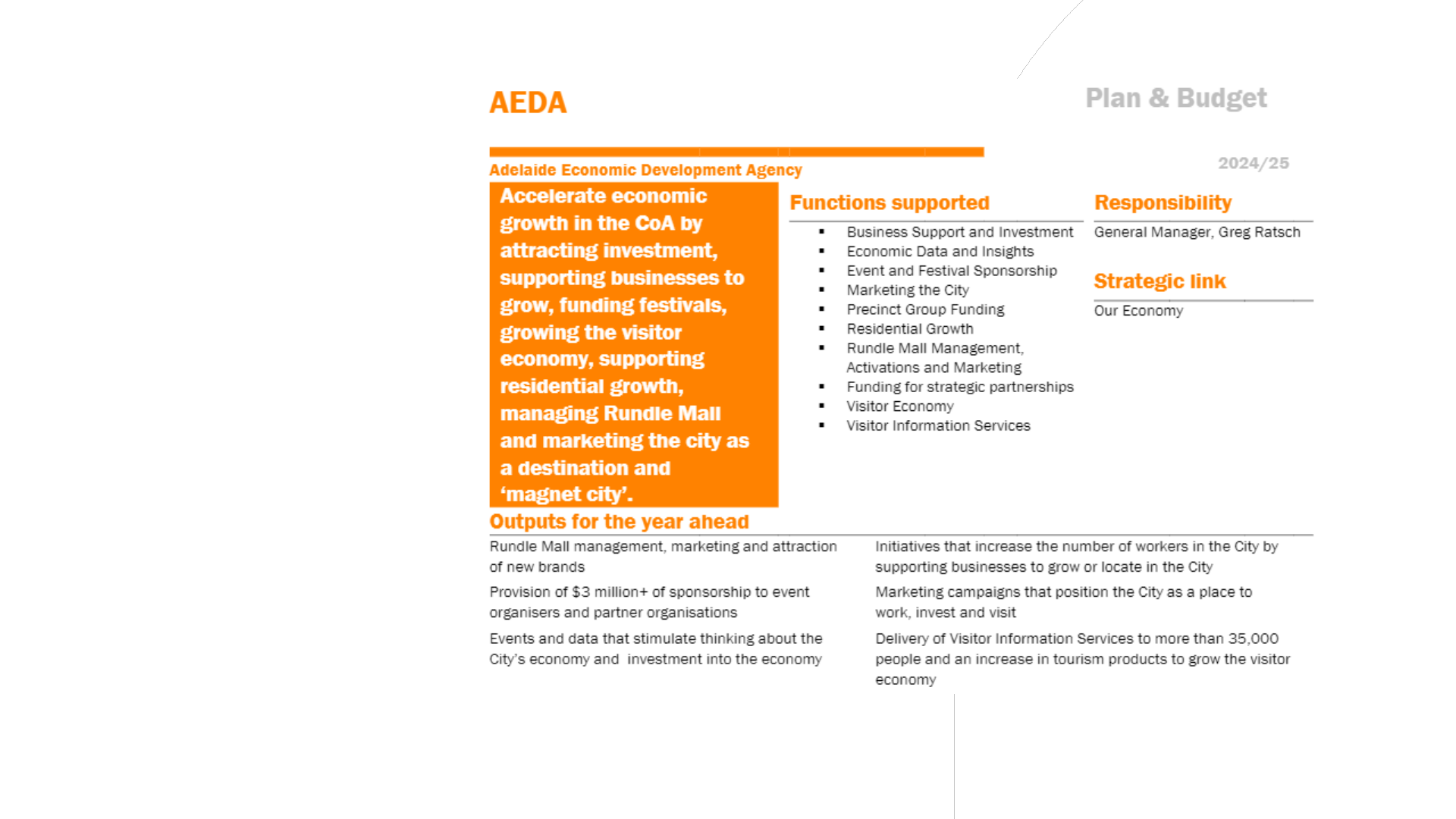

Adelaide Economic Development Agency

Greg Ratsch, General Manager

AEDA 2024/25 Business

Plan and Budget

This workshop seeks Council Members’

feedback on the AEDA 2024/25 draft

Business Plan and Budget.

• The draft AEDA 2024/25 BP&B has been prepared in consideration of the CoA

Strategic Plan and Long-Term Financial Plan

• The BP&B is underpinned by the objects and purposes of the Agency and

feedback received through consultation

• This draft Budget has been approved by the AEDA Board.

AEDA 2024/25 BP&B

Key Messages

AEDA 2024/25 BP&B | 19 March 2024

Do Council Members

have any feedback on

the draft 2024/25

AEDA Business Plan

and Budget?

KEY QUESTION

AEDA 2024/25 BP&B

Key Questions

AEDA 2024/25 BP&B | 19 March 2024

Adelaide Economic

Development Agency

Draft 2024/25 Business

Plan and Budget

Adelaide Economic Development Agency | Slide 6

Overview

The annual Business Plan and Budget (BP&B) of the Agency fits

in with the Council’s strategies and documents as follows:

City of Adelaide Economic Development Strategy

City of Adelaide Strategic Plan 2024-2028

AEDA Strategic Plan

AEDA Business Plan & Budget

AEDA Charter

slide 5

CoA Strategic Plan Alignment

The CoA Strategic Plan is a key overarching document to the AEDA BP&B, particularly whilst the Economic Development Strategy

is being developed with its potential impact on the AEDA Strategic Plan.

CoA’s Strategic Plan contains an action to “continue the support for the Adelaide Economic Development Agency (AEDA)

Subsidiary and the delivery of the AEDA Charter and Business Plans” with an associated indicator of success being “support the

delivery of the key actions of the AEDA Strategic Plan to support investors, emerging sectors, entrepreneurs and business owners

to be successful, innovative and responsive to a changing business environment.”

Specific actions of particular relevance to AEDA in CoA’s Strategic Plan include:

Provide services and

information that

contribute towards a

high

productivity economy

Create partnerships to grow and

develop current and emerging

sectors such as medical,

technology, creative and

professional services sectors

Work with partners,

universities and

businesses to attract

investment and improve

employment

opportunities

Partner with the State Government,

universities, associations, community

and advocacy groups to activate and

upgrade precincts to stimulate

investment, visitation and maximise

opportunities

Reinforce the position of Adelaide

as the State’s central business

district and amplify Adelaide’s

reputation as a place to learn, work

and start a business

Refresh the way in

which information is

provided to visitors to

the city

Support increased

residential growth and

housing affordability through

partnerships and advocacy

Elevate the City’s reputation for

exceptional and unique arts and

cultural experiences by encouraging

and providing arts, culture and

events partnerships, grants and

sponsorship opportunities

Objects & Purposes of AEDA

The AEDA Charter outlines the objects and purposes of the Agency, which are:

To accelerate economic growth in the

City of Adelaide by attracting

investment and supporting

businesses, festivals and events, as

well as visitor, student and residential

growth

.

To promote the City of Adelaide as a

destination and ‘magnet city’ and

increase its visitation and use by

residents, workers, visitors and the

community in general

,

.

To position the Rundle Mall as the

State’s premier retail and commercial

shopping precinct in order to sustain

retail, business and economic viability

.

To ensure that the Agency operates

within the terms of this Charter and

the Council’s Strategic Plan

.

Context

The 2024/25 AEDA draft BP&B has been informed by:

• Engagement with the AEDA Board

• Engagement with the AEDA Advisory Committee

• Review of the CoA Strategic Plan Feedback

• AEDA Strategic Plan Consultation with AEDA Board, Advisory

Committee & Staff

Strategies & Actions

Business, Investment & Residential Growth

City Indicators that will be impacted Key Result Area Measures

•

Commenced international student

numbers maintained at 2023 levels

(29,143 as of October)

•

2+% increase in the number of city

workers above 2022/23 levels (157,000)

to 160,647

•

2+% increase in the number of city

businesses above 2022/23 levels

(12,558) to 12,809

•

50 inward investment proposals/local expansions supported, with at least 1,500 jobs created

•

750 Welcome to Adelaide employee introduction packs distributed

•

Increase of bookable tourism experiences in the city

•

30+ vacant shopfronts/premises activated

•

Deliver 3 industry briefing events

•

Outcomes from collaborative partnerships with MTPConnect; SouthStart and University of Adelaide/Thinclab to

support small businesses to grow and scale

•

5 projects/market interventions to support emerging industries in the city

•

Supported/ facilitated 6 networking/knowledge transfer events for businesses

An environment that attracts investment, supports new businesses to start, existing businesses to grow and increases the city’s population.

CoA Strategic Plan

Alignment

•

Activate and upgrade precincts to stimulate investment, visitation and maximise opportunities

•

Provide services and information that contribute to a high productivity economy

•

Work with partners, universities and businesses to attract investment and improve employment opportunities

•

Grow and develop sectors such as medical, technology, create and professional services

•

Deliver economic data and insights to our business community

•

Support increased residential growth

Outcomes

•

The position of the State’s Central Business District is reinforced

and its strengths and opportunities are known nationally and globally

•

Existing businesses grow and new firms including retailers, medical, technology, creative and professional services choose the city

•

Knowledge based industries grow and innovation networks develop further

•

Investment and business decision makers in the city have access to reliable data

•

Enhanced partnerships with the state government, private investors and industry groups to stimulate residential and commercial

investment

Visitor Growth

City Indicators that will be impacted Key Result Area Measures

• City hotel occupancy above 70%

• Jobs filled & businesses data (AEDA refining and sourcing target)

• TiCSA Tourism Barometer Report

o industry confidence & forward booking sentiment

o workforce sentiment

o Adelaide operators compared to total sentiment

(AEDA refining and

sourcing target)

• Delivery of the new Experience Adelaide Visitor Centre

• 20 new bookable city tourism products/experiences

• Visitor & community sentiment index (to be developed)

Visitors have an enjoyable, vibrant and dynamic city experience so that they are encouraged to return again and become ambassadors for the Adelaide as a

destination of choice

CoA Strategic Plan

Alignment

•

Increase the number of people who visit the city through local, interstate and international visitation

•

Refresh the way in which information is provided to visitors to the city

Outcomes

•

Adelaide is a world class events city hosting a diverse range of festivals and events, including business events, spread

across the city over the year

•

Strengthened partnerships and programs to increase awareness of the city, leading to increased bookings from regional,

national and international visitors

•

Visitors are highly satisfied with their experience and can easily find information about planning their trip before they arrive

and during their visit

•

A sustainable tourism sector, that continues to grow by diversifying and expanding product offerings, job growth, and

attraction of new operators

Rundle Mall

City Indicators that will be impacted Key Result Area Measures

•

Increased spend in the city

•

Reduced retail vacancy rates from 15.3%

•

Increased market share in hospitality categories

•

Demonstrate uplift in market share and foot traffic across 3 core campaigns

•

5 new brands commit to Rundle Mall

•

2 public realm infrastructure projects completed.

•

A minimum of $20m new capital investment delivered or committed in the Rundle Mall

precinct.

•

Completed concept plans for Twin Street upgrades.

•

10 Business or industry media stories relating to Rundle Mall.

•

Uplift in Rundle Mall small business sentiment index over FY24/25

Rundle Mall, the State’s premier retail and commercial shopping precinct, energises city life and enriches the Adelaide experience

CoA Strategic Plan

Alignment

•

Activate and upgrade precincts to stimulate investment, visitation and maximise opportunities

•

Reinforce the position of Adelaide as the State’s central business district to amplify Adelaide’s reputation as a place to le

arn,

work and start a business

•

Deliver quality street and laneway upgrades, Mainstreet’s, precincts and neighbourhood revitalisation and improvements

that make Adelaide well-designed, safe and unique.

Outcomes

•

Rundle Mall evolves and regenerates with new capital investment

•

Rundle Mall develops a reputation as a food, wine and hospitality precinct

•

A vibrant and multi-

dimensional day and night destination that’s curated and programmed with memorable events, festivals,

activations, and installations.

• Rundle Mall is a healthy and vibrant mix of world class flagships, local brand heroes and gems that you can’t find anywhere

else

•

Through shading, greening and other initiatives, Rundle Mall remains an attractive place to visit as climate variations

become more extreme

Brand and Marketing

The voice of the city to consumers through Experience Adelaide and to businesses as the Adelaide Economic Development Agency

City Indicators that will be impacted Key Result Area Measures

• Increased awareness of AEDA among target audience(s)

• Increased foot traffic in key precincts and areas

• Total city expenditure above $4.45b

•

10% increase to $2.2m on 2023/24 in media mentions (advertising space rate) with reference

to AEDA

• Maintain a variance of 85% – 95% neutral and/or positive sentiment of media mentions

• Increase awareness of AEDA amongst target audience by X% (metrics to be determined by

research scheduled for completion in May)

• Brand health metric for “city” and Adelaide” as a destination to visit (metrics to be determined

by May)

CoA Strategic Plan

Alignment

•

Reinforce the position of Adelaide as the State’s central business district and amplify Adelaide’s reputation as a place to lear

n,

work and start a business

•

Provide services and information that contribute to a highly productive economy

•

Partner with State Government, universities, associations and community to activate and upgrade precincts to stimulate

investment, visitation and maximise opportunities

•

Refresh the way in which information is provides to visitors to the city

Outcomes

•

Unified key messaging and branding of the city to intrastate, interstate and international audiences

•

More workers, residents, students, and visitors in the city

•

Increased spend in the city

•

AEDA is a partner of choice for businesses and other organisations with a mutual interest in enhancing the city’s economy

•

Adelaide is considered a destination of choice for leisure travellers

Draft Budget

Program Plan

Overview

Program Plan

Budget

Program Plan

Budget

Program Plan

Budget

Budget

The AEDA Budget has been prepared consistent with the 2024/25 City of Adelaide

BP&B process, built on the basis of budget repair and consistent with Council’s

Strategic Plan and Long-Term Financial Plan. It has been prepared with a view to

efficient delivery of the actions outlined in the draft business plan and received

AEDA Board approval on 12 March 2024 for submission to Council as a draft

budget for consultation purposes.

• $13.5m annual budget including Rundle Mall levy and strategic projects

equating to 5.9% of the City of Adelaide’s annual budget

• $9.1m CoA appropriation which is approximately 4.0% of City of Adelaide’s

total budget

• AEDA has 33.6 FTE budgeted (including vacancies), equating to 4.3% of the

City of Adelaide’s total FTE count.

Rundle Mall Fees & Charges

The AEDA Board considered proposed changes to the Rundle Mall Levy and Casual Mall Lease

rates at their 13 February 2024 Board meeting and endorsed the following:

Rundle Mall Levy

• Increase the Levy by 2.8% in line with the standard indexation being applied by Council for

the upcoming budget, and with Long-Term Financial Plan parameters and principles

• This table outlines the implications of the proposed increase on forecast Rundle Mall income:

Casual Mall Leases

• An increase of 2.8% for the Casual Mall Lease (CML) rates in 2024/25. An approximate 2.8%

increase is applied to individual fee amounts as opposed to an exact 2.8% to ensure the

fees consist of practical denominations.

2023/24 2024/25 % Increase

Gross Rates 3,937,808 4,048,067 2.8%

Rebates (17,802) (18,301) 2.8%

Objections (30,000) (30,000) -

Net 3,890,006 3,999,766 2.8%

To change image:

• click once on the photo

below the arrow.

• Right click > ‘Change Picture’ >

‘From a File…’.

• Delete this instruction box

and arrow.

Thank You