Portfolio Strategy

Understanding Collateralized

Loan Obligations

Summary

Collateralized loan obligations (CLOs) are typically a high yielding, scalable,

oating-rate investment alternative to corporate bonds with a history of

stable credit performance. CLOs represent a $970 billion asset class within

the broader $12 trillion structured credit xed-income market, which also

includes asset-backed securities (ABS). CLOs derive principal and interest

from an actively managed, diversied pool of non-investment grade,

senior-secured corporate loans.

These loans, also known as bank loans or leveraged loans, typically occupy

a rst-lien position in the company’s capital structure, are secured by the

company’s assets, and rank rst in priority of payment ahead of unsecured

debt in the event of bankruptcy.

The combination of diversified, actively managed, senior-secured loan

collateral along with sound securitization structures has resulted in

favorable historical ratings performance. CLOs’ historically low default rate

across the ratings spectrum compares favorably to corporate debt.

Investing in CLOs is not without risk. As with other securities, CLOs

are subject to credit, liquidity, and mark-to-market risk, and the basic

architecture of CLOs requires that investors must understand the waterfall

mechanisms and protections as well as the terms, conditions, and credit

prole of the underlying loan collateral.

However, CLOs have several features that make them an integral

component of Guggenheim’s xed-income strategies. One of the most

important characteristics of CLOs is their oating-rate coupon, which helps

insulate bond prices from volatile interest rates.

§ Collateralized Loan Obligations (CLOs) represent a high yielding,

scalable, floating-rate investment alternative with a history of stable

credit performance.

§ Credit performance through the Great Financial Crisis (GFC) and COVID-19

risk cycles has supported growth in the CLO market, broadened the investor

base, and supported secondary market liquidity.

§ Guggenheim Investments’ long-term experience mobilizing credit research,

structural analysis, analytic infrastructure, and legal expertise in service of

our investment process positions us to capture the attractive relative and

fundamental value in CLOs though a cycle.

Contents

Report Highlights

Investment Professionals

Anne B. Walsh, JD, CFA

Chief Investment Ocer,

Guggenheim Partners

Investment Management

Karthik R. Narayanan, CFA

Managing Director,

Head of Structured Credit

Scott Kanouse

Director,

Structured Credit

Overview: What Are CLOs? ............................................................. 2

Understanding CLO Collateral: Leveraged Loans ........................... 3

Understanding CLO Structures ...................................................... 4

Historical Performance .................................................................. 7

Investor Sponsorship ..................................................................... 8

Investing in CLOs ......................................................................... 10

The Guggenheim Approach ........................................................... 11

1Guggenheim Investments Understanding Collateralized Loan Obligations – 2023

Overview: What Are CLOs?

1. Source: Guggenheim Investments, SIFMA, JP Morgan, Bank of America. Data as of 9.30.2023. CLOs are complex investments and not suitable for all investors. Investors in CLOs

generally receive payments that are part interest and part return of principal. These payments may vary based on the rate at which loans are repaid. Some CLOs may have structures

that make their reaction to interest rates and other factors dicult to predict, make their prices volatile, and subject them to liquidity and valuation risk. Please see “Important Notes

and Disclosures” at the end of this document for additional risk information.

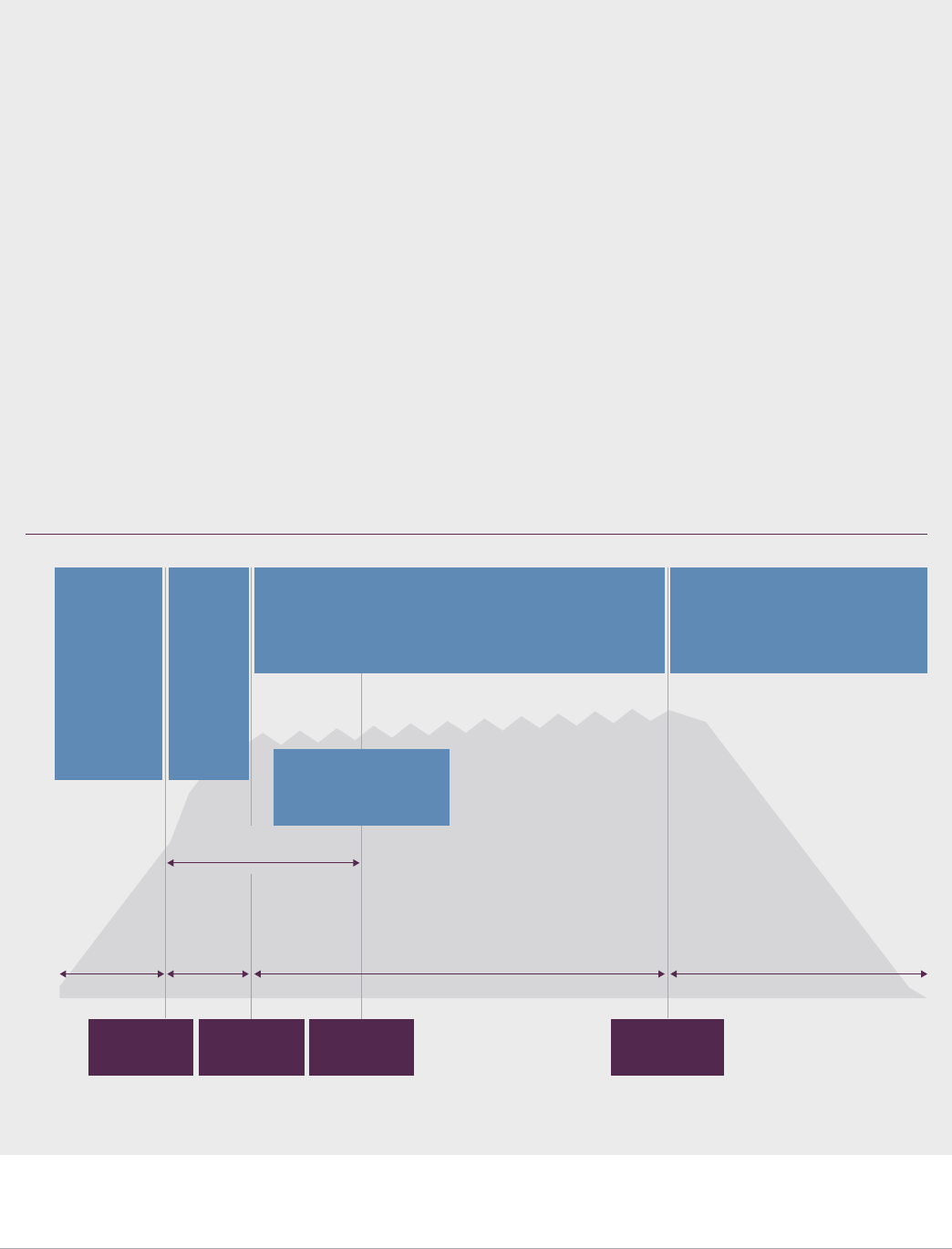

Understanding CLOs: CLO Capital Market Ecosystem

§ Finance buyouts, dividends, or CapEx

§ Rated below investment grade

§ Borrowing is oating rate at SOFR + 300–600bps

§ Private equity sponsors

§ Public markets

§ Private ownership

§ Banks

§ Money Managers

69% or $970bn

§ 31% or $430bn

§ Loan ETFs

§ Separately Managed Accounts

§ Credit Funds, Business Development

Companies (BDCs)

§ Banks

§ Hedge Funds

§ BDCs

§ Money

Managers

§ Banks

§ Money

Managers

§ Insurance

Companies

Leveraged Loan Market ($1.4 trillion) Equity

CLO Market (69%) Debt Investors (31%)

AAA (65%) BB-Equity (13%)AA-BBB (22%)

Source: Guggenheim Investments, SIFMA, LCD. Data as of 9.30.2023.

CLOs are a $970 billion asset class within the broader $12

trillion structured credit xed-income market

1

, which also

includes asset-backed securities (ABS). CLOs derive principal

and interest from an actively managed, diversied pool of

non-investment grade, senior-secured corporate loans.

CLOs use funds received from the issuance of debt and

equity to investors to acquire a diverse portfolio of typically

more than 200 loans. The debt issued by CLOs consists of a

variety of tranches, each with a risk/return prole based on

its seniority and claim priority on the cash ows produced by

the underlying loan pool.

These loans, also known as “bank loans” or “leveraged loans,”

typically occupy a rst-lien position in the company’s capital

structure, are secured by the company’s assets, and rank

rst in priority of payment ahead of unsecured debt in the

event of bankruptcy. Economically, the CLO equity investor

is the owner of the pool of loans and the CLO debt investors

provide term nancing to acquire the pool of loans.

2 Guggenheim InvestmentsUnderstanding Collateralized Loan Obligations – 2023

Leveraged loans’ senior secured status has historically led to lower default rates and higher recoveries compared to high-yield bonds.

CLOs historically have further mitigated default and recovery risk of individual company credits by holding diverse portfolios of leveraged

loans—typically more than 200 borrowers—that are actively managed.

Leveraged Loan vs. High-Yield Default Rates

High-Yield Bonds Par-Weighted Default Rate Loans Default Rate by Volume

0%

2%

4%

6%

8%

10%

12%

14%

16%

2004

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2022

2021

1998

1999

2000

2001

2002

2003

2005

Source: Guggenheim Investments, JP Morgan. Data as of 10.31.2023. Past performance does not guarantee future success.

Recovery Rates for Leveraged Loans and High-Yield Bonds

High-Yield Bond Recovery Rate 1st Lien Loan Recovery Rate

0

10

20

30

40

50

60

70

80

90

100

2004

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2022

2021

1999

2000

2001

2002

2003

2005

LTM

Understanding CLO Collateral: Leveraged Loans

A portfolio of loans act as the collateral supporting a CLO.

The proceeds of these loans are typically used by

non-investment grade borrowers to support a range of

activities, including mergers and acquisitions, stock

repurchases, dividend payments, leveraged buyouts, or

investment in new projects. Loans are provided by a group

or “syndicate” of institutional lenders and arranged by an

investment bank. Most CLO collateral consists of senior

secured loans, or rst-lien loans, which have a priority

claim on all of the related company’s assets in the event of

a bankruptcy and are intended to be a less risky investment

in these companies. Loans carry oating-rate coupons

typically benchmarked to the Secured Overnight Financing

Rate (SOFR). Loans carry a number of covenants, including

nancial covenants that may restrict lender-unfriendly

actions, and require compliance with certain credit metrics.

The senior secured position of these loans has contributed to

higher historical recoveries in default scenarios than those

seen in the high-yield bond market.

3Guggenheim Investments Understanding Collateralized Loan Obligations – 2023

Understanding the Typical Structure of a CLO

Cash ow distributions begin with the senior-most debt tranches of the CLO capital structure and ow down to the bottom equity

tranche, a distribution methodology that is referred to as a waterfall.

Hypothetical illustration showing a generic single-B corporate capital structure and a generic CLO capital structure with typical pricing levels in the current market as of 9.30.2023.

Corporate Capital Structure CLO Capital Structure

Equity

Enterprise

Value

Senior

Secured

Loans

Unsecured / Subordinated Debt

Equity

Understanding CLO Structures

At its inception, a CLO raises money to purchase a portfolio

of loans by selling various debt and equity tranches to

investors. Each tranche has a dierent claim priority on

the cash received from the loan pool and exposure to loss

from the underlying collateral pool. Cash ow distributions

begin with the senior-most debt tranches of the CLO capital

structure and ow down to the junior-most equity tranche—

a distribution methodology that is referred to as a waterfall.

The cash ow waterfall and a suite of performance tests and

collateral concentration limits provide varying degrees of

protection to the CLO’s debt tranches.

The CLO’s most senior and highest-rated AAA tranche carries

the lowest coupon but is entitled to the highest claim on

the cash ow distributions and is the most loss-remote.

Mezzanine tranches pay higher coupons but are more

exposed to loss and have lower ratings. The most junior

and riskiest part of the CLO capital structure is the equity

tranche, which is neither rated nor coupon bearing. Instead,

the equity tranche represents a claim on all excess cash ows

that remain once the obligations for all debt tranches have

been met. AAA senior tranches are the largest and typically

AAA

SOFR+170 bps; 6.5yr WAL

BBB

SOFR+500 bps; 9.4yr

Equity

Debt

Losses

Payments

AA

SOFR+260 bps; 8.5yr

A

SOFR+300 bps; 9.0yr

BB

SOFR+825 bps; 9.7yr

4 Guggenheim InvestmentsUnderstanding Collateralized Loan Obligations – 2023

represent 70 percent of the capital structure. Mezzanine

AA to BB-rated tranches are much smaller and typically

represent 4–12 percent of the capital structure each. Equity

tranches vary in size but are typically about 8–10 percent of

the capital structure.

CLOs are governed by a series of coverage tests to measure

the adequacy of the collateral balance and of cash ows

generated by the underlying bank loan collateral. One such

test is an overcollateralization test (OC test), which ensures

the principal value of the bank loan collateral pool exceeds

the outstanding principal of the CLO debt tranches. If the

bank loan collateral’s principal value declines below the

OC test trigger value, cash that otherwise would have been

distributed to the equity and junior CLO tranches will be

used to instead pay down senior debt tranche investors.

Another test computes interest coverage (IC test), which

ensures the adequacy of cash collected from the bank loan

collateral to pay CLO tranche interest. If collateral collections

decline below the IC test trigger value, cash that otherwise

would have been distributed to the equity and junior CLO

tranches will be used instead to pay down senior debt

tranche investors, in a manner similar

to the OC test described earlier. CLOs are also subject

to a variety of collateral concentration limits that seek

to limit risk in the bank loan collateral pool and protect

CLO investors from loss. Examples of these limits include

requirements for industry diversication in the underlying

pool of bank loans and exposure to non-senior secured loans

and single obligors. There are also limitations on the balance

of CCC-rated loans that can be included in the underlying

collateral pool, which helps contain overall default risk.

Most CLO portfolios are actively managed. The collateral

manager seeks to mitigate losses from loan defaults and

optimize the bank loan portfolio’s value through actively

managing the holdings and positioning of the portfolio

over a predened reinvestment period. CLOs do not have

mark-to-market tests and are only dependent upon cash ow

performance (e.g., timely payment of principal and interest),

ratings, maturities, and defaults of the underlying bank

loans. Therefore, CLO managers are not forced sellers during

periods of market volatility, and can buy and sell bank loans

to take advantage of opportunities in the market to nd

value or minimize losses on deteriorating credits.

Performance Tests

Excess Spread: The weighted average coupon of the

loan collateral is higher than the coupon paid to investors

to create an additional buer of cash.

Subordination: Deals are structured so junior tranches

absorb losses before senior tranches.

Risk-reduction technique that increases the likelihood

of repayment relative to the intrinsic risks of the

underlying collateral.

Overcollateralization Test: Par amount of assets / Outstanding

amount of related tranche and all tranches senior to it.

Interest Coverage Test: Interest on Assets / Interest due on

related tranche and all tranches senior to it.

Risk-reduction technique that increases the

likelihood

of repayment relative to the intrinsic risks of the

underlying collateral.

Redirect cash ows from subordinate tranches to purchase

additional collateral loans and repay senior debt if collateral

performance deteriorates.

Structural Protections of CLOs

Credit Enhancement

Excess Spread: The weighted average coupon of the

loan collateral is higher than the coupon paid to investors

to create an additional buer of cash.

Subordination: Deals are structured so junior tranches

absorb losses before senior tranches.

Risk-reduction technique that increases the likelihood

of repayment relative to the intrinsic risks of the

underlying collateral.

Excess Spread: The average interest collected from the

loan collateral is higher than the interest paid to investors

to create an additional buer of cash.

Subordination: Deals are structured so that junior tranches

absorb losses before senior tranches.

Risk-reduction technique that increases the

likelihood

of repayment relative to the intrinsic risks of the

underlying collateral.

Risk-reduction feature that increases the likelihood

of repayment relative to the intrinsic risks of the

underlying collateral.

Source: Guggenheim Investments.

5Guggenheim Investments Understanding Collateralized Loan Obligations – 2023

Breaking Down a CLO’s Lifecycle

CLO Lifecycle: CLOs typically last eight to 10 years, during

which time a series of milestones are passed.

Warehouse Period: A warehouse provider nances the

CLO manager’s acquisition of leveraged loan assets. The

warehouse period typically takes three to nine months. The

warehouse loan is expected to be paid o with the proceeds

from the CLO’s issuance.

Ramp-Up Period: After closing, the CLO manager uses the

proceeds from the CLO issuance to purchase additional assets.

The ramp-up period usually lasts three to six months and

concludes at the ramp-up end date.

Reinvestment Period: The collateral manager is permitted to

actively trade underlying assets within the CLO and uses

principal cash ow from underlying assets to purchase new

assets. The reinvestment period may last up to ve years.

Non-Call Period: During the non-call period the equity may

not call or renance the CLO debt tranches. Non-call periods

may last six months to two years, depending on the length

of the reinvestment period. After that point, CLO equity

tranche owners have the right, but not the obligation, to

renance the CLO.

Amortization Period: After the reinvestment period ends,

the CLO enters its amortization period, during which cash

ows from the CLO’s underlying assets are used to pay down

outstanding CLO debt. The amortization period represents

the end of a CLO’s lifecycle.

Lifecycle of a CLO

Source: Guggenheim Investments, Wells Fargo.

$ Collateral Balance

Date

Reinvestment

Period Ends

Non-Call

Period Ends

Ramp-Up

End Date

CLO Closing

Date

Warehouse

Period

Warehouse

bank provides

CLO manager

with nancing

to acquire

assets.

Ramp-Up

Period

Proceeds

from CLO

issuance

are used

to

purchase

additional

assets.

Reinvestment Period

CLO collateral manager is permitted to actively trade

underlying assets, and uses principal cash ows from

underlying assets to purchase new assets.

Amortization Period

Cash ows from assets are used to

pay down the outstanding notes.

Non-Call Period Ends

CLO equity investor can

renance CLO tranches.

2 years

3–6 months

3–9 months 4–5 years 2–3 years

6 Guggenheim InvestmentsUnderstanding Collateralized Loan Obligations – 2023

Performance Summary of CLOs Issued Before and After the GFC

The combination of diversied, actively managed, senior-secured loan collateral along with sound securitization structures has resulted

in favorable historical ratings performance.

Source: Guggenheim Investments, Standard and Poor’s. Data as of 9.30.2023.

CLO 1.0 CLO 2.0 Default %

Original Rating Category

Original Rating

Count

Default

Count

Original Rating

Count

Default

Count

CLO 1.0 CLO 2.0

AAA 1,540 0 3,639 0 0.0% 0.0%

AA 616 1 2,964 0 0.2% 0.0%

A 790 5 2,449 0 0.6% 0.0%

BBB 783 9 2,230 0 1.1% 0.0%

BB 565 22 1,818 8 3.9% 0.4%

B 28 3 389 11 10.7% 2.8%

Total 4,322 40 13,489 19 0.9% 0.1%

Historical Performance

The combination of diversied, actively managed, senior-

secured loan collateral along with sound securitization

structures has resulted in favorable historical ratings

performance. According to Standard & Poor’s, CLO 1.0s

(CLOs that were issued before the GFC) exhibited strong

credit performance during the nancial crisis and produced

a very small number of lifetime defaults. CLO 2.0s (CLOs

issued after the GFC) feature numerous additional credit

improvements compared to their pre-crisis counterparts.

First, rating agencies now require that CLOs carry

substantially more overcollateralization than their pre-crisis

counterparts. Second, whereas pre-crisis CLOs were able

to make meaningful investments in subordinated bonds

and other structured credit instruments, post-crisis CLOs

are collateralized almost exclusively by senior secured

bank loans. Third, post-crisis CLOs’ documentation is

much more investor friendly, for example, by shortening

the trading period during which the manager is able to

actively manage the loan portfolio, and limiting extension

risk for CLO securities. Due to their enhanced collateral and

structural improvements, CLO 2.0s experienced even better

performance than CLO 1.0.

CLOs’ historically low default rate across the ratings

spectrum compares favorably to corporate debt.

7Guggenheim Investments Understanding Collateralized Loan Obligations – 2023

CLOs Are the Largest Leveraged Loan Investor

CLOs purchased 69 percent of all new issue leveraged loans in 2022, and own 70 percent of the overall leveraged loan market.

Source: Guggenheim Investments, S&P LCD, Bank of America. Data as of 9.30.2023.

0%

10%

20%

30%

40%

50%

60%

70%

80%

$ 200bn

$400bn

$600bn

$800bn

$1,000bn

$1,200bn

$1,400bn

$1,600bn

U.S. Institutional Loan Market (LHS) U.S. CLO Market (LHS) % CLO Share (RHS)

$0bn

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

YTD

Source: Guggenheim Investments, Standard and Poor’s. Data as of 9.30.2023.

CLO 1.0 + 2.0CLO 1.0 + 2.0 Corporate

Original Rating Category Original Rating Category 5 Year5 Year 10 Year10 Year

AAA 0.00% 0.42% 0.83%

AA 0.03% 0.41% 0.96%

A 0.15% 0.64% 1.65%

BBB 0.30% 1.79% 3.93%

BB 1.26% 7.26% 13.35%

B 3.36% 17.4 8% 24.79%

CLO and Corporate Bond Cumulative Defaults

CLOs’ historically low default rate across the ratings spectrum compares favorably to corporate debt.

Investor Sponsorship

The CLO marketplace has evolved since the GFC. The CLO

market grew from a post-crisis trough of $263 billion to $970

billion as of September 2023, according to Bank of America

data. Many new investors were attracted to the strong histor-

ical credit performance and oating-rate coupon following

the GFC. The CLO market has grown in-step with the bank

loan market and expanded at a quicker pace than other cred-

it market sectors.

8 Guggenheim InvestmentsUnderstanding Collateralized Loan Obligations – 2023

Prior to the GFC, investor sponsorship was largely dominated

by hedge funds, structured investment vehicles, and Wall

Street trading desks. However, post-crisis regulation has

all but eliminated these highly leveraged investor types.

Today’s CLO investor base is primarily composed of

large institutional asset managers, banks, and insurance

companies. These investors do not employ the high leverage

strategies of the pre-crisis investor base and, as a result, are

less prone to the forced selling that arises from mark-to-

market volatility and margin call pressures.

Source: Guggenheim Investments, Bank of America. Data as of 6.30.2022.

Investor Types

Rating Outstanding

Insurance Banks

Japanese

Banks

Asset Managers /

Hedge Funds

AAA $527bn 17% 35% 19% 28%

AA $103bn 50% 50%

A $55bn 64% 36%

BBB $53bn 49% 51%

BB $38bn 20% 80%

Equity $97bn 20% 80%

Investor Composition of CLOs

Today’s CLO investor base is primarily composed of large institutional asset managers and insurance companies. These investors do not

employ the high leverage strategies of the pre-crisis investor base and, as a result, are less prone to the forced selling that arises from

mark-to-market volatility and margin call pressures.

Source: Guggenheim Investments, Bank of America. Data as of 12.31.2022.

Secondary trading volumes in investment-grade CLO

tranches have been fairly stable year over year, and

underscore the ability of risk to change hands even in

challenging market environments. The buy-and-hold

oriented sponsorship of investment-grade CLO tranches can

be observed in the lower level of turnover. In contrast, non

investment-grade CLO tranche trading volumes are higher

and more variable, highlighting their more opportunistic

and risk-tolerant buyer base.

9Guggenheim Investments Understanding Collateralized Loan Obligations – 2023

Investment-Grade Turnover (%) Below Investment-Grade Turnover (%)

10%

20%

30%

40%

50%

60%

2015 2016 2017 2018 2019 2020 2021 YTD 2023

Turnover (%)

0%

2022

Trading Volumes of CLOs: Investment Grade and Below Investment Grade Turnover Breakdown

Secondary trading volumes in both investment-grade and non-investment-grade CLO tranches underscore the ability of risk to change

hands even in challenging market environments.

Source: Guggenheim Investments, FINRA. Data as of 9.30.2023.

Investing in CLOs

CLOs have several features that make them an integral

component of Guggenheim’s xed-income strategies.

In addition to their investor-friendly structural protections

and historical credit performance, one of the most important

characteristics of CLOs is their oating-rate coupon, which

helps insulate bond prices from volatile interest rates. Fixed-rate

securities decline in value as interest rates rise and investors

discount the value of the xed-rate bonds’ relatively low

coupons. However, the coupons on oating-rate securities

such as CLOs adjust based on the current short-term interest-

rate environment. As a result, oating-rate securities’ prices

tend to be more stable in volatile interest-rate environments

than those of their xed-rate counterparts.

Investing in CLOs is not without risk. As with other securities,

CLOs are subject to credit, liquidity, and mark-to-market risk,

and the basic architecture of CLOs requires that investors must

understand the waterfall mechanisms and protections as well

as the terms, conditions, and credit prole of the underlying

loan collateral. Thus, the relative value determination for a

CLO simultaneously considers potential returns relative to

other securitized and corporate xed-income sectors as well

as its pricing relative to other short-duration options.

Capturing opportunities in the CLO market requires the

expertise to perform bottom-up research on individual

bank loans in the underlying collateral pool. Because CLOs

routinely have over 200 issuers in their collateral pools,

investment managers must have signicant corporate credit

research capabilities to fully evaluate the underlying credit

risk in each CLO.

The importance of understanding a CLO’s structural

characteristics cannot be underestimated. Two CLOs with

the identical collateral assets may perform dierently due to

structural dierences. The legal documentation that governs

a typical CLO can be in excess of 300 pages, and a high degree

of expertise and consistent market presence are required to

analyze these documents and discuss key terms with managers

looking to access the market. The ability to access the value in

CLOs becomes available to investors with the appropriate mix

of credit research, structuring experience, and legal expertise.

10 Guggenheim InvestmentsUnderstanding Collateralized Loan Obligations – 2023

The Guggenheim Approach

Guggenheim’s approach to investing in CLOs is consistent

with our process for all our xed-income investments. With

CLOs, the Guggenheim investment process starts with

a bottom-up fundamental approach to CLO structures.

Guggenheim brings to bear its extensive research insights

across a broad spectrum of the bank loan market and the

structuring and legal expertise necessary to understand the

nuances of each individual CLO investment opportunity.

Collateral, structure, and manager attributes are evaluated,

and stress testing and scenario analyses are performed.

Research is augmented by our in-house legal team and by

the obligor-level credit views of our corporate credit team.

Investments are integrated into portfolio strategies by

considering relative value, risk, and sector targets, as well as

the risk-adjusted return potential evaluated from a long-term

holding period point of view.

11Guggenheim Investments Understanding Collateralized Loan Obligations – 2023

Important Notices and Disclosures

GLOSSARY OF TERMS

Basis Point: A unit of measure used to describe the percentage changes in the value or rate of an instrument. One basis point is equivalent to 0.01 percent.

First Lien: A security interest in one or more assets that lenders hold in exchange for secured debt financing. The first lien to be recorded is paid first.

Mark-to-Market: A measure of the fair value of an asset or liability, based on current market price.

Mezzanine Financing: A hybrid of debt and equity financing that is typically used in the expansion of existing companies.

Second Lien: Debts that are subordinate to the rights of more senior debts issued against the same collateral or portions of the same collateral.

Secured Overnight Financing Rate (SOFR): A broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Structured Investment Vehicles: Pools of investment assets that attempt to profit from credit spreads between short-term debt and long-term structured finance products such as asset-

backed securities.

Tranche: Related securities that are portions of a deal or structured financing, but have dierent risks, return potential and/or maturities.

Waterfall: A hierarchy establishing the order in which funds are to be distributed.

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment

product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does

not constitute a solicitation of an oer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion.

Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the author or speaker, but not necessarily those of Guggenheim Partners, LLC, or its subsidiaries. The opinions contained herein are subject to change without

notice. Forward-looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained

herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty

as to the current accuracy of, nor liability for, decisions based on such information. No part of this material may be reproduced or referred to in any form, without express written permission

of Guggenheim Partners, LLC.

Investing involves risk, including the possible loss of principal. Investments in bonds and other fixed-income instruments are subject to the possibility that interest rates could rise, causing

their value to decline. Investors in asset-backed securities, including mortgage-backed securities, collateralized loan obligations (CLOs), and other structured finance investments, generally

receive payments that are part interest and part return of principal. These payments may vary based on the rate at which the underlying borrowers pay o their loans. Some asset-backed

securities, including mortgage-backed securities, may have structures that make their reaction to interest rates and other factors dicult to predict, causing their prices to be volatile. These

instruments are particularly subject to interest rate, credit and liquidity and valuation risks. High-yield bonds may present additional risks because these securities may be less liquid, and therefore

more dicult to value accurately and sell at an advantageous price or time, and present more credit risk than investment-grade bonds. The price of high-yield securities tends to be subject

to greater volatility due to issuer-specific operating results and outlook and to real or perceived adverse economic and competitive industry conditions. Bank loans, including loan syndicates

and other direct lending opportunities, involve special types of risks, including credit risk, interest rate risk, counterparty risk, and prepayment risk. Loans may oer a fixed or floating interest

rate. Loans are often generally below investment grade, may be unrated, and can be dicult to value accurately and may be more susceptible to liquidity risk than fixed-income instruments of

similar credit quality and/or maturity.

Applicable to United Kingdom investors: Where this material is distributed in the United Kingdom, it is done so by Guggenheim Investment Advisers (Europe) Ltd., a U.K. Company authorized

and regulated by the Financial Conduct Authority (FRN 499798) and is directed only at persons who are professional clients or eligible counterparties for the purposes of the FCA’s Conduct

of Business Sourcebook.

Applicable to European Investors: Where this material is distributed to existing investors and pre 1 January 2021 prospect relationships based in mainland Europe, it is done so by Guggenheim

Investment Advisers (Europe) Ltd., a U.K. Company authorized and regulated by the Financial Conduct Authority (FRN 499798) and is directed only at persons who are professional clients or

eligible counterparties for the purposes of the FCA’s Conduct of Business Sourcebook.

Applicable to Middle East investors: Contents of this report prepared by Guggenheim Partners Investment Management, LLC, a registered entity in their respective jurisdiction, and aliate

of Guggenheim Partners Middle East Limited, the Authorized Firm regulated by the Dubai Financial Services Authority. This report is intended for qualified investor use only as defined in the

DFSA Conduct of Business Module.

©2023, Guggenheim Partners, LLC. All rights reserved. Guggenheim, Guggenheim Partners, and Innovative Solutions. Enduring Values. are registered trademarks of Guggenheim Capital,

LLC. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC.

59452

Guggenheim Investments

Guggenheim Investments is the global asset management

and investment advisory division of Guggenheim Partners,

with more than $218 billion

1

in total assets across xed

income, equity, and alternative strategies. We focus on the

return and risk needs of insurance companies, corporate and

public pension funds, sovereign wealth funds, endowments

and foundations, consultants, wealth managers, and high-

net-worth investors. Our 250+ investment professionals

perform rigorous research to understand market trends and

identify undervalued opportunities in areas that are often

complex and underfollowed. This approach to investment

management has enabled us to deliver innovative strategies

providing diversication opportunities and attractive

long-term results.

Guggenheim Partners

Guggenheim Partners is a diversied nancial services

rm that delivers value to its clients through two primary

businesses: Guggenheim Investments, a premier global

asset manager and investment advisor, and Guggenheim

Securities, a leading investment banking and capital

markets business. Guggenheim’s professionals are based

in oces around the world, and our commitment is to

deliver long-term results with excellence and integrity while

advancing the strategic interests of our clients. Learn more

at GuggenheimPartners.com, and follow us on LinkedIn and

Twitter @GuggenheimPtnrs.

1. Guggenheim Investments Assets Under Management are as of 9.30.2023 and include leverage of $15.9bn. Guggenheim Investments represents the following aliated investment management

businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment

Advisors, LLC, Guggenheim Partners Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, GS GAMMA Advisors,

LLC, and Guggenheim Partners India Management. Securities delivered by Guggenheim Funds Distributors, LLC.

Guggenheim’s Investment Process

Guggenheim’s xed-income portfolios are managed by a

systematic, disciplined investment process designed to

mitigate behavioral biases and lead to better decision making.

Our investment process is structured to allow our best

research and ideas across specialized teams to be brought

together and expressed in actively managed portfolios.

We disaggregated xed-income investment management

into four primary and independent functions—

Macroeconomic Research, Sector Teams, Portfolio

Construction, and Portfolio Management—that work

together to deliver a predictable, scalable, and repeatable

process. Our pursuit of compelling risk-adjusted return

opportunities typically results in asset allocations that

dier signicantly from broadly followed benchmarks.

For more information, visit GuggenheimInvestments.com.