© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Updated Principles for

Structured Securities RBC

Follow-up to Presentation to NAIC’s RBCIRE

December 2, 2023

Steve Smith, MAAA, FSA, CFA

Chairperson, Academy C-1 Subcommittee

1

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Executive Summary: C-1 Asset Modeling

The American Academy of Actuaries proposes a flowchart to

determine whether

An asset class needs to be modeled, and

Securities within an asset class need to be modeled individually

to determine C-1 factors.

Simpler solutions are preferred—if an existing factor can be used, it

should be used.

Individual security modeling for C-1 determination is a last resort.

2

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Executive Summary: Principles-Based Approach for

Structured Securities

If the result of the flowchart is that an asset class requires modeling, we would

support a principles-based approach to the derivation of C-1 factors

A principles-based approach to RBC for structured securities (referred to

as “ABS” throughout this presentation) allows flexibility when adapting to

new structures as they emerge in the marketplace

3

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Discussion Topics

I. C-1 Modeling Flowchart

II. Structured Securities C-1 Principles

III. Appendices

a) Appendix A—RBC Arbitrage

b) Appendix B—Definitions of Terms

4

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

C-1 Modeling Flowchart

5

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Threshold Questions

For an asset class to be considered using this flowchart, it should

first be verified as having all of the following attributes:

1. Materiality or likely materiality in the future across the industry.

Allocations from a small handful of companies would not justify

changes to the RBC formula.

2. The risk that would be modeled needs to be incorporated in C-1. For

example, illiquidity alone would not be a sufficient justification

because

C-1 does not measure illiquidity risk.

3. The expected benefits of a more precise calculation should outweigh

the expected costs of building and using a new model. Costs include

both time and energy spent to build the model as well as the

negative effect of added complexity within the RBC formula.

The burden to verify these attributes falls on the party asking for

a more exact determination of RBC.

6

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

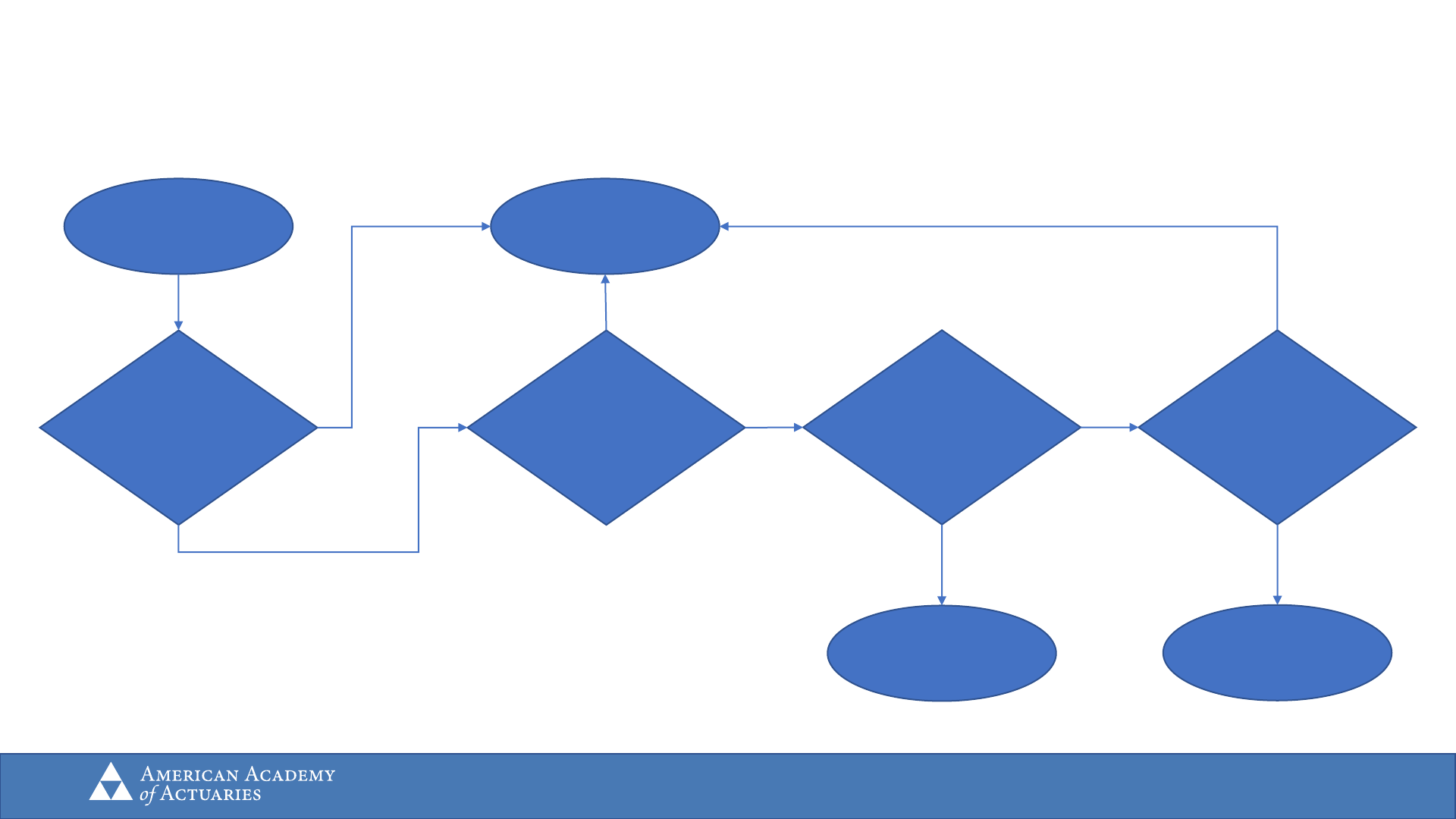

Considering

C-1 for an

asset class

Similar risk

vs. existing

C-1 asset

models?

Sufficient

data?

C-1 Modeling Flowchart

Comparable

attributes?

Practical to

model

individually?

Use existing

C-1 factors

Create new

C-1 factors

Model assets

individually

No

Yes

Yes

Yes

Yes No

No

No

7

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Decision—similar risk vs.

existing C-1 asset models

Answer “yes” if the relative risk differences between risk categories

(usually ratings or designations for fixed income) is similar to that of

an existing set of C-1 factors.

For example, municipal bonds and bank loans would each likely have an

answer of “yes,” because relative increase in risk as ratings decrease is

similar to that of corporate bonds.

CLOs and some other structured securities would likely have an

answer of “no,” because tail risk increases more quickly as the rating

decreases compared to corporate bonds.

8

CLO = collateralized loan obligation.

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Decision—sufficient data

Answer “yes” if data exist to enable risk modeling, and in

particular tail risk modeling.

For example, CLOs would likely have an answer of “yes,” because their

bank loan collateral has ample historical loss data and the waterfall

structure is well documented.

Some esoteric ABS, especially residual tranches, may have an

answer of “no” if insufficient data are available.

9

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Decision—comparable attributes

Answer “yes” if most individual assets within this asset class have

an easily identifiable attribute that can be used to sort the assets

into risk buckets.

For example, CLOs would likely have an answer of “yes,” because most

CLOs are rated by CRPs and those ratings can reasonably sort each

individual CLO security into a risk bucket.

Asset classes that are typically not rated by CRPs may have an

answer of “no” here, but don’t automatically. For example,

commercial mortgage loans are also a likely “yes” because DSCR

and LTV substitute for CRP ratings as comparable attributes.

10

CRP = credit rating provider. DSCR = debt service coverage ratio. LTV = loan-to-value.

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Decision—practical to model individually

Answer “yes” if individual assets within the asset class have several

attributes that differentiate individual assets and can be used for risk

modeling or if existing modeling software can be used.

For example, CLOs would likely have an answer of “yes” because off-the-shelf

software exists that can model individual CLOs (however, CLOs may never have

arrived at this decision point if they were deemed to have comparable

attributes).

If modeling cannot reasonably be done in a timely and cost-effective

manner for RBC filing, then the answer here must be “no.”

Some esoteric ABS may have an answer of “no” if the relevant risk is so

specific to each deal that a common modeling framework does not

apply across a reasonably large share of securities.

11

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Outcome—use existing C-1 factors

This outcome can either mean to use existing C-1 factors directly,

without adjustment, or it can mean to make slight adjustments to

existing C-1 factors.

For example, municipal bonds and bank loans currently use corporate

bond C-1 factors without adjustment.

Schedule BA real estate currently uses Schedule A real estate

C-1 factors, but with an upward adjustment resulting in a

proportionately higher C-1 factor for BA real estate.

12

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Outcome—create new C-1 factors

This outcome means that a new set of C-1 factors should be

developed for this asset class.

For example, CLOs may retain the 20 possible designations that they

are currently mapped into. But instead of those 20 designations

corresponding to the 20 corporate bond C-1 factors, CLOs may instead

have their own set of 20 C-1 factors.

Instead of just a slight adjustment to existing C-1 factors, this

outcome requires fundamental modeling work to derive new

factors.

13

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Outcome—model asset individually

This outcome means that each asset within this asset class needs to be

modeled individually in order to generate a C-1 factor.

In practice, this is currently how non-agency RMBS and CMBS are

treated. The modeling work is done by the Structured Securities Group

to determine the NAIC designation, after which point corporate bond

factors are used. This is functionally similar to modeling each RMBS

and CMBS security individually to determine its C-1 factor.

Because of the significant operational complexity involved, this

outcome is a last resort.

14

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Structured Securities C-1 Principles

15

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Glossary of Terms

ABS: bonds falling within the emerging definition of ABS in SSAP 26, most recently

exposed November 16, 2022

Vertical Slice: an investment in all tranches of an ABS in equal proportion to the

total outstanding

RBC-transformative ABS

1

: ABS where a vertical slice draws a lower aggregate C-1

requirement, considering only base factors (before portfolio adjustment and

covariance adjustment), than its underlying collateral would draw if held directly by

a life insurer

RBC Arbitrage (narrower): holding a vertical slice of an RBC-transformative ABS

RBC Arbitrage (broad): holding any part of an RBC-transformative ABS

16

1. Conversely, one could then define RBC-neutral ABS as ABS where a vertical slice draws aggregate C1 equal to that which would be drawn by its underlying collateral.

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Principle #1.

The RBC Formula Is a Blunt Filtering Tool

The purpose of RBC is to help regulators identify potentially weakly

capitalized insurers, therefore changes that have a small impact on RBC

ratios may not justify a change to the RBC formula

The frequency of changes to the RBC formula is practically limited by

NAIC processes and stakeholders’ available time, therefore it is

important to prioritize the most material potential changes to the RBC

formula.

Small allocations to RBC-transformative ABS by a limited number of

insurers may not require a change in C-1 requirements across the

entire industry.

17

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Principle #2.

Emerging Risks Require Regulatory Scrutiny

Emerging investment risks create concerns for regulators, and existing regulatory tools can be

considered alongside RBC for addressing these newer risks—but RBC needs to be considered when

there are material solvency issues.

RBC should address solvency issues, but not every risk will create a material solvency concern.

Modifications to RBC may be necessary, but complementary regulatory tools should also be considered (e.g.,

ORSA, AAT/AG53, disclosures, examinations, etc.).

RBC-transformative ABS that are held by a small but growing number of insurers or with increased allocation

may justify changes to the RBC formula.

More responsive refinements to RBC may be justified in areas where an insurer can more easily adjust its

business model to optimize around the RBC formula.

Refinements that are made should generally be principle-driven and agnostic to specific market conditions.

Temporary relief may be warranted on occasion, even though it has the effect of contributing anti-cyclicality into

RBC.

18

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Principle #3.

RBC Is Based on Statutory Accounting

C-1 requirements should generally reflect the impact of risk on

statutory surplus. Changes in accounting treatment will affect RBC.

All else equal, assets that are marked to market (“MTM”) may have

higher C-1 requirements because C-1 on MTM assets incorporates

price fluctuations in addition to credit losses.

In practice, this means that C-1 for residual tranches would consider

price fluctuations, whereas C-1 for unimpaired rated debt tranches

only considers credit losses.

Impaired rated debt tranches are part of a broader issue that applies

beyond just structured securities and are therefore outside the scope

of this candidate-principle.

19

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Principle #4.

C-1 Aligns With Risk

C-1 requirements for a given tranche should align with that tranche’s risk, to the extent

practical.

If an ABS has a type of collateral that is not typically rated, the unrated status may not directly

factor into the appropriate way to determine the ABS’ appropriate C-1 requirement if similar

information is captured in the ABS debt tranches’ ratings

For example, if a CRP has assigned a rating to an ABS debt tranche that incorporates a granular

assessment of the underlying collateral, the lack of rating on the collateral per se is not necessarily

indicative of the level of risk

The existence of unrated collateral does not automatically imply that an ABS should have a higher C-

1 requirement.

The existence of unrated collateral also does not automatically imply that an ABS should not have a

higher C-1 requirement.

20

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Principle #5.

C-1 Requirements Reflect Likely Future Trading Activity

C-1 requirements on ABS should treat the collateral as a dynamic pool of assets,

incorporating future trading activities that are reasonable and vary appropriately by

economic scenario.

C-1 requirements should not be reduced by any amount due to an assumption of credit alpha.

This candidate-principle refers to the trading activity that is subject to or mandated by the structure’s legal

documents.

If C-1 requirements on ABS acknowledge the evolving nature of the collateral pool, the total C-1 of the

structure may not equal the C-1 of a snapshot of the collateral pool at any one point in time. A reasonable

relationship should exist between the C-1 requirements of the collateral pool and the ABS.

If designations are based on CRP ratings, then explicit recognition of trading activity may not be required

to the extent CRP ratings account for this.

21

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Principle #6.

Appropriate Risk Measures

Each C-1 factor is based on the asset class’s risk profile. However, the risk profile for

ABS differs from the risk profile for bonds. Therefore, C-1 requirements for ABS

should be calibrated to different risk measures where appropriate.

In our December 2022 report to RBCIRE WG, the Academy recommended adopting a different risk

measure for CLOs—Conditional Tail Expectation (“CTE”)—because CTE may better capture tail risk

inherent in CLOs.

While different risk measures may be appropriate, each asset’s C-1 factor aims for a similar

magnitude or level of risk.

This candidate-principle implies that not all ABS structures are necessarily RBC-neutral, because the

collateral and the ABS would have C-1 requirements set to different statistical safety levels. A

reasonable relationship should exist between the C-1 requirements of the collateral pool and the

ABS.

22

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Summary of Principles

1. The purpose of RBC is to help regulators identify potentially weakly capitalized insurers,

therefore changes that have a small impact on RBC ratios may not justify a change to

the RBC formula.

2. Emerging risks require regulatory scrutiny.

3. C-1 requirements reflect the impact of risk on statutory surplus. Changes in accounting

treatment will affect RBC.

4. C-1 requirements on a given tranche align with that tranche’s risk.

5. C-1 requirements on ABS should treat the collateral as a dynamic pool of assets.

6. C-1 requirements for ABS should be calibrated to different risk measures where

appropriate.

23

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Appendix A: RBC Arbitrage

24

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Impact of Principles on Definition of RBC Arbitrage

By discussing broader principles, this presentation seeks to spark conversation on the

definition of Risk-Based Capital (RBC) arbitrage in Asset Backed Securities (ABS) and

clarify the implications of conflicting RBC arbitrage definitions.

The NAIC’s Investment Analysis Office (IAO) has proposed a constraint in the model used

to determine designations, and therefore RBC requirements, for CLOs. This constraint

would eliminate RBC arbitrage, as defined by the IAO, that the IAO believes is present in

CLOs.

Competing definitions among interested parties and regulators have been used in some

formal and informal discussions, so far without a forum for being discussed directly.

This presentation attributes differences in RBC arbitrage definitions to underlying

principles of RBC. The Academy is requesting guidance from regulators on which

principles should be followed. Once the principles have been identified, RBC arbitrage

can be more clearly defined and more effectively mitigated. These principles will also

guide a broader effort around improving the C-1 framework for all ABS.

25

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Asset Classes With Greatest Potential

for RBC Arbitrage

Quantifying RBC arbitrage

is most direct when the

underlying collateral has an

explicit C-1 factor

Tranched structures are

more likely to produce RBC

arbitrage than pass-through

structures because

tranching transforms risk

RBC arbitrage discussions

should focus on tranched

structures with established

asset-class-specific C-1

CLO

Non-Agency RMBS/CMO

CMBS

CFO

Consumer Finance

Asset-based Lending

Credit feeder fund

Agency RMBS

Established

asset-class-

specific C-1

No established

asset-class-

specific C-1

Tranched Pass-Through

26

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Definitions of RBC Arbitrage

IAO has expressed its view that holding any tranche of a securitization

whose vertical slice carries a different aggregate C-1 requirement

compared to the underlying collateral constitutes RBC arbitrage—we term

this the broad

1

definition of RBC arbitrage

An alternative, narrower

1

definition of RBC arbitrage includes only

instances where an insurer holds a vertical slice

1

Many other possible definitions lie somewhere in between

1. Please see Appendix BDefinitions of Terms for precise definitions of technical terms.

27

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

IAO Usage of the Term “RBC Arbitrage”

A letter from IAO to VOSTF dated May 25, 2022, introduces the concept of

RBC arbitrage within the context of CLOs: “The aggregate RBC factor for

owning all of the CLO tranches should be the same as that required for

owning all of the underlying loan collateral. If it is less, it means there is

RBC arbitrage.”

SVO’s Structured Equity & Funds Proposal dated November 28, 2022, also

uses the term “RBC arbitrage” with effectively the same meaning but

expanding the scope from CLOs to include certain feeder fund structures.

28

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Academy Usage of “RBC Arbitrage”

In our presentation to RBCIRE WG dated December 14, 2022, the Academy

disagreed with the concept that the existence of RBC arbitrage, as defined

by IAO, necessarily implied an incorrect C-1 requirement

The Academy believes dialogue among all parties will be improved if we

first collectively agree on a definition of RBC arbitrage before discussing

its implications for C-1 requirements

29

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Related Regulatory Concerns

IAO has also pointed out the possibility of RBC-transformative ABS being

used to reclassify investments to technically comply with investment limits

set forth in state insurance law, for example converting equity to debt for

statutory purposes

RBC-transformative ABS may also be used to reclassify investment returns

or losses from an accounting perspective

While we acknowledge these related potential issues, this presentation

focuses only on C-1 implications of RBC-transformative ABS

30

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Appendix B: Definitions of Terms

31

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

ABS Definition

RBC arbitrage discussions typically involve structured securities, for

example CLOs and rated note feeder fund structures.

Within this presentation, we refer to all such structured securities as ABS,

and we intend for the definition of ABS to align with the emerging

definition of ABS in SSAP 26, most recently exposed November 16, 2022.

Under this definition, ABS has a primary purpose of raising debt capital

backed by collateral that provides the cash flows to service the debt.

32

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

ABS Definition, Continued

Exposed principles-based

definition of ABS is

illustrated here

Image taken from “Assets:

Regulatory Updates in Life

Insurance” April 4, 2023,

webinar by the American

Academy of Actuaries

33

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Vertical Slice Definition

A vertical slice is an investment in all tranches of an ABS in equal proportion

to the total outstanding. A vertical slice is economically equivalent to a direct

investment in the underlying collateral at any one point in time.

34

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

RBC-Transformative ABS Definition

An RBC-transformative ABS is any ABS where a vertical slice draws a lower

aggregate C-1 requirement than its underlying collateral would draw if held

directly by a life insurer.

35

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Narrowly Defined RBC Arbitrage

Holding a vertical slice of an RBC-transformative ABS constitutes RBC

arbitrage under the narrow definition.

In this case, it is unambiguously true that absent the structure of the ABS, a

life insurer would be required to hold a higher level of C-1 capital.

Even under the narrow definition of RBC arbitrage, C-1 requirements for the

collateral may be inappropriately high rather than the ABS C-1 requirements

being inappropriately low. Also, C-1 for the ABS and its collateral may be

calibrated precisely to the prescribed risk measures despite the ABS being

RBC-transformative. Regardless, in such cases holding a vertical slice of an

RBC-transformative ABS would still constitute RBC arbitrage.

36

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

Broadly Defined RBC Arbitrage

Holding any part of an RBC-transformative ABS constitutes RBC arbitrage

under the broad definition.

For example, any CLO holdings would constitute RBC arbitrage under this

definition, because CLOs are an RBC-transformative ABS (as discussed in the

Academy’s December 2022 presentation to RBCIRE WG).

IAO letters written to VOSTF during 2022 employ the broad definition of RBC

arbitrage.

37

© 2023 American Academy of Actuaries. All rights reserved.

May not be reproduced without express permission.

QUESTIONS

Contact:

Amanda Barry-Moilanen, Life Policy Analyst

barrymoilanen@actuary.org

38