COUNTRYWIDE CREDIT INDUSTRIES, INC.

4500 Park Granada

Calabasas, California 91302-1613

WWW.COUNTRYWIDE.COM

CCI 2001 ANNUAL REPORT

WWW.COUNTRYWIDE.COM

Countrywide Credit Industries, Inc.

2001 Annual Report

Shareholder Information

Inquiries Regarding Your Stock Holdings

In all correspondence or telephone inquiries,

please mention Countrywide Credit Industries,

your name as printed on your stock certificate,

your social security number, your address and

your telephone number.

Registered Shareholders

(Shares held in your name)

Address shareholder inquiries to:

The Bank of New York

Shareholder Relations Department-11E

P.O. Box 11258

Church Street Station

New York, NY 10286-1258

(800) 524-4458

E-mail Address:

Shareowner[email protected].com

Send certificates for transfer and address

changes to:

The Bank of New York

Receive and Deliver Department-11W

P.O. Box 11002

Church Street Station

New York, NY 10286-1002

(800) 524-4458

Beneficial Shareholders

(Shares held by your broker in the name

of the brokerage house)

Questions should be directed to your broker.

Employee Stock Option Participants

Questions regarding your account, outstanding

options or shares received through option

exercises should be addressed to:

Countrywide Credit Industries, Inc.

Equity Benefit Plan Administration

4500 Park Granada

MSN CH-56

Calabasas, CA 91302-1613

(818) 225-3456

Employee 401(k) Benefit Plan Participants

Questions regarding your 401(k) statements, loan

provisions, fund transfers or other matters should

be addressed to:

Countrywide Credit Industries, Inc.

Human Resources: Benefits Department

1515 Walnut Grove

MSN RM-56

Rosemead, CA 91770

(800) 881-4968, Ext. 3999

Dividend Reinvestment Plan

By enrolling in Countrywide Credit Industries,

Inc.’s Dividend Reinvestment and Optional Cash

Stock Purchase Plan, shareholders may reinvest

cash dividends on all, or some portion, of their

common stock and may purchase the Company’s

common stock on a monthly basis with optional

cash payments. Information on this plan is

available from:

The Bank of New York

Securities Transfer Division

Dividend Reinvestment

P.O. Box 1958

Newark, NJ 07101-9774

(800) 524-4458

Company Information

Shareholders with questions regarding Countrywide

Credit Industries, Inc., or who are interested in

obtaining a copy of the Company’s Form 10-K

without exhibits for Fiscal 2001, or a copy of the

corporate annual report of Balboa Life & Casualty

may contact:

Countrywide Credit Industries, Inc.

Investor Relations

4500 Park Granada

MSN CH-19

Calabasas, CA 91302-1613

(818) 225-3550

You may also reach us through the Internet at

www.countrywide.com

Annual Shareholders’ Meeting

The Annual Meeting of Shareholders

will be held on Thursday, July 12, 2001

at 10:00 a.m. (

PDT) at

Hyatt Westlake Plaza

880 South Westlake Boulevard

Westlake Village, CA 91361

Mortgage Financing and Insurance Products

If you are in the process of purchasing a new

home, are interested in refinancing or obtaining

a home equity loan or would like to know about

our diversified financial products and services,

we are ready to serve you. A special unit of

our company is dedicated to responding to your

inquiries and ensuring that you are satisfied.

Please call the Shareholder Hotline at

(800) 544-8191.

Countrywide Insurance Services, Inc. is also

pleased to offer you personally tailored and

competitive insurance products and services.

Please call (800) 669-6656, Ext. 3175, for

a quote.

You may also reach us through the Internet at

www.countrywide.com or www.cwinsurance.com

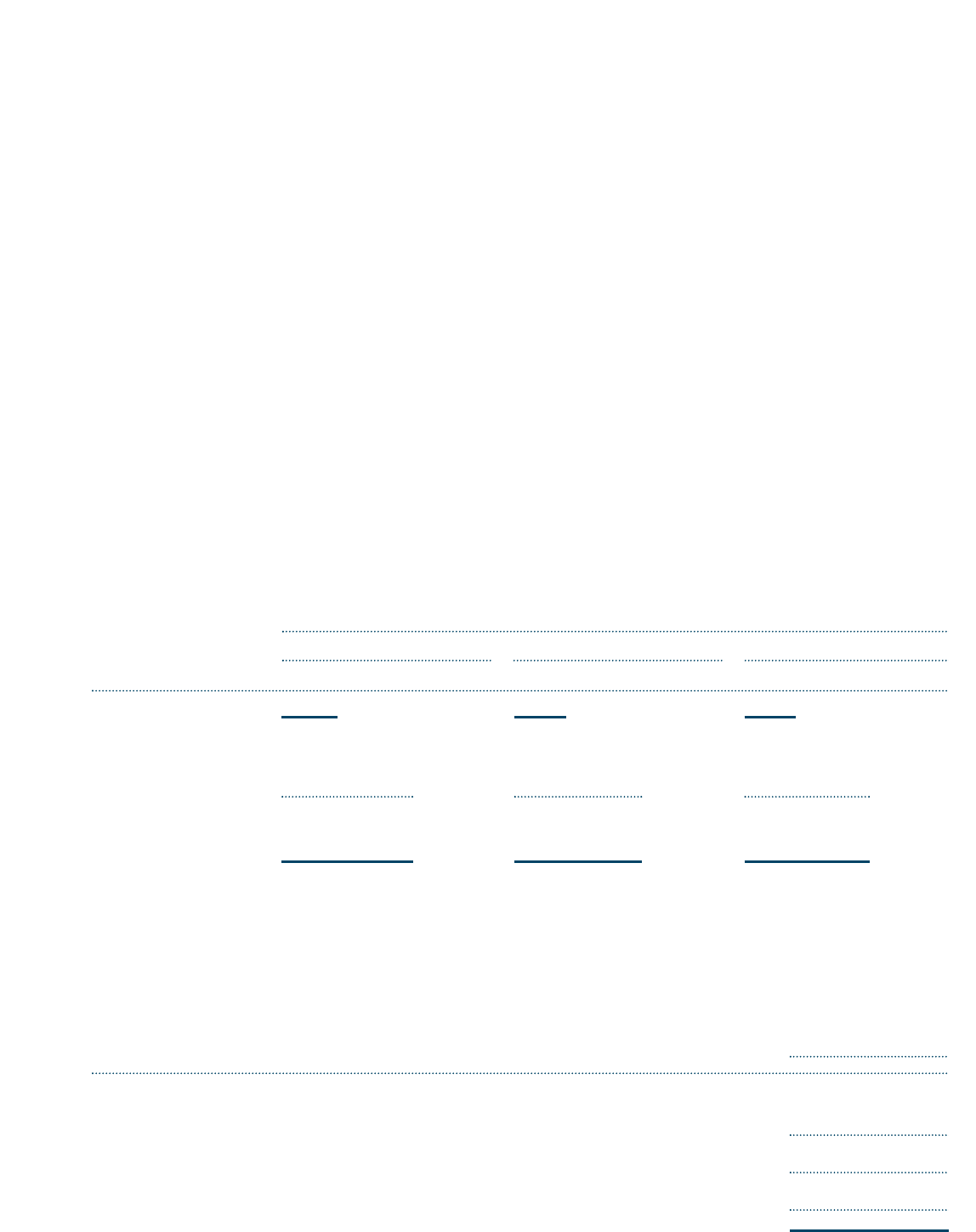

Fiscal Year Ended February 28 (29),

Dollar amounts in millions, except per-share data 2001 2000 1999

Revenues $ 2,056 $ 1,871 $ 1,804

Net earnings $ 374 $ 410 $ 385

Total assets $ 22,954 $ 15,822 $ 15,648

Common shareholders’ equity $ 3,559 $ 2,888 $ 2,519

Earnings per share — diluted

(1) (2)

$ 3.14 $ 3.52 $ 3.29

Common shareholders’ equity per share

(at year-end) $ 30.23 $ 25.45 $ 22.37

(1)

Based on weighted average diluted common shares outstanding.

(2)

Earnings per share for Fiscal Year 2000 include a $25.0 million tax benefit primarily related to a corporate reorganization.

Excluding the non-recurring tax benefit, diluted earnings per share would have been $3.31.

Financial Highlights

Table of Contents

IBC 60 58 55 54 17 06 04 02 01 IFC

Financial Highlights

Company Profile

Letter to Shareholders

Countrywide at a Glance

Countrywide’s Transformation

and Senior Management Team

Financial Information

Common Stock and Dividend Information

Production Office Locations

Subsidiaries

Corporate Information

Shareholder Information

Company Profile

Founded in 1969, Countrywide Credit Industries, Inc. is a member of the S&P 500 and the Forbes 500.

The company provides consumer and business-to-business financial services in domestic and international

markets. Consumer businesses include residential mortgages, loan closing services, consumer insurance and

other financial products. Business-to-business activities encompass capital markets, processing and technology,

and insurance products. The company is headquartered in Calabasas, California and has more than 12,000

employees. Principal subsidiaries of the company include:

• Countrywide Home Loans, Inc., which originates, purchases, securitizes, sells and services home loans

• Full Spectrum Lending, Inc., a sub-prime residential lender

• LandSafe, Inc., a provider of loan closing services

• Countrywide Insurance Services, Inc., a full service insurance agency

• Countrywide Capital Markets, a mortgage-related investment banker

• Balboa Life and Casualty, a national provider of property, liability and life insurance

• Countrywide owns 50 percent of Global Home Loans, Limited, a European mortgage banking joint venture

For more information, please visit Countrywide’s website at www.countrywide.com.

Certain of the information included in this Annual Report may contain forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties, which

could cause actual results to differ materially from historical results or those anticipated due to a number of factors such as the direction and level of interest rates, competitive and

general economic conditions in each of our business sectors, expense and loss levels in our mortgage, insurance and other business sectors, general economic conditions in the United

States and abroad and in the domestic and international areas in which we do business, regulatory and legislative environments in which the company operates, changes in accounting

and financial reporting standards, decisions by the company to change its business mix, and other risks detailed in documents filed by the company with the Securities and Exchange

Commission from time to time. Words like “believe,” “expect,” “should,” “may,” “could,” “anticipated,” “promising” and other expressions which indicate future events and trends

identify forward-looking statements. The company undertakes no obligation to publicly update or revise any forward-looking statements.

02 CCI

Letter to Shareholders

In last year’s Annual Report, we focused on Countrywide’s strategic transformation. Once a singularly focused mortgage bank,

we have made significant strides in implementing our strategy of becoming a diversified financial services provider to both retail

and institutional customers, domestically and internationally. This year’s Annual Report will describe how Countrywide achieved

this transformation by leveraging the unmatched expertise and robust work ethic of our dedicated employees and seasoned

management team.

Countrywide’s Transformation Strategy Founded in 1969, Countrywide Credit Industries, Inc., built itself into an industry

leader through an unwavering focus on its core business of mortgage banking and a relentless dedication to furthering the

American dream of homeownership. This highly focused strategy enabled the company to emerge as one of the nation’s home

finance leaders during the mid-1990’s.

Over the last five years, however, Countrywide has sought to create additional value for its shareholders by broadening

its mission to include new businesses and markets. Today, the company is a diversified financial services powerhouse in the

U.S. with a foothold to operate in international markets as well. Countrywide’s array of businesses includes a range of

consumer and institutional products and services. Consumer businesses include mortgage banking, consumer insurance and

other retail financial services. Our

B2B activities include processing and technology, capital markets and insurance. The

powerful combination of our core business strength and our innovative diversification strategy has propelled Countrywide into

the S&P 500 and Forbes 500.

Countrywide’s success would not have been possible without the outstanding efforts of our employees, who we believe are

the smartest, best-trained and hardest-working people in our industry. In this year’s Annual Report, we are pleased to introduce

you to our four new Senior Managing Directors, who embody Countrywide’s creativity and work ethic. These four — Kevin Bartlett,

Tom Boone, Carlos Garcia and Dave Sambol — have overseen the implementation of our strategic transformation. We invite you

to learn more about the company, its strategies and its future as described in the following pages by these key individuals.

Countrywide’s Senior Management Team The last few years have brought increasing complexity to our business. Although

our infrastructure has been strong enough to manage this complexity, nevertheless it became clear that high-level organizational

changes were needed to prepare us for the rapid growth and continued diversification which we expect in the coming years.

Therefore, we made the decision to realign our top-level management structure into four newly developed Senior Managing

Director roles. Each Senior Managing Director has responsibilities for carrying out elements of both our core business and

diversification strategies.

Kevin Bartlett is Senior Managing Director and Chief of Secondary Markets for Countrywide. As such, he is responsible for

the securitization and sale of the mortgages we originate. He oversees our mortgage-backed securities trading desk as well as

all mortgage pricing and hedging activities. Among his other accomplishments, he was responsible for brokering the unique

strategic alliance between Countrywide and Fannie Mae in 1999. Kevin joined the company in 1986 after a six-year career

in public accounting. In his previous role at Countrywide, he served as Managing Director, Secondary Markets.

Tom Boone is Senior Managing Director and Chief of Global Processing. He now oversees domestic loan servicing and sub-

servicing, international processing and consulting, and other transaction processing. He has been integral to the formation of

Angelo R. Mozilo Stanford L. Kurland

03 CCI

Countrywide’s European mortgage banking joint venture, Global Home Loans, Ltd., and serves on its Board of Directors.

Previously, Tom was Managing Director of Loan Administration. He came to Countrywide in 1984 from Chase Manhattan Bank.

Carlos Garcia is the Senior Managing Director of Finance and Chief Financial Officer for Countrywide, and Chief Operating

Officer for its subsidiary Countrywide Home Loans, Inc. He is responsible for all corporate operations including finance,

administration, human resources and technology. In addition, he oversees Countrywide’s insurance and banking subsidiaries.

Previously he served as Chief Financial Officer of Countrywide Home Loans, Inc. Carlos joined the company in 1984. Prior to

joining Countrywide, Carlos worked in public accounting.

David Sambol is Senior Managing Director and Chief of Production. He oversees all segments of our loan origination net-

work, including our retail branches, telemarketing, and Internet production; our mortgage broker operations; our correspondent

lending division; and our subprime lending operations. In addition, he is in charge of our investment banking subsidiary,

Countrywide Capital Markets. Dave came to Countrywide in 1985 and has served in various capacities. Most recently, he was

Managing Director of Capital Markets. He has an accounting background.

Fiscal Year 2001 Performance During the latter part of the fiscal year ended February 28, 2001 (“Fiscal 2001”), a soft-

ening of the U.S. economy resulted in a falling interest rate environment, which spurred refinance activity throughout the

mortgage industry. Countrywide capitalized on this opportunity, producing $69 billion in mortgages, the second-highest annual

total in company history. At the end of Fiscal 2001, our mortgage-servicing portfolio stood at $294 billion, representing nearly

3 million borrowers.

Net earnings for Fiscal 2001 were $374 million as compared to $410 million for the prior fiscal year (“Fiscal 2000”).

Diluted earnings per share were $3.14 as compared to $3.52 in Fiscal 2000. The decline in earnings this year from last year’s

record-setting levels was primarily a result of a slow market for loan originators in the early part of Fiscal 2001. In addition,

Fiscal 2000 earnings included a non-recurring tax benefit of $25 million or $0.22 per diluted share. Earnings from non-core

operations (which include insurance, capital markets, loan closing services and international operations) accounted for 27

percent of earnings in Fiscal 2001, compared to 13 percent in Fiscal 2000.

Among our consumer businesses, the consumer mortgage origination sector accounted for 32 percent of consolidated

earnings in Fiscal 2001, compared to 35 percent in Fiscal 2000. The mortgage-related investments sector contributed

28 percent of earnings, compared to 39 percent in Fiscal 2000. B2C insurance provided 1 percent of earnings, the same

as the previous fiscal year.

Among our institutional businesses, the processing and technology sector accounted for 11 percent of Countrywide’s

earnings in Fiscal 2001, compared to 6 percent in Fiscal 2000. Capital Markets contributed 16 percent of earnings this

year, compared to 14 percent in Fiscal 2000. B2B insurance provided 12 percent of earnings, versus 5 percent last year.

Market Outlook As we begin Fiscal 2002, the key driver of the mortgage market continues to be the low interest rate environ-

ment. Should this environment be sustained, the mortgage industry can expect to see a total origination market which approaches

or even exceeds record volume. As of April 2001, the Mortgage Bankers Association of America, Fannie Mae and Freddie Mac

have projected the total market for calendar year 2001 to approach or break the previous record of $1.5 trillion set in 1998.

Countrywide’s mortgage origination business should benefit from these conditions, and our previous record for annual

origination volume, $93 billion in Fiscal 1999, could be within reach. On the servicing side, the risk of portfolio erosion would

be mitigated by the massive surge in loan originations, as the company has seen historically. In the fourth quarter of Fiscal

2001, for example, originations exceeded prepayments by $10.3 billion.

Over the near term, this environment creates opportunities for accelerated growth. Over the longer term, our well-developed

strategy of diversification and globalization provides the potential for enhanced stability and further upside in our income stream.

The Future As Countrywide’s strategic transformation takes us into diverse businesses and new markets around the globe,

Countrywide will face new challenges. We are confident that the employees of Countrywide, under the direction of our Senior

Managing Director team, will rise to these challenges and take the company to new heights, while creating value for our share-

holders. On behalf of all the people at Countrywide, we thank you for your continued interest and support.

Angelo R. Mozilo

Chairman, CEO & President

Stanford L. Kurland

Executive Managing Director & COO

04 CCI

CONSUMER INSURANCE

Countrywide at a Glance

Consumer Loans

Consumer Markets Division

• Lends directly to consumers. Borrowers who are buying or refinancing a home make

contact through a branch office, over the telephone or through the Internet.

• Funded $19.0 billion in loans in Fiscal 2001.

Wholesale Lending Division

• Lends to consumers through a network of nearly 15,000 mortgage brokers.

• Funded $19.9 billion in loans in Fiscal 2001.

Full Spectrum Lending, Inc.

• Lends directly to sub-prime consumers through a nationwide network of 41 branches.

• Funded $1.6 billion in loans in Fiscal 2001.

Note: e-Commerce, which includes telemarketing and Internet fundings, is a growing

and important component of our consumer lending businesses. Consumer e-commerce

loan fundings represented 44 percent of total consumer loan fundings in Fiscal 2001.

Loan Closing Services

Through LandSafe, Inc., Countrywide offers an array of loan closing services for residen-

tial mortgage loan transactions, including property appraisals, credit reporting services,

flood zone determinations, pre-purchase home inspections, title searches and escrow and

closing documentation.

• Completed more than 2.6 million appraisal, credit reporting, flood zone determination

and title orders in Fiscal 2001.

Countrywide offers retail property and casualty insurance, as well as life and disability

insurance products, directly to consumers through Countrywide Insurance Services, Inc.

• $226.6 million in annualized premiums at February 28, 2001.

• Over 514,000 policies in force at February 28, 2001.

In connection with Countrywide’s mortgage banking activities, the company retains

certain mortgage-related assets, which include capitalized mortgage servicing rights

and residual interests. In addition, the company also manages a servicing hedge

which is designed to protect these investments against prepayment risk.

CONSUMER MORTGAGE ORIGINATIONS

MORTGAGE-RELATED INVESTMENTS

05 CCI

Correspondent Lending

• Countrywide purchases closed loans from mortgage bankers, commercial banks,

and other financial institutions.

• Funded $28.4 billion in Fiscal 2001.

• Countrywide Warehouse Lending provides warehouse lines of credit to mortgage

originators to finance their origination or acquisition of residential mortgage loans.

Countrywide Capital Markets (CCM)

Countrywide Securities Corporation

• Specializes in trading and underwriting of fixed income products, with an emphasis on

mortgages and mortgage-related products, agency and corporate debt, and certificates

of deposit.

• Total trading volume for Fiscal 2001 was $742 billion.

Countrywide Servicing Exchange

• Brokers bulk servicing for third parties and arranges mortgage servicing purchases

for Countrywide Home Loans (

CHL).

Countrywide Asset Management Corporation

• Specializes in the purchase, acquisition, servicing, management and disposition

of residential mortgage assets, including mortgage servicing rights.

Services total domestic loan portfolio of $293.6 billion

• $285 billion portfolio for

CHL at February 28, 2001.

• $8.6 billion portfolio for sub-servicing for other lenders at February 28, 2001.

50 percent ownership of Global Home Loans, Limited (

GHL)

• GHL services over 750,000 loans for our joint venture partner, Woolwich, plc.

• GHL processes over 10,000 loans per month for Woolwich, plc.

Countrywide serves the insurance needs of institutional clients, business partners, and

their customers through Balboa Life and Casualty (“Balboa”), a national property, liability,

and life insurance carrier, and DirectNet Insurance, which offers a wide array of insurance

products through its website, call centers, and direct-mail efforts.

• Balboa’s net written premiums for the twelve month period ending February 28, 2001

were $244 million. Countrywide acquired Balboa on November 30, 1999.

PROCESSING AND TECHNOLOGY

CAPITAL MARKETSB2B INSURANCE

Angelo R. Mozilo

Stanford L. Kurland

Q&A Countrywide’s Transformation and Senior Management Team

In 1969, Angelo Mozilo co-founded Countrywide Credit Industries, Inc. Today, he serves as Chairman,

Chief Executive Officer and President of the company, which has grown from a small lender into a

diversified financial services provider and a member of the S&P 500 and Forbes 500. In 1979, Angelo

hired Stan Kurland to serve as Countrywide’s controller. Stan is now Executive Managing Director and Chief

Operating Officer for Countrywide, and also serves as

CEO and President of Countrywide Home Loans, Inc.

Together, Angelo and Stan provide the leadership and vision for the company.

Since the mid 1990’s, Countrywide’s pace of diversification and growth has accelerated dramatically. In

addition, the company now operates in markets outside the U.S. As a result, the task of running Countrywide’s

operations has become much more challenging. In 2000, Angelo and Stan made a decision to realign the

company’s management infrastructure, handing off portions of the day-to-day operational control to four newly-

promoted Senior Managing Directors. This new structure will provide enhanced operational strength and

flexibility as the company continues to become larger and more complex.

06 CCI

07 CCI

Our company is in the midst of a dramatic and far-reaching transformation. Evidence of

this strategic shift is everywhere. At the corporate level, for example, nearly one half of

our earnings are now derived from business lines which didn’t exist at Countrywide ten

years ago. The change is also illustrated by the company’s decisive entries into the

B2B

insurance and banking markets, as well as our dramatic growth in capital markets (as a

niche investment banker focused on mortgage products) and our globalization initiative

in the European mortgage market. Change is taking place at all levels within the company.

Our aim is not just to withstand change, but to embrace it. Historically, our ability to do

so has been one of our greatest competitive advantages.

To meet the demands of the growing marketplace, not to mention the increasing com-

plexity of our own operations, we realized that we must realign our senior management

structure into four functional areas of expertise. Each one of the newly created senior

managing directors is accountable for different elements of our core businesses, as well

as major parts of our diversification strategies. We feel strongly that this realignment will

enhance our ability to manage complexity and change. However, our transformation is far

from complete. Our objectives are to maintain a dominant position in our core mortgage

banking business, to become a strong player in the insurance, banking and capital markets

industries, and to develop a leadership position in the European mortgage markets. In

support of these goals, we now have a strong, deep team in place, consisting of these four

key individuals who will help keep us focused on our mission and assist Angelo and me

in leading the company forward.

“Our company is in the midst

of a dramatic and far-reaching

transformation. Evidence of this

strategic shift is everywhere.”

ANGELO

STAN

What progress is

being made in the

effort to transform

Countrywide?

Why did the company

promote four new

Senior Managing

Directors last year

?

Countrywide is not a portfolio lender, so all of our loan production must be sold. The

majority of the company’s loan production is securitized and sold in sizes that range from

$1 million to over $1 billion. Our role is to make sure we get the best possible execution,

meaning the highest price while minimizing risk. We develop products that can be sold

into the secondary market, then we provide underwriting guidelines and prices to

Countrywide’s production personnel. Once the loans are in the pipeline, we hedge them

against changes in the interest rate environment until they’re settled with investors.

Since Countrywide is a very large producer of mortgage loans, we run one of the largest

mortgage trading positions in the nation.

Dave Walker, Executive Vice President, Credit Risk Management, is responsible for

developing products and underwriting guidelines, as well as loan quality control. In addi-

tion, he oversees much of the securitization process for products of lesser credit grade.

David Spector, Executive Vice President, Loan Sales, runs our trading desk and related

operations. Nick Krsnich, Executive Vice President, Secondary Marketing Trading,

08 CCI

Kevin Bartlett

Senior Managing Director

and Chief of Secondary Markets

Kevin Bartlett is Senior Managing Director and Chief of Secondary Markets for Countrywide. In this role, he oversees pricing and

administration of all loan products, securitization and sale of loans, hedging, quality control and relationships with government-

sponsored entities including Fannie Mae, Freddie Mac and Ginnie Mae (“the GSEs”). Among his accomplishments, he was

responsible for brokering Countrywide’s unique strategic alliance with Fannie Mae in 1999.

KEVIN

KEVIN

What is the role of

Secondary Markets

operations at

Countrywide?

Who are some of the

key people in your

operations?

09 CCI

handles the financial pricing and execution strategy. Jeff Speakes, Managing Director of

Risk Management, and Mike Smith, Executive Vice President, Portfolio Risk Management,

focus on hedging our servicing asset. Jeff, Mike, David Spector and Nick oversee a diverse

risk management team which is responsible for protecting our pipeline of loans in process,

our inventory of mortgages and mortgage-backed securities, and our portfolio of mortgage

servicing rights. This team performs quantitative analysis of our exposure to interest rate

risk and develops proprietary, cost effective strategies for mitigating this risk.

Fannie Mae, Freddie Mac, Ginnie Mae and, most recently, the Federal Home Loan

Banks (

FHL Banks), are important business partners for us. They offer a method of mort-

gage securitization which usually provides the best execution for the majority of the loans

we originate. We have an especially strong relationship with Fannie Mae, resulting from

the strategic alliance we signed with them in 1999. This historic agreement provided us

with a number of benefits, including new securitization structures to enhance our capital

efficiency; new products and processes to create greater efficiency and lower cost; and

opportunities to accelerate the growth of some of our ancillary businesses. While the

volume we do with each of the GSEs and the

FHL Banks can vary over time, we share

their commitment to and passion for making home financing more affordable and

accessible to all Americans.

“Since Countrywide is a very

large producer of mortgage

loans, we run one of the largest

mortgage trading positions in

the nation.”

KEVIN

Could you tell us

about Countrywide’s

relationships with

the

GSEs?

Countrywide is one of the largest mortgage loan servicers in the U.S., with a portfolio

of $294 billion at the end of Fiscal 2001, which represents nearly 3 million borrowers.

Servicing is one of our core business lines, generating over $1.2 billion in revenues in

Fiscal 2001, but it has strategic importance beyond that. Servicing is the part of our

business which has the most contact with our customers. It also presents opportunities

to realize economies of scale. Furthermore, it performs well in high interest rate environ-

ments, serving as a natural counterbalance to the cycles of loan production, our other

core business line.

We believe we have the most efficient mortgage servicing operation in existence. Richard

DeLeo, Managing Director of Domestic Loan Administration, heads up a management

team which is focused on continuous process improvement in all functions. We have a

heavy focus on automation and technology. For example, we’ve migrated much of our

customer service to the Internet or to automated telephonic prompting.

TOM

TOM

Tom Boone

Senior Managing Director

and Chief of Global Processing

10 CCI

Tom Boone is Senior Managing Director and Chief of Global Processing for Countrywide. He oversees domestic loan servicing

and subservicing, international processing and servicing operations, international consulting, and other transaction processing

businesses. One of Tom’s most notable accomplishments was his integral role in the establishment of Global Home Loans, Ltd.,

the European mortgage banking joint venture Countrywide formed in 1999 with UK-based Woolwich plc.

Can you describe

Countrywide’s

domestic servicing

operations and their

importance?

What’s the secret

to Countrywide’s

success in the

servicing business?

11 CCI

The starting point was Europe. We believe Countrywide has the world’s foremost operating

expertise and technology relative to mortgage processing and servicing, but we were seek-

ing a partner with a strong market presence. We found that partner in Woolwich plc, one

of the largest lenders in the UK, and we established a joint venture called Global Home

Loans (

GHL). We provide GHL with technology and operational expertise, and Woolwich

signed a contract to outsource all their loan processing and servicing to the joint venture.

Recently, Woolwich was acquired by Barclays plc, a large UK-based international bank,

and we view this as an opportunity to increase our share in that market. Meanwhile, we

continue to look for other European opportunities, using

GHL as a platform. We also have

an international consulting operation which provides fee income and helps us identify

opportunities in markets outside of Europe and the U.S. Current or recent consulting

assignments have taken place in Japan, Korea, Singapore, Mexico and Colombia.

Michael Keating, Executive Vice President of Global Markets, manages various aspects

of our European operations, including our technology development efforts and our rela-

tionships with existing and potential European business partners. Kevin Meyers, from

our domestic servicing operations, will soon be joining

GHL as its new Chief Executive

Officer. Michael Lea is President of Countrywide International Consulting Services.

“We believe we have the most

efficient mortgage servicing

operation in existence...

We have a heavy focus on

automation and technology.”

TOM

TOM

How did Countrywide

enter the international

arena?

Who are some of

the key people in

your international

operations?

For many years, our captive insurance agency, Countrywide Insurance Services (CIS), has

marketed property, casualty and life insurance to our mortgage customers. This entity is

now one of the largest of its kind, with over 500,000 customers. Two years ago, we acquired

Balboa Life and Casualty, which is an insurance carrier focusing on meeting the needs

of financial institutions. There’s been a strong synergy between the two companies, with

CIS’s powerful retail sales force and Balboa’s capability to design product and market

coverage to institutional clients. We also have been successful in generating income in

the private mortgage insurance arena, with a captive reinsurance subsidiary called Second

Charter. Marshall Gates, Managing Director, oversees all of our insurance operations.

In April 2001, we cleared two regulatory hurdles, obtaining approval from the

OCC to

acquire a small company called Treasury Bank, and gaining Federal Reserve Board approval

to operate as a bank and financial holding company. The strategic intent is to further

diversify our consumer offerings by marketing traditional bank products to our 3 million

mortgage customers and 500,000 insurance customers. This will enable us to better serve

their needs, and it will enhance our potential to retain these customers. In addition, we

12 CCI

Carlos Garcia is Senior Managing Director of Finance and Chief Financial Officer for Countrywide and Chief Operating Officer of its

principal subsidiary, Countrywide Home Loans, Inc. He oversees all major support and administrative areas of the company, including

finance, human resources, administration and technology. In addition, he oversees our insurance operations, which represent one of

our largest non-core business lines, and our banking subsidiary, which is one of our newest businesses.

CARLOS

CARLOS

Carlos Garcia

Senior Managing Director of Finance

and Chief Financial Officer

Countrywide is

growing rapidly in

the insurance sector.

Can you describe

these operations?

Countrywide recently

made headlines by

moving closer to

obtaining a bank

charter. What are your

plans in this business?

13 CCI

will seek to bring in-house certain functions which historically Countrywide outsourced to

banks. Clay Simmons, President and Chief Operating Officer of Countrywide Financial

Holding Company, Inc., heads up the effort to build our banking operations.

Countrywide is fortunate to have outstanding managers in its support areas. Keith

McLaughlin serves as Managing Director and Chief Financial Officer of

CHL, overseeing

all finance, accounting and treasury functions. Anne McCallion, Managing Director and

Chief Administrative Officer of

CHL, oversees human resources, facilities, procurement

and other administrative areas. Richard Jones, Managing Director and Chief Technology

Officer, leads our central

IT function, and links our divisional development efforts to the

corporate strategy. Rich Lewis, Managing Director of Profitability Enhancement Initiatives,

recently returned after a term in Europe as

Chief Executive Officer of Global Home

Loans. Paul Decoff, Executive Vice President, Corporate Operations Officer, leads a

team that provides consulting services and analytical tools to enhance the productivity

of all areas of the company. Lisa Novacek, Executive Vice President of New Business

Development, supports new initiatives and directs the integration of new acquisitions.

“Two years ago, we acquired

Balboa Life and Casualty,

which is an insurance carrier

focusing on meeting the needs

of financial institutions.”

CARLOS

In addition to

overseeing these

non-core businesses,

you are the Chief

Operating Officer for

Countrywide Home

Loans. How do

you manage these

additional duties?

DAVE

DAVE

Countrywide is one of the largest mortgage lenders in the U.S. In Fiscal 2001, we originated

$69 billion in home loans, the second-highest annual total in company history. We source

these loans through various channels. Our retail arm is the Consumer Markets Division,

which encompasses some 400 local branches, plus state-of-the-art call centers and the

industry’s leading Internet presence. The Wholesale Lending Division serves nearly

15,000 mortgage brokers nationwide. Both of these divisions report to Greg Lumsden,

Managing Director of Originations, and Greg also oversees Full Spectrum Lending, Inc.,

our retail sub-prime subsidiary. On the institutional side, our Correspondent Lending

Division, under the direction of Doug Jones, Executive Vice President, purchases closed

loans from a network of 1,900 financial institutions. Doug also manages Countrywide

Warehouse Lending, which provides inventory financing to several of our mortgage

banking clients.

On the retail side, we have a powerful retail brand, backed by a nationwide branch network

and one of the industry’s best-known websites. In all channels, we provide a compelling

value proposition highlighted by a broad product line, outstanding service and competitive

Dave Sambol

Senior Managing Director

and Chief of Production

14 CCI

Dave Sambol is Senior Managing Director and Chief of Production. In this role, he oversees Countrywide’s consumer and institutional

loan production, which includes retail, mortgage broker and correspondent channels, as well as related loan closing services. In

addition, he leads Countrywide Capital Markets, Inc., one of the company’s most successful non-core businesses, which provides

mortgage-related investment banking services to institutional clients.

Loan origination

is Countrywide’s

highest-profile

business. Could

you describe your

operations in

this area?

What are the keys

to Countrywide’s

success in this arena?

“In Fiscal 2001, we originated

$69 billion in home loans, the

second-highest annual total in

company history.”

15 CCI

What is Countrywide

Capital Markets

(

CCM), and what

is its significance

to the company?

DAVE

pricing, all of which are made possible in part because of our emphasis on automation

and technology. Years ago, for example, Countrywide was the first lender to launch an

artificial intelligence underwriting program

(CLUES). Our comprehensive product line

contains virtually every loan program available in the U.S., including conventional, govern-

ment, conforming, jumbo, fixed, adjustable, sub-prime and home equity loans. We have

also expanded into loan closing services through our subsidiary LandSafe, Inc., under the

direction of Marshall Gates, Managing Director, which provides title, appraisal, credit

reporting, pre-purchase home inspections, escrow and closing documentation, and flood

determination services. This increases the profitability of each loan we originate, and

also allows us to better control the quality of service we provide to our customers.

CCM is a fixed income investment banking firm engaged in sales, trading and under-

writing of mortgage and other debt securities, as well as related research and advisory

activities.

CCM consists of three subsidiaries directed by Ranjit Kripalani, President:

Countrywide Securities Corporation, an

NASD regulated broker-dealer; Countrywide

Servicing Exchange, one of the nation’s largest brokerage firms specializing in mortgage

servicing rights transactions; and Countrywide Asset Management Corporation, a manager

of distressed mortgage related assets. Through its offices in Los Angeles, New York, Fort

Lauderdale, and London,

CCM primarily serves institutional fixed income investors and

other financial institutions. The creation and growth of

CCM has represented one of

Countrywide’s most successful diversification efforts, accounting for 8 percent of

Countrywide’s total income in Fiscal 2001.

STAN

ANGELO

They should understand the quality of our people. We’ve focused on our four newly pro-

moted Senior Managing Directors, who are among the most accomplished and experienced

people in the financial services industry. Kevin Bartlett, Tom Boone, Carlos Garcia and

Dave Sambol collectively have over 60 years of experience with Countrywide, and they’ve

been responsible for building new businesses and forming strategic alliances which set us

apart from our competition. We’ve also described some of the Senior Managing Directors’

key direct reports, including Managing Directors and Executive Vice Presidents who are

recognized experts in their respective disciplines or functions.

There are other senior managers who are important to Countrywide’s success who report

directly to me or Angelo who have not yet been mentioned. These include four Managing

Directors: Andy Bielanski, Managing Director of Marketing, who oversees all branding,

direct marketing and public relations activities; Sandy Samuels, Managing Director and

General Counsel, who manages all legal matters; Sidney Lenz, one of our longest-tenured

employees, with extensive industry experience as Managing Director of Industry Affairs;

and Eric Sieracki, Managing Director of Corporate Finance, who directs our Investor

Relations, Strategic Planning and enterprise corporate finance functions.

As strong as this senior management team is, these individuals represent just the tip of

the iceberg. Working with them are some 12,000 men and women who work hard every day

to make Countrywide one of the top financial services firms in the nation, as well as the

small but growing number of expatriates who are taking our expertise into foreign markets.

Within five years, our strategic objective is to achieve at least 10 percent market share in our

core domestic businesses – mortgage origination and servicing. In our non-core businesses,

which include insurance, capital markets, loan closing services and banking, our goal is to

achieve even more rapid growth than that of our core businesses, which would result in a

shift in the composition of earnings toward a more diverse mix. On the international scene,

we plan to continue expanding our already considerable presence in the UK market, and

to use

GHL as a platform to penetrate the mortgage markets in continental Europe. Five

years from now, we also expect to be capitalizing on opportunities in non-European markets,

including countries in Asia and Latin America.

These are lofty goals. But we believe the company has the best operational team in the

business, across all levels of the organization. It’s the quality of these people that gives us

confidence we can meet the challenging objectives we’ve set for Countrywide.

■

16 CCI

“It’s the quality of these people

that gives us confidence we can

meet the challenging objectives

we’ve set for Countrywide.”

What is the key

message that

readers should take

away from this

Annual Report?

What’s in store for

Countrywide over

the next few years?

Final Thoughts: Angelo Mozilo and Stan Kurland

Financial Table of Contents

54 53 34 33 32 31 30 29 19 18

Selected Consolidated Financial Data

Management’s Discussion and Analysis

Consolidated Balance Sheets

Consolidated Statements of Earnings

Consolidated Statement of

Common Shareholders’ Equity

Consolidated Statements of Cash Flows

Consolidated Statements of

Comprehensive Income

Notes to Consolidated Financial Statements

Report of Independent Certified

Public Accountants

Common Stock and Dividend Information

Year ended February 28 (29),

(Dollar amounts in thousands, except per share data) 2001 2000 1999 1998 1997

Statement of Earnings Data

(1)

:

Revenues:

Loan origination fees $ 398,544 $ 406,458 $ 623,531 $ 301,389 $ 193,079

Gain on sale of loans 611,092 557,743 699,433 417,427 247,450

Loan production revenue 1,009,636 964,201 1,322,964 718,816 440,529

Interest earned 1,341,402 998,646 1,029,066 584,076 457,005

Interest charges (1,348,242) (922,225) (977,326) (564,640) (418,682)

Net interest income (6,840) 76,421 51,740 19,436 38,323

Loan servicing revenues 1,201,177 996,861 842,583 734,982 614,355

Amortization and impairment/recovery of mortgage

servicing rights, net of servicing hedge (617,153) (445,138) (600,766) (328,845) (226,686)

Net loan administration income 584,024 551,723 241,817 406,137 387,669

Net premiums earned 274,039 75,786 12,504 5,643 1,995

Commissions, fees and other income 195,462 198,318 175,363 132,574 89,351

Gain on sale of subsidiary — 4,424 — 57,381 —

Total revenues 2,056,321 1,870,873 1,804,388 1,339,987 957,867

Expenses:

Salaries and related expenses 769,287 689,768 669,686 424,321 286,884

Occupancy and other office expenses 275,074 270,015 264,575 179,308 126,261

Marketing expenses 71,557 72,930 64,510 42,320 34,255

Insurance net losses 106,827 23,420 — — —

Other operating expenses 247,541 183,542 173,812 128,492 88,569

Total expenses 1,470,286 1,239,675 1,172,583 774,441 535,969

Earnings before income taxes 586,035 631,198 631,805 565,546 421,898

Provision for income taxes 211,882 220,955 246,404 220,563 164,540

Net earnings $ 374,153 $ 410,243 $ 385,401 $ 344,983 $ 257,358

Per Share Data

(2)

:

Basic

(3)

$ 3.26 $ 3.63 $ 3.46 $ 3.21 $ 2.50

Diluted

(3)

$ 3.14 $ 3.52 $ 3.29 $ 3.09 $ 2.44

Cash dividends per share $ 0.40 $ 0.40 $ 0.32 $ 0.32 $ 0.32

Weighted average shares outstanding:

Basic 114,932,000 113,083,000 111,414,000 107,491,000 103,112,000

Diluted 119,035,000 116,688,000 117,045,000 111,526,000 105,677,000

Selected Balance Sheet Data at End of Period

(1)

:

Total assets $ 22,955,907 $ 15,822,328 $ 15,648,256 $ 12,183,211 $ 7,689,090

Short-term debt $ 7,300,030 $ 2,529,302 $ 3,982,435 $ 3,279,489 $ 2,345,663

Long-term debt $ 7,643,991 $ 7,253,323 $ 5,953,324 $ 4,195,732 $ 2,367,661

Common shareholders’ equity $ 3,559,264 $ 2,887,879 $ 2,518,885 $ 2,087,943 $ 1,611,531

Operating Data (dollar amounts in millions):

Loan servicing portfolio

(4)

$ 293,600 $ 250,192 $ 215,489 $ 182,889 $ 158,585

Volume of loans originated $ 68,923 $ 66,740 $ 92,881 $ 48,772 $ 37,811

(1)

Certain amounts in the Consolidated Financial Statements have been reclassified to conform to current year presentation.

(2)

Adjusted to reflect subsequent stock dividends and splits.

(3)

Earnings per share for Fiscal 1998 include a $57.4 million gain on sale of subsidiary. Excluding the non-recurring gain on sale of subsidiary, basic and diluted

earnings per share would have been $2.88 and $2.78, respectively.

(4)

Includes warehoused loans and loans under subservicing agreements.

Selected Consolidated Financial Data

18 CCI

General

The Company’s businesses fall into six general categories: consumer mortgage originations, mortgage-related investments, B2C insurance, processing

and technology, capital markets and B2B insurance. See “Business – Mortgage Originations Segment,” “Business – Mortgage-Related Investments

Segment,” “Business – B2C Insurance Segment,” “Business – Processing and Technology Segment,” “Business – Capital Markets Segment”

and “Business – B2B Insurance Segment.” The Company intends to continue its efforts to expand its operations in each of these areas. A strong

production capability and a growing servicing portfolio are the primary means used by the Company to reduce the sensitivity of its earnings to

changes in interest rates because the effect of interest rate changes on loan production income is countercyclical to their effect on servicing income.

The operations of the B2C Insurance Segment includes acting as an agent in the sale of insurance, including homeowners, fire, flood, earthquake,

life and disability and creditor-placed auto and homeowner insurance. The operations of the Capital Markets Segment include trading MBS and

other mortgage-related assets as well as brokering service contracts and bulk purchases and sales of whole loans. In addition, the Capital Markets

Segment also purchases closed loans from mortgage bankers, commercial banks and other financial institutions through the Correspondent

Division. The operations of the B2B Insurance Segment includes underwriting insurance, including homeowners, fire, flood, earthquake, life and

disability and creditor-placed auto and homeowner insurance.

The Company’s results of operations historically have been influenced primarily by the level of demand for mortgage loans, which is affectedby

such external factors as the level and direction of interest rates, and the strength of the overall economy and the economy in each of the Company’s

lending markets.

The fiscal year ended February 28, 1999 (“Fiscal 1999”) was a then record year for the Company in terms of revenues and net earnings. Loan

production increased to $92.9 billion, an all-time Company record, up from $48.8 billion in the prior fiscal year. The Company attributed the increase

in production to: (i) an increase in the overall mortgage market driven largely by refinances; (ii) the generally strong economy and home purchase

market; and (iii) an increase in the Company’s market share, driven largely by the expansion of its Home Finance Network and Consumer Markets

Division and Wholesale branch networks, including new retail sub-prime branches. For calendar 1998, the Company ranked second in the amount

of single-family mortgage originations nationwide. During calendar 1998, the Company’s market share increased to approximately 6.1%, up from

approximately 5.1% in calendar 1997. During Fiscal 1999, the Company’s loan servicing portfolio grew to $215.5 billion, up from $182.9 billion

at the end of Fiscal 1998. This growth resulted from the Company’s loan production during the year and bulk servicing acquisitions amounting

to $4.6 billion. This growth in the loan servicing portfolio was partially offset by prepayments, partial prepayments and scheduled amortization of

$53.2 billion and the transfer out of $6.5 billion of subservicing. The prepayment rate in the servicing portfolio was 28%, up from the prior year

due to increased refinance activity driven by the lower mortgage interest rate environment in Fiscal 1999.

The fiscal year ended February 29, 2000 (“Fiscal 2000”) was again a record year for the Company in terms of revenues and net earnings. Loan

production decreased to $66.7 billion, down from $92.9 billion in the prior fiscal year. The Company attributed the decrease in production primarily

to a decrease in the overall mortgage market driven largely by a decrease in refinance activity, combined with a slight decrease in the Company’s

market share. For calendar 1999 the Company ranked third in the amount of single-family mortgage originations nationwide. During calendar 1999

the Company’s market share decreased to approximately 5.8% down from approximately 6.1% in calendar 1998. During Fiscal 2000, the Company’s

loan servicing portfolio grew to $250.2 billion, up from $215.5 billion at the end of Fiscal 1999. This growth resulted from the Company’s loan pro-

duction during the year and bulk servicing acquisitions amounting to $2 billion. This growth in the loan servicing portfolio was partially offset by

prepayments, partial prepayments and scheduled amortization of $28.5 billion. The prepayment rate in the servicing portfolio was 13%, down from

28% the prior year due to the higher mortgage interest rate environment in Fiscal 2000.

The fiscal year ended February 28, 2001 (“Fiscal 2001”) was another strong year for the Company in terms of revenues and net earnings. Loan

production increased slightly to $68.9 billion, up from $66.7 billion in the prior fiscal year. The Company attributed the increase in production to an

increase in the Company’s market share. For calendar 2000, the Company ranked third in the amount of single-family mortgage originations nation-

wide. During calendar 2000 the Company’s market share increased to approximately 5.9% up from approximately 5.8% in calendar 1999. During

Fiscal 2001, the Company’s loan servicing portfolio grew to $293.6 billion, up from $250.2 billion at the end of Fiscal 2000. This growth resulted

from the Company’s loan production during the year and bulk servicing acquisitions amounting to $8.7 billion. This growth in the loan servicing

portfolio was partially offset by prepayments, partial prepayments and scheduled amortization of $28.7 billion. The prepayment rate in the servicing

portfolio was 11%, down from 13% the prior year.

19 CCI

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

19 CCI 19 CCI

Fiscal 2001 Compared with Fiscal 2000

Operating Segment Results

The Company’s pre-tax earnings by segment is summarized below.

Pre-Tax Earnings

(Dollar amounts in thousands) Fiscal 2001 Fiscal 2000

Consumer Businesses:

Consumer Mortgage Originations $ 190,411 $ 218,121

Mortgage-Related Investments 166,944 250,296

B2C Insurance 4,158 6,041

Total Consumer Businesses 361,513 474,458

Institutional Businesses:

Processing and Technology 62,540 35,924

Capital Markets 94,373 87,028

B2B Insurance 69,874 31,759

Total Institutional Businesses 226,787 154,711

Other (2,265) 2,029

Pre-Tax Earnings $ 586,035 $ 631,198

Consumer Mortgage Originations Segment

The Consumer Mortgage Originations Segment activities include loan origination through the Company’s retail branch network (Consumer Markets

Division and Full Spectrum Lending, Inc.) and the Wholesale Division, the warehousing and sales of such loans and loan closing services.

Total Consumer Mortgage Originations Segment loan production by Division is summarized below.

Loan Production

(Dollar amounts in millions) Fiscal 2001 Fiscal 2000

Consumer Mortgage Originations:

Consumer Markets Division $ 18,976 $ 19,967

Wholesale Division 19,940 19,116

Full Spectrum Lending, Inc. 1,605 1,417

Total $ 40,521 $ 40,500

The decline in pre-tax earnings of $27.7 million in Fiscal 2001 as compared to Fiscal 2000 was primarily attributable to reduced margins and

increased price competition throughout Fiscal 2001. The lower net earnings rate on the inventory was due to an increase in short-term rates during

Fiscal 2001 combined with a decrease in long-term rates. The declines were partially offset by improved margins on home equity and sub-prime

loan production and increased profits from loan closing services.

Mortgage-Related Investments Segment

Mortgage-Related Investment Segment activities include investments in assets retained in the mortgage securitization process, including MSRs,

residual interests in asset-backed securities and other mortgage-related assets.

The decrease in pre-tax earnings of $83.4 million in Fiscal 2001 as compared to Fiscal 2000 was primarily due to increased amortization and

impairment of the MSRs net of servicing hedge expense, increased interest expense related to financing the mortgage-related investments and higher

servicing expenses driven by the growth in the servicing portfolio, including the subservicing fee paid to the Processing and Technology Segment. These

factors offset an increase in revenues generated from a larger servicing portfolio and improved performance of the residual investments. The growth

in the Company’s servicing portfolio since Fiscal 2000 was the result of loan production volume and the acquisition of bulk servicing rights. This

was partially offset by prepayments, partial prepayments and scheduled amortization.

During Fiscal 2001, the Company recorded gains of $208.3 million in accumulated other comprehensive income related to the available-for-sale

securities included in its Servicing Hedge.

During Fiscal 2001, the annual prepayment rate of the Company’s servicing portfolio was 11%, compared to 13% for Fiscal 2000. In general,

the prepayment rate is affected by the level of refinance activity, which in turn is driven primarily by the relative level of mortgage interest rates. The

weighted average interest rate of the mortgage loans in the Company’s servicing portfolio as of February 28, 2001 was 7.8% compared to 7.5% as

of February 29, 2000.

B2C Insurance Segment

B2C Insurance Segment activities include the operations of CIS, an insurance agency that provides homeowners, life, disability and automobile as

well as other forms of insurance, primarily to the Company’s mortgage customers. The decrease in pre-tax earnings of $1.9 million in Fiscal 2001

as compared to Fiscal 2000 was primarily due to a decline in new policies sold.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

20 CCI

Processing and Technology Segment

Processing and Technology Segment activities include internal sub-servicing of the Company’s portfolio, as well as mortgage subservicing and sub-

processing for other domestic and foreign financial institutions. The increase in pre-tax earnings of $26.6 million in Fiscal 2001 as compared to Fiscal

2000 was primarily due to growth in the servicing portfolio and subprocessing for foreign financial institutions. As of February 28, 2001 Global Home

Loans subserviced approximately $40 billion of mortgage loans for the Company’s joint venture partner, Woolwich, plc.

Capital Markets Segment

Capital Markets Segment activities include primarily the operations CSC, a registered broker-dealer specializing in mortgage-related securities, and

the Correspondent Division, through which the Company purchases closed loans from mortgage bankers, commercial banks and other financial

institutions. The increase in pre-tax earnings of $7.3 million in Fiscal 2001 as compared to Fiscal 2000 was primarily due to increased profitability of

CSC driven by higher trading volumes.

B2B Insurance Segment

B2B Insurance Segment includes the activities of Balboa, an insurance carrier that offers property and casualty insurance (specializing in creditor

placed insurance), and life and disability insurance together with the activities of Second Charter Reinsurance Company, a mortgage reinsurance

company. The increase in pre-tax earnings of $38.1 million in Fiscal 2001 as compared to Fiscal 2000 was due to the acquisition of Balboa (on

November 30, 1999) and increased mortgage reinsurance premium volume.

Other

In Fiscal 2000, the Company sold Countrywide Financial Services, Inc. which resulted in a $4.4 million pre-tax gain.

Consolidated Earnings Performance

Revenues for Fiscal 2001 increased to $2.1 billion, up from $1.9 billion for Fiscal 2000. The increase in revenues for Fiscal 2001 compared to

Fiscal 2000 was primarily due to the acquisition of Balboa on November 30, 1999. Revenues for Fiscal 2001, excluding Balboa, decreased 1%

compared to Fiscal 2000. The decline in revenues, excluding Balboa, for Fiscal 2001 compared to Fiscal 2000 was primarily due to a reduction

in production margins, an increase in net servicing hedge expense and increased interest expense related to financing the mortgage-related invest-

ments. The decline was partially offset by increased revenues from the Processing and Technology, Capital Markets and B2B Insurance Segments.

Net earnings decreased 9% to $374.2 million for Fiscal 2001, down from $410.2 million for Fiscal 2000. The decrease in net earnings for Fiscal

2001 was primarily due to a reduction in revenues and a nonrecurring tax benefit of $25 million that related primarily to a corporate reorganization

during Fiscal 2000.

The total volume of loans produced by the Company increased 3% to $68.9 billion for Fiscal 2001, up from $66.7 billion for Fiscal 2000. The

increase in loan production was driven largely by an increase in market share.

Total loan production by purpose and by interest rate type is summarized below.

Loan Production

(Dollar amounts in millions) Fiscal 2001 Fiscal 2000

Purchase $ 49,696 $ 43,594

Refinance 19,227 23,146

Total $ 68,923 $ 66,740

Fixed Rate $ 59,349 $ 57,178

Adjustable Rate 9,574 9,562

Total $ 68,923 $ 66,740

Total loan production by Segment is summarized below.

Loan Production

(Dollar amounts in millions) Fiscal 2001 Fiscal 2000

Consumer Mortgage Originations $ 40,521 $ 40,500

Correspondent Division 28,402 26,240

Total $ 68,923 $ 66,740

The factors which affect the relative volume of production among the Company’s Segments include the price competitiveness of each

Segment’s various product offerings, the level of mortgage lending activity in each Segment’s market and the success of each Segment’s sales

and marketing efforts.

Non-traditional loan production (which is included in the Company’s total volume of loans produced) is summarized below.

Non-Traditional Loan Production

(Dollar amounts in millions) Fiscal 2001 Fiscal 2000

Sub-Prime $ 5,360 $ 4,156

Home Equity 4,659 3,636

Total $ 10,019 $ 7,792

21 CCI

Loan production revenues increased in Fiscal 2001 as compared to Fiscal 2000 due to increased trading activity in the Capital Markets Segment

and improved margins on home equity and sub-prime loan production partially offset by reduced margins on prime credit quality, first lien mort-

gages. Sub-prime loans contributed $256.3 million to the gain on sale of loans in Fiscal 2001 and $185.7 million in Fiscal 2000. The sale of home

equity loans contributed $122.5 million and $86.9 million to gain on sale of loans in Fiscal 2001 and Fiscal 2000, respectively. In general, loan

production revenue is affected by numerous factors including the volume and mix of loans produced and sold, the level of competition in the

market place and changes in interest rates.

Net interest expense (interest earned net of interest charges) of $6.8 million for Fiscal 2001 was down from net interest income of $76.4 million

for Fiscal 2000. Net interest income (expense) is principally a function of: (i) net interest income earned from the Company’s mortgage loan inventory

($92.5 million and $157.5 million for Fiscal 2001 and Fiscal 2000, respectively); (ii) interest expense related to the Company’s mortgage-related

investments ($392.3 million and $280.0 million for Fiscal 2001 and Fiscal 2000, respectively); (iii) interest income earned from the custodial

balances associated with the Company’s servicing portfolio ($232.2 million and $172.2 million for Fiscal 2001 and Fiscal 2000, respectively); and

(iv) interest income earned from investments in the Capital Markets and

B2B Insurance Segments ($55.3 million and $15.8 million for Fiscal 2001

and Fiscal 2000, respectively).

The decrease in net interest income from the Company’s mortgage loan inventory was primarily attributable to lower inventory levels combined

with a lower net earnings rate during Fiscal 2001, which resulted from an increase in short-term rates. The increase in interest expense related to

mortgage-related investments resulted primarily from an increase in amounts financed coupled with an increase in short-term interest rates. The

increase in net interest income earned from the custodial balances was primarily due to an increase in the earnings rate and an increase in the

average custodial balances. The increase in net interest income from the investments in the Capital Markets and

B2B Insurance Segments was

primarily due to the acquisition of Balboa on November 30, 1999.

The Company recorded MSR amortization for Fiscal 2001 totaling $518.2 million compared to $459.3 million for Fiscal 2000. The Company

recorded impairment of $896.1 million Fiscal 2001 compared to recovery of previous impairment of $278.3 million for Fiscal 2000. The primary

factors affecting the amount of amortization and impairment or impairment recovery of MSRs recorded in an accounting period are the level of pre-

payments during the period and the change, if any, in estimated future prepayments. To mitigate the effect on earnings of MSR impairment that

may result from increased current and projected future prepayment activity, the Company acquires financial instruments, including derivative

contracts, that increase in aggregate value when interest rates decline (the “Servicing Hedge”).

In Fiscal 2001, the Company recognized a net benefit of $797.1 million from its Servicing Hedge. The net benefit included unrealized net gains

of $520.9 million and realized net gain of $276.2 million from the sale of various financial instruments that comprise the Servicing Hedge net of

premium amortization. In addition, the Company recorded additional gains of $208.3 million in accumulated other comprehensive income related

to the available-for-sale securities included in its Servicing Hedge. In Fiscal 2000, the Company recognized a net expense of $264.1 million from its

Servicing Hedge. The net expense included unrealized net losses of $230.9 million and realized net loss of $33.2 million from the sale of various

financial instruments that comprise the Servicing Hedge net of premium amortization. In addition, the Company recorded additional losses of $50.0

million in accumulated other comprehensive income related to the available-for-sale securities included in its Servicing Hedge.

The financial instruments that comprised the Servicing Hedge included interest rate floors, principal only securities (“P/O Securities”), options

on interest rate swaps (“Swaptions”), options on MBS, options on interest rate futures, interest rate swaps, interest rate swaps with the Company’s

maximum payment capped (“Capped Swaps”), principal only swaps (“P/O Swaps”) and interest rate caps.

The Servicing Hedge is designed to protect the value of the MSRs from the effects of increased prepayment activity that generally results from

declining interest rates. To the extent that interest rates increase, the value of the MSRs increases while the value of the hedge instruments declines.

With respect to the interest rate floors, options on interest rate futures and MBS, interest rate caps, and Swaptions, the Company is not exposed to

loss beyond its initial outlay to acquire the hedge instruments plus any unrealized gains recognized to date. With respect to the interest rate swaps,

Capped Swaps and P/O Swaps contracts entered into by the Company as of February 28, 2001, the Company estimates that its maximum exposure

to loss over the remaining contractual terms is $1 million.

Salaries and related expenses are summarized below for Fiscal 2001 and Fiscal 2000.

Fiscal 2001

Consumer Institutional Corporate

(Dollar amounts in thousands) Businesses Businesses Administration Total

Base Salaries $ 248,416 $ 150,527 $ 106,691 $ 505,634

Incentive Bonus and Commissions 119,605 42,192 18,682 180,479

Payroll Taxes and Benefits 41,129 23,817 18,228 83,174

Total Salaries and Related Expenses $ 409,150 $ 216,536 $ 143,601 $ 769,287

Average Number of Employees 6,069 3,942 1,693 11,704

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

22 CCI

Fiscal 2000

Consumer Institutional Corporate

(Dollar amounts in thousands) Businesses Businesses Administration Total

Base Salaries $ 266,120 $ 101,402 $ 101,514 $ 469,036

Incentive Bonus 98,759 26,533 20,659 145,951

Payroll Taxes and Benefits 41,231 15,345 18,205 74,781

Total Salaries and Related Expenses $ 406,110 $ 143,280 $ 140,378 $ 689,768

Average Number of Employees 6,321 2,837 1,776 10,934

The amount of salaries increased during Fiscal 2001 as compared to Fiscal 2000 primarily due to an increase in staff in the institutional busi-

nesses due to a larger servicing portfolio and the acquisition of Balboa on November 30, 1999. Incentive bonuses and commissions earned during

the Fiscal 2001 increased primarily due to an increase in production volume, the addition of commissioned sales personnel in the Consumer

Mortgage Originations Segment and increased activity in the Capital Markets Segment.

Occupancy and other office expenses for Fiscal 2001 increased to $275.1 million from $270.0 million for Fiscal 2000. The increase was primarily

due to the acquisition of Balboa and growth in the Processing and Technology Segment.

Marketing expenses for Fiscal 2001 decreased 2% to $71.6 million as compared to $72.9 million for Fiscal 2000.

Insurance net losses are attributable to insurance claims in the B2B Insurance Segment. Insurance losses were $106.8 million for Fiscal 2001.

These losses will increase or decrease during a period depending primarily on the volume of claims caused by natural disasters. The increase in

losses for Fiscal 2001 is due to the acquisition of Balboa on November 30, 1999.

Other operating expenses were $247.5 million for Fiscal 2001 as compared to $183.5 million for Fiscal 2000. The increase was primarily due

to the acquisition of Balboa.

Fiscal 2000 Compared with Fiscal 1999

Operating Segment Results

The Company’s pre-tax earnings by segment is summarized below.

Pre-Tax Earnings

(Dollar amounts in thousands) Fiscal 2000 Fiscal 1999

Consumer Businesses:

Consumer Mortgage Originations $ 218,121 $ 517,827

Mortgage-Related Investments 250,296 (26,319)

B2C Insurance 6,041 3,325

Total Consumer Businesses 474,458 494,833

Institutional Businesses:

Processing and Technology 35,924 33,367

Capital Markets 87,028 90,140

B2B Insurance 31,759 13,084

Total Institutional Businesses 154,711 136,591

Other 2,029 381

Pre-Tax Earnings $ 631,198 $ 631,805

Consumer Mortgage Originations Segment

The Consumer Mortgage Originations Segment activities include loan origination through the Company’s retail branch network (Consumer Markets

Division and Full Spectrum Lending, Inc.) and the Wholesale Division, the warehousing and sales of such loans and loan closing services.

Total consumer mortgage loan production by division is summarized below.

Loan Production

(Dollar amounts in millions) Fiscal 2000 Fiscal 1999

Consumer Mortgages:

Consumer Markets Division $ 19,967 $ 28,508

Wholesale Division 19,116 30,917

Full Spectrum Lending, Inc. 1,417 708

Total $ 40,500 $ 60,133

The decline in pre-tax earnings of $299.7 million in Fiscal 2000 as compared to Fiscal 1999 was primarily attributable to lower prime credit

quality first mortgage loan production and margins driven by a significant reduction in refinances. These declines were partially offset by increased

loan production and increased sales of higher margin home equity and sub-prime loans.

Mortgage-Related Investments Segment

Mortgage-Related Investment Segment activities include investments in assets retained in the mortgage securitization process, including mortgage

servicing rights, residual interests in asset-backed securities and other mortgage-related assets.

23 CCI

The increase in pre-tax earnings of $276.6 million in Fiscal 2000 as compared to Fiscal 1999 was primarily due to an increase in servicing

revenues resulting from servicing portfolio growth combined with a reduction in amortization and a recovery of previous impairment of the MSRs,

and improved performance of the residual investments. These factors were partially offset by higher servicing expenses driven by growth in the

servicing portfolio, including the subservicing fee paid to the Processing and Technology Segment. The growth in the Company’s servicing portfolio

since Fiscal 1999 was the result of loan production volume and the acquisition of bulk servicing rights. This growth was partially offset by prepay-

ments, partial prepayments and scheduled amortization.

During Fiscal 2000, the annual prepayment rate of the Company’s servicing portfolio was 13%, compared to 28% for Fiscal 1999. In general,

the prepayment rate is affected by the level of refinance activity, which in turn is driven primarily by the relative level of mortgage interest rates.

B2C Insurance Segment

B2C Insurance Segment activities include the operations of CIS, an insurance agency that provides homeowners, life, disability and automobile as

well as other forms of insurance, primarily to the Company’s mortgage customers. The increase in pre-tax earnings of $2.7 million in Fiscal 2000

as compared to Fiscal 1999 was primarily due to an increase in renewal policies.

Processing and Technology Segment

Processing and Technology Segment activities include internal sub-servicing of the Company’s portfolio, as well as mortgage subservicing and sub-

processing for other domestic and foreign financial institutions. The increase in pre-tax earnings of $2.6 million in Fiscal 2000 as compared to Fiscal

1999 was primarily due to growth in the sub-servicing portfolio and in sub-processing activities.

Capital Markets Segment

Capital Markets Segment activities include primarily the operations of CSC, a registered broker-dealer specializing in mortgage-related securities, and

the Correspondent Division, through which the Company purchases closed loans from mortgage bankers, commercial banks and other financial

institutions. The decrease in pre-tax earnings of $3.1 million in Fiscal 2000 as compared to Fiscal 1999 was primarily due to CLD’s decreased pro-

duction volume and reduced margins on prime credit quality first mortgages driven primarily by the decline in refinance activity. This decline was

partially offset by increased profitability of CSC due to higher trading volumes.

B2B Insurance Segment

B2B Insurance Segment includes the activities of Balboa, an insurance carrier that offers property and casualty insurance (specializing in creditor

placed insurance) and life and disability insurance, together with the activities of Second Charter Reinsurance Company, a mortgage reinsurance

company. The increase in pre-tax earnings of $18.7 million in Fiscal 2000 as compared to Fiscal 1999 was due to the acquisition of Balboa (on

November 30, 1999) and increased mortgage reinsurance premium volume.

Consolidated Earnings Performance

Revenues for Fiscal 2000 increased 4% to $1.9 billion, up from $1.8 billion for Fiscal 1999. Net earnings increased 6% to $410.2 million for Fiscal

2000, up from $385.4 million for Fiscal 1999. The slight increase in revenues for Fiscal 2000 compared to Fiscal 1999 was primarily attributed to

the Mortgage-Related Investments and

B2B Insurance Segments, together with increased production of non traditional loan products (i.e., home

equity and sub-prime loans). This increase was largely offset by a decline in traditional prime loan originations, which was attributable to a market-

wide decline in refinance activity. Included in net earnings in Fiscal 2000 was a nonrecurring tax benefit of $25 million that related primarily to a

corporate reorganization.

The total volume of loans produced by the Company decreased 28% to $66.7 billion for Fiscal 2000, down from $92.9 billion for Fiscal 1999.

The decrease in loan production was primarily due to a decrease in the mortgage market, driven largely by a reduction in refinances.

Total loan production by purpose and by interest rate type is summarized below.

Loan Production

(Dollar amounts in millions) Fiscal 2000 Fiscal 1999

Purchase $ 43,594 $ 39,681

Refinance 23,146 53,200

Total $ 66,740 $ 92,881

Fixed Rate $ 57,178 $ 88,334

Adjustable Rate 9,562 4,547

Total $ 66,740 $ 92,881

Total loan production by Segment is summarized below.

Loan Production

(Dollar amounts in millions) Fiscal 2000 Fiscal 1999

Consumer Mortgages $ 40,500 $ 60,133

Correspondent Division 26,240 32,748

Total $ 66,740 $ 92,881

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

24 CCI

The factors that affect the relative volume of production among the Company’s Segments include the price competitiveness of each Segment’s

product offerings, the level of mortgage lending activity in each Segment’s market and the success of each Segment’s sales and marketing efforts.