Merrill Funding Guide for NextGen 529

Account

(for existing NextGen 529 clients only)

Certain banking and brokerage accounts may be ineligible for real-time money movemen t, including but not limited to transfers to/from bank IRAs (CD, Money

Market), 529s, Bank of America Advantage SafeBalance Banking™, Credit Cards and transfers from IRAs, Loans (HELOC, LOC, Mortgage) and accounts held in the

military bank. Accounts eligible for realtime transfers will be displayed online in the to/from drop down menu on the transfer screen.

Neith er Merrill nor any of its affiliates or financial advisors provide legal, tax or accounting advice. Clients should be instructed to con sult with their legal and/or tax advisors

before making any financial decisions.

Merrill L yn ch , P ierce, Fenn er & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed,

distributed or provided by companies that are affiliates o f Bank of America Corporation (“BofA Corp.”). MLPF&S is a registered broker-dealer, regis tered investment

adviser, M ember SIP C and a who lly owned su bsid iary of Bof A Co rp.

Banking products are provided by Bank of America, N.A.,, Member FDIC and a wholly owned subsidiary of B of A Corp.

Inves tment pro ducts:

© 2023 Ban k of America Corporation. All rights reserved. M AP5 46 096 7

Are Not FDIC Insured Are Not BankGuaranteed May LoseValue

Disclosure

38 March 2023

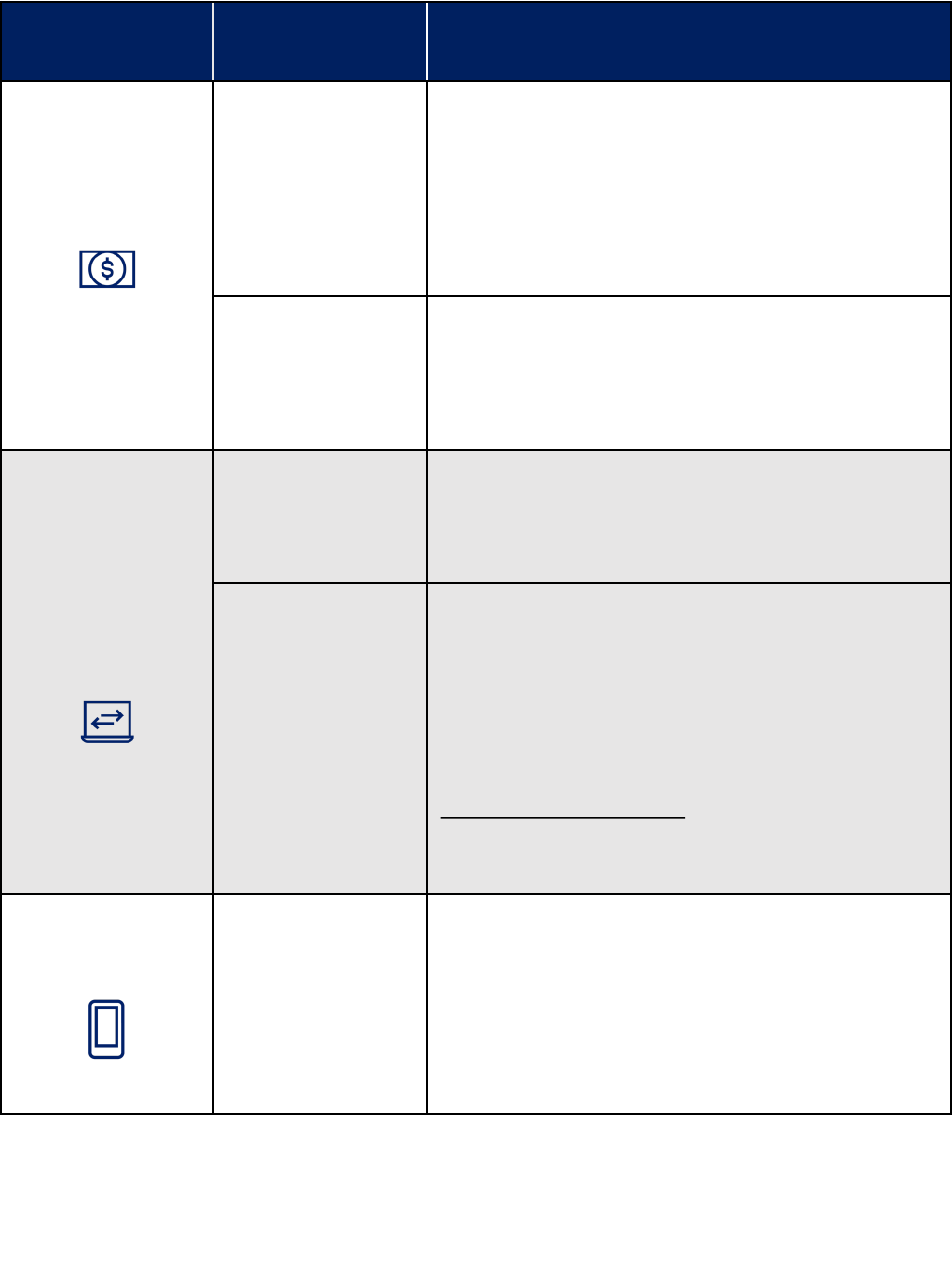

Funding action

How long will it

take?

How to submit

One time bank

transfer

From Bank of America &

Merrill

Realtime

Used to move money between your linked Bank of America banking and

Merrill investment accounts:

• Navigate through menu tab: Accounts -> Transfer Money &

Securities -> Ca s h

To link your existing Bank of America account to your Merrill NextGen

529 account you can click the banner titled “Sign up for convenient

oneclick access to your Bank of America accounts” located below the

Welcome greeting on the account summary page

External Account

1-4 Days

Used to move money between your external bank accounts:

• Navigate through menu tab: Accounts -> Transfer Money &

Securities -> Ca s h

• Not all external banks participate in third-party linking services – if

your bank doesn’t participate you can submit one time transfers via

check

Recurring

contributions from

bank

From Bank of America &

Merrill

Realtime

Used to set recurring contributions from Bank of America accounts:

• Navigate through menu tab: Accounts -> Transfer Money &

Securities -> Ca s h

• Set desired frequency

External Account

Requests must be received

at least 10 business days

before the specified start

date in order for

contributions to begin as

elected. Late requests will

begin in the following

period.

Used to establish recurring contributions from your external bank

accounts to your Merrill NextGen 529 account:

• Navigate through menu tab: Help & Settings -> Forms & Applications

• Search for NextGen AFS Enrollment and Change Authorization Form

– complete form

• Copy of voided check required

Note: A hard copy can also be mailed upon request

Eligible for 3

rd

party contributions: Participant and third-party

contributor signature required on the form, the original signed form is

required. An electronic signature is not acceptable for third-party

contributions.

Mobile Check

Deposit

1 – 3 Days to credit to

account

Mobile Deposit for iPhone, iPad, iPod Touch, and Android allows

Consumer Investments clients to deposit checks to their eligible Merrill

investment or Bank of America banking account directly from their

supported mobile device

To initiate a deposit on the device, you will access the feature by tapping

Check Deposit from either the Menu or global navigation bar in the

Merrill Edge app

Follow on-screen instructions to complete deposit.

Note: Aggregate value of all 529s for the beneficiary can not exceed limit set in the Program Description

*Processing timeline is in business days and accounts for time it takes for assets to deposit into account – it does not reflect investing timeline

4

Funding action

How long will it

take?

How to submit

Check

1 – 3 Days to credit to

account

Used to make a one time contribution to an account (excluding rollover

checks):

• Mail check to Merrill Edge, NJ2-140-02-01, 1400 American Boulevard,

Pennington, NJ 08534

• Make check payable to: NextGen 529 FBO (Name of Designated

Beneficiary)

• Include the 8 digit Merrill account number in the memo line if

possible

Eligible for 3

rd

party contributions

Rollover

10 – 15 Days

Used to rollover assets from another state’s section 529 Program,

Coverdell ESA, or qualifying savings bonds such as EE (Merrill account

titling must match the participant and beneficiary listed on the rollover

plan):

• Navigate through the online menu tab: Help & Settings -> Forms &

Applications

• Search for NextGen 529 Incoming Rollover Form – complete the form

• Contact your contra firm to request check made payable to:

NextGen 529 FBO (designated beneficiary)

Account # (NextGen 529 Account #)

• Delivery instructions available on NextGen 529 Incoming Rollover

Form

Note: A hard copy can also be mailed upon request

Payroll deduction

1 – 3 days for Merrill

processing

+ the length of time it

takes for your employer to

process the instructions

Used to establish contributions directly through a payroll deduction:

Step 1

• Navigate through the online menu tab: Help & Settings -> Forms &

Applications

• Search for NextGen 529 Payroll Deduction Form – complete the form

Step 2

• Once the form is processed by Merrill, a letter will be delivered to

your online account inbox and also sent to your mailing address

Step 3

• Provide your employer with a copy of the letter generated by Merrill

which contains the necessary information to update your payroll

with requested 529 allocation

If you are a Bank of America employee, please call 877.653.4732.

Eligible for 3rd party contributions: The letter Merrill generates (Step 2)

will be mailed to the participants address only. The participant must

provide the 3rd party with the letter so they can complete Step 3.

Additional Information

• To link your existing Bank of America banking account to your Merrill NextGen 529 account you can click the banner titled “Sign up for convenient

one-click access to your Bank of America accounts” located below the Welcome greeting on the account summary page.

• To confirm what has been contributed for a specific timeframe, navigate to Accounts > Activity and use filter option to select dates and activity

type.

Note: Aggregate value of all 529s for the beneficiary can not exceed limit set in the Program Description

*Processing timeline is in business days and accounts for time it takes for assets to deposit into account – it does not reflect investing timeline

8 March 2023