DeterminingAnnualIncome

Presentedbythe

SingleFamilyHousingDirectDivision

RevisionDate:September1,2023

WelcometotheSection502DirectLoanand504Loan/GrantProgramstrainingon

DeterminingAnnualIncome.ThispresentationwaspreparedbytheSingleFamily

HousingDirectDivisionwitharevisiondateofSeptember1,2023.

Thepurposeofthispresentationistogive viewersabasicoverviewofhowto

determineannual

incomeforthe502and504SingleFamilyHousingDirectPrograms.

1

ThreeIncomeTypes

ANNUAL

ADJUSTED

REPAYMENT

TheSingleFamily HousingDirect502and 504programsconsideranduse threetypes

ofincomewhenprocessinganapplication:Annual,Adjusted,andRepayment.Each

oftheseincomecalculationsplayanimportantrolewhendeterminingifan

applicationiseligibleforaparticularprogram.Inthispresentation,wewillbe

discussingannualincome,which

mustbecalculatedfirst,asitisthebasisforother

incomecalculationswhichfollow.

2

WorksheetsforComputingIncome

FortheSection502programs,theAttachment4‐A,WorksheetforComputing

IncomeandMaximumLoanAmountCalculatorislocatedontheDirectLoan

ApplicationPackagerssiteunderResourcesat:

https://www.rd.usda.gov/programs-services/services/direct-loan-application-

packagers

• WorksheetforComputingIncomeTutorial‐ locatedontheDirectLoan

ApplicationPackagerssiteunderTrainings.

FortheSection504programs,the504AutomatedWorksheetcanbelocatedon

the“ToApply”tabat:https://www.rd.usda.gov/programs‐services/single‐family‐

housing‐repair‐loans‐grants

Before we go into the details of annual income, let’s briefly discuss

the worksheets forcomputingincome.

For the Section 502 program,

the Worksheet for Computing Income and Maximum LoanAmountCalculatorcanbe

foundontheDirectLoanApplicationPackagerssite,linkshownontheslide,under

Resources.Thereisalsoatutorialavailablethatcovershowtocompletethe

worksheet,whichcanalsobefoundontheDirectLoanApplicationsPackagerssite

underT

raining.

FortheSection504programs,the504AutomatedWorksheetcanbefoundonthe

‘ToApply’tabontheprogramoverviewfortheSFHRepairLoansandGrantspage,

thereisalinktothesiteprovidedontheslide.

Pleasenotethattheseworksheetsareupdatedperiodicallysoitisimport

anttouse

themostrecent,postedversion.

3

WhoCompletesthe

Worksheet?

Receivedfrom

Applicant=Rural

Development

Packagedloan=

Packager

Forapplicationsreceiveddirectlyfromtheapplicant,theLoanOriginatorcompletes

theapplicableworksheetfortheLoanApprovalOfficial’sreview.

Foranypackagedloan,theapplicableworksheetiscompletedbythepackagerand

submittedtoRDwiththecompleteapplicationpackage.TheRDstaffthen

reviews/concursorrevises,ifnecessary.In

theeventRDstaffdoesnotconcurwith

thepackager’scalculations,anewworksheetiscompletedbyRDandacopyprovided

tothepackager.

Inallcases,theapplicant electroniccasefilemustcontainacopyofthe

applicable/completedworksheet.

4

WhoseIncomeisConsidered?

Incomeofall householdmembersfromall sources(unlessexcludedby

theprogram):

• Anypersonexpectedtoresideinthehome

• Includesahouseholdmemberthatistemporarilyabsent

• Doesnotincludelive‐inaidsandfosterpersons(incomereceived

forthecareoffosterpersonsisalsoexcludedfromtheincome

types)

ANNUALINCOMEistheincomeofall householdmembersfromall sourcesunless

excludedbasedontheguidanceinHB‐1‐3550.

Ahouseholdmemberisanypersonwhoisexpectedtoresideinthehomeinvolved

withtherequestforRDassistance;thiswouldincludeahouseholdmemberthatis

temporarilyabsent.Live‐inaidsandfosterpersons(childrenoradults)arenot

consideredmembersofthehousehold;andthepaymentsreceivedforthecareof

fosterpersonsareexcludedfromtheincometypes.

Theapplicantmustidentifyallhouseholdmembersandallsourcesofhousehold

incomewhencompletingtheirapplication.Theapplicantmustalsoprovide

verificationofallhousehold incomeasoutlined

inthechecklistofitemsto

accompanytheapplication(Attachment3‐JfortheSection502programand

Attachment12‐EfortheSection504programs).

5

IncometoIncludevs.Exclude

INCLUDE

• Grossincome

• UnearnedIncome

• NetIncome

• Self‐Employment

• Interest/dividendsfromrealor

personalproperty

EXCLUDE

(unlessfromanapplicantortheirspouse)

• Earnedincomeofahousehold

memberunder18yearsofage

• Earnedincomeinexcessof $480ofa

householdmemberwhoisafull‐

timestudent18yearsofageorolder

• FosterChildren/AdultsandLive‐in

Aides

• Temporary,nonrecurring,or

sporadicincome

Oncethehouseholdmembersareidentified,thendeterminewhatsourcesofincome

existandwhethertheyaretobeincludedorexcluded.RefertoHB‐1‐3550,Chapter4

foramorecomprehensivelistofannualincometocount.

WhatisincludedinAnnualIncome?Generally,youwillincludegrossincome

and

unearnedincome.Netincomeisconsideredforself‐employmentearningsand

interest/dividendsfromrealorpersonalproperty.

ForFULLtimestudentswhoarenotanapplicantorthespouseoftheapplicant,only

countthefirst$480forearnedannualincome.Youwillconsiderthefullamountof

anyunearnedincome(suchas,socialsecurity)forfulltimestudents.

Whatisexcluded?

Theearnedincomeofahouseholdmemberunder 18yearsofage.

ForFULLTimestudentswhoarenotanapplicantor

thespouseoftheapplicant,only

countthefirst$480forearnedannualincomeandanyincomeinexcessof $480 is

excluded;however,pleasenote,youwillconsiderthefullamountofanyunearned

income(suchas,socialsecurity)forfull timestudents18yearsofageor older.Again,

6

theseexclusionsdonotapplytotheapplicantortheirspouse.

Alsoexcludepaymentsforthecareoffosterchildrenoradults,Live‐inAides,and

temporary,nonrecurring,orsporadicincome(includinggifts).

6

Earnedvs.UnearnedIncome

Scenario

Carlaisafull‐timecollege student

whoisa householdmember

Shehasaparttimejob, earning

$4,000/year

Shealsoreceives $200/monthin

Social SecurityDisability Payments

IncomeCalculation

PartTimeJob $480

SocialSecurity

$200x12= $2,400

Total$2,880

Let’slookatascenariowithbothearnedandunearnedincome.Inthisexample,

Carlaisa20‐year‐oldfulltimecollegestudent.Shehasaparttimejob,earning

$4,000peryearandshealsoreceives$200/monthinSocialSecurityDisability

Payments.Becausesheisafull‐timestudent,

wewillonlyconsiderthefirst$480of

earnedincome,eventhoughshemakes$4,000totalfortheyear.Allherunearned

income($2,400)isconsidered.ThetotalincomeusedforannualincomeforCarlais

$2,880.

7

CommonIncomeSources

• Wages

• Self‐employment

• Interest/dividendsfromrealorpersonalproperty

• SocialSecuritybenefits(includingbenefitsreceivedbyadultson

behalfofminorsorbyminorsintendedfortheirownsupport)

• Periodicpayments(e.g.,annuities,retirementfunds,and

disability/deathpayments)

Incomemaybereceivedfrommultiplesources.Handbook‐1‐3550,Paragraph4.3

discussessourcesofincomeandspecifieswhetherthesourcesareconsideredfor

annualincome,repaymentincome,both,ornone.

Herearethecommonincomesourcesincludedinannualincomewhenreceivedbya

householdmemberandincludedinrepayment

incomewhenreceivedbythe

applicant.

• Wages. Thiscouldincludewagesbasedonsalary,anhourlyrate,overtime,

bonuses,commissions,tips,housingallowa nces,andanyotherincomereceived

fromanemployer.Fringebenefitssuchascar/mileageallowance,employer

providedmedical/lifeinsurance,stockoptions,workexpensereimbursement,etc.

aretypicallynot

includedinannualincome,unlesstheemployerreportsthemas

taxableincome.

• SelfEmploymentIncome.Thenet incomefromtheoperationofafarm,business,

orprofession asreportedtotheInternalRevenueService(IRS).Theformusedfor

theIRSfilingmayvarydependingonthetypeofbusinessstructure.Loan

OriginatorsandLoanApprovalOfficialsmustanalyzethetaxfilingtodetermine

whichbusinessdeductionsare“allowed”.Forinstance:Abusinesslossreported

to

theIRSisconsidered“$0”indeterminingannualincomebecauseanegative

8

amountcannotbeusedtooffsetotherfamilyincome.

• InterestIncome.Thismay includeinterest,dividends,andothernetincomefrom

realorpersonalpropertysuchas:sharesfromincomedistributedfromatrust

fund,withdrawalofcashorassetsfromaninvestment,etc.

• SocialSecurityIncome.Include thefullamount

ofthebenefitbeforedeductions

aretaken.Whenconsideringannualhouseholdincome,youwouldinclude

benefitsreceivedbyadultmembersofthehouseholdaswellasthosereceived by

adultsonbehalfofminors,orbyminors intendedfortheirownsupport.Regular,

recurringpaymentsareconsidered.Intheeventthat anapplicant

hadreceiveda

lumpsumdistributionorbenefits,thiswouldnotbeprojectedasannualincome

fortheupcoming12‐monthperiod.

• Periodicpayments(e.g. a nnuities,retirementfunds,disability/deathbenefit

payments).Anyrecurringretirementor disabilityincomereceivedonarecurring

basisisincludedinannualincomewhetheritisreceivedmonthly,

quarterly,oron

anannualbasis.

8

CommonIncomeSources(Continued)

• Paymentsinlieuofearnings(e.g.,unemployment,disability

compensation,worker’scomp,andseverancepay)

• Publicassistance

• Childsupport/alimony

• Recurringmonetarygifts

• Regularpay,specialpay(exceptforpersonsexposedtohostilefire),

andallowancesofamemberofthearmedforceswhoistheapplicant

orspouse

• Paymentsinlieuofearnings.Thismayincludeincomesourcessuchas

unemployment,disabilitycompensation,worker’scompensation,andseverance

pay.Somesourcesmaybereceivedonarecurringbasiswhileothersarereceived

onaone‐timebasis.Caremustbetak entoreviewthesourceanddetermineifit

isongoingandshouldbeprojectedasannualincomeforthenext12months.For

instance,anapplicantwhoisafarmlaborermaywork8monthsoutoftheyear

andbeunemployedfor4.Theunemploymentbenefitsinthatsituationare typical

andwouldbeprojectedasannual

income.However,inthecaseofanapplicant

whowaslaidofflastyear,receivedunemploymentbenefitsfor4monthswhile

lookingforajobandisnowbackinafulltime position–thatincomewouldnotbe

consideredinannualbecauseitisnotanticipatedtobereceived.

• PublicAssistance.

Themonthlygrossamountreceivedforthehouseholdinpublic

assistanceisincludedinannualincome.

• ChildSupport/Alimony.Typically,childsupportandalimonyareawardedbythe

courtinadivorcedecree,separationagreement,orparentingplan/custody

agreement.Theamountincludedinannualincomeistheamountactually

received.

Forexample,iftheparentingplanindicatesthattheapplicantshould

receive$350/month,buttheyhaveevidencethatonly$100/monthisreceivedand

theyhaveattemptedtocollectamountsdue,thenonly$100wouldbecountedin

9

annualincome.Asanotherexample,ifthedivorcedecreeindicated$200/month

alimonybuttheapplicantisreceiving$500/monthduetobackpaymentswhich

werenotreceivedandthoseareanticipatedtobereceivedinthenext12months,

thenthe$500/monthwouldbeconsidered.

• RecurringGifts.Thisincomesourcedoes

notmeanthatiftheapplicant’sparents

givethem$300fortheirbirthdayeveryyear,youwouldcountitinannualincome.

Abetterexampleofarecurringgiftpaymentwouldbeasenioronafixedincome

whosechildgiveshim$100eachmonthtohelphimmeetexpenses.This

isan

ongoinggiftwhichisnotbasedonwages,publicassistance,oraretirementsource

butiscomingfromsomeoneoutsideofthehouseholdandisreceivedona

recurringbasis.

• Military/Armed Forcespay.Includeregularpay,specialpay(exceptforpersons

exposedtohostilefire),andallowancesof

amemberofthearmedforceswhois

theapplicantorspouse,whetherornot thatfamilymembercurrentlylives inthe

home.Thismeansthateventhoughthepersonmaybedeployedandawayfrom

thehome,theyareconsideredahouseholdmember andthisincomeiscounted.

9

VerifyingIncomeSources

Preferredsource

• Readilyavailabletotheapplicant

• Inapplicant’srecordsorobtainedonline

Acceptablealternative,whenpreferredsourceis

• Unavailable

• Cannotbeobtainedwithoutcost

• Discrepancies/questionable

Handbook‐1‐3550,Paragraph4.3includesa“PreferredSourceofVerification”table

whichoutlinesthepreferredsourceofverificationforthevariousincomesourcesand

theacceptablealternativeifthepreferredsourceisunavailable,questionable,

insufficient,orcannotbeobtainedwithoutcost.

Thepreferredsourceshouldbereadilyavailabletothe

applicant;thesedocuments

arelikelykeptbytheapplicantintheirpersonalrecordsorcanbeeasilyobtainedby

themonline.

Let’sgothroughsomeexamplesofpreferredsourceverifications:

• Wagesareverifiedusingcopiesofnotlessthanfourconsecutiveweeksofrecent

paycheckstubsorpayrollearningsstatements

asofthedatetheloanapplicationis

receive.Iftheapplicanthasworkedfortheemployerforlessthanayearorother

verificationtypesareinconsistent,thenanoralverificationcompletedbytheRD

staffmaybeused.Incomeinformationshouldnotbediscussedduringtheoral

verification.

• Self‐employmentisverifiedusingcurrentdocumentationofincomeandexpenses,

whichcannotbeolderthanthepreviousfiscalyear,withthelasttwocomplete

10

Federalincometaxreturnswiththeapplicableschedules.

• SocialSecurityisverifiedusingacopyofthemostrecentawardlet ter.

• Childsupportisverifiedthrougha12‐monthpaymenthistoryfromthecourt

appointedentityresponsibleforhandlingpayments.

Alternativesourcesmayincludeformsorothermethodsasdiscussed

inHandbook1‐

3550Chapter4,Paragraph4.3,butshouldonlybeusedwhennecessary.

Regardlessofthesourceofverificationused(preferredoracceptablealternative),the

informationshouldbecomparedtootherpertinentdocumentsinthecasefile.For

example,thepaycheckstubsshouldbecomparedtowhatwasreported

onthe

application,theapplicant’slasttwoFederalincometaxreturns,andtheirbank

statementswithdirectdepositsfromtheemployer.Significantdiscrepancieswill

needtobeaddressed.

Verificationsaretypicallyvalidfor120days(fromthedateoftheverification)and

mustbevalidatthetimeofeligibility,

loanapproval,loanclosing,andconstruction‐

to‐permanentconversions.

10

Projecting AnnualIncome

Incomesourcesare

identifiedand

verified

Expectedincomeis

projectedforthe

next12months

Eachincome

sourceis

calculated,

compared,and

analyzedusingall

applicableincome

calculation

methodstoavoid

under/over

estimatingincome

Oncethehousehold’sincomesourceshavebeenidentifiedandverified,itistimeto

projecttheexpectedincomeforthenext12months.Eachincomesourceshouldbe

calculated,compared,andanalyzedusingallapplicableincomecalculationmethods

toavoidunderestimatingoroverestimatingincome.

Only theincomefromhouseholdmembersshouldbe

included.Live‐inaides,foster

childrenandfosteradultsarenotconsideredhouseholdmembersandtheirincome

wouldnotbeincludedintheannualincomecalculations.

Income isprojectedforthenext12months,usingthedatacollectedtoverifythe

incomesource.Ifthereisknown,verifiableevidencethata

changewilloccur,the

changemustbedocumented andtheincomemaybeexcluded.

11

ExamplesofProjectingIncome

Householdwith3children

Childsupport$200/monthforthe

oldestchildwhois17:

• $200x12months=$2,400

Whensheturns18in4months,the

childsupportwillend

• Projection:

$200x4months=$800

ConstructionWorker

Typicallyworks9 months;receives3

monthsunemploymentbenefits

TaxReturnsindicate:

Wages‐ $40,000,

Unemployment$10,000

Projectincomebasedonhistorical,

ratherthanhourlyrateof40

hours/weekx52weeks

Asanexample:ahouseholdhas3childrenandisreceivingchildsupportinthe

amountof$200/monthfortheoldestchildwhois17.Whensheturns18in4

months,thechildsupportpaymentswillend.Inthiscase,ratherthanprojecting

$2,400inannualchildsupportincomefor

thehousehold,youwouldcalculate

$200/monthx4monthsforatotalprojectionof$800fortheupcomingyear.This

reasoningdoesnotapplytomostincomesourcesbecausethereistypicallynota

known,verifiableenddate.

Whenconsideringseasonal,unemploymentandselfemploymentincomeitisoften

necessary

toanalyzewhatiscurrentlyreceived,aswellashistoricaldata.For

example,someonewhoworksinconstructionmaytypicallywork9monthsoutofthe

yearandreceive3monthsunemploymentbenefits.Usinghistoricaldatawillassist

whenanalyzingtrendstodeterminetheprojectionforthatincomesource.Inthis

case–determineifthecurrentwagerateisthesameaslastyear.Ifso,usingthe

historicaldatamaybethemostaccuratewhenprojectingincome.However,ifthe

applicanthasreceivedawageincreasesincelastyear,thenyoumayneedtobasethe

projectiononthecurrentwagerateforthenext9months,withprojected

unemploymentof3months.

Next we'll review and define the four income calculation methods, followed by an

example of calculating all four methods.

12

FourIncomeMethods

Straight

Based

Average

Historical

Year‐to‐

Date

TermsMovingForward:

Hours–hrs.

Weeks–wks.

Year–yr.

Year‐to‐Date‐ YTD

Onceanincomesourceisverified,theLoanOriginatormustprojecttheexpected

incomefromthissourceforthenext12months.The 12-month projection should be

based on a comparison and analysis of the figures derived from using all applicable

calculation methods.

Therearefourincome calculationmethodsarestraight‐based,average,year‐to‐date,

andhistorical.Toestablishearningsandavoidunderestimatingincome,themore

methodsusedthebetter.

Whenpossibleandapplicable,allfourmethodsshouldbe

calculated.However,someincomesources(forinstancesocialsecurityincome) will

onlylendthemselvestoonemethod.ThefourmethodsarediscussedinHB‐1‐3550,

Chapter4,4.3(E)(2).

Aswecontinuetodiscusstheseincomemethods,wewillbeusing

andabbreviating

termsasfollows:

Hours–hrs.

Weeks–wks.

Year–yr.

Yeartodate‐ YTD

13

Straight‐Based

Convertingtheincometotheannualequivalent

• Danteispaid$10/hr.for40hrs./week

• Heworksyear‐roundwhichis52wks./yr.

• Hetypicallyworks25hoursofovertime/yr.withatime‐and‐a‐halfovertimerateof$15/hr.

Base:$10/hr.x40hrs./wk.x52wks./yr.=$20,800

Overtime:$15/hr.x25hr

s./yr. =$375

$20,800+$375=$21,175

Straight‐based involvesconvertingtheincometotheannualequivalent.

Withthestraight‐basedmethod,theapplicanttypicallyhasafixedhourlywageor

salary,afixedoraveragenumberofhoursworkedperweekandthosefix edamounts

areconvertedintoanannualequivalent.

Danteispaid$10/hour;works40hours/w eek;worksyear‐round‐ 52weeks/year;

andworks

25hoursofovertimeayearwithatime‐and‐a‐halfovertimerateof

$15/hr.

Usingthatinformation,youwouldcalculatehisincomeforthestraight‐basedmethod

asfollows:

Wages:$10/hr.x40hrs./wk.x52wks./yr.=$20,800

Overtime:$15/hr.x25hrs./yr.=$375

Wagesof$20,800+anticipatedovertimeof$375=$21,175annualincome

Using the straight-based method, Dante's projected annual income totals $21,175.

14

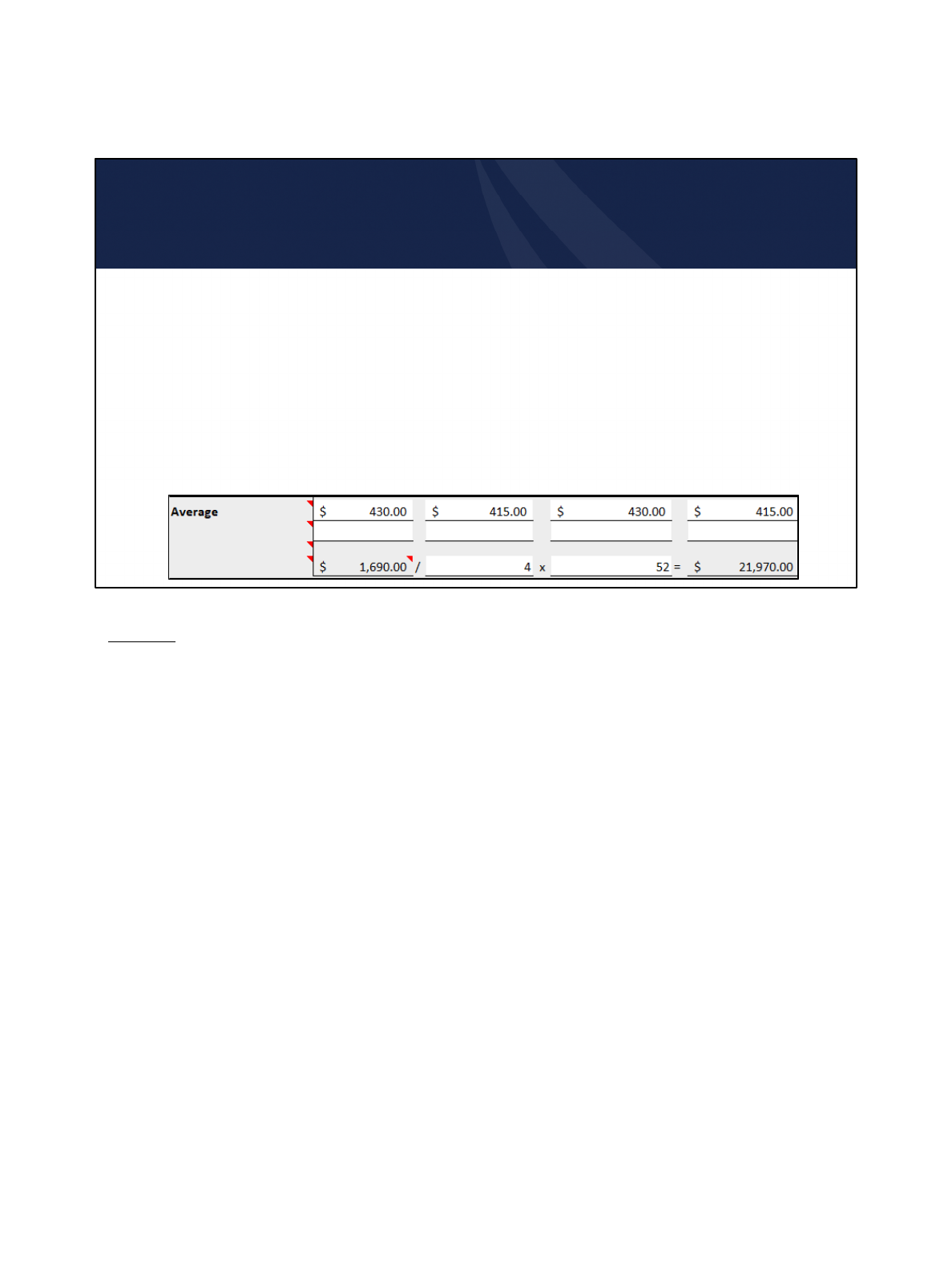

Average

Averageincomereceivedwithinthelast30days,thenconverttotheannualequivalent

• Dante’slastfourweeklypaystubsreflectagrossincomeof:

$430,$415,$430,and$415.

$430+$415+$430+$415=$1,690

$1,690/4wks.=$422.50/wk.

$422.50/wk.x52wks./yr.=$21,970

Average involvesaveragingtheincomereceivedwithinthelast30daysandthen

convertingthatamounttotheannualequivalent.

Inotherwords,ifyouarereviewingthelastfourweeksofpaystubs,youwouldadd

thegrossincomefromthosepaystubs,divideby4toobtaintheweeklyaverage,then

multiplythatby52weekstoobtaintheannualequivalent.

Dante’slastfourweeklypaystubsreflectagrossincomeof$430,$415,$430,and

$415.

Todeterminehisweeklyaverage,addthe4together,so:$430+$415+$430+$415=

$1,690

Andthendividethe$1,690totalby4wks.toreachtheaverageweeklyincomeof

$422.50/wk.

Theaverageamountof$422.50/wk.x52wks./yr.=$21,970

15

Usingtheaveragemethod,

Dante’sprojectedannualincometotals$21,970.

Pleasenote,thedataenteredwilldependonhowtheapplicantispaid,forexample:

For weekly paystubs - enter the 4 weekly amounts, divide by 4 (to get the average weekly

amount) and multiply by 52 weeks to annualize.

For bi-weekly paystubs – enter the 2 biweekly amounts, divide by 2 to obtain the average

amount and multiply by 26 pay periods to annualize.

For bi-monthly paystubs – enter the 2 bi-monthly amounts, divide by 2 to obtain the

average amount and multiply by 24 pay periods to annualize.

15

Year‐To‐Date

Dividethegr ossYTDearningsbytheapplicableYTDinterval,thenannualize

• Dante’smostrecentpaystubcovers16weeksandreflectsgross

YTDincomeof$6,640.

16wks.x7days/wk.=112days

$6,640/112days=$59.29/day

$59.29/dayx365days/yr.=$21,639.29

Thethirdmethodisbasedonyear‐to‐dateincome.Year‐To‐Date(YTD) involves

dividingthegrossYTDearningsbytheapplicableYTDintervalandthenmultiplying

thatamountby365toannualize.

Inthisexample,Dante’smostrecentpaystubfor16weeksreflects$6,640ingross

income.

Whiletheautomatedcalculatorhasafeaturetohelpcalculatethenumberofdays

shownonthepaystub,let

’sreviewhowtodothisbyhand.

First,determinethenumberofdaysrepresentedbythepaystub.16weeksx7days

perweekis112days.Then,tak ethegrossincomeasreflectedonthepaystuband

divideitbythenumberofdays.Inthisexample,$6,640isdividedby112da

ys,

resultingin$59.29/day.Toannualizethedailyamount,multiplythedailyfigureof

$59.29/dayby365days.Dante’sannualizedincomeusing theYTDmethodis

$21,639.29.

Rememberwhenusingthismethod,careshouldbetak entoverifythe“paid

through”dateasitmayvaryfromtheda

teofthepaystub.

16

Historical

Incomeasreportedontheprioryear’sFederalincometaxreturn

• Dante’sFederalincometaxreturnindicatesthatheearned$20,350

lastyear.

HistoricalIncome=$20,350

Historical incomeinvolvesusingtheincomeasreportedonthepreviousyear’s

Federalincometaxreturn.

RememberthatyouareconsideringgrossIncomebeforeanydeductionsforthings

likeretirementaccounts,flexiblespendingaccounts,healthcareplans, etc.When

thoseitemsarededucted,block1willtypicallyreflectalowerwagethanBlock3

“SocialSecuri tywages”.UseBlock3asthiswillreflectthegrossincome,before

allowabledeductionsfortaxablewages.

Ifnodataisreportedonline3,thenuseline5.

For historical, any declining income trend, especially for repayment income, must be

carefully documented in the income analysis.

Dante's Federal income tax return indicates that he earned $20,350.

17

ExampleofComparingtheMethods– ApplicantDante

Straight‐based: $21,175.00

Average: $21,970.00

YTD: $21,639.29

Historical: $20,350.00

Whichincomeismostaccurate?

Why?

Whatquestionsshouldyouask?

NowthatwehavecalculatedtheincomeforDanteusingthefourmethods,itistime

toanalyzetheresults.

Asyoucansee,noneoftheincomecalculationsarethesame.However,the

calculationsdoshowincomeinageneralrange.ItistheresponsibilityoftheRDstaff

topr

ojecttheincomeinamannerthatmostrepresentswhattheapplicantislikely

expectedtoearninthenext12months.Becausetheincomemethodshavedifferent

results,youwillneedtoaskadditionalquestions.

Sincethehistoricalincomeislessthantheotherthreemethods,youwillneedto

in

vestigatetodeterminewhythereisadifference.Potentialquestionstoaskthe

applicantinclude:

• Haveyoureceivedapayraisesincelastyear?

• Didyouworklessovertimelastyear?

• Wereyouemployedforthefullyearlastyear?

Theotherthreemethodsarewithin$795ofeachotherandar

eallwithina

reasonablerange.Selectingeitherofthethreeisreasonableandappearstobea

18

likelyindicationofincometobereceivedinthenext12months.Todeterminewhich

isthemostaccurate,youmayneedtoask:

• Is overtimeearnedyear‐roundorjustduringcertainperiods?Forinstance,

Dantemayonlyworkovertimeinthefirstfourmonthsoftheyear,and

thendoesn’tre

ceiveovertimefortheremainderoftheyear.Projectingthe

samerateofovertimefortheentireyearwilloverestimatehisincome.

• Dothenumberofhourswork edperweekfluctuateseasonally?

Alternatively‐ ifDante’sprioryear’sFederalincometaxreturnindicatedheearned

$30,000,thetypeofquestionsaskedwo

uldbequitedifferent:

• Wasthereadditionalovertimelastyear?

• Didyoureceiveabonuslastyear?Ifso,isthatlikelytocontinuethisyear?

• Wereyoudemoted?

• Haveyourhoursbeenreducedthisyearorwasthereaperiodof

unemploymentthisyear?

Comparingtheresultsoftheincomec

alculationmethodshelpidentify anomalies

whichmayimpactwhichmethodisultimatelyusedfortheprojection.Considering

themethodsforDanteaboveatfacevalue,itappearsthathistoricalistheleastlikely

methodtouseandselectingaverageorYTDisprobablythemostreasonableasthey

aretheclosestinra

nge.However,asking thequestionswediscussedmayleadyouto

anotherdecision.Unlikeamathtestwithabsoluteanswers,whenprojectingincome

thereisn’tnecessarilya“right”anda“wrong”answer.Twopeoplelookingatthe

sameinformationmayprojectslightlydifferentincomemethods.Thekeypointisto

ca

lculateallfourmethodswhenapplicable,asktheappropriatequestions,document

theapplicant’sresponses,selecttheincomewhichseemsthemostlikely,andthen

documentyourdeterminationinthecasefile.

Inthisexample,ifapackagerorLoanOriginatorhadrecommendedtouseaverage

incomeasthebasisfortheloan,itwo

uldbereasonablefortheLoanApprovalOfficial

toconcurwiththatdetermination.

18

ProjectingAnnualIncome–Areallfourmethodsneeded?

Fixed

Income

Seasonal

Variations

Multiple

Types

Aspreviouslymentioned,eachincomesourceshouldbecalculated,compared,and

analyzedusingallapplicableincomecalculationmethods.Allfourmethodsareused

onlyifrelevantandreasonable.Anincomesourcemayonlybesuitableforone

method,twomethods,orthreemethods.

Forinstance:

• Whentheapplicanthasafixe dmon

thlyincome,suchassocialsecurity,theonly

methodnecessarytocalculateisthestraight‐basedmethodbecausethereareno

fluctuationstotheincomesource,andtheapplicantmaynotberequiredtofilea

taxreturn.

• Year‐to‐dateincomemaynotaccuratelyreflectseasonalovertimeorbonuses.For

exa

mple,iftheapplicantreceivesabonuseveryyearinOctoberandhassignificant

overtimefromOctoberthroughDecember,butmostrecentpaystubsreflectsthe

year‐to‐dateincomethroughJune,thentheYTDincomemethodwillnotresultin

anaccurateincomeprojection.However,inthiscase,itiss

tillimportantto

calculatethemethodbecausethosedifferenceswilllikelyshowupwiththe

resultingannualizedincomefigure.Whenthatfigureiscomparedtothehistorical,

itwillleadyoutoaskquestions.

19

• Anapplicantmayhavedifferenttypesofincome.Forexample,theyhaveafixed

salaryof$30,000peryear,butalsoreceivecommissions.Althoughthesalary

won’tchange,thestraight‐basedmethodwouldbethemostaccurateto

determinethesalaryincome,butitmaybenecessarytodetermineallfour

me

thodstodeterminethecommissionincome.

Regardlessofwhatincomecalculationmethodsareused andultimatelyselected,itis

criticaltodocumentthecasefiletosupportyourdecisionoftheincomemethod

selected.Eachapplicantshouldbereviewedbasedontheirspecificsituationand

income.

Projectingincomeisrarely anexactscience.Comparingtheinc

omeusingthefour

methods,askingadditionalquestionsasneeded,andanalyzingthedataareallcritical

stepstoreachingareasonableprojectionofincomethatislikelytooccur.

19

TheImportanceofAccuratelyProjectingAnnualIncome

Overestimatingtheincomeprojectioncouldleadtoafalse

determinationofrepaymentability.

Underestimatingtheincomeprojectioncouldleadto

unauthorizedpaymentassistancewhichwouldhavetobe

repaidbytheborrower.

Overestimatingtheincomeprojectioncouldleadtoafalsedeterminationof

repaymentability.Underestimatingtheincomeprojectioncouldleadto

unauthorizedpaymentassistancewhichwouldhavetoberepaidbytheborrower.

Inadditiontomakingloanstoqualifiedapplicants, aLoanApprovalOfficialmustbe

concernedwithlimitingtheAgency’srisk.Applic

antsaredeterminedeligible when

theydemonstrateareasonableabilityandwillingnesstobeasuccessfulhomeowner

whocanmaketheirmortgagepayments,maintaintheproperty,andpaytheirdebt

obligations.Ahomeownerwhoisunabletodothis,willlikelyend upindefaulton

theirmortgagepaymentandbecomeaser

vicingissue,orriskfortheAgency.An

over‐projectionofincomepotentiallymeansmakingaloanthattheapplicantcan’t

afford.Ontheflipside,underestimatingtheincomemeansthattheapplic antwill

receivemorepaymentassistancethantheyshouldhave.Whentheirincomeis

reviewedattheirfirstpa

ymentassistancerenewal,iftheyhavemoreincomethan

wasprojected,theymayendupwithabillforunauthorizedpaymentassistance

whichtheymustthenrepay.

20

IncomeofTemporarilyAbsentFamilyMember

Householdmembersmaybetemporarilyabsentfromthehousehold.Theincome

forthesehouseholdmembersisconsideredwhencalculatingtheannualhousehold

incomewhen:

• Householdmemberisawayfortemporaryemployment

• Studentswholiveawayfromhomeduringtheschoolyear

Incomenot considered:

Anabsentmemberisnotconsideredamemberofthehousehold

Householdmembersmaybetemporarilyabsentfromthehouseholdforavarietyof

reasons.Theincomeforthesehouseholdmembersisconsideredwhencalculating

theannualhouseholdincome,and forrepaymentiftheyareanapplicantorco‐

applicant.

Incomemaybecountedwhenahouseholdmemberisabsentforthef

ollowing

reasons:

‐ Ifthehouseholdmemberisawayfortemporaryemployment,or

‐ Studentswholiveawayfromhomeduringtheschoolyear

Iftheabsentpersonisnotconsideredahouseholdmember(absenceispermanent,

ratherthantemporary)andisnotapartytothenote,theincomemustnot be

c

ounted.

21

ContactUs

Areyouinterestedinlearningmoreaboutthe

Single‐FamilyHousingDirectPrograms?

PleasecontactyourapplicableRDStateOffice:

https://www.rd.usda.gov/contact‐us/state‐offices

USDAisanequalopportunityprovider,employer,andlender.

Inthiswebinar,wehaveexaminedhowtodetermineannualincomewhichisthe

basisforotherincomecalculationsrelatedtoapplicanteligibility.

AreyouinterestedinlearningmoreabouttheSingle‐FamilyHousingDirect

Programs?

PleasecontactyourapplicableRDStateOffice.Contactinformationcanbefound

usingthelinkonthisslide.

Finally

,pleasenotethatthecontentsofthistrainingarecurrentasofthis

presentation’srevisiondate.Pleaserefer toHandbook‐1‐3550forthemostrecent

guidanceontheprograms.

Thankyouforjoiningusforthiswebinarondeterminingannualincomeforthe

Single‐FamilyHousingDirectpr

ograms.

22

End Slide

23