ERPB/2015/016

Document ERPB CTLP 70-15

Version 1.1

Date: 5 November 2015

ERPB FINAL REPORT

MOBILE AND CARD-BASED CONTACTLESS

PROXIMITY PAYMENTS

Abstract

This document presents the final report on mobile and card-based

contactless proximity payments.

Document Reference

ERPB CTLP 70-15

Issue

Version 1.1

Date of Issue

5 November 2015

Reason for Issue

Final report to ERPB meeting 26 November 2015

Produced by

ERPB CTLP Working Group

2015-11-26 ERPB item 6 ERPB CTLP working group final report 2/66

Table of Contents

Executive Summary ................................................................................................................................ 4

0 Document information .................................................................................................................... 9

0.1 Structure of the document ........................................................................................................................ 9

0.2 References ............................................................................................................................................... 9

0.3 Definitions ............................................................................................................................................. 10

0.4 Abbreviations ........................................................................................................................................ 12

1 Scope ............................................................................................... ................................................ 13

2 Methodology .................................................................................................................................. 13

3 Vision .............................................................................................................................................. 14

4 Contactless and other proximity implementations in Europe .................................................. 14

4.1 Some “contactless” payment statistics .................................................................................................. 15

4.2 Some lessons learnt ............................................................................................................................... 20

5 Main barriers for the realisation of the vision ........................................................................... 21

5.1 Barriers for proximity payments ............................................................................................................ 22

5.1.1 Lack of a common (open) set of specifications and implementation guidelines for proximity

payments transactions ................................................................................................................................... 22

5.1.2 Lack of customer demand and contactless payment experience ................................................... 23

5.1.3 Lack of ubiquity of POIs ............................................................................................................... 24

5.1.4 Security and privacy ...................................................................................................................... 24

5.1.5 Consumer interaction with POI ..................................................................................................... 25

5.2 Additional barriers for mobile proximity payments .............................................................................. 26

5.2.1 Fragmented and immature mobile technology landscape.............................................................. 26

5.2.2 Complexity and security of mobile devices ................................................................................... 27

5.2.3 Lack of ubiquity of appropriate mobile devices ............................................................................ 28

5.2.4 Mobile competitive landscape ....................................................................................................... 28

5.2.5 Regulatory framework ................................................................................................................... 29

5.2.6 Complexity of mobile ecosystem .................................................................................................. 31

6 Recommendations and guidelines ............................................................................................... 32

Annex 1: Mandate of the ERPB Working Group on mobile and card based contactless proximity

payments ................................................................................................................................................ 38

Annex 2: Composition of the ERPB Working Group on mobile and card based contactless

proximity payments .............................................................................................................................. 40

Annex 3: Template of the survey on mobile and card based contactless proximity payments ..... 42

Annex 4: Outcome on barriers identified through the survey .......................................................... 48

Annex 4.1 Common barriers ............................................................................................................................. 48

Annex 4.2 Additional barrier for contactless card payments ............................................................................ 50

Annex 4.3 Additional barriers for mobile proximity payments ........................................................................ 50

Annex 5: Legal and regulatory documents impacting mobile and card-based contactless

proximity payments in Europe ............................................................................................................ 54

Annex 6: Technical and security reference documents related to mobile and card-based

contactless proximity payments ........................................................................................................... 56

Annex 7: Country profiles .................................................................................................................... 65

Annex 7.1 Poland .............................................................................................................................................. 65

Annex 7.2 UK ................................................................................................................................................... 65

Annex 8: Impact analysis of IF Regulation on contactless payments .............................................. 66

2015-11-26 ERPB item 6 ERPB CTLP working group final report 3/66

List of tables

Table 1: Recommendations ....................................................................................................................... 8

Table 2: References ................................................................................................................................. 10

Table 3: Terminology.............................................................................................................................. 12

Table 4: Abbreviations ............................................................................................................................ 13

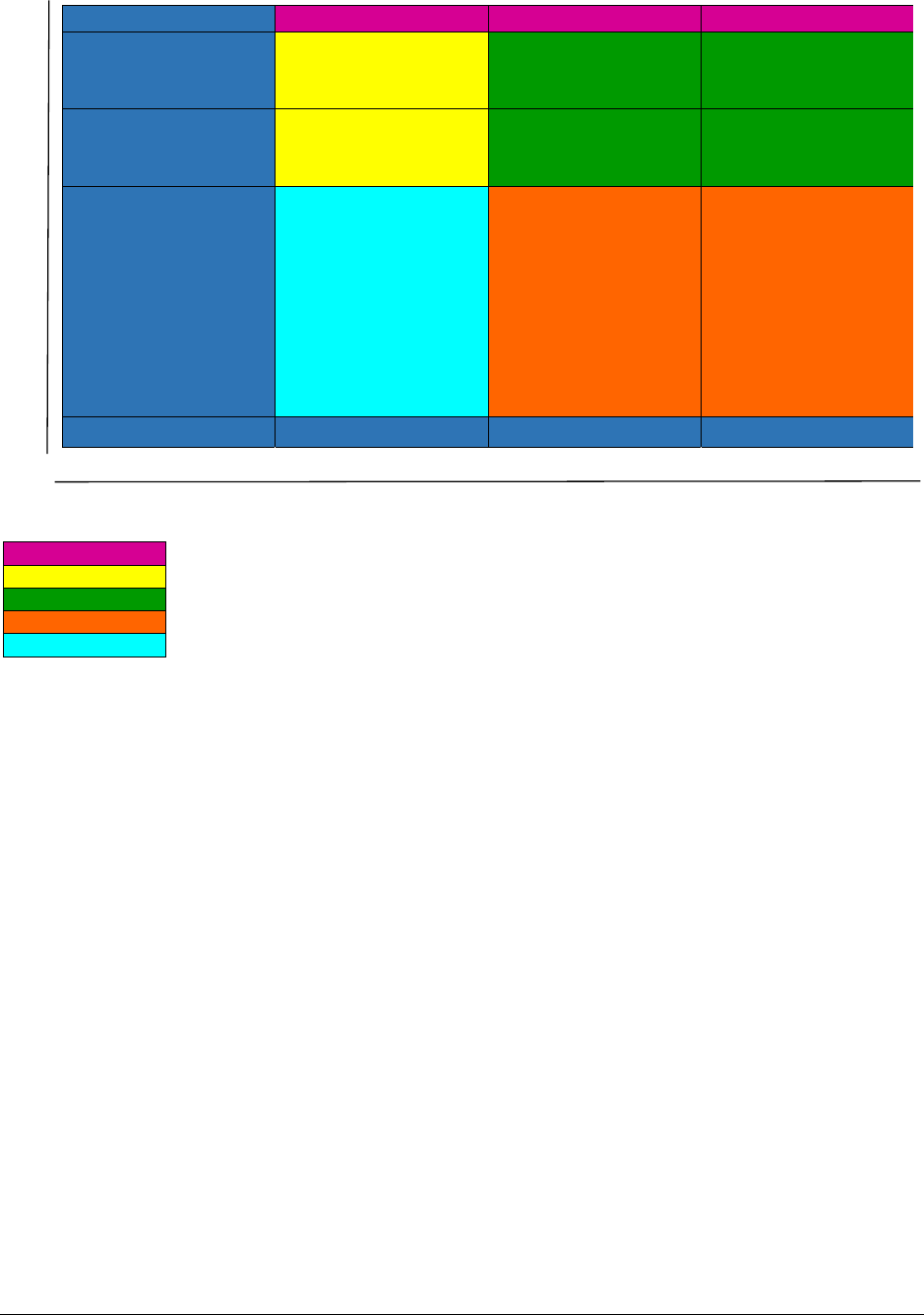

Table 5: Definition of levels of card transactions per country ................................................................ 15

Table 6: Card transactions per country ................................................................................................... 16

Table 7: Contactless transactions penetration (Q2 2015) ....................................................................... 17

Table 8: Definition of country clusters for contactless payments ........................................................... 18

Table 9: Country clusters for contactless payments ................................................................................ 19

Table 10: Contactless infrastructure penetration (Q2 2015) ................................................................... 20

Table 11: Recommendations ................................................................................................................... 36

Table 12: Guidelines for the country clusters ......................................................................................... 37

Table 13: ERPB WG participants ........................................................................................................... 41

Table 14: Barriers for card and mobile proximity payments .................................................................. 50

Table 15: Additional barrier for contactless card payments ................................................................... 50

Table 16: Additional barriers for mobile proximity payments ............................................................... 53

Table 17: Legal and regulatory documents ............................................................................................. 55

Table 18: Mobile Payment Architectural Zones (courtesy EMVCo) ..................................................... 56

Table 19: Technical and security reference documents .......................................................................... 64

2015-11-26 ERPB item 6 ERPB CTLP working group final report 4/66

Executive Summary

This final report provides the outcome of the work conducted by the ERPB Working Group on mobile

and card based contactless proximity payments from January 2015, following the mandate given by

the ERPB meeting in December 2014 (see Annex 1), until November 2015.

In order to gain a better insight into these types of payments, the Working Group decided to conduct a

landscaping exercise through a survey amongst Working Group participants. The survey focused on

the existing or planned mobile and card based contactless proximity payment solutions; on the

appropriate technical and security specifications and guidelines, on the related existing and planned

regulations and recommendations and last but not least on the issues and barriers that may prevent the

development and the adoption of pan-European solutions for these types of payments.

The survey results highlighted that the market is fragmented in terms of maturity of the contactless

solutions adoption and the related technical standards implementations. Likewise, the mobile

proximity payments environment shows strong complexities, mainly related to the usage of different

technologies and the large number of business stakeholders involved in the mobile ecosystem.

Based on the results of the survey and subsequent inputs received, the Working Group specified an

overall vision for these payments in the European Union. It further derived from the survey the barriers

and gaps which need to be addressed towards the realisation of that vision. The feedback, based on the

49 inputs received may be found in Annex 4, with an indication if they are in the competitive or

cooperative space. The Working Group subsequently identified and prioritised a number of main

barriers and gaps. For each prioritised barrier, this report provides an issue description based on the

inputs received as well as related key observations made through an analysis by the Working Group.

These have formed the basis for the development of the following recommendations, to be taken in

order for the essential conditions in the cooperative space to materialise towards the realisation of the

vision.

# Addressee(s) Rationale Recommendations Deadline

A

EMVCo

Multiple

standards with a

variety of options

are currently

present in the

market. The

rationale is to

streamline the

standards used in

the industry.

i. Speed up the creation of a single

common POI kernel specification

for contactless (already planned

under Next Generation) and make

the specifications publicly available

as soon as possible.

ii. Limit the number of terminal

configuration options into the EMV

Next Generation specifications, in

order to allow consistency among

implementations and therefore

provide consumers a streamlined

payment experience across

different terminals.

iii. Include in the Next Generation

specifications a parameter that

would allow the identification of

the latest

Dec 2016

2015-11-26 ERPB item 6 ERPB CTLP working group final report 5/66

the form factor of the consumer

device used for the initiation of the

contactless transaction.

B

Card Scheme

Sector

Aligned Card

Scheme

requirements and

the promotion of

the adoption of

open protocols in

the POI domain

will ease the take

up of contactless

payments.

i. Define an aligned European

mandate for the implementation of

contactless enabled POIs including

a specification of where they

should be available. The ECB

should act as facilitator for this.

ii. Harmonise the level of transaction

limits at POI at country level for

payments per use case / payment

context.

iii. Request the usage of open

protocols in the POI domain and

the POI to Acquirer domain which

are compliant to the Cards

Standardisation Volume and

labelled by the Cards Stakeholders

Group.

iv. Mandate a common

implementation plan for the

EMVCO Next Generation

specifications with an appropriate

migration period

1

.

mid 2016

on-going

mid 2017

Dec 2017

C

Cards

Stakeholders

Group

The

standardisation of

open

specifications for

a card and mobile

contactless

payment

application, could

allow payment

application

developers and

card

manufacturers to

reach economy of

scales and would

i. Develop common requirements for

contactless transactions for

inclusion in the Cards

Standardisation Volume Version 8.

ii. Conduct a feasibility study on the

development of open specifications

for a card and mobile contactless

payment application, their

implementation, maintenance and

testing. For mobile applications, the

open specifications should also

address the different possible

configurations for the management,

provisioning and personalisation of

the card data: Secure Element

Dec 2016

Dec 2016

1

This would also cover the identification of the form factor used for the initiation of the contactless transaction,

see Recommendation A.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 6/66

lower the cost of

these items for the

Issuers, fostering

contactless

adoption.

The specification

of common POI

implementation

guidelines will

lead to a more

uniform payment

experience, for

both the

consumer and

merchant

(UICC, Embedded, SD Card) and

HCE. The future specifications

should leverage the work of

EMVCo and Global Platform.

iii. Develop use cases/payment

contexts for contactless payments

(card and mobile based) for

integration in Cards

Standardisation Volume Version 8.

iv. Develop POI implementation

guidelines including common

minimum requirements for

contactless POIs (both for the

payment process side and for the

consumer/POI interface) hereby

leveraging the EMVCo work and

addressing the requirements of

disabled people associations.

Adequate usage of available input

should be made (see for instance

[DNF1], [EAN1], [GIRO1] and

[UKC2] in Annex 6).

Dec 2016

Dec 2016

D EPC,

Consumer

and Retailers

Associations

Enhance society

awareness on

contactless

payments

Coordinate in co-operation with the Card

Schemes an institutional communication

campaign of the ERPB members to

increase the familiarity with contactless

payment products (card and mobile based).

The communication campaign should

result in the creation and distribution of

informative material on contactless

payment solutions and their usage to all the

ERPB members and affiliates. Moreover

ERPB members and the ECB are requested

to make the informative material produced

available on their websites.

This communication material should

include the following topics:

how to use contactless (both from a

consumer and a retailer

perspective);

highlight the improved payment

experience for the consumers;

choice of application for

mid 2016

2015-11-26 ERPB item 6 ERPB CTLP working group final report 7/66

contactless payments;

explain the benefits of using

contactless;

address consumer concerns

(privacy, safety, security, freedom

of choice, etc…);

training material for retailer staff.

E

Public

Admin. and

Transport

Sector where

card

payments are

suitable

The adoption of

contactless

payments by

certain sectors has

proven to be an

important catalyst

and is even

critical for their

take-up in various

countries.

Prioritise the installation and use of POI

terminals which are enabled to accept

EMVCo based contactless transactions.

on-going

F

ETSI

The

standardisation of

a generic secure

platform for the

mobile device and

of complementary

processes will

contribute to the

cost-effectiveness

with respect to the

development,

certification and

implementation of

mobile proximity

payment services.

i. Agree and put forward the

development of the specifications

of a “Smart Secure Platform”

(enabling the provision of value-

added services relying on

authentication of the user,

regardless of the mobile device,

communication channel and

underlying technology) taking into

account the requirements for

mobile payments, hereby

leveraging work already done by

EMVCo and Global Platform.

ii. Develop implementation guidelines

thereby leveraging work already

done by Global Platform that

define:

o a process to provide the

service providers with the

credentials to have access to

secure elements

o a process that allows a

service provider to be

authenticated, to securely

get the credentials to access

mobile device’s hardware

White paper

mid 2016

Specific.

Dec 2017

Dec 2016

2015-11-26 ERPB item 6 ERPB CTLP working group final report 8/66

vaults (e.g. the secure

element) and to

communicate with these

vaults.

G

Mobile

Payment

Providers

Promote the

usage of a generic

secure platform

for the mobile

device

Require the mobile devices to be qualified

according to the future work developed by

the ETSI “Smart Secure Platform” (see

Recommendation F).

Dec 2018

H

GSMA Provide clarity on

NFC enabled

mobile device

evaluation /

certification

processes

i. Develop an overview paper on the

functional and security evaluation /

certification of NFC enabled

mobile devices (covering all

aspects and configurations #SE

types, HCE, TEE, etc…) in co-

operation with Global Platform and

EMVCo. More in particular issues

related to contactless interference

issues should be addressed.

ii. Encourage European MNOs to

promote the sales of NFC enabled

equipment.

mid 2016

on-going

I

Mobile

Device

Manufacturer

s, Mobile OS

Developers

and GSMA /

MNOs

Consumer

independence of

mobile device for

the freedom of

choice on mobile

contactless

payment services

Provide access to the mobile device

contactless interface in order to ensure that

the consumer can have a choice amongst

payment applications from different

mobile payment providers, independently

of the mobile device and the operating

system used.

on-going

J

European

Commission,

Regulators

and the Cards

Stakeholders

Group

Address legal

issue for the

potential negative

impact it could

have on the take-

up of contactless

payments

To work together to ensure a consistent

understanding on “the choice of

application” in the IF Regulation (see [8])

and to address the impact that it could have

on contactless payments. Hereby the

impact analysis undertaken by the Cards

Stakeholders Group (see Annex 8) should

be taken into account.

mid 2016

Table 1: Recommendations

2015-11-26 ERPB item 6 ERPB CTLP working group final report 9/66

0 Document information

0.1 Structure of the document

This section describes the structure of this final report. Section 0 provides the definitions, and

abbreviations used in this document. The scope of the work is provided in section 1. Section 2 contains

a description of the methodology and survey used to gather the information represented in this report.

The vision for mobile and card-based contactless proximity payments is specified in Section 3. Section

4 portrays the current situation with respect to the actual implementations or planned implementations

of these types of payments through the description of country clusters. Section 5 is devoted to the

description of the barriers and gaps prioritised by the ERPB Working Group which were identified

through the survey. It further contains key observations related to these barriers which have been used

as basis to specify the recommendations presented in Section 6.

Annex 1 presents the ERPB Mandate while Annex 2 shows the composition of the ERPB Working

Group. The survey used for the preparation of this report is provided in Annex 3. Annex 4 represents

the outcome on the barriers and gaps identified through the survey. Annex 5 lists the legal and

regulatory requirements identified which impact these payments while Annex 6 provides the technical

and security references for these payments. Annex 7 provides some country profiles as typical

examples for the implementation of contactless payments. Annex 8 provides the outcome of the impact

analysis of the IF Regulation on contactless payments conducted by the Cards Stakeholders Group.

0.2 References

This section lists the references mentioned in this document. Square brackets throughout this document

are used to refer to a document of this list.

[1]

EMVCO specifications

http://www.EMVCo.com

[2]

Global Platform

TEE System Architecture

http://www.globalplatform.org/

[3]

ISO/IEC 14443: Identification cards -- Contactless integrated circuit cards --

Proximity cards – Parts 1-4.

http://www.iso.org

[4]

ISO/IEC 18092: Information technology -- Telecommunications and

information exchange between systems -- Near Field Communication --

Interface and Protocol (NFCIP-1).

http://www.iso.org

[5]

ISO 20022: Financial Services - Universal financial industry message scheme –

Parts 1-8.

http://www.iso.org

[6]

Payment Services Directive

Directive 2007/64/EC of the European Parliament and of the Council of 13

November 2007 on payment services in the internal market.

[7] Payment Service Directive 2

Ref. Title

2015-11-26 ERPB item 6 ERPB CTLP working group final report 10/66

Draft Directive of the European Parliament and of the Council on payments

services in the internal market and amending Directives 2002/65/EC,

2013/36/EU and 2009/110/EC and repealing Directive 2007/64/EC

[8]

IF Regulation

Regulation (EU) 2015/751 of the European Parliament and of the Council of 29

April 2015 on interchange fees for card-based payment transactions.

Table 2: References

0.3 Definitions

The following terminology is applied in this document. The abbreviations used may be found in

section 0.4.

Term Definition

2D barcodes

A two dimensional barcode is a machine-readable optical label that

contains digital information. They are also referred to as matrix

barcodes. Examples include QR codes and tag barcodes.

Acquirer

A PSP or one of their agents that enters into a contractual relation with a

merchant and an issuer via the card payment scheme, for the purpose of

accepting and processing card transactions.

Authentication

The provision of assurance of the claimed identity of an entity or of data

origin.

Bluetooth low energy

(BLE)

A wireless personal area network technology designed and marketed by

the Bluetooth Special Interest Group aimed at novel applications

including beacons. Compared to classic Bluetooth, BLE is intended to

provide considerably reduced power consumption and cost while

maintaining a similar communication range.

Card Payment Scheme A card payment scheme is a technical and commercial arrangement

(often referred to as the “rules”) between parties in the card value chain,

resulting in a set of functions, procedures, arrangements, rules and

devices that enable a consumer (cardholder) to perform a payment

transaction, and/or cash withdrawal or any other card service. The

members of the card scheme can issue or acquire transactions performed

within the scheme.

Consumer

A natural person who, in payment service contracts covered by the [6],

is acting for purposes other than his trade, business or profession (as

defined in [6]).

Consumer Verification

Method

A method for checking that a consumer is the one claimed.

Contactless Technology

A radio frequency technology operating at very short ranges so that the

user has to perform a voluntary gesture in order that a communication is

initiated between two devices by approaching them. It is a (chip) card or

mobile payment acceptance technology at a POI device which is based

on ISO/IEC 14443 (see [3]).

Contactless Card

Payment

A card based proximity payment where the payer and the payee

communicate directly using contactless technologies.

Customer

A consumer or a merchant.

Credential(s)

Payment account related data that may include a code (e.g., mobile

code), provided by the issuer to their customer for

2015-11-26 ERPB item 6 ERPB CTLP working group final report 11/66

identification/authentication purposes.

Digital wallet

A service accessed through a consumer device which allows the wallet

holder to securely access, manage and use a variety of

services/applications including payments, identification and non-

payment applications. A digital wallet is sometimes also referred to as

an e-wallet.

EMVCo

An LLC formed in 1999 by Europay International, MasterCard

International and Visa International to enhance the EMV Integrated

Circuit Card Specifications for Payments Systems. It manages,

maintains, and enhances the EMV specifications jointly owned by the

payment systems. It currently consists of American Express, Discover,

JCB, MasterCard, Union Pay and VISA (see [1]).

Host Card Emulation

(HCE)

A technology that enables mobile devices to emulate a contactless card.

HCE does not require the usage of a secure element for storage of

sensitive data such as credentials, cryptographic keys, …

Issuer

A PSP or one of their agents that supplies the card payment account and

the card services (including card data) to the cardholder, and is a

member of a card payment scheme.

The Issuer enters into a contractual relationship with a consumer

(cardholder) and guarantees payment to the acquirer for transactions that

are in conformity with the rules of the relevant card payment scheme.

Merchant

The beneficiary within a mobile payment scheme for payment of goods

or services purchased by the consumer/payer. The merchant is a

customer of its PSP.

Mobile code

A user verification method used for mobile card payments. It is a code

entered via the keyboard of the mobile device to verify the cardholder’s

identity as a cardholder verification method.

Mobile Contactless

Payment (MCP)

A mobile proximity payment where the payer and the payee

communicate directly using contactless technologies.

MCP application

An application residing in a secure environment performing the payment

functions related to a Mobile Contactless Payment (MCP), as specified

by the MCP application issuer in accordance with the payment scheme.

Mobile device

Personal device with mobile communication capabilities such as a

telecom network connection, Wi-Fi, Bluetooth … which offers

connections to internet.

Examples of mobile devices include mobile phones, smart phones,

tablets.

Mobile Network

Operator (MNO)

A mobile phone operator that provides a range of mobile services,

potentially including facilitation of NFC services. The MNO ensures

connectivity Over the Air (OTA) between the consumer and its PSP

using their own or leased network.

Mobile payment service

Payment service made available by software/hardware through a mobile

device.

(Mobile) proximity

payment

A (mobile) payment where the consumer and the merchant (and/or their

equipment) are in the same location and where the communication

between the consumer device (card or mobile device) and the Point of

Interaction device takes place through a proximity technology (e.g.,

contactless including NFC, 2D barcodes, BLE, etc.). (Mobile) proximity

payments include but are not limited to (mobile) contactless payments.

Contact card payments are excluded.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 12/66

Mobile service

Service such as identification, payment, ticketing, loyalty, etc., made

available through a mobile device.

Mobile wallet

A digital wallet accessed through a mobile device. This service may

reside on a mobile device owned by the consumer (i.e. the holder of the

wallet) or may be remotely hosted on a secured server (or a combination

thereof) or on a merchant website. Typically, the so-called mobile wallet

issuer provides the wallet functionalities but the usage of the mobile

wallet is under the control of the consumer.

NFC (Near Field

Communication)

A contactless protocol specified by ISO/IEC 18092 [4].

Payment account

Means an account held in the name of one or more payment service

users which is used for the execution of payment transactions (see [6]).

Payment Service

Provider

The bodies referred to in Article 1 of the [6] and legal and natural

persons benefiting from the waiver under Article 26 of the [6].

Payment transaction

An act, initiated by the consumer of placing, transferring or withdrawing

funds (as defined in [6]).

POI device

“Point of Interaction” device; the initial point where data is read from a

consumer device or where consumer data is entered in the merchant’s

environment. As an electronic transaction-acceptance product, a POI

consists of hardware and software and is hosted in acceptance

equipment to enable a consumer to perform a payment transaction. The

merchant controlled POI may be attended or unattended. Examples of

POI devices are Point of Sale (POS), vending machine, Automated

Teller Machine (ATM).

Secure Element (SE)

A certified tamper-resistant platform (device or component) capable of

securely hosting applications and their confidential and cryptographic

data (e.g., key management) in accordance with the rules and security

requirements set forth by a set of well-identified trusted authorities.

Examples include universal integrated circuit cards (UICC), embedded

secure elements, chip cards and secure digital cards.

Secured Server

A web server with secure remote access that enables the secure storage

and processing of payment related data.

Trusted Execution

Environment (TEE)

An execution environment (as defined by Global Platform, see [2]) that

runs alongside, but isolated from a main operating system. A TEE has

security capabilities and meets certain security-related requirements: it

protects TEE assets from general software attacks, defines rigid

safeguards as to data and functions that a program can access, and resists

a set of defined threats.

User Interface (UI)

An application enabling the user interactions.

Table 3: Terminology

0.4 Abbreviations

Abbreviation Term

2D barcode

Two dimensional barcode

BLE

Bluetooth Low Energy

C2B

Consumer-to-Business

C2C

Consumer-to-Consumer

ETSI

European Telecommunications Standards Institute

2015-11-26 ERPB item 6 ERPB CTLP working group final report 13/66

GP

GlobalPlatform

GSMA

The GSM Association

HCE

Host Card Emulation

HSM

Hardware Security Module

MCP

Mobile Contactless Payment

MNO

Mobile Network Operator

NFC

Near-Field Communications

OS

Operating System

OTA

Over the Air

POI

Point of Interaction

PSD

Payment Services Directive

PSP

Payment Service Provider

QR code

Quick Response code

SE

Secure Element

TEE

Trusted Execution Environment

UI

User Interface

Table 4: Abbreviations

1 Scope

The scope for this report on mobile and card based contactless proximity payments was specified in

the mandate given in December 2014 by the ERPB (see Annex 1) to the dedicated Working Group

(see Annex 2 for its composition).

The main goal is to address issues related to the muted take up of mobile and card based contactless

proximity payments. Several innovative payment solutions rely on contactless technologies to perform

payments or on proximity technologies to initiate payments. They usually provide a more convenient

user experience at the point of interaction (POI) and a substantially faster check-out. Even though

these types of payments are still at an early stage of development, there is already a trend towards

setting standards that differ across schemes, devices and countries. The purpose of the work it to

analyse existing solutions and standards (both national and international) and assess to what extent

there are differences in standards and technical implementation preventing interoperability at pan-

European level.

This final report contains a vision for mobile and card based contactless proximity payments in the

European Union, the analysis of the market conditions and a set of recommendations. These

recommendations identify concrete actions to be taken in the cooperative space in order to realise the

essential conditions to materialise the vision.

2 Methodology

Throughout the first semester of 2015 the participants to the ERPB Working Group on mobile and card

based contactless proximity payments gathered and analysed information related to these payments. A

dedicated survey (see Annex 3) amongst the participants of the Working Group was organised to

collect this information.

The aim of this survey was to provide input on the following topics:

2015-11-26 ERPB item 6 ERPB CTLP working group final report 14/66

A. Existing or planned mobile and card based contactless proximity payment solutions;

B. Existing or planned white papers and technical and security specifications / standards

related to mobile and card based contactless proximity payments;

C. Existing or planned regulations and recommendations / guidelines on mobile and card

based contactless proximity payments, including security and privacy aspects;

D. Issues or barriers that may prevent the development of pan-European solutions.

In total 57 responses to the survey have been received, representing 25 countries both from the demand

and the supply side. The input received on existing and planned mobile and card based contactless

proximity implementations is reflected in section 4.

Based on the inputs received, the Working Group specified an overall vision for mobile and card based

contactless proximity payments in the European Union which is presented in section 3. It further

derived from the survey the barriers and gaps which need to be addressed towards the realisation of

that vision. The feedback, based on the 49 inputs received on the barriers and gaps identified through

this survey, is contained in Annex 4, with an indication if they are in the competitive or cooperative

space. The Working Group subsequently prioritised a number of main barriers and gaps and specified

for each barrier related key observations (see section 5). These barriers and key observations have

formed the basis to develop concrete recommendations including guidelines and actions to be taken in

order for the essential conditions in the cooperative space to materialise towards the realisation of the

vision.

3 Vision

The Working Group defined the vision for mobile proximity and card based contactless payments in

the European Union as follows:

“To ensure over time, across Europe, a secure, convenient, consistent, efficient and trusted payment

experience for the customer (consumer and merchant) for retail transactions at the Point of

Interaction (POI), based on commonly accepted and standardised contactless and other proximity

payment technologies.”

This vision is based on the following guiding principles:

Technical interoperability of contactless and other proximity transactions across Europe (based

on common technical, functional and security standards and certification / evaluation

framework) both for consumer devices (cards, mobile devices, wearables, …) and POIs;

Wide availability and usability of appropriate POI equipment and consumer devices;

Appropriate security and privacy to build up and maintain trust.

This should lead to an enhanced payment experience - faster check out, user-friendliness, better

integration of value added services with payment - and to cost-effectiveness for Society.

4 Contactless and other proximity implementations in Europe

This section portrays the current situation with respect to the actual implementations of mobile and

card based contactless payments through the description of country clusters. Focus has been given to

this type of payments since they appear to be the most mature proximity payments in the market.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 15/66

However, it should be noted that different countries have also implemented other types of proximity

payments, mostly based on QR codes, however, most of them appear to be closed, proprietary

solutions which do not operate cross-border.

4.1 Some “contactless” payment statistics

Given that the European market shows a heterogeneous level of consumer adoption of electronic

payment instruments across countries and, considering as well that different paces and approaches are

noted for the adoption of contactless payments, the present report presents a European payment market

analysis conducted at country level, where fewer differences occur.

With the objective to streamline the definition of guidelines and strategies aimed to expand the usage

of mobile and card based contactless payments, the WG identified groups of countries that show

similar levels of usage of contactless payment solutions and defined them as country clusters. The

criteria adopted to define these country clusters are the usage of card payments and the presence and

usage of contactless solutions (mainly card based). The WG used both the ECB payment statistics data

and the contributions of their participants.

As the level of presence of card payments in a country was identified as an important factor with

respect to the possible take-up of contactless payments in view of the existing card payment

infrastructure and customer habituation (consumer and merchant), a first criterion which was analysed

was the number of card

2

payment transactions. Hereby, three segments were defined in relation to this

criterion, namely “low”, “medium” and “high” as follows:

Level Number of card transactions per capita

Low

< 75 transactions per year (an average of circa 1,5 transactions per week)

Medium

between 75 and 150 transactions per year (an average of between 1,5 and 3

transactions per week)

High

> 150 transactions per year (an average of more than 3 transactions per week)

Table 5: Definition of levels of card transactions per country

The table below summarises the result of the segmentation exercise based on the 2014 figures

provided by the ECB for the first criterion.

2

Debit, Credit, Deferred debit.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 16/66

Table 6: Card transactions per country

As second criterion the total numbers of contactless transactions versus the total numbers of face to

face card transactions were analysed, defining a penetration percentage per country. Four segments

were defined in relation to this criterion as shown in the table below whereby every country was

classified in accordance to the data gathered from the ERPB WG participants.

The table below summarises the result of the segmentation exercise based on the second criterion.

Refyear

2014

Population

(million)

TotalCard

Transactions

(million)

Card

Trans a ctions

percapita

(units)

Level

Austria 9 559 65 low

Belgium 11 1,508 135 medium

Bulga ria 7 65 9 low

Czech 11 484 46 low

Denmark 6 1,516 269 high

Germany 82 3,335 40 low

Estonia 1 247 187 high

Ireland 5 435 94 medium

Greece 11 88 8 low

Spain 46 2,760 59 low

France 66 9,438 143 medium

Croatia 4 218 51 low

Italy 61 2,034 33 low

Cyprus 1 40 47 low

Latvia 2 191 96 medium

Lithuania 3 172 59 low

Luxembourg 1 102 182 high

Hungary 10 359 36 low

Malta 0 19 45 low

Netherlands 17 3,169 188 high

Norway 5 1,890 369 high

Poland 38 1,873 49 low

Portugal 10 1,274 123 medium

Romania 20 228 11 low

Slovenia 2 140

68 low

Slova kia 5 273 50 low

Finland 5 1,331 244 high

Sweden 10 2,620 270 high

UK 65 13,010 201 high

2015-11-26 ERPB item 6 ERPB CTLP working group final report 17/66

Table 7: Contactless transactions penetration (Q2 2015)

The combination of these two indicators can be used to define five different clusters of countries with

respect to the take-up of contactless payments. The clusters identified are labelled as follows:

“Developed”, “In development”, “Movers”, “Slow movers” and “Last Movers”. The table below

provides a brief description of the different clusters.

TransactionPenetration

<3%

TransactionPenetration

3%‐9%

TransactionPenetration

10%‐50%

TransactionPenetration

>50%

Markets Belgium

Bulgaria

Cyprus

Denmark

Estonia

Finland

Germany

Greece

Italy

Latvia

Lithuania

Luxemburg

Malta

Norway

Portugal

Romania

Slovenia

Sweden

Austria

Croatia

France

Ireland

Netherlands

Spain

Hungary

Poland

Slovakia

UK

CzechRepublic

2015-11-26 ERPB item 6 ERPB CTLP working group final report 18/66

Labels Country cluster description

Developed

The consumers in the countries assigned to this cluster present a

consolidated usage of contactless payments. These markets are pioneering

the payment innovation and the consumer adoption of contactless payments

is massive. It is driving a consistent increase in the total number of card-

based transactions.

In development

The consumers in the countries assigned to this cluster present a medium

usage of contactless payment and the market stakeholders are actively

pursuing the implementation of contactless solutions despite the fact that

consumers in these payment markets are not strongly accustomed to using

card payments. Consumer adoption of contactless payments is often mainly

concentrated in metropolitan areas. It is driving a noticeable increase in the

total number of card-based transactions.

Movers

The consumers in the countries assigned to this cluster present a medium

level of usage of contactless payments in a market where consumers are

already accustomed to using card payments. Consumer adoption of

contactless payments is increasing fast and is driving a consistent increase

in the total number of card-based transactions.

Slow movers

The consumers in the countries assigned to this cluster present a low level

of usage of contactless payments. On the other hand these markets are

among the most developed in terms of card and electronic payments usage.

The introduction of contactless solutions has not been recognised yet as a

factor for further development of consumer payment behaviour.

Last Movers

The consumers in the countries assigned to this cluster present a low level

of usage of contactless payments in a market that is also less developed in

terms of card payments usage. The introduction of contactless solutions

might be a factor for further development of consumer payment behaviour

and number of card-based transactions.

Table 8: Definition of country clusters for contactless payments

The next table presents the result of the clusterisation analysis of country markets based on the

previously defined labels in Table 8 and using the criteria of Tables 6 and 7:

2015-11-26 ERPB item 6 ERPB CTLP working group final report 19/66

Table 9: Country clusters for contactless payments

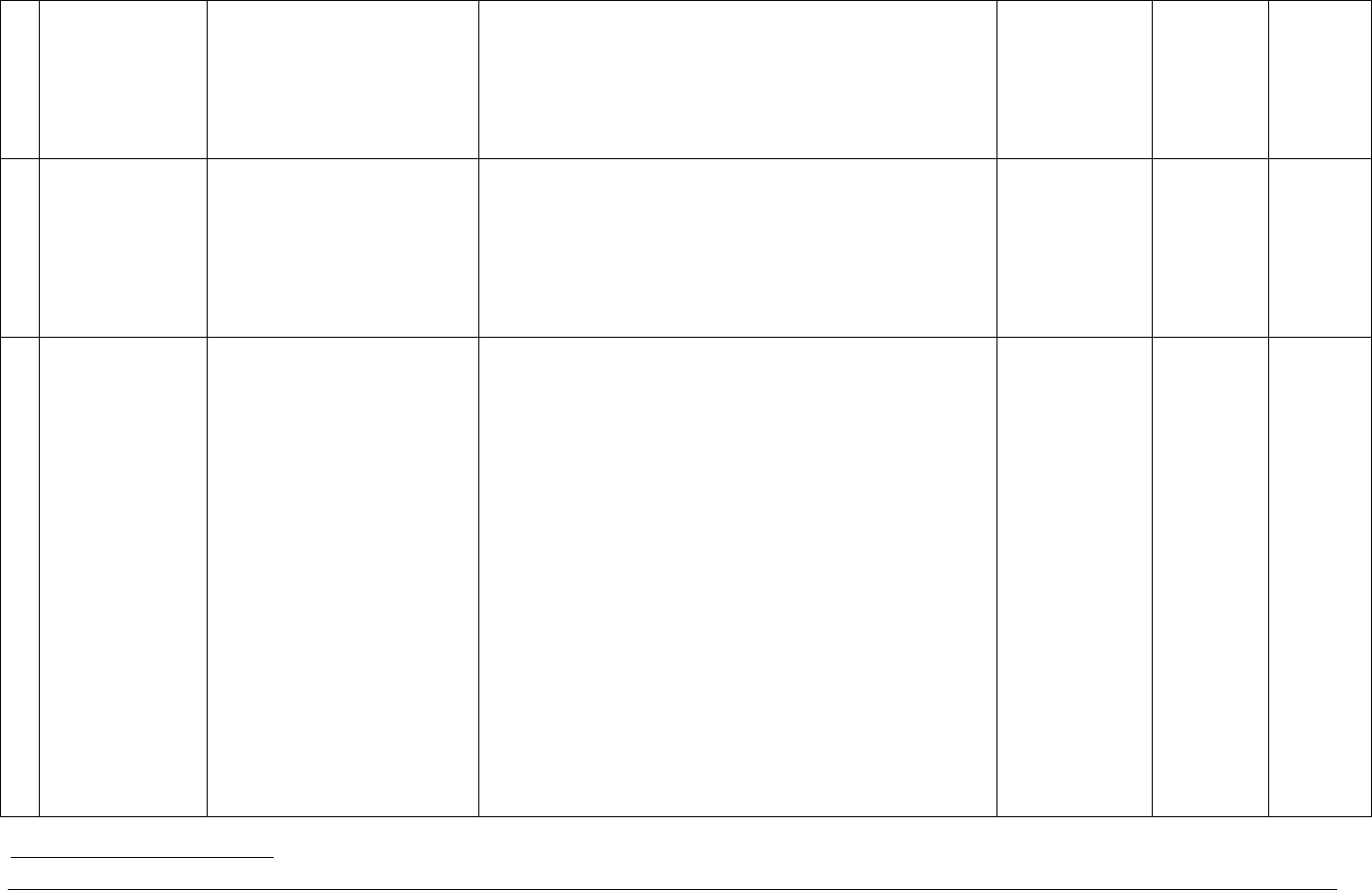

An additional indicator for the take-up of contactless payments is the proportion of contactless cards

and active contactless enabled POIs versus the total number of cards and POIs. The table below shows

the actual contactless infrastructure penetration grid based on Q2 2015 figures obtained from the

ERPB WG participants.

Contactlesspaymentsusage(2015)

Cardpaymentsusage(2014)

>50% CzechRepublic

Between10%and50%

Hungary

Poland

Slovakia

UK

Between3%and9%

Austria

Croatia

Spain

France

Ireland

Netherlands

<3%

Bulgaria

Cyprus

Germany

Greece

Italy

Lithuania

Malta

Romania

Slovenia

Belgium

Latvia

Portugal

Denmark

Estonia

Finland

Luxemburg

Norway

Sweden

Low Medium High

Developed

In development

Movers

Slowmovers

Lastmovers

2015-11-26 ERPB item 6 ERPB CTLP working group final report 20/66

Issuance penetration: percentage of contactless enabled cards within all cards issued

Acceptance penetration: percentage of activated contactless enabled POIs within all POIs

Table 10: Contactless infrastructure penetration (Q2 2015)

4.2 Some lessons learnt

Next to the statistics provided in the previous section, it is also interesting to have a closer look to

some specifics of countries which have introduced contactless payments over the past years. As an

example, a closer analysis has been made on Poland and the UK with the purpose to derive some key

findings with respect to increasing the speed of the introduction and usage of contactless payment. A

detailed description of these two country profiles may be found in Annex 7.

The key findings derived may be described as follows

The importance of central coordination in the country:

The central coordination between the different (even competing) stakeholders involved, in the

launch of a pilot and further roll-out of contactless payments has played a key role in the

smooth implementation in certain countries. It has allowed for a more consistent customer

experience, a coordinated retailer approach, issuance of supporting documentation at country

level (e.g. the UK guidelines for POIs, see [UKC2] in Annex 6), the prompt common handling

of issues detected, and last but not least cost-effectiveness.

The contactless transaction amount limit:

The common agreement by all stakeholders involved in the market roll-out of contactless

payments in a country on the transaction amount limit without the presentation of a consumer

verification method (e.g. PIN or mobile code) and subsequent monitoring on the transaction

behaviour and impact has proven to considerably influence the take-up of contactless

payments. As an example, the UK has increased the transaction amount limit for a third time.

Contactlesscards Lowacceptance

penetration(<10%)

Mediumacceptance

penetration(10%‐50%)

Highacceptance

penetration(>50%)

Highissuance

penetration(>50%)

Austria

France

Ireland

Netherlands

CzechRepublic

Poland

Slovakia

Mediumissuance

penetration(10%‐49%)

Denmark

Luxembourg

Portugal

Norway

Bulgaria

Croatia

Cyprus

Finland

Germany

Greece

Italy

Romania

Slovenia

Hungary

Spain

UK

Lowissuancepenetration

(<10%)

Belgium

Latvia

Sweden

2015-11-26 ERPB item 6 ERPB CTLP working group final report 21/66

In Poland only recently transactions above the limit can be conducted contactless with the

presentation of a consumer verification method (e.g. PIN at POI or mobile code at mobile

device) where before a contact card transaction was required.

The involvement of certain sectors: large retail stores, transport/transit sector:

The take-up of contactless payments by major retailers (e.g. groceries) and the transit sector has

given a great boost to contactless payments. Indeed, the fact that consumers daily make use of

these services has considerable contributed to their habituation to and embracement of

contactless technology. Moreover, the usage by the transit sector of EMV-based contactless

technology in certain countries like the UK, rather than developing their own solution, had a

direct impact on the usage scale of these payments and obviously led to cost-effectiveness.

Merchant staff training

The appropriate training of merchant staff is recognised as a key factor for the consumer

experience in the retail shops. Not only appropriate knowledge of how a contactless transaction

needs to be handled but also regular asking consumers to pay contactless should be part of the

staff education. This training could be accompanied by appropriate promotion campaigns (e.g.

“tap & go”).

Consumer communication and awareness

The combined usage of various means of communication to consumers is important. This could

include explaining the feature in the welcome call, in the welcome pack, statement insert, ATM

screens, dedicated campaigns to support contactless payments and promotional messages

mainly for customer education where for instance the measured contactless speed and facts are

included.

5 Main barriers for the realisation of the vision

The survey reflected that nowadays the market has considerably matured with respect to card

contactless payments, largely based on the EMVCo specifications, while it appears to be still early

days for mobile proximity payments, including mobile contactless payments. Concerning the latter,

NFC seems to be the widest adopted technology nowadays for mobile proximity payments (in analogy

to contactless card payments) although also other technology solutions have been introduced to initiate

mobile proximity payments such as 2D barcodes, beacons, ... It should be noted that for the latter, the

underlying payment instrument may not be a card payment.

The survey highlighted the presence of barriers and gaps for the different types of payments in scope.

In view of their market maturity, less barriers and gaps have been identified for contactless card

payments compared to mobile proximity payments. It is generally expected that the creation of the

necessary conditions for removing these barriers might be easier for card based contactless payments

than for mobile based proximity payments.

Below in section 5.1 follows a list of the barriers which were prioritised as being valid for both

contactless card and mobile proximity payments, while section 5.2 presents a list of additional barriers

dedicated to mobile proximity payments.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 22/66

5.1 Barriers for proximity payments

5.1.1 Lack of a common (open) set of specifications and implementation guidelines

for proximity payments transactions

Issue description

The lack of a complete common set of (open) specifications and implementation guidelines for

proximity payment transactions, - both card and mobile device based - creates differences across

Europe in proximity payment products and in customer (both consumer and merchant) experience

which hinder technical interoperability and prevent cost-effectiveness for Society.

More in particular, the survey identified the following issues for mobile and card based EMV

contactless payments which should be addressed through standardisation work:

Multiplicity of acceptance implementation options creating issues at the POI (e.g. PIN on line

not supported, TAP + mobile code + TAP not supported, etc.);

Difference in implementation between online and offline transactions in different geographies

in Europe may lead to an inconsistent consumer experience (and missed business opportunities

for merchants and PSPs);

In addition, the following specific issues for standardisation (in random order) related to mobile

proximity payments were reported through the survey:

Lack of interoperability of existing acceptance infrastructure (accepting NFC and 2D barcodes

on the same POI).

Time at check-out with POI should be at least as fast as with a card payment;

Lack of standardisation in the payment initiation message for new proximity technologies such

as 2D barcodes

3

or BLE;

Lack of standards for the enrolling in digital wallets;

The absence of standard procedures to personalise card data into secure elements;

The presence of multiple consumer verification methods (no PIN, PIN at POI, mobile code,

fingerprint,…) leading to non-interoperable solutions and consumer confusion;

Co-existence of multiple mobile contactless payment applications on multiple secure elements,

cloud, host card emulation, etc. need to be addressed in a consistent manner to ensure optimal

consumer experience.

Key observations

Within the card and mobile based proximity payments environment, the standardisation work for EMV

contactless payments is already well-advanced and implemented, especially with regards to the

interaction between the POI and the consumer device (either card or mobile device). Some

improvements may be identified to further enhance the customer experience and solve some

interoperability issues as noted through the survey. On the opposite, for other proximity payment

techniques (such as 2D barcodes, BLE, etc.) there are no (open) common specifications yet and

existing proximity technologies and standards are not yet widely known in the payment industry.

The most prevalent technology on the market nowadays for contactless payments is based on NFC and

employs the EMVCo specifications (see [1]). EMVCo is already working on the next generation of

their specifications which aim to unify the requirements for all payment contexts, covering both

3

Note that the EPC published guidelines on the usage of QR codes for the initiation of a SEPA credit transfer (EPC 069-

12) but not for the specific usage in a mobile environment.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 23/66

contact and contactless card transactions through a single specification for the POI kernel (currently

multiple kernel specifications exist – to date 7 have been registered by EMVCo). The final version of

these specifications, referred to as “EMV Next Generation” are planned to be released by end 2016.

The implementation of EMV Next Generation specifications could be part of a solution to create a

level playing field through standardisation in the cards-to-POI and in the POI application domains.

This process might be further complemented with the development of common minimum security

requirements for the contactless payment application and of specifications for the POI-to-acquirer

domain, the latter being addressed by other organisations such as Nexo. The migration to a single

protocol in the POI-to-acquirer domain would allow moving away from domestic, proprietary

protocols which hinder cross-border interoperability and would result in an improved cost-

effectiveness. Simplifying the access to the card acquiring market via the standardisation of contactless

card environment related specifications enhances competition.

There are EMV and Global Platform specifications for personalising card data into secure elements

that could be referenced in a set of standard personalisation procedures.

The lack of commonality between EMV implementations within Europe (e.g. some countries support

online PIN, others do not) could be addressed through the development of implementation guidelines.

Complementary to the development of implementation guidelines specifications and requirements,

appropriate existing testing, evaluation and certification processes should be revisited and potentially

further developed to meet these new requirements which should be resulting in a “unified” certification

framework.

5.1.2 Lack of customer demand and contactless payment experience

Issue description

A lack of familiarity makes it difficult for customers (both consumers and merchants) to employ

contactless payments. Trust and confidence in these payments should be built by the industry

leveraging the advantages of these solutions. The multiple solutions that exist in contactless payment

products create some variations in the user experience. For example, different consumer devices can be

used to initiate a contactless transaction (card, mobile, sticker, key fob, watch, etc.) and POIs may have

different set-ups (see also section 3.5). Moreover, multiple consumer verification methods are

available (PIN on POI, mobile code on mobile device, biometrics on mobile device or absence of any

consumer verification methods, etc.). These variances contribute to the creation of a lack of clarity

with regards to contactless payments and a lack of trust both from consumers and merchants. This

affects the take-up of contactless payment products.

Key observations

Customers (both consumers and merchants) lack familiarity and trust with other form factors and

technologies than contactless cards. The customer experience could be improved by defining

standardised sets of rules and user interface requirements

4

for the different payment use cases and

merchant environments which ultimately may result in a more consistent user experience across SEPA

(see also section 5.1.5).

4

In analogy to the document developed by the UK Cards Association with MasterCard and Visa on a Contactless User

Interface for Europe and the UK, based on EMV Contactless Specifications for Payment Systems – Book A: Architecture

and General Requirements (see [1]).

2015-11-26 ERPB item 6 ERPB CTLP working group final report 24/66

Furthermore, the consumer awareness should be increased through communication activities (with

respect to liability, security, proximity habits, speed, etc.) by merchants and/or payment service

providers, but possibly also through multi-stakeholder generic commercials. A coordinated

communication effort by all stakeholders might effectively contribute to increasing the familiarity with

contactless payment products. This would promote the market take-up of these solutions.

Finally to enhance the trust and confidence, the consumer should be provided with an opt-out to

contactless products. How to achieve this is a PSP’s implementation option.

5.1.3 Lack of ubiquity of POIs

Issue description

The payments market is a two-sided market. This means that for a payment product to become

successful, it has to be frequently used by consumers on one side, but also widely accepted by

merchants on the other side. A large part of the POI terminals in Europe today is not equipped for

contactless transactions yet. The average merchant take-up of contactless POIs is slow because it is

usually linked to the POI lifecycle (i.e. renewal of POIs) and the associated costs. The European

market presents itself fragmented in that respect; in some countries the retailers already have a large

percentage of POIs which support contactless technology while in other countries only a limited

number of merchants with contactless POIs are available. As a consequence, consumers which have

been provisioned with a contactless payment instrument are not always offered sufficient opportunities

to use contactless technology. This hinders consumer and merchant habituation and ultimately leads to

an even slower take-up of contactless payment solutions.

Key observations

A lack of availability of contactless POIs makes the uptake of contactless payments by consumers

difficult. Note that this is not only matter of take-up by the retail sector but in some countries a lack of

support from the acquirers for promoting, selling and deploying contactless POIs is to be noted.

Deployment of EMV compatible contactless POI terminals has been successful where coordination at

country level took place (e.g. UK, Poland, and Czech Republic). A second success factor is the

involvement of particular retail sectors, such as large grocery departments, were the consumer has a

recurrent payment experience or the involvement of other consumer services such as public transport.

In order to enhance the availability of contactless POI terminals, some of the (international and

domestic) card schemes have mandated in Europe the migration of the POI terminal base to support

contactless technology.

Where legally possible, a further incentive could be created through the deployment of contactless

technologies by public authorities and administrations in the respective countries in Europe. They may

play an exemplary role in this by for instance accepting contactless payments related to public services

such as specific tax and (local) administrative fees collections.

5.1.4 Security and privacy

Issue description

Various stakeholders have a general concern about the security and the privacy issues related to

contactless payments. Additional risks are perceived from the introduction and the usage of contactless

technology (e.g.; short range technology used in the communication between the consumer device and

the POI creating an opportunity for electronic eavesdropping) and should be adequately addressed.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 25/66

Also new risks associated with the usage of mobile devices (see also section 5.2.2), instead of physical

cards, by the consumers pose new security challenges.

With regard to mobile proximity payments, payment credentials may be stored in new environments

(such as hardware / software modules on the mobile device or back-end servers (clouds) accessed via

the mobile device), each come with different security and privacy threats which need to be

appropriately countered by security measures.

In case of security breaches, the appearance of subsequent fraudulent transactions may result in a lack

of trust in contactless payments which in turn can hinder market take-up.

Key observations

With respect to contactless payments in general, it is very important to have an appropriate

communication towards the customers to address privacy and data protection concerns, to inform

about the security of the payment instrument and to explain how (exceptional) fraudulent transactions

would be handled. This communication is important to create customer (both consumer and merchant)

trust which is an important pillar for an increased market take-up of contactless payment products.

Merchants also expressed the need for the identification of the form factor of the consumer device at

the POI.

Privacy appears to be a bigger concern with mobile proximity payments than contactless card

payments. The mobile environment is seen as more vulnerable than the card.

In particular, related to the security of mobile contactless payments, the SecuRe Pay Forum drafted a

preliminary set of security recommendations in 2013. This work was handed over to the EBA as one of

the potential inputs for the future development of guidelines and regulatory technical standards

mandated within the PSD2 (see [7]).

Last but not least, in the mobile proximity payment ecosystem, which is far more complex than the

contactless card ecosystem and which involves many more stakeholders, a same minimum level of

security for each stakeholder in the payment chain should be ensured. At the same time, a relevant

distribution of liabilities should be applied accordingly amongst these stakeholders.

5.1.5 Consumer interaction with POI

Issue description

Besides the lack of familiarity of consumers regarding contactless payment products in general which

was mentioned in section 5.1.2, there still seems to be a lot of uncertainty when consumers face a POI

and wish to perform a contactless payment: is the POI contactless enabled, where should I wave my

consumer device (the POIs which are contactless enabled may have the contactless interaction point

placed in different positions), has the payment been executed, do I get a receipt?

There are also accessibility issues concerning contactless POIs for people who are visually impaired or

have a physical or mental disability or who are chronically ill. For example, the sound of the beep at

the moment of contactless interaction is not loud enough, the palpability of certain keys is not good

enough or the contrasting colors on the display make it difficult to read. These issues prevent certain

groups of consumers to use contactless payment products.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 26/66

Key observations

The development of common minimum requirements for contactless POIs, including a common

symbol for the contactless spot, requirements on audio feedback and on the displays and keyboards to

ensure that everyone in the society is able to use contactless payment products, may contribute to a

more uniform payment experience. EMVCo has already undertaken some work in that respect with

specifications for the POI user interface which are contained in the EMV Contactless Specifications

for Payment Systems – Book A: Architecture and General Requirements (see [1]). However, the POI

vendors have a number of choices within the specified requirements.

EMVCo has also developed two contactless marks: a contactless indicator (e.g. the consumer device)

and a contactless symbol (e.g. for the POI) with licensing agreements and reproduction requirements

which may be found in the “Best Practices” section on their website (see [1]).

5.2 Additional barriers for mobile proximity payments

This section provides a description of additional prioritised barriers which apply specifically to mobile

proximity payments.

5.2.1 Fragmented and immature mobile technology landscape

Issue description

The market for mobile proximity payments is very fragmented with a lot of innovative but immature

solutions. The fragmentation derives either from the presence of multiple mobile solutions with a

limited geographical coverage or from the usage of different technologies, standards and business rules

across the existing mobile solutions.

Mobile devices provide the payment industry with multiple technologies to initiate and/or perform

payments. They have the capability to capture, store and transmit data in diverse and numerous ways.

The versatility of the mobile devices leave stakeholders in the ecosystem (including merchants, PSPs,

Mobile Network Operators (MNO), other service providers, …) with major challenges with respect to

the development of strategies / road maps with a viable business case and market reach.

Furthermore, being that the market for payment services is a multi-sided market, mobile proximity

payments solutions should be simultaneously introduced and employed on the consumer and merchant

sides. However, there is a lot of uncertainty how the market will develop and what will be the future

prevalent technology solution.

Some initiatives in this area are leveraging the card contactless acquiring infrastructure, others are

creating closed loop solutions with selected merchants, which are often subsidised for technology

integration. In many counties domestic solutions with local protocols are being employed. This results

in a large variety of solutions across Europe with no pan-European acceptance. Those solutions

involve different technologies and infrastructures resulting in interoperability issues which are a main

barrier for market integration. The market fragmentation is leading consumers and merchants to

confusion and limited adoption of the existing solutions.

Key observations

New payment products are often promoted to a national audience rather than European level. In this

situation similar solutions are developed and launched in different countries but unfortunately they are

not always interoperable with each other. This creates market fragmentation in Europe. Market

2015-11-26 ERPB item 6 ERPB CTLP working group final report 27/66

fragmentation in turn makes it difficult for suppliers of payment products to reach scale economies,

which in the payments market is a key factor for a business model to be successful.

The focus should be to develop basic standards for each of the mobile proximity technologies which

can be addressed at this very moment in view of where the market is today. Taking into account that

contactless payments are already much better adopted than other mobile proximity payments, it could

be appropriate to further develop pan-European implementation standards for mobile proximity

payments which are based on the EMVCo contactless specifications (see also 5.1.1).

It is also to be noted that the speed for adoption of card contactless payments has proven to be much

quicker in countries (e.g.; UK, Czech Republic, Poland …) where a centralised coordination took place

across payment market stakeholders with the support of the card schemes. A similar approach could be

advisable for mobile proximity payments.

5.2.2 Complexity and security of mobile devices

Issue description

A mobile device may be considered as a quite complex piece of equipment with many different

components, including the baseband, operating system, firmware, software, NFC controller, multiple

external interfaces, possibly a Trusted Execution Environment (TEE) and one or multiple Secure

Elements (SEs). Moreover, the production of these components involves different manufacturers

before integration in the mobile device. This means that functional and security standards should be

ensured throughout the whole production cycle. Also the presence of different software on the mobile

device, developed by diverse vendors or service providers, poses a significant challenge to the integrity

of the mobile device ecosystem.

It is also important to note that for providers of mobile contactless payment applications there is a

strong dependency on the handset manufacturers and mobile OS providers, which is a highly

competitive space with little cooperation on standardisation. Therefore they face a huge complexity

with different solutions for each handset and/or mobile OS. This means that they need to develop their

applications for a large number of different mobile platforms (combinations of different hardware and

software) in view of the current platform incompatibilities. This obviously comes with a cost impact

and may in some cases also lead to consumer confusion. The fact that there are multiple solutions on

the market which are different - read not compatible - makes it challenging for the supply side.

Moreover, once the devices are in usage by the consumer, there are a number of additional challenges

which remain to be addressed; security and privacy are the most relevant ones.

Indeed, consumer trust in mobile proximity payments is strongly linked to security and privacy. Two

aspects of security have to be considered, the first is the customer perceived security in the solution or

in the system, the second is the level of security the solution has which is strongly linked to its cost and

usability. Enhanced security often comes with additional costs while the user experience may be

negatively affected.

The mobile device is exposed to threats in view of the many interfaces it has, including change of

behaviour or incompatibility due to software upgrades, rooting (jail-breaking) of mobile phones, etc.

The increased presence of malware on mobile devices has to be noted and should also be kept under

careful consideration.

Finally, with regard to diversity and complexity, the consumers interact potentially with a multitude of

user interfaces related to different payment solutions, adding a further layer of complexity.

2015-11-26 ERPB item 6 ERPB CTLP working group final report 28/66

Key observations

The security threats and risk models related to the usage of mobile devices for payments are different

to the threats encountered for payments with contactless cards. Also the security features offered to

counter the threats are different for contactless card payments compared to mobile proximity

payments.

Security standards for mobile devices in support of mobile payments are not yet widespread nor

adopted since the market is living its early days.

Some organisations have already developed specifications and standards for securing the mobile

contactless payment environment. Furthermore, they have also created some testing and certification

activities in accordance with those standards and specifications.

Nevertheless the payment industry is still missing an overall framework for the usage of mobile

devices which addresses functionality, security and privacy. Such a framework could ensure a

widespread adoption and usage of mobile devices for (proximity) payments. There is a need for the

development of minimal security objectives / requirements for mobile devices (possibly through a