1

Medicare

This booklet provides basic information about Medicare

and coverage options. You can visit Medicare.gov or call

the toll-free number 1-800-MEDICARE (1-800-633-4227)

or the TTY number 1-877-486-2048 for the latest

information about Medicare.

What is Medicare?

Medicare is a federal health insurance program for people

age 65 or older. People younger than age 65 with certain

disabilities, permanent kidney failure, or amyotrophic

lateral sclerosis (ALS, also known as Lou Gehrig’s

disease), may also be eligible for Medicare. The program

helps with the cost of health care, but it doesn’t cover all

medical expenses or the cost of most long-term care. You

have choices for how you get Medicare coverage. If you

choose to have Original Medicare (Part A and Part B)

coverage, you can buy a Medicare Supplement Insurance

(Medigap) policy from a private insurance company.

Medigap covers some of the costs that Medicare does

not, such as copayments, coinsurance, and deductibles.

If you choose Medicare Advantage, you can buy a

Medicare-approved plan from a private company

that bundles your Part A, Part B, and usually Part D

(prescription drug coverage) into one plan.

Although the Centers for Medicare & Medicaid Services

(CMS) is the agency in charge of the Medicare program,

Social Security processes your application for Original

Medicare (Part A and Part B). We provide general

information about the Medicare program and can help

you get a replacement Medicare card. Notify us timely of

address changes, name changes, and deaths.

2

Parts of Medicare

Social Security enrolls you in Original Medicare (Part A

and Part B).

• Medicare Part A (hospital insurance) helps cover

inpatient care in hospitals (including critical access

hospitals) and skilled nursing facilities (not custodial

or long-term care). Part A also pays for some home

health care and hospice care and inpatient care in a

religious non-medical health care institution.

• Medicare Part B (medical insurance) helps cover

medically necessary doctors’ services, outpatient

care, home health services, durable medical

equipment, mental health services, and other medical

services. Part B also covers many preventative

services.

Other parts of Medicare are run by private insurance

companies that follow rules set by Medicare.

• Supplemental (Medigap) policies help pay Medicare

out-of-pocket copayments, coinsurance, and

deductible expenses.

• Medicare Advantage Plan (previously known as

Part C) includes all benets and services covered

under Part A and Part B, plus prescription drugs and

additional benets such as vision, hearing, and dental,

bundled together in one plan.

• Medicare Part D (Medicare prescription drug

coverage) helps cover the cost of prescription drugs.

You can sign up for Original Medicare (Part A and Part B)

through Social Security’s online Medicare application.

Visit Medicare’s website, Medicare.gov, to get

more information about Original Medicare, Medicare

Advantage, or Part D coverage. You can download a copy

3

of the publication Medicare & You (Publication No. CMS-

10050). You can also call the Medicare toll-free number at

1-800-633-4227; TTY users can call 1-877-486-2048.

A word about Medicaid

Medicaid and Medicare are 2 different programs.

Medicaid is a state-run program that provides hospital and

medical coverage for people with low income. Each state

has its own rules about who’s eligible and what Medicaid

covers. Some people are eligible for both Medicare and

Medicaid. For more information about the Medicaid

program, contact your local medical assistance agency,

social services ofce, or get state contact information at

www.Medicaid.gov.

Who can get Medicare?

Medicare Part A (hospital insurance)

People age 65 or older, who are citizens or permanent

residents of the United States, are eligible for Medicare

Part A. You’re eligible for Part A at no cost at age 65 if 1

of the following applies:

• You receive or are eligible to receive benets from

Social Security or the Railroad Retirement Board

(RRB).

• Your spouse (living or deceased, including a divorced

spouse) receives or is eligible to receive Social

Security or RRB benets.

• You or your spouse worked long enough in a

government job through which you paid Medicare

taxes.

• You are the dependent parent of a fully insured

deceased child.

4

If you don’t meet these requirements, you may be able

to get Medicare Part A by paying a monthly premium.

Usually, you can purchase this coverage only during

designated enrollment periods.

NOTE: Even though the full retirement age for Social

Security is no longer 65, you should sign up for Medicare

3 months before your 65th birthday. You can apply at

www.ssa.gov.

Before age 65, you are eligible for Medicare Part A at no

cost if 1 of the following applies:

• You’ve been entitled to Social Security Disability

Insurance (SSDI) benets for 24 months.

• You receive a disability pension from the RRB and

meet certain conditions.

• You receive SSDI benets and have Lou Gehrig’s

disease (amyotrophic lateral sclerosis).

• You worked long enough in a government job through

which you paid Medicare taxes and have met the

requirements of the SSDI program for 24 months.

• You’re the child or surviving spouse age 50 or older,

including a divorced surviving spouse, of a worker

who has worked long enough under Social Security

or in a Medicare-covered government job. Also, you

meet the requirements of the SSDI program.

• You have permanent kidney failure (end-stage renal

disease) and you receive maintenance dialysis or a

kidney transplant and 1 of the following applies:

—You’ve worked long enough under Social Security or

the railroad retirement system.

—You’ve worked long enough in a Medicare-covered

government job.

—You’re the child or spouse (including a divorced

spouse) of a worker (living or deceased) who has

worked long enough under Social Security, or the

5

railroad retirement system. Or, they have worked in

a Medicare-covered government job.

Medicare Part B (medical insurance)

Anyone who’s eligible for Medicare Part A at no cost

can enroll in Medicare Part B by paying a monthly

premium. Some people with higher incomes will

pay a higher monthly Part B premium. For more

information, visit our webpage Medicare Premiums:

Rules for Higher Income Beneciaries or visit

www.ssa.gov/benets/medicare/mediinfo.html.

If you’re not eligible for Part A at no cost, you can buy Part

B without having to buy Part A. You must be age 65 or

older and 1 of the following:

• A U.S. citizen.

• A lawfully admitted noncitizen who has lived in the

United States for at least 5 years.

You can only sign up for Part B during designated

enrollment periods. If you don’t enroll in Part B when

you’re rst eligible, you may have to pay a late enrollment

penalty for as long as you have Part B coverage.

Read the “Signing up for Medicare” section for more

information.

Medicare Advantage plans

If you receive your Part A and Part B benets directly

from the government, you have Original Medicare. If

you receive your benets from a Medicare Advantage

organization or other private company approved by

Medicare, you have a Medicare Advantage plan. Many of

these plans provide extra coverage and may lower your

out-of-pocket costs.

If you have Medicare Parts A and B, you can join a

Medicare Advantage plan. With these plans, you can’t

have a Medigap policy, because Medicare Advantage

6

plans cover many of the same benets a Medigap policy

covers. This includes benets like extra days in the

hospital after you’ve used the days that Medicare covers.

Medicare Advantage plans include all the following:

• Health Maintenance Organization (HMO) plans.

• Preferred Provider Organization (PPO) plans.

• Private Fee-for-Service (PFFS) plans.

• Special Needs Plans (SNPs).

If you decide to join a Medicare Advantage plan, you

use the health card that you get from your Medicare

Advantage plan provider for your health care. Also, you

might have to pay a monthly premium for your Medicare

Advantage plan because of the extra benets it offers.

You can enroll in a Medicare Advantage plan during

your Initial Enrollment Period (IEP), as explained

under the “Signing up for Medicare” section, once

you become eligible for Medicare. You can also enroll

during the annual Medicare open enrollment period from

October 15 to December 7 each year. The effective date

for the enrollment is January 1 of the following year. For

example, if you signed up on November 8, 2023, your

coverage would become active on January 1, 2024. There

are also special enrollment periods for some situations.

Medicare Part D (Medicare prescription drug

coverage)

Anyone who has Original Medicare (Part A or Part

B) is eligible for Medicare prescription drug coverage

(Part D). Part D benets are available as a stand-alone

plan or built into Medicare Advantage, unless you

have a Medicare private fee-for-service (PFFS) plan.

The prescription drug benets work the same way in

either plan. Joining a Medicare prescription drug plan

is voluntary and you pay an extra monthly premium

for the coverage. Some beneciaries with higher

7

incomes will pay a higher monthly Part D premium.

For more information, visit our webpage Medicare

Premiums: Rules for Higher Income Beneciaries, or visit

www.ssa.gov/medicare/mediinfo.html.

If you don’t enroll in a Medicare prescription drug plan

when you’re rst eligible, you may pay a late enrollment

penalty if you join a plan later. You’ll have to pay this

penalty for as long as you have Medicare prescription

drug coverage. However, you won’t pay a penalty if you

have Extra Help (see the “Extra Help” section below),

or another creditable prescription drug plan. To be

creditable, the coverage must pay, on average, at least as

much as Medicare’s standard prescription coverage.

You can enroll during your IEP (as explained under

the “Medicare” section) once you become eligible for

Medicare. You can also enroll during the annual Medicare

open enrollment period from October 15 to December 7.

The effective date for the enrollment is January 1 of the

following year. There are also special enrollment periods

for some situations.

Rules for higher-income beneciaries

If you have higher income, the law requires an adjustment

to your monthly Medicare Part B (medical insurance)

and Medicare prescription drug coverage premiums. We

call the additional amount the income-related monthly

adjustment amount. This affects less than 5% of people

with Medicare, so most people don’t need to pay a higher

premium.

If you’re single and your income is above $103,000,

or married with an income above $206,000, you are

considered to be a higher-income beneciary. For more

information, visit our webpage Medicare Premiums: Rules

for Higher Income Beneciaries.

8

Monthly Medicare premiums for 2024

The standard Part B premium for 2024 is $174.70. If

you’re single and led an individual tax return, or married

and led a joint tax return, our online chart applies to

you, regardless of your income. If you disagree with the

decision about your income-related monthly adjustment

amounts, you have the right to appeal. You can nd more

information on our webpage Medicare Premiums: Rules

for Higher Income Beneciaries.

Medicare Savings Programs (MSP)

If you can’t afford to pay your Medicare premiums and

other medical costs, you may be able to get help from

your state. States offer Medicare Savings Programs for

people entitled to Medicare who have limited income.

Some programs may pay for Medicare premiums and

some pay Medicare deductibles and coinsurance. To

qualify, you must have Medicare Part A and have limited

income and resources.

You can go online to get more information about these

programs from Medicare’s costs webpage by visiting

www.medicare.gov/basics/costs. Find the link titled,

“Get help with costs.” You can also read Get Help With

Your Medicare Costs: Getting Started (Publication No.

CMS-10126).

Only your state can decide if you qualify for help under

these programs. To nd out, contact your state or local

medical assistance (Medicaid) agency, social services, or

welfare ofce.

Extra Help

You may also be able to get Extra Help paying for the

monthly premiums, annual deductibles, and prescription

co-payments related to the Medicare prescription drug

program. You may qualify for Extra Help if you have

9

limited resources and income (tied to the federal poverty

level). These resources and income limits usually change

each year. You can check for the current numbers at

www.ssa.gov/medicare/part-d-extra-help.

You automatically qualify and don’t need to apply for Extra

Help if you have Medicare and meet 1 of the following

conditions:

• Have full Medicaid coverage.

• Have Supplemental Security Income (SSI).

• Take part in a state program that pays your

Medicare premiums.

For more information about getting help with your

prescription drug costs or to apply for Extra Help, visit us

at www.ssa.gov/medicare/part-d-extra-help. You can

also contact Social Security for more information.

Signing up for Medicare

When should I apply?

If you live in Puerto Rico, you don’t automatically get Part

B. You must sign up for it. See “Initial Enrollment Period

for Part B” below for more information or read Medicare

in Puerto Rico (Publication No. 05-10521).

Some People Get Part A and Part B Automatically

If you’re already getting benets from Social Security or

the RRB, you’ll automatically be enrolled in both Part A

and Part B starting the 1

st

day of the month you turn 65.

If your birthday is on the 1

st

day of the month, Part A and

Part B will start the 1

st

day of the prior month. If you’re

under 65 and have a disability, you’ll automatically get

Part A and Part B after you get disability benets from

Social Security for 24 months. Also, you’ll automatically

get Part A and Part B after you get certain disability

10

benets from the RRB. If you have ALS, you’ll get Part A

and Part B automatically the month your SSDI benets

begin.

NOTE: Medicare Part B is voluntary and you must pay a

premium if you decide you want the coverage, unless you

get help from your state.

If You Are 65 and Not Getting Social Security or

Railroad Retirement Benets

If you’re approaching age 65 and not receiving benets,

you should contact us about 3 months before your 65

th

birthday to sign up for Medicare. You should sign up for

Medicare even if you don’t plan to retire at age 65.

However, if you are eligible for Medicare and your medical

insurance coverage is through a current employer’s

group health plan, Medicare has a Special Enrollment

Period (SEP) to sign up for Medicare Part B. This SEP

qualies you to delay enrolling in Medicare Part B without

having to wait for a General Enrollment Period (GEP) and

paying the penalty for late enrollment. You can nd more

information, under the section titled “Special Enrollment

Period for people covered under an employer group

health plan”.

Getting Your Medicare Card

After you enroll in Medicare, you’ll receive a red, white,

and blue Medicare card showing whether you have

Part A, Part B, or both. Keep your card in a safe place

so you’ll have it when you need it. If your card is lost

or stolen, you can request a replacement card online

by setting up a personal my Social Security account at

www.ssa.gov/myaccount, or call our toll-free number

at 1-800-772-1213, TTY 1-800-325-0778. You’ll also

receive Medicare & You (Publication No. CMS-10050), a

handbook that describes your Medicare benets and plan

choices.

11

Other enrollment situations

You should also contact us about applying for Medicare if

1 of the following applies:

• You’re a surviving spouse with a qualifying disability

and between age 50 and age 65, but haven’t applied

for disability benets because you’re already getting

another kind of Social Security benet.

• You’re a government employee and have a disability

that occurred before age 65.

• You, your spouse, or your dependent child has

permanent kidney failure.

• You had Medicare Part B in the past, but dropped the

coverage.

• You turned down Medicare Part B when you rst got

Part A.

• You or your spouse worked for the railroad industry.

Initial Enrollment Period for Part B

If you are already getting benets from Social Security

or the RRB, you will automatically get Part A and Part B

starting on the 1

st

day of the month when you turn 65. If

your birthday is on the 1

st

day of the month, Part A and

Part B will start the 1

st

day of the prior month.

You will need to choose which way to get your Medicare

health coverage:

• Original Medicare — includes Part A and Part B.

You can buy supplemental coverage from a private

company to help pay your out-of-pocket costs. You can

also add Medicare drug coverage (Part D).

• Medicare Advantage — a Medicare-approved plan

from a private company that bundles your Part A, Part

B, and usually Part D (prescription drug coverage) into

1 plan. Most plans include extra benets like vision,

hearing, dental, and more.

12

If you’re under 65 and have a disability, you’ll

automatically get Part A and Part B after you get SSDI

benets or certain disability benets from the RRB after

24 months.

If you are not receiving Social Security or Railroad

Retirement benets at age 65, you can sign up for Part

A and Part B. You can do so during the 7-month period

that begins 3 months before the month you turn 65. This

period includes the month you turn 65 and ends 3 months

after the month you turn 65.

NOTE: If you don’t enroll in Part B when you’re rst

eligible for it, you may have to pay a late enrollment

penalty for as long as you have Part B coverage. Also,

you may have to wait to enroll, which will delay this

coverage.

When does my enrollment in Part B become

eective?

If you accept the automatic enrollment in Medicare Part B

or if you enroll during the rst 3 months of your age

65 IEP, your coverage will start with the month you’re

rst eligible. If you enroll during the last 4 months, your

coverage will start the 1

st

day of the month after you sign

up.

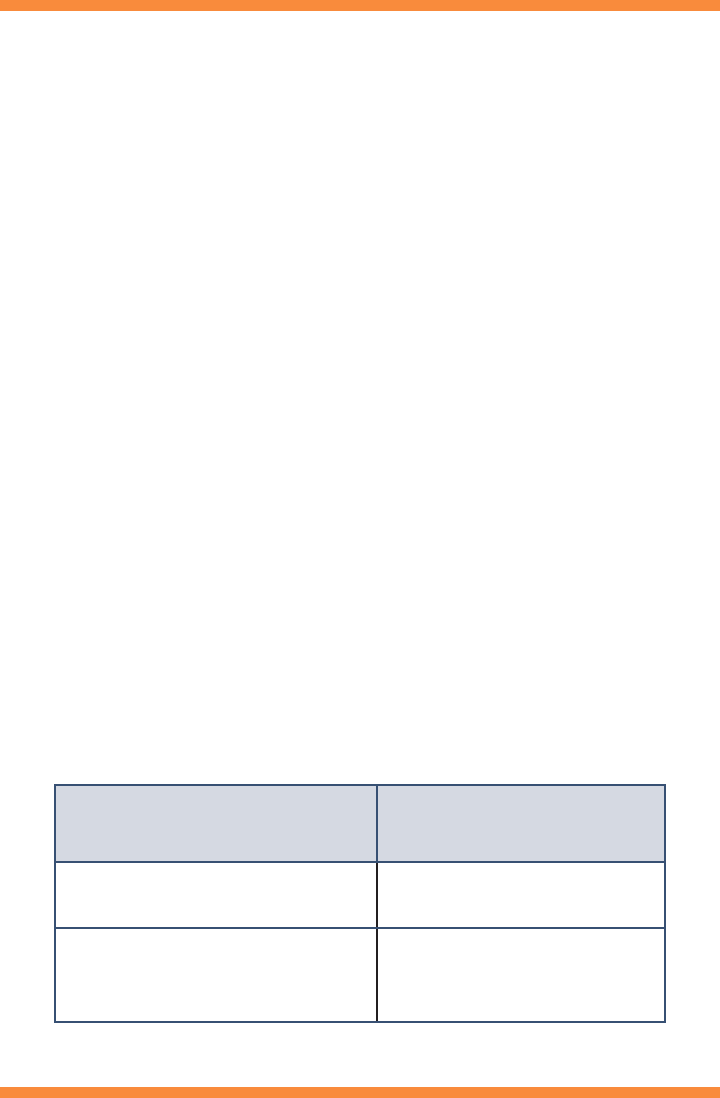

The following chart shows when your Medicare Part B

becomes effective:

If you enroll in this month

of your Initial Enrollment

Period

Your Part B Medicare

coverage starts

1 to 3 months before you

reach age 65

The month you reach

age 65.

The month you reach age

65 or 1 to 3 months after

you reach age 65

The 1

st

day of the month

after you sign up.

13

General Enrollment Period for Part B

If you don’t enroll in Medicare Part B during your IEP, you

have another chance each year to sign up during a GEP

from January 1 through March 31. Your coverage starts

the

1

st

day of the month after you sign up. However, you may

have to pay a late enrollment penalty for as long as you

have Part B coverage. Your monthly premium will go up

10% for each 12-month period you were eligible for Part B,

but didn’t sign up for it.

Medicare Advantage Open Enrollment Period for

people leaving Medicare Advantage plan

If you’re in a Medicare Advantage plan, you can leave

that plan and switch to Original Medicare from January

1 through March 31. If you use this option, you also

have until March 31 to join a Medicare Part D (Medicare

prescription drug plan). Your coverage begins the 1

st

day

of the month after the plan gets your enrollment form.

Special Enrollment Period for people covered

under an employer group health plan

If you’re 65 or older and covered under a group health

plan, either from your own or your spouse’s current

employment, you may sign up for Medicare Part B during

your SEP. This means that you may delay enrolling in

Medicare Part B without having to wait for a GEP and

paying the penalty for late enrollment. There are limits,

so we strongly advise you to contact us up to 3 months

before your 65th birthday if you are unsure of your

situation.

The SEP rules allow you to do 1 of the following:

• Enroll in Medicare Part B any time while you or your

spouse have a group health plan based on current

employment.

14

• Enroll in Medicare Part B during the 8-month period

that begins the month after the employment ends or

the group health coverage ends, whichever happens

rst.

You can’t enroll using an SEP until your IEP is over. If

your employment or the employer-provided group health

plan coverage ends during your IEP, see the enrollment

chart under the “When does my enrollment in Part B

become effective?” section.

When you enroll in Medicare Part B while you’re still in the

group health plan, or during the 1

st

full month when you

are no longer in the plan with current employment, your

coverage begins either:

• On the 1

st

day of the month you enroll.

• By your choice, on the 1

st

day of any of the following 3

months.

If you enroll during any of the remaining 7 months of the

SEP, your Medicare Part B coverage begins on the 1

st

day of the following month.

If you don’t enroll by the end of the 8-month period, you’ll

have to wait until the next GEP, which begins January 1 of

the next year. You may also have to pay a late enrollment

penalty for as long as you have Part B coverage, as

described previously.

If you get SSDI benets and have coverage under a large

group health plan (100 or more employees) from either

your own or a family member’s current employment, you

may also have an SEP. If so, you have premium rights

similar to those for current workers age 65 or older.

NOTE: COBRA and retiree health coverage don’t count

as current employer coverage.

15

Signing up for Part B during the Special

Enrollment Period

You can do 1 of the following:

1. Go to “ Apply Online for Medicare Part B During a

Special Enrollment Period” and complete CMS-40B

and CMS-L564. Then, upload your evidence of Group

Health Plan or Large Group Health Plan.

2. Fax your CMS-40B and employer-signed CMS-L564

forms to your local Social Security ofce.

3. Mail your CMS-40B and employer-signed CMS-L564

to your local Social Security ofce.

NOTE: When completing the CMS-L564:

• State, “I want Part B coverage to begin (MM/YY)” in

the remarks section of the CMS-40B form or online

application.

• If your employer is unable to complete Section B,

please complete that portion as best as you can on

behalf of your employer without your employer’s

signature. Then, submit 1 of the following forms of

secondary evidence:

—Income tax returns that show health insurance

premiums paid.

—W-2s reecting pre-tax medical contributions.

—Pay stubs that reect health insurance premium

deductions.

—Health insurance cards with a policy effective date.

—Explanations of benets paid by the group health

plan or large group health plan.

—Statements or receipts that reect payment of health

insurance premiums.

16

Choices for receiving health services

Medicare beneciaries have choices for getting health

care services.

You can get more information about your health care

choices from the following publications:

• Medicare & You (Publication No. CMS-10050) —

CMS mails this guide to people after they enroll in

Medicare and sends them an updated version each

year after that.

• Choosing a Medigap Policy: A Guide to Health

Insurance for People with Medicare (Publication No.

CMS-02110) — This guide describes how other

health insurance plans supplement Medicare and

offers some shopping hints for people looking at those

plans.

To get a copy of these publications visit

Medicare.gov/publications or call the toll-free number,

1-800-MEDICARE (1-800-633-4227). If you’re deaf or

hard of hearing, call TTY 1-877-486-2048.

If you have other health insurance

Medicare Part A (hospital insurance) is free for almost

everyone. You have to pay a monthly premium for

Medicare Part B (medical insurance). If you already

have other health insurance when you become eligible

for Medicare, you may wonder if it’s worth the monthly

premium costs to sign up for Part B.

The answer varies with each person and the kind of other

health insurance you have. Although we can’t give you

“yes” or “no” answers, we can offer information that can

help you decide. We can also advise if you’ll be subject to

a late enrollment penalty if you delay signing up.

17

If you have a private insurance plan

Get in touch with your insurance agent to see how your

private plan ts with Medicare Part B. This is especially

important if you have family members who have coverage

under the same policy. And remember, just as Medicare

doesn’t cover all health services, most private plans don’t

either. In planning your health insurance coverage, keep

in mind that most nursing home care isn’t covered by

Medicare or private health insurance policies.

NOTE: For your own protection, do not cancel any

health insurance you now have until after your Medicare

coverage begins.

If you have insurance from an employer-provided

group health plan

By law, group health plans of employers with 20 or

more employees have to offer current workers and their

spouses who are age 65 (or older) the same health

benets as younger workers.

If you or your spouse are still working and covered under

an employer-provided group health plan, talk to the

personnel ofce before signing up for Medicare Part B.

If you have a Health Savings Account

You can’t contribute to your Health Savings Account

(HSA) once Medicare Part A or Part B coverage begins.

However, you may use money that’s already in your HSA

after you enroll in Medicare to help pay for deductibles,

premiums, copayments, or coinsurance. If you contribute

to your HSA after your Medicare Part A or Part B

coverage starts, you may have to pay a tax penalty.

18

Remember, premium-free Part A coverage begins 6

months before the date you apply for Medicare (or Social

Security/RRB benets), but no earlier than the 1

st

month

you were eligible for Medicare. To avoid a tax penalty, you

should stop contributing to your HSA at least 6 months

before you apply for Medicare. If unsure of how Medicare

Parts A or B will work with your employer coverage,

talk with your employer about your HSA options. We

recommend you have this discussion up to 6 months

before you turn age 65.

If you have health care protection from other

plans

If you have TRICARE (insurance for active-duty, military

retirees, and their families), your health benets can

change or end when you become eligible for Medicare.

This applies for any reason, regardless of age or place

of residence. If you’re retired from the military or are

a military retiree’s family member, you must enroll in

Part A and Part B once you become eligible to keep

TRICARE coverage. You can nd a military health

benets adviser at milconnect.dmdc.osd.mil or

call the Defense Manpower Data Center, toll-free at

1-800-538-9552 (TTY 1-866-363-2883), before you decide

whether to enroll in Medicare Part B.

If you have health care protection from the Indian Health

Service, Department of Veterans Affairs, or a state

medical assistance program, contact those ofces. They

can help you decide if it’s to your advantage to have

Medicare Part B.

IMPORTANT: If you have VA coverage and don’t enroll

in Part B when you’re rst eligible, you may have to pay

a late enrollment penalty. This penalty applies for as long

as you have Part B coverage. Also, you may have to wait

to enroll, which will delay this coverage.

19

For more information on how other health

insurance plans work with Medicare, visit

www.medicare.gov/publications to view the booklet

Medicare and Other Health Benets: Your Guide to Who

Pays First (Publication No. CMS-02179) or call Medicare’s

toll-free number, 1-800-MEDICARE (1-800-633-4227). If

you’re deaf or hard of hearing, call TTY 1-877-486-2048.

Contacting Us

There are several ways to contact us, such as online,

by phone, and in person. We’re here to answer your

questions and to serve you. For nearly 90 years, we have

helped secure today and tomorrow by providing benets

and nancial protection for millions of people throughout

their life’s journey.

Visit our website

The most convenient way to conduct business with us is

online at www.ssa.gov. You can accomplish a lot.

• Apply for Extra Help with Medicare prescription drug

plan costs.

• Apply for most types of benets.

• Start or complete your request for an original or

replacement Social Security card.

• Find copies of our publications.

• Get answers to frequently asked questions.

When you create a personal my Social Security account,

you can do even more.

• Review your Social Security Statement.

• Verify your earnings.

• Get estimates of future benets.

• Print a benet verication letter.

20

• Change your direct deposit information (Social Security

beneciaries only).

• Get a replacement SSA-1099/1042S.

Access to your personal my Social Security account may

be limited for users outside the United States.

Call us

If you cannot use our online services, we can help you by

phone when you call our National toll-free 800 Number.

We provide free interpreter services upon request.

You can call us at 1-800-772-1213 — or at our TTY

number, 1-800-325-0778, if you’re deaf or hard of hearing

— between 8:00 a.m. – 7:00 p.m., Monday through

Friday. For quicker access to a representative, try calling

early in the day (between 8 a.m. and 10 a.m. local time)

or later in the day. We are less busy later in the week

(Wednesday to Friday) and later in the month. We

also offer many automated telephone services, available

24 hours a day, so you may not need to speak with a

representative.

If you have documents we need to see, they must be

original or copies that are certied by the issuing agency.

21

Notes

22

Notes

Social Security Administration | Publication No. 05-10043

January 2024 (Recycle prior editions)

Medicare

Produced and published at U.S. taxpayer expense