IRS TRANSCRIPT ANALYSIS

CLARICE LANDRETH, EA, NTPI FELLOW

Understanding various IRS transcripts is key to resolving

a taxpayer’s IRS issues

You will learn how to read and understand various IRS

transcripts, the entries made on those transcripts, and

how they impact the taxpayer’s overall IRS situation

OBJECTIVE

After completing this course you will be able to:

• Describe various ways a representative can obtain IRS

transcripts

• Explain what a transaction code on an IRS transcript

indicates about actions on the account

• Determine if a taxpayer qualifies for First Time Abate

from IRS account transcripts

• Demonstrate the ability to analyze IRS transcripts

through the use of case studies

AT COMPLETION OF COURSE

Helps determine information, such as:

• Estimated Tax Payments

• Extension Filed

• Balances

• Original or Substitute Return Filed

• Return Filed on Time

TRANSCRIPTS

HISTORY OF TAXPAYER’S ACCOUNT

• Important Notices Issued

• Collection Due Process (CDP) Hearing filed?

• Installment Agreements

• Liens Filed/Released

• Payments

• Collection Statute Expiration Date (CSED)

TRANSCRIPTS

HISTORY OF TAXPAYER’S

ACCOUNT(CONT’D)

6

Important actions previously taken include:

• Number of installment agreements (IA)

• If an Offer in Compromise (OIC) had been filed

• Open to collection action

• Identify serial non-filers

• Substitute for return (SFR)

• CSED tolling events

TRANSCRIPTS

IMPORTANT ACTIONS

Two main ways for Tax Professionals to obtain

transcripts:

• e-Services

• Practitioner Priority Service (PPS)

TRANSCRIPTS

OBTAIN TRANSCRIPTS AS A TAX

PROFESSIONAL

Examples of times you will call PPS:

• No 2848/8821 and taxpayer is in your office

• 2848/8821 filed recently and is not recorded

• 2848/8821 incorrectly recorded

• Taxpayer is a victim of identity theft

PRACTITIONER PRIORITY

SERVICE(PPS)

POA not on file

PPS can upload transcripts to secure mailbox on your

e-Services account

Requires e-Services User ID

e-SERVICES AND SECURE MAILBOX

Transcripts not currently available

Must contact PPS to obtain the balance due amount

Helpful to list separately on Power of Attorney

SHARED RESPONSIBILITY

PAYMENTS

Taxpayer will need to provide the following information to

register and use Get Transcript:

• SSN

• Date of Birth

• Filing Status and Mailing Address

• Access to email account

• Personal account number from a credit card, mortgage, etc.

•

Mobile phone linked to their name.

GET TRANSCRIPT

TRANSCRIPTS

TYPES (cont’d)

Transcript Type Years Limited To

Tax Return Available for the current year and returns

processed during the prior three

processing years

Tax Account Any account that is active on the Master

File

Wage and Income Current and nine prior tax years

Record of Account Current and three prior tax years

Verification of Non-Filing Current and three prior tax years

Available for individual tax returns

Limited to following BMF returns:

• Form 1065, U.S. Return of Partnership Income

• Form 1120, U.S. Corporation Income Tax Return

• Form 1120-H, U.S. Income Tax Return for Homeowners

Associations

• Form 1120-L, U.S. Life Insurance Company Income Tax

Return

• Form 1120-S, U.S. Income Tax Return for an S Corporation

TRANSCRIPTS

TAX RETURN (CONT’D)

Appendix A – 14

Provides an account history

Available for any account that is active on the Master File

TRANSCRIPTS

TAX ACCOUNT

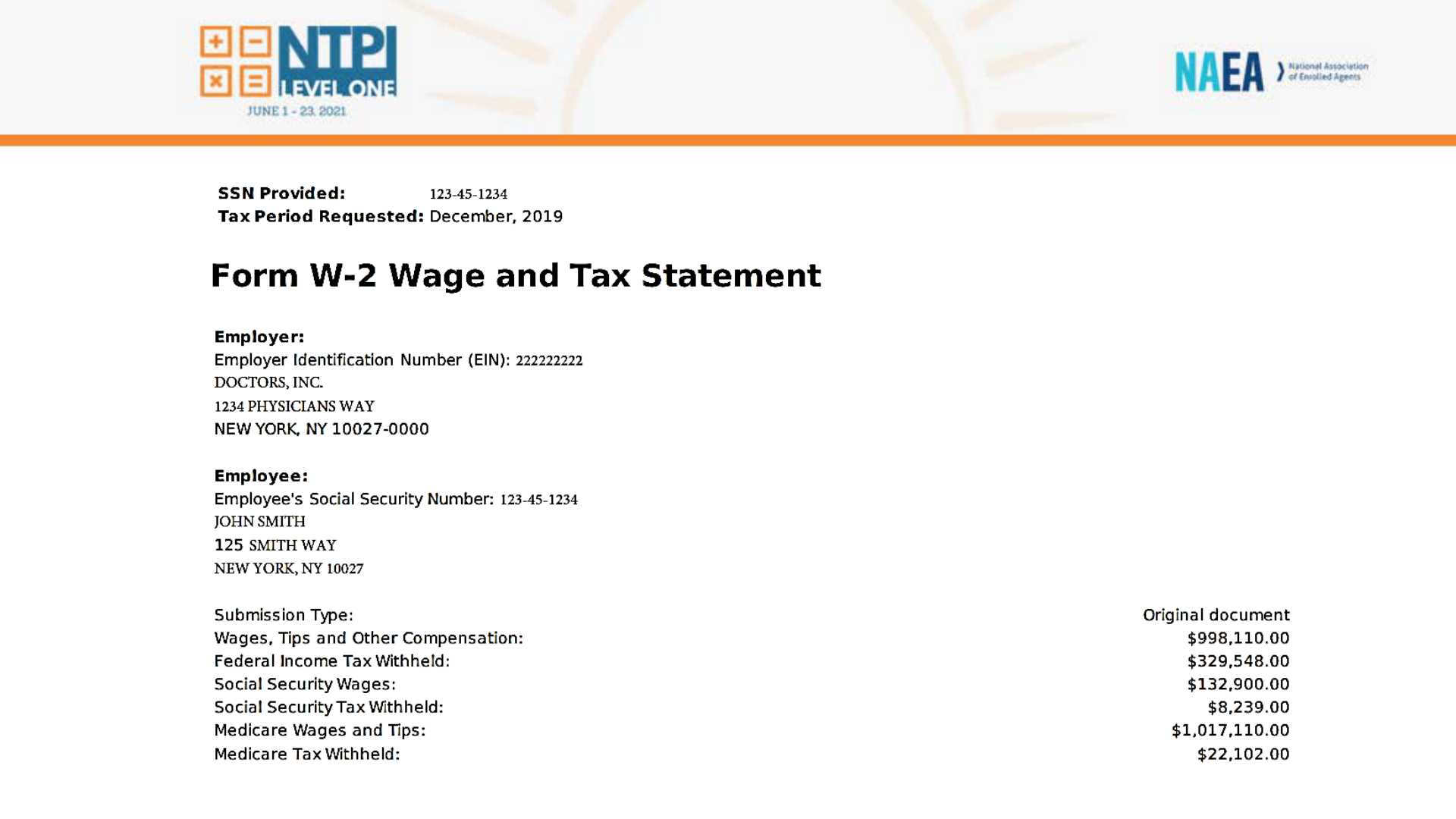

Wage and income transcripts are derived from information

returns, including, but not limited to:

• W-2 Series Forms

• 1098 Series Forms

• 1099 Series Forms

• Form 2439, Notice to Shareholder of Undistributed

Long-Term Capital Gains

• Form 5498, IRA Contribution Information

TRANSCRIPTS

WAGE AND INCOME (CONT’D)

TRANSCRIPTS

RECORD OF ACCOUNT

TRANSCRIPTS

RECORD OF ACCOUNT (CONT’D)

Proves that the IRS does not have a record of an IMF return

processed for the requested period

Available for current and three prior tax years

TRANSCRIPTS

VERIFICATION OF NON-FILING LETTER

• Code 140 Inquiry for Non-filing of Tax

Return

• Code 150 Tax Return Filed and Tax Liability

Assessed

• Code 290 Additional Tax Assessment

• Code 420 Examination Indicator

• Code 480 Offer in Compromise Pending

• Code 500 Military Deferment

TRANSCRIPTS

COMMON TRANSACTION CODES

• Code 520 IRS Litigation Instituted

• Code 530 Currently Not Collectible

• Code 582 Lien Placed on Assets Due to

Balance Owed

• Code 583 Removed Lien

• Code 599 Satisfying Transaction

TRANSCRIPTS

COMMON TRANSACTION CODES (CONT’D)

• Code 608 Write-off Balance due

• Code 922 Unreported Income

• Code 960 Appointed Representative

• Code 971 Miscellaneous Transaction

TRANSCRIPTS

COMMON TRANSACTION CODES (CONT’D)

Same TC may have a different explanation

Complicates reading transcript

Evaluate some codes in the context in which they are used

TRANSCRIPTS

SAME CODES WITH DIFFERENT EXPLANATIONS

Tax Return Filed and Tax Liability Assessed

Used by IRS for both original returns and substitute for

returns (SFR)

CODE 150

Bankruptcy or Other Legal Action Filed

Legal actions include but are not limited to:

Bankruptcy

Filing a Collection Due Process (CDP) Request

Tax Court Petition

CODE 520

Satisfying Transaction

Indicator for a Substitute for Return

TC 599 followed by “tax return secured”

does not mean that an original return was filed

CODE 599

42

Miscellaneous Transaction

Catch-all for many different types of transactions

Including:

Notice Issued

Pending Installment Agreement

Etc.

CODE 971

Lots of Data

Data missing, such as:

Liability with Revenue Officer

Assessment Statute Expiration Date

TRANSCRIPTS

BASICS OF READING ACCOUNT TRANSCRIPTS

44

JOINT 1040 ENTRIES FOR SEPARATE ASSESSMENT

1040 SEPARATE ASSESSMENT ENTRIES

Available for penalty relief the first time a taxpayer is

subject to one or more of the following penalties:

• Failure to file (FTF)

• Failure to pay (FTP)

• Failure to deposit (FTD)

*Note: IRS will apply FTA criteria before applying

reasonable cause criteria

IRM 20.1.1.3.3.2.1 First Time Abatement

IRM 20.1.1.3 Criteria for Relief From Penalties

FIRST TIME ABATEMENT (FTA)

FTA relief does not apply to the following:

• Returns with event-based filing requirement such as

Form 706 and Form 709

• Daily delinquency penalty – IRC 6652(c)(2)(A) and IRM

20.1.8 Employee Plans and Exempt Organization

Penalties

• Information reporting that is dependent on another

filing

• List is not all inclusive

FIRST TIME ABATEMENT (FTA)

(CONT’D)

Requirements:

• Taxpayer has filed, or filed a valid extension for, all

required returns currently due, AND

• Taxpayer has paid, or arranged to pay, any tax currently

due. Taxpayer is current with this requirement if they

have a valid open payment plan and are current with

the required installment payments.

FIRST TIME ABATEMENT (CONT’D)

NO MISSING RETURNS/IA BUT NO PAYMENTS BEING

MADE

DOES 2018 BALANCE QUALIFY FOR A FTA?

EXAMPLE

TAX PERIOD BALANCE

2015 NO BALANCE/NO PENALTIES

2016 NO BALANCE/NO PENALTIES

2017 NO BALANCE/NO PENALTIES

2018 $84,050.55/$11,574 PAYMENT PENALTIES

BREAKOUT ROOMS

Identify the following on the transcript:

• Assessed Balance

• Amount Currently Owed

• Date Return Was Filed

• Date Tax Was Assessed

• Original Return or Substitute for Return

• Date Collection Due Process Notice of Intent to Levy

Issued

• Did the taxpayer file bankruptcy?

ACCOUNT TRANSCRIPT

ANALYZATION

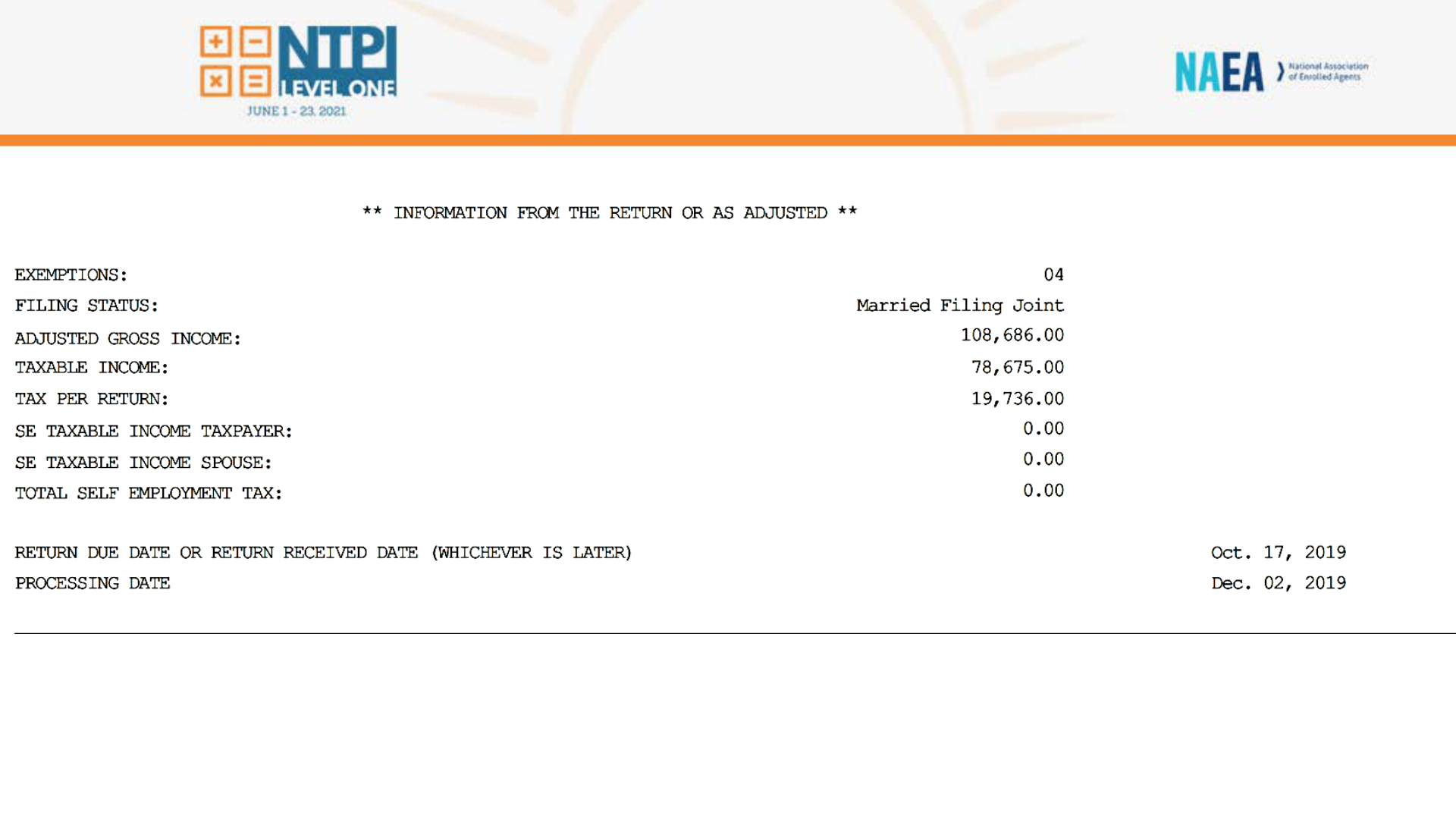

All required returns are filed. Analyze the provided

transcripts and answer the following:

• Does the taxpayer qualify for a first-time abatement?

• Explain why or why not.

FIRST-TIME ABATEMENT EXAMPLE

Transcripts are a crucial tool in our representation

toolbox

Use this information to help direct the course of the

case

Proficiency in analyzing transcripts can help prevent

further problems in our representation

CONCLUSION