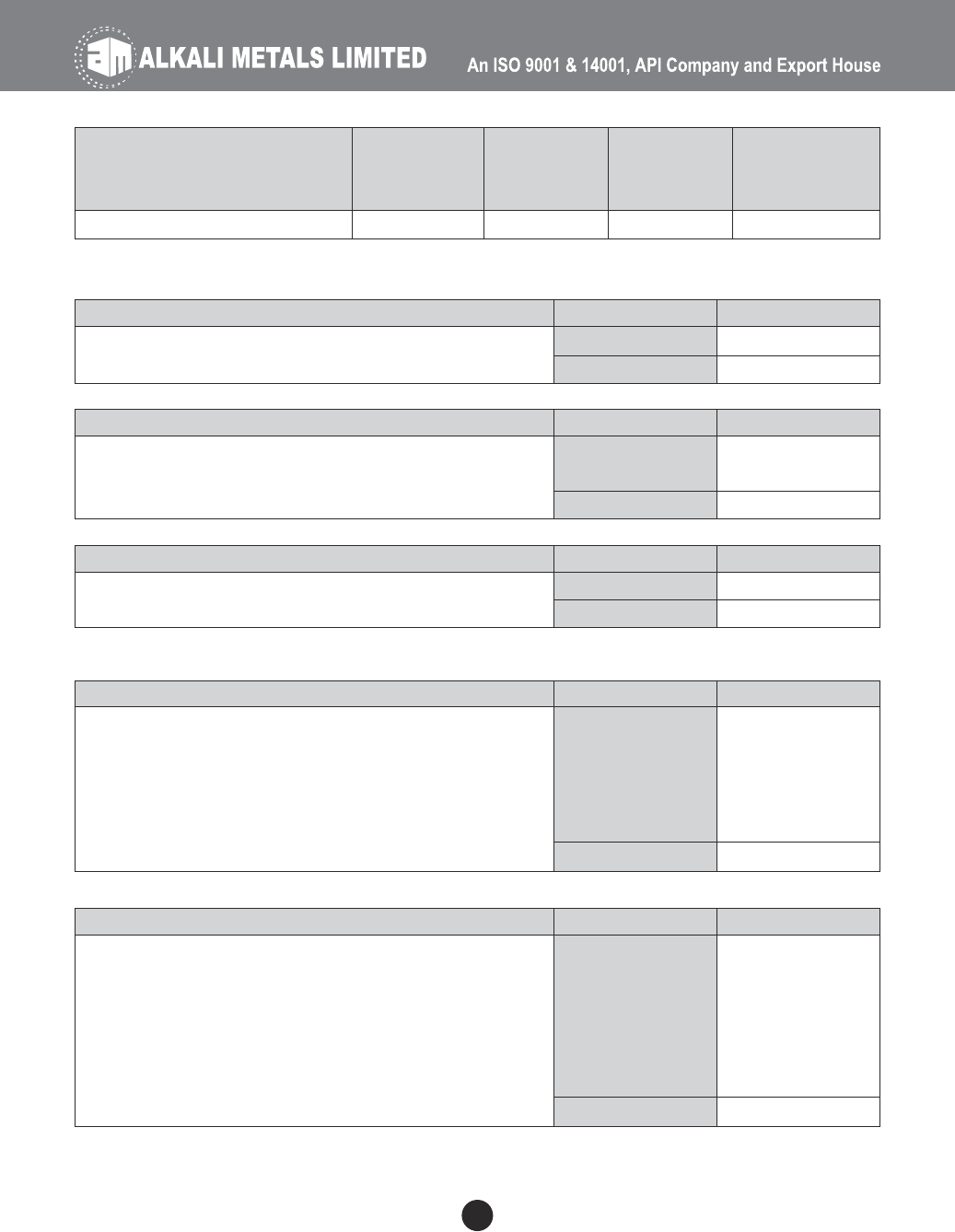

Board of Directors & Key Managerial Personnel

Dr. J.S. Yadav Chairman & Independent Director

Sri. G. Jayaraman Independent Director

Sri. Y.S.R. Venkata Rao Managing Director

Sri. K.V. Suryaprakash Rao Independent Director

Dr. A.R. Prasad Director

Smt. Y. Lalithya Poorna Director

Mr. Y.V. Prashanth Executive Director (w.e.f. 10 November 2022)

Ms. K. Uma Kumari Chief Financial Officer

Mr. Siddharth Dubey Company Secretary

Statutory Auditors

M/s. G. Nagendrasundram & Co.

Chartered Accountants

Internal Auditor

Ramakrishna & Associates

Chartered Accountants

Secretarial Auditor

CS B. Venkatesh Babu

Practising Company Secretary

Bankers

State Bank of India

SME Yellareddy Guda Branch,

st

8-3-961/B, 1 Floor, Srinagar Colony Main Rd,

Yella Reddy Guda, Hyderabad, Telangana 500073

Registered Office & Unit - I

Plot B-5, Block III, Industrial Development Area,

Uppal, Hyderabad - 500 039, Telangana, India

Unit - II

Sy.No. 299 to 302, Dommara Pochampally Village,

Qutubullapur Mandal, Medchal District - 500 043, Telangana, India

Unit - III

Plot No. 36, 37 & 38, JN Pharma City,

Visakhapatnam - 531 019, Andhra Pradesh, India

Registrar &Share Transfer Agent

M/s. Cameo Corporate Services Limited

Subramanian Building, No.1, Club House Road,

Chennai - 600 002.

ANNUAL REPORT 2022 -2023

CIN : L27109TG1968PLC001196

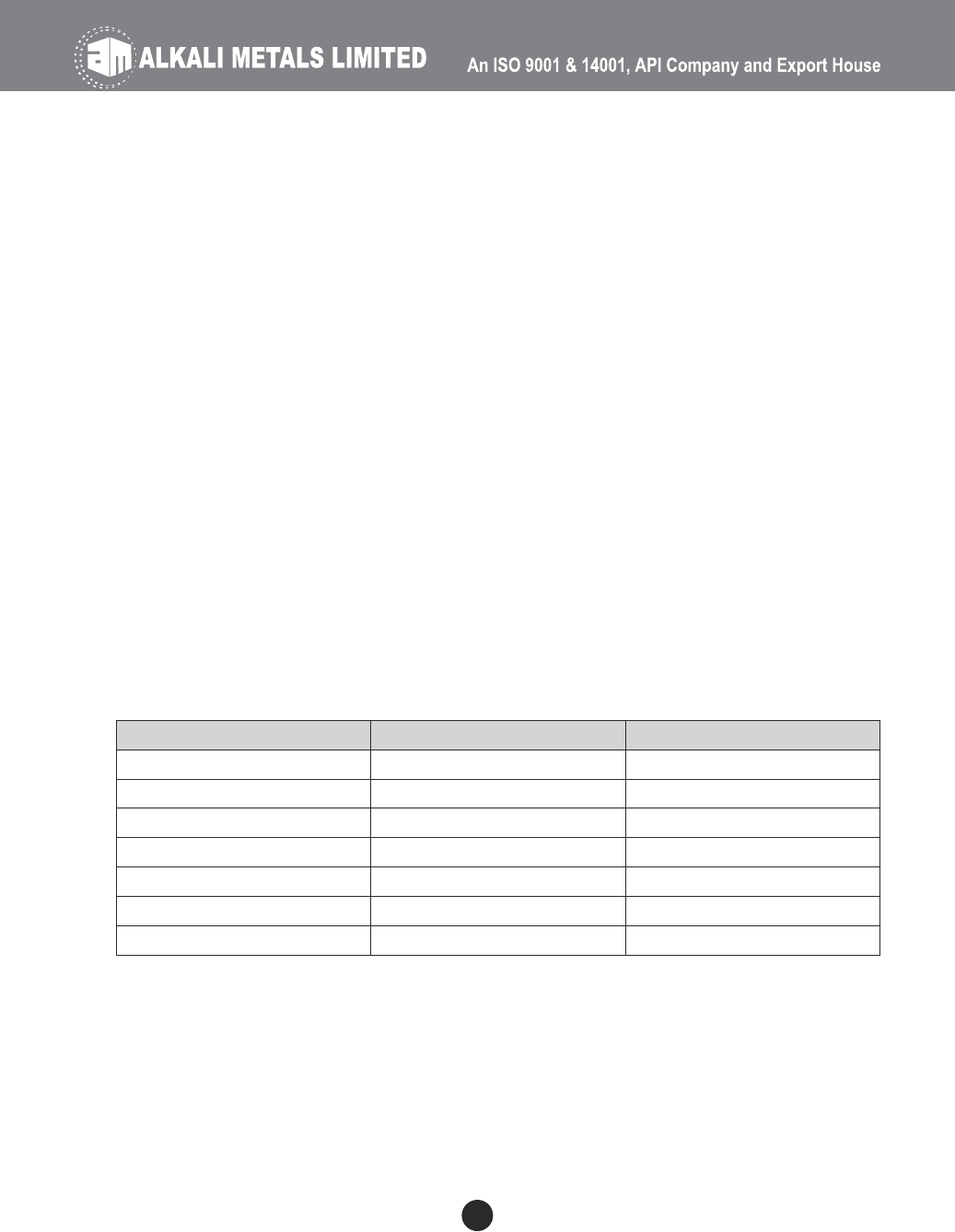

Contents

S.

No.

Particulars

Page

No.

th

1. Notice of the 55 Annual General Meeting 1

2. Board’s Report 13

3. Secretarial Audit Report 24

4. Secretarial Compliance Report 28

5. Annual Report on CSR Activities 32

6. Management Discussion and Analysis 35

7. Report on Corporate Governance 37

8. Independent Auditor’s Report 52

9. Audited Financial Statements for FY 2022-23 including Notes to Financial Statements 62

1

TH

NOTICE OF THE 55 ANNUAL GENERAL MEETING

th

Notice is hereby given that the 55 Annual General Meeting of M/s. Alkali Metals Limited will be

held on Monday the 21 August, 2023 at 11:00 AM through Video Conference(VC)/Other Audio Visual

Means(OAVM) to transact the following business:

ORDINARY BUSINESS

1. To receive, consider and adopt the Audited Financial Statements as on 31March, 2023 together with

the reports of the Directors and Auditors thereon.

2. To declare dividend for the financial year 2022-23.

3. To elect a Director in place of Dr. A.R. Prasad (DIN:08765436) who retires by rotation and is eligible

for re-appointment.

SPECIAL BUSINESS

4. To consider and if thought fit, to pass with or without modification(s), the following resolution as a

Special Resolution:

“RESOLVED THAT pursuant to the provisions of Sections 149, 150, 152 and any other applicable

provisions of the Companies Act, 2013 and the Companies (Appointment and Qualification of

Directors) Rules, 2014 (including any statutory modification(s) or re enactment thereof for the time

being in force) read with Schedule IV to the Companies Act and applicable regulations of the SEBI

(LODR) Regulations, 2015 (as amended from time to time), Sri K.V. Suryaprakash Rao (DIN:

06934146), Independent Director of the Company who has submitted a declaration that he meets the

criteria for independence as provided in the Companies Act and Listing Regulations and who is

eligible for re-appointment, be and is hereby re-appointed as an Independent Director of the Company

to hold office for a second term of five consecutive years with effect from 16 October 2023 to

15 October, 2028.”

5. To consider and if though fit, to pass with or without modification(s) the following resolution as a

Special Resolution:

“RESOLVED THAT the consent of the members be and is hereby accorded to re-appoint

Sri. Y.S.R. Venkata Rao as Managing Director in accordance with the provisions of Section 196, 197

and 203 read with Schedule V and all other applicable provisions of Companies Act, 2013 and the

Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 (including any

statutory modifications or re-enactment thereof for the time being in force), for a further period of

3 years with effect from 1 May, 2024 on the following remuneration:

Basic Pay : ` 7,50,000 per month

H.R.A : ` 2,50,000 per month

Commission : 5% on profits (calculated as per Section 198 of Companies Act, 2013)

Medical benefit : Medi-claim policy for `5,00,000

Insurance : Accidental Insurance for `25,00,000

Leave Travel : One month’s basic pay per year which can be accumulated upto 2 years

Vehicle : Company car with a driver for official use

Telephone & Email : Free Cell and email service for official use

Gratuity : Half month’s basic pay for each completed year of service

RESOLVED FURTHER THAT the Board be and is hereby authorized to provide an annual increment

at the rate of 10% p.a. on such remuneration.

RESOLVED FURTHER THAT the above remuneration will be paid as the minimum remuneration

and in any case if the amount exceeds the limits specified in Schedule V, Company may obtain the

approval in compliance with the provisions of the Companies Act, 2013.”

By order of the Board of Directors

For Alkali Metals Limited

Y.S.R. Venkata Rao

Managing Director

DIN: 00345524

Place : Hyderabad

Date : 27 May, 2023

2

NOTES

1. As per the guidelines issued by the Ministry of Corporate Affairs (MCA) vide General Circular No.

10/2022, dated 28 December, 2022, it has been decided to allow companies whose AGM is due to be

held in the year 2023, to conduct their AGM on or before 30 September 2023 through video

conferencing (VC) or other audio visual means (OAVM) Video in accordance of the requirements laid

down in the earlier Circulars, namely Circular No. 20/2020 dated 5 May 2020 and General Circular

th

No. 02/2022 dated 5 May 2022. Thereby, the ensuing 55 AGM will be held through video

conferencing (VC) or other audio visual means (OAVM). The members can attend and participate in

the ensuing AGM through VC/OAVM.

2. Pursuant to the provisions of Section 108 of the Companies Act, 2013 read with Rule 20 of the

Companies (Management and Administration) Rules, 2014 (as amended) and Regulation 44 of SEBI

(Listing Obligations & Disclosure Requirements) Regulations 2015 (as amended), and MCA

Circulars dated 08 April 2020, 13 April 2020 and 5 May 2020 the Company is providing facility of

th

remote e-voting to its Members in respect of the business to be transacted at the 55 AGM. For this

purpose, the Company has entered into an agreement with Central Depository Services (India)

Limited (CDSL) for facilitating voting through electronic means, as the authorized e-Voting’s

agency. The facility of casting votes by a member using remote e-voting as well as the e-voting system

th

on the date of the 55 AGM will be provided by CDSL.

th

3. The Members can join the 55 AGM in the VC/OAVM mode 30 minutes before the Meeting and also

after the scheduled time of the commencement of the Meeting by following the procedure mentioned

th

in the Notice. The facility of participation at the 55 AGM through VC/OAVM will be made available

to at least 1000 members on first come first served basis. This will not include large Shareholders

(Shareholders holding 2% or more shareholding), Promoters, Institutional Investors, Directors, Key

Managerial Personnel, the Chairpersons of the Audit Committee, Nomination and Remuneration

Committee and Stakeholders Relationship Committee, Auditors etc. who are allowed to attend the

AGM without restriction on account of first come first served basis.

4. The attendance of the Members attending the AGM through VC/OAVM will be counted for the

purpose of ascertaining the quorum under Section 103 of the Companies Act, 2013.

5. Pursuant to MCA Circular No. 14/2020 dated 8 April 2020, the facility to appoint proxy to attend and

cast vote for the members is not available for this AGM. However, in pursuance of Section 112 and

Section 113 of the Companies Act, 2013, representatives of the members such as the President of

India or the Governor of a State or body corporate can attend the AGM through VC/OAVM and cast

their votes through e-voting.

6. In line with the Ministry of Corporate Affairs (MCA) Circular No. 17/2020 dated 13 April 2020, the

Notice calling the AGM has been uploaded on the website of the Company at

https://alkalimetals.com/ . The Notice can also be accessed from the websites of the Stock Exchanges

i.e. BSE Limited and National Stock Exchange of India Limited at www.bseindia.com and

www.nseindia.com respectively. The AGM Notice is also disseminated on the website of CDSL

(agency for providing the Remote e-Voting facility and e-voting system during the AGM)

i.e.www.evotingindia.com.

7. The Register of members and transfer books of the company will remain closed from Thursday the

17August 2023 to Monday the 21 August 2023 both days inclusive.

13

8. Members, who hold shares in electronic / Demat form are requested to furnish the change of

address, details of their bank accounts, viz, name of the bank, full address of the branch, account

no. etc., to their respective Depository Participants and who hold shares in physical form to the

Company’s Registrars and Transfer Agents M/s. Cameo Corporate Services Ltd., Subramanian

Building, No.1, Club House Road, Chennai – 600002 so as to enable the Company to incorporate

the bank details on the dividend warrants.

9. Pursuant to Section 72 of the Companies Act, 2013 and the Rules made there under the

Members holding shares in single name may, at any time, nominate in form SH-13, any

person as his/her nominee to whom the securities shall vest in the event of his/ her death.

Nomination would help the nominees to get the shares transmitted in their favor without hassles.

Members desirous of making any cancellation/variation in the said nomination can do so in SH-14.

10. Members holding shares in identical order of names in more than one folio are requested to write

to the company’s Registrars & Transfer Agents enclosing their share certificates to enable

consolidation of their shareholdings in one folio. As per the amended Provisions based on the PAN, all

different folios of the same PAN will be treated as one folio.

11. The Securities and Exchange Board of India (SEBI) has mandated the submission of Permanent

Account Number (PAN) by every participant in securities market. Members holding shares in

electronic form are, therefore, requested to submit the PAN to their Depository Participants with

whom they are maintaining their Demat accounts. Members holding shares in physical form can

submit their PAN details to the Registrars and Transfer Agents of Company.

12. Pursuant to SEBI Circular No. SEBI/HO/CFD/CMD/CIR/P/2020/242 dated 9 December 2020,

under Regulation 44 of Securities and Exchange Board of India (Listing Obligations and Disclosure

Requirements) Regulations, 2015, listed entities are required to provide remote e-voting facility to its

shareholders, in respect of all shareholders’ resolutions. However, it has been observed that the

participation by the public non-institutional shareholders/retail shareholders is at a negligible level.

Currently, there are multiple e-voting service providers (ESPs) providing e-voting facility to listed

entities in India. This necessitates registration on various ESPs and maintenance of multiple user IDs

and passwords by the shareholders.

In order to increase the efficiency of the voting process, pursuant to a public consultation, it has been

decided to enable e-voting to all the demat account holders, by way of a single login credential,

through their demat accounts/ websites of Depositories/ Depository Participants. Demat account

holders would be able to cast their vote without having to register again with the ESPs, thereby, not

only facilitating seamless authentication but also enhancing ease and convenience of participating in

e-voting process.

In compliance with provisions of Section 108 of the Companies Act, 2013 and Rule 20 of the

Companies (Management and Administration) Rules, 2014 as amended from time to time,

Regulation 44 of the SEBI (Listing Obligations and Disclosure Requirement) Regulations 2015 and

Secretarial Standard on General Meetings (SS2) issued by the Institute of Company Secretaries of

India, the Company is pleased to provide the members with facility to exercise their right to vote

at the Annual General Meeting (AGM) by electronic means and the business may be transacted

through remote e-voting Services provided by Central Depository Services (India) Limited (CDSL).

4

The e-voting period commences on Friday the 18 August 2023 (09:00 A.M.) and ends on Sunday

20 August 2023 (05:00 P.M). During this period shareholders of the Company, holding shares as

on cut-off date of Thursday the 16 August 2023 either in physical form or in Dematerialized

form, may cast their vote electronically. The e-voting portal shall be disabled by CDSL for voting

thereafter. Once the vote on a resolution is cast by the shareholder, the shareholder shall not be

allowed to change it subsequently. The voting rights of shareholders shall be in proportion to their

shares of the paid up equity share capital of the Company. A member who has cast his/ her vote by

electronic means are entitle to attend the AGM but not entitled to vote again at the AGM.

CS B. Venkatesh Babu, Company Secretary in Practice (F6708) has been appointed as the scrutinizer

to scrutinize the remote e-voting process. The Scrutinizer shall, immediately after the conclusion

of voting at the general meeting, will first count the votes cast at the meeting and thereafter

unblock the votes cast through remote e-voting in the presence of at least two witnesses not in the

employment of the Company and he will submit his report within the period not exceeding

three working days from the conclusion of e-voting. The Chairman will declare the results on or

after the AGM of the Company accordingly and will also be placed at the company website and

also forward the same to the stock exchanges where the shares has been listed.

THE INSTRUCTIONS FOR SHAREHOLDERS FOR REMOTE E-VOTING ARE AS UNDER:

13. i. Shareholders who have already voted prior to the meeting date would not be entitled to vote at

the meeting venue.

ii. In terms of SEBI circular no. SEBI/HO/CFD/CMD/CIR/P/2020/242 dated 9 December 2020

on e-Voting facility provided by Listed Companies, Individual shareholders holding securities

in demat mode are allowed to vote through their demat account maintained with Depositories

and Depository Participants. Shareholders are advised to update their mobile number and email

Id in their demat accounts in order to access e-Voting facility.

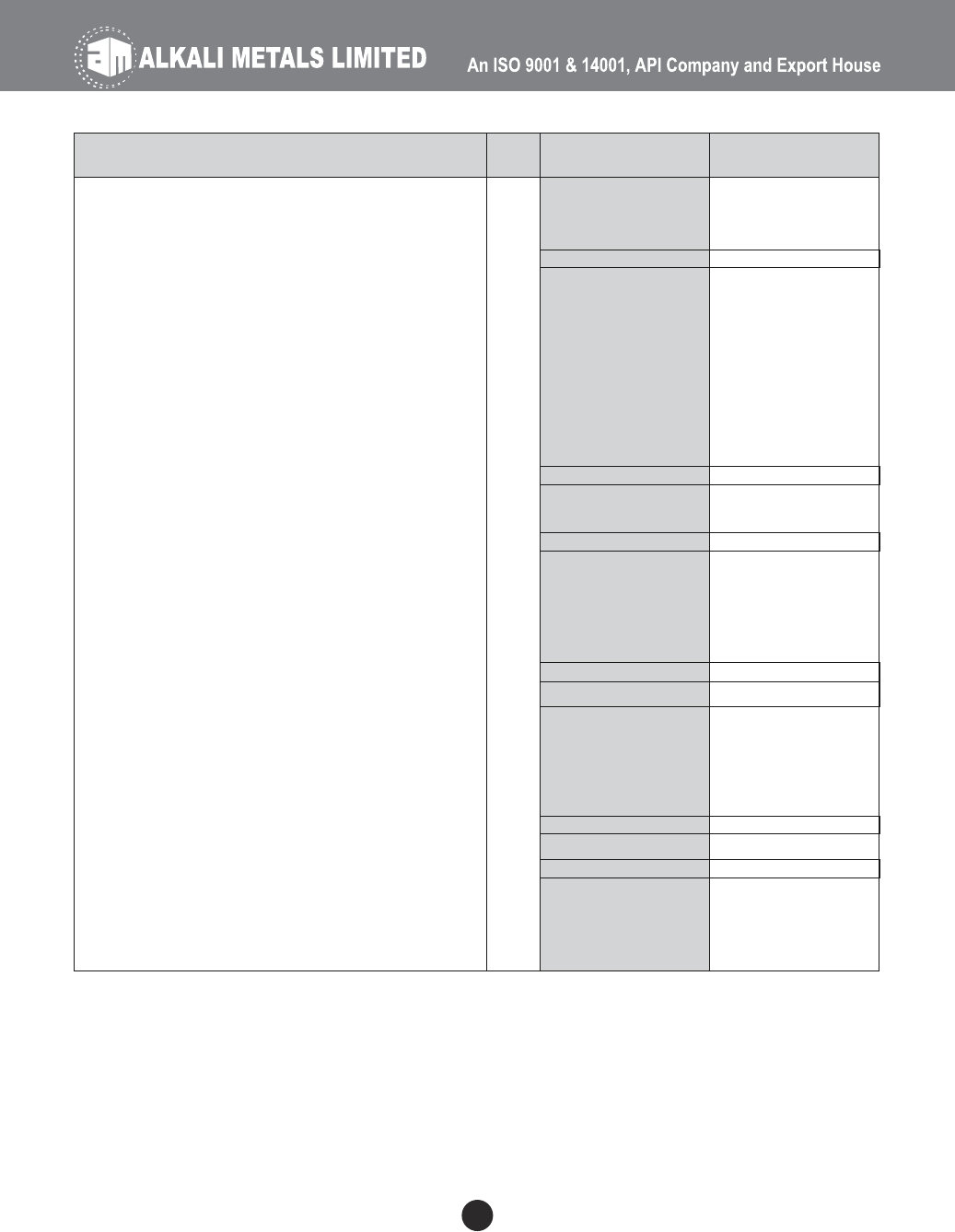

Pursuant to above said SEBI Circular, Login method for e-Voting and joining virtual meetings

for Individual shareholders holding securities in Demat mode CDSL/NSDL is given below:

Login Method

a) Users who have opted for CDSL Easi / Easiest facility, can login through their

existing user id and password. Option will be made available to reach e-Voting

page without any further authentication. The users to login to Easi / Easiest are

requested to visit CDSL website www.cdslindia.com and click on login icon&

New System Myeasi Tab.

b) After successful login the Easi / Easiest user will be able to see the e-Voting option

for eligible companies where the e-voting is in progress as per the information

provided by company. On clicking the e-voting option, the user will be able to see

e-Voting page of the e-Voting service provider for casting your vote during the

remote e-Voting period or joining virtual meeting & voting during the meeting.

Additionally, there is also links provided to access the system of all e-Voting

Service Providers, so that the user can visit the e-Voting service providers’ website

directly.

Type of

shareholders

Individual

Shareholders

holding

securities

in Demat

mode with

CDSL

Depository

5

c) If the user is not registered for Easi/Easiest, option to register is available at CDSL

website www.cdslindia.com and click on login & New System Myeasi Tab and

then click on registration option.

d) Alternatively, the user can directly access e-Voting page by providing Demat

Account Number and PAN No. from a e-Voting link available on

www.cdslindia.com home page. The system will authenticate the user by sending

OTP on registered Mobile & Email as recorded in the Demat Account. After

successful authentication, user will be able to see the e-Voting option where the e-

voting is in progress and also able to directly access the system of all e-Voting

Service Providers.

a) If you are already registered for NSDL IDeAS facility, please visit the e-Services

website of NSDL. Open web browser by typing the following URL:

https://eservices.nsdl.com either on a Personal Computer or on a mobile. Once

the home page of e-Services is launched, click on the “Beneficial Owner” icon

under “Login” which is available under ‘IDeAS’ section. A new screen will open.

You will have to enter your User ID and Password. After successful authentication,

you will be able to see e-Voting services. Click on “Access to e-Voting” under e-

Voting services and you will be able to see e-Voting page. Click on company name

or e-Voting service provider name and you will be re-directed to e-Voting service

provider website for casting your vote during the remote e-Voting period or

joining virtual meeting & voting during the meeting.

b) If the user is not registered for IDeAS e-Services, option to register is available at

https://eservices.nsdl.com. Select “Register Online for IDeAS “Portal or click

at https://eservices.nsdl.com/SecureWeb/IdeasDirectReg.jsp

c) Visit the e-Voting website of NSDL. Open web browser by typing the following

URL: https://www.evoting.nsdl.com/ either on a Personal Computer or on a

mobile. Once the home page of e-Voting system is launched, click on the icon

“Login” which is available under ‘Shareholder/Member’ section. A new screen

will open. You will have to enter your User ID (i.e. your sixteen digit demat

account number hold with NSDL), Password/OTP and a Verification Code as

shown on the screen. After successful authentication, you will be redirected to

NSDL Depository site wherein you can see e-Voting page. Click on company

name or e-Voting service provider name and you will be redirected to e-Voting

service provider website for casting your vote during the remote e-Voting period

or joining virtual meeting & voting during the meeting

You can also login using the login credentials of your demat account through your

Depository Participant registered with NSDL/CDSL for e-Voting facility. After

Successful login, you will be able to see e-Voting option. Once you click on e-

Voting option, you will be redirected to NSDL/CDSL Depository site after

successful authentication, wherein you can see e-Voting feature. Click on

company name or e-Voting service provider name and you will be redirected to e-

Voting service provider website for casting your vote during the remote e-Voting

period or joining virtual meeting & voting during the meeting.

Individual

Shareholders

holding

securities

in demat

mode with

NSDL

Depository

Individual

Shareholders

(holding

securities in

demat mode)

login through

their Depository

Participants

(DP)

6

Individual Shareholders holding

securities in Demat mode with CDSL

Individual Shareholders holding

securities in Demat mode with NSDL

Members facing any technical issue in login can contact

CDSL helpdesk by sending a request at

contact at toll free no. 1800 22 55 33

Members facing any technical issue in login can contact

NSDL helpdesk by sending a request at [email protected]

or

call at toll free no.: 1800 1020 990 and 1800 22 44 30

Login Type

Helpdesk Details

iii. Access through CDSL e-Voting system in case of shareholders holding shares in physical mode and

non-individual shareholders in demat mode.

Login method for e-Voting and joining virtual meetings for Physical shareholders and

shareholders other than individual holding in Demat form.

a) The shareholders should log on to the e-voting website www.evotingindia.com.

b) Click on “Shareholders” module.

c) Now enter your User ID

- For CDSL: 16 digits beneficiary ID,

- For NSDL: 8 Character DP ID followed by 8 Digits Client ID,

- Shareholders holding shares in Physical Form should enter Folio Number registered with the

Company.

d) Next enter the Image Verification as displayed and Click on Login.

If you are holding shares in demat form and had logged on to www.evotingindia.com and voted

on an earlier e-voting of any company, then your existing password is to be used.

e) If you are a first-time user follow the steps given below:

PAN

Enter your 10digit alpha-numeric *PAN issued by Income Tax Department

(Applicable for both demat shareholders as well as physical shareholders)

• Shareholders who have not updated their PAN with the

Company/Depository Participant are requested to use the sequence

number sent by Company/RTA or contact Company/RTA.

Enter the Dividend Bank Details or Date of Birth (in dd/mm/yyyy format) as

recorded in your demat account or in the company records in order to login.

• If both the details are not recorded with the depository or company, please

enter the member id / folio number in the Dividend Bank details field.

Dividend

Bank Details

OR

Date of Birth

(DOB)

Mode

For Physical shareholders and other than individual

shareholders holding shares in Demat.

Important note: Members who are unable to retrieve User ID/ Password are advised to use Forget User ID

and Forget Password option available at abovementioned website.

Helpdesk for Individual Shareholders holding securities in demat mode for any technical issues

related to login through Depository i.e. CDSL and NSDL

7

f) After entering these details appropriately, click on “SUBMIT” tab.

g) Shareholders holding shares in physical form will then directly reach the Company selection

screen. However, shareholders holding shares in demat form will now reach ‘Password Creation’

menu wherein they are required to mandatorily enter their login password in the new password

field. Kindly note that this password is to be also used by the demat holders for voting for

resolutions of any other company on which they are eligible to vote, provided that company opts for

e-voting through CDSL platform. It is strongly recommended not to share your password with any

other person and take utmost care to keep your password confidential.

h) For shareholders holding shares in physical form, the details can be used only for e-voting on the

resolutions contained in this Notice.

i) Click on the EVSN for the relevant <Company Name> on which you choose to vote.

j) On the voting page, you will see “RESOLUTION DESCRIPTION” and against the same the

option “YES/NO” for voting. Select the option YES or NO as desired. The option YES implies that

you assent to the Resolution and option NO implies that you dissent to the Resolution.

k) Click on the “RESOLUTIONS FILE LINK” if you wish to view the entire Resolution details.

l) After selecting the resolution, you have decided to vote on, click on “SUBMIT”. A confirmation

box will be displayed. If you wish to confirm your vote, click on “OK”, else to change your vote,

click on “CANCEL” and accordingly modify your vote.

m) Once you “CONFIRM” your vote on the resolution, you will not be allowed to modify your vote.

n) You can also take a print of the votes cast by clicking on “Click here to print” option on the Voting

page.

o) If a demat account holder has forgotten the login password then Enter the User ID and the image

verification code and click on Forgot Password & enter the details as prompted by the system.

p) There is also an optional provision to upload BR/POA if any uploaded, which will be made

available to scrutinizer for verification.

iv. Additional Facility for Non – Individual Shareholders and Custodians –For Remote Voting only.

a) Non-Individual shareholders (i.e. other than Individuals, HUF, NRI etc.) and Custodians are

required to log on to www.evotingindia.com and register themselves in the “Corporates” module.

b) A scanned copy of the Registration Form bearing the stamp and sign of the entity should be emailed

c) After receiving the login details a Compliance User should be created using the admin login and

password. The Compliance User would be able to link the account(s) for which they wish to vote

on.

d) The list of accounts linked in the login will be mapped automatically & can be delink in case of any

wrong mapping.

e) It is Mandatory that, a scanned copy of the Board Resolution and Power of Attorney (POA) which

they have issued in favour of the Custodian, if any, should be uploaded in PDF format in the system

for the scrutinizer to verify the same.

f) Alternatively Non Individual shareholders are required mandatory to send the relevant Board

Resolution/ Authority letter etc. together with attested specimen signature of the duly authorized

signatory who are authorized to vote, to the Scrutinizer and to the Company at the email address

viz; [email protected] , if they have voted from individual tab & not uploaded same

in the CDSL e-voting system for the scrutinizer to verify the same.

8

INSTRUCTIONS FOR SHAREHOLDERS ATTENDING THE AGM THROUGH VC/OAVM &

E-VOTING DURING MEETING ARE AS UNDER:

14. i. The procedure for attending meeting & e-Voting on the day of the AGM is same as the instructions

mentioned above for e-voting.

ii. The link for VC/OAVM to attend meeting will be available where the EVSN of Company will be

displayed after successful login as per the instructions mentioned above for e-voting.

iii. Shareholders who have voted through Remote e-Voting will be eligible to attend the meeting.

However, they will not be eligible to vote at the AGM.

iv. Shareholders are encouraged to join the Meeting through Laptops / IPads for better experience.

v. Further shareholders will be required to allow Camera and use Internet with a good speed to avoid

any disturbance during the meeting.

vi. Please note that Participants Connecting from Mobile Devices or Tablets or through Laptop

connecting via Mobile Hotspot may experience Audio/Video loss due to Fluctuation in their

respective network. It is therefore recommended to use Stable Wi-Fi or LAN Connection to mitigate

any kind of aforesaid glitches.

vii. Shareholders who would like to express their views/ask questions during the meeting may register

themselves as a speaker by sending their request in advance at least 3 days prior to meeting by

mentioning their name, demat account number/folio number, email id, mobile number at

viii. Those shareholders who have registered themselves as a speaker will only be allowed to express

their views/ask questions during the meeting.

ix. Only those shareholders, who are present in the AGM through VC/OAVM facility and have not

casted their vote on the Resolutions through remote e-Voting and are otherwise not barred from

doing so, shall be eligible to vote through e-Voting system available during the AGM.

x. If any Votes are cast by the shareholders through the e-voting available during the AGM and if the

same shareholders have not participated in the meeting through VC/OAVM facility, then the votes

cast by such shareholders may be considered invalid as the facility of e-voting during the meeting

is available only to the shareholders attending the meeting.

PROCESS FOR THOSE SHAREHOLDERS WHOSE EMAIL/MOBILE NO. ARE NOT

REGISTERED WITH THE COMPANY / DEPOSITORIES.

15. i. For Physical shareholders - Please provide necessary details like Folio No., Name of shareholder,

scanned copy of the share certificate (front and back), PAN (self attested scanned copy of PAN

card), AADHAR (self attested scanned copy of Aadhar Card) by email to Company/RTA email id.

ii. For Demat shareholders - Please update your email id & mobile no. with your respective

Depository Participant (DP)

iii. For Individual Demat shareholders – Please update your email id & mobile no. with your

respective Depository Participant (DP) which is mandatory while e-Voting & joining virtual

meetings through Depository.

If you have any queries or issues regarding attending AGM & e-Voting from the CDSL e-Voting System,

you can write an email to helpdesk.evoting@cdslindia.com or contact at toll free no. 1800 22 55 33

All grievances connected with the facility for voting by electronic means may be addressed to Mr.

Rakesh Dalvi, Sr. Manager, (CDSL, ) Central Depository Services (India) Limited, A Wing, 25th

Floor, Marathon Futurex, Mafatlal Mill Compounds, N M Joshi Marg, Lower Parel (East),

Mumbai - 400013 or send an email to [email protected] or call toll free no. 1800

22 55 33.

9

EXPLANATORY STATEMENT PURSUANT TO SECTION 102 OF

THE COMPANIES ACT 2013

Item No. 4

Sri. K.V. Suryaprakash Rao, Independent Additional Director appointed by the Board on 15October 2018

were appointment for a period of 5 years i.e upto 14October 2023. As per the provisions of the Companies

Act, re-appointment for a second term of 5 years will require a special resolution to be passed at a general

meeting.

Based on recommendation of Nomination and Remuneration Committee and in terms of the provisions of

Companies Act and the Listing Regulations the above proposed appointment was recommended by the

Board to be passed as a special resolution as specified in the notice. His brief profile is stated below:

He has around 38 years of experience in the field of promoting Research & Development and academia. He

has been the Head of Research & Development by Industry (RDI) Division and Advisor (Equivalent to

Joint Secretary) in the Department of Scientific and Industrial Research (DSIR) of the Ministry of Science

& Technology. His educational qualification being, M.Tech in Plant Engineering, Management from JNTU

and PG Diploma in Operations Management from IGNOU. He is also a Fellow of the Institution of

Engineers (India) and, Government of India.

Except the Director for his own appointment, none of the Directors and Key Managerial Personnel of the

Company and their relatives is concerned or interested, financially or otherwise, in the resolution set out at

Item No. 4 of the accompanying Notice of the AGM.

Item No.5

Appointment of Sri Y.S.R. Venkata Rao, Managing Director, is valid upto 30 April 2024. As per the

provisions of the Section 196 of the Companies Act 2013, appointment/re-appointment of a person who has

attained the age of 70 years is to be made by passing a special resolution at a General Meeting.

Sri. Y.S.R. Venkata Rao is of the age of 72 years., hence his appointment is being considered in the ensuing

AGM. for the approval of the shareholders by way of Special Resolution.

The Board is of the opinion, that Sri. Y.S.R. Venkata Rao re-appointment as Managing Director will benefit

the Company and his rich experience will boost the next generation to taken up the company into next level.

Except the Proposed Director, Smt. Y. Lalithya Poorna and Mr Y.V. Prashanth none of the Directors and

Key Managerial Personnel of the Company and their relatives is concerned or interested, financially or

otherwise in the said resolution set out in Item no.5 of the accompanying notice of the AGM.

STATEMENT OF PARTICULARS AS PER SCHEDULE V:

A statement containing information required to be provided to the shareholders as per the provisions of

Schedule V of Companies Act, 2013 in respect of re-appointment of Sri. Y.S.R. Venkata Rao, as Managing

Director is given below:

1. GENERAL INFORMATION:

i Nature of industry : Manufacturing of Drug Intermediaries mainly Sodium Derivatives,

Pyridine Derivatives and Fine Chemicals.

ii Date or expected date of commencement of commercial production: Not applicable, as the

Company is an existing Company.

iii In case of new companies, expected date of commencement of activities as per project approved

by financial institutions appearing in the prospectus: Not Applicable

10

(` in Lakhs)

v. Foreign Earnings, investments or collaborations, if any

Particulars 2020-21 2021-22 2022-23

Sales &Other Income 5,556.74 9,130.68 8,937.13

Profit before finance charges, depreciation and taxation 625.54 1,167.44 1,081.96

Finance Charges 254.17 263.13 266.60

Depreciation 334.87 385.87 429.30

Profit/(Loss) before exceptional items and tax 36.50 518.44 386.06

Exceptional & Extraordinary items 14.47 15.03 9.41

Profit/(Loss) before Tax 22.03 503.41 376.66

Taxes including deferred tax and previous years 142.73 155.33 85.37

Net Profit (120.70) 348.08 291.28

Other comprehensive income (net) 29.17 4.70 (9.19)

Total Comprehensive Income (91.53) 352.78 282.09

Particulars 2020-21 2021-22 2022-23

Earnings 2,577.09 5,296.29 5,711.86

Outgo 1,351.69 1,462.68 1,195.05

There is no foreign investment as well as collaboration by the Company.

2. INFORMATION ABOUT THE APPOINTEE:

Sri. Y.S.R. Venkata Rao, B.E.(Mechanical). He joined the Company

during 1977. He played a pivotal role in steering the growth of Alkali

Metals from being a manufacturer of alkali metals to producer of sodium

derivatives, cyclic compounds, fine chemicals, which find wide

application in industries circle. Under the leadership of

Sri. Y.S.R. Venkata Rao, Company Listed its securities in BSE and NSE.

His rich experience in the Industry and relation with the Company will

help to enhance the growth of the Company.

` 108.37 Lakhs per annum for 31.03.2023.

Member of the Year Award for the year 2002 from the All India

Manufacturers’ Association, Andhra Pradesh State Board.

He worked at various posts in FAPCCI, PHARMEXCIL, BDMA,

VSEZ and such other Organisations.

Sri. Y.S.R. Venkat Rao, Managing Director of the Company. He looks

after the production operations, R&D, Finance and other technical

issues. He had rich experience which will help the Company in

achieving its goals.

i. Background details

ii. Past Remuneration

iii. Recognition or awards

iv. Job profile and his

suitability

iv. Financial performance based on given indicators

11

12

` 10 Lakhs per month and other perks and commission as provided

in the resolution

v. Remuneration proposed

The remuneration offered to Sri Y.S.R. Venkata Rao is justifiable and

comparable with the industry norms considering the nature of industry,

size of the Company, profile and position of person.

vi. Comparative

remuneration profile

with respect to

industry, size of the

company, profile of

the position and

person (in case of

expatriates the

relevant details would

be w.r.t. the country

of his origin)

vii. Pecuniary

relationship directly

or indirectly with the

company, or

relationship with

the managerial

personnel, if any

Sri Y.S.R. Venkata Rao is Second Generation Promoter of the

Company.

He hold 67.81% stake in the Company.

3. OTHER INFORMATION:

i. Reasons of loss or inadequate profits:

Inadequate profits are mainly due to increase in overheads as well as global competition.

ii. Steps taken or proposed to be taken for improvement:

The Company is continuously working on identifying new products, processes and

commercializing the new products based on the Industry and client requirements. The Company

is looking for options to commercialize few of the R&D Products in order to increase the

turnover and margins.

iii. Expected increase in productivity and profits in measurable terms:

The Management has adopted focussed and aggressive steps to control the process costs and

improve the turnover and profitability of the Company. The Management is confident of having

a higher growth ratio in the period to come.

4. DISCLOSURES

The details of remunerations and other information will be given as per the provisions of the

applicable act.

Y.S.R. Venkata Rao

Managing Director

DIN: 00345524

By order of the Board of Directors

For Alkali Metals Limited

Place: Hyderabad

Date : 27 May, 2023

13

During the year 2022-23, the Company recorded a turnover of ` 8,823.27 Lakhs and Net Profit of

` 282.09 Lakhs compared to the turnover of ` 9,101.59 Lakhs and Net Profit of ` 352.78 Lakhs (after

comprehensive items) of previous year 2021-22.

Company is able to operate almost same level of operations as compared to previous year and earned

the net profit of ` 282.09 Lakhs which is lower as compared to previous year.

2. Dividend

The Board of Directors recommends dividend of 20% amounting ` 2 per equity share of ` 10 each

paid-up for the approval of the shareholders at the ensuing Annual General Meeting for the Financial

Year 2022-23 and the said dividend will be paid to shareholders who hold shares as on record date

within 30 days of declaration by the shareholders.

3. Reserves

During the year under review, Company had not transferred any amount to General Reserves.

Board’s Report

To,

The Members,

Alkali Metals Limited

th

Your Directors have pleasure in presenting the 55 Annual Report on the business and operations of the

Company and the accounts for the Financial Year ended 31 March, 2023.

1. Results of our operations

The results of our Operations for the Financial Year ended 31 March, 2023 is summarized as below:

Particulars

Financial Year

2022-23

Financial Year

2021-22

Turnover 8,823.27 9,101.59

Other Income 113.86 29.09

Total Revenue 8,937.13 9,130.68

Profit/(Loss) before finance charges, depreciation and taxation 1,081.96 1,167.44

Less : Finance Charges 266.60 263.13

Depreciation and Amortization expense 429.30 385.87

Profit/(Loss) before exceptional items and tax 386.06 518.44

Less: Exceptional items 9.41 15.03

Profit/(Loss) before tax 376.66 503.41

Less : Current Year's tax (MAT) 65.12 84.89

MAT Credit Entitlement (65.12) (84.89)

Deferred Tax 85.37 155.33

Profit/(Loss) After tax 291.28 348.08

(All figures in ` Lakhs)

4. Future outlook

As per forecast the Chemical Industry is expected to grow 9% p.a. However, the geopolitical

scenarios and global economic conditions could have an impact.

The Company is continuously working to identify new products, processes and commercializing the

new products based on the Industry and client requirements. To understand the International Market,

your Company has participated in International Pharma Exhibitions. Accordingly in-house R&D

team is trying to develop new products. Your Directors are hopeful of doing good business in the

coming years.

5. Research & Development

The Company has spent `111.42 Lakhs towards Research and Development during the Financial

Year under review. The R&D team is putting its efforts to develop the new products and processes to

ensure optimum material consumption and effective yield.

6. Change in the nature of business, if any

The Company had not changed its nature of business during the year under review.

7. Material changes and commitments after the closure of Financial Year

There are no material changes or commitments affecting the financial position of the Company

between the end of the Financial Year and the date of the report.

8. Significant and Material Orders

There are no significant and material orders passed by the regulators or court or tribunals impacting

the going concern status and Company operations in future.

9. Internal Financial Controls

Your Company had adequate internal controls and such procedures adopted by the Company for

ensuring the orderly and efficient conduct of its business, including safeguarding of all its assets and

prevention/detection of frauds and errors, accuracy and completeness of accounting records.

Auditors have verified the internal financial controls and tested the adequacy and the procedures

adopted by the Company and confirm that the controls are adequate to the size of the transactions. The

audit committee reviews and monitors the controls and processes on a regular basis.

10. Risk Management

The Management of the Company will take adequate steps in identifying, assessing, controlling and

mitigating the risks associated with different areas of its business operations.

11. Details of Subsidiary/Joint Ventures/Associate Companies

Your Company had no subsidiaries, Joint Ventures and associate companies during the Financial Year

under review.

12. Deposits

Your Company has not accepted any deposits covered under Chapter V of the Companies Act, 2013

during the year under review and also no outstanding deposits at the beginning of the Financial Year.

14

13. Auditors

Statutory Auditors

The members at the 51st Annual General Meeting of the Company held on 3 August, 2019 had

appointed M/s. G. Nagendrasundaram & Co., Chartered Accountants as Statutory Auditors for a term

of 5 years from the conclusion of the 51st Annual General Meeting on such remuneration as may be

determined by the Board of Directors.

Pursuant to Section 139 of the Companies Act, 2013 the statutory auditors G. Nagendrasundaram &

Co., Chartered Accountants have confirmed that they are eligible to continue as auditors. Their report

for the Financial Year 2022-23 does not contain any adverse remark/comment. However the Auditors

have made a factual disclosure in their CARO report forming part of the Audit Report. Their

disclosure and Company’s reply is stated as under:

- Customs Duty Outstanding for more than six months- For an export obligation the Company

had to pay Customs Duty to the extent of ` 44.93 Lakhs.

The Company paid ` 34.30 Lakhs and is in the process of paying the balance.

- Cyber Fraud against the Company- while proceeding with the payment for CPHI Europe during

July 2022 ` 19 Lakhs were lost due to business email compromise at the CPHI agency.

As a precautionary measure supplier call back process to authenticate bank details has been

included in the payment process. The Company had reported the matter at Local Cyber Crime

Police Station and the same was also reported on the National Cyber Crime Reporting Portal.

Internal Auditors

The Board of Directors of the Company had appointed M/s. Ramakrishna & Associates, Chartered

Accountants as Internal Auditors to conduct the Internal Audit of the company for the Financial Year

ended 31 March, 2023.

M/s. Ramakrishna & Associates, Chartered Accountants have been re-appointed as Internal Auditors

for FY 2023-24.

Secretarial Auditors

The Board of Directors of the Company had appointed CS B. Venkatesh Babu, Practicing Company

Secretary as Secretarial Auditor to conduct Secretarial Audit and Secretarial Compliance Report of

the Company for the Financial Year ended 31 March, 2023 and his report does not contain any

qualification, reservation or adverse remark.

CS B. Venkatesh Babu, Practicing Company Secretary has been re-appointed as Secretarial Auditor

for FY 2023-24.

14. Share Capital

Your Company had not issued and raised any share capital including sweat equity, employee stock

options during the Financial Year under review. Your Company has also not provided any money for

purchase of its own shares by employees or for the benefit of employees.

15. Extract of the Annual Return

Pursuant to the provisions of Section 92(3) read with Section 134(3) (a) of the Companies Act, 2013, a

copy of the Annual Return of the Company is available at the Company’s website. this can be accessed

using the link https://www.alkalimetals.com/annualreturn

15

16. Conservation of energy, technology absorption and foreign exchange earnings and outgo

The details of conservation of energy, technology absorption, foreign exchange earnings and outgo

have been provided in Annexure - 1 and shall form part of this report.

17. Corporate Social Responsibility (CSR)

In terms of Section 135 of the Companies Act, 2013, the Company has constituted Corporate Social

Responsibility Committee to monitor the CSR activities of the Company in terms of the provisions of

the Companies Act, 2013. The Committee's constitution, terms of reference and role are in

compliance with the provisions of the Companies Act, 2013.

The committee comprises of following members:

i. Sri. K.V. Suryaprakash Rao- Chairman

ii. Sri. Y.S.R. Venkata Rao- Member

iii. Sri. G. Jayaraman- Member

Corporate Social Responsibility policy was adopted by the Board of Directors on the

recommendation of Corporate Social Responsibility Committee. Report on Corporate Social

Responsibility as Per Rule 8 of Companies (Corporate Social Responsibility Policy) Rules, 2014 is

prepared and the same is enclosed as ANNEXURE - 5 to this Report.

18. Directors

i. Appointment:

During the year under review, the Board had appointed Mr. Y.V. Prashanth as an Additional

Director and Executive Director on 10 November 2022 as a part of succession plan for

Managing Director. His appointment was approved by the members at the EGM conducted on

15 December 2022.

ii. Retire by Rotation:

Dr. A.R. Prasad, Director, retires by rotation and is eligible for reappointment at the ensuing

Annual General Meeting.

Details of number of Board meetings and profile of directors are covered under the Corporate

Governance section.

iii. Declaration by an Independent Director:

Company had received the declarations by all the Independent Directors that they meet the

criteria of independence as per the provisions of Section 149 of the Companies Act, 2013 and

they are registered with Indian Institute of Corporate Affairs (IICA) as per the amended

provisions of the Companies Act, 2013.

iv. Formal Annual Evaluation:

Pursuant to the provisions of the Companies Act, 2013, the Board has devised a policy on

evaluation of performance of Board of Directors, Committees and Individual Directors.

Accordingly, the Chairman of the Nomination and Remuneration Committee obtained from all

the Board members duly filled in evaluation templates for evaluation of the Board as a whole,

evaluation of the committees and peer evaluation. The summary of the evaluation reports were

presented to the respective Committees and the Board for their consideration.

16

19. Key Managerial Persons

There was no change in the Key Managerial Personnel(s) during the year under review.

20. Director’s Responsibility Statement

As per the provisions of clause (c) of sub-section (3) of Section 134 of the Companies Act, 2013, your

Directors shall state that–

i. in the preparation of the annual accounts, the applicable accounting standards have been

followed along with proper explanation relating to material departures;

ii. they have selected such accounting policies and applied them consistently and made judgments

and estimates that are reasonable and prudent so as to give a true and fair view of the state of

affairs of the company at the end of the Financial Year and of the profit of the company for that

period;

iii. they have taken proper and sufficient care for the maintenance of adequate accounting records in

accordance with the provisions of this Act for safeguarding the assets of the company and for

preventing and detecting fraud and other irregularities;

iv. the annual accounts on a going concern basis; and

v. they have laid down internal financial controls to be followed by the company and that such

internal financial controls are adequate and were operating effectively.

vi. proper systems to ensure compliance with the provisions of all applicable laws and that such

systems were adequate and operating effectively.

21. Committees of Board

Your Company has Audit Committee, Nomination and Remuneration Committee, Stakeholders

Relationship Committee and Corporate Social Responsibility Committee, the details are provided in

the Corporate Governance section.

22. Vigil mechanism for Directors and Employees

The Company believes in the standard of conduct which all employees are expected to observe in

their business endeavors. The Code (Vigil Mechanism) reflects the Company’s commitment to

principles of integrity, transparency and fairness. The copy of the Code of Vigil Mechanism is

available on the Company website www.alkalimetals.com under Investors tab.

The Company has adopted a Whistle Blower Policy, as part of vigil mechanism to provide appropriate

avenues to the Directors and employees to bring to the attention of the management any issue which is

perceived to be in violation of or in conflict with the fundamental business principles of the Company.

The employees are encouraged to voice their concerns by way of whistle blowing and all the

employees have been given access to the Audit Committee.

Mr. Y.V. Prashanth, Executive Director is designated as ombudsperson to deal with all the complaints

registered under the policy.

23. Policy on Sexual Harassment

There has always been an endeavor on the part of the Company to create and provide an environment

that is free from discrimination and harassment including sexual harassment. The Company had

adopted policy on Prevention of Sexual Harassment of Women at Workplace in accordance with The

Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013.

During the year, the Internal Complaints Committee has not received any complaints pertaining to

incident of harassment.

17

24. Particulars of loans, guarantees or investments

The Company had not given any loans, guarantees or made investments as per the provisions of

Section 186 of the Companies Act, 2013 during the Financial Year under review. Also there are no

outstanding amounts of loans given, guarantees provided and/or investments made at the beginning

of the year as well.

25. Particulars of contracts or arrangements with related parties

During the Financial Year under review, Company had entered into certain Related Party

Transactions which are all on arms length basis; details of all such transactions as required under

section 188 of Companies Act are annexed in Form AOC-2 forming part of the Board’s Report as

ANNEXURE-2.

The Company has formulated a policy on materiality of Related Party Transactions and dealing with

Related Party Transactions which can be accessed at the Company website www.alkalimetals.com

under Investors tab.

26. Managerial Remuneration / Employee Details

The Details required to be provided pursuant to Rule 5(1) of the Companies (Appointment and

Remuneration of Managerial Personnel) Rules, 2014 are annexed and forming part of the Board’s

Report as ANNEXURE -3.

There are no employees in the Company in receipt of amounts covered in rule 5(2) of the Companies

(Appointment and Remuneration of Managerial Personnel) Rules, 2014.The details pertaining to top

10 employees falling in this category will be provided to the shareholders who make specific request

to the Company.

27. Secretarial Audit Report

Secretarial Audit Report including Secretarial Compliance Report as per SEBI (LODR) Regulations

for the Financial Year 2022-23 obtained from CS B. Venkatesh Babu, Company Secretary in Practice

is annexed and forming part of the Board’s Report as ANNEXURE -4.

28. Corporate Governance and Management Discussion and Analysis

In terms of Regulation 34 of the SEBI (LODR) Regulations, 2015, a Report on Corporate Governance

along with Compliance Certificate issued by Statutory Auditor’s of the Company and also the

Management Discussion and Analysis report is annexed and forms integral part of the Board’s

Report.

29. Insurance

All the properties and insurable interests of the Company including Building, Plant and Machinery

and Stocks have been adequately insured. The Company has-Directors & Officers Indemnity Policy-

for Directors and Key Managerial Personnel, Group Accidental policy- for staff and workmen and

Group Medical Policy - for those who are not covered under ESI.

30. Listing on Stock Exchanges

The securities of the Company are continued to be listed on BSE and NSE. The listing fees for these

stock exchanges are paid till the current Financial Year.

31. Cost Records

The provisions of Section 148 of the Companies Act 2013 for maintaining the Cost Records are not

applicable to the Company.

18

32. Compliance of Secretarial Standards

The Company has duly complied with the applicable Secretarial Standards issued by The Institute of

Company Secretaries of India, for the Board and General Meetings.

33. Acknowledgements

Your Directors express their gratitude to all Members, Staff and Workers, Bankers, Regulatory

Authorities, Government, Customers, Suppliers, Business Associates from India and abroad for their

continued support at all times and look forward to have the same in our future endeavours. Directors

are pleased to record their appreciation of the sincere and dedicated services of the employees and

workmen at all levels.

Your Directors look forward to the long term future with confidence

Y.S.R. Venkata Rao

Managing Director

DIN: 00345524

For and on behalf of Board of Directors

For Alkali Metals Limited

Place : Hyderabad

Date : 27 May, 2023

Dr. J.S. Yadav

Chairman

DIN: 02014136

19

ANNEXURE -1

3. FOREIGN EXCHANGE EARNINGS AND OUTGO

(All figures in ` Lakhs)

2022-23 2021-22

Earnings 5,711.86 5,296.29

Outgo 1,195.05 1,462.68

Raw Materials 1,163.74 1,395.11

Equipment - 67.58

Foreign currency Expenses 31.31 -

Net Foreign Exchange earnings 4,516.81 3,833.61

Disclosure of particulars with respect to conservation of energy, technology absorption and foreign

exchange earnings and outgo as required under provisions of Section 134(3)(m) read with Companies

(Accounts) Rules, 2014:

1. CONSERVATION OF ENERGY

i. The steps taken or impact on conservation of energy:

Continuous measures are being taken by the Company to conserve the energy. Hydrogen recovery

plant and Nitrous oxide generation plant have been installed at all the units, it helps in re-usage of

fuels thereby it conserves energy. All the measures taken by the Company has resulted in cost

savings.

ii. The steps taken by the Company for utilizing alternate sources of energy:

The Company operations are mainly carried out using electrical power supported by generator back

up for continuous operations. However, the Company is evaluating the possibilities of utilizing

alternative sources of energy.

iii. The Capital investment on energy conservation equipments:

Not envisaged any additional investment in the coming year.

2. TECHNOLOGY ABSORPTION

i. The Efforts made towards technology absorption:

Presently, the Company applies its own technology and the indigenous technology for the

manufacturing processes carried out. There has been a continuous endeavor to develop the

technology required for the Company.

ii. The Benefits derived are:

• maintenance of quality standards

• commercialization of new products

• time saving by automation of repetitive R&D tasks

• reduced dependence on external source for technology adaptation.

iii. Details of technology imported during the past 3 years:

No technology has been imported during the past 3 years.

iv. The expenditure incurred on Research and Development: ` 111.42 Lakhs.

Y.S.R. Venkata Rao

Managing Director

DIN: 00345524

For and on behalf of Board of Directors

For Alkali Metals Limited

Place : Hyderabad

Date : 27 May, 2023

Dr. J.S. Yadav

Chairman

DIN: 02014136

20

21

ANNEXURE-3

Statement of particulars as per Rule 5 of Companies (Appointment and

Remuneration of Managerial personnel) Rules, 2014.

1. The ratio of the remuneration of each director to the median remuneration of the employees of the

company for the financial year:

S.No

Name of the Director

Ratio of the remuneration to the

median remuneration of the employees

Note : No other director is drawing remuneration other than specified above.

Mr. Y.V. Prashanth was appointed on 10 November 2022, his annual salary is used for

calculation purpose

2. The percentage increase in remuneration of each Director, Chief Financial Officer, Chief Executive

Officer, Company Secretary or Manager in the financial year:

i. Sri. Y.S.R.Venkata Rao, Managing Director 3.41%

ii. Mr. Y.V. Prashanth, Executive Director Not applicable

iii. Ms. K. Uma Kumari, CFO 6.29%

iv. Mr. Siddharth Dubey, CS 6.24%

Average Increase/(Decrease) in remuneration

Company’s performance

Turnover ` 8,823.27 Lakhs

Net Profit ` 287.59 Lakhs

Total Remuneration to KMP ` 164.62 Lakhs

S.No.

Name of the Director and KMP

Percentage increase in remuneration

6.46 %

Turnover is `8,823.27 Lakhs and

Net Profit is ` 287.59 Lakhs

i. Sri. Y.S.R.Venkata Rao, Managing Director 26.73

ii. Mr. Y.V. Prashanth, Executive Director 15.34

Note: The percentage increase of remuneration to CFO and CS pertains to Bonus paid during the

Financial Year.

3. The percentage increase in the median remuneration of employees in the financial year: 33.96%

4. The number of permanent employees on the rolls of Company:

There are 113 employees as on 31 March, 2023.

5. The explanation on the relationship between average increase in remuneration and company’s

performance

6. Comparison of the remuneration of the Key Managerial Personnel (KMP) against the performance of

the company

7. Variations in the market capitalization of the company, price earnings ratio as at the closing date of the

current financial year and previous financial year and percentage increase or decrease in the market

quotations of the shares of the company in comparison to the rate at which the company came out with

the last public offer:

22

Note: We have provided actual payment of remuneration to Mr Y.V. Prashanth for the part of the year.

10. The key parameters for any variable component of remuneration availed by the directors:

Managing Director and Executive Director is entitled 5% on profits computed as per Section 198 of the

Companies Act 2013, as part of remuneration during the year ended 31 March 2023.

11. The ratio of remuneration of the highest paid director to that of the employees who are not directors but

receive remuneration in excess of the highest paid director during the year

Not Applicable.

12. Affirmation that remuneration is as per the remuneration policy of the Company. It is hereby affirmed

that the remuneration paid is as per the Remuneration Policy for Directors, KMPs and Other Employees.

S.No.

Particulars

31.03.2023 31.03.2022

i. Market Capitalization

BSE (amount in `in Lakhs) 9327.17 7962.72

NSE (amount in ` in Lakhs) 9316.99 8074.73

ii. Price Earnings ratio (based on Basic EPS)

BSE 32.48 22.57

NSE 32.45 22.88

iii. Market quotation of the shares compared to rate at which it came out with IPO.

The Company came with Initial Public Offer during the period of 2008 at a price of ` 103 per

share. As on 31 March 2023(last trading day) the market quotation of the company shares price is

` 91.6 on BSE and ` 91.5 for NSE as on 31 March 2023

1. Sri. Y.S.R. VenkataRao, MD ` 108.37 Lakhs

2. Mr Y.V. Prashanth, ED ` 29.34 Lakhs

3. Ms. K. Uma Kumari, CFO ` 18.62 Lakhs

4. Mr. Siddharth Dubey, CS ` 8.30 Lakhs

S.

No.

Name

Remuneration of

Key Managerial

Person

Performance of the

Company during

2022-23

Turnover ` 8823.27 Lakhs

Net Profit ` 287.59 Lakhs

% to

Turnover

1.23%

0.33%

0.21%

0.09%

Y.S.R. Venkata Rao

Managing Director

DIN: 00345524

For and on behalf of Board of Directors

For Alkali Metals Limited

Place : Hyderabad

Date : 27 May, 2023

Dr. J.S. Yadav

Chairman

DIN: 02014136

8. Average percentile increase already made in the salaries of employees other than the managerial

personnel in the last financial year and its comparison with the percentile increase in the managerial

remuneration and justification thereof and point out if there are any exceptional circumstances for

increase in the managerial remuneration:

The Average percentage of increase in remuneration of employees other than the managerial

personnel is 4.15% and Managerial Personnel is 31.41%.(as we have appointed Executive Director

during the year).

9. Comparison of remuneration of each Key Managerial Personnel against the performance of the

company:

23

ANNEXURE-4

FORM MR-3

[Pursuant to Section 204(1) of the Companies Act, 2013 and Rule No. 9 of the Companies

(Appointment and Remuneration of Managerial Personnel) Rules, 2014]

SECRETARIAL AUDIT REPORT

(For the Financial Year ending 31 March, 2023)

To

The Members of

M/s. Alkali Metals Limited

Hyderabad.

I have conducted the Secretarial Audit on the compliance of applicable statutory provisions and the adherence

to good corporate practices by M/s. Alkali Metals Limited (CIN: L27109TG1968PLC001196)

(hereinafter called ‘the Company’). Secretarial Audit was conducted in a manner that provided us a reasonable

basis for evaluating the corporate conducts/statutory compliances and expressing our opinion thereon.

Based on my verification of the Alkali Metals Limited, books, papers, minute books, forms and returns filed

and other records maintained by the Company and also the information provided by the Company, its

officers, agents and authorized representatives during the conduct of secretarial audit, I hereby report that in

my opinion, the Company has, during the audit period covering the financial year ended on March 31,2023,

complied with the statutory provisions listed hereunder and also that the Company has proper Board-

processes and compliance-mechanism in place to the extent, in the manner and subject to the reporting

made hereinafter:

The Company is carrying on the business activities of manufacture of Intermediaries such as Organic and

Inorganic Chemicals, Fine Chemicals and Bulk Drug.

I have examined the books, papers, minute books, forms and returns filed and other records maintained by

the Company for the financial year ended on 31 March, 2023 according to the provisions of:

1. The Companies Act, 2013 (the Act) and the Rules made there under;

2. The Securities Contracts (Regulation) Act, 1956 (‘SCRA’) and the Rules made there under;

3. The Depositories Act, 1996 and the Regulations and Bye-laws framed there under;

4. Foreign Exchange Management Act, 1999 and the Rules and Regulations made there under to the

extent of Foreign Direct Investment, Overseas Direct Investment and External Commercial

Borrowings;

5. The following Regulations and Guidelines prescribed under the Securities and Exchange Board of

India Act, 1992 (‘SEBI Act’) to the extent applicable to the Company:-

a. The Securities and Exchange Board of India (Substantial Acquisition of Shares and

Takeovers)Regulations, 2011;

b. The Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015;

c. The Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements)

Regulations, 2015;

24

d. The Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements)

Regulations, 2018;

e. The Securities and Exchange Board of India (Employee Stock Option Scheme and Employee

Stock Purchase Scheme) Guidelines, 1999;

f. The Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations,

2008;

g. The Securities and Exchange Board of India (Registrars to an Issue and Share Transfer Agents)

Regulations, 1993 regarding the Companies Act and dealing with client;

h. The Securities and Exchange Board of India (Delisting of Equity Shares) Regulations, 2009;

and

i. The Securities and Exchange Board of India (Buyback of Securities) Regulations, 1998;

I have also examined compliance with applicable clauses of the following:

i. The Secretarial Standards on the meeting of the Board of Directors and General Meetings issued

by The Institute of Company Secretaries of India.

ii. The Memorandum and Articles of Association.

During the year under review the Company has complied with the provisions of the Acts, Rules,

Regulations, Guidelines, Standards etc mentioned above to the extent applicable to the Company subject to

as provided below.

However, please note that SEBIs ICDR, ESOS, Listing of Debt Securities, Registrar to an Issue, Delisting

and Buyback of Securities are not applicable as there being no such activity/acts/events during the audit

period for the Company.

The Company has identified the following laws as specifically applicable to the Company:

a. Petroleum And Explosives Safety Organisation (Formerly Department of Explosives)

b. Drugs and Cosmetics Act, 1940

c. Prohibition and Excise

d. Water (Prevention and Control of Pollution) Act, 1974

e. Air (Prevention and Control of Pollution) Act, 1981

f. Hazardous Wastes (Management, Handling and Transboundary, Movement)Rules, 2008

g. Indian Boilers Act, 1923

I further report that based on the information received, explanations given, process explained there are

adequate systems and processes in the Company commensurate with the size and operations of the

Company to monitor and ensure compliance with Sector Specific laws, rules, regulations and guidelines.

I further report that:

1. The Board of Directors of the Company is duly constituted with proper balance of Executive

Director, Non-Executive Directors, Independent Directors and Woman Director.

The following are the changes in the composition of the Board of Directors and KMPs during

the year under review.

25

• Mr. Y.V. Prashanth was appointed as an Additional Director and Executive Director on

10 November, 2022 and his appointment was approved by the shareholders at the EGM

held on 15 December, 2022.

2. Adequate notice is given to all directors to conduct the Meetings of Board and its committees.

Detailed notes on agenda were sent and financials were sent at shorter period in advance, and a

system exists for seeking and obtaining further information and clarifications on the agenda

items before the meeting and for meaningful participation at the meeting.

3. All decisions at Board Meeting and committee meetings were carried out unanimously as

recorded in the minutes of the meeting and there were no instances of dissenting members in the

board and committee meetings.

4. During the year, the Company had entered into related party transactions at arm’s length price

with the approval of the audit committee and Board.

I further report that there are adequate systems and processes in the Company commensurate with the size

and operations of the Company to monitor and ensure compliance with applicable laws, rules, regulations

and guidelines.

I further report that during the audit period, there were no specific events / actions having a major bearing on

the company’s affairs in pursuance of the above referred laws, rules, regulations, guidelines, standards, etc.

as referred to above.

CS B. Venkatesh Babu

Company Secretary

FCS No. 6708, CP.No. 5103

Peer Review No. 1954/2022

UDIN F006708E000393534

Place: Hyderabad

Date : 27 May, 2023

Note: This report is to be read with our letter of even date, which is annexed, and form an integral part of this report.

26

ANNEXURE TO THE SECRETARIAL AUDIT REPORT

To

The Members of

M/s. Alkali Metals Limited

Hyderabad.

Our Report of even date is to be read along with this letter

1. Maintenance of secretarial records is the responsibility of the management of the Company. Our

responsibility is to express an opinion on these secretarial records based on our audit.

2. We have followed the audit practices and processes as were appropriate to obtain reasonable

assurance about the correctness of the contents of the secretarial records. The verification was done on

the random test basis to ensure that correct facts are reflected in secretarial records. We believe that the

processes and practices, we followed provide a reasonable basis for our opinion.

3. We have not verified the appropriateness of financial records and Books of Accounts of the Company.

4. Wherever required, we have obtained the Management representation about the compliance of laws,

rules and regulations and happening of events etc.

5. The compliance of the provisions of Corporate and other applicable laws, rules, regulations,

standards is the responsibility of the Management. Our examination was limited to the verification of

procedures on the random test basis.

6. The Secretarial Audit report is neither an assurance as to the future viability of the Company nor of the

efficacy or effectiveness with which the management has conducted the affairs of the Company.

Place : Hyderabad

Date : 27 May, 2023

CS B. Venkatesh Babu

Company Secretary

FCS No. 6708, CP.No. 5103

Peer Review No. 1954/2022

UDIN F006708E000393534

27

Secretarial Compliance Report of ALKALI METALS LIMITED

for the financial year ended 31 March, 2023

I have conducted the review of the compliance of the applicable statutory provisions and the adherence to

good corporate practices by ALKALI METALS LIMITED (CIN:L27109TG1968PLC001196)

(hereinafter referred as ‘the listed entity’),having its Registered Office at B-5, Block III, IDA, Uppal,

Hyderabad 500039, Secretarial Review was conducted in a manner that provided me a reasonable basis for

evaluating the corporate conducts/statutory compliances and to provide my observations thereon.

Based on my verification of the listed entity’s books, papers, minutes books, forms and returns filed and

other records maintained by the listed entity and also the information provided by the listed entity, its

officers, agents and authorized representatives during the conduct of Secretarial Review, I hereby report

that the listed entity has, during the review period covering the financial year ended on 31 March, 2023

complied with the statutory provisions listed hereunder in the manner and subject to the reporting made

hereinafter:

I CS B. Venkatesh Babu, have examined:

(a) all the documents and records made available to me and explanation provided by

M/s. Alkali Metals Limited (“the listed entity”),

(b) the filings/ submissions made by the listed entity to the stock exchanges,

(c) website of the listed entity,

(d) any other document/ filing, as may be relevant, which has been relied upon to make this report, for the

financial year ended 31 March, 2023 (“Review Period”) in respect of compliance with the provisions of :

(a) the Securities and Exchange Board of India Act, 1992 (“SEBI Act”) and the Regulations,

circulars, guidelines issued thereunder; and

(b) the Securities Contracts (Regulation) Act, 1956 (“SCRA”), rules made thereunder and the

Regulations, circulars, guidelines issued thereunder by the Securities and Exchange Board of

India (“SEBI”);

The specific Regulations, whose provisions and the circulars/guidelines issued thereunder, have been

examined, include:-

(a) Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements)

Regulations, 2015;

(b) Securities and Exchange Board of India(Issue of Capital and Disclosure Requirements) Regulations,

2018

(c) Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations,

2011;

(d) Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015;

28

I (a) The listed entity has complied with the provisions of the above Regulations and circulars/guidelines issued thereunder, except in

respect of matters specified below:

Nil

Advisory/

Clarification/

Fine/ Show

Cause

Notice/

Warning,

etc.

Sr.

No.

Compliance

Requirement

(Regulations

/ circulars /

guidelines

including

specific

clause)

Regulation /

Circular No.

Deviations

Action

Taken by

Type of

Action

Details

of

Violation

Fine

Amount

Observations/

Re-marks of

the Practising

Company

Secretary

Management

Response

Remarks

(b) The listed entity has taken the following actions to comply with the observations made in previous reports:

Sr.

No.

Compliance

Requirement

(Regulations/

circulars/ guide

lines including

specific clause)

Regulation/

Circular No.

Deviations Action

Taken by

Type of

Action

Nil

Advisory/

Clarification/

Fine / Show

Cause

Notice/

Warning,

etc.

Details of

Violation

Fine

Amount

Observations/

Re-marks of

the Practicing

Company

Secretary

Management

Response

Remarks

th

Note : In the Last report waiver of fine from BSE is awaited for not having 6 Director during 1 October , 2020 to 11 February, 2021

and the same was also confirmed the BSE during the reporting period.

II. Compliances related to resignation of statutory auditors from listed entities and their material subsidiaries as per SEBI Circular

CIR/CFD/CMD1/114/2019 dated 18 October, 2019:

Sr.

No.

Particulars

Compliance

Status

(Yes/No/NA)

Observations /

Remarks

by PCS*

1. Compliances with the following conditions while appointing/re-appointing an auditor

i. If the auditor has resigned within 45 days from the end of a quarter of a

financial year, the auditor before such resignation, has issued the limited

review/ audit report for such quarter; or

ii. If the auditor has resigned after 45 days from the end of a quarter of a financial

year, the auditor before such resignation, has issued the limited review/ audit

report for such quarter as well as the next quarter; or