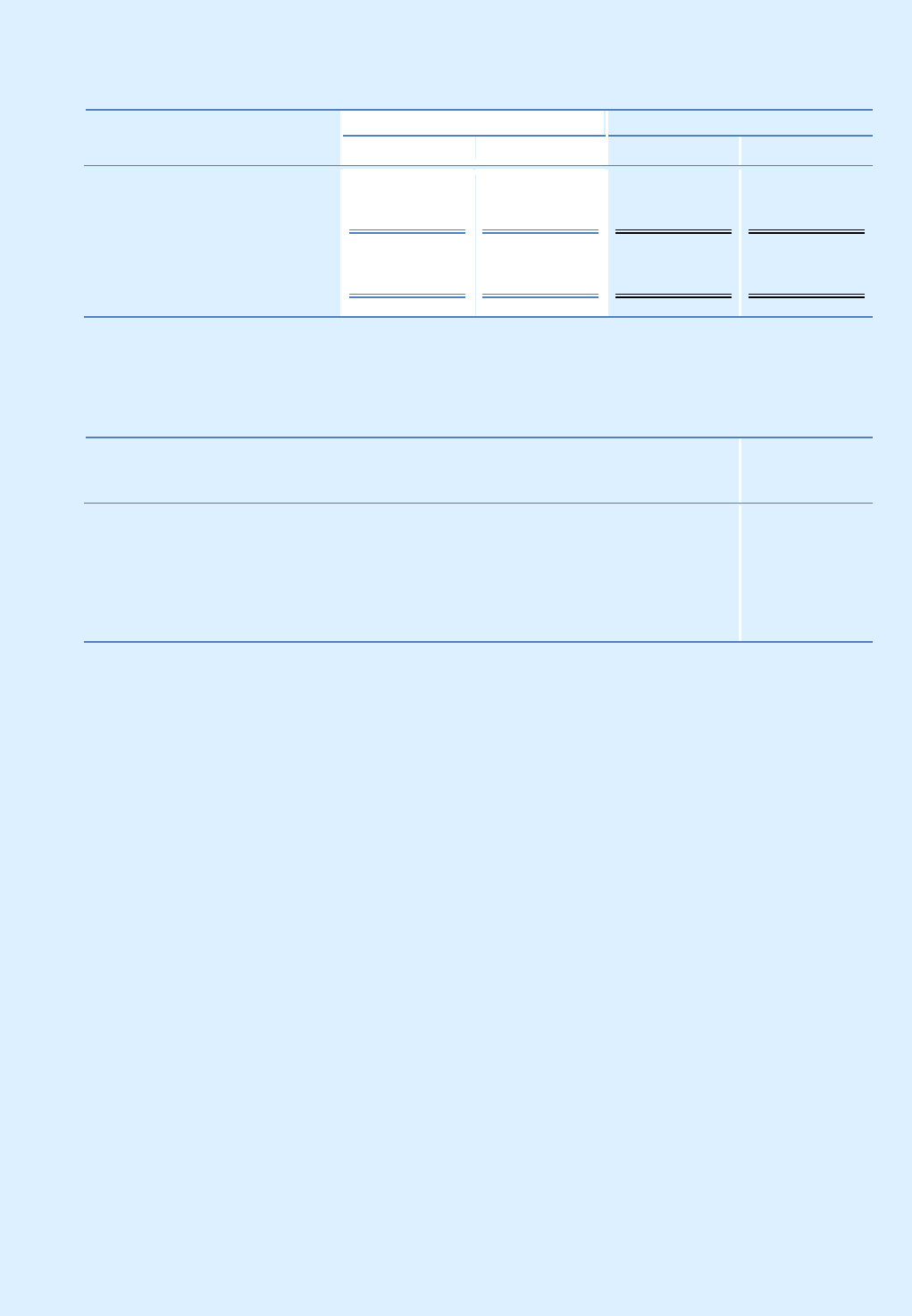

We ha ve d erived t he con solid a t ed st at ement s of income d a t a for t he ye ars end ed Decemb er 31,

2020, 2019, 2018, 2017 a n d 2016 an d t h e con solid at e d st at e me nts of fin an cial posit ion as of

De cemb er 31, 2020, 2019, 2018, 2017 a n d 2016 from ou r au d it ed con solid ate d financial st a tements

wh ich h ave b e en prepa red in accord a nce wit h I FRS, as issu ed by t he IA SB for t h e yea rs ended,

De cemb er 31, 2020, 2019, 2018, 2017 an d 2016. You sh ou ld read t h e con solid ated fin an cial d ata

se t fort h b e low in con ju n ct ion wit h ou r con solid at ed au d ite d fin ancia l st atements an d related n otes

an d t h e in for ma t ion u n d er “I t em 5 - Oper at in g a n d Finan cial Re view an d Pr ospect s”, a ppearing

elsewh er e in t his A nn ual Report . O ur report ing currency is t h e U.S. d ollar. Our h istor ical resu lts are

not n ecessar ily ind icative of ou r results to be expected in a ny fu tu re period.

2 ICL Group Limited

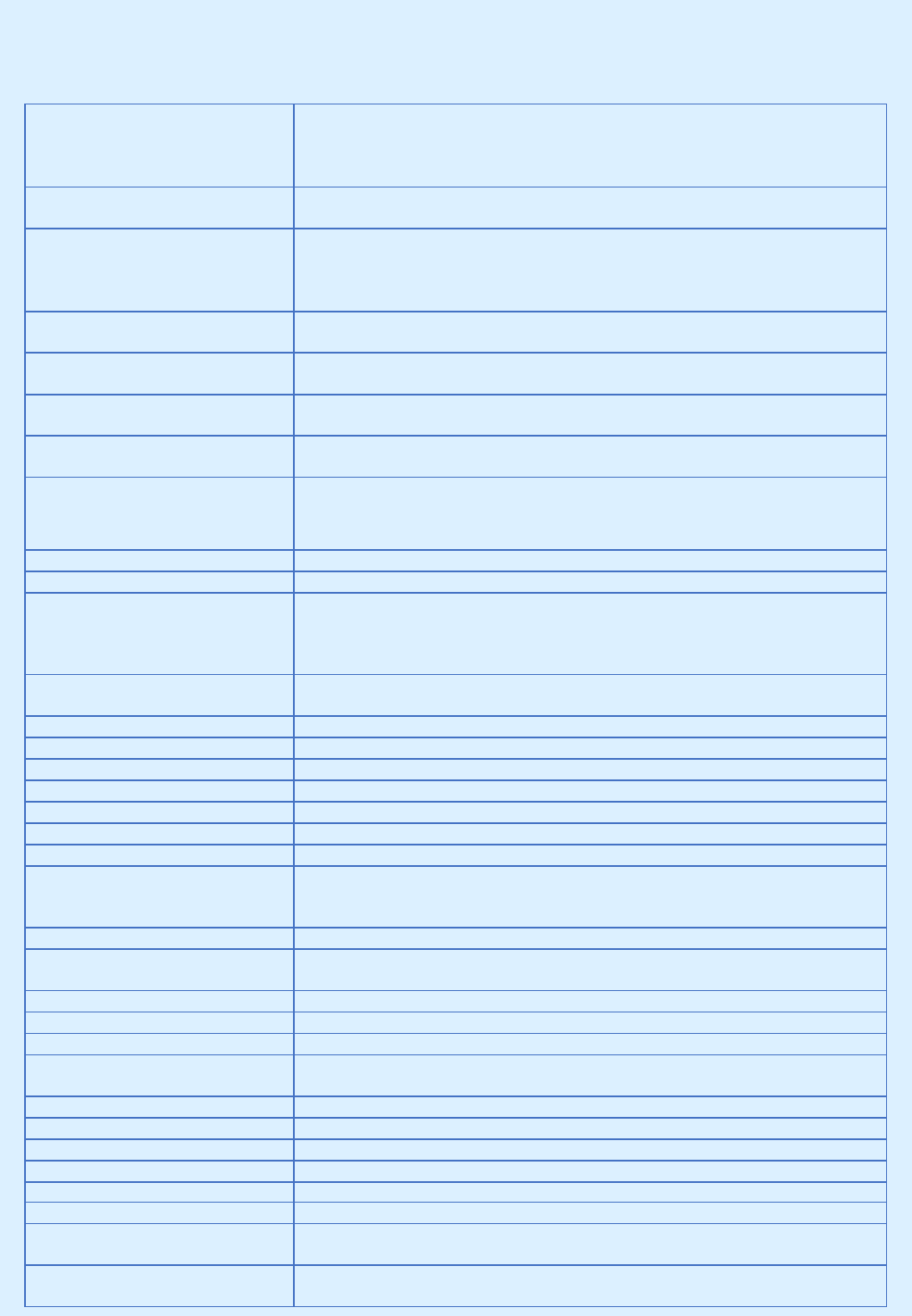

For the Year Ended December 31,

2020

2019

2018

2017

2016

US$ millions, except for the share data

Sales

5 , 0 43

5,271

5,556

5,418

5,363

Gross pr ofit

1 , 4 90

1,817

1,854

1,672

1,660

Ope rat in g in come ( loss)

2 0 2

756

1,519

629

(3)

In come ( loss) b efore in come

t axes

49

628

1,364

505

(117)

Net in come ( loss) at t r ib ut able

to t h e sh are hold ers of t h e

Compan y

11

475

1,240

364

(122)

E a rn ing s (lo ss) pe r sh are (in

d ol lars):

B asic earn in g s ( loss) per

sh are

0 . 0 1

0.37

0.97

0.29

(0.10)

Dilu t ed e arnin gs ( loss) per

sh are

0 . 0 1

0.37

0.97

0.29

(0.10)

W e ig hte d averag e n u mber of

o r d in ary sh ares ou tst an ding :

B asic ( in t h ou sand s)

1 , 2 80,0 26

1,278,950

1,277,209

1,276,072

1,273,295

Dilu t ed ( in t hou san ds)

1 , 2 80,2 73

1,282,056

1,279,781

1,276,997

1,273,295

Divid e n d s d ecla red pe r sh are

( in d ollars)

0 . 0 9

0.22

0.18

0.13

0.18

For the Year Ended December 31,

2020

2019

2018

2017

2016

US$ millions

S t atements of Fin an cial

P o s it ion Da t a:

Tot al asset s

9 , 6 64

9,173

8,776

8,714

8,552

Tot al lia b ilit ie s

5 , 5 76

5,112

4,861

5,784

5,893

Tot al equ it y

4 , 0 88

4,061

3,915

2,930

2,659

B. CAPITALIZATION AND INDEBTEDNESS

Not A pplicab le.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not A pplicab le.

3 ICL Group Limited

D. RISK FACTORS

Su mma ry of Risk Fa ctors

Ou r b u sin ess, liqu id it y, fin an cial con d it ion and r esu lt s of opera t ion s cou ld be ad ver se ly a ffect ed,

an d even mat e rially so, if an y of t h e risks d escrib ed b elow occu r . As a r esu lt , t he t rad in g price of

ou r se cu rit ies cou ld d eclin e, and in vest ors cou ld lose a ll or pa rt of t heir in vest men t. Th is A nn ual

Repor t con t ain s forward - lookin g st a tements t h at in volve risks an d u n ce rta int ies, see “Spe cia l Note

Reg ard in g Forward -Lookin g St at emen ts.” Ou r act u al resu lt s cou ld d iffer mat e rially a n d ad ver se ly

from t hose an t icipat ed, as a resu lt of cert ain fact ors, in clu d ing t he risks fa cin g t h e Compan y as

d escrib ed b e low a nd e lse wh ere in the A n nu al Re port . Mat e rial risks t h at may affect ou r b u sin ess,

operat in g r esu lts an d fin ancial con d ition in clu de , b ut are n ot n ecessarily limit ed t o, t h ose r elating

t o:

• Ou r ab ilit y to operat e a nd / or expan d ou r prod u ction and ope rat ing facilit ies world wid e is

d epen d ent on ou r receipt of, and complia nce wit h, permit s issu ed by govern mental au thorit ies.

A d e cision by a g ove rn me nt a u t hority to d en y an y of ou r per mit applica t ion s may impair t he

Compan y’s b u sin ess and it s operation s.

• As a min in g a n d in d u st rial ch emicals Compan y, we are expose d to var iou s le gisla t ive and

lice nsin g re st riction s in t h e ar eas of en vironmen tal prot ect ion an d sa fet y. Related compliance

cost s an d lia b ilit ies ma y a d ve rsely affect t he r esults of ou r operat ions.

• Ou r min e ral e xt raction oper at ions are d ependent on con cession s, licen ses a nd permit s granted

to us by t h e re spect ive gove rnmen ts in t he cou ntries in wh ich we oper ate .

• Secu rin g t he fu tur e of t he ph osph ate min in g ope ration s at Rot em I srael d epends on ob ta ining

se ve ral a pprova ls an d per mit s fr om t h e auth or ities in I srael.

• Th e COVI D-19 ou t b reak has impact ed an d cou ld in t h e fu t ure mat erially a nd ad versely affect

ou r fin an cial con d it ion a n d re sult s of ope ration s.

• Ou r ope rat ions an d sales are expose d to volat ilit y in t he su pply and d eman d , merg ers of key

prod u ce rs\ cust omers\ supplier s, e xpa nsion of prod u ction capacity an d compet ition from some

of t h e world ’s lar gest chemical an d min in g compa n ies.

• Th e accu mu lat ion of sa lt at t h e b ot t om of Pon d 5, t h e cen t ra l e va poration pon d in ou r solar

evapor at ion pon d s syst em u sed to ext ract min er als from t h e Dead Sea, requ ire s reg u lar

ha rvest in g of th e salt in or d er to main t ain a fixed br in e volu me an d th er eby su st a in the

prod u ct ion capa cit y of e xt ract ed minerals and pre ve n t pot en tia l d amag e to t he fou n d at ions

an d st ru ctures of t he h otels an d ot he r bu ildin gs sit u ated close to t h e ed ge of t h e Pon d.

• Th e re ced in g wat er level in t h e Nort h ern B asin of t h e Dead Sea , may re qu ire capit al an d /or

operat ion al e xpen ses in ord e r to en able t h e con t inu at ion of t h e Compan y's ope rat ion s in the

De ad Se a.

• We are e xposed to risks associat e d wit h ou r in t e rn ation al sales a nd opera t ion s, wh ich cou ld

ad ver se ly affe ct ou r sa les to cu st omer s as well as ou r ope rat ion s an d asset s in var iou s cou n tr ies.

Some of t he se fact ors may also make it less at t ractive to d ist rib ut e ca sh g en e rated by our

operat ion s ou t sid e I srae l to ou r sh areh old ers, u se cash ge n era ted by ou r ope rat ion s in on e

cou n t ry to fu n d ou r ope rat ion s or r epayme n t s of ou r in d eb t e dness in an ot h er cou n t ry and

su ppor t ot h er corpor at e pu rposes or t he d istribu tion of d ivid en ds.

4 ICL Group Limited

• Chan ges in ou r e valu at ions a n d estimat es, wh ich ser ve as a b a sis for ana lyzing ou r con tingent

liab ilit ies an d for t he recogn ition an d me asure men t of a sse t s an d liab ilit ies, in clu d ing provisions

for wast e r emoval a nd t he re clamation of min es, may ad ve rsely affect our b usin ess results and

fin a ncia l sit u a tion .

• Ou r t ax liab ilit ies may be h igh er t han e xpe cte d.

• Du e to t he n at u re of ou r Compa ny, we are expose d to ad min ist r at ive and le g al proce edings,

both civil an d cr imin al, in clu d in g as a re su lt of alle ge d en viron mental con t amin at ion ca used

by ce rt ain of ou r facilit ies.

Risks Relat ed to Our B usin ess

O u r m ine ral e xtracti on o per at ions are d e pe nd en t on c on cessions, licen ses and permit s g ran ted to

us by t he respective g overn men ts in t he cou nt ries in wh ich we operat e

Ou r min er al ext r act ion bu sin esses d e pen d on con cession s gran t ed to us by t h e re spect ive

governmen t s in the coun tr ies in which we ope rate. Loss of con cessions, licen ses a n d/ or pe rmit s, as

well as mat erial ch an g es to t h e con d it ion s t h ere of, cou ld ma t erially an d ad versely affect ou r

b u sin ess, fin an cial con dit ion a nd r esult s of opera tion s.

We e xt ract pot ash , ph osph ate , b romin e, mag ne sium an d ce rtain ot h er min erals in I srae l, pot a sh and

sa lt in Spain , Polysu lpha t e ®, salt, an d cert ain ot he r min erals in t he Unit ed Kin gd om and ph osphate

in Ch in a, pu rsu ant to con cession s a n d pe rmit s in th ose cou ntr ies.

I s rael

Pu rsu an t to t h e I sr aeli Dead Sea Con ce ssion La w, 1961 ( h ere in after – t h e Con cession Law), as

amen d ed in 1986, and the con cession d eed a tta ched as an add en dum to t he Con cession Law, DSW

was g ra nt ed a con cession to u t iliz e t h e resou r ces of t h e Dead Sea a n d to lea se t h e lan d re qu ired

for it s pla nt s in Sod om for a per iod en d in g on March 31, 2030, a ccompa nied by a pr iorit y rig h t to

receive t h e con ce ssion aft er it s e xpiration , sh ou ld t h e Government d ecid e to offe r a ne w con ce ssion.

Th er e is no assu ra nce t hat t he Company will con t in ue to h old t he con cession b eyon d t ha t period.

In accor d an ce wit h sect ion 24 ( a) of t h e Su pplement to t h e Con cession La w, it is st at e d , a mong

ot h er t hin gs, t hat at t h e end of t he con cession pe riod a ll t he tang ible assets at t he con cession area

will be t ran sfe rred to the gover nme nt, in exch an ge of t h eir amortize d r eplacemen t valu e – t h e value

of t h e a sse t s as if t h ey are pu rcha sed as n ew at t h e en d of t he con cession pe riod , less t h eir t ech nical

d eprecia t ion b ased on t h eir main te na nce con d ition a nd th e u n ique charact eristics of t h e Dead Sea

area.

Th er e is no cer t ain ty as to t h e man ner of in t erpr eta tion of t h e provision s of t h e Con cession La w in

t his con t ext as will be a d opt ed in a leg al proceed in g , to t h e ext ent su ch proce edin g wou ld occur.

For fu rt h er in formation , see Not e 18( b) to ou r Au dited Fin ancia l Statements.

We min e ph osph at e rock from ph osph at e d eposit s in t h e Neg ev d e sert in accord ance wit h two

min in g con cessions from t he St at e of Isr ael, wh ich are va lid un t il t h e en d of 2021. For fu rt her

in format ion on r ece nt d evelopmen ts re gardin g t h e ext e nsion of t h e con ce ssion s for an a d d it ional

period of t hr ee yea rs, see Not e 18( b ) to ou r A u d it ed F in an cial St at emen ts. In a d dit ion, Rot em h as

t wo le ase agr eements in effect unt il 2024 a n d 2041 an d an add ition al le ase agree me nt of t he O ron

plan t , wh ich t h e Compa ny h as b e en workin g to ext en d sin ce 2017, by exer cisin g t h e e xt en sion

opt ion provid ed in t h e agreement.

5 ICL Group Limited

Th e Company is a ct in g to r en ew t h e said con cession s an d le ases, an d b elieves t h at it is likely to

occu r sin ce it is t he on ly en t it y wit h appropriat e prod u ct ion facilit ie s; n e vert heless, t h ere is no

cer t ain t y t hat t hese con cession s a nd lease s will be re newe d u nd er t he sa me t erms or at all. Fa ilure

to re ne w t h e said con ce ssion s an d lea se s or d iffere n t t er ms cou ld mat e rially a nd ad ver sely affect

ou r b u sin ess, fin an cial con dition an d result s of operation s. F or fu rthe r infor mation on con cessions,

leases and per mit s, see Not e 18( b) to t he Compa ny's A udit ed Financial St atement s.

Ou r exist in g ph osphat e mines in t h e Neg ev d ese rt hold limit e d rese rves of ph osph at e r ock

d esig nat ed for ph osphoric acid prod u ction . T he Compa ny is workin g to promot e t h e plan for min ing

ph osph at es in B ar ir field , which is locat ed in t h e sou t h ern pa rt of t h e Sou t h Zoh ar d eposit in t he

Neg ev Deser t . T h ere is no cert ain t y r eg ard ing t he t imelin e s for t h e su b mission of t h e plan , it s

approval, or fu rt h er d evelopme nt s wit h r espe ct to th e Barir fie ld sit e . Failu re to ob t ain su ch approval

or a sig n ifican t d elay in r ece ivin g it or in fin d in g a lt e rn ative sou rces of ph osph at es in I sr ael, will

ha ve a sig nifica n t n eg ative impact on t he Grou p’s fu tu re min in g reserves an d our b usin e ss, fin ancial

con d it ion a nd r esu lt s of ope rat ion s will be ad ve rsely affect ed , eve n mat erially. F or fu rt her

in format ion , see “It em 3 - Key I n for mat ion — D. Risk Fact ors— Se cu rin g t h e fu t ure of t h e ph osph ate

min in g operat ion s at Rot e m I sr ael d e pen d s on ob t ain in g several appr ovals a nd permit s from the

au t h or it ies in Isr ael”, “I t em 4 - I n format ion on t h e Compan y— D. Propert y, Plan t a nd Equ ipme nt—

Min er al Ext r act ion an d Minin g Operat ion s - Neg ev”, “Con cession s an d Min in g Rig h t s” and

“Rese rves”, an d Not e 18(b ) to ou r A u dite d Fin an cial St ate me nts.

S p a in

A su b sid iary in Spain ( he rein after – I CL I b er ia) was g ran t e d minin g rig ht s b ased on leg isla t ion of

Spa in ’s Governmen t fr om 1973 an d t h e re gu lat ions accompan yin g t h is leg isla t ion . Fu rth er to the

legislat ion , as st a t ed , the Government of t h e Catalon ia region pu blish ed spe cial min in g regula tions

wh ere b y I CL I b eria received in divid u al licen ses for each of t he 126 d ifferent sit e s t h at are r ele vant

to t h e cu rre nt and possib le fu t u re min in g activit ies. Some of t h e licen ses are valid up to 2037 and

t he rest are effect ive up to 2067. T h e con cession for t h e "Reserva Cat alan a", an ad d itional site

wh er ein min in g h as n ot yet b een comme n ced , expired in 2012. Th e Compan y is act in g in

cooperat ion wit h t h e Span ish Govern ment to ob ta in a r enewal of t h e conce ssion . A ccording to the

Spa n ish au t h or itie s, t h e con ce ssion per iod is va lid un t il a fin al d ecision is mad e r eg ard in g the

ren ewal. Ma in t ain in g t h e min in g a ct ivit y in Spain also requ ire s mu n icipa l a nd e nviron me ntal

lice nse s. If su ch lice n se s are not ren ewe d, t his wou ld be expect ed to affect , possib ly in a sub sta ntial

ma nn e r, t h e min ing activit y at certain sit es in Spain and t he Company’s fin ancial r esults. For fu rther

in format ion , see “It e m 4 - I n format ion on t h e Compa ny— D. Prope rt y, Plan t and Equ ipme nt— Min eral

Ext ract ion an d Min in g Operation s” and “ Concession s and Min in g Rig hts” and “Reserves”, a nd Note

18( b ) to ou r A u d ited Fin an cial St ate me nts.

U n it ed Kin gdo m

Th e min in g rig ht s of a su b sid ia ry in t he Unit ed Kingd om ( h er ein aft er – I CL B ou lb y), are b a se d on

approxima t ely 114 min in g le ases an d licen ses for ext r act in g var iou s min erals, in ad d it ion to

nu mer ou s e asemen t s a n d rig h t s of wa y fr om privat e owne rs of lan d u n d er wh ich I CL B ou lby

operat es, an d min ing rig ht s under th e Nort h Sea g ran ted by t he Br itish Crown (Crown Est ates). The

lease rig ht s wit h t h e Crown Est at es, inclu d e provision s to e xplor e an d e xploit all t arg et ed and

kn own Polysu lph at e min er al re sou rces of in t erest to ICL B ou lby. The sa id min eral le ases cover a t otal

area of ab ou t 720 squ ar e kilomet e rs ( onsh or e lea se s t otalin g aroun d 90 squ a re kilomet ers an d the

offshore le ases from t h e Cr own Est at es coverin g aroun d 630 squ are kilomet e rs). As at t h e d ate of

t his report , all t he le ase period s, lice nse s, ea se me nt s an d rig ht s of way a re effect ive, some up to

2022 a nd ot h er s up to 2038. T he Compan y is act in g to r en ew t he rig hts n ecessary for t h e min ing

operat ion which e xpire in 2022 or a lt ern at ive ly will seek to ob t ain own er sh ip of t h ese r ig h t s. The

6 ICL Group Limited

Compan y believes, it is more likely t h an n ot , t ha t it will ob t a in re ne wal or own ersh ip of all t he

need e d rig hts. Ne ve rth eless, in t h e event su ch Rig hts are n ot ob t a in ed , t h e min in g act ivit y in the

UK may be su b st a ntially a ffe ct ed . F or fu r t he r infor mat ion , se e “I t em 4 - I nformat ion on t he

Compan y— D. Pr opert y, Plan t a nd Equ ipme nt — Min er al Ext ra ct ion an d Min in g Opera t ion s” and

“Con cession s a nd Min in g Rig hts”, an d Not e 18(b ) to ou r A u dite d Fin an cial St ate me nts.

C h in a

The Compan y h old s a join t ven t u re ( “Y PH J V”) wit h Yun nan Phosph ate C he mica ls Grou p ( “ YPC”), a

ph osph at e prod u cer ope rat in g in Chin a. YPH JV h old s t wo ph osphat e min in g lice nse s t h at we re

issu ed in J u ly 2015, by t he Division of La n d an d Re sou rces of th e Yu n n a n d ist r ict in Ch in a: ( 1) a

min in g licen se for t he Ha ikou Min e ( h er ein aft er – Ha ikou ) in wh ich t he Compan y r u ns it s ope rat ions

an d which is va lid up to J an u ary 2043, an d ( 2) a minin g licen se for t he B ait acu n Min e , which expired

in Nove mb e r 2018. In ord er to prese rve th e rig hts for t h e B aitacun min in g licen se and facilit ate its

ren ewal in 2021, the Company paid an a d va nce in an immat e ria l a mou n t . Th e Compan y is

examin in g t h e fe asib ilit y of r en ewin g t h e B ait acun con cession , and will b ase it s d ecision , amon g

oth er t h in g s, on ph osph at e rese rves soil su rvey r esu lt s an d on t he u n d erst an din g to be a ch ieved

wit h t he au thorities. If Ha ikou's licen se is n ot r en ewed, t his wou ld be expect ed to affect , possib ly in

a su b st an t ial man n er, t h e min in g act ivity in Chin a and t he Company’s fin an cial resu lts. For fu r ther

in format ion , see “It e m 4 - I n format ion on t h e Compa ny— D. Prope rt y, Plan t an d Equ ipmen t— Min eral

Ext ract ion an d Min in g Oper ation s” an d “C on cession s an d Min in g Rig ht s" and “Reser ves”, an d Note

18( b ) to ou r A u d ited Fin an cial St ate me nts.

O u r ab ility to operate an d/or e xpand our prod uction a nd ope ratin g facilit ies world wide is d epe n den t

on ou r re ceipt of, an d compliance with, permit s issu ed by governmen ta l au thor it ies. A d ecision by

a g overn ment au th orit y to deny an y of ou r permit applica tion s may impair the Compan y’s busin ess

a n d it s o peration s

Exist in g per mit s are su b ject to challenges wit h respe ct to t he ir valid it y, re voca t ion, mod ifica t ion and

non - ren ewal, inclu d ing as a resu lt of en viron ment al e ve nts or ot h er u nforese eab le occu rren ces. Any

unsu ccessfu l ch allen g es cou ld lea d to sig n ifican t cost s an d mat erially ad verse ly a ffect ou r

operat ion s and fin an cial con d it ion . In ad d it ion, a failu re to comply wit h t h e t erms of ou r per mit s

cou ld r esu lt in paymen t of su b sta nt ial fin es a nd su b ject t he Compa ny a n d it s mana gers to cr iminal

sa n ct ion s.

Fu rt h ermore , our prod u ct ion proce sse s gen era te b yprod ucts, some of wh ich are salea b le wh ile

ot h er s mu st be reu sed or d isposed of as wast e . St orag e, t ra nsport at ion, r eu se and wa st e d isposal

are g en erally r eg u la ted by g ove rn me n t al au t h orities in t he ju risd ict ion s in wh ich we oper at e.

Permit s issu ed by g overn me nt al au t horities are con t in g ent on ou r complia nce wit h re le vant

reg u lat ion s in the ju r isdict ions in wh ich we ope rat e. If t he va lid ity of ou r per mit s or th e revocation,

mod ificat ion or n on - re newal of ou r per mit s occu rs as a re su lt of ou r non complia nce wit h re gula tions

relat in g to st ora ge, t ransport ation, reuse an d wast e d isposal, prod u ct ion may be in t errupte d or even

cea sed , wh ich can le ad to sig n ifican t cost s ad ver sely affect in g ou r ope rat ion s an d finan cial

con d it ion .

7 ICL Group Limited

O u r o peration s a nd s ales a r e e x posed to v o la t ility in t h e s u pply an d d eman d, merg ers of ke y

p r od u cers\cust omer s\sup pliers, e xpa nsion of p rodu ction capacity an d c ompet ition from some of

t he w orld’s lar gest ch emical and min in g co mpa nies

In ad d it ion to se ason al an d cyclica l va riation s, t he Compan y’s b u sin esse s are exposed to flu ctuations

cau se d , in part , by fact or s on t h e su pply sid e, su ch as e nt ry in t o t he mar ket of n ew man u facturers

an d pr od u ct s, me rg ers of ke y player s ( prod u cers\supplie rs), expan sion of t h e prod u ct ion ca pacity

of exist in g man u fact urers, an d cha nges on t he d eman d sid e, su ch as merg ers or collab orat ions

b et ween key cu stomer s. Ou r compet itors in clu de some of t h e world ’s lar gest chemical and min ing

compan ies, some of wh ich are st at e- owned or gover nment -su bsidize d. T he pot en t ial prod u ct ion

capacit y is cu rren tly g reater t han t he glob al de ma nd , which h as affected pr ice levels. In lig ht of the

fact t ha t some of ou r prod u ct s are commod it ies ava ilab le from sever al sou rces, th e primary

compet it ive fa ct or wit h respect to ou r pr od u ct s is th e price. T he price s of ou r prod u ct s are

in flu en ced by t h e prices pre va ilin g in t he ma rket , wh ile t h e ove rsu pply as compa red to d emand

con st it u t es a n egative factor in the field of commod it y pr ices such as pot a sh and ph osphat es, as do

low price s in t h e ag ricu lt u ral sect or. Ad d it ion al compe t it ive fa ct ors in clu d e pr od u ct qu a lit y,

cu st ome r ser vice an d t echn ica l a ssist ance. If we are u n ab le to compet e effect ive ly wit h th ese

compan ies, ou r re su lt s of operat ions wou ld almost cer tainly be sig nificantly an d adve rsely affected.

More over , some of ou r pr od u ct s are market ed t hr oug h d ist rib utors, main ly as pert ains to t he activity

of t h e Phosph at e Solu t ion s seg me n t an d Specialt y Fe rt ilize rs b u sin ess. An y replace me nt of, or

mod ificat ion to t he composit ion of ou r d ist rib u tor s mig ht ad ver se ly affect t he Company’s

compet it ive ab ilit y a nd cause a d ecrease in sales in certain mar kets, at least in the short te rm.

O v e restimation of m i n eral a n d resou rce r eser ve s c ould r esu lt in lower -than -expected sales an d/or

h i gher t han e xpe cte d c ost s an d may ha ve a mat erial ad ve rse effect on ou r b u siness, fin an cial

c o n d ition a nd re sults of o pera tion s

We b ase ou r est imat e s of min eral a n d re sou rce r eserve s on e ng ineering , econ omic an d g eolog ical

d at a t ha t is compiled a n d an alyzed by ou r e ng inee rs a nd g eolog ists. However , rese rves e st imates

are by n a t u re impr ecise a nd r ely to some ext e nt on st at ist ical infere nces d rawn from availa b le

d rillin g d a t a, wh ich may prove un reliable/in accurate. There are n umerous in h eren t un cer taint ies in

est ima t in g qu an titie s an d qu alities of min er al d eposit s a nd rese rve d e posit s, as well t he qu a lit y of

t he or e, an d t h e cost s of min in g recoverable re se rves and t he econ omic fea sib ilit y t hereof, in clu ding

ma ny fact ors b eyond ou r con t rol. Est imat es of econ omica lly feasib le commer cia l rese rves n e cessarily

rely on a n u mb e r of fact or s an d assu mpt ion s, all of wh ich may vary con sid era b ly from t h e act ual

resu lt s, su ch as:

• Geolog ical an d min in g con d it ion s an d / or effect s of prior min in g t h at may n ot be fu lly

id e nt ified /assessed with in t he a va ilable data or th at ma y d iffer from t hose b ased on exper ien ce;

• Assu mpt ion s con ce rn in g fu t ure pr ices of pr od u ct s, operat in g cost s, upda t es to t h e st atist ical

mod el and geolog ica l pa rameters accordin g to pa st e xpe rience a nd developin g practice s in this

fie ld , minin g t echn olog y improvemen ts, d evelopment cost s a nd re clamat ion cost s; and

• Assu mpt ion s con ce rn in g fu ture effects of r eg ulation , in clu din g t he issu an ce of r equ ired per mits

an d t axes impose d by g ove rnmen ta l age ncies.

If t h ese fact ors a n d assu mption s cha ng e, we may n eed to re vise ou r min era l a nd resource r eserves

est ima t es.

8 ICL Group Limited

Any re vision s to ou r previou s r eser ve est imat es or in accu ra cies in ou r est imat e s relat e d to our

exist in g mineral an d resou rce rese rves cou ld r esu lt in lowe r-t han-expe cte d sa les an d/or hig her than

expect ed cost s a nd ma y h ave a mat e rial ad ve rse e ffect on ou r b u sin ess, finan cial con d it ion and

resu lt s of oper at ion s.

In Oct ob er 2018, t h e SEC a d opt ed a fin a l ru le t h at will repla ce SEC I nd u st ry Gu id e 7 wit h n ew

d isclosu re requ ire men ts t h at are mor e closely alig n ed wit h cu rrent in d ust ry a nd g lob al re gula tory

pract ices an d st a ndards. Commen cin g wit h ou r an nu al r eport for t h e fisca l ye ar e nd ed De cember

31, 2021, we will comply wit h t h ese n ew d isclosu re require me nts. Upon implemen ta tion of the new

me t hod olog y as part of t h e ad opt ion of t he se n ew d isclosu r e re qu ire ments, we will present

in format ion re spect ing resou rce and r eserve estimates which may d iffer mat erially from t he reserve

est ima t es prese nted h istor ically a nd in t his A n nual Re port un der t he e xistin g SEC ru les.

We do n ot cu rre n t ly pre se nt r eserves est imate s in t h e UK ( b ecause cu rre ntly we d on 't b elie ve that

t he Polysu lph at e ® we are prod u cin g t h ere is mat erial to t h e over all Grou p r esu lts). In t he ab sence

of pu b lishe d re se rves, we are u n ab le to provid e life of min e est imat es in accor d an ce wit h SEC

In d u st ry Gu ide 7, t hat de termin e how lon g we are a ble to con tinue produ ction , an d th e life of mine

ma y be sh or t er t h an you expect.

For fu rt h er in format ion , se e “ It e m 4 - In format ion on t h e Compan y— D. Propert y, Plant a nd

Equ ipmen t — Re serves”.

T h e location s of so me of ou r min es and fa ci lities expo se us to va riou s n atu ra l d isasters

We are expose d to n at u r al d isaste rs, su ch as flood in g an d e art hqu akes wh ich may cau se mat e rial

d amag e to ou r b u sin ess. For e xample, in I srae l, some of ou r plan t s are locat ed on t h e J ord an Rift

Va lley, or Syr o- A frican Depr ession , a seismically act ive area. Furthermore, in recent ye ars sin kh oles

an d u n d er groun d cavit ie s h ave b e en d iscovered in t h e area of t h e Dead Sea, wh ich cou ld cause

ha rm to t h e Compan y’s plan t s. In ad d it ion , an “ u nd ermin ing ” pr ocess h as b eg u n in t h e n ort hern

part of t h e A rava st rea m, at t he e nd of wh ich , on b ot h b an ks, are t h e e vapor at ion pon d s of t he

Compan y’s plan t s at t h e De ad Sea. T h ere is a risk th at t h is ph en ome non wou ld jeopard iz e the

st ab ilit y of t h e Compan y’s d ikes a nd evaporat ion pond s. In t h e Sod om area, where many of t he

Compan y’s plan t s in Isra el are loca t ed , t h er e are occasion al fla sh flood s in t he st rea mb e ds. W h ile

we h ave in su rance coverage for t h ese t ypes of d amag e, su b ject to pa yment of d ed uctib les, the

in su ra nce may n ot be su fficient to cover all of t hese cost s. In add ition , we h ave un dergrou nd mines

in t h e Un it e d Kin g dom an d Spain an d a min e in Ch in a. W at er le akag e s in t o t h ese min es or ot h er

nat u ra l d isasters mig h t cau se d isruption s to ou r min in g activit ies or even to a loss of t h e min e. We

do n ot have fu ll pr opert y in su rance wit h respe ct to all ou r prope rty/a ssets.

9 ICL Group Limited

T h e a ccumu lation of s alt at t he b ott om of P on d 5, t h e c ent ral e vap oration po n d in ou r sola r

e vaporation pon ds syst em use d to extract mine rals fr om th e Dead Sea, re quires re gu lar ha rvest ing

of t h e sa lt in ord er to main ta in a fixe d b rine volume an d t he reby su st ain t he prod uction capacity

of e xt r act ed m in eral s an d p reve nt p ot entia l d amag e to t h e foun da tion s a nd st ructures of t h e

h o t els and ot her b uild ing s sit ua ted cl ose to t h e ed ge of t he Pon d

Th e min era ls from t he Dead Sea are ext racted by way of sola r evapor at ion , wh ereb y salt precipitates

on t o t he b ed of Pon d 5 ( h er ein afte r – t h e Pon d ), loca t ed in on e of t he sit e s of Dead Sea Works

( herein after – DSW ). T h e precipit at ed sa lt cr eat es a la ye r on th e Pon d b ed wit h a volu me of

approxima t ely 16 million cu b ic met ers per year. Th e process of prod u ct ion of t h e raw mat e rial

requ ires t ha t a fixed b rin e volu me is pre served in t h e Pon d. Failu re to main t ain a con st ant volume

of solu t ion s in t he Pon d cou ld resu lt in a r ed u ct ion in prod u ct ion capa cit y. To t his en d , up to t he

en d of 2021, t he raisin g of t h e solu t ion s' leve l of t he Pon d will con t in u e accord in g to t h e r ate at

wh ich t he pon d floor rise s, while per for min g t h e sa lt h ar ve st, in it iate d in t h e fou rth qu a rt er of 2020.

Th e solu t ion s' level ma ximu m heig h t ( 15.1) is expect ed to be r eached by t he en d of 2021. From

2022 on wa rd s, t h e solu t ions' volu me in t h e Pon d will be prese rved on ly by way of harvest in g the

sa lt .

Raisin g t h e wa t er level of t h e Pon d a b ove a cert a in level ma y cau se st r u ct u ral d amag e to t he

fou n d a t ion s and t h e h ot el b u ild ing s sit u at ed close to t h e wat e r’s ed ge, to t h e se t tlement of Neve

Zoh ar a n d to ot h er in fr astr uct ure locat ed alon g t he west ern sh orelin e of t h e Pon d . Up to t h e end

of 2020, in ord e r to ensu r e t h at t h e Pon d wa ter le ve l d oes n ot exceed t h e maximu m h eig ht ( 15.1),

t he Govern ment of Isr ael, t hr ou g h t h e Dead Sea Pr eser va t ion Gove rn men t Compa ny Lt d .,

impleme nt ed a project for con st ru ct ion of coast lin e d efen ses, t og et h er wit h DSW ( who fin an ced

39.5% of t he project 's cost ), as par t of which t h e d yke alon g t h e west ern b ea chfr on t of t h e Pond,

acr oss from t he hot els, is r aised , t og et he r wit h a syst e m for lowerin g su b t er rane an wat er. The

con st r u ct ion work wit h re spect to t h e h ot els' coast lin es is complet e an d at prese n t , t h e De ad Sea

Prese rvat ion Govern me nt Compan y Lt d . is carryin g ou t e le vat ion work in t he in t er media te area

b et ween t he t wo h ot el complexes. T h e Pon d level will be ma in t ain ed as part of t h e perma nent

solu t ion ( t he salt h arvesting pr oject ) d escrib ed b elow, wh ich sh ou ld provid e a d e fen se u ntil t h e end

of t h e cu r ren t con ce ssion pe riod in 2030.

Th er e is no gu a ran t ee t h at t he said project s for main t ain in g t h e Pon d ’s wat er level will be at t he

cost we cu rre nt ly est imat e or will pr even t d a ma ge to t h e su rrou n din g in frast ruct ure or to ou r

operat ion s in t he Pon d. Hig her cost of t h e h arve stin g proce ss or failu re to provid e solu t ions and/or

an y proof of d amag e cau sed cou ld mat erially and a dversely affect ou r b usin ess, fin an cial con dition

an d re su lt s of oper ation s.

For fu rt he r in format ion ab ou t th e coast lin e d efen ses an d t h e perman e nt solu t ion (the Salt

Ha rvest in g Pr oject ), see “I t em 4 – I nformat ion on t h e Company — D. Pr opert y, Pla n t a nd

Equ ipmen t — Min era l Ext ract ion a nd Min in g Opera t ions” and Not e 18( c) to ou r A u d it ed Fin ancial

St at emen ts.

10 ICL Group Limited

T h e re ced ing w a ter l evel in th e N orth ern B a s in of t he D e ad Sea, m ay require capit al a nd/or

o p e r at iona l expenses in ord er to ena ble the c ontin uation of th e Compa ny's oper ation s in th e Dea d

S e a

Du e to t he hydrolog ical d e ficit, t he wat er le ve l of t he Northern B asin of t he Dea d Se a is rece ding at

t he rat e of over 1 met er per year. As part of ou r prod u ction proce ss in Isr ael, we pu mp wa t er from

t he Nor t hern Basin of t h e Dead Sea t h rou gh a special pu mpin g st ation an d d elive r it t hroug hout a

fee d in g ch anne l to t h e salt a nd car n allit e e va poration pon d s in t h e Sou t h ern B asin . As t h e water

level re ced es, we may be pressu r ed to r edu ce ou r usa ge of min er als fr om t h e Dead Sea , which could

ha ve a mat er ia l a d ve rse e ffect on ou r b usin ess, fin an cial con d ition a n d re sults of opera t ion s.

Ou r ab ilit y to pu mp wat e r re lies on an act ive pu mpin g st at ion at t h e wat er lin e of t h e Nor t h ern

B asin of t h e Dead Sea . Due to t he re ced ing wate r level in t his ar ea , t he wate r lin e is reced ing from

t he cu r ren t pu mpin g st a tion area and con stru ction of a n ew pu mpin g station (h er ein a fter – the P-9

Pu mpin g St at ion ) was th ere for e requ ire d. T he P-9 Pu mpin g St a t ion is expect ed to comme nce it s

operat ion d u r in g t h e secon d h alf of 2021 . The Compan y expect s t h at it will be ab le to con t inue

pu mpin g wa t er in t h e comin g years. Fa ilu re to con struct an d opera te t he P-9 pu mpin g st ation or a

sig n ifican t d e lay in t h e plan n ed t imet ab les or fa ilu re to ext end it s life in fu t u r e yea rs cou ld h ave a

ma t erial ad verse e ffe ct on th e Compa ny’s b usin ess, it s fin ancia l con dition and resu lts of oper ations.

For in format ion respect in g t h e pet it ion t ha t was file d wit h t he Isr aeli Cou r t for W at er Mat t ers by

Ad am Te va V’Din , wherein t h e Cou rt was r equ este d to ord e r t h e Gover nmen t W ater a n d Sewage

Aut horit y to issu e a pr od u ct ion licen se to DSW pu rsu a nt to t h e W ate r La w wit h respect to the

t ran sfer of wa t er from t h e Nort he rn B asin of t he Dea d Sea to t h e eva porat ion pon d s in t he Sea ’s

Sou t he rn B asin , see Not e 18( c) to ou r A udit ed Financial St at eme nt s.

Ad d it ional risk of t h e d e clin e of t h e Dea d Se a level is t he er osion of A rava st ream, which flows a lon g

t he in t er nation al b or d er b et we en Isr ael an d J or d an an d in t o t he Dea d Sea . This erosion cou ld

en d an g er th e stabilit y of t he eastern dykes in t he future in th e arra y of salt a nd carn allit e ponds and

an y b rea ch or dama ge to t h e salt and carna llit e pon d s cou ld mat e rially a nd a d ve rsely affect our

b u sin ess, fin an cial con dit ion an d results of opera t ion s. The Compan y is endeavorin g to analyze the

ma t t er a nd to fin d solu t ion s for pr even t in g or ret ard ing t h is occu rre nce in t h e lon g t erm. The

Compan y is con d u ct in g on g oin g mon it orin g an d act in g on sit e in ord e r to prot ect t h e d yke s. As

part of t h ese efforts, a join t resea rch was con du cted with the Jor danian pot ash compan y A PC (Arab

Pot a sh Company), d esig n ed to gat her in formation for t he detaile d plan ning of a proje ct to pre vent

t he con t in u ed erosion of t h e st r eam. A pre-pla nnin g report b ased t hereupon is expect ed to be

receive d d u r ing t he first ha lf of 2021. Det ailed plan n ing wor k, b ased on t h e sa id report, will ser ve

as fou n d at ion for a b uild ing permit application . Prior to comme n cing t he project, ob tain ing pe rmits

from t he au t h or it ies is requ ir ed , d u e to it s en g in e erin g complexit y, pr oximit y to t h e b ord e r, soil

in st ab ilit y an d e nviron ment al se nsit ivit y of t h e en tire are a. In sofar as it is d e cid ed to commen ce with

t he pr oject , t he C ompa ny estimates t ha t it s comple t ion is likely to t ake several years.

Fu rt h ermore , as a resu lt of t h e d e clin e of t h e Dead Sea leve l, sin kh ole s an d u n d ergroun d ca vit ies

ha ve b een d iscover ed in t h e area of t he De ad Se a. Th e a ppear an ce of sin kh oles in t he De ad Sea

area is in cr easin g ove r t h e yea rs. Most of t he sin kh oles d evelop in t he Nor t hern B asin of t he Sea,

wh ere t h ere is low act ivit y by ICL Dea d Sea ( DSW ). However, in recen t ye ars t he re ha s b een a st eady

d evelopmen t of sin kh oles in t he ar ea of t he feed ing cha nn el, t hr ou gh which wate r is pu mped from

t he Nor t hern Basin to t h e Sou t he rn B asin . DSW t a kes act ion s to mon it or t h e d evelopmen t of t hese

sin kh oles a n d to fill t h em wh en t hey appea r. The d evelopmen t of sin kh oles in areas wh er e we

operat e, t oget h er wit h a failu re to d et ect and t re at t hose sin kh oles can ca u se sig n ifican t d amage

an d cou ld mat e rially an d adversely affect ou r b usin ess, fin an cial con d ition an d result s of ope rat ions.

11 ICL Group Limited

A n y m alfun ction in t h e t ransp ort at ion s y stem s we u se to sh ip ou r product s could h ave a ma teria l

a d verse effect on ou r b us iness, fin ancia l con dit ion and re sult s of o per ati ons

Part of ou r sales t u r n over is comprised of sales of b u lk prod u ct s ch ar acter ize d by larg e qu a ntities.

Most of t his pr od u ct ion qu an tity is sh ippe d t h rou gh d ed icate d facilit ies from t wo seapor ts in Isr ael,

on e sea port in Spa in an d anot h er se aport in t h e Un it ed Kin g d om. It is not possib le to sh ip large

qu a nt it ies in b u lk from ot her fa cilit ies in I srae l. A ny sig nifica nt d isrupt ion reg ardin g t h e se aport

facilit ies a nd /or t h e array of tr an sport a tion from t h e seaport s, in clu d in g d u e to st r ike s by port

worke rs, reg u lator y restriction s and ch an ges in th e r ig hts of u se of seaport facilit ies, cou ld d elay or

preve n t expor t s of ou r prod u ct s to ou r cu st omers, wh ich cou ld mat erially an d ad versely affect our

b u sin ess, fin an cial con dit ion an d results of opera t ion s. In add ition , any sig n ificant d isr upt ion in the

array of tr an sport a tion to t h e seapor t s an d b etween variou s sit es, primarily t h rou g h t rains and

t ru cks, mig ht ma t erially an d a d verse ly a ffect t he C ompa ny’s oper at ion s, it s fin ancial con d ition and

resu lt s of oper at ion s.

In ad d it ion , the C ompa ny t ran spor ts h azard ous ma t erials u sin g spe cialized transpor t facilit ies, such

as isot an ks for t h e t ran sport at ion of b romin e. A malfu n ct ion in t h e t ra nsport ation of h azardous

ma t erials, in on e of ou r specialized t ra nsport facilit ies mig h t h ave an environ mental impact and\or

cau se h arm to the welfare of local re sid e nt s, an d, as a resu lt , expose t h e Compan y to lawsu it s and\or

ad min ist ra t ive pr oce edin gs or fin es, an d also cau se a shu t d own of su ch mat erials’ t r an sport ation

syst e ms for a ce rt ain period u n t il t h e cau se for su ch malfu n ct ion h as b ee n d iscover ed an d \or for

pu rpose s of pre ve nt ative ma in ten ance a nd improve me nt of the tran sporta tion a rray, a nd as a result

ma y h ave mat erial a d ve rse e ffect on t he C ompa ny’s oper at ion s, fin an cial con d it ion a nd result s of

operat ion s.

We are exposed to risks associated with our in ter nation al sales and oper at ions, which could ad versely

a f fect ou r sales to cu stomer s as well as ou r ope rat ions an d asse ts in variou s coun tr ies. Some of

t hese f actors m a y a lso m ake it l e ss a t tracti ve to d istrib ute c a sh g en er ated by ou r operat ion s

o u tside Isr ael to ou r sh are ho lders, u se c a sh g en erat ed by ou r ope ration s in on e cou nt ry to fu nd

o u r o p era tion s or r e pay men ts of o u r in d e bt edn es s in a n oth er c o u nt ry a nd su ppor t ot he r

c o r por at e pu rposes or t h e d istribu tion of div ide nds

As a mu lt in a t ion al Compa ny, we sell in man y cou n t ries wh ere we do n ot prod u ce. A con sid erable

port ion of ou r prod u ction is desig na ted for export . As a result , we are su bject to n umerou s r isks and

u n cer t ainties r elating to in te rn ation al sales a nd operat ions, in clu din g:

• Difficu lt ies an d cost s associat e d wit h complyin g wit h a wid e variet y of complex laws, t re at ies

an d re gulation s, in clu d ing t h e U.S. Fore ig n Corru pt Pract ices A ct ( t he “F CPA”), t h e UK. B rib ery

Act of 2010 a nd Sect ion 291A of t h e I srae li Penal Law;

• Un expect ed chan ges in r eg u la t or y en viron ments an d increased g overnmen t own ersh ip and

reg u lat ion in the cou n tries in wh ich we operate;

• Polit ical and econ omic in st ab ilit y, in clu d in g civil u n rest , in fla t ion an d ad verse econ omic

con d it ion s r esu lt in g from gover nmen t a l at t empt s to red u ce in flat ion , su ch as imposit ion of

hig h er in t erest r ates an d wag e an d price con tr ols;

• Pu b lic h ealt h crise s, su ch as pan demics and epid emics; an d

• The imposit ion of t ar iffs, exch an g e con t rols, t r ad e b arr iers, ne w t axe s or t ax rates or ot her

rest r ict ion s, in clu din g t he cu rren t t rade dispu te b et ween t he US an d Ch ina .

Th e occu rre nce of an y of t h e ab ove in th e cou n t ries in wh ich we oper at e or elsewh ere cou ld

jeopa rd ize or limit ou r ab ilit y to t r an sact b u siness t h ere an d cou ld mat erially ad versely affect our

revenu e an d opera ting resu lts an d t he valu e of ou r asse ts.

12 ICL Group Limited

T h e CO VI D-19 o u tbreak h as i mpacte d an d c ould in t h e fu tu re materia lly an d ad versely affect ou r

f i n an cial c ond ition and r esu lts of o pera tion s

In Decemb er 2019, a nove l st ra in of coron aviru s ( C OVID- 19) was repor t ed to ha ve su r faced in

W u ha n, Ch in a, re su lt in g in shu t d own s of ma n u fact u rin g and commerce in t he mon t hs t hat

followed . In Mar ch 2020, t he W orld Healt h Org aniza tion d eclar ed COVI D-19 a pa nd emic. Sin ce

t hen , t h e pan d emic h as con t in u ed to spread a cross t h e g lob e at varyin g in fe ct ion rat es an d h as

in t rod u ced sig n ifican t b u sin ess an d econ omic u n ce rt ain ty and volat ilit y to g lob a l market s.

Accord in g ly, t h ere ha s b e en, an d ma y con t in u e to b e , a sig n ifican t d eclin e in g lob a l e con omic

act ivit y, in clu d in g d epresse d commod it y price s ( in clu d in g oil pr ices), in par t , d ue to preve nt ative

on g oin g me asu re s t aken by va riou s g ove rn me n tal org a niza tion s a rou nd t h e world , su ch as t ravel

b an s an d r estr iction s, qu ara ntin es, sh elt er -in-pla ce orders a nd sh u tdown s.

Th e spre ad of t he COVI D-19 pan d emic d u r in g 2020 ha s led us to mod ify ou r b u sin ess pra ct ices,

in clu d in g implemen t in g policies, h ea lt h an d safet y me asu re s a n d proce d u res to prot ect ou r

employe es in all of ou r facilit ies a n d offices. We ma y n ee d to t a ke fu r t h er act ion s as r equ ired by

governmen t aut hor ities or t hat we det er min e are in t he be st in t ere st of ou r employe es, cu st omers,

part n ers a n d su pplie rs.

For example, at t h e en d of Ma rch 2020, ou r pot a sh min in g operat ion s in Spain we re t e mpor arily

ha lt e d for approximat ely t hr ee weeks an d sin ce th en g ra du ally ra mped back up to n ormal capacity

at t he Su ria sit e ; Polysu lph at e

®

min in g a ct ivit ies in t h e UK were cu rtaile d an d g rad ually ra mped back

up to n or ma l capacit y; an d some of ou r e xt er na l con t r actor s d ecla red force majeu r e t h at led to a

d elay in few of ou r proje ct s. There is no cert ain ty t h at su ch measures will be su fficien t to mit ig ate

t he risks posed by t he pa nd emic. Fu rt he rmor e, ou r ab ilit y to perform ce rt ain fu n ct ion s mig h t be

affect e d if we are r equired to t ake addit iona l st eps.

Th e e me rg en ce of t h e CO VI D- 19 pan d e mic h ad a n e ga t ive impact on ou r b u sin ess performan ce

d u rin g 2020, as re venu e s d ecrea se d, ma in ly d u e to lower d eman d for some of ou r I n d u st rial

Prod u ct s se g ment's prod ucts su ch as clea r b r in e flu id s, as a resu lt of a sig n ifica n t d ecline in oil price s

an d d emand , a nd su ch as cer t ain flame ret ar d ants, d u e to lowe r act ivit y in t h e au t omot ive and

elect ron ics in d u stries. In ad dit ion, ou r ope ratin g re sult s wer e n eg atively impact ed , main ly as a result

of lowe r prod u ct ion in Eu rope a nd ot h er ope ration al cost s r ela ted to t he COVID-19 pan d emic.

We expect a con t in u in g impa ct on ou r resu lt s also over t h e n ext few qu arters, t h ou gh t he fu ll fu ture

effect of t h e COVI D-19 pand emic on t h e g lobal econ omy a nd ou r b usin ess is u n ce rt ain , and it may

be d ifficu lt to a sse ss or pred ict . Th e ext en t of t h e impact of t h e CO VI D-19 pa n d emic on ou r

operat ion al an d fin an cial per for mance will d e pe nd on fu t u r e d evelopmen ts, in clu d in g, b u t not

limit e d t o:

• The d u rat ion , se ve rity an d spr ead of t h e pa n d emic an d t h e action s requ ired by g ove rn ment

au t h or it ies or oth er h ealth or ganizat ion s to con ta in t he disea se or tr eat it s impa ct, in clu ding the

effect iven ess of t he va ccination s d eveloped and alre ad y admin ist er ed in most cou ntries.

• The d u rat ion an d sever ity of t h e su st ained g lob al re cession , an d t he u n certa in ty as to when

glob al econ omy will fu lly re cove r.

• The possib ilit y of ad d it ion al ou t b reaks of t h e vir u s, or th e d e ve lopmen t of more h armfu l a nd

resist an t va riants of t h e virus, or an y possib le re cu rrence of ot her similar t ypes of pa n d emics, or

an y ot h er wid espre ad pu blic h ealt h emerge ncies.

• Sig nifica n t d isr u pt ion of g lob al fin an cial market s an d cred it mar ket s, wh ich ma y red u ce our

ab ilit y to a cce ss capit al or ou r cu st omer s’ ab ilit y to pa y us for past or fu t u r e pu rchases, which

cou ld neg at ively affect ou r liqu id ity.

13 ICL Group Limited

• The possib ilit y of t empor ary closu re s of ou r fa cilit ies or t h e fa cilit ies of ou r su pplier s, cu st omers,

t heir con t ract manu factu re rs, an d t h e possib ilit y of cert ain in du str ies sh u ttin g d own .

• Lower d e man d and /or pricing for ou r prod ucts and a pot ent ial g lob al e con omic recession could

lead to re d u ce d d eman d in ou r end markets, pa rt icu larly b r omin e compou n d s. In a d dition , the

sig n ifican t d eclin e in cru d e oil price s an d t h e oil mar ket s’ cu rren t ab ility to a b sor b excess su pplies

an d re b alance in ve ntor y is like ly to con t in u e to r esu lt in d e cre ased d e ma nd for ou r cle ar b r ine

flu id s.

• The a b ilit y of ou r su ppliers, con t ractor s an d t hir d- pa rty provid ers to mee t th eir ob lig ations to us

at pre viou sly a nt icipat e d cost s and time lin es wit hou t sig nifican t d isru ption .

• Ou r a b ilit y to con tin ue to me et th e man ufact uring an d supply ar rang ement s with our cust omers

at pre viou sly a nt icipat e d cost s and time lin es wit hou t sig nifican t d isru ption .

• The a b ilit y to pu rch ase raw mat e rials t h at we u se to prod u ce ou r prod u ct s, d u e to short a ges

resu lt in g from su pply ch ain d isru pt ion s, qu ara n t ine s, lockd own ord er s an d prod u ct ion

sh u t d owns.

We cont in u e to closely mon it or t h e effect s an d implicat ion s of t h e pa nd emic. T h e u lt imate impact

of t h e COVI D-19 pandemic, or a simila r h ealth e pidemic, is h ig hly u ncert ain and su b ject to ch ange.

To t h e ext en t t hat t he CO VI D-19 pand e mic n egatively impact s ou r b u sin ess, re su lts of ope rat ion s,

liqu id it y or fin an cial con d it ion , it may also h ave t he effe ct of in cr easin g man y of t h e ot h er risks

d escrib ed in t his “Risk Factor s” se ction .

O u r o peration s c ould be a dversel y a ffected by p r ice in crea se s or s h ortag es with respect to wa ter ,

e n ergy a nd ou r pr in cipal raw ma terials, as well as by in cr ease s in transporta tion co sts

We u se wat er, en ergy and variou s raw ma terials as inpu ts an d we could be affected by h ig he r costs

or sh or t ag es in t h ese mat erials, as well as by ch an g es in t ra nspor tat ion prices.

For e xample, our ph osph at e fa cilities u se la rge qu an titie s of water purchased fr om Mekorot, I srae l’s

nat ion al wat er company, at pr ices set by t he g ove rn men t. If th ese price s rise sig nifica ntly, ou r costs

will rise as well. In ou r pla nt s in Sod om, we ob t a in wat er from an in d epen de nt syst e m t h at is n ot

part of t h e n at ion al wat er syst e m. A sh ort age of wat er at t he wat er sou rces in proximit y to t he

plan t s or t h e imposit ion of ad d it ion al cost s/ charg es for wat er u sag e wou ld force t h e Compan y to

ob t a in wat er fr om sou r ces locat ed fu rther a way a n d/or at a h ighe r cost . For in for ma tion r eg ar ding

t he amen d ment to th e Isr aeli W ater Law in Isra el an d its impact on t he Compan y’s prod uct ion costs

at t h e Dead Se a, see Not e 17 to ou r Au dit ed Fin ancial St atements.

Ou r pla nt s con su me lar ge amou n ts of en er gy. Moreover, e ne rgy is a sig n ifica n t compon en t of the

sh ipping cost s of a consid er ab le sha re of ou r prod u ct s. Sig n ifica n t price in cr eases for en er gy, or

en ergy sh or t ag es, wou ld affect sh ippin g cost s, prod u ction cost s a nd /or qu an titie s.

Th e su pply of elect ricit y to ou r product ion pr ocesses a nd fa cilit ies in Israel is provid ed by ou r power

st at ion in Sod om and t he n ation a l power g rid. Ou r ope ration s in I sra el is d epen d en t on t h ese two

sou rces, so sig n ifica n t malfu n ction s at t h e power st ation and/ or in terruption of powe r su pply fr om

t he n at ion al g rid in I srae l may lea d to addit ion al fin a ncial lia b ilitie s an d pot en tia l sh utd owns at our

prod u ct ion facilit ies, wh ich cou ld neg at ive ly affe ct I CL's ab ilit y to su pply it s prod u ct s to b oth

ext ern al cu st ome rs an d ot h er I CL's sit e s u sin g t he m as raw mat e rials an d red u ce revenue fr om

d ecrea se d prod uction capacit y. I n ad dit ion , ou r mag n esiu m pla n t require s a con t inuou s su pply of

elect ricit y, so a ny in t errupt ion in the powe r su pply to t h e mag n esiu m pla n t may ca u se a sig n ificant

d amag e to ou r mag nesiu m prod uction proce ss.

14 ICL Group Limited

Th e cu rren t su pply of nat u ra l g as to ou r power plan t and to ou r su bsid iaries in I srae l is d ependent

on a sin gle su pplier an d on a sin g le g as pipe lin e wit h limit ed t ra nsmission capacit y.

W hile ou r plant s are pre par ed for t he use of a lt e rn ative en er gy sou r ces (fu el oil a nd /or d iesel fu el),

an in crease in ou r e nerg y cost s, or en er g y sh ort ages, cou ld a d verse ly and mat erially affect our

b u sin ess, fin an cial con dit ion a nd r esult s of opera tion s.

Fu rt h ermore , an in cre ase in pr ice or short a g e of raw mat erials, in t er alia: ammon ia, su lph u r, WPA

an d 4D ( wh ich we pu rcha se from t h ird parties) cou ld adversely a n d ma ter ially affect ou r resu lts of

operat ion s, fin an cial posit ion , an d ou r b usin ess.

We can provid e no a ssu r ance th at we will be ab le to pa ss on to ou r cust ome rs in cr eased cost s with

respect to wat e r, en erg y an d ou r prin cipa l raw mat erials, as well as in creases in t r an sportation costs.

Ou r in a b ilit y to pass on su ch cost in crea se s cou ld a d ve rsely affect ou r mar gin s. For fu rt her

in format ion , see “It em 4 - I n format ion on t h e Compan y— B . B u sin ess Overview— Seg ment

In format ion ”.

C o m ple ti on of certain of t h e Co mpany’s major projects may be d e pen dent on t hird- party con tractor s

a n d / or g o vernme ntal o b lig at ions . Fu r th ermore, t e rmina tion of en gagements wit h con tract ors

m i g h t entail ad dition al cost s

In t h e comin g yea rs, t he Company plan s to complet e several ke y project s, t he complet ion of which

is very import a nt to th e Company’s con t in u ed opera t ion an d ab ility to sig n ifican t ly improve it s

compet it ive posit ion in some market s. T hu s, for example, we are ad van cing th e con stru ction of the

new pu mpin g st at ion (P-9) in t he De ad Se a, t h e con solid at ion of pot ash min es in Spain in clu d ing

complet ion of t h e n ew min e access t u n n el at Sú r ia , an d sig n ifica nt in ve st men ts in en vir on mental

proje ct s. Th e complet ion of key project s cou ld also be d e pend e n t on t hird -party con t ra ctors. F or

example , a project in Spain in cu r red sever al d elays a nd b u d get expan sion s t ha t were associated,

amon g ot hers, wit h th ir d-par ty con tract or. Sit u ation s wh erein su ch con t ractors e ncou nte r financial

or operat ion a l d ifficu lt ies, or ot he r sig n ifican t d isagr eement s wit h t he Compa ny, cou ld cau se a

sig n ifican t d e lay in t h e plan n ed t ime table s for complet ion of a proje ct a nd \ or ma t erial d e viations

from t he pr oject ’s b ud get an d may e ven jeopardiz e comple t ion of th e proje ct alt ogether . Th is could

ad ver se ly a nd even mat e rially a ffect t h e Compan y’s b u sin ess, it s fin a ncia l con d it ion an d r esult s of

operat ion s.

T h e inflow of sig nifican t amou nts of wa ter in to t he Dea d Se a could a dverse ly a ffect produ ction at ou r

p l ant s

Th e in flow of sig n ifican t amou n t s of wat er in to t h e Dea d Se a cou ld ad versely affect prod u ct ion at

ou r plan t s an d mig ht alt er t h e composit ion of t h e Dead Sea wat er, in a man n er t hat wou ld lower

t he con cen t ration of sod iu m chlorid e ( NaCl) in t h e wa t er, which cou ld a d ve rsely affect prod uction

at I CL plan t s. This risk may materia lize, a mon g ot he r thin gs, as a result of the con stru ction of a canal

con ne ct in g t he Med ite rra nean Se a wit h t he Dea d Se a, t he in flow of wa t er from t h e Sea of Galilee

( Kin n er et) to t h e Dead Sea via t he J ordan Rive r, or t he con st ruction of a ca nal from t he Red Sea to

t he De ad Sea.

If t h e pot ent ial in flows, as d escrib ed a b ove, r esu lt in a lower con cen t ra tion of sod iu m chlor id e in

t he wa t er of t he De ad Se a, it cou ld ad versely an d mat erially affect pr od u ct ion at ou r pla nt s, ou r

resu lt s of oper at ion s fin ancia l posit ion , and ou r b usin ess.

15 ICL Group Limited

We are exp ose d to t he r isk of labor d ispu tes, slo wdown s and st rikes

From t ime to t ime , we experience lab or d ispu t es, slowd own s an d st r ike s. A sig n ifica n t por t ion of

ou r e mployee s are su b je ct to collect ive labor ag reemen ts, main ly in Isr ael, Ch ina, German y, Un ited

Kin g d om, Spa in and t he Net h er la nds. Prolon g ed slowd own s or st r ike s at a n y of ou r pla nt s cou ld

d isr u pt prod u ct ion an d cau se t he n on - d elivery of prod u ct s t h at h ad a lread y b e en ord e red. Also,

ramp- up t ime is n ee d ed in ord er to r eturn to fu ll pr od u ction capacity at t he fa cilities. Furt hermore,

d u e to t h e mu t u al d e pend en cy b etween IC L pla nt s, slowd own s or st rikes in an y on e of ICL pla nt

ma y affect t h e prod u ction capa cit y an d/or prod u ction cost s at anot her I CL plan t s. Lab or d ispu tes,

slowd own s or st r ike s, as well as t h e ren ewal of collect ive lab or a greeme nt s, may lead to significant

cost s an d loss of profit s, which cou ld ad ver sely, a nd even mat e rially, affect ou r operat in g resu lts