THE TRANSITION TO CAGE-FREE EGGS

Authors: Dr.

Vincenzina Caputo, Dr. Jayson Lusk, Dr. Glynn Tonsor, and M.S. Aaron Staples

February 2023

For inquiries, please contact:

Dr. Vincenzina Caputo, Associate Professor

Michigan State University

vcaputo@msu.edu • T: 517-505-9221

Acknowledgments: The research was directed by Dr. Vincenzina Caputo from Michigan State University and conducted in collaboration with

Dr. Jayson Lusk from Purdue University and Dr. Glynn Tonsor from Kansas State University. The authors acknowledge the work of the graduate

student, Aaron Staples (Michigan State University), who assisted with the implementation of the individual interviews and surveys, as well as

with the data analysis and the assembly of the report. This report was made possible with support from the United Egg Producers, The Food

Industry Association, FMI, and the United Egg Association.

i

Executive Summary

State regulations, retailer pledges, and final consumer demand have contributed to a rising share

of egg-laying hens housed in cage-free systems over the past decade. Nonetheless, conversion

from conventional to cage-free housing is costly for both egg producers and final consumers. As

such, there remains uncertainty about the extent to which egg producers will be willing and able

to continue the transition to cage-free housing at a rate commensurate with retailers’ cage-free

pledges. To explore this issue, this study investigates the challenges and opportunities associated

with the transition to cage-free housing, including interviews with and a survey of egg producers,

a survey of egg consumers, and economic modeling of the sector. Key insights and implications

are as follows:

• While there is a high level of stated support for retailers to make cage-free pledges among

the general public, more than half of consumers (56%) are unaware of whether their

grocery store has made such a pledge, and only 19% believe their store has made a pledge.

Consumers do not expect a full conversion to cage-free egg systems by 2026, and on

average, expect a 10-percentage point increase in cage-free laying hens from now to

January 2026.

• Consumers prefer government policies to subsidize the transition to cage-free or mandatory

labels to policies that mandate producers adopt certain housing practices. Amongst the

policies to restrict housing practices, consumers prefer minimum cage size requirements to

an outright ban on conventional production.

• There are segments of consumers willing to pay significant premiums for cage-free eggs,

but the largest segment (representing 55% of consumers) is primarily motivated by price

and does not discriminate between cage and cage-free eggs. If prices remain unchanged

and conventional eggs are removed from the market, the share of consumers choosing not

to buy eggs will increase by 20 percentage points.

• Egg producer interviews reveal the prevalence of long-lasting contractual relationships

with retailers, the importance of retailer demand driving the evolution of the market to

cage-free, and opportunities to reset the conversation with animal advocacy organizations.

However, these interviews also reveal several barriers and unintended consequences to

further transition to cage-free, including:

o Higher costs and labor requirements associated with cage-free production;

ii

o Challenges obtaining financing to convert or build cage-free facilities without

longer-term commitments from retailers, particularly in an environment of rising

interest rates and when existing facilities can no longer serve as collateral;

o Divergent interests of grocery and food service/egg product sectors with respect to

hen housing;

o Concerns that transition to cage-free production could facilitate consolidation given

that larger producers often have better resources and access to capital; and

o Skepticism that retailer pledges can be met by January 2026 without significant

financial incentives, particularly given the high costs of building materials and long

construction lags associated with the permitting and supply chain disruptions.

• A majority of egg producers view conventional housing as superior in food affordability,

production efficiency, and environmental impact relative to cage-free production.

• Producers anticipate revenue from cage-free systems to be 8% higher than conventional

systems, on average. But costs are estimated to be at least 8-19% higher, on average,

depending on the category of expense, with additional labor and capital costs anticipated

to be the categories with the largest increases.

• Producers are more likely to be willing to transition to cage-free production when cost-plus

contracts are available and at higher anticipated return on investment (ROI) levels.

• In aggregate, egg producers believe cage-free production will grow to 51% of total

production by January 2026.

• Economic modeling focused on the shell egg marketing indicates the following:

o For every 1% reduction in the equilibrium quantity of conventional eggs produced

and sold, it takes a roughly 1.9% increase in the equilibrium quantity of cage-free

eggs produced and sold and an increase of at least $21.6 million year in total

wholesale egg spending to leave egg producer profits unharmed; and

o If the share of shell eggs sold cage-free increases by 20-percentage points, the cost

of producing cage-free is 20% higher than for conventional, and consumer demand

does not change, egg producer profits would fall $72.5 million/year in aggregate,

not counting any additional fixed costs producers would have to incur to facilitate

the transition.

iii

Table of Contents

List of Tables ................................................................................................................................................ v

List of Figures ............................................................................................................................................. vi

Chapter 1: Motivation and Objectives ...................................................................................................... 1

1.1. Motivation........................................................................................................................................... 1

1.2 Research Objectives ............................................................................................................................. 3

Chapter 2: Individual Interviews with Egg Producers ............................................................................ 5

2.1. Semi-Structured Interview Questions and Procedures ....................................................................... 5

2.2. Producer Profiles ................................................................................................................................ 6

2.3. Comparing Operational Activities: Cage-Free v. Conventional......................................................... 7

2.4. Business Plan and Relations with Buyers ......................................................................................... 10

2.5. Future of the Industry: Barriers and Opportunities ........................................................................... 12

2.5.1. Barriers ...................................................................................................................................... 13

2.5.2 Opportunities .............................................................................................................................. 17

2.6. Final Remarks ................................................................................................................................... 20

Chapter 3: Egg Producer Survey ............................................................................................................. 21

3.1. Producer Survey Questions and Procedures ..................................................................................... 21

3.2 Transitional Situation and Views ....................................................................................................... 23

3.2.1. National, Industry-Wide Perspective ......................................................................................... 23

3.2.2. Own-Operation Perspective ....................................................................................................... 26

3.3. Laying Hen Housing Investment Decisions ..................................................................................... 31

3.4. Provided Comments.......................................................................................................................... 35

3.5 Final Remarks .................................................................................................................................... 36

Chapter 4: Consumer Survey on Egg Product and Policy Preferences ............................................... 37

4.1. Consumer Survey Questions and Procedures ................................................................................... 37

4.1.1 Section 1: Sample demographics and egg purchasing habits ..................................................... 37

4.1.2 Section 2: Egg Purchasing Habits ............................................................................................... 37

4.1.3 Section 3: Word Associations ..................................................................................................... 38

4.1.4 Section 4: Consumer knowledge, attitudes, and perceptions of the egg industry ...................... 38

4.1.5 Section 5: Choice Experiment on Egg Selection ........................................................................ 39

4.1.6. Section 6: Policy Preferences and Ballot Initiatives .................................................................. 42

4.2 Data Analysis ..................................................................................................................................... 43

4.3 Results................................................................................................................................................ 44

4.3.1 Sample Characteristics ................................................................................................................ 44

iv

4.3.2 Egg Purchasing Habits ................................................................................................................ 46

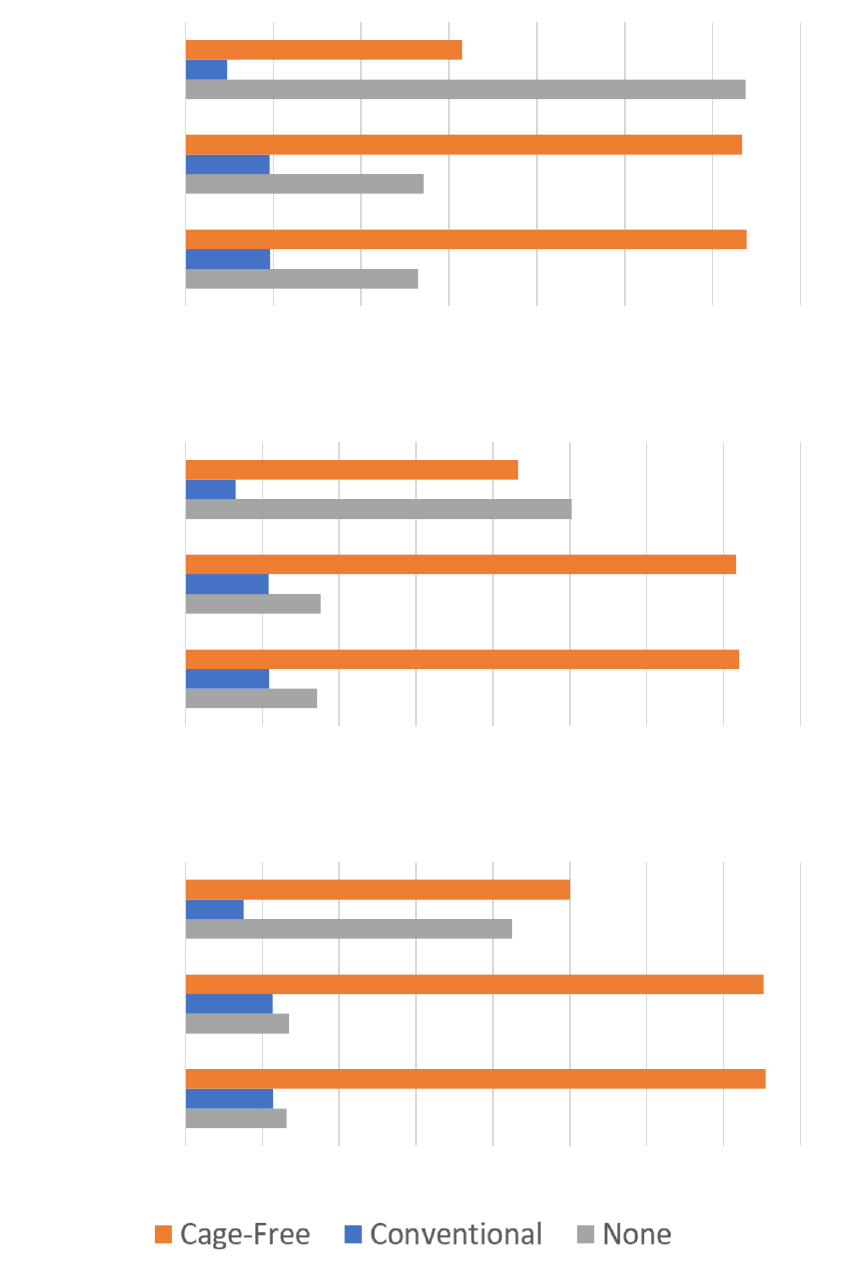

4.3.3 Consumer knowledge, attitudes, and perceptions of the egg industry ....................................... 49

4.3.4 Word Association ....................................................................................................................... 51

4.3.5 Choice Experiment ..................................................................................................................... 52

4.3.6 Policy Preferences ...................................................................................................................... 58

4.4 Final Remarks .................................................................................................................................... 61

Chapter 5: Market and Producer Impacts of the Conversion to Cage-Free Egg Housing ................ 62

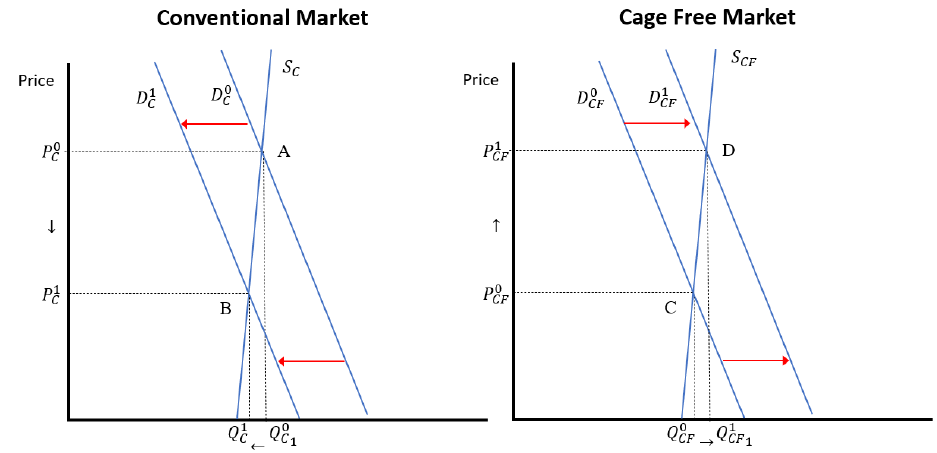

5.1. Equilibrium Displacement Model ..................................................................................................... 62

5.2. Disaggregated Egg Market Analysis ................................................................................................ 63

5.2.1 Data and Parameter Estimation .................................................................................................. 66

5.2.2 Results for Expenditure Neutral Demand Shifts ........................................................................ 71

5.2.3 Results for Egg Producer Profit Neutral Demand Shifts ............................................................ 73

5.3. Aggregate Egg Market Analysis ....................................................................................................... 74

5.3.1 Data and Parameter Estimation .................................................................................................. 75

5.3.2 Results......................................................................................................................................... 76

Chapter 6: Conclusion and Implications ................................................................................................. 78

Chapter 7: References ............................................................................................................................... 80

v

List of Tables

Table 2.1. Thematic areas and core questions in the qualitative interviews with producers ........................ 6

Table 2.2. Egg producer profiles ................................................................................................................... 7

Table 4.1. Labels used in the consumer choice experiment and their meaning .......................................... 41

Table 4.2. Consumer sample demographics relative to U.S. census (n = 961, % frequencies) .................. 45

Table 4.3. Egg purchasing habits of the sample ......................................................................................... 46

Table 4.4. Total and marginal WTP estimates from the LCM ($/dozen) ................................................... 52

Table 4.5. Own- and cross-price elasticities of demand ............................................................................. 55

Table 4.6. Total and marginal WTP, by market segment ........................................................................... 58

Table 4.7. Best-worst scale response frequencies ....................................................................................... 59

Table 5.1. Descriptive statistics for variables used in regression analysis ................................................. 67

Table 5.2. Estimates of demand for conventional and cage-free eggs ........................................................ 69

Table 5.3. Estimates of supply for conventional and cage-free eggs .......................................................... 70

Table 5.4. Change in producer profits from conversion to cage-free housing, varying assumptions ......... 77

vi

List of Figures

Figure 1.1. Shell egg retail prices by region over time, Source: USDA (2022) ........................................... 3

Figure 2.1. Cage-free system operational activities discussed with producers............................................. 8

Figure 2.2. Main barriers and opportunities to cage-free adoption mentioned by producers ..................... 13

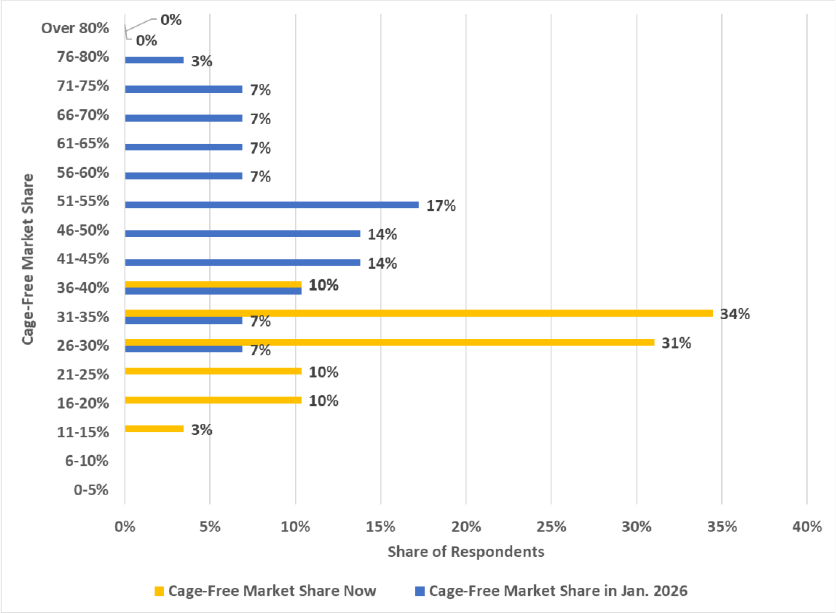

Figure 3.1. Views on national cage-free market share, now and January 2026 ......................................... 24

Figure 3.2. Views regarding laying hen housing, opportunity vs. challenge.............................................. 25

Figure 3.3. Views on which production method ranks best across different characteristics ...................... 26

Figure 3.4. Percent premium for cage-free annual expenses compared to caged, retrofit v. new .............. 28

Figure 3.5. Example laying hen investment decision question ................................................................... 31

Figure 3.6. Projected investment: Contract options and common ROI in both production settings .......... 33

Figure 3.7. Projected investment: Conventional with spot pricing and cage-free with cost-plus .............. 35

Figure 4.1. United Egg Producers certification criteria, Source: UEP (2022) ............................................ 39

Figure 4.2. Example choice experiment task .............................................................................................. 41

Figure 4.3. Example best-worst policy question ......................................................................................... 43

Figure 4.4. Attributes that are most and least important to consumers when buying eggs ........................ 47

Figure 4.5. Consumer perceptions over past and future egg prices ............................................................ 48

Figure 4.6. Consumer perceptions over why egg prices have increased over the past year (n = 766) ....... 49

Figure 4.7. Respondent estimates for percentage of cage-free laying hens, currently and Jan. 2026 ........ 50

Figure 4.8. Consumer perceptions of egg producers providing different services to laying hens .............. 51

Figure 4.9. Mean WTP to keep each egg product in the choice experiment ($/dozen) .............................. 53

Figure 4.10. Market simulation demonstrating the effects of the removal of conventional eggs............... 54

Figure 4.11. Variation in mean premiums ($/dozen) relative to conventional, by select demographics.... 57

Figure 4.12. Best-worst scaling (BWS) results, differential in voting........................................................ 60

Figure 4.13. Responses to various ballot initiatives ................................................................................... 60

Figure 5.1. Effects of decrease in demand for conventional and increase in demand for cage-free .......... 65

Figure 5.2. Expenditure neutral shifts in conventional and cage-free egg demand .................................... 71

Figure 5.3. Impacts of expenditure-neutral demand shifts on egg producer profitability .......................... 72

Figure 5.4. Increases in retailer egg spending required to hold egg producers’ profits constant ............... 74

1

Chapter 1: Motivation and Objectives

1.1. Motivation

The U.S. is the second largest egg producer in the world, with a total production of 113 billion

eggs in 2019 alone (FAO, 2021; Ha, 2021). Most of the egg production takes place in the Midwest,

specifically Iowa (15%), Ohio (9%), and Indiana (9%) (Ha, 2021). More than 70% of the laying

hens producing eggs are held in conventional production, 22.5% are cage-free, and 6.8% are in a

certified organic production system (UEP, 2023b). In the last several years, the number of cage-

free layers and cage-free produced eggs has increased. Between December 2020 and December

2021 alone, the number of cage-free laying flocks increased from 80 million to 94.3 million hens,

an almost 18% increase. Likewise, weekly cage-free egg production increased by 17% from the

beginning to the end of 2021 (USDA AMS, 2021a, b; USDA ERS, 2021a).

Coinciding with an increase in consumer demand for cage-free and organic, two additional

factors are driving the transition to cage-free egg production methods: (i) the recent legal

developments such as cage-free mandates, which require eggs and egg products to come from hens

raised in cage-free facilities and (ii) the widespread private sector commitments to going cage-free

in the next five years (McDougal, 2021; Shanker and Pollard, 2021). Legal developments have

occurred state-by-state through ballot measures and legislative action instead of federal efforts. To

date, ten states have passed legislation to transition to 100% cage-free eggs (USDA ERS, 2021b,

Fatka, 2021). For example, California voters passed Proposition 12 in 2018, banning the sale of

caged eggs as of January 1, 2022. States with similar mandates require the transition by January

1, 2026.

While it remains too early to conclude the economic implications of cage-free mandates,

Oh and Vukina (2021) predict that California’s implementation of Proposition 12 will result in an

annual welfare loss for California consumers and retailers of $72 million and $23 million,

respectively. Studies have also explored the economic cost of previous production mandates in the

egg industry, such as California Assembly Bill (AB) 1437, which banned the sale of eggs that did

not meet heightened minimum space requirements. Mullally and Lusk (2018) state that the

implementation of AB 1437 increased prices by 9% and cost California consumers at least $25

million per year. Carter, Schaefer, and Scheitrum (2021) suggest that AB 1437 decreased

economic surplus by $2.85 billion across the country between January 2015 – December 2017,

with nearly 70% of this burden borne by out-of-state market participants.

2

Interestingly, citizens have voted for stricter production practices despite having

purchasing patterns that deviate from their ballot preferences.

1

This wedge between voting patterns

and revealed purchasing behavior creates uncertainty across the supply chain and will likely elicit

diverse responses from producers depending on individual circumstances. Even in states without

such legislation, the largest U.S. retailers, including Wal-Mart, Kroger, and Meijer, have

voluntarily pledged to 100% transition to cage-free eggs by 2025. To fulfill the pledges, around

three-quarters of all egg production will have to transition to cage-free production (see Lusk,

2019). This trend has obvious implications for egg producers and other actors along the supply

chain (including retailers and consumers) as production adjusts to these new circumstances.

A key challenge for producers is the need to make capital investments to transition to

alternative housing when there remains high uncertainty about the future. Converting from cage

to cage-free systems is costly and requires significant capital (Trejo-Pench and White, 2020).

These factors lead to increased production costs. These costs are likely to be at least partially

passed through the supply chain and onto the final consumer, particularly given the inelastic

consumer demand for eggs. This partly explains why cage-free eggs are significantly more

expensive than conventional eggs. The average market price for a dozen Grade A eggs was around

$1.17 in November 2021 (USDA ERS, 2021b) compared to $1.64 for cage-free eggs in the same

month (USDA AMS, 2021b), meaning an almost $0.50 premium is charged on average for cage-

free eggs. The extent of this premium varies significantly across regions; see Chang et al. (2010)

for a discussion and Figure 1.1 for more recent price data at a retailer level. As a result, a producer’s

willingness to adopt cage-free production is likely dependent on their location.

2

This diversity in generatable premiums and the existing differences in physical and

financial inventory among business operations suggest that the adaptation mechanisms of

producers are expected to be highly heterogeneous. These challenges highlight the need to better

understand conversion costs and how such costs might be transmitted through the supply chain.

Understanding these aspects is important to producers and processors to make informed production

decisions and long-term investments. Likewise, it has relevance for policymakers trying to

1

The phenomenon is known as the vote-buy gap (Norwood, Tonsor, and Lusk, 2019; Paul et al., 2019).

2

Note that conventional eggs in Figure 1.1. refers to Grade A large eggs. For the 2022 Northwest data, the USDA

only reports the price for Grade AA large eggs instead of Grade A.

3

evaluate how the transition and possible subsidies or incentives could impact the wider supply

chain, including consumers.

Figure 1.1. Shell egg retail prices by region over time, Source: USDA (2022)

1.2 Research Objectives

This project provides a wide-scale investigation of the U.S. egg sector, including an analysis of

necessary production adjustments, changes in consumer behavior, and market effects from a

potential conversion to cage-free. In particular, this project conducts a comprehensive economic

evaluation of the cage-free conversion to better inform industry decisions, policymakers, and

consumers. To accomplish this overall goal, the project was organized around four main

objectives:

• Objective 1: Evaluate producer attitudes, concerns, and adoption willingness of cage-free

production via egg producer individual interviews.

• Objective 2: Determine current egg producer’s financial situation and expected transition

timing regarding hen-housing methods via an egg producer survey.

• Objective 3: Determine consumer preferences and buying patterns for eggs in “cage-free

only” marketplaces via an egg consumer survey.

4

• Objective 4: Summarize the research team’s opinions and provide economic-informed

recommendations to key stakeholders to navigate the future landscape of the egg market.

The remainder of this report is structured as follows. Chapter 2 describes the qualitative results

of semi-structured interviews with seven egg producers on their general sentiments and concerns

regarding the transition to cage-free eggs. Chapter 3 describes the results of a national producer

survey sent to UEP members, providing a more granular quantitative analysis of industry attitudes

and expectations. Chapter 4 outlines the findings from a national egg consumer survey, evaluating

consumer perceptions and preferences toward egg products and egg policy. Chapter 5 builds on

the findings from the previous chapters with an equilibrium displacement model predicting how

market shifts could affect egg producer profitability. Chapter 6 concludes with a discussion of the

implications of this report and the future outlook of the U.S. egg industry.

5

Chapter 2: Individual Interviews with Egg Producers

2.1. Semi-Structured Interview Questions and Procedures

We conducted semi-structured interviews with seven egg producers in June 2022. Interviews were

conducted individually via Zoom and lasted between 45-75 minutes. We followed a topic-guided

approach where each interview started with a schematic presentation of the topics. Questions were

arranged into four themes: (i) current business operations, (ii) cage-free production, (iii) business

plan and relationship with buyers, and (iv) future industry directions. For each theme, we asked

questions developed following recent debates about cage-free production and through a pilot in-

person interview with a large U.S. egg producer. Table 2.1 presents the thematic areas and core

questions, while the questionnaire is available as supplemental material accompanying this report.

3

Probing questions were also asked to explore issues in more detail, while closing questions were

used to gain additional egg production-related information or answer producer questions.

Individual responses were mapped to one of the survey themes, and patterns across each theme

were identified by comparing responses across participants.

In what follows, we discuss the results of each of the four survey themes. We begin with a

broad overview of the aggregate producer profile before describing the cage-free conversion and

producer insights on the difference between production systems. Then, we explore the producers’

relationships with their buyers and how these relationships influence their business plans and

financial decisions. The section concludes with a discussion of the producers’ perceptions about

3

The full questionnaire is available here: link.

Summary

We conducted semi-structured individual interviews with seven egg producers to evaluate their

attitudes, sentiment, and willingness to adopt cage-free production. Producers compared the

operational activities of cage and cage-free facilities, spoke to the primary barriers and

opportunities in cage-free markets, and offered their perspective on cage-free ballot initiatives

and retailer pledges. Producers indicated higher fixed and variable costs in cage-free housing

systems, with capital and labor costs being two of the central drivers of the cost increase. While

several producers indicated a willingness to adopt cage-free production once their consumer

wants cage-free egg products, most were hesitant to view the transition as an opportunity. The

most commonly cited barriers to cage-free adoption included limited consumer demand, high

capital costs, a contradiction to environmental sustainability efforts, and food insecurity.

6

the future of the industry, including the barriers preventing further adoption of cage-free eggs in

the United States, as well as potential opportunities.

Table 2.1. Thematic areas and core questions in the qualitative interviews with producers

Thematic Areas

Core Questions

Business

operations

• Can you please provide a brief overview of your current production setup?

This could include your (i) role in the supply chain; (ii) number of

production plants and geographic location(s); (iii) annual production; and

(iv) variety and type of egg products.

Cage-free

production

• What share of your egg production is from cage-free facilities?

• How has the switch to cage-free affected your (i) labor demand; (ii) capital

requirements; (iii) feeding process; (iv) safety and quality control; (v)

disease management; and (vi) marketing strategies?

Business plan

and relations

with buyers

• What percentage of your eggs do you sell under contracts, and how long

have you had these relationships with your buyers?

• How often do you communicate with your buyer about the transition to

cage-free eggs?

• Does your company have an annual business plan for the transition to

cage-free? Does this plan include strategies on what to do with the

outsourced cages?

• How difficult is it to finance the new construction of cage-free facilities,

and have there been significant barriers to capital?

Future

industry

directions

• How do you perceive the legislative changes occurring in different states

towards going 100% cage-free?

• What do you perceive as the biggest challenges to converting to cage-free?

2.2. Producer Profiles

Seven egg producers participated in the individual interviews (Table 2.2). We interviewed one

small producer, one medium producer, and five large producers. Producers covered the shell egg

and liquid egg marketplaces and supplied both grocery stores and the wider food service industry.

Current cage-free adoption rates of the seven interviewed producers varied quite significantly. Six

producers had less than 30% cage-free production, while one had more than 60% cage-free

production. Three of the seven producers have ongoing cage-free construction projects. To

maintain producer anonymity, producers’ production level, employment, exact current cage-free

adoption rates, etc., are withheld from this report.

7

Table 2.2. Egg producer profiles

Producer

Gender

Farm Size

% Cage-Free

Customers

Egg Types

A

Male

Small

< 30%

Grocery stores

Shell egg

B

Male

Medium

< 30%

Food service companies

Liquid eggs

C

Male

Large

< 30%

Grocery stores & food

service companies

Liquid eggs &

shell eggs

D

Male

Large

< 30%

Grocery stores

Shell eggs

E

Male

Large

< 30%

Grocery stores & food

service companies

Liquid eggs &

shell eggs

F

Male

Large

< 30%

Food service companies

Liquid eggs

G

Male

Large

> 60%

Grocery stores & food

service companies

Liquid eggs &

shell eggs

2.3. Comparing Operational Activities: Cage-Free v. Conventional

To better understand the differences between systems, we asked respondents to compare and

contrast the operational activities of cage-free and caged systems. More specifically, interviewees

were asked to describe how the cage-free transition affects five interrelated factors: (i) labor

demand, (ii) capital requirements (infrastructure), (iii) feed system and associated costs, (iv)

disease management, and (v) food safety/quality. The results are summarized in Figure 2.1.

Producers were first asked to discuss the difference in capital requirements for

infrastructure investment for cage and cage-free systems. All seven producers stated that cage-free

systems require at least two times the capital of caged facilities and would require investment in

cage-free pullet houses. Producers recommended that the bird spend their entire life in a cage-free

environment to be trained to maneuver through the system. For instance, Producer A stated: “Try

to get that pullet as well-trained in that [cage-free] equipment so they know where to lay the eggs,

they know how to go up and down the system to get feed and water. Once you’ve lost that training

period, you’re never going to get that back.” In addition, six out of seven producers recommend

against retrofitting caged facilities into a cage-free environment. They argued that while

retrofitting can be seen as a way to reduce capital investments, it could sometimes create long-

term problems within the facility. Producer C suggested, “We've done some remodels of existing

8

facilities. We don't really find that to be economical or in the long-term best interests from an

animal care standpoint and a total best cost standpoint.” For this particular producer, greenfield

facilities are preferred.

Figure 2.1. Cage-free system operational activities discussed with producers

The second factor our producers unanimously discussed was increased labor demand.

Securing willing workers for a cage-free environment and training them requires higher wages.

Speaking of their own experiences, producers reported that the labor demand for cage-free systems

was about 2-4 times as high as that of caged production. For example, when asked about labor

demand, Producer C stated that cage-free requires “much more of an animal care role where

people are actually interacting with the birds, and they have to be much more attuned to the

behaviors. It requires a lot more training, a lot more experience, and a lot more care… [and] also

a different labor rate.” Given the more specialized tasks and the enhanced need of fulfilling a

• Cage-free systems require at least 2 times the capital to caged facilities

• Also must consider investment in new cage-free pullet houses for training

purposes

Capital Requirements

• Cage-free production houses require 2-3 times more labor than caged

facilities

• Cage-free facilities also require more specialized labor

• Fecal matter and poor ventilation are most commonly cited worker safety

concerns

Labor Demand and Worker Safety

• Cage-free facilities require 2-3 lbs. more feed per 100 hens than caged

systems

• Slight differences in feeding schedules across systems

Feed System

• Disease can be more common and widespread in cage-free systems due to the

bird's increased contact with other birds and fecal matter

• Cage-free systems can require a more intense vaccine regime

Disease Management and Animal Welfare

• Same level of food safety can be achieved, but the presence of floor eggs in

cage-free systems is a potential food safety concern

• Cage-free facilities can have lower percentages of Grade A eggs due to

manure stains and cracks in the shell

Food Safety/Quality

9

“more animal husbandry role” (as stated by Producer D), the pool of potential employees shrinks.

The pool further shrinks when considering the implications of the transition for worker welfare.

In addition, business operations will incur costs due to an increased need for feed. For

example, Producer E stated that “cage-free systems can require 2 lbs. more per 100 birds and can

even be as high as 3 lbs. more per 100 birds.” Expanding on this point, Producer F remarked,

“Conventional housing generally requires 22.5 lbs of feed per 100 birds per day while cage-free

can require two pounds more.” These numbers align with calculations by Alltech (2022), who

reported a 7-8% increase in feed intake for cage-free flocks relative to caged ones.

The increased contact of the birds with feces and other birds in a cage-free environment

increases the disease risk meaning “a much more intensive vaccine regime for cage-free birds,”

as stated by one of the producers (Producer E), and “higher testing requirements for diseases such

as salmonella” (Producer C) are needed. The disease pressure and rigorous vaccine regime present

long-term risks and costs to producers. Additionally, three producers (Producers B, D, and E)

suggested that mortality rates can be 2-3 times greater in cage-free systems compared to

conventional facilities. In their opinion, this is mainly because of the birds' interaction with their

fecal material, more cannibalistic behavior, and the birds' protective instinct to "crowd" one

another. The higher mortality rate suggested by producers aligns with findings from Alltech (2021,

2022) and Weeks, Lambton, and Williams (2016), reporting lower mortality rates in conventional

systems than in cage-free and free-range systems. However, Producer C stated that the mortality

rates were similar across systems, though they agreed that mortality rates could be higher during

the first few years as the producer adjusts to the transition. Indeed, research from Schuck-Paim,

Negro-Calduch, and Alonso (2021) support this claim, stating that producer experience plays a

role in reducing mortality rates. Their findings suggest that cage-free mortality rates have declined

over time, and there is no statistical difference between the conventional and cage-free systems.

Freire and Cowling (2013) also find no differences in laying-hen mortality rates between systems.

Thus, debate surrounds whether cage-free mortality rates are actually higher than caged systems.

The safety risks affect not only the birds but also the eggs they lay. Cage-free systems

result in floor eggs (i.e., any egg laid on the litter floor), and these floor eggs are more susceptible

to safety concerns. One issue with floor eggs is that it is difficult for workers to know how long

the egg has been on the floor. When found, there is also a higher chance that they might have been

10

contaminated with diseases (as stated by one of the producers).

4

Even more, there can be a food

quality concern. Producer D noted that a higher share of eggs in a cage-free system tend to be

undergrade “due to manure stains and cracks.” With poor shell appearance, Producer E reports

that “conventional systems can average from 94-97% Grade A eggs, while cage-free production

generally ranges from 88-94%.” Thus, there is a potential difference in terms of overall egg

quality, which will impact the profit producers can generate.

2.4. Business Plan and Relations with Buyers

Interviewees were asked to provide a broad overview of their contractual obligations, including an

estimated number of buyers and the percentage of eggs for shell-egg and liquid-egg markets. Each

producer stated that they sell the majority of their eggs through formal contracts to a few primary

customers. Most contracts are long-lasting relationships, with some spanning multiple decades.

Three producers explicitly described some of their contractual agreements as need-based, where

the contract does not specify a specific quantity but rather an agreement to meet the need of the

customer; two of seven producers describe having informal handshake agreements with buyers.

Spot markets make up a small share of annual sales, ranging from 0 – 20% for our seven producers.

All producers stated that they consistently monitor the cage-free situation with their

customers, but the frequency of these conversations varied. Producer F indicated that they had

weekly discussions with their buyer, while Producer B said their conversations were annual. The

remaining producers stated that they converse with their customers about once a month or less

regarding the transition to cage-free.

One point consistently made by each producer was that their customer drives the decision

to transition to cage-free. From these discussions, there also appears to be a positive correlation

between the percentage of cage-free production and sales to shell-egg markets. For example,

Producer E stated that most of their cage-free eggs are destined for grocery stores, while Producer

B, who supplies all liquid eggs, added, “We’re not marketing to retailers and consumers who are

looking at an egg as an egg. We’re marketing to big branded processed food companies where we

4

The anticipated share of eggs ending as floor eggs differed across producers with some of our interviewees reporting

losses up to 20% floor eggs at times (Producer D), while others indicated a share of around 5-6% (Producer A).

Nevertheless, all producers agreed that achieving 1% floor eggs was the goal, although even 1 % loss already

represents a huge loss.

11

are one of five to ten ingredients on a back panel, and the consumer is not as locked-in on the

choice of am I eating an egg, and where does it come from. They just want to make pancakes.”

This apparent relationship may stem from the fact that the cage-free attribute is more salient

on a carton of eggs than on a processed food box for a product containing eggs. In other words,

there is likely a difference in the way consumers think about eggs as a final product versus

eggs as an ingredient. There also may be regional variation in cage-free adoption rates, where

producers whose primary customers are located in regions without cage-free mandates are less

likely to transition. For example, Producer A stated, “In the West and the Northeast, you’re

probably going to continue to see a lot quicker of a transition than in other parts of the country.

We’re in the Southeast, and there have not been any major legislative pushes in our areas toward

going cage-free. So, it really just depends on where you’re located and where your customer base

is.”

Interviewees were also asked whether they had a business plan to transition more of their

facilities to cage-free. While three out of seven producers had ongoing projects, these were always

customer driven. Each producer stated that they would not engage in speculative building based

on the voluntary, informal pledges made by retailers. Relatedly, when asked whether federal

support would incentivize a faster transition to cage-free, all producers stated that this would not

solve the long-term issue of finding a buyer. Thus, producers will only transition to cage-free at

the request of their customers.

Regarding financing their completed or ongoing cage-free construction products, each

producer stated that securing funding through banks has not been a significant barrier. However,

they did note that loan approval required proof of a long-term commitment from the customer.

Without this contract outlining the transition timeline, banks may be hesitant to approve the loan

given the significant capital investment. Producers also suggested that while funding has been

available, it could become more difficult to acquire as more producers transition. That is, if

mandates restricting caged production are imposed, all producers will be forced to transition at

once, and funding could become more difficult to obtain. This is particularly true because cages

will lose their value. As cages lose value, producers cannot claim them as collateral, which

increases the producer’s debt-to-asset ratio and makes the bank less likely to lend. Smaller

producers are more likely to be negatively affected by this precautionary lending, which raises

concerns over industry consolidation. We discuss this concern more later in the chapter.

12

Most producers stated that they are not opposed to any production system, but they want

to know that the market demand is there before transitioning. “We don’t have a preference on the

style of production, cage-free versus conventional. But our models are predicated on

understanding the customer and delivering what they want, where they want it,” claimed Producer

F. Producers requested clear communication and firm commitments from their customers. With

producers suggesting that it takes two to three years to build new cage-free facilities and no hard

commitments made, the 2025 deadlines for the retailer pledges look infeasible.

2.5. Future of the Industry: Barriers and Opportunities

Producers were asked what, in their perspective, were the (three) largest barriers and (three)

opportunities to transitioning to 100% cage-free production. As summarized in Figure 2.2,

customer demand, capital financing, environmental sustainability, and food security were the most

commonly cited barriers. Innovation and entrepreneurship opportunities, an industry “reset” within

the animal activist community and gaining market share were listed as potential opportunities in

cage-free. In what follows, we discuss key findings that express barriers and opportunities raised

by the producers.

13

Figure 2.2. Main barriers and opportunities to cage-free adoption mentioned by producers

2.5.1. Barriers

Barrier 1: Customer demand and commitment

Customer demand and commitment by the retailers was one primary concern raised by producers

during the interview. Each raised similar concerns regarding the commitments made by the

retailers to transition to cage-free eggs by January 1, 2026. Producer E stated, “Retailers that did

try to make the decision when the conventional option was still present saw consumers continue

to buy the conventional option. Then, when they subsequently removed the conventional option,

they experienced a significant decline in egg sales.” This response addresses two key issues. First,

14

with cage-free commitments in place, retailers will find it difficult to attain cage-free goals when

consumers still have the option to purchase cage eggs. There is a disconnect between consumer

voting behavior and current purchasing behavior. Indeed, three of seven producers used the phrase

“consumers vote with their wallet” to demonstrate how consumers vote to impose stricter

production standards yet continue to purchase the cheaper, caged product option. Secondly,

Producer E’s quote demonstrates that in states without a cage-free mandate, no retailer has a first-

mover advantage to switch to cage-free. That is, if a retailer voluntarily removes the cage egg

alternative from their shelves, they will experience a “significant decline in egg sales” as

consumers shop at a competitor’s store for the cheaper alternative. Indeed, research indicates that

consumers compare food products/prices, shop at multiple retailers, and substitute across retail

outlets (e.g., Bonfrer, Chintagunta, and Dhar, 2022; Richards and Jura Liaukonytė, 2022). Yet,

there appears to be an agreed-upon, soft commitment to a 2025 deadline for all the major retailers

to go cage-free.

The differences in voting and purchasing behavior create uncertainty and risk in the supply

chain. In the current market, the producer is waiting for the retailer to act, and the retailer is waiting

for the producer to act. As a result, producers mentioned that the cage-free transition period would

be a tension point across the supply chain. For example, when describing the impending 2025

deadlines and the cage-free transition, Producer F stated, “Most retail chains are saying, ‘Yeah, do

that for me, and I’ll buy it in 2025.’ ‘Well, what about 2023 and 2024 when I have to make that

transition?’ ‘Yeah, I’ll buy them in 2025.’ So that’s the dilemma that, as an industry, we are

perplexed with.” In other words, retailers want producers to invest in cage-free facilities to be ready

for the hard switch, but retailers are hesitant to purchase cage-free eggs during the transition, given

what is known about current consumer purchasing behavior. Producers, on the other hand, will not

engage in the speculative construction of cage-free facilities. They will only invest once they have

a long-term commitment from their customers to account for the transition period.

Barrier 2: Capital, financing, and equipment

When asked about the three limiting factors to cage-free production, Producer F’s response was

“Capital, capital, and capital.” Producers, as a whole, agreed that cage-free capital requirements

are at least double that of caged systems, and they need a long-term contract in place with a

customer before requesting funding from a bank. Producers use this contract to demonstrate to the

15

bank that they have a committed buyer, increasing the probability of loan approval. As discussed

above, some producers feel like they are “in the dark” (Producer A) as to what their customer

wants. Producer C added, “The industry is being asked to make a conversion that is an expenditure

and a commitment of time and resources orders of magnitude beyond anything we have been asked

to consider in the past. It simply is not going to happen in a vacuum; it has to be a partnership.”

Even when a long-term commitment is in place, it will take approximately 2-3 years to

build cage-free facilities (Producers C, D, E, and F). Producers D and F also suggested that

permitting concerns and the construction of cage-free pullet facilities can add to this timeline.

Moreover, limited equipment supplies and ongoing supply chain constraints could present

additional hurdles. Specifically, Producers C, D, and E each mentioned that as demand for cage-

free facilities increases, firms might find it more difficult to obtain equipment because there are

only a limited number of suppliers. This could further delay the speed at which the industry can

convert to cage-free production.

While the producers interviewed here stated that they have not had trouble securing funding

to date, Producers A and D acknowledged that this could become a concern if producers were

forced to transition all at once. A bank’s decision to approve a loan will depend on the value of the

firm’s assets, and as cages lose their value, it could become more difficult for firms to secure

funding (Producer D). This is particularly true for smaller firms that have a weaker market position,

leading the bank to view the loan as riskier. If financing becomes difficult to acquire, larger

producers may view the transition to cage-free as an opportunity to buy out smaller firms and gain

market share.

Barrier 3: Environmental sustainability efforts

While cage-free production and environmental sustainability are often lumped into the same

discussion, multiple producers stated that cage-free runs against their environmental goals.

According to at least four of the seven producers, cage-free production—which is more expensive

than caged production—requires more water, feed, and land while also having a higher carbon

footprint. These insights are supported by Leinonen et al. (2012), whose life-cycle assessment of

different egg production systems finds that the cage system has lower environmental impacts and

16

global warming potential than cage-free and organic systems.

5

Shepherd et al. (2015) also suggest

that cage-free systems have higher carbon dioxide emission rates than cage systems, likely driven

by increased hen activity and lower stocking densities. Producer E stated that their transition to

cage-free facilities had pushed them “further away from their goal of attaining carbon neutrality,”

while Producer D suggested that cage-free production runs “diametrically opposed” to their

environmental sustainability initiatives. There is a concern in the industry that consumers,

policymakers, and actors across the supply chain do not understand this tradeoff (Producers B, C,

D, and E). In these producers’ eyes, mandating cage-free production counters the progress in

reducing the industry’s environmental impact.

With regard to a growing population and a growing demand for protein, Producer D noted

that he believes environmental sustainability efforts need to be center stage “because the need for

that production, the need for more food, the need for more farmland without destroying the

environment is going to become intense.” When speaking about the transition, Producer D added,

“It’s hard to scale it back when it’s time to say, all right, we got to get back to the environment.

So, I really hope we don’t make too many wrong turns that are hard to undo if it does become

apparent soon that the environment is what we really need to be focused on.” As the country pivots

towards a higher cost, lower efficiency system with a higher environmental footprint, producers

suggest exercising caution over further mandates, and they encourage honest, open conversations

about cage-free production across the supply chain.

Barrier 4: Food affordability and security

With ongoing concerns about inflation and increasing food costs, the U.S. is already experiencing

issues with food security (USDA ERS, 2022). Producers B, D, E, and F see the conversion to 100%

cage-free as a food security issue. Capital and variable costs are higher in the cage-free system,

and the higher costs are typically passed down the value chain and borne by the consumer. This

difference in production costs explains the current price premium for cage-free eggs compared to

conventional caged eggs.

5

Specifically, Leinonen et al. (2012) find that the cage system requires less feed, water, and housing or land than non-

organic cage-free, organic cage-free, and free-range. With less input requirements, the cage system has lower

eutrophication and acidification potential, which are commonly used metrics for assessing environmental concerns in

agriculture systems. The cage system also has lower electricity use for ventilation, lighting, etc., which contributes to

the lower primary energy use and global warming potential.

17

If the conventional caged alternative is removed from the market, and all producers and

retailers must supply cage-free eggs, then the average cost for eggs increases. As the price

increases, the quantity demanded decreases, and fewer eggs are bought and sold in the

marketplace. The price increase will be most detrimental to the lowest income bracket, who rely

on eggs as a cheap source of protein. Forcing a transition to a more expensive product with an

identical nutritional profile while removing the cheaper alternative is likely to disproportionately

impact the most food-insecure groups. “We have to think smart, or we’re going to have a hungry

nation,” stated Producer E.

2.5.2 Opportunities

When asked to provide three potential opportunities in cage-free production, many producers

struggled to provide a complete list. Others were skeptical of viewing the transition to cage-free

as an opportunity. Producer A stated that he sees the transition “as more of a risk than an

opportunity because of the capital requirements and the unknowns,” while Producer B said that it

comes down to “educating the consumer about what they’re signing up for… What are we selling

to people, and do they really want it?” Producer B added that he currently sees limited opportunity

in the liquid egg marketplace but noted, “If everybody’s operating under the same rules… I think

the industry can become more efficient. The more volume and scale people have in the arena, the

better they are going to get at it.”

Opportunity 1: Innovation and entrepreneurship opportunities

Some producers were hesitant to suggest opportunities for entrepreneurship on the production side.

For instance, when asked about areas for entrepreneurship, Producer B stated, “I think on the

processing side, for sure, there’s always that flexibility. How do you add value? But on the

production side, no… I think any entrepreneurship is going to get mowed down by the scale of

production.” Producer C agreed with this assessment, adding that an entrepreneur “can start small

and try to build a niche brand, but by the time you look at the land and all the other resources…

the capital requirements are so enormous. It’s such a barrier.” Producer C instead suggested that

there should be an emphasis on helping the industry “solve the labor challenge.”

Producer C was not alone in assessing the need for technologies such as robotics to help

with labor. When describing the differences in labor demand and labor tasks between caged and

18

cage-free systems, Producer D noted that “Well, I don’t really need people if I could find a robot

to do some of those things. I think robotics is a big part of where we’re going as an industry, both

in production and in our processing plants.” Producers D, F, and G also mentioned advancements

in ventilation and other technologies to provide a more sanitary environment for the hens and to

dry the manure. For example, Producer G notes that they have installed in-floor heating, a

technology that dries out the manure to a point where the robots can sweep it; it also reduces the

smell for workers. Relatedly, Producers F and G discussed ways to convert manure into fertilizer,

turning a byproduct of production into a new product line.

Opportunity 2: “Reset” with the animal activist community

Producer C stated that the conversion to cage-free “presents an opportunity for the industry to have

a reset in how the consumer sees us, and how the animal welfare community perceives the

industry… I think the industry has an opportunity to prove and show how effectively and efficiently

they can do this while improving animal welfare.” Over the past few decades, there has been an

increase in consumer demand for animal welfare attributes in food. At the same time, there has

been an increase in corporate responsibility for animal welfare standards. One example is Producer

G’s zero-tolerance policy for a failure to handle the bird properly. To promote animal welfare,

workers must watch a three-minute video daily on how to handle a bird, body cameras and security

cameras track behavior, and auditors monitor workers to ensure they are handling the bird

correctly. Producer C added that the transition to cage-free serves as “an opportunity to exit some

of the oldest systems and the oldest production methodologies.” With the expectation that most

producers will build greenfield facilities instead of retrofitting caged facilities, producers can

model their future facilities to incorporate technologies such as recovery pens (Producers C and

G).

Additionally, now that some producers have been producing cage-free for more than a

decade (Producers C, D, E, F, and G), there have been improvements in technologies and

production practices that have reduced some of the early challenges. For example, when first

learning about cage-free production, at least two producers (Producers E and F) consulted with

European producers that were further ahead in the cage-free transition. One issue was that the

European producers could not replicate the scale of U.S. production. Thus, while producers could

learn about some key aspects of the business, there was still a substantial learning curve.

19

“Like anything, there is a learning curve associated with transitioning to cage-free systems.

This includes how you grow the pullets, transitioning the pullets to the layer house, and labor

training,” stated Producer A. One example of this learning curve comes from Producer C saying,

“over the last ten years, we’ve gone from a situation where mortality in cage-free was significantly

higher than in convention production, to today, where it’s as good if not lower.” Noting that this

has to do with bird training, a more specialized workforce, and experience, there are avenues to

improve animal welfare. With more experience, producers will continue to adjust to the cage-free

setting, and there will likely be improvements in housing and equipment design.

Opportunity 3: Gain market share

Whether cage-free is viewed as an opportunity depends on the company’s size. In general, larger

producers benefit from economies of scale, and they have larger customers that may agree to long-

term cage-free agreements making funding easier to acquire. Small producers, however, may find

it difficult to compete in this space due to high capital costs and barriers to entry. Producer F noted,

“I’m afraid that the industry is going to continue to consolidate… there are a lot of producers out

there that are struggling to figure out what to do. Do we invest in cage-free? Do we sell the

business? Do we let somebody else worry about it? I think those are all valid questions that every

producer in the egg business is trying to figure out and are struggling with today.” Producer D

agreed that consolidation is likely, adding, “If we’ve got money, it’s in chickens, in cages, and

trucks. Our ability to borrow money is based on the value of our assets. And when you have 10

million cages worth of farm, and all of a sudden, your customers say, ‘I’m not buying eggs from

those cages in two years.’ They’re not worth very much.” As cages lose value, and without a long-

term contract, it may be more difficult to acquire funding, and banks may view smaller producers

are more risky borrowers.

Indeed, when asked to describe the potential opportunities for cage-free production,

Producer A (a small producer) stated, “I think this is going to drive consolidation. If you’re a

producer that can buy people out that might not be as good a financial shape, you know that’s

probably an opportunity to grow the business.” Producers B and D noted that small producers

would have to search for ways to supply a niche market, potentially through developing more

specialty products. Even amongst large producers, the excitement over cage-free was limited

(except for Producer G, who has already transitioned more than 60% of their facilities to cage-

20

free). For example, Producer E stated, “there is an opportunity for additional revenue, but it also

comes at a cost. So ultimately, it could cancel out.”

2.6. Final Remarks

In interviews with seven egg producers, we heard similar experiences and perceptions regarding

the transition to cage-free production. Interviewees described the differences between cage-free

and cage production and echoed common barriers preventing the transition to cage-free

production.

Producers indicated significantly higher fixed and variable costs in cage-free

environments. With lower stocking densities, producers estimated that cage-free capital costs are

more than double those of conventional production. This is the most commonly cited barrier to

cage-free adoption, with producers also speaking to the need for long-term commitments from

buyers to finance construction. With limited consumer demand—where retailers are hesitant to

commit to cage-free before the pledge date, and consumers continue to purchase the cheaper

alternative—the transition period from cage to cage-free production may be a point of tension

across the supply chain. Heightened annual expenses also result from additional pullet training,

vaccinations, feed, and labor relative to cage production. These heightened costs, along with the

increased risk and variability in the cage-free system, will have ripple effects across the supply

chain and most likely translate to higher egg prices for the consumer.

With these production barriers and anticipated market shocks, producers emphasized a

need for full transparency and honest conversations surrounding cage-free systems. This includes

a better understanding of the capital investment and transition timeline and more conversations

about the potential unintended consequences of cage-free production. In the wake of current

macroeconomic conditions and supply chain constraints, producers believe the timeline for the

transition to cage-free must better reflect current market conditions, equipment constraints, and

other logistical challenges. There was a consensus amongst producers that the 100% cage-free

commitments by January 2026 made by retailers are infeasible, and additional conversations are

needed to better incentivize the investment and transition to cage-free production.

21

Chapter 3: Egg Producer Survey

3.1. Producer Survey Questions and Procedures

In the final week of September 2022, Chad Gregory distributed an email encouraging all UEP

members to use an enclosed link and complete a 31-question survey. By November 3, 2022, 68

UEP members had opened the survey. Among these 68 respondents, 29 (mostly) completed the

survey. To demonstrate when the other 39 respondents exited the survey, 48 answered the survey’s

first question, 38 answered the 5

th

question, 34 answered the 10

th

question, and 30 answered the

24

th

question.

6

Ultimately, in this report, we focus on the 29 complete surveys such that the comparison

of responses across survey questions reflects information from the same set of UEP members.

Complete documentation of survey responses received is in the supplemental material

accompanying this text, along with a copy of the survey instrument. To assess the possible impacts

of focusing on the 29 fully complete surveys, we compare feedback from the fully available sample

with the complete surveys. This comparison indicates that both samples are very similar in their

6

Low response rates are becoming increasingly common in online surveys. While the small sample size may be seen

as a limitation, it is particularly important to emphasize the share of the overall industry represented in our completed

responses. As we describe later in the report, our best estimate is that the 29 completed responses represent 28-41%

of U.S. domestic egg production.

Summary

Building upon the individual producer interview feedback, the research team built a survey

inviting more comprehensive feedback on the transition to cage-free production. UEP members

were invited to complete a survey designed to gather feedback regarding the current and future

status of laying hen housing in the U.S. A total of 29 members completed the survey,

representing nearly 50% of UEP membership production. While there is diversity of opinion,

UEP members generally view the laying hen housing situation as more a challenge than an

opportunity. The majority of UEP members view conventional housing as superior in food

affordability, production efficiency, and environmental impact. Annual revenue for cage-free

systems is estimated to be 8% higher than conventional systems, but annual costs are estimated

to be 8-19% higher. On aggregate, respondents believe cage-free production will grow to 51%

of total production by January 2026. Using information from potential investment decision

environments, producers are identified to be more likely to invest when expected return on

investment (ROI) increases and when Cost-Plus contracts are available.

22

assessment of current cage-free prevalence in the U.S. and expectations for the number of laying

hens in January 2026 that may produce table or market-type eggs. Combined, this adds some

reassurance regarding focusing on the 29 complete surveys.

We further consider the collective production of the 29 complete respondents. The survey’s

24

th

question identified the current laying hen operation size. Consistent with the need to assure

anonymity and encourage survey participation, seven answer ranges were presented, spanning

from “Less than 500,000 laying hens” to “Over 5 million laying hens.”

7

We can use mid-point

levels of the presented size ranges to approximate operation size. It is important to note that 11 of

the 29 respondents selected the largest presented size of over 5 million laying hens. If we first

assume a small or conservative value of 5.5 million applies to these 11 respondents (on average),

then combined, the 29 respondents may represent about 90.5 million laying hens. Knowing that

some operations exceed 10 million laying hens, this estimate is likely too low. If we alternatively

assume 9.5 million applies to the 11 selecting the largest presented size range, then the 29

respondents may represent about 134.5 million laying hens. For context, there are approximately

300 million layers under UEP membership (UEP, 2023a; b). Given this, we are confident that the

29 complete respondents represent over 30% of UEP membership production, and our best

assessment is that about 50% of UEP membership production is represented.

8

As UEP members

account for 92% of U.S. egg production (UEP, 2023a), our sample represents 28-41% of all

domestic egg production.

To further classify current production practices, questions 21 and 22 asked how many

facilities (barns) are currently operating as cage-free and conventional. The most common

response for both production systems was operating six or more facilities. Consistent with

heterogeneity in the industry, three respondents (11%) indicated they do not currently have cage-

free facilities, and four respondents (14%) indicated they do not currently have conventional

facilities.

Which state respondent’s laying hen businesses were based in was asked to provide

geographic insight into our sample [Q23]. Twenty-five respondents indicated their state of

7

The exact survey question is available in the Appendix along with response counts, both for the sample of 29

complete responses and the entire set of responses received.

8

For clarity note that throughout this report, simple rather than weighted-responses are reported. This reflects an

inability to confidently extrapolate the available n=29 data sample to the national level in a manner consistent with

the industry’s actual size distribution.

23

business, with four in California, five in Indiana, four in Iowa, three in Michigan, two each in New

York, Pennsylvania, and Utah, and one each in Maryland, North Carolina, and Oregon. Combined,

this indicates that about 28% of respondents are from the West, 24% are from the East, and 48%

are from the Central/Midwest regions.

9

As a final base question, we asked the duration respondents expect their laying hen business

to remain operating [Q25]. While 10% (3 respondents) indicated less than 5 years and one

respondent (3%) suggested 6-10 years, the overwhelming majority (86%, 25 respondents) reported

over 20 years.

We now sequentially provide results for various survey questions. A complete set of

response statistics is available in the Appendix. Throughout the text, we include the question

number in [.] as a guide to comparing with the Appendix resources.

3.2 Transitional Situation and Views

3.2.1. National, Industry-Wide Perspective

The beginning of the survey, Q1-Q9, focused on the national egg situation. On average,

respondents believe 29% of U.S. laying hens currently are housed in cage-free systems [Q1 mid-

points] and that by January 2026, this will be 51% [Q2 mid-points]. Figure 3.1 provides a

distributional summary of responses.

Beyond the expected increase on average, Figure 3.1 reveals varied opinions on the future

cage-free market share (wider dispersion of responses). This is not surprising given diverse

discussions and likely associated views on the industry’s future. To appreciate the diversity of

views on the industry’s future, note that two (7%) respondents expect less than 30% cage-free, 13

respondents (45%) expect 31-50% cage-free, 11 respondents (38%) expect 51-70% cage-free, and

the remaining three respondents (10%) expect 71-80% cage-free in January 2026.

In January 2026, respondents expect that 53% of cage-free eggs will be table (vs. breaker

eggs) [Q3] and that 50% of conventional eggs will be table eggs [Q4]. Combined, this indicates

minimal shifts are expected. Average expectations are for about 315 million laying in January

2026 producing table or market-type eggs, representing industry growth given a current estimate

of 303 million [Q5 mid-points]. Only four respondents (14%) expect less than 300 million

9

To further assure anonymity, we do not further associate state of business with facility count nor operation size

information in this report.

24

reflecting a shrinking industry; six respondents (21%) expect between 300 and 309 million,

reflecting little to no change; and 19 (66%) respondents expect 310 to 349 million. A key point to

appreciate here is that despite ongoing dialogue around housing practices, on balance industry

growth is expected.

Figure 3.1. Views on national cage-free market share, now and January 2026

To assess perceptions regarding productivity, respondents were first informed that the

average laying hen produced about 296 eggs per year in 2020. They were then asked, separately

by housing system, what productivity they expected in January 2026 [Q6]. On average,

respondents indicate cage-free yield will be 11 eggs per year lower, with 295 eggs per year

expected for conventional and 284 for cage-free systems. This on-average statement masks notable

variation as six (21%) respondents indicate cage-free yield will be higher, with the highest

differential being 15 eggs per year (325 cage-free vs. 310 conventional). Conversely, the majority

(19 respondents, 66%) expect conventional systems will yield more eggs, with one respondent

25

expecting 75 eggs per year higher (250 cage-free vs. 325 conventional). The other four respondents

(14%) suggested equivalent yields.

A qualitative question was included to broadly assess where respondents fell on an

opportunity-challenge spectrum regarding laying hen housing [Q7]. On a 5-point scale, spanning

from “enormous opportunity” to “enormous challenge,” respondents were asked what best aligns

with their view for the national industry regarding a possible increase in cage-free production. As

summarized in Figure 3.2, nobody responded “enormous opportunity,” 5 (18%) responded

“opportunity,” 10 (36%) responded “equally balanced opportunity & challenge,” 5 (18%)

responded “challenge,” and 8 (29%) responded “enormous challenge.” Combined, while there is

a diversity of opinion, this indicates that UEP members view the housing situation as more of a

challenge than an opportunity.

Figure 3.2. Views regarding laying hen housing, opportunity vs. challenge

To gather insight into how housing systems differ, a question asked which housing system

ranked highest or best (cage-free, conventional, or no major difference) regarding specific

categories of wide interest, including sustainability, animal welfare, production efficiency, food

affordability, and environmental impact [Q8]. Figure 3.3 provides a summary of views revealing

26

several key points. Overall, UEP members view conventional housing as superior in food

affordability, production efficiency, and environmental impact. A slight majority (62%) view

conventional systems as best for sustainability, with about one-fourth seeing cage-free and

conventional as equivalent. Animal welfare is the only area where more (45%) view cage-free as

superior. It is worth noting that the definitions of these terms were left to the producers’ discretion,

which presents a degree of subjectivity in the responses to Figure 3.3.

Figure 3.3. Views on which production method ranks best across different characteristics

3.2.2. Own-Operation Perspective

Questions 10-25 in the survey focused on the respondent’s situation and views, rather than the

national industry perspective discussed above [Q1-Q9].