2023

PERSONAL PROPERTY TAX FORMS

AND

INSTRUCTIONS

FOR

COMMUNICATIONS SERVICE PROVIDERS

AND

MULTICHANNEL VIDEO PROGRAMMING SERVICE

PROVIDERS

*****************************************************

This packet contains forms and instructions for filing your current year personal property tax forms for

communications service providers and multichannel video programming service providers. This return does not

apply to commercial radio and television broadcast companies.

Please:

• File with the Department of Revenue by May 15. If May 15 falls on a weekend, the return is due the rst

business day following May 15. All returns postmarked after May 15, will be assessed for the tax plus

applicable penalties and interest by the Department of Revenue.

• There is no ling extension provision for personal property tax returns.

• Enter your Social Security or Federal Employer Identication Number on all returns, schedules,

attachments and correspondence.

• Sign all returns and list appropriate telephone numbers.

• DO NOT FILE property tax returns with the income tax return.

• DO NOT SEND PAYMENT WITH THE RETURN.

• Taxpayers may submit their completed tax return to the following e-mail address:

Telecom61A500@ky.gov

(E-MAIL FOR 61A500 ONLY)

Should you have any questions regarding this property tax return, please do not hesitate to contact the Department

of Revenue, Division of State Valuation at (502) 564-8175. Go to revenue.ky.gov to download forms.

61A500(P)(1-23)

Reminders for Tax Year 2023

Eective with the 1/1/2019 assessment date the conversion factors computed for Communication Service Providers and

Multichannel Video Programming Service Providers used to estimate the fair cash value of the tangible personal property is

utilizing the Producer Price Index.

Schedule A-1 is for the wireless industry

The following services are covered: Cellular and other wireless carriers Paging

Schedule A-2 is for the wireline industry

The primary output of this industry is the transmission of voice, data, text, sound, and video, using a wired telecommunications

network, to residential and business (including government) customers. Services can be provided individually or bundled

in packages of two or more services. The mode of service delivery varies by type of establishment, as voice, data, and

programming services may be transmitted via cable or telephone networks.

The services for which indexes are available include:

• Local telephone service

• Public switched toll service (long distance)

• Private line service

• All-distance telephone service

• Video programming subscriber services

• Video programming advertising services

• Internet access services

• Bundled access services

• Cable and other program distribution

• Internet service providers

• Other wired telecommunications services

Eective for 1/1/2019, the salvage value is now 10%.

REFUNDS

Pursuant to KRS 134.590(6), a taxpayer seeking a refund of taxes paid to a local taxing entity (such as a board of education)

must le a refund request with that taxing entity within two years of payment of the taxes, unless the taxpayer has instituted

litigation against the local taxing entity. Each claim or application for a refund shall be in writing and state the specic

grounds upon which it is based.

See also OAG 83-202 (“KRS 134.590…requires that refund requests be led with the Department of Revenue and any other

taxing district that has received these taxes (city, county, school district, etc.) within two years from the date payment was

made.”)

For questions call Public Service Branch at 502-564-8175.

INSTRUCTIONS

PERSONAL PROPERTY TAX RETURN

(REVENUE FORMS 61A500)

Denitions and General Instructions

This tax return includes instructions to assist taxpayers in

preparing Revenue Form 61A500. These instructions do not

supersede the Kentucky Constitution or applicable Kentucky

Revised Statutes.

Taxpayer—All individuals and business entities who are

communications service providers or multichannel video

programming service providers and who own, lease or have

a benecial interest in taxable tangible property located within

Kentucky on January 1 must le the personal property tax

form for communications service providers and multichannel

video programming service providers (Revenue Form 61A500).

This return and instructions do not apply to real property,

registered motor vehicles, apportioned vehicles,

commercial watercraft companies, distilled spirits held in

bonded warehouses and public service companies taxed

under the provisions of KRS 136.120.

Assessment Date—The assessment date for all tangible

personal property is January 1.

Situs of Tangible Property—The taxable situs of tangible

personal property in Kentucky is in the jurisdiction where the

property is physically located on January 1. See the enclosed

listing of taxing jurisdiction in Kentucky.

Filing Requirements—To properly report, note the following:

• File a single 61A500 tangible property tax return for all

property which is located within Kentucky.

• The return and all supporting schedules must be

included when ling the tax return, if not included the return

will not be accepted as timely led.

• File the return between January 1 and May 15.

• Complete all schedules when ling this return, failure to

properly complete this form and schedules will result in

the return being considered late and subject to penalties.

If May 15 falls on a weekend, the return is due the rst

business day following May 15.

• Do not enclose this return with the income tax return.

• File the return with the State Valuation Branch.

• There is no ling extension for this return.

Payment of Taxes and Refunds—Do not send payments

with your return. The local taxing authorities in each county

will mail the local tax bills and the state bill is billed directly by

the Department of Revenue.

Refunds—Pursuant to KRS 134.590(6), a taxpayer seeking

a refund of taxes paid to a local taxing entity (such as a board

of education) must le a refund request with that taxing entity

within two years of payment of the taxes, unless the taxpayer

has instituted litigation against the local taxing entity. Each

claim or application for a refund shall be in writing and state

the specic grounds upon which it is based. See also OAG

83-202 (“KRS 134.590…requires that refund requests be led

with the Department of Revenue and any other taxing district

that has received these taxes (city, county, school district, etc.)

within two years from the date payment was made.”)

Lessors and Lessees of Tangible Personal Property—

Leased property must be listed by the owner on Revenue Form

62A500, regardless of the lease agreement’s terms regarding

tax liability. Classify leased assets based upon their economic

life. Leases which transfer all of the benets and risks inherent

in the ownership of the property such as a capital lease should

be reported by the lessee. A rental agreement which may be

for any term and may be cancelable or non-cancelable for a

xed period of time and there is no transfer of ownership such

as an operating lease should be reported by the lessor. The

tax return must contain the name of the lessee and location

of the property. A separate return is required for each

property location within Kentucky. The lessee must le

Revenue Form 62A500-L.

Property leased to Communications Service Providers and

Multi-Channel Video Programming Service Providers under

an operating lease must be reported on Form 62A500 by the

lessor.

Depreciable Assets—List depreciable assets on the

appropriate schedule(s) at original cost. Apply appropriate

factor(s) to obtain reported value. Do not use book depreciation

for computing the fair cash value of depreciable assets.

Inventories—List inventories at fair cash value using full

absorption rst-in-rst-out (FIFO) costing. Such costs include

freight, labor, taxes and duties. LIFO deductions are not

allowable. Goods held for lease or rent may be considered

merchants inventory. See line 31 instructions for details.

Foreign Trade Zones—Tangible property located within an

activated foreign trade zone, as designated under Title 19

U.S.C. Sec. 81, is subject to a state rate only but must be

included in the appropriate schedule or line of the return.

Complete Schedule J for property located in an activated

foreign trade zone. Attach a copy of the foreign trade zone

activation certicate or letter.

Rebuilds or Capitalized Repairs—Cost gures for rebuilt

equipment must be segregated according to “original” and

“rebuild” costs and listed under two economic life classes on

the tangible personal property tax return. The original cost of all

assets is included in the year of acquisition in the appropriate

class life. Any rebuild(s) capitalized for book or tax purposes are

to be entered in the appropriate class life for the expected life

of the rebuild. If a second rebuild occurs, the second rebuild is

again included in age 1 of the appropriate class for the expected

life of that rebuild. The rst rebuild is then deleted from the

original cost column and dropped from the valuation process.

1

Exceptions to the Fair Cash Value Computation

Taxable property inoperable and held for disposal as of

the assessment date may be valued separately. List this

property on Schedule C and include an adavit explaining

the circumstances and the basis for valuation. Such property

is valued as follows:

• if component parts have been removed and the remainder

is useless to the business, report the actual scrap or

salvage value; or

• if a visual inspection conrms that useful life has not ended,

the true value is the greater of its depreciated book value

or the actual salvage value; or

• property sold on or before the due date of the return

through a proven arm’s length transaction is reported at

the selling price.

Temporary idleness is not sufficient cause for separate

valuation. This includes idleness attributed to seasonal

operation or from repair or overhaul of equipment.

Listing and Valuing Tangible Personal Property

List depreciable property on Form 61A500, Schedule A-1

Wireless or A-2 Wireline, based on its economic life. To assist

taxpayers in determining proper economic life classication a

partial listing of North American Industry Classication system

(NAICS) codes is included. Property descriptions frequently

used in these specic industries are listed under each code.

Most businesses have property falling into more than one

economic life classication.

An asset listing of each item of property must be available

to the Department of Revenue upon request. The asset

listing must include original cost, acquisition date, make, model,

serial number and/or other identication numbers, and physical

location (street address, jurisdiction, county, listed on Schedule

A, and line number on Form 61A500).

Fair Cash Value Computation

The fair cash value computation begins with cost. Cost must

include inbound freight, mill-wrighting, overhead, investment

tax credits, assembly and installation labor, material and

expenses, and sales and use taxes. Premium pay and payroll

taxes are included in labor costs. Costs are not reduced by

trade-in allowances. Capitalize costs of major overhauls in the

year in which they occur.

Cost should be net of additions, disposals and transfers

occurring during the year. Multiply aggregate cost by the

applicable conversion factor to determine reported value.

The column totals represent the total original cost and total

reported value of each class of property. Original cost totals

must generally reconcile with the book cost. NOTE: Property

written o the records, but still physically on hand, must be

included in the computation.

Alternative Reporting Requirement

If a taxpayer believes the composite factors in the return have

overvalued or undervalued the property, the taxpayer may

petition the Department of Revenue to accept an alternative

reporting method. Check the box on Form 61A500, page 1, if

an alternative method of valuation is submitted. The taxpayer

must le the completed return and schedules based on

the Department of Revenue’s methodology as well the

adavit of the alternative valuation with the Division of State

Valuation. The adavit must include a proposed alternate

valuation method, justication of the method chosen, any

evidence that supports the proposed method, and all the

forms and schedules of the 61A500 with the “reported value”

being changed to the term “taxpayers valuation.” Accepting

the alternative valuation method as filed in order to

expedite the processing of the return does not aect the

department’s right to audit the return and the method used.

GENERAL INFORMATION

Revenue Form 61A500

For valuation information or assistance in ling this return,

contact the Division of State Valuation at (502) 564-8175. Go to

revenue.ky.gov to download forms.

General Information—Provide the following information:

• Social Security number or Federal Employer Identication

Number;

• NAICS code that most closely identies your business

activity;

• type of business activity;

• alternative valuation (check appropriate box);

• name and address of business;

• organization type (check appropriate box);

• taxpayer signature, email, and telephone number and

the preparer’s (other than taxpayer) name and contact

information at the bottom of Form 61A500, Schedule C.

Failure to properly complete the general information

section may result in omitted property notices, subject to

penalties and interest.

Instructions for Lines 11–16 and 21–26 (Depreciable Assets)

Schedule A property includes, but is not limited to:

• business furniture and xtures;

• professional trade tools and equipment;

• signs and billboards;

• drilling, mining and construction equipment;

• mini- and mainframe computers;

• telecommunications equipment; and

• poles and wires

Schedules A list six economic life classes. Property is classied

by the expected economic life, not the depreciable life used

for accelerated income tax purposes.

2

The age of property, whether purchased new or used, is

determined as follows: property purchased in the year prior

to the assessment date is age 1; purchases made 2 years

prior are age 2; etc. Assets listed into Classes I, II and III,

whose ages exceed the maximum age for each class (13

years), should be aggregated on “Age 13+” of the original

cost column. Assets listed into Classes IV and V whose ages

exceed the maximum age for each class (27 years) should be

aggregated on “Age 27+” of the original cost column. As long

as an asset is in use, it is valued using the appropriate factor

as determined by its class and age. Multiply the original cost

by the conversion factor to arrive at the reported value. Add

original costs for each class to determine the total original cost

by class. Add reported values for each class to determine the

total reported value by class. The column totals for original

cost and reported value for each class of property are listed in

the space provided for Schedule A property on Form 61A500,

page 1. The grand total of original cost and reported value for

all classes of property are summarized on lines 17 and 27.

Line-by-Line Instructions

The following describes the various property categories. Report

these values on Form 61A500, page 1.

31 Merchants Inventory—Merchants inventory represents

goods held for sale or machinery and equipment that originated

under a oor plan nancing agreement. It may include retail

goods, wholesale goods, consigned goods and goods held by

a distributor. Attach a separate schedule for machinery and

equipment reported as inventory.

35 Goods Stored in Warehouse/Distribution Center—Report

personal property placed in a warehouse or distribution center

for shipment to a Kentucky destination or held longer than six

months on line 35.

36 Goods Stored in Warehouse/Distribution Center—in

Transit—Personal property placed in a warehouse or

distribution center for purposes of further shipment to an out-

of-state destination shall be reported on line 36. The owner of

the property must demonstrate that the personal property will

be shipped out of state within the next six months. Property

shipped to in-state destinations or held longer than six months

is reported on line 35.

60 Other Tangible Personal Property—List the totals from

Schedule C on Form 61A500, line 60.

Schedule C property includes:

• documented watercraft;

• aircraft for hire;

• materials, supplies and spare parts;

• investment properties such as coin, stamp, art or other

collections;

• research libraries; and

• precious metals.

List aircraft for hire on the appropriate line on Schedule C at

fair market value.

Materials, supplies and spare parts, normally expensed, must

be segregated and valued separately. Any supplies included

in inventory should be removed from the inventory value and

reported on Schedule C. In all cases, list such property at

original cost.

Supply items are valued at original cost in the amount on hand

at year-end. Returnable containers, such as barrels, bottles,

carboys, coops, cylinders, drums, reels, etc., are valued

separately at original cost.

List the fair market value of all coin collections, stamp

collections, art works, other collectibles and research libraries.

List the number of ounces of all gold, silver, platinum and other

precious metals. If the market value of a precious metal is

known, list the value per ounce as of the preceding December

31 in the Value Per Ounce column. Multiply the number of

ounces by the value per ounce to determine the total fair

market value.

82 Construction Work in Progress (Other Tangible Property)—

During the construction period, list all tangible property that

“does not” become real estate. NOTE: Tangible property

includes contractor’s building components.

Schedule H: Report of Total Personal Tangible Property

in Kentucky

This form is a summary of the personal tangible property the

company has in Kentucky as of January 1. Indicate the original

cost, book depreciation, net book value, and reported value for

the listed categories of tangible personal property.

Schedule I: Summary of Gross Tangible Personal Property

by Taxing Jurisdiction

This form must contain a summary by the amount of the gross

book value of the tangible personal property located in this

state for each county, city, and special taxing jurisdiction. It

must reconcile with Schedule H totals by classication.

(1) Taxpayers must le Revenue Form 61A500(I) which must

contain gross book value of the tangible personal property

in each county and for every taxing jurisdiction within that

county. A list of taxing jurisdictions is available from the

Department of Revenue’s Web site at revenue.ky.gov and

from the Oce of Property Valuation, Division of State

Valuation.

(2) Example: a company has a total of $200 in gross book

value on Schedule A, line 17. That property is located in

two counties: $125 in Jeerson county, the whole $125 is

in the Jeerson Common School, and in the Urban Service

District. The remaining $75 is in Franklin County with $25 in

the Franklin Common School and the remaining $50 in the

Frankfort Independent School and in the City of Frankfort.

You should ll in the Schedule I like this:

3

Original Cost

Name of Taxing District Schedule A

(Line 17)

Franklin 37 $75 (=a+b)=c

Frankfort Independent School $50 a

Franklin Common School $25 b

Frankfort $50

Jeerson 56 $125 (=d+e)=f

Anchorage Independent School $0 d

Jeerson Common School $125 e

Urban Service District $125

Total county $200 (=c+f)

Total of all school districts $200 (=a+b+d+e)

Schedule J: Summary of Reported Tangible Personal

Property by Taxing Jurisdiction

This form must contain a summary by the amount of reported

value of the tangible personal property located in this state

for each county, city and special taxing jurisdiction. It must

reconcile with Schedule H totals by classication.

(3) Taxpayers must le Revenue Form 61A500(J) which must

contain reported value of the tangible personal property

in each county and for every taxing jurisdiction within that

county. A list of taxing jurisdictions is available from the

Department of Revenue’s Web site at revenue.ky.gov and

from the Oce of Property Valuation, Division of State

Valuation.

(4) Example: a company has a total of $200 in reported value

on Schedule A, line 17. That property is located in two

counties: $125 in Jeerson County, the whole $125 is in

the Jeerson Common School, and in the Urban Service

District. The remaining $75 is in Franklin County with $25

in the Franklin Common School and the remaining $50

in the Frankfort Independent School and in the City of

Frankfort. You should ll in the Schedule J like this:

Reported Value

Name of Taxing District Schedule A

(Line 17)

Franklin 37 $75 (=a+b)=c

Frankfort Independent School $50 a

Franklin Common School $25 b

Frankfort $50

Jeerson 56 $125 (=d+e)=f

Anchorage Independent School $0 d

Jeerson Common School $125 e

Urban Service District $125

Total county $200 (=c+f)

Total of all school districts $200 (=a+b+d+e)

Schedule K: Tangible Personal Property Listing by Taxing

Jurisdiction

This schedule must contain an inventory of the amount and

kind of tangible personal property owned and located in this

state for each county, city, and special taxing jurisdiction.

For large telecommunication companies, the Division of State

Valuation prefers that the schedule be completed and submitted

in an Excel spreadsheet.

(1) Taxpayer must le a Revenue Form 61A500(K) for each

taxing jurisdiction within each county and one for the

total county. A list of possible taxing jurisdictions is listed

on Schedule J or available from the Oce of Property

Valuation, Division of State Valuation.

(2) In Column (A), “Year of Acquisition,” report the year in

which the tangible personal property was acquired.

(3) In Column (B), “Description of Property,” report all tangible

personal property owned. This listing must be specic and

detailed. Property should be reported using the classied

rate structure from KRS 132.020.

Note: All tangible property owned by the company

regardless of age, condition or book value must be

reported, including property which has been fully

depreciated.

(4) In Column (C), “Street Address,” indicate the physical

address where the tangible personal property is located.

(5) In Column (D), “City,” indicate the city name where the

tangible personal property is located.

(6) In Column (E), “Schedule A or Line Number,” indicate

whether the tangible personal property is Schedule A

property; or whether the property was entered on a specic

line item (31-82) shown on the front page of the return.

(7) In Column (F), “Class Life (I to VI),” indicate the class life

(I through VI) for the tangible personal property reported

on Schedule A.

(8) In Column (G), “Taxpayer’s Original Cost,” report the total

cost of the item described. This is to include any cost to

improve this item subsequent to purchase.

(9) In Column (H), “Taxpayer’s Net Book Value,” report the

net book value (gross less accumulated depreciation) of

each property.

(10) In Column (I), “Reported Value,” this should be the factored

cost for the property as derived from the Schedule A.

4

Property Classication Guidelines

List depreciable property based on its economic life. To assist

taxpayers in determining proper economic life classications,

a partial listing of North American Industry Classication

System (NAICS) codes follows. Property frequently used in

these specic industries are listed under each code. Most

businesses have property falling into more than one economic

life classication.

Communications Service Providers and

Multi-Channel Video Programming Service Providers

NAICS Business Description

5152 Cable and Other Subscription Programming

51521 Cable and Other Subscription Programming

515210 Cable and Other Subscription Programming

517 Telecommunications

5171 Wired Telecommunications Carriers

51711 Wired Telecommunications Carriers

517110 Wired Telecommunications Carriers

5172 Wireless Telecommunications Carriers (except

Satellite)

51721 Wireless Telecommunications Carriers (except

Satellite)

517211 Paging

517212 Cellular and Other Wireless Telecommunications

5173 Telecommunications Resellers

51731 Telecommunications Resellers

517310 Telecommunications Resellers

5174 Satellite Telecommunications

51741 Satellite Telecommunications

517410 Satellite Telecommunications

5175 Cable and Other Program Distribution

51751 Cable and Other Program Distribution

517510 Cable and Other Program Distribution (DBS)

5179 Other Telecommunications

51791 Other Telecommunications

517910 Other Telecommunications

517919 VoIP service providers, using client-supplied

telecommunications connections

517110 VoIP service providers, using own operated wired

telecommunications infrastructure

______ IPTV Internet Protocal Television

5

6

I GENERIC PERSONAL COMPUTERS—Printers, Mini-Computers, Micro-Processors, Associated Peripherals

I CELLULAR TELEPHONES, PAGERS, TABLETS, SMART PHONES, DIGITAL CAMERAS

I CATV HEADEND EQUIPMENT

I CUSTOMER PREMISE EQUIPMENT—DVRs, Box Converters, Set Top Boxes, Customer MODEMS, WI-FI Routers

I SWITCHING EQUIPMENT

I RADIO EQUIPMENT

I PRE-WRITTEN SOFTWARE, RIGHT TO USE (RTU) SOFTWARE

II OFFICE DATA HANDLING EQUIPMENT—Typewriters, Calculators, FAX Machines, Duplicating Equipment, Photocopiers

II SATELLITE Tracking, Telemetry, Control and Monitoring Equipment

II SERVICE AND TEST EQUIPMENT

III COMMUNICATION SYSTEMS—Telephone systems, Voice Mail, VoIP

III OFFICE FURNITURE & FIXTURES—Desks, File Cabinets, Chairs

III SECURITY SYSTEMS & COMPONENTS and FIRE SUPPRESSION SYSTEMS

III STORE, WAREHOUSE, SHOP TOOLS, and OTHER SPECIAL TOOLS

III TRENCHERS, BORING MACHINES, DITCH DIGGERS, BACKHOES, and FORK LIFTS

III EMERGENCY POWER GENERATORS / BATTERIES

III CATV PROGRAM ORIGINATION EQUIPMENT—Cameras, Film Chains, Video Tape Recorders, Lighting, Remote Location Equipment

III CATV MICROWAVE SYSTEMS—Antennas & supports, Transmitting / Receiving Equipment, Broad Band Assets

III CATV SUBSCRIBER CONNECTIONS & DISTRIBUTION SYSTEM—Passive Devices, Directional Taps, Pedestals, Pressure Taps,

Ampliers, Connecting Hardware, Power Equipment, Matchinge Transformers, Multiple Set Connector Equipment, and Converters

III TELEPHONE STATION EQUIPMENT—Station apparatus and connections teletypewriters, telephone booths, private exchanges,

and comparable equipment. See FCC Part 21 Accts 231, 232, & 234

III CABLES, WIRE, DROP LINES

III CELLULAR-VOCODERS, MODEMS, OPTICAL CROSS CONNECT BAYS, OPERATION.,; AND MANAGEMENT PLATFORMS, AND

ASSOCIATED CABLES AT A MTSO CELLULAR-DEDICATED POWER, BATTERIES, BATTERY BACKUP SYSTEMS, HEATING

AND COOLING EQUIPMENT AT A MTSO

III CELLULAR-BASE STATION CONTROLLER, BASE TRANSCEIVER STATION EQUIPMENT, CENTRAL CONTROL UNIT,

CHANNELCARD, AMPLIFIERS, VOCODERS, ALARM & SUPPORT EQUIPMENT, MICROWAVE EQUIPMENT AT CELL SITES

III CELLULAR—Antenna systems & supports, RET equipment at cell sites.

V HEAVY RACKS & STORAGE RACKS

V CRANES and HOISTS

V SAFES and SECURITY VAULTS

VI TELEPHONE POLES

VI TOWERS (cellular & telephone), MONOPOLES, TRANSMITTING TOWERS

VI PROPANE TANKS and ABOVE GROUND TANKS

VI SHELTERS, HUTS, MOBILE BUILDINGS, MODULAR BUILDINGS, PREFABRICATED & PORTABLE STRUCTURES

VI HAVC Equipment

VI HEAVY DUTY GENERATORS—Primary, Backup, Mobile

VI SIGNS (Exterior)

2023 PERSONAL PROPERTY CLASSIFICATIONS

TYPE PROPERTY AND DESCRIPTION

CLASS

LIFE

61A500 (1-2023)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Oce of Property Valuation

Division of State Valuation

Public Service Branch

501 High Street, Station 32

Frankfort, KY 40601-2103

Original Reported For Ocial Original Reported For Ocial

Cost Value Use Only Cost Value Use Only

Taxpayer’s For Ocial

Valuation Use Only

Class Class

2023

TANGIBLE PERSONAL

PROPERTY TAX RETURN

For

Communications Service Providers and

Multichannel Video Programming

Service Providers

Property Assessed January 1, 2023

Check applicable box

Federal ID No.

Social Security No.

2nd SSN if joint return

NAICS

CODE

Type of Business

Check if applicable Yes

DOR’s prescribed method

of valuation?

Alternative method

of valuation?

Organization

Type

Individual 1

Joint (Co-Owners) 2

Partnership/LLP 3

Domestic Corp./

LLC 4

Foreign Corp./

LLC 5

Fiduciary—Bank 6

Fiduciary—Other 7

Name of Business

Name of Taxpayer(s) Telephone Number

( )

Number and Street or Rural Route

City or Town State ZIP Code

Name Contact Telephone Number

Enterprise Zone Yes No Fax Number

If yes, attach certicate.

E-mail GNC Number

FROM SCHEDULE A-1 Wireless FROM SCHEDULE A-2 Wireline

11 I 11 I

12 II 12 II

13 III 13 III

14 IV 14 IV

15 V 15 V

16 VI 16 VI

17 Total 17

See pages 3 through 5 for instructions.

31 Merchants Inventory

35 Goods Stored in Warehouse/Distribution Center (see instructions)

36 Inventory—In Transit (see instructions)

60 Other Tangible Property (from Schedule C) (page 2)

70 Activated Foreign Trade Zone

82 Construction Work in Progress (other tangible property)

Tax Agent Name and Address

DUE DATE:

May 15

File this return with the Oce of Property Valuation. For E–mail use address—Telecom61A500@ky.gov (EMAIL FOR 61A500 ONLY)

SCHEDULE C

Other Tangible Personalty Not Listed Elsewhere

Description

Taxpayer’s For Ocial

Value Use Only

Materials and Supplies

Coin Collections

Stamp Collections

Art Works

Other Collectibles

Research Libraries

Other Tangible Property

Aircraft for Hire

Documented Watercraft (commercial purposes)

Precious Metals

Gold

Platinum

Silver

Other

Total (enter this gure on Line Item 60) ........................................................................................

Comments

Additional comments and/or information regarding alternative values may be provided by classication below:

Classication Type Comments/Information

I declare, under the penalties of perjury, that this return (including any accompanying schedules and statements) is a correct and complete

return; and that all my taxable property has been listed.

Signature of Taxpayer Name of Preparer Other Than Taxpayer

Telephone Number of Taxpayer Date

Number Value Per Ounce

of Ounces December 31

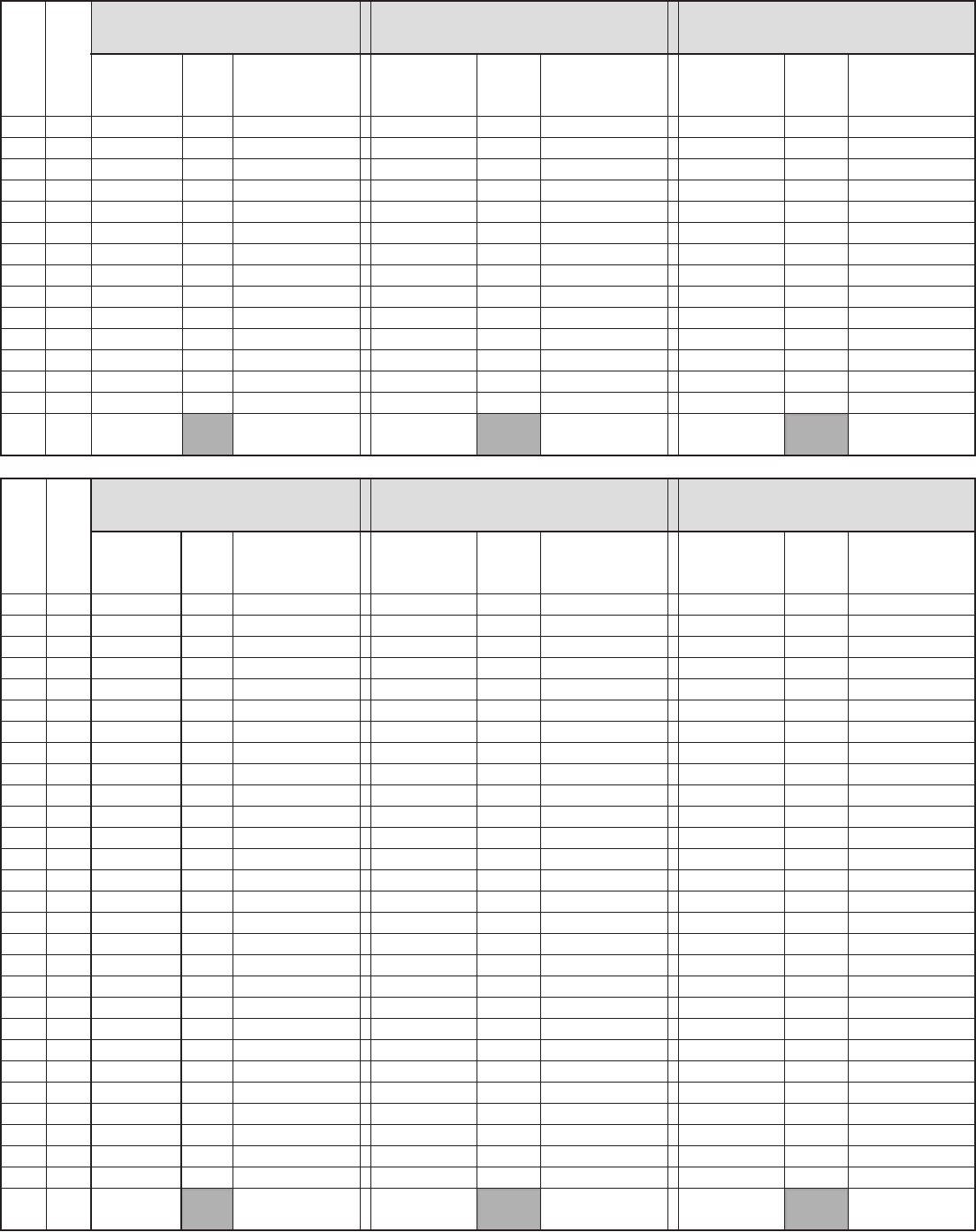

SCHEDULE A-1 Wireless

Personal Property Subject to Full State and Local Rates

Factor

Factor Factor

CLASS I CLASS II CLASS III

Under 5 Year Economic Life 6-8 Year Economic Life 9-11 Year Economic Life

Factor

Factor Factor

CLASS IV CLASS V CLASS VI

12–14 Year Economic Life 15–18 Year Economic Life Over 18 Year Economic Life

1 .803 .861 .904

2 .483 .617 .725

3 .288 .437 .576

4 .173 .313 .462

5 .100 .220 .363

6 .100 .147 .272

7 .100 .100 .202

8 .100 .100 .147

9 .100 .100 .111

10 .100 .100 .100

11 .100 .100 .100

12 .100 .100 .100

13 .100 .100 .100

13+ .100 .100 .100

Total

1 .942 .958 .976

2 .818 .864 .914

3 .695 .762 .838

4 .602 .686 .783

5 .525 .622 .738

6 .457 .562 .693

7 .388 .495 .635

8 .334 .443 .589

9 .286 .395 .546

10 .245 .351 .504

11 .209 .311 .464

12 .179 .276 .428

13 .154 .247 .397

14 .100 .217 .363

15 .100 .193 .336

16 .100 .174 .315

17 .100 .157 .294

18 .100 .100 .268

19 .100 .100 .241

20 .100 .100 .217

21 .100 .100 .192

22 .100 .100 .168

23 .100 .100 .149

24 .100 .100 .133

25 .100 .100 .119

26 .100 .100 .107

27 .100 .100 .100

27+ .100 .100 .100

Total

Age

Age

Yr.

Acq.

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

Original

Cost

Original

Cost

Original

Cost

Reported

Value

Reported

Value

Reported

Value

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

Reported

Value

Reported

Value

Reported

Value

Original

Cost

Original

Cost

Original

Cost

Yr.

Acq.

61A500(A-1)(1-23)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

SCHEDULE A-2 Wireline

Personal Property Subject to Full State and Local Rates

Factor

Factor Factor

CLASS I CLASS II CLASS III

Under 5 Year Economic Life 6-8 Year Economic Life 9-11 Year Economic Life

Factor

Factor Factor

CLASS IV CLASS V CLASS VI

12–14 Year Economic Life 15–18 Year Economic Life Over 18 Year Economic Life

1 .816 .874 .918

2 .503 .641 .754

3 .303 .460 .605

4 .186 .336 .496

5 .100 .248 .409

6 .100 .182 .336

7 .100 .130 .270

8 .100 .100 .220

9 .100 .100 .178

10 .100 .100 .144

11 .100 .100 .100

12 .100 .100 .100

13 .100 .100 .100

13+ .100 .100 .100

Total

1 .942 .958 .976

2 .818 .864 .914

3 .695 .762 .838

4 .602 .686 .783

5 .525 .622 .738

6 .457 .562 .693

7 .388 .495 .635

8 .334 .443 .589

9 .286 .395 .546

10 .245 .351 .504

11 .209 .311 .464

12 .179 .276 .428

13 .154 .247 .397

14 .100 .217 .363

15 .100 .193 .336

16 .100 .174 .315

17 .100 .157 .294

18 .100 .100 .268

19 .100 .100 .241

20 .100 .100 .217

21 .100 .100 .192

22 .100 .100 .168

23 .100 .100 .149

24 .100 .100 .133

25 .100 .100 .119

26 .100 .100 .107

27 .100 .100 .100

27+ .100 .100 .100

Total

Age

Age

Yr.

Acq.

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

Original

Cost

Original

Cost

Original

Cost

Reported

Value

Reported

Value

Reported

Value

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

Reported

Value

Reported

Value

Reported

Value

Original

Cost

Original

Cost

Original

Cost

Yr.

Acq.

61A500(A-2)(1-23)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

61A500(H) (1-23)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Report of Total Personal Tangible Property in Kentucky

As of January 1, 2023

Name of Taxpayer________________________________________________________________________

PERSONAL PROPERTY

General Plant

Distribution Plant-wire

Furniture and Fixtures

Computers and Software

Materials and Supplies

CWIP-Personal

Business Inventory Held for Resale

Towers

Miscellaneous Personal Property

Capital Leased Personal Property

Personal Property Held in Foreign Trade Zone

Total Personal Property in Kentucky

Motor Vehicles Owned–not included with this return

Commercial Watercraft–not included with this return

Noncommercial Aircraft–not included with this return

Consigned Inventory–not included with this return

Documented Boats–not included with this return

Kentucky

Original Cost

Kentucky

Depreciation

Kentucky

Net Book Value

Kentucky

Reported Value

H

INSTRUCTIONS

FOR

SCHEDULES I AND J

(I) SUMMARY OF GROSS PERSONAL TANGIBLE PROPERTY LISTING BY TAXING DISTRICT

(J) SUMMARY OF REPORTED PERSONAL TANGIBLE PROPERTY LISTING BY TAXING DISTRICT

This form must contain a listing of the amount and type of personal tangible property located in this state for each county,

city and special taxing jurisdiction.

(1) Report the company totals for each type of property in the appropriate column on Line 9.

(2) Below the company totals column report the property in the county or counties where it is physically located. Be sure to

include any city or special jurisdictions where the property is located. Enter the total county amount on the rst line—COUNTY

FISCAL COURT GENERAL. Please note that for counties that do not have an independent school, the amount for the county will

automatically be placed in the county general school.

For counties that have one or more independent schools, report the property in the appropriate school jurisdiction(s).

The total amount of property reported for the schools must equal the total amount for the county. If the total county amount does

not equal the amount reported for the schools, a message will appear that says “OUT OF BALANCE”. If this occurs you must

nd the error and adjust accordingly. You will see a “SCHOOL CHECK” for each county that has at least one independent school.

(3) The following counties have set boundaries dened for special districts: re, ambulance, and garbage:

Fire District (1) Anderson Countywide except Lawrenceburg

Fire District (1) Bath Countywide except Owingsville

Fire District (9) Boone Fire districts cover Countywide except Florence

Fire District (6) Boyd

Fire District (1) Boyle Countywide except Danville, Junction City and Perryville

Fire District (4) Bullitt

Fire District (1) Calloway Countywide except Hazel and Murray

Fire District (6) Campbell

Fire District (1) Carroll Covers City of Ghent plus additional unincorporated areas

Fire District (15) Floyd Fire districts cover Countywide except Prestonsburg, Martin and

Wheelwright

Fire District (1) Fulton Covers City of Hickman Only

Fire District (1) Gallitin

Fire District (4) Garrard Fire districts cover Countywide except Lancaster

Fire District (1) Grant

Fire District (2) Graves

Fire District (9) Greenup

Fire District (1) Harrison Countywide except for Berry and Cynthiana

Fire District (2) Hickman

Fire District (1) Hopkins

Fire District (11) Jeerson Fire districts cover Countywide except for the Urban Services and

city of Shively

Fire District (2) Jessamine Countywide less City of Nicholasville and City of Wilmore

Fire District (6) Kenton

Fire District (1) Knox

Fire District (1) Laurel

Fire District (1) Lawrence

Fire District (7) Lewis

Fire District (1) Lincoln Countywide except Crab Orchard, Eubank, Hustonville and Stanford

Fire District (3) Livingston

Fire District (2) Lyon

Fire District (6) McCracken

Fire District (5) McCreary Fire districts cover entire Countywide

Fire District (7) Marshall

Fire District (5) Meade

Fire District (1) Mercer Countywide except Burgin and Harrodsburg

Fire District (1) Montgomery Countywide except Mt Sterling

Fire District (1) Nelson

Fire District (1) Nicholas Countywide except Carlisle

Fire District (7) Oldham

Fire District (9) Shelby

Fire District (2) Spencer Countywide except Mt. Eden Fire District

Fire District (1) Woodford Countywide except Midway and Versailles

Garbage District (1) Marshall Countywide except Calvert City

Paducah Jr. College City (1) McCracken Same size as City of Paducah

Paducah Jr. College County (1)

McCracken Countywide less City of Paducah

Fire (2) & Ambulance (1) Pendleton Fire and Ambulance equals county total

Ambulance District (1) Wayne Limited area in northern Wayne County

Ambulance District (1) Webster Countywide except Providence

For each county that has a dened taxing jurisdiction you will see a “FIRE DISTRICT CHECK”, “GARBAGE DISTRICT CHECK”, or

“AMBULANCE DISTRICT CHECK.” If the total county amount does not equal the amount reported for the city or cities and the special

districts a message will appear that says, “OUT OF BALANCE.” If this occurs you must nd the error and adjust accordingly.

At the bottom of each schedule there is a check to make sure the company totals for each column equal the total for the counties.

(4) If a particular taxing jurisdiction (i.e., city) does not appear on the list, they do not tax tangible personal property and it

should not be listed.

REMINDERS

NOTE

(A)

For Jeerson County, the following mergers are in eect:

Lake Dreamland Fire District has merged into Pleasure Ridge Park Fire District

NOTE

(B)

For Hardin County, the following merger is in eect:

West Point Independent School District has merged with Hardin County Common School

NOTE

(C)

For Fulton County, the following merger is in eect:

Property reported in City of Hickman also must be reported in Hickman Fire Apparatus District

Schedule I

“Summary of Gross Personal Tangible Property Listing By Taxing District”

This form is available in an Excel format at the Department of Revenue website:

revenue.ky.gov

You are required to complete and submit this schedule.

Failure to properly complete and submit this required schedule could result in the

entire tax return being considered incomplete and subject to penalty.

Schedule J

“Summary of Reported Personal Tangible Property Listing By Taxing District”

This form is available in an Excel format at the Department of Revenue website:

revenue.ky.gov

You are required to complete and submit this schedule.

Failure to properly complete and submit this required schedule could result in the

entire tax return being considered incomplete and subject to penalty.

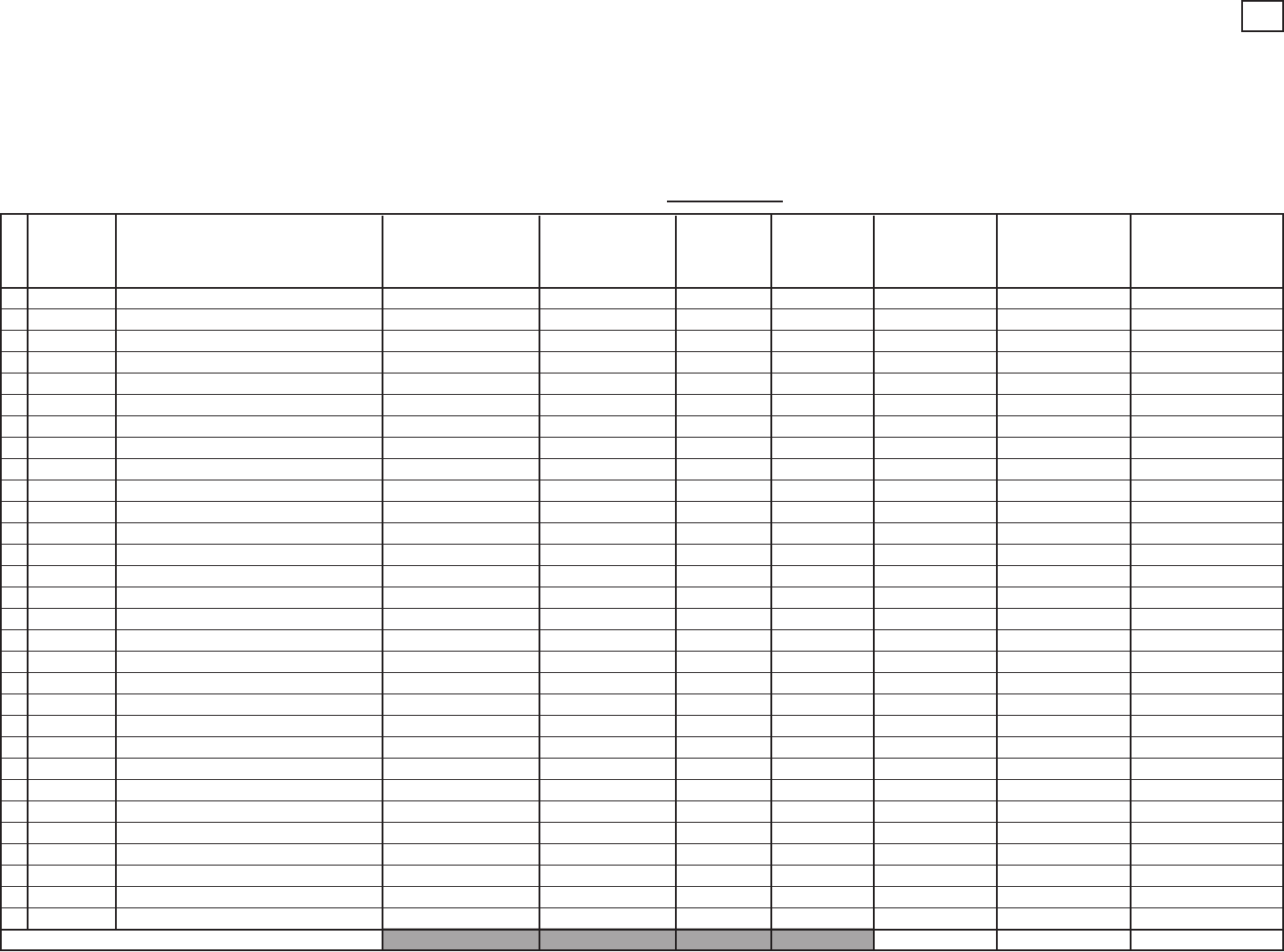

Personal Tangible Property Listing by Taxing District

As of January 1, 2023

61A500(K) (1-23)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

K

Page _______

(H)

Taxpayer’s

Net Book

Value

(G)

Taxpayer’s

Original

Cost

(I)

Kentucky

Reported

Value

(B)

Detailed Description of Property

(provide account name, description and

separate by property class)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

Total in Jurisdiction

(A)

Year of

Acquisition

(C)

Street Address

Physical Location

(D)

City

(E)

Sch A

Line #

(F)

Class Life

(I to VI)

Name of Taxpayer ___________________________________________________________________

List of Property in (Name of County) _____________________________________________________

Name of Taxing Jurisdiction ____________________________________________________________

NOTE: The DOR prefers this document to be submitted in an Excel spreadsheet.

This form is available in an Excel format version at the Department of Revenue website revenue.ky.gov . You are required to complete and submit this schedule.