CHAPTER 13: CORPORATE PROFITS

(Updated: December 2023)

Definitions and Concepts

Recording in the NIPAs

Overview of Source Data and Estimating Methods

Annual (except most-recent-year) estimates

Most-recent-year estimates

Current quarterly estimates

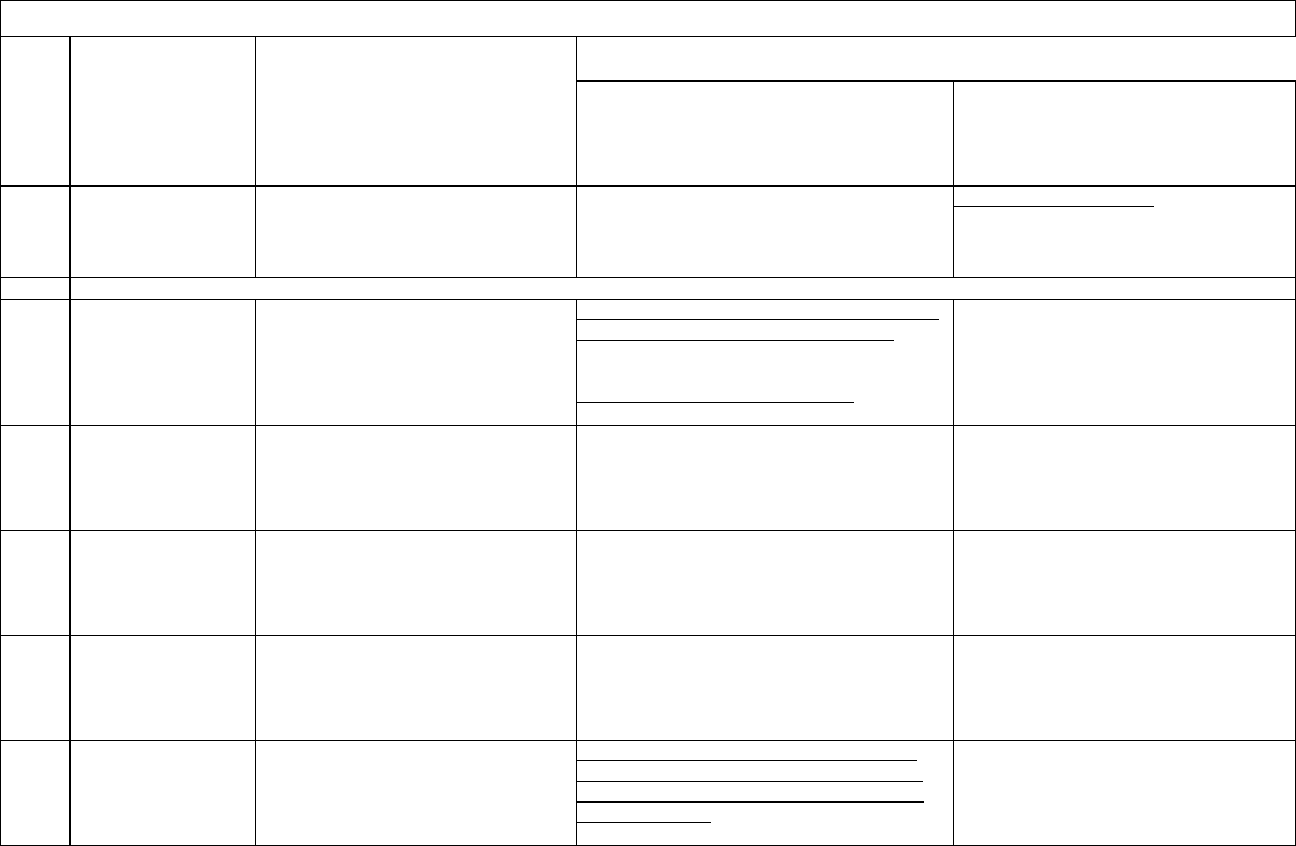

Table 13.A—Summary of Methodology for Corporate Profits

Technical Note: Adjustments to IRS Tax Return Data

Appendix: Domestic Gross Corporate Value Added and Related Measures

Corporate profits represents the portion of the total income earned from current

production that is accounted for by U.S. corporations. The estimates of corporate profits

are an integral part of the national income and product accounts (NIPAs), a set of

accounts prepared by the Bureau of Economic Analysis (BEA) that provides a logical and

consistent framework for presenting statistics on U.S. economic activity (see “Chapter 2:

Fundamental Concepts”).

Corporate profits is one of the most closely watched U.S. economic indicators.

Profitability provides a summary measure of corporate financial health and thus serves as

an essential indicator of economic performance. Profits are a source of retained earnings,

providing much of the funding for capital investments that raise productive capacity. The

estimates of profits and of related measures may also be used to evaluate the effects on

corporations of changes in policy or in economic conditions.

Profits are also frequently used in measuring the rate of return on investment and

the relationship between earnings and equity valuation. For example, the estimates of

corporate profits before and after tax, along with estimates of corporate net value added,

are used in preparing BEA’s annual measures of aggregate rates of returns for domestic

nonfinancial corporations.

1

BEA’s featured measure of corporate profits—profits from current production—

provides a comprehensive and consistent economic measure of the income earned by all

U.S. corporations. As such, it is unaffected by changes in tax laws, and it is adjusted for

nonreported and misreported income. It excludes dividend income, capital gains and

losses, and other financial flows and adjustments, such as deduction for “bad debt.” Thus,

the NIPA measure of profits is a particularly useful analytical measure of the health of

the corporate sector. For example, in contrast to other popular measures of corporate

1

See Sarah Osborne and Bonnie A. Retus, “Returns for Domestic Nonfinancial Business,” Survey of

Current Business 98 (December 2018).

CHAPTER 13: CORPORATE PROFITS

13-2

profits, the NIPA measure did not show the large run-up in profits during the late 1990s

that was primarily attributable to capital gains.

In addition, BEA prepares associated measures of payments arising from

corporate profits, including taxes and dividends. Taxes on corporate income consists of

taxes on income paid to government and to the rest of the world. Corporate taxes are an

important source of funding for federal and for state and local government operations.

Net dividend payments consists of payments to shareholders by U.S. corporations.

Corporate dividends paid to shareholders measures investment returns to them in the

form of current income, including dividends paid to persons as a component of the NIPA

measure of personal income.

Definitions and Concepts

Corporate profits measures the income, before deducting income taxes, of

organizations treated as corporations in the NIPAs. These organizations consist of all

entities required to file federal corporate tax returns, including mutual financial

institutions and cooperatives subject to federal income tax; nonprofit organizations that

primarily serve business; Federal Reserve banks; and federally sponsored credit agencies.

Reflecting the concepts of national economic accounting, income in the NIPAs is defined

as that arising from current production. This income is measured as receipts less expenses

as defined in federal tax law, but with several important differences.

2

Table 13.1 shows the types of transactions that are included in, and excluded

from, corporate profits.

Table 13.1—Content of Corporate Profits

Category of transaction

Comments

Corporate profits before tax

Includes all U.S. corporations, including private

corporations and S corporations.

Includes other organizations that do not file federal

corporate tax returns—such as certain mutual financial

institutions and cooperatives, nonprofits that primarily

serve business, Federal Reserve banks, and federally

sponsored credit agencies.

Receipts exclude gains, net of losses, from the sale of

property.

Receipts exclude dividends received.

Expenses include distributions to shareholders of

regulated investment companies that represent interest

income, which are classified as interest payments in the

NIPAs.

2

The NIPA measures of corporate profits are closely related to the measures for corporations in the System

of National Accounts (SNA). However, the SNA definition has a broader definition of the corporate sector

that includes most federal government and state and local government enterprises and private entities such

as limited liability partnerships and nonprofit institutions that are primarily engaged in market production.

(See Stephanie H. McCulla, Karin E. Moses, and Brent R. Moulton, “The National Income and Product

Accounts and the System of National Accounts 2008: Comparison and Research Plans,” Survey 95 (June

2015): 1-17.)

CHAPTER 13: CORPORATE PROFITS

13-3

Excludes the cost of trading and issuing corporate

securities.

Expenses exclude deductions for bad debt, depletion,

and state and local taxes on corporate income.

Expenses exclude expensing for, and include

depreciation of, intangible amortization, mining

exploration, shafts, and wells, and intellectual property

products.

Inventory valuation adjustment

Inventory withdrawals are valued at current cost.

Capital consumption adjustment

Depreciation is valued at current cost.

Most businesses report profits on both a financial-accounting basis and a tax-

accounting basis.

3

Both financial accounting and tax accounting calculate profits as the

difference between receipts and expenses; however, they differ in the definitions of some

receipts and expenses, in the timing of when the receipts and expenses are recorded, and

in the purposes for which the information is prepared. Financial-accounting measures,

which reflect “generally accepted accounting principles,” underlie the reports to

stockholders, to lenders, and to government regulatory agencies; tax-accounting measures

underlie corporate income tax returns. The Internal Revenue Service (IRS) has tabulated

an information return (the M-3) that reconciles various items (such as employee stock

options) reported on financial reports with the same items reported on most corporate tax

returns, beginning with 2005. The annual and quarterly financial reports prepared by

individual companies provide the basis for another widely followed set of indicators of

corporate profits—the Standard and Poor’s (S&P) 500 measures of reported earnings,

operating earnings, and earnings per share, which reflect the aggregate earnings of the

500 corporations that compose the S&P stock index.

4

When available, BEA uses data collected on a tax-accounting basis as the primary

source of information on corporate profits. These data are based on well-specified,

consistent accounting definitions that, in general, more closely parallel NIPA concepts

and definitions. For example, in financial accounting, corporations sometimes record the

value of extraordinary losses before they actually incur the expenses associated with the

losses. Financial accounting also allows some flexibility in the way definitions are

applied by corporations—for example, in the selection of asset service lives and in the

valuation of liabilities. In addition, tax-accounting tabulations are comprehensive,

covering all incorporated businesses—both publicly traded and privately held—and all

industries, while financial-accounting tabulations cover a subset of the corporate

universe. However, financial-accounting information is more timely than tax-return data,

so it is used by BEA to derive the estimates for the most recent year and for the current

quarters. Neither set of accounting data is entirely suitable for implementing the NIPA

concept of profits from current production. Consequently, BEA’s procedure for

3

For a general discussion of the NIPA accounting framework and of the underlying accounting principles,

see the section “Accounting Framework,” in Chapter 2. For an in-depth discussion, see “

An Introduction to

National Economic Accounting,” Methodology Paper No. 1, September 2007 on BEA’s website at

www.bea.gov.

4

The NIPA and S&P measures of profits differ significantly in purpose, coverage, source data, definitions,

and methodologies; see Andrew W. Hodge, “

BEA Briefing: Comparing NIPA Profits With S&P 500

Profits,” Survey 91 (March 2011): 22–27.

CHAPTER 13: CORPORATE PROFITS

13-4

estimating NIPA corporate profits mainly consists of adjusting, incorporating, and

supplementing these data.

5

Profits from current production, the featured measure of corporate profits in the

NIPAs, is derived as the sum of profits before tax (PBT) and of two adjustments—the

inventory valuation adjustment (IVA) and the capital consumption adjustment (CCAdj).

PBT—sometimes referred to as “book profits”—reflects corporate income

regardless of any redistribution of income made through taxes. The PBT estimates are

primarily based on tax-return information provided by the IRS in Statistics of Income:

Corporation Income Tax Returns, which is then adjusted to conform to BEA coverage

and definitions.

6

PBT is distributed to government as taxes on corporate income and to

shareholders as dividends, or is retained as undistributed profits. The estimates of PBT

are prior to the IVA and CCAdj (which are discussed in the following two paragraphs),

so PBT reflects the charges used in business tax accounting for inventory withdrawals

and for depreciation.

As prices change, businesses that value inventory withdrawals at original

acquisition (historical) costs may realize inventory profits or losses. In the NIPAs, these

gains or losses that result from holding goods in inventory are not considered income

from current production and thus are removed from business income. The IVA converts

the business-accounting valuation of withdrawals from inventory, which is based on a

mixture of historical and current costs, to a current-cost basis by removing the capital-

gain-like or the capital-loss-like element that results from valuing these withdrawals at

prices of earlier periods.

7

Depreciation measured on a business-accounting basis must be adjusted to reflect

consistent economic-accounting measures that are valued at current-replacement cost.

The CCAdj is a two-part adjustment that (1) converts valuations of depreciation that are

based on a mixture of service lives and depreciation patterns specified in the tax code to

valuations that are based on uniform service lives and empirically based depreciation

patterns; and (2) like the IVA, converts the measures of depreciation to a current-cost

basis by removing from profits the capital-gain-like or capital-loss-like element that

arises from valuing the depreciation of fixed assets at the prices of earlier periods.

8

5

See the section “Overview of Source Data and Estimating Procedures.” In addition, for an in-depth

discussion of estimation issues regarding corporate profits, see Dylan G. Rassier, “

The Role of Profits and

Income in the National Accounts,” Survey 91 (February 2012): 8–22.

6

For more information, see “Business Tax Statistics, Corporations,” at www.irs.gov/statistics/soi-tax-stats-

corporation-tax-statistics.

7

For more information, see “Chapter 7: Change in Private Inventories,” 7–4.

8

After the September 11, 2001, attacks on the World Trade Center and the Pentagon and the subsequent

perceived weakness in the economy, legislation was passed to stimulate business investment by temporarily

modifying tax-based depreciation rules. As part of the Job Creation and Worker Assistance Act of 2002,

businesses were permitted to depreciate a “bonus” amount during the first year, over and above that

allowed under traditional tax accounting rules. Because total depreciation cannot exceed the amount of the

investment, the amount of depreciation remaining to be taken in future years was reduced. Hence,

depreciation was raised during the “bonus” span and lowered thereafter, and because depreciation is an

CHAPTER 13: CORPORATE PROFITS

13-5

The composition of profits from current production—that is, corporate profits

with IVA, and CCAdj—is illustrated below.

2017 estimate

(billions of

dollars)

Corporate profits with IVA and CCAdj

2,225.2

PBT

2,295.1

IVA

-47.6

CCAdj

-22.3

For consistent accounting at historical cost

140.9

For current-cost valuation

-163.2

The NIPAs include tabulations for both “national” profits and “domestic” profits.

9

The profits component of national income includes “profits originating in the rest of the

world.” This measure is calculated as receipts by all U.S. residents, including both

corporations and persons, of dividends from foreign corporations, and, for U.S.

corporations, their share of the reinvested earnings of their incorporated foreign affiliates,

and the earnings of unincorporated foreign affiliates, net of corresponding payments. The

profits component of domestic income excludes the income earned abroad by U.S.

corporations and includes the income earned in the United States by foreign-owned

corporations. These relationships are illustrated below.

expense in calculating profits, PBT was understated during the “bonus” span and overstated thereafter. A

number of subsequent economic stimulus acts also included provisions for “bonus” depreciation; therefore,

the effects of tax acts of later years are net of offsetting bonus depreciation that was claimed in previous

years.

Profits from current production (PBT with IVA and CCAdj) was not affected by the acts, because it does

not depend on the depreciation-accounting practices used for federal income tax purposes; instead, this

measure of profits is based on an estimate of the value of fixed capital actually used up in the production

process. However, because the acts reduced tax liability, profits from current production on an after-tax

basis was adjusted by the net effect of the tax acts. Because the acts affect tax depreciation, the CCAdj was

also adjusted by the same amount. BEA estimates of the adjustment are based on data from the Office of

Tax Analysis (OTA) of the U.S. Department of the Treasury and on other source data (for more

information, see OTA’s working paper “

Corporate Response To Accelerated Tax Depreciation: Bonus

Depreciation For Tax Years 2002-2004”).

9

For a general discussion of domestic and national measures in the NIPAs, see the section “Geographic

coverage” in Chapter 2

.

2017 estimate

(billions of dollars)

Corporate profits with IVA and CCAdj

2,225.2

Less: Rest of the world

498.9

Receipts from the rest of the world

804.1

Less: Payments to the rest of the world

305.2

Corporate profits with IVA and CCAdj,

domestic industries

1,726.3

CHAPTER 13: CORPORATE PROFITS

13-6

Other principal profits measures that are presented in the NIPAs (see NIPA table

1.12) are defined as follows:

Taxes on corporate income consists of taxes paid on corporate earnings to federal,

state, and local governments and to foreign governments. These earnings include capital

gains and other income excluded from PBT. The taxes are measured on an accrual basis,

net of applicable tax credits.

Profits after tax with IVA and CCAdj is equal to corporate profits with IVA and

CCAdj less taxes on corporate income. It provides an after-tax measure of profits from

current production.

Net dividends consists of payments in cash or other assets, excluding the

corporation's own stock, made by corporations located in the United States and abroad to

stockholders who are U.S. residents. The payments are netted against dividends received

by U.S. corporations, thereby providing a measure of the dividends paid by U.S.

corporations to other sectors.

Undistributed corporate profits with IVA and CCAdj is equal to corporate profits

with IVA and CCAdj less taxes on corporate income and less net dividends. It measures

corporate saving from profits.

Net cash flow with IVA is equal to undistributed corporate profits with IVA and

CCAdj plus consumption of corporate fixed capital less capital transfers paid (net). It is a

profits-related measure of internal funds available for investment.

Consumption of fixed capital (CFC) is the economic charge for the use of fixed

capital. It is defined as the decline in the value of the stock of assets due to wear and tear,

obsolescence, aging, and accidental damage except that caused by a catastrophic event.

10

Capital transfers paid (net) is the net measure of unrequited transfers associated

with the acquisition or disposal of assets between the corporate sector and other sectors.

Corporate profits with IVA is defined in the same way as corporate profits with

IVA and CCAdj, except corporate profits with IVA reflects the depreciation-accounting

practices used for federal income tax returns. Profits by industry is shown on this basis

because estimates of the CCAdj by industry are not available.

10

In the 2009 comprehensive update, BEA introduced a new treatment of major disasters (those in which

either the associated property losses or the insurance payouts exceed 0.1 percent of GDP) that records them

as “changes in the volume of assets” rather than as CFC; see Eugene P. Seskin and Shelly Smith, “

Preview

of the 2009 Comprehensive Revision of the NIPAs: Changes in Definitions and Presentations,” Survey 89

(March 2009): 11–15.

CHAPTER 13: CORPORATE PROFITS

13-7

Profits after tax without IVA and CCAdj is equal to PBT less taxes on corporate

income. It consists of net dividends and undistributed corporate profits. This measure is

often used in comparisons with the S&P measures of reported earnings.

Undistributed corporate profits without IVA and CCAdj is equal to PBT less taxes

on corporate income and less net dividends. It measures corporate saving from book

profits.

In addition, BEA prepares estimates of gross corporate value added (see NIPA

table 1.14), which is defined as the total value of all goods and services produced by the

corporate sector (gross output) less the value of those goods and services that are used up

in production (total intermediate inputs). For a discussion of the derivation of gross

corporate value added and of related measures, see the appendix to this chapter.

Recording in the NIPAs

As described in Chapter 2, the NIPAs can be viewed as aggregations of accounts

belonging to individual transactors in the economy. In the seven summary accounts of the

NIPAs, corporate profits with IVA and CCAdj appears in the Private Enterprise Account

(account 2), and undistributed corporate profits with IVA and CCAdj appears in the

Domestic Capital Account (account 6). Taxes on corporate income appears in the Private

Enterprise Account, the Government Receipts and Expenditures Account (account 4), and

the Foreign Transactions Current Account (account 5). Corporate dividends appears in

the Private Enterprise Income Account, the Personal Income and Outlay Account

(account 3), the Government Receipts and Expenditures Account, and the Foreign

Transactions Current Account.

The NIPAs include a substantial number of tables that present aggregate and

detailed current-dollar estimates of corporate profits. In most of the NIPA tables, the

totals are shown on a national basis. In tables showing industry detail, profits on a

national basis are shown as the total of profits for domestic industries and for the “rest-of-

the-world” industry. The NIPA tables that present estimates of seasonally adjusted and

not seasonally adjusted corporate profits are identified in table 13.2 below.

CHAPTER 13: CORPORATE PROFITS

13-8

Table 13.2--Measures of Corporate Profits in NIPA Tables

Profits measures National total Rest of the world

Domestic

Total

Financial

1

Nonfinancial

Aggregate

Industry

detail

Current production measures:

Corporate profits with IVA & CCAdj

1.7.5, 1.12, 1.16, 6.16

NA

1.10, 1.13,

1.14, 8.2

NA

NA

1.14

Less: Taxes on corporate income

2

1.10, 1.12, 1.16, 3.1, 6.18,

7.16

6.18

1.10, 1.14,

6.18, 8.2

6.18

NA

1.14

Equals: Profits after tax with IVA & CCAdj

1.12, 1.16

NA

1.10, 1.14

NA

NA

1.14

Less: Net dividends

3

1.12, 1.16, 6.20, 7.10, 7.16

6.20, 7.10, 7.16

1.10, 1.14,

7.10, 8.2

6.20

7.10

1.14, 7.10

Dividends paid

7.10

1.16, 4.1, 7.10

7.10

NA

7.10

7.10

Less: Dividends received

7.10

1.16, 4.1, 7.10

7.10

NA

7.10

7.10

Equals: Undistributed profits with IVA &

CCAdj

1.12, 1.16, 5.1

NA

1.10, 1.14, 8.2.

NA

NA

1.14

Plus: Consumption of fixed capital

1.12, 7.5

NA

1.14, 7.5

NA

7.5

7.5, 1.14

Less: Capital transfers paid (net)

5.11, 1.12

NA

NA

NA

NA

NA

Equals: Net cash flow with IVA

1.12

NA

NA

NA

NA

NA

Derivation from "book profits":

Profits before tax (PBT) or "book profits"

1.12, 6.17, 7.16

1.13, 6.17

1.14, 6.17

6.17

NA

1.14

Plus: IVA

1.12, 5.1, 6.14

NA

1.14, 6.14

6.14

NA

1.14

Equals: Corporate profits with IVA

1.12, 6.16

6.16

6.16

6.16

6.16

6.16

Plus: CCAdj

1.12, 1.13, 5.1, 7.13

NA

1.14, 7.6

NA

7.6

1.14, 7.6

Equals: Corporate profits with IVA & CCAdj

Other "book" measures:

Profits after tax

1.12, 6.19, 7.16

6.19

1.14, 6.19

6.19

NA

1.14

Undistributed profits

1.12, 6.21, 5.1

6.21

6.21

6.21

NA

NA

NA Not available

CCAdj Capital consumption adjustment

IVA Inventory valuation adjustment

NIPA National income and product accounts

1. Financial corporations consist of finance and insurance and of banks and other holding companies.

2. Federal taxes on corporate income are shown in "Selected" table 3.2; seasonally unadjusted quarterly estimates appear in table 3.22

annually. State and local taxes on corporate income are shown in "Selected" table 3.3; seasonally unadjusted quarterly estimates appear in

table 3.23 annually. State taxes on corporate income are shown in table 3.20 annually; local taxes on corporate income are shown in table

3.21 annually.

3. Personal dividend income, a component of personal income, is shown in NIPA tables 2.1, 2.6, and 7.10.

In addition, estimates of gross corporate value added and of real gross corporate

value added for nonfinancial domestic corporate business are presented in NIPA table

1.14, and estimates of price, costs, and profit per unit of real gross value added of

nonfinancial domestic corporate business are presented in NIPA table 1.15. For a

description of these estimates, see the appendix to this chapter.

CHAPTER 13: CORPORATE PROFITS

13-9

Overview of Source Data and Estimating Procedures

As described earlier in the handbook, the NIPA estimates, including those for

corporate profits, are prepared using a wide variety of source data (see “Chapter 3:

Principal Source Data”) and using estimating methods that adjust the source data to the

required NIPA concepts and that fill in gaps in coverage and timing (see “Chapter 4:

Estimating Methods”). As discussed earlier in the chapter, corporate profits from current

production is derived as the sum of PBT, IVA, and CCAdj. The primary source for the

PBT estimates is tax return information provided by the IRS in Statistics of Income:

Corporation Income Tax Returns (Corporation Returns); BEA makes a series of

adjustments to these data to conform them to NIPA coverage and definitions. BEA then

adjusts the PBT estimate with the IVA and the CCAdj in order to derive an estimate of

income earned from current production that is consistent with NIPA concepts.

This section describes the sources and methods used for estimating PBT and for

estimating the distributions of PBT.

11

Payments from PBT to government as taxes on

corporate income and to shareholders in other sectors as dividends are estimated

independently and are discussed below. Undistributed profits—that is, profits that are

retained by corporations—are derived by subtracting taxes on corporate income and net

dividends from PBT.

Table 13.A at the end of the main text summarizes the source data and estimating

methods that are used to prepare the annual estimates and the current quarterly estimates

of corporate profits for the industry categories shown in NIPA table 6.16. The source data

and methods for the current quarterly estimates reflect both seasonally adjusted and not

seasonally adjusted estimates unless otherwise noted.

Annual (except most-recent-year) estimates

For all but the most recent year, the annual estimates of PBT, taxes on corporate

income, and net dividends for domestic industries are based primarily on annual

tabulations of corporate income tax returns. The annual estimates of PBT and of net

dividends for the rest of the world are from BEA's international transactions accounts

(ITAs).

12

The tabulations of corporate income tax returns are prepared by the IRS and

published in Statistics of Income: Corporation Income Tax Returns. The tabulations are

based on a stratified sample of unaudited tax returns that currently includes all active

corporations with more than $50 million of assets (with certain exceptions) and smaller

firms on a probability basis. The information on the returns is edited by the IRS in the

course of preparing the tabulations. The tabulations provide the basis for estimates for the

11

For information on the derivation of the estimates of the IVA and the CCAdj, see “Chapter 7: Change in

Private Inventories,” and see U.S. Bureau of Economic Analysis, Fixed Assets and Consumer Durable

Goods in the United States, 1925–97, September 2003.

12

For a detailed description of the ITA’s, see “U.S. International Transactions Accounts: Concepts and

Methods” (June 2014) on BEA’s website at www.bea.gov.

CHAPTER 13: CORPORATE PROFITS

13-10

corporate totals—by industry—for many of the items on the corporate income tax

returns, including receipts and expenses, tax liabilities, and balance-sheet items.

The IRS totals are the starting point for preparing the NIPA estimates. The

preliminary and final IRS tabulations become available about 2 years and 3 years,

respectively, after the year to which they refer, and this timing determines the

incorporation of these data into the NIPA estimates. For example, in the September 2023

annual update of the NIPAs, the final IRS tabulations for 2020 became the primary

source for the estimates of corporate profits for 2020 (replacing the preliminary

tabulations as the source), and the preliminary IRS tabulations for 2021 became the

primary source for the profits estimates for 2021. The estimates for the most recent year,

2022, were obtained by extrapolating the 2021 estimates (see the section “Most-recent-

year estimates”).

The adjustments that BEA makes to the IRS tabulations are summarized in the

following section, and they are described in detail in the technical note to this chapter.

Adjustments to the IRS tax return data

As discussed, the IRS corporate tax return data are the primary source for BEA’s

estimates of corporate profits. A reconciliation of the IRS and the NIPA measures is

presented annually in NIPA table 7.16, which is reproduced for the year 2017 in table

13.3 below.

CHAPTER 13: CORPORATE PROFITS

13-11

Table 13.3—Relation of NIPA Corporate Profits, Taxes, and Dividends to Corresponding

Measures as Published by the IRS

[Billions of dollars]

Line in NIPA

table 7.16

NIPA line item

2017

1

Total receipts less total deductions, IRS

1,577.8

2

Plus: Adjustment for misreporting on income tax returns

411.5

3

Posttabulation amendments and revisions

1

357.1

4

Income of organizations not filing corporation income tax returns

96.4

5

Federal Reserve banks

78.8

6

Federally sponsored credit agencies

2

8.8

7

Other

3

8.8

8

Depletion on domestic minerals

17.3

9

Adjustment to depreciate expenditures for mining exploration, shafts, and wells

-8.9

10

State and local taxes on corporate income

54.4

11

Interest payments of regulated investment companies

-226.7

12

Bad debt expense

135.1

13

Adjustment to depreciate expenditures for intellectual property products

4

140.3

14

Disaster adjustments (net)

5

30.6

Less: Tax return measures of:

15

Gains, net of losses, from sale of property

306.6

16

Dividends received from domestic corporations

331.2

17

Income on equities in foreign corporations and branches (to U.S. corporations)

159.1

18

Costs of trading or issuing corporate securities

6

54.8

19

Excess of employer expenses over actual employer contributions for defined benefit employee pension

plans

7

-63.2

20

Plus: Income received from equities in foreign corporations and branches (by all U.S. residents, net of

corresponding payments)

498.9

21

Equals: Profits before taxes, NIPAs

2,295.1

22

Federal income and excess profits taxes, IRS

358.9

23

Plus: Posttabulation amendments and revisions, including results of audit and renegotiation and carryback

refunds

-34.5

24

State and local taxes on corporate income

54.4

25

Taxes paid by domestic corporations to foreign governments on income earned abroad

12.4

26

Less: U.S. tax credits claimed for foreign taxes paid

59.6

27

Investment tax credit

8

28

Other tax credits

8

34.4

29

Equals: Taxes on corporate income, NIPAs

297.2

30

Profits after tax, NIPAs (line 21 minus line 29)

1,998.0

31

Dividends paid in cash or assets, IRS

1,876.7

32

Plus: Posttabulation adjustments and revisions

9

-323.0

33

Dividends paid by Federal Reserve banks and certain federally sponsored credit agencies

2

84.4

34

U.S. receipts of dividends from abroad, net of payments to abroad

210.4

35

Earnings remitted to foreign residents from their unincorporated U.S. affiliates

9.0

36

Interest payments of regulated investment companies

-226.7

37

Less: Dividends received by U.S. corporations

374.9

38

Earnings of U.S. residents remitted by their unincorporated foreign affiliates

2.0

39

Equals: Net corporate divided payments, NIPAs

1,253.9

1. Consists largely of an adjustment to expense all meals and entertainment, of oilwell bonus payments written off, of adjustments for insurance

companies and savings and loan associations, of amortization of intangible assets, residential real estate disposal costs, of tax-exempt interest

income and of timing adjustments.

2. Consists of the Farm Credit System and the Federal Home Loan Banks and amounts paid to U.S. Treasury by Federal Reserve banks.

3. Consists of nonprofit organizations serving business and of credit unions.

4. Intellectual property products consists of software, research and development, and entertainment, literary, and artistic originals.

5. Consists of disaster losses valued at historic-cost basis less net insurance receipts for disaster-related losses valued at replacement cost.

6. Includes the imputed financial service charge paid by corporations to domestic securities dealers who do not charge an explicit commission.

7. Employer expenses for defined benefit employee pension plans include actual employer contributions, imputed employer contributions, and

imputed interest for unfunded (or overfunded) actuarial liability.

8. Beginning with 1984, the investment tax credit is included in other tax credits (line 28).

9. Consists largely of an adjustment to remove capital gains distributions of regulated investment companies and real estate investment trusts.

CHAPTER 13: CORPORATE PROFITS

13-12

The major adjustments to IRS “total receipts less total deductions” (line 1)

required to arrive at PBT for domestic industries consist of the following:

• An allowance for the misreporting of corporate income (line 2), based on

IRS audit data;

• IRS deductions that are not elements of costs of current production:

depletion on domestic minerals (line 8), expensing of expenditures for

mining exploration, shafts, and wells (line 9), state and local taxes on

corporate income (line 10), bad debt expense (line 12), and the adjustment

to depreciate expenditures for intellectual property products (line 13);

• Elements of costs of production that are not IRS current deductions:

interest payments of regulated investment companies (line 11), net disaster

adjustments (line 14), and costs of trading or issuing corporate securities

(line 18);

• Elements of IRS income that are not income from current domestic

production: gains, net of losses, from the sale of property (line 15),

dividends received from domestic corporations (line 16), and income on

equities in foreign corporations and branches (line 17);

• The excess of employer expenses over actual employer contributions for

defined benefit employee pension plans, based on data from the Employee

Benefit Security Administration, the Pension Benefit Guarantee

Corporation, the Social Security Administration, and the American

Council of Life Insurance (line19).

To arrive at PBT on a national basis, rest-of-the-world profits, derived from the ITAs, is

added (line 20).

The adjustments to IRS “federal income and excess profits taxes” (line 22) that

are required to arrive at NIPA taxes on corporate income consist of the following:

• Tax liability disclosed by audit, renegotiation, and carryback refunds (part of

line 23);

13

• Elements of NIPA taxes on corporate income that are not included in IRS

federal income and excess profits taxes: state and local taxes on corporate

income (line 24);

• Taxes paid by domestic corporations to foreign governments on income

earned abroad (nonresident taxes) (line 25);

• IRS tax credits deducted in arriving at NIPA taxes on corporate income:

foreign tax credits (line 26), investment tax credit (line 27), and other tax

credits (line 28).

The adjustments to IRS “dividends paid in cash or assets” (line 31) required to

arrive at NIPA dividends consist of the following:

• Posttabulation amendments and revisions (line 32);

13

“Carryback refunds” are refunds claimed by corporations with losses in the current year against taxes that

they had paid in preceding years.

CHAPTER 13: CORPORATE PROFITS

13-13

• Elements of NIPA dividends not included in IRS dividends paid in cash or

assets: dividends paid by Federal Reserve banks and other federally sponsored

credit agencies (line 33) and measures of U.S. receipts of dividends from the

rest of the world net of payments to the rest of the world (lines 34, 35, and

38);

• Elements of IRS dividends paid in cash or assets that are not included in NIPA

dividends: capital gains distributions of regulated investment companies (part

of line 32), interest payments of regulated investment companies (line 36),

and dividends received by U.S. corporations (line 37).

NIPA dividends shown as net corporate dividend payments are found on line 39. This net

number accounts for dividend payments made to persons and to government (also shown

on line 18 of NIPA table 7.10, which shows a breakdown of dividends paid and received

by sector). Dividends payments made to government (federal plus state and local

governments on line 13 of table 7.10) are subtracted from total net corporate dividend

payments to arrive at personal dividend income (line 21 of table 7.10).

14

Most-recent-year estimates

Profits before tax

For PBT, the estimates for the most recent year are prepared by extrapolating the

estimates for the preceding year (for a general description of the extrapolation method,

see “Interpolation and extrapolation using an indicator series” in chapter 4). The

extrapolations are carried out separately for each of about 75 industries using indicators

that are based on a variety of source data. Two of the principal sources are the Census

Bureau’s Quarterly Financial Report and BEA tabulations of samples of shareholder

reports.

The Quarterly Financial Report is the source for the indicators for the following

industries: mining; manufacturing; wholesale trade; retail trade; information; and

professional, scientific, and technical services, except legal services. The indicators are

based on tabulations of corporate income statements collected and published quarterly by

the Census Bureau. They are derived by taking the Quarterly Financial Report measure

“income (loss) before taxes” and subtracting the following items where possible: (1)

dividend income, (2) nonrecurring items, including gain (loss) on sale of assets,

restructuring costs, and asset write-downs, and (3) net income (loss) of foreign branches

and equity in earnings (losses) of nonconsolidated subsidiaries, net of foreign taxes.

Aggregated shareholder reports are the source for the indicators for all of the

components of the following industries: construction; administrative and waste

management services; educational services; health care and social assistance; arts,

14

For more information on the derivation of dividend payments received by state and local governments,

see the NIPA methodology paper MP-5 “Government Transactions

” (September 2005) on BEA’s website

at www.bea.gov.

CHAPTER 13: CORPORATE PROFITS

13-14

entertainment, and recreation; and other services, except government. In addition, they

are the source for the indicators for most of the components of the following industries:

utilities; transportation and warehousing; finance and insurance; and real estate and rental

and leasing. The indicators are based on income from samples of shareholder reports,

including data drawn from S&P’s Compustat database for all public U.S. corporations

that have reported data for the current and the prior year. For each industry, the indicator

used is “pre-tax income” less “special charges” (unusual or nonrecurring items reported

by the company before the deduction of taxes). In addition to the removal of special

charges, BEA judgmentally removes certain other non-operating charges, such as

unrealized mark-to-market gains or losses, asset write-downs, and other valuation gains

or losses.

For some financial industries, the indicators are based on information from reports

filed with various government regulatory agencies, such as Call Reports with the Federal

Financial Institutions Examination Council, and from the annual reports of the various

financial institutions. The indicators for the few remaining domestic industries are based

on judgmental trends. For the rest-of-the-world industry, the estimates are from the ITAs.

(For more information, see table 13.A.)

Taxes on corporate income

For the two tax series for which the annual estimates are not based on IRS

tabulations of corporate income tax returns—nonresident taxes and state and local taxes

on corporate income—the estimates for the most recent year are prepared using the same

methods as those used for the preceding year (see the technical note to this chapter, table

13.8, lines 24–26).

For federal taxes, the estimates of the carryback refunds adjustment for the most

recent year are prepared using the same methods as those for the preceding annual

estimates, while the audit tax adjustment is a judgmental estimate (see the technical note,

table 13.8, line 23). For federal taxes (net of tax credits), the estimates for each industry

are prepared by extrapolation, using indicators that are based on the same sources as

those used for the PBT estimates. The industry estimates are summed and then forced to

match a control total by absorbing proportionate shares of the difference. The control

total is primarily based on data on tax collections from the Monthly Treasury Statement,

separated by liability year using information from the Department of the Treasury’s

Office of Tax Analysis.

Net dividends

Estimates for the most recent year are extrapolated, using indicators that are based

on the same sources as those used for the PBT estimates. For dividends received by U.S.

corporations from abroad, the IRS-based estimates are extrapolated using dividends paid

by foreign corporations from the ITAs. For regulated investment companies, the

estimates are extrapolated based on data from the Investment Company Institute. For real

estate investment trusts, the estimates are extrapolated based on industry source data. For

CHAPTER 13: CORPORATE PROFITS

13-15

Federal Reserve banks and for federally sponsored credit agencies, the estimates for

dividends are prepared using the same methods as those used for the preceding year (see

the technical note, table 13.9, line 34). As with the preceding annual estimates, total net

corporate dividends less dividend payments made to government yields personal dividend

income.

Current quarterly estimates

The seasonally adjusted current quarterly estimates of PBT are derived by

extrapolating the most-recent-year estimates (for an explanation of this method, see

“Interpolation and extrapolation using an indicator series” in Chapter 4). The industry

indicators used for the quarterly extrapolations are generally based on the same

(seasonally adjusted) source data as those used for the most-recent-year estimates (see

table 13.A).

Not seasonally adjusted estimates of PBT are derived using the same methods as

the seasonally adjusted estimates, using not seasonally adjusted versions of the same

indicators.

For nonresident taxes, the current quarterly estimates are prepared using the same

methods as those used for the annual estimates. Seasonally adjusted (SA) estimates of

other federal taxes are estimated by industry by dividing the SA PBT estimates by the

implicit quarterly tax rate from the most recent year and judgmentally adjusting for

outliers. This technique is based on the assumption that tax laws have not changed much

from the previous year; if tax laws change appreciably, further judgmental adjustments

are made. For state and local taxes, the estimates are based on tax collections data and on

a timing factor that, in turn, is a function of the quarter-to-quarter change in NIPA profits

before tax and the average tax rate.

15

Not seasonally adjusted (NSA) tax rates are

calculated in the same manner as SA tax rates; the SA PBT estimates are divided by the

implicit quarterly tax rate from the most recent year and judgmentally adjusting for

outliers.

Quarterly estimates of gross flows of domestic corporate dividends paid and

received are not prepared. Therefore, the current quarterly estimate of net national

dividends is derived as a residual in the calculation of the current quarterly personal

dividends.

For the first, second, and third quarters of the calendar year, preliminary quarterly

estimates of PBT, taxes on corporate income, and net dividends are released

approximately 55 days after the end of the quarter (along with the “second” estimates of

GDP), and revised quarterly estimates are released approximately 85 days after the end of

the quarter (along with the “third” estimates of GDP). In general, the preliminary

quarterly estimates are based on less complete information than the revised estimates. For

15

See Eugene P. Seskin and Alyssa E. Holdren, “Annual Revision of the National Income and Product

Accounts,” Survey 92 (August 2012): 25.

CHAPTER 13: CORPORATE PROFITS

13-16

example, for industries extrapolated with information from the Quarterly Financial

Report, the preliminary estimates are based on a subsample of the information that

becomes available a month later. For the fourth quarter of the year, preliminary estimates

are not prepared, and the only current estimates for that quarter are released

approximately 85 days after the end of the quarter. This delay occurs because the fiscal

year for most corporations ends in the fourth quarter, and additional time is needed to

complete the more comprehensive end-of-year reports.

As part of the calculation of dividends received by persons, an estimate of net

national dividends paid by corporations becomes available on the same schedule as the

estimates of GDP, approximately 25 days, 55 days, and 85 days after the end of the

quarter. In a reversal of the accounting identities used for preparing the annual estimates

of dividends, personal dividends received are estimated first. Monthly estimates of SA

personal dividends are prepared using as an indicator the seasonally adjusted dividends

paid based on a Compustat sample. The monthly estimates are averaged to derive

quarterly estimates of personal dividends received, which are then added to dividends

received by government to derive net national dividends. Rest-of-the-world dividends

(net) are subtracted to derive net domestic dividends, which are then split into financial

and nonfinancial sectors using data from the Compustat sample. NSA personal dividends

are derived using an NSA indicator based on a Compustat sample.

CHAPTER 13: CORPORATE PROFITS

13-17

Table 13.A—Summary of Methodology Used to Prepare Estimates of Corporate Profits

Line in

NIPA

table

6.16

Component

Annual (except most-recent-year)

estimates

Most-recent-year estimates*

(Indicator series used to extrapolate prior

annual estimate)

Current quarterly estimates

(Indicator series used to extrapolate most

-

recent-year estimate) *

1

Corporate profits with inventory valuation adjustment (IVA) and capital consumption adjustment:

8

Corporate profits with IVA:

9

Domestic industries:

10

Financial:

11

Federal Reserve

banks

Net income before tax—current net

earnings less assessments for the

Board of Governors and currency

costs

—from the annual report of the

Board of

Governors of the Federal

Reserve System.

Same as for annual.

Profits before tax, based on information

from the Federal Reserve Board.

12

Other financial:

Credit intermediation

and related activities

Commercial banking, savings

institutions,

and other depository credit

intermediation

: r

eceipts less deductions

from IRS tabulations of corporate

income tax returns, adjusted for

understatement of income on tax

returns and for conceptual differences.

Credit

unions:

net income after dividend

payments to shareholders and after

interest refunds, from the National

Credit Union Administration.

Federally sponsored credit agencies

:

net income as reported in the annual

reports of the following agencies: the

Federal

Home Loan Bank Board, the

Federal Home Loan Mortgage

Corporation, and the Farm Credit

System.

Nondepository credit intermediation:

r

eceipts less deductions from IRS

tabulations of corporate income tax

Commercial banking, savings institutions, and

other depository credit intermediation

: net

income before tax

—income before security

gains and losses plus provisions for loan

losses

—for insured commercial banks and

savings institutions reported to bank regulatory

agencies and compiled by the FDIC in

Quarterly Banking Profile

.

Credit u

nions: same as for annual.

Federally sponsored credit agencies

: same as

for annual.

Nondepository credit intermediation

: net

income from

BEA tabulations of samples of

shareholder reports.

Commercial banking, savings institutions,

and

other depository credit intermediation

:

for the revised estimate, same as for most

recent year; for the preliminary estimate, if

the

Quarterly Banking Profile is not

available, BEA tabulations of data from

Federal Financial Institutions Examination

Council

(FFIEC) Call Reports.

Credit u

nions: judgmental trend.

Federally sponsored credit agencies

:

same as for annual.

Nondepository credit intermediation: same

as for most recent year.

CHAPTER 13: CORPORATE PROFITS

13-18

Table 13.A—Summary of Methodology Used to Prepare Estimates of Corporate Profits

Line in

NIPA

table

6.16

Component

Annual (except most-recent-year)

estimates

Most-recent-year estimates*

(Indicator series used to extrapolate prior

annual estimate)

Current quarterly estimates

(Indicator series used to extrapolate most

-

recent-year estimate) *

returns, adjusted for understatement of

income on tax r

eturns and for

conceptual differences.

Securities, commodity

contracts, and

investments

Receipts less deductions from IRS

tabulations of

corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Net income before tax from BEA tabulations of

samples of shareholder reports.

Same as for most recent year.

Insurance carriers and

related activities

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Life insurance carriers: net income before tax

from BEA tabulations of sa

mples of

shareholder reports.

Property and casualty insurance carriers

: net

income before tax

—investment income plus

net underwriting gains less dividends paid to

policyholders

—and a portion of catastrophic

losses from the Insurance Service Office.

Insurance agencies, brokerages, and related

services

: judgmental trend.

Life insurance carriers: same as for most

recent year.

Property and casualty insurance carriers

:

for revised estimate, same as for most

recent year; for preliminary estimate, BEA

tabul

ations of samples of shareholder

reports, and a portion of catastrophic

losses that is judgmentally trended.

Insurance agencies, brokerages, and

related services

: same as for most recent

year.

Funds, trusts, and

other financial vehicles

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Regulated investment companies and other

financial vehicles

: judgmental trend.

Same as for most recent year.

Management of

companies and

enterprises

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Bank holding companies: net income before

ta

x—income before security gains and losses

plus provisions for loan losses

—for insured

commercial banks reported to bank regulatory

agencies and compiled by the FDIC in

Quarterly Banking Profile

.

Other holding companies: judgmental trend.

Bank holding companies: for the revised

estimate, same as for most recent year;

for the preliminary estimate, if the

Quarterly Banking Profile

is not available,

BEA tabulations of data from the

FFIEC

Call Reports

.

CHAPTER 13: CORPORATE PROFITS

13-19

Table 13.A—Summary of Methodology Used to Prepare Estimates of Corporate Profits

Line in

NIPA

table

6.16

Component

Annual (except most-recent-year)

estimates

Most-recent-year estimates*

(Indicator series used to extrapolate prior

annual estimate)

Current quarterly estimates

(Indicator series used to extrapolate most

-

recent-year estimate) *

Other holding companies: same as for

most recen

t year.

13

Nonfinancial:

14

Utilities

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Power generation and natural gas distribution

(including combination electric and gas)

: net

income before tax from BEA tabulations of

samples of shareholder reports.

Water, sewage, and other systems: judgmental

trend.

Same as for most recent year.

15

Manufacturing

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Net income before tax from the Census

Bureau

Quarterly Financial Report, with

adjustments for conceptual d

ifferences.

Same as for most recent year.

28

Wholesale trade

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Net income before tax from the Census

Bureau

Quarterly Financial Report, with

adjustments for conceptual differences.

Same as for most recent year.

29

Retail trade

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjuste

d for understatement of

income on tax returns and for

conceptual differences.

Net income before tax from the Census

Bureau

Quarterly Financial Report, with

adjustments for conceptual differences.

Same as for most recent year.

30

Transportation and

warehousing

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Air transportation, rail transportation, water

transportation

, truck transportation, pipeline

transportation, and other transportation and

support activities

: net income before tax from

Same as for most recent year.

CHAPTER 13: CORPORATE PROFITS

13-20

Table 13.A—Summary of Methodology Used to Prepare Estimates of Corporate Profits

Line in

NIPA

table

6.16

Component

Annual (except most-recent-year)

estimates

Most-recent-year estimates*

(Indicator series used to extrapolate prior

annual estimate)

Current quarterly estimates

(Indicator series used to extrapolate most

-

recent-year estimate) *

BEA tabulations of samples of shareholder

reports.

Transit and ground passenger transportation

and warehousing and storage

: judgmental

trend.

31

Information

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Net income before tax from the Census

Bureau

Quarterly Financial Report, with

adjustments for conceptual differences.

Same as for most recent year.

32

Other nonfinancial:

Agriculture, forestry,

fishing, and hunting

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Farms: BEA estimates of net farm income,

based on information from the U.S.

Department of Agriculture.

Other

: judgmental trend.

Same as for most recent year.

Mining

Receipts less deductions from IRS

tabulations of corporate income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Net income before tax from the Census

Bureau

Quarterly Financial Report, with

adjustments for conceptual differences.

Same as for most recent year.

Professional, scientific,

and technical services

Receipts less deductions from IRS

tabulations of corporat

e income tax

returns, adjusted for understatement of

income on tax returns and for

conceptual differences.

Computer systems design and related services

and miscellaneous professional, scientific, and

technical services

: net income before tax from

the Census Bureau

Quarterly Financial Report

,

with adjustments for conceptual differences.

Legal services: judgmental trend.

Same as for most recent year.

Other

Receipts less deductions from IRS

tabulations of corporate incom

e tax

returns, adjusted for understatement of

Construction; real estate; administrative and

waste management services

; educational

services;

health care and social assistance;

arts, entertainment, and recreation;

Same as for most recent year.

CHAPTER 13: CORPORATE PROFITS

13-21

Table 13.A—Summary of Methodology Used to Prepare Estimates of Corporate Profits

Line in

NIPA

table

6.16

Component

Annual (except most-recent-year)

estimates

Most-recent-year estimates*

(Indicator series used to extrapolate prior

annual estimate)

Current quarterly estimates

(Indicator series used to extrapolate most

-

recent-year estimate) *

income on tax returns and for

conceptual differences.

accommodation and food services; and other

services, except government

: net income

before tax from BEA tabulations of samples of

shareholder reports.

Rental and leasing services and lessors of

intangible assets: judgmental trend.

33

Rest of the world

Receipts and payments from BEA’s

international transactions accounts,

adjusted to NIPA concepts and

definitions.

Same as for annual.

Same as for annual.

* The description “Same as for annual” indicates that the estimate is prepared using a methodology similar to that used for the annual estimate rather than by

using an indicator series to interpolate or extrapolate the annual estimate.

BEA Bureau of Economic Analysis

FDIC Federal Deposit Insurance Corporation

IRS Internal Revenue Service

NIPAs National income and product accounts

CHAPTER 13: CORPORATE PROFITS

13-22

Technical Note: Adjustments to IRS Tax Return Data

This technical note provides detailed descriptions of the adjustments that are

made to the IRS corporate tax return data on profits, taxes, and dividends in order to

conform them to NIPA concepts and definitions. These adjustments are published

annually in “Table 7.16. Relation of Corporate Profits, Taxes, and Dividends in the

National Income and Product Accounts to Corresponding Measures as Published by the

Internal Revenue Service.” Reproductions of portions of this table are shown below in

tables 13.4, 13.8, and 13.9.

Corporate profits before tax

The starting point for the derivation of the estimates of profits before tax (PBT) is

“Total receipts less total deductions, IRS” shown on line 1 in table 13.4 below. For each

industry, total receipts less total deductions is obtained from Corporation Income Tax

Returns. (This item differs from income subject to tax, as defined on the corporate tax

return, in that it includes tax-exempt interest and excludes special statutory deductions

that are available for corporations.) The adjustments to the IRS data are discussed below

in the order shown in the table.

CHAPTER 13: CORPORATE PROFITS

13-23

Table 13.4—Relation of NIPA Corporate Profits to Corresponding Measures as

Published by the IRS

[Billions of dollars]

Line in

NIPA

table

7.16

NIPA line item

2017

1

Total receipts less total deductions, IRS

1,577.8

2

Plus: Adjustment for misreporting on income tax returns

411.5

3

Posttabulation amendments and revisions

1

357.1

4

Income of organizations not filing corporation income tax returns

96.4

5

Federal Reserve banks

78.8

6

Federally sponsored credit agencies

2

8.8

7

Other

3

8.8

8

Depletion on domestic minerals

17.3

9

Adjustment to depreciate expenditures for mining exploration, shafts, and

wells

-8.9

10

State and local taxes on corporate income

54.4

11

Interest payments of regulated investment companies

-226.7

12

Bad debt expense

135.1

13

Adjustment to depreciate expenditures for intellectual property products

4

140.3

14

Disaster adjustments (net)

5

30.6

Less: Tax return measures of:

15

Gains, net of losses, from sale of property

306.6

16

Dividends received from domestic corporations

331.2

17

Income on equities in foreign corporations and branches (to U.S.

corporations)

159.1

18

Costs of trading or issuing corporate securities

6

54.8

19

Excess of employer expenses over actual employer contributions for defined benefit

employee pension plans

7

-63.2

20

Plus: Income received from equities in foreign corporations and branches (by all

U.S. residents, net of corresponding payments)

498.9

21

Equals: Profits before taxes, NIPAs

2,295.1

1. Consists largely of an adjustment to expense all meals and entertainment, of oilwell bonus payments

written off, of adjustments for insurance companies and savings and loan associations, of amortization

of intangible assets, residential real estate disposal costs, of tax-exempt interest income and of timing

adjustment.

2. Consists of the Farm Credit System and the Federal Home Loan Banks.

3. Consists of nonprofit organizations serving business and of credit unions.

4. Intellectual property products consists of software, research and development, and entertainment,

literary, and artistic originals.

5. Consists of disaster losses valued at historic-cost basis less net insurance receipts for disaster-related

losses valued at replacement cost.

6. Includes the imputed financial service charge paid by corporations to domestic securities dealers who

do not charge an explicit commission.

7. Employer expenses for defined benefit employee pension plans include actual employer contributions,

imputed employer contributions, and imputed interest for unfunded (or overfunded) actuarial liability.

Adjustment for misreporting on income tax returns (line 2). This adjustment is primarily

based on IRS audit data. Unlike the tax-return source data, which reflects a specific tax

year, the audit data is based on the year the audit is resolved and collected. For the audit

data, it is assumed there is a 1-year lag between the referenced tax year and the year in

CHAPTER 13: CORPORATE PROFITS

13-24

which the majority of audits for that tax year are resolved. Thus, for the misreporting

adjustment, the most recent audit data is used to derive an adjustment for the preceding

tax year. For example, in the 2023 comprehensive update of the NIPAs, 2021 was the

most recent tax year, and 2020 was the year for which the available audit data were used

to prepare the misreporting adjustment. For subsequent years, the adjustment was

judgmentally extrapolated.

The IRS audit consists of three steps. First, the IRS audits a small sampling of

corporations and recommends how much, if any, additional tax liability is owed. Next,

the corporations can appeal those recommendations. Finally, a resolution between the

corporation and the IRS is reached, and the corporation pays the IRS.

The methodology for the misreporting adjustment is to capture only the amount of

tax actually collected (see the section “Taxes on Corporate Income”), raise it to a

universe total, and then convert it from a tax-liability measure to a profits measure. The

IRS publishes data on the recommended additional tax liability owed, stratified by asset

size, but the amount actually collected is provided only for the total. Therefore, a ratio of

additional collected tax to recommended additional tax is developed and applied to the

recommended amounts on an asset-by-size basis to derive a universal total for additional

tax liability. Finally, this tax-liability estimate is converted to a profits estimate using the

statutory tax rate.

The above methodology applies to corporations that are paying taxes on positive

net income. For companies that report deficits and pay no taxes, the percentage of

corporate deficits reported by IRS (based on historical research) is added to the above

estimate of profits misreporting to arrive at the corporate misreporting adjustment.

Posttabulation amendments and revisions (line 3). This adjustment includes a number of

various items. They are described briefly in table 13.5 below.

CHAPTER 13: CORPORATE PROFITS

13-25

Table 13.5—Current Post-tabulation Amendments and Revisions to IRS "Total Receipts Less Total Deductions"

Adjustment Start year

Estimates

(millions of

dollars)

Type and purpose of

adjustment

Sources and methods

2017

Special

assessments

1946

-776

Definitional adjustment: To reflect the

inclusion of assessments for the costs of

improvements, such as streets and curbs,

that benefit property owners as expenses

in calculating NIPA profits.

Adjustments are based on Census

Bureau data on state and local

government receipts.

Oil well bonus

payments

1946

254

Definitional adjustment: To reflect the

exclusion of bonus payments for drilling

rights to land owners and lessors as

expenses in calculating NIPA profits.

Adjustments are based on Energy

Information Administration

annual estimates of dry-hole

expenses.

Fines

1978

-39,379

Definitional adjustment: To reflect the

inclusion of fines as an expense in

calculating NIPA profits.

Adjustments are based on federal

budget data and on information on

court awards.

Intangible

amortization

1981

118,820

Definitional adjustment: To reflect the

exclusion of the amortization of intangible

assets as an expense in calculating NIPA

profits.

Adjustments are based on CITR

data.

Imputed tax

returns

1984

0

Coverage adjustment: To replace imputed

tax data for a year with the tax return data

for that year

Adjustments are based on IRS

data.

1120-S pass

through

1987

-22,862

Definitional adjustment: To restate profits

of small business corporations to reflect

the income and expenses that are passed

to shareholders rather than reported by the

corporation.

Adjustments are based on CITR

tabulations.

Business

entertainment

1987

-21,111

Definitional adjustment: To treat all the

expenses for business meals and

beverages and entertainment as expenses

in calculating NIPA profits.

Adjustments are based on BEA's

input-output calculations.

Corporate share is based on CITR

tabulations.

Insurance

adjustments

1985

5,826

Definitional adjustment: To remove all

unpaid premiums and losses from receipts

and deductions so that the profits of

property and casualty insurance

companies and of mutual life insurance

companies are restated and reflect the

amounts paid to policyholders as

dividends.

Adjustments are based on CITR

tabulations.

Dividends

received from

Federal Reserve

banks (FRBs)

and Federal

Home Loan

Banks (FHLBs)

1959

-2,319

Definitional adjustment: To reflect the

exclusion of taxable dividends received

by commercial banks from Federal

Reserve banks and by savings and loan

associations from FHLBs, which are

included in CITR "other receipts," from

NIPA profits.

1

Adjustments are based on FRB

and FHLB data.

Domestic

production

activities

deduction

2005

30,837

Definitional adjustment: To remove the

deduction for domestic production

activities from the calculation of NIPA

profits.

Adjustments are based on CITR

data.

CHAPTER 13: CORPORATE PROFITS

13-26

Residential real

estate disposal

costs

1929

-1,620

Definitional adjustment: Residential

disposal costs are capitalized for NIPA

purposes and thus included in estimates of

capital consumption allowance (CCA).

For tax purposes, residential disposal

costs adjust the basis on which capital

gains (losses) are calculated. Because

profits measures exclude the impact of

capital gains (losses), a subtraction

adjustment is made to offset the related

CCA adjustment.

Adjustments are based on NIPA

investment data.

Other

2

1959

289,167

Miscellaneous adjustments to put profits

on a current production basis including

the following: deductions of regulated

investment companies,

nontaxable

subsidies, interest expense limitations,

interest capitalization and timing

differences.

3

Adjustments are based on CITR

data and other sources.

BEA Bureau of Economic Analysis

CITR Statistics of Income: Corporation Income Tax Returns

IRS Internal Revenue Service

NIPA National income and product accounts

1. Dividends received by domestic corporations are excluded from NIPA profits; see line 16 of NIPA table 7.16.

2. These adjustments are grouped to avoid the disclosure of information.

3. For more information on the treatment of regulated investment companies and real estate investment trusts within

corporate profits, see Robert J. Kornfeld,

Improved Measures of Regulated Investment Companies and Real Estate

Investment Trusts for the U.S. National Economic Accounts, Survey of Current Business 103 (May 2023).

Income of Federal Reserve banks and other federally sponsored credit agencies (lines 5

and 6). Federal Reserve banks, Federal Home Loan Banks, and the Farm Credit System

are included in the corporate sector of the NIPAs. Because these institutions do not file

tax returns, their income and expenses are not included in Corporation Income Tax

Returns. Through this adjustment, the profits of these institutions are included in PBT,

based on information on net income from their annual reports.

Other organizations not filing corporation income tax returns (line 7). Personal injury

trusts, the Universal Service Administration Company (USAC), and nonprofit

organizations serving business that are exempt from income tax under section 501(c) are

included in the NIPA corporate sector. Personal injury trusts are business-established

independent legal entities that administer payments for damages resulting from product

liability claims. These payments are considered transfer payments from business to

persons at the time the funds are disbursed. Receipts and payments data are collected

from individual trust fund reports. USAC earnings are measured as receipts less outlays,

from the Monthly Treasury Statement. The earnings (surplus) of agricultural

organizations, business leagues, chambers of commerce, real estate boards, boards of

trade, and organizations to finance crop operations are based on IRS tabulations of

information returns filed by tax-exempt organizations.

CHAPTER 13: CORPORATE PROFITS

13-27

The earnings of credit unions are treated as PBT in the NIPAs; however, they are

not reflected in Corporation Income Tax Returns, because income of these institutions is

not taxed. The adjustment consists of net income less dividends to shareholders and

interest refunds as tabulated by the National Credit Union Administration for state-

chartered and federally chartered credit unions.

Depletion on domestic minerals (line 8). Natural resource discoveries are not considered

to be capital formation in the NIPAs; consequently, depletion—the charge for the using

up of these resources—is not a charge against current production. In contrast, the IRS

permits depletion to be charged as an expense. Through this adjustment, the Corporation

Income Tax Returns expense “depletion” is reduced by the domestic depletion claimed on

tax returns, thereby increasing profits. The adjustment is calculated as the difference

between depletion from Corporation Income Tax Returns and an estimate of foreign