!

!

!

!

!

!

!

!

!

!

!

!

!

!

!"#$%&'()*+',%*-(./01(2%*3/0241.'()*5&01&%)'%.6!

74"8%*+',%*9%0./.*:;/<*=%0#>*-(?%.&*&4%*@',,%0%(2%A!

!

!

!

By

!

!

!

!

!

Jordon!Hastin

gs

!

!

!

!

!

!

!

!

*!*!*!*!*!*!*!*!*!

!

!

!

!

!

!

!

Submitted!in!partial!fulfil

lme

n

t!

of!the!requirements!fo

r

!

Honors!in!the!Department!of!Econo

m

ics

!

!

!

!

UNION!COLLEGE!

June,!

2013

!

i

!

!

B;5

=

CB

!=!

!

HASTINGS,!JORDON! Competing!Life!Insurance!Purchasing!Strategies:! Whole!Life!Versus!“Buy!

Term,!Invest!the!Difference”.!!Department!of!Economics,!June!2013!

!

ADVISOR:! Professor!Tomas!Dvorak!

!

!

!

!

!

Financial!experts!have!been!conflicted!for!decades!in!regards!to!the!most!effective!

strategy!for!purchasing!life! insu rance.! Specif ically,!is!buying!an!expensive!whole!life!insurance!

policy!the!most!appropriate!solution,!or!is!purchasing!cheap!term!insurance!and!investing!the!

rest!of!the!money!in!a!side!fund!more!effective?! These!strategies!were!compared!side!by!sid e!

across!a!variety!of!scenarios!with!varying!account!allocations,!time!horizons!and!tax!treatments.!

Based!on!our!results,!buying!term!and!investing!the!difference!is!the!most!appropriate!solution!

across!the!majority!of!the!scenarios!that!were!tested.! This!was!due!mainly!to!the!higher!rates!

of!return!that!are!experienced!in!the!market!compared!to!the!modest!growth!of!whole!life

!

!

policies.!!Ultimately,!however,!it!was!still!difficult!to!claim!that!buying!term!and!investing!the!

difference!was!the!superior!solution!overall,!as!some!experts!claim.!!The!whole!life!strategy!has!

many!advantages,!especially!when!it!comes!to!leaving!bequests!which,!as!past!research!has!

indicated,!are!a!driving!force!behind!demand!for!life!insu rance.!!Whole!life!insurance!is!a!safe,!

tax!efficient!place!to!save!money!that!complements!many!of!the!side!funds!utilized!in!the!“buy!

term,!invest!the!difference”!strategy.! Many!of!these!accounts!have!contribution!limits,!so!

individuals!who!max!them!out!would!benefit!greatly!from!allocati ng!some!additional!savings!

toward!a!whole!life!insurance!policy.!

ii

!

!

=B;+D*EF*!E

G=DG

=

5

!

!

List!of!Tables!and!Figures! iii!

!

Introduction!

1

!

!

Understanding!the!Difference!Between!Term!and!Whole!Life!Insurance!

4

!

Term!Life!Insurance!

Whole!Life!Insurance!

!

Previous!Works!on!Life!Insurance!

12

!

Price!Elasticity!

Demand!Determinants!

!

Buy!Term,!Invest!the!Difference!Side!Fund!Options!

14

!

Saving!in!a!Tax]deferred!Account!(401K!or!Traditional!IRA)!

Saving!in!a!Taxable!Account!(Brokerage)!

Saving!in!a!Tax]free!Account!(Roth!401K,!Roth!IRA) !

!

Strategy!Parameters!

21

!

Whole!Life!Strategy!

Life!Insurance!Policy!

Death!

Benef

i

t

!

Living!

Bene

fit!

Buy!Term,!Invest!the!Difference!Strategy!

Life!Insurance!Policy!

Death!

Benef

i

t!

Living!

Bene

fit!

Choosing!a!“Winn

er

”!

!

Results!and!Analysis!of!Strategy!Testing!

27

!

Tax]deferred!Account!vs.!Whole!Life!

Taxable!Account!vs.!Whole!Life!

Tax]free!Account!vs.!W hole!Life!

!

Conclusions!

40

!

!

References!

44

!

iii

!

!

+-5=*EF*=B;+D5*BG@*

F-

H

ICD5

!

!

Figure!1:!Cost!of!Term!versus!Whole!Life!Insurance!

8

!

!

Table!1:!Term!+!Tax]deferred!Account!versus!Whole!Life!

28

!

!

Figure!2:!Years!20]40!BTID!versus!Whole!Life!Death!Benefit!

29

!

!

Table!2:! Term!+!Taxable!Account!versus!Whole!Life!

32

!

!

Figure!3:!Liquidity!Comparison!of!Taxable!Account!and!Whole!Life!CSV!

34

!

!

Table!3:! Term!+!Tax]free!Account!versus!Whole!Life!

36

!

!

Figure!4:!BTID!+!Tax]free!vs.!Whole!L ife!

38

!

1

!

!

-J* -(&0"K/2&'"(!

!

In!trying!economic!times!such!as!these,!the!subject!of!pers onal!finance!is!p laced!at!the!

forefront!of!most!people’s!minds.! When!putting!together!a!sound!financial!plan!for!yourself!

and!your!family,!it!is!important!to!first!build!a!stro ng!foundation!based!on!managing!risks.! One!

of!the!most!critical!components!of!this!foundation!is!life!insurance,!an d!it!is!also!one!of!the!

most!confusing!and!controversial.! Dave!Ramsey!has!written!a!number!of!books!on!personal!

finance,!two!of!which!landed!on!the!New!York!Times!bestseller!list,!and!is!what!some!consider!a!

financial!guru.!!Ramsey!states!that!“whole!life!insurance!is!one!of!the!worst!financial!products!

available”!in!the!article!The$Truth$About$Life$Insurance$that!he!wrote!for!his!personal!webpage.!

He!is!not!alone!in!this!view,!as!many!believe!that!purchasing!a!basic!term!insurance!policy!and!

investing!the!mon ey!you!would!save!(due!to!the!much!lower!premiums!compared!to!a!whole!

life!policy!of!equal!value)!in!mutual!funds!and!the!like.!!“Gurus”!like!Dave!Ramsey,!however,!are

!

!

offering!advice!to!the!masses,!so!who!is!to!say!that!a!whole!life!policy!may!not!be!a!great!

investment!for!someone!and!their!family?!

!

Many!people!do!not!like!this!kind!of!“one!size!fits!all”!approach!that!is!often!

implemented!by!these!financiers.! It!is!for!this!reason!that!people!may!be!drawn!to!sitting!down!

with!representatives!of!insurance!companies!to!develop!a!more!personalized!plan.! These!

representatives!may!be!big!proponents!of!whole!life!policies!and!would!likely!point!out!that!the!

policy!cannot!be!outlived!(whereas!term!can)!and!that!the!cash!value!returns!are!guaranteed!at!

a!minimum!rate!based!on!company!performance.! Stoughton!and!Zechner!(2011)!provide!

evidence!to!suggest!that!utilizing!an!advisor!actually!increases!total!welfare!between!the!

advisor!and!the!consumer!even!in!the!presence!of!kickbacks.! However,!the!presence!of!these

!

2

!

!

kickbacks!is!exactly!what!drives!many!away!from!using!advisors!as!pointed!out!by!Cooper!and!

Frank!(2005)!when!they!surveyed!CLUs!and!ChFCs.!!They!found!that!kickbacks!provide!incentive!

to!push!more!expensive!products,!whole!life!being!one!of!them,!so!that!they!will!be!paid!more!

rather!than!focusing!on!their!fiduciary!duties.!

!

We!are!left!with!a!dilemma!pitting!experts!like!Dave!Ramsey!against!many!personal!

financial!advisors!on!whether!or!not!whole!life!is!an!effective!strategy.! The!advisors!are!faced!

with!the!criticism!that!they!may!be!acting!selfishly!because!they!have!a!lot!to!gain!from!

consumers!purchasing!whole!life!due!to!its!large!price!tag,!but!they!are!also!the!ones!offerin

g!

the!personalized!approach!and!we!are!supposed!to!trust!that!they!would!not!suggest!it!if!it!was!

not!the!right!fit.!!The!“gurus”!do!not!directly!benefit!f rom!the!actual!purchases!of!the!

consumers,!so!it!is!safe!to!assume!that!they!are!offering!unbiased!advice!since!they!have!no!

incentive!to!do!otherwise.!!However,!they!aren’t!actually!sitting!down!and!meeting!with!

individuals!to!find!out!what!is!truly!in!their!best!interest.!To!say!that!whole!life!is!a!terrible!

investment!may!be!true!for!some,!but!the!opposite!may!be!true!for!others.! In!fact ,!renowned!

IRA!expert!Ed!Slott,!who!also!happens!to!be!a!practicing!CPA,!advocates!the!use!of!whole!life!

insurance!as!an!essential !piece!to!any!retirement!plan!in!his!book!“The$Retirement$Savings$Time$

Bomb…and$How$to$Defuse$It”.! The!Northwestern!Mutual!Life!Insurance!Company!recently!

released!(2012)!a!pamphlet!entitled!“Buy$Term,$Invest$the$Difference?”$that!displayed!the!after]!

tax!rate!of!returns!required!in!a!s ide!fund!to!equal!the!cash!value!of!their!own!whole!life!

insurance!policies!over!the!course!of!20!years!(1992] 2011)!and!30!years!(1982]2011).! The!

company!claimed!that!a!7.60%!and!an!8.66%!after]tax!rate!of!return!was!required!to!equal!the!

whole!life!policy!for!the!20]year!and!30]year!periods!respectively.! The!pamphlet!also!displayed!

3

!

!

how!various!asset!classes!(ranging!from!low!r isk!Treasury!Bills!to!high!risk!common!stocks)!were!

unable!to!match!those!after]tax!rates!of!return!over!those!same!time!periods.!!This!evidence!

suggests!that,!at!least!within!the!past!30!years,!saving!money!outside!of!Northwestern!Mutual!

whole!life!policies!yielded!less!favorable!after]tax!returns!which!heavily!contests!the!claims!

made!by!whole!life!opponents.!

!

The!life!insurance!market!lacks!the!transparency!o f!many!other!consumer!mar kets!and!

this!can!make!purchasing!policies!a!very!confusing!process.! Not!to!mention!the!fact!that!

financial!experts!cannot!seem!to!agree!on!a!particular!strategy!for!purchasing!life!insurance.! In!

hopes!of!shedding!some!light!on!the!matter,!this!paper!will!take!an!unbiased!approach!to!

compare!the!performance!of!alternative!life!insurance!strategies.! One!strategy!is!to!purchase!a!

whole!life!insurance!policy!and!let!the!cash!valu e!accumulate!over!time,!a!strategy!someone!

like!Ed!Slott!would!recommend!as!a!component!of!a!retirement!plan.!!The!other!strategy!is! a

!

!

favorite!of!Dave!Ramsey,!and!that!is!to!purchase!a!term!insurance!policy!and!take!

t

h

e!

diff

ere

n

ce

!

in!premium!between!the!term!and!a!whole!life!of!equal!value!and!invest!it!in!a!side!fund!in!the!

market.! This!strategy!is!commonly!referred!to!as!“buy!term,!invest!the!difference”!(BTID).!!

Rather!than!trying!to!decipher!technical!jargon!and!complicated!formulas,!this!perform ance!

comparison!highlights!the!strengths!and!weaknesses!of!each!strategy!and!offers!a!very!simple!

way!to!determine!which!strategy!may!be!most!appropriate!for!you,!the!consumer.!

4

!

!

--J* I(K%0.&1(K'()*&4%*@',,%0%(2%.*;%&L%%(*=%0#*1(K *74"8%*+',%!

-(./01(2%!

!

Term%Life%Insurance:!

!

Before!evaluating!the!two!strategies,!it!is!important!to!understand!the!differences!

between!the!two!life!insurance!policies.! Term!life!insurance,!as!the!name!suggests,!provides!

coverage!for!a!specified!term!and!expires!when!that!term!is!up.!!Imagine!that!a!35!year!old!

married!man!in!good!health!has!determined!that!he!needs!$500,000!in!life!insurance.! If!h

e!

were

!to!choose!to!fulfill!this!need!through!term!insurance!he!would!have!two!options.! The!first!

would!be!to!purchase!the!most!basic!term!policy!where!the!term!only!lasts!for!one!year.! At!the!

end!of!that!year,!this!man!would!need!to!renew!the!policy!in!order!to!continue!being!insured.!

This!process!is!not!a!si mple!as!it!may!sound.! The!man!must!first!qualify!for!life!insurance,!i.e.!be

!

!

deemed!insurable.! This!is!based!primarily!on!his!health,!both!at!the!present!time!as!well!as!in!

the!past.!!If!he!had!a!terminal!illness!such!as!cancer,!for!example,!he!would!be!deemed!

uninsurable!because!he!does!not!meet!the!health!qualifications!due!to!the!fact!that!the!

chances!of!him!dying!during!the!term!are!incredibly!high!and!the!insurance!provider!is!unwilling

!

!

to!take!that!risk.! By!utilizing!one!year!term!policies,!this!man!would!have!to!provide!proof!of!

insurability!each!year!in!order!to!retain!the!coverage.! This!means!that!if!during!one!year!he!

finds!out!that!h e!has!cancer,!but!does!not!pass!away!prior!to!the!expiration!of!the!insurance!at!

the!end!of!that!year,!he!will!not!be!able!to!renew!the!policy!and!will!no!longer!be!able!to!

purchase!life!insurance.! In!order!to!avoid!providing!proof!of!insurability!each!year!and!making!

the!renewal!process!much!simpler,!he!could!choose!to!purchase!an!an nu ally!renewable!term!

(ART)!policy.!!This!operates!nearly!the!same!as!a!normal!one!year!term!policy!but!instead!of!

5

!

!

requiring!proof!of!insurability!at!the!en d !of!each!year,!thes e!policies!guarantee!insurability!

based!on!the!information!they!receive!upon!the!initial!purchase.! T his!guarantee!can!cover!

periods!from!10,!20!or!30!years!and!in!some!cases!(depending!on!the!company)!up!to!age!80!or!

even!95.! That!way,!this!man!would!not!be!at!risk!of!losing!his!coverage!even!if!he!develops!an!

illness!that!would!normally!deem!him!uninsurable.!

!

It!is!also!important!to!understand!how!these!one!year!term!insu rance!and!ART!policies!

are!paid!for.! The!costs!of!the!policies!are!paid!for!through!premium!payments,!which!can!be!

periodically!paid!for!monthly,!quarterly,!semi]annually!or!annually.!!In!this!case,!since!th e!

term!

is!only!one!year!long,!an!annual!payment!would!be!the!entire!cost!of!the!policy!and!this!cost!

gets!reevaluated!each!time!a!renewal!is!made.!!The!premiums!are!calculated!based!on!actuarial!

mortality!tables,!basically!meaning!that!the!probability!of!the!proposed!insured!dying!during!

the!term!is!allocated!a!price. !!Let’s!take!the!same!married!man!from!before!and!compare!him!to

!

!

a!man!who!is!10!years!older!and!smokes!cigarettes!and!everything!else!is!held!constant.! The!

married!man!is!35!years!old!compared!to!the!other!man!being!45,!meaning!that!the!45!year!old!

man!has!a!higher!probability!of!dying!during!the!one!year!term!simply!because!he!is!older.!

Additionally,!the!45!year!old! man!is!a!smoker!and!smoking!has!a!negative!impact!on!health,!

thus,!reducing!this!man’s!life!expectancy!and!further!increasing!his!probability!of!death!within!

the!one!year!term.!!Having!taken!all!of!this!into!account,!the!35!year!old!man!would!have!a!

much!lower!p remium!cost!for!the!same!term!insurance!policy!than!the!45!year!old!man .!

Because!of!these!factors,!one!year!term!insurance!policies!and!even !the!ART!policies!become!

more!expensive!each!year!because!the!insured!person!is!one!year!older!than!they!were!

previously.! If!a!term!policy!were!renewed!for!20!years,!that!person!would!have!paid!increasing!

6

!

!

premium!costs!throughout!that!time!period.! As!a!result!of!the!constantly!increasing!premiums,!

it!stands!to!reason!that!term!insurance!becomes!t oo!expen si ve!past!a!certain!age!when!the!

insurance!companies!begin!taking!higher!risks!in!issuing!the!insurance.!

!

The!last!type!of!term!insurance!policies!are!known!as!level!term!life!insurance.!!These!

policies!provide!coverage!for!periods!of!10!to!30!years;!therefore,!there!is!no!need!to!renew!

these!policies!annually.! For!example,!a!man!purchases!a!20!year!level!term!policy!at!age!35!and!

when!he!reaches!age!55!the!coverage!will!expire.! However,!provided!he!is!able!to!establish!

proof!of!insurability!at!age!55,!he!can!renew!that!20!year!level!term!policy!and!be!guaranteed!

insurance!coverage!until!he!reaches!age!75,!for!a!higher!premium!of!course.!!The!premiums!on!

these!level!term!policies!are,!as!the!name!suggests,!set!to!a!level!amount!for!the!entirety!of!the!

term.! They!are!also!calculated!in!the!exact!same!way!as!the!one]year!term!policies!are,!the!

probability!of!dying!du ring!the!given!term.! The!reason!that!they!do!not!increase!each!year!

during!a!20]year!level!term!policy,!for!example,!is!because!the!premium!payment!is!based!on!

t

h

e

!probability!of!dying!du ri ng!a!20]year!time!period!rather!than!a!one!year!time!period.! This!

leads!to!a!much!higher!cost!than!a!one!year!term!policy!because!the!chances!of!dying!in!

20!

year

s!is!much!greater!than!the!chances!of!dying!in!one!year,!holding!all!other!things!constant.!

Imagine!that,!somehow,!two!people!were!able!to!get!term!insurance!at!the!same!

exact!

p

re

miu

m

!

costs.! If!one!person!chose!to!purchase!and!ART!and!renewed!it!for!20!years!while!the!other!

person!chose!to!buy!a!20]year!level!term!policy,!they!would!be!covered!for!the!same!period!of!

time.! The!person!who!chose!the!20]year!level!policy!would!pay!higher!premiums!that!the!

person!with!the!ART!policy!for!the!first!few!years!b ecause!the!premiums!are!based!on!a!higher!

probability!of!death!at!that!point!in!time.! However,!eventually!the!ART!policy!will!

7

!

!

become!more!expensive!when!the!person!ages!while!the!20]year!level!premiums!remain!at!the!

constant!level.! Basically,!the!level!term!policies!are!more!expensive!early!on,!but!

eve

n

t

ually!

en

d!

up!being!cheaper!toward!the!end!of!the!term.!

!

Whole%Life%Insurance:!

!

Whole!life!insurance,!also!commonly!known!as!permanent!life!insurance,!is!much!

different!from!term!insurance!for!a!number!of!reasons.! The!most!obvious!reason!is!that,!as!the!

names!suggest,!these!policies!remain!in!force!for!the!entire!life!of!the!insured,!meaning!that!the!

policy!is!guaranteed!to!pay!out!when!the!insured!dies.!!There!is!no!n eed!for!renewal!once!a!

whole!life!policy!is!purchased!and!there!is!also!never!a!need!to!provide!any!proof!of!insurability!

in!the!future.! If!the!insured!purchased!a!whole!life!policy!three!years!ago!and!suddenly!

develops!a!terminal!illness!that!would!norma lly!render!them!uninsurable,!the!only!thing!they

!

!

need!to!do!is!continue!to!pay!the!premiums!and!they!will!not!have!to!worry!abo ut!losing!their!

insurance.! This!is!a!huge!advantage!over!term!policies!because!once!you!get!approved!once,!

you!are!locked!in!for!life!and!the!insurance!company!is!not!allowed!to!do!anything!to!change!

that!assuming!the!premiums!continue!to!be!paid.!!The!premiums!are!calculated!similarly!to!the!

way!they!are!in!level!term!p olicies.!!In!this!case,!however,!the!probability!of!dying!is!

100%!

durin

g

!

a!whole!life!policy!since!they!are!designed!to!provide!insurance!until!that!point.!!Factors!such!as!

smoking!and!other!health!related!things!still!impact!the!premium!amounts!because!if!there!is!a!

high!probability!of!dying!in!30!years,!the!company!wants!to!make!sure!that!it!

c

an!

c

o

ver

!the!costs!

of!paying!the!death!benefit!when!only!30!years]worth!of!payments!are!made.!Just!like!the!level!

terms,!the!premiums!are!more!expensive!relative!to!the!coverage!in!th e!early!stages!of!the!

policy,!but!the!fact!that!they!remai n!level!throughout!causes!that!value!to!actually!

8

!

!

be!cheaper!as!the!insured!gets!older.!!Figure!1!highlights!the!long]term!cost!effectiveness!of!the!

whole!life!level!premiu ms!compared!to!the!increasing!premiums!of!renewab le!term!insurance!

policies.!

!

F')/0%*M6* !".&*",*=%0#*?%0./.*74"8%*+',%*-(./ 01(2%!

Source:!!Altfest!(2007)!“P er so na l$F inancial!

Planni ng”!pg.!272.!

!

As!expected,!though ,!these!premiums!are!substantially!higher!than!those!of!term!policies!and!it!

is!this!difference!in!premium!that!composes!the!“invest!the!difference”!component!of!the!term!

insurance!strategy.!

!

These!high!premiums!also!serve!an other!purpose!rather!than!simply!to!purchase!death!

benefit!of!the!insurance.! Unlike!term!policies,!whole!life!also!has!a!living!benefit!known!as!cash!

surrender!value!(CSV)!that!builds!up!over!time!as!premiums!are!paid.!!Walden!(1985)!

hypothesized!that!whole!life!insurance!policies!behaved!as!an!options!package!and!that!the!

pricing!was!a!reflection!of!the!various!options.!!He!found!that,!from!dat a!based!on!the!most!

popular!policies!from!59!North!Carolina!insurers,!his!hypothesis!was!accurate!and!that!if!cash!

value!and!dividends!are!held!constant!then!prices!vary!gre atly!depending!on!policy!provisions!

and!the!insurer’s!characteristics.!!Therefore,!assumptions!must!be!made!not!only!in!terms!of!

characteristics!of!th e!insured,!but!also!th e!characteristics!of!the!policy!itself.!!It!stands!to!reason!

that!part!of!the!premium!calculation!accounts!for!the!expected!performance!of!the!company’s!

9

!

!

general!account,!which!typically!consists!of!bonds,!some!stocks,!real!estate,!etc.! Obviously,!the!

performance!in!the!future!can!only!be!estimated!so!there!is!no!way!of!knowing!what!

w

ill!

act

ually!happen.! Thus,!there!will!be!times!during!the!duration!of!the!policy!where!the!premium!

represents!an!overcharge!(the!company!p erf o rmed!better!than!was!expected)!or!an!

undercharge!(the!company!did!not!live!up!to!expectations).!

!

The!CSV!has!two!noteworthy!aspects,!the!first!being!the!tax!treatment.!When!the!CSV!

account!is!left!untouched,!there!are!no!taxes!placed!upon!it!whatsoever,!meaning!it!is!allo

we

d!

t

o!grow!tax]free.! However,!if!a!lump!sum!is!taken!from!the!CSV!account!(in!cash),!the!amount!

exceeding!the!premiums!paid!is!taxed!as!ordinary!income,!which!makes!sense!being!that!t he!

premiums!are!after]tax!dollars.!!The!second!aspect!is!that!the!insurance!companies!actually!

provide!a!guaranteed!amount!of!cash!value!for!every!whole!life!policy!that!they!issue.! Granted,!

these!values!result!from!a!miniscule!amount!of!growth!in!the!neighborhood!of!around!2%!and!it

!

!

will!not!exceed!the!amount!of!money!put!into!the!policy!until!many!years!down!the!road.!

However,!should!someone!choose!to!terminate!their!whole!life!policy,!they!would!at!least!get!a!

certain!some!of!money!back!whereas!with!term!they!would!receive!nothing!in!return.!!Again,!

term!is!much!cheaper,!so!if!the!whole!life!is!cancelled!early!on!they!would!have!still!been!better!

off!buying!term!because!even!the!amount!of!cash!they!would!receive!would!not!make!up!the!

difference!in!premium!costs.!!This!guaranteed!amount!represents!the!absolute!worst!case!

scenario!for!the!performance!of!the!CSV!component!of!the!policy,!and!much!of!that!

performance!can!be!attributed!to!the!company!issuing!the!policy.!

10

!

!

There!are!two!types!of!insurance!companies,!stock!and!mutual,!and!the!most!notable!

difference!between!them!is!the!way!they!distribute!their!earnings.!!These!earnings!payments!

are!called!dividends!and!are!somet imes!referred!to!as!refunds!because!they!are!partially!a!

result!of!the!company!overcharging!their!policyholders!because!they!ended!up!exceeding!

expectations!with!respect!to!their!general!account.! It!is!important!to!note,!however,!that!in!

order!for!a!whole!life!policyholder!to!receive!dividends!the!policy!must!be!a!participating!policy.

!

!

Non]participating!p olicies!are!not!eligible!to!receive!these!dividends!because!these!policies!

st

ate

!that!once!the!premiums!are!established,!they!can!never!change!in!any!fashion.! These!

dividends!or!refunds!can!be!used!in!a!few!different!ways.! The!policyholders!can!simply!take!

them!in!cash!each!year,!h ave!them!be!used!to!reduce!the!premium!payment!for!that!year!(

t

his!

is!why!a!non]participating!policy!does!not!receive!dividends)!or!they!can!be!used!to!purchase!

additional!insurance!through!reinvestment!into!the!policy.!!Using!the!dividends!to!purchase!

additional!insurance!not!only!results!in!an!increase!in!the!death!benefit,!but!it!is!also!a!

particularly!effective!way!to!maximize!the!CSV!account!because!a!portion!of!the!money!used!to!

purchase!the!additional!death!benefit!gets!reinvested!into!the!company’s!general!account!and!

allows!the!CSV!to!increase!by!a!greater!amount.!Strategies!for!utilizing!the!CSV!component!of!

whole!life!policies!will!be!discussed!later!on!in!this!paper.!

!

When!a!stock!company!begins!to!distribute!their!earnings,!the!first!obligation!they!must!

fulfill!is!the!need!of!the!stockholders,!since!they!are!the!“owners”!of!the!company.! Whatever!

amount!is!leftover!from!the!stockholder!compensations!can!then!be!distributed!amongst!the!

policy!holders.! Mutual!companies!do!not!have!stockholders!to!please,!so!the!“owners”!of!these!

companies!are!actually!the!policyholders.! They!are!first!in!line!to!receive!these!dividend!

11

!

!

payments!from!the!company!each!year!and!it!is!because!of!this!that!many!people!recommend!

using!a!mutual!insurer!when!purchasing!whole!life!ins urance.!!This!notion!is!supported!by!the!

research!of! Spiller!(1972)!when!he!examined!the!performan ce!of!st ock!and!mutual!companies!

in!his!paper!by!comparing!19!stock!companies!and!27!mutual!companies!in!New!York!State.!

Spiller’s!results!indicated!that!the!objectives!of!stock!companies!were!different!than!those!of!

mutual!companies!due!to!the!focus!of!pleasing!stockholders,!causin g!them!to!perform!at!

different!levels.! James!H.!Hunt,!a!life!insurance!actuary!who!has!been!in!the!business!since!

1955,!in!2001!explained!that!whole!life!policies!issued!by!mutual!companies!tend!to!be!superio r!

to!those!issued!by!other!companies,!citing!his!experience!reviewing!thousands!of!policies!over!

the!decades!of!his!career.!

12

!

!

---J* 30%?'"/.*7 "0N.*"(*+',%*-(./01 (2%!

!

Price%Elasticity:!

!

Risk!management!is!really!the!foundation!of!financial!planning!and!one!of!the!most!

critical!components!of!this!facet!is!life!insurance.! Therefore,!it!wasn’t!surprising!that!Babbel!

(2005)!found!the!price!elasticity!of!demand,!for!all !forms!of!life!insurance,!to!be!inelastic.!!He!

studied!the!costs!of!life!insurance!policies!sold!in!the!U.S.!from!1953!and!1979!across!all!

companies.! After!regressing!different!company!sales!prices!against!the!industry,!no!evidence!

was!found!to!suggest!that!consumers!“shop!around”!for!the!best!prices!or!switch!to!a!company!

with!lower!costs.! Frees!and!Sun!(2009)!took!a!slightly!different!approach!and!looked!at!the!

household!demand!for!life!insurance,!specifically!term!and!permanent!(whole!life).! Their!

research!resu lted!in!a!conclusion!that!term!and!whole!life!are!substitutes!in!terms!of!frequency!

(owning!one!or!the!other),!but!they!are!actually!complements!with!regards!to!severity!(amount!

of!insurance!coverage!purchased).! Simply!put,!if!people!are!only!concerned!with!owning!an!

insurance!policy,!then!they!are!more!likely!to!own!either!a!whole!life!policy!or!a!term!policy,!not!

both.! This!information!indicates!that!evaluating!strategies!based!on!solely!a!term!insurance!

policy!or!a!whole!life!policy!would!be!useful,!due!to!the!f act!that!it!is!common!for!households!to!

only!hold!one!or!the!other,!while!al so!alluding!to!the!plausibility!that!one!strategy!is!not!always!

dominant.!

!

Demand%Determinants:!

!

Additionally,!the!fact!that!many!households!only!hold!either!term!or!whole!life!indicates!

that!the!motives!behind!the!purch ase!of!these!policies!probably!differ.!!Inkmann!and!

Michaelides!(2010)!examined!the!United!Kingdom!insurance!market !and!found!that!household!

13

!

!

factors!of!being!married,!having!children!and!reporting!a!positive!probability!of!leaving!a!

bequest!were!all!statistically!significant!in!determining!the!purchase!of!term!life!insura nce.!

Grace!and!Lin!(2007)!and!Fischer!(1973)!investigated!th e!life!cycle!demand!for!life!insurance!

using!different!methods!but!ultimately!ended!up!with!the!same!result.! The!former!focused!on!

household!income!as!well!as!income!volatility!and!how,!over!time,!that!impacted!the!demand!

for!life!insurance!while!Fischer!ran!multiple!simulations!accounting!not!only!for!income,!but!

also!basic!wealth!and!risky!assets.! Their!results!indicate!that!the!demand!for!term!life!

insurance!is!impacted!by!income!and!that!it!tends!to!be!purchased!early!on!in!life!when!income!

is!more!volatile!while!the!demand!for!whole!life!remains!unchanged.! The!demand!for!term!

decreases!with!age!as!income!tends!to!stabilize!and!people!begin!living!off!of!their!wealth,!

however,!there!is!evidence!that!this!is!when!the!demand!for!whole!life!insurance!increases!as!

well.! Sauter,!Walliser!and!Winter!(2010)!studied!whole!life!insurance!holdings!in!Germany!

before!and!after!the!unanticipated!tax!reform!in!2000,!which!cut!the!tax!exemption!statuses!in!

half!and,!thus,!raised!taxes!on!numerous!household s. ! Based!on!the!data,!a!10 %!increase!in!

taxes!resulted!in!approximately!a!3.3%!increase!in!probability!of!whole!life!insurance!purchase!

with!a!5.2%!increase!in!households!actually!affected!by!the!reform.!!Therefore,!tax!incentives!

appear!to!be!a!significant!driving!force!behind!the!demand!for!whole!life!insurance.!

!

Thus,!evaluating!the!whole!life!insurance!strategy!versus!the!“buy!term,!invest!the!

difference”!strategy!begs!the!comparison!of!how!a!bequest!would!be!fulfilled,!what!role!

different!taxation!methods!play!and!how!different!types!of!investment!vehicles!may!impact!

these!characteristics.!

14

!

!

-9J* ;/<*=%0#>*-(?%.&*=4%*@',,%0%(2%*5'K%*F/(K*E$&'"(.!

!

The!approach!for!comparing!the!BTID!strategy!to!the!whole!life!strategy!is!relatively!

simple,!conceptually.! The!whole!life!insurance!strategy!consists!of!the!death!benefit!to!be!paid!

out!to!beneficiaries!and!a!CSV!account!that!provides!a!living!benefit!to!the!owner.! The!BTID!

strategy!consists!of!term!life!insurance!that!will!provide!a!death!benefit!to!the!beneficiaries,!but!

also!a!side!fund!where!the!difference!in!premium!between!the!term!and!the!whole!life!policy!is!

invested.! This!account!not!only!represents!the!living!benefit!to!the!owner,!but!also !is!the!other!

portion!of!what!the!beneficiaries!stand!to!receive!upon!death!of!the!insured.! When!the!term!

policies!can!no!longer!be!purchased,!this!serves!as!both!the!living!and!d eath!benefit!

simultaneously!and!is,!therefore,!a!crucial!part!of!the!BTID!strategy.! The!following!highlights!

the!features!of!the!different!types!of!investment!accounts!that!will!be!tested!in!the!BTID

!

!

strategy!and!how!they!differ!from!one!another.!

!

!

Saving%in%a%Tax>deferred%Account%(401K%or%Traditional%IRA):!

!

Retirement!vehicles!are!a!common!method!that!people!utilize!when!they!are!looking!for!

ways!to!save!money!and!accumulate!wealth!for!the!future.! An!employer]sponsored!401k!is!an!

example!of!one!of!these!vehicles!that!most!people!are!familiar!with!and!serves!as!a!great!

example!of! a! tax]deferred!investment!account.! Another!example!is!what!is!known!as!an!

individual!retirement!account,!or!IRA!for!short.!!There!are!a!couple!of!reasons!why!these!tax]!

deferred!accounts!are!attractive.! First,!these!accounts!allow!for!pre]tax!dollars!to!b

e!

c

on

t

ribu

ted

!and!deducted!from!that!person’s!taxable!income!unlike!life!insurance!

contributions,!which!are!not!tax!deductible.! This!allows!for!immediate!tax!relief!because!that

!

!

person’s!taxable!income!is!reduced!by!the!amount!of!the!contribution,!which!would!be!

15

!

!

particularly!useful!for!individuals!in!high!tax!brackets.! Contributing!money!to!a!tax]deferred!

account!gives!the!ability!to!reduce!taxable!income!by!however!much!is!chosen!to!be!

contributed,!which!is!very!useful!if!taxes!are!expected!to!be!higher!now!compared!to!later!

when!it!is!expected!th at!money!will!be!withdrawn.! Not!only!are!fewer!taxes!paid!now,!but!the!

money!that!is!contributed!is!also!allowed!to!grow!free!of!tax.! This!is!a!huge!advantage!due!to!

the!compounding!i nterest!factor.! The!money!that!is!put!into!the!tax]deferred!account!gains!

interest!the!first!year!and!if!it!is!left!in!the!account!for!another!year,!th at!principal!amount!will!

gain!interest!again!but!so!will!the!amount!gained!due!to!interest!from!that!previous!year.!

Essentially,!interest!is!earned!on!the!previous!year’s!interest,!which!is!where!the!term!

“compounding”!comes!from,!causing!the!money!to!grow!in!an!exponential!fashion.!

!

That!is!not!to!say!that!the!tax]deferred!account!does!not!have!its!limitations.!!The!most!

notable!being!that!it!is!not!a!tax]free!account;!rather,!it!is!what!is! commonly!referred!to!as!a!

tax]deferred!account.! This!simply!means!that,!although!the!contributions!and!growth!are!all!

free!from!tax,!any!withdrawals!that!are!made!from!the!account!in!the!future!are!taxed!at!the!

ordinary!income!tax!rate!at!that!point!in!time.! Imagine!that!someone!has !let!their!401k!account!

grow!untouched!for!10!years!causing!it!to!be!worth!$100,000!and!they!have!decided!to!

purchase!a!house!and!need!to!withdraw!that!money!from!the!account.! The!entire!$100,000!

amount!would!be!taxed!as!ordinary!income,!so!if!he!made!$85,000!per!year!(25%!tax!bracket)!

he!would!have!to !pay!taxes!on!$185,000!per!year!(33%!tax!bracket).!!This!can!be!particularly!

burdensome!if!the!person!has!al ready!entered!a!higher!tax!bracket!since!making!the!

contributions.! In!addition!to!this,!if!the!person!chooses!to!withdraw!funds!from!the!account!

and!they!are!younger!than!59!½!years!old,! they!also!have!to!pay!a!10%!excise!tax!on!the!entire!

16

!

!

amount!withdrawn.! Thus,!if!that!person!was!40!years !old!and!withdrew!the!$100,000!to!

purchase!a!home,!he!would!owe!$10,000!in!excise!tax!in!addition!to!the!federal!income!tax.!

The!presence!of!this!penalty!dissuades!owners!from!using!the!401k!as!a!savings!account!for!use

!

!

before!retirement,!which!is!actually!helpful!since!not!withdrawing!prior!to!age!59!½!avoids!the!

tax!but!also!maximizes!the!biggest!advantage!of!the!account!which!is!the!tax]free!growth.! Th is!

basically!means!that!money!is!illiquid!prior!to!age!59!½,!though!borrowing!from!the!plan!is!

commonly!an!option,!but!for!the!purpose!of!this!paper!these!accounts!will!be!treated!as!illiquid!

up!to!that!point.!

!

Saving%in%a%Taxable%Account%(Brokerage):!

!

An!alternative!for!saving!money!that!may!need!to!be!used!within!a!short!number!of!

years,!contrary!to!a!401k!retirement!account,!would!be!a!basic!taxable!account!like!a!bro kerage!

account.! These!are!typically!made!up!of!various!stocks,!bonds,!mutual!funds!and!the!like!that!

can!be!custom!tailored!to!the!preferences!of!the!owner,!whereas!something!like!a!401k!is!

limit

ed

!to!what!the!employer!offers.! This!means!that!if!someone!prefer s!to!take!on!additional!

risk!in!exchange!for!higher!potential!returns,!the!account!can!be!easily!allocated!with!a!higher!

percentage!of!stocks!rather!than!bonds!in!hopes!of!achieving!large!returns!over!time.! However,!

if!later!it!is!decided!that!the!volatility!associated!with!the!potential!for!high!returns!is!too!

worrisome,!the!account!can!just!as!easily!be!reallocated!and!the!percentage!of!stocks!can!be!

reduced!while!increasing!the!percentage!of!safer!assets!like!bonds!and! Treasury!Bills.!

!

The!main!difference!between!a!taxable!account!and!a!tax]deferred!is,!obviously,!based!

on!the!tax!treatment.! The!contributions!made!towards!something!like!a!brokerage!account!do!

not!have!any!impact!on!current!taxable!income!as!those!toward!a!tax]deferred!account!do.!

17

!

!

Therefore,!any!contribution!made!toward!a!brokerage!account!is!still!recognized!as!part!of!the!

taxable!income,!meaning!these!contributions!can!be!con si dered!after]tax!dollars.!!Also!unlike!

the!tax]deferred!account,!the!growth!in!a!taxable!account!does!not!go!untaxed!and!is,!

therefore,!unable!to!fully!appreciate!the!advantages!of!compounding!interest.!!The!

contributions!in!a!brokerage!account!gain!interest!based!on!the!allocated!asset!returns,!but!

these!assets!also!pay!dividends!and!they!are!taxed!as!ordinary!income!(Topic!409,!IRS.gov).! For!

example,!a!40!year]old!male!in!the!35%!tax!bracket!has!been!contributing!in to!a!brokerage!

account!with!a!return!rate!of!10%!each!year!and!a!3%!dividend!rate,!resulting!in!a!capital!gain!of!

!

7%.! This!account!would!grow!by!the!capital!gain!of!7%!each!year!p lus!65%!(as!a!result!of!the!

!

35%!tax)!of!the!3%!dividends.! Thus,!if!there!were!$100,000!in!the!account,!it!wou ld!grow!to!

!

$107,000!and!he!would!pay!the!35%!tax!on!$3,000!which!leaves!him!with!$1950,!making!the!

account!worth!$108,950!at!the!end!of!the!year.! If!this!were!a!401k,!it!would!have!been!worth!

$110,000!because!none!of!the!capital!gains!or!divi dends! are!taxed.

!

!

!

On!the!other!hand,!withdrawing!money!from!a!taxable!account!is!quite!different!from!

doing!so!from!a!tax]deferred!account.! For!one,!there!is!no!penalty!for!withdrawing!money!

based!on!how!old!you!are;!in!that!sense!it!is!much!more!liquid! th an!something!like!a!401k.! If!

someone!had!to!dip!into!their!savings!and!had!to!choose!between!withdrawing!from!their!401k!

or!brokerage!and!they!were!under!the!age!of!59!½,!the!brokerage!would!certainly!be!the!

smartest!method!both!because!the!10%!penalty!would!be!avoided!and!because!the!401k!would!

continue!to!grow!uninterrupted.! However,!the!brokerage!account!is!still!taxed!when!money!is!

withdrawn!and!it!differs!depending!on!the!conditions.!!If!$100,000!is!withdrawn,!that!whole!

amount!is!not!susceptible!to!tax!like!it!would!be!in!the!401k!scenario.!The!only!parts!that!are!

18

!

!

taxable!are!the!capital!gains!and!there!are!two!different!types,!unrealized!and!realized.!

Unrealized!capital!gains!are!represented!by!the!amount!that!the!brokerage!account!grows!and!

are!not!subject!to!taxation,!but!once!they!become!realized,!meaning!the!assets!are!sold,!

t

h

ey!

c

an!and!will!be!taxed.! The!reason!that!the!money!that!was!contributed!is!exempt!from!taxation!

upon!withdrawal!is!because!it!was!contributed!as!an!after]tax!amount.!!Assume!that!$60,000!

was!contributed!into!the!account!an d!h as!grown!to!$100,000;!this!means!that!$40,000!is!a!

result!of!capital!gains!and!it!is!only!taxable!(realized)!when!all!of!the!assets!purchased!by!th e

!

!

$60,000!contribution!are!sold.!

!

!

However,!there!are!two!dif ferent!types!of!realized!capital!gains,!short] term!and!long]!

term,!and!this!is!what!determines!the!tax!method.! A!short]term!realized!capital!gain!results!

from!an!asset!being!held!for!less!than!a!year!before!being!sold!and!these!gain s!are!taxed!at!an!

ordinary!income!rate.! A!long]term!realized!capital!gain!results!from!assets!that!have!been!held!

for!more!than!a!year!before!being!sold!and!these!are!taxed!at!15%,!meaning!that!it!is!in!

t

h

e!

b

est

!interest!of!the!owner!to!hold!assets!for!at!least!a!year,!especially!if!the!owner!is!in!a!high!

income!tax!bracket!(Topic!409,!IRS.gov).! Thus,!continuing!the!previous!scenario!where!$40,000

!

!

of!the!$100,000!are!realized!capital!gains,!we!will!assume!that!they!are!long]term!so!

withdrawing!$100,000!would!ultimately!yield!$94,000!after!taxes!($60,000!+!$40,000*(1]0.15)).!

In!order!for!this!same!person!to!withdraw!$94,000!after!taxes!from!a!401k,!assuming!a!35%!

income!tax!bracket,!they!would!have!to!withdraw!$144,615!from!the!account!as!opposed!to!

$100,000!from!the!brokerage.

!

19

!

!

Saving%in%a%Tax>free%Account%(Roth%401k,%Roth%IRA) :!

!

The!third!alternative!that!was!tested!for!investing!the!difference!in!the!BTID!strategy!

!

was!a!tax]free!account,!examples!of!which!are!Roth!401Ks!and!Roth!IRAs.!!These!accounts!differ!

from!their!traditional!counterparts!in!that!their!contributions!are!not!tax!deductible!and!the!

withdrawals!are!made!tax]free.! However,!these!accounts!do!suffer!from!the!10%!excise!tax!if!

withdrawals!are!made!prior!to!age!59!½,!so!they!are!also!considered!illiquid!up!to!that!point.!

However,!just!like!the!tax]deferred!accounts,!the!Roth!contributions!also!grow!tax]free!and!fully!

experience!the!compounding!interest!over!time.! A!p ractical!example!of!the!proper!way!to!

utilize!a!tax]free!account!would!be!a!young!professional!choosing!to!invest!their!savings!in!a

!

!

Roth!401k!(tax]free)!early!in!their!career!and!pay!taxes!up!front!because!they!exp ect!to!be!in!a!

higher!tax!bracket!by!the!time!they!plan!on!receiving!distributions!from!that!account.! On !the!

contrary,!if!a!man!is!saving!for!his!retirement!and!feels!that!his!tax!bracket!will!be!lower!than!it!

currently!is,!he!would!save!in!a!tax]deferred!account!and!pay!taxes!on!the!distributions!at!the!

lower!rates.!

!

The!only!difference!between!the!tax]free!accounts!and!the!tax]deferred!account!is!

when!the!taxation!occurs.! The!government!basically!understands!how!advantageous!these!

vehicles!are!in!terms!of!tax!efficiency!that!they!had!to!create!ways!to!limit!their!use!to!prevent!

them!from!being!abused.!!In!2013,!if!you!are!49!years!of!age!or!younger!the!maximum!amount!

of!money!that!you!can!contribute!t o !Roth!and!Traditional!IRAs!is!limited!to!$5,500!and!it!

increases!to!$6,500!if!you!are!50!years!of!age!or!older.! For!both!types!of!401Ks,!the!

contribution!limit!is!$17,500!during!2013.! Additionally,!there!is!also!a!maximum!income!limit!

for!qualification!to!contribute!to!an!IRA,!t raditional!or!Roth.!In!regard!to!both!types!of!IRAs,!if!

20

!

!

the!person!is!singl e!they!can!qualify!for!maximum!contribution!as!long!as!they!earn!less!than!

!

$110,000!per!year!(28%!tax!bracket)!and!can!qualify!for!partial!contribution!if!they!earn!less!

!

than!$125,000!per!year.! If!it!is!a!married!couple,!they!must!earn!less!than!a!combined!$173,000!

per!year!(28%!t ax!b racket)!to!qualify!for!full!contributions!and!for!partial!contributions!they!

must!earn!less!than!$183,000!per!year.! There!are!no!income!limitations!placed!on!either!type!

of!401k!plan.!

21

!

!

9J* 5&01&%)<*3101#%&%0.!

!

Whole%Life%Strategy:!

!

+',%*-(./01(2%*3"8'2<!

!

An!illustration!of!a!$500,000!participating!65!life!whole!life!policy!issued!by!

Northwestern!Mutual!Life!(NML)!in!November!of!2012!was!used!in!every!scenario!that!was!

tested.! The!term!65!life!indicates!that!the!policy!will!be!fully!paid!for!when!the!insured!reaches!

age!65,!meaning!that!premium!payments!will!no!longer!be!required!after!that!year.!!Attached!

to!this!policy!was!a!paid!up! additions!(PUA)!rider,!which!results!in!any!dividends!paid!by!NML!to!

be!used!to!purchase!addition al !insurance.!!The!premium!payment!is!valued!at!$8,870!per!year!

and!it!is!assumed!that!it!is!paid!annually.! This!was!cal culated!based!upon!the!insured!being!

assumed!to!be!a!35!year]old!non]smoking!male!in!perfect!health!and!based!on!the!fact!that!it!is!

designed!to!be!fully!funded!when!he!is!65!years!old,!meaning!30!annual!premium!payments!are!

required.!

!

It!must!be!noted!that!life!insurance!illustrations!are!in!no!way!a!guarantee!of! actual!

performance;!however,!the!predictions!are!based!on!current!economic!conditions!as!well!as!

past!company!performance.! Pritchett!(1998)!points!out!that!the!high!interest!rate!1980’s!

highlights!the!flaw!of!basing!predictions!on!current!conditions!because!the!life!insurance!

companies!had!a!hard!time!living!up!to!their!predictions!when!the!interest!rates!fell.!!It!is!

because!of!this!uncertainty!that!NML!was!chosen!t o!pro vi de!the!illustration.!!NML!is!one!of!the!

most!respected,!ranked!#1!most!admired!company!in!the!life!insurance!industry!by!Fortune!

Magazine!in!2011,!insurance!companies!in!the!industry!and!they!have!paid!dividends!every!year!

without!fail!since!1872.! The!company!also!b oasts!A++!and!Aaa!ratings!from!A.M.!Best!Company!

22

!

!

and!Moody’s!Investor!service!respectively,!both!highest!possible!ratings.! Therefore,!although!

the!predictions!are!not!guaranteed,!NML’s!reputation!leads!us!to!believe!that!they!are!done!in!

good!faith!and!are!accurate.! Mass!Mutual,!another!highly!rated!similar!to!NML,!recently!

released!(in!2012)!a!historical! dividend!study!that!showed!their!own!illustrated!policies!issued!

in!1980!side!by!side!with!h ow!those!policies!actually!p erformed!for!32!years!and!the!actual!

performance!wound!up!exceeding!expectations.!

!

@%1&4*;%(%,'&!

!

There!are!a!number!of!factors!that!were!analyzed!to!evaluate!the!performance!of!the!

whole!life!strategy,!the!first!being!the!amount!the!beneficiaries!stand!to!receive!at!certain!

points!during!the!life!of!the!policy.! The!PUA!rider!causes!the!death!benefit!on!the!policy!to!

increase!each!year!that!a!dividend!is!paid.! The!death!benefit!can!never!go!below!the!original!

$500,000!that!it!is!worth!in!the!first!year!and!once!it!increases!it!can!never!go!below!that!new!

level!if!premiums!continue!to!be!paid!in!full!and!the!policy!is!left!alone.! Therefore,!the!amount!

that!the!beneficiaries!on!the!policy!stand!to!receive!upon!death!of!the!insured!is!projected!to!

increase!each!year!that!a!dividend!is!paid.! This!death!benefit!is!funded!with!after]tax!dollars!

and!the!dividends!represent!re fund s!of!those!dollars,!allowing!it!to!grow!tax]free!for!the!

duration!of!the!policy.! The!beneficiaries!also!get!to!receive!that!death!benefit!upon!death!of!

the!insured!tax]free!as!well,!meaning!that!whatever!the!death!benefit!is!worth,!that!is!exactly!

the!amount!that!will!be!paid!to!the!beneficiaries!(Code!Sec.!101(a)).!

!

+'?'()*;%(%,'&!

!

The!living!benefit!is!the!amount!that!the!owner!is!able!to!withdraw!while!the!insured!is!

still!alive.!!The!living!benefit!of!this!policy!(the!CSV!account)!also!grows!each!year!as!premiums!

23

!

!

and!dividends!are!paid!and,!ju st!like!the!death!benefit,!can!never!decrease!at!any!point!if!it!is!

left!untouched!and!premiums!continue!to!be!paid.!!The!reason!this!is!referred!to!as!a!living!

benefit!is!because!the!beneficiaries!have!no!stake!in!the!CSV,!only!the!owner!of!the!policy!has!

access!to!that!money!while!the!insured!is!alive.! If!the!insured!dies,!NML!would!take!the!CSV!

and!pay!the!beneficiaries!whatever!amount!the!death!benefit!is!worth,!regardless!of!the!

amount!of!CSV!had!grown!to.!!There!are!a!couple!of!options!to!consider!when!withdrawing!

funds!from!the!CSV.! The!first!option,!and!the!option!that!was!used!in!all!of!our!testing,!allows!

the!owner!to!make!a!cash!withdrawal!up!to!the!total!amount!of!premiums!paid!in!t o!the!policy!

tax]free,!while!any!amount!exceeding!the!total!premiums!paid!gets!taxed!as!ordinary!income!

(tax]deferred!growth).! This!is!what!would!happen!if!someone!decided!to!terminate!their!policy,

!

!

but!withdrawing!from!the!CSV!will!not!impact!the!insurance!coverage!so!long!as!the!premiums!

keep!getting!paid,!which !we!assume!they!do!during!our!testing.!!The!other!option!allows!the!

owner!to!get!tax]free!cash!up!to!the!amount!of!CSV!by!taking!it!out!in!the!form!of!a!policy!loan!

at

!an!interest!rate!that!may!b e!higher!or!lower!than!the!market!rate.! This!is,!essentially,!

borrowing!your!own!money,!which!is!why!taxes!need!not!be!paid,!and!the!other!advantage!is!

that!you!do!not!actually!have!to!pay!the!loan!back.! The!dividends!can!be!used!to!pay!back!the!

interest!and!a!portion!of!the!death!benefit!can!be!used!to!do!this!as!well.! However,!this!can!be!

dangerous!if!the!policy!does!not!pay!back!the!loan!quick!enough!by!itself.! This!can!lead!to!

changes!in!coverage!and!can!require!the!owner!to!pay!higher!premiums!to!pay!back!the!loan.!

Due!to!the!uncertainty!associated!with!this!option,!it!would!require!professional!consultation!to!

determine!if!it!would!be!a! useful!strategy;!therefore,!it!was!not!considered!in!the!testing.!

24

!

!

Buy%Term,%Invest%the%Difference%Strategy:!

!

+',%*-(./01(2%*3"8'2<!

!

The!policies!used!for!the!BTID!strategy!were!$500,000!20]year!level!t erms!issued!by!

Northwestern!Mutual!Life!and!the!premiums!were!calculated!based!on!the!same!35!year!old!

non]smoking!male!in!perfect!health.! The!premium!came!out!to!$487!per!year,!making!the!

difference!between!that!and!the!whole!life!premium!$8,383!and!that!is!what!gets!invested!into!

the!various!side!funds.! !Since!the!term!policy!expires!after!20!years,!it! must!be!renewed!and!to!

do!this!the!same!person!needs!to!be!used.! The!only!thing!that!changed!was!his!age,!which!is!55!

for!the!second!20]year!term!policy;!because!we!assume!that!he!is!still!in!perfect!health!and!has!

not!taken!up!smoking.! This!causes!the!premium!to!increase!to!$1,757!per!year!for!the!next!20!

years,!dropping!the!difference!down!to!$7,113.! No w,!being!that!the!whole!life!policy!is!paid!up!

at!age!65!of!the!insured,!the!difference!in!premiums!need!only!be!invested!until!that!point!in!

the!term!strategy!as!well !since!the!whole!life!strategy!no!longer!requires!payments.!!Again,!we

!

!

are!assuming!that!all!p remiums!and!the!differences!are!paid!each!year!in!full.!!Once!that!20]!

year!term!expires,!however,!the!insured!man!that!the!premiums!have!been!based!upon!will!be!

75!years!old.!!No!matter!what!his!health!status,!he!is!deemed!uninsurable!purely!due!to!his!age!

and!no!longer!has!the!ability!to!purchase!any!life!insurance.!

!

@%1&4*;%(%,'&6!

!

Evaluating!the!performance!of!BTID!is!a!bit!more!complicated!than!it!is!for!whole!life.!

First,!the!amount!the!beneficiaries!receive!depends!not!only!on!the!$500,000!of!insurance!

during!the!first!two!20]year!term!policies,!but!also!on!the!value!of!the!side!fund!that!the!

premium!differences!were!invested!in.! Per!the!discussion!of!the!side!fund!options,!the!tax!

25

!

!

implications!associated!with!paying!out!the!side!fund!varies!depending!on!the!type!of!side!fund!

it!is!and!in!some!cases!the!40%!estate!tax!needed!to!be!taken!into!account!as!well.!!Therefore,!

during!the!period!when!the!term!policies!were!in!force,!the!$500,000!death!benefit!is!added!

tax]free!to!the!value!of!the!side!fund!at!that!point!in!time!with!the!appropriate!taxes!and

!

!

penalties!accounted!for.!!When!the!insured!reaches!age!75!and!no!longer!has!the!insurance,!

then!the!amount!paid!at!death!to!the!beneficiaries!is!equal!to!the!value!of!the!side!fund!with!

the!appropriate!taxes!accounted!for.! It!is!assumed!that!these!accounts!will!be!cashed!out!upon!

the!death!of!the!insured!because!the!whole!life!strategy!yields!a!cash!payment!to!the!

beneficiaries,!so!it!stands!to!reason!that!the!same!be!done!in!the!BTID!strategy.!

!

+'?'()*;%(%,'&!

!

The!living!benefit!of!the!BTID!scenario!can!be!defined!as!the!value!of!the!side!fund!in!

each!of!the!scenarios!after!accounting!for!taxes!that!would!be!required!upon!withdrawal!from!

the!specific!fund.!!However,!there!are!a!number!of!assumptions!that!must!be!made!throughout!

this!process.! First,!the!income!tax!rate!is!assumed!to!remain!constant! at!35%!throughout!the!

entire!duration!of!the!testing!(60!years!total).! Assuming!high!tax!brackets!makes!sense!because!

the!strategies!requi re!a!large!sum!of!money!be! contributed,!due!to!the!fact!that!the!policies!are!

for!$500,000,!which!would!most!likely!be!paid!by!someone!in!one!of!the!top!brackets.!!We!are!

also!assuming!that!the!contributions!are!made!at!the!beginning!of!the!year!and!that!any!

withdrawals!are!made!at!the!en d!of!the!year,!which!keeps!the!timing!consistent!and!makes!the!

values!comparable!to!each!other.! Additionally,!there!are!some!scenario]specific!assumptions!

that!will!be!discussed!upon!their!evaluat ion.!

26

!

!

Choosing%a%Winner:!

!

Both!the!death!and!living!benefits!of!each!strategy!will!be!taken!into!account!when!

determining!which!strategy!is!superior!given!a!certain!scenario.! On!the!death!benefit!side,!the!

amount!that!the!beneficiaries!stand!to!inherit,!in!cash!after!taxes,!determines!which!strategy!

“wins”.!!Basically,!if!BTID!provides!$3!mil lion!after!taxes!to!the!beneficiaries!and!whole!life!only!

pays!out!$2!million,!then!BTID!“wins”!that!category.!!Th e!same!goes!for!the!living!benefit!

category.! The!CSV!after]tax!(paid!on!the!excess!of!the!total!premium!contributions)!withdrawal!

value!and!the!after]tax!withdrawal!value!on!each!of!the!three!types!of!side!funds!will!be!

compared.! Whichever!fund!provides!more!money!to!the!owner!of!the!account!at!a!given!

period!in!time!would!“win”!that!particular!scenario.! However,!in!the!event!that!the!values!are

!

!

relatively!close!liqui dity!serves!as!the!tiebreaker!of!sorts.!!It!was!established!that!whole!life!is!

illiquid!in!the!early!stages!of!testing!(first!20!years)!and!then!relatively!liquid!thereafter!(income!

tax!paid!on!growth!only).!!The!tax] deferred!account!has!similar!liquidity!to!the!whole!life!

strategy,!while!the!taxable!account!is!more!liquid,!meaning!that!in!the!event!of!a!tie!a!taxable!

account!would!take!the!advantage.!!Obviously,!there!are!multiple!aspects!being!tested!and!this!

makes!it!difficult!to!declare!one!a!“winner”,!rather,! one!strategy!may!prove!to!have!an!overall!

advantage!in!a!certain!scenario,!but!it!may!not!“win”!each!aspect.!

27

!

!

9-J* C%./8&.*1( K*B(18<.'.*",*5&01&%)<*=%.&'() !

!

The!three!side!funds!(tax]d eferred,!taxable!and!tax]free)!were!allocated!in!

t

h

ree!

diff

ere

n

t

!

ways;!aggressive,!conservative!and!safe!by!using!historical!market!data!gathered!by!Ibbotson!

Associates!for!the!Stocks,$Bonds,$Bills$and$Inflation$Yearbook.! The!aggressively!allocated!

accounts!have!a!rate!of!return!of!9.78%!as!that!has!been!the!mean!return!of!large!company!

stocks!from!1926!–!2011.! The!conservative!allocations!have!a!rate!of!return!of!6.05%,!which!

represents!the!mean!return!for!long]term!government!bonds!from!1926!–!2011.! Finally,!the!

safely!allocated!accounts!were!assigned!a!rate!of!return!of!3.58%,!the!mean!return!of!U.S.!

Treasury!bills!from!1926!–!2011.! This!gives!u s!nine!scenarios!spread!evenly!over!three!

investment!vehicles!and!each!of!them!is!tested!over!a!60]year!period!that!is!broken!up!in

t

o!

t

h

ree

!20]year!periods.! This!enabled!the!evaluation!of!the!short,!med ium!and!long]term!

effectiveness!of!each!strategy!over!the!nine!scenarios,!providing!a!thorough!analysis!of!the!

performance!of!each!scenario.! Due!to!the!complexity!of!the!analysis!of!each!scenario,!it!is!likely!

that!both!strategies!will!come!out!on!top!at!various!points.! This!helps!illustrate!the!strengths!

and!weaknesses!of!each!strategy.!

!

Tax>deferred%Account%vs.%Whole%Life:!

!

Table!1!summarizes!th e!results!of!the!comparison!of!whole!life!to!the!BTID!strategy!that!

utilizes!a!tax]deferred!account,!such!as!a!401k,!as!a!side!fund.! The!contributions!were!made!

with!pre]tax!dollars,!so!investing!the!difference!was!a!bit!more!complex!than!it!may!seem.!

During!the!first!20]year!period,!the!level!term!annual!policy!premiums!were!$487!while!the!

whole!life’s!annual!premium!was!$8,870,!leaving!a!difference!of!$8,383!to!be!invested!for!the!

first!20!years.! However,!$8,383!represents!a!post]tax!difference,!since!whole!life!insurance!

28

!

!

premiums!are!paid!with!after]tax!dollars,!whereas!contributions!toward!a!401k!are!tax!

deductible,!resulting!in!an!equivalen t!investment!that!is!actually!larger.!!A!35%!income!tax!

bracket!is!assumed,!meaning!that!in!order!for!the!$8,383!to!be!represented!in!pre]tax!dollars!it!

must!be!divided!by!(1]0.35)!=!0.65,!resulting!in!$12,896.! This!value!represents!what!should!be!

contributed!to!the!account!for!the!first!20!years!because!it!has!the!same!impact!on!income!as!

an!$8,383!after]tax!contribution.! The!same!method!must!be!done!for!the!second!20]year!

period!when!the!p olicy!is!renewed.! The!new!term!pre mium!is!$7,113!and!when!that!is!divided!

by!0.65,!because!of!the!35%!tax!bracket,!we!are!left!with!$10,943.! This!amount!is!contributed!

toward!the!account!for!only!10!years,!instead!of!the!full!20!years,!because!at!that!point!the!

whole!life!policy!has!been!paid!up!premiums!are!no!longer!being!paid.!!From!this!point!on,!and!

beyond!the!expiration!of!the!term!policy,!the!amount!in!the!account!is!left!to!grow!as]is,!tax]!

deferred!of!course.!

!

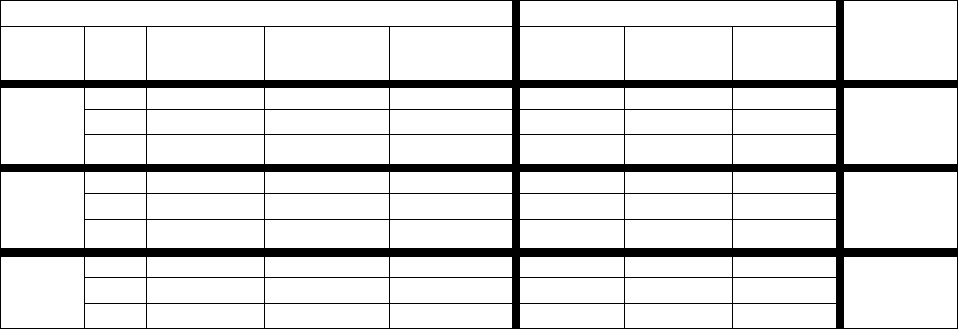

=1O8 %*M6 * =%0#*P*=1QRK%,%00%K*B22"/(&*?%0./.*74"8%*+',%!

!

;/<*=%0#>*-(?%.&*@',,%0%(2%

!

74"8%*

+',%

!

!

BK?1(&1)%!

Return

!

Year

!

Side$Fund:

!

401k

!

Withdraw

!

Value

!

Pay$at

!

Death

!

CSV

!

Withdraw

!

Value

!

Pay$at

!

Death

!

Stocks!

9.78%

!

20!

$790,929!

$435,011!

$1,014,103!

$248,583!

$223,668!

$744,096!

!

BTID!

40!

$5,593,785!

$3,635,960!

$3,981,974!

$863,820!

$657,722!

$1,260,850!

60

!

$36,155,165!

$23,500,857!

$15,400,514!

$1,960,048!

$1,370,270!

$2,178,049!

Bonds!

6.05%

!

20!

$505,836!

$278,209!

$828,793!

$248,583!

$223,668!

$744,096!

!

BTID!

40!

$1,913,536!

$1,243,799!

$1,743,799!

$863,820!

$657,722!

$1,260,850!

60!

$6,195,128!

$4,026,833!

$3,716,100!

$1,960,048!

$1,370,270!

$2,178,049!

Bills!

3.58%

!

20!

$380,898!

$209,494!

$747,584!

$248,583!

$223,668!

$744,096!

!

Whole!Life!

40!

$959,438!

$623,634!

$1,123,634!

$863,820!

$657,722!

$1,260,850!

60!

$1,938,809!

$1,260,266!

$1,260,266!

$1,960,048!

$1,370,270!

$2,178,049!

!

!

In!the!aggressively!allocated!account,!BTID!came!out!as!a!clear!winner!at!all!points!

during!the!60]year!period ,!accumulating!millions!of!dollars!in!both!the!taxed!withdrawal!

amounts!(living!benefit)!as!well!as!the!p ayments!to!the!beneficiaries!at!death!(death!benefit).!

29

!

!

The!value!of!the!account!itself !was!worth!more!than!the!entire!death!benefit!that!whole!life!

provided!at!the!end!of!the!first!20!years,!but!the!account!took!a!huge!hit!with!respect!to!the!

35%!income!tax!and!the!10%!ex cise!tax!(due!to!being!only!55!years!old)!when!calculating!the

!

!

withdrawal!value.! This!indicates!that!the!account!is!relatively!illiquid!during!this!time!period,!

though!whole!life!is!equally!illiquid!due!to!the!fact!that!the!CSV!takes!so!long!to!exceed!the!total!

contributions.!However,!the!term!insurance!death!benefit!allowed!for!BTID!to!make!u p!the!

difference!lost!due!to!taxation!and!exceed!that!of!the!whole!life.! I!would!actually!argue!that,!in!

this!particular!scenario,!the!performance!of!the!tax]deferred!account!actually!eliminated!the!

need!for!the!renewal!of!the!20]year!term!policy!as!the!value!of!the!account!more!than!covered!

the!value!of!the!death!benefit!in!comparison!to!what!whole!life!had!to!offer,!as!Figure!2!

displays.!

!

!

!

!

!

!

!

!

!

!

!

918/%!

F')/0%*S6* T%10.*SURVU*;=-@*?.J*74"8%*+',%*@%1&4*

;%(

%,

'&

!

$6 ,000,000.00 !

!

$5 ,000,000.00 !

!

$4 ,000,000.00 !

!

$3 ,000,000.00 !

!

$2 ,000,000.00 !

!

$1 ,000,000.00 !

!

$0 .0 0 !

21!!!23!!!25!!!27!!!29!!!31!!!33!!!35!!!37!!!

39

!

T%10.

!

!

!

Pre!Tax!

Value!

!

!

After!

Tax!

Value!

!

WL!

Death!

Ben!

!

BTID !

Death!

Ben!

!

!

The!withdrawal!value!of!BTID!in!the!40

th!

year!(insured’s!age!75)!was!more!than!what!the!whole!

life!death!benefit!was!projected!to!be,!rendering!the!term!death!benefit!essentially!

unnecessary.! Although!that!value!is!nearly!$4!mi llion!and!the!pay!at!death!in!the!60

th!

year!

30

!

!

(insured’s!age!95)!is!more!than!$15!million,!it!is!worth!noting!that!these!values!were!a!result!of!

the!40%!estate!tax!in!addition!to!the!35%!income!tax!(assuming!the!beneficiaries!are!also!in!

that!tax!bracket)!because!the!overall!value!of!the!account!exceeded!the!$5!million!exemption!in

!

!

both!cases!(the!estate!tax!only!applies!to!the!amount!that!exceeds!$5!million,!not!the! value!of!

the!total!account).! If!nothing!else,!it!is!unnerving!to!see!the!value!of!the!account!cut!by!more!

than!half!when!it!is!passed!on!to!the!beneficiaries.!

!

The!story!is!similar!with!respect!to!the!conservatively!allocated!account,!though!to!a!

smaller!degree!of!magnitude!due!to!the!lower!rate!of!return.! Just!like!with!the!aggressive!

account,!the!BTID!exceeded!whole!life!in!both!living!and!death!benefits!at!each!time!period!and!

even!accumulated!enough!cash!to!fall!victim!to!the!estate!tax!in!the!60

th!

year!before!paying!out!

to!the!beneficiaries!(though!it!still!more!than!doubled!the!whole!life!death!benefit).!!The!first!

20]year!period!is!evenly!matched,!though!BTID!proves!superior!in!the!withdrawal!value!by!more!

than!$50,000.! The!death!benefit!of!the!term!policy!combined!with!this!withdrawal!value!allows!

BTID!to!narrowly!exceed!th e!payment!the!death!benefit!of!the!whole!life!strategy.! During!the!

next!20]year!period,!with!the!renewed!term !policy,!the!withdrawal!value!in!BTID!nearly!doubles!

the!withdrawal!value!of!the!whole!life!CSV!account.! However,!unlike!wit h!the!aggressive!

account,!the!withdrawal!value!does!not!exceed!the!death!benefit!of!the!whole!life,!meaning!the!

death!benefit!of!the!term!policy!was!needed!to!make!up!the!difference.! With!that!being!said,!

BTID!ends!up!paying!out!more!than!$480,000!more!to!the!beneficiaries!than!whole!life!does.!

By!the!time!the!60

th!

year!is!reached,!the!withdrawal!value!for!BTID!is!more!than!$4!million

!

!

compared!to!whole!life’s!$1.37!million.!!However,!if!the!insured!were!to!pass!away!the!

!

beneficiaries!would!only!get!$3.7!million!due!to!the!combination!of!the!35%!income!tax!and!the!

31

!

!

estate!tax!on!the!value!of!the!actual!account,!which!was!upward!of!$6!million.!!However,!the!

whole!life!strategy!o nly!provides!$2.17!million!to!th e!beneficiaries!at!that!point!so!BTID!still!has!

an!advantage,!even!after!the!taxes!on!the!account!are!considered.!

!

When!the!tax]deferred!account!is!allocated!conservatively,!with!a!return!rate!of!3.58%,!

the!whole!life!strategy!is!found!to!be!superior!over!each!of!the!criteria.! The!withdrawal!value!of!

the!whole!life!strategy!after!20!years!is!slightly!larger!than!that!of!the!BTID!strategy!and,!being!

that!each!are!equally!illiquid,!the!advantage!leans!toward!whole!life.!!Since!beneficiaries!do!not!

need!to!pay!the!10%!early!withdrawal!penalty,!the!term!death!benefit!plus!the!value!of!the!

account!taxed!at!35%!does!pay!slightly!more!than!whole!life!at!this!time!period!though!not!by!

as!much!as!the!whole!life!exceeds!BTID!in!the!living!benefit.! For!the!first!20]year!p eriod,!whole!

life!has!a!slight!advantage,!though!it!would!be!just!as!fair!to!call!it!a!tie.!!The!results!are!not!that!

close!for!the!remainder!of!the!periods!where!we!see!whole!life!actuall y!become!more!

advantageous!due!to!the!margin!between!the!living!and!death!benefits!widening!over!time.!

This!scenario!also!highlights!the!difference!between!withdrawing!funds!from!a!tax]deferred!

account!like!a!401k!and!the!whole!life!CSV.! Although!whole!life!comes !out!ahead!in!terms!of!

after]tax!consideration!each!time,!the!pre]tax!value!of!the!BTID!account!is!greater!than!the!CSV!

of!whole!life!at!every!time!period!(excluding!the!60

th!

year).! The!fact!that!whole!life!CSV!is!only!

taxed!on!the!amount!that!exceeds!the!contributions,!compared!to!the!tax]deferred!account!

being!taxed!at!face!value!including!contributions!(since!they!were!not!taxed!up!front),!pro vi des!

the!leverage!needed!to!shift!the!advantage!toward!the!whole!life!strategy.!

32

!

!

Taxable%Account%vs.%Whole%Life:!

!

Table!2!summarizes!th e!results!of!the!comparison!between!BTID!strategy!when!investing!

in!a!taxable!account!and!the!whole!lif e!strat egy. ! Again,!the!same!20]year!level!term!policies!and!

the!same!whole!life!policy!are!present!in!these!scenarios!as!well.!!The!difference!in!premiums!

between!the!whole!life!and!level!term!for!the!first!20!years!remains!$8,383,!just!like!th

e

!p

re

vious!

scenario,!and!the!difference!following!the!level!term!renewal!during!the!second!20!years!is!still!

$7,113!(wh ere!it!is!invested!for!10!years,!wh en!the!insured!reaches!age!65).! Just!

like!whole!life!premiums,!contributions!to!brokerage!and!other!taxable!accounts!are!made!with!

after]tax!dollars.!!This!means!that!the!investing!the!difference!is!as!simple!as!it!sounds,!in!that!

the!two!differences!in!premiums!are!equivalent!to!what!will!be!contributed !in!the!BTID!

strategy.!

!

!

=1O8 %*S6 * =%0#*P*=1Q1O8 %*B22"/(&*?.J* 74"8%*+',%!

!

;/<*=%0#>*-(?%.&*@',,%0%(2%

!

74"8%*

+',%

!

!

BK?1(&1)%!

Return

!

Year

!

Account:

!

Brokerage!

Withdraw

!

Value!

Pay$at

!

Death!

CSV

!

Withdraw

!

Value!

Pay$at

!

Death!

Stocks

!

9.78%!

20

!

$472,038!

$466,988!

$966,988!

$248,583!

$223,668!

$744,096!

!

BTID!

40

!

$2,966,796!

$2,935,055!

$3,435,055!

$863,820!

$657,722!

$1,260,850!

60

!

$16,872,921!

$16,692,405!

$11,943,236!

$1,960,048!

$1,370,270!

$2,178,049!

Bonds

!

6.05%!

20

!

$268,619!

$268,213!

$768,213!

$248,583!

$223,668!

$744,096!

!

BTID!

40

!

$761,085!

$759,936!

$1,259,936!

$863,820!

$657,722!

$1,260,850!

60

!

$1,766,524!

$1,763,856!

$1,763,856!

$1,960,048!

$1,370,270!

$2,178,049!

Bills

!

3.58%!

20

!

$247,584!

$219,610!

$719,610!

$248,583!

$223,668!

$744,096!

!

Whole!Life!

40

!

$623,634!

$488,939!

$988,939!

$863,820!

$657,722!

$1,260,850!

60

!

$1,260,226!

$902,723!

$902,723!

$1,960,048!

$1,370,270!

$2,178,049!

!

!

In!the!aggressively!allocated!account,!where!the!rate!of!return!is!9.78%,!BTID!had!a!clear!

advantage.! At!the!end!of!the!first!20]year!period,!the!living!benefit!(withdrawal!value)!in!the!

BTID!strategy!was!nearly!double!that!of!the!whole!life!strategy.! On!top!of!that,!it!is!clearly!more!

liquid!(as!we!have!established!that!whole!life!is!illiquid!in!the!first!20!years!and!mildly!liquid!

33

!

!

after!that)!than!whole!life,!as!indicated!by!the!rather!small!difference!between!the!full!value!of!

the!account!and!its!withdrawal!value.! This!is!due!to!the!fact!that!the!money!is!t axed!up!front!

and!the!growth!is!taxed!each!year!in!the!form!of!d ividends!being!treated!as!ordinary!income!

(dividends!in!this!case!were!assumed!to!be!2%!each!year,!resulting!in!a!capital!gain!of!7.78%!

annually).!!Unlike!the!previous!scenario,!th ere!is!also!no!excise!t ax!for!withdrawal!made!prior!to!

age!59!½.!!The!only!thing!taxed!at!withdrawal!is!the!realized!capital!gain!(resulting!from!sto cks!

being!sold),!which!is!done!so!at!15%!as!we!assume!all!stocks!to!be!held!for!more!than!a!year!

prior!to!being!sold.!!BTID!also!paid!nearly!$225,000!more!to!the!beneficiaries!than!whole!life!

was!able!to!provide.! The!values!at!the!end!of!the!40

th!

year!indicate!that!the!renewal!of!the

!

!

level!term!policy!was!unnecessary,!as!we!saw!with!the!tax]deferred!account.! The!withdrawal!

value!of!the!BTID!strategy!was!worth!nearly!$3!million!compared!to!the!whole!life!CSV!

withdrawal!value!of!$657,722.! The!death!b enefit!of!whole!life!was!just!over!$1.26!million!

compared!to!BTID’s!nearly!$3.5!million!payout,!which!is!well!over!the!$500,000!difference!the!

term!policy!is!designed!to!account!for.!!BTID!widens!the!margin!in!each!category!by!the!end!of!

the!60

th!

year,!even!with!the!presence!of!the!40%!est ate!tax.!

!

With!a!conservatively!allocated!taxable!account,!where!returns!closer!to!bo nd!rates!are!

expected!(which!is!where!the!6.05%!rate!was!calculated),!the!two!strategies!are!evenly!

matched.! BTID!does!get!the!advantage!for!the!first!20]year!period,!as!indicated!b y!the!greater!

living!and!death!benefit.! The!term!policy!was!an!essential!component!to!the!BTID!strategy!in!

providing!the!extra!funds!needed!to!exceed!the!death!benefit!of!the!whole!life!policy!during!

this!period.!!At!the!end!of!the!40

th!

year,!whole!life!edges!out!BTID!in!the!death!benefit!category

!

!

by!less!than!$1,000.! However,!the!withdrawal!value!of!the!taxable!account!exceeded!that!of!

34

!

!

the!whole!life!strategy!by!more!than!$10,000!and!combined!with!the!superior!liquidity,!BTID!

!

has!an!advantage!during!this!period!as!well.!!By!the!end!of!the!60

th!

year!the!living!benefit!of!the!

BTID!strategy!is!worth!nearly!$400,000!more!than!that!of!the!whole!life!strategy,!while!

t

h

e!

w

hole!life!provides!nearly!the!same!amount!more!in!death!benefit!than!BT ID.!!Being!that!

bequests!are!a!driving!force!behind!demand!for!life!insurance,!it!wou ld!seem!that!that!would!be!

the!more!important!category!in!this!particular!case,!especially!considering!that!the!insured!is!95!

years!old!at!that!point.!!This!gives!whole!life!the!edge!during!that!time!period,!though!BTID!

appears!to!have!th e!overall!advantage!when!using!a!conservatively!allocated!taxable!account,!

due!mainly!to!the!liquidity!and!performance!of!the!living!benefit,!which!is!illustrated!nicely!by!

Figure!3.!

!

!

!

F')/0%*W6* +'X/'K'&<*!"#$10'."(*",*=1Q1O8%*B22"/(&*1(K*74"8%!

$2 ,500,000.00 !

+',%*!59!

!

!

!

!

!

918/%!

$2 ,000,000.00

!

!

$1 ,500,000.00

!

!

$1 ,000,000.00

!

!

$5 00,000.00

!

!

Account!Value!

Withdrawal!Value!

WL!CSV!

CSV!Withdrawal!

!

$0 .0 0

!

!

1!! 5!! 9!

13

!

17

!

21

!

25

!

29

!

33

!

37

!

41

!

45

!

49

!

53

!

57

!

T%10.

!

!

!

If!the!owner!was!particularly!concerned!with!leaving!a!bequest,!which!is!not!an!unreasonable!

assumption!given!past!research;!it!would!not!necessarily!be!unfair!to!shift!the!verd ict!toward!a!

tie.!!Additionally,!it!is!important!to!note!that!the!growth!in!the!conservatively!allocated!account!

is!much!less!than!that!of!the!aggressively!all ocated!account,!even!more!so!than!the!difference!

in!return!rates!would!indicate.!!This!is!due!to!the!fact!that!a!5%!coupon!rate!was!assumed!(this

!

35

!

!

is!taxed!as!ordinary!income,!as!the!dividends!were)!which!leaves!only!a!1.05%!annual!capital!

gain!compared!to!the!7.78%!in!the!aggressive!account.! The!rest!of!the!taxation!is!handled!

equivalently,!but!the!lack!of!growth!is!a!result!of!the!difference!in!capital!gains!rather!than!the!

assumed!rates!of!return.!

!

With!a!safely!allocated!taxable!account,!the!whole!life!comes!o ut!with!a!clear!advantage.!!

The!end!of!the!20

th!

year!shows!the!living!and!death!benefits!of!whole!life!to!be!slightly!greater.!!

The!fact!that!the!taxable!account!is!mo re!liquid!during!this!period!can!make!up!for!the!small!

(roughly!$4,000)!difference!in!living!benefit!and!be!called!a!tie,!but!the!whole!life!strategy!

provides!nearly!$25,000!more!death!benefit!than!BTID,!which!gives!it!the!slight!advantage!over!

this!time!period.! From!this!point!on,!however,!whole!life!is!clearly!a!more!appropriate!strategy.!!

The!value!of!the!death!benefit!of!BTID!n ever!exceeds!$1!million,!something!that!whole!life!does!

comfortably!by!the!end!of!the!40

th!

year.! The!living!benefit!of!

BTID!is!also!still!worth!less!than!$500,000!at!the!end!of!th e!40

th!

year,!while!whole!life’s!CSV

!

!

withdrawal!value!is!upwards!of!$650,000,!and!still!is!not!worth!$1!million!by!the!end!of!the!60

th

!

!

year!when!whole!life’s!is!worth!nearly!$2!million.!!Regardless!of!the!fact!that!the!taxable!

!

account!is!considerably!more!liquid!than!the!whole!live!CSV!account,!the!margins!are!simply!too!

wide!for!that!to!make!up!the!difference!for!BTID.!!Additionally,!the!total!value!of!the!t axable!

account,!before!taxes!are!taken!at!withdrawal,!never!exceeds!the!value!of!the!whole!life!CSV!

account!at!any!point!in!time!following!the!20

th!

year.!

!

Tax>free%Account%vs.%Whole%Life:!

Table!3!summarizes!th e!scenario!in!which!BTID!involves!the!20]year!level!term!policies!

with!the!difference!invested!in!a!tax]free!account,!such!as!a!Roth!401k,!competes!with!the!

largely!the!same!as! what!was!experience!with!the!aggressively!allocated!tax]deferred!account.

!

BTID!has!the!clear!advantage!across!all!criterions!throughout!the!time!periods.! The!10%!excise

!

36

!

!

whole!life!strategy.! Again,!all!of!the!life!insurance!policies!are!the!same!as!in!the!previous!

scenarios!tested,!meaning!that!the!difference!to!be!invested!in!the!first!20!years!is!$8,383!and!

the!difference!invested!for!the!first!10!years!of!the!next!20!years!is!$7,113.! Both!whole!life!

premiums!and!contribut ions!made!towards!tax]free!accounts!are!paid!for!with!after]tax!dollars,!

just!like!the!previous!scenario!involving!the!taxable!account,!meaning!that!the!difference!in!

premium!represents!the!equivalent!amount!invested!in!the!BTID!strategy.! Unlike!the!previous!

scenario!with!the!taxable!account,!the!after]tax!contributions!toward!the!tax]free!account!grow!

free!from!taxation!and!no!taxes!are!taken!out!upon!withdrawals!after!age!59!½!.!!It!is!worth!

noting!that!due!to!the!assumption!that!income!t ax!is!constant!at!35%,!the!performance!of!the!

tax]free!account!is!very!similar!to!that!of!the!tax]deferred!account,!which!is!to!be!expected,!

though!the!slight!differences!make!investigating!both!scenarios!worthwhile!and!will!be!

highlighted.!

!

=1O8 %*W6 * =%0#*P*=1Q R,0%%*B22"/(&*?.J*74"8%*+',%!

!

;/<*=%0#>*-(?%.&*@',,%0%(2%

!

74"8%*

+',%

!

!

BK?1(&1)%!

Return

!

Year

!

Account:

!

Roth $401k

!

Withdraw

!

Value

!

Pay$at

!

Death

!

CSV

!

Withdraw

!

Value

!

Pay$at

!

Death

!

Stocks!

9.78%

!

20!

$514,103!

$462,693!