American

Patients First

The Trump Administration Blueprint to Lower Drug Prices

and Reduce Out-of-Pocket Costs

MAY

The U.S. Department of Health & Human Services

Hubert H. Humphrey Building

200 Independence Avenue, S.W.

Washington, D.C. 20201

Toll Free Call Center: 1-877-696-6775

American

Patients First

The Trump Administration Blueprint to Lower Drug Prices

and Reduce Out-of-Pocket Costs

MAY

One of my greatest priorities is to reduce

the price of prescription drugs. In

many other countries, these drugs cost

far less than what we pay in the United

States. That is why I have directed

my Administration to make fixing the

injustice of high drug prices one of our

top priorities. Prices will come down.”

— PRESIDENT DONALD J. TRUMP

“

| 4 | American Patients First

| 5 |

T S H H S

W, D.C.

Message from the Secretary

THE UNITED STATES is first in the world

in biopharmaceutical investment

and innovation. Combining our free

market system and generous pub-

lic investment made America home

to the first chemotherapy treat-

ments for cancer, the first effective

treatments for HIV, the first cure

for Hepatitis C, and now, the first

therapies that turn our own immune

systems against cancer.

But too often, this system has not

put American patients first. We have

access to the greatest medicines in

the world, but access is meaningless

without affordability.

When it comes to the cost of pre-

scription drugs, our healthcare sys-

tem faces four major challenges: high

list prices for drugs; seniors and gov-

ernment programs overpaying for

drugs due to lack of the latest nego-

tiation tools; high and rising out-of-

pocket costs for consumers; and for-

eign governments free-riding off of

American investment in innovation.

Alex M. Azar II

These problems have often been

discussed, but gone unaddressed.

Under President Trump, that has now

changed. This blueprint is a historic

plan for bringing down the high price

of drugs and reducing out-of-pocket

costs for the American consumer.

The time to act is now: Not only

are costs spiraling out of control, but

the scientific landscape is changing

as well. Securing the next generation

of cures for the next generation of

American patients will require radi-

cal reforms to how our system works.

Our blueprint will bring immediate

relief to American patients while also

delivering long-term reforms.

The men and women of the

Department of Health and Human

Services (HHS) are looking at every

facet of HHS’s programs, author-

ities, and spending. Working with

our partners in the private sector,

we will turn this vision into action,

and thereby improve the health and

well-being of every American.

CONTENTS

I. Trump Administration Blueprint in Brief............................................................9

II. What’s the Problem? .............................................................................................. 12

III. Trump Administration Accomplishments on Drug Pricing ........................18

IV. Responding to President Trump’s Call to Action .......................................... 23

V. Further Actions Under Review and Opportunities for Feedback .................26

| 8 | American Patients First

I. Trump Administration Blueprint In Brief | 9 |

I. Trump Administration

Blueprint in Brief

HHS has identified four challenges in the

American drug market:

• High list prices for drugs

• Seniors and government programs overpaying for

drugs due to lack of the latest negotiation tools

• High and rising out-of-pocket costs for consumers

• Foreign governments free-riding o of American

investment in innovation

Under President Trump, HHS has proposed a comprehen-

sive blueprint for addressing these challenges, identify-

ing four key strategies for reform:

• Improved competition

• Better negotiation

• Incentives for lower

list prices

• Lowering out-of-pocket costs

HHS’s blueprint encompasses two phases: 1) actions the

President may direct HHS to take immediately and 2)

actions HHS is actively considering, on which feedback is

being solicited.

| 10 | American Patients First

Increased Competition

Immediate Actions

• Steps to prevent manufacturer

gaming of regulatory processes

such as Risk Evaluation and

Mitigation Strategies (REMS)

• Measures to promote innovation

and competition for biologics

• Developing proposals to stop

Medicaid and Aordable Care

Act programs from raising prices

in the private market

Further Opportunities

• Considering how to

encourage sharing of samples

needed for generic drug

development

• Additional eorts to promote

the use of biosimilars

Better Negotiation

Immediate Actions

• Experimenting with

value-based purchasing

in federal programs

• Allowing more substitution

in Medicare Part D to address

price increases for single-

source generics

• Reforming Medicare Part D to

give plan sponsors significantly

more power when negotiating

with manufacturers

• Sending a report to the President

on whether lower prices on some

Medicare Part B drugs could be

negotiated for by Part D plans

• Leveraging the Competitive

Acquisition Program in Part B.

• Working across the

Administration to assess the

problem of foreign free-riding

Further Opportunities

• Considering further use of

value-based purchasing in

federal programs, including

indication-based pricing and

long-term financing

• Removing government

impediments to value-based

purchasing by private payers

• Requiring site neutrality

in payment

• Evaluating the accuracy

and usefulness of current

national drug spending data

I. Trump Administration Blueprint In Brief | 11 |

Incentives for Lower

List Prices

Immediate Actions

• FDA evaluation of requiring

manufacturers to include list

prices in advertising

• Updating Medicare’s drug-pricing

dashboard to make price increases

and generic competition

more transparent

Further Opportunities

• Measures to restrict the use of

rebates, including revisiting

the safe harbor under the Anti-

Kickback statute for drug rebates

• Additional reforms to the

rebating system

• Using incentives to discourage

manufacturer price increases for

drugs used in Part B and Part D

• Considering fiduciary status

for Pharmacy Benefit

Managers (PBMs)

• Reforms to the Medicaid Drug

Rebate Program

• Reforms to the 340B drug

discount program

• Considering changes to

HHS regulations regarding

drug copay discount cards

Lowering Out-of-Pocket Costs

Immediate Actions

• Prohibiting Part D contracts

from preventing pharmacists

telling patients when they

could pay less out-of-pocket

by not using insurance

• Improving the usefulness

of the Part D Explanation

of Benefits statement by

including information about

drug price increases and

lower cost alternatives

Further Opportunities

• More measures to inform

Medicare Parts B and D

beneficiaries about lower-

cost alternatives

• Providing better annual, or more

frequent, information on costs to

Part D beneficiaries

Insurance

Contract

Reimbursement for Consumers’ Rx

Share of Manufacturer Rebates

Consumers

Payers

Drug

Manufacturer

Pharmacies

Pharmacy

Benefits Manager

Formulary Agreement

Copayment

Network Agreement

PBM Agreement

Payment for

Dispensed Drugs

Formulary

Rebates & Other Fees

Premium

Drugs

Money

Contracting

Dispensed

Drugs

Prime Vendor Agreement

Shipped Bulk Drugs

Payment for

Wholesale Drugs

Distributor

Payment for

Wholesale Drugs

Shipped Bulk Drugs

Distributor Agreement

| 12 | American Patients First

II. What’s the Problem?

TODAY’S COMPLEX U.S. PHARMACEUTI-

CAL MARKET is characterized by high

and rising list prices, increasing

consumer out-of-pocket costs, and

a new era of high-cost drugs lacking

competition. Recent developments

and challenges in the market include

a business model built on opaque re-

bates and discounts that favor high

list prices, a generational loss of

patent exclusivity, the Affordable

Care Act’s taxes, rebates, and ex-

pansion of the 340B drug discount

program, expansion of internation-

al price controls, government pro-

grams lacking modern negotiation

tools, and changes in insurance ben-

efit design that shifted the burden of

rising prices to consumers.

i. A Recent Drug Pricing History

A Business Model Is Born

Thirty years ago, the majority of pre-

scriptions filled at retail pharmacies

were cash transactions. Over time,

however, health plans began to oer

drug coverage to compete for new

members, knowing the benefit could

be oered at relatively low cost.

But the complexity, price, and

benefits associated with prescrip-

tion drugs dramatically increased

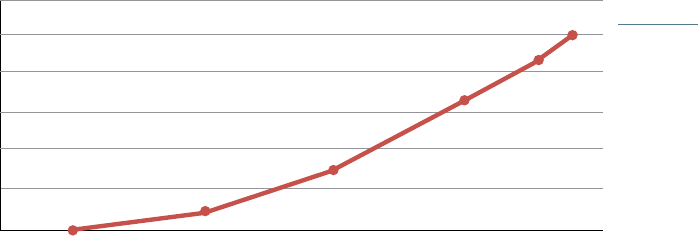

during the 1990s. U.S. drug spend-

ing grew between 11 and 17% per

year in the 1990s, as both prices and

volume soared.

1

As more complex and more ex-

pensive drugs came on the market,

FIGURE 1

ADAPTED FROM: Fein,

Adam. J., The 2016

Economic Report on

Retail, Mail and Specialty

Pharmacies, Drug Channels

Institute, January 2016.

BILLIONS

$

$

$

$

$

$

$

$

$-

$ GROWTH

Ii. What’s The Problem | 13 |

FIGURE 2

Retail Prescription

Drug Spend

SOURCE

CMS Oice of the Actuary

plans used formularies and copay-

ments to manage utilization and

keep drug costs low. But drug manu-

facturers paid rebates and discounts

to be oered as preferred drugs with

lower copays, and few drugs were

excluded from coverage.

In response to rising prices, private

health plans began to use closed for-

mularies to manage drug spending and

negotiate higher rebates and discounts

from drug manufacturers, holding

down increases in net drug prices.

Medicare and Medicaid Evolve

Medicare Part D introduced new dy-

namics to the market, as the first

truly insured prescription drug ben-

efit. Part D plan sponsors agreed to

accept the financial risk of providing

covered drugs to Medicare benefi-

ciaries in exchange for a per-benefi-

ciary, per-month payment.

Part D Plans negotiated ag-

gressively to keep premiums and

drug costs low for cost-conscious

Medicare beneficiaries, and the Part

D Plan Finder brought transparency

to premiums, formularies, and drug

prices. Private health plans outside

of Medicare adopted the tools used

by Part D plans, and Part D has in

large part succeeded at holding down

costs for seniors.

Meanwhile, drug spending has

been held down in the Medicaid pro-

gram by other tools. The program’s

rules prohibit the use of closed for-

mularies, but states use “preferred

drug lists” to negotiate larger sup-

plemental rebates than required by

law and limit the use of drugs made

by manufacturers not oering sup-

plemental rebates. As a result, drug

manufacturers have faced pressure

to oer higher rebates to main-

tain volume, or risk losing revenue

growth caused from being excluded

from markets.

A Generational Loss of Exclusivity

Around two decades after the boom

in drug spending of the 1990s, be-

ginning in 2012, the expiration of

patents of popular drugs—many

“blockbuster drugs” with U.S. sales

| 14 | American Patients First

of $1 billion or more—led to the loss

of over $140 billion in drug manu-

facturer revenue.

2

New generic com-

petition coincided with a slowdown

in new product development, creat-

ing additional financial pressure.

Aordable Care Act Taxes

and Rebates

The Affordable Care Act (ACA)

shifted costs and changed the

Medicaid Drug Rebate Program in

ways that may have driven up pric-

es for consumers, especially in the

private market.

The ACA also created a new tax

on branded prescription drug sales

to Medicare, Medicaid, and other

government health care programs.

Drug companies paid $2.5 billion in

2011, based on their market share

in government programs, a number

that increased to $4.1 billion in 2018.

The ACA also increased the manda-

tory Medicaid base rebate on brand

name drugs to 23.1%, and extended

the Medicaid rebate to drugs pur-

chased by Medicaid Managed Care

Organizations, more than doubling

the number of Medicaid covered

lives using rebate-eligible drugs.

3,4

This expansion of discounts may

have placed pressure on list prices by

forcing drug manufacturers to raise

prices overall.

340B Growth

The ACA also increased the demands

on the 340B drug discount program:

For one, it made critical access hos-

pitals and other hospital types el-

igible for the first time, while the

ACA’s Medicaid expansion made

more hospitals eligible by increas-

ing their Disproportionate Share

Hospital enrollment.

5

In fact, the number of 340B hos-

pitals grew from nearly 1,700 in 2011

to 2,479 in 2017. The number of

non-hospital covered entities, o-

site clinics or “child sites,” hospital

outpatient departments, and con-

tract pharmacies also grew substan-

tially.

6

As a result, discounted drug

purchases made by covered entities

under the 340B program totaled

more than $16 billion in 2016—

nearly a 400% increase in purchases

from 2009.

7

The additional billions

of dollars in discounted sales and the

cross-subsidization necessary may

have created additional pressure on

manufacturers to increase list price.

Growth in International

Price Controls

The global financial crisis in 2008

spurred austerity measures in

most European countries, includ-

ing more aggressive use of existing

drug price controls. Between 2010

and 2011, 23 countries implement-

ed 89 distinct measures to contain

government spending on prescrip-

tion drugs. Most used their sin-

gle-payer healthcare systems to

impose drug price controls along-

side increased copayments, val-

ue-added tax rates on prescription

drugs, and other measures.

8

In 2013, the World Health

Organization published a paper de-

Ii. What’s The Problem | 15 |

scribing the growing use of exter-

nal reference pricing, or the prac-

tice of using the price of a medicine

in one or several countries to derive

a benchmark or reference price for

the purposes of setting or negotiat-

ing the price of the product in a giv-

en country.

9

Every time one country

demands a lower price, it leads to a

lower reference price used by oth-

er countries. Such price controls,

combined with the threat of market

lockout or intellectual property in-

fringement, prevent drug compa-

nies from charging market rates for

their products, while delaying the

availability of new cures to patients

living in countries implementing

these policies.

ii. Where We Are Today

Industry Impact

The loss of patent exclusivity on suc-

cessful products, new ACA taxes, and

requirements to extend higher re-

bates and discounts to a markedly in-

creased Medicaid and 340B popula-

tion created an estimated $200 billion

of downward pressure on pharma-

ceutical industry revenues—during

a five-year period when innovation

was decreasing. International price

controls and delayed global product

launches exacerbated the problem.

Absent new products to launch

and the ability to increase revenue

through volume, and in the face of

a more sophisticated PBM industry

demanding higher rebates and re-

stricting access to markets, the in-

One in seven

employees, and

a growing number

of people with

individually-

purchased

insurance, now

have a separate

drug deductible.

dustry turned to its remaining tool

to drive growth: increasing price.

Prices soared on certain advanced

small molecule drugs and new spe-

cialty drugs. Meanwhile, PBMs ex-

ploited new utilization management

tools and “price protection” con-

tracts to extract even higher rebates,

further widening the gap between

list and net prices.

Each increase in list prices sat-

isfied the drug industry’s need to

grow revenue and increased admin-

istrative fees paid to PBMs, but also

boosted the prices paid by payers

and, especially, consumers.

Lack of Modern Negotiation Tools

in Government Programs

Private health plans in non-govern-

FIGURE 3

List Price vs.

Net Price

SOURCE

Medicine Use and Spending in

the U.S.; A Review of 2017 and

Outlook to 2022. April 19, 2018

Retai Net

Retai Gross

330

310

290

270

250

Biions ($)

230

210

| 16 | American Patients First

ment programs use aggressive formu-

lary management tools to negotiate

better deals for high-cost drugs dis-

pensed in pharmacies. Private health

plans are also presently experimenting

with competitive acquisition and utili-

zation management of drugs adminis-

tered in physicians’ oces.

Medicare rules limit the ability of

Part D plans to use these tools, mak-

ing it harder for plans to negotiate as

eectively for drugs, particular high-

cost drugs that lack competition.

Changes in Beneft Design

Consumers are more and more being

exposed to the rising cost of their

prescription drugs.

In 2016, nearly 40% of adults with

employer-sponsored insurance, and

over half of adults with individual-

ly purchased insurance, enrolled in a

high-deductible

health plan. One in

seven employ

ees, and a growing num-

ber of people with individually-pur-

chased insurance, now have a sepa-

rate drug deductible.

10

Private health

plans in both the employer-sponsored

and individually-purchased markets

are more frequently relying on pre-

scription drug coinsurance regardless

of formulary tier, although they do so

most often for non-preferred brands

and specialty drugs.

Consumers who have not met

their deductible or are subject to

coinsurance, pay based on the

pharmacy list price, which is not

reduced by the substantial drug

manufacturer rebates paid to PBMs

and health plans. As a result, the

growth in list prices, and the wid-

ening gap between list and net

prices, markedly increases con-

sumer out-of-pocket spending,

particularly for high-cost drugs

not subject to negotiation.

This is not only a financial chal-

lenge, but a health issue as well: One

study found that consumers asked

to pay $50 or more at the pharma-

cy counter are four times more likely

to abandon the prescription than a

consumer charged $10.

11

Speciaty Spend

Traditiona Spend

Biions ($)

700

600

500

400

300

200

100

-

% Decrease

% Increase

Ii. What’s The Problem | 17 |

What had been a hidden negotia-

tion and wealth transfer between drug

manufacturers and PBMs is now a

direct increase on consumer out-of-

pocket spending that likely decreases

drug adherence and health outcomes.

The Growth of High-Cost Drugs

New challenges are emerging onto

this landscape. A growing number of

complex drugs account for a grow-

ing percentage of health care spend-

ing. The pharmaceutical industry

has shifted its attention to high-cost

drugs that face little to no competi-

tion, because they oer the freedom

to set high launch prices and in-

crease them over time.

Though these drugs oer hope

to the 1 percent of insured benefi-

ciaries who use them, they account

for 35-40% of health plan spending,

and will increase to over half of drug

spending over the next 5 years.

12

Absent reform, the growth of high

cost drugs will further compound

the issues already described.

FIGURE 4

Growth in

Specialty Drug

Spending

SOURCE

Medicine Use and Spending in

the U.S.; A Review of 2017 and

Outlook to 2022. April 19, 2018

The Situation Today

Taken together, these drivers con-

tribute to high and rising list prices

and consumer out-of-pocket spend-

ing. Because health plans, pharma-

cy benefit managers (PBMs), and

wholesalers receive higher rebates

and fees when list prices increase,

there is little incentive to control

list prices. Consumers, however, pay

higher copayments, coinsurance, or

pre-deductible out-of-pocket costs

when list prices rise.

The Trump Administration be-

lieves it is time to realign the sys-

tem in four ways: increasing com-

petition, improving government

negotiation tools, creating in-

centives for lower list prices, and

bringing down out-of-pocket costs

for consumers.

| 18 | American Patients First

III. Trump Administration

Accomplishments on Drug Pricing

THE PRESIDENT has consistently em-

phasized the need to reduce the price

of prescription drugs. The Trump

Administration has already taken

a number of significant adminis-

trative steps, and proposed in the

President’s FY2019 Budget, to im-

prove competition and end the gam-

ing of regulatory processes, support

better negotiation of drug discounts

through government insurance pro-

grams, create incentives for phar-

maceutical companies to lower list

prices, and reduce consumer out-

of-pocket spending at the pharmacy

and other care settings.

A. Increasing Competition

Since the beginning of the Trump

Administration, HHS has taken a

number of actions to increase com-

petition and end the gaming of regu-

latory processes that may keep drug

prices artificially inflated or hin-

der generic, branded, or biosimilar

competition. These eorts include:

• Accelerating Food and Drug

Administration (FDA) approval of

generic drugs. Studies show that

greater generic competition is

associated with lower prices. FDA

is publishing the names of drugs

that have no competitors in order

to spur new entrants and bring

prices down. Over 1,000 generic

drugs were approved in 2017,

which is the most in FDA’s history

in a calendar year by over 200

drugs. These generic approvals

saved American consumers and

taxpayers nearly $9 billion in 2017.

• Drug Competition Action

Plan. In 2017, President

Trump’s FDA established a

Drug Competition Action Plan

to enable patients to access

more affordable medications

by focusing the agency’s

efforts in three key areas: (1)

improving the efficiency of

the generic drug development,

review, and approval process;

(2) maximizing scientific and

regulatory clarity with respect

to complex generic drugs; and

(3) closing loopholes that allow

brand-name drug companies

to “game” FDA rules in ways

that forestall the generic

competition Congress intended.

The agency also has taken

steps to prioritize its review

of generic drug applications;

issued guidance to improve

efficiencies in the development,

review, and approval processes

for generic drugs, including

Iii. Trump Administration Accomplishments On Drug Pricing | 19 |

complex generic drugs; and

issued guidance to further

streamline the submission

and review process for shared

system Risk Evaluation and

Mitigation Strategies (REMS),

and to allow collective

submissions to streamline

the review of shared REMS.

• FDA also announced it will

facilitate opportunities for

enhanced information sharing

between manufacturers, doctors,

patients and insurers to improve

patient access to medical

products, including through

value-based insurance.

• Speeding access to more

aordable generics by spurring

competition. Today, a generic

manufacturer that has been

awarded 180-day exclusivity for

being the first generic to file can

“park” its application with FDA,

preventing additional generic

manufacturers from entering the

market. The President’s FY2019

Budget proposes to prevent

companies from using their 180-

day exclusivity to indefinitely

delay real competition and

savings for consumers by seeking

a legislative change to start a

company’s 180-day exclusivity

clock in certain instances when

another generic application is

ready for approval, but is blocked

solely by such a first applicant’s

180-day exclusivity.

• Finalizing a policy in which each

biosimilar for a given biologic

gets its own billing and payment

code under Medicare Part B,

to incentivize development of

additional lower-cost biosimilars.

Prior approaches to biosimilar

coding and payment would have

created a race to the bottom of

biosimilar pricing, while leaving

the branded product untouched,

making it an unviable market that

few would want to enter.

B. Better Negotiation

Medicare Part D has been very suc-

cessful since it launched in 2006.

However, prescription drug markets

are dierent than they were 12 years

ago, and in some cases Part D plan

sponsors may be prohibited from

doing what private payers outside

the Medicare program do to nego-

tiate eectively and keep costs low.

More can also be done across the

Medicare program to provide ben-

eficiaries with the lower costs and

greater price transparency resulting

from better negotiation.

Since the beginning of the Trump

Administration, HHS has taken a

number of actions to support better

negotiation. These eorts include:

• Finalizing changes to the

Medicare Prescription Drug

Program in the 2019 Part C and

Part D regulation allowing for

faster mid-year substitution of

generic drugs onto formularies.

| 20 | American Patients First

“We’re the largest

buyer of drugs in

the world, and

yet we d

on’t bid

properly.”

–

PRESIDENT TRUMP

• Proposing in the President’s

FY2019 Budget

i

a 5-part plan to

modernize the Medicare Part

D program, a portion of which

includes enhancing Part D

plans’ negotiating power with

manufacturers by changing Part

D plan formulary standards to

require a minimum of one drug

per category or class rather than

two. We note that the 5-part plan

is intended to be implemented

together, as eliminating even one

piece of the package significantly

changes the proposal’s impacts.

• Proposing in the President’s

FY2019 Budget to address abusive

drug pricing by manufacturers

by: establishing an inflation limit

for reimbursement of Medicare

Part B drugs; reducing Wholesale

Acquisition Cost (WAC)-Based

Payment when Average Sales

Price (ASP) isn’t available; and

improving manufacturers’

reporting of Average Sales Prices

to set accurate payment rates.

• Increasing the integrity of the

Medicaid Drug Rebate Program,

so that manufacturers pay their

fair share in rebates, by proposing

in the President’s FY2019 Budget

to remove ambiguity regarding

how drugs should be reported

under the program. HHS is also

manually reviewing each new

drug that has been reported in

the Medicaid rebate system on

a quarterly basis to make sure

classifications are correct, and

the United States took legal

action against Mylan for its

misclassification of EpiPen,

resulting in an agreement for

Mylan to pay back $465 million in

rebate payments.

• Proposing in the President’s

FY2019 Budget to further clarify

the Medicaid definition of brand

drugs, which would address

inappropriate interpretations

leading some manufacturers to

classify certain brand and over-

the-counter drugs as generics

for Medicaid rebate purposes,

reducing the rebates they owe.

• Proposing in the President’s

FY2019 Budget to call for new

Medicaid demonstration authority

i. https://www.whitehouse.gov/wp-content/uploads/2018/02/budget-fy2019.pdf

Iii. Trump Administration Accomplishments On Drug Pricing | 21 |

for up to five states to test drug

coverage and financing reforms

that build on private sector best

practices. Participating states

would determine their own

drug formularies, coupled with

an appeals process to protect

beneficiary access to non-

covered drugs based on medical

need, and negotiate drug prices

directly with manufacturers.

HHS and participating states

would rigorously evaluate these

demonstrations, which would

provide states with new tools to

control drug costs and tailor drug

coverage decisions to state needs.

• Proposing in the President’s

FY2019 Budget to authorize

the HHS Secretary to leverage

Medicare Part D plans’

negotiating power for certain

drugs covered under Part B.

• Addressing price disparities in

the international market. The

Administration is updating a

number of historical studies

to analyze drug prices paid

in countries that are a part

of the Organisation for

Economic Co-operation and

Development (OECD).

C. Creating Incentives

to Lower List Prices

The list price of a drug does not re-

flect the discounts or price conces-

sions paid to a PBM, insurer, health

plan, or government program.

Obscuring these discounts can shift

costs to consumers in commercial

health plans and Medicare bene-

ficiaries. Many incentives in the

current system reward higher list

prices, and HHS is interested in cre-

ating new incentives to reward drug

manufacturers that lower list prices

or do not increase them.

Since the beginning of the Trump

Administration, HHS has taken a

number of actions to create incen-

tives to lower list prices.

These eorts include propos-

ing in the President’s FY2019 bud-

get a 5-part plan to modernize the

Medicare Part D program, a portion

of which includes the exclusion of

manufacturer discounts from the

calculation of beneficiary out-of-

pocket costs in the Medicare Part

D coverage gap, and the establish-

ment of a beneficiary out-of-pock-

et maximum in the Medicare Part D

catastrophic phase to reduce out-

of-pocket spending for beneficia-

ries who spend the most on drugs.

The changes in the catastrophic

phase would shift more responsibil-

ity onto plans, creating incentives

for plans to negotiate with manu-

facturers to lower prices for high-

cost drugs. We note that the 5-part

plan is intended to be implemented

together, as eliminating even one

piece of the package significantly

changes the proposal’s impacts.

In addition, the President’s

FY2019 Budget proposes reforms to

improve 340B Program integrity and

| 22 | American Patients First

ensure that the benefits derived from

participation in the program are used

to benefit patients, especially low-in-

come and uninsured populations.

D. Reducing Patient

Out-of-Pocket Spending

American patients have the right to

know what their prescription drugs

will really cost before they get to the

pharmacy or get the drug. Too many

people abandon their prescriptions

at the pharmacy when they discover

the price is too high, and too many

patients are never informed of lower

cost options.

Since the beginning of the Trump

Administration, HHS has taken a

number of steps to lower consumer

out-of-pocket spending and improve

transparency. These eorts include:

• Finalizing Medicare Outpatient

Prospective Payment System (OPPS)

rules to reduce beneficiary out-of-

pocket spending for 340B drugs

administered in certain hospitals by

an estimated $320 million in 2018,

which would equal $3.2 billion when

multiplied over ten years.

• Seeking information about

changes in the Medicare

Prescription Drug Program

regulations for contract year 2019

that would increase transparency

for people with Medicare

prescription drug coverage.

The proposed rule included a

Request for Information soliciting

comment on potential policy

approaches for applying some

manufacturer rebates and all

pharmacy price concessions to the

price of a drug at the point of sale.

• Finalizing changes to the

Medicare Prescription Drug

Program in the 2019 Part C

and Part D regulation allowing

Medicare beneficiaries receiving

low-income subsidies to access

biosimilars at a lower cost.

• Proposing in the President’s

FY2019 Budget a 5-part plan to

modernize the Medicare Part

D program, a portion of which

includes eliminating cost-

sharing on generic drugs for

low-income beneficiaries and

requiring Medicare Part D plans

to apply a substantial portion

of rebates at the point of sale.

We note that the 5-part plan

is intended to be implemented

together, as eliminating even one

piece of the package significantly

changes the proposal’s impacts.

We also note that in the months

following this Part D proposed

rule and the President’s budget

proposal that included this policy

change explicitly, several major

insurers and pharmacy benefit

managers announced they would

pass along a portion of rebates

to individual members in their

fully-insured populations

or when otherwise requested

by employers.

Iv. Responding To President Trump’s Call To Action | 23 |

IV. Responding to President

Trump’s Call to Action

PRESIDENT TRUMP has called on the

Administration to propose new

strategies and take bold actions to

improve competition and end the

gaming of regulatory processes,

support better negotiation of drug

discounts through government in-

surance programs, create incentives

for pharmaceutical companies to

lower list prices, and reduce con-

sumer out-of-pocket spending at

the pharmacy and other care set-

tings. HHS may undertake these and

other actions, to the extent permit-

ted by law, in response to President

Trump’s call to action.

A. Improve Competition

In response to President Trump’s

call to action, HHS may support im-

proved competition by:

• Taking steps to prevent gaming

of regulatory processes: FDA

will issue guidance to address

some of the ways in which

manufacturers may seek to use

shared system REMS to delay or

block competition from generic

products entering the market.

• Promoting innovation and

competition for biologics. FDA

will issue new policies to improve

the availability, competitiveness,

and adoption of biosimilars as

aordable alternatives to branded

biologics. FDA will also continue

to educate clinicians, patients,

and payors about biosimilar and

interchangeable products as we

seek to increase awareness about

these important new treatments.

B. Better Negotiation

In response to President Trump’s

call to action, HHS may support bet-

ter negotiation by:

• Directing Centers for Medicare

& Medicaid Services (CMS) to

develop demonstration projects to

test innovative ways to encourage

value-based care and lower drug

prices. These models should

hold manufacturers accountable

for outcomes, align with CMS

priorities of value over volume

and site-neutral payments, and

provide Medicare providers,

payers, and states with additional

tools to manage spending for

high-cost therapies.

• Allowing Part D plans to adjust

formulary or benefit design

during the benefit year if

necessary to address a price

| 24 | American Patients First

increase for a sole source generic

drug. Presently, Part D plans

do not contract with generic

drug manufacturers for the

purchase of generic drugs, and

generally are not permitted

to change their formulary or

benefit design without CMS

approval in response to a price

increase. This change could

ensure Part D plans can respond

to a price increase by the only

manufacturer of a generic drug.

• Providing plans full flexibility

to manage high-cost drugs

that do not provide Part D plans

with rebates or negotiated

fixed prices, including in the

protected classes. Presently,

Part D plans are unable to

negotiate lower prices for high-

cost drugs without competition.

This change could allow Part D

plans to use the tools available

to private payers outside of the

Medicare program to better

negotiate for these drugs.

• Updating the methodology used

to calculate Drug Plan Customer

Service star ratings for plans

that are appropriately managing

utilization of high-cost drugs.

Presently, if a Part D plan issues

an adverse redetermination

decision, the enrollee, the

enrollee’s representative or the

enrollee’s prescriber may appeal

the decision to the Independent

Review Entity (IRE). This process

may discourage Part D plan

sponsors from appropriately

managing utilization of high-

cost drugs. This change could

provide Part D plan sponsors

with the ability to appropriately

manage high-cost changes, while

holding sponsors accountable

primarily using other successful

enforcement mechanisms.

• Evaluating options to allow

high-cost drugs to be priced

or covered dierently based on

their indication. Presently, Part

D plans must cover and pay the

same price for a drug regardless

of the indication for which it was

prescribed. This change could

permit Part D plans to choose to

cover or pay a dierent price for a

drug, based on the indication.

• Sending the President a report

identifying particular drugs or

classes of drugs in Part B where

there are savings to be gained by

moving them to Part D.

• Taking steps to leverage

the authority created by the

Competitive Acquisition

Program (CAP) for Part B Drugs

& Biologicals. This program will

generally provide physicians a

choice between obtaining these

drugs from vendors selected

through a competitive bidding

process or directly purchasing

these drugs and being paid under

the current average sales price

Iv. Responding To President Trump’s Call To Action | 25 |

(ASP) methodology. The CAP,

or a model building on CAP

authority, may provide

opportunities for Federal savings

to the extent that aggregate bid

prices are less than 106 percent of

ASP, and provides opportunities

for physicians who do not wish

to bear the financial burdens and

risk associated with being in the

business of drug acquisition.

• Working in conjunction with the

Department of Commerce, the U.S.

Trade Representative, and the U.S.

Intellectual Property Enforcement

Coordinator to develop the

knowledge base necessary to

address the unfair disparity

between the drug prices in America

and other developed countries.

The Trump Administration

is committed to making the

appropriate regulatory changes

and seeking legislative solutions to

put American patients first.

C. Lowering List Prices

In response to President Trump’s

call to action, HHS may:

• Call on the FDA to evaluate the

inclusion of list prices in direct-

to-consumer advertising.

• Direct CMS to make Medicare and

Medicaid prices more transparent,

hold drug makers accountable for

their price increases, highlight

drugs that have not taken price

increases, and recognize when

competition is working with an

updated drug pricing dashboard.

This tool will also provide

patients, families, and caregivers

with additional information to

make informed decisions and

predict their cost sharing.

• Develop proposals related to the

Aordable Care Act’s Maximum

Rebate Amount provision, which

limits manufacturer rebates on

brand and generic drugs in the

Medicaid program to 100% of the

Average Manufacturer Price.

D. Reduce Patient

Out-of-Pocket Spending

In response to President Trump’s

call for action, HHS may:

• Prohibit Part D plan contracts

from preventing pharmacists

from telling patients when they

could pay less out-of-pocket by

not using their insurance – also

known as pharmacy gag clauses.

• Require Part D Plan sponsors to

provide additional information

about drug price increases and

lower-cost alternatives in the

Explanation of Benefits they

currently provide their members.

| 26 | American Patients First

V. Further Actions Under Review

and Opportunities for Feedback

BUILDING ON THE IDEAS already pro-

posed, HHS is considering even

bolder actions to bring down pric-

es for patients and taxpayers. These

include new measures to increase

transparency; fix the incentives that

may be increasing prices for pa-

tients; and reduce the costs of drug

development. HHS is interested in

public comments about how the de-

partment can take action to improve

competition and end the gaming of

regulatory processes, support bet-

ter negotiation of drug discounts

through government insurance pro-

grams, create incentives for phar-

maceutical companies to lower list

prices, and reduce consumer out-

of-pocket spending at the pharmacy

and other care settings. HHS is also

interested in public comments about

the general structure and function

of the pharmaceutical market, to

inform these actions. Proposals de-

scribed in this section are for admin-

istrative action, when within agency

authority, and legislative proposals

as necessary.

HHS is soliciting comments on

these and other policies under active

consideration.

A. Increasing competition

Underpricing or Cost-Shifting. Do

HHS programs contain the correct

incentives to obtain aordable pric-

es on safe and eective drugs? Does

the Best Price reporting requirement

of the Medicaid Drug Rebate Program

pose a barrier to price negotiation

and certain value-based agreements

in other markets, or otherwise shift

costs to other markets? Are govern-

ment programs causing underpricing

of generic drugs, and thereby reduc-

ing long-term generic competition?

Aordable Care Act taxes and re-

bates. The Aordable Care Act im-

posed tens of billions of dollars in

new taxes and costs on drugs sold in

government programs through a new

excise tax, an increase in the Medicaid

drug rebate amounts, and an exten-

sion of these higher rebates to com-

mercially-run Medicaid Managed

Care Organizations. How have these

changes impacted manufacturer

list pricing practices? Are govern-

ment programs being cross-subsi-

dized by higher list prices and excess

costs paid by individuals and em-

ployers in the commercial market?

If cross-subsidization exists, are the

taxes and artificially-depressed pric-

es causing higher overall drug costs

or other negative eects?

Access to reference product samples

Distribution restrictions. Certain

prescription drugs are subject to

V. Further Actions Under Review And Opportunities For Feedback | 27 |

limitations on distribution. Some

of these distribution limitations are

imposed by the manufacturer, while

others may be imposed in connec-

tion with an FDA-mandated Risk

Evaluation and Mitigation Strategy

(REMS). Some manufacturers may

be gaming these distribution lim-

itations to prevent generic devel-

opers from accessing their drugs

to conduct the tests that are legal-

ly required for a generic drug to be

brought to market, thereby limiting

opportunities for competition that

could place downward pressure on

drug prices. In some instances, for

products that are subject to REMS

that impact distribution, manufac-

turers continue to restrict access to

generic developers even after the

FDA issues a letter stating that it has

favorably evaluated the develop-

er’s proposed safety protections for

testing and would not consider the

provision of drug samples to this de-

veloper for generic development to

violate the applicable REMS. Should

additional steps be taken to review

existing REMS to determine whether

distribution restrictions are appro-

priate? Are there terms that could

be included in REMS, or provided in

addition to REMS, that could expand

access to products necessary for ge-

neric development? Are there other

steps that could be taken to facilitate

access to products that are under

distribution limitations imposed by

the manufacturer?

Samples for biosimilars and

interchangeables. Like some ge-

Some manufacturers

may be gaming

distribution

limitations to

prevent generic

developers

from accessing

their drugs.

neric drug developers, companies

engaged in biosimilar and inter-

changeable product development

may encounter diculties obtain-

ing sucient samples of the ref-

erence product for testing. What

actions should be considered to fa-

cilitate access to reference product

samples by these companies?

Biosimilar development, approval,

education, and access

Resources and tools from FDA: FDA

prioritizes ongoing eorts to im-

prove the eciency of the biosimilar

and interchangeable product devel-

opment and approval process. For

example, FDA is working to identify

areas in which additional informa-

tion resources or development tools

may facilitate the development of

high-quality biosimilar and inter-

| 28 | American Patients First

changeable products. What specif-

ic types of information resources or

development tools would be most

eective in reducing the develop-

ment costs for biosimilar and inter-

changeable products?

Improving the Purple Book. In

the Purple Book, FDA publishes in-

formation about biological prod-

ucts licensed under section 351 of the

Public Health Service Act, including

reference products, biosimilars, and

interchangeable products. The Purple

Book provides information about

these products that is useful to pre-

scribers, pharmacists, patients, and

other stakeholders. FDA is committed

to the timely publication of certain

information about reference prod-

uct exclusivity in the Purple Book.

How could the Purple Book be more

useful to health care professionals,

patients, manufacturers, and other

stakeholders? What additional infor-

mation could be added to increase the

utility of the Purple Book?

Educating providers and pa-

tients. Physician and patient con-

fidence in biosimilar and inter-

changeable products is critical to

the increased market acceptance of

these products. FDA intends to build

on the momentum of past educa-

tion eorts, such as the launch of its

Biosimilars Education and Outreach

Campaign in 2017, by developing

additional resources for health care

professionals and patients. What

types of information and educa-

tional resources on biosimilar and

interchangeable products would be

most useful to heath care profes-

sionals and patients to promote un-

derstanding of these products? What

role could state pharmacy practice

acts play in advancing the utilization

of biosimilar products?

Interchangeability. How could

the interchangeability of biosimilars

be improved, and what eects would

it have on the prescribing, dispens-

ing, and coverage of biosimilar and

interchangeable products?

B. Better Negotiation

The American pharmaceutical mar-

ketplace is built on innovation and

competition. However, regula-

tions governing how Medicare and

Medicaid pay for prescription drugs

have not kept pace with the avail-

ability of new types of drugs, partic-

ularly higher-cost curative therapies

intended for use by fewer patients.

Drug companies, commercial insur-

ers, and states have proposed cre-

ative approaches to financing these

new treatments, including indica-

tion-based pricing, outcomes-based

contracts, long-term financing

models, and others. Value-based

transformation of our entire health-

care system is a top HHS priority.

Improving price transparency is an

important part of achieving this aim.

What steps can be taken to improve

price transparency in Medicare,

Medicaid, and other forms of health

coverage, so that consumers can

seek value when choosing and using

their benefits?

V. Further Actions Under Review And Opportunities For Feedback | 29 |

Value-Based Arrangements and

Price Reporting. What benefits would

accrue to Medicare and Medicaid

beneficiaries by allowing manufac-

turers to exclude from statutory price

reporting programs discounts, re-

bates, or price guarantees included

in value-based arrangements? How

would excluding these approach-

es from Average Manufacturer Price

(AMP) and Best Price (BP) calcu-

lations impact the Medicaid Drug

Rebate program and supplemental

rebate revenue? How would these

exclusions aect Average Sales Price

(ASP) and 340B Ceiling Prices? What

benefits would accrue to Medicare

and Medicaid beneficiaries by ex-

tending the time for manufacturers

to report restatements of AMP and/

or BP reporting, as outlined in 42 CFR

§447.510, to accommodate adjust-

ments because of possible extended

Value-based Purchasing (VBP) eval-

uation timeframes? Is there a time-

frame CMS should consider that will

allow manufacturers to restate AMP

and BP without negative impact on

state rebate revenue? What modifi-

cations could be made to the follow-

ing regulatory definitions in the cur-

rent Medicaid Drug Rebate Program

that could facilitate the development

of VBP arrangements: 1) bundled

sale; 2) free good; 3) unit; or 4) best

price? Would providing specific AMP/

BP exclusions for VBP pricing used

for orphan drugs help manufactur-

ers that cannot adopt a bundled sale

approach? What regulatory changes

would Medicaid Managed Care or-

ganizations find helpful in negotiat-

ing VBP supplemental rebates with

manufacturers? How would these

changes aect Medicare or the 340B

program? Are there particular sec-

tions of the Social Security Act (e.g.,

the anti-kickback statute), or other

statutes and regulations that can be

revised to assist with manufacturers’

and states’ adoption of value-based

arrangements?

Indication-based payments. Pre-

scription drugs have varying degrees

of eectiveness when used to treat dif-

ferent types of disease. Though drugs

may be approved by the FDA to treat

specific indications, or used o-la-

bel by prescribers to treat others, they

are typically subject to the same price.

Should Medicare or Medicaid pay the

same price for a drug regardless of the

diagnosis for which it is being used?

How could indication-based pricing

support value-based purchasing?

What lessons could be learned from

private health plans? Are there unin-

tended consequences of current low-

cost drugs increasing in price due to

their identification as high value? How

and by whom should value be deter-

mined?? Is there enough granularity

in coding and reimbursement systems

to support indication-based pricing?

Are changes necessary to CMS’s price

reporting program definitions or how

the FDA’s National Drug Code num-

bers are used in CMS price reporting

programs? Do physicians, pharma-

cists, and insurers have access to all

the information they need to support

indication-based payments?

| 30 | American Patients First

Long-term fnancing models.

States and other payers typically es-

tablish budgets or premium rates for

a given benefit year. As such, their

budgets may be challenged when a

new high-cost drug unexpected-

ly becomes available in the benefit

year. Long-term financing models

are being proposed to help states,

insurers, and consumers pay for

high-cost treatments by spread-

ing payments over multiple years.

Should the state, insurer, drug man-

ufacturer, or other entity bear the

risk of receiving future payments?

How should Medicare or Medicaid

account for the cost of disease avert-

ed by a curative therapy paid for by

another payer? What regulations

should CMS consider revising to al-

low manufacturers and states more

flexibility to participate in novel

value-based pricing arrangements?

What eects would these solutions

have on manufacturer development

decisions? What current barriers

limit the applicability of these ar-

rangements in the private sector?

What assurances would parties need

to participate in more of these ar-

rangements, particularly with re-

gard to public programs?

Part B Competitive Acquisition

Program. HHS has the authority to

operate a Competitive Acquisition

Program for Part B drugs. What

changes would vendors and pro-

viders need to see relative to the

2007-2008 implementation of this

program in order to successful-

ly participate in the program? Has

the marketplace evolved such that

there would be more vendors capa-

ble of successfully participating in

this program? Are there a sucient

number of providers interested in

having a vendor selected through

a competitive bidding process ob-

tain these drugs on their behalf, and

bear the financial risk and carrying

costs? How could this program be

implemented in a way that ensures

a competitive market among multi-

ple vendors? Is it necessary that the

vendors also hold title to the drugs

and provide a distribution channel

or are there other ways they can pro-

vide value? What other approaches

could lower Part B drug spending for

patients of providers choosing not to

participate, without restricting their

access to care?

Part B to D. The President’s

Budget requested the authority to

move some Medicare Part B drugs

to Medicare Part D. Which drugs or

classes of drugs would be good candi-

dates for moving from Part B to Part

D? How could this proposal be imple-

mented to help reduce out-of-pock-

et costs for the 27% of beneficiaries

who do not have Medicare prescrip-

tion drug coverage, or those who

have Medicare supplemental benefits

in Part B? What additional informa-

tion would inform how this proposal

could be implemented and operated?

Part B drugs are reportedly avail-

able to OECD nations at lower prices

than those paid by Medicare Part B

providers. HHS is interested in re-

ceiving data describing the dier-

V. Further Actions Under Review And Opportunities For Feedback | 31 |

ences between the list prices and

net prices paid by Medicare Part B

providers, and the prices paid for

these same drugs by OECD nations.

Though these national health sys-

tems may be demanding lower pric-

es by restricting access or delaying

entry, should Part B drugs sold by

manufacturers oering lower prices

to OECD nations be subject to nego-

tiation by Part D plans? Would this

lead to lower out-of-pocket costs on

behalf of people with Medicare? How

could this aect access to medicines

for people with Medicare?

Fixing Global Freeloading. U.S.

consumers and taxpayers general-

ly pay more for brand drugs than do

consumers and taxpayers in oth-

er OECD countries, which often have

reimbursements set by their central

government. In eect, other countries

are not paying an appropriate share of

the necessary research and develop-

ment to bring innovative drugs to the

market and are instead freeriding o

U.S. consumers and taxpayers. What

can be done to reduce the pricing dis-

parity and spread the burden for in-

centivizing new drug development

more equally between the U.S. and

other developed countries? What pol-

icies should the U.S. government pur-

sue in order to protect IP rights and

address concerns around compulsory

licensing in this area.

Site neutrality for physician-ad-

ministered drugs. Currently un-

der Medicare Part B and often in

Medicaid, hospitals and physi-

cians are reimbursed comparable

“We want to look at

negotiating for drugs

in Medicare that

have never been

negotiated for.”

– SECRETARY AZAR

amounts for drugs they adminis-

ter to patients, but the facility fees

when drugs are administered at

hospitals and hospital-owned out-

patient departments are many times

higher than the fees charged by phy-

sician oces. What eect would a

site neutral payment policy for drug

administration procedures have on

the location of the practice of med-

icine? How would this change aect

the organization of health care sys-

tems? How would this change aect

competition for health care services,

particularly for cancer care?

Site neutrality between inpatient

and outpatient setting. Medicare

payment rules pay for prescription

drugs dierently when provided

during inpatient care (Part A) or ad-

ministered by an outpatient physi-

cian (Part B). Beneficiaries also have

dierent cost-sharing requirements

in Part A and Part B. Some drugs can

be administered in either the in-

patient or outpatient setting, while

| 32 | American Patients First

“For high-cost

products, the

amount that

Medicare pays

diers dramatically

based on the

site of service.”

– CMS ADMINISTRATOR

SEEMA VERMA

others are currently limited to in-

patient use because of safety con-

cerns. Do the dierences between

Medicare’s Part A and Part B drug

payment policies create aordabil-

ity and access challenges for bene-

ficiaries? What policies should CMS

consider to ensure inpatient and

outpatient providers are neither

underpaid nor overpaid for a drug,

regardless of where it was admin-

istered? Which elements of the in-

patient or outpatient setting lead to

naturally dierential payments, and

why? If a drug can be used safely in

the outpatient setting, and achieve

the same outcomes at a lower cost,

how should Medicare encourage the

shift to outpatient settings? In what

instances would inpatient adminis-

tration actually be less costly?

Accuracy of national spending

data. Are annual reports of health

spending obscuring the true cost of

prescription drugs? What is the val-

ue of better understanding the dif-

ference between gross and net drug

prices? How could the Medicare

Trustees Report, annual National

Health Expenditure publications,

Uniform Rate Review Template, and

other publications more accurately

collect and report gross and net drug

spending in medical and pharmacy

benefits? Should average Part D re-

bate amounts be reported separately

for small molecule drugs, biologics,

and high-cost drugs? What inno-

vation is needed to maximize price

transparency without disclosing

proprietary information or data pro-

tected by confidentiality provisions?

C. Create Incentives

to Lower List Prices

Government programs, commercial

insurers, and individual consumers

pay for drugs dierently. The price

paid at the pharmacy counter or re-

imbursed to a physician or hospital

is the result of many dierent com-

plex financial transactions between

drug makers, distributors, insur-

ers, Pharmacy Benefits Managers,

pharmacies and others. Public pro-

grams are also subject to state and

federal regulations governing what

drugs are covered, who can be paid

for them, and how much will be paid.

Too often, these negotiations do not

result in the lowest out-of-pocket

V. Further Actions Under Review And Opportunities For Feedback | 33 |

costs for consumers, and may actu-

ally be causing higher list prices.

Fiduciary duty for Pharmacy

Benefit Managers. Pharmacy Benefit

Managers (PBMs) and benefits con-

sultants help buyers (insurers, large

employers) seek rebates intended to

lower net drug prices, and help sellers

(drug manufacturers) pay rebates to

secure placement on health plan for-

mularies. Most current PBM contracts

may allow them to retain a percentage

of the rebate collected and other ad-

ministrative or service fees.

Do PBM rebates and fees based on

the percentage of the list price cre-

ate an incentive to favor higher list

prices (and the potential for higher

rebates) rather than lower prices?

Do higher rebates encourage bene-

fits consultants who represent pay-

ers to focus on high rebates instead

of low net cost? Do payers manage

formularies favoring benefit designs

that yield higher rebates rather than

lower net drug costs? How are ben-

eficiaries negatively impacted by

incentives across the benefits land-

scape (manufacturer, wholesaler,

retailer, PBM, consultants, and in-

surers) that favor higher list prices?

How can these incentives be reset to

prioritize lower out-of-pocket costs

for consumers, better adherence and

improved outcomes for patients?

What data would support or refute

the premise described above?

Should PBMs be obligated to act

solely in the interest of the entity for

whom they are managing pharma-

ceutical benefits? Should PBMs be

Too oen,

negotiations do not

result in the lowest

out-of-pocket costs

for consumers.

forbidden from receiving any pay-

ment or remuneration from manu-

facturers, and should PBM contracts

be forbidden from including rebates

or fees calculated as a percentage of

list prices? What eect would im-

posing this fiduciary duty on PBMs

on behalf of the ultimate payer (i.e.,

consumers) have on PBMs’ ability to

negotiate drug prices? How could this

aect manufacturer pricing behav-

ior, insurance, and benefit design?

What unintended consequences for

beneficiary out-of-pocket spending

and federal health program spend-

ing could result from these changes?

Reducing the impact of rebates.

Increasingly higher rebates in fed-

eral health care programs may be

causing higher list prices in public

programs, and increasing the prices

paid by consumers, employers, and

commercial insurers. What should

CMS consider doing to restrict or

reduce the use of rebates? Should

Medicare Part D prohibit the use of

rebates in contracts between Part D

plan sponsors and drug manufac-

| 34 | American Patients First

Increasingly

higher rebates

in federal health

care programs

may be causing

higher list prices.

turers, and require these contracts

to be based only on a fixed price for

a drug over the contract term? What

incentives or regulatory chang-

es (e.g., removing the discount safe

harbor) could restrict the use of re-

bates and reduce the eect of rebates

on list prices? How would this aect

the behavior of drug manufacturers,

PBMs, and insurers? How could it

change formulary design, premium

rates, or the overall structure of the

Part D benefit?

Incentives to lower or not in-

crease list prices. Should manufac-

turers of drugs that have increased

their prices over a particular look-

back period or have not provided a

discount be allowed to be includ-

ed in the protected classes? Should

drugs for which a price increase has

not been observed over a particu-

lar lookback period be treated dif-

ferently when determining the ex-

ceptions criteria for protected class

drugs? What should CMS consider

doing, under current authorities,

to create incentives for Part D drug

manufacturers committing to a

price over a particular lookback pe-

riod? How long should the lookback

period be?

The Healthcare Common Pro-

cedure Coding System (HCPCS)

codes for new Part B drugs are not

typically assigned until after they

are commercially available. Should

they be available immediately at

launch for new drugs from man-

ufacturers committing to a price

over a particular lookback period?

What should CMS consider doing,

under current authorities, to create

incentives for Part B drugs com-

mitting to a price over a particular

lookback period? How long should

the lookback period be?

How could these incentives aect

the behavior of manufacturers and

purchasers? What are the operation-

al concerns to implementing them?

Are there other incentives that could

be created to reward manufacturers

of drugs that have not taken a price

increase during a particular look-

back period?

Infationary rebate limits. The

Department is concerned that lim-

iting manufacturer rebates on brand

and generic drugs in the Medicaid

program to 100% of calculated AMP

allows for excessive price increas-

es to be taken without manufactur-

ers facing the full eect of the price

inflationary penalty established by

Congress. This policy, implemented

as part of the ACA, may allow for run-

V. Further Actions Under Review And Opportunities For Feedback | 35 |

away price increases and cost-shift-

ing. When is this limitation a valid

constraint upon the rebates manu-

facturers should pay? What impacts

would removing the cap on the in-

flationary rebate have on list prices,

price increases over time, and public

and private payers?

Exclusion of certain payments,

rebates, or discounts from the deter-

mination of Average Manufacturer

Price and Best Price. The Department

is concerned that excluding pharma-

cy benefit manager rebates from the

determination of Best Price, imple-

mented as part of the ACA, may al-

low for runaway price increases and

cost-shifting. The Department is also

interested in learning more about the

eect of excluding payments received

from, and rebates or discounts pro-

vided to Pharmacy Benefit Managers

from the determination of Average

Manufacturer Price.

What impacts would these chang-

es have on list prices, price increas-

es over time, and public and private

payers? What data would support or

refute the premise described above?

Copay discount cards. Does the

use of manufacturer copay cards

help lower consumer cost or actu-

ally drive increases in manufactur-

er list price? Does the use of copay

cards incent manufacturers and

PBMs to work together in driving

up list prices by limiting the trans-

parency of the true cost of the drug

to the beneficiary? What data would

support or refute the premise de-

scribed above?

CMS regulations presently ex-

clude manufacturer sponsored drug

discount card programs from the de-

termination of average manufacturer

price and the determination of best

price. What eect would eliminating

this exclusion have on drug prices?

Would there be circumstances

under which allowing beneficiaries of

federal health care programs to uti-

lize copay discount cards would ad-

vance public health benefits such as

medication adherence, and outweigh

the eects on list price and concerns

about program integrity? What data

would support or refute this?

The 340B drug discount program

The 340B Drug Pricing Program was

established by Congress in 1992, and

requires drug manufacturers partic-

ipating in the Medicaid Drug Rebate

Program to provide covered outpa-

tient drugs to eligible health care

providers—also known as covered

entities—at reduced prices. Covered

entities include certain qualify-

ing hospitals and federal grantees

identified in section 340B of the

Public Health Service Act (PHSA).

The Health Resources and Services

Administration (HRSA) adminis-

ters and oversees the 340B Program,

and the discounts provided may af-

fect the prices paid for drugs used

by Medicare beneficiaries, people

with Medicaid, and those covered by

commercial insurance.

Program growth. The 340B

program has grown significantly

since 1992—not only in the num-

| 36 | American Patients First

Does the use of

manufacturer

copay cards help

lower consumer

cost or actually

drive increases

in manufacturer

list price?

ber of covered entities and contract

pharmacies, but also in the amount

of money saved by covered entities.

HRSA estimates that covered enti-

ties saved approximately $6 billion

on approximately $12 billion in dis-

counted purchases in Calendar Year

(CY) 2015 by participating in the

340B Program.

ii

It is estimated that

discounted drug purchases made by

covered entities under the 340B pro-

gram totaled more than $16 billion

in 2016—a more than 30 percent in-

crease in 340B Program purchases in

just one year.

iii

How has the growth

of the 340B drug discount program

aected list prices? Has it caused

cross-subsidization by increasing list

prices applicable in the commercial

sector? What impact has this had on

insurers and payers, including Part

D plans? Does the Group Purchasing

Organization (GPO) exclusion, the

establishment of the Prime Vendor

Program, and the current inventory

models for tracking 340B drugs in-

crease or decrease prices? What are

the unintended consequences of this

program? Would explicit general reg-

ulatory authority over all elements of

the 340B Program materially aect

the elements of the program aect-

ing drug pricing?

Program Eligibility. Would

changing the definition of “patient”

or changing the requirements gov-

erning covered entities contracting

with pharmacies or registering o-

site outpatient facilities (i.e., child

sites) help refocus the program to-

ward its intended purpose?

Duplicate Discounts. The 340B

statute prohibits duplicate dis-

counts. Manufacturers are not re-

quired to provide a discounted

340B price and a Medicaid drug re-

bate for the same drug. Are the cur-

rent mechanisms for identifying

and preventing duplicate discounts

effective? Are drug companies pay-

ing additional rebates over the

ii. 340B Drug Pricing Program Ceiling Price and Manufacturer Civil Monetary Penalties Regulation, 82 Fed. Reg.

1210, 1227 (Jan. 5, 2017).

iii. Aaron Vandervelde and Eleanor Blalock, Measuring the Relative Size of the 340B Program: 2012-2017, BERKE-

LEY RESEARCH GROUP (July 2017), available at

https://www.thinkbrg.com/media/publication/928_Vandervelde_Measuring340Bsize-July-2017_WEB_FINAL.pdf.

V. Further Actions Under Review And Opportunities For Feedback | 37 |

statutory 340B discounts for drugs

that have been dispensed to 340B

patients covered by commercial

insurance? What is the impact on

drug pricing given that private in-

surers oftentimes pay commercial

rates for drugs purchased at 340B

discounts? Do insurers, pharmacy,

PBM, or manufacturer contracts

consider, address, or otherwise

include language regarding drugs

purchased at 340B discounts? What

should be considered to improve

the management and the integri-

ty of claims for drugs provided to

340B patients in the overall insured