© 2022

QuickBooks Online for Business Owners

Introductory Training

©2022

Standard Legal Notices

This training material is presented without warranty of any kind, either

express or implied respecting the contents of this book, including but not

limited to implied warranties for the book’s quality, performance,

merchantability, or fitness for any particular purpose.

Copyright

Presentation and workbook copyright© 2022 by Intuit. All rights reserved.

Printed in the United States of America. No part of this book may be used or

reproduced in any form or by any means without prior written permission

from Intuit. Material remains the property of Intuit.

Trademark Acknowledgments

All product names and services mentioned in this workbook are trademarks or

registered trademarks of their respective companies.

Disclaimer

QuickBooks Online Foundations

QuickBooks Online Discount

3

QuickBooks Online Foundations

QuickBooks® Online Foundations

Important Information about the Structure of this Training

READ THIS SLIDE BEFORE MOVING ON.

Our QuickBooks Online course is intended to help the business owner establish a strong

financial foundation using QuickBooks® Online as a bookkeeping, business management

and cash flow building tool. The material provides action steps, in order, for establishing

bookkeeping best practices and ensuring accurate financial information.

Please ask questions throughout the training. Entrepreneurial success is

based on the ability to understand what your numbers are telling you and

how to use them to improve company performance.

In addition to what you will learn today, these manuals are for use

as a post class reference guide.

(The Craig’s Landscaping test drive company resets itself when you log out. Occasionally

you may encounter a screen shot that looks different than

what is posted in the manual. Our materials are updated throughout the year, however

with technology advances,

prompting updates, you may encounter an update

that is not yet reflected in this manual.)

We are happy you are here and look forward

to helping you master QuickBooks!

4

QuickBooks Online Foundations

QuickBooks® Online Foundations

The most important reason to advance our knowledge of QuickBooks® Online and basic

bookkeeping principles, whether you are a business owner or employee, is to gain an

understanding of what the numbers mean and how to use them to improve business

performance.

While we identify specific learning objectives at the beginning of each section,

4 Overall Objectives include:

1. Introduction to basic features in QuickBooks Online and how they apply to best practice

bookkeeping and accounting principles.

2. How to effectively and efficiently use QuickBooks Online to manage daily tasks and

develop an understanding of how the data is entered, processed and reviewed.

3. How to customize QuickBooks Online to meet the specific needs of a business.

4. How to access and use data in QuickBooks Online to analyze the current financial

condition of a company and establish action steps for improvement.

The Importance of QuickBooks® Online and Managing Cash Flow:

Business owners typically identify Cash Flow as their number one area of concern.

QuickBooks Accounting Software, when utilized correctly, allows users to run Cash Flow

projections and develop a Cash Flow management strategy to prevent shortfalls. This

training will help participants develop a strong knowledge base of how to use QuickBooks

reports to manage a business and build cash flow.

The foundation of business success is in the daily use of accurate, real-time financial data.

What we measure, we manage; what we manage, we improve.

5

QuickBooks Online Foundations

The Power of QuickBooks® Online

It is important to focus on the areas of our business that contribute most to

profitability. QuickBooks helps us quickly identify areas of focus if we know

where to look.

The 80/20 rule, the ‘Pareto Principle’, is a powerful concept that consistently rings true.

In most cases, 20% of our customers generate 80% of our net profit. At the same time, 20%

of the goods or services we sell contribute 80% of our revenue, etc. You get the idea.

The most important aspect of accurate financial data

is the action plan it creates.

By generating daily reports that uncover the best customers, jobs, services, or products,

you will soon see how you can refocus internal efforts on doing highly valuable work.

Accurate real-time data with one click access to reports, is an enormous benefit of using

QuickBooks® Online the ‘right-way’.

6

QuickBooks Online Foundations

Table of Contents

Section 1 - A Business Owners Journey 10

The Business Owner’s Journey 11

Case Study Storyline 12

Section 2 – Getting Started in QuickBooks Online 13

Goals 14

Features 15

Craig’s Landscaping Test Drive Company

Setup Your Company File 19

Navigation 26

Doable Action Steps 37

Section 3 – Set Up Your New QuickBooks® Online Company 38

Goals 39

Account and Settings 40

Manage Users 60

Lists 64

Chart of Accounts 66

Doable Action Steps 75

Section 4 - Products and Services 80

Goals 81

Products and Services 82

Products and Services List 83

Products and Services Types 86

Products and Services Reports 94

Doable Action Steps 95

Section 5 – Beginning Balances 97

Goals 98

Beginning Balances 99

Historical Transactions 101

Recurring Transactions 104

Doable Action Steps 107

7

QuickBooks Online Foundations

Table of Contents

Section 6 – Bank & Credit Card Accounts 108

Goals 109

Connect Accounts 111

Banking Center 112

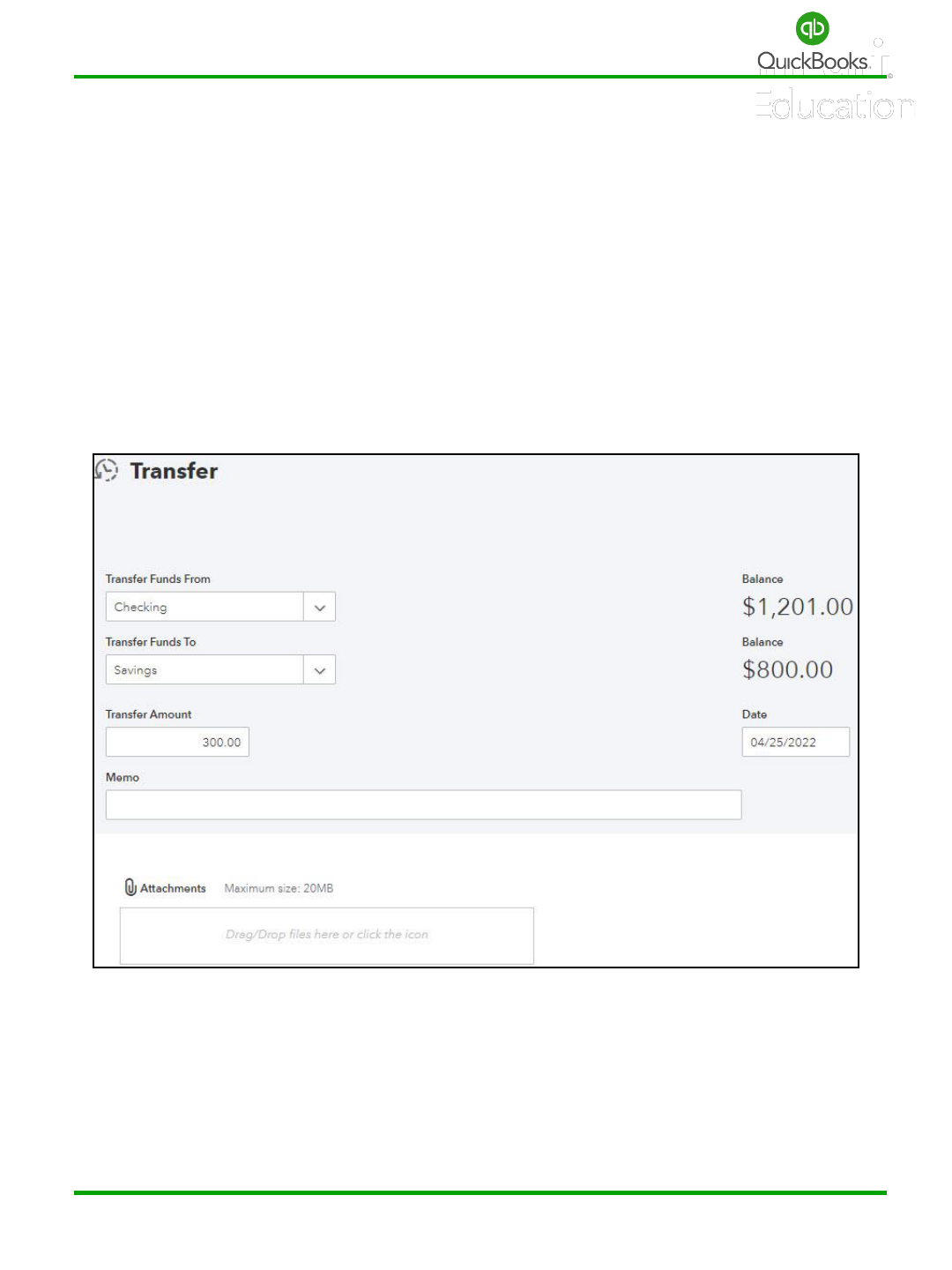

Transfers 123

Reconcile Accounts 124

Doable Action Steps 129

Section 7 - Understanding Your Numbers 130

Goals 131

Balance Sheet 133

Profit and Loss 139

Ask My Accountant 142

Audit Log 144

Closing Date 145

Doable Action Steps 147

Section 8 - Accounts Payable (A/P) 148

Goals 149

Vendor Center 151

Contractors 157

1099s 158

Expenses 162

Checks 163

Bills 164

Pay Bills 165

Bill Pay for QuickBooks Online 166

Vendor Credits 167

Apply Vendor Credits 168

A/P Reports 169

Doable Action Steps 170

8

QuickBooks Online Foundations

Table of Contents

Section 9 – Accounts Receivable (A/R) 171

Goals 172

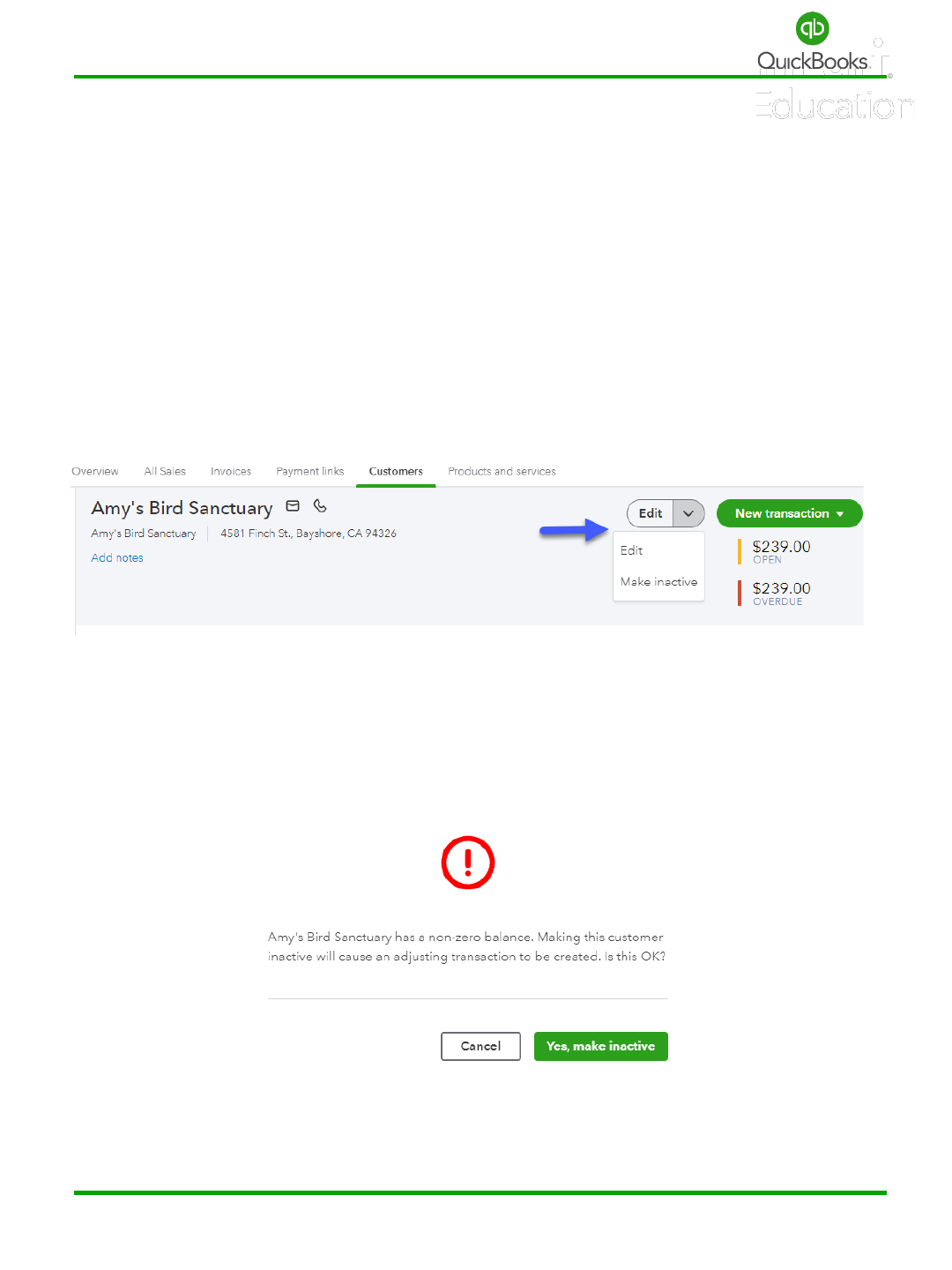

Customer Center 174

Sales Receipts 182

Bank Deposits 184

Invoices 186

Receive Payments 187

QuickBooks Payments 189

Credit Memos 190

Apply Credits 191

Refund Receipts 192

Sales and A/R Reports 193

Statements 195

Doable Action Steps 197

Appendix A – Additional Features 198

Appendix B – Glossary of Terms & Keyboard Shortcuts 202

Appendix C – Resources 207

9

10

SECTION 1:

A BUSINESS OWNERS JOURNEY

The Business Owner’s Journey

Case Study Storyline

Online Foundations

QuickBooks Online Foundations

The Business Owner’s Journey

As a business owner moves through various stages of building and growing a business, from

inception to the realization of goals, it is important to track data every step of the way to

help guide us to entrepreneurial success. You may be surprised to learn that most action

steps in a business intertwine directly with your accounting application. For this reason, it

is important to set up QuickBooks Online early in the business journey to save significant

time, money and stress!

Let’s consider why this matters. One example includes the fact that qualified business

expenses are often overlooked, forgotten or lost in the shuffle. Let’s say you stopped by the

local office supply store to grab a new headset. If QBO was already set up, you would

simply open the app on your phone, snap a picture of your receipt, make a few selections

and the software takes care of the rest. QBO attaches the receipt to the transaction,

correctly codes the transaction and does the bookkeeping for you. Next time you go to

“Expenses” in QBO, you can find exactly what you are looking for in seconds.

Another example includes setting up your business bank account and company credit card.

Did you know with one action step you can import every transaction from both, have them

correctly coded and entered in the correct location in the accounting app? You can log into

one place, QBO, to check bank balances, see what cleared and what is outstanding, see

how much people owe you and how much you owe, look at cash flow projections and

more!

It is wise to set up your accounting app in early stages to save time on manual data entry.

11

QuickBooks Online Foundations

Case Study Storyline

Throughout the Introductory and Advanced training sections, we follow the journey of

small business owner, Chris Craig, owner of Craig’s Landscaping. Chris is a landscaping

specialist with training in water and soil conservation. Her company, located in San Pablo,

CA, is a full-service landscaping company servicing commercial and residential clients with a

focus on new construction. Services include landscape design and implementation,

installation of irrigation systems, trees, flowers, shrubbery, sod, concrete, rock, etc. Services

also include mowing and clean-up, pest control, trimming, and more. The company

provides monthly subscription services as well as services on an “as needed” basis.

Craig’s was established as an S-Corp Limited Liability Company (see Appendix for additional

information on S-Corps) and uses the 1120 S Tax Form to file taxes. Chris currently has two

employees. Craig’s Landscaping is required to collect sales tax on items the company sells

such as trees, fountains, etc. She has established a goal of building a 2-million-dollar

business over the next 2 years, increasing the number of employees, trucks, locations, etc.

Chris understands to thrive, she needs a solid financial foundation in place and an in-depth

understanding of how to use financial data to continually improve company performance.

Let’s begin by guiding Chris through the important process of setting up her accounting

application, QuickBooks Online®, to track all money flowing in and out of the business. It is

an important early step, as the automation built into the application completes much of the

bookkeeping process. By eliminating most of the manual data entry, Craig’s Landscaping

will be a more profitable company. As we help Chris become the hero of her own story,

consider how each section pertains to your own business. Do not hesitate to ask questions

if you see numbers, categories, or anything else you do not understand.

Let the adventure begin as we watch the data come to life and take on meaning!

12

13

SECTION 2:

GETTING STARTED IN

QUICKBOOKS ONLINE

Goals

Features

Setup Your Company File

Navigation

Doable Action Steps

Online Foundations

QuickBooks Online Foundations

Section 2 Goals

Upon completion of Section 2, each participant will be familiar with:

• How to use additional features.

• How to choose the right subscription for your business.

• How to setup a company file.

• How to navigate using QuickBooks Online Plus.

Chris Craig understands “order of operations” is important when taking steps to set up her

accounting application, however, she has no idea where to begin and what to do in what

order. Chris considers financial literacy to be outside of her skillset and is intimidated by her

lack of understanding of financial data. Not to worry, this training is the first step to gain in-

depth understanding of what the numbers mean.

Now that the entity selection has been made (S-Corp), Craig’s Landscaping has been

registered with the State, IRS, etc., Chris is ready to implement best practice policies related

to the daily management of the business.

Her first step is to learn about the financial tools built into QuickBooks Online and how they

can help her grow a profitable business. Chris then needs to setup and customize Craig’s

accounting application to meet the company’s specific needs and begin tracking all money

flowing in and out of the business.

Let’s follow Chris as she learns to navigate the powerful features in QBO. Economic analysis

by Sage and Plum Research estimates the use of accounting software could save a small

business upwards of $24,000 per year, equivalent to getting 27.6 days a year back to focus

on revenue-generating activities. WOW!

While progressing through the training, give some thought to which features best meet the

specific needs of your business.

14

QuickBooks Online Foundations

Features

Chrome Browser

Chrome is the recommended browser used to access QuickBooks Online. There are a few

things you need to know going forward.

Cookies and Cache

If you receive an error message when trying to access your company file:

Click the three dots in the upper right section of the Chrome browser.

Click More Tools.

Click Clear browsing data.

15

QuickBooks Online Foundations

Features

Select the Time range, Cookies and other site data, and Cached images and files.

Click Clear data.

Create Bookmarks to save favorite pages. Click the Star on the right top of the browser bar

to create bookmarks. Choose a name and select a folder, then click done. Incognito Mode

“referred to as private browsing” is a privacy feature that disables the browsing history of

Chrome.

16

QuickBooks Online Foundations

Features

Multiple Windows

Web-based applications utilize the functionality of web browsers. Imagine working in

several different windows in your QuickBooks® Online company file. Log in to your

company data file (in this example we will use Google Chrome).

Right click the QuickBooks Tab -> Duplicate. You now have multiple windows open for your

data file and can perform multiple tasks. This is a great way to enter and review historical

transactions during the setup or cleanup process.

Another way to access multiple windows is as follows:

After logging into QuickBooks® Online go to the URL/address bar and copy (Ctrl + C) the

website’s address. Then, open a new tab. Paste (Ctrl + V) this address into the window.

The tabs are as follows: first tab – Dashboard, second tab – Search, and

third tab – Bank Deposit.

Note: In Chrome you can create an additional user specifically for QuickBooks® Online. You

can then save all your favorite tabs/pages and have them available when you log in to your

company data file.

17

QuickBooks Online Foundations

Features

QuickBooks Online Mobile App

The QuickBooks Online Mobile App allows instant access to your QBO data from

your mobile device. More and more business owners are on the go and need easy and fast

visibility to their accounting data. You can create multiple types of transactions and attach

supporting documents or photos from your mobile app. Download the QuickBooks® Mobile

App to your Android phone, iPhone, or tablet. Once you complete the installation, log in to

your company file.

QuickBooks Mobile App

Compare Mobile App Features

How to Use the QuickBooks Mobile App Tutorial

How to Attach Receipts Using Your Mobile Phone

Log in to your company data file from a computer. Click the Search icon and select the

transaction you just created from your mobile app to add or change information as needed.

Verify the receipt photo/document is now available in the attachments list.

18

QuickBooks Online Foundations

Setup Your Company File

Setup Wizard

Complete the following steps to successfully create your new Intuit QuickBooks Online

Account. Fill in the required fields -> Create Account -> Next.

If you have an existing Intuit account, click Sign in -> Username or Email -> Password.

Verify your account. Click Continue.

Next, you will see a “Welcome! We’re glad you’re here” window. Click Next.

19

QuickBooks Online Foundations

Set Up Your Company File

For the Legal business name, use the exact legal business name used when you set up your

entity (to prevent problems with the IRS). Click Next.

Next, select the best option relevant to your situation. Are you importing from QuickBooks

Desktop, using another financial application, spreadsheets or other? If you are not

importing data, choose Nothing, I’m just getting started. Click Next.

20

QuickBooks Online Foundations

Set Up Your Company File

Search and select the industry specific to your business. This will auto-populate a basic

Chart of Accounts category list. You will learn how to manage your Chart of Accounts later

in the training.

Important! If you leave the field blank and click Skip for now, less account categories will

auto-populate. This will reduce the amount of time you spend on customizing your Chart of

Accounts.

Select the entity type used when setting up your business. Click Next.

21

QuickBooks Online Foundations

Set Up Your Company File

Select the options that apply to your company. Do you provide services, sell products, or

both? Click Next.

What is your role in the business? Select the option that applies, click Next.

22

QuickBooks Online Foundations

Set Up Your Company File

Who helps run your business? Select the option that applies. Click Next.

Note: If you choose, I fly Solo, you can always add payroll and contractor info later.

The next window that appears is based on your selections above. If you choose employees,

an option to add a payroll subscription will appear. Click I don’t want to add payroll.

Next, click Skip for now. You can always connect third-party applications later.

23

QuickBooks Online Foundations

Set Up Your Company File

Would you like to continue setting up your QuickBooks company file or explore a little first?

You can click Skip for now, if you're not sure.

You can link bank and credit card accounts to manage data from the Banking Center. We

will cover the banking section more in depth later in the training. Click Skip for now.

24

QuickBooks Online Foundations

Set Up Your Company File

You have the option to setup customer invoices and track receipts and bills. Click Skip for

now.

What is everything you want to setup? Check all options to match the screen shot below.

Click Next or Skip for now. You will see a window pop up, We’re almost ready to dive in!

Click Let’s Go.

25

QuickBooks Online Foundations

Navigation

Let’s start with Navigation and master moving around QuickBooks Online. There are two

ways to view the left navigation bar. Click the Gear icon.

Click Switch to Accountant or Business view.

26

Left Navigation Bar

Business View

Note: We will use Accountant vs. Business View for the remainder of this training.

Your subscription may look slightly different depending on which version you are

using. It is also possible updates have been released.

Left Navigation Bar

Accountant View

QuickBooks Online Foundations

Navigation

Left Navigation Bar (Business View)

The Business view allows you to customize and bookmark centers and features. It is a

different view and way to organize your centers and features.

27

Use the + New icon to manually input data for Customers,

Vendors, Employees and other.

The links on the left side act as your menu bar and will take

you to frequently used areas in QuickBooks® Online.

Post Bank and Credit Card transactions in the Banking

Center.

View Expense history and Vendor information.

Access Sales, Customers and Products from the Sales

Center.

Manage Customers and Leads.

Run Payroll and Track time.

Review and maintain Sales and Payroll taxes.

Customize the list, create and manage Bookmarks.

Click the dots to the right of the name in the Left Navigation Bar. Select Customize this

menu to create a custom list using the Bookmark feature.

QuickBooks Online Foundations

Navigation

Left Navigation Bar (Accountant View)

This view comes organized and is more specific to features related to the centers. You do

not have the Bookmark feature in this view. Note: This is a personal preference. You can

switch between the views.

28

Use the + New icon to manually input data for Customers,

Vendors, Employees and other.

The links on the left side act as your menu bar and will take

you to frequently used areas in QuickBooks® Online.

Post Bank and Credit Card transactions in the Banking

Center.

View Expense history and Vendor information.

Access Sales, Customers and Products from the Sales

Center.

Manage Projects and Workers.

Run Payroll and Track time.

View and customize reports.

Review and maintain Sales and Payroll taxes.

Track your Mileage.

Maintain your Chart of Accounts categories.

Invite an Accountant or find a ProAdvisor.

Explore the Application Marketplace.

QuickBooks Online Foundations

Navigation

Dashboard (Getting things done).

Once the new company setup process is complete, you will automatically land on

the Dashboard (Getting things done) tab. The icons shown in the screen shots

below are shortcuts to various areas of QuickBooks Online.

Feel free to click and explore. You cannot hurt anything by navigating

through the clickable icons.

29

QuickBooks Online Foundations

Navigation

Dashboard (Business Overview).

Monitor the activity and status of your company, access your data and drill down to

detailed information with a simple click.

You can access Customers, Vendors, Transactions, and Reports. You can also organize and

monitor Bank and Credit Card accounts, review Income and Expenses, and watch Sales

trends.

Tip: Click anywhere there is a word in bolded color, an icon, a drop-down arrow, etc.

Feel free to explore without worry!

Let’s begin!

30

QuickBooks Online Foundations

Navigation

31

Sales

The Sales section of the

Dashboard displays a

graphical view of sales

for the prior month.

Click the drop-down

arrow next to Last

Month to change the

period for which the data

is displayed.

Profit and Loss

This section of the

Dashboard provides a

graphical view of your net

income, income, and

expenses for the last 30

days.

Click the drop-down arrow

next to Last Month to

change the period for

which the data is displayed.

QuickBooks Online Foundations

Navigation

32

Expenses

The Expenses section of the Dashboard

allows you to view a graph of expenses

broken down by amounts based on the

last 30 days.

Scroll your mouse over the graph to

create a pop-up of expenses related to

specific categories.

Click the drop-down arrow next to Last

Month to change the period for which

the data is displayed.

Income

The income section of the

Dashboard allows you to view

Invoices that are open, overdue,

and paid in the last 30 days.

Click the Invoices color bars to

view and manage a detailed list

of open invoices currently owed

to you by your customers.

QuickBooks Online Foundations

Navigation

Access and manage bank accounts from the Dashboard. Turning on the Privacy button will

hide the bank balances. Change the order of how your accounts are displayed and access

registers. You can connect bank and credit cards accounts here and in the Banking Center.

Note: The order displayed here will be the same in the Bank Center.

33

QuickBooks Online Foundations

Navigation

The + New icon in the Left Navigation Bar provides access to data input windows. This is

where you go to Create Invoices, Receive payments, Enter Expenses, Checks, Bills and

more. Although you will spend most of your time in the banking center, you still need to

know how to enter transactions manually.

Click the (+ New) icon to create manual transactions.

Tip: Always enter data from “top to bottom, left to right’ to avoid missing fields that require

information.

Additional Icons include Help, Search, Notifications and Settings. Click the Help icon to

address questions for specific areas of QuickBooks®. Click the Bell icon to view recent

notifications and the C icon to sign out.

34

QuickBooks Online Foundations

Navigation

The Search (magnifying glass) icon at the top of the Dashboard will allow you to easily

search recent and historical transactions.

Click the Search icon.

Enter a transaction number, date, amount etc.

for a simple search.

Click Advanced Search to filter specific transaction types and more. Click the down-arrows

to the right of All transactions, Reference no. or Contains. to access additional search

options.

35

QuickBooks Online Foundations

Navigation

Click the Gear icon at the top right of your Dashboard to access company default settings,

lists, and tools.

Logo

Click the Logo icon to add your custom company logo from your desktop or hard drive.

36

QuickBooks Online Foundations

Section 2 Doable Action Steps

All business owners should complete this section and apply the knowledge to their own

company file. Remember! You can always refer to various sections of training if you need

additional reminders of how features works.

1. Review Video Links - Ctrl + Left Click

Billing and Subscriptions

How to Get Started with QuickBooks Online

How to Use QuickBooks Mobile App

2. Choose your Subscription and signup if you have not already done so.

3. Explore these features:

Chrome – Clear your cookies and cache.

Multiple Windows – Create a duplicate window.

Mobile App – Go to the app store and install QuickBooks Online on your mobile device.

4. Dashboard - Click through words in bold as well as icons, drop-down arrows, etc.

5. Left Navigation Bar – Choose your view, then click on the Centers and explore.

6. + New – Learn how to navigate this menu and click through various options to become

familiar with the different fields per window.

7. Search - Become familiar with search filters.

8. Gear – Learn to navigate the Gear menu and click through various options.

37

38

SECTION 3:

SET UP YOUR NEW

QUICKBOOKS® ONLINE COMPANY

Goals

Account and Settings

Manage Users

Chart of Accounts

Doable Action Steps

Online Foundations

QuickBooks Online Foundations

Section 3 Goals

Upon completion of Section 3 each participant will be familiar with:

• How to manage Account and Settings default preferences.

• How to set up and manage Users.

• How to import Lists.

• How to set up and use the Chart of Accounts, and how it connects to all

transactions.

Now that Chris understands how to navigate QBO and where to locate important features,

it is time to customize the application for Craig’s Landscaping. Let’s help her select settings

that will best serve the needs of her business in the Accounts and Settings section, then

move on to set up Users and Permissions.

To eliminate the need to hand enter data, let’s also walk Chris through the process of how

to import lists. We will then help her establish the all-important Chart of Accounts (COA), a

financial tool that provides a complete listing of every account in the general ledger of a

company, broken into subcategories.

QuickBooks is a very forgiving program. Most mistakes can be fixed, as you can go back and

make historical changes. However, a correct setup will prevent the need to do so.

An accurate accounting software setup and optimized Chart of Accounts is very

important. After attending the training, if you need additional help customizing the

application to meet the unique needs of your business, please reach out to your

Accountant for assistance.

39

QuickBooks Online Foundations

Account and Settings

Use Account and Settings to turn on/off QuickBooks® Online features. It is important to

turn off features you will not be using because it creates less fields during the input

process. It is OK to turn on features as the need arises. This creates more efficiency and less

guess work.

Although it is simple to turn settings on and off, it is important to set up your company

settings and data correctly. Seek help from your Instructor/Advisor if you find you are

“guessing.”

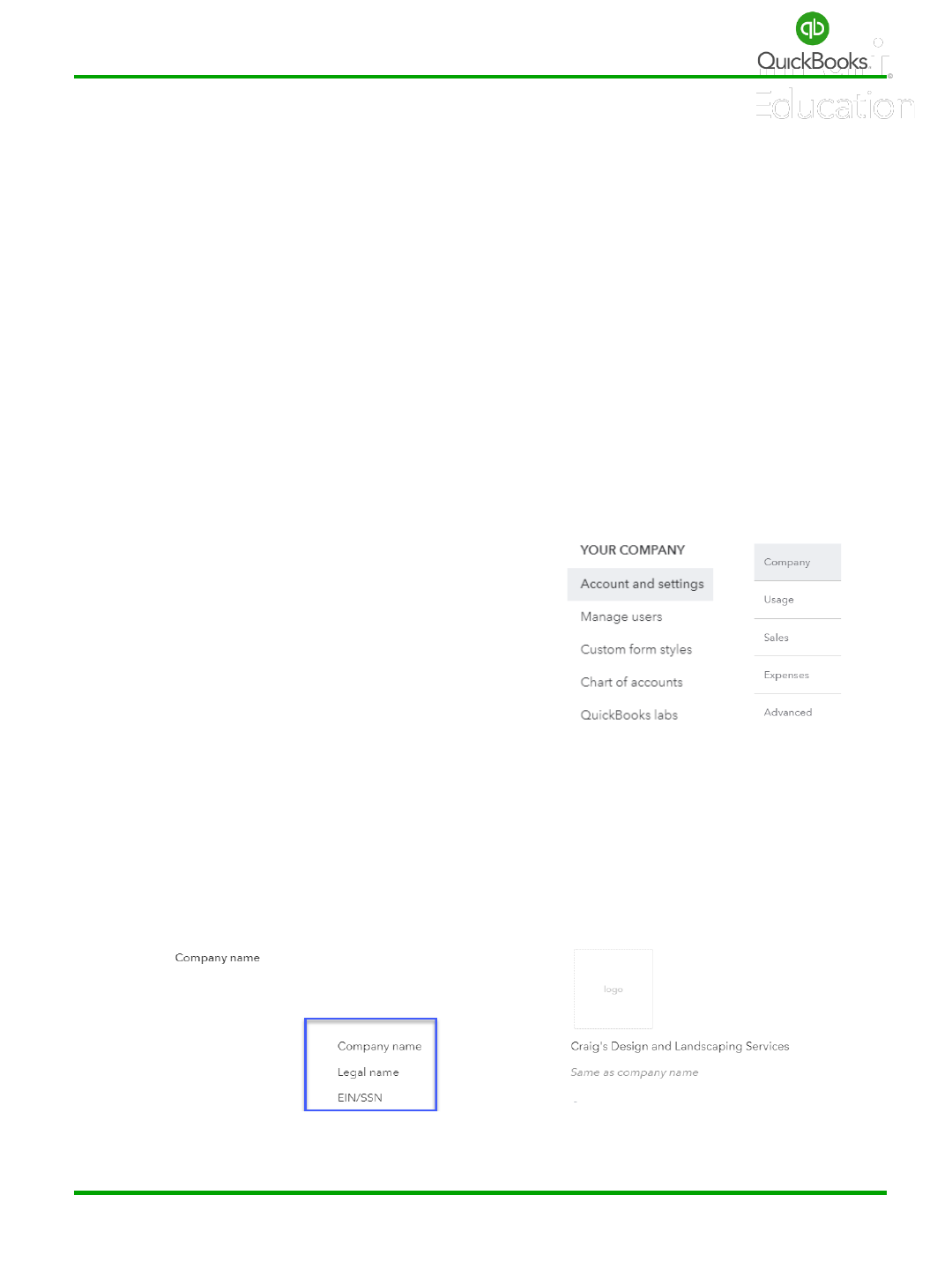

Click the Gear icon to review, edit, and turn on/off settings.

Click Account and Settings.

Click the Company tab in the left menu bar;

then click the setting you choose to edit or

click the pencil on the right side of the screen.

Company Name

Add a customized logo, verify your company name, or add a legal name and EIN to match

the information on the company tax return. Click Save anytime you change settings.

40

QuickBooks Online Foundations

Account and Settings

Company Type

Select the legal entity type you will use when filing your tax return, then select industry

type. Click Save.

Contact Info

Verify or edit contact info. Click Save.

Address

Verify or edit your company address. Click Save.

41

QuickBooks Online Foundations

Account and Settings

Communications with Intuit

Click Marketing Preferences to allow or disallow promotional offers from Intuit.

Usage

Click the Usage tab in the left menu bar.

This is where you monitor users and

account categories limits. If you reach the limits,

you will be required to upgrade your subscription.

42

QuickBooks Online Foundations

Account and Settings

Sales Settings

Click the Sales tab in the left menu bar.

Click the setting you choose to edit or

click the pencil on the right side of the screen.

Customize

Click Customize Look and Feel to customize invoices, estimates, and sales receipts.

You can edit the existing standard template or create a new custom template.

Click New Style. Select Style and choose the type of sales form you would like to customize.

Select a template, add a title and logo, choose a color scheme, and preview the form.

Let’s choose Invoice for this example.

43

QuickBooks Online Foundations

Account and Settings

44

Select the Design tab to change your invoice template, add a logo, modify color schemes,

change font sizes, or print a sample.

Select the Content tab and then click on Invoice Form to change the header, form name

and numbers, or displayed information, or to add a customer field.

Select the Emails tab to change the outgoing email subject and default message. Note:

Do not overlook the Reminder Email feature.

Select the Payments tab to add ACH and Credit Card payment options to your sales

forms. Note: This will require you to sign up for Intuit Merchant Services.

Click Preview PDF to review the sales form or click Done.

QuickBooks Online Foundations

Account and Settings

Sales Form Content

Click Sales Form Content to select and turn on/off settings for sales forms.

Preferred Invoice Terms sets the default payment date. "Net 30" means payment is due 30

days from the date used to create the invoice.

Preferred Delivery Method will allow you to set a preferred default to print or send sales

forms later.

Shipping adds a shipping field to sales forms.

Custom fields can be added and managed in Gear settings -> Lists -> Custom fields.

Custom Transaction Numbers allows you to choose your own numbering system.

Service Date creates a service date field. This tracks the dates services were performed

when they are different from the invoice date.

Note: When you turn on the Shipping feature, be sure to add the default shipping account

category in the Advanced->Chart of Accounts Settings.

45

QuickBooks Online Foundations

Account and Settings

Discount will add a discount field to invoices.

Deposit adds a deposit field to invoices and allows you to offset the balance owed with

amounts paid before the service was completed.

Note: Once you turn on Discounts, you will need to add a discount account in the

Advanced -> Chart of Accounts Settings.

Tips and Gratuity- Adds a tips field to sales forms. Select (Just Me) to record tip income or

select (My Team) to track tips that need to be paid out to your team.

Note: Once you turn on Tips and Gratuity, you will need to add a Tip Income (Just Me)

account or Tips Payable (My Team) account in the Accounts and Settings->Advanced->Tips

Payable Account.

Tags allow you to create tags and tag groups to customize the way you track information.

(Recommended feature we will cover in more detail later in the training.)

46

QuickBooks Online Foundations

Account and Settings

Click Products and Services to turn on/off desired settings.

Show Product/Service column on sales forms adds a column so you can choose from the

list of products or services.

Show SKU column allows you to track products and services by SKU number.

Turn on price rules allows you to provide discounts for specific products to certain

customers for a specified amount of time.

Track quantity and price/rate adds a field to show quantities and pricing on sales forms.

Track inventory quantity on hand allows the tracking of products you buy, store and sell.

Late Fees allow you to automatically apply a flat fee or percentage to outstanding invoices.

Select “Default charge applied to overdue invoices” to turn this feature on. Select Flat fee

or Percentage of remaining balance and continue to select the required information. Click

Save.

47

QuickBooks Online Foundations

Account and Settings

Progress invoicing

Progress invoicing allows you to create multiple partial invoices from a single estimate.

(This feature is great for contractors providing services for new construction.)

Messages

Click Messages to add a default email message sent with sales forms, invoices, estimates,

credit memos, sales receipts, statements, and refund receipts.

Click Email me a copy to receive a copy of emailed sales forms

48

QuickBooks Online Foundations

Account and Settings

You can include a Cc or Bcc email as well. Your default message sent with sales forms can

be changed when creating estimates, invoices and other sales forms.

Note: A default email message sent with reminders is also available.

Click Reminders to change the default subject and email message. Turn on Automatic

invoice reminders and let the system do the work for you.

49

QuickBooks Online Foundations

Account and Settings

Online Delivery

Click Online delivery to attach sales forms as a PDF, show summary or detail, and change

your email text preference.

Statements

Click Statements to change settings to display all your customers’ unpaid transactions by a

single line item or include detail. Show aging table displays outstanding balances by days

delinquent at the bottom of the statement. Send a courtesy statement when customers are

no longer current. Click Save->Done in the bottom right corner.

50

QuickBooks Online Foundations

Account and Settings

Expenses

Click the Expenses tab in the Account and Settings

menu bar and then click the setting you choose to edit

or click the pencil on the right side of the screen.

Bills and Expenses

Click Bills and expenses to turn on/off settings, add columns on forms, and track expenses.

Show Items table on expense and purchase forms adds products column to forms.

Show Tags field adds a field that allows you to track transactions using tags and tag groups.

Track expenses and Items by customer adds a column to track transactions by customers.

Make expenses and items billable adds a column to track expenses billable to the

customer and gives you the option to add a default markup rate.

Track billable expenses and items as income allows you to use one or multiple income

accounts to track billable expenses. Note: Go to Advanced > Chart of accounts > Billable

expenses income account.

Default bill payment terms is used to set default terms for bills, such as net 30.

51

QuickBooks Online Foundations

Account and Settings

Purchase Orders

Click Purchase orders to turn on/off Use purchase orders and create custom fields.

Purchase orders are used to track product purchased from vendors. This is helpful when

tracking open orders for inventory and in comparing costs to actual bills.

Custom fields allow you to add extra fields to Purchase Orders to track information using

custom reports.

Custom transaction numbers allow you the option to use your own numbering system. If

this is not checked, QuickBooks® Online will automatically assign a number.

Default message on purchase orders adds a default message to all Purchase Orders. This

can be changed when adding new Purchase Orders in QuickBooks® Online.

Note: Click Messages to change outgoing email messages specifically for purchase orders.

Click Save -> Done.

52

QuickBooks Online Foundations

Account and Settings

Payments Tab

This is where you manage your QuickBooks Online and merchant service subscriptions.

Time

Click Time to turn on/off and edit settings.

First day of work week sets the starting day of a work week on the timecard entry form.

Add Service field to timesheets is a field used to enter specific services performed.

Allow time to be billable is a feature that tracks billable time by customer.

Show billing rate to users entering time allows users to view the rates you use to invoice

customers.

53

QuickBooks Online Foundations

Account and Settings

Advanced

Click Advanced in the Account and Settings menu bar

and then click the setting you choose to edit or click

the pencil on the right side of the screen.

Click Accounting to turn on/off and change settings.

First month of fiscal year is usually January, based on the calendar.

Some companies use a different month to start their fiscal year.

First month of income tax year lets you click the drop-down arrow to select January or

Same as fiscal year.

Accounting Method includes two Accounting methods for running reports: accrual and

cash. If you use Accounts Receivable and/or Accounts Payable in QuickBooks® Online, then

choose the Accrual basis. If not, then use the Cash basis.

Close the books is a great feature that allows you to close a period and assign a password.

Turning on this setting triggers a warning box that prevents users from changing historical

data, especially important when sales, payroll, and tax returns have been filed.

54

QuickBooks Online Foundations

Account and Settings

Company Type

Tax Form

Click the Tax form drop-down list to select the entity type you used when filing your

company’s tax return. If you are unsure about this, contact your accountant.

Chart of Accounts

Click Chart of Accounts to turn on/off account numbers and assign default income

accounts. This allows business owners to organize their Chart of Accounts categories in a

way that is meaningful to them.

55

QuickBooks Online Foundations

Account and Settings

Categories: Classes

Classes allow you to track transactions in order to gather data and review reports by a

specific class.

For example, Craig’s can track commercial vs residential jobs, or jobs per city to determine

sales by city for state license reporting. The use of classes provides the capability to review

Profit & Loss by class.

Click the appropriate box to turn on Track classes. Then click “Warn me when a transaction

isn’t assigned a class.” This will create an alert when the class entry is missed during the

data entry process.

Assign classes gives you the option to assign classes to a transaction or to individual line

items.

56

QuickBooks Online Foundations

Account and Settings

Locations

Track locations is used to gather data for a specific location, department, property, etc. Not

all businesses need to use locations. An example; Craig’s could use locations to track sales

by county or sales by property address. This provides the ability to review a Profit & Loss by

location.

Automation

Click Automation to turn on/off settings for pre-filled forms, apply credits, and more.

Pre-fill Forms with previously entered content fills form fields with memorized content

from prior vendor, customer, and employee transactions.

Automatically apply credits posts outstanding credits to newly created invoices.

Automatically invoice unbilled activity creates an invoice for tagged transactions waiting

to be billed to a customer. When the invoice is generated, an alert is sent to the activities

section of the Dashboard.

Automatically apply bill payments applies bill payments to the oldest open bill first.

57

QuickBooks Online Foundations

Account and Settings

Projects

Turning on Projects allows you to organize all job-related activity in one place. It allows you

to review all Sales, Expenses, and Time by Project. Here we can track information from a

cost perspective.

Currency

Multicurrency lets you track transactions in foreign currencies. Use it only if you have bank

accounts, customers, or vendors that do not use your home currency. Otherwise, select the

default, Home Currency. Warning! Once you select a home currency, you will not be able

to change the currency. Select Multicurrency

Note: Once you turn this feature on, you cannot turn it off or change your home currency.

58

QuickBooks Online Foundations

Account and Settings

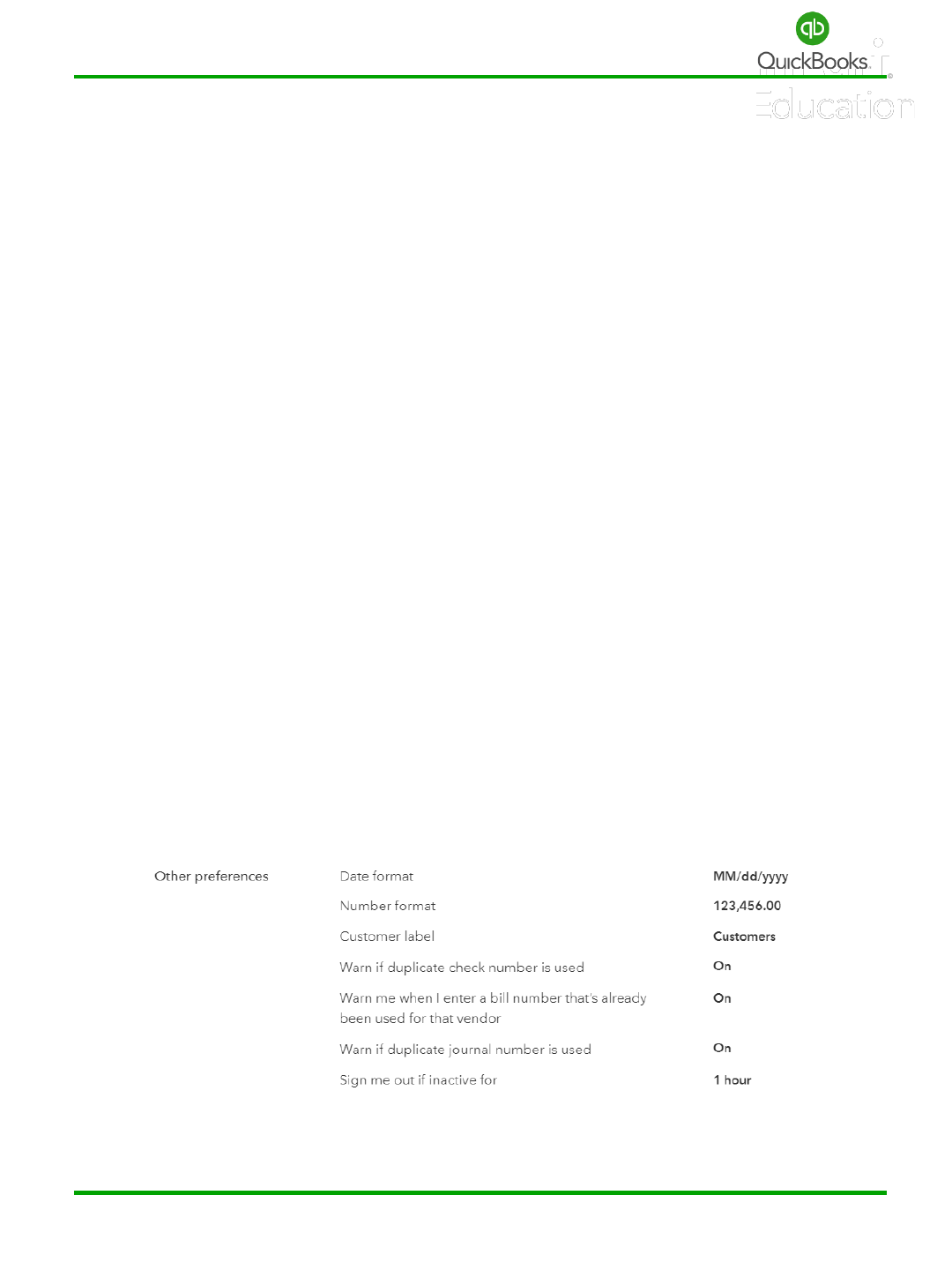

Other Preferences

Click Other Preferences to turn on/off and edit settings that trigger warnings and

formatting preferences.

Date format is a preference with several options.

Number format is a personal preference.

Customer label reflects the type of customers you service or sell to. The label you choose

will appear on the Navigation Menu Bar and transactions related to customers, such as

invoices, sales orders, credit memos, etc.

Warn if duplicate check number is used populates a warning box when a duplicate check is

entered.

Warn me when I enter a bill number that’s already been used for that vendor populates a

warning box when a duplicate number is used.

Warn if duplicate journal number is used populates a warning box when a duplicate

journal entry number is used.

Sign me out if inactive for a period. It let's you choose between 1 and 3 hours. Click Save ->

Done.

59

QuickBooks Online Foundations

Manage Users

When inviting users, you can determine how much or little access a user has to your

company data. Maintaining user access is important to implement checks and balances and

view activity by user. This can serve as a training tool to address and avoid common errors.

Click the Gear icon -> Manage Users.

Select the Users tab to add and customize a user or select the Accounting Firms tab to

invite your accountant. The initial user is known as the primary admin. If you want to

transfer this role to another user, set them up as an admin user and use the action drop-

down menu to transfer the rights to the new user. The new user will receive an email

notification.

60

Note: You can add up to two accountants to your QuickBooks® Online data file in

addition to the number of users your subscriptions allow. In order to do this, your

accountant must subscribe to QuickBooks® Online Accountant.

QuickBooks Online Foundations

Manage Users

Click Add User to add a new user.

Standard User will allow you to select which areas a user can access.

Company admin has access to all areas of QuickBooks® Online Plus.

Reports only will allow users access to most reports; the exceptions are Payroll and

Contact info. They do not count toward your user limit.

Time Tracking only limits users to entering their time. They do not count towards your user

limit.

Click Next and follow the screens until you have successfully added a user.

Note: User options may be limited depending on the type of subscription. This example is

based on the Plus version of QuickBooks® Online.

61

QuickBooks Online Foundations

Manage Users

Continue to click Next until you complete the Add User process.

Note: A box appears with a list of access rights based on your selection.

For those with a Plus subscription, you will have the ability to set the administrative rights

for specific users.

62

QuickBooks Online Foundations

Manage Users

Enter username and email information; an invite will be sent to the user. They will be

invited to accept the invite and create a password.

To invite an accounting firm with administrative rights to your company data,

from the Manage Users main screen click Accounting Firms if your accountant subscribes

to QuickBooks® Online Accountant.

Enter your accountant’s email address and ask your accountant to accept the invite.

63

QuickBooks Online Foundations

Lists

Lists are one of the basic features of QuickBooks® Online. Lists are triggered when turning

on features in Account and Settings. A list is a series of like information compiled into an

organized directory. This helps save time and ensures that information is entered

consistently and correctly.

Click the Gear icon.

Click All Lists -> Select the list you would like to maintain.

64

QuickBooks Online Foundations

Lists

Importing Lists

You can import list information from Excel or Google Sheets to save time. You can import

customers, vendors, accounts, and products and services. You can download a sample file

to see how to set up your import file.

Click Gear icon -> Import data.

Click on the icons to access and download the sample CSV, Excel, or Google template. You

can download or preview a sample file to get started.

Note: What type of lists can be imported? Review above.

65

QuickBooks Online Foundations

Chart of Accounts

The Chart of Accounts is a list of categories that make up your Balance Sheet and

Profit & Loss Statements. Every transaction entered in QuickBooks® will post to the

accounts list. This is how data is compiled to produce important reports used to manage a

business.

Balance Sheet

Assets (what your company owns): bank accounts, petty cash, fixed assets (equipment or

vehicles), inventory, undeposited funds (payments from customers waiting to be

deposited).

Liabilities (what your company owes): accounts payable, loans, sales, payroll taxes.

Equity (the net worth of your company): Money that owners contribute to or draw from

the business and an accumulation of net profits and losses from the start of the business to

present or sale.

Profit & Loss

Income (what you have earned): sales of products, labor, interest, rental income, materials,

etc.

Expenses (what you have spent): office expenses, wages, professional fees, rent, utilities,

etc.

The Profit & Loss Statement shows the net loss or gain for a period. At the end of a

calendar or fiscal year, the net profit or loss rolls into the equity section of the Balance

Sheet.

Note: Keep your Chart of Accounts simple. Add new accounts when you need to track

specific information. Use reports to customize information within an account. Discuss

account changes with your accountant. Start by adding bank and credit card accounts.

66

QuickBooks Online Foundations

Chart of Accounts

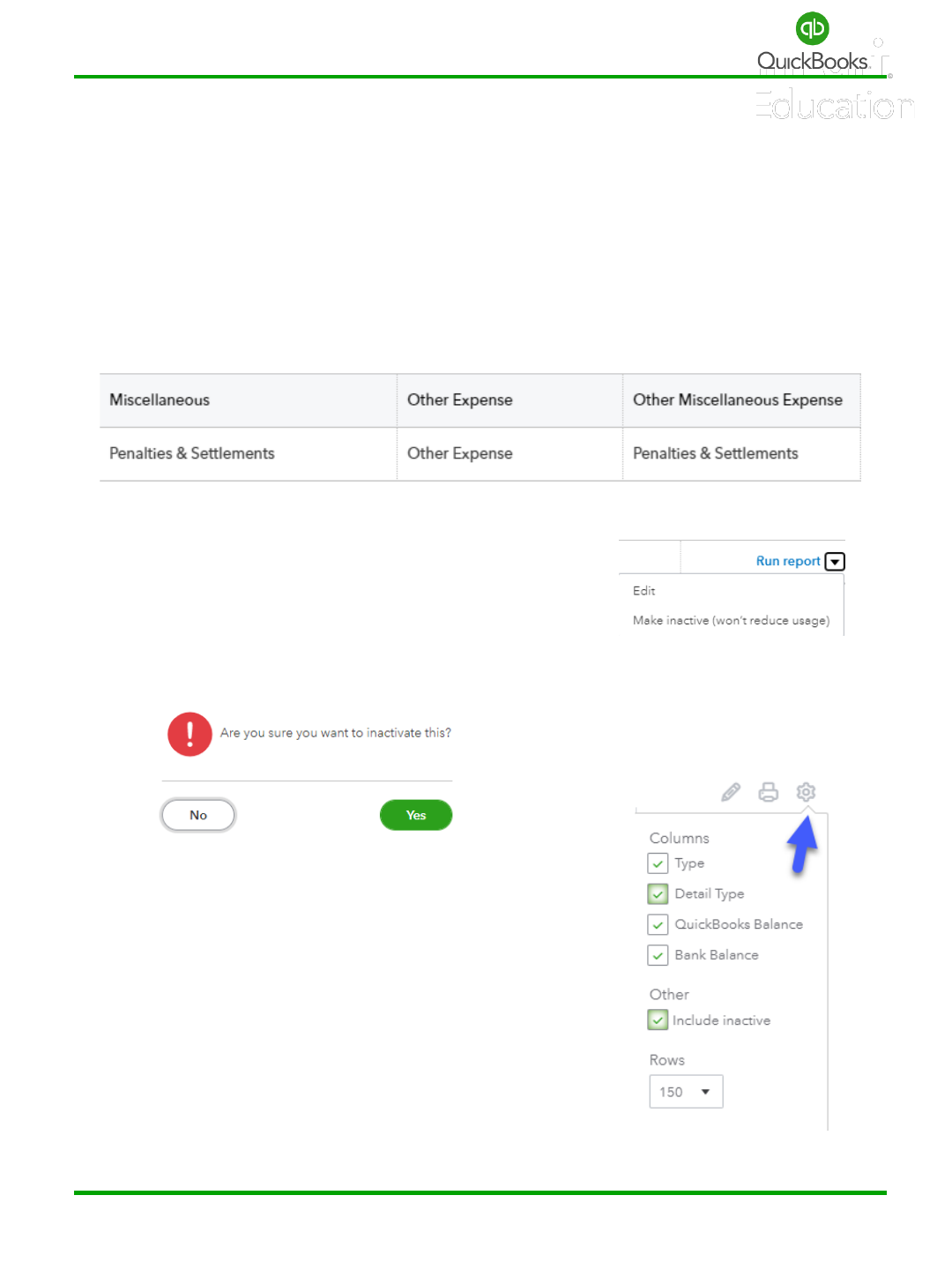

Manage Accounts

Click the Gear icon -> Chart of Accounts.

Or Left Navigation Bar -> Accounting -> Chart of Accounts.

Click View Register to manage transactions for a specific account.

Click the drop-down list to edit, make inactive, or run reports.

Click the header name to sort by column.

Type an account name in the Filter by name field to search for an account.

Select Show all or categories that count towards your usage limits.

Click the pencil icon to edit multiple Chart-of-Account names.

Click the printer icon to print a list of your Chart of Accounts.

Click the gear icon to add/remove display columns, change the number of rows, or include

inactive accounts.

Note: Remember to turn on account numbers in Accounts and Settings if you want to

customize the organization of your Chart of Accounts.

67

QuickBooks Online Foundations

Chart of Accounts

Add Accounts

Click New or the drop-down list to

add an account or import from a .csv file.

Create a new account and name it Ask My Accountant. Set the Account Type to Other

Expense and the Detail Type to Other Miscellaneous Expense. Change the account name

to “Ask My Accountant”.

This will position the account at the bottom of your Profit & Loss Statement, where it will

stand out as a reminder to address or research questionable transactions before processing

financials for the month or year. Click Save and New to add another account or Save and

Close to return to the Chart of Accounts list.

Note: Home Depot and Walmart are not account categories. They are vendors used to

purchase supplies and materials (supplies and materials are account categories).

68

QuickBooks Online Foundations

Chart of Accounts

69

Click New from the Chart of

Accounts List.

Select the Account Type from

the drop-down menu.

In this example we are setting

up a new bank account.

Select the appropriate

Detail Type.

Each Account Type has a

specific detail type list to

select from.

Being consistent with type

choices is important in case

you need to merge

accounts in the future.

Add Bank Accounts

QuickBooks Online Foundations

Chart of Accounts

Edit Account

From the Chart of Accounts list locate the account you would like to edit.

In this example: The Loan Payable is a five-year vehicle loan and should be categorized as a

long-term liability. Current liabilities are usually paid within a year; examples are sales and

payroll taxes, lines of credit etc.

From the Action Menu column, click the drop-down list->Edit.

Use the Account Type drop-down list to change the type from Other Current Liabilities to

Long Term Liabilities. Change the Detail Type to Notes Payable and change the name and

description to be more specific. Remember to click Save and Close.

70

QuickBooks Online Foundations

Chart of Accounts

Make Inactive

From the Chart of Accounts List:

Click one time to highlight the account you would like to inactivate.

For this example, we will inactivate the Miscellaneous account.

Click Make inactive in the action column drop-down list.

An “alert” will pop up and ask you to confirm. Click Yes.

The Miscellaneous account will no longer appear in the

Chart of Accounts List. However, the account is technically

inactive and will appear on the list when you choose

Include Inactive from the gear icon.

71

QuickBooks Online Foundations

Chart of Accounts

Merge Accounts

Merging accounts is helpful if two or more accounts are being used for the same types of

transactions and you want to combine the transactions into a single account.

Caution: The merge process cannot be undone and is permanent. It is important to confirm

that the merge process will not affect the financial statements used to file tax returns.

It is advisable to discuss the cleanup of your Chart of Accounts with your Instructor,

Accountant or QuickBooks ProAdvisor before merging accounts.

In this example we have two accounts being used to track office expenses.

We will merge Accounting with Bookkeeping from the Chart of Account Settings window.

Click one time to highlight the account you will keep, “Office Expenses.”

Click Edit from the Action Column drop-down list.

Note: The Account Type and Detail Type must be the same for accounts you intend to

merge. When merging sub-accounts, both accounts must be a sub of the same parent

account.

72

QuickBooks Online Foundations

Chart of Accounts

Highlight the name Accounting and copy (Ctrl + C) the account name.

Click the Cancel button in the lower left to return to the Chart of Accounts Settings List.

Select the account “Bookkeeper.”

Click Edit from the action column drop-down list.

Highlight the Name Bookkeeper and Paste (Ctrl + V) to replace “Bookkeeper” with

“Accounting.” Click Save -> Yes.

73

QuickBooks Online Foundations

Chart of Accounts

Sub-accounts

Sub-accounts are a great way to organize your Chart of Accounts when used properly.

It is important to select sub-accounts in all transactions and avoid using the main account.

Click New from the Chart of Accounts List.

For this example, we will create sub-accounts for automobile expenses.

Note: The Account Type is Expenses, the Detail Type is Auto, and the Name is Service.

Click the box Is sub-account and select the main account Automobile. repeat the process

to create additional subaccounts for Fuel, License, and Service.

Now that you have created a Main Account for Automobile and sub-accounts for Fuel,

License, and Service, the Chart of Accounts should look like this:

74

QuickBooks Online Foundations

Section 3 Doable Action Steps

All business owners should complete this section and apply the knowledge to their own

company file. Remember! You can always refer to various sections of training if you need

additional reminders of how features works.

1. Watch the video Links - Ctrl + Left Click

How to Set Up Company Settings

How to Customize Invoices and Sales Forms

How to Add & Manage Users for Your Company

Understanding the Chart of Accounts

How to Add Accounts to your Chart of Accounts

2. Review your Company and Account settings and turn on/off features that are specific

to your company. Turn off anything you do not currently need. If you are unsure about

what settings you need, talk to your Instructor/Accountant.

3. Add users (Bookkeeper, Tax Professional, etc.).

4. Customize your Chart of Accounts.

Information that may help - Remember Office Depot, Costco, Walmart, etc. are not

account categories, they are vendors. Another example, Office Expense can include

postage, supplies, printers etc..

75

QuickBooks Online Foundations

Section 3 Doable Action Steps

Important to note: Your subscription will auto-populate some Chart of Accounts categories

based on the industry you choose in the setup process. Here is a sample Chart of Accounts

that auto-populated when the industry field was left blank. (Yours will not look like this.)

Your challenge is to manually add, edit, merge or inactivate accounts to create your own

custom Chart of Accounts. Keep it simple.

76

QuickBooks Online Foundations

Section 3 Doable Action Steps

77

QuickBooks Online Foundations

Section 3 Doable Action Steps

78

QuickBooks Online Foundations

Section 3 Doable Action Steps

79

80

SECTION 4

PRODUCTS AND SERVICES

Goals

Product and Services List

Product and Service Types

Product and Sales Reports

Doable Action Steps

Online Foundation Training

QuickBooks Online Foundations

Section 4 Goals

Upon completion of Section 4, each participant will be familiar with:

• How to set up Products and Services.

• How to manage the Products and Services list.

• How to determine Products and Services types.

• How to review Products and Services reports.

The next step in the Craig’s Landscaping setup process is to create a Products and Services

list. The Products and Services list represents the list of Products and/or Services that a

business sells, a foundational element in QuickBooks Online. Items from the Products and

Services list are used to create Customer Invoices, Purchase Orders, Checks, etc. The list

also interacts with the Inventory feature and keeps track of Inventory on hand, Sales of

specific items and far more.

Chris wants to track Inventory items such as sprinkler and irrigation system parts they stock

and sell customers. She also wants to track non-inventory items, such as special-order

fountains and service items for labor related repairs and installations. While the differences

in these classifications may seem confusing, we will explain these in-depth as we proceed

through this section of training.

WOW! Think Inventory Management is not important? Look at these stats:

• Carrying too much extra inventory can increase costs by as much as 35%

(2020 Easier Accounting)

• 50% of excess Inventory goes unused each year

• Excess Inventory makes up 15-18% in annual carrying costs

• 90% of maintenance, repair, and operations (MRO) Inventory is used less than 6x a

year (Source Grangier Consulting Services)

Setting up the Products and Services list is mandatory in QuickBooks Online, so let’s help

Chris take the next step to establishing her solid financial foundation.

81

QuickBooks Online Foundations

Product and Services

Products and services are required on sales forms, bills, checks, and expenses to track sales

and costs per item.

• Inventory items – Products we purchase, store on a shelf, and sell later. This type of

item is tracked as an Inventory Asset on your Balance Sheet. When we sell an

inventory item, the asset is reduced, and the sale and cost of the item is recorded

on the Profit and Loss as income and Cost of Goods Sold.

• Non-inventory items – Products we do not stock but buy and sell to customers. We

can track how many we have sold without tracking quantity on hand. The sale is

recorded as Income and the purchase is recorded as Cost of Goods Sold on the

Profit & Loss.

• Service items –Services you provide customers such as Installation Fees (fountains,

etc.) and Landscape Design. This type of item also allows us to see how much we

have sold per item.

• Bundle Items – A group of multiple existing items. A Bundle will populate on sales

forms when we use them. This works great when you have recurring invoices with

multiple items that are the same each month.

Note: If you are using a shopping cart or other third-party platform to track sales, you will

need to map the application to QBO if you want to sync the information.

82

QuickBooks Online Foundations

Products and Services List

Products and Services

It is time to set up a list of Products and Services if you are using invoices and sales receipts

to charge customers, generate sales reports and track top selling items.

Click the Gear icon -> Products and Services.

If the following window appears, click Add an item.

If not, continue forward to the next slides.

Select a type to add or click the X to return to the products and services list window. We

will utilize Inventory, Non-inventory, Service, and Bundle items.

Note: You are not required to use the Products and Services list. However, if you intend to

invoice customers, track sales and populate sales reports you will need to create and

maintain a Products and Services list. Products and services allow you to use standardized

descriptions across all customer sales forms.

83

QuickBooks Online Foundations

Products and Services List

Products and Services

It is time to set up a list of products and services you currently offer customers. As you add

items to your list, you can use the following features to manage your products and services.

This will help ensure accuracy between the list and the Chart of Accounts.

Click the Gear icon.

Click Products and Services.

Click the Small Gear to add or remove columns

you wish to display in your Products and Services list.

This will provide information at the time of need.

You can Print or Export your list.

84

QuickBooks Online Foundations

Products and Services List

Search Products and Services

Use the Search and Filter features to find specific items. You can filter by Status (Active,

Inactive, or All), as well as by Type and Category.

Edit Products and Services

Click Edit to change information for a Product or Service.

Click the down arrow to duplicate, inactivate, or

run a report for a service item.

Run Reports or group products/services by Category.

The Product and Services list displays information for

each product or service.

Click the Gear icon to add and remove columns from the list.

85

QuickBooks Online Foundations

Products and Services Types

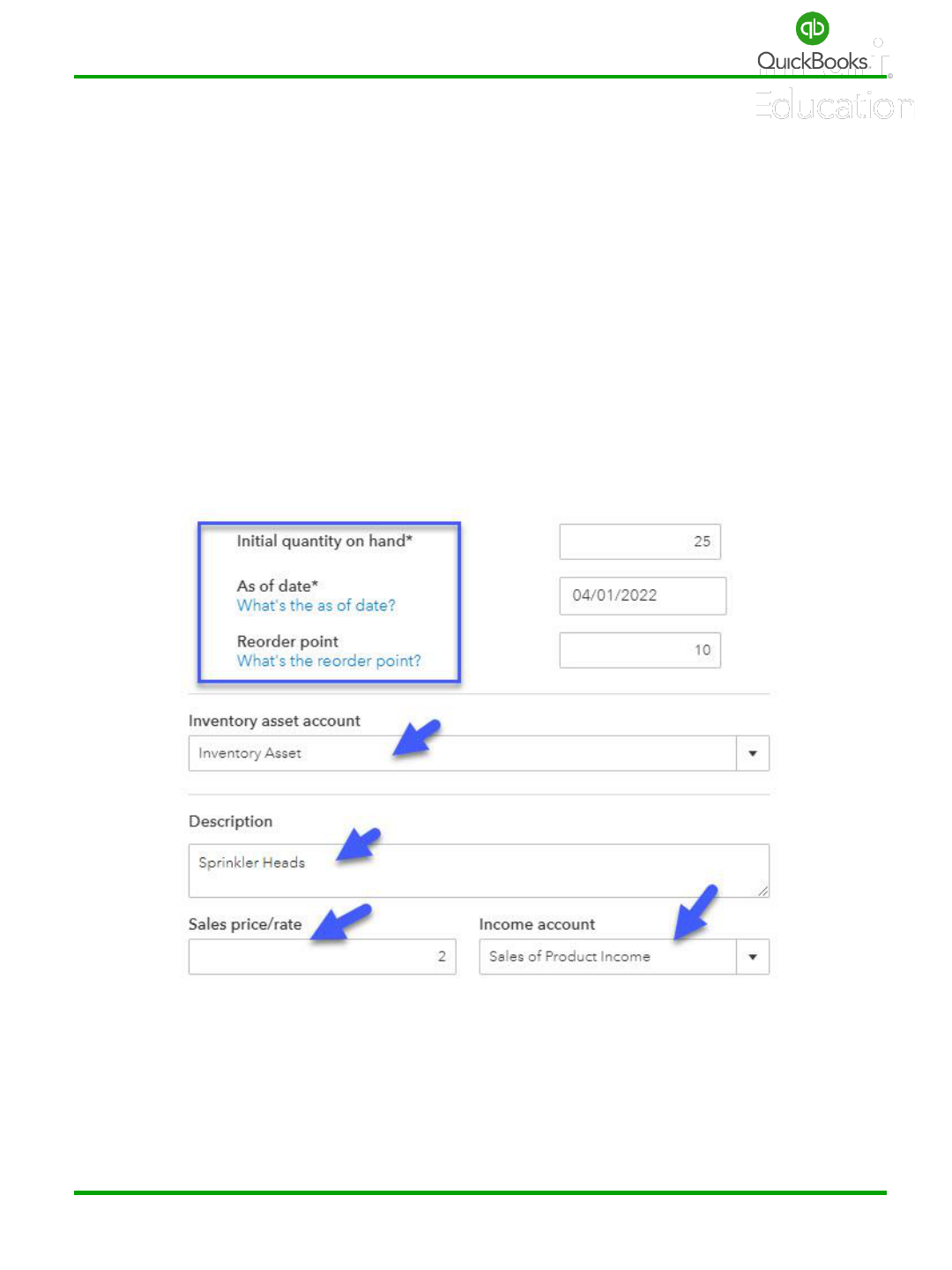

Inventory Item

Inventory items are products we purchase, store on a shelf, and sell later.

Enter the Name of the Inventory item, SKU number if applicable, Upload a Photo of the

product, and organize products by Category.

Click the Gear icon -> select Inventory.

Note: The name and category fields are filled in. Categories help us group Products and

Services. If you are using Classes, you can add a default Class to an item.

Note: Non-Inventory items and Services and Bundles can be reclassified as an Inventory

item if you decide to stock it in inventory at some point. Once you change the type to an

Inventory item, you cannot change it again.

86

QuickBooks Online Foundations

Products and Services Types

When you create an Inventory Item, the quantity and starting value will be zero. It is

important to set the starting value date prior to the date you will use when entering

transactions related to this item. The re-order point alerts us when we are getting low as

we sell those items. The Inventory Asset default account tracks current inventory value on

our Balance Sheet. The description will auto populate on sales receipts and invoices. It is

important to set a default sales price and income account. This helps us track a value for

income on the Profit & Loss. This information is also tracked with Inventory and Sales

reports.

Note: For each product and service, you need to enter an income account in order to

record the sale properly. Products allow you to set reorder points to track low quantities.

87

QuickBooks Online Foundations

Products and Services Types

The last section of an Inventory Item setup is to enter purchase information. Products we

sell are often considered taxable and we are required to collect the tax on behalf of the

state. It is important to select the taxable option to track this information. The purchase

information will auto-populate on purchase orders, bills, checks and expenses. The cost and

expense accounts will track and post information to the Profit and Loss. We will discuss

sales tax, purchasing and inventory later in this training.

Note: What you need to know about Inventory items: Inventory is anything you buy, sell,

and track quantity on hand. Inventory is available with QuickBooks Plus and Advanced.

When you setup an inventory item, you must specify the quantity on hand as the starting

point (even if it is zero). You can adjust the quantity on hand. Use the Open Purchase Order

Detail report to see the inventory items that have been ordered and are waiting to be

received.

88

QuickBooks Online Foundations

Products and Services Types

Sales Tax

As you create new taxable products or items, you can edit the sales tax default options. It is

important to carefully set the default for each item. This will help with accuracy to ensure

you apply the correct rates and prevent errors when collecting and reporting to your sales

tax agency.

89

QuickBooks Online Foundations

Products and Services Types

Non-Inventory Item

Non-inventory items are products we sell to customers without tracking quantity on hand.

We purchase them specifically for jobs and projects. This type of item gives us the ability to

track sales of items without having to keep track of inventory.

Click the Gear icon -> Products and Services -> New -> select Non-Inventory.

Note: The name and category fields are filled in. Categories help us organize products and

services and you can change the type after you create the product or service in the system.

In our example, fountains can be purchased as Inventory items and made available for sale,

or they can be treated as Non-inventory which allows the customer to order a specific

fountain for a specific project.

90

QuickBooks Online Foundations

Products and Services Types

Notice the box, “I sell this product/service to my customers”, is checked. A sales price and

income account are required. This Non-inventory item is taxable. We do not check the box

“I purchase this product/service from a vendor” when we do not purchase the item from a

supplier to resell. An example would be a product you create from multiple other parts and

sell it as a whole product. In this case, we do purchase custom items from vendors for

specific jobs. However, we do not store them as inventory. Important! Remember to verify

your sales tax default settings.

91

QuickBooks Online Foundations

Products and Services Types

Service Item

A Service item is used to track all services you provide customers.

Click the Gear icon -> select Service.

Notice you can change a service item type after you set up the service. This helps to fix

errors when setting the type incorrectly.

Note: The sales tax field would be set to “Nontaxable”; the purchase information does not

typically apply to service items. Simply uncheck the box “I purchase this product/service

from a vendor.” We would not need a ‘Design’ income category since we are tracking sales

by service. We already have it set up as a Service item tracked through reports.

92

QuickBooks Online Foundations

Products and Service Types

Bundle

A bundle is created when we group individual items together as a package. This helps to

populate several line items on a Sales Receipt or Invoice using one item made up of

multiple items. Each individual item has its own default setting, then is grouped in the

bundle.

93

QuickBooks Online Foundations

Product and Services Reports

Do not overlook the power of reports and the importance of consistently utilizing the

information to manage your business. In most Centers or areas of QuickBooks Online, you

will find useful reports to help develop a deeper understanding of your business and how to

use the financial data to continually improve company performance. Reports can be very

powerful when the data is accurate.

Click Reports in the Left Navigation Bar -> Standard -> Search Sales to locate the following

reports, (save them as favorites):

Sales by Products/Services Summary provides a summarized view for all sales of Products

and Services. When sorted in descending order, we can see our top selling products or

services instantly.

Sales by Products/and Services Detail - Provides detailed information for sales of Products

and Services.

94

QuickBooks Online Foundations

Section 4 Doable Action Steps

All business owners should complete this section. Apply the knowledge to your own

company file. You can always refer to the training in each section if you need a friendly

reminder.

In order to record sales and invoice customers, we need to set up our Products and Services

items. Remember, this allows you to track sales by Product or Service to determine top

selling Products and Services. Chris has determined items that will be used when recording

sales going forward.

Profit and Pricing Analysis Best Practices

The success of your business depends on how well finances are managed. Unfortunately,

many business owners do not understand exactly where they are making money. In order

to properly manage and grow your business, you must identify ways to sell more Products

and Services at the most profitable margins. The Implementation of Pricing best practices

will help you understand what price point to sell Products and Services, identify where you

are making money and where you are not profitable, and provide needed direction in how

to improve company performance.

Once your accounting application is up and running and you have at least several months of

data, we recommend the following:

1. Sales and Profit Forecasting

2. Comparing Cost of Goods Sold to Sales Price

3. Analysis of Profit Margins by Product Line

4. Learning about Volume, Cost and Price Drivers and applying the knowledge to your

own data.

95

QuickBooks Online Foundations

Section 4 Doable Action Steps

All business owners should complete this section and apply the knowledge to their own

company file. Remember! You can always refer to various sections of training if you need

additional reminders of how features works.

1. Review Video Links – Ctrl + Left Click

How to set up products & services

How to Use Reports Center: Categories, Insights & Information

2. Brainstorm a list of items you are selling. (Services, Inventory, or Non-Inventory items)

This list should reflect the items you want to track using Products and Services reports.

3. Determine the types of Products and Services you will need to set up.

4. Determine whether you will use Classes with Products and Services.

5. Determine whether your Products are taxable.

6. Determine sales price per Product or Service.

7. Determine the cost of each item if applicable.

8. Create your Products and Services List.

9. Determine how you will organize your Products & Services List by using categories to

group your items.

Click the Gear icon -> All lists -> Product Categories -> New Category. Assign the

category to each item on your list.

96

97

SECTION 5

BEGINNING BALANCES

Goals

Beginning Balances

Historical Transactions

Recurring Transactions

Doable Action Steps

Online Foundation Training

QuickBooks Online Foundations

Section 5 Goals

Upon completion of Section 5, each participant will be familiar with:

• How to enter Beginning Balances.

• How to enter Historical Transactions.

• How to manage Recurring Transactions.

• How and when to use Adjusting Journal Entries.

When Craig’s Landscaping was first established, Chris incurred costs prior to setting up her

business bank account. She bought a truck, took out a loan and used a personal credit card

to pay for various items and services. In addition, she bought items she has not yet paid for,

and has bills coming due. Chris provided services to a few clients without getting her

accounting application setup in advance and used a Word.doc to create invoices for new

customers. She wants to add the information to the Accounts Receivable Center. How does

she go about entering the above information in QBO?

Fortunately, Chris kept a shoebox full of receipts and asked her accountant to create journal

entries to record beginning balances. Had she opened her bank account and run expenses

through the bank, this process would have been much easier and saved hours of time. (You

do need an Employer Identification Number to set up a business bank account.) The

accountant pointed out the importance of adding an Adjusting Journal Entry (AJE) for all

startup costs, including those paid by the owner personally. He is also creating a balance

sheet for 12/31 of the prior year to simplify the process for Chris.

Taking advantage of efficiencies in an accounting application translates into higher profit

margins and not missing an expense; one more reason to setup your accounting application

early in the process.

98

QuickBooks Online Foundations

Beginning Balances

It is important to verify or enter beginning balances and historical data. Your accountant

can assist you in using a journal entry or you can add beginning balances when adding bank

accounts to your Chart of Accounts list.

If you have converted data, then you would have compared a Balance Sheet and Profit &

Loss Statement (set for all dates and accrual basis) in QuickBooks® Online with the same

reports in the accounting application you were using.

Enter beginning balances when setting up a new bank account, credit card account, and

other assets and liabilities. Opening balances default to Open Balance Equity in the Chart

of Accounts.

Note: Accounts Receivable (customer invoices) and Accounts Payable (unpaid bills) should

be entered individually to match beginning balances.

99

QuickBooks Online Foundations

Beginning Balances

Journal Entries are used to record beginning balance transactions, or transactions that

occur outside of the business bank and credit card accounts. QuickBooks automatically

enters the date and journal entry number, but you can change them anytime. You must enter

at least two accounts and at least one debit and one credit, in order to save the journal

entry. The debit and credit totals must match.

Click + New -> Journal Entry.

Verify the date and Journal number. Enter the account, amounts, description and name if

applicable. Click Save.

Note: What is required to create a journal entry? Accountants typically provide adjusting

journal entries when completing the tax return. For example, Depreciation Expense is used

in conjunction with Fixed Assets. We depreciate assets over specific periods of time.

100

QuickBooks Online Foundations

Historical Transactions

Entering Historical Information

When you start a new QBO file, you may need to enter historical data. Use the following

process for each area of the business:

Accounts Receivable – Enter transactions (invoices, incoming payments, and deposits) in

the same order and date they were created or received. This process creates a historical

record of transactions by customer.

Invoice – Click the + New icon -> Invoice and enter each invoice sent between your start

date and today. Be sure to use the correct dates as well as the Products and Services List.

Receive Payment – Click the + New icon -> Receive Payment and enter all payments

received from Customers between your start date and today. When payments are received,