Department of Defense | Defense Human Resources Activity

Agency Program Coordinator Guide

Government Travel Charge Card Program

May 2022

APC Guide June 2021

Defense Travel Management Office 1 defensetravel.dod.mil

APC Guide May 2022

Defense Travel Management Office i defensetravel.dod.mil

Table of Contents

Chapter 1. Introduction ......................................................................................................... 1

1.1 Acronyms and Icons ............................................................................................................ 1

Chapter 2. Laws, Regulations, and Policy Governing the DoD Travel Card Program .... 2

Chapter 3. GTCC Program Roles and Responsibilities ..................................................... 4

3.1 General Services Administration (GSA) .............................................................................. 4

3.2 Defense Travel Management Office (DTMO) ....................................................................... 4

3.3 Component Program Manager (CPM) ................................................................................. 4

3.4 Agency Program Coordinator (APC) ................................................................................... 4

3.4.1 As-Necessary Tasks ..................................................................................................... 4

3.4.2 Daily Tasks .................................................................................................................... 5

3.4.3 Weekly Tasks ................................................................................................................ 5

3.4.4 Monthly Tasks ............................................................................................................... 5

3.4.5 Annually ........................................................................................................................ 7

3.5 Cardholder (CH) .................................................................................................................... 7

Chapter 4. Charge Card Accounts ....................................................................................... 8

4.1 Individually Billed Accounts (IBAs) ..................................................................................... 8

4.2 Centrally Billed Accounts (CBAs) ....................................................................................... 8

Chapter 5. Hierarchical Structure ............................................. Error! Bookmark not defined.

Chapter 6. Training Requirements .................................................................................... 11

6.1 Requirements ...................................................................................................................... 11

6.2 Travel Explorer (TraX) ........................................................................................................ 11

6.3 Citi Training and Resources .............................................................................................. 11

Chapter 7. Citi Tools ........................................................................................................... 13

7.1 CitiManager ......................................................................................................................... 13

7.2 The CitiManager Transaction Management Module ......................................................... 15

7.3 The CitiManager Reporting Module ................................................................................... 15

7.4 The CitiManager Learning Center Module ........................................................................ 17

Chapter 8. Operational Setup ............................................................................................. 18

8.1 New Account Applications and Setup ............................................................................... 18

8.1.1 Individually Billed Accounts ...................................................................................... 18

8.1.2. Paper CBA Applications ............................................................................................ 21

8.2 Post Application Processing Actions ............................................................................... 21

8.2.1 Card Receipt Report ................................................................................................... 22

APC Guide May 2022

Defense Travel Management Office ii defensetravel.dod.mil

8.2.2 Defense travel system Profile Update ....................................................................... 22

8.2.3 APC Wrap-up with Cardholder ................................................................................... 22

Chapter 9. Account Maintenance ...................................................................................... 23

9.1 Defense Travel System Reports ........................................................................................ 23

9.2 Demographic Updates ........................................................................................................ 23

9.3 Temporary Credit Limit Updates ....................................................................................... 24

9.4 Opening and Closing at Risk Accounts ............................................................................ 24

9.5 Mission Critical ................................................................................................................... 25

9.5.1 PCS .............................................................................................................................. 25

9.6 Hierarchy Transfers ............................................................................................................ 25

9.7 Disputes /Transfers ............................................................................................................ 25

9.8 APC Termination of Accounts ........................................................................................... 26

9.9 Deceased Cardholder ......................................................................................................... 27

9.10 Credit Balance Refunds ................................................................................................... 27

Chapter 10. Delinquency Management ............................................................................. 29

10.1 Overview ........................................................................................................................... 29

10.2 Delinquency Milestones ................................................................................................... 30

10.2.1 IBA Delinquency Milestones .................................................................................... 30

10.2.2 CBA Delinquency Milestones .................................................................................. 31

10.3 Fees ................................................................................................................................... 32

10.4 Delinquency Management Reports ................................................................................. 33

10.5 Cardholder Payment Options .......................................................................................... 33

10.5.1 Reduced Payment Plan (RPP) .................................................................................. 34

10.5.2 Salary Offset ............................................................................................................. 34

10.5.3 Charge-Off/3rd Party Collections ............................................................................ 34

10.5.4 Payment Options available to the cardholder......................................................... 34

Chapter 11. Misuse ............................................................................................................. 35

11.1 Visa IntelliLink .................................................................................................................. 36

Chapter 12. Account Services ........................................................................................... 37

12.1 Upgrade ............................................................................................................................. 37

12.2 Reinstatement of Cancelled Accounts ............................................................................ 37

12.2.1 IBA Reinstatements .................................................................................................. 37

12.2.2 CBA Reinstatements ................................................................................................ 37

12.3 Exception Status for CBAs .............................................................................................. 38

12.3.1 Exception Requests for CBAs Beyond the Third Request .................................... 38

12.4 Renewals ........................................................................................................................... 39

APC Guide May 2022

Defense Travel Management Office iii defensetravel.dod.mil

12.5 Lost/Stolen ........................................................................................................................ 39

Chapter 13. Additional Resources ..................................................................................... 40

13.1 Citi Customer Service and Support - Cardholders ......................................................... 40

13.2 Client Account Specialist (CAS) Support - APCs ........................................................... 40

13.3 CitiManager (Resources/Forms Links) ............................................................................ 40

13.4 Travel Assistance Center (TAC) ...................................................................................... 40

13.5 Additional websites .......................................................................................................... 41

APC Guide May 2022

Defense Travel Management Office 1 defensetravel.dod.mil

Chapter 1. Introduction

This document provides Agency Program Coordinators (APCs) with a general overview and guidance on

processes and procedures necessary for the successful execution and daily operations of their Organization’s

Government Travel Charge Card (GTCC) Program. It includes information on the administration of both

Individually Billed Accounts (IBAs) and Centrally Billed Accounts (CBAs). APCs must also refer to their

component’s guidance related to the GTCC Program. In addition to this DoD-wide guidance, APCs must refer to

their service or agency specific guidance, as it may include additional or more specific requirements for their

component.

Note: Although all DoD Travel Card stakeholders will find value in this document, this guide is principally

intended for Department of Defense (DoD) GTCC APCs, therefore the word “you” implies “APC.”

Denotes especially important information or helpful tip.

1.1 Acronyms and Icons

Below are common DoD Acronyms that will be used in this guide and in the administration of the GTCC program.

Acronym Description Acronym Description

APC Agency Program Coordinator GSA General Services Administration

BIN Bank Identification Number GTCC Government Travel Charge Card

BP Basis Point HL Hierarchy Level

CAS Client Account Services (Citibank) IBA Individually Billed Account

CBA Centrally Billed Account MC Mission Critical

CBA-S Centrally Billed Account Specialist MCC Merchant Category Code

CBR Credit Balance Refund` PAD PAD Days, Padding or extra time

CCV Charge Card Vendor PCS Permanent Change-of-Station

CPM Component Program Manager POS Point of Sale

CVV Card Verification Value RPP Reduced Payment Plan

DFAS Defense Finance and Accounting Service SO Salary Offset

DoD Department of Defense SoU Statement of Understanding

DPB Days Past Billing SP3 SmartPay3 GSA Master Contract

DTA Defense Travel Administrator TMC Travel Management Company

DTMO Defense Travel Management Office TO Transportation Officer

DTS Defense Travel System TraX Travel Explorer

EAS Citi’s Electronic Access System WBT Web Based Training

APC Guide May 2022

Defense Travel Management Office 2 defensetravel.dod.mil

Chapter 2. Laws, Regulations, and Policy Governing the DoD Travel Card

Program

It is recommended that you become familiar with the laws and regulations upon which DoD GTCC Policies are

founded:

• Public Law 105-264

The Travel and Transportation Reform Act (TTRA) of 1998

Mandates use of the GTCC by U.S. Government civilian and military personnel for official travel.

https://www.gsa.gov/cdnstatic/public_law_105-264.pdf

• Public Law 109-115 Section 846

Requires each Organization to evaluate the creditworthiness of an individual before issuing an IBA GTCC.

https://www.gpo.gov/fdsys/pkg/PLAW-109publ115/html/PLAW-109publ115.htm

• Public Law 112-194

Government Charge Card Abuse Prevention Act of 2012 SEC 3. Management of Travel Cards

Requires all federal agencies to establish internal controls for government charge card programs, ensure

periodic internal control reviews are conducted, and penalties imposed for violations when circumstances

warrant. https://www.gpo.gov/fdsys/pkg/PLAW-112publ194/pdf/PLAW-112publ194.pdf

• Public Law 107-314 Section 2784

of the Bob Stump National Defense Authorization Act for Fiscal Year 2003

Requires split disbursement of travel reimbursement directly to the GTCC vendor, and allows the withholding of

funds (through Salary Offset) payable to a DoD employee when in debt to the GTCC vendor.

https://www.gpo.gov/fdsys/pkg/PLAW-107publ314/content-detail.html

• Title 10 U.S.C. 2784a

Management of travel cards

Provides for disbursement of travel allowances directly to creditors.

https://www.gpo.gov/fdsys/pkg/USCODE-2010-title10/pdf/USCODE-2010-title10-subtitleA-partIV-chap165-

sec2784a.pdf

• Joint Travel Regulations (JTR)

Pertaining to per diem, travel and transportation allowances, relocation allowances, and certain other

allowances of Uniformed Service Active Duty members, Uniformed Service Reserve Component members, DoD

civilians, and civilians traveling on DoD funding. Only expenses authorized by the JTR should be charged to the

GTCC, unless specifically allowed per the GTCC Regulations authorized by DoDI 5154.31, Volume 4.

https://travel.dod.mil/Policy-Regulations/Joint-Travel-Regulations/

• Government Travel Charge Card (GTCC) Regulations

Establishes command supervisory and personal responsibility for use of the GTCC and the operation for the DoD

travel card program, program structure, and APC responsibilities.

https://travel.dod.mil/GTCC-Regs

• Office of Management and Budget (OMB) Circular A-123, Appendix B

Prescribes policies and procedures regarding how to maintain internal controls that reduce the risk of fraud,

waste, and error in government payment solution programs.

https://www.whitehouse.gov/wp-content/uploads/2019/08/Issuance-of-Revised-Appendix-B-to-OMB-Circular-A-

123.pdf

APC Guide May 2022

Defense Travel Management Office 3 defensetravel.dod.mil

• OUSD Memo, 3 May 2007 Reduction of Centrally Billed Accounts

Approved the IBA as the primary payment mechanism for all travel costs.

https://www.defensetravel.dod.mil/Docs/Reduction_of_CBAs_050307.pdf

• GSA Smart Bulletin 31

Describes and defines the requirement for creditworthiness assessments for travel card applicants.

https://smartpay.gsa.gov/sites/default/files/downloads/SPSmartBulletinNo031_OMBCircularA123_Implmenting

GuidanceAndClarifications_v2_0.pdf

APC Guide May 2022

Defense Travel Management Office 4 defensetravel.dod.mil

Chapter 3. GTCC Program Roles and Responsibilities

3.1 General Services Administration (GSA)

The GSA awards and administers a Master Contract, for the SmartPay charge card products and services for

Purchase, Travel and Fleet. The current Master Contract for SmartPay3 expires November 29, 2031.

3.2 Defense Travel Management Office (DTMO)

The DTMO, on behalf of the DoD, awards and manages a tailored task order defining the Department’s

requirements for Travel card products and services. The DTMO represents the Department’s Travel Card

interests with all sectors of the Government and Industry, to include the Services’ and Defense Agencies’

Component Program Managers, OSD-Comptroller, DoDIG, Office of Management and Budget, GSA, and DoD’s

contracted bank (currently Citibank).

3.3 Component Program Manager (CPM)

The Component Program Manager (CPM) serves as the primary administrator for their Service or Agency and

must be designated in writing. Minimum CPM responsibilities include:

• Maintaining their component’s organizational hierarchy structure.

• Notifying the DTMO and the travel card contracted bank of any changes affecting their program

organization (i.e., hierarchy).

• Conducting periodic reviews (see GTCC Regulations, Annex 8 for a compliance checklist) to ensure:

travelers submit travel vouchers within five working days of completion of official travel and comply

with split disbursement requirements; IBAs and CBAs are properly approved; credit limits are

adjusted/appropriate to meet mission requirements; unused accounts are closed; the APC is part of the

check in/check out process; APCs are running and analyzing the GTCC reports to assist in program

management; APCs are following procedures to notify delinquent cardholders and suspected misuse,

abuse, or fraud; maximum utilization of the travel card; and APCs report findings of significant

weaknesses to the CPM and Command or Agency Head.

APCs, from a hierarchical prospective, receive their GTCC Program guidance from their Component’s CPM.

3.4 Agency Program Coordinator (APC)

The APC must be designated in writing by their Organization’s Commander or Director. Some APC tasks must be

performed at least once per billing cycle, but best-practice recommends more frequent attention to some

specific areas of the program. To assist you with keeping track of these tasks and their recommended frequency,

see below.

APC Self Maintenance Prohibition: APCs that are also cardholders are not authorized to perform account

maintenance such as activating or deactivating or making credit limit adjustments on their own IBA. If an

APC/cardholder needs APC functions performed on their IBA, they must direct the request to a higher level APC

or CPM.

3.4.1 As-Necessary Tasks

o Collect and review required cardholder documentation prior to card issuance; e.g. signed

application, Statement of Understanding, and Programs & Policies – Travel Card Program –

Travel Card 101 [Mandatory] certificate of completion

APC Guide May 2022

Defense Travel Management Office 5 defensetravel.dod.mil

o Self-register your APC profile in CitiManager (Citi’s online tool)

o Remind cardholders to verify their profile information in CitiManager when their account

application is approved

o Proactively communicate with IBA cardholders and CBA managers to minimize account

delinquencies

o Process CBA applications with required approval needed from your CPM

o Respond promptly to cardholder inquiries

o Maintain (add, update/modify, remove) APC and cardholder profiles in the GTCC EAS for

individuals within your span of control

o Facilitate cardholder moves between GTCC organizational hierarchies

o Manage and monitor accounts based on authorized travel dates, any history of misuse or

potential concerns about inappropriate card use and component or agency guidance.

o Adjust IBA credit limits as necessary for the travel mission

o Place IBAs in PCS Status or Mission Critical Status as applicable (per Component guidance)

and supervisor justification

o Work with your Defense travel system DTAs to ensure travelers on long term TDY are setup

for Scheduled Partial Payments (SPPs)

o Adjust CBA credit limits, as necessary, for the travel mission

o Request CBA exceptions through the CPM, as needed

o Perform maintenance and reporting utilizing the EAS (Transaction Management and

Reporting Modules)

3.4.2 Daily Tasks

o Process Account (IBA & CBA) applications within 24-hours of receipt

o Process requests to: manage and monitor accounts with compliance concerns, set card active

start and end dates, open or close – temporary block accounts, adjust IBA credit limits, place

accounts in PCS status, Mission Critical status, update demographic information, etc.

3.4.3 Weekly Tasks

o Decline Authorization reports in the Reporting module (mandatory to run no less than once

per cycle):

To identify all ATM/cash and purchase transactions that were attempted for an

account, but were declined. This report will help you determine where and why

transactions failed, so you can be proactive in assisting cardholders with activating

their accounts, raising credit limits, updating DTS or MyTravel profiles, or pointing-out

improper use of the card.

Unsubmitted Voucher Report (DTS) – may require coordination with the Defense

Travel System Defense Travel Administrator (DTA).

3.4.4 Monthly Tasks

o APCs are expected to obtain mandatory reports listed in the GTCC Regulations 041402 (IBA)

and 041403 (CBA) on a monthly basis, at a minimum.

o “IBA and CBA Account Activity Text File-CD100T” Report

You must run and review this report for IBAs no less than monthly, but recommend

as often as weekly to identify potential improper use of the GTCC. The earlier misuse

is identified, the earlier it can be corrected with the cardholder.

APC Guide May 2022

Defense Travel Management Office 6 defensetravel.dod.mil

o Account Listing Report (IBA)

Ensure cardholders are keeping their personal information current with the GTCC

vendor by validating the detailed content of the Account Listing report with each

cardholder (e.g. full name, physical mailing address, e-mail address and phone

number).

Ensure cardholders no longer assigned to the organization/hierarchy are either

transferred or their account closed.

This report will also allow you to be proactive in reminding cardholders (and

potentially the cardholders’ DTAs), to update GTCC card numbers or expiration dates

in their Defense travel system profiles.

o Delinquency Report – Hierarchy (IBA and CBA)

This report displays accounts that are delinquent by time frame (i.e. 31, 61, 91, 120 or

more days past billing). You should use this report to aggressively work all

delinquencies.

o DoD Travel IBA Aging Analysis or IBA Aging Analysis Summary Report

This report will identify detailed account delinquencies and summary level

information by component hierarchy. You will use one, or both, reports to get a point

in time listing of your delinquencies. These reports should be run at the completion of

each cycle, and used in conjunction with the Delinquency Report.

o DoD Travel CBA Aging Analysis

This report will identify summary level delinquency information by Component HL.

o Complete monthly CBA Reconciliation and ensure that payments post to your account (if CBA

reconciliation is applicable to you).

o Validate in/out-processing cardholders based on component procedures. Close cards

immediately for those former cardholders leaving the DoD; deactivate cards for those

transferring (except when in a PCS status), but remaining in DoD; close accounts of deceased

cardholders.

o Coordinate with your Defense travel system DTA and have them run the Traveler Status

Report. Identify any at risk accounts (accounts with a history of misuse or delinquency)

against the Account Listing Report that should be placed in the closed – temporary block

status indefinitely during non-travel periods. At risk cards can also be managed and made

unavailable for use by very specifically setting the card active start and end dates for narrowly

defined periods of travel.

o Complete ad hoc requests to add/remove APCs that require access to CitiManager.

o Comply with the monthly IntelliLink requirement (See 11.1) and respond to IntelliLink case

inquiries as applicable or if so delegated.

APC Guide May 2022

Defense Travel Management Office 7 defensetravel.dod.mil

3.4.5 Annually

Recommended annual tasks that you should complete include (but aren’t limited to):

o Identify all cardholders that need to complete required course, Programs & Policies – Travel

Card Program – Travel Card 101 [Mandatory] other sources, as approved by the applicable

CPM (every three years).

o Identify all cardholders that need to complete a new SOU (every three years or new duty

station).

o Complete any refresher APC training as mandated (every three years; available in TraX).

o Run and review a CBA Listing report annually to determine whether accounts are being

utilized, and if any modifications need to be made to credit limits, CBA Points of Contact, etc.

3.5 Cardholder (CH)

Cardholders (CHs) must:

• Read, sign and comply with the DD3120-ardholder Statement of Understanding (SoU) initially, every

three years and upon arrival at each new duty station.

• Complete traveler training available in TraX

(Programs & Policies – Travel Card Program – Travel Card

101 [Mandatory]) initially and every three years.

• Read and comply with the GTCC vendor’s cardholder agreement

• Verify receipt of their card with the bank and set up a PIN

• Ensure all cardholder contact information (email address, mailing address, telephone number, name

changes, etc.) are kept current with the GTCC vendor, as well as within their Defense travel system

traveler profile

• Verify that their account is open and available for use before authorized travel begins by checking their

account online or by calling Citi and either using the Interactive Voice Response (IVR) system or talking

to an agent

• Contact their APC if they need assistance to make their card available for use or to adjust the available

credit limit on their account if they need an increase

• Use their GTCC for ALL authorized travel-related expenses /charges, where the GTCC is accepted

• Submit their travel voucher within five working days of trip-end

• Split disburse their travel expense reimbursement directly to the GTCC vendor in either DTS or

MyTravel (via Payment Total screen in DTS), to avoid late payments

• Pay all undisputed charges on their GTCC monthly billing statement by the due date, regardless of

whether reimbursement has been received

• Review GTCC billing statements and submit disputes within 60 days of the first appearance of an

erroneous charge

• Coordinate with their APC when they receive PCS orders, so the APC can make the necessary PCS

Status updates to the account, as needed

• Coordinate with their DTA to schedule partial payments (SPP) for long term TDY and/or PCS travel

• Maintain awareness of, and stay within their available credit limit, while they are traveling by accessing

their GTCC account online or on the mobile app on their smartphone or by calling the customer service

number on the back of the travel card itself. If additional credit limit is necessary based on the travel

mission (long-term travel or travel to a high cost area for example), contact their APC to request an

increase

• Notify the APC and card vendor immediately if the card is lost or stolen

APC Guide May 2022

Defense Travel Management Office 8 defensetravel.dod.mil

Chapter 4. Charge Card Accounts

Citi is DoD’s GTCC vendor under the GSA SmartPay3 master contract (effective November 30, 2018 to November

29, 2031). Citi’s portfolio of travel card products offers a wide-variety of options, but DoD primarily uses two

types of individually billed accounts (IBAs) – standard travel accounts and restricted travel accounts; and, two

types of centrally billed accounts (CBAs) - transportation only accounts and unit travel accounts.

4.1 Individually Billed Accounts (IBAs)

IBA initial spending limits are established based on the DoD’s requirements. However, the APC may

(temporarily) adjust the spending limits based on mission needs; permanent increases are not authorized. Any

individual that may travel as part of their official duties should obtain a GTCC card. Qualifications, credit limits,

and the types of IBAs for DoD were established in the DoD task order and are specified in the GTCC Regulations.

The IBA is a liability of the cardholder, and they are responsible for payment of all undisputed transactions on

the account.

There are two types of IBAs: 1) Standard, and 2) Restricted. Standard Accounts are issued to individuals who

authorize a credit score check and have a credit score of 660 or higher. The credit score check is a soft pull that

does not impact an applicant’s credit score. An applicant with a credit score below 660 will receive a restricted

account. If the applicant does not authorize a credit score check, they must complete the alternate

creditworthiness assessment form DD 2883.

Applicants not authorizing the bank to pull a credit score and who provide any false responses to any of

the true and false questions on the DD 2883 are not eligible for a travel card.

Note: Applicants who were not successful in applying for a travel card because they did not authorize a credit

score check and provided any false response on the DD 2883 can reapply and authorize a credit score check and

still receive a travel card based on their credit score criteria. There is no longer an APC restricted card option. If

an applicant is not successful in applying for a travel card for having a false response on the DD 2883 and will not

authorize a credit score check, they are ineligible to receive the IBA travel card.

4.2 Centrally Billed Accounts (CBAs)

A CBA is an account that has been issued to a DoD organization to pay for official travel transportation charges

such as air, rail, bus, and for other official government travel related expenses. The CBA is the sole liability of the

government and requires monthly reconciliation of the invoice. The APC and/or CBA Manager have the

responsibility to ensure that the CBA invoice is reconciled in a timely manner and by the statement due date to

avoid delinquency and/or suspension of the CBA. The account has a net 30-day payment term, and is subject to

the Prompt Payment Act of 1982. These accounts contain a unique prefix that identifies the account as a CBA for

official federal government travel. Transportation-only CBAs are typically used to purchase transportation (air,

bus, and rail) for individuals that do not have and/or are otherwise not eligible to be issued a GTCC IBA. An

additional, separate CBA called a Unit Card can be established to support groups of travelers, such as escort

teams, military bands, etc., needing the flexibility of charging directly to a CBA. Unit cards (which require CPM

approval) may be used to charge all authorized travel expenses, such as transportation, lodging, meals, etc.

There are five different kinds of CBAs, and the reason for the use of the CBA for your organization will determine

which type the APC would apply for on the CBA application. These accounts contain a unique prefix (Bank

Identification Number – BIN) that identifies the account as a CBA for official federal government travel. This

APC Guide May 2022

Defense Travel Management Office 9 defensetravel.dod.mil

prefix also identifies the account as eligible for government travel rates including city pair program fares and tax

exemption where applicable.

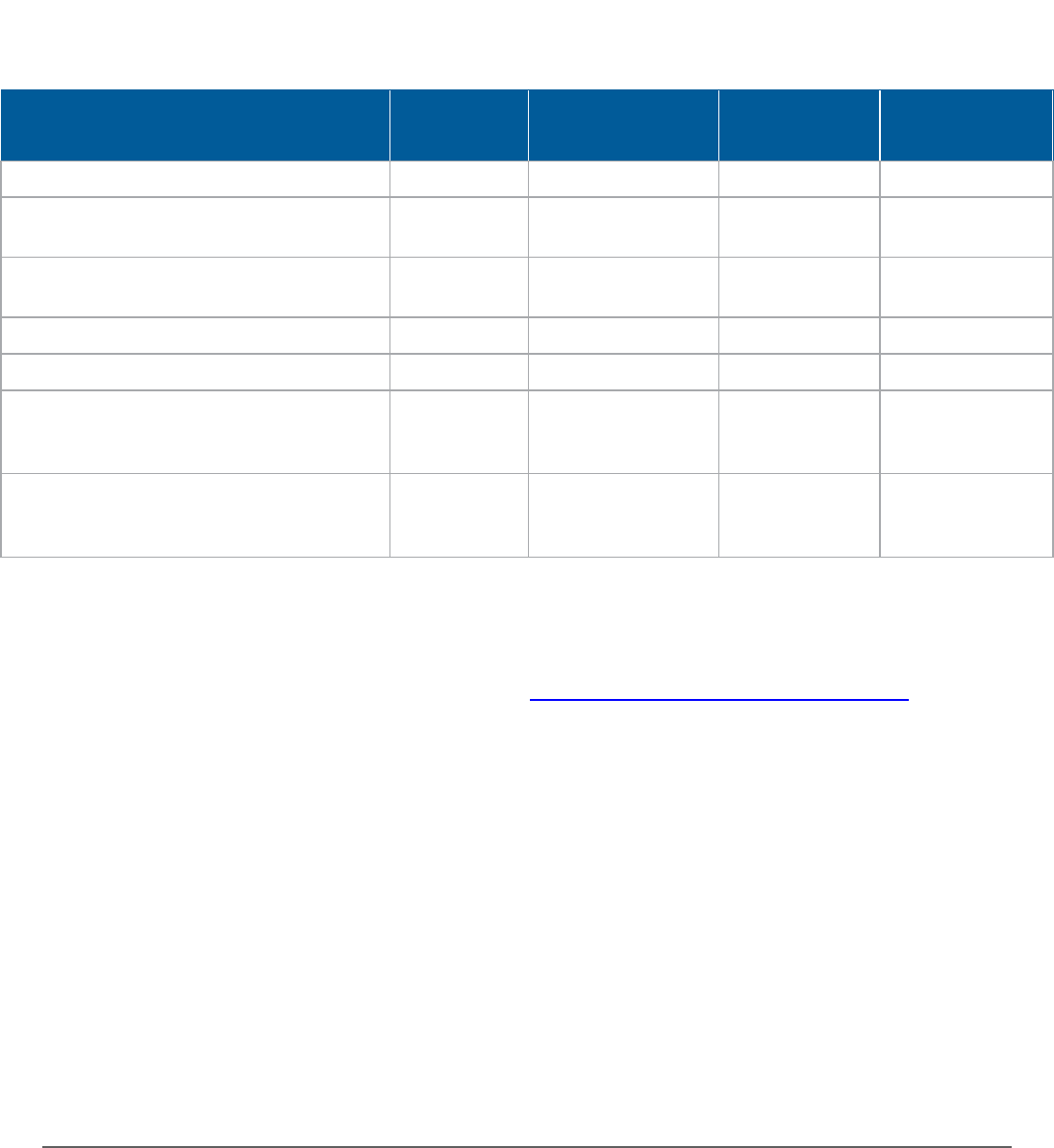

Types of CBA Accounts

Types of CBA’s Description BIN DTS

CPP/Tax

Exempt

Defense Travel

System (DTS)

Reconciled

The DTS CBA is a CBA that is reconciled

electronically in the DTS. Only air, rail and

related point of sale fees can be billed to a DTS

CBA. This type of account allows for the invoice

to be received electronically in DTS. This type of

CBA is loaded into the DTS and is used to pay for

DTS airline tickets. The card for this account is

what is referred to as ‘white plastic’ and cannot

be swiped at a point of sale terminal.

27 Yes Yes

Traditional CBA

Accounts

The Traditional CBA is used to make reservations

and purchasing tickets (air, rail, and bus) on

behalf of individuals who have not been issued

an IBA. This type of CBA can be loaded in DTS for

ticketing. This type of CBA is also used for non-

DTS transportation needs and is loaded in the

Travel Management Center (TMC) script. The

card for this account is what is referred to as

‘white plastic’ and cannot be swiped at a point

of sale terminal. This type of CBA is reconciled

manually (outside of DTS) using a component-

based process or system.

26 Yes Yes

Unit Travel

Charge Card

Accounts

A Unit Card is typically issued to a DoD

component in the traveler’s or the

Agency’s/Organization’s name. This type of CBA

can be used for point of sale transactions so the

type of transactions that can be billed to this

type of CBA is the most flexible. The Unit CBA

cannot be used for DTS travel. These types of

cards are used sparingly due to the

administrative oversight needed and manual

reconciliation of the monthly invoices. Note that

unit cards require CPM approval.

29 No Yes

Special Program

CBA CPP

(Bus/Ground

Transportation)

Special Program CBAs City Pairs Program (CPP)

are used specifically for bus and ground

transportation ticketing.

28 No Yes

Special Program

CBA non-CPP

(MEPS Account)

Special Program CBAs non-CPP are used

specifically for MEPs ticketing.

70 No No

APC Guide May 2022

Defense Travel Management Office 10 defensetravel.dod.mil

Chapter 5. Hierarchical Structure

APCs are responsible for maintaining the hierarchy structure and accounts within their hierarchy structure. Citi

uses a Hierarchy Level (HL) structure to define the reporting structure of accounts for IBAs and CBAs. These

structures will then determine what accounts you have access to and can run reports against. The DoD hierarchy

can contain up to eight levels. An example of a service hierarchy is as follows:

• Level 1: Department of Defense (DTMO)

• Level 2: Military Components (Service CPMs)

• Level 3: Major Command/CPM level for Defense Agencies

• Level 4: Installations/Units/Agency Subordinate Commands

• Level 5-8: Subordinate Commands

Each HL is unique, and all levels of the DoD hierarchy are required on each cardholder/CBA application. APCs

must ensure that they have proper access to their HL so they can support their IBA and CBA cards. If access is

needed, the APC should go to their next higher level APC to gain access (i.e., You are an APC at the HL4 and need

access, your HL3 APC or CPM in the Defense Agencies would process the request).

APC Guide May 2022

Defense Travel Management Office 11 defensetravel.dod.mil

Chapter 6. Training Requirements

6.1 Requirements

The Government Travel Charge Card Regulations, Section 0408, defines the travel card training requirements for

Cardholders and APCs.

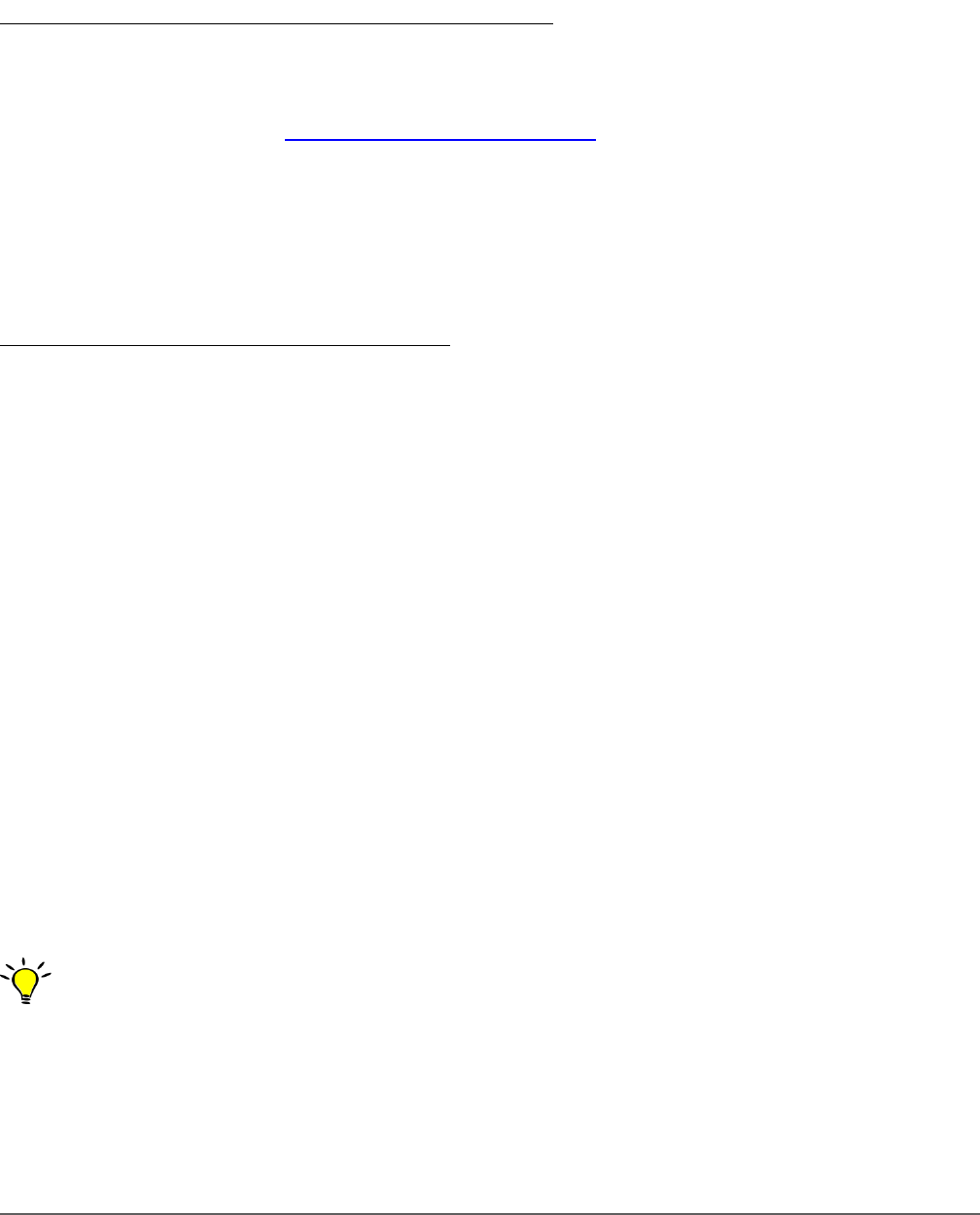

Government Travel Card Training

Requirements for Cardholders and APCs

Cardholder

Mandatory

Cardholder

Recommended

APC

Mandatory

APC

Recommended

Travel Card Program Mgmt. (APC Course) X

Travel Card Program Mgmt. (every three

years)

X

Retain Completion Certificate for APC

Course

X

EAS Training X X

GSA Smart Pay Training X

Programs & Policies – Travel Card Program

– Travel Card 101 [Mandatory] (initially and

then every three years).

X X

Retain Completion Certificate for Programs

& Policies – Travel Card Program – Travel

Card 101 [Mandatory]

X X

6.2 Travel Explorer (TraX)

Travel Explorer (TraX) is a centralized source of travel information that includes travel assistance, training, and

access to trip tools and other useful information for DoD traveler's and administrators. To access TraX, users

must register through Passport at DTMO's web portal at https://travel.dod.mil/Training/eLearning/

. TraX aids

DoD travelers and administrators by functioning as an extension of the Travel Assistance Center (TAC), which is

the 24x7 help desk for DoD travelers. An individual can do the following in TraX:

• Submit help desk tickets and track the progress of the ticket

• Access Training materials and references to include ’How To’ guides, information papers, FAQs, Web

Based Training (WBTs), demonstrations and Instructor Led Training (ILT)

• Obtain information to assist with official DoD trip planning using the Trip Tools to review airline city

pairs and associated fares, per diem rates, rental car ceiling rates, and destination weather forecasts.

6.3 Citi Training and Resources

Citi offers instructor led training and on-line training to support APCs in the use of the travel card vendor’s

online tools. Online training also includes web based training (WBTs) modules, instructional guides, and

webinars. Registration for all Citi training is available in Citi's training environment – The Learning Center. The

Learning Center is located in CitiManager (see Chapter 7.4 of this guide for additional details).

Instructor Led Training:

APC Guide May 2022

Defense Travel Management Office 12 defensetravel.dod.mil

• On-Site Training – Citi offers on-site training at no cost for organizations meeting the required 20-

participant minimum. An online training request form for onsite instructor led training must be

submitted via The Learning Center so logistics can be coordinated with Citi's Training team.

• Regional Citi Training Facilities - Citi also offers day-long, hands-on training by a Citi instructor, for APC

classes of up-to 20 students, at the following locations:

o Washington, DC

o Norfolk, VA

o O'Fallon, MO

o Jacksonville, FL

o Wilmington, DE

Training information is available by logging into Citi’s website at https://home.cards.citidirect.com/ and then

selecting “Web Tools” and the “Learning Center” link.

APC Guide May 2022

Defense Travel Management Office 13 defensetravel.dod.mil

Chapter 7. Citi Tools

Citi’s electronic access system, CitiManager, is a web-based tool that automates many of the administrative

tasks performed by APCs. The CitiManager tools are broken down into four main modules: CitiManager,

Transaction Management, Reporting, and The Learning Center which all APCs need access to in order to

successfully manage their GTCC program.

Before an APC can use Citi’s electronic access system (EAS) they have to be appointed in writing and must

complete the Programs & Policies – Travel Card Program – Travel Card 101 [Mandatory] and APC training. Once

registered in the EAS by the higher level APC/CPM, the new APC will receive two emails with instructions on how

to access the CitiManager website and complete the “Self-registration for Non Cardholders.”

7.1 CitiManager

CitiManager allows APCs to access a variety of card program tasks and web tools that provide the following

functions. The functions you have access to are based on your role and entitlements. It is used by both APCs, as

well as Cardholders.

• For APCs:

APCs will use Manage Users Card Accounts to view statements online. APCs can securely and easily access the

various details of card charges and use this module for assisting and auditing individual cardholders.

Features of the Manage Users Module Card Accounts page include:

o View accounts, statements, balances and transactions including pending transactions

o Dispute transactions

o View authorizations/declines

o View, approve or reject application

o Perform account maintenance

o Review pending user requests

o Activate and deactivate users

o Assign applications

o Set passcodes

o Manage alerts

o Manage your profile

o Access on-demand training resources in the Learning Center

o View Resources to include:

Links/Help (link to various sites that are used by the APC in managing their program)

Web Tools (access to Transaction Management, Reporting and The Learning Center

Modules)

APCs will follow this path to log in and access Manage Card Accounts:

https://home.cards.citidirect.com/, Manage Card Accounts

CitiManager: User Guide – Non-Cardholder (Available in the Learning Center for DoD)

APC Guide May 2022

Defense Travel Management Office 14 defensetravel.dod.mil

• For Cardholders:

Manage Card Accounts in CitiManager and CitiManager Mobile.

o Cardholders who applied after March 6th of 2020 will have a CitiManager account established

by Citibank as part of the card issuance process.

o Cardholders that were issued travel cards before March of 2020 can, and should, self-enroll

by accessing at https://home.cards.citidirect.com/

and click on Self Registration for

Cardholders. APCs should highly recommend this to their cardholders so they can easily

manage their account electronically, which is a huge benefit when they are away from their

home or office.

o Existing cardholders need only their card number and their name as it appears on the card

and can self-enroll for their online account.

Features of the online and mobile accounts include:

o Ability to make online payments

o Credit balance refund request (CBR)

Refunds requested by the cardholder will be issued in the form of an electronic

payment (ACH)

CBRs can be requested on-line in CitiManager, by phone in the Interactive Voice

Response (IVR) system or by talking to a customer service representative

Must be less than the current balance

Cannot obtain CBR on open disputes

Amounts above $10,000 can be disbursed in more than one payment

Citibank will issue email alerts to cardholders that they have CBRs at 60, 90 and 120

days

Once requested and approved the funds will be deposited in their bank account

within 2 to 3 business days

Refunds can be tracked under “View Refund Requests” on the “Card Details” tab in

CitiManager

o View, print, and download statements

o View unbilled transactions

o Set alerts

o Update account information (address, phone number, email)

o Access and change account settings (POC info for CH, enrollment for mobile, paperless

statements, etc.)

CitiManager: User Guide –Cardholder (Available in Links)

APC Guide May 2022

Defense Travel Management Office 15 defensetravel.dod.mil

7.2 The CitiManager Transaction Management Module

The CitiManager Transaction Management Module is the online application that APCs use to maintain users and

view and search for transactions. Depending upon your access, you will log in separately to either CBA or IBA

hierarchy. The Home screen displays a high-level summary of total number of accounts and number of APCs. The

Transaction Management Module is a secure electronic tool that contains four modules for various functions in

support of your GTCC program including:

o Hierarchy – to view structure or add/delete APC Points of Contact

o Search – account lookup, Point of Contact, statement, or transaction

o Resources – Links & Help, reports: APC listing report (in CTMS it is called the Multiple

Business Unit Contact Report) or Non-cardholder User Access Report (located in CTMS)

o Alerts

Additionally, APCs will have access to the Citi Help Desk support, as well as onsite training, comprehensive

online learning and self-help tools to help manage the GTCC program. The self-help tools including user guides

and quick reference cards can be found in Learning Center or within the Transaction Management Module, Links

& Help under the Resources tab.

Corresponding Learning Center module recommendations

• Document: DoD Travel: CitiManager — Cardholder End-to-End User Guide

• Course: DoD Travel: CitiManager CBT – Individual Online Applications and Maintenance

• Course: DoD Travel: CitiManager CBT – Getting Started

• Course: DoD Travel: CitiManager CBT — Manage Card Program

• Course: DoD Travel: CitiManager CBT — Manage Cardholder Accounts

• Course: DoD Travel: CitiManager CBT — Manage Users

• Course: DoD Travel: CitiManager CBT — My Profile

• Course: DoD Travel: CitiManager CBT – Resources, Web Tools and Alerts

• Course: DoD Travel: CitiManager CBT – Reporting CBT – Basic

• Course: DoD Travel: CitiManager CBT – Supervisor (Approver1) Activities

• Course: DoD Travel: Transaction Management CBT – A/OPC

• Document: DoD Travel: CitiManager — A/OPC End-to-End User Guide

7.3 The CitiManager Reporting Module

CitiManager Reporting Module is a robust tool that enables APCs to closely monitor and better manage their

Travel Card Programs for policy compliance, potential misuse, spend trends and patterns, account transaction

activity, and account delinquencies, just to name a few. The Reporting Module supports DoD’s reporting

requirements in two ways: first, it provides a variety of standard report templates that simplify the reporting

process for new APCs; and, second, it provides a dynamic custom reporting capability for the more experienced

APCs with advanced reporting requirements.

APC Guide May 2022

Defense Travel Management Office 16 defensetravel.dod.mil

• Helpful Reporting Module features:

o Pre-defined reports that can be used, or that can serve as templates for customized reports

o Ability to schedule reports by establishing subscriptions (identified under the report) to run at

a variety of time periods, including daily load complete, weekly, cycle-end, or at month-end.

APCs also have the option to enter e-mail addresses to notify when the report is available.

o Ability to create ‘Ad-Hoc’ reports that can be built to the APCs needs

o Access to a history list of reports run in the past. Simply add the report to your History List in

the Reporting module.

The GTCC Regulations, in section 0414, identify the available reports and denotes which are mandatory.

Mandatory Reports for IBA:

1. Account Activity Text Report

2. Account Listing Report

3. Declined Authorization Report

4. Delinquency Report-Hierarchy

5. DoD Travel IBA Aging Analysis or IBA Aging Analysis Summary

Mandatory Reports for CBA:

1. Declined Authorization Report

2. Delinquency Report

3. DoD Travel CBA Aging Analysis

Additional reports are available to the APC and are located in the Supplemental Reports folder within the

Department of Defense Travel Shared Reports that you may find useful.

Follow the path below to access Supplemental Reports in The Reporting Module:

⇒ https://home.cards.citidirect.com

o Web Tools

o Reporting

o Select IBA or CBA Travel (will depend on the APCs access)

o GSA auto populates

o Organizational Shared Folders

o Department of Defense Travel Shared Reports

o Supplemental Reports

Additional Resources

Quick Reference Guide and Data Dictionary available within the Reporting Module by selecting Help.

https://www.customreporting.cards.citidirect.com/app/ccrs/mstrWeb

APC Guide May 2022

Defense Travel Management Office 17 defensetravel.dod.mil

Corresponding Learning Center module recommendations:

• Document: DoD Travel: CitiManager - Reporting Shared Reports Tip Job Aid

• Document: DoD Travel: Reporting Program Dashboards User Guide

• Document: DoD Travel: CitiManager – Reporting User Guide

• Course: DoD Travel: CitiManager Reporting CBT - Basic

7.4 The CitiManager Learning Center Module

The CitiManager Learning Center Module is a module within CitiManager that provides a Citi single source

training environment for APCs that includes manuals, Computer-Based Training (CBTs), demos, instructor led

training, and much more. This training environment provides APCs with the system functionality of using Citi’s

tools to support your travel card program.

APCs will follow this path to log in to CitiManager then go to the Learning Center:

https://home.cards.citidirect.com

The Learning Center environment is flexible, equally accommodating APCs interested in a single lesson, as well

as those interested in a comprehensive curriculum that includes fundamental skills for all of Citi’s online tools

and associated capabilities (e.g. CitiManager, The Transaction Management and Reporting Modules, etc.).

The Learning Center CBTs can be interrupted and picked right back up where you previously stopped, and

once the training is completed, the certificates can be printed right from The Learning Center.

Each APC should be knowledgeable with using CitiManager, Transaction Management, Reporting and Learning

Center Modules. If training is not provided by their command, they should utilize the training in The Learning

Center in order to learn how to use the tools and resources available in support of their travel card program.

There is a Learning Center Quick Reference Guide available in CitiManager under Resources/Links Help that will

provide usability and navigation instructions for the Learning Center.

There is a current listing of courses and descriptions that are available in the Learning Center. When accessing

the Learning Center, please be sure to look for the courses and user guides that begin with “DoD Travel”.

APC Guide May 2022

Defense Travel Management Office 18 defensetravel.dod.mil

Chapter 8. Operational Setup

8.1 New Account Applications and Setup

The GTCC program includes Individually Billed Accounts (IBAs) and Centrally Billed Accounts (CBAs). For every

new account established with the travel card vendor an application is required. Citi will determine whether to

issue a card to designated government travelers and organizations upon review of the application.

8.1.1 Individually Billed Accounts

The Department of Defense (DoD) policy is that the Government Travel Charge Card (GTCC) will be used by DoD

personnel (military or civilian) to pay for all costs related to official government travel. IBAs are a direct liability

of the cardholder. IBA applications for cardholders must be submitted by the APC and can be done so either

online (the preferred method), electronic/fillable PDF or via paper applications.

The cardholder is required to provide the following information on the application:

o Full Name

o Social Security Number (this is not optional)

o Date of Birth

o Address

o Email Address

o Phone

o Applicant’s Signature/Date of Signature

o Approving Supervisor Signature/Date of Signature

o Credit Score Review Authorization or complete a DD 2883

In addition, the cardholder will be required to complete the following:

o Programs & Policies – Travel Card Program – Travel Card 101 [Mandatory]

o The DD 3120 Statement of Understanding (SoU) that is found on the DoD Forms website at

https://www.esd.whs.mil/Portals/54/Documents/DD/forms/dd/dd3120.pdf

NOTE: Regardless of the application process used by the cardholder (online/electronic PDF/paper), when

the cardholder signs the application for the GTCC, they agree to the terms and conditions in the cardholder

agreement. The cardholder agreement can be downloaded from the Department of Defense Travel Program

section at:

https://www.citibank.com/tts/sa/federal-government-program-administrators-guides-and-forms/gsa.html.

Once the application is received by the travel card vendor for processing, they will review the application, and

based on the results of the credit score check or alternate creditworthiness assessment form DD 2883, the

traveler will be issued either a standard or a restricted IBA (See Chapter 4.1). The DD 2883 must be retained

locally and not uploaded to CitiManager.

APC Guide May 2022

Defense Travel Management Office 19 defensetravel.dod.mil

8.1.1.1 Online Applications

Online applications are the preferred method of processing an IBA application.

Benefits for submitting an online application include:

Fewer errors from illegible handwriting and faxing on the manual application

No paper, better for the environment

Provides ability for the APC to see the status of the application

Online recordkeeping versus paper

Provides the fastest expedited application processing and card delivery

APCs first set the invitation passcode for their organization per component or agency policy, they will then send

the applicant the link to the CitiManager log in page: https://home.cards.citidirect.com, the invitation passcode

and the inviter’s email address. The applicant will then go to the CitiManager landing page and select “Apply for

Card”. Next they select the radio button for “Invitation Passcode” and then continue. On the User Registration

page, they enter both the invitation passcode and the inviter’s email address. Citi provides a user guide on the

application process: DoD Travel: CitiManager - Cardholder Online Applications Quick Start User Guide.

Expedited processing online is the fastest way to process an expedited application in response to an official

mission requirement but expedited applications can also be processed using the electronic/fillable PDF or paper

application. Cardholders will receive expedited cards in two to three business days, while the standard

processing time is between three to five business days.

Step by step instructions for the APC to initiate a new online cardholder application can be found in the User

Guide and online training.

Corresponding Learning Center module recommendations:

• Document: DoD Travel: CitiManager – A/OPC Online Applications Quick Start User Guide

• Document: DoD Travel: CitiManager - Cardholder Online Applications Quick Start User Guide

• Document: DoD Travel: CitiManager – Supervisor(Approver1) Online Applications Quick Start Guide

• Course: DoD Travel: CitiManager CBT – Individual Online Applications and Maintenance

8.1.1.2 Electronic PDF and Paper Applications

Paper applications are available for those individuals that do not have access to the online tool for submitting

IBA applications but the online application should be used as much as possible. Once completed by all parties,

the application is then emailed, scanned and emailed to Citi or faxed to the number referenced on the paper

application. The processing time for a manual application, either electronic PDF or paper once received by the

card vendor is approximately two – three business days. Due to the PII information that is required by the bank

and on the paper application, the APC MUST ensure that all documentation is stored in a secure location. APCs

must adhere to archiving requirements of the GTCC Regulations and your organization. The travel card vendor

accepts digital signatures on IBA applications done electronically but for paper applications that are printed out

and filled in by hand, wet signatures (using pen and ink) must be provided by the APC, the applicant’s supervisor

and the cardholder. Prior to submission of the IBA application form to Citi, the APC should verify that the form

has been completed in its entirety and that all information is legible and correct. Applications sent via email

APC Guide May 2022

Defense Travel Management Office 20 defensetravel.dod.mil

must be limited to a single application per email. Email applications to: dodtravelcard@citi.com , Fax paper

applications to: 866-671-5910 or 605-338-5745

APCs can access the electronic PDF IBA application (which can also be printed out for a hard copy paper form) at

the following URL:

https://www.citibank.com/tts/solutions/commercial-cards/assets/docs/govt/Individually-Billed-Account-

Application.pdf

The form has designated areas that must be completed by the cardholder, the cardholders approving

supervisor, as well as the APC.

8.1.1.3 Expedited Applications

Expedited applications, which allow a travel card to be shipped within 24 hours of the GTCC vendor receiving the

application, may be used for personnel who are scheduled to travel within five working days. Remind travelers

to plan ahead and apply for a travel card far enough in advance to avoid the need for an expedited application.

Only expedite cards when necessary. The GTCC vendor does not charge a fee for expedited card delivery.

The steps for expedited applications (including online, electronically completed and paper applications) are:

1. The cardholder, approving supervisor, and you complete the application for an IBA.

2. You will review the application and verify that all sections are completed (particularly the credit score review

authorization and expedited delivery fields) and that the cardholder and approving supervisor signed the

application.

3. You will complete the APC sections on hierarchy, complete the account specification section (if applicable),

and complete and sign the authorization fields.

4. You will then submit the online application or send the manual PDF form or scanned paper copy

electronically via the GTCC vendor website file depository (e.g. Citi Library) or fax the paper application to

the GTCC vendor as soon as possible.

5. You can see the status of your submitted online applications in the system or you will need to verify with the

GTCC vendor whether the application has been received if it were otherwise an electronic or paper

application form.

6. The GTCC vendor will process the application within 24 hours and will send out expedited travel cards with 2

to 3 business day shipping to the individual cardholder’s stated primary address, or to an alternate/physical

address annotated on the application.

7. Both expedited standard and restricted travel cards will be delivered in an open status.

8. The cardholder must verify receipt of their travel card and set up a PIN.

APC Guide May 2022

Defense Travel Management Office 21 defensetravel.dod.mil

8.1.1.4 Emergency Applications

Emergency application procedures are only for responses to natural disasters (e.g., hurricanes, earthquakes),

threats to national security, and military mobilization.

The steps for emergency applications are similar to expedited applications except:

1. The application must be submitted through the GTCC vendor’s dedicated agent by the HL3 or by the local

APC with appropriate enterprise level coordination (e.g., NORTHCOM, DoD, or the Installation Commander).

2. When necessary, oral instruction can be provided to the GTCC vendor to set-up an account and issue a card.

The oral request must be followed by a written confirmation sent electronically within five calendar days to

the dedicated agent or the agency support box with the completed paper application.

3. The GTCC vendor shall process and initiate delivery within 24 hours of the request by overnight delivery.

Cards for emergency applications will be delivered in an open status and are immediately available for use

once the cardholder verifies receipt.

8.1.2. Paper CBA Applications

CBA Applications can only be processed manually via paper or electronically. There is no online CBA application.

The CBA paper application is available from the Citibank Department of Defense Travel Program web page:

https://www.citibank.com/tts/sa/federal-government-program-administrators-guides-and-forms/gsa.html

Then scroll down to Department of Defense Travel Program / Applications.

Once the application has been completed by the APC, they must forward the application to the CPM for

approval. The APC and/or CPM will then forward the application to their customer account representative at Citi

who will process the application. The application can be completed electronically and accommodates digital

signatures. A CBA requires additional setup time due to the type of product it is, and can take up to two weeks

to establish with the charge card vendor. The CBA card will then be mailed to the APC address on the

application. Depending on the type of CBA account, there could be a ‘white plastic’ for non-point of sale (POS)

cards (cards which are not used at a POS terminal) that serve to keep track of the account number, expiration

date, three-digit Card Verification Value (CVV) number, etc. CBA accountholders provide the CBA information

(account number/expiration date) to the TMC to enter the account “script” in their system. The CBA

accountholder verifies receipt, keeps the card properly secured and maintains the white plastic.

8.2 Post Application Processing Actions

Upon processing either the IBA or the CBA, there are actions that MUST be taken in order for the cards to be

open and available for ticketing purposes. The necessary actions include: 1) The cardholder must verify receipt

of their card and set up a PIN; 2) The cardholder must update Defense travel system profiles and TMC scripts, as

needed.

APC Guide May 2022

Defense Travel Management Office 22 defensetravel.dod.mil

8.2.1 Card Receipt Report

In order for an IBA or a CBA to be used, the cardholder and/or APC must confirm receipt of the card. Each card

will have instructions (a sticker on the card) on how to receipt verify the card. The cardholder will verify receipt

of their IBA and the APC is responsible to verify receipt of their CBA card by following the instructions on the

card mailer. IBA holders must also set up a PIN for their card to be available for use. Until this action has taken

place, the card cannot be used. APCs can monitor who in their organization has confirmed receipt of their IBA

travel card by running the Accounts Listing of Chip Cards report in the Reporting tool in the Supplemental

Reports / Chip & Pin Reports folder. For CBAs the report is called the Chip & Pin Account Listing with Active Start

and End Dates.

8.2.2 Defense Travel System Profile Update

All travelers must ensure that their Travel System profile is updated in either DTS or MyTravel. Travelers are

responsible for their Defense Travel System and MyTravel Traveler profiles and APCs must coordinate with their

CBA Administrator for updating the CBA information so it’s available for use. APCs can provide their travelers

with the following link that provides directions on how to update their DTS traveler profile:

https://media.defense.gov/2022/Jul/18/2003036995/-1/-1/0/DTS_FRP.PDF

APCs need to compare GTCC information in travel systems to the Citi system. As most APCs do not have the

same access as a Defense travel system DTA, APCs should request information on their traveler’s profile status

on a monthly basis from their Defense travel system DTA. APCs should request the Defense travel system DTA to

run an Accounts Info List and compare the GTCC IBA information including the cardholder’s expiration date

listed in travel systems with the information in the Citi system and correct accordingly. The report is run in DTS

within the DTA Maintenance Tool by selecting the View Person List and the drop down titled Accounts List Info.

APCs will use the CBA Load Sheet to provide to their CBA DTAs any new CBA’s that should be loaded into DTS so

it’s available for use by the organization’s travelers or when there is a new expiration update that must be

completed. The CBA Load sheet is available for download on the DTMO website under Quick Links and

Resources at:

https://media.defense.gov/2022/Jun/29/2003027266/-1/-

1/0/CBA_ACCOUNT_LOAD_WORKSHEET.PDF

8.2.3 APC Wrap-up with Cardholder

APCs should reach out to their cardholders to close the loop and ensure they have completed all required

actions. This is also a good opportunity to ensure that cardholders know how to check their account online or

with the mobile app with their smartphone while they are away on travel. APCs can also use this opportunity to

ensure they have a copy of the cardholder’s Programs & Policies – Travel Card Program – Travel Card 101

[Mandatory] certificate, Statement of Understanding and answer any remaining questions with the cardholder

about their responsibility concerning the GTCC.

APC Guide May 2022

Defense Travel Management Office 23 defensetravel.dod.mil

Chapter 9. Account Maintenance

APCs will be required to perform maintenance on their cardholder’s accounts to ensure account information is

kept current as well as complete program administrative tasks for accounts within their hierarchy. Account

maintenance is completed in the CitiManager Manage Users Icon Card Accounts Module.

Corresponding Learning Center module recommendation:

• Document: DoD Travel: CitiManager – A/OPC End-to-End User Guide

9.1 Defense Travel System Reports

The following reports are recommended in the Defense travel system to support APCs in managing their GTCC

program. APCs can request these reports from their Defense travel system DTA:

Report Name Frequency APC Action

Unsubmitted Voucher Report Weekly

Identifies travelers that have not submitted their travel

voucher closing out payments that are due to the GTCC

People – Accounts Info List Monthly

Identifies travelers within the Defense travel system

organization. Report identifies cardholders with expired

card data or missing GTCC card data in their profile for

the APC’s action.

Organizations – View CBA List Quarterly

Identifies CBA data that is loaded in Defense travel

systems for travelers to use if they don’t have an IBA.

Report indicates CBAs that are expiring and that need to

be updated in Defense travel systems, as well as

organizations that have access to the CBA for ticketing.

9.2 Demographic Updates

The APC must ensure all cardholder information is kept up-to-date to guarantee effective program

management. The APC must maintain individual cardholder information such as primary mailing address, email

address and phone number. Not keeping this information current could result in a cardholders account to be

temporarily closed due to returned mail. The account will remain closed until the primary address is verified or

updated and the returned mail status is removed from the account. As the DoD and the charge card vendor

move more towards digital communications, email address, and mobile numbers also need to be kept current to

ensure receipt of Citi communications by the cardholder.

APC Guide May 2022

Defense Travel Management Office 24 defensetravel.dod.mil

9.3 Temporary Credit Limit Updates

The APC, CPMs and the DTMO have authority to raise individual credit limits on a temporary basis to meet

mission requirements. The chart below details the authority for each level CPM/APC in respect to raising

individual credit limits as of the date of this APC Guide and is subject to adjustment by Citi.

Standard account credit limit increases are limited to a temporary duration of no more than 12 months.

Restricted account credit limit increases are limited to a temporary duration of no more than 6 months. After

such time, the temporary limits will be reset back to the default limits.

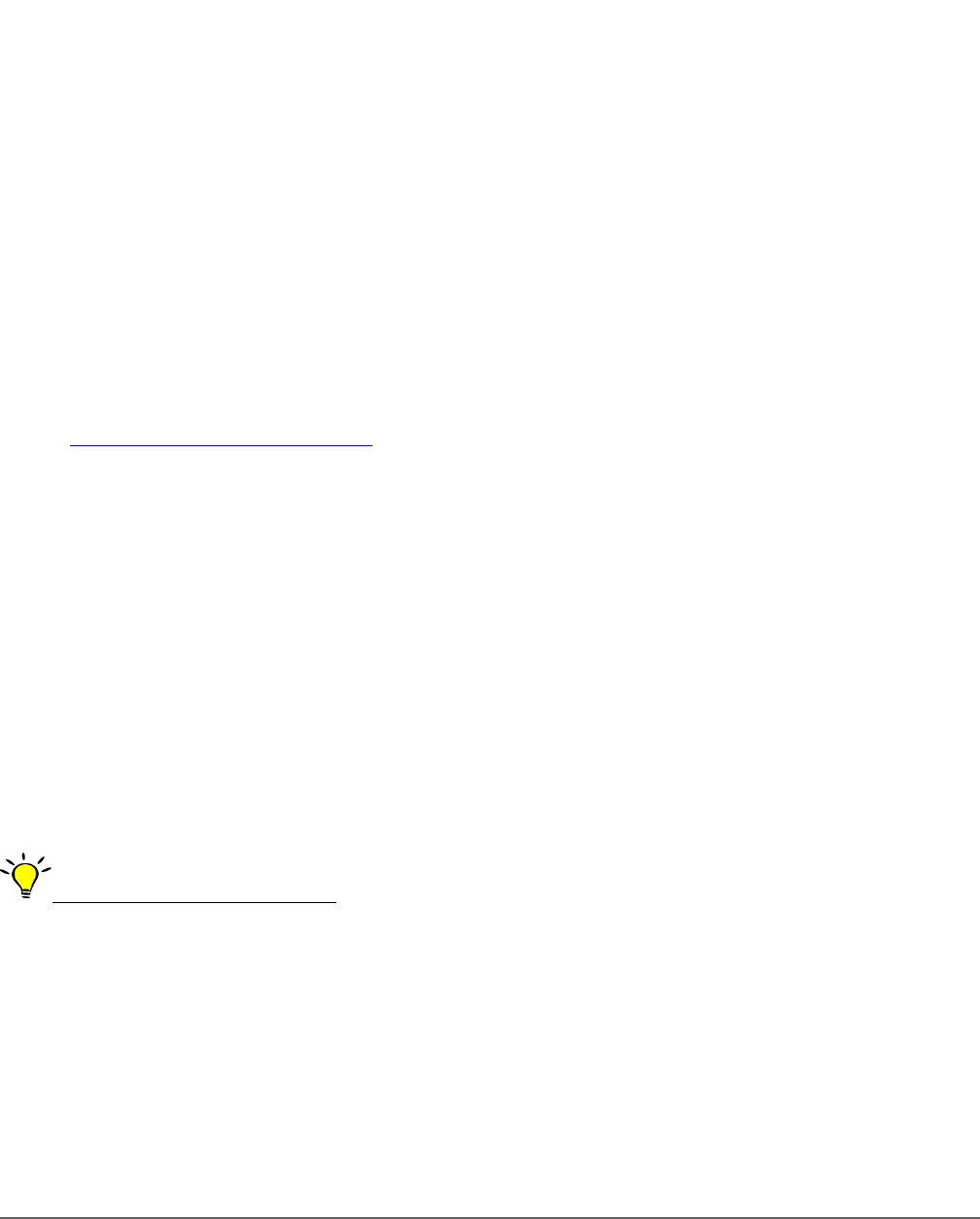

Department of Defense

Government Travel Card Credit Limits

Default

APC (HL4/5 — 8)

Approval Maximum

APC (HL3/4)

Approval Maximum

CPM (HL2/3)

Approval Maximum

DTMO (HL1)

Approval Maximum

Standard

Credit $7,500 $15,000 $25,000 $50,000 No Maximum

Travel $7,500 $15,000 $25,000 $50,000 No Maximum

Cash $250 $5,000 $10,000 $25,000 No Maximum

Retail $250 $500 $1,000 $2,000 No Maximum

Restricted

Credit $4,000 $15,000 $25,000 $50,000 No Maximum

Travel $4,000 $15,000 $25,000 $50,000 No Maximum

Cash $250 $5,000 $10,000 $25,000 No Maximum

Retail $100 $500 $1,000 $2,000 No Maximum

9.4 Opening and Closing at Risk Accounts

Per component or agency policy, certain accounts may require being placed in a closed – temporary block status

during indefinite periods of non-travel. The APC can also set specific dates for which the card is available for use,

as well as when it will become unavailable for use, based on travel dates for the cardholder. Additionally, the

APC may place accounts in a closed – misuse status during periods of non-travel in response to a known history

of card misuse or during suspected card misuse research. Managing accounts with the use of specific card active

start and end dates or setting the card status to open or closed is available through EAS.

APC Guide May 2022

Defense Travel Management Office 25 defensetravel.dod.mil

9.5 Mission Critical

Mission critical status is applied to an IBA when travel is being performed under competent orders and the

traveler is performing duties in a remote location that, through no fault of their own, may prohibit the traveler

from filing a voucher for their outstanding travel card charges. The purpose of applying mission critical status to

an IBA is to prevent the account from being suspended or cancelled due to delinquency, which would render the

account unusable. Only an APC or CPM can enroll accounts in mission critical status with supervisor justification;

cardholders may not enroll their own account.

Mission critical status should not be used as a means of avoiding delinquency for the cardholder due to

untimely processing of travel vouchers, but used only in situations that apply for mission critical status.

APCs may only enroll accounts into mission critical status prior to the account suspending (delinquent 60 days or

less), however, CPMs may request Citi customer support place accounts suspended for delinquency, in a MC

status. While in this status: (1) accounts will not suspend, cancel or charge off; (2) accounts will not report as

delinquent, no late fees will be charged; and (3) accounts will not begin aging until the status end date. Monthly

statements will continue to be sent to the cardholder’s address of record. Mission critical updates can be made

using the EAS.

9.5.1 PCS

For services that allow IBAs to be used by their cardholders, the account should be placed into a PCS status. This

status allows additional processing time of PCS vouchers and prevents delinquency and suspension of the

account prior to when they begin in-processing at their new duty station. Depending on component/agency

policy, this process may be accomplished through automated file transfer, manual file exchange with Citi or the

Bulk Maintenance process in CitiManager. Please review your component/agency specific policy for more

information on the PCS status process.

9.6 Hierarchy Transfers

APCs are responsible for ensuring that cardholders are located in the correct hierarchy level (HL). Accounts are

transferred between HL’s in the Transaction Management Module. APCs can ONLY “pull” accounts into their

hierarchy (by account numbers or social security number) and are unable to transfer (“push”) an account into a

hierarchy level that is not within their HL span of control. HL transfers can be made using the EAS.

9.7 Disputes /Transfers

Cardholders, as a best practice, should monitor and reconcile their monthly statements to validate charges

against their travel card. Discrepancies identified need to be reviewed, and, if necessary, a dispute should be

initiated through the charge card vendor for IBAs. For CBAs, review to verify if a transfer transaction form or a

dispute is necessary. If the transaction occurred in DOD a transfer form should be completed rather than a

dispute form to transfer the transactions to the appropriate Service, Agency, or hierarchy level.

A cardholder, or an APC on behalf of the cardholder, may choose to dispute transactions on his/her Statement

of Account for a variety of reasons.

APC Guide May 2022

Defense Travel Management Office 26 defensetravel.dod.mil

Disputes typically fall into the categories of:

• Questionable Charges

• Duplicate Billings

• Unauthorized Charges (i.e., charged an extra night for a hotel room)

• Incorrect Charges (i.e., airline charged $2000 instead of $200 for airline ticket)

For CBA transactions, it is very important that the CBA manager researches the transaction and identifies that it

is truly an unauthorized transaction and not just an error with an incorrect CBA that was billed. CBAs with

excessive disputes can be closed by the bank due to perceived suspicious activity. This will result in CBA

reconciliation issues. In those instances, a Transfer Transaction Form should be completed to move the

transaction from the erroneous CBA to the correct CBA.

The Transfer Transaction Form is available at:

https://www.citibank.com/tts/sa/federal-government-program-administrators-guides-and-forms/gsa.html

Disputes must be submitted to Citi within 60 days of the date of the invoice on which the charge(s) first

appeared. After 60 days, the right to dispute a charge is relinquished.

For all merchant issues, the cardholder should first make every attempt to resolve the issue directly with the

merchant. This approach has the greatest potential for quick and efficient resolution of the issue.

There are two ways that a cardholder or an APC can dispute a transaction(s): Online (the preferred method) or

Manual dispute. The manual dispute process requires the cardholder or APC to:

• Step 1: Contact the merchant directly (Most disputes are resolved by contacting the merchant directly)

• Step 2: If the merchant is unable to help, contact Citi to initiate the dispute process or submit the

dispute form directly to Citi

Contact Citi at 800-200-7056 (cardholder) or 1-866-670-6462 (APC)

Citi will research the transaction with the merchant and their acquirer on the cardholder’s behalf and issue a

provisional credit for the dispute amount until the dispute resolution is finalized.

Regardless that the APC initiated a dispute with Citi via phone, the cardholder or APC will still need to complete

and submit the dispute form, including additional required documentation.

The form can be accessed using the hyperlink:

https://www.citibank.com/tts/solutions/commercial-cards/assets/docs/govt/Dispute-Form.pdf

Note: The signature blocks on the dispute form accommodates digital signatures.

The cardholder must provide any requested additional information to Citi, or the dispute may be resolved in the

merchant’s favor. If the dispute is found in favor of the merchant, the provisional refund will be reversed and

the cardholder will see the re-billing of that transaction on their next monthly statement.

9.8 APC Termination of Accounts

When a cardholder leaves DoD, is terminated from employment, or no longer requires a GTCC, the APC must

close the account or notify Citi immediately. The APC or his/her designated representative should thereafter

retrieve and destroy the GTCC if the employee does not have the card at termination or instruct the employee

to destroy the card immediately. Citi does not require that the destroyed card be returned to Citi.

APC Guide May 2022

Defense Travel Management Office 27 defensetravel.dod.mil

9.9 Deceased Cardholder

Once notification has been provided that a cardholder is deceased, APCs have a responsibility to place the

account into a deceased status (Closed Deceased status via the EAS), which will close the account.

CPMs and APCS (HL1 – HL3) are the only authorized persons who may request an account be placed in a