REPORT TO THE PRESIDENT

CORPORATE FRAUD TASK FORCE

2008

REPORT

TO THE PRESIDENT

CORPORATE FRAUD

TASK FORCE

2008

Report To The President – Corporate Fraud Task Force 2008

Members of the

Corporate Fraud Task Force

Mark Filip, Chairman

Deputy Attorney General

United States Department of Justice

Alice Fisher

Assistant Attorney General of the

Criminal Division

Nathan J. Hochman

Assistant Attorney General of the

Tax Division

Robert S. Mueller, III

Director

Federal Bureau of Investigation

Michael J. Garcia

United States Attorney for the

Southern District of New York

Patrick J. Fitzgerald

United States Attorney for the

Northern District of Illinois

Donald J. DeGabrielle, Jr.

United States Attorney for the

Southern District of Texas

Patrick L. Meehan

United States Attorney for the

Eastern District of Pennsylvania

Joseph P. Russoniello

United States Attorney for the

Northern District of California

Benton J. Campbell

United States Attorney for the

Eastern District of New York

Thomas P. O’Brien

United States Attorney for the

Central District of California

Henry M. Paulson, Jr.

Secretary

United States Department of the Treasury

Elaine L. Chao

Secretary

United States Department of Labor

Christopher Cox

Chairman

Securities and Exchange Commission

Walter L. Lukken

Chairman

Commodity Futures Trading Commission

Joseph T. Kelliher

Chairman

Federal Energy Regulatory Commission

Kevin J. Martin

Chairman

Federal Communications Commission

James B. Lockhart, III

Director

Federal Housing Enterprise

Oversight Office

Alexander Lazaroff

Chief Postal Inspector

United States Postal Inspection Service

Table of Contents

Table of Contents............................................................................................................i

Letter from the Chairman of the Corporate Fraud Task Force..............................iii

Corporate Fraud Task Force Member Contributions ........................................1.1

a. Criminal Enforcement ........................................................................................1.3

Cases Prosecuted By DOJ’s Criminal Division ................................................1.3

Cases Prosecuted By DOJ’s Tax Division..........................................................1.4

Cases Prosecuted By Task Force United States Attorneys’ Offices ..................1.5

Other Significant Federal Criminal Cases ......................................................1.14

Federal Bureau of Investigation ......................................................................1.19

Department of Treasury ..................................................................................1.20

United States Postal Inspection Service ..........................................................1.22

b. Civil Enforcement..............................................................................................1.23

Department of the Labor ................................................................................1.23

Office of Federal Housing Enterprise Oversight............................................1.23

Securities and Exchange Commission ............................................................1.25

Commodity Futures Trading Commission ....................................................1.29

Federal Communications Commission ..........................................................1.34

Federal Energy Regulatory Commission ........................................................1.36

i

Message from the Chairman

April 2, 2008

MESSAGE FROM THE CHAIRMAN

On July 9, 2002, President George W. Bush created the Corporate Fraud Task

Force “to strengthen the efforts of the Department of Justice and Federal, State, and local

agencies to investigate and prosecute significant financial crimes, recover the proceeds of

such crimes, and ensure just and effective punishment of those who perpetrate financial

crimes.” The Task Force was formed in response to a number of high-profile acts of

fraud and dishonesty that occurred in corporate executive suites and boardrooms across

the country. The brunt of these schemes was borne by innocent corporate employees,

pensioners, and investors—whose futures and fortunes were harmed, and at times, even

shattered, by corporate leaders they trusted with their savings.

Since 2002, the President’s Corporate Fraud Task Force has worked hard to hold

wrongdoers responsible and to restore an atmosphere of accountability and integrity

within corporations across the country. Relying both on traditional investigative

techniques and on new tools made available by the Congress at the request of the

President, the Task Force has punished corporate malfeasance and encouraged corporate

transparency and self-regulation.

The Task Force combines the talents and experience of thousands of

investigators, attorneys, accountants, and regulatory experts. Ten federal departments,

commissions, and agencies are involved with the Task Force, in addition to seven

U.S. Attorneys’ Offices and two Divisions within the Justice Department. This

commitment of resources and expertise reflects the Government’s resolve to combat

corporate fraud and to foster an environment in which ethical and honest corporate

conduct is encouraged and promoted.

Since July 2002, the Department of Justice has obtained nearly 1,300 corporate

fraud convictions. These figures include convictions of more than 200 chief executive

officers and corporate presidents, more than 120 corporate vice presidents, and more than

50 chief financial officers. These convictions are the product of the hard work and

cooperation of prosecutors, federal agents, accountants, and support staff from dozens of

agencies and offices within the Justice Department and other Task Force components.

Some of the contributions of the Task Force are documented in greater detail in this

Report.

iii

Report To The President – Corporate Fraud Task Force 2008

As you will see, criminal enforcement is only one aspect of the Task Force’s

effort to combat corporate fraud. Task Force members also filed administrative

enforcement suits, civil injunctive actions, and amicus briefs in civil corporate fraud

cases; provided regulatory oversight for government-sponsored enterprises; established

mandatory debarment procedures to prevent those with a history of fraudulent activity

from participating in certain federal programs; implemented new anti-manipulation

regulations; and issued show cause orders addressing market manipulation. Many of

these activities involved the cooperation and coordination of multiple Task Force

member agencies. The Task Force remains committed to using all appropriate means to

continue combating corporate fraud and to promoting the integrity of the American

financial marketplace.

The Task Force is proud of its efforts to bring hundreds of unethical corporate

officers to justice and to recoup hundreds of millions of dollars in fines, forfeitures, and

civil judgments. That said, it is important to appreciate that criminal and unethical

corporate leaders are the exception in our nation. Corporations play a vital role in our

country—providing jobs for our people and vitality and innovation to our national

economy—and the men and women who lead American corporations are

overwhelmingly people of talent, dedication, and integrity. By holding unscrupulous

corporate officers and entities to account, the Task Force hopes to minimize unfair

competition and investor distrust that can curtail the success of law-abiding businesses.

The cooperation of numerous upstanding businesses and individuals with federal

investigators has been vital to the success of the Task Force’s efforts.

Since 2002, the Task Force has prosecuted numerous unlawful actors who have

operated in the American marketplace. The Task Force remains committed to fulfilling

its mission of combating corporate fraud, and helping to protect all Americans by

promoting integrity in our national marketplace. Task Force members proudly serve in

this capacity, and look forward to doing so in the future.

Mark Filip

Chairman

President’s Corporate Fraud Task Force

iv

Cor

porate Fraud

Task Force Member

Contributions

Corporate Fraud Task Force Member Contributions

Criminal Enforcement

Cases Prosecuted By DOJ’s Criminal

Division

Enron Task Force

The Department established the Enron Task

Force within its Criminal Division in 2002 in

response to the discovery of accounting fraud at

Enron Corporation. The Task Force, which con-

sisted of experienced federal prosecutors and

agents from around the country, worked for four

years to investigate and prosecute cases arising

from the fraud at Enron. The Task Force

charged a total of 34 defendants. Of those 34

defendants, 26 were former Enron executives. A

former CEO of Enron was sentenced to 292

months in prison after being found guilty at trial.

The guilty verdicts against the former chairman

were dismissed following his death prior to sen-

tencing. Enron’s former CFO pled guilty and

was sentenced to six years in prison and its chief

accounting officer received a sentence of five and

one-half years following his guilty plea. The

Department has also seized more than $100 mil-

lion and has worked with the SEC to obtain

orders directing the recovery of more than $450

million for the victims of the Enron fraud.

Enterasys

Eight former officers of Enterasys Network

Systems, Inc., including the chairman and the

CFO, have pled guilty or been found guilty at

trial in December 2006 on charges stemming

from a scheme to artificially inflate revenue to

increase, or maintain, the price of Enterasys

stock. The fraud caused Enterasys to overstate

its revenue by over $11 million in the quarter

ending Sept. 1, 2001. The fraud and its public

disclosure resulted in a loss to shareholders of

about $1.3 billion. As a result, in July 2007,

Enterasys CFO Robert J. Gagalis was sentenced

to 11 years in prison. Bruce D. Kay, formerly

Enterasys’s senior vice president of finance, was

sentenced to nine and one half years in prison.

Robert G. Barber, a former Enterasys business

development executive, was sentenced to eight

years in prison and fined $25,000. Hor Chong

(David) Boey, former finance executive in

Enterasys’s Asia Pacific division, was sentenced

to three years in prison.

Qwest

Joseph E. Nacchio, the former CEO of

Qwest Communications International, Inc., was

found guilty on 19 counts of insider trading on

April 19, 2007, on charges stemming from his

sale of more than $100 million in Qwest stock

while in possession of material, non-public

information regarding Qwest’s financial health.

Nacchio was sentenced to six years’ imprison-

ment and received the maximum $19 million

fine on July 29, 2007. A former CFO pled guilty

to insider trading.

British Petroleum

BP America, Inc., entered into a deferred

prosecution agreement in October 25, 2007, in

which it admitted that its traders illegally cor-

nered the market for February 2004 TET

propane, which is propane transported via

pipeline from Texas to the Northeast and

Midwest. BP North America agreed to pay a

$100 million penalty, make a $25 million pay-

ment to the U.S. Postal Inspection Service’s

Consumer Fraud Fund, pay restitution of more

than $53 million, and pay a $125 million civil

penalty to the CFTC. BP America also agreed

to cooperate with an independent monitor,

who will be appointed for a three-year period.

In addition, four BP traders have been indict-

ed on charges of conspiracy, commodities mar-

ket manipulation, and wire fraud in the

Northern District of Illinois. In June 2006,

Dennis Abbott, a BP energy trader, pled guilty

1.3

Report To The President – Corporate Fraud Task Force 2008

to one count of conspiracy to commit com-

modities fraud and agreed to cooperate in the

Government’s ongoing investigation.

AEP

AEP Energy Services, Inc. (AEPES), is a

wholly owned subsidiary of American Electric

Power, Inc. (AEP), one of the nation’s largest

electric utilities. AEPES entered into a deferred

prosecution agreement on January 25, 2005, in

which it admitted that its traders manipulated

the natural gas market by knowingly submitting

false trading reports to market indices. AEPES

agreed to pay a $30 million criminal penalty.

Three energy traders also pled guilty. In sepa-

rate actions, the CFTC filed a civil injunction

against AEP and AEPES. The companies also

agreed to pay $21 million to the Federal Energy

Regulatory Commission.

PNC

PNC ICLC Corporation, a subsidiary of the

PNC Financial Services Group, Inc., the sev-

enth largest bank holding company in the

nation, was charged with conspiracy to violate

securities laws by fraudulently transferring $762

million in mostly troubled loans and venture

capital investments from PNC ICLC to off-

balance sheet entities. PNC entered into a

deferred prosecution agreement on June 2,

2003, and PNC ICLC agreed to pay a total of

$115 million in restitution and penalties.

Cases Prosecuted By DOJ’s Tax Division

Superior Electric

In November 2006, the 50% owner and

president of Superior Electric Company, a com-

mercial electrical contracting company based in

Columbus, Ohio, pled guilty to bank fraud and

to conspiracy to defraud the United States. The

company’s CFO also pled guilty to conspiracy

to defraud the United States. As part of the

conspiracy, they falsely characterized the presi-

dent’s personal use of corporate funds as busi-

ness expenses. The expenditures included the

costs of enhancing and operating his 65-foot

yacht, the salaries of the yacht captain and first

mate, the cost of landscaping at his residence,

and credit card payments for his boat captain

and maid. From 1998 through 2001, the com-

pany president used more than $2 million in

corporate funds for personal expenditures, but

he failed to report it as income on his tax

returns. Also, he directed the CFO not to pay

the company’s payroll tax liability. The president

also provided false financial documents to

National City Bank to support an increase in

the company’s line of credit with the bank. The

president was sentenced to 34 months in prison

and ordered to pay $4.8 million in restitution

for the tax fraud scheme. The CFO was sen-

tenced to 15 months in prison and ordered to

pay more than $1.62 million in restitution to

the IRS.

Th

yssen, Inc.

In August 2004, a federal jury in Detroit,

Michigan, found two former executives of

Thyssen, Inc., guilty of tax fraud, conspiracy,

and money laundering charges in a $6.5 million

kickback scheme. Kenneth Graham and Kyle

Dresbach are the former CEO and executive

vice president, respectively, of Thyssen, a

Detroit steel-processing company. Their attor-

ney, Jerome Jay Allen (both an attorney and

CPA), pled guilty to conspiracy in August 2003,

and cooperated with the prosecution. Graham

and Dresbach had conspired with Allen to pay

inflated prices for cranes and steel slitting

machines. The vendors of the cranes and slitting

machines paid the inflated prices as commis-

sions to a consultant, Hurricane Machine.

Hurricane Machine then paid kickbacks to

more than a dozen entities controlled by Allen.

He laundered the funds and used his client trust

1.4

Corporate Fraud Task Force Member Contributions

fund accounts to pay kickbacks to Graham and

Dresbach. As part of this conspiracy, Graham

and Dresbach also conspired with Allen to file

false individual income tax returns that did not

report the kickback payments. Graham was sen-

tenced to 75 months in prison and was ordered

to pay restitution of $8.8 million. Dresbach was

sentenced to 58 months in prison and was

ordered to pay restitution of $8.4 million. Allen

was sentenced to 34 months in prison and was

ordered to pay restitution of $8 million.

UNI Engineering, Inc.

In October 2006, a federal grand jury in

Camden, New Jersey, returned an indictment

charging the controller of UNI Engineering,

Inc., a privately-held company, with obstruct-

ing the internal revenue laws, filing a false pay-

roll tax return, and failing to pay more than

$400,000 in payroll taxes to the IRS. The

indictment alleges that the controller con-

cealed from the owners of UNI Engineering

and the IRS that UNI Engineering did not

accurately report and pay its employment taxes

from 1998 through 2001, and that he misap-

propriated funds that UNI Engineering was

required to pay to the IRS for employment

taxes. The controller pled guilty to five felony

tax charges and admitted that he misappropri-

ated unpaid payroll taxes of the company and

filed false payroll and individual income tax

returns with the IRS. He was sentenced to 24

months in jail and ordered to pay a $7,800 fine.

Neways, Inc.

In September 2006, a federal judge in Salt

Lake City sentenced Utah executives Thomas

E. Mower and Leslie D. Mower and their cor-

porate counsel, James L. Thompson, for their

respective roles in a scheme to defraud the

United States. Thomas Mower, founder and

CEO of Neways, Inc., an international multi-

level marketing company, was sentenced to 33

months in prison and ordered to pay a $75,000

fine. Leslie Mower, Neways’s CFO, was sen-

tenced to 27 months in prison and ordered to

pay a $60,000 fine. Thompson, Neways’s cor-

porate counsel from 1995 through 1997, was

sentenced to 12 months and one day in prison.

They had concealed from the IRS more than

$1 million of Neways’s gross receipts and $3

million of the Mowers’ commission income.

The Mowers used nominee bank accounts,

nominee entities, and nominee social security

numbers for various bank accounts. Thompson

had created and presented a false loan docu-

ment to the investigating agent.

Cases Prosecuted By Task Force United

States Attorneys’ Offices

U.S. Attorney’s Office for the Central

District of California

Milberg Weiss

This national class action law firm, several

partners, and other individuals were indicted

for making illegal, undisclosed payments to

class plaintiffs. The attorneys subsequently

made false statements in court filings regarding

these payments. The indictment charges

defendants with conspiracy, fraud, and money

laundering counts. Several of the attorneys

involved – including former law firm name

partners William Lerach and David Bershad –

pled guilty in 2007 and are cooperating with

the government. Trial against the remaining

parties is currently scheduled for 2008.

Homestore.com, Inc.

Eleven executives and employees of this

California-based Internet company were con-

victed for their roles in a complicated revenue

inflation scheme. Homestore fraudulently paid

itself millions of dollars in bogus “roundtrip

deals” to meet quarterly revenue expectations.

1.5

Report To The President – Corporate Fraud Task Force 2008

The company’s senior management, finance

department, and sales staff were convicted of

conspiracy, insider trading, wire fraud, and other

securities law violations for their roles in the

transactions. After a lengthy jury trial in 2006,

Homestore’s former CEO was found guilty of

numerous criminal counts, including filing false

quarterly statements with the SEC and lying to

auditors. He was sentenced to 15 years in

prison and ordered to pay $13 million in fines

and restitution.

U.S. Attorney’s Office for the Northern

District of California

M&A West

Zahra Gilak, corporate secretary at M&A

West, was convicted of one count of securities

fraud and five counts of money laundering. The

jury found that Gilak participated in a stock

manipulation scheme in connection with the

purchase and sale of shares of three publicly trad-

ed companies on the Over-the-Counter Bulletin

Board in 1999-2000. Gilak devised a scheme to

gain a controlling interest over three companies

and concealed her interest by holding stock

through multiple shell companies that she con-

trolled. After manipulating demand for the

stock, Gilak sold the securities, reaping approxi-

mately $14 million in net proceeds. Gilak was

sentenced in April 2007 to 51 months’ imprison-

ment and 36 months’ supervised release. She was

ordered to pay a $600 special assessment and

$2.5 million in restitution. She also forfeited

$881,000. Gilak has appealed. F. Thomas Eck,

III, attorney, and Scott Kelly, former CEO of

M&A West, both pled guilty on related charges.

Eck was sentenced in June 2004 to 70 months’

custody and three years’ supervised release, and

was ordered to pay a $100 special assessment.

Kelly was sentenced on August 28, 2007, to 14

months’ custody and three years’ supervised

release. Kelly was ordered to pay a $200 special

assessment, $200,000 forfeiture, and $6.5 million

in restitution.

U

.S. Wireless

Oliver Hilsenrath, CEO, and David Klarman,

general counsel, were charged with defrauding

U.S. Wireless shareholders by improperly trans-

ferring company stock and cash to offshore

entities they controlled and also causing U.S.

Wireless to file false and misleading financial

statements with the SEC. When the fraud was

discovered, U.S. Wireless restated its financial

results, increasing its fiscal year 2000 loss by more

than 55%. Hilsenrath pled guilty and was sen-

tenced on July 9, 2007, to five years’ probation.

He was ordered to pay $2 million in restitution, a

$2,000 fine, and a $200 special assessment. D.

Klarman pled guilty and was sentenced on July

10, 2007, to three years’ probation and received a

$100 special assessment.

U.S. Attorney’s Office for the Northern

District of Illinois

Mercury Finance Company

Mercury Finance Company was a NYSE-

listed subprime lending company. As a result of

an extensive accounting fraud scheme designed

to inflate the company’s revenues and to under-

state its delinquencies and charge offs over sever-

al years, the market capitalization of the compa-

ny decreased by nearly $2 billion in one trading

day after the existence of the fraud was publicly

announced. Commercial paper purchasers also

eventually lost about $40 million and longer term

lenders lost another $40 million. The former

CFO admitted his role in the fraudulent scheme

and cooperated with the investigation, but he

died unexpectedly before charges were brought.

John Brincat Sr., the former CEO and chairman

of the board of directors of the company, pled

guilty to wire fraud and conspiracy in connection

with the scheme. On May 23, 2007, Brincat was

sentenced to 10 years in prison. Previously,

Bradley Vallem, the former treasurer of the com-

pany, pled guilty to engaging in the accounting

fraud scheme, agreed to cooperate and received a

1.6

Corporate Fraud Task Force Member Contributions

20-month sentence. Lawrence Borowiak, the

former accounting manager, pled guilty to trad-

ing Mercury Finance Company stock on inside

information, agreed to cooperate, and received a

sentence of 12 months in prison.

Anicom, Inc.

Anicom, Inc., was a publicly held national

distributor of wire and cable products such as

fiber optic cable. The former chairman of the

board of directors and six others at the compa-

ny were charged with engaging in an account-

ing fraud scheme. The scheme involved creat-

ing fictitious sales of more than $24 million,

understating expenses, and overstating earn-

ings and net income by millions of dollars. The

scheme led to a market capitalization loss of

more than $80 million. All of the defendants

except the former chairman have pled guilty

and are cooperating. These include a former

CEO, a former COO, a former CEO, a former

controller, a former vice president of sales and

a shipping manager.

U.S. Attorney’s Office for the Eastern

District of New York

Comverse

Between 1998 and 2002, the CEO, CFO,

and general counsel of Comverse Technology,

Inc., defrauded Comverse shareholders by

secretly backdating Comverse's option grants

to executives and employees. The defendants

backdated Comverse stock options to mask

that the options were in fact granted "in the

money" (with an exercise price below the fair

market value of Comverse shares on the date of

the grant) and to avoid properly accounting for

the in-the-money grants in SEC filings (which

would have had the effect of increasing com-

pensation expense and decreasing the compa-

ny’s reported earnings). Among other things,

the three executives lied to their outside audi-

tors and to institutional investors to conceal their

fraudulent options practices. In addition, the

CEO and CFO created a secret slush fund of

options (code-named "Phantom" and "Fargo")

which they made through the surreptitious grant

of hundreds of thousands of options to fictional

employees. Options from the Phantom/Fargo

slush fund were transferred to favored employees

at Alexander's discretion, with neither the

knowledge nor the oversight of the board of

directors of Comverse, nor with any disclosure or

accounting for these options in Comverse's pub-

lic filings. The loss to Comverse and its share-

holders resulting from the stock option fraud

schemes at the company is currently estimated at

$51 million.

The option fraud schemes concluded in April

2002 and came to light in March 2006. The

CEO immediately attempted to buy off the

CFO, offering him $2 million, then $5 million,

then asking him to "name your price," to take sole

responsibility for the options schemes and to

absolve him. On October 24, 2006, the CFO

pled guilty to charges of securities fraud and con-

spiracy to commit securities fraud pursuant to a

cooperation agreement. The SEC simultaneously

announced a settlement with the CFO providing,

among other things, for him to disgorge approx-

imately $2.4 million. On November 2, 2006, the

general counsel pled guilty to conspiracy to com-

mit securities fraud. The general counsel was sen-

tenced to 12 months and one day of incarcera-

tion. The former CEO is a fugitive. In June 2006,

he fled to a vacation home in Israel. During the

month of July 2006 alone, he laundered at least

$57 million by transferring assets from the

United States to Israel and elsewhere. He was

arrested in Namibia on September 27, 2006. The

pending indictment against the CEO charges

him with 35 counts, including securities fraud,

mail fraud, wire fraud, conspiracy, false statements

to the SEC, obstruction of justice, and money

laundering. It also contains two forfeiture allega-

tions. The Government is seeking extradition.

1.7

Report To The President – Corporate Fraud Task Force 2008

Computer Associates

From approximately 1998 through 2000,

senior executives at Computer Associates,

including Sanjay Kumar (president and COO,

and then CEO), Stephen Richards (head of

worldwide sales) and others, caused the compa-

ny to backdate billions of dollars' worth of

license agreements in order to prematurely rec-

ognize revenue to avoid missing Wall Street’s

projected earnings per share estimates for the

given quarter. Later, when the Government

began investigating this conduct, the defendants

implemented a massive scheme to obstruct jus-

tice. In the end, eight defendants pled guilty. On

November 2, 2006, Kumar was sentenced to 12

years' imprisonment. On November 14, 2006,

Richards was sentenced to seven years' impris-

onment. Five additional cooperating witnesses

have been sentenced since January 1, 2007.

Friedman’s Jewelers

From approximately 2000 through 2003,

Friedman’s Inc. was a fine-jewelry retailer with

publicly traded stock. Friedman’s offered an

installment credit program, which the company

described as an “integral part” of its business strat-

egy, to help its customers finance jewelry purchas-

es. The majority of Friedman’s sales were made on

credit, and Friedman’s public filings represented

that it strictly followed company guidelines as to

when and how much credit to issue to Friedman’s

customers. In reality, Friedman’s employees, with

management’s encouragement, routinely violated

these guidelines in issuing credit. As a result,

Friedman’s had a rising level of uncollectible

accounts receivable. Instead of disclosing its col-

lection problems, senior management manipulat-

ed Friedman's accounting to hide the collection

problems from the investing public. These manip-

ulations created the appearance that the company

had met Wall Street’s expectations in multiple

quarters, when it in fact had not. Friedman’s for-

mer CFO, Victor Suglia, and Friedman’s former

controller, John Mauro, have been cooperating

with the investigation and recently pled guilty to

conspiracy to commit securities fraud, wire fraud

and mail fraud. On February 13, 2007, a grand

jury indicted Friedman’s and Crescent’s former

CEO, Bradley Stinn, on multiple charges stem-

ming from this conspiracy. In November 2005,

Friedman’s entered into a non-prosecution agree-

ment with the Government. Under the terms of

the agreement, Friedman’s acknowledged that it

violated federal criminal law through the conduct

of certain former Friedman’s executives, officers

and employees and admitted that former

Friedman’s executives conspired to commit and

engaged in securities fraud. As part of the agree-

ment, Friedman’s agreed to implement numerous

corporate reforms, continue its cooperation with

the Government’s investigation and pay

$2,000,000 to the U.S. Postal Inspection Service

Consumer Fraud Fund. The Government also

entered into a non-prosecution agreement with

Crescent Jewelers, an affiliate of Friedman’s.

Under the terms of the agreement, Crescent

acknowledged that it violated federal criminal law

through the conduct of certain former Crescent

executives and admitted that former Crescent

executives conspired to defraud Friedman’s share-

holders through the scheme outlined above.

Crescent also agreed to implement numerous cor-

porate reforms, continue its cooperation with the

Government’s investigation and pay $1,000,000.

Al

lou Healthcare, Inc.

The case centered on a Long Island based

public company called Allou Healthcare, Inc.

(“Allou”). The principals of Allou and its affili-

ated companies, all members of the Jacobowitz

family, engaged in a massive, decade-long con-

spiracy involving bank fraud and securities

fraud. The scheme caused losses to creditors and

investors of nearly $200 million, and involved

an array of shell companies, phony transactions,

and wire transfers of funds to foreign countries.

In an attempt to cover up the massive fraud at

1.8

Corporate Fraud Task Force Member Contributions

Allou, the Jacobowitzes planned a fire at Allou’s

Brooklyn warehouse in September 2002 to

recover $100 million in insurance proceeds. This

plan ultimately went awry when Allou’s insurers

refused to pay the $100 million claim because of

the fire department’s conclusion that the fire

was arson. To bolster Allou’s insurance claim

and to obstruct the criminal investigations into

the origin of the fire, the Jacobowitzes and their

associates then offered to pay a fire marshal

$100,000 in cash to change the fire depart-

ment’s conclusion regarding the origin of the

fire. Eight defendants, including the company

president, pled guilty to various charges of fraud

and bribery.

American Tissue, Inc.

American Tissue, Inc. (ATI) was the fourth

largest tissue manufacturer in the United States,

with offices in Happaugue, Long Island, and

approximately a dozen manufacturing facilities

throughout the United States and Mexico. ATI

issued $165 million worth of bonds that were

publicly traded, and it operated under a revolv-

ing loan facility which included several banks

but was administered by LaSalle Business

Credit (“LaSalle”). During 2000 and 2001, ATI

began to experience severe financial difficulties,

due largely to reckless over-expansion and a

downturn in the market. As a consequence, cor-

porate executives, including the CEO Mehdi

Gabayzadeh and VP of Finance John Lorenz,

engaged in various schemes designed to defraud

LaSalle into loaning operating funds to ATI.

These schemes also included a conspiracy to fal-

sify SEC filings and press releases regarding

ATI's financial condition, in hopes of propping

up the value of ATI's existing bonds and suc-

cessfully offering an additional $200 million

worth of bonds to raise capital. The fraud was

uncovered in early September 2001 and ATI

declared bankruptcy. Several months later,

Gabayzadeh was forced out of ATI and he

formed a second corporation, American Paper

Corporation. As CEO of American Paper

Corporation, Gabayzadeh engaged in addition-

al schemes to defraud the bankrupt ATI out of

assets that were owned by creditors.

In September 2006, Gabayzadeh was con-

victed after trial and sentenced to 15 years’

imprisonment, five years’ supervised release, and

restitution in the amount of $64,933,931. In

January 2007, Lorenz was sentenced to 18

months’ imprisonment and three years of super-

vised release, and was ordered to pay restitution

in the amount of $64,682,588. Two additional

executives also pled guilty.

DHB Industr

ies

DHB Industries manufactures body armor

and has been the primary supplier of body

armor to the military since approximately

2002. Until recently, it was headquartered in

Westbury, Long Island, with manufacturing

facilities in Pompano Beach, Florida and

Jacksonville, Tennessee. The former CFO and

the former COO were indicted for conspiracy

to commit securities fraud and securities fraud,

including insider trading charges. From 2003

until 2005, they inflated DHB's inventory val-

uations in order to boost reported profits, and

they improperly reclassified expenses to

increase DHB's reported gross margin per-

centage. In addition, during the first quarter of

2005, they falsified DHB's records to reflect

the existence of $7 million worth of non-exis-

tent inventory. When auditors first uncovered

this fraud, the CFO insisted the inventory

existed and provided bogus documents to back

up her claim. After the auditors discredited the

claim, they admitted to the auditors that the

inventory entry was false. In November and

December of 2004, while DHB was reporting

the profit and gross margin numbers fraudu-

lently inflated by the CFO and the COO, the

CFO sold approximately $3 million worth of

DHB and the COO sold approximately $5

1.9

Report To The President – Corporate Fraud Task Force 2008

million worth of DHB stock, both doing so

through the execution of cashless warrant

options.

U.S. Attorney’s Office for the Southern

District of New York

Accounting / Financial Fraud

Adelphia. Following a four-month trial, the

former CEO and CFO of Adelphia Commun-

ications Corp. were convicted of fraud charges

arising from their participation in a complex

financial statement fraud and embezzlement

scheme that defrauded Adelphia’s shareholders

and creditors out of billions of dollars. John and

Timothy Rigas were sentenced to 15 and 20

years’ imprisonment, respectively. The Govern-

ment also obtained the forfeiture of more than

$715 million from the Rigas family and Adelphia

for distribution to victims.

Refco. The former CEO of Refco, a com-

modities brokerage firm based in New York, the

CFO, and a half owner were indicted for their

roles in a scheme to hide from Refco's investors

massive losses sustained by the company in the

late 1990s; public investor losses exceed $2 bil-

lion. Trial is currently scheduled for March 2008.

The Government entered into a non-prosecution

agreement in which BAWAG Bank admitted

facilitating the Refco fraud, agreed to cooperate,

and to forfeit more than $400 million.

Impath. The former president and COO of

Impath, Inc., a New York-based biotechnology

company, was convicted after a three-week trial

for his role in a massive accounting fraud that

caused a decline in the company’s market capital-

ization in excess of $260 million. He was sen-

tenced to 42 months' imprisonment and was

ordered to pay $50 million in restitution and $1.2

million in forfeiture.

Optio

ns Backdating

Safenet. In October 2007, the former presi-

dent, COO, and CFO of SafeNet, Inc., a

Maryland-based software encryption company,

pled guilty to one count of securities fraud, with

a plea agreement stipulating a sentencing guide-

lines range of 97-121 months. He schemed with

others to backdate millions of dollars of stock

options at SafeNet from 2000 through 2006

without recording or reporting the option grants

as compensation expenses. The indictment

alleges eight different sets of backdated option

grants. In each case, the options were backdated

to dates on which SafeNet's stock was trading at

historical low points.

MonsterWorldwide. In February 2007, Myron

Olesnyckyj, former general counsel of recruit-

ment services giant MonsterWorldwide, Inc.,

pled guilty in connection with the backdating of

millions of dollars’ worth of employee stock

option grants at Monster. Olesnyckyj and other

senior executives at Monster backdated options

by papering them as if they had been granted on

dates in the past on which Monster’s stock price

had been at a periodic low point.

Insider Trading

Reebok. In 2006, the Government charged an

associate at Goldman Sachs, an investment

banking analyst at Merrill Lynch, and several

other defendants with participation in a massive

insider trading scheme that resulted in more

than $6.7 million in illicit gains. The defendants

traded on inside information from: (1) Merrill

Lynch; (2) advance copies of Business Week’s

"Inside Wall Street" column; and (3) a grand

juror hearing evidence of accounting fraud at

Bristol-Myers Squibb. Five defendants have

pled guilty.

1.10

Corporate Fraud Task Force Member Contributions

UBS. In March 2007, the Government

charged an executive director at UBS, a former

in-house attorney at Morgan Stanley, and 11

other defendants with participating in two mas-

sive insider trading schemes and in two separate

bribery schemes that, in total, provided the

defendants with more than $8 million in illegal

profits. Eight of the 13 defendants have pled

guilty.

Imclone. Martha Stewart, former CEO of

Martha Stewart Living Omnimedia, was con-

victed of conspiracy, obstruction of justice, and

false statement charges and was sentenced to

five months in prison and five months in home

confinement. The charges arose from Stewart’s

efforts to obstruct federal investigations into her

trading in the securities of ImClone Systems,

Inc., on the eve of that company’s announce-

ment of extremely negative news. Peter

Bacanovic, Stewart’s Merrill Lynch broker, was

also convicted and sentenced to five months in

prison. The former CEO of Imclone, Samuel

Waksal, pled guilty to insider trading charges

and is serving a seven-year sentence.

Hedge F

unds

Bayou. Principals of the Connecticut-based

Bayou Hedge Funds, Samuel Israel III, Daniel

E. Marino, and James G. Marquez, pled guilty

to fraud and conspiracy charges based on their

substantial and prolonged misrepresentation of

the value of the assets of the funds, to which

investors had entrusted more than $450 million.

The Government obtained $106 million for dis-

tribution to victims.

Tax Shelter Prosecutions

KPMG and HVB. KPMG and HVB (a Ger-

man bank) each entered into deferred prosecu-

tion agreements in which they admitted partic-

ipating in a multi-billion dollar fraud on the

United States in connection with fraudulent tax

shelter transactions. Together the entities have

paid a total of over $485 million in monetary

penalties and restitution to the Government.

KPMG. Nineteen defendants, including three

successive heads of tax for KPMG, a former

KPMG associate general counsel, and a former

partner at Brown & Wood, were charged with

participating in a multi-billion dollar fraud on

the United States relating to fraudulent tax

shelters. Two of these individuals pled guilty,

and the Government is currently appealing an

adverse ruling in connection with the remain-

ing 13 individuals.

Ernst & Young. Four current and former

partners of Ernst & Young were charged with

conspiracy to defraud the IRS, as well as mak-

ing false statements to the IRS and additional

tax offenses. In addition, Belle Six, who

worked with E&Y and later went on to work

with two of E&Y ’s tax shelter co-promoters,

pled guilty to participating in the same con-

spiracy and forfeited approximately $13 mil-

lion in fees she collected from the sale of fraud-

ulent tax shelters.

Oil for Food Cases

Bayoil (USA). This case was brought as a

result of a wide-ranging criminal investigation

into the United Nations Oil-for-Food

Program (“OFFP”). In mid-2000, the former

Government of Iraq, under Saddam Hussein,

began conditioning the right to purchase Iraqi

oil under the OFFP – a program intended to

provide humanitarian aid to the Iraqi people –

on the purchasers’ willingness to return a por-

tion of the profits secretly to Hussein’s govern-

ment, then the subject of international sanc-

tions. The Government investigated and prose-

cuted several of the U.S.-based individuals and

entities who agreed to pay the secret illegal sur-

charges to the Hussein regime in order to insure

continued access to the lucrative oil contracts

1.11

Report To The President – Corporate Fraud Task Force 2008

from the Hussein regime: David B. Chalmers, Jr.,

the CEO and sole owner of Bayoil (USA) and

Bayoil Supply & Trade, and executive Lubmil

Dionissiev, as well as the Bayoil entities; Oscar S.

Wyatt, Jr.; and several foreign individuals and

entities. In August 2007, Chalmers, Bayoil

(USA), and Bayoil Supply & Trade pled guilty

and agreed to forfeit more than $9 million.

Dionissiev pled guilty on the same day. Wyatt

pled guilty on October 1, 2007, nearly four weeks

into his criminal trial, and agreed to forfeit more

than $11 million.

El Paso Corporation. On February 7, 2007,

the Government reached an agreement with the

El Paso Corporation and its subsidiaries, in

which El Paso admitted to obtaining Iraqi oil

under the Oil-for-Food Program from third par-

ties that paid secret, illegal surcharges to the for-

mer Government of Iraq. El Paso agreed to for-

feit approximately $5.5 million as part of the

agreement.

U.S. Attorney’s Office for the Eastern

District of Pennsylvania

Beacon Rock

In the first criminal prosecution of market

timing fraud in the United States, guilty pleas

were entered by Beacon Rock Capital, a

Portland, Oregon based hedge fund, and

Thomas Gerbasio, Beacon Rock’s broker.

Mutual funds attempting to prevent market

timing were deceived by an elaborate scheme

utilizing more than 60 different account names

and numbers, 26,000 trades structured to avoid

detection, and false assurances that no market

timing was being conducted. The trades result-

ed in profits of $2.4 million. Though market

timing is not per se illegal, the defendant’s

deceptions prevented the funds from protecting

the value of shares from dilution for fund par-

ticipants.

DVI, Inc.

A CFO was charged in one of the nation’s

first indictments for violation of the reporting

requirements of Sarbanes-Oxley in a $50 million

fraud scheme. Steven Garfinkel, CFO of DVI,

Inc., a publicly traded healthcare finance compa-

ny, was sentenced to 30 months’ imprisonment

for fraud. Garfinkel altered corporate records to

double count $50 million in assets, which result-

ed in false quarterly reports filed under the

requirements of Sarbanes-Oxley, and losses of

almost $50 million to financial institutions upon

the collapse and bankruptcy of the company.

Philadelphia Seaport Museum

The corporate head of a major Philadelphia

museum received a 15-year sentence for stealing

from the non-profit institution. On November

2, 2007, John Carter, president of the

Philadelphia Seaport Museum, was sentenced

to 15 years’ imprisonment for fraud and tax eva-

sion. Over a 10-year period, Carter falsified

records of the museum and created fictitious

invoices to divert $2 million to his own use in

order to maintain a lavish lifestyle, including

making additions to his Cape Cod home and

purchasing art work, vacations, and three

yachts. He also forged documents in an attempt

to divert $1 million from the cash value of an

insurance policy maintained by the museum

after he learned of the federal investigation.

Amkor Technologies

A corporate general counsel of Amkor

Technologies, one the world’s largest packagers

of semiconductors, abused his position to enrich

himself through insider trading. In October

2007, Kevin Heron was convicted of insider

trading and conspiracy for his own trading in

Amkor stock over several periods in 2005, and

for trading information about Amkor and

1.12

Corporate Fraud Task Force Member Contributions

Neoware Corporation with Neoware employee

Stephen Sands, who pled guilty to conspiracy

charges. Heron, who enforced Amkor’s insider

trading policy, advised members of the board

of directors they could not trade while he him-

self was conducting trades. Heron realized

profits and avoided losses totaling $300,000

through the use of options, puts, calls, and

direct purchases and sales of stock.

Cyberkey

A brazen securities pump and dump was

uncovered at Cyberkey, a Utah electronics firm.

In July 2007, charges were filed against the CEO,

who schemed to inflate the value of Cyberkey

stock through false public announcements that

Cyberkey had a $24 million contract with the

Department of Homeland Security, and through

the use of a telemarketing firm to push the sale of

the stock. The over-the-counter stock rose

sharply with the false news and plummeted after

the fraud was discovered, with investors defraud-

ed of $3.5 million. The CEO attempted to cover

up the fraud, and was also charged with obstruc-

tion of justice for lying and providing false docu-

ments to the SEC.

Fountainhead Fund

Abuse of investors by hedge fund managers

resulted in prosecution of two founders and

directors of a hedge fund, Fountainhead Fund

LP. The defendants misrepresented the risks of

the fund, falsely assuring investors that the fund

dealt in insured, conservative investments. The

fund soon began to lose money, but defendants

solicited new investors and kept early investors

from closing their accounts by creating fictitious

account statements and K1 tax reports that

reflected profits. When the fraud was uncovered

and the fund frozen, investors had lost over $2

million of the $5.2 million invested. One defen-

dant was sentenced to five years’ imprisonment,

the other to one year.

Computer Video Store

A wide-ranging infomercial fraud on con-

sumers and financial institutions was perpetuat-

ed by George Capell, president and CEO, and

Patrick Buttery, CFO, through Computer

Video Store, which grossed $100 million annu-

ally selling computers through television

infomercials to thousands of consumers. As the

company failed, they continued to take con-

sumer orders, order form suppliers, and increase

funding from financial institutions. They falsi-

fied corporate records and sales records, and

diverted funds to their own use, defrauding con-

sumers of over $3 million, suppliers of $13.5

million, and financial institutions of $22.5 mil-

lion. Capell was sentenced to over seven years’

imprisonment, ordered to pay $31.9 million in

restitution, and required to forfeit $475,000, two

properties, and three vehicles. Buttery was sen-

tenced to one year’s imprisonment.

E-Star

Strong sanctions were imposed on a foreign

corporation cheating on federal taxes by not

reporting $99 million worth of stock bonuses to

its American employees. In April 2007, E-Star,

a subsidiary of a Taiwanese corporation, was

sentenced for failure to pay taxes on $99 million

worth of stock bonuses to employees. The com-

pany devised a manual, off-the-books system to

track stock bonuses, and transacted stock sales

and payments in Taiwan and through overseas

accounts to mask the tax liability. The company

was ordered to pay over $45 million in taxes,

penalties, interest, and fines.

U.S. Attorney’s Office for the Southern

District of Texas

Dynergy

Gene Foster, Dynegy’s former vice president

of tax, and Helen Sharkey, formerly a member

1.13

Report To The President – Corporate Fraud Task Force 2008

of Dynegy’s Risk Control Group and Deal

Structure Groups, pled guilty to conspiracy to

commit securities fraud related to “Project

Alpha.” This was an accounting scheme designed

to borrow $300 million from various lending

institutions while publicly misrepresenting the

proceeds of those loans as revenue from opera-

tions rather than debt. It was also part of the con-

spiracy to prevent disclosure to the SEC, the

shareholders and the investing public. On

January 5, 2006, Foster was sentenced to 15

months’ confinement and three years’ supervised

release. He was ordered to pay a $1,000 fine and

$100 special assessment. Sharkey was sentenced

to 30 days in jail and three years of supervised

release (with the first six months on home con-

finement). She was ordered to pay a $10,000 fine

and $100 special assessment. Jamie Olis, former

vice president of finance, was convicted by a jury

on November 13, 2003, of conspiracy, securities

fraud, mail fraud and wire fraud. Olis received a

sentence of 72 months’ imprisonment and three

years’ supervised release, and ordered to pay a

$25,000 fine and $600 special assessment.

Seitel

Paul Frame, ex-CEO of Seitel, was indicted

for defrauding his former corporation of

approximately $750,000, laundering the pro-

ceeds of the fraud, and lying to the SEC about

the fraud. He was convicted on April 7, 2005,

and sentenced on October 27, 2005, to 63

months in prison and three years’ supervised

release. He was ordered to pay restitution of

$750,000.

Enron

Enron’s director of benefits for its Human

Resources Department fraudulently billed

Enron for approximately $3 million. He was

convicted and sentenced to three years in prison

on April 19, 2007.

Other Significant Federal Criminal Cases

Hamilton Bank

The Hamilton Bank case involved the crim-

inal undertakings of Eduardo Masferrer, the

chairman and CEO of both Miami-based

Hamilton Bank and its holding company,

Hamilton Bancorp, in concert with Carlos

Bernace, Hamilton Bank’s president, and John

Jacobs, Hamilton Bancorp’s CFO. These three

defendants removed certain distressed Russian

loans from Hamilton Bank’s books by recording

that these assets had been successfully sold for

no loss, despite consequent multi-million dollar

losses realized from the sales, which was accom-

plished through fraudulent accounting entries.

The undisclosed quid pro quo for these sales

consisted of the bank’s concurrently conducted

purchase of various Latin American securities

from the same foreign banks also at fraudulent-

ly inflated prices. In order to conceal this

accounting fraud, the fortuitous Russian loan

sales were recorded without revealing the related

and necessary purchase transactions. Masferrer

was convicted in the Southern District of

Florida in May 2006 of all 16 counts alleging

securities fraud, bank fraud, wire fraud, false

statements, obstruction of regulatory proceed-

ings, and conspiracy. Bernace and Jacobs each

had pled guilty to securities fraud charges and

testified against Masferrer. Masferrer was sen-

tenced to 30 years’ imprisonment (what is

believed to be one of the lengthiest sentences

for a corporate accounting fraud scheme in

American history) and ordered to pay $17.2

million in restitution to the FDIC as receiver

for Hamilton Bank, as well as $14.5 million to

investors who had purchased Hamilton Bancorp

stock. Bernace and Jacobs were each sentenced to

28 months’ imprisonment and were also ordered

to pay $14.5 million to the investor victims.

1.14

Corporate Fraud Task Force Member Contributions

Chiquita Brands International, Inc.

In March 2007, Chiquita Brands

International, Inc. ("Chiquita" or "Company")

pled guilty in the District of Columbia to the

felony charge of engaging in transactions with

a specially designated global terrorist. On

September 17, 2007, the Company was sen-

tenced to a criminal fine of $25 million and

five years of probation. From 1997 through

early 2004, Chiquita paid money to the

Colombian terrorist organization Autodefen-

sas Unidas de Colombia (“the AUC”), a spe-

cially designated global terrorist organization.

Chiquita paid the AUC in total over $1.7 mil-

lion in over 100 installments. The investigation

into the Company's conduct revealed that

Chiquita had violated the “books and records”

provision of the Foreign Corrupt Practices Act.

In connection with the guilty plea, the

Company admitted that its corporate books

and records never reflected that the ultimate

and intended recipient of these funds was the

AUC.

Suprema Specialties Inc

Suprema Specialties, Inc., was a public

company that manufactured, processed, and

distributed a variety of purportedly all natural

cheese products. Between the mid-1990's and

early 2002, various individuals at Suprema,

with the assistance of some of their customers,

engaged in a massive fraud by fraudulently

inflating Suprema’s sales, inflating the value of

Suprema’s inventory, and misrepresenting the

nature of some of Suprema’s products. They

then used these misrepresentations to obtain

money from Suprema’s banks under a line of

credit and from the investing public through a

secondary offering of stock in November 2001.

This fraud resulted in losses to banks and the

investing public of more than $100 million.

(Suprema entered Chapter 7 liquidation in

2002 and is no longer operational.). Mark

Cocchiola, a Suprema founder and former

CEO and chairman of the board of directors,

and Steven Venechanos, its former CFO and a

director, were found guilty on 38 counts of

conspiracy, bank fraud, securities fraud, mail

fraud and wire fraud. Six individuals pled

guilty in U.S. District Court for the District of

New Jersey in connection with this fraud and

agreed to cooperate with the Government.

CUC/Cendant Cor

p.

From the late 1980s through April 15, 1998,

executives Walter A. Forbes and E. Kirk

Shelton, together with their coconspirators,

artificially inflated the earnings at CUC

International and its corporate successor,

Cendant Corporation, to create the appearance

that CUC/Cendant was meeting the growth

targets set by Wall Street stock analysts. The

defendants and their coconspirators engaged in

four separate accounting frauds to inflate CUC’s

earnings: (1) improperly reversing merger

reserves; (2) understating the membership can-

cellation reserve; (3) delaying recognition of

rejects-in-transit; and (4) engaging in early rev-

enue recognition. Between 1995 and 1997

alone, those four separate accounting frauds

overstated CUC’s income by more than $252

million. When Cendant publicly announced its

initial findings regarding the fraud in the former

CUC businesses, Cendant’s stock price declined

by 47% in a single day, and Cendant’s share-

holders lost more than $14 billion in market

value. Cendant remains one of the largest

accounting frauds of the 1990s. In 2005, a jury

found Shelton, who was Cendant’s vice chair-

man, guilty on 12 counts, and he received a sen-

tence of 120 months of imprisonment and was

ordered to pay $3.275 billion in restitution. A

jury found Forbes, who was Cendant’s chair-

man, guilty on three counts: one count of con-

spiring to file false statements with the SEC

1.15

Report To The President – Corporate Fraud Task Force 2008

and to commit securities fraud; and two counts

of filing false statements with the SEC. In

January 2007, the U.S. District Court for the

District of New Jersey imposed a sentence of

151 months’ imprisonment and $3.275 billion

in restitution.

Terry Manufacturing Company

Roy and Rudolph Terry were brothers who

owned and managed Terry Manufacturing

Company (“TMC”), a manufacturer of uniforms

in Roanoke, Alabama. TMC began to decline

financially in the late 1990s. In order to keep

TMC afloat, Roy Terry began a four-year-long

campaign to fraudulently obtain financing for

TMC. Through the use of false financial state-

ments, Roy Terry fraudulently obtained over $20

million for TMC from banks and individual

investors. Roy Terry also embezzled funds from

the TMC pension plan. Rudolph Terry partici-

pated in the defrauding of individual investors to

the extent of $5.5 million. In a case handled in

the Middle District of Alabama, on June 17,

2005, Roy Terry pled guilty to an information

charging mail, wire, and bank fraud; misuse of

pension funds; and interstate transportation of

fraudulently obtained proceeds. On April 3,

2006, Rudolph Terry pled guilty to an informa-

tion charging conspiracy. Rudolph Terry was sen-

tenced to 41 months’ imprisonment. Roy Terry

was sentenced to 78 months’ imprisonment.

World Auto Parts

This case concerns fraud by an owner and

top management of a privately held company,

World Auto Parts, against Chase Bank. The

defendants engaged in fraud against the bank,

in particular, falsifying asset information pro-

vided to the bank, for the purpose of keeping

the bank's revolving line of credit going. Had

the bank been aware of the true financial status

of the company, it would likely have called the

loan. The company comptroller has pled guilty

and was a key witness during the trial. His sen-

tencing was adjourned until after the trial,

which concluded with a verdict convicting the

owner of six counts of the indictment against

him. Three of those counts carry statutory max-

imum penalties of 30 years’ imprisonment,

while the other three counts have 20-year max-

imums. The total loss to the bank as a result of

his conduct was approximately $11 million.

Sentencing is pending in the Western District

of New York.

National Air Cargo, Inc.

National Air Cargo, Inc., a national air freight

forwarder based in Orchard Park, New York, and

owned by Christopher Alf, entered into a corpo-

rate plea in the U.S. District Court for the

Western District of New York to a felony charge

of making a material false statement to the

Government. National Air Cargo, which con-

tracts with the Department of Defense to trans-

port freight, admitted falsifying a document to

show an "on time" delivery date to the

Government, when in fact, that delivery had

been made later than the date reported. This plea

resolved an ongoing multi-agency investigation

into defendant’s domestic billing and shipping

practices. Pursuant to Rule 11(c)(1)(C) of the

Federal Rules of Criminal Procedure, defendant

agreed, upon the acceptance of the plea and at the

time of sentencing, to make payments totaling

$28 million. Such payments would represent the

largest criminal monetary resolution in the his-

tory of the Western District of New York. Of

that amount, defendant, in addition to agreeing

to pay the maximum fine of $8.8 million, has

also agreed to pay restitution to the United

States in the amount of $4.4 million, and to set-

tle a related civil forfeiture claim with a payment

of $7.429 million, as well as an additional $7.129

million in settlement of a related civil qui tam

action.

1.16

Corporate Fraud Task Force Member Contributions

International Heritage

In November, 2006, Stanley H. Van Etten

was sentenced in the Eastern District of North

Carolina following his conviction for charges

related to his activities as founder and CEO of

the former International Heritage, Inc. (IHI),

a Raleigh-based multilevel marketing company

and for fraud related to Mayflower Venture

Capital Fund III (Mayflower) and its purport-

ed investment in BuildNet, a Durham-based

software company. Van Etten was given 10

years’ imprisonment and ordered to make resti-

tution in the amount of $14,484,620 to the

victims of the now defunct Mayflower Venture

Capital Fund III. The case involved two

schemes: first was IHI, determined by federal

regulators to be one of the biggest pyramid

schemes they had ever seen, involving over

150,000 individuals and gross receipts of over

$150 million at its peak; and second,

Mayflower Fund III, a Raleigh-based capital

venture fund which was supposed to invest in

the BuildNet IPO. It was discovered that 120

investors were defrauded of over $15 million

when the Mayflower funds were used for other

purposes without the investors’ knowledge.

Five former Van Etten IHI associates pled

guilty to IHI-related charges including co-

founders Claude Savage and Larry G. Smith.

Also VP John Brothers was found guilty.

Convictions were further obtained against the

IHI principal accountant and an attorney.

P

innacle Development Partners, LLC

Gene A. O'Neal served as CEO and presi-

dent of Pinnacle Development Partners, LLC

("Pinnacle"), a real estate investment fund

headquartered in Atlanta. Between October

2005 and October 2006, O'Neal raised more

than $60 million in investment from more

than 2,000 nationwide investors. The scope

and rate of investment in Pinnacle flowed from

O'Neal's promise of a 25% rate of return in 60

days, which O'Neal falsely represented was

generated by Pinnacle's real estate develop-

ment activities. The returns were in fact paid

solely by later investors' capital contributions,

resulting in a huge, and undisclosed, debt bur-

den. By the time the SEC and FBI interceded

in October 2006, O'Neal's investors had lost

over $20 million. He was indicted by the

Northern District of Georgia U.S. Attorney’s

Office in March 2007, pled guilty, and was

sentenced to 144 months in prison in

September 2007.

Key Bank

David Verhotz was a senior vice president

and the head of international banking for Key

Bank in Cleveland. During a nine-year period

from October 1997 to November 2006, Verhotz

fraudulently obtained 106 loans totaling $40.6

million. When this activity was discovered in

November 2006, there were 29 unpaid loans

totaling $18.6 million. In a case prosecuted by

the U.S. Attorney’s Office for the Northern

District of Ohio, Verhotz pled guilty to bank

fraud on January 25, 2007. He was sentenced to

97 months’ imprisonment, five years’ supervised

release, and ordered to pay $18.6 million restitu-

tion. Verhotz agreed to forfeit substantial real

and personal property, including a $5.6 million

home in Sagaponack, New York; $2.7 million in

escrow for the purchase of a condominium on

Park Avenue in New York; and more than $2

million in jewelry.

Fruit of the Loom, Inc.

Kalen Watkins, the former director of envi-

ronmental services for Fruit of the Loom, Inc.,

located in Bowling Green, Kentucky, was

charged by the U.S. Attorney’s Office for the

Western District of Kentucky with seven

counts arising from a conspiracy to defraud

1.17

Report To The President – Corporate Fraud Task Force 2008

Fruit of the Loom of approximately $1 million.

In this case, which involves self-dealing by a

corporate insider, Watkins enlisted co-conspira-

tors to submit false invoices to Fruit of the

Loom for services never rendered, or to submit

inflated invoices. When the invoices were paid,

Watkins’ co-conspirators paid kickbacks to

Watkins in return for Fruit of the Loom busi-

ness. On April 25, 2007, Watkins pled guilty to

three counts of the indictment: conspiracy to

commit mail fraud, and two counts of money

laundering. Watkins was pending trial on the

remaining four counts of the indictment. On

August 24, 2007, three days before two of

Watkins’ co-conspirators went to trial, Watkins

pled guilty to additional counts of money laun-

dering and obstruction of justice for creating

fraudulent correspondence that was produced in

response to a grand jury subpoena.

National Century Financial Enterprises,

Inc. (“NCFE”)

NCFE was the largest healthcare finance

company in the United States prior to its col-

lapse in November 2002. Through two of its

subsidiaries, NCFE sold billions of dollars of

asset-backed securities to large institutional

investors from around the world by representing

that investor funds would be used to purchase

health care accounts receivable. From about

1994 through October 2002, NCFE’s owners

and executives diverted billions of investor dol-

lars for other purposes, including the unjust

enrichment of NCFE’s owners. The loss to

investors in NCFE asset-backed securities was

in excess of $2.88 billion at the time the com-

pany collapsed. Four of NCFE’s executives,

including its CFO and another executive vice

president, pled guilty to conspiracy, money

laundering, and/or securities fraud offenses.

Seven other owners and executives of NCFE

are awaiting trial on an indictment that charges

them with conspiracy, money laundering, mail

fraud, wire fraud, and securities fraud offenses,

and that includes a $1.9 billion forfeiture count.

The charges against these individuals were the

result of one of the largest fraud investigations

involving a privately held corporation ever con-

ducted by the FBI. The U.S. Attorney’s Office

for the Southern District of Ohio and the

Criminal Division prosecuted this case.

MC

A Financial Corp.

MCA Financial Corp., based in Southfield,

Michigan, was a privately held mortgage company

that made conventional and subprime loans to

individual homebuyers in Michigan and several

other states. MCA was also a mortgage and land

contract broker and servicer. MCA defrauded

both its investors, who purchased MCA’s bonds

and mortgage-backed securities, and institutional

lenders by misrepresenting its true financial condi-

tion in financial statements that were regularly

filed with the SEC. As the result of paper transac-

tions involving low-income housing in the City of

Detroit between MCA and numerous off-book

partnerships controlled by MCA’s top two execu-

tives, tens of millions of dollars in sham assets and

revenues were booked. Seven former MCA exec-

utives, including its chairman and CEO, president

and COO, CFO, and controller, were convicted in

the Eastern District of Michigan of conspiracy,

wire fraud, mail fraud, bank fraud, and filing false

statements with the SEC. Their sentences, the last

of which were imposed in 2006, ranged from 10

years’ imprisonment, for the former chairman, to

12 months of alternative confinement, for a senior

vice president who cooperated. The defendants

were also ordered to pay restitution, jointly and

severally, to investors and lenders in the amount of

$256 million.

Electr

o Scientific Industries

On June 25, 2007, James T. Dooley, the for-

mer CEO of Electro Scientific Industries, a

high tech manufacturer headquartered in

Portland, pled guilty to one count of making

1.18

Corporate Fraud Task Force Member Contributions

false statements to a publicly traded company.

During the process of closing the books for the

first quarter of FY 2003, he unilaterally elimi-

nated the retirement benefits for all employees

in Asia. He falsely represented to the compa-

ny’s auditor that legal counsel had approved

the decision, when in fact no such legal advice

had been procured. During the second quar-

terly review process of 2003, a second employ-

ee, James Lorenz, failed to disclose that he had

made a significant change in the way a certain

category of inventory was treated, changing the

item from an expense to a company asset.

Lorenz pled guilty to making false statements

to the auditor. Sentencing is scheduled for

February 2008 in the District of Oregon.

Federal Bureau of Investigation

Securities Fraud Market Manipulation

Initiative

The FBI has undertaken several proactive

S

ecurities Fraud Market Manipulation initiatives

that aggressively pursue corrupt participants in

the financial markets.These initiatives use under-

cover techniques not only to target traditional

market manipulation schemes, but also to curb

the rising threat posed by market manipulations

carried out via computer intrusion.

Corporate Fraud Response Team

The Corporate Fraud Response Team

(CFR

T) is designed to provide a rapid start to

complex corporate fraud matters through a team

deployment of Special Agents, Financial

Analysts, and Asset Forfeiture investigators.

CFRT members have the experience and finan-

cial expertise necessary to provide expert advice

and assistance to case agents investigating large-

scale corporate frauds. CFRT members assist

case agents in the planning and execution of

searches, the immediate identification of perti-

nent documents, efficient document manage-

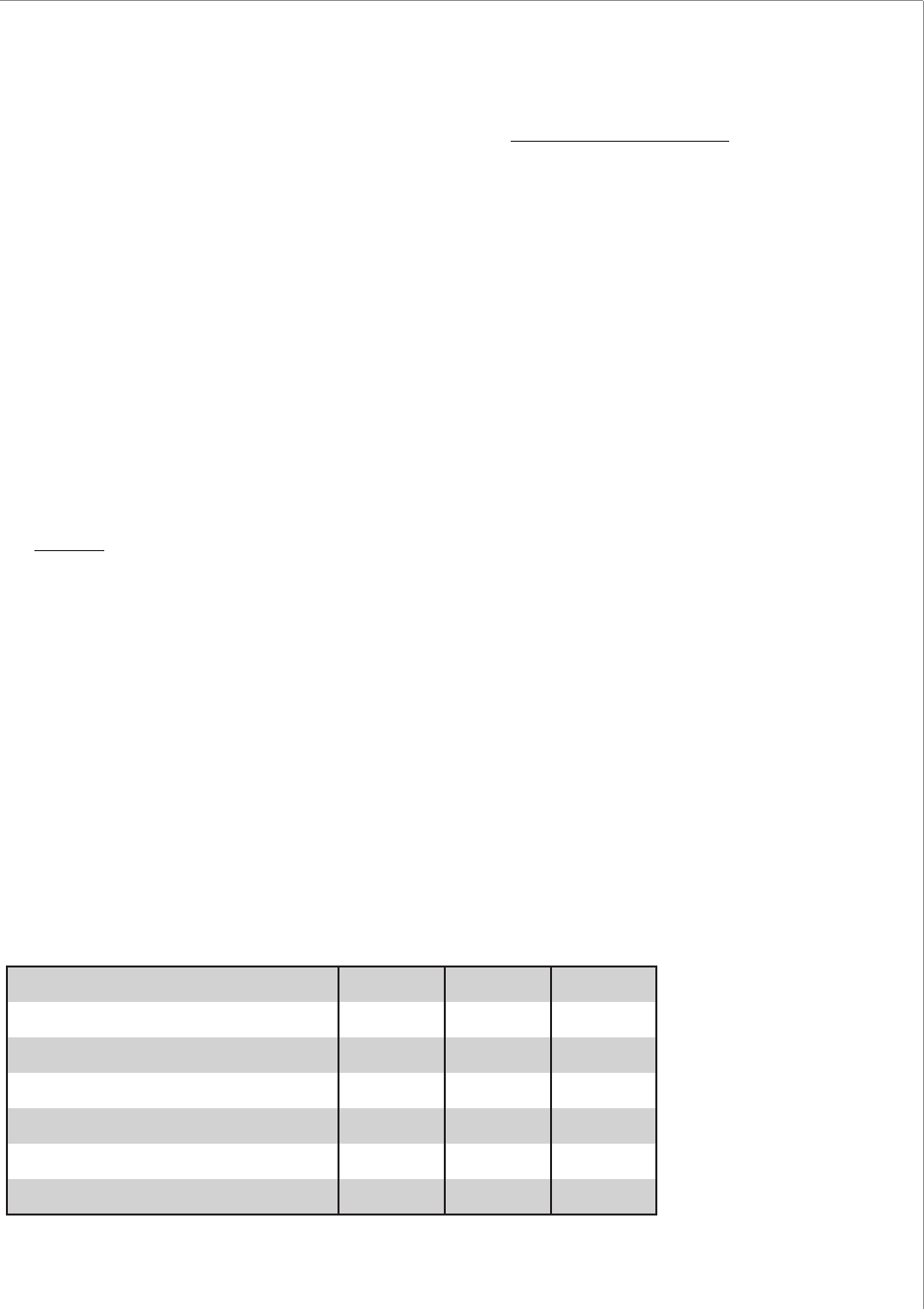

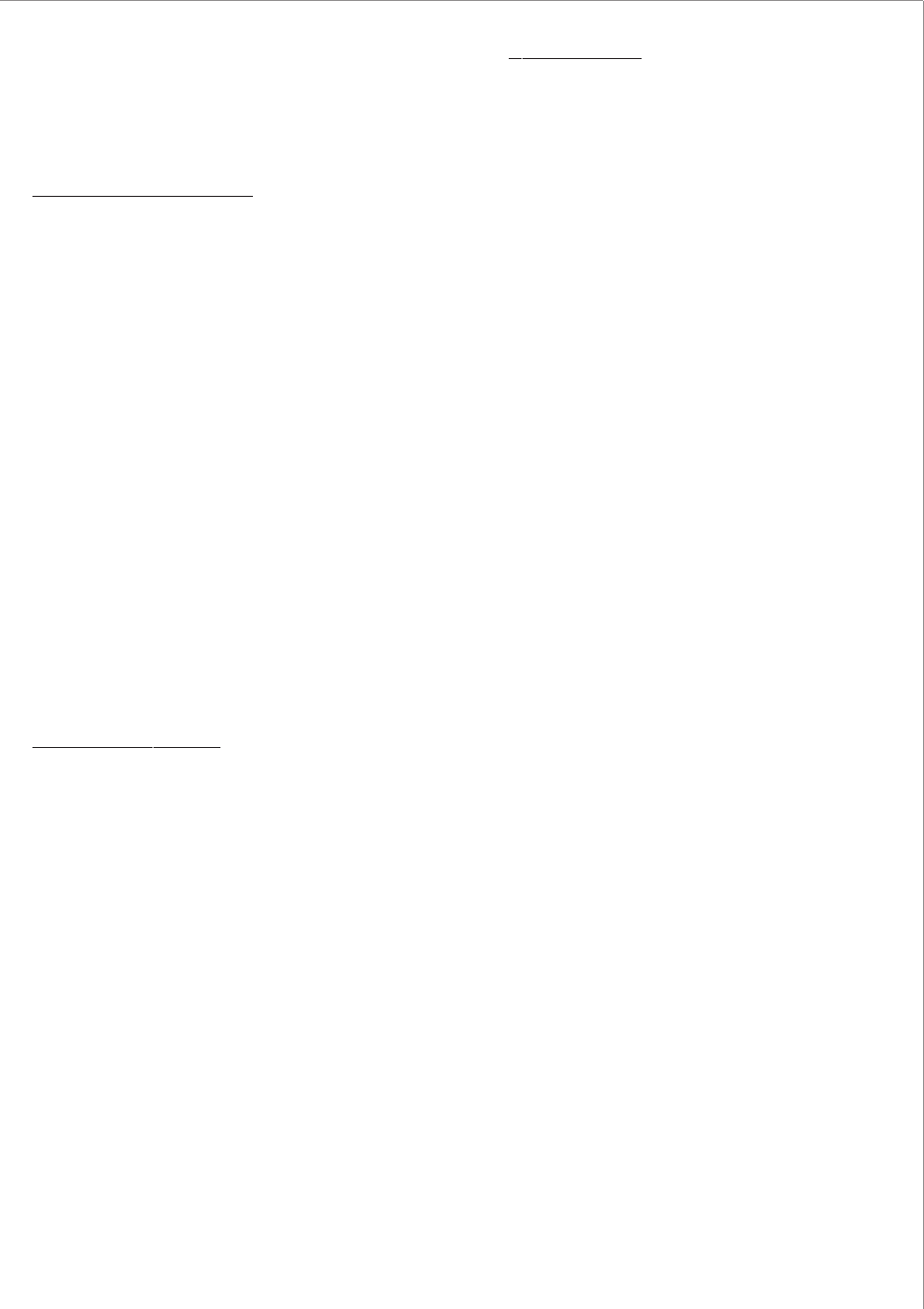

FBI Corporate & Securities Fraud Statistics

Fiscal Years 2003-2007

2003 2004 2005 2006 2007

0

500

1000

1500

2000

1215

1319

1562

1655

1746

Cases

Over the five year period from FY 2003 to FY 2007, the FBI has opened a

consistent average of 505 new Corporate and Securities Fraud cases each year.

Informations/indictments and convictions have also remained relately stable

at an average of 531 and 458 each year, respectively.

2003 2004 2005 2006 2007

0

200

300

400

600

463

431

513

413

473

Convictions

500

100

2003 2004 2005 2006 2007

0

200

300

400

600

Fiscal Years

508

585

505

496

567

Informations & Indictments

500

100

Percent change from FY01- FY07

43.70%

Percent change from FY01- FY07

2.16%

Percent change from FY01- FY07

11.61%

ment, interviews, and by providing "best practice"

guidance for large-scale corporate fraud investi-

gations. CFRT deployments produce well-

organized corporate fraud investigations that will

ultimately lead to more efficient prosecutions.

The CFRT is available for temporary deploy-

ment to any field office nationwide.

1.19

Report To The President – Corporate Fraud Task Force 2008

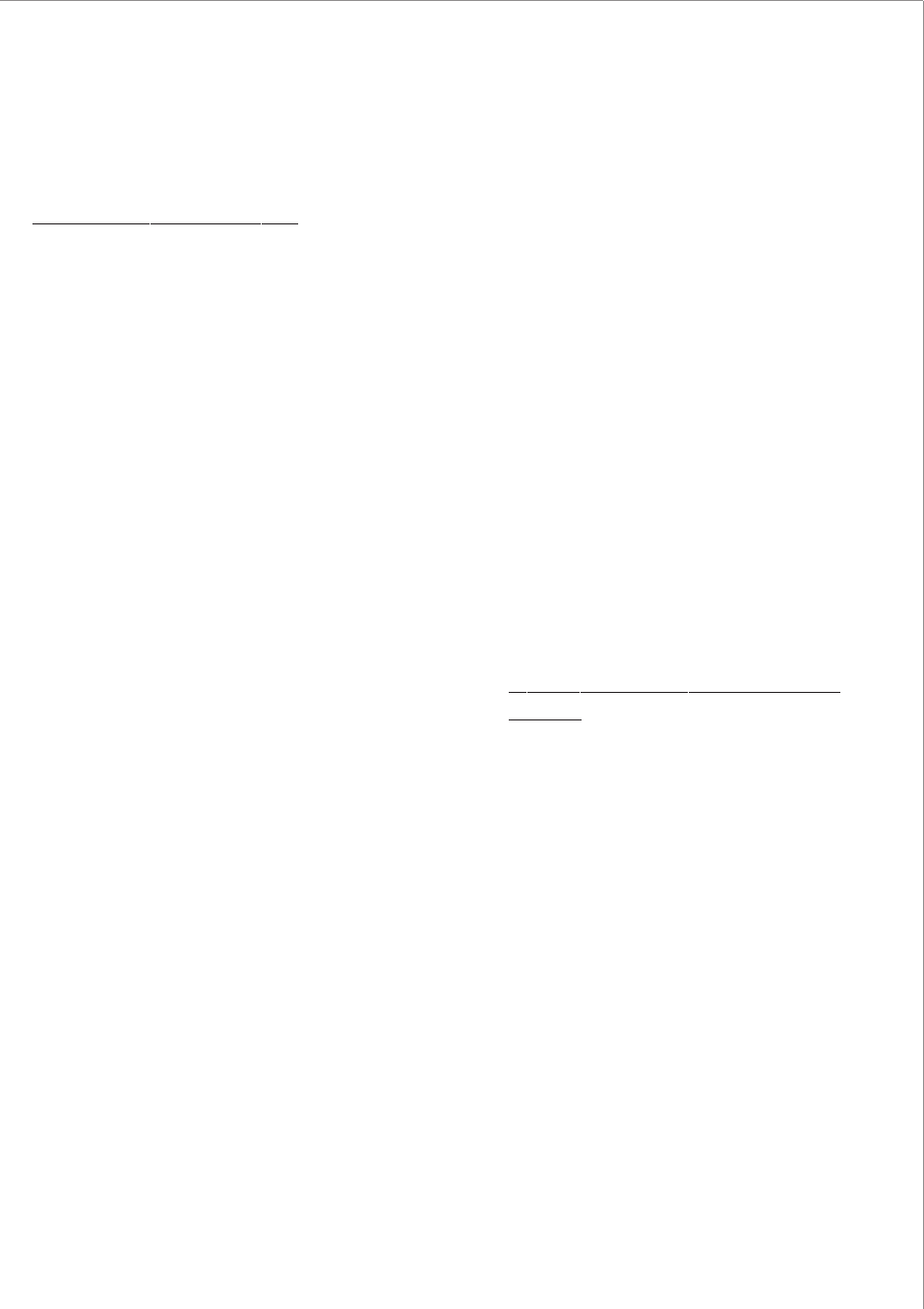

FBI Corporate Fraud Statistics

Fiscal Years 2003-2007

2003 2004 2005 2006 2007

0

100

300

400

600

287

332

423

490

529

Cases

Over the past five years, the FBI has opened a consistent average of 161 new

Corporate Fraud investigations each year. Informations/indictments and

convictions have also remained relatievely stable at an average of 175 and

145 each year, respectively.

500

200

2003 2004 2005 2006 2007

0

120

160

200

143

126

150

134

173

Convictions

80

40

0

120

160

200

80

40

2003 2004 2005 2006 2007

0

Fiscal Years

150

192

178

176

183

Informations & Indictments

Percent change from FY01- FY07

84.32%

Percent change from FY01- FY07

20.98%