Visa Consulting & Analytics

Assessing the Role of Biometrics

in Advancing Financial Inclusion

© 2019 Visa. All Rights Reserved.

2

© 2019 Visa. All Rights Reserved.

Executive Summary

Biometrics technology has received widespread attention as a means of enhancing convenience and security of

digital payments. Many observers have highlighted potential benefits of using biometrics technology to advance

financial inclusion.

This paper analyses how, and under what conditions, biometrics can facilitate access to and usage of financial

services for lower income and unbanked populations. It examines the technology’s potential and its present limits

to advancing financial inclusion. The paper also highlights the policies and regulations that are necessary to enable

biometrics to play a beneficial role in financial inclusion.

Introduction

Measuring biometrics against five key features of

financial inclusion (convenience, trustworthiness,

accessibility, affordability, and usefulness) indicates that

the technology holds considerable potential for helping

to reach unbanked populations. Biometrics may enhance

convenience of financial services, for instance by reducing

reliance on cards, PINs or passwords. They may improve

trustworthiness, by re-assuring account holders that

they have sole access to their accounts – an especially

important issue for women. In some cases, biometrics

may help make financial services more accessible for

marginalized populations by providing solutions to

those with limited access to identity documents. Where

biometrics are tied to a centralized identity or biometric

database, they may help make it more affordable and thus

scalable for financial service providers to reach the under-

banked.

At the same time, deployment of biometrics can present

challenges or trade-offs. For instance, biometrics can be

expensive to deploy, with a high cost for providers to

enroll customers, and to record and store their biometric

data. Intermittent connectivity in regions with limited

infrastructure and hardware failures due to dust and

humidity can challenge reliability, and thus confidence

in the system. And, users around the world are

increasingly concerned about privacy, security,

and control over their data.

As governments, industry players, international

organizations, community groups and others come

together to advance financial inclusion, stakeholders

may come to different conclusions about the optimal

role for biometrics in supporting financial inclusion

objectives in specific contexts. Yet, biometric solutions

play a beneficial role in leveraging technology to help

address persistent and emerging challenges in financial

inclusion. Cross-sector dialogue on these challenges

and opportunities can help smooth implementation

of potential solutions and provide avenues to explore

public-private partnerships to meet the needs of

unbanked populations.

The term biometrics refers to the unique,

intrinsic characteristics that can be used to

identify or verify the identity of an individual.

Biometrics are categorized as either physical

or behavioral. Physical biometrics are individual

biological or physiological traits such as

fingerprints, facial characteristics, and iris

patterns. Behavioral biometrics are traits that

describe how individuals operate or function,

such as a person’s keystroke patterns or gait.

3

Terminology

Visa’s definition of financial inclusion is that everyone, everywhere

is able to use secure, convenient and affordable payment and

financial services to meet everyday needs and long-term goals.

This denition rests on ve key features:

Convenience

- Once an underserved

consumer accesses an affordable and

useful financial service, it must be

convenient to activate and continue using.

This typically means that financial services

must be available to consumers during their

normal routine and require only minimal

time to maintain.

Trustworthiness - Financial services must

provide a basic level of security and an

assurance of privacy to support ongoing

trust and financial value.

Accessibility - Financial services must

be readily available. Individual consumers

and business owners must be able to

reach a financial service and use it with

the knowledge and tools they already

possess or can easily obtain.

Aordability - Financial services for

unbanked populations must be relatively

affordable when compared to existing

options such as cash, bartering, and

traditional forms of credit and insurance,

while offering providers a rate of return

that facilitates sustainability and investment.

Usefulness - While local context and

cultural norms are important considerations,

generally the financial needs of the unbanked

are no different than those of the banked.

These needs include the following: ability to

make payments, means to save, capacity to

acquire credit, and mechanism for insurance.

4

© 2019 Visa. All Rights Reserved.

Biometrics for Financial Inclusion

Based on current applications, biometrics technology is serving as a useful tool to support the five

criteria for financial inclusion.

Convenience

Biometrics can enhance the

convenience of financial services.

For those who are new to the use of

formal financial products, using familiar

and intuitive biometrics like fingerprints can help foster

comfort with financial transactions. Applying the finger to

a scanner can make formal due diligence processes feel

less foreign or alienating, compared to having to present

a formal identity card for inspection or a signature for

review. Biometrics can help populations with low levels

of literacy better navigate typical financial processes, for

example reducing the instances of written forms to be

completed.

Inconveniences such as resetting forgotten passwords

or exposed PINs can quickly become major barriers, and

are eliminated with biometrics. Biometrics may also be

appealing to young people, who are often more

tech-savvy than other segments of the unbanked

population, and may help draw them into the formal

financial sector.

Biometrics, however, may themselves impose barriers

to some of the very population financial inclusion seeks

to serve. For low income people who are day laborers

and farmers, degraded fingerprints may make the most

common biometric identifier unavailable to them.

Older people may experience similar degradation

of fingerprints. Biometrics may also impose barriers

for populations with physical limitations, e.g., impaired

eyes and fingers with limited mobility. Providing

consumers with multiple authentication choices,

such as secondary biometric modalities and/or

more traditional authentication mechanisms

1

,

can help accommodate users with special needs.

Convenience and use can be further enhanced

by tailoring biometric systems to the desired user

population and geography, e.g., including local

dialects in voice recognition systems, and ensuring facial

recognition algorithms include female features and skin

tones of minority groups. Tailored approaches like these

can help improve financial inclusion by broadening the

user base, including under-represented groups

and communities.

1

“Biometric Authentication in Payments: Considerations for Policymakers.” Promontory Financial Group. November 2017. http://promontory.com/payment_biometrics/

5

Trustworthiness

Biometrics can increase trust in the

formal financial ecosystem among

under-banked populations. A

biometric identity is attached to an

individual in a way that no other form of identification

can be: it cannot be lost or forgotten. Moreover, people

of all economic and educational levels share an intrinsic

understanding that biometrics are inherent to who

an individual is – for example, my fingerprint is me.

This basic fact can create trust in a process, even if the

process is new or not well understood.

Use of biometrics may also help make moments of

authentication or access less susceptible to cultural

or legal discrimination against certain populations, as

may occur when a bank teller, financial service provider,

or official reviews a piece of identification that reveals

name, gender, address or, in some cases, ethnicity.

Another aspect of trust stems from security and privacy.

In some situations, biometrically-based access can offer

consumers increased privacy, ownership security, and

protection of their financial assets – which may incent

account opening and confer other socio-economic

benefits. This can be especially beneficial for women in

certain socio – cultural contexts. For example, biometrics

can empower and protect women in situations

when customs dictate that a man has a right to his

wife’s property, or that of a relative’s widow. Because

biometrics are tied to a particular individual, they can

aid providers in protecting account privacy, even in the

presence of adverse societal or communal pressures.

As part of a layered, risk-based approach to payments

security, biometrics can help ecosystem players enhance

security while reducing friction at the point of sale.

With risk-based authentication, ecosystem players may

choose to take a selective or segmented approach;

instead of requiring all transactions to be actively

authenticated, irrespective of their characteristics,

advanced authentication (such as biometrics) may be

reserved for the small proportion of transactions that

look suspicious. Low-risk transactions may require more

limited authentication, removing friction and creating

a more seamless customer experience. This approach

allows financial system entities, including those that

target unbanked populations, to focus limited resources

on transactions with the greatest risk.

6

© 2019 Visa. All Rights Reserved.

At the same time, trust-related considerations around

the use of biometrics are complex. For example,

while individuals may be open to providing biometric

information for enhanced convenience, they may

be uncomfortable with a requirement to share this

same data. This has implications when enrollment of

biometrics in a state-run digital identity program is a

requirement for receipt of social services and other

benefits. It may also be a concern if the request comes

from a private provider that does not provide consumer

choice or alternative identification means.

Additional considerations around trustworthiness

include: where biometric data is stored (in a centralized

repository such as at a bank or government agency, or

in a decentralized location such as on a consumer card);

who is responsible for the security of that data; what

information is transmitted to whom and when; and, how

consumer consent is obtained.

For some users, local biometric storage on a card or

device is an attractive alternative to centralized storage

as it provides users with more direct control over their

biometric data. Yet, this approach has trade-offs for costs,

and can raise other data storage and security issues.

Other individuals may have questions about security

while using biometrics, e.g., questions around spoofing,

or trying to fool a biometric authentication system using

a fingerprint replica, facial photo, or other mimicked

biometric. The biometrics industry is investing in a variety

of techniques to make it harder for fraudsters to spoof a

fingerprint, photo, or voice and use it to commit fraud.

For example, cameras are now capable of registering

micro-movements to distinguish between a real user

and a photo of the user. “Liveness” checks are available

or coming to many biometrics systems. Continued

investments in this area can help to mitigate fraudulent

usage and also increase trust in biometric systems.

Case Study: Opportunity International in Malawi

Opportunity International, one of the first organizations

to roll out biometrics-supported banking for low-income

customers, has facilitated fingerprint-based customer

registration and verification in Malawi since 2003.

Following the product launch, Opportunity International

noted an uptick in women opening accounts.

At one point, Opportunity International reported a client

base that was approximately 84 percent female, far greater

than the female participation rate for the overall financial

system.

2

And, while the cost of the product was relatively

high for the consumer, Opportunity International came

to understand that the privacy and trust engendered

by biometrics played an important role in the product’s

success, and reach to unbanked people.

The account cards issued to customers incorporated

biometric fingerprint verification. This enabled local bank

tellers and managers to resist peer and communal pressure

to provide male relatives with access to women’s accounts,

and assured women that they had full ownership of

their savings. This also removed some of the barriers for

clients with low levels of literacy and numeracy since the

fingerprint verification replaced other common forms of

verification such as a written signature or a pin number.

For the bank, incorporating biometrics was complicated

by connectivity issues, hardware degradation, and the lack

of a national digital identity program. All of these increased

costs for Opportunity International, highlighting factors that

affect scale and sustainability, and could discourage other

entities from offering similar products in other markets.

2

Based on discussions between Visa staff and Opportunity International representatives in May 2018.

7

Accessibility

Meeting financial industry identity due

diligence requirements can be time-

consuming and complex for consumers,

who may be asked to provide multiple

forms of identity or to document identifying elements such

as physical address or birth records. These requirements can

be particularly challenging for marginalized populations and/

or itinerant communities.

Biometrics can make financial services more accessible to

individuals when financial service providers are able to tap

into a centralized database of biometrics information to verify

a customer’s identity. Biometrics can also help to temporarily

provide a solution for incomplete or missing identity

documentation. For example, biometrics can help create a

single, continuous identity by acting as a benchmark against

which existing records, once recovered, can be compared.

3

In this way, biometrics may provide unique identification

for refugees who have lost access to some or all of their

documentation in the process of being displaced.

Typically, during enrollment, biometrics ar

e registered and

linked to a formal identity. Biometrics are not used to register

an identity – you are you – in the first place, which is defined

by national law. Especially where serious concerns about

security or fraud exist, biometrics are generally not accepted

as sole proof of identification.

Terminology

Enrollment is when biometric data is

initially collected and registered and

linked to a formal identity.

Identication is when biometric data is

compared to enrolled data (previously

associated with an identifier) to establish

the identity of an individual.

Authentication refers to the process of

using a previously established identity

to validate that an individual is who

he or she claims to be. These terms

are increasingly important to financial

services, given the advent of Know Your

Customer (KYC) requirements as a tool for

countering money laundering and the

financing of terrorism.

Case Study: United Nations High Commissioner for Refugees (UNHCR)

The UNHCR has developed a biometric identity

management system to re-establish and preserve

identities among refugees. It reports that linking

biometrics to UNHCR’s existing registration data not only

improves efficiency, but also mitigates against refugees’

personal identities being lost, registered multiple times,

or stolen.

4

UNHCR is also using biometrics as a method to

re-establish identity – a prerequisite for accessing financial

services as well as receiving aid benefits – in cases where

displaced individuals have otherwise lacked a formally

registered identity or documentation, and were previously

registered by UNHCR.

5

3

Gelb, Alan and Anna Diofasi Metz. Identication Revolution: Can Digital ID Be Harnessed for Development? Center for Global Development. 2018.

https://www.cgdev.org/publication/identification-revolution-can-digital-id-be-harnessed-development

4

“Biometric Management Identity System: Enhancing Registration and Data Management.” UNHCR. 2015. http://www.unhcr.org/550c304c9.pdf

5

“Biometric Management Identity System: Enhancing Registration and Data Management.” UNHCR. 2015. http://www.unhcr.org/550c304c9.pdf

8

© 2019 Visa. All Rights Reserved.

Aordability

Customer identity verification is

fundamental to maintaining security

and trust in the financial services

ecosystem, but it is also a significant cost

to financial service providers. These costs can be important

considerations for providers evaluating products for low-

income customers as these products typically have tight

profit margins and target audiences who are not able to

absorb sizeable pass-through costs.

Where there is a centralized repository of identity

information that includes biometrics, biometric

authentication can shift or reduce the cost of identity

verification, leading to lower-cost financial services for

consumers. Typically, a national government operates

this type of centralized database, and permits trusted

third parties such as financial service providers to verify

a customer’s identity using his or her biometric data.

Whether publicly or privately run, a centralized identity

database can reduce total costs by eliminating expensive

duplicate enrollment processes. It may also redistribute

costs from financial service providers to a government,

or enable the sharing of costs among public and private

entities. This redistribution or sharing of costs may improve

the economics of designing and delivering products that

reach underserved populations. Not all countries have

national identity programs, however, and not all include

biometric information, with governments deterred by

the cost of enrolling biometrics information, security

challenges, privacy considerations, and other factors.

Governments use biometric authentication in diverse

programs, such as to deliver social benefits or pensions,

because it can reduce fraud and delinquency, lower

costs, and enhance efficiency. For example, according to

the CEO of the South African Social Security Agency, the

requirement for biometric authentication for delivery of

benefits resulted in the “elimination of ghost accounts,

duplications, and other irregularities…creating annual

savings of approximately US$157 million.”

6

Program design can also affect affordability. Creating

a closed loop system to enroll and stor

e biometric

information may provide a government agency or financial

service provider with a quick way to implement a new

program. However, the sponsoring entity bears the total

cost, without the benefit of economies of scale offered by

a shared database. This design may affect the affordability

of program-issued products and services. If the program

requires that biometric information be stored on a card,

a set-up that can be advantageous in locations with

unreliable connectivity, the expensive enrollment process

must be repeated each time a card is lost.

Finally, use of biometrics introduces different operational

costs to ecosystem players. For instance, in the experience

of Opportunity International (OI), an organization that

provides financial solutions and training to low-income

populations, physical infrastructure related to the use of

biometrics is relatively affordable (OI has used small devices

that can be plugged in to existing terminals), but highly

durable devices that can withstand heavy use or extreme

conditions are more expensive.

7

Outreach to consumers,

connectivity, training, and additional staff all add to costs.

6

Riley, Thyra A., and Anoma Kulathunga. 2017. Bringing E-money to the Poor: Successes and Failures. Directions in Development.

Washington, DC: World Bank. doi:10.1596/978-1-4648-0462-5. License: Creative Commons Attribution CC BY 3.0 IGO

http://documents.worldbank.org/curated/en/340701503568346911/pdf/119070-PUB-PUBLIC-PUB-DATE-8-22-17.pdf

7

Based on discussions between Visa staff and Opportunity International representatives in May 2018.

9

Usefulness

Biometrics may contribute to the overall

usefulness of financial services to an

underserved consumer or small business

owner. Usefulness refers to how well a product meets the needs

and underlying goals of the user: for example, the ability to make

payments without leaving one’s self-run store or standing in

line for hours; safely saving for school fees; securing long-term

financing to invest in a business; or, obtaining insurance to

protect against frequent flooding of crops.

Usefulness is typically achieved in the design of the product or

service itself. However, over time, a common, secure biometric

authentication process might be leveraged as an efficient

way to migrate consumers or small businesses from low value

products to higher value services that meet their long-term

goals (such as long-term financing) with minimal transaction

costs or requirements.

Case Study: Pakistan’s National Database and Registration Authority

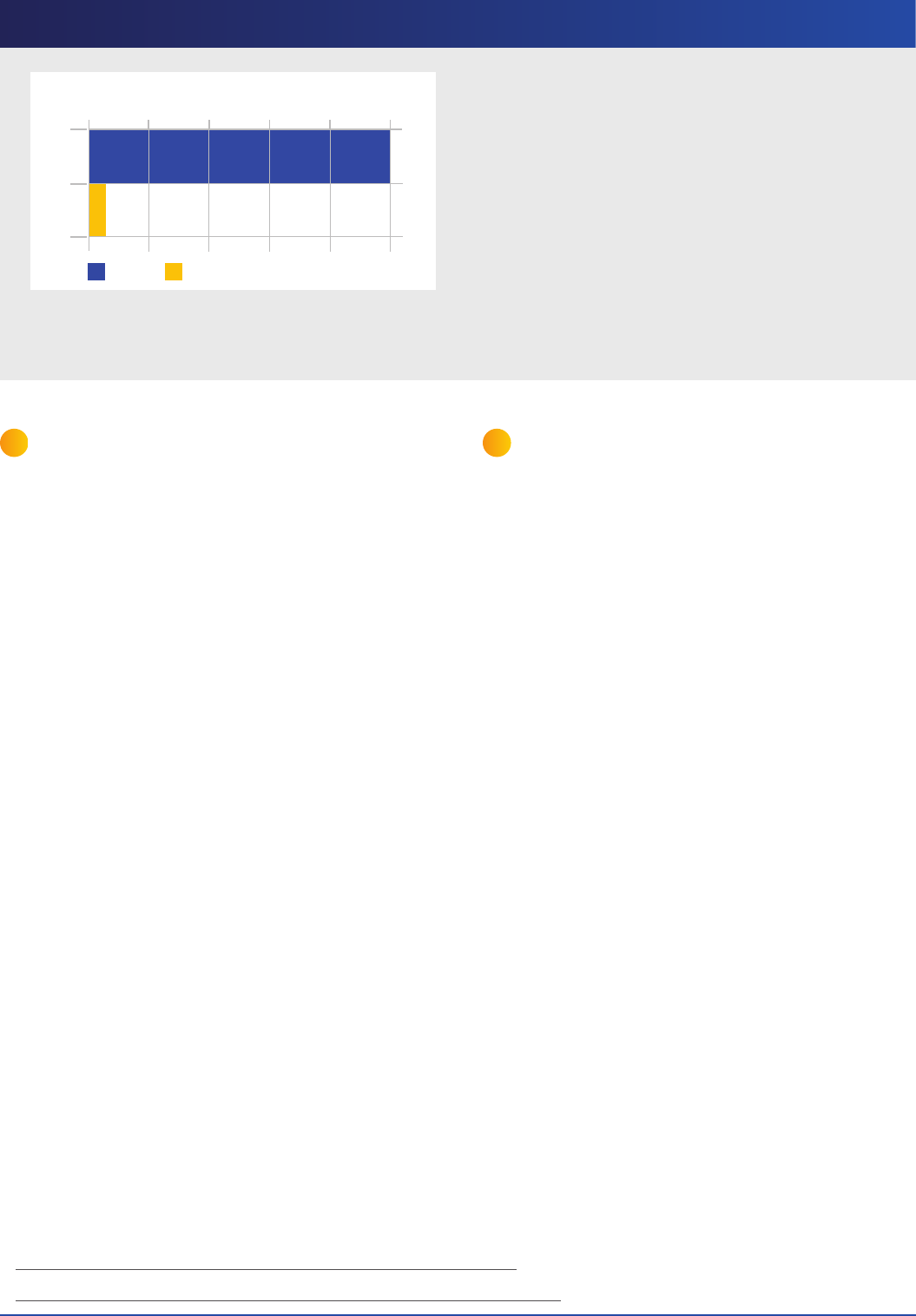

Mobile wallet accounts 2015

15m

10m

5m

2008m 2015m

In Pakistan, the National Database and Registration

Authority’s (NADRA’s) risk-based, tiered approach to

regulations around bank account opening and its collection

of biometric information helped pave the way to a more

convenient account opening process.

Starting in 2008, Pakistan’s NADRA began to collect

fingerprints of individuals registered with the national

identity program. NADRA’s use of biometrics made

account opening more convenient for consumers thanks

to branchless banking regulations that required only a

biometric fingerprint scan at agent locations, instead of a

branch visit, to open the lowest level mobile wallet. These

regulations were revised in 2016 to allow users the ability to

establish a mobile wallet account through a biometrically

verified SIM authenticated by the NADRA database.

In 2015, the total number of mobile wallet accounts tripled

from 5 to 15 million, with approximately 50 percent of new

registered mobile wallet accounts opened using biometric

authentication.

8

8

Rashid, Naeha and Stefan Staschen. “Unlocking Financial Inclusion Using Biometrically Verified SIMs,” Consultative Group to Assist the Poor (CGAP) Blog. July 26, 2016.

This translation was not created by CGAP and should not be considered an official translation. CGAP shall not be liable for any content or error in this translation.

www.cgap.org/blog/unlocking-financial-inclusion-using-biometrically-verified-sims

10

© 2019 Visa. All Rights Reserved.

Policy Enablers

The following policies and regulations can enable biometrics to play a beneficial role in advancing digital

payments and financial inclusion in sustainable, scalable and responsible ways, alongside other national goals.

1 National and Digital Identity Frameworks

Biometrics hold potential to advance financial inclusion, but depend on a national legal identification framework to answer

the primary question of ‘who are you’ to which biometrics are then tied. Policymakers can enable biometrics to help

advance financial inclusion and social welfare goals by strengthening the national identification framework so that it covers

all citizens, if it does not already do so. Including possibilities for self-identification or peer-identification in specific, limited

circumstances can boost financial inclusion possibilities among populations who lack formal birth records or permanent

addresses, for example. Establishing multiple ‘on ramps’ for citizen enrollment in a biometric registry is also helpful.

Shared registries of identity information, including biometrics, may reduce the costs faced by financial institutions in

meeting their identity due diligence requirements, thus enabling the offering of low-cost products tailored to underserved

people and businesses. There are various models, such as government run and federations including private sector. In these

and other models, allowing trusted financial service providers access to the database eliminates the need for each provider

to establish their own proprietary database. This can improve speed and efficiency of account opening, and thus the overall

experience for consumers. Combined, these factors can foster on-going innovation and interoperability, and help financial

service providers reach scale more quickly.

2 Data Security and Privacy Policies

Policymakers can further support the benefits of

biometrics by strengthening their data security and

privacy laws to increase confidence in the formal

financial sector in general and in biometric usage

specifically. Strong, harmonized standards and

requirements on the ways in which public and private

entities register, store, secure, transmit, manage and

share biometric data can help avoid unintended

negative consequences in the provision of financial

services to low-income populations. For example,

what data needs to be shared and transmitted to

achieve identity verification goals? Would sharing

an assertion of a data match be sufficient to meet

authentication goals instead of sharing actual biometric

data? Industry-led standards for secure data storage and

transmission, developed with cross-sector input, can

improve security practices for handling consumer data

while enabling interoperability (i.e., the ability of systems

or devices to exchange information and operation in

conjunction with each other).

Harmonized, global standards can also encourage interoperability and reduce costs. Such standards do not necessitate

a certain form of biometric identification but instead require overall standards that ensure interoperability, privacy, and

security. Common standards can facilitate economies of scale, helping individual providers feel confident in receiving

financial returns on their investments and therefore encourage the creation of new and innovative biometric-enabled

products.

9

Implementing already-established global standards can increase efficiencies, ease the burden on domestic

entities to create and maintain their own standards, and ensure interoperability across national borders. By leveraging

global standards, domestic investment can support more local product development and financial inclusion efforts.

9

“Biometric Authentication in Payments: Considerations for Policymakers.” Promontory Financial Group. November 2017. http://promontory.com/payment_biometrics/

11

Case Study: India’s Aadhaar

Onboarding costs

$0 $1 $2 $3 $4 $5

2009 2008

Year

New

Previous

By some estimates, services of Aadhaar, India’s identity

database launched in 2009, have reduced the cost of

onboarding a customer from around US$5 for commercial

banks to US$0.07 for the new “payments banks” set up

to increase financial inclusion.

10

These figures indicate

that, through Aadhaar’s biometrics, some financial

institution operational expenses have been transferred

to the government, offsetting costs for banks and

changing the economics of expanding their reach to

the financially excluded.

However, the savings from Aadhaar remain contested.

Banks and other entities must pay a fee to use Aadhaar’s

authentication services, and some banks - particularly small

ones serving low-income, rural populations - have issued

complaints arguing that these fees are not affordable.

11

3

T

elecommunications and

Financial Infrastructure

Extensive, reliable infrastructure is key to advancing

financial inclusion and social impact through digital means.

Using biometrics generally requires robust infrastructure

including electricity and internet or phone connectivity

with wide coverage. For example, biometric scanners may

require electricity connection or battery power. Connecting

to a centralized identity database to authenticate biometric

information typically requires communications connectivity.

Erratic, slow, or expensive connectivity can discourage

usage. A number of innovative products have been

designed to overcome the lack of reliable electricity and

connectivity. These include products that store biometric

information on a beneficiary or consumer card. During a

transaction, scanned biometric information is compared

to the verified data stored on the card. While effective, this

approach has trade-offs in terms of costs and ease of use.

Beyond the cost of establishing a common registry there

are many infrastructure costs associated with biometric

identification and authentication. Examples include:

upgrades to point-of-transaction terminals to enable

biometric data capture, dissemination of secure cards

that store biometric data, and maintenance of reliable

connectivity between a central identity registry and

individual financial service providers.

As the cost of these requirements is compounded in

rural settings, investments that improve the overall

infrastructure of a country may support greater adoption

of biometric-based identification systems and greater

financial inclusion.

4 Government Use and

Promotion

Policymakers can increase the scale of biometric

authentication by tying certain government services

to centralized identity databases. For example, many of

the most impoverished individuals rely on government

or international agency aid to meet their daily needs.

A number of governments have already introduced

biometric verification as a requirement to receive

such benefits. This can help introduce consumers to

biometrics and financial services, and can jump start the

use of biometrics in markets.

The design of such a program has implications for

scale and cost, and the number of additional financial

services that can be layered on to biometric-enabled

accounts. Tying social and civic services such as

voting, land and property registration, and mass

transit ticketing to biometric authentication can

further increase demand and scale. At the same time,

linking core public services and benefits programs to

biometrics could lead to exclusion if non-biometric

options are not also available as an alternative

authentication mechanism. Without multiple on-ramps

available to establish one’s biometric identity, those

without access to such a system may find themselves

further dis-enfranchised and marginalized.

10

Gelb, Alan and Anna Diofasi Metz. Identication Revolution: Can Digital ID Be Harnessed for Development? Center for Global Development. 2018.

https://www.cgdev.org/publication/identification-revolution-can-digital-id-be-harnessed-development

11

Saha, Manojit. “Banks baulk at high cost of Aadhaar verication.” The Hindu. June 16, 2018.

https://www.thehindu.com/news/national/banks-baulk-at-high-cost-of-aadhaar-verification/article24175437.ece

12

© 2019 Visa. All Rights Reserved.

5

Consumer Protection

Strong laws and regulations that protect an individual’s

right to his or her account and biometric data are

essential. At the user level, individuals, particularly women

in countries with a history of patrimonial control, need to

be confident that their relatives or others will not be able

to access their savings or conduct transactions without

their consent. The very personal and individual nature of

biometrics can enhance certainty in this area. Even this

powerful technology must be backed up with a sound

legal framework and trustworthy jurisprudence.

Regulations to ensure consumer protection, such

as requirements for clear disclosures, can help avoid

unintended negative consequences in the provision

of financial services to low-income populations. By

anticipating implementation challenges, policymakers

may be able to avoid creating an inequitable situation

in which traditionally underserved populations are

forced to surrender a level of privacy enjoyed by more

advantaged populations.

6

P roportional, Risk-Based

Financial Regulations

Creating proportional regulatory frameworks around

Know Your Customer (KYC) requirements can help to

protect the financial ecosystem, while also supporting

financial inclusion goals. Traditional KYC verification

requirements such as multiple forms of identification

and proof of a physical address are often difficult for low

income, unbanked and marginalized individuals to provide.

Implementation of a tiered KYC regulatory framework

can enable individuals to open a simple – yet formal –

transactional account with basic identity information.

The simplest tier of basic accounts may permit a tailored

threshold of initial identification to obtain a prepaid card

or open an account. In exchange, they may incorporate

a low maximum account balance and limited monthly

transactions, parameters which are typically sufficient

to meet the relatively basic needs of the previously

unbanked. In fact, allowing for a zero initial balance can

help achieve maximum accessibility.

In some cases, governments may allow an unbanked

individual to open a limited transaction account throughan

agent, presenting just a fingerprint or iris to establish

identity. In other cases, financial service providers may

leverage a centralized identity registry to verify the

identity of a new customer. Within tiered KYC frameworks,

biometrics are a tool that banks or governments can

incorporate toease and expedite onboarding processes

– especially for lower-tier accounts geared toward low-

income and unbanked individuals.

7

Branchless Banking, Mobile Money

and Other Innovations

Biometrics are often most effective in supporting

financial inclusion when combined with other

innovations such as branchless banking and mobile-

based banking, as well as banking through post offices.

With supportive regulations, financial service providers

may enable agents to use biometrics as a secure,

convenient method for authenticating consumers,

further driving reach and scale.

Allowing different models of branchless banking

provides flexibility for local providers to develop market-

appropriate solutions. Encouraging new entrants in

the financial services area, such as financial technology

(fintech) firms or other service providers, can help

expand the types of solutions available to underserved

populations. This may merit some initial regulatory

flexibility, commensurate with associated risk. More

generally, ensuring that non- financial institutions and

new entrants offering branchless banking are subject to

the same prudential regulations as financial institutions

can provide consumers with a baseline of security and

protections across the ecosystem. Looking ahead, systems

that use biometrics in conjunction with other emerging

technologies may offer further potential to build scale.

13

8 Training and Financial Literacy

Some low-income, under-banked populations have low

levels of financial literacy, which can act as a barrier to

participation in the formal financial system. Educational

efforts among consumers, merchants, financial institutions,

technology providers, and independent agents are critical –

especially for micro and small merchants who often provide

points of access for low-income consumers. Training in

using biometric readers – via smart phones, dedicated

readers, ATM adaptors, or other devices – can support

adoption from a practical sense. Educating consumers on

methods to use and protect their biometric data can help

grow trust in new forms of authentication.

9 Political Leadership and Coordination

Political leadership is critical to successfully leveraging

biometrics to increase financial inclusion. Because

scale is so important for the ultimate success of

biometrics to achieve greater financial inclusion,

coordination across government agencies can help

maximize investment, leverage existing human and

physical infrastructure, build interoperability, and

avoid competing standards. Addressing biometric

usage and program design as part of national financial

inclusion strategies or policies can also help drive

expanded use.

Case Study: South Africa’s Social Grant Distribution Program

In 2012, the South African Social Security Agency (SASSA) consolidated multiple systems for distributing social grants into a

centralized program. As part of the consolidation, the SASSA reregistered recipients with their biometrics. Outside observers

noted that the use of biometrics helped to reduce fraud and delinquency,

12

but in some cases, the financial products offered

through the grant delivery system reportedly did not align with the financial goals of the targeted population. Thus, while

effective at eliminating fraud, incorporating biometrics did not automatically address the usefulness of the underlying

products (e.g., product design and delivery).

Conclusion

Biometrics technology holds sizeable potential as a tool to advance financial inclusion, contributing to the convenience,

trustworthiness, accessibility, affordability, and usefulness of financial services for underserved populations. However, biometrics are

not a stand-alone solution to all financial inclusion challenges. Considerations around consumer protection, infrastructure, and other

issues factor into individual government decisions about how and when to leverage biometrics to drive financial inclusion forward.

The practical application of biometrics to the financial ecosystem is built on a complex foundation of policy enablers. Biometrics can

be most impactful when incorporated as part of broader financial inclusion strategies, and in contexts where governments take a

principles-based, innovation -friendly approach to regulation and policy making.

12

Gelb, Alan and Anna Diofasi Metz. Identication Revolution: Can Digital ID Be Harnessed for Development?

Center for Global Development. 2018. https://www.cgdev.org/publication/identification-revolution-can-digital-id-be-harnessed-development

14

14 Visa Consulting & Analytics

Visa

The terms described in this material are provided for discussion purposes only and are non-binding on Visa. Terms and any proposed commitments or obligations are subject to and contingent

upon the parties’ negotiation and execution of a written and binding definitive agreement. Visa reserves the right to negotiate all provisions of any such definitive agreements, including terms

and conditions that may be ordinarily included in contracts. Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes

only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. neither makes any warranty or representation as to the completeness or

accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The Information contained herein is not intended

as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required. When implementing any new strategy or practice,

you should consult with your legal counsel to determine what laws and regulations may apply to your specific circumstances. The actual costs, savings and benefits of any recommendations,

programs or “best practices” may vary based upon your specific business needs and program requirements. By their nature, recommendations are not guarantees of future performance or results

and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. All brand names, logos and/or trademarks are the property of their respective owners, are used for

identification purposes only, and do not necessarily imply product endorsement or affiliation with Visa.

© 2019 Visa. All Rights Reserved.