IS YOUR STATE

MAKING THE GRADE?

2023 NATIONAL REPORT CARD ON STATE EFFORTS

TO IMPROVE FINANCIAL LITERACY IN HIGH SCHOOLS

™

10th Anniversary Edition

BY JOHN PELLETIER

Director, Center for Financial Literacy

at Champlain College

December, 2023

Includes Two

Additional Articles

by Other Authors

See Table

of Contents

All States Should Provide High School Students

Equitable Access to Substantive Personal Finance Education.

© 2023 Champlain College, Inc. All rights reserved

TABLE OF CONTENTS

Acknowledgments ..............................................................................................4

Letter from the Champlain College President

......................................................... 5

About Champlain College and the Center for Financial Literacy

.............................. 6

2023 Report Card Introduction

............................................................................ 7

Why Equitable Access to High School Personal Finance Is Needed in America

......... 9

Racial and Ethnic Disparities in Financial Capability

by Angela Fontes, Hanna Gilmore, Gary Mottola, and Olivia Valdes

........ 11

Why High School?

............................................................................................18

Why Is Requiring Financial Education in High School

a Good Investment? by Carly Urban

............................................... 22

The 2023 Report Overview

............................................................................... 25

Grade Changes from the Class of 2017 to the Class of 2023

................................ 29

Grade Changes from the Class of 2023 to the Projected Class of 2028

................. 30

State Grade Changes Over Time

.........................................................................31

Methodology

.................................................................................................... 33

Changes to the 2023 Report from the Previous 2017 Report

................................ 34

A Quick Guide to the Grading System

................................................................ 36

Class of 2023 Final Grade

................................................................................. 38

ARTICLE:

ARTICLE:

Class of 2028 Projected Final Grade .................................................................. 39

State Assessments by Grade

.............................................................................. 40

Percent of High School Population by Grade

.......................................................46

How Can My State Flunk When My Child’s School Has a Personal Finance Class?

... 50

When Should Personal Finance Be Taught in High School?

................................... 50

The Four Keys to High School Personal Financial Literacy

......................................51

Financial Literacy Education Should Be a High School Graduation Requirement

..... 52

Educators Need Access to Free Curriculum and Tools

.......................................... 52

Teacher Training Is Critical

................................................................................. 53

What Is Required to Be Taught in Grades Pre-K to 8?

........................................... 55

State Fact Sheets

.............................................................................................. 56

State Summaries: 2023 National Report Card Fact Sheets

.................................... 57

Additional References and Resources Referred to in the Report

...........................155

Links contained within the report are subject to change without notice.

All links are accurate as of October 10, 2023.

Report designed by

Stride Creative Group

2023 NATIONAL REPORT CARD | 4

Acknowledgments

The 2023 National Report Card on State Efforts

to Improve Financial Literacy in High Schools

™

would not have been possible without the efforts of

many individuals who helped our Center complete this

research and turn it into the final report that you have

before you. There are too many individuals to list all

of them, but it is important to recognize the following

organizations and individuals who have been particularly

supportive of this project. I would like to extend my

sincere thanks to:

• The Law Firm Antiracism Alliance (LFAA): The

LFAA is a nonprofit organization that brings

together the collaborative effort of more than 300

law firms. Several of the LFAA Alliance firms

provided our Center with hundreds of hours

of pro bono legal research regarding the laws,

regulations, and the high school financial literacy

public policy of each state and the District of

Columbia. Much of their excellent research work is

reflected in the State Fact Sheets at the end of this

report. Any errors or mistakes that may appear in

the State Fact Sheets are exclusively the Center’s.

• The Rauch Foundation for providing funding that

supported this important research.

• Angela Fontes, Hanna Gilmore, Gary Mottola,

and Olivia Valdes for authoring the article “Racial

and Ethnic Disparities in Financial Capability” for

inclusion in this report.

• Carly Urban, Professor of Economics at Montana

State University for authoring the article “Why Is

Requiring Financial Education in High School a

Good Investment?” for inclusion in this report.

• Bill Johnson, whose edits, comments, and

friendship over the past decade have made all

of our Center’s National Report Cards so

much better due to his expert advice.

The grades given to the states and the District of

Columbia in this report and any other statements,

interpretations, or conclusions included in this report

(excluding the two articles previously mentioned and

written by others) are exclusively the author’s and do

not necessarily represent the views of the LFAA, the five

authors of the two articles previously described, or

Champlain College.

John Pelletier

Director, Center for Financial Literacy

Champlain College

2023 NATIONAL REPORT CARD | 5

Letter from the Champlain College President

Champlain College prepares students to be READY.

Ready for work. Ready for life. Ready to make a

difference. We do this by providing a radically

pragmatic, career-focused education.

We are one of the few colleges in America that requires

our students to learn personal finance. Through our

Insight program, we ensure that every student graduates

with the tools to take ownership of their career, finances,

and self-care.

Our Center for Financial Literacy’s 2023 National

Report Card on State Efforts to Improve Financial

Literacy in High Schools

™

is an extension of our

radically pragmatic mission, and complements our

values, which include ensuring that all young people

have the knowledge and skills to succeed in their

personal and professional lives.

John Pelletier, director of our Center, is among the

nation’s leaders in advocating for personal finance

education at all educational levels. His 2023 Report

Card focuses appropriately on high school, since

high school is the threshold to adult life, with its many

complex financial decisions. This report details why high

school personal finance education is so crucial to every

young person’s future success.

Currently, 23 states have laws and regulations that will

guarantee, now or by 2028, that every high school

student graduates having taken a standalone, full-

semester personal finance course or its equivalent. That

is the gold standard, and we believe the Center for

Financial Literacy will continue to be a key influencer in

this national movement to reach this standard in all 50

states and the District of Columbia in the near future.

Financial literacy plays an important role in decreasing

poverty and inequality in our country. By equipping

students with the skills to make sound financial choices,

financial literacy serves as a vital tool in promoting

economic mobility and narrowing the wealth gap,

ultimately fostering a more equitable and

prosperous society.

Congratulations to John and his Center on producing

their fourth report card on this subject, released on

the 10th anniversary of the initial 2013 report card.

It is extremely gratifying to witness how this national

effort aligns with our mission and values that embrace

pragmatic learning.

In service,

Alex

Alex Hernandez

President

Champlain College

2023 NATIONAL REPORT CARD | 6

About Champlain College

and the Center for Financial Literacy

CHAMPLAIN COLLEGE

Founded in 1878, Champlain College is a small, private,

not-for-profit institution located in Burlington, Vermont.

The College offers an innovative approach to education

that enables students to begin major-related courses and

obtain internships in their first year. Champlain College

prepares students to excel through a career-focused

education, transformative hands-on experiences, and

meaningful connections and collaborations that engage

the passions of our students to create a better world.

Champlain College has also been a leader in online

education for over 30 years, providing a high-quality

academic experience through acclaimed associate,

bachelor’s, master’s, and certificate programs, and a key

partner for the Center for Financial Literacy. Champlain’s

3,000+ online students can be found in all 50 states and

around the globe.

Financial Literacy education has been an integral piece

of the Champlain College experience, and the school is

one of the few colleges in America that requires students

to learn personal finance. Champlain’s InSight program

requires personal finance education as a graduation

requirement for traditional undergraduate students and

the four-year program ensures that all students graduate

with the tools to take ownership of their career, finances,

and self-care.

CENTER FOR FINANCIAL LITERACY

AT CHAMPLAIN COLLEGE

Champlain College’s Center for Financial Literacy

is nationally known and respected for its work to

increase the financial capability of our nation through

its research, advocacy, and financial literacy educator

training programs. The Center for Financial Literacy’s

(CFL) trusted research, the National Report Cards (High

School, Adult, and Prepped for Success) have informed

and led financial literacy debates nationwide. Founded

in 2010, the Center for Financial Literacy has also

developed two innovative and nationally recognized

training programs to support educators in improving

financial education in their classroom, helping our

youth to be equipped to handle the complexities and

intricacies of today’s financial world.

The CFL’s director is John Pelletier, who was formerly

chief operating officer and chief legal officer at some of

the largest asset management firms in the United States.

John is an attorney and has been involved in numerous

state and national financial literacy advisory commissions

as well as a valuable media resource for current financial

literacy topics.

2023 NATIONAL REPORT CARD | 7

2023 Report Card Introduction

The Center for Financial Literacy at Champlain College

was established in 2010. At that time, our Center was

trying to understand the requirements for personal

finance education in public high schools in each state

and the District of Columbia. As our Center gathered

this information on each state, we decided that we

should share it with the public and issued our inaugural

National Report Card on State Efforts to Improve

Financial Literacy in High Schools

™

in the summer

of 2013.

This report is the fourth issued by our Center on this

topic over the last decade (reports in 2013, 2015, 2017,

and 2023). On this 10th anniversary of our first report,

we hope that continuing to grade each state on how

well it teaches high school personal finance will play a

part in moving America closer to guaranteeing access to

financial literacy education for all high school students.

Our Center last looked at personal finance education in

America with its 2017 National Report Card. At that

time, just five states earned an A grade, and less than

one out of 10 public school students nationwide lived in

a state that guaranteed access to this critical course prior

to graduating from high school.

There was so little substantive change by the summer of

2019 from the 2017 report that we decided to delay the

update for a year or more. Then COVID-19 arrived in

March 2020.

The pandemic did two things. It delayed our fourth

report card to 2023 as our Center reimagined how we

could provide our existing financial literacy training to

many more of our nation’s K to 12 educators. It also

greatly accelerated the pace of policy change occurring

in the states. For students who graduated in spring

2023, seven states guaranteed a standalone personal

finance course, but more importantly, in five years, we

project that 23 states will have this guarantee.

In 2018, less than half of the adults surveyed indicated

that they had a rainy-day fund that would cover three

months of expenses (49%) in the FINRA Financial

Capability Study. When COVID-19 hit the nation,

unemployment skyrocketed from 3.5% in January 2020

to 14.7% in April 2020—levels not seen since the Great

Depression. Through no fault of their own, millions living

paycheck to paycheck were deciding whether to buy

groceries or pay the rent, mortgage, or utilities.

During the pandemic, it became clear to state legislators

how financially fragile many of their constituents

were. Overnight, legislators in states across the nation

became more receptive to the need for personal finance

education in our schools. Witness how, in recent years,

legislation requiring a personal finance course as a

high school graduation requirement passed easily by

incredibly wide margins in many states. During a time

of intense political division in our nation, this change in

state policy is a purple issue, not a red or blue one.

It may be one of the few issues that Americans,

regardless of their politics, agree on. A 2022 poll

by the National Endowment for Financial Education

(NEFE) indicated that nearly nine out of 10 (88%) adults

surveyed wanted their state to require a semester or

yearlong financial education course for graduation from

high school, and eight in 10 adults wished they had

been required to take such a class when they went

to school.

In 2023, 1.7 million students attended high schools in

our grade A states, while in 2028, there are projected

to be 6.4 million students attending school in grade A

states. Thus, in five short years, more than four out of

10 U.S. high school students will be enrolled in high

schools where a stand-alone, full-semester course in

personal finance is required before graduating. That’s

a 229% increase from the 2017 report.

The personal finance education momentum has been

building in part because of the availability of free,

online curricular resources offered by state departments

of education and by many other organizations, often

nonprofits. But as this momentum continues, we must

pay attention to the critical importance of teacher

training. For example, we project that there will be

a need for 30,000 highly trained personal finance

educators in just the grade A and B states by 2028.

2023 NATIONAL REPORT CARD | 8

Our Center knows that many high school administrators

believe that teachers from various disciplines can teach

personal finance. However, we found that untrained

teachers often lack the confidence and knowledge to

teach this complex subject well. Taxpayers and parents

rightfully expect teachers to be trained in personal

finance, just as they are required to be trained to teach

language arts, history, civics, math, or a foreign language.

Personal finance education is a cumulative process,

so our Center always encourages the teaching of this

subject in grades Pre-K through 8. However, grades 11

and 12 in high school are critically important in terms of

honing financial knowledge and skills. Students in those

grades are poised to enter college, the workforce, or

the military and will quickly face a host of complicated

financial decisions. We’ve outlined these later in the

report, but suffice it to say that learning personal finance

at this juncture arms young people to navigate a world

of college loans, leases, credit cards, savings, investing,

and much more.

Because projections don’t always happen, we have

tweaked our grading system and now grade a state for

its policy applied to the students that graduate in the

year the report is issued. But we also have a second

projected grade for states with new policy changes that

will not be fully implemented until a future date. We

know from experience that policies can be diluted prior

to implementation.

In addition to the projected grade described above,

two other changes distinguish this report from the three

previous versions. The first is the inclusion in our state

summaries of the public policy for each state regarding

financial literacy instruction in grades Pre-K to 8. This

is provided for informational purposes only and is not

taken into account when grading the states. The second

change is including, for the first time, articles written by

leading national experts on two topics that we want to

highlight in this particular report.

The first article by Angela Fontes, Hanna Gilmore, Gary

Mottola, and Olivia Valdes, from the FINRA Investor

Education Foundation, reviews the racial and ethnic

disparities in financial capability drawn from the most

recent FINRA National Financial Capability Study. The

authors conclude that closing this gap will require a

concerted effort that addresses obstacles adults of color

face, including access to high-quality financial education.

The second article is written by Dr. Carly Urban of

Montana State University. It highlights research that

shows the many benefits of requiring financial literacy

education in high school and how this type of education

is a low-cost investment for states to make. She also

highlights research that shows why such an educational

intervention is most successful when done as a stand-

alone graduation requirement. She adds that educators

assigned to teach financial literacy appear to increase

their own financial capability.

2023 NATIONAL REPORT CARD | 9

Why Equitable Access to High School Personal

Finance Education Is Needed in America

Financial literacy is linked to positive outcomes, like

wealth accumulation, stock market participation, effective

retirement planning, and avoiding high-cost alternative

financial services. Conversely, poor financial literacy and

negative financial behaviors often go hand in hand.

A fantastic annual report/survey that highlights the

connection between financial literacy knowledge and

personal finance behaviors has been issued every year

since 2017 by the Global Financial Literacy Excellence

Center: The TIAA Institute-GFLEC Personal Finance Index

(P-Fin Index). Its press release for the 2023 report does

a great job of summarizing this connection based on its

in-depth national adult survey:

“Financial literacy matters: American workers with a

very low level of financial literacy are twice as likely

to have decreased their retirement savings and

more than 4 times as likely to have stopped saving

for retirement compared to their peers with very

high levels of financial literacy.

Further, overall, compared to those with a very high

level of financial literacy, those with a very low level

of financial literacy are:

• More than 4 times as likely to typically have

difficulty making ends meet (44% vs 10%).

• Nearly 3 times as likely to be debt constrained

(34% vs 12%).

• More than 4 times as likely to lack emergency

savings sufficient to cover one month of living

expenses (56% vs 13%).

• More than 3 times as likely to spend at least

10 hours a week coping with issues related to

personal finances (32% vs 10%).”

We live in a country with increasing income inequality

and systemic disparities. Addressing racial equity is

required for the progress of our society. One crucial

step toward achieving this goal is to ensure that all

students have equal and guaranteed access to a stand-

alone personal finance course in high school and that it

is a graduation requirement.

All too often, students from underprivileged

backgrounds enter adulthood with insufficient

knowledge of personal finance, which continues the

cycle of poverty and inequality. To help address racial

inequities, we should give all students the tools they

need to make informed financial decisions. Many

educators agree with this sentiment.

NEA Today

(the

teachers’ union flagship publication) recently published

an article that notes that personal finance education in

our nation’s classrooms can “chip away at racial wealth

gaps.” Racial equity in personal finance education has

become a high priority for the NAACP, which issued a

2020 resolution to support more financial literacy in K

to 12 schools in order “to close the financial literacy gap

for the African American Community.”

Next Gen Personal Finance (NGPF) commissioned

research from Dr. Carly Urban that looked at course

catalogs from 12,588 public high schools serving

12,488,245 high school students nationwide. The

2023 NGPF study notes that in states that do not

mandate a personal finance course as a graduation

requirement and leave such decisions up to local

school district control, troubling racial and income

disparities appear.

In such states without this requirement, the predominantly

minority high schools have only a 7% chance of being

locally required to take such a course. Meanwhile,

predominantly white high schools are more than twice

as likely to have such a local graduation requirement

(14.2%). The statistics are similar when looking at high

2023 NATIONAL REPORT CARD | 10

school income levels. Predominantly rich schools are

more than twice as likely as predominantly poor schools to

have such a local school district graduation requirement

(11.4% versus 4.6%, respectively).

Requiring all high school students to take a financial

literacy course, regardless of their race, ethnicity,

or economic status, is an important step toward

reducing inequality. High school graduates with a

strong foundation in personal finance concepts will have

the tools they need to make informed decisions about

saving, investing, and managing debt. These important

skills should help students break the cycle of poverty and

narrow persistent income and wealth gaps.

Predatory lending practices disproportionately affect

communities of color. Financial literacy education

can help students avoid these exploitative financial

practices, such as payday loans, title loans, pawn

shops, rent-to-own stores, and other high-interest

lending practices. By teaching students about the

dangers of these financial products, we can reduce

the number of marginalized individuals who become

victims of these predatory practices.

Financially capable high school graduates have a better

chance of achieving financial stability in the future.

Financial literacy education in our nation’s high schools

not only benefits the students but can also increase the

economic health of our nation.

For a detailed discussion on the racial and ethnic

differences in financial literacy knowledge and

behaviors, please see the article on page 11 entitled

“Racial and Ethnic Disparities in Financial Capability”

authored by Angela Fontes, Hanna Gilmore, Gary

Mottola, and Olivia Valdes.

ARTICLE

2023 NATIONAL REPORT CARD | 11

Racial and Ethnic Disparities

in Financial Capability

Many people of color in the United States face obstacles

that can hinder their financial capability. For example,

income, wealth, and educational disparities create

barriers unique to this population and contribute to

the widening wealth gap in the U.S. and the inequality

associated with it.

Using measures related to making ends meet, planning

ahead, financial product use, and financial knowledge/

decision-making from the most recent wave of the FINRA

Foundation’s National Financial Capability Study (NFCS),

we examined how financial capability varies across Asian

American/Pacific Islander (AAPI), Black/African American

(Black), Hispanic/Latino (Latino), and white adults. Our

findings indicate large differences in financial capability

among different groups in the United States.

MAKING ENDS MEET

An important indicator of financial capability is people’s

ability to get by day-to-day. Debt is often a sign of difficulty

managing everyday expenses, due to insufficient income

or excess spending. While access to credit allows people

to purchase high-cost goods like homes, having too much

debt and enduring the costs of servicing that debt via

interest and fees can be extremely problematic and an

indication that a household may be struggling to make

ends meet. Unfortunately, excessive debt appears to be

widespread among U.S. adults. On average, 34 percent of

U.S. adults reported having too much debt. This number

is nearly four in 10 (39 percent) for adults who are Black,

followed closely by those who are Hispanic (35 percent)

and white (33 percent). Twenty percent of those identifying

as AAPI reported having too much debt.

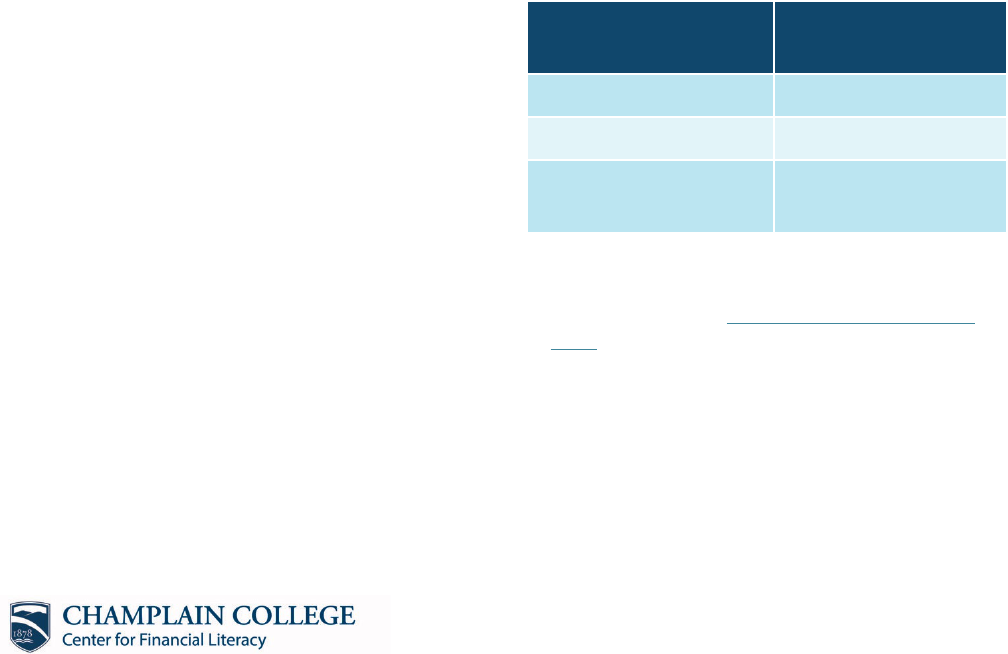

Figure 1. Over One-Third of Adults Reported Excessive Debt Levels

Total AAPI

Percent Reporting “Too Much Debt”

Black WhiteHispanic

34%

20%

39%

35%

33%

Figure 1. Over One-Third of Adults Reported Excessive Debt Levels

Percent Reporting “Too Much Debt”

0%

100%

“How strongly do you agree with the following statement: I have too much debt right now”

—percent responding 5, 6, or 7 on a 7-point scale where 1 is strongly disagree and 7 is strongly agree.

Note: The White/Hispanic comparison is not statistically significant. All other comparisons are significant at p < .01.

ARTICLE

2023 NATIONAL REPORT CARD | 12

PLANNING AHEAD

Planning ensures that a household is prepared for both

short-term emergencies and long-term financial goals,

such as retirement or educational pursuits. One way to

deal with an unexpected expense is to have emergency or

“rainy-day” savings. Having emergency savings, which we

define as having enough savings to cover three months

of expenses, is a frequently used indicator of planning

ahead financially. Lack of emergency savings could

have long-term implications for other areas of financial

capability, like burdensome debt or an overreliance on

high interest credit cards to cover expenses.

On average, a little more than half of U.S. adults (53

percent) reported having three months of emergency

savings. Rainy-day funds are most common among AAPI

adults (70 percent). Many fewer white (54 percent),

Hispanic (48 percent), and Black (44 percent) adults

reported having emergency savings.

0%

100%

Total AAPI Black WhiteHispanic

Figure 2. Fewer Than Half of Black and Hispanic Adults

Reported Having Emergency Savings

Percent with Emergency Savings

53%

70%

44%

48%

54%

“Have you set aside emergency or rainy-day funds that would cover your expenses for 3 months, in case

of sickness, job loss, economic downturn, or other emergencies?”—percent responding ‘Yes.’

Note: All comparisons statistically significant at p <.01.

ARTICLE

2023 NATIONAL REPORT CARD | 13

Not planning ahead financially, as noted, can create

downstream financial problems and stresses, evident in

another measure of financial capability: the ability to cope

with an unexpected expense. Unfortunately, 30 percent of

U.S. adults would have difficulty coming up with $2,000

in 30 days to pay an unexpected expense. This figure

increases to 38 percent for Black adults and 34 percent

for Hispanic adults. AAPI adults less often have trouble

covering an unexpected charge (17 percent).

Total AAPI Black WhiteHispanic

Figure 3. Over One-Third of Black and Hispanic Adults

Could Not Cover an Unexpected Expense

Percent Reporting Difficulty Covering an Unexpected Expense

0%

100%

30%

17%

38%

34%

28%

“How confident are you that you could come up with $2,000 if an unexpected need arose within the

next month?”—percent reporting that they probably or definitely could not come up with $2,000.

Note: All comparisons statistically significant at p <.01.

ARTICLE

2023 NATIONAL REPORT CARD | 14

MANAGING FINANCIAL PRODUCTS

Engaging with financial products is an important part of

everyday financial management. Households’ decisions

about which products to use and how to use them can

determine whether they experience successful financial

outcomes or serious financial distress. One commonly

used financial product is the credit card; about eight in

10 (79 percent) of U.S. adults reported having at least one

credit card.

NFCS respondents with a credit card were asked a series

of questions about how they use them, allowing us to

identify whether they engaged in credit card behaviors

that are costly and could detract from their financial

wellbeing. These costly behaviors include: being charged

an overlimit or late fee, receiving a cash advance,

exceeding a credit card balance, and/or making only the

minimum payment on the card.

43%

27%

64%

Total AAPI Black WhiteHispanic

Figure 4. Many Reported Costly

Credit Card Behavior

Percent Reporting Costly Credit Card Behavior

0%

100%

53%

39%

Note: All comparisons statistically significant at p <.01.

On average, 43 percent of credit card holders report engaging in at least one costly behavior. Fifty-three percent of

Hispanic and 64 percent of Black adults reported one or more costly credit card behaviors, over twice the percent of

AAPI adults (27 percent).

ARTICLE

2023 NATIONAL REPORT CARD | 15

FINANCIAL KNOWLEDGE

AND DECISION-MAKING

Making sound financial decisions requires the financial

knowledge and skills to apply that knowledge. While

we know that financial knowledge can predict important

financial outcomes (Angrisani et al., 2020), financial

knowledge levels in the U.S. are generally low. On

average, only 32 percent of U.S. adults have high

financial knowledge (correctly answering at least four of

five financial knowledge questions). This includes about

half of AAPI adults (47 percent), 36 percent of white

adults, 23 percent of Hispanic adults, and 14 percent of

Black adults.

Total AAPI Black WhiteHispanic

Figure 5. Large Differences in Financial Knowledge

Based on Race/Ethnicity

Percent with High Financial Knowledge (4+ out of 5 Correct Answers)

0%

100%

32%

47%

14%

23%

36%

Note: All comparisons statistically significant at p <.01.

ARTICLE

2023 NATIONAL REPORT CARD | 16

Related to financial knowledge is the concept of financial self-efficacy, which is the belief that you have the knowledge,

skills, and tools to achieve your financial goals. Financial self-efficacy does not vary much by race and ethnicity.

Confidence in one’s ability to achieve their financial goals deviated marginally from the national average of 73 percent.

Total AAPI Black WhiteHispanic

Figure 6. Similar Levels of Financial Self-Efficacy

Across Race/Ethnicity

Percent Confident in Ability to Achieve Financial Goals

73%

0%

100%

72%

74%

81%

76%

“If you were to set a financial goal for yourself today, how confident are you in your ability to achieve it?”

—percent reporting that they are somewhat or very confident.

Note: Hispanic/White and Hispanic/Black comparisons are not statistically different. All other comparisons

statistically significant at p <.01.

CONCLUSION

We found large disparities in financial capability among

different groups in the U.S. While this brief only examined

a subset of variables from a national dataset, the results

align with a body of research describing similar race-

and ethnic-based differences (Lusardi & Mitchell, 2014).

Closing this gap will require a concerted multifaceted

effort, including promoting widespread access to high-

quality financial education, which can equip people with

the knowledge and skills needed to make informed and

effective financial decisions throughout life (see Carly

Urban’s essay on page 22).

ARTICLE

2023 NATIONAL REPORT CARD | 17

METHODOLOGY

These analyses used data from the FINRA Foundation’s

2021 National Financial Capability Study, a large-scale

survey research project aimed at monitoring and better

understanding financial capability in the U.S. Started

in 2009 and administered every three years, the NFCS

now has data from over 125,000 U.S. adults spanning

12 years.

The sample consisted of 27,118 adults (ages 18+) across

the U.S., with approximately 500 respondents per state,

plus the District of Columbia, broken out as follows:

• AAPI, n=1,193

• Black, n=2,716

• Hispanic, n=2,174

• White, n=20,062

• All other groups, n= 973 (not reported)

The 2021 State-by-State NFCS survey was fielded from

June through October 2021. Results are weighted to be

representative of the U.S. adult population in terms of

age, gender, ethnicity, education, and Census Division.

The dataset used for these analyses as well as more

detailed methodological information can be found at

FINRAFoundation.org/NFCS.

REFERENCES

• Angrisani, M., Burke, J., Lusardi, A., & Mottola,

G. (2023). The evolution of financial literacy

over time and its predictive power for financial

outcomes: evidence from longitudinal data.

Journal of Pension Economics and Finance

, 22(4).

• Lusardi, A. & Mitchell, O. (2014). The economic

importance of financial literacy: Theory and

evidence.

Journal of Economic Literature

, 52(1).

AUTHORS

• Angela Fontes, PhD, Visiting Scholar,

FINRA Foundation

• Hanna Gilmore, Intern, FINRA Foundation

• Gary Mottola, PhD, Research Director,

FINRA Foundation

• Olivia Valdes, PhD, Principal Research Analyst,

FINRA Foundation

DISCLOSURE

All results, interpretations, and conclusions expressed

are those of the authors alone and do not necessarily

represent the views of the FINRA Investor Education

Foundation, FINRA, or any of its affiliated companies.

2023 NATIONAL REPORT CARD | 18

Why High School?

Personal finance education should start early, both at

home and in school. Ideally, personal finance concepts

should be taught in elementary, middle, and high school

and should continue into college. In mathematics, you

start with counting, move on to addition and subtraction,

and then move on to division and multiplication. You

need to learn letters and phonics before you can read.

Personal finance education should be a cumulative

process, with age-appropriate topics taught each

school year. The reality is that many states and school

districts do not provide any substantive personal finance

education until high school, if at all.

The basics of personal financial planning and money—

its value, how to save, invest, and spend, and how not

to waste it—should be taught in school as early as the

elementary level. But too many school districts teach

personal finance for the first and only time in high

school, if at all.

According to the National Center for Education Statistics

(NCES), in 2021 about 62% of students were enrolled

in college in the fall immediately following high school

completion. That means that about 38% of students are

likely to enter the workforce after high school. For those

graduates who choose to go on to higher education,

personal finance education in college is often scant and

scattered, with some colleges offering a personal finance

elective and even fewer requiring personal finance

instruction as a graduation requirement. Regardless of

when a young person’s formal education ends, they will

be thrust into situations where they need to know how

to manage daily living expenses. So, high school seems

like the best and most logical place to deliver personal

finance education to America’s youth.

Admittedly, a high school focus could omit some of

the students who have dropped out of high school.

NCES indicates that the high school dropout rate

(percentage of high school dropouts among persons

16 to 24 years old) was 5.1 % in 2021.

The Center’s National Report Card focuses on each

state’s financial literacy education policy because

that data is obtainable. It is very hard to measure the

amount and intensity of personal finance instruction

that is occurring in people’s homes, and there is less

meaningful data on this topic with regard to elementary

and middle schools than exists for high schools.

2023 NATIONAL REPORT CARD | 19

THE CASE FOR HIGH SCHOOL

FINANCIAL LITERACY

Personal finance education in high school provides

students with the knowledge and skills to manage

financial resources effectively for a lifetime of financial

well-being. Here are just some of the reasons our young

people need to learn about personal finance:

• The number of financial decisions an individual

must make continues to increase, and the variety

and complexity of financial products continues

to grow. Young people often do not understand

debit and credit cards, mortgages, banking,

investment and insurance products and services,

payday lending, auto title loans, rent-to-own

products, credit reports, credit scores, etc.

• Many students do not understand that one of the

most important financial decisions they will make

in their lives is choosing whether they should go

to college after high school, and if they decide

to pursue additional education, what field to

specialize in.

• Kids are not learning about personal finance at

home. A 2022 T. Rowe Price Survey noted that

57% of parents have some reluctance about

discussing financial matters with their kids and

37% do not like to talk to their children about

money. This is not surprising; 65% of parents

wished they were more financially savvy, and 54%

indicated that they were not financially prepared

for the pandemic. Three out of four children

indicated that they would go to their parents for

money advice. But they indicated that they would

look to their teachers, siblings, friends, YouTube,

Facebook, Instagram, TikTok, and X (formerly

Twitter) for financial advice as well.

• On a 2018 international financial literacy test of

15-year-olds, the U.S. ranked sixth out of 13 OECD

countries, trailing Estonia, Finland, Canada,

Poland, and Australia, and it was just slightly, but

not statistically, better than Portugal, Latvia, and

Lithuania. That’s four formerly communist nations

that are doing as well or better than the USA—

what a “Sputnik moment.”

• Most college students borrow to finance their

education, yet they often do so without fully

understanding how much debt is appropriate for

their education or the connection between their

area of study and the income level that they can

expect to earn upon graduation. Many students

attend college without understanding financial

aid, loans, debt, credit, inflation, budgeting, and

credit scores.

• At many colleges, financial literacy education is

largely composed of brief, federally mandated

entrance and exit loan counseling for students.

Student feedback indicates that most do not

comprehend the information presented and view

it as one more requirement of the financial aid

process rather than a learning opportunity.

• The 2021 adult survey in the most recent

FINRA Investor Education Foundation’s

Financial Capability Study indicated that just

one in five American adults were offered and

took financial literacy instruction in school,

college, or the workplace. Most adults never get

this education since it is not required instruction.

• Student debt can be very high for some recent

college graduates and large debt variations

exist from state to state. According to a recent

Project on Student Debt study for 2020 four-

year public and private college graduates, these

students left college with average student debt

that ranged from a low of $18,350 in Utah to

a high of $39,950 in New Hampshire. The

percentage of these students graduating with

debt ranged from a low of 39% in Utah to a

high of 73% in South Dakota.

• Employee pension plans have been disappearing

for most private sector workers for decades and

have been replaced by defined contribution

retirement programs, which impose greater

responsibilities on young adults to save and

invest and ultimately spend retirement savings

wisely. If they fail to do this, they could become

a significant economic burden on our society.

2023 NATIONAL REPORT CARD | 20

Most adults will not have pension plans. The US

Bureau of Labor Statistics indicated that in 2022

only 11% of private sector workers participated in

pension plans compared to 75% of state and local

governmental workers.

• Financial literacy tends to improve as we age.

This makes sense. Many are learning from their

financial mistakes as they get older. The 2022

GFLEC P-Fin Index Study indicated that the

average percentage of P-Fin Index questions

answered correctly by each generation was as

follows: Gen Z 42%, Gen Y 46%, Gen X 51%.

Baby Boomers 54% and the Silent Generation

54%. Despite this increase in knowledge as adults

age, each generation would earn an F on this

personal finance knowledge quiz.

• A 2019 LendingTree survey indicated that nearly

four out of 10 adults have no idea how their credit

scores were calculated. Credit scores are a difficult

concept for many young adults to understand. A

2023 Credit.com survey indicated that 42% of

Gen Z respondents didn’t know what their credit

score was. The economic cost of a low (or no)

credit score is very high. One’s credit score and

borrowing history impact one’s daily life when

applying for a credit card, purchasing a home

or car, renting an apartment, buying insurance,

signing up for certain utilities, and even getting a

new job. Having an excellent credit score could

save a consumer in excess of $100,000 in interest

payments over a lifetime (see: Credit.com’s Lifetime

Cost of Credit Calculator).

Financial literacy leads to better personal finance

behaviors. There are a variety of studies that indicate that

individuals with higher levels of financial literacy make

better personal finance decisions.

As a society, we need more training programs that

increase the number of financially literate citizens who

are able to make better and wiser financial decisions

during their lives. Such programs are not just good

for the individual but also helpful to society. The 2008

financial crisis and the 2020 pandemic clearly show that

poor financial decisions by individuals can have negative

consequences on our country.

The good news is that studies indicate that financial

literacy educational interventions in high school have

a positive impact, increasing student knowledge and

resulting in an increase in positive financial behaviors.

For a detailed discussion on the many benefits and

low cost of a stand-alone personal finance course

requirement, please see Dr. Carly Urban’s article in this

report on page 22, entitled “Why Is Requiring Financial

Literacy in High School a Good Investment?”

Studies also indicate that giving educators the training

they need to successfully teach personal finance topics

in their classrooms works:

• Educators Who Learn to Teach Personal

Finance in a Graduate-Level Course Are

Dramatically More Confident and Effective.

Students who learned personal finance from these

trained teachers showed significant knowledge

gains in all test topics, while a control group of

students who did not receive personal finance

education dropped slightly in knowledge in all

but one area. Also, students who received formal

education by trained teachers reported some

improvement in most personal finance behaviors

measured. Indeed, students who received

personal finance education from trained teachers

had “high financial literacy” on par with the

literacy levels of Generation X (ages 35 to 49)

and higher than that of older Millennials (ages

18 to 34) (see our Center’s 2015 Prepped for

Success study.) In addition, the trained educators

also reported improvement in their own personal

finance behaviors after taking the graduate course.

2023 NATIONAL REPORT CARD | 21

• High School Educators Who Already Teach

Personal Finance Substantially Improve Student

Results After Receiving Substantive Personal

Finance Training. An April 2021 Game Changer

study shows the importance of training educators

on financial literacy topics. This study looked at

educators who were already teaching personal

finance and whether substantive educator training

improved student outcomes. It did—after receiving

the training, those same teachers increased their

student knowledge impact threefold from the

academic year prior to the training. The training

greatly increased the positive effect on student

knowledge gained from the course when results

from before and after the training were compared.

These effects were even more pronounced

for Black students—in fact, the improvement

in knowledge for this group of students was

significantly higher than their white counterparts.

The knowledge improvement was significantly

greater for students from households with parents

having just a high school degree than for those

students with college-educated parents. Unbanked

students improved their scores more than their

banked peers. The training helped educators

with less teaching experience come closer to the

student outcomes obtained by their much more

experienced peers. This suggests that substantive

education of this nature is particularly important

to educators who are new to teaching the topic

of financial literacy in the classroom. This study

also suggests that all educators teaching personal

finance should be required to take substantive

training of this nature as a prerequisite to teaching

a stand-alone course in financial literacy.

After students leave high school, not a day will go by

when these young adults will not have to think about

money—how to earn it, spend it, and save it. Financial

literacy, just like reading, writing, and arithmetic,

builds human capital by empowering individuals with

the ability to create personal wealth to buy a home,

go to college, start a business, and have rainy-day and

retirement funds.

We would not allow a young person to get in the driver’s

seat of a car without requiring driver’s education, and

yet, in too many states, we allow our youth to enter the

complex financial world without any related substantive

education. An uneducated individual armed with a credit

card, a student loan, and access to a mortgage can be

nearly as dangerous to themselves and their community

as a person with no training behind the wheel of a car.

ARTICLE

2023 NATIONAL REPORT CARD | 22

Why Is Requiring Financial Education

in High School a Good Investment?

Carly Urban

Professor of Economics, Montana State University

Research Fellow, Institute for Labor Economics (IZA)

Fellow, TIAA Institute

Carly[email protected]

A 2020 study compiled results from all (76) randomized

financial education experiments, and the findings were

clear: on average, financial education improved financial

knowledge and behaviors.

1

The interventions were cost-

effective, and the levels of improvement were similar

to other interventions in math or reading education.

While financial education overall is an effective tool for

improving financial behaviors, requiring it in high school

is a specific policy lever in a complex setting. At the

same time, more states are requiring a full semester of

personal finance education. In 2020, five states required

a full semester of personal finance education for all

high school graduates, though a recent surge increased

that number to 23 states.

2

Is requiring personal finance

instruction in high school an effective tool?

WHAT ARE THE BENEFITS?

A recent wave of research estimates the

causal

effect of

requiring personal finance education for high school

graduation on financial behaviors. Overwhelmingly, high

school financial education improves credit and debt

behaviors. Requiring financial education improves credit

scores,

3

reduces delinquency rates,

4

reduces the use of

alternative financial services (e.g., payday lending),

5

and

shifts students from high-interest to low-interest methods

of financing a college education.

6

It increases longer-

run student loan repayment rates for first-generation

college students and students from low-income families.

7

Subjective financial well-being improves up to 12 years

after graduation.

8

The intervention does not change

all financial behaviors. Required personal finance

instruction does not change eventual retirement savings,

income, educational attainment, or college choice.

9

The benefits of financial education go beyond students.

Recent research from Peru showed that randomly

assigning schools to required financial education

instruction not only improved student behaviors but

also increased savings rates among teachers.

10

Further,

lower-income parents of children randomly assigned to

complete the course saw improvements in their

credit scores.

11

WHAT ARE THE COSTS?

No intervention is costless. In educational settings, one

concern is always that adding another requirement

could reduce high school graduation rates, creating

another barrier for students. Research does not confirm

this suspicion. Requiring a one-semester personal

finance course did not affect overall graduation rates or

the likelihood of remaining “on time” for high school

graduation.

12

The standalone course requirement also did

not reduce the likelihood of graduating or remaining “on

time” for more vulnerable students: students of color and

students from families with lower household incomes.

Another cost associated with the requirement comes

from training teachers and creating content. High-quality

online teacher professional development opportunities

exist and are largely funded through private donors as

opposed to taxpayer dollars. Given that personal finance

is a field where high-quality curricula exist free of

charge, the cost of content is negligible.

ARTICLE

2023 NATIONAL REPORT CARD | 23

WHY IS A STANDALONE COURSE

REQUIREMENT NECESSARY?

Given the nature of local control in education, a mandate

is sometimes challenging to pass. There are three main

reasons that a requirement is necessary, based on

recent research.

1. Access is limited. While more states now require

a standalone course in personal finance for

high school graduation, others embed personal

finance content into another required course (such

as Economics) or content area (such as Social

Studies). Recent research uses data from all high

schools in the US with online course catalogs to

gauge the level of personal finance instruction

nationwide. When personal finance is required

as a standalone course, every student in the state

is in a school where the requirement is in place.

When states embed personal finance into

another course, only 49 percent of students

are in schools that require personal finance

content.

13

When states have no requirements at

all, only 16 percent of students are in schools

requiring personal finance in some capacity.

This means that not all students have access

without a statewide requirement for a standalone

class. Since schools have competing priorities,

in the absence of statewide mandates personal

finance is often left behind.

2. There are inequities in access. Without

requirements, schools with higher fractions

of students of color are less likely to have

access to required personal finance courses

or content.

14

In states without standalone

course requirements, 20 percent of schools

with above median fractions of white students

have standalone course requirements, whereas

only 9 percent of schools with below median

fractions of white students have standalone course

requirements. Looking at any content requirements

tells a similar story: 29 percent of schools with

higher fractions of students of color require

some personal finance content, while 38 percent

of schools with predominantly white students

require some personal finance content. Allowing

schools to choose their level of personal finance

instruction exacerbates structural racial inequities

in access to credit, low-cost financial products,

and quality general education.

3. Offering an elective does not change behavior.

One study shows that when schools offered a

class, this did not change financial behaviors;

requirements did.

15

This could be because the

students who select into the courses are already

from more affluent backgrounds.

DISCUSSION

Overall, requiring financial education in high schools is

a policy lever that can improve the financial footing of

young adults in pivotal years. Meeting students where

they are makes this a lower-cost intervention when

compared to other education interventions in adulthood.

The research is clear: personal finance instruction

improves the financial behaviors of young adults for

years to come. Without a statewide requirement,

students of color remain without access.

ARTICLE

2023 NATIONAL REPORT CARD | 24

SOURCES

1

Kaiser, T., Lusardi, A., Menkhoff, L., & Urban,

C. (2022). Financial education affects financial

knowledge and downstream behaviors.

Journal of

Financial Economics

, 145(2), 255–272. https://doi.

org/10.1016/j.jfineco.2021.09.022

2

This number includes all states that have passed

legislation to require a standalone personal finance

course for high school graduation as of August 14,

2023. Many of these will not go into effect for at least

three years.

3

Urban, C., Schmeiser, M. D., Collins, J. M., & Brown,

A. (2020). The effects of high school personal financial

education policies on financial behavior.

Economics

of Education Review

, 78, 101786. https://doi.

org/10.1016/j.econedurev.2018.03.006 and Brown,

M., Grigsby, J., Van Der Klaauw, W., Wen, J., & Zafar, B.

(2016). Financial education and the debt behavior of the

young.

Review of Financial Studies

, 29(9), 2490–2522.

https://doi.org/10.1093/rfs/hhw006

4

Urban, C., Schmeiser, M. D., Collins, J. M., & Brown,

A. (2020b). The effects of high school personal

financial education policies on financial behavior.

Economics of Education Review

, 78, 101786. https://

doi.org/10.1016/j.econedurev.2018.03.006 and Brown,

M., Grigsby, J., Van Der Klaauw, W., Wen, J., & Zafar, B.

(2016b). Financial education and the debt behavior of

the young.

Review of Financial Studies

, 29(9), 2490–

2522. https://doi.org/10.1093/rfs/hhw006

5

Harvey, M. (2019). Impact of financial education

mandates on younger consumers’ use of alternative

financial services.

Journal of Consumer Affairs

, 53(3),

731–769. https://doi.org/10.1111/joca.12242

6

Stoddard, C., & Urban, C. (2019). The effects of

State‐Mandated Financial Education on college

financing behaviors.

Journal of Money, Credit and

Banking

, 52(4), 747–776. https://doi.org/10.1111/

jmcb.12624

7

Mangrum, D. (2022). Personal finance education

mandates and student loan repayment.

Journal of Financial Economics

, 146(1), 1–26.

https://doi.org/10.1016/j.jfineco.2022.06.006

8

Burke, J., Collins, J. M., & Urban, C. (2020, October 1).

Does state-mandated financial education affect financial

well-being?

University of Wisconsin-Madison Center for

Financial Security. https://cfs.wisc.edu/2020/09/10/

state_mandated_fin_ed/

9

Harvey, M., & Urban, C. (2022). Does financial

education in high school affect retirement savings

in adulthood? Wharton Pension Research Council

Working Paper No. 2022-03. https://doi.org/10.2139/

ssrn.4037547

10

Frisancho, V. (2022). Is School-Based Financial

Education Effective? Immediate and Long-Lasting

Impacts on High School students.

The Economic Journal

,

133(651), 1147–1180. https://doi.org/10.1093/ej/

ueac084

11

Frisancho, V. (2023). Spillover effects of financial

education: The impact of school-based programs

on parents.

Journal of Financial Literacy and Wellbeing

,

1(1), 138-153. doi:10.1017/flw.2023.2

12

Urban, C. (2023). Does state-mandated financial

education reduce high school graduation rates?

Economics of Education Review

, 95, 102427.

https://doi.org/10.1016/j.econedurev.2023.102427

13

Urban, C. (2023, March 28). Financial education

in high schools across America: Trends and statistics.

https://papers.carlyurban.com/Report2023.pdf

14

Ibid.

15

Stoddard, C., & Urban, C. (2019b). The effects of

State‐Mandated Financial Education on college

financing behaviors.

Journal of Money, Credit and

Banking

, 52(4), 747–776. https://doi.org/10.1111/

jmcb.12624

2023 NATIONAL REPORT CARD | 25

The 2023 Report Overview

Nearly halfway through the academic year, our high

school students are working hard to master a variety of

subjects. So it is an appropriate time to reflect on how

well our high schools are providing personal finance

education. After a year of intensive research, our Center

has graded all 50 states and the District of Columbia

(D.C.) on their efforts to produce financially literate

high school graduates (the 50 states and D.C., which is

technically not a state, are referred to collectively in this

report as “states”).

When it comes to report cards, everyone wants an A.

But when the Center finished its grading, only seven

states earned an A for the Class of 2023. That’s just

a two-state increase since our last report, in 2017, which

focused on the Class of 2017. Iowa and Mississippi are

the two new additions to this grade A list. Looking at

just these two data points would lead one to believe that

personal finance education policy is changing nationally

at a glacial rate. But the reality is quite different. Change

is happening very quickly and will be accelerating

dramatically over the next five years. States are so rapidly

passing laws and changing regulations that we estimate

we will have 23 grade A states for the graduating

Class of 2028, or 45% of all states (assuming full

implementation of new laws and regulations).

It often takes four or five years for a major policy change,

like adding a new high school course graduation

requirement in personal finance, to be fully implemented

statewide. The key takeaway is that the wheels of state

policy change are moving decisively forward.

BIG CHANGE IS COMING. Sixteen states are in the

process of implementing policy changes that are

projected to increase the number of states requiring

a standalone personal finance course as a high school

graduation requirement, from seven states for the

Class of 2023 to 23 states for the Class of 2028—

that’s a whopping increase of 229% in half a decade.

Here is the implementation timeline:

• Three states by the Class of 2024: Nebraska,

North Carolina, and Rhode Island

• Two states by the Class of 2026: Florida and Ohio

• Six states by the Class of 2027: Connecticut,

Kansas, Louisiana, New Hampshire, Oregon, and

South Carolina

• Five states by the Class of 2028: Georgia,

Indiana, Michigan, Minnesota, and West Virginia

Our Center estimates that when the Class of 2028

graduates, 41 percent of students will reside in a

state that requires them to take a standalone course

(or its equivalent) in personal finance.

When the Class of 2007 graduated, there were no

states that had fully implemented a standalone financial

literacy course graduation requirement. During the

Great Recession, Utah became the first state to require

a standalone course for the Class of 2008. In just two

decades, we will have seen this important course go

from being required in zero to 23 states—nearly half of

the nation.

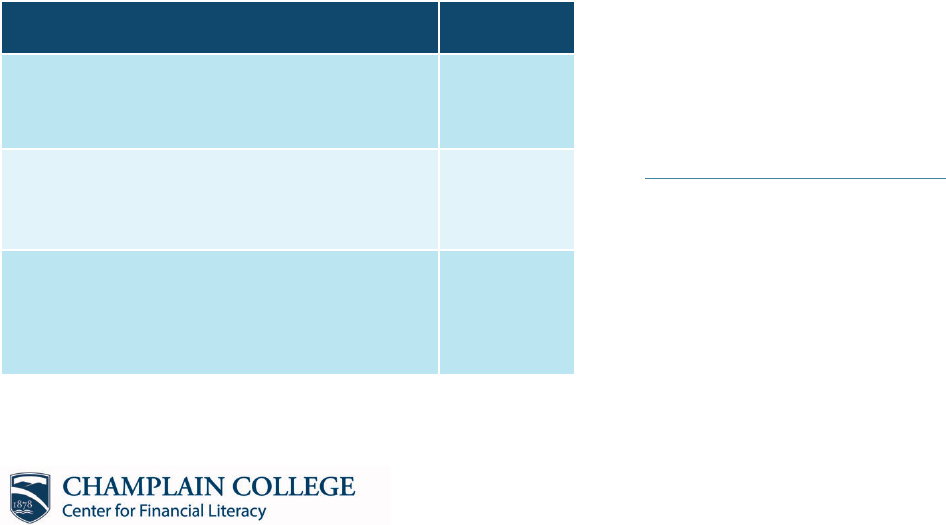

Graduating Class Grade A States

Class of 2017 Alabama, Missouri,

Tennessee, Utah,

and Virginia

Class of 2023 Alabama, Iowa,

Mississippi, Missouri,

Tennessee, Utah,

and Virginia

2023 NATIONAL REPORT CARD | 26

0

5

10

15

20

25

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

Grade A States by Year of Full Implementation

Class of 2008 to 2028*

State Fully Implements

Total Number of States

Total States Fully Implemented

*Projections

for Years 2024

to 2028

From the Class of 2017 (our last report) to the Class of 2028, we expect the number of grade A states to increase

from five to 23 states. That means that 18 states have already or are expected to move to grade A from grades B,

C, D, or F since our last report in 2017, six years ago.

Grade Class of 2017* Class of 2023 Projected Class of

2028 Grade

Grade A 10% (5 States) 14% (7 States) 45% (23 States)

Grade B 37% (19 States) 41% (21 States) 27% (14 States)

Grade C 24% (12 States) 25% (13 States) 12% (6 States)

Grade D 8% (4 States) 10% (5 States) 8% (4 States)

Grade F 22% (11 States) 10% (5 States) 8% (4 States)

It is important to note that no state that has implemented a stand-alone personal finance course

requirement (or its equivalent) has ever reversed course.

2023 NATIONAL REPORT CARD | 27

It is also encouraging that nine states that have moved or

will move to grade A were already highly committed to

personal finance education and received B grades in our

2017 report. Here is the breakdown of the states projected

to move to grade A by 2028 from our 2017 report:

• Nine states that have moved or are projected to

move from Grade B to Grade A: Florida, Georgia,

Michigan, Minnesota, New Hampshire, North

Carolina, Ohio, South Carolina, and West Virginia.

• Six states have moved or are projected to move

from Grade C to Grade A: Indiana, Iowa,

Kansas, Mississippi, Nebraska, and Oregon.

• One state is projected to move from Grade D to

Grade A: Louisiana.

• Two states are projected to move from Grade F

to Grade A: Connecticut and Rhode Island.

We still have much more to do, but the country is

definitely moving in the right direction. Our Center

estimates that the number of states getting a grade

of C, D, or F will drop from 53% in 2017 to 28% in

2028. And by 2028, only four states in the nation are

projected to be grade F states: California, the District

of Columbia, Massachusetts, and South Dakota.

The 23 states that received grades C, D, or F for the Class

of 2023 are projected to decrease to just 14 states for

the Class of 2028. For the Class of 2023, more than half

of the states, 55% (28 states), were given grades of A or

B. These are grades that you would want your children

to bring home from school. The good news is that this

group is projected to grow to 73% (37 states) for the Class

of 2028. And the 10 states (20%) with grades D or F are

projected to drop to eight states (16%) by or before the

Class of 2028.

Grade A Grade B Grade C Grade D Grade F

2017

5 19 12 4 11

2023

7 21 13 5 5

By 2028 23 14 6 4 4

0

5

10

15

20

25

Number of States

Number of States Grade Distribution

for the Classes of 2017, 2023 & Projected 2028

Based on Current Policies

2023 NATIONAL REPORT CARD | 28

2017

5%

10%

15%

20%

25%

30%

35%

40%

45%

2023 By 2028

States Percentage Distribution by Grade

for the Classes of 2017, 2023 & Projected 2028

Based on Current Policies

Grade A Grade B Grade C

Grade D Grade F

2023 NATIONAL REPORT CARD | 29

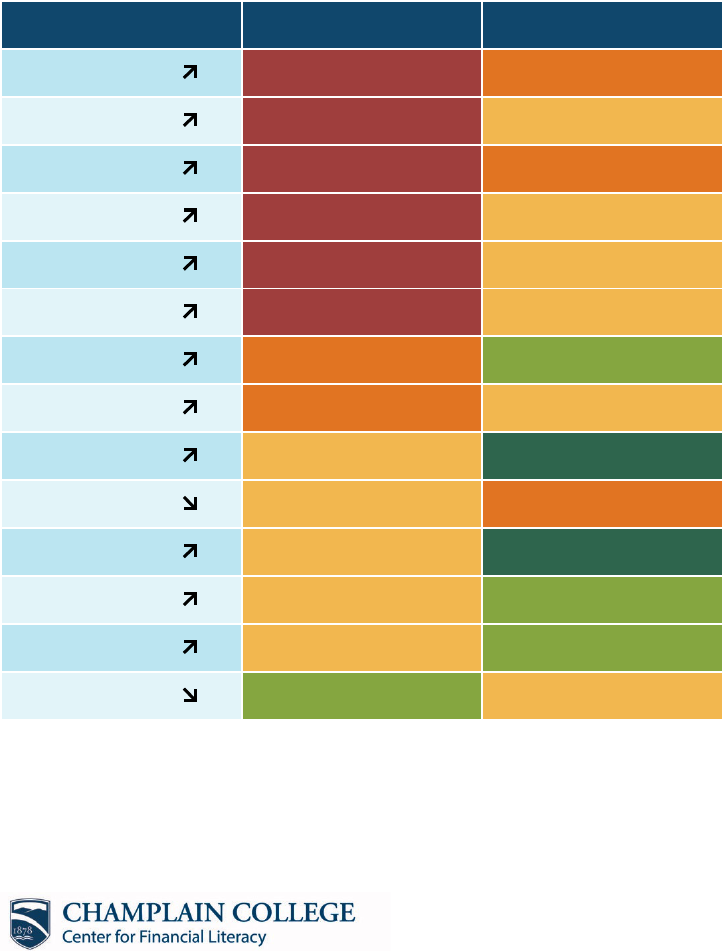

Grade Changes from the Class

of 2017 to the Class of 2023

Twelve states improved their grades, and two states saw

their grades go down during this period. Six states went

from F to C or D, four improved from C to A or B, and two

upped their grades from D to B or C. But Florida’s grade

dropped from B to C, and Kansas’ grade fell from C to D.

Both of these declines were due to policy changes, but the

good news is additional changes will lead both Florida and

Kansas to rise to an A in 2026 and 2027, respectively.

You can read the details behind each state’s grade change

for the Class of 2023 in its State Fact Sheet, which is at the

back of this report. Below is a summary of the 14 states

with grade changes from 2017 to 2023:

State Trend Class of 2017 Grade Class of 2023 Grade

Alaska Grade F Grade D

Delaware Grade F Grade C

Hawaii Grade F Grade D

Pennsylvania Grade F Grade C

Rhode Island Grade F Grade C

Wisconsin Grade F Grade C

Louisiana Grade D Grade B

Vermont Grade D Grade C

Iowa Grade C Grade A

Kansas Grade C Grade D

Mississippi Grade C Grade A

Nevada Grade C Grade B

Oklahoma Grade C Grade B

Florida Grade B Grade C

2023 NATIONAL REPORT CARD | 30

Grade Changes from the Class of 2023

to the Projected Class of 2028

Eighteen states are projected to have grade changes from

2023 by or before 2028, and the grades of all 18 are

expected to rise. Sixteen of these states will improve their

grades to an A, and two will rise to a B.

You can read the details behind each state’s grade change

projected by or before 2028 in its State Fact Sheet, which

is at the back of this report. Below is a summary of the 18

states with projected grade changes from 2023 to 2028:

State Trend Class of 2023 Grade Projected Grade Change by

or before the Class of 2028

Georgia Grade B Grade A (Class of 2028)

Louisiana Grade B Grade A (Class of 2027)

Michigan Grade B Grade A (Class of 2028)

Minnesota Grade B Grade A (Class of 2028)

New Hampshire Grade B Grade A (Class of 2027)

North Carolina Grade B Grade A (Class of 2024)

Ohio Grade B Grade A (Class of 2026)

South Carolina Grade B Grade A (Class of 2027)

West Virginia Grade B Grade A (Class of 2028)

Florida Grade C Grade A (Class of 2026)

Indiana Grade C Grade A (Class of 2028)

Kentucky Grade C Grade B (Class of 2024)

Nebraska Grade C Grade A (Class of 2024)

New Mexico Grade C Grade B (Class of 2027)

Oregon Grade C Grade A (Class of 2027)

Rhode Island Grade C Grade A (Class of 2024)

Kansas Grade D Grade A (Class of 2027)

Connecticut Grade F Grade A (Class of 2027)

2023 NATIONAL REPORT CARD | 31

State Grade Changes Over Time

CLASS OF 2017, CLASS OF 2023, AND PROJECTED CLASS OF 2028

The following is a chart that shows the actual and projected grades

over an 11-year period: 2017 to 2028.

State Trend 2017 Grade 2023 Grade Projected 2028 Grade

Alabama Grade A Grade A Grade A

Missouri Grade A Grade A Grade A

Tennessee Grade A Grade A Grade A

Utah Grade A Grade A Grade A

Virginia Grade A Grade A Grade A

Arizona Grade B Grade B Grade B

Arkansas Grade B Grade B Grade B

Florida Grade B Grade C Grade A

Georgia Grade B Grade B Grade A

Idaho Grade B Grade B Grade B

Illinois Grade B Grade B Grade B

Maine Grade B Grade B Grade B

Maryland Grade B Grade B Grade B

Michigan Grade B Grade B Grade A

Minnesota Grade B Grade B Grade A

New Hampshire Grade B Grade B Grade A

New Jersey Grade B Grade B Grade B

New York Grade B Grade B Grade B

2023 NATIONAL REPORT CARD | 32

State Trend 2017 Grade 2023 Grade Projected 2028 Grade

North Carolina Grade B Grade B Grade A

North Dakota Grade B Grade B Grade B

Ohio Grade B Grade B Grade A

South Carolina Grade B Grade B Grade A

Texas Grade B Grade B Grade B

West Virginia Grade B Grade B Grade A

Colorado Grade C Grade C Grade C

Indiana Grade C Grade C Grade A

Iowa Grade C Grade A Grade A

Kansas Grade C Grade D Grade A

Kentucky Grade C Grade C Grade B

Mississippi Grade C Grade A Grade A

Nebraska Grade C Grade C Grade A

Nevada Grade C Grade B Grade B

New Mexico Grade C Grade C Grade B

Oklahoma Grade C Grade B Grade B

Oregon Grade C Grade C Grade A

Washington Grade C Grade C Grade C

Louisiana Grade D Grade B Grade A

Montana Grade D Grade D Grade D

Vermont Grade D Grade C Grade C

Wyoming Grade D Grade D Grade D

Alaska Grade F Grade D Grade D

California Grade F Grade F Grade F

2023 NATIONAL REPORT CARD | 33

State Trend 2017 Grade 2023 Grade Projected 2028 Grade

Connecticut Grade F Grade F Grade A

Delaware Grade F Grade C Grade C

District of Columbia Grade F Grade F Grade F

Hawaii Grade F Grade D Grade D

Massachusetts Grade F Grade F Grade F

Pennsylvania Grade F Grade C Grade C

Rhode Island Grade F Grade C Grade A

South Dakota Grade F Grade F Grade F

Wisconsin Grade F Grade C Grade C

Methodology

At the end of this report are State Fact Sheets, brief

overviews of how each state approaches personal finance

education in its public high schools. The Center’s research

includes detailed reviews of high school graduation

requirements, state academic standards for personal

finance education, and laws, regulations, and guidelines

that relate to how each state delivers personal finance

education in its public high schools. We also report on

each state’s policy regarding the teaching of personal

finance to students in grades Pre-K to 8.

As thorough as the Center’s researchers tried to be,

it is possible that some of the grades in this report

are based on incomplete or inaccurate information

and thus might be too severe or too lenient for a

particular state. We want the grades to be based on

the best information possible, and so we welcome

any corrections or additional data for future updates.

We encourage you to send any information that you

believe we should be made aware of to

2023 NATIONAL REPORT CARD | 34

Changes to the 2023 Report

from the Previous 2017 Report

The grading methodology used in our 2023 report is

basically unchanged from the previous 2017 report. What

has changed is what we are grading. In the past, we gave

each state a single grade based on its current public

policy on financial literacy education in high school. This

resulted in states getting grades based on the state policy

applied to the graduating class in the year the report was

issued. Sometimes the grade was based on what the state

planned to do in the future, that is, based on recent legal

or regulatory changes. So, a state that recently passed

a law requiring all students to take a financial literacy

course would receive a grade A in the report, even if that

requirement would not be fully implemented for another

four years. The grade was given before the policy change

was fully implemented. After doing state financial literacy

policy research for more than a decade, it became clear

that occasionally states modify, weaken, or revoke policies

before they are fully implemented. To avoid the risk of

unfair state grade inflation, our report now gives the

following two distinct grades:

• Class of 2023 Grade: This grade is given to

a state for its current public policy on personal

finance education in public high schools for the

graduating Class of 2023.

• Projected Grade: This grade is given to a state

for its new public policy that has not yet been

fully implemented for a graduating high school

class. This grade makes assumptions based on