SUBJECT: SELLING UPDATES

This Guide Bulletin announces:

Home Possible

®

Mortgages

• A revision to the eligibility requirements for Home Possible

®

Mortgages – July 3, 2019

• Additional clarifications related to Home Possible Mortgage eligibility

Assets as basis for repayment of obligations

• A revision to our calculation for establishing the debt payment-to-income ratio when qualifying a

Borrower using assets as a basis for repayment of obligations – July 3, 2019

Second home Mortgages

• Updates to our requirements for second home Mortgages

• Revised Multistate Second Home Rider

Income documentation requirements

• Updates to the documentation requirements language for retirement income, survivor and dependent

benefit income, long-term disability income and Social Security Supplemental Security Income

Guide Form 1077, Uniform Underwriting and Transmittal Summary

• An update to the mandatory effective date of revised Form 1077 for Seller/Servicers using this form –

February 1, 2020

Single Security Initiative

• Updates to the Guide to reflect changes related to the Single Security Initiative announced in our March

5, 2019 Industry Letter – June 3, 2019

Additional Guide updates

• Further updates as described in the Additional Guide Updates section of this Bulletin

EFFECTIVE DATE

All of the changes announced in this Bulletin are effective immediately unless otherwise noted.

HOME POSSIBLE MORTGAGES

Limitation on the number of financed residential properties owned

Effective for Mortgages with Settlement Dates on and after July 3, 2019

At the instruction of the FHFA, we are revising our requirements for Home Possible Mortgages to state that the

occupying Borrower(s) must not have an ownership interest in more than two financed residential properties,

including the subject property, as of the Note Date, or for Construction Conversion and Renovation Mortgages,

the Effective Date of Permanent Financing.

Loan Product Advisor

®

feedback messages will be updated by July 3, 2019 to reflect these changes.

TO: Freddie Mac Sellers April 3, 2019 | 2019-7

Page 2

Guide impact: Section 4501.7

Borrower income

In response to Seller questions regarding the use of rental income from an investment property to qualify a

Borrower for a Home Possible Mortgage, we are adding language stating that the requirements of Topics 5300

and 5400, including eligible income types, apply to Home Possible Mortgages. In the event any requirements of

Topics 5300 or 5400 conflict with the requirements in Section 4501.9 the requirements of Section 4501.9 apply.

Guide impact: Section 4501.9

Texas Equity Section 50(a)(6) Mortgages

We are updating Section 4501.3 to specify that Texas Equity Section 50(a)(6) Mortgages originated in

accordance with Section 4301.7, may be Home Possible Mortgages. We are also updating Section 4501.10 to

add a specific reference to Texas Equity Section 50(a)(6) Mortgage loan-to-value (LTV) and total LTV (TLTV)

ratio requirements in Section 4301.7(d) and, for consistency, a reference to the location of LTV and TLTV ratio

requirements for Home Possible Mortgages with RHS Leveraged Seconds.

Guide impacts: Sections 4501.3 and 4501.10

ASSETS AS A BASIS FOR REPAYMENT OF OBLIGATIONS

Effective for Mortgages with Settlement Dates on and after July 3, 2019, but Sellers may implement

immediately

We received feedback from Sellers that the calculation for establishing the debt payment-to-income ratio for

assets as a basis for repayment of obligations is too limiting. After additional research into how assets are

typically used during retirement, we are revising the calculation. The calculation will now require the Seller to

divide the net eligible assets by 240 (instead of 360, as was previously required) to determine the amount used to

establish the debt payment-to-income ratio. The new calculation remains aligned with our intent that only assets

that are reasonably expected to be used to repay the Mortgage are used for qualifying the Borrower.

Guide impact: Section 5307.1

SECOND HOME MORTGAGES

In response to Seller feedback, we are updating our requirements for second home Mortgages to:

• Permit second homes with seasonal limitations on year-round occupancy (e.g., lack of winter

accessibility) to be eligible for sale to Freddie Mac provided the appraiser includes at least one

comparable sale with similar seasonal limitations to demonstrate the marketability of the subject property

• Specify that the property may be rented out on a short-term basis provided that:

➢ The Borrower keeps the property securing the second home Mortgage available primarily (i.e., more

than half of the calendar year) as a residence for the Borrower’s personal use and enjoyment; and

➢ The property is not subject to any rental pools or agreements that require the Borrower to rent the

property, give a management company or entity control over the occupancy of the property or

involve revenue sharing between any owners and developer or another party

Guide impacts: Sections 4201.15 and 5601.2

Multistate Second Home Rider Uniform Instrument

Freddie Mac and Fannie Mae have revised the Multistate Second Home Rider-Single-Family – Fannie

Mae/Freddie Mac Form 3890 (rev. 4/19). For more information, visit Freddie Mac’s Uniform Instrument News &

Updates web page.

As a result, we are updating Guide Exhibit 4, Single Family Uniform Instruments, to reflect the revised Second

Home Rider.

Page 3

Guide impact: Exhibit 4

INCOME DOCUMENTATION REQUIREMENTS

In response to Seller feedback, we are updating the documentation requirements language for retirement income,

survivor and dependent benefit income, long-term disability income and Social Security Supplemental Security

Income to specify that one or more of the required documents (i.e., benefit verification letter, award letter, pay

statement, 1099 and bank statement(s)) can be used to verify income type, source, payment frequency, payment

amount and current receipt of the income. As a result, separate verification of current receipt of income is not

required if the documentation obtained to support income type, source, payment frequency and predetermined

payment amount also verifies current receipt of income.

The applicable Loan Product Advisor feedback messages will be updated to reflect these changes.

Guide impact: Section 5305.2

GUIDE FORM 1077, UNIFORM UNDERWRITING AND TRANSMITTAL SUMMARY

Effective for Mortgages with Application Received Dates on and after February 1, 2020

In Bulletin 2018-24, Freddie Mac announced an updated version of Form 1077 developed after joint review with

Fannie Mae. Seller/Servicers could begin using the revised form immediately but would be required to use the

revised form for Mortgages with Application Received Dates on or after June 5, 2019.

As a result of industry feedback, for Seller/Servicers using Form 1077, we are extending the mandatory usage

date for the revised form. While Seller/Servicers may use the revised form sooner if they choose to, they must use

the revised form for Mortgages with Application Received Dates on or after February 1, 2020, which aligns with

the previously announced requirement for mandatory use of revised Form 65, Uniform Residential Loan

Application.

Freddie Mac and Fannie Mae are discussing additional changes to Form 1077 and will notify Sellers of those

changes in a future Guide Bulletin.

Guide impact: Form 1077

SINGLE SECURITY INITIATIVE

On February 28, 2019, the FHFA issued a final rule supporting the Uniform Mortgage-Backed Security

(UMBS

TM

). As outlined in the final rule, the FHFA instructed Freddie Mac and Fannie Mae to modify and align

their pooling practices for fixed-rate Mortgages to enhance UMBS fungibility.

As a result, on March 5, 2019, Freddie Mac issued an Industry Letter announcing changes to the Note Rate to

Coupon spreads and a reduction in the maximum Servicing Spread for Mortgages serving as collateral for UMBS

and MBS, effective for Mortgages sold under Freddie Mac’s fixed-rate Guarantor or MultiLender Swap program

with Settlement Dates on or after June 3, 2019. This Bulletin updates the Guide to reflect these required changes.

The FHFA has also instructed Freddie Mac and Fannie Mae to monitor the Weighted Average Coupon (WAC) of

MBS and take actions as appropriate such that MBS WAC would be generally consistent with historical WAC

levels. The FHFA, Freddie Mac and Fannie Mae are working to determine an appropriate target MBS WAC, such

as 80 basis points or slightly higher (given current guarantee fees and minimum servicing levels).

As a reminder, Bulletin 2018-24 communicated that effective for contracts taken out on or after April 19, 2019 for

Mortgages with Settlement Dates on or after June 3, 2019, Sellers will be able to take out guarantor contracts,

including the new 10-year guarantor contract, in Loan Selling Advisor

®

to deliver Mortgages into a UMBS or an

MBS. Sellers will be able to take out Gold PC contracts for Mortgages with Settlement Dates prior to June 3,

2019. For more information on the Loan Selling Advisor changes, refer to the April 3, 2019 Single-Family News

Center article.

For more information on the Single Security Initiative (“Initiative”), refer to the Single Security and the Common

Securitization Platform web page and Bulletin 2018-24 that announced Guide updates reflecting other Initiative

Page 4

required changes, including new naming conventions for the securities Freddie Mac will issue beginning June 3,

2019 and the payment delay for these securities.

Guide impacts: Sections 6201.3, 6202.3, 6203.3, 6203.7, 6205.3, 6205.7 and 8105.1

Lender-paid mortgage insurance

We are revising the Guide sections related to the sale of fixed-rate Mortgages with annual- and monthly-premium

lender-paid mortgage insurance to reflect a 50 basis points maximum Minimum Contract Servicing Spread for

Mortgages sold under the fixed-rate Guarantor and MultiLender Swap programs.

Guide impact: Section 4701.2

ADDITIONAL GUIDE UPDATES

Form 900SA, Loan Selling Advisor Selling Agent Identification Authorized User Role Form

Previously, Form 900SA could be submitted to Freddie Mac only via mail. To provide additional flexibility, we are

allowing alternate methods of delivery of the completed form. Form 900SA can now also be submitted via:

• E-mail to pe_customer_setup@FreddieMac.com

• Fax to 703-738-1532

Guide impact: Form 900SA

Delivery requirements for GreenCHOICE Mortgages

SM

Effective May 1, 2019

As announced in Bulletin 2019-4, in alignment with the Uniform Loan Delivery Dataset (ULDD) specification, we

removed the delivery requirements and notes for ULDD Data Point, Escrow Balance Amount (Sort ID 363) for all

Mortgages from Section 6302.5 but continue to require it in the special delivery requirements for fixed-rate

Mortgages sold through Cash-Released XChange

SM

in Section 6302.26.

The requirement is also attributable to the special delivery requirements for GreenCHOICE Mortgages

SM

in

Section 6302.23 to align with the mortgage eligibility requirements of Section 4606.4.

Therefore, we are updating Section 6302.23 to reflect the following required ULDD Data Points:

• Escrow Indicator (Sort ID 234) with a valid value of "true"

• Escrow Balance Amount (Sort ID 363) with a valid value of an Escrow balance amount sufficient to cover

the cost of the energy and/or water efficiency improvements

The conditional requirements for Escrow Balance Amount will be reflected in a future ULDD Addendum.

Guide impact: Section 6302.23

Document Custody Procedures Handbook

Based on comments and questions received and as part of our annual review, on March 13, 2019, we updated

the Document Custody Procedures Handbook to add clarification around Note exceptions regarding affidavits,

powers of attorney, and to make other revisions and clarifications.

GUIDE UPDATES SPREADSHEET

For a detailed list of the Guide updates associated with this Bulletin and the topics with which they correspond,

refer to the Bulletin 2019-7 (Selling) Guide Updates Spreadsheet available at

http://www.freddiemac.com/singlefamily/guide/docs/bll1907_spreadsheet.xls.

Page 5

CONCLUSION

If you have any questions about the changes announced in this Bulletin, please contact your Freddie Mac

representative or call the Customer Support Contact Center at 800-FREDDIE.

Sincerely,

Christina K. Boyle

Chief Client Officer

Single-Family Business

SUBJECT: SERVICING UPDATES

(We are reissuing Bulletin 2019-8 on April 12, 2019 to clarify the changes in the Property Insurance

Loss Settlements section are effective on July 1, 2019, but may be implemented immediately. No

other changes have been made to the Bulletin.)

This Guide Bulletin announces:

Reimbursements

• Changes to approved Servicer reimbursement amounts – April 18, 2019

Property insurance loss settlements

• Updated requirements for insurance loss settlements – July 1, 2019

Partial release of a lien or grant of an easement

• New required form to request a partial release of a lien or grant of an easement – August 1, 2019 (New)

Investor Reporting Change Initiative

• Changes and reminders related to the Investor Reporting Change Initiative – May 1, 2019

Additional Guide updates and reminders

• Further updates as described in the Additional Guide Updates and Reminders section of this Bulletin

EFFECTIVE DATE

All of the changes announced in this Bulletin are effective immediately unless otherwise noted.

REIMBURSEMENTS

Effective for reimbursement claims submitted in the Freddie Mac Reimbursement System on and after

April 18, 2019

We are revising our attorney fee reimbursement amounts and certain Servicer requirements related to:

• Uncontested foreclosures

• Bankruptcy services

• Other legal expense items

Uncontested foreclosures

We are increasing the approved Servicer reimbursement amounts for attorney fees associated with uncontested

foreclosures in the States listed in Guide Exhibit 57A.

Bankruptcy services

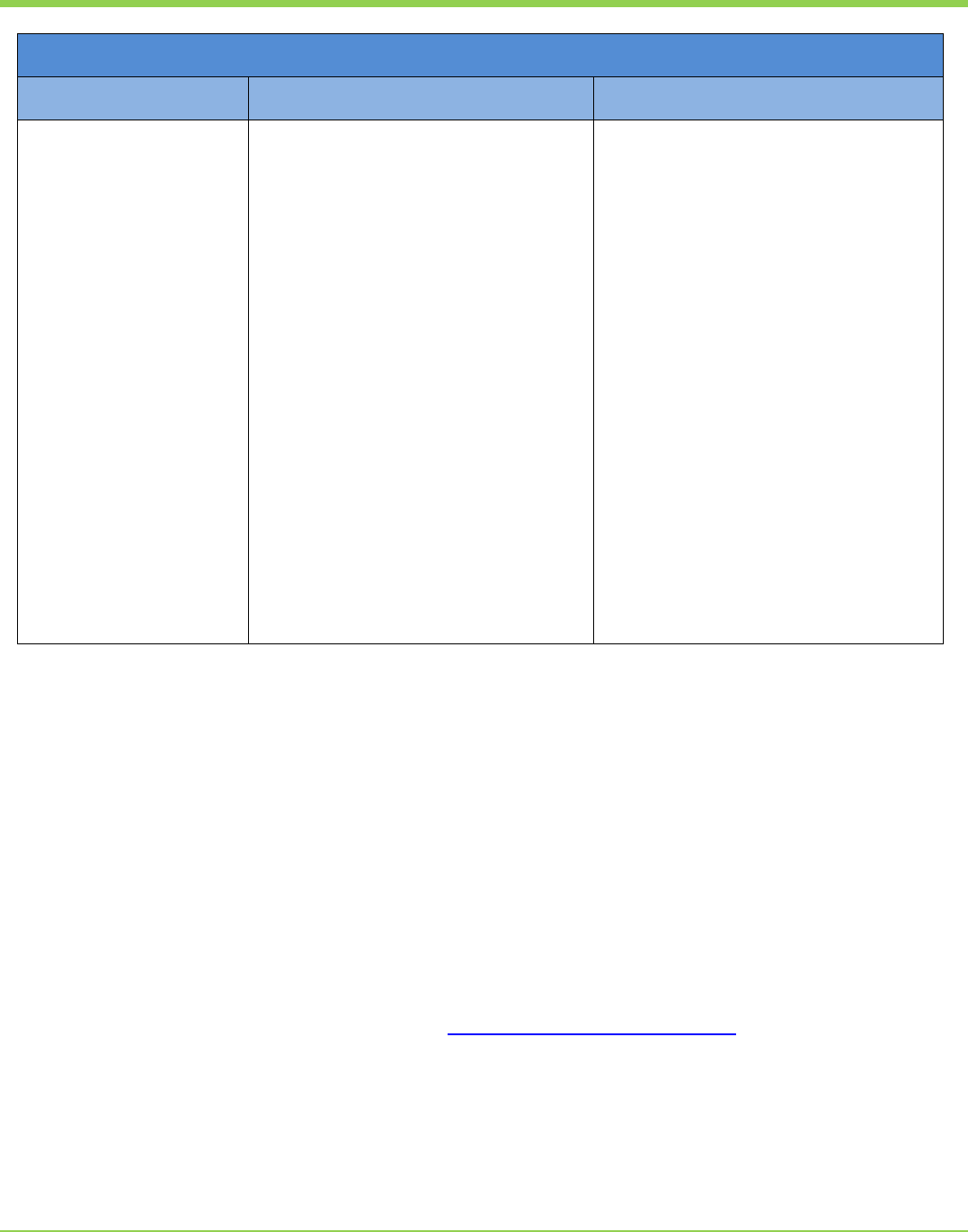

In response to numerous changes made when Servicing Mortgages where the Borrower has filed for bankruptcy

protection, we are increasing the approved Servicer reimbursement amounts for attorney fees associated with

certain bankruptcy services as follows:

TO: Freddie Mac Servicers April 10, 2019 | 2019-8

Page 2

Bankruptcy attorney fee(s)

Current maximum reimbursement

amount

New maximum reimbursement

amount

Bankruptcy Chapter 7

Motion for Relief (up to two

hearings)

$750

$950

Additional Hearings (up to two

hearings)

$250

$500

Bankruptcy Chapters 11 and 12

POC

$750

$950

Motion for Relief (up to two

hearings and order)

$850

$1,050

Amended Plan (up to two

occurrences)

$150

$300

Additional Hearings (up to two

hearings)

$250

$500

Bankruptcy Chapter 13

POC

$650

$950

Motion for Relief (up to two

hearings and order)

$850

$1,050

Payment Change Notifications (up

to two notifications)

$100

$200

Amended Plan (up to two

occurrences)

$150

$300

Additional Hearings (up to two

hearings)

$250

$500

Notice of Fees, Expenses and

Charges (up to two notifications)

$100

$200

Other legal expense items

We are increasing the limit for expense code 600021 (Skip Trace/Investigative Report) from $90 to $160.

Page 3

Reminder on reasonable and customary fees and costs

As a reminder, Servicers must verify that legal fees and costs incurred are reasonable and customary for the area

in which the Mortgaged Premises is located. For reimbursement of expenses that exceed the current expense

limits in Exhibit 57A, Servicers must request Freddie Mac's approval prior to incurring the expense.

Guide impacts

We are updating Exhibits 57A and 74 to reflect these changes.

PROPERTY INSURANCE LOSS SETTLEMENTS

Effective July 1, 2019, but Servicers may implement immediately

In Bulletin 2017-25, we expanded our requirements for Borrowers impacted by an Eligible Disaster who need

assistance with insurance proceeds to repair or rebuild their homes. We are now including these requirements in

Guide Section 8202.11 to expedite the release of loss settlement funds without limiting it to losses caused by an

Eligible Disaster. Additionally, we are clarifying that “Mortgage status at the time of loss” means the Mortgage

status as of the date the damage for which the insurance claim is based.

Guide impact: Section 8202.11

PARTIAL RELEASE OF A LIEN OR GRANT OF AN EASEMENT

Effective August 1, 2019, but Servicers may implement earlier if they are ready to do so

Previously, to request a partial release of a lien or grant of an easement, Servicers were required to e-mail

Freddie Mac the information listed in Section 8401.1(a). To streamline the partial release of a lien or grant of an

easement process, remove any uncertainty about what must be submitted and ensure that Servicers are sending

all information necessary to execute a partial release or easement, we have created new Guide Form 715,

Borrower Application for Partial Release or Easement.

Completed forms should be sent to Distressed_property@freddiemac.com. Servicers must begin using

Form 715 no later than August 1, 2019.

Guide impacts: Section 8401.1 and Form 715

INVESTOR REPORTING CHANGE INITIATIVE

Effective May 1, 2019

Investor reporting requirements for biweekly Mortgages

The Investor Reporting Change Initiative (Initiative) will result in changes to Freddie Mac’s remittance cycles and

reporting requirements for single-family Mortgages. Freddie Mac has determined that certain loan-level reporting

requirements for Mortgages originated and delivered to Freddie Mac with a biweekly payment schedule in

accordance with Section 4201.9 (“biweekly Mortgages”) must be modified. These modified requirements do not

apply to Mortgages where the Servicer and Borrower agree to a biweekly payment plan in accordance

with Section 8104.2 after the Mortgage has been sold to Freddie Mac.

Servicers must service biweekly Mortgages in accordance with the following requirements:

• Reporting monthly principal and interest: Servicers must report the biweekly contractual principal and

interest payment as stated on the Note. If a Servicer reports more than one payment in an Accounting Cycle,

then the cumulative principal received and forecasted scheduled interest for that Accounting Cycle must be

reflected in each reported loan-level transaction.

• Reporting DDLPI: Once the Initiative is implemented, Servicers must report the DDLPI for each biweekly

installment. However, if the Due Date falls on the first day of the month, Servicers must report that DDLPI as

the second day of the month.

Page 4

• Reporting inactivation of biweekly Mortgages: Do not inactivate a biweekly Mortgage that becomes

120 days delinquent as ordinarily required by Section 8303.21. Instead, Servicers must report $0 principal

and $0 scheduled interest, and not advance the DDLPI until at least one full biweekly payment is collected

from the Borrower.

Note: If a Servicer attempts to inactivate a biweekly Mortgage that becomes 120 days delinquent by

selecting “inactivation” in the Freddie Mac Service Loans application or reporting Loan Level Reporting

exception code 40 (Inactivation), it will receive an edit. To clear the edit, Servicers must report $0 principal

and $0 scheduled interest and not advance the DDLPI until at least one full biweekly payment is collected

from the Borrower.

Guide impacts: Sections 4201.9, 8303.15 and 8303.21 and Exhibit 60

Matured payoffs

Based on Servicer feedback, we are clarifying requirements when a Mortgage matures and the Servicer fails to

report a payoff transaction (Payoff – Matured) in the month in which the Mortgage matures. Freddie Mac will

simulate a payoff transaction at the end, plus one Business Day, of the Accounting Cycle following the maturity

date, which will establish the Payoff Date as the first calendar day of the month following the maturity date. The

proceeds will post to the Draft Report and will be drafted on the second Business Day after Freddie Mac

simulates the matured payoff transaction.

The following example illustrates how Freddie Mac will simulate a payoff transaction and draft payoff proceeds

when a Mortgage matures and the Servicer does not report a payoff transaction in the month it matures.

Guide impact: Section 8303.3

Prepayments following a recast

In Bulletin 2019-6, we stated that to avoid a 910E edit when processing a recast following a partial prepayment

(curtailment), Servicers must report Loan Level Reporting exception code 91 (Recast) in the Accounting Cycle

containing the Due Date of the new Mortgage principal and interest (P&I) monthly payment. We are now clarifying

that if all contractual payments with the pre-modified P&I constant have previously been reported, then the recast

exception code, the modified P&I constant, and the modified Mortgage P&I payment may be reported in the

Accounting Cycle prior to the Due Date of the modified Mortgage P&I payment.

Guide impact: Section 8103.7

Page 5

Servicer notice of change of service bureau

Currently, Freddie Mac provides limited responses to loan-level transactions prior to processing the data and

comparing it to Freddie Mac’s databases. As a result, Servicers are not required to notify Freddie Mac of the

service bureau they use.

After the Initiative is implemented, Freddie Mac will provide a more robust response that will include loan-level

details after loan-level reporting files are processed that include, but are not limited to, the daily Business-to-

Business Response File and the Business-to-Business Draft File. These reports will be made available to

Servicers via the Service Loans application or the business-to-business interface used by self-reporting Servicers

or service bureaus.

Freddie Mac will identify Servicers that use a service bureau for data reporting based on reporting activity during

the April 2019 Accounting Cycle.

To ensure these files are sent to the correct entity, on and after May 1, 2019, Servicers must notify Freddie Mac

at least 45 days prior to the effective date via e-mail to Servicing_Ops_[email protected] if

they change or begin using a new service bureau or would like Freddie Mac to send these files to a specific

service bureau. The e-mail must include the Seller/Servicer number(s), point of contact, phone number, current

and future service bureau with its contact information and the effective date of the change. The Servicer

acknowledges and agrees that Freddie Mac will send reports, data and information on these Mortgages to the

service bureau identified by the Servicer.

Guide impacts: Sections 4201.9, 8301.10 and 8301.15

Initiative retired reports reminder

In Bulletins 2017-4 and 2017-15, we announced the following reports would be retired in the Service Loans

application once the Initiative is implemented:

• Remittance Detail

• Seller/Servicer Remittance Analysis (will be retired after the May reporting cycle closes, June 3, 2019)

• Remittance Analysis Amount Due Drilldown

• Remittance Analysis Amount Received Drilldown

Archived copies of these reports from prior Accounting Cycles will not be retained in the Service Loans

application. Servicers who wish to retain copies of these reports must download copies prior to May 11, 2019.

Custodial Account reconciliation

To make the transition to the Initiative as smooth and efficient as possible, Freddie Mac will utilize an extended

45-day cutover Accounting Cycle, from April 16, 2019 through May 31, 2019. During this extended cycle, a

Monthly Account Statement (MAS) will not be produced, Custodial Accounting reconciliation will be suspended,

and Servicers will not be required to complete Forms 59 or 59E. However, Servicers are still required to maintain

their bank statements and monthly summary of cash collection and provide them to Freddie Mac upon request.

In June 2019, Freddie Mac will provide Servicers with their beginning June MAS balance via e-mail. To maintain

continuity in their Custodial Accounts, Servicers may use the Draft Report, available through Service Loan

application, to reconcile loan-level transactions for the extended May 2019 cycle to the June MAS beginning

balance amount.

Beginning in July 2019, Freddie Mac will resume production of the MAS (which will reflect June 2019 activity) and

provide a loan-level detail report to the Servicer’s investor reporting representatives via e-mail on an ongoing

basis. More details on the new report will be provided on FreddieMac.com prior to the implementation of the

Initiative.

Page 6

ADDITIONAL GUIDE UPDATES AND REMINDERS

Disaster-related requirements for current Mortgages

Previously, in the event of an Eligible Disaster, Servicers were required to ascertain the number of Mortgages

impacted and the extent of damages caused to each Mortgaged Premises, which Servicers may determine

through discussions with the Borrower and/or a property inspection. This requirement may be unnecessarily

burdensome in situations where a Mortgage was current or no more than 30 days delinquent at the time of the

Eligible Disaster and does not become more than 30 days delinquent following the event.

To provide flexibility for Servicers so they can focus their efforts on assisting Borrowers who are or become more

than 30 days delinquent, Servicers may, but are no longer required to, determine the extent of damages caused

to the Mortgaged Premises where the Mortgage was current or 30 or fewer days delinquent at the time of the

Eligible Disaster. However, should such a Mortgage subsequently become more than 30 days delinquent,

Servicers must initiate collection efforts in accordance with Guide Chapters 9101 and 9102 and order property

inspections as required by Section 9202.12.

Guide impact: Section 8404.2

Exhibit 57 updates

In Bulletin 2018-26, we announced that Servicers could maintain and execute winterization and yard maintenance

without seasonal time frame restrictions.

In response to Servicer inquiries, we are revising Exhibits 57 and 74 to simplify the winterization and yard

maintenance expense amount descriptions.

Guide impacts: Exhibits 57 and 74

Single Security Initiative

In Bulletin 2019-7, we updated the Guide to reflect updated requirements to the Note Rate to Coupon spreads

and a reduction in the maximum Servicing Spread for Mortgages serving as collateral for Uniform Mortgage-

Backed Security and Mortgage-Backed Security (MBS), effective for Mortgages sold under Freddie Mac’s fixed-

rate Guarantor or MultiLender Swap program with Settlement Dates on or after June 3, 2019.

Additionally, we revised Guide sections related to the sale of fixed-rate Mortgages with annual- and monthly-

premium lender-paid mortgage insurance to reflect the 50 basis points maximum Minimum Contract Servicing

Spread for Mortgages sold under the fixed-rate Guarantor and MultiLender Swap programs.

As a reminder, the FHFA has instructed Freddie Mac and Fannie Mae to monitor the Weighted Average Coupon

(WAC) of MBS and take actions as appropriate such that MBS WAC would be generally consistent with historical

WAC levels. The FHFA, Freddie Mac and Fannie Mae are working to determine an appropriate target MBS WAC,

such as 80 basis points or slightly higher (given current guarantee fees and minimum servicing levels).

Guide Form 1077

In Bulletin 2019-7, Freddie Mac announced the extension of the mandatory usage date for the revised Form 1077,

Uniform Underwriting and Transmittal Summary. While Sellers/Servicers may begin to use the revised form

sooner if they choose, they must use the revised form for Mortgages with Application Received Dates on or after

February 1, 2020, which aligns with the previously announced requirement for mandatory use of revised Form 65,

Uniform Residential Loan Application.

We have updated Form 1077 to reflect this change.

Document Custody Procedures Handbook

Based on comments and questions received and as part of our annual review, on March 13, 2019, we updated

the Document Custody Procedures Handbook to add clarification around Note exceptions regarding affidavits,

powers of attorney, and to make other revisions and clarifications.

Page 7

GUIDE UPDATES SPREADSHEET

For a detailed list of the Guide updates associated with this Bulletin and the topics with which they correspond,

refer to the Bulletin 2019-8 (Servicing) Guide Updates Spreadsheet available at

http://www.freddiemac.com/singlefamily/guide/docs/bll1908_spreadsheet.xls.

CONCLUSION

If you have any questions about the changes announced in this Bulletin, please contact your Freddie Mac

representative or call the Customer Support Contact Center at 800-FREDDIE.

Sincerely,

Yvette W. Gilmore

Vice President

Servicer Relationship and Performance Management

SUBJECT: SELLING UPDATES

(We are reissuing Bulletin 2019-9 on May 3, 2019 to provide Sellers time to implement the new

requirement for “Seller disclosure on Contaminated Sites, Hazardous Substances or other adverse

conditions.” We are moving the effective date for this requirement from May 1, 2019 to

August 1, 2019. No other changes have been made to the Bulletin.)

This Guide Bulletin announces:

Property eligibility and appraisal requirements

• Updates to our requirements for comparable sale selection for a 1-unit property with an accessory unit

• Addition of a requirement for Sellers to disclose to the Borrower information regarding Contaminated

Sites, Hazardous Substances or other adverse conditions of which the Seller is aware – August 1, 2019

(New)

• Removal of the requirement for an appraisal update for a subsequent transaction subject to certain

conditions

Modification Construction Conversion Documentation

• Updates to our requirements to allow Sellers to use Modification Construction Conversion

Documentation for Mortgages secured by Manufactured Homes

Income commencing after the Note Date

• Updates to our requirements for income commencing after the Note Date – August 1, 2019

Freddie Mac CHOICEHome

SM

• CHOICEHome, our product for Manufactured Homes that are titled as real property and have features of

a site-built home – New

Loan Product Advisor

®

resubmission

• Revisions to our tolerances for Loan Product Advisor resubmission – August 1, 2019

Mandatory cash contract extensions

• Introduction of an automated process to provide Sellers with the capability in Loan Selling Advisor

®

to

extend the expiration date for Mandatory Cash Contracts – June 10, 2019

Additional Guide updates

• Further updates as described in the Additional Guide updates section of this Bulletin

EFFECTIVE DATE

All of the changes announced in this Bulletin are effective immediately unless otherwise noted.

TO: Freddie Mac Sellers May 1, 2019 | 2019-9

Page 2

PROPERTY ELIGIBILITY AND APPRAISAL REQUIREMENTS

Accessory unit comparable sale selection

Previously, Freddie Mac required an appraisal to include at least one comparable sale with an accessory unit

when the subject 1-unit property has a legal accessory unit. Based on Seller feedback, we recognize there are

situations where comparable sales with an accessory unit are limited.

To provide flexibility and expand access to credit, we are modifying this requirement to provide alternatives for the

appraiser to consider when a comparable sale with an accessory unit is not available.

If a comparable sale with an accessory unit is not available in the subject neighborhood, the appraiser can use a

comparable sale in the subject neighborhood without an accessory unit as long as the appraiser can justify and

support such use in the appraisal report. Freddie Mac will purchase eligible Mortgages secured by a property with

an accessory unit if the appraiser can develop an accurate opinion of market value for the property. Refer to

Guide Section 5601.12 for additional guidance on appraising a property with an accessory unit.

Additionally, to provide greater specificity, we are identifying an accessory unit as an additional living space that

includes at least a kitchen, a bathroom, and a separate entrance and is independent of the primary dwelling unit.

Guide impact: Section 5601.12

Seller disclosure on Contaminated Sites, Hazardous Substances or other adverse conditions

Effective for Mortgages with Settlement Dates on and after August 1, 2019

We are adding a new requirement to specify that the Seller must disclose to the Borrower any information that the

Seller is aware of that may adversely affect the market value, condition or marketability of the subject property.

This includes, but is not limited to, the presence of any Contaminated Site, Hazardous Substance or other

adverse conditions affecting the subject property or neighborhood.

Guide impact: Section 5601.3

Appraisal re-use for a subsequent transaction

Previously, an appraisal update was required for a subsequent transaction, regardless of the time elapsed from

the effective date of the original appraisal. Based on Seller feedback and to provide efficiency and potential cost

savings, we are revising our requirement to state that an appraisal update is not required unless the effective date

of the appraisal is more than 120 days prior to the new Note Date for the subsequent “no cash-out” refinance.

Guide impact: Section 5601.8

MODIFICATION CONSTRUCTION CONVERSION DOCUMENTATION

In response to Seller feedback, we are providing Sellers with the flexibility to use Modification Construction

Conversion Documentation for Mortgages secured by Manufactured Homes.

We are also updating delivery instructions to reflect this change.

Guide impacts: Sections 4602.3 and 6302.28

INCOME COMMENCING AFTER THE NOTE DATE

Effective for Mortgages with Settlement Dates on and after August 1, 2019, but Sellers may implement

immediately

We reviewed our requirements for income commencing after the Note Date but prior to the Delivery Date (Option

2), and are revising our requirements as follows:

• To verify that the income commenced before the Mortgage is delivered to Freddie Mac, we are adding a

requirement for the Seller to obtain one of the following:

➢ A paystub

Page 3

➢ A written verification of employment, or

➢ A third-party employment verification

• Requiring verification of additional funds only when there are more than 15 calendar days between the

Note Date and the start date of the new employment. This change provides flexibility when the potential

employment gap is not expected to impact the Borrower’s ability to make their first scheduled Mortgage

payment and meet their other debt obligations. Currently, Sellers must verify additional funds regardless

of how soon after the Note Date the Borrower is expected to begin receiving the income.

In addition, we are adding a worksheet Sellers may use to calculate the amount of additional funds required

under both options.

Guide impact: Section 5303.2

FREDDIE MAC CHOICEHOME

CHOICEHome is our innovative, affordable mortgage product for Manufactured Homes that are titled as real

property and have features and characteristics of a site-built home. This offering expands availability of financing

for manufactured housing for families with moderate incomes and complements our existing programs for

Borrowers with low- and very-low incomes.

A Manufactured Home is granted CHOICEHome certification and is eligible for CHOICEHome financing if the

Manufactured Home meets certain specifications, such as a higher pitch roof, a permanent foundation with

masonry perimeter, dry wall throughout, energy-efficient features such as additional insulation and windows with a

low-e rating and a garage or carport.

Additional requirements for a Mortgage secured by a CHOICEHome provided in the revised Section 5703.9

include, but are not limited to, the following:

CHOICEHome requirements

Eligibility

• The Mortgage must be a:

➢ Purchase or “no cash-out” refinance Mortgage

➢ Fixed-rate Mortgage with up to a 97% loan-to-value (LTV) ratio

➢ 5/5, 5/1, 7/1 or 10/1 ARM with up to a 95% LTV ratio*

• A CHOICEHome Mortgage must be secured by a Manufactured Home

that is the Borrower’s Primary Residence and is a multi-wide, 1-unit

dwelling meeting the requirements in Section 5703.9

*Freddie Mac HomeOne

SM

and Freddie Mac Home Possible

®

Mortgages must

be fixed-rate

Underwriting

requirements

The Mortgage must be assessed through Loan Product Advisor and be an

Accept Mortgage

Appraisal requirements

The appraiser may use site-built homes as comparable sales if no

CHOICEHome sales are available

Credit Fee in Price

A Manufactured Home Credit Fee in Price will not be assessed for a Mortgage that

meets the requirements for a CHOICEHome Mortgage

Freddie Mac prior approval

Although the eligibility requirements are provided in the Guide, a Seller must obtain Freddie Mac’s written

approval before selling Mortgages secured by a CHOICEHome to Freddie Mac. Sellers should contact their

Freddie Mac representative or the Customer Support Contact Center at 800-FREDDIE for more information.

Page 4

Guide impacts

The contents of existing Section 5703.9 are moving to new Section 5703.10. We are also updating Sections

5703.9, 6302.25 and Guide Exhibits 19 and 34 to reflect the CHOICEHome requirements.

LOAN PRODUCT ADVISOR RESUBMISSION

To ensure that the Loan Product Advisor resubmission requirements align with our current view of credit risk, we

are revising the resubmission tolerances.

Increase in debt payment-to-income (“DTI”) ratio – effective for Mortgages with Settlement Dates on and

after August 1, 2019

As reflected in the following table, Loan Product Advisor resubmission will be required any time the DTI ratio

exceeds 45%.

Loan Product Advisor resubmission tolerances

Current tolerance

Revised tolerance

Resubmission to Loan

Product Advisor is not

required when…

• The total difference does not

change the total DTI ratio by

more than three percentage

points, and

• The total DTI ratio on the

previous submission did not

exceed 45%

• The new DTI ratio does not

exceed 45%, and

• The total difference does not

change the total DTI ratio by

more than three percentage

points

Decrease in the loan amount on a refinance transaction

As reflected in the following table, to ensure there is no change in the appraisal waiver eligibility, Loan Product

Advisor resubmission is required if the loan amount has decreased on a refinance transaction and the Seller has

accepted an appraisal waiver offer.

Page 5

Loan Product Advisor resubmission tolerances

Current tolerance

Revised tolerance

Resubmission to Loan

Product Advisor is not

required when…

• The loan amount decreases by

no more than 1%; and

• At the time of the most recent

Loan Product Advisor

submission mortgage

insurance is not required or

mortgage insurance is

required, and:

➢ The change does not

impact the amount of the

mortgage insurance

coverage; and

➢ The amount of the

mortgage insurance

premium collected by the

Seller is based on the new

loan amount and the Seller

obtains a new mortgage

insurance certificate

• The loan amount decreases by

no more than 1%; and

• At the time of the most recent

Loan Product Advisor

submission mortgage insurance

is not required or mortgage

insurance is required, and:

➢ The change does not

impact the amount of the

mortgage insurance

coverage, and

➢ The amount of the

mortgage insurance

premium collected by the

Seller is based on the new

loan amount and the Seller

obtains a new mortgage

insurance certificate, and

• For Mortgages that qualify for

an appraisal waiver, the Seller

has not accepted the

appraisal waiver offer

Guide impact: Section 5101.6

MANDATORY CASH CONTRACT EXTENSIONS

Effective June 10, 2019

In response to Seller feedback, we are introducing an automated process in Loan Selling Advisor to provide

Sellers with the capability to extend the expiration date for Mandatory Cash Contracts. Section 6101.3(f)

describes the requirements for extending a Mandatory Fixed-Rate Cash Contract and Section 6102.4(f) for

Mandatory WAC ARM Cash Contract extensions.

In addition, for Best Efforts Contracts, relock functionality will be available in Loan Selling Advisor. Requirements

for performing a Best Efforts Contract relock are described in Section 6101.4(e).

The Best Efforts extension language for contracts that are unfulfilled for more than 30 days is being deleted from

Section 6101.4(d) as it is no longer permitted.

Guide Forms 900 and 900SA are being updated to clarify existing, and reflect added functionality, as applicable,

to the Secondary Analyst and Cash SMO user roles.

For additional information refer to the April 23, 2019, Single-Family News Center article.

Guide impacts: Sections 6101.3, 6101.4, 6102.4, Forms 900 and 900SA

Page 6

ADDITIONAL GUIDE UPDATES

Homeownership education

Homeownership education is required for certain Mortgages, as described in Section 5103.6. To align with the

information typically included in the homeownership education completion certificates, we are updating the Guide

to specify that homeownership education programs “provided by” rather than “developed by” mortgage insurance

companies, HUD-approved counseling agencies, Housing Finance Agencies or Community Development

Financial Institutions are acceptable.

Delivery requirements

To provide greater specificity, Guide Chapter 6302 is being updated to:

• Describe all valid values for ULDD Data Points Counseling Confirmation Type/Counseling Confirmation

Type Other Description (Sort IDs 576/577) and Counseling Format Type/Counseling Format Type Other

Description (Sort IDs 578/579) for Home Possible Mortgages and HomeOne Mortgages

• Include new Section 6302.9(b)(ii) to reflect the delivery requirements of the ULDD Data Points noted

above for homeownership education for any transaction when the credit reputation for all Borrowers is

established using Noncredit Payment References, previously announced in Bulletin 2017-2

Guide impacts

We are updating Sections 5103.6, 6302.9, 6302.14 and 6302.41 to align with these changes.

Certificate of Incumbency and wire authorization forms

We are enhancing the functionality of Forms 483, 987E, 988SF, 989SF and 990SF as follows:

• Deleting the instruction page(s) and adding tooltips, which appear when a Seller hovers over certain

fields in the forms

• Auto populating certain fields within the forms to eliminate reentering the same information within the

form

Additionally, in Forms 987E and 483 we made the following edits:

• Language referencing “Beneficiary Bank” has been replaced with “Receiving Bank”

• Added language requesting that the notary stamp is shaded over with a pencil or crayon for visibility

• Made minor language changes throughout the forms for specificity

These enhancements will provide flexibility and convenience for Seller/Servicers when completing these

forms.

Guide impacts: Forms 483, 987E, 988SF, 989SF and 990SF

Guide launch on FreddieMac.com

Later this Spring, we are launching a modernized version of the Guide on a redesigned Single-Family website.

The enhanced Guide experience on FreddieMac.com will include robust search and navigation capabilities along

with other productivity features. No changes to our requirements will be made with the rollout of the enhanced

Guide on the Single-Family website. Both the Guide on our website and on AllRegs will be updated through our

regular Guide Bulletin process. The Guide on AllRegs will remain the official electronic version until further notice.

Please see our April 30, 2019 Single-Family News Center article for more information.

Form 91 functionality

Based on Seller feedback, we are reviewing the functionality of Form 91 and are temporarily removing the

automatic calculations from all subtotal fields within the form. Sellers using Form 91 must complete the

calculations manually. No changes are being made to the form content. We will inform Sellers in a future

communication when our analysis is complete and enhanced functionality is added back to Form 91.

Page 7

GUIDE UPDATES SPREADSHEET

For a detailed list of the Guide updates associated with this Bulletin and the topics with which they correspond,

refer to the Bulletin 2019-9 (Selling) Guide Updates Spreadsheet available at

http://www.freddiemac.com/singlefamily/guide/docs/bll1909_spreadsheet.xls.

CONCLUSION

If you have any questions about the changes announced in this Bulletin, please contact your Freddie Mac

representative or call the Customer Support Contact Center at 800-FREDDIE.

Sincerely,

Christina K. Boyle

Chief Client Officer

Single-Family Business

SUBJECT: PURCHASE OF LIBOR ARMS

We currently purchase ARMs, including those indexed to the London Interbank Offered Rate (LIBOR). Due to the

anticipated discontinuance of the publication of the LIBOR index in 2021, we will no longer purchase LIBOR

ARMs with Settlement Dates more than six months after the Note Date. This change is effective immediately and

is being implemented in consultation with the FHFA.

We will continue to purchase newly originated LIBOR ARMs while we work with the industry on a LIBOR index

transition plan.

Loan Selling Advisor

®

will be updated by May 21, 2019 to reflect this change.

Our ARM eligibility requirements in Guide Section 4401.3 and Guide Exhibit 17S, Available Mortgage Products,

will be updated to reflect this change in a future Guide Bulletin.

CONCLUSION

If you have any questions about the changes announced in this Bulletin, please contact your Freddie Mac

representative or call the Customer Support Contact Center at 800-FREDDIE.

Sincerely,

Christina K. Boyle

Chief Client Officer

Single-Family Office of the Client

TO: Freddie Mac Sellers May 17, 2019 | 2019-10

TO: Freddie Mac Sellers June 5, 2019 | 2019-11

SUBJECT: SELLING UPDATES

This Guide Bulletin announces:

Condominiums

• Changes to our requirements for Condominium Projects, including:

➢ Ineligible Condominium Projects

➢ Condominium Project reviews

➢ Delivery requirements

➢ Condominium Projects with commercial parking facilities – September 5, 2019

Credit underwriting and Mortgage eligibility

• Revisions to recovery period requirements for Manually Underwritten Mortgages for Borrowers with history of

Chapter 12 bankruptcy

• Updates to allow the delivery of Mortgages secured by Manufactured Homes with land contract or contract for

deed pay offs

• Updated language specifying that monthly bridge loan payments must be included in debt payment-to-income

ratio calculations

Private flood insurance

• Updates to clarify our acceptance of private flood insurance

Form 65 – Demographic Information Addendum

• Adding an authorized change to Form 65 to permit the use of the Demographic Information Addendum

Mortgages with Electronic Documentation

• The addition of eMortgage requirements to the Guide – June 12, 2019 (New)

• Delivery instruction updates for Mortgages with Electronic Documentation – June 12, 2019 (New)

UMBS™ and MBS with Coupons not divisible by 0.5% and fixed-rate assumable products

• Eligibility of odd coupons and fixed-rate assumable products – July 1, 2019

Additional Guide updates

• Further updates as described in the Additional Guide updates section of this Bulletin

EFFECTIVE DATE

All of the changes announced in this Bulletin are effective immediately unless otherwise noted.

2

Bulletin

CONDOMINIUMS

In response to Seller feedback, we continue to review our requirements related to Condominium Projects and are

making the following updates, which will help expand eligibility and provide greater efficiency in originating

Condominium Unit Mortgages.

Ineligible Condominium Projects requirements

We are updating our eligibility requirements for Condominium Projects by making the following updates to the list of

ineligible projects in Guide Section 5701.3:

Topic

Updated requirements

Project in litigation

To provide greater flexibility, we are expanding the types of eligible

minor litigation to include litigation where the estimated or known

amount is not expected to exceed 10% of the Condominium Project’s

funded reserves, provided that this does not violate the applicable

jurisdiction’s laws and regulations.

Single investor

concentration

Sellers may now exclude from the single investor concentration

calculation:

• Units owned/controlled by non-profits for affordable housing

• Units in affordable housing programs, and

• Units retained by higher education institutions for workforce

housing

Guide impact: Section 5701.3

Condominium Project reviews

We are updating our Condominium Project review requirements as follows:

Topic

Updated requirements

Condominium

Project compliance

(Section 5701.2)

We are specifying that we require the Condominium Project to remain

in full compliance with applicable State laws and regulations, the

requirements of the relevant jurisdiction and all other applicable laws

and regulations.

Streamlined review

(Section 5701.4)

To provide greater access to credit, we are increasing the maximum

total loan-to-value (TLTV) ratio and Home Equity Line of Credit TLTV

(HTLTV) ratio requirements for a Mortgage secured by a

Condominium Unit in an Established Condominium Project located in

Florida to be eligible for streamlined review. The new loan-to-value

(LTV)/TLTV/HTLTV ratio requirements are as follows:

Primary Residences: 75/90/90%

Second homes and Investment Properties: 70/75/75%

Reciprocal review –

Fannie Mae-approved

and certified projects

(Section 5701.9)

For Condominium Projects that have a final Project Eligibility Review

Service (PERS) approval from Fannie Mae, we are clarifying that

Sellers must comply with any conditions set by Fannie Mae on the

final PERS approval.

To align with our increased TLTV and HTLTV ratio requirements for

Condominium Units in Established Condominium Projects located in

Florida, we are increasing the TLTV and HTLTV ratio requirements

3

Bulletin

for Mortgages approved through Fannie Mae’s Condo Project

Manager™ (CPM™).

Reciprocal Review –

FHA-Approved Project

review for Condominiums

(Section 5701.9)

Previously, Sellers were not permitted to utilize an approval through

FHA’s HUD Review and Approval Process (HRAP) for conventional

Mortgages.

To provide more flexibility, we are permitting Sellers to deliver

conventional Mortgages secured by Condominium Units in

Established Condominium Projects approved by HRAP if the

requirements in Section 5701.9(b) are met.

Guide impacts: Sections 5701.2, 5701.4 and 5701.9

Delivery requirements for “Exempt From Review” Condominium Unit Mortgages

We are updating the Guide to align the delivery instructions for Condominium Unit Mortgages that are delivered as

“Exempt From Review” with the ULDD specifications.

Guide impact: Section 6302.20

Condominium Projects with commercial parking facilities

Effective for Mortgages with Settlement Dates on or after September 5, 2019, but Sellers may implement the

change to the calculation of excessive commercial or non-residential space earlier if they are operationally able

to do so, provided that Sellers at the same time also implement the project budget requirement regarding income

from commercial parking facilities

We are updating the Guide to allow Sellers to exclude commercial parking facilities from the commercial or non-

residential space calculation when determining whether a project contains excessive commercial or non-residential

space.

Condo Project Advisor

SM

messages will not be updated until November 15, 2019 to reflect the exclusion of

commercial parking facilities in the calculation. Sellers may disregard references to include commercial parking in

these messages between the date a Seller implements this change and November 15, 2019.

In conjunction with the changes to the calculation of commercial or non-residential space, for Established and New

Condominium Projects review types, we are updating the requirements for the project budget to provide that a

homeowners association must not receive more than 10% of its budgeted income from the renting or leasing of

commercial parking facilities.

Guide impacts: Sections 5701.5, 5701.6 and 5701.11

CREDIT UNDERWRITING AND MORTGAGE ELIGIBILITY

Chapter 12 bankruptcy

We are revising our recovery period requirements for Manually Underwritten Mortgages to permit a Chapter 12

bankruptcy to be treated the same as a Chapter 13 bankruptcy when the derogatory event is caused by financial

mismanagement. As a result, the recovery time period for a discharged Chapter 12 bankruptcy is being reduced from

48 months to 24 months.

Additionally, we are specifically referencing Chapter 7 and Chapter 11 bankruptcy instead of generally referring to

other bankruptcy types.

Guide impact: Section 5202.5

Eligibility of Manufactured Homes with payoff of land contract

To expand Mortgage eligibility for Manufactured Homes, we are allowing Mortgages secured by Manufactured

Homes with proceeds used to pay the outstanding balance under a land contract or contract for deed to be eligible

for sale to Freddie Mac.

Guide impacts: Sections 4404.1 and 5703.3

4

Bulletin

Bridge loans

To provide greater specificity, we are updating the Guide to note that, as with any other financing secured by a

property, required monthly payments on bridge loans must be included in the monthly debt payment-to-income ratio

calculation.

Guide impact: Section 5401.2

PRIVATE FLOOD INSURANCE

Flood insurance is required on a property when it is located in a FEMA-designated special flood hazard area (SFHA).

Currently, the Guide allows private flood insurance as an alternative to the National Flood Insurance Program (NFIP),

when the terms and conditions of the private flood insurance policy are at least equivalent to the standard NFIP

policy, and the insurer meets the ratings requirements for property insurers.

On February 20, 2019, the federal banking agencies announced a joint final rule that impacts private flood

insurance requirements for financial institutions subject to their supervision. The rule becomes effective July 1, 2019.

Freddie Mac is not subject to the federal banking agencies’ rule. Freddie Mac is separately authorized by the Biggert-

Waters Act to accept private flood insurance policies and establish requirements for financial solvency, strength or

claims-paying ability for insurers who issue private flood insurance policies for the Mortgaged Premises securing

Freddie Mac Mortgages.

Freddie Mac will continue to apply our criteria for acceptance of a private flood insurance policy, as defined in the

Biggert-Waters Act. These Guide requirements in Section 8202.3, with insurer rating requirements in Section 8202.1,

apply to all Seller/Servicers, including an institution subject to the federal banking agencies’ rule regardless of the

rule provision (mandatory or discretionary) used to accept a private flood insurance policy.

We are updating the Guide to clarify that a private flood insurance policy is acceptable to satisfy the flood insurance

requirement if the terms and conditions are equivalent to the standard NFIP policy and the insurer meets the ratings

requirements in Section 8202.1.

Guide impact: Section 8202.3

FORM 65 – DEMOGRAPHIC INFORMATION ADDENDUM

As part of the Uniform Mortgage Data Program and in support of the updated Home Mortgage Disclosure Act (HMDA)

regulation for collecting demographic information, Freddie Mac published a Demographic Information Addendum on its

Uniform Residential Loan Application & Uniform Loan Application Dataset web page in September 2017 and

updated the Addendum in December 2017, although the Addendum tagline did not change. We are updating Guide

Exhibit 5 to confirm that, as provided on the webpage, Sellers may use the Demographic Information Addendum as a

replacement for the existing Section X, Information for Government Monitoring Purposes, on Guide Form 65. If the

Demographic Information Addendum is used with Form 65, Section X may be left blank, crossed or grayed out or

otherwise deleted.

Guide impact: Exhibit 5

MORTGAGES WITH ELECTRONIC DOCUMENTATION

eMortgages

Effective June 12, 2019

An eMortgage is a Mortgage that is originated using an eNote (as defined in new Section 1402.2), while the Security

Instrument and other Mortgage documents may be paper or Electronic Records (as defined in Section 1401.2).

eMortgages can help simplify the closing process for Sellers and Borrowers and shorten timeframes from origination

to sale of the Mortgage in the secondary market.

While Freddie Mac’s prior written approval to sell to and/or service eMortgages for Freddie Mac will still be required,

the eMortgage Guide on FreddieMac.com is being retired and all requirements will now be contained in new Chapter

1402. This will provide greater visibility of Freddie Mac’s eMortgage requirements as eMortgage adoption continues

to grow. Additionally, we are adding Exhibits 45, 46 and 47, which are sample forms that may be helpful to

Seller/Servicers of eMortgages.

5

Bulletin

Seller/Servicers of eMortgages must comply with all selling and Servicing requirements of the Guide and the

Seller/Servicer’s other Purchase Documents, as applicable, including the special requirements set forth in Chapter

1402.

Seller/Servicers who wish to sell to and/or service eMortgages for Freddie Mac should contact their Freddie Mac account

representative or the Freddie Mac eMortgage Team (eMortgage_[email protected]) to begin the process of

determining their eligibility to sell eMortgages to and/or service eMortgages for Freddie Mac. As part of the

Seller/Servicer’s approval process, the Seller/Servicer’s eClosing System and eNote Vault System (as those terms are

defined in Section 1402.2) used to originate and close eMortgages and store related eNotes must go through a review

and approval process.

Chapter 1402 contains eMortgage requirements, and Exhibits 45, 46, 47 and Form 994SF support the requirements in

Chapter 1402. All other impacted Guide sections are related to the eMortgage requirements found in Chapter 1402.

Guide impacts: Chapter 1402, Sections 1301.8, 1401.1, 1401.2, 1401.11, 1401.12, 1401.16, 1401.23, 2101.1,

6302.5, 6304.1, 6305.1, 7101.2, 7101.4, 8102.1, 8103.6, 8103.7, 8104.7, 8107.1, 8406.7, 9206.17, 9207.6, 9208.8,

9209.8 and 9402.2, Exhibits 5, 7, 45, 46 and 47, Forms 960 and 994SF

Delivery instruction updates for Mortgages with Electronic Documentation

Effective June 12, 2019

We are updating Section 6302.5 to include special delivery instructions for Mortgages with Electronic Documentation,

including eMortgages and Mortgages with Remote Online Electronic Notarization.

Guide impacts: Section 6302.5 and Exhibit 34

UMBS™ AND MBS WITH COUPONS NOT DIVISIBLE BY 0.5% AND FIXED-RATE ASSUMABLE

PRODUCTS

Effective July 1, 2019

In response to feedback from Housing Finance Agencies and to provide additional options, we will allow 15- and 30-year

fixed-rate Mortgages to be sold in exchange for UMBS™ and MBS with Coupons at any increment (i.e., Coupons not

divisible by 0.5% (such Coupons, “Odd Coupons”)).

In addition to Odd Coupon pricing, Freddie Mac will offer new 15- and 30-year fixed-rate assumable Mortgages eligible for

sale under the Guarantor program. These products may be used outside Odd Coupon functionality.

Sellers interested in selling Mortgages in exchange for UMBS and MBS with Odd Coupons and/or selling fixed-rate

assumable Mortgages under the Guarantor program must obtain Freddie Mac’s written approval to do so by contacting its

Freddie Mac representative or the Customer Support Contact Center at 800-FREDDIE.

Guide impacts: Sections 4101.10 and 6202.1

ADDITIONAL GUIDE UPDATES

10-year cash contracts

With the implementation of the Single Security Initiative, a new 10-year cash contract and distinct pricing for 10-year

Mortgages will be available in Loan Selling Advisor

®

. As a result, we are removing Mortgages with a 10-year term from the

list of Mortgages eligible for a cash specified payup. The payup amount will now be embedded in the 10-year contract

price.

In addition, Sellers may choose the cash-specified option for 10-year super-conforming Mortgages. Sellers should only

select super conforming from the Cash Specified Pool Type field when they have exceeded their monthly thresholds for

super conforming cash deliveries.

Review our At-a-Glance resource on loan deliveries for more information on operational changes related to 10-year cash

contracts and pricing.

Guide impact: Section 6101.3

6

Bulletin

Relief refinance Mortgages

As announced in Bulletin 2017-17, Freddie Mac Relief Refinance Mortgages

SM

– Same Servicer and Freddie Mac Relief

Refinance Mortgages

SM

– Open Access must have Settlement Dates on or before September 30, 2019. Exhibit 19 has

been updated to reflect the expiration date of the offerings.

Guide impact: Exhibit 19

Purchase of LIBOR ARMs

In Bulletin 2019-10, we announced that Freddie Mac will no longer purchase LIBOR ARMs with Settlement Dates more

than six months after the Note Date due to the potential discontinuance of the publication of the LIBOR index. We will

continue to purchase newly originated LIBOR ARMs.

Guide impacts: Section 4401.3 and Exhibit 17S

GUIDE UPDATES SPREADSHEET

For a detailed list of the Guide updates associated with this Bulletin and the topics with which they correspond, access the

Bulletin 2019-11 (Selling) Guide Updates Spreadsheet via the Attachments drop-down available at

https://guide.freddiemac.com/app/guide/bulletin/2019-11.

CONCLUSION

If you have any questions about the changes announced in this Bulletin, please contact your Freddie Mac representative

or call the Customer Support Contact Center at 800-FREDDIE.

Sincerely,

Christina K. Boyle

Chief Client Officer

Single-Family Division

TO: Freddie Mac Servicers June 12, 2019 | 2019-12

SUBJECT: SERVICING UPDATES

This Guide Bulletin announces:

Deed-in-lieu of foreclosure inspection requirements

• Removal of the requirement to perform a final interior inspection of the Mortgaged Premises for

deed-in-lieu of foreclosure properties – July 15, 2019

EDR Codes

• Updates to reporting requirements to no longer require:

➢ EDR default action code 20 (Reinstatements (Full or Partial)) when processing and reporting full

reinstatements and loan modifications

➢ EDR default action code TM (Alternative Modification Trial Period)

➢ EDR default action code H5 (Complete Borrower Response Package Received)

Subsequent Transfer of Servicing requirements

• Updates to our Subsequent Transfers of Servicing requirements for a Mortgage registered with MERS

®

Escrow

• Clarification of our requirements when a Servicer advances funds for an unpaid Escrow charge

Exhibit 33

• Updates to Guide Exhibit 33

Participation Mortgages

• Removal of requirements for participation Mortgages from the Guide

Additional Guide updates and reminders

• Further updates as described in the Additional Guide Updates and Reminders section of this Bulletin

EFFECTIVE DATE

All of the changes announced in this Bulletin are effective immediately unless otherwise noted.

DEED-IN-LIEU OF FORECLOSURE INSPECTION REQUIREMENTS

Effective July 15, 2019

Currently, Guide Section 9209.5 requires that Servicers perform a final inspection on the Mortgaged Premises subject to a

deed-in-lieu of foreclosure (“DIL”) no more than two Business Days following receipt of the executed DIL documents to

ensure that the property is vacant, undamaged and in broom-swept condition. If the final inspection reveals that there is

damage to the Mortgaged Premises caused by the Borrower, or the Mortgaged Premises was not left in broom-swept

2

Bulletin

condition, we instructed the Servicer to reduce any Borrower relocation assistance by the amount of the estimated cost of

remediating the issue.

To complement the changes to Servicer requirements for REO properties announced in Bulletin 2019-6, we also are

removing the requirement that Servicers perform a final interior inspection of the Mortgaged Premises.

Additionally, Servicers must pay the full amount of the relocation assistance to eligible Borrowers within 30 days, unless

otherwise instructed by Freddie Mac.

Guide impacts: Sections 9202.12, 9209.4, 9209.5, 9209.7 and Guide Form 1013

EDR CODES

EDR default action code 20 reporting requirements

Previously, Servicers were required to report EDR default action code 20 (Reinstatements (Full or Partial)) to report

full and partial reinstatements. With the implementation of the Investor Reporting Change Initiative, Freddie Mac

systems will validate payment activity against the reported DDLPI and automatically reinstate loans when necessary.

Servicers will no longer be required to report EDR default action code 20 to reinstate a loan except when Servicers

accept a partial reinstatement and need to change the mortgage status from “Foreclosure" to "Delinquent.” We also

are renaming the code to EDR default action code 20 (Reinstatement (Partial)).

Guide impacts: Sections 9203.3, 9203.6, 9203.11 and 9206.17

EDR default action code TM

We are removing references to EDR default action code TM (Alternative Modification Trial Period). Servicers are

reminded that they should use EDR default action code BF (Freddie Mac Standard Modification Trial Period) to

report all Trial Period Plans, including those for the Freddie Mac Flex Modification

®

that were offered under

streamlined eligibility criteria.

Guide impact: Section 9206.13

EDR default action code H5

We are updating references to EDR default action code H5 (Complete Borrower Response Package Received).

Servicers will no longer be required to use this code to notify Freddie Mac of receipt of a complete Borrower

Response Package, but are still encouraged to do so.

Guide impact: Section 9102.5

SUBSEQUENT TRANSFERS OF SERVICING REQUIREMENTS

We are updating the Guide to include requirements for Subsequent Transfers of Servicing for a Mortgage registered

with MERS

®

. The requirements that apply to Concurrent Transfers of Servicing for Mortgages registered with MERS

also apply to Subsequent Transfers of Servicing.

Guide impact: Section 7101.6

ESCROW

Currently, if Escrow is not collected and the Servicer discovers nonpayment of any charge otherwise payable from

Escrow, the Servicer is required to advance funds for the unpaid charge and applicable penalty if the Borrower is unable

to make the payment or does not provide proof of payment within 30 days.

We are updating the Guide to clarify that if a Servicer advances funds for an unpaid Escrow charge and is unable to reach

a mutually satisfactory agreement for the Borrower's repayment of the advance, or if the Borrower fails to comply with the

terms of any such arrangement, the Servicer must comply with the collection, loss mitigation, and if necessary,

foreclosure referral requirements in accordance with Guide Chapters 9101 or 9102, as applicable.

Guide impact: Section 8201.1

3

Bulletin

EXHIBIT 33

Freddie Mac’s standard Acknowledgment Agreement requires a Secured Party to execute a Release (as these terms are

defined in Guide Exhibit 33, Acknowledgment Agreement Incorporated Provisions). We are updating the definition of

“Release” in Exhibit 33, to address situations where a Secured Party’s interests arising out of or related to the Collateral

and the Acknowledgment Agreement (as those terms are defined in Exhibit 33) have been terminated due to a Transfer of

Servicing or a voluntary partial cancellation of the Servicer’s Servicing Contract Rights.

Guide impact: Exhibit 33

PARTICIPATION MORTGAGES

With the implementation of the Uniform Loan Data Delivery requirements in March 2012, Freddie Mac ceased the

purchase of participation Mortgages. With the implementation of the Investor Reporting Change Initiative, Freddie Mac no

longer has participation Mortgages in its portfolio. Therefore, any requirements for purchase and Servicing of participation

Mortgages are being removed from the Guide.

Guide impacts: Sections 1201.3, 1301.9, 1301.11, 3302.3, 3602.5, 4702.2, 6303.3, 6303.5, 7101.4, 8103.2, 8104.5,

8105.1, 8301.6, 8302.9, 8303.11, 8503.7, 8503.9, 9208.8, 9701.4, Exhibit 60 and Glossary J-Q

ADDITIONAL GUIDE UPDATES AND REMINDERS

Servicer Success Scorecard – Loan Level Reporting Compliance metric

In Bulletin 2018-14, we introduced the Loan Level Reporting Compliance metric that will measure the number of loans not

reported as of the last loan level reporting on the P&I Determination Date divided by the number of total loans serviced,

excluding loans with outstanding edits. Servicers receive a PASS or FAIL on this metric based on the number of loans not

reported.

While the numerator and denominator of the Loan Level Reporting Compliance metric remain unchanged, and the PASS

or FAIL calculation remains the same, we are updating this metric’s description to ensure consistency with the description

Servicers view in the user interface.

Effective with the July 2019 Servicer Success Scorecard that will be published at the end of August 2019, Servicers will

receive a PASS or FAIL based on their rank group (Groups 1-4) and the following:

• Group 1 (≥200,000 loans serviced): greater than or equal to 99% reported, then PASS; more than 1% not

reported, then FAIL

• Group 2 (75,000-199,999 loans serviced): greater than or equal to 98% reported, then PASS; more than 2% not

reported, then FAIL

• Group 3 (20,000-74,999 loans serviced): greater than or equal to 97% reported, then PASS; more than 3% not

reported, then FAIL

• Group 4 (<20,000 loans serviced): greater than or equal to 96% reported, then PASS; more than 4% not

reported, then FAIL

Borrower income documentation

Borrower income documentation requirements for loss mitigation assistance specify that, in most instances, a

Borrower may submit his or her two recent bank statements to support the Borrower’s income source.

In response to Servicer feedback, we are clarifying that Servicers may, with Borrower consent, leverage a third-party

service provider (e.g., Finicity

®

) to obtain bank account data to verify income provided by the Borrower on Form 710.

Form 59

We are updating Form 59 to embed the formula used to calculate the adjusted bank balance. Additionally, we are

clarifying that the adjusted bank balance must be calculated as follows:

Current cycle Ending Bank Balance + Deposits in Transit – Outstanding Debits

Guide impact: Form 59

4

Bulletin

Community Land Trust Mortgages

We have added new Section 8104.8 to refer Servicers to Chapter 8701 for special Servicing requirements for

Community Land Trust Mortgages.

Guide impact: Section 8104.8

Reminder on Servicing Mortgages impacted by Eligible Disasters

As the 2019 hurricane season begins, we are reminding Servicers of our requirements for Servicing Mortgages impacted

by Eligible Disasters. Servicers must comply with Chapter 8404 when Servicing Mortgages where the related Borrower’s

Mortgaged Premises or place of employment is located in an Eligible Disaster Area.

Servicers are also reminded that the Servicing requirements announced in Bulletins 2017-21 (property inspection

reimbursement) and 2017-25 (Freddie Mac Extend Modification for Disaster Relief) remain in effect. The Guide was not

updated to reflect these requirements.

Servicers should refer to the following for additional disaster-related information:

• Our Disaster Relief web page, including the Disaster Relief Reference Guide and Managing Distressed

Properties Quick Reference document

• The Freddie Mac Learning Center which includes the Disaster Relief: Modifications webinar

• The Federal Emergency Management Agency’s (FEMA) web site to determine if a Borrower’s Mortgaged

Premises or place of employment is located in an Eligible Disaster Area

Guide updates from Bulletin 2019-11

eMortgages

An eMortgage is a Mortgage that is originated using an eNote (as defined in new Section 1402.2), while the Security

Instrument and other Mortgage documents may be paper or Electronic Records (as defined in Section 1401.2).

eMortgages can help simplify the closing process for Sellers and Borrowers and shorten timeframes from origination

to sale of the Mortgage in the secondary market.

While Freddie Mac’s prior written approval to sell to and/or service eMortgages for Freddie Mac will still be required,

the eMortgage Guide on FreddieMac.com is being retired and all requirements will now be contained in new

Chapter 1402. This will provide greater visibility of Freddie Mac’s eMortgage requirements as eMortgage adoption

continues to grow. Additionally, we are adding Exhibits 45, 46 and 47, which are sample forms that may be helpful to

Seller/Servicers of eMortgages.

Seller/Servicers of eMortgages must comply with all selling and Servicing requirements of the Guide and the

Seller/Servicer’s other Purchase Documents, as applicable, including the special requirements set forth in

Chapter 1402.

Seller/Servicers who wish to sell to and/or service eMortgages for Freddie Mac should contact their Freddie Mac

account representative or the Freddie Mac eMortgage Team (eMortgage_T[email protected]) to begin the

process of determining their eligibility to sell to and/or service eMortgages for Freddie Mac. As part of the

Seller/Servicer’s approval process, the Seller/Servicer’s eClosing System and eNote Vault System (as those terms