2023 Michigan

Taxpayer

Assistance Manual

1

Table of Contents

CHAPTER 1 - INTRODUCTION .....................................................................................................................................7

INTRODUCTION TO THE TAXPAYER ASSISTANCE MANUAL....................................................................................7

INFORMATION FOR 2023: ......................................................................................................................................7

WHAT’S NEW..........................................................................................................................................................7

SUMMARY OF CHANGES FOR 2023..................................................................................................................... 10

SUMMARY OF CHANGES FOR PRIOR YEARS........................................................................................................ 11

GENERAL GUIDELINES ......................................................................................................................................... 11

COPY OF RETURN............................................................................................................................................. 11

SIGNATURES .................................................................................................................................................... 12

RELEASE TO DISCUSS INFORMATION .............................................................................................................. 12

ARRANGING AND MAILING RETURNS AND ATTACHMENTS ........................................................................... 12

POSTAGE.......................................................................................................................................................... 12

DECEASED TAXPAYER ...................................................................................................................................... 12

COMPLETEING A PAPER-FILED RETURN .......................................................................................................... 13

ELECTRONIC FILING PROGRAMS ......................................................................................................................... 13

How Fed/State (Linked) E-File Works.............................................................................................................. 15

How State Standalone (Unlinked) E-File Works .............................................................................................. 15

Who May Participate....................................................................................................................................... 16

Application and Acceptance Process............................................................................................................... 16

Michigan Portion of the Electronic Return...................................................................................................... 16

Electronic Michigan Returns............................................................................................................................ 17

Nonelectronic Portion of Michigan Returns.................................................................................................... 22

Michigan E-file Signature Process ................................................................................................................... 22

TAX REFUND AND PAYMENT INFORMATION...................................................................................................... 23

STATE RETURNS............................................................................................................................................... 23

CITY OF DETROIT RETURNS.............................................................................................................................. 25

FOR MORE INFORMATION .............................................................................................................................. 25

POST-FILING INFORMATION................................................................................................................................ 26

MAILING ADDRESSES....................................................................................................................................... 26

AMENDED MICHIGAN INCOME TAX RETURNS (SCHEDULE AMD) .................................................................. 26

CUSTOMER SELF-SERVICE................................................................................................................................ 27

CHAPTER 2 – MICHIGAN INCOME TAX (FORM MI-1040) ........................................................................................ 32

2

GENERAL INFORMATION..................................................................................................................................... 32

MI-1040 ........................................................................................................................................................... 32

FILING REQUIREMENTS ................................................................................................................................... 32

DUE DATE OF RETURN..................................................................................................................................... 33

EXTENSION ...................................................................................................................................................... 33

IDENTIFICATION SECTION................................................................................................................................ 34

SOCIAL SECURITY NUMBER(S) ......................................................................................................................... 34

SCHOOL DISTRICT CODE .................................................................................................................................. 34

STATE CAMPAIGN FUND.................................................................................................................................. 34

FILING STATUS ................................................................................................................................................. 35

RESIDENCY STATUS.......................................................................................................................................... 35

NONRESIDENT ALIENS ..................................................................................................................................... 36

EXEMPTIONS.................................................................................................................................................... 36

ADJUSTED GROSS INCOME.................................................................................................................................. 38

ADDITIONS TO ADJUSTED GROSS INCOME ..................................................................................................... 38

SUBTRACTIONS FROM ADJUSTED GROSS INCOME......................................................................................... 38

PENSION AND RETIREMENT BENEFTIS INFORMATION ....................................................................................... 40

GENERAL INFORMATION................................................................................................................................. 40

EMPLOYER PLANS............................................................................................................................................ 40

INDIVIDUAL PLANS .......................................................................................................................................... 41

PENSION LIMITATIONS .................................................................................................................................... 43

UNLIMITED PUBLIC PENSION SUBTRACTION .................................................................................................. 45

MICHIGAN AND FEDERAL PUBLIC PENSIONS .................................................................................................. 45

PUBLIC PENSIONS FROM OTHER STATES ........................................................................................................ 46

PRIVATE PENSIONS.......................................................................................................................................... 46

RAILROAD PENSION BENEFITS......................................................................................................................... 46

PENSION SUBTRACTION EXAMPLES ................................................................................................................ 47

INDIVIDUAL RETIREMENT ACCOUNTS (IRAs) .................................................................................................. 48

2023 PENSION AND RETIREMENT SUBTRACTION TABLE FOR RETIREES BORN BEFORE 1946........................ 48

FORM 1099-R DISTRIBUTION CODES............................................................................................................... 49

DEFERRED COMPENSATION ................................................................................................................................ 50

INTEREST, DIVIDENDS, AND CAPITAL GAINS DEDUCTION .................................................................................. 50

FOR SENIOR CITIZENS BORN BEFORE 1946 ......................................................................................................... 50

TAX INFORMATION.............................................................................................................................................. 51

3

TAX RATE ......................................................................................................................................................... 51

VOLUNTARY CONTRIBUTIONS......................................................................................................................... 51

USE TAX ........................................................................................................................................................... 51

TAX CREDITS (NONREFUNDABLE)........................................................................................................................ 51

WHAT IS A NONREFUNDABLE TAX CREDIT...................................................................................................... 51

CREDIT FOR INCOME TAX IMPOSED BY QUALIFIED GOVERNMENT UNITS OUTSIDE OF MICHIGAN.............. 51

MICHIGAN HISTORIC PRESERVATION CREDIT ................................................................................................. 53

TAX CREDITS (REFUNDABLE) ............................................................................................................................... 53

HOMESTEAD PROPERTY TAX CREDIT .............................................................................................................. 53

FARMLAND PRESERVATION TAX CREDIT......................................................................................................... 53

EARNED INCOME TAX CREDIT ......................................................................................................................... 54

INCOME TAX WITHHELD.................................................................................................................................. 54

CLAIM OF RIGHT DOCTRINE ............................................................................................................................ 54

ESTIMATED PAYMENTS/CREDIT FORWARD .................................................................................................... 54

CHAPTER 3 – HOMESTEAD PROPERTY TAX CREDIT (FORM MI-1040CR AND FORM MI-1040CR-2) ....................... 55

GENERAL INFORMATION..................................................................................................................................... 55

INTRODUCTION ............................................................................................................................................... 55

CREDIT REFUND............................................................................................................................................... 55

INSTRUCTIONS................................................................................................................................................. 55

WHO MAY CLAIM A CREDIT............................................................................................................................. 55

HOMESTEADS THAT DO NOT QUALIFY............................................................................................................ 56

CALCULATION OF THE CREDIT......................................................................................................................... 56

SENIOR CREDIT REDUCTION CHART .................................................................................................................... 57

PERCENT OF PROPERTY TAXES NOT REFUNDABLE - TOTAL HOUSEHOLD RESOURCES OF $6,000 OR LESS ... 58

MAXIMUM CREDIT .......................................................................................................................................... 58

PHASE-OUT...................................................................................................................................................... 58

CREDIT PHASE-OUT CHART.................................................................................................................................. 58

WHEN TO FILE A CLAIM ................................................................................................................................... 59

WHICH FORM TO USE (MI-1040CR OR MI-1040CR-2)..................................................................................... 59

IDENTIFICATION................................................................................................................................................... 60

SOCIAL SECURITY NUMBER(S) ......................................................................................................................... 60

SCHOOL DISTRICT CODE .................................................................................................................................. 60

AGE 65 OR OLDER............................................................................................................................................ 60

DISABILITY DEFINITIONS .................................................................................................................................. 60

4

FILING STATUS ................................................................................................................................................. 61

RESIDENCY STATUS.......................................................................................................................................... 61

COMPUTATION.................................................................................................................................................... 62

PROPERTY OWNER .......................................................................................................................................... 62

RENTER ............................................................................................................................................................ 64

TYPES OF HOUSING ......................................................................................................................................... 65

TOTAL HOUSEHOLD RESOURCES (THR)............................................................................................................... 68

TOTAL HOUSEHOLD RESOURCES CALCULATION............................................................................................. 72

REPORTED THR LOWER THAN REPORTED LIVING EXPENSES.......................................................................... 72

CREDIT COMPUTATION METHODS...................................................................................................................... 73

GENERAL CLAIMANT........................................................................................................................................ 74

PARAPLEGIC, QUADRAPLEGIC, HEMIPLEGIC, DEAF, BLIND, OR TOTALLY AND PERMANENTLY DISABLED

PERSONS.......................................................................................................................................................... 74

SENIOR CITIZEN - REGULAR METHOD FOR HOMEOWNER OR RENTER .......................................................... 75

SENIOR CITIZEN - ALTERNATIVE METHOD FOR RENTER ................................................................................. 76

(RENT GREATER THAN 40% OF THR) ............................................................................................................... 76

SERVICE PERSONS, VETERANS, OR THEIR WIDOW OR WIDOWER.................................................................. 77

BLIND PERSON ................................................................................................................................................. 78

PUBLIC ASSISTANCE/ MICHIGAN DEPARTMENT OF HEALTH and HUMAN SERVICES BENEFITS RECIPIENT ... 79

SPECIAL SITUATIONS........................................................................................................................................ 80

CHAPTER 4 – HOME HEATING CREDIT (FORM MI-1040CR-7)................................................................................. 87

GENERAL INFORMATION..................................................................................................................................... 87

INTRODUCTION ............................................................................................................................................... 87

INSTRUCTIONS................................................................................................................................................. 87

WHEN TO FILE A CLAIM ................................................................................................................................... 87

ELIGIBILITY ....................................................................................................................................................... 87

IDENTIFYING INFORMATION ........................................................................................................................... 88

CITIZENSHIP STATUS........................................................................................................................................ 88

HEAT PROVIDER AND HEAT TYPE CODE .......................................................................................................... 88

FILING STATUS ................................................................................................................................................. 88

RESIDENCY STATUS.......................................................................................................................................... 88

HOW MUCH WERE YOU BILLED FOR HEAT?.................................................................................................... 89

CARE FACILITY.................................................................................................................................................. 89

EXEMPTIONS.................................................................................................................................................... 89

5

DEPENDENTS AND HOUSEHOLD MEMBERS.................................................................................................... 90

COMPUTATION.................................................................................................................................................... 90

TOTAL HOUSEHOLD RESOURCES (THR)........................................................................................................... 90

STANDARD CREDIT OR ALTERNATE CREDIT COMPUTATION: ......................................................................... 91

WHICH METHOD TO USE................................................................................................................................. 91

STANDARD CREDIT COMPUTATION FOR 2023................................................................................................ 91

ALTERNATE CREDIT COMPUTATION FOR 2023 ............................................................................................... 94

CREDIT PAYMENTS ENERGY DRAFTS OR WARRANTS (CHECKS)...................................................................... 95

DIRECT DEPOSIT............................................................................................................................................... 96

CHAPTER 5 – ADDITIONAL INFORMATION.............................................................................................................. 97

TAXABILITY OF FEDERAL OBLIGATIONS............................................................................................................... 97

INCOME ALLOCATION CHART.............................................................................................................................. 99

INCOME AND DEDUCTIBLE ITEMS, SUMMARY CHART ..................................................................................... 101

MICHIGAN CITIES LEVYING AN INCOME TAX .................................................................................................... 108

6

CHAPTER 1 - INTRODUCTION

INTRODUCTION TO THE TAXPAYER ASSISTANCE MANUAL

The Taxpayer Assistance Manual is a guide to completing the following Michigan income tax forms:

• MI-1040

MICHIGAN INDIVIDUAL INCOME TAX RETURN

• MI-1040CR

HOMESTEAD PROPERTY TAX CREDIT CLAIM

• MI-1040CR-2

HOMESTEAD PROPERTY TAX CREDIT CLAIM FOR

VETERANS AND BLIND PEOPLE

• MI-1040CR-7

HOME HEATING CREDIT CLAIM

This Manual does not supersede the Income Tax Act of 1967 or the Revenue Act of 1941, both as

amended.

This Manual is provided as a useful tool to assist volunteer tax preparers when preparing a return. It

covers most taxpayer situations that are likely to be encountered by a volunteer preparer and should

be used in conjunction with the instruction booklets for each form when preparing the tax return. If a

taxpayer’s circumstance is unusual or if a volunteer preparer is unsure of how to apply these

instructions, call the Michigan Department of Treasury (Treasury) Volunteer Help Line at 1-888-860-

8389. Additional information on more complex issues is also in the Tax Text for tax practitioners

available at www.michigan.gov/taxes.

INFORMATION FOR 2023:

WHAT’S NEW

RAB 2022-26 Treatment of Ordinary and Necessary Expenses for Certain Marihuana Establishments

RAB 2022-26 explains the income tax expense deduction provided under the Michigan Regulation and

Taxation of Marihuana Act (Initiated Law 1 of 2018) (MRTMA) available to certain marihuana

establishments. The MRTMA regulates and taxes what is commonly referred to as adult-use, as

opposed to medical, marihuana. A marihuana establishment validly licensed under the MRTMA can

deduct on its Michigan income tax return those “ordinary and necessary” business expenses that it is

otherwise prohibited from deducting on its federal return due to Internal Revenue Code (IRC) Sec.

280E. This deduction is only available to MRTMA licensees and not medical licensees. In addition, the

RAB explains how the income tax deduction applies to taxpayers holding licenses to operate both

medical and adult-use marihuana businesses.

RAB 2023-14 Impact of COVID-19 Extensions and Penalty and Interest Waivers on the Statute of

Limitations

RAB 2023-14 describes the impact of Covid-19 extensions and waivers on the statute of limitations for

Individual Income Tax (IIT), Corporate Income Tax (CIT), and Sales, Use, and Withholding (SUW) taxes.

The Michigan Department of Treasury (Treasury) issued multiple notices during the Covid-19 pandemic

that extended filing deadlines and waived penalty and interest for late filing and remittance of tax, due

7

to the impact of the pandemic on individuals and businesses. Generally, income tax extensions

extended the due date of the return, and therefore, has an impact on the statute of limitations.

Conversely, the sales and use tax notices were merely waivers of penalty and interest for late filing and

do not impact the statute of limitations.

RAB 2023-22 Individual Income Tax – Treatment of Retirement Income Under Public Act 4 of 2023

RAB 2023-22 discusses the tax treatment of retirement and pension income following the changes to

Section 30 of the Michigan Income Tax Act (MITA) enacted by Public Act 4 of 2023 (PA 4). The RAB also

discusses Pre-2012 Michigan tax treatment of retirement distributions and Post-2012 Michigan tax

treatment of retirement distributions.

RABs are located under the “Reports and Legal” tab on Treasury’s website.

Legislation

2023 PA 4 Retirement and Pension Income Tax Deduction: PA 4 allows a taxpayer to make an election,

choosing between the existing limitations for deductions of retirement and pension income and

limitations for the new pension phase-in income tax deduction. The PA 4 phase-in subtraction will take

effect in 2023.

The existing retirement and pension limitations provide an income tax deduction for taxpayers based

upon the year in which the taxpayer was born.

The new limitations are phased-in percentages of the maximum private retirement deduction

available. The maximum private retirement deduction is adjusted annually. PA 4 provides that:

• Beginning with the 2023 tax year, taxpayers born after 1945 and before 1959 are able to deduct

retirement or pension benefits up to 25% of the maximum private retirement deduction for the

taxpayers born before 1946. For tax year 2023, the deduction is $15,380 for single filers and

$30,759 for joint filers.

• For tax year 2024, taxpayers born after 1945 and before 1963 will be able to elect to deduct

retirement and pension benefits up to 50% of the maximum private retirement deduction for

the taxpayers born before 1946.

• In the 2025 tax year, taxpayers born after 1945 and before 1967 will be able to elect to deduct

retirement and pension benefits up to 75% of the maximum private retirement deduction for

the taxpayers born before 1946.

• For the 2026 and subsequent tax years, taxpayers will be able to elect to deduct retirement and

pension benefits up to 100% of the maximum private retirement deduction.

Public Safety Employees: Beginning with tax year 2023, certain taxpayers receiving retirement or

pension benefits from service performed as a public police or fire department employee, state police

trooper or state police sergeant, or county corrections officer in a county jail, work camp, or other

8

facility maintained by a county that houses adult prisoners may also elect to deduct pension or

retirement benefits without any additional limitations.

Earned Income Tax Credit: PA 4 also increased the refundable Earned Income Tax Credit from 6% of

the federal credit to 30% of the federal credit for tax year 2022. Taxpayers that claimed the credit for

tax year 2022 are not required to file an amended return to receive the additional 24% of the credit.

Increased Exemptions

The personal exemption amount for 2023 is $5,400. The stillbirth exemption for 2023 is $5,400. The

special exemption amount for 2023 is $3,100.

Income Tax Rate

The income tax rate for 2023 is 4.05 percent.

Anatomical Gift Donor Registry

2023 PAs 100 to 102 require Treasury to allow taxpayers to register for the anatomical gift donor

registry as part of filing an individual income tax return. An individual taxpayer willing to participate in

the anatomical gift donor registry must complete the Voluntary Contributions and Anatomical Gift

Donor Registry Schedule (Form 4642) and submit it with the taxpayer’s State income tax return.

Treasury will forward the information to the Michigan Department of State to be added to the registry.

9

SUMMARY OF CHANGES FOR 2023

Tax Rate

4.05%

Personal Exemption

$5,400

Special Exemption

$3,100

Qualified Disabled Veteran Deduction

$400

Stillbirth Exemption

$5,400

Tier 2 Michigan Standard Deduction. Taxpayers born January 1,

1946, through December 31, 1952. The deduction is $40,000 for

married filing joint and $20,000 for single/married filing separate if

the older of you or your spouse (if married filing joint) has reached

the age of 67.

Tier 3 Michigan Standard Deduction. Taxpayers born January 1,

1953, through January 1, 1957. The deduction is $40,000 for

married filing joint and $20,000 for single/married filing separate if

the older of you or your spouse (if married filing joint) has reached

the age of 67 on or before December 31, 2023. The standard

deduction against all types of income may be reduced by personal

exemption amounts, taxable Social Security benefits, military

compensation (retirement benefits included), Michigan National

Guard retirement benefits and railroad retirement benefits

included in adjusted gross income (AGI).

Pension Deduction:

Single Filer

(2012 Limitations)

Born before 1946: private pension limit

$61,518

Born in 1946-1952: Standard deduction against all income

$20,000

Born after 1952, pension not deductible*

0

(2023 Phase-in Limitations)

Born 1946 through 1958

$15,380

Joint Filers

(2012 Limitations)

Born before 1946: private pension limit

$123,036

Born in 1946-1952: Standard deduction against all income

$40,000

Born after 1952, pension not deductible*

0

(2023 Phase-in Limitations)

Born 1946 through 1958

$30,759

Senior Interest, Dividend, and Capital Gains

Single Filer (not available for senior born after 1945)

$12,697

Joint Filers (not available for senior born after 1945)

$25,394

*Exception: Taxpayers who have reached age 62 and receive pension benefits from

Social Security exempt employment may be eligible for a pension deduction. See Pension

and Retirement Benefits.

10

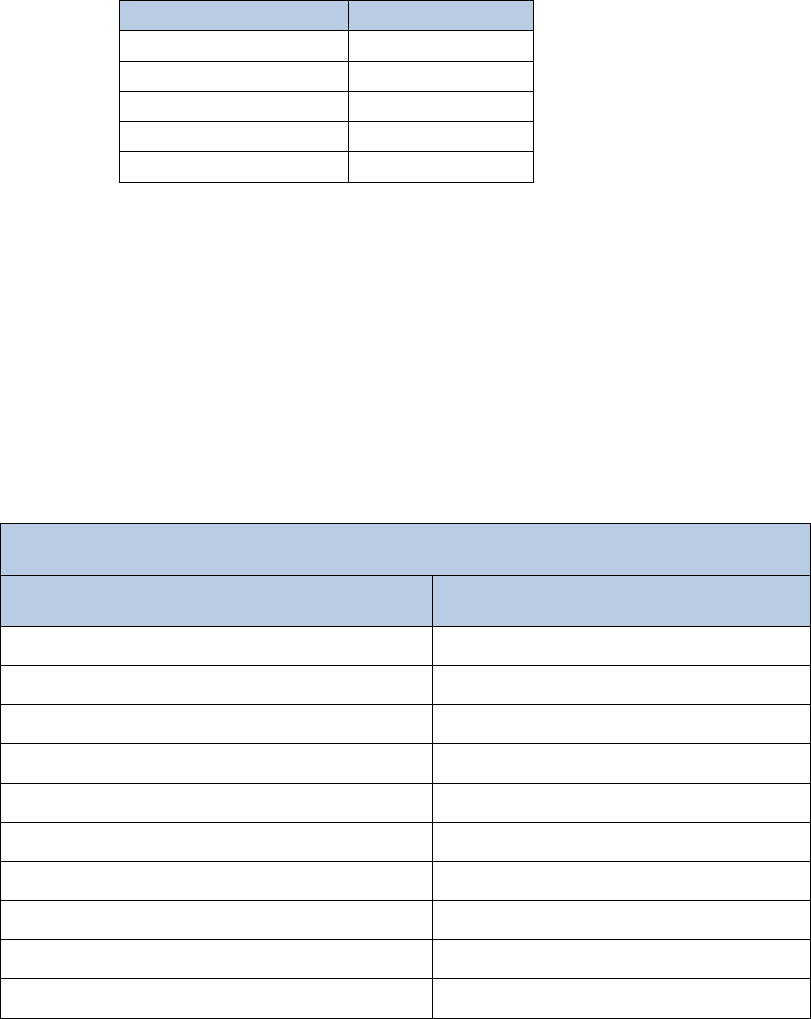

SUMMARY OF CHANGES FOR PRIOR YEARS

2019

2020

2021

2022

Tax Rate

4.25%

4.25%

4.25%

4.25%

Personal Exemption

$4,400

$4,750

$4,900

$5,000

Stillbirth Exemption

$4,400

$4,750

$4,900

$5,000

Special Exemption

$2,700

$2,800

$2,800

$2,900

Qualified Disabled Veteran Deduction

$400

$400

$400

$400

Pension Deduction

Single Filer:

Born before 1946: private pension limit

$52,808

$53,759

$54,404

$56,961

Born after 1945 and age 67 or older:

Standard deduction against all income

$20,000

$20,000

$20,000

$20,000

Born 1946 through 1952 and age 66 or less

$20,000

$20,000

$20,000

$20,000

Born after 1952, pension not deductible

0

0

0

0

Joint Filers:

Born before 1946: private pension limit

$105,615

$107,517

108,808

$113,922

Born after 1945 and age 67 or older:

Standard deduction against all income

$40,000

$40,000

$40,000

$40,000

Born 1947 through 1952 and age 66 or less

$40,000

$40,000

$40,000

$40,000

Born after 1952, pension not deductible

0

0

0

0

Senior Interest, Dividend, and Capital Gains

Single Filer (not available for senior born

$11,771

$11,983

$12,127

$12,697

after 1945)

Joint Filers (not available for senior born

$23,542

$23,966

$24,254

$25,394

after 1945)

Note: For additional information on topics in this chapter, visit www.michigan.gov/taxes

select “Individual Income Tax,” and “Reports and Legal” tab for a list of resources.

GENERAL GUIDELINES

COPY OF RETURN

E-Filed Returns: When electronically filing (e-filing), provide the taxpayer with a paper copy of the

return. It may be helpful to mark “COPY” on the taxpayer’s copy to eliminate any confusion and

reduce the number of duplicate returns received, for instance when a taxpayer’s return is e-filed and

then later mailed.

Paper Returns: Prepare all returns in duplicate. File the original return and give the copy to the

taxpayer. Inform the taxpayer that it is important to keep a copy of the return.

In e-filed or paper return filings, if there are problems regarding the tax return, the taxpayer will be

able to refer to the copy to see exactly what was entered on the return. Advise the taxpayer to bring

11

the copy the following tax year to expedite preparation.

SIGNATURES

After you have prepared the return, enter your site designation and the date prepared in the

preparer’s signature area. Then have the taxpayer (and spouse, if applicable) sign and date the return.

RELEASE TO DISCUSS INFORMATION

Ask the taxpayer if they want to authorize personnel in Treasury to discuss the return with the

volunteer tax preparer if additional information is needed. If so, have the taxpayer check the box.

NOTE: Since volunteer preparers do not enter their name, this instruction is generally applicable only

to paid preparers.

ARRANGING AND MAILING RETURNS AND ATTACHMENTS

Each form contains a two-digit attachment sequence number in the upper-right corner to help guide

with the proper assembly of the Individual Income Tax Return (Form MI-1040) and related schedules.

Place all supporting documents at the end.

Do not attach the Home Heating Credit Claim (Form MI-1040CR-7) to the other returns. Fold it

and leave it loose in the envelope.

Mail the return to the address shown on the bottom of the return.

POSTAGE

The U.S. Post Office calculates postage based on the weight, size, and thickness of an envelope.

Consult with the Post Office to avoid delays in delivery; items with insufficient postage will be returned

to the sender by the Post Office.

DECEASED TAXPAYER

If a deceased taxpayer has a surviving spouse and a joint return is filed, use both surviving and

deceased spouse’s names and Social Security numbers (SSN). Enter “DECD” after the deceased’s

name. Include all income (including the deceased spouse’s) on the return. A full exemption

allowance is allowed for the deceased spouse.

If there is no surviving spouse and you are preparing a return for the personal representative or a

claimant filing single or joint returns for deceased taxpayer(s), you must attach a copy of U.S. Form

1310 or Michigan Claim for Refund Due a Deceased Taxpayer (Form MI-1310). Enter the deceased

person’s name(s) in Filer and Spouse Name fields as indicated and the representative/claimant

name(s), title, and address in the Home Address field on the MI-1040.

For examples, refer to the MI-1040 instruction booklet.

12

COMPLETEING A PAPER-FILED RETURN

Treasury uses scanning equipment to capture the information from paper income tax returns. To avoid

unnecessary delays caused by manual processing, follow the guidelines below, so that returns are

processed quickly and accurately.

• Use black or blue ink. Do not use pencil, red ink, or felt tip pens. Do not highlight information.

• Print using capital letters (UPPER CASE): Capital letters are easier to recognize.

• Print numbers like this: 0 1 2 3 4 5 6 7 8 9. Do not put a slash through the zero or seven.

• Leave lines/boxes blank if they do not apply or if the amount is zero.

• Do not write extra numbers, symbols, or notes on the return, such as cents, dashes, decimal

points, or dollar signs. Enclose any explanations on a separate sheet unless instructed to write

explanations on the return. The taxpayer’s name, SSN, tax year, and form number should be

entered on any attachments.

• Stay within the lines when entering information in boxes.

• Use whole dollars. Round down amounts less than 50 cents. Round up amounts of 50 cents

through 99 cents. Do not enter cents (e.g., 129.49 becomes 129, 129.50 becomes 130).

Treasury has seen an increase in the volume of both returns and e-file payment vouchers with a

masked or truncated SSN and bank account number information. Taxpayers have been mailing the

masked copy of their documents instead of the copy with the full account information displayed, which

may cause significant delays in processing the returns and payments. Tax preparers should emphasize

to their customers the importance of not mailing the masked copies.

ELECTRONIC FILING PROGRAMS

Information included in this section was current at the time of this publication.

Department of Treasury (Treasury) partners with the Internal Revenue Service (IRS) to provide

electronic filing (e-filing) of IIT returns. The Fed/State e-file Program enables taxpayers to e-file both

federal and State (including the City of Detroit) returns through tax preparers as part of the program’s

effort to provide “one-stop shopping” for tax preparation and filing. The State and/or City Unlinked e-

file Program enables taxpayers to e-file their State and/or City of Detroit return separately from their

federal return.

Nearly 100 million people nationwide know e-filing is the way to go! Over 4 million

Michigan taxpayers choose to e-file their tax returns. Thank you for making e-file a

success.

13

Tax preparers who complete 11 or more IIT returns are required to e-file all eligible returns. Software

developers producing tax preparation software or computer-generated forms must support e-file for

all Michigan and City of Detroit IIT forms that are included in the software package.

Michigan, along with many other state revenue agencies, is requesting additional information in an

effort to combat stolen-identity tax fraud to protect taxpayers and their tax refund. If the taxpayer has

a driver’s license or state-issued identification card, please provide the requested information from it.

Providing the information could help process their return more quickly. The return will not be rejected

if the taxpayer’s driver’s license or state-issued identification information is not provided.

There are many benefits to tax preparers who participate in the e-file program:

• Expanded services offered. E-file is a valuable addition to a tax preparer’s list of client services,

which can mean more clients. In addition, prospective clients can find an authorized e-file provider

at www.IRS.gov.

• Faster refunds for e-file returns. E-filed returns are processed faster than paper returns. Allow 14

days before checking the status of the Michigan e-filed return by visiting www.michigan.gov/iit and

clicking on “eServices Individual Income Tax.” Clients can also choose direct deposit and have their

state refund deposited directly into their account at the financial institution of their choice. Clients

can check the status of their City of Detroit e-filed return by visiting www.michigan.gov/citytax.

• Payment with tax due returns. Payment on a 2021, 2022 or 2023 tax due return can be made using

direct debit at the same time the tax return is e-filed, when supported by software.

• Improved return accuracy. Treasury processes the same data the tax preparer enters into the

computer. When e-filing federal, State, and City of Detroit returns together, much of the same data

is used, so information is entered only once, again lessening the possibility of error. Treasury

systems automatically check returns for mistakes. When easy-to-fix mistakes like math errors or

missing forms are found, the return is sent back for correction. The error can then be fixed and sent

back to Treasury, which prevents a simple mistake from holding up a refund.

• Detailed error conditions. Modernized e-File (MeF) business rules pinpoint the location of the error

in the return and provide complete information in the acknowledgement file that is passed back to

the transmitter. MeF business rules use simple wording to clarify each error that triggers a

rejection. Treasury will provide up to ten business rule errors per return submission.

• Increased customer satisfaction. Only tax preparers and their client see the return. Tax information

is encrypted and transmitted directly to the IRS and Michigan. Also, an acknowledgment is sent to

verify the return was received and accepted for processing.

• Prior year and amended returns. Michigan and City of Detroit tax returns for 2021, 2022, and 2023

will be accepted during the 2024 processing year.

• Portable Document Format (PDF) attachments. MeF accepts PDF attachments with e-filed returns.

Refer to the “Michigan Portion of the Electronic Return” section for a listing of PDF attachments

accepted by Michigan.

14

How Fed/State (Linked) E-File Works

Tax preparers and transmitters accepted into the IRS Fed/State 1040 MeF Program may file federal

and/or State (including City of Detroit) returns together in one transmission to the IRS Service Center.

The State submission can be linked to the IRS submission by including the IRS Submission ID of the

federal return. If the State submission is linked to an IRS submission (also referred to as the Fed/State

return), the IRS will check to see if there is an accepted IRS Submission ID. If there is not an accepted

federal return, the IRS will deny the State submission and a rejection acknowledgment will be sent to

the transmitter. Treasury has no knowledge that the State return was rejected by the IRS. If there is an

accepted federal return under the Submission ID, the IRS will perform minimal validation on the State

submission. The State data will then be made available for retrieval by Treasury. After the State data is

retrieved, it will be acknowledged and, if accepted, processed by Treasury.

Treasury will acknowledge receipt of all returns retrieved from the IRS. The transmitter should receive

the Michigan acknowledgment within three days from the date the return is successfully transmitted

to the IRS.

The IRS recommends sending the IRS submission first and, after it has been accepted, sending the State

submission.

When filing a Michigan return that includes City of Detroit forms, an error occurring in either the State

or City form will cause the entire submission (State and City) to be rejected.

All returns, whether e-filed or paper-filed, are subject to Treasury audit and can be delayed regardless

of the acknowledgment code received. Returns are processed and refunds are issued daily.

How State Standalone (Unlinked) E-File Works

The federal return does not have to be e-filed and accepted before e-filing the state unlinked return.

However, the federal tax return should be computed before computing the state tax return.

Tax preparers and transmitters accepted in the IRS e-file Program may participate in the State unlinked

e-file Program when supported by their software. The IRS will perform minimal validation on the State

return and issue an acknowledgment. If the return passes validation, the State data will be made

available for retrieval by Treasury. After the data is retrieved, it will be acknowledged and, if accepted,

processed by Treasury.

When filing a Michigan return that includes City of Detroit forms, an error occurring in either the State

or City form will cause the entire submission (State and City) to be rejected.

All returns, whether e-filed or paper-filed, are subject to Treasury audit and can be delayed regardless

of the acknowledgment code received. Returns are processed and refunds are issued daily.

15

Who May Participate

E-filing of Michigan returns is available to all individuals who have been accepted into the IRS e-file

Program and who transmit returns to an IRS Service Center. The IRS mandates preparers filing 11 or

more IIT returns to e-file those returns, with minor exceptions. Michigan would expect any preparer e-

filing federal returns to also e-file the Michigan and/or City of Detroit returns.

Application and Acceptance Process

To participate, applicants must first apply to the IRS and be accepted. Individuals must register with IRS

e-Services and create a new or revised IRS e-file application. Individuals can contact IRS e-help toll-free

at 1-866-255-0654 for assistance.

Publication 3112 IRS e-file Application and Participation specifies the application process and

requirements for federal participation. The definitions used by the IRS of the various categories of e-

filers, Electronic Return Originators (EROs), transmitters, or software developers also apply for

Michigan e-filing purposes.

Once accepted into the IRS e-file Program, participation in Michigan’s e-file Program is automatic.

Michigan will use the Electronic Filer Identification Number (EFIN) assigned by the IRS. Michigan does

not assign additional identification numbers.

IRS regulations require paid tax preparers to use Preparer Tax Identification Numbers (PTINs) for all tax

returns and refund claims. Visit the IRS website at www.irs.gov for more information.

To participate in Michigan e-file Programs, e-filers must use software that has successfully completed

the IRS and Michigan Assurance Testing System (ATS). Confirm that the software chosen has been

approved for Michigan and that the Michigan e-file Program is operational before transmitting returns.

If, after acceptance, a tax preparer/transmitter or software company has production problems,

Treasury reserves the right to suspend that tax preparer/transmitter or software company until the

problems are resolved to Treasury’s satisfaction.

Treasury may conduct a suitability check on applicants who have been accepted in the Fed/State e-file

Program. Participation in the program may be denied if a company is not registered to conduct

business in Michigan, or if there is an outstanding tax liability with Michigan.

A list of approved software companies is available on Treasury’s website. Tax preparers are not

required to file test returns with Michigan.

Michigan Portion of the Electronic Return

The Michigan portion of an electronic return consists of data transmitted electronically and the

supporting paper documents. The paper documents contain information that cannot be transmitted

electronically.

16

Electronic Michigan Returns

Michigan e-file supports the following forms and schedules:

Form

Title

3174

Direct Deposit of Refund

4013

Resident Tribal Member Annual Sales Tax Credit

4642

Voluntary Contributions Schedule

4884

Pension Schedule

4973

Pension Continuation Schedule

4976

Home Heating Credit Claim MI-1040CR-7 Supplemental

5049

Married Filing Separately and Divorced or Separated Claimants Schedule

5472

Direct Debit of Individual Income Tax Payment

5530

Amended Return Explanations of Changes (Sch AMD)

5595

Excess Business Loss MI-461

5674

Net Operating Loss Deduction

5678

Signed Distribution Statement for Joint Owners of Farmland Development Rights Agreements

5792

First-Time Home Buyer Savings Program

5803

Historic Preservation Tax Credit for Plans Approved after December 31, 2020

(e-file limited to four occurrences)

5889

Report of Oil, Gas, and Nonferrous Metallic Minerals Extraction – Income and Expenses

MI-1040

Individual Income Tax Return

MI-1040CR

Homestead Property Tax Credit Claim

MI-1040CR-2

Homestead Property Tax Credit Claim for Veterans and Blind People

MI-1040CR-5

Farmland Preservation Tax Credit Claim

MI-1040CR-7

Home Heating Credit Claim

MI-1040D

Adjustments of Capital Gains and Losses

MI-1040H

Schedule of Apportionment (e-file limited to six occurrences)

MI-2210

Underpayment of Estimated Income Tax

MI-4797

Adjustments of Gains and Losses from Sales of Business Property

MI-8949

Sales and Other Dispositions of Capital Assets

Schedule 1

Additions and Subtractions

Schedule MI-1045

Net Operating Loss

Schedule CR-5

Schedule of Taxes and Allocation to Each Agreement

Schedule NR

Nonresident and Part-Year Resident Schedule

5118

City of Detroit Resident Income Tax Return

5119

City of Detroit Nonresident Income Tax Return

5120

City of Detroit Part-Year Resident Income Tax Return

5121

City of Detroit Withholding Tax Schedule (City Schedule W)

5253

City of Detroit Withholding Tax Continuation Schedule

5338

City of Detroit Underpayment of Estimated Income Tax

Information from the W-2 and 1099 forms is entered in the software and transmitted with the e-file

return. Do not mail W-2 and/or 1099 forms to Treasury. All W-2 and 1099 information, when

applicable, is required when submitting a state unlinked return.

17

When the following forms are included, the MI-1040 can be e-filed, but the following forms must be

mailed to the address indicated on the form.

Form

Title

4*

Application for Extension of Time to File Michigan Tax Returns

MI-1310

Claim for Refund Due a Deceased Taxpayer

MI-1040ES*

Michigan Estimated Individual Income Tax Voucher

* If the taxpayer makes either the extension payment or estimated payments electronically,

using Michigan’s Individual Income Tax e-Payments System, there is no need to mail each

of the identified forms to Treasury.

Michigan will accept e-file returns for deceased taxpayers. If a U.S. 1310 is required, that data must be

included within the federal folder of the Michigan e-file return. When e-filing on behalf of a single,

deceased taxpayer, with a balance due federal return and a refund Michigan return, the Michigan

return can be e-filed and the U.S. 1310 or the MI-1310 (and required documents) included as a PDF

attachment when supported by the software or mailed to Treasury.

Following is a list of IIT forms, line references, and filing conditions where PDF attachments are

accepted by Michigan.

Form

Line

Description

File Name

Required

State Returns

Power of Attorney

POA.pdf

No

City Returns

Power of Attorney

CityPOA.pdf

No

All Returns

MI-1310

MI-1310.pdf

No

Letter of Authority

LetterOfAuthority.pdf

No

Death Certificate

DeathCertificate.pdf

No

All Forms and

Lines

Explanation. Must include the

form and line number reference.

Explanation.pdf

No

MI-1040

9d

Certificate of Stillbirth from

MDHHS.

CertificateOfStillbirth.pdf

Yes

MI-1040

18

Other State Returns

OtherStateReturn.pdf

No

MI-1040

Grantor Letter

GranterLtr.pdf

No

MI-1040

MI-1040CR-5

26

Worksheet to allow claimants to

identify percentages they can

claim for a farmland

preservation tax credit.

FarmlandK1.pdf

No

18

Form

Line

Description

File Name

Required

MI-1040

MI-1040CR-5

26

A breakdown of the taxable value and

property taxes for the farmland

preservation tax credit.

Assessor.pdf

No

MI-1040

29

Flow-Through Entity Tax Credit

Documentation

FTECreditDocumentation.pdf

Yes

MI-1040CR

MI-1040CR-2

MI-1040CR-5

10

10

Property Tax Statement

PropertyTaxStatement.pdf

No

MI-1040CR

MI-1040CR-2

MI-1040CR-7

22

21

24

Custodial Party End of

Year Statement

FEN851.pdf

No

MI-1040CR

Letter from the landlord stating the

portion of the monthly payment that

constitutes rent, or if not available, the

prorated share of property taxes.

SpecialHousingStmt.pdf

No

Schedule 1

Schedule NR

Business Activity Worksheet

BusinessActivity.pdf

No

Schedule 1

10

Supporting statement when claiming

subtraction for when income from U.S.

obligations exceeds $5,000

USObligationsDetail.pdf

No

Schedule 1

11

Claiming a subtraction of taxable railroad

retirement benefits. This can include

income from the RRB-1099 and/or RRB-

1099R.

RRB1099R.pdf

No

Schedule 1

22

Subtraction for Marihuana Business

Expenses

MRTMADocuments.pdf

Yes

Schedule 1

23

Claiming subtraction for federal Schedule

R but not required to include Schedule R

with federal return.

FedSchR.pdf

No

Schedule 1

26

Tier 3 Standard Deduction Worksheet

StandDedTier3Wksht.pdf

No

MI-1040H

13

Unitary Calculation

UnitaryCalculation.pdf

Yes

Schedule

MI-1045

5595

19

10E

NOL Worksheet

NOLWksht.pdf

No

5674

2 or 3

NOL Worksheet

NOLWksht.pdf

No

5674

2 or 3

Prior Year NOL Documents

PriorYrNOLDocuments.pdf

No

5792

Explanation of VARIOUS dates of

withdrawal

Explanation.pdf

Yes

5792

3

Account statements, real estate

settlement statement, and/or Form 1099

FirstTimeHomeBuyerDocuments.p

df

Yes

5803

4c

Certificate of Completed Rehabilitation

CertificateOfCompleteRehabilitatio

n.pdf

Yes

5803

5

Historical Credit Documentation

HistoricalCreditDocumentation.pdf

Yes

5889

5

17

Report of Oil, Gas, and Nonferrous

Metallic Minerals Extraction – Income

and Expenses

OilAndGasDocuments.pdf

No

5119

Part 5

Finance Director Approval Letter

ApprovalLetter.pdf

Yes

5121

Part 3

Employer Letter and Work Log

EmployerLetterAndWorkLog.pdf

No

5119

5120

28

23

Explanation. Employee Business Expenses

EmployeeBusinessExpenses.pdf

No

19

Software may include a “Preparer Notes” field for the federal, State, and/or City return. The purpose of

this field is to capture additional descriptive information from lines that did not have sufficient space.

Michigan Preparer Notes can contain up to 150 characters. Tax preparers are encouraged to utilize

Preparer Notes and PDF attachments when supported by the software.

Using Preparer Notes and including the recommended PDF attachments may reduce processing delays

and the need for Treasury to contact the taxpayer for additional information.

Examples of information that can be included in Preparer Notes and when a PDF attachment is

recommended:

• Combat Zone. If a taxpayer is serving in a combat zone.

• Federal Extension granted to MM-DD-YYYY. If a taxpayer has been granted an extension to file

their federal return.

• Explanation of a large subtraction. Recommend including an Explanation.pdf when not

supported by federal forms.

• Explanation of a miscellaneous subtraction. Recommend including an Explanation.pdf when not

supported by federal forms.

• Explanation of how expenses were met when total household resources are very low.

Recommend including an Explanation.pdf.

• Co-owners share of property taxes. Recommend including the PropertyTaxStatement.pdf.

• Explanation of taxpayers paying room and board/property tax credits. Recommend including

the SpecialHousingStmt.pdf.

• Farmland agreement number reduced for exception by percent. Recommend including

Assessor.pdf.

• Identify where prior year farmland refund is included on federal return. Recommend including

an explanation in Preparer Notes.

• Withholding corrected on an amended MI-1040. Recommend including Explanation.pdf and to

provide copies of the W-2(s).

The taxpayer is not eligible for e-file for tax year 2023 if:

Form

Line

Description

Various

Filing federal returns or forms excluded from MeF.

All Michigan forms

Prior year return(s) for tax year 2020 or prior.

MI-1040

19

Filing a return that includes both Form 5803 and

3581

20

Form

Line

Description

Schedule 1

25

Claiming the Tier 2 Standard Deduction and has

received benefits from SSA exempt employment,

has retired as of January 1, 2013, and was born

January 1, 1956.

Schedule 1

25

26

28

Claiming both the Michigan Standard Deduction (line 25 or line

26) and the dividend/interest/capital gain deduction (line 28) as

the unremarried surviving spouse of someone born before 1946

who was at least 65 at the time of death.

Filing and claiming the Tier 3 Michigan Standard Deduction on

line 26 with a birthdate of January 1, 1957.

Schedule 1

27

Claiming a pension/retirement subtraction using Form 4884

when the oldest of filer or spouse was born in 1956 and died

during the tax year before reaching age 67.

Claiming a pension/retirement subtraction using Section C of

Form 4884 when the oldest of the filer or spouse was born

January 1, 1962.

MI-1040CR, CR-2 or MI-1040CR-7

Filing an amended credit-only return.

MI-1040CR

38

39

41

Claiming the Homestead Property Tax credit on the MI-1040CR,

needing to prorate the maximum credit limit due to being

deceased, and having fewer “days of occupancy” than the

number of days the taxpayer lived during the tax year.

MI-1040CR-5

8

Using different total household resources than on the

MI-1040CR, MI-1040CR-2 or MI-1040CR-7.

MI-1040CR-7

13b

Claiming more Deaf/Disabled/Blind exemptions than the total

personal, child and dependent adult exemptions.

MI-8949

1

Filing with more than 36 short-term capital gains/losses.

3

Filing with more than 48 long-term capital gains/losses.

MI-4797

2

Filing with more than 16 sales/exchanges of property held more

than one year.

10

Filing with more than 13 ordinary gains/losses of property held

one year or less.

MI-4797

19

Filing with more than 17 gains from disposition of property

under Sections 1245, 1250, 1252, 1254 and 1255.

5595

Claiming more than 300 Business Entities on Form 5595.

MI-1040H

13

Filing with more than 28 entities unitary with one another for

which apportionment is being combined.

5792

Filing with more than six entries on Form 5792

5121

Part 2

Reporting City Tax Paid by a Partnership.

21

Nonelectronic Portion of Michigan Returns

The nonelectronic portion of the Michigan return consists of the following supporting documents:

• Michigan Individual Income Tax Certification for e-file (Form MI-8453). See the “Michigan E-file

Signature Process” section for more information on Form MI-8453.

• Michigan Individual Income Tax Payment Voucher (Form MI-1040-V). State tax due returns

must submit payment by the due date.

• City Income Tax e-file Payment Voucher (Form City-V). City tax due returns must submit

payment by the due date or extended due date if filing an Application for Extension of Time to

File City Tax Returns (Form 5029). Form City-V should only be used for e-file payments. For

other payment options see the “Tax Refund and Payment Information” section.

• Michigan Direct Debit of Individual Income Tax (Form 5472). Provides the taxpayer with a copy

of their direct debit request entered in the electronic return submission.

• Signed Distribution Statement for Joint Owners of Farmland Development Rights Agreements

(Form 5678). Used for farmland returns claiming unequal distribution of property taxes on

jointly owned land and must be signed by all owners. Do not mail a copy of Form 5678 or the

signed statement to Treasury. A copy of the signed statement should be retained to avoid

reduction and/or denial of the credit. Treasury may later request a copy of the signed

statement to verify the unequal distribution claimed.

Michigan E-file Signature Process

For Fed/State Returns

When e-filing the federal and Michigan returns together, Michigan will accept the federal signature

(PIN).

For State and/or City of Detroit Unlinked Returns

When e-filing a State and/or City of Detroit unlinked (standalone) return, the filer must sign the return

with the Electronic Signature Alternative (ESA) or paper Form MI-8453. The ESA consists of the SSNs,

previous year’s Adjusted Gross Income (AGI) or total household resources, and the previous year’s tax

due or refund amount.

The AGI or total household resources and refund or tax due amount must be from the previous year’s

return. Treasury can accept this information from the original return, amended return, or return as

corrected by Treasury.

If the return is signed using the ESA and the return is rejected because the ESA does not match, the

taxpayer/tax preparer may correct the ESA information and retransmit. There is no limit on how many

times the return can be retransmitted in this circumstance.

22

Do not send Form MI-8453 to Treasury unless requested to do so.

For Tax Preparers

When e-filing a State and/or City unlinked (standalone) return, Form MI-8453 is used to capture the

paid preparer (as defined by Internal Revenue Code (IRC) § 7701) signature and as a preparer

certification document to be retained in their records. Part 3 of Form MI-8453 must contain the paid

preparer’s signature and date to be used for this purpose.

Volunteer Groups

If the taxpayer chooses to complete Form MI-8453, it should not be mailed to Treasury. Volunteer tax

preparers should provide taxpayers with form MI-8453 and instruct them to retain a copy with their

tax records.

Assistance is available using TTY through the Michigan Relay Service by calling 711. Printed material in

an alternative format may be obtained by calling 517-636-4486.

TAX REFUND AND PAYMENT INFORMATION

STATE RETURNS

State Tax Returns Claiming Refunds

Michigan taxpayers can elect to have their Michigan income tax refunds directly deposited into their

checking or savings accounts. When carrying the direct deposit information from the federal return to

the Michigan return, verify the information is correct for the Michigan return. This is especially

important when taxpayers have a Refund Anticipation Loan and have designated their federal refund

to pay their loans. The State refund should not go to pay those loans.

Direct deposit is only available when Treasury is issuing a state refund and only on the first return filed

each year. The Home Heating Credit Program sends the credit in the form of an Energy Draft directly to

the energy provider or to the claimant. Only a claimant whose heat is included in rent should use Direct

Deposit of Refund (Form 3174).

Direct deposit requests associated with a foreign bank account are classified as International

Automated Clearing House Transactions. If the income tax refund direct deposit is forwarded or

transferred to a financial institution in a foreign country, the direct deposit will be returned to

Treasury. If this occurs, the refund will be converted to a check (warrant) and mailed to the address on

the tax return. Taxpayers should contact their financial institutions for questions regarding the status

of their bank account.

Treasury cannot make any changes to direct deposit information after the return is transmitted.

Refund requests cannot be made by direct deposit for an amended return. A refund check will be

mailed to the address on the Michigan return.

23

State Tax Returns with Tax Due

In the event that tax is due on the return, the taxpayer must submit payment by April 15, 2024. If full

payment of that tax due is not submitted by April 15, the taxpayer will receive a bill with applicable

penalty and interest.

Payments can be made by:

• Direct Debit: Direct debit from a checking or savings account when the return is e-filed and

supported by the software. A direct debit is a tax payment electronically withdrawn from the

taxpayer’s bank account through the tax software used to electronically file the IIT return.

Submitting the electronic return with the direct debit information provided, acts as the

taxpayer’s authorization to withdraw the funds from their bank account. Requesting the direct

payment is voluntary and only applies to the electronic return that is being filed.

Important: When the State return has tax due and the City return has a refund, the City refund

cannot be reduced to cover the State tax due.

Direct debit will not be available for the Michigan 2023 amended tax due return. Payment for

an e-filed 2023 Michigan amended tax due return should be made using the Individual Income

Tax Payment Voucher (MI-1040-V).

• Warehousing a payment. Warehousing a tax payment allows the taxpayer to designate the

date the payment will be withdrawn from their bank account. Treasury will accept a

warehoused payment date up to 90 calendar days before, but not beyond, April 15, 2024.

Direct debit requests after the April 15, 2024, due date cannot be warehoused and must

contain a direct debt date that is equal to the transmission date of the e-filed return. Treasury

will not withdraw a payment from the designated bank account prior to the requested debit

date. Allow three to four business days from the direct debit date of the payment for the funds

to be withdrawn from the account.

Penalty and interest will accrue on any tax due that has not been paid by the due date of the

return. The day the return was transmitted, if accepted by Michigan, is the received date.

• Mailing Form MI-1040-V with a check or money order after e-filing the MI-1040 return. The

MI-1040-V should not be included with a copy of the return and should not be used for any

other payments made to the State of Michigan (SOM) (such as a City of Detroit tax due). When

the payment is made electronically, there is no need to mail the MI-1040-V to Treasury.

• Michigan IIT e-Payments system by direct debit (eCheck) from a checking or savings account,

or by using a credit or debit card. Michigan IIT filers have the option of making payments

electronically using IIT e-Payments system. Paying electronically is easy, fast, and secure. The

available payment types include IIT payments (tax due on the MI-1040), quarterly estimated

income tax payments, and IIT extension payments. Payments can be made using eCheck from a

checking or savings account, or credit or debit card. There is no fee for eCheck payments.

Credit and debit payments will be charged a convenience fee of 2.35 percent of the total

payment for credit cards and a flat fee of $3.95 for debit cards, which is paid directly to the

24

payment processing vendor. Visit www.michigan.gov/iit for more information.

CITY OF DETROIT RETURNS

City of Detroit Tax Returns Claiming Refunds

Direct deposit will not be available for City of Detroit refunds. All City of Detroit tax refunds will be

issued checks and mailed to the address on the return.

City of Detroit Tax Returns with Tax Due

In the event that tax is due on the return, the taxpayer must submit payment by April 15, 2024. If full

payment of that tax due is not submitted by April 15, the taxpayer will receive a bill with applicable

penalty and interest. Payment using Michigan’s Individual Income Tax e-Payments system is not

available for City of Detroit tax due returns.

Payments can be made by:

• Direct Debit for tax year 2020, 2021, 2022 and 2023: Direct debit from a checking or savings

account when the return is e-filed and supported by the software. A direct debit is a tax

payment electronically withdrawn from the taxpayer’s bank account through the tax software

used to electronically file the IIT return. Submitting the electronic return with the direct debit

information provided acts as the taxpayer’s authorization to withdraw the funds from their

bank account. Requesting the direct payment is voluntary and only applies to the electronic

return that is being filed.

Important: When the City of Detroit return has a tax due and the State return has a refund,

the State refund cannot be reduced to cover the City tax due.

Warehousing a payment. Warehousing a tax payment allows the taxpayer to designate the

date the payment will be withdrawn from their bank account. Treasury will accept a

warehoused payment date up to 90 calendar days before, but not beyond, April 15, 2024.

Direct debit requests after the April 15, 2024, due date cannot be warehoused and must

contain a direct debit date that is equal to the transmission date of the e-filed return. Treasury

will not withdraw a payment from the designated bank account prior to the requested debit

date. Allow three to four business days from the direct debit date of the payment for the funds

to be withdrawn from the account.

Penalty and interest will accrue on any tax due that has not been paid by the due date of the

return. The day the return was transmitted, if accepted by Michigan, is the received date.

• Mailing the Income Tax e-file Payment Voucher (City-V) with a check or money order after e-

filing the City of Detroit return. The City-V should not be included with a copy of the return

and should not be used for any other payment made to the SOM (such as a Michigan tax due on

Form MI-1040). When the payment is made electronically, there is no need to mail the City-V

to Treasury.

FOR MORE INFORMATION

25

Visit the federal website at www.irs.gov and Michigan website at www.MIfastfile.org for more

information on the Fed/State e-file Program.

Assistance is available using TTY through the Michigan Relay Service by calling 711. Printed material in

an alternative format may be obtained by calling 517-636-4486.

POST-FILING INFORMATION

MAILING ADDRESSES

General income tax correspondence or returning a home heating draft for a check:

Michigan Department of Treasury

Customer Contact

P.O. Box 30757

Lansing, MI 48909

Write “Void” across the draft and include a letter of explanation. When returning home heat drafts,

the dollar amount of the check may be 50 percent of the returned draft and there will be further

review of the account.

Returning State of Michigan checks:

Michigan Department of Treasury

Office of Financial Services

P.O. Box 30788

Lansing, MI 48909

Write “Void” across the check and include a letter of explanation.

Visit www.michigan.gov/treasury for more information.

AMENDED MICHIGAN INCOME TAX RETURNS (SCHEDULE AMD)

To correct or amend information reported on an Individual Income Tax Return (Form MI-1040), check

the “Amended” box at the top of page 1 of the form. A Schedule AMD and applicable supporting

documentation must be included when the amended MI-1040 is filed.

If the original return was adjusted by Treasury and the taxpayer disagrees with the adjustments, it is

not necessary to file an amended return. Simply respond to the adjustment notice with documentation

to support the original claim. Treasury will review the documentation for further adjustment.

26

Exceptions:

• When correcting a Homestead Property Tax Credit (Form MI-1040CR) and no Form MI-1040 was

filed with the original claim, a MI-1040X-12 or MI-1040X are not required. File the Form MI-

1040CR using the corrected figures and check the “Amended” box at the top of the form.

• When correcting a Home Heating Credit (Form MI-1040CR-7), file a MI-1040CR-7 and check the

“Amended” box at the top of the form. An amended claim requesting an additional Home

Heating Credit must be submitted by September 30, following the year of the claim.

• When correcting a Farmland Preservation Tax Credit Claim (Form MI-1040CR-5), file a MI-

1040CR-5 with a new MI-1040 and check the “Amended” box at the top of the form. Submit the

amended form along with a description and any documentation needed to explain the change.

• When claiming a refund from a Michigan net operating loss (NOL) carryback, do not file an

amended return. To request a refund from a farming loss carryback, file Farming Loss Carryback

Refund Request (Form 5603).

• An amended return is not required to change an incorrect SSN or incorrect mailing address.

Contact Treasury at www.michigan.gov/iit or call 517-636-4486.

An amended return claiming an additional refund must be filed within four years of the due date of

the original return.

CUSTOMER SELF-SERVICE

Treasury’s suite of web systems, eServices, offer easily accessible and fast ways for taxpayers and

authorized representatives to get information about taxpayer accounts and ask account-specific or

general questions.

Treasury must protect sensitive taxpayer information. Therefore, to access privileged taxpayer records

electronically, customers must answer shared secret questions. These questions are based on tax

return data filed or certified by the taxpayer that is on file with Treasury. To answer the shared secret

questions successfully, have the following information available for the tax year of your inquiry:

• Primary filer’s Social Security Number (SSN)

• Primary filer’s last name

• Tax year

• Filing status

• Adjusted Gross Income (AGI)/Total Household Resources (THR)

For phone access to IIT account information, call 517-636-4486.

IIT eService

Treasury’s IIT eService is a web platform used by the taxpayer to check refund status, view tax

account information, ask questions, and more. The IIT eService is specific to individual income tax

and used by the taxpayer. You can access IIT eService at etreas.michigan.gov/iit.

27

Taxpayers can interact with Treasury through the IIT eService in 3 ways:

• Guest Services

The Guest Services portal provides secure access to a Treasury tax account through easy-

to-use self-service options:

▪ Where’s My Refund?

▪ Change My Address

▪ View Estimated Tax Payments, and

▪ Penalty and Interest Calculator.

Guest Services are transactional, meaning each time a taxpayer needs information, they

must provide answers to the shared secret questions.

• Account Services

The Account Services portal offers access to all the Guest Services functionality in one

place. The advantage of using Account Services is a taxpayer only needs to answer the

shared secret questions for a tax year one time, instead of each time they need information

about their Treasury tax account. An added feature of Account Services is the ability to

view Treasury-issued notices by uploading documentation.

• Inquiries

The Inquiries portal establishes an electronic communication pathway with Treasury. A

taxpayer can ask general or account-specific questions, retrieve and review answers to

their questions, and request copies of correspondence.