1

Insights@Katie

The Economic Impact of the Insurance Industry

in Illinois: 2016 Study

By Katie School of Insurance and Financial Services at Illinois State University

Table of Contents

Key Findings of the Study .............................................................................................................. 2

Introduction to Study ...................................................................................................................... 4

The Insurance Industry as Contributor to the Economy of Illinois ................................................ 5

The Insurance Industry as Investor in Government and Businesses ............................................... 8

The Insurance Industry as Protector from Financial Loss .............................................................. 8

Illinois Insurer Strength and Trust ............................................................................................ 10

Insurance Industry as Employer .................................................................................................... 10

Demographic Changes Requiring New Hires ........................................................................... 11

The Sales Force in Illinois Insurance Industry ......................................................................... 11

Wages and Salaries of Insurance Workers................................................................................ 12

The Insurance Industry as Contributor to State Tax Revenue ...................................................... 12

Insurance Industry as Citizen of the State..................................................................................... 14

Summary ....................................................................................................................................... 15

Appendix ....................................................................................................................................... 16

Appendix A State, District, Territory Ranking By Sector ....................................................... 16

Appendix B- Gross Domestic Product by State (millions of current dollars) .......................... 17

Appendix C- Gross domestic product (GDP) by industry in Illinois........................................ 19

Appendix D- Illinois Insurers Key Financials Compared to Surrounding States ..................... 23

Appendix E Insurance Industry Occupations in Illinois 2008-2018 ......................................... 24

Appendix F- Life and Health Insurers ...................................................................................... 25

Appendix G- Illinois Property Casualty Insurers (192) ............................................................ 27

2

The Economic Impact of the Insurance Industry in Illinois

This Study was conducted in 2016 by the Katie School of Insurance at Illinois State University

under the direction of Katie School Executive Director, James R. Jones. Questions regarding the

content of this study should be directed to [email protected]

Key Findings of the Study

The Illinois insurance industry is exceptionally robust and competitive. As of 2015, there

were 192 property and casualty insurers, 39 life insurers, and 41 health insurers

domiciled in Illinois.

1 out of every 5 dollars of property and casualty insurance premium in the U.S. is

underwritten by Illinois insurance companies.

The Illinois insurance industry GDP in 2014 was fourth in the entire nation with respect

to the national insurance industry. .

The insurance industry in Illinois contributes 3.67 percent of the GDP to the state of

Illinois. This is higher than construction, transportation, information, and accommodation

and food services industries, and many times more than industries such as agriculture or

mining.

According to SNL Financial, Illinois insurance companies wrote nearly $190 billion in

insurance premiums for property-casualty, life, and health insurance combined in 2015.

This placed Illinois second overall in the country and ranks higher than in every sector

compared to other “insurance industry rich” states like Wisconsin, California, and Ohio,

and much higher than the surrounding states of Indiana, Iowa, and Missouri.

$126 billion comes from the Property & Casualty sector. This represents a remarkable

21.64 percent of the entire P&C insurance sector in the United States.

144, 723 people are employed directly by the insurance industry in Illinois. This is more

than any of the surrounding states and in fact is more than twice the insurance industry

employment of Indiana or Iowa.

The median wage for insurance workers was nearly 50 percent higher than median for all

workers in Illinois.

The median wage for insurance workers in Illinois was 15 percent higher than the median

wage for workers in insurance nationally.

Over 300,000 people are employed either directly or indirectly related to insurance

industry for Illinois.

3

Illinois insurer’s investments totaled over $412 billion; with nearly $306 billion in bonds

of which nearly $29 billion were in the government bonds. This means the insurance

industry serves to finance a wide array of projects such as schools, roads, bridges, mass

transit initiatives and health care facilities

In 2015, Illinois insurers paid out $122 billion for P&C, life, and health losses and over

$61 billion to policyholders in the U.S for losses to homes, autos, and businesses. That

represents 21.27 percent of all property and casualty claims made in the entire country!

$186 billion in policyholder surplus was held on Illinois insurer balance sheets in 2015.

Illinois has just under 5 percent of the workforce in the insurance industry. However,

some occupations are particularly present in Illinois, such as insurance underwriters with

more than 10 percent of those in the country working in Illinois.

Workers in the insurance industry in Illinois earned just over $12 billion or nearly 3

percent of the total earnings for workers in the state.

Illinois revenue from insurers through taxes, licenses, fees, and fines totaled

$411,371,823 in 2015.

Insurance workers were estimated to have paid over $1.5 billion in taxes to the state of

Illinois in 2014.

4

Introduction to Study

This study conducted in 2016 by the Katie School of Insurance at Illinois State University

examined the role of the insurance industry in Illinois with respect to its impact on the economy,

including its role in state employment, loss indemnification, and institutional investment in

government and corporate bonds, and its role as a contributor to state tax revenues.

Data was sourced from SNL Financial database, the Bureau of Economic Analysis (BEA), the

Bureau of Labor Statistics (BLS), U.S. Census Bureau, Illinois Comptrollers Website, Illinois

Insurance Department website, Illinois Information Workforce Center, Illinois Department of

Employment Security (IDES), and then with the Insurance Information Institute, and other

sources to confirm data. The most recent available information was included in this study. For

insurance company financial data the last available year is the 2015 results. The most recent

available economic and employment data was 2014.

Thanks to Illinois State University Economics graduate assistant, S. Azfar Hussain for his hard

work on this project. A special thanks to the Independent Insurance Agents of Illinois, the

Illinois Insurance Association, and NAIFA for sponsoring this study.

About the Katie School at Illinois State University

The Katie School at Illinois State University has a mission to support students interested in

pursuing careers in the insurance industry. The Katie School provides scholarships, internships,

education, extracurricular programs, and cutting-edge research win which students can

participate. The Katie School supports high school students by hosting summer risk management

and insurance camps. The Katie School supports applied, relevant research focused on providing

insights on real industry issues, and supports continuous learning and professional development

for industry practitioners, through seminars and workshops.

5

The Insurance Industry as Contributor to the Economy of Illinois

The insurance industry favorably affects the state economy through both direct and indirect

economic activity. Typical direct contributions expected by any business, include contribution to

the local economy’s GDP, employment of workers, and payment of corporate taxes. Insurance

also has some unique direct economic impacts both through its role as protector of economic

loss, and through its role as institutional investor in government and business.

A less recognized, but arguably equally significant indirect contribution is its ability to promote

economic development via a better understanding of the risks, encouragement of loss mitigation,

and enabling individuals and businesses to engage in productive activities that involve risk.

Insurance is a financial risk management tool that allows individuals and businesses to reduce or

avoid risk through the transfer, pooling or sharing of risk with a third party, usually an insurer.

While various risk-sharing arrangements have been in existence for centuries, risk today is

usually contractually transferred (via an insurance policy) to and absorbed by an insurance

company in exchange for a payment (i.e., the premium). The insurer contractually obligates itself

to pay the losses of policyholders.

Individuals and businesses who are insured against a variety of potentially catastrophic losses,

are then enabled to engage in activities that produce or preserve wealth, create jobs, and foster

investment, innovation and entrepreneurship. As individuals and businesses have greater

security to protect themselves from loss they need to hold less capital which means people and

business have more to consume and invest in things like human capital and technology, making

state economies more competitive and robust.

Having adequate insurance protection for homes and businesses in times of increasing

catastrophic losses is important for governments as the need for state government disaster relief

is mitigated. This is especially important in the current climate where federal disaster relief is

highly politicized, and state funding is uncertain. Regardless of the political party in control of

Congress, funding for disaster relief and FEMA will continue to be uncertain. This uncertainty

affects state budgets to the extent that they may have to contribute for more of their own local

disaster relief. Private market solutions will continue to be sought, and a competitive and robust

insurance industry in a state can reduce uninsured rates, and the need for public disaster

assistance, and may in some cases, obviate the need for state subsidized insurance.

The Illinois insurance industry is exceptionally robust and competitive. As of 2015, there were

192 property and casualty insurers, 39 life insurers, and 41 health insurers domiciled in Illinois.

In fact 1 out of every 5 dollars of property and casualty insurance premium in the U.S. is

underwritten by Illinois insurance companies!

This has a tremendous positive impact on the economy of Illinois. We can look at the

contribution of Illinois insurers in several ways. The percentage to the overall insurance

industry’s contribution to our national GDP, and as a percentage of the state of Illinois GDP for

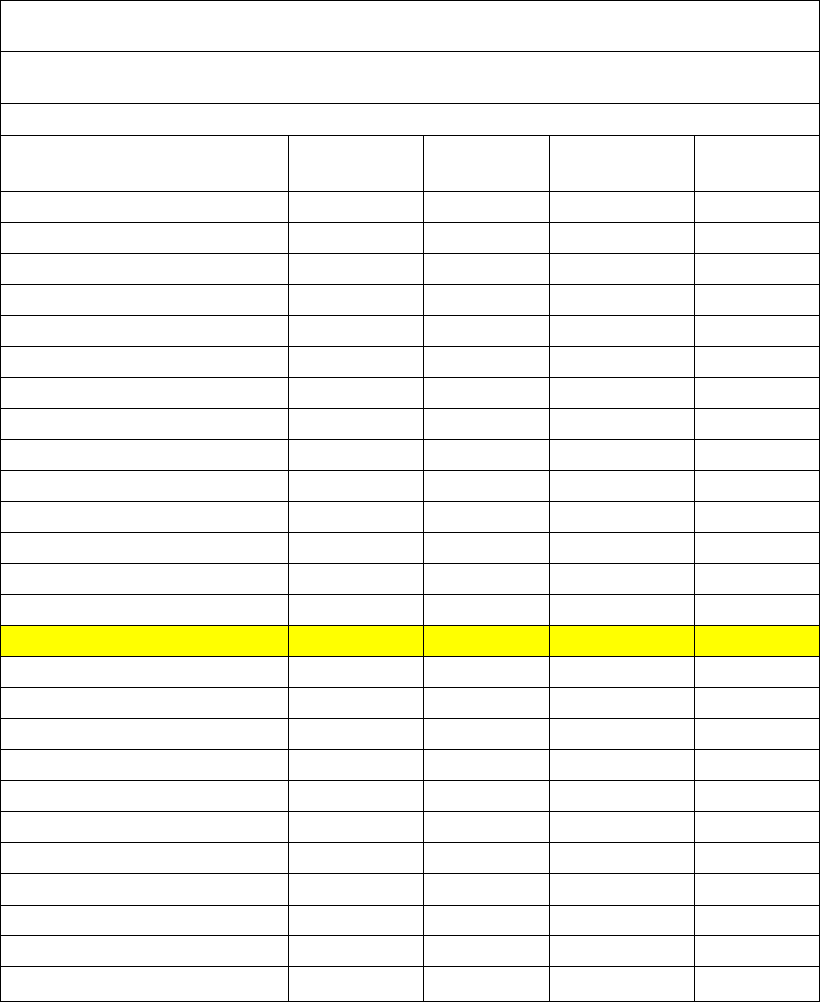

all industries. Exhibit 1 shows the contribution to the insurance industry’s national GDP.

Exhibit 1- Percentage of U.S. Insurance Industry Contribution to National GDP

6

Millions of Dollars

% of National INS

IND

New York

39,978

9.74%

California

31,352

7.64%

Texas

26,495

6.46%

Illinois

26,283

6.41%

Pennsylvania

20,882

5.09%

Source: Bureau of Economic Analysis,

Exhibit 2 shows the insurance industry’s contribution to Illinois GDP in comparison to other

industries in Illinois. As detailed in Exhibit 2, the insurance industry in Illinois contributes

3.67% percent of the GDP to the state of Illinois. This is higher than construction, transportation,

information, and accommodation and food services industries, and many times more industries

such as agriculture or mining. Although insurance is not the top contributing industry to the state

GDP, it is one of the more significant industries. Appendix C lists all industries and their

contribution to the state GDP.

Exhibit 2- Illinois Gross Domestic Product by Industry

Gross Domestic Product by State (millions of current dollars)

Illinois 2013

Millions of

Dollars

% of State GDP

Insurance carriers and related activities

26,283

3.67%

Transportation and warehousing

25,897

3.62%

Information

24,702

3.45%

Construction

24,441

3.42%

Accommodation and food services

18,181

2.54%

Agriculture, forestry, fishing, and hunting

11480

1.61%

Mining

3797

0.53%

Source: 2013 Bureau of Economic Analysis, State GDP

Another way to consider the economic impact is to consider the premiums written (revenue

generated) by Illinois insurers compared to other states. According to SNL Financial, Illinois

insurance companies wrote $189.61 billion in insurance premiums for property-casualty, life,

and health insurance combined. This placed Illinois second overall in the country.

Exhibit 3 depicts where Illinois placed in each of the three insurance sectors, P&C, Life, and

Health. Illinois ranks higher in every sector compared to Wisconsin, California, and Ohio, and

ranks much higher than the surrounding states of Indiana, Iowa, and Missouri.

Exhibit 3 - Ranking of Illinois Insurance Premiums Written to Other States

State, District, Territory Ranking By Sector

Direct Premiums 2015

States, District, Territory

Rank-Overall

Rank P&C

Rank Health

Rank Life

7

CT

10

8

29

2

IL

2

1

1

14

NY

1

3

4

1

WI

7

10

3

12

PA

8

11

2

17

OH

3

2

6

10

NE

11

5

35

5

CA

17

9

27

22

TX

4

7

5

7

FL

15

14

8

30

IN

16

26

21

6

IA

14

15

33

3

MO

18

18

15

27

Source: SNL Database 2015

Exhibit 4 illustrates the extent to which the Illinois insurance industry dominates the property

and casualty industry (often referred to as P&C, which covers items such as personal and

commercial autos, homes, buildings, and professional legal liability). $125.947 billion of the

total $582 billion comes from the P&C sector represents a 21.64 percent of the entire P&C

insurance sector! That is extraordinary for any product for one state to be so dominate. This is

more than the percentage of autos manufactured in Michigan.

1

Exhibit 4 – Premiums Written by Insurance Sector Compared to U.S. Total Premiums

Written

Area

P&C Ins

Life Ins

Health Ins

Direct Premiums

Written 2015 Total All

Lines ($000)

Direct Premiums &

Annuity Consid: Life,

A&H 2015 Y Total All

Lines ($000)

Direct Premiums

Written 2015 Y AR:

Total All Lines

($000)

ILLINOIS

125,946,981.658

18,313,896.374

45,355,965.657

U.S. Total

582,041,689.038

680,150,362.327

516,867,636.692

Percentage of U.S. Total

21.64%

2.69%

8.78%

SNL Database – 2015

The size alone conveys only one dimension of the industry’s importance. The benefits that

accrue to individuals, businesses, the economy and society as a whole are many and varied in

nature.

Although specific sections of this study cover the topics of the role of the insurance industry as

investor, employer, and contributor to Illinois tax revenues, it is worthwhile mentioning in this

section that the economic impact to Illinois goes beyond the direct employment and

compensation paid to workers in the insurance industry. Indirect effects of their employment and

1

http://www.detroitchamber.com/econdev/chamber-initiatives/michauto-universal-name/the-auto-industry-in-

michigan/

8

compensation include transactions increasing the demand for goods and services in other directly

affected industries. This is known as the multiplier effect and is well-recognized in econometric

modeling systems. It can be estimated that the insurance industry supports over 300,000 jobs in

Illinois using econometric modeling systems such as REMI, RIMS II, and IMPLAN

Direct employment and compensation to insurance industry workers will be discussed later in

detail in the section dedicated to that topic.

The Insurance Industry as Investor in Government and Businesses

As policyholders take out insurance, insurers invest the premiums until claims are paid. Insurers

boost the economy by increasing investments heavily in both government and corporate bonds.

The insurance industry’s need to maintain large holdings of assets to back claims and satisfy

regulator and ratings agency requirements means that the industry is one of the largest

institutional investors in world. Indeed, the industry is usually ranked among the top three

institutional investors across a broad range of asset categories. Insurers are necessarily

conservative investors and as such concentrate their investments in relatively low risk, highly

liquid securities, especially bonds. This conservative portfolio allocation is illustrated by an

Insurance Information Institute study showing on average two-thirds of invested assets for

property-casualty insurers are in the form of bonds, and three-quarters of life insurers’ portfolio

is in fixed income securities.

2

Exhibit 5 shows that Illinois insurers’ investments totaled over $412.4 billion, of these

investments nearly $305.3 billion were in bonds.

Exhibit 5 - Investments of Illinois Insurers 2015 ($000)

Insurance Sector

Total Cash &

Investments

Investment in Govt.

Bonds:

NET ADM Bonds 2015

Health Insurers

11,401,188.97

2,245,757.65

8,304,415.97

Life Insurers

164,207,148.90

8,471,864.61

128,896,047.71

P&C Insurers

236,839,740.64

17,934,849.52

168,095,934.55

Total

412,448,078.50

28,652,471.78

305,296,398.23

SNL Database - 2015

On average, about 10 percent of the insurance industry’s bond portfolio is invested in

government securities issued by states and counties, and cities. What this means for state and

local economies is that the insurance industry serves to finance a wide array of projects such as

schools, roads, bridges, mass transit initiatives and health care facilities.

The Insurance Industry as Protector from Financial Loss

The main role of the insurance industry is to protect policyholders from financial loss covered

under insurance policies. The three major sectors of insurance industry are property-casualty,

life, and health. Although there are a few insurers who participate in all three sectors, in general

2

http://financialservices.house.gov/uploadedfiles/hhrg-112-ba04-wstate-rhartwig-20120724.pdf

9

the insurers in each sector are different for each sector. A complete list of Illinois insurers, as of

2015, by insurance sector can be found in the appendix of this study.

In the P&C industry each year auto and home insurers pay billions to hundreds of thousands of

policyholders whose vehicles or homes were damaged or destroyed in accidents or by natural

disasters as well as to individuals who suffered bodily injuries as the result of liability losses

covered by these policies. A similar sum is paid each year to business owners for claims arising

from a wide spectrum of property and liability claims, including injuries suffered by workers in

occupational settings (via worker compensation insurance policies).

The life insurance industry provides individuals and families (beneficiaries) with financial

protection against the possibility of loss of income due to death of an insured individual. They

also provide payments for annuities. An annuity, in its simplest form, is a contract between an

individual and a life insurance company specifying a future stream or series of payments that

will be made in exchange for a payment made to that insurance company today. The annuity

arrangement allows the purchaser of the annuity to transfer to the insurer the risk associated with

outliving one’s assets.

Health insurers pay for medical expenses including routine health care and prescriptions, as well

as acute care requiring hospitalization, surgeries, and treatments for chronic and terminal

illnesses. Health insurance also included disability coverages and long term care and nursing

care.

In 2015, Illinois insurers paid out $122.129 billion for P&C, life, and health losses. Exhibit 6

highlights the losses paid out in 2015 by insurance sector, and the percentage of losses paid out

by Illinois insurers compared to the U.S. as a whole.

What is perhaps most striking from this exhibit is that the U.S. economy as a whole is a

beneficiary of insurers in Illinois, which are significantly non-life property and casualty losses.

In 2015, Illinois property and casualty insurance paid out over $61 billion to policyholders in the

U.S for losses to homes, autos, and businesses. That represents 21.27 percent of all property and

casualty claims made in the entire country, helping individuals and communities recover from

disasters.

Exhibit 6 - Losses Paid By Illinois Insurers as Percentage of U.S. Payments By Insurance Sector

Area

P&C Ins

Life Ins

Health Ins

Losses Paid Less Salvage

2015 Y AR: Total All

Lines ($000)

Benefits & Losses 2015

Y AR: Total All Lines

($000)

Medical Losses Incurred

2015 Y AR: Total All

Lines ($000)

ILLINOIS

61,108,034.86

19,888,312.96

41,133,438.52

U.S. Total

287,316,065.75

616,779,676.13

470,675,350.68

Percentage of U.S. Total

21.27%

3.22%

8.74%

Source: SNL Database – 2015

10

Insurers also play a role in preventing losses and encouraging loss prevention and mitigation by

offering discounts for not smoking, taking driver’s education classes, installing sprinklers and

alarms, participating in worker safety programs, buying cars with higher safety ratings, and many

other discounts to encourage policyholders to prevent and reduce losses. Insurers also sponsor

organizations such as the Insurance Institute for Highway Safety which performs tests on

automobile crashworthiness. Over the years insurance industry funded studies have contributed

to automobile safety via, seat belts, head rests, airbags, reducing teen related highway deaths,

reduced alcohol fatalities, auto crash tests, breakaway light poles, guard rails, compression zones

on highway barriers, and other initiatives. The industry funds the Institute for Business & Home

Safety which studies how to make buildings safer from disasters. Illinois insurers play a

significant role in funding these organizations and others related organizations.

Illinois Insurer Strength and Trust

Because insurers assume trillions of dollars of exposure in exchange for premiums received from

millions of policyholders each year, insurers necessarily hold assets large enough to pay any

reasonable—and even highly improbable—levels of claim activity.

Insurers maintain surpluses according to regulatory and rating agency requirements in order to be

able to meet their financial obligations in times of catastrophes.

Exhibit 7 details the $186.2 billion in policyholder surplus held on Illinois insurer balance sheets

in 2015.

Exhibit 7 - Illinois Insurers Policyholder Surplus

Insurer Type

Surplus as Regards Policyholders 2015 Y ($000)

Health Insurers

11,456,889

Life Insurers

20,957,660

P&C Insurers

153,777,254

Source: SNL Database - 2015

Consumers also benefit from Illinois insurers. Several Illinois insurers have consistently been

rated highly for customer satisfaction. For example, in 2015, two out of the top three auto

insurers (as rated by J.D. Powers for customer satisfaction) were insurers domiciled in Illinois.

3

Insurance Industry as Employer

The insurance industry in the U.S. employs nearly 3 million people. In 2014, 144,723 people

were employed directly by the insurance industry in Illinois. This is more than any of the

surrounding states and in fact is more than twice the employment of Missouri, Indiana, or Iowa.

These people work in various occupations in insurance industry, in organizations ranging in size

from large insurance companies to single person insurance agencies. Exhibit 8 provides detailed

employment numbers from 2007 to 2014, for the U.S., Illinois, and surrounding states.

3

http://www.jdpower.com/press-releases/2015-us-auto-insurance-study

11

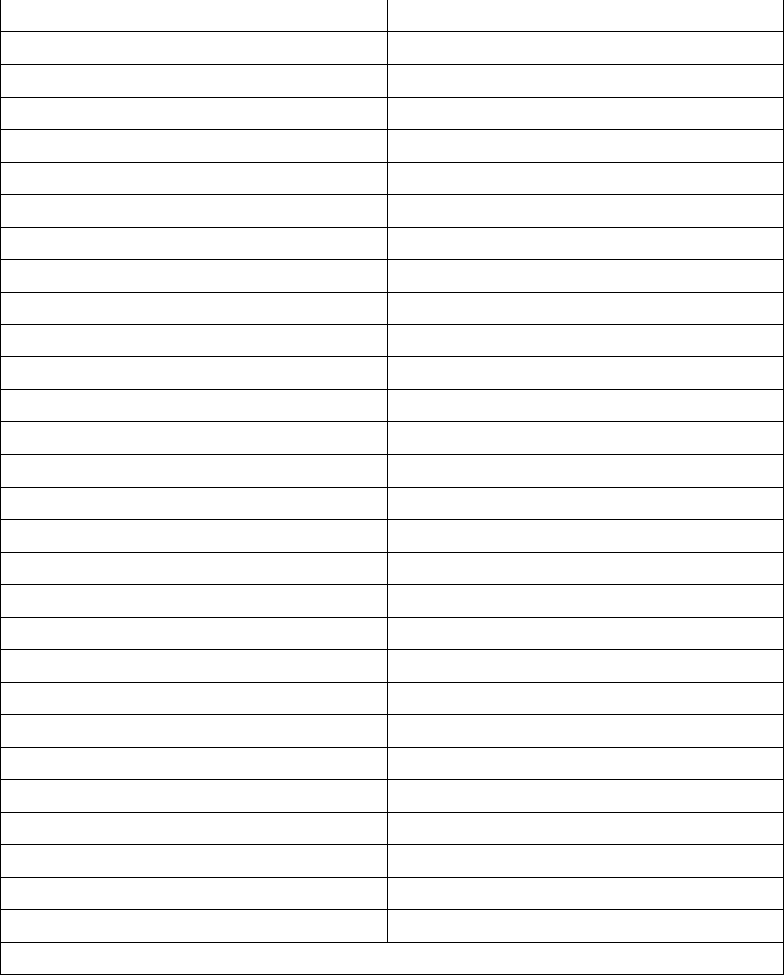

Exhibit 8 - Total full and part-time employment in Insurance Industry

SA25N Insurance carriers and related activities (number of jobs)

State or Area

2007

2008

2009

2010

2011

2012

2013

2014

United States

2919200

2931300

2922200

2900000

3024700

3013000

3022800

3109200

Illinois

145519

144670

143198

143034

145741

144807

142500

144723

Surrounding States

Wisconsin

80793

81247

81619

80273

82453

82411

80748

79188

Missouri

61752

61695

61579

62518

65324

65590

64878

66641

Indiana

57766

58988

58502

58152

60329

59495

59016

61502

Iowa

54267

55681

53938

53605

55174

54248

54341

55423

Source: Bureau of Economic Analysis : http://www.bea.gov/regional/index.htm

Although the state of Illinois has just under 5 percent of the workforce in the insurance industry,

some occupations are more present in Illinois. For example, Illinois is home to almost 10 percent

of insurance underwriters in the country. What may be interesting for some is to see that while

four of the top five occupations are somewhat industry specific, most of the occupations are not.

For example, Illinois has over 13 percent of all the business operation specialists and all the

commodities and securities sales force in the industry. Illinois is home to more than its share of

several other well-paying occupations such as accountants, financial analysts, management

analysts, computer systems analysts, and computer software engineers.

Demographic Changes Requiring New Hires

What is not reflected in the percentage growth is the change in the demographics of the

workforce of the insurance industry. Insurers also have greater exposure to the aging workforce

than most industries due to its long time focus on experienced workers. For this reason, even the

underwriting occupation, where the absolute number is declining, new hiring opportunities exist

as younger workers replace retiring workers. The number of insurance workers 55 or older has

increased by 74 percent in the last 10 years, compared to a 45 percent increase for the overall

workforce. This means that 20 percent of the insurance workforce is near retirement age

(compared to 15 percent of the broader financial services workforce). By 2018, this number is

projected to rise to 25 percent.

4

High growth insurance occupations through 2020 in Illinois are expected to be computer systems

analysts, insurance agents, customer service representatives, and claims adjusters, and marketing.

The Sales Force in Illinois Insurance Industry

One unique and important part of the industry relates to insurance agents and brokers. Contrary

to popular belief, insurance agents and brokers are not becoming obsolete in a digital

environment. Insurance is a relationship business built on trust, and technology may enhance that

4

http://www.griffithfoundation.org/uploads/McKinsey-Talent-white-paper-FINAL.pdf

12

relationship customers, but for many products and services an agent or broker is still preferred.

Illinois is home to some of the largest insurance brokerage firms in the world.

Exhibit 9 shows the breakdown of the insurance agents and brokers’ workforce in 2014,

including self-employed agents, principals, managers and customer service representatives

working for insurance agents and brokers.

Exhibit 9 Insurance Agents and Brokers Workforce in Illinois, May 2014

NAICS 524210 - Insurance Agencies and Brokerages, Illinois, May 2014

Occupation Code

Occupational Title

Employment

Percentage of

Total Emp.

(Estimated)

All Occupations*

5,765,880

100%

41-3021

Insurance Sales Agents

18,200

0.32%

43-4051

Customer Service Representatives*

117,520

2.04%

43-9041

Insurance Claims and Policy Processing Clerks*

11,420

0.20%

13-0000

Business and Financial Operations Occupations*

299,620

5.20%

11-0000

Management Occupations*

368,230

6.39%

Self Employed

Insurance Sales**

16802

Total Agent and Brokers Workforce including Self-

employed

74,242

*NOTE- The Insurance Sales Agent figure is reported specifically in the IDES. The other occupations numbers are based on the national average

of percentage of these occupations within the Insurance Agents and Brokers industry sub-category. ** This is based on Census Data for 2010 for

“non-employer” status working as agent or broker in Illinois. “Non-employers” are self-employed individuals operating unincorporated businesses

(known as sole proprietorships), which may or may not be the owner's principal source of income.

Wages and Salaries of Insurance Workers

According to the Bureau of Economic Analysis, workers in the insurance industry in Illinois

earned just over $12 billion in 2014. The jobs in the insurance industry jobs compare favorably

to the average employment in Illinois. According to the BLS workers in the insurance industry

earn nearly 50 more than the median for all workers in Illinois.

5

In addition wages for Illinois

workers in the insurance industry compare favorable to national averages for the same

occupations

6

.

As mentioned in the section on economic impact, the employment and income in the insurance

industry has significant impact on employment and income in other industries, this is especially

true for Illinois which hosts an industry with such high-paying occupations.

The Insurance Industry as Contributor to State Tax Revenue

5

Median for all workers was $48,780 for 2014 compared to the median wage of workers employed in the insurance

industry in Illinois which was $72,370.

6

Source: SOC code: Standard Occupational Classification code -- see

http://www.bls.gov/oes/current/oes_il.htm#13-0000; http://www.bls.gov/oes/current/naics3_524000.htm

13

Illinois’s tax policy with respect to the insurance industry is different from other industries and

has some unique taxes. Exhibit 10 illustrates some of the various sources of revenue the state of

Illinois gets from the insurance industry. The state of Illinois collected $411,371,823 from the

insurance industry as of December 2015 and $396,537,356 in 2014.

Exhibit 10- Illinois Revenue from Insurers 2014 and 2015 Taxes, Licenses, Fees, and Fines

Code

Revenue Source

Year 2015

Year 2014

Total

$411,371,823

$396,537,356

394

PRIVILEGE TAX-INSURANCE

$182,795,367

$171,284,230

468

RETALIATORY TAX

$127,743,620

$122,390,880

915

LICENSES FEES OR REGISTRATION

$9,137,017

$6,746,775

1846

SURPLUS LINE TAX - INSURANCE

$43,389,062

$40,123,259

111

FIRE MARSHALL TAX

$26,896,407

$25,441,508

780

FINES PENALTIES OR VIOLATIONS

$14,492,366

$12,457,481

713

SELF INSURERS ASSESSMENTS

$1,148,452

$2,593,531

104

EMPLOYER PAY/EMPLOYEE COMP

$1,107,508

$1,035,177

344

1/2% COMP PYMT MADE EMPLOYER

$4,662,023

$14,464,514

Source:

http://www.wh1.ioc.state.il.us/Expert/Rev/ERControl.cfm?Control=State&Reset=Y&GroupBy=Fund&SortName=No&CFID=28904

50&CFTOKEN=ae38ac89dfa1e555-BB476730-5056-93B5-5E7DFB23B62CE5B3

The two largest categories are privilege taxes and retaliatory taxes. Both of these are related to

taxes on insurance premiums.

Exhibit 11- State Government Tax Collections: 2014

(Amounts in thousands)

Item

United States

Illinois

Indiana

Iowa

Missouri

Wisconsin

Insurance premium

Tax

18,094,904

359,240

223,072

105,532

302,166

185,502

Total taxes

865,752,089

39,182,894

16,846,961

8,271,839

11,240,657

16,410,925

Percent of State Tax

2.09%

0.92%

1.32%

1.28%

2.69%

1.13%

http://www.census.gov/govs/statetax/

14

Premium Taxes in 2014 (which does not include license fees and some other revenue items)

equaled $359,240,000 representing 0.92% of the Illinois state’s revenues. This is the least

compared to surrounding states where insurers play significant economic roles in their states’

economies. The percentage of premium insurance taxes to overall state revenue in Illinois was

less than Indiana (1.32%); Iowa (1.28%), and Wisconsin (1.13%) as detailed below in Exhibit

11.

In addition to taxes from insurance organizations, the state collects incomes, sales, excise, and

property taxes from employees working in the industry. Taxes paid by insurance workers to the

state of Illinois are estimated to be over $1.5 billion.

7

Insurance Industry as Citizen of the State

Property/casualty and life/health insurance companies contribute to the economy far beyond their

core function of helping to manage risk. According to the Insurance Information Institute, the

insurance industry is the 11th largest charitable giver in the U.S. and the 7th largest globally by

employee. U.S. property/casualty insurers have increased their charitable giving by an average of

7

Employee compensation for workers in Illinois in 2014 was $409.93 billion. Insurance industry workers were paid 3% of overall employee

compensation for the state therefore the estimated individual income taxes paid by industry workers to the state was $ 1, Additionally data from

the taxfoundation.org was used to estimate sales, excise, and property taxes for 144,723 workers. These added an addition ($206,230,275 sales

and excise taxes, and 287,275,155 Property tax). This is likely to be underestimated because sales tax and property taxes correlate with income,

so the 50 percent higher income would make that $1.5 billion even more.

Explanation of Tax Calculation

Per Section 409 of the Illinois Insurance Code (215 ILCS 5/409, effective May 29, 1998), there is a premium tax

of 0.4% on the net taxable premium for all accident and health written, 0.5% on the net taxable premiums

written for all other types of insurance premiums written. This premium tax is paid by the insurers for the

“privilege” of writing insurance in Illinois. This applies to all insurers doing business in Illinois. However, some

insurers domiciled in other states (foreign insurers) are required to pay an additional tax to retaliate for the

higher taxes charged against Illinois insurers doing business in their home states.

Illinois law (215 ILCS 5/444, Reg. 2515.10 to 2515.100) states that “Any taxes, licenses or other fees in the

aggregate, or any fines, penalties, deposit requirements as would be imposed on Illinois insurers as a

condition precedent to their doing business in other states that would exceed those Illinois imposes on

insurers, agents or representatives of insurers domiciled in other states, shall result in a retaliatory tax.” The

purpose of the retaliatory tax is “to promote the interstate business of domestic insurance companies and

thus attempt to prevent other states from handicapping Illinois domestic companies with excessive taxes.”

The way in which states enforce this tax is by charging a retaliatory tax on insurers from other states whose

premium tax is higher than its own. For example, insurers from state #1 incur a higher tax when operating in

state #2, then state #1 will charge the higher tax to insurers of state #2 who wish to do business in state #1.

For example, consider an insurance firm domiciled in Ohio writing a policy in Illinois. Illinois's privilege

(premium) tax rate was 0.5%. The Ohio rate was 1.4%. The Ohio insurer must pay the 0.5% Illinois premium

tax on policies written in Illinois. Additionally, the Ohio insurer must pay the state of Illinois a retaliatory tax of

.9% (the Ohio premium tax rate of 1.4% minus the Illinois rate of .5%).

15

15 percent since 2011, to an industry total of $575 million in 2014 benefiting communities in

which they operate throughout the United States.

The Insurance Industry Charitable Foundation, established by the property/casualty insurance

industry in 1994, has contributed more than $23.5 million in local community grants and nearly

200,000 volunteer hours to hundreds of community nonprofit organizations. .Some of the most

charitable firms are domiciled in Illinois. Insurers such as State Farm, Allstate, Zurich North

America, and CNA for example all have foundations that make charitable contributions to local

causes.

Summary

The insurance industry in Illinois has an exceptional impact on both the economy of Illinois and

on the U.S. economy as a whole. The insurance industry’s employment, contribution to state

GDP, premiums written, losses paid, and investments made placed the Illinois insurance industry

as one of the top ranking industry’s in the nation. The importance of Illinois property and

casualty insurers as one of the country’s most significant mechanisms for insuring losses to

homes, autos, and businesses is difficult to overstate. The insurance industry in Illinois is a key

driver of the Illinois, and arguable U.S. economy. Efforts should be made to ensure that

employment in the industry continues to grow, as these well-paying jobs are able to support

Illinois state and local communities.

16

Appendix

Appendix A- Ranking of State Insurance Industries

Appendix B- Gross Domestic Product for Insurance by State

Appendix C- Gross Domestic Product Illinois (millions of current dollars) 2013

Appendix D- Illinois Insurers Key Financials Compared to Surrounding States

Appendix E- Insurance Industry Occupations in Illinois 2008-2018

Appendix F- Illinois Life and Health Insurers

Appendix G- Illinois Property and Casualty Insurers

Appendix A State, District, Territory Ranking By Sector

Net Premiums 2015

States, District, Territory

Rank-

Overall

Rank

P&C

Rank

Health

Rank Life

AK

45

40

.

.

AL

28

17

25

39

AR

38

39

26

38

AZ

36

38

47

15

CA

17

9

27

22

CO

20

29

23

16

CT

10

8

29

2

`DC

40

46

24

.

DE

37

52

42

8

FL

15

14

8

30

GA

22

21

14

37

HI

43

41

30

43

IA

14

15

33

3

ID

49

50

39

42

IL

2

1

1

14

IN

16

26

21

6

KS

30

32

36

19

KY

25

23

13

40

LA

26

24

20

33

MA

6

4

9

11

MD

27

28

22

29

ME

33

33

41

20

MI

5

12

7

4

MN

12

6

31

9

MO

18

18

15

27

MS

31

22

34

32

17

MT

52

48

50

47

NC

32

27

19

45

ND

51

49

46

44

NE

11

5

35

5

NH

42

43

45

25

NJ

9

13

10

13

NM

44

45

32

.

NV

21

30

17

.

NY

1

3

4

1

OH

3

2

6

10

OK

41

36

44

28

OR

23

34

18

21

PA

8

11

2

17

PR

48

51

.

36

RI

34

16

40

41

SC

29

35

28

23

SD

46

44

43

34

TN

13

19

11

18

TX

4

7

5

7

UT

35

37

37

24

VA

19

25

16

26

VT

39

20

48

35

WA

24

31

12

31

WI

7

10

3

12

WV

47

47

38

.

WY

50

42

49

46

Appendix B- Gross Domestic Product by State (millions of current dollars)

Gross domestic product (GDP) by state (millions of current dollars)

Bureau of Economic Analysis

Insurance carriers and related activities

Fips

Area

2013

Percent of State GDP

0

United States

410277

1000

Alabama

3594

0.90%

2000

Alaska

357

0.10%

4000

Arizona

7921

1.90%

5000

Arkansas

1700

0.40%

6000

California

31352

7.60%

8000

Colorado

5912

1.40%

9000

Connecticut

17139

4.20%

10000

Delaware

5874

1.40%

11000

District of Columbia

1163

0.30%

18

12000

Florida

19845

4.80%

13000

Georgia

9869

2.40%

15000

Hawaii

1267

0.30%

16000

Idaho

926

0.20%

17000

Illinois

26283

6.40%

18000

Indiana

8796

2.10%

19000

Iowa

10821

2.60%

20000

Kansas

4098

1.00%

21000

Kentucky

4084

1.00%

22000

Louisiana

3523

0.90%

23000

Maine

1593

0.40%

24000

Maryland

6945

1.70%

25000

Massachusetts

13201

3.20%

26000

Michigan

11459

2.80%

27000

Minnesota

10933

2.70%

28000

Mississippi

1580

0.40%

29000

Missouri

7377

1.80%

30000

Montana

626

0.20%

31000

Nebraska

5374

1.30%

32000

Nevada

1762

0.40%

33000

New Hampshire

3037

0.70%

34000

New Jersey

19688

4.80%

35000

New Mexico

1085

0.30%

36000

New York

39978

9.70%

37000

North Carolina

6809

1.70%

38000

North Dakota

760

0.20%

39000

Ohio

17673

4.30%

40000

Oklahoma

2754

0.70%

41000

Oregon

3499

0.90%

42000

Pennsylvania

20882

5.10%

44000

Rhode Island

2087

0.50%

45000

South Carolina

3613

0.90%

46000

South Dakota

916

0.20%

47000

Tennessee

6902

1.70%

48000

Texas

26495

6.50%

49000

Utah

2173

0.50%

50000

Vermont

777

0.20%

51000

Virginia

6240

1.50%

53000

Washington

5943

1.40%

54000

West Virginia

1110

0.30%

55000

Wisconsin

12220

3.00%

56000

Wyoming

264

0.10%

19

91000

New England

37835

9.20%

92000

Mideast

94529

23.00%

93000

Great Lakes

76430

18.60%

94000

Plains

40277

9.80%

95000

Southeast

68869

16.80%

96000

Southwest

38255

9.30%

97000

Rocky Mountain

9901

2.40%

98000

Far West

44180

10.80%

Legend / Footnotes:

Note-- NAICS Industry detail is based on the 2007 North American Industry Classification System

(NAICS).

Note-- Per capita real GDP statistics for 1997-2014 reflect Census Bureau mid-year population

estimates available as of December 2014.

Appendix C

Appendix C- Gross domestic product (GDP) by industry in Illinois

Industry

Description

2012

2013

101

All industry total

709257

715239

102

Private industries

635484

640680

103

Agriculture, forestry, fishing, and hunting

6170

11480

104

Farms

5723

11039

105

Forestry, fishing, and related activities

448

441

106

Mining

3522

3797

107

Oil and gas extraction

229

210

108

Mining, except oil and gas

3112

3418

109

Support activities for mining

180

168

110

Utilities

9397

9382

111

Construction

23013

24441

112

Manufacturing

103370

96339

113

Durable goods manufacturing

52219

49757

114

Wood products manufacturing

393

448

115

Nonmetallic mineral products manufacturing

1512

1628

116

Primary metals manufacturing

2442

2237

117

Fabricated metal products

9546

9274

118

Machinery manufacturing

20153

16492

119

Computer and electronic products manufacturing

4963

6132

120

Electrical equipment, appliance, and components

manufacturing

3066

3200

20

121

Motor vehicles, bodies and trailers, and parts

manufacturing

4090

4099

122

Other transportation equipment manufacturing

866

832

123

Furniture and related products manufacturing

962

1014

124

Miscellaneous manufacturing

4226

4400

125

Nondurable goods manufacturing

51151

46583

126

Food and beverage and tobacco products

manufacturing

10950

11980

127

Textile mills and textile product mills

180

196

128

Apparel and leather and allied products

manufacturing

329

350

129

Paper products manufacturing

1808

2096

130

Printing and related support activities

2535

2557

131

Petroleum and coal products manufacturing

11949

8930

132

Chemical products manufacturing

18393

15297

133

Plastics and rubber products manufacturing

5007

5178

134

Wholesale trade

52467

54246

135

Retail trade

36709

36976

136

Transportation and warehousing

25374

25897

137

Air transportation

5642

5889

138

Rail transportation

2563

2857

139

Water transportation

360

400

140

Truck transportation

6565

6540

141

Transit and ground passenger transportation

1705

1743

142

Pipeline transportation

314

328

143

Other transportation and support activities

5038

5053

144

Warehousing and storage

3188

3086

145

Information

23681

24702

146

Publishing industries, except Internet (includes

software)

6177

6050

147

Motion picture and sound recording industries

2125

2166

148

Broadcasting and telecommunications

12995

13849

149

Data processing, internet publishing, and other

information services

2384

2637

150

Finance, insurance, real estate, rental, and leasing

156480

154615

151

Finance and insurance

67071

63964

152

Federal Reserve banks, credit intermediation, and

related services

24170

24395

153

Securities, commodity contracts, and investments

12974

12122

154

Insurance carriers and related activities

26840

26283

21

155

Funds, trusts, and other financial vehicles

3086

1164

156

Real estate and rental and leasing

89409

90651

157

Real estate

80473

81647

158

Rental and leasing services and lessors of intangible

assets

8936

9004

159

Professional and business services

95798

97186

160

Professional, scientific, and technical services

55458

56029

161

Legal services

13275

13389

162

Computer systems design and related services

9018

9542

163

Miscellaneous professional, scientific, and technical

services

33165

33098

164

Management of companies and enterprises

17132

17719

165

Administrative and waste management services

23209

23437

166

Administrative and support services

21247

21505

167

Waste management and remediation services

1961

1932

168

Educational services, health care, and social assistance

58854

60140

169

Educational services

10153

10241

170

Health care and social assistance

48700

49900

171

Ambulatory health care services

20599

21188

172

Hospitals and nursing and residential care facilities

24123

24559

173

Social assistance

3979

4153

174

Arts, entertainment, recreation, accommodation, and

food services

24104

24781

175

Arts, entertainment, and recreation

6443

6600

176

Performing arts, spectator sports, museums, and

related activities

3205

3373

177

Amusements, gambling, and recreation industries

3238

3227

178

Accommodation and food services

17660

18181

179

Accommodation

4208

4540

180

Food services and drinking places

13452

13641

181

Other services, except government

16546

16700

182

Government

73772

74559

183

Federal civilian

11071

10672

184

Federal military

3432

3290

185

State and local

59269

60597

186

Natural resources and mining

9692

15277

187

Trade

89176

91221

188

Transportation and utilities

34771

35279

189

Private goods-producing industries

136075

136057

22

190

Private services-providing industries

499410

504624

Footnotes: NAICS Industry detail is based on the 2007 North American Industry Classification System

(NAICS).

Source: U.S. Department of Commerce / Bureau of Economic Analysis / Regional Product Division

23

Appendix D- Illinois Insurers Key Financials Compared to Surrounding States

U.S Insurers Policyholder Surplus

States

Surplus as Regards Policyholders 2015 Y ($000)

Premiums Written by Insurance Sector Compared to U.S. Total Premiums Written

States

P&C Ins

Life Ins

Health Ins

Direct Premiums

Written 2015

Total All Lines

($000)

Percentage

of U.S. Total

Direct Premiums

& Annuity Consid:

Life, A&H 2015 Y

Total All Lines

($000)

Percentage

of U.S. Total

Direct Premiums

Written 2015 Y

AR: Total All

Lines ($000)

Percentage

of U.S. Total

ILLINOIS

125,946,981.658

21.64%

18,313,896.374

2.69%

45,355,965.657

8.78%

IOWA

15,124,192.009

2.60%

61,422,876.857

9.03%

3,448,671.387

0.67%

INDIANA

22,413,776.533

3.85%

39,933,682.008

5.87%

8,322,079.584

1.61%

KENTUCKY

1,175,947.648

0.20%

166,774.606

0.02%

14,074,554.330

2.72%

MISSORI

8,678,403.177

1.49%

2,074,304.181

0.30%

12,371,372.175

2.39%

WISCONSIN

27,268,149.273

4.68%

24,682,806.825

3.63%

36,923,362.193

7.14%

U.S. Total

582,041,689.038

680,150,362.327

516,867,636.692

SNL Database - 2015

Losses Paid By Illinois Insurers and surrounding states as Percentage of U.S. Payments By Insurance Sector

Area

P&C Ins

Life Ins

Health Ins

Losses Paid Less

Salvage 2015 Y

AR: Total All

Lines ($000)

Percentage

of U.S. Total

Benefits &

Losses 2015 Y

AR: Total All

Lines ($000)

Percentage

of U.S. Total

Medical Losses

Incurred 2015 Y

AR: Total All Lines

($000)

Percentage

of U.S. Total

ILLINOIS

61,108,034.86

21.27%

19,888,312.96

3.22%

41,133,438.52

8.74%

IOWA

4,187,740.19

1.46%

58,957,424.36

9.56%

3,040,976.89

0.65%

INDIANA

6,158,626.18

2.14%

36,170,238.43

5.86%

7,167,478.01

1.52%

KENTUCKY

747,310.68

0.26%

282,764.64

0.05%

12,024,179.60

2.55%

MISSOURI

2,959,908.95

1.03%

9,193,609.84

1.49%

10,226,830.29

2.17%

WISCONSIN

12,597,504.96

4.38%

24,034,976.24

3.90%

31,645,624.51

6.72%

U.S. Total

287,316,065.75

616,779,676.13

470,675,350.68

Source: SNL Database - 2015

24

Health Ins

Life Ins

P&C Ins

ILLINOIS

11,456,888.82

20,957,659.50

153,777,253.97

IOWA

1,573,674.42

29,526,530.48

10,320,384.98

INDIANA

1,229,428.06

13,192,151.64

21,945,468.63

KENTUCKY

1,828,762.20

284,167.20

1,529,423.59

MISSOURI

2,742,251.38

14,870,290.90

9,741,635.61

WISCONSIN

5,935,699.04

22,489,695.03

29,907,587.80

Source: SNL Database - 2015

Appendix E Insurance Industry Occupations in Illinois 2008-2018

Occupation

Illinois

Employment

2008

Projected

2018

National

Employment

Percent

Of

National

Insurance

Industry

Insurance Agents

13,578

15,705

308320

4.4%

Customer Service

9,813

10,781

247,080

4.0%

Claims Adjusters

9,278

9,743

184,650

5.0%

Insurance Claims Processing

9,157

9,131

194820

4.7%

Insurance Underwriters

8,100

7,863

83510

9.7%

Business Operations

Specialists

4,133

4,074

31590

13.1%

Secretary Admin Support

3,641

3,588

58650

6.2%

First Line Office Managers

2,270

2,243

52670

4.3%

Accountants

2,235

2,335

34,430

6.5%

Management Analysts

2,182

2,127

34030

6.4%

Computer Systems Analysts

2,026

2,283

37,410

5.4%

Managers

1,761

1,735

38340

4.6%

Financial Analysts

1,408

1,523

18,090

7.8%

Computer Software Engineers

Applications

1,324

1,620

24,830

5.3%

Financial Managers

1,258

1,282

26,630

4.7%

Commodities and Securities

Sales

1,241

1,301

9540

13.0%

Computer Programmers

1,144

904

13,140

8.7%

Computer and IS Managers

742

834

17,750

4.2%

Actuaries

598

646

13020

4.6%

Insurance Appraiser

344

346

10340

3.3%

Personal Financial Advisors

N/A

6940

N/A

25

Source: Illinois Information Workforce Center 2008-2018 (IDES 2012)

Comparison of 2014 Wages for Insurance Occupations in Illinois Compared to National

Average

Illinois Insurance Industry Occupation

(SOC code) 2014

Illinois Annual

Mean Wage 2014

National Annual

Mean Wage 2014

Insurance Industry

All Insurance Carriers (NAICS 524000)

$72,370

$62,510

Claims Adjusters Examiners and Investigators(131031)

$63,830

$63,500

Personal Financial Advisors(132052)

$98,640

$108,090

Insurance Underwriters(132053)

$65,250

$70,570

Insurance Sales Agents(413021)

$73,860

$63,730

Securities Commodities and Financial Services Sales

Agents(413031)

$104,660

$103,260

Insurance Claims and Policy Processing Clerks(439041)

$38,030

$38,740

Actuaries 15-2011

$99,460

$110,090

Source: SOC code: Standard Occupational Classification code -- see

http://www.bls.gov/oes/current/oes_il.htm#13-0000;

http://www.bls.gov/oes/current/naics3_524000.htm

Appendix F- Life and Health Insurers

Life Insurers (39)

Health Insurers (40)

4 Ever Life Insurance Co.

Access Care General Inc.

Allstate Assurance Co.

Aet. Better Hlth Inc. (IL)

Allstate Life Insurance Co.

American Specialty Hlth Ins Co

Amalgamated L&H Insurance Co.

Celtic Insurance Co.

Bankers Life & Casualty Co.

Cig. HealthCare of IL Inc.

Columbian Life Insurance Co.

Cmnty Care Alliance of IL NFP

Combined Insurance Co. of Am

CompBenefits Dental Inc.

COUNTRY Investors Life Assr Co

Coventry Health Care of IL Inc

COUNTRY Life Insurance Co.

Delta Dental of Illinois

Dearborn National Life Ins Co.

Dental Benefit Providers of IL

Destiny Health Insurance Co.

Family Health Network Inc.

26

Educators Life Ins Co. of Am

First Cmnwlth Ltd Health (IL)

ELCO Mutual Life & Annuity

First Commonwealth Ins Co.

EquiTrust Life Insurance Co.

Harmony Health Plan of IL Inc.

Federal Life Ins Co. (Mutual)

HCSC Insurance Services Co.

Fidelity Life Assn. A Legal

Health Alliance - Midwest Inc.

Guarantee Trust Life Ins Co.

Health Alliance Connect Inc.

Horace Mann Life Insurance Co.

Health Alliance Med Plans Inc.

Illinois Mutual Life Ins Co.

HlthCare Svc Corp. a Mutual

Life Assurance Co. of America

Huma. Benefit Plan of IL Inc.

Lincoln Heritage Life Ins Co.

Huma. Dental Concern Ltd.

Mutual Trust Life Insurance Co

IlliniCare Health Plan Inc.

Old Repub Life Insurance Co.

Land of Lincoln Mutl Hlth Ins

Pekin Life Insurance Co.

Meridian Health Plan of IL Inc

Physicians' Bnfts Tr Life Ins

Merit Health Insurance Co.

Professional Life & Cas Co.

Moli. Healthcare of IL Inc

ProTec Insurance Co.

.tio.l Dental Care Inc.

Reliance Standard Life Ins Co.

Preferred Insurance Svcs Inc.

Resource Life Insurance Co.

Pre-Paid Health Services Inc.

State Farm Health Insurance Co

Sidney Hillman Health Centre

State Farm Life & Accdt Assr

Sterling Life Insurance Co.

State Farm Life Insurance Co.

Symphonix Health Insurance Inc

Trustmark Insurance Co.

TruAssure Insurance Co.

Trustmark Life Insurance Co.

Union Health Service Inc.

United Insurance Co of America

Union Medical Center

United Natl Life Ins Co. of Am

UnitedHealthcare Ins Co. (IL)

Wilcac Life Insurance Co.

UnitedHealthcare Ins Co. of IL

XL Life Insurance & Annuity Co

UnitedHealthcare of IL Inc.

Zurich American Life Ins Co.

UnitedHealthcare Plan

.

Vision Service Plan of IL NFP

SNL Database – 2015

27

Appendix G- Illinois

Property Casualty

Insurers (192)

Company Name

1. ACIG Insurance Co.

2. ACSTAR Insurance Co.

3. Affirmative Insurance Co.

4. AGCS Marine Insurance

Co.

5. AIG Specialty Insurance

Co.

6. Alamance Insurance Co.

7. Allianz Global Risks US

Ins Co

8. Allianz Underwriters Ins

Co.

9. Allstate F&C Insurance

Co.

10. Allstate Indemnity Co.

11. Allstate Insurance Co.

12. Allstate New Jersey Ins

Co.

13. Allstate NJ P&C Insurance

Co.

14. Allstate North American

Ins Co

15. Allstate Northbrook Indem

Co.

16. Allstate P&C Insurance

Co.

17. Allstate Vehicle & Ppty

Ins Co

18. American Access Casualty

Co.

19. American Alliance

Casualty Co.

20. American Country

Insurance Co.

21. American Freedom

Insurance Co.

22. American Heartland Ins

Co.

23. American Medical

Assurance Co.

24. American Service

Insurance Co.

25. American Zurich Insurance

Co.

26. AMEX Assurance Co.

27. Apollo Casualty Co.

28. Argo.ut Great Central Ins

Co.

29. Argo.ut Insurance Co.

30. Argo.ut Ltd Risk Insurance

Co

31. Argo.ut-Midwest

Insurance Co.

32. Argo.ut-Southwest Ins Co.

33. Ashmere Insurance Co.

34. Associated Intl Insurance

Co.

35. AXIS Insurance Co.

36. AXIS Surplus Insurance

Co.

37. Benefit Security Insurance

Co.

38. BITCO General Insurance

Corp.

39. BITCO .tio.l Insurance Co.

40. Blue Hill Specialty Ins Co.

41. Castle Key Indemnity Co.

42. Castle Key Insurance Co.

43. CEM Insurance Co.

44. Chicago Insurance Co.

45. Citizens Insurance Co. of

IL

46. Clarendon .tio.l Ins Co.

47. Clear Blue Insurance Co.

48. Columbia Casualty Co.

49. Continental Casualty Co.

50. Contractors Bonding & Ins

Co.

51. COUNTRY Casualty

Insurance Co.

52. COUNTRY Mutual

Insurance Co.

53. COUNTRY Preferred

Insurance Co

54. Delphi Casualty Co.

55. Diamond Insurance Co.

56. Direct Auto Insurance Co.

57. Doctors Direct Insurance

Inc.

58. Echelon P&C Insurance

Co.

59. Economy Fire & Casualty

Co.

60. Economy Preferred

Insurance Co

61. Economy Premier

Assurance Co.

62. Encompass Floridian

Indem Co.

63. Encompass Floridian Ins

Co.

64. Encompass Home & Auto

Ins Co.

65. Encompass Indemnity Co.

66. Encompass Independent

Ins Co.

67. Encompass Insurance Co.

28

68. Encompass Insurance Co.

of Am

69. Encompass Insurance Co.

of NJ

70. Encompass P&C Co.

71. Encompass P&C Ins Co.

of NJ

72. Evanston Insurance Co.

73. Falcon Insurance Co.

74. Farmers Automobile Ins

Assn.

75. Farmers New Century Ins

Co.

76. FB Alliance Insurance Co.

77. Fi.ncial Indemnity Co.

78. First Chicago Insurance

Co.

79. First Fi.ncial Insurance Co.

80. First Liberty Insurance

Corp.

81. Florists' Insurance Co.

82. Florists' Mutual Insurance

Co.

83. Fortress Insurance Co.

84. Founders Insurance Co

(IL)

85. Frontline Ins Unlimited

Co.

86. Governmental

Interinsurance

87. Granite State Insurance

Co.

88. Guilford Insurance Co.

89. Harco .tio.l Insurance Co.

90. Hartford Insurance Co. of

IL

91. HDI Global Insurance Co.

92. Hiscox Insurance Co.

93. Homesite Insurance Co. of

FL

94. Homesite Insurance Co. of

IL

95. Horace Mann Insurance

Co.

96. Horace Mann P&C

Insurance Co.

97. Hutterian Brethren Mutl

Ins

98. IL Cas Co. (A Mutual Ins

Co.)

99. IL State Bar Assn. Mutl

Ins Co

100. Illinois Farmers Insurance

Co.

101. Illinois .tio.l Insurance Co

102. Illinois Union Insurance

Co.

103. Independent Mutual Fire

Ins Co

104. Insurance Co. of Illinois

105. Interstate Fire & Casualty

Co.

106. ISMIE Indemnity Co.

107. ISMIE Mutual Insurance

Co.

108. Kemper Financial

Indemnity Co.

109. Kemper Independence Ins

Co.

110. Lancer Insurance Co.

111. Liberty Ins Underwriters

Inc.

112. Liberty Insurance Corp.

113. Lighthouse Casualty Co.

114. LM General Insurance Co.

115. LM Insurance Corp.

116. Lutheran Mutual Fire Ins

Co.

117. Madison Mutual Ins Co.

(IL)

118. Markel Insurance Co.

119. Medical Alliance

Insurance Co.

120. Mendakota Casualty Co.

121. Merastar Insurance Co.

122. Mercury Insurance Co. of

IL

123. Mercury .tio.l Insurance

Co.

124. MidStates ReInsurance

Corp.

125. Midvale Indemnity Co.

126. Midwest Insurance Co.

127. Mount Carroll Mutual Ins

Co.

128. Mt. Hawley Insurance Co.

129. .tio.l Fire & Casualty Co.

130. .tio.l Heritage Insurance

Co

131. .tio.l Surety Corp.

132. .tl Fire Ins Co. of Hartford

133. New Hampshire Insurance

Co.

134. NHRMA Mutual Insurance

Co.

135. North Light Specialty Ins

Co.

136. Oglesby Reinsurance Co.

137. Old Repub General Ins

Corp.

138. Old Repub Union

Insurance Co.

139. Omni Indemnity Co.

140. Omni Insurance Co.

141. OMS .tio.l Insurance Co.

RRG

142. OneCIS Insurance Co.

143. PACO Assurance Co.

144. Peerless Indemnity Ins Co.

145. Pekin Insurance Co.

29

146. Podiatry Insurance Co. of

Am

147. Prime Insurance Co.

148. Prime P&C Insurance Inc.

149. Public Service Insurance

Co.

150. Republic Credit Indemnity

Co.

151. Response Insurance Co.

152. Response Worldwide

Direct Auto

153. Response Worldwide Ins

Co.

154. RLI Insurance Co.

155. Rockford Mutual

Insurance Co.

156. Safeco Insurance Co. of IL

157. Safety First Insurance Co.

158. Safeway Ins Co. of AL

Inc.

159. Safeway Insurance Co.

160. SeaBright Insurance Co.

161. Select Markets Insurance

Co.

162. Specialty Risk of America

163. Specialty Surplus

Insurance Co

164. Spinker Insurance Co.

165. Standard Mutual Insurance

Co.

166. Starr Surplus Lines Ins Co.

167. State Farm Fire & Casualty

Co.

168. State Farm General Ins Co.

169. State Farm Guaranty Ins

Co.

170. State Farm Indemnity Co.

171. State Farm Mutl

Automobile Ins

172. Stonegate Insurance Co.

173. Teachers Insurance Co.

174. Third Coast Insurance Co.

175. TransGuard Ins Co. of Am

Inc.

176. Transit General Insurance

Co.

177. Transportation Insurance

Co.

178. U.S. Insurance Co. of

America

179. Underwriters at Lloyd's

(IL)

180. Unique Insurance Co.

181. United Casualty Ins Co. of

Am

182. United Equitable Insurance

Co.

183. United Sec Hlth & Cas Ins

Co.

184. Unitrin Direct Insurance

Co.

185. Unitrin Direct P&C Co.

186. Univ Underwriters of TX

Ins Co

187. Universal Underwriters Ins

Co.

188. USPlate Glass Insurance

Co.

189. Virginia Surety Co.

190. Warner Insurance Co.

191. Western Select Insurance

Co.

192. Zurich American Ins Co.

of IL