Renewed for the Future: Renewable and Non-Renewable Energy

Sources and Their Costs

Jacob Nelson

The University of Akron

Department of Economics

Senior Project

Spring 2021

2

Abstract:

Renewable energy sources have come to the forefront of energy production policy

over the last twenty years. Studies of external and direct costs of both renewable

and nonrenewable energy sources have contributed to growing understandings of

ways in which these energy sources can be compared in a monetary context.

Using data from the U.S. Energy Information Administration (EIA) alongside

international data from the International Renewable Energy Agency (IRENA)

among other sources, we have developed forecasts for the future costs, both direct

and social, of each energy source as well as a difference-in-difference experiment

to determine potential effects of state-level energy policy changes on state level

energy prices. Forecasting is generally reliable as long as no major shocks to the

variables in question present themselves during the period being forecast. This

paper finds that renewable energy’s social and direct costs are both forecasted to

be lower than nonrenewable energy’s cost even while considering renewable

energy’s higher up-front costs. Additionally, statewide energy policy appears to

have no significant effect on renewable energy prices in the three years following

adoption, so further research with larger datasets is recommended.

3

Contents

Renewed for the Future: Renewable and Non-Renewable Energy Sources and Their Costs. .................. 1

I. Introduction ................................................................................................................................... 4

II. Literature Review .......................................................................................................................... 6

III. Data ......................................................................................................................................... 10

IV. Theory and Methodology ........................................................................................................ 14

V. Results ......................................................................................................................................... 19

VI. Conclusion .............................................................................................................................. 22

VII. References ............................................................................................................................... 23

Acknowledgements

I would like to thank Dr. Enami, Dr. Weinstein, and Dr. DeDad for their assistance provided for

this project. I would also like to thank the entire Department of Economics for inspiring my

classmates and me in our endeavors over our entire careers at The University of Akron.

4

I. Introduction

Energy markets across the globe have rapidly changed in the past twenty years in

response to new technology, problems, and production solutions. Renewable energy’s

technology and applications have advanced it to a position in which it can begin to compete with

traditional nonrenewable energy sources. Problems of pollution affecting public health, the

environment, and other resources have come to the forefront of national politics, and these new

renewable technologies offer a solution to the dangers of fossil fuels. Governments invest in and

look to these renewable energy sources to better serve their populations and maintain public

wellbeing in addition to ending reliance on the financially volatile fossil fuel economy.

There exists an alternative to renewable energies when emissions reductions are the goal.

One major alternative consists of a combination of the non-renewable sources with technologies

that reduce their negative environmental impact, such as carbon capture technology. This

alternative approach may be more cost-effective than adopting renewable energies in the near

future as it supplements already existing energy facilities creating a potentially cheaper solution

when compared to constructing entirely new renewable energy industries. Studies of the energy

market’s alternatives to renewables have focused on how to determine the cost of greenhouse gas

emissions reduction (Gillingham and Stock,2018; Kiuila and Rutherford, 2013), potential new

forms of carbon abatement (Lin and Ge, 2019), the economic and environmental impacts of

renewable energy sources (Varun, Bhat, and Prakash, 2009), and even a discussion of how much

fossil fuels would continue to be demanded in the future through a review of a worldwide

demand analysis (Pyper, 2018). However, there have been few publicly available analysis of if

prioritizing renewables would be an overall cheaper and more effective option for producing

energy in the near future, particularly in the next ten years.

5

Will it be more efficient to continue using fossil fuels with new carbon abatement

technologies in the US alongside renewables or will fossil fuels fall out of use due to abatement

technologies not making it as cost effective as renewables? Comparing the forecasted costs of

each of these energy sources while including the abatement cost of carbon emissions and the

public and environmental costs of fully utilizing renewable energy will allow policymakers to

see if it is more efficient for renewables to be used alongside fossil fuels for many years or if a

full switch to renewables should be done as soon as is technologically possible. Additionally, an

analysis of the relationship of costs to determine if and how renewable energy costs and fossil

fuel energy costs are related could prove useful in determining future actions. Finally, another

important question is: How have energy costs changed for US states that passed policy requiring

a certain percentage of energy production to be renewably produced? As the data is looked into

more deeply, these questions will be adjusted to determine which can be reasonably answered

with present day data.

Through the forecasting of key variables related to the costs of energy sources and an

application of these forecasted values to equations in order to craft estimates of per-kilowatt-hour

costs in the near future, comparisons between these two groups of energy sources are made.

Additionally, an analysis of differences in energy prices between states that have energy

portfolio requirements and those that do not is done to determine the short term effects of these

policy actions. The rest of this paper is organized as follows: a review of previous studies on

various facets of renewable energy followed by exploration of the data. From this foundation, a

review of economic theory informs the development of a methodology for creating a cost benefit

analysis alongside a difference-in-difference analysis. Finally, the results are organized into

graphs and conclusions are drawn from the models and projections created.

6

II. Literature Review

Previous cost benefit analyses (CBAs) have been conducted on both large and small

scales. The International Energy Agency (IEA) conducted a large-scale cost benefit analysis

throughout countries participating in their Renewable Energy Technology Deployment project

(RETD) to analyze technologies, costs, and externalities as well as more specific variables

relating to present day electrical systems. Given its comprehensive nature, this study provides a

general structure for how to conduct a CBA and data for variables such as the estimated external

costs of nonrenewable energy resources. For this study, costs are defined as long-run marginal

costs and benefits are excluded for simplicity’s sake. Some research has utilized consumer

willingness to pay to determine the benefits of renewable energy specifically, but no clear data is

available for this and the results of studies like this particularly Roe, et. al. (2001) are restricted

to the 1990s and early 2000s. The IEA analysis was in depth and attempted to discover which

forms of renewable energy have positive net benefits in comparison to more traditional sources

when externalities are not considered. The findings of this research point to hydro and wind

power having the lowest lifetime costs of generation with coal following close behind. Biomass

and Gas had roughly the same cost per megawatt hour, but biomass having much lower CO2

emissions. Additionally, analyses are done by the IEA that included externalities in total cost,

allowing an early comparison between renewable and nonrenewable sources despite limited data.

(IEA RETD, 2007).

Previous literature also discusses ways of determining costs and proper valuation on

external costs associated with energy production. The literature is not conclusive on the projected

costs and benefits of renewable energy, and no real benchmark numbers for energy costs are

available from the studies discussed. In Mathioulakis et. al. (2013), one such CBA was

7

undertaken in Greece and applied to “solar domestic hot water systems,” or water systems heated

by solar energy. The paper describes a utilization of net present value as one option in

determining the costs and utilizes an average of initial costs as well as maintenance costs and an

“expected lifetime” cost of their particular energy product (in this case, photovoltaic panels) to

develop the overall energy cost for their CBA (Mathioulakis et. al., 2013). The findings of this

study included the real energy savings by consumers who utilized these solar hot-water systems

and how these types of benefits can assist in supporting a more efficient power grid. Benefits

were developed in this model based largely around the “cost of saved electrical energy” from the

Athens network (Mathioulakis et. al., 2013). Despite the importance of net present value for cost-

benefit analyses as detailed in Mathiolakis et. al. (2013), the wide variation in estimates for

emissions costs creates a challenge in creating an NPV strategy for this study, so United States

Environmental Protection Agency (EPA) estimates will instead be used.

A major focus of renewable energy is the added benefit to consumers as can be revealed

in retail prices. Using retail prices to reveal these benefits have been done in past studies,

specifically hedonic housing studies. Roe et. al. (2001) conducted a survey of 1001 adults across

eight US cities and utilized a hedonic housing model controlling for premium prices of regional

“green energy” plans offered by electricity companies. The overall outcome of this research is a

linear regression model where each additional percent of renewable energy utilized increases

premiums by roughly $0.81, each percent of newly created renewable energy sources increases

these premiums by $6.21, and a “Green-e” certification for the energy provider provides a

$60.86 premium; this “Green-e” certification is representative of lower emissions. The authors

interpret these coefficients alongside their survey to conclude that the people surveyed most

likely value environmental benefits from both renewable energy and lower emissions, but lower

8

emissions are enough to convince consumers to pay premiums, even if renewable energy is not

championed (Roe et. al., 2001).

On the other hand, other researchers prefer to focus on more direct costs; the following

studies focus more closely on these direct costs. One study prefers to value renewable energy via

total life cycle benefits of each general type of plant (geothermal, wind, solar) available on

military bases and the total lifetime costs associated with these plants (McFaul and Rojas, 2012).

Although useful, the authors discuss the potential environmental benefits and costs associated

with these renewable sources but do not include them in their cost-benefit analysis. Some have

also attempted determining renewable energy cost through the abatement costs of nonrenewable

sources. Although not considered a true “valuation,” but instead a general “evaluation” by

Menegaki, abatement costs remain useful in developing, but not providing, effective estimates of

the cost of renewable energy (Menegaki, 2014). These abatement costs are utilized by the EPA

to develop the social costs utilized in our analysis. Finally, some researchers chose to value

renewable energy via determining the costs incurred to replace nonrenewable sources.

Replacement costs rest on the assumption that nonrenewable energy sources will be completely

replaced by renewables at some point in the future. In determining “sustainability” and

“economic welfare,” replacement cost theory is deemed sound by a critic of indices that utilize

replacement costs, but the same author champions a different, more complex, valuation method.

(Lawn, 2005). This is also in line with Menegaki’s approach, with an orientation around public

welfare being an essential part of cost-benefit analyses.

One of the simplest ways of estimating the production cost of electricity is to divide the

“annualized expenses of the [energy] system” by the “annual electricity generated by the

[energy] system” to gain a cent/kWh measure (Varun and Prakash, 2009). This may be simple

9

enough to utilize when comparing overall energy costs as renewables begin to represent a greater

percentage of overall energy usage. A report from the National Renewable Energy Laboratory

(NREL) also contributes in part to developing a lifetime cost of energy production facilities.

Through a study on the lifetime greenhouse gas (GHG) emissions by fuel source, it will be

possible to apply a cost to each fuel source utilized in a CBA to internalize this emissions

externality (NREL, 2013). Additionally, renewable energy sources reduction of GHG’s over

their lifetimes is an important benefit to discuss in implementing a holistic, welfare-oriented

CBA as described by Menegaki, and data on these benefits are presented in the NREL study. In

determining raw energy rates, another direct approach is available directly through data releases

from the US Department of Energy.

Externalities are another key part of costs discussed in the literature. Benefits, or reduced

costs as our study defines them, can be calculated through energy savings and environmental

wellbeing via emissions reductions (Mathioulakis et. al., 2013; Varun and Prakash, 2009). One

additional benefit that may be included is public health benefits, as emissions reductions also

influence this. One study estimated costs of abating CO

2

and willingness to pay for “reduced

mortality risk” to develop estimated benefits of renewable energy in each US region. This more

recent research provides useful numbers for estimating overall external costs associated with

health externalities (Buonocore et. al., 2019).

In addition to influencing public health and environmental factors, renewable energy

infrastructure (notably wind turbines) has also been assumed to create aesthetic externalities.

Hoen et. al.’s 2014 analysis Spatial Hedonic Analysis of the Effects of US Wind Energy Facilities

on Surrounding Property Values utilized a hedonic analysis in the US and found no evidence of

significant influence of wind energy’s visual or auditory status on nearby home prices, despite

10

previous studies with smaller sample sizes resulting in different conclusions. One such study

found that housing prices in Illinois were potentially lowered by 12-20% due to the presence of

visible wind turbines (Hinman, 2010). Although aesthetic externalities do not appear to influence

housing prices on a large scale, consumer preferences may not be fully explained in this analysis

or may be offset by some other feature of the region from which the data came. (Hoen et. al.,

2014)

III. Data

First, data is gathered from the US Energy Information Administration (EIA), the EIA’s

State Energy Data System (SEDS), the International Renewable Energy Agency (IRENA), and

the International Energy Agency (IEA). Data on electricity prices were unavailable in the time

period of 1984-1989 so they were left blank for that period of time. A large amount of SEDS

data also covers different variables associated with each energy source, so averages had to be

taken when they were not available directly within the data. Renewable energy costs before 2010

were not available, so forecasts were developed using only 2010-2019 data with zeroes excluded

from the fit procedure. Similarly, nonrenewable cost per kWh were not available after 2016, so it

had to be computed through available data on cost per short ton

1

of coal, cost per thousand cubic

feet of natural gas, and cost per barrel of crude oil each divided by the average kWh produced by

each of those metrics. Renewable energy as percent of total energy was developed through

dividing total renewable energy consumed by total primary energy consumed.

1

1 Short ton is equivalent to 2000 pounds and roughly 0.91 metric tons

11

The variables of interest as shown in Table 1 consist of energy production and

consumption metrics, price and cost data, and emissions data in determining the social cost of

each energy source as well as comparing reactions to state policy. The time series for these

variables are shown in Appendix A. First, energy production and consumption data are available

for certain sources, with most available data on fossil fuels being measured by production and

more renewable sources being calculated through consumption. These metrics are not equivalent,

due to losses while transporting, storing, and converting energy for use. Thus, it is imperative to

remember that the total energy consumed will be less than the total energy produced. However,

they will be assumed to be close enough for the comparison in this study. Both production and

consumption are assumed to increase over time with growing economies and growing

populations. Emissions data is largely available through the EPA, which determines social cost

of emissions (while including abatement costs in this estimate) for each unit of CO2 released into

the atmosphere and these emissions are expected to have a positive relationship with energy cost

due to environmental and health externalities. Energy cost is available through levelized cost

Table 1: Variables

Variable Name

Time Period

Source

Total Energy Expenditures

1980-2018

EIA

Total Energy Emissions

1980-2018

EIA

Renewable Energy Percent of

Total Energy

1980-2018

Created from two EIA

sources (Energy Production

and renewable Energy

Production)

Average Renewable Cost

2010-2018

IRENA

Average Nonrenewable Cost

1970-2018

Created from many EIA

sources (SEDS)

Average Retail Energy Price

1980-1983, 1989-2018

EIA

Figure 1: Variables Utilized to determine social costs.

Note: Total Expenditures, Emissions, and Renewable Energy Percent were removed from the analysis as ARIMA models were

adopted, replacing VAR model.

12

research, and much of the cost of renewable energy is calculated through these research releases

like those compiled by IRENA whereas fossil fuel cost is calculated through a combination of

production price determined by markets within the US and external costs associated with

reductions in CO2 emissions.

Each state also had data available in terms of prices and production costs from 1960 to

2018 through the EIA SEDS, allowing a difference-in-differences analysis to be attempted to

determine the change in energy cost as a result of renewable energy policy. Estimates of

abatement costs to develop a comparison between non-renewables and renewables are also

useful yet quite hard to determine. A plethora of studies have been done to determine abatement

costs in different industries, so applying one to the entire nation is not easy. In this general case

for comparison’s sake, an estimate of the social cost of CO2 as determined by the US

Environmental Protection Agency (EPA) is utilized. It must be noted that this estimate is not

perfect but considers the general social cost of each ton of CO2 rather than the cost needed to

abate CO2, allowing each industry’s (and even each plant’s) unique abatement cost to be ignored

in favor of a general cost summary. Abatement costs differ depending on industries and fuels,

but the cost of CO2 developed by the EPA takes into account these costs weighted by the amount

of energy produced by each nonrenewable energy source. Because of this method of estimation,

it is possible that, for example, despite the whole group of nonrenewable sources potentially

being more expensive than the whole renewable group, certain nonrenewable sources may be

less expensive than certain renewable sources.

Due to the nature of time series data, traditional descriptive statistics are not useful in

describing the data. Instead, augmented Dickey-Fuller tests assist in the determination of

stationarity in the data as that is required for the ARIMA model to function properly. In the

13

below figure (Figure 2), any p-values above 0.05 represent a significant probability of

stationarity in the data, so adjustments must be made in the ARIMA models to account for this.

The only non-stationary variable in this case is the cost of renewable energy (seen below as

“Renewable Cost”).

Figure 2: ADF Tests.

Note: Supported by clear visible trends in the graphs of the data

Additionally, autocorrelation functions like those below are utilized to ensure no autocorrelation

in the residuals of a series, which allows for more accurate forecasts. Autocorrelation is

essentially when the value of a time series is correlated with its own lags, which Each data series

is manipulated to ensure no autocorrelation within the residuals through differencing or

logarithmic transformation.

14

Figure 3: Autocorrelation Function of Total Emission's Residuals

Note: No lag being above or below confidence interval implies no significant autocorrelation in the series. See “Methodology”

for explanation of autocorrelation.

IV. Theory and Methodology

Theory

The most common costs discussed in theory and literature are the direct costs for

producing the energy. Both renewable and nonrenewable energy production requires set-up,

transportation, storage, and direct production costs. Further costs are incurred with the

production of energy through the traditional non-renewable methods such as coal, oil, and

natural gas. Gasses emitted from these sources such as CO

2

cause a plethora of health and

environmental problems that increase the costs of energy production on society (Buonocore et

al., 2019). Renewable energy technology aims to not only decrease the external costs of energy

to society but also the monetary costs associated with each kilowatt-hour of energy produced.

The combination of private costs and external costs create a cost to society for producing energy.

Renewable sources, such as solar and wind energy, have fewer negative effects on the health of

15

society and wellbeing of the environment, leading to their place as a possible replacement or

supplement to traditional fossil fuel energy production. On the other hand, non-renewable energy

sources, that may have a lower production costs, may be able to address their higher external

costs through technologies such as carbon abatement. The question then boils down to: Will

traditional energy sources with carbon abatement technology or renewable energy sources be

more socially efficient in producing energy in the future? Moreover, are renewable sources

economically feasible to compete with non-renewable energy on the national or international

stage without considering externalities?

Methodology

The foundation of the methodology lies in developing forecasts that can be used to create

useful estimated cost values. Each of the variables described in the data section will undergo

forecasting to obtain estimated values in the future. To develop overall costs of each method of

energy production, Autoregressive Integrated Moving Average (ARIMA) models are utilized to

forecast each cost to a specific point in the future and a summation of these costs gives us an

estimated total cost of that energy source per kilowatt-hour. Each specific variable has been

either sourced from government agencies and NGOs or created using available variables from

the former.

Autocorrelation Functions and Cross-correlation functions are utilized to ensure there is

little or no autocorrelation within individual variables or across different variables. As the time

series are annually reported, seasonal adjustment is unnecessary, but they are adjusted, if

16

necessary, to be stationarity. Differencing is also utilized to account for trends within the data

series, which makes the model an ARIMA model. Upon completion of fitting the model to the

data, autocorrelation functions are utilized to ensure no autocorrelation in the residuals of each

lag, which is essential for models such as these. Autocorrelation within the data from which the

forecast is created can lead to greater errors in our forecasts and generally make the forecast less

reliable. The overall process begins with a forecast of each aforementioned variable ten years

into the future using the fitted ARIMA models. As renewable energy has only come to the

forefront of production in the last twenty to thirty years, models based on the full dataset from

1980-2018, referred to later in the results as the “40 year data”, were supplemented with fits for

data from 2000-2018, referred to later as the “20 year data”. Each variable will have a forecast

generated using each length of data. The ARIMA(p,d,q) where p is the number of lags in the

model, d is the number of differences, and q is the order of moving average, can be described

with Equation 1:

Equation 1.

= +

y

+ +

y

e

e

+

where Φ is the AR parameter, ϴ is the MA parameter, and the number of differences is how

many times a previous lag of y

(also known as y

) is subtracted from y

, where y is our

variable of interest.

2

Each parameter is a single value applied by the forecast to develop the

model to be most accurate based on AIC values. Energy production costs are available from our

energy sources as per kwh measures. The external cost of emissions is calculated using estimates

from the EPA and applying it to average emissions per kWh of nonrenewable energy produced.

2

In this equation,

is simply the moving average error at lag t, which is the residual of the model to the actual

data.

17

Summing the per kilowatt-hour production cost and the per kilowatt-hour external costs results

in a per kilowatt-hour social cost of nonrenewable energy. On the other hand, renewable energy

cost results in negligible emissions and so the social cost equals the per kilowatt-hour production

cost. Variables for total energy expenditures, percentage of total energy produced by renewable

sources, and total emissions ended up not being utilized due to a change in the methodology

from a VAR model to multiple ARIMA models. These variables were still forecasted and are

present in Appendix B.

In addition to a forecast and a comparison of cost, this analysis will include state-to-state

comparisons to attempt to determine the effect of energy policy on retail energy price in that

state through a panel difference-in-differences analysis. This portion of the analysis will not be

utilizing forecasted values but will instead be a separate analysis utilizing the same data sources

between the years of 2004 and 2014. One additional data source, “State renewable portfolio

standards and goals” from the NCSL, is necessary to determine which states have which policies.

Marked differences in retail energy prices between two similar states who have different

makeups of energy production will be a sign that policy has an effect on cost in one way or

another. Energy cost differences between states can be influenced by demand for energy and fuel

costs, but nearby states with similar resources should be roughly comparable. T-Tests will be

utilized for the retail energy prices in these states to determine if their energy prices are before a

treatment (in this case, the treatment will be policy mandating increased utilization of renewable

energy) and then an analysis of the difference between an untreated state and a treated state will

estimate the effect of these policies on retail energy prices. Equation (2) represents the

difference-in-differences model in this analysis. The variables of interest are the left side variable

”EndPrice” which is made up of a three year average before and after the treatment is applied

18

for each state, the treatment variable “policy” which takes a value of “1” if the state establishes a

renewable energy portfolio policy between 2004 and 2014 and takes a value of “0” if no policy is

established or had been established before 2004, the time dummy variable “after” which uses a

value of “1” to identify the states in the post treatment period and “0” in the pre-treatment period,

and an interaction term between “policy” and “after.” The coefficient (

) of this interaction

term is the estimator for this diff-in-diff analysis. If this coefficient is deemed significant in the

final analysis, then we can say there is evidence of different retail prices after the treatment takes

place. The variable ε represents the error term of this model.

Equation 2.

=

+

+

+

(

)

+

(2)

19

V. Results

Due to changes in the energy landscape throughout the 1990s and early 2000s, only the

“20 year” data was utilized to develop forecasts and begin to determine social costs based on

different energy sources. Figures for each individual forecast and the individual orders of each

ARIMA model are in Appendix B below. These results point toward lower per-kWh social and

production costs for renewable energy sources going into the future. Figures 3 and 4 demonstrate

these differences with mean estimates alongside highs and lows with 95% confidence intervals.

The production cost and social cost graphs look quite similar because the estimates for the

emissions cost of nonrenewable energy is between one and two cents per kilowatt-hour (EPA).

External costs other than the cost of emissions were assumed to be negligible due to examples in

the literature, but there may be some external costs unaccounted for that could influence the

results. The results of the difference-in-differences point toward there being no significant

difference between retail energy prices in states that had renewable energy portfolio policies and

those that did not.

20

Figure 3: Forecasts of Social Costs and 95% Confidence Intervals

-$0.10

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

Cents Per Kilowatt-Hour

Forecasted Energy Social Cost per kWh

Renewable Energy Cost Nonrenewable Energy Cost

21

Figure 4: Forecasts of Direct Costs and 95% Confidence Intervals

-$0.10

-$0.05

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

2019 2020 2021 2022 2023 2024 2025 2026 2027 2028

Forecasted Energy Direct Cost per kWh

NON Nonrenewable Energy Cost REN Renewable Energy Cost

22

VI. Conclusion

The findings of this research can be summarized the social cost of renewable energy

being clearly lower than the social cost of nonrenewable energy. Additionally, we found no

significant differences in retail energy prices between states with and without renewable energy

portfolio policies. Renewable energy now appears to be a reasonable investment as the cost

continues to fall and the real reductions in external costs as a result of an increased use of

renewable energy sources further make the case for greater utilization of renewable energy. Even

when including the up-front costs of renewable energy facilities through the use of levelized cost

data, renewable energy provides lower direct per-kWh costs and vastly lower social per-kWh

costs. The lack of significant differences in retail prices between treated states and untreated

states in the three years following could imply the effects of these policies exist in the long term

rather than the short term or that incentives to energy producers to employ renewable energy

facilities would be more effective than policy requirements.

The models used for estimation could undoubtedly be improved. Future studies could

better define costs and benefits of energy sources and develop a more equal footing between the

energy sources. The lack of available production cost data for renewable energy sources and the

reliance on levelized cost research may have influenced the results in a biased manner and may

not represent the costs of renewable energy within the United States.

23

VII. References

Buonocore, J. J., Hughes, E. J., Michanowicz, D. R., Heo, J., Allen, J. G., & Williams, A.

(2019). Climate and health benefits of increasing renewable energy deployment in the

United States. Environmental Research Letters, 14(11), 114010. doi:10.1088/1748-

9326/ab49bc

Frequently asked Questions (FAQs) - U.S. Energy Information Administration (EIA).

Retrieved February 19, 2021, from https://www.eia.gov/tools/faqs/faq.php?id=19&t=3

Hinman, J. L. (2010). Wind Farm Proximity and Property Values: A Pooled Hedonic

Regression Analysis of Property Values in Central Illinois (Master's thesis, Illinois

State University, 2010). Pierre: South Dakota Public Utilities Commission.

doi:https://puc.sd.gov/commission/dockets/electric/2017/el17-055/exhibit4.pdf

Hoen, B., Brown, J., Jackson, T., Thayer, M., Wiser, R., & Cappers, P. Spatial Hedonic

Analysis of the Effects of US Wind Energy Facilities on Surrounding Property Values.

United States. https://doi.org/10.2172/1220223

International Renewable Energy Agency (IRENA). Renewable power generation costs in

2019. Retrieved February 21, 2021, from

https://www.irena.org/publications/2020/Jun/Renewable-Power-Costs-in-2019.

Lawn, P.A. An Assessment of the Valuation Methods Used to Calculate the Index of

Sustainable Economic Welfare (ISEW), Genuine Progress Indicator (GPI), and

24

Sustainable Net Benefit Index (SNBI). Environ Dev Sustain 7, 185–208 (2005).

https://doi.org/10.1007/s10668-005-7312-4

Mathioulakis, E., Panaras, G., & Belessiotis, V. (2013). Cost-benefit analysis of renewable

energy systems under uncertainties. 16th International Congress of Metrology.

doi:10.1051/metrology/201309002

McFaul, J., & Rojas, P. (2012). Comparative Cost-Benefit Analysis of Renewable Energy

Resource Trade Offs for Military Installations (Master's thesis, Naval Postgraduate

School, 2012). Fort Belvoir: DTIC. https://apps.dtic.mil/dtic/tr/fulltext/u2/a574363.pdf

Murshed, M., & Tanha, M. M. (2020). Oil price shocks and renewable ENERGY transition:

Empirical evidence from net Oil-importing South Asian economies. Energy, Ecology

and Environment. doi:10.1007/s40974-020-00168-0

National Renewable Energy Laboratory. (2013). Life Cycle Greenhouse Gas Emissions from

Electricity Generation [Fact Sheet]. NREL. https://doi.org/10.2172/1062479

Organization for Economic Co-operation and Development (OECD). Renewable Energy Costs

and Benefits for Society – Final Report. (2007). RECABS. Copenhagen: RETD ©

OECD/IEA.

Ricke, K., Drouet, L., Caldeira, K., & Tavoni, M. (2018). Country-level social cost of carbon.

Nature Climate Change, 8(10), 895-900. doi:10.1038/s41558-018-0282-y

25

Roe, B., Teisl, M. F., Levy, A., & Russell, M. (2001). US consumers’ willingness to pay for

green electricity. Energy Policy, 29(11), 917-925. doi:10.1016/s0301-4215(01)00006-4

U.S. Energy Information Administration (EIA). Retrieved February 19, 2021, from

https://www.eia.gov/.

U.S. Energy Information Administration - EIA – State Prices and Expenditures. (n.d.).

Retrieved February 19, 2021, from https://www.eia.gov/state/seds/seds-data-

complete.php?sid=US#PricesExpenditures.

U.S. Environmental Protection Agency (EPA) – Social Cost of Carbon. Retrieved February

19, 2021, from https://www.epa.gov/.

Varun, R., & Prakash, I. (2009, June 21). Energy, economics and environmental impacts of

renewable energy systems. Retrieved from

http://www.sciencedirect.com/science/article/pii/S136403210900094X.

26

VIII. Appendix A

Time Series Graphs

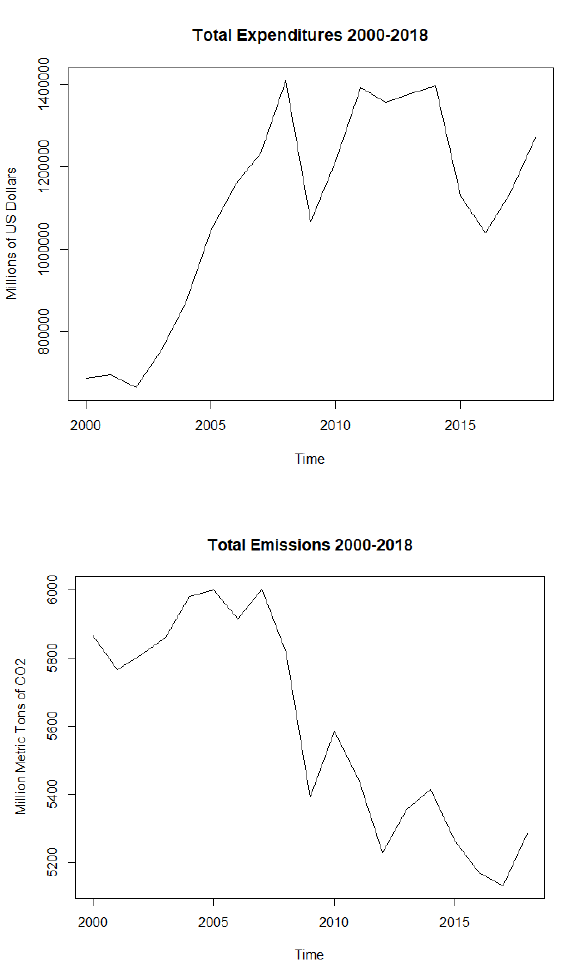

The following figures are plotted data from IRENA (for renewable cost data) and the EIA

(all other variables) from 2000-2019.

Figure A1

Figure A2

27

Figure A3

Figure A4

28

Figure A5

Figure A6

29

IX. Appendix B

Forecast Graphs

The following figures are plots of the forecasted values for each variable. The bright blue

line is the mean estimated value with the area of gray representing a 95% confidence interval for

that forecast. Additionally, B7 contains the order of the ARIMA model for each variable.

Figure B1

30

Figure B2

Figure B3

31

Figure B4

Figure B5

32

Figure B6

Figure B7

Variable

ARIMA Order

Total Energy Expenditure

(1,0,0) (0,1,0)

Total Emissions

(1,0,0) (0,1,0)

Renewable Percent

(1,0,0) (0,1,0)

Renewable Cost

(1,0,0) (0,1,0)

Nonrenewable Cost

(0,0,0) (0,1,1)

Energy Retail Price

(2,0,0) (0,1,0)

X. Appendix C

R Code

#loading in datasets

library(readxl)

overall<-read_excel("C:/Users/joesc/Documents/SeniorYear/spring/Senior

Projec/doc3/data/mds.xlsx",

sheet="overall")

33

overall20<-read_excel("C:/Users/joesc/Documents/SeniorYear/spring/Senior

Projec/doc3/data/mds.xlsx",

sheet="overall20year")

library(forecast)

ts.totex<-ts(data=overall$TEE, start=1980, freq=1)

ts.totem<-ts(data=overall$TEM, start=1980, freq=1)

ts.renpct<-ts(data=overall$RPT, start=1980, freq=1)

ts.avgrencst<-ts(data=overall$REC, start=1980, freq=1)

ts.avgnoncst<-ts(data=overall$NEC, start=1980, freq=1)

ts.avgretprc<-ts(data=overall$REP, start=1980, freq=1)

ts.totex20<-ts(data=overall20$TEE, start=2000, freq=1)

ts.totem20<-ts(data=overall20$TEM, start=2000, freq=1)

ts.renpct20<-ts(data=overall20$RPT, start=2000, freq=1)

ts.avgrencst20<-ts(data=overall20$REC, start=2010, end=2018, freq=1)

ts.avgnoncst20<-ts(data=overall20$NEC, start=2000, freq=1)

ts.avgretprc20<-ts(data=overall20$REP, start=2000, freq=1)

#View Graphs

ts.plot(ts.totex20, main="Total Expenditures 2000-2018", ylab= "Millions of

US Dollars")

ts.plot(ts.totem20, main="Total Emissions 2000-2018", ylab="Million Metric

Tons of CO2")

ts.plot(ts.renpct20, main="Percent of Energy Produced by Renewable Sources in

the US 2000-2018", ylab="Percent")

ts.plot(ts.avgrencst20, main="Average Renewable Cost 2010-2019",

ylab="Dollars/KWH")

ts.plot(ts.avgnoncst20, main="Average Nonrenewable Cost 2000-2018",

ylab="Dollars/KWH")

ts.plot(ts.avgretprc20, main="Average US Energy Retail Price 2000-2018",

ylab="Dollars/KWH")

#making stationary

stl.totem<-(diff(log(ts.totem)))

stl.renpct<-(diff(log(ts.renpct)))

stl.avgrencst<-(diff(log(ts.avgrencst)))

stl.avgnoncst<-(diff(log(ts.avgnoncst)))

stl.avgretprc<-(diff(log(ts.avgretprc)))

acf(stl.totem, main="Autocorrelation Function Graph for Total

Emissions")

acf(stl.renpct)

acf(stl.avgrencst)

acf(stl.avgnoncst)

acf(stl.avgretprc)

ccf(stl.totem, stl.renpct)

ccf(stl.totem, stl.avgrencst)

ccf(stl.totem, stl.avgnoncst)

ccf(stl.totem, stl.avgretprc)

ccf(stl.renpct, stl.avgrencst)

ccf(stl.renpct, stl.avgnoncst)

ccf(stl.renpct, stl.avgretprc)

ccf(stl.avgrencst, stl.avgnoncst)

ccf(stl.avgrencst, stl.avgretprc)

34

ccf(stl.avgnoncst, stl.avgretprc)

stl.totem20<-(diff(ts.totem20))

acf(stl.totem20)

#correlations

library(ggpubr)

library(Hmisc)

library(corrplot)

coroverall<-cor(overall)

corrplot(coroverall)

#time series visual analysis

ts.plot(cbind(ts.totex, ts.renpct))

layout(1:2)

ts.plot(ts.avgrencst)

ts.plot(ts.renpct)

layout(1:2)

ts.plot(ts.totem, main="Total Emissions 1980-2018", ylab="Total Emissions

(Million Metric Tons CO2)")

abline(v=c(2008), col=c("blue"))

ts.plot(ts.renpct, main="Renewable Percent of Total Energy 1980-2018",

ylab="Renewable Percent of Total Energy (%)")

abline(v=c(2008), col=c("blue"))

#Time Series Dickey Fullers

library(tseries)

adf.test(ts.totex20)

adf.test(ts.totem20)

adf.test(ts.renpct20)

adf.test(ts.avgrencst20)

adf.test(ts.avgnoncst20)

adf.test(ts.avgretprc20)

#ARMA models

#ARMA 20 Year Data

fit.totex20<-auto.arima(ts.totex20, stepwise=FALSE, d=FALSE)

fc.totex20<-forecast(fit.totex20, h=10, level= c(95))

plot(fc.totex20, main="Forecast of Total Energy Expenditure",

ylab="US Dollars")

fit.totem20<-auto.arima(ts.totem20, stepwise=FALSE, d=FALSE)

fc.totem20<-forecast(fit.totem20, h=10, level= c(95))

plot(fc.totem20, main="Forecast of Total Emissions",

ylab="Metric Tons of CO2")

fit.renpct20<-auto.arima(ts.renpct20, stepwise=FALSE, d=FALSE)

35

fc.renpct20<-forecast(fit.renpct20, h=10, level= c(95))

plot(fc.renpct20, main="Forecast of Renewable Percent",

ylab="Percent of Energy from Renewable Sources")

fit.ren20<-auto.arima(ts.avgrencst20, stepwise=FALSE)

fc.ren20<-forecast(fit.ren20, h=10, level= c(95))

plot(fc.ren20, main="Forecast of Renewable Energy Cost",

ylab="USD per kWh")

fit.non20<-auto.arima(ts.avgnoncst20, stepwise=FALSE, d=FALSE)

fc.non20<-forecast(fit.non20, h=10, level= c(95))

plot(fc.non20, main="Forecast of Nonrenewable Energy Cost",

ylab="USD per kWh")

fit.ret20<-auto.arima(ts.avgretprc20, stepwise=FALSE, d=FALSE)

fc.ret20<-forecast(fit.ret20, h=10, level= c(95))

plot(fc.ret20, main="Forecast of Energy Retail Price", ylab="USD

per kWh")

#exporting forecasts

write.csv(rbind(fc.non20$mean, fc.ren20$mean, fc.renpct20$mean,

fc.ret20$mean, fc.totem20$mean, fc.totex20$mean),

file="C:/Users/joesc/Documents/SeniorYear/spring/Senior

Projec/forecasts.csv")

write.csv(rbind(fc.non20$upper, fc.ren20$upper, fc.renpct20$upper,

fc.ret20$upper, fc.totem20$upper, fc.totex20$upper),

file="C:/Users/joesc/Documents/SeniorYear/spring/Senior

Projec/forecastsupper.csv")

write.csv(rbind(fc.non20$lower, fc.ren20$lower, fc.renpct20$lower,

fc.ret20$lower, fc.totem20$lower, fc.totex20$lower),

file="C:/Users/joesc/Documents/SeniorYear/spring/Senior

Projec/forecastslower.csv")

#Difference in Difference

did<-

read_excel("C:/Users/joesc/Documents/SeniorYear/spring/Senior

Projec/DataForRevisedDiffInDiff.xlsx",

sheet="treatmenttest")

didreg <- lm(EndPrice ~ policy + after + int, data=did)

summary(didreg)

#No significant difference between states after treat