Mail: John Deere Financial

P.O. Box 5328

Madison, WI 53791-9605

Fax: 1-800-732-0251

FAX COVER SHEET

Use this cover sheet when you fax a credit application to John Deere Financial or are requesting an

increase to a Special Terms credit limit. Please use this cover sheet to shorten the decision time

and assist us in getting the proper credit for your customers.

Merchant Name: ________________________________________________________________

Merchant Number: ___________________ Merchant Contact: ___________________________

Merchant Phone Number: ______________ Merchant Fax Number: _______________________

Pending Manufacturer purchase?

Identify the manufacturer:

BASF Bayer Monsanto Syngenta Other: __________________________________

Select one:

NEW multi-use account applicant - attach the completed Credit Application.

Applicant Name: ___________________________________________________________

EXISTING multi-use account customer

Account Number: _________________ Customer Name: __________________________

Indicate the credit needs of the customer:

Total Credit limit request: $__________________________________

(Regular credit limit + Special Terms credit limit)

Regular limit request: $_____________ Special Terms limit Request: $______________

Indicate how the customer’s identity was verified, if submitting an application: (select one)

Verify and record here and retain and submit a photocopy (if possible) of the government issued ID

with the application.

PRIMARY APPLICANT (required) CO-APPLICANT, if applicable (required)

Drivers License Passport Drivers License Passport

Military ID State Issued ID Military ID State Issued ID

ID #: __________________________ ID #: ____________________________

Expiration Date: ____/____/_________ Expiration Date: ____/____/__________

State of issued ID: ________________ State of issued ID: _________________

Multi-use accounts are a service of John Deere Financial, f.s.b.

Print Name

When your application is completed your John Deere Financial Merchant can fax it to 1-800-732-0251.

For a credit limit up to $50,000* – YOU CAN STOP HERE

Primary Owner Signature Individually - Required for Corporation, LLC & Partnership in addition to the signature on behalf of the Organizational Applicant above (by signing,

such Primary Owner shall be personally liable for all transactions and obligations arising under any John Deere Financial account that may be approved by JDF pursuant to

this Application).

Applicant’s Signature (required)

Print Name

PLEASE TELL US ABOUT YOUR BUSINESS. Fields marked with an asterisk (*) are required by law (USA PATRIOT ACT). Your application cannot be processed without this information.

MULTI-USE ACCOUNT AGRICULTURAL, COMMERCIAL & GOVERNMENTAL APPLICATION

(Required if spouse or person other than Primary Owner identified above has an interest in farming operation or assets listed on page 2 and is also a co-applicant.

If applicable, signature required below.)

PRIMARY OWNER INFORMATION REQUIRED FOR PARTNERSHIPS, LLCS AND CORPORATIONS (Required for all applications submitted on behalf of an organization. If applicable, signature required below.)

Contact Name:

Notice to applicant or Representatives of Applicant(s):(1) You represent that the information given in the entire application, including all applicant names and any other information

provided on any attached page(s) is complete and accurate, is provided for the purpose of obtaining credit in an amount set by the credit policies and practices of John Deere Financial,

f.s.b. (“JDF”), and authorize JDF to check with reporting agencies, credit references, and other sources disclosed herein in investigating the information given. (2) You also grant JDF

permission to obtain a credit report on you for all legitimate purposes in connection with this transaction. Such purposes include assisting in making a credit decision, reviewing your

account, and assisting in taking collection activity. (3) Married applicants may apply for an individual account. (4) You understand that any decision to grant or deny revolving credit will

be made by JDF in Wisconsin. You understand this account is for agricultural, commercial, governmental use only. You further certify that you are authorized to sign on behalf of the

applicant. (5) You agree that any notices and disclosures can, at the option of JDF, be provided electronically to the last Internet address that you provided to JDF. (6) You also authorize

JDF to disclose financial information about you as described in the credit agreement and future notices JDF may send you. (7) You hereby give all lenders authorization to provide a copy

of your financial statements, including but not limited to your balance sheet, cash flow statment, and income statement to JDF. You have received a true copy of this agreement and

agree to its terms.

Your Business Structure

(Sole Proprietor, Corporation, General Partnership, Limited Partnership, Limited Liability Company, Non-Profit, Government)

Your Primary Use

Agricultural

Commercial (Non-Ag)

Governmental Other

*Organization Legal Name (Do not abbreviate)

(Or) *Individual’s Legal First Name

Middle Initial

*Date of Birth

*Last Name

Suffix

*Social Security # *Tax ID #

Applicant’s Phone #

*Applicant’s Physical Street Address

Alternate Phone #

*City

*State

*ZIP

County

Mailing or P.O.Box # (if different than Physical Street Address)

*First Name Middle Initial *Last Name

*Physical Street Address

*City *State

*ZIP

*Social Security #

*City

*Social Security #

*Date of Birth

*Date of Birth

*First Name

*Physical Street Address

*Last Name

*ZIP

CO-APPLICANT/SPOUSE INFORMATION

Assets

Gross Sales

Liabilities

Net Worth (assets - liabilities)

Net Business Income

Years In Business

Primary Financial Institution

City

*State

State

Phone Number Primary Operating Lender

Phone Number

SIGN HERE

X

, Individually

X

X

Title

Date

Date

Date

FOR MERCHANT USE ONLY:

Merchant Name:

Merchant Number:

Contact Name:

Phone Number:

Customer Account Number: Patron Number:

Middle Initial

APPLICANT FINANCIAL INFORMATION

Co-Applicant’s Signature

*John Deere Financial reserves the right to request additional information if needed.

CR3910253 Litho in U.S.A. (12-03)

March 2012

Multi-use account Application - Page 2 Applicant Name _______________________________________________________

Balance Sheet Date _________________________

Cash, Checking, Savings $ ___________________ CCC Loans $ _______________________

Securities $ ___________________ Operating Principal $ _______________________

Accounts Receivable $ ___________________ Accounts Payable $ _______________________

Investment in Growing Crop $ ___________________ Current Intermediate Debt $ _______________________

Feed & Grain Inventory $ ___________________ Current Long-Term Debt $ _______________________

Market Livestock $ ___________________ Leases $ _______________________

Government Payments Receivable $ ___________________ Misc. Current Liabilities $ _______________________

Other Current Assets $ ___________________ Specify __________________________

Specify ____________________________

Total Current Assets $ ___________________ Total Current Liabilities $ ______________________

Breeding Livestock $ ___________________ Notes Payable – Specify _____________ $ ______________________

Machinery & Equipment $ ___________________ Machinery & Equipment Loans $ ______________________

Vehicles $ ___________________ Vehicle Loans $ ______________________

Other Intermediate Assets $ ___________________ Other Intermediate Debt $ ______________________

Specify ____________________________ Specify __________________________

Total Intermediate Assets $ ___________________ Total Intermediate Liabilities $ ______________________

Real Estate Value $ ___________________ Mortgage Loans $ ______________________

Buildings $ ___________________ Other Long-Term Debt $ ______________________

Other Long-Term Assets $ ___________________ Specify __________________________

Specify ____________________________

Total Long-Term Assets $ ___________________ Total Long-Term Liabilities $ ______________________

TOTAL ASSETS $ ___________________ TOTAL LIABILITIES $ ______________________

Crop Production Information

1. Owned Acres: ___________________ 2. Owned Tillable Acres: __________________

3. Total Share Rent Acres: ___________________ 4. Your Share Rent Acres: + __________________

5. Total Cash Rent Dollars Paid Per Year: $ ___________________ 6. Total Cash Rent Tillable Acres: + __________________

Your Share of Total Crop Production (2+4+6): = __________________

% Avg Double Second Crop Insurance Coverage Contracted Crops

First Crop Acres Irrigated Yield Crop Crop Type & % Price %

Corn _________ _________% _________ Y / N _________ CAT/YP/RP/RPE/GRIP/GRP _________% $_________ _________%

Soybeans _________ _________% _________ Y / N _________ CAT/YP/RP/RPE/GRIP/GRP _________% $_________ _________%

Wheat _________ _________% _________ Y / N _________ CAT/YP/RP/RPE/GRIP/GRP _________% $_________ _________%

Cotton _________ _________% _________ Y / N _________ CAT/YP/RP/RPE/GRIP/GRP _________% $_________ _________%

Peanuts _________ _________% _________ Y / N _________ CAT/YP/RP/RPE/GRIP/GRP _________% $_________ _________%

___________ _________ _________% _________ Y / N _________ CAT/YP/RP/RPE/GRIP/GRP _________% $_________ _________%

___________ _________ _________% _________ Y / N _________ CAT/YP/RP/RPE/GRIP/GRP _________% $_________ _________%

If necessary to fulfill loan request, is a security position available on growing crops? Y / N

Crop Insurance Agent Information

Agent Name ______________________________ Phone: (_________)_______________________

Livestock Production Information

Herd Size Annual Production Estimated Annual Revenue

_______Sows ______#of market sold annually _________ #of feeder sold annually $__________________

_______Beef Cattle ______#of market sold annually _________ #of feeder sold annually $__________________

_______Dairy Cattle ______lbs. of milk sold annually $__________________

_______Poultry ______#sold annually $__________________

_______Other (specify____________________) ______#sold annually $__________________

ASSETS LIABILITIES

For a total credit limit over $120,000*, please attach the most recent two years of lender prepared (or equivalent) balance sheets and

supporting schedules. If a Partnership, Corporation or LLC, include most recent two years’ personal balance sheets with supporting schedules

of the general partner, president, owner or managing member.

For a credit limit over $300,000*, in addition to the above-listed documents, also attach the most recent two years’ tax returns. If a Partnership,

Corporation or LLC, include most recent two years’ personal tax returns of the general partners, president, owner or managing member.

March 2012

Notice for Ohio Residents - The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reporting agencies

maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

For a total credit limit greater than $50,000*, please complete the additional information below and submit your application as directed

on the back of this page. If a Partnership, Corporation or LLC, include personal balance sheets with supporting schedules of the general

partner, president, owner or managing member. Include any interest held by a co-applicant, including spouse, if applicable.

MULTI-USE AGRICULTURAL/COMMERCIAL

OR GOVERNMENTAL USE CREDIT AGREEMENT

TERMINOLOGY.

In this Agreement the words , , and mean each person and/or business

entity who applies for and is granted a multi-use account, including any co-applicant identified on the

application, as well as any person permitted to use the Account.

John Deere Financial, f.s.b., or

any subsequent holder of the Account or any balances arising under the Account. When the terms “finance

charge” and “interest charge” are used in this agreement and on other documents related to your account,

they have the same meaning.

MULTI-USE ACCOUNT.

You request a multi-use account from JDF, and further authorize JDF to issue a

multi-use account card to each merchant from whom you may make a purchase. By applying for a Preferred

Account, or by using a Merchant Authorized Account to make a purchase from a merchant who requests

JDF to open one for you, you agree that this Credit Agreement will apply to all purchases made through

your multi-use account by you or any person you authorize. You authorize JDF to honor any purchases you

make by mail, telephone, Internet, facsimile transmission (fax) or other electronic means on your Account.

You agree that a signature is not necessary as identification in such cases. You agree that any authorized

use of your Account constitutes your acceptance of all the terms and conditions of this Agreement, as it

may be amended from time to time. If you submit your application to JDF by Internet, facsimile transmission

(fax) or other electronic means, you agree that the application will have the same effect as a signed original.

You agree that you will promptly notify JDF in writing of any suspected loss, theft, or unauthorized use of

the Account. You may be liable for the unauthorized use of your multi-use account before you notify JDF

in writing at John Deere Financial, P.O. Box 5328, Madison, Wisconsin 53705-0328 of the unauthorized

use. In any case, your liability will not exceed $50. You agree to give JDF prompt notice of any change

in your name, mailing address, or place of employment. You agree that until JDF receives notice of your

new address, JDF may continue to send statements and other notices to the address you gave JDF on the

application for this Account. You agree that, for the purposes of this Agreement, you will be deemed to

“reside” in the state of your billing address as shown on JDF’s records. You consent and agree that your

telephone conversations with JDF may be recorded to further improve JDF’s customer service. You agree

that JDF and any affiliate and any retained debt collector may place phone calls to you using any telephone

number, including a mobile phone number, you have provided to JDF, any affiliate or any retained debt

collector, including calls using an automatic dialing and announcing device and prerecorded calls, and

that such calls are not “unsolicited” under state or federal law. If more than one person or entity signed

the application, each is jointly and severally responsible for all obligations, and amounts due, under this

agreement. This agreement is not binding on JDF until JDF has approved your credit and given you notice of

approval. If Maryland law applies, Subtitle 9 of Title 12 of the Maryland Commercial Law will apply.

ACCOUNT TYPE.

If your multi-use account arose through JDF’s purchase of your existing account balance

with a merchant, or at the request of one or more merchants, your Account may be classified as a

. Certain special features or promotions that JDF may offer from time to time may be

made available only to Preferred Accounts. Merchant Authorized Accounts are useable only at a merchant

who asked JDF to finance your purchases from them. JDF may, in its sole discretion, classify your account

as a Preferred Account. When JDF opens your Account, and on each monthly statement, JDF will indicate

whether your Account is either a Preferred or Merchant Authorized Account.

ACCOUNT USE.

By applying for or accepting a multi-use

,

you agree to use your Account

to make purchases for agricultural, commercial or governmental

use, and not for personal, family or household use. You agree to pay JDF all amounts charged by the use of

the Account, plus Finance Charges, and the other charges described below, as provided in this Agreement.

You agree that JDF is not responsible for the refusal of anyone to allow a purchase to be made through

your multi-use account.

CREDIT LIMITS.

JDF will establish and advise you of your credit limit(s) when JDF opens your Account and

on each monthly statement. JDF may, in JDF’s sole discretion, establish and advise you of a special terms

credit limit. JDF may also, in its sole discretion, establish separate additional credit limits with special

conditions. The special conditions of any special terms or additional credit limit will be disclosed to you

when JDF opens your Account, by a merchant at the time of purchase or on your monthly statement. Your

use of any such special terms or additional credit limit(s) shall constitute your agreement to any disclosed

special conditions.

You agree that JDF may increase or decrease your credit limit(s) at any time, in JDF’s sole discretion,

without prior notice to you.

You agree to promptly prepare and provide to JDF any financial and Account information that JDF may, in its

sole discretion, request from you.

MONTHLY STATEMENT.

JDF will send you a monthly statement whenever there is activity on your Account,

unless the only activity is a payment in full. Your monthly statement will show your New Balance, any

Finance Charge, any Late Fees, the Minimum Required Payment and the Payment Due Date. In addition, it

will show your Credit Limit(s), an itemized list of current Purchases, Payments, and Credits, as well as other

information concerning your Account. JDF will send your monthly statements on dates and in intervals

determined by JDF. Such statement shall be deemed correct and accepted by you unless JDF is notified to

the contrary in writing within 60 days of the date of that statement.

If you think your monthly statement is incorrect, write to JDF on a separate sheet at the address shown on

the back of your billing statement. Describe the error as best you can and include your Account number in

all correspondence.

PAY MEN T.

The Payment Due Date is the date the payment must be received at the address shown on the

front of your monthly statement. You may at any time pay your entire New Balance or pay more than the

Minimum Required Payment, and you may avoid or reduce Finance Charges by doing so. However, payment of

more than the Minimum Required Payment, while reducing your balance will not prepay your Account or be

applied against future Minimum Required Payments. If your Payment Due Date falls on a Saturday, Sunday or

holiday, the Payment Due Date will not be extended. All payments must be in U.S. dollars and drawn on funds

on deposit in the United States. Payments must be sent to John Deere Financial, at the address designated on

your monthly payment stub or to any other payment address JDF later designates on your monthly statement

payment stub.

FINANCE CHARGE RATES.

Finance Charges on your multi-use account may be calculated using

variable

rates

that will be determined by reference to a “

Base Rate.

” The

Base Rate

from which your variable rates

will be determined is the annual percentage rate of interest announced publicly from time to time by

Citibank, N.A., in New York, New York, as the base rate it uses for interest rate determinations, which was in

effect at the close of business on the fifteenth (15th) calendar day of each month, or the next succeeding

business day if the fifteenth is not a business day (“Reference Day”).

Finance Charges on your Account will be calculated by adding a “

Spread

” to the Base Rate to arrive at the

current rate. The

Spreads

added to the

Base Rate

to determine the

ANNUAL PERCENTAGE RATES (APRs)

that will apply to your Account will be:

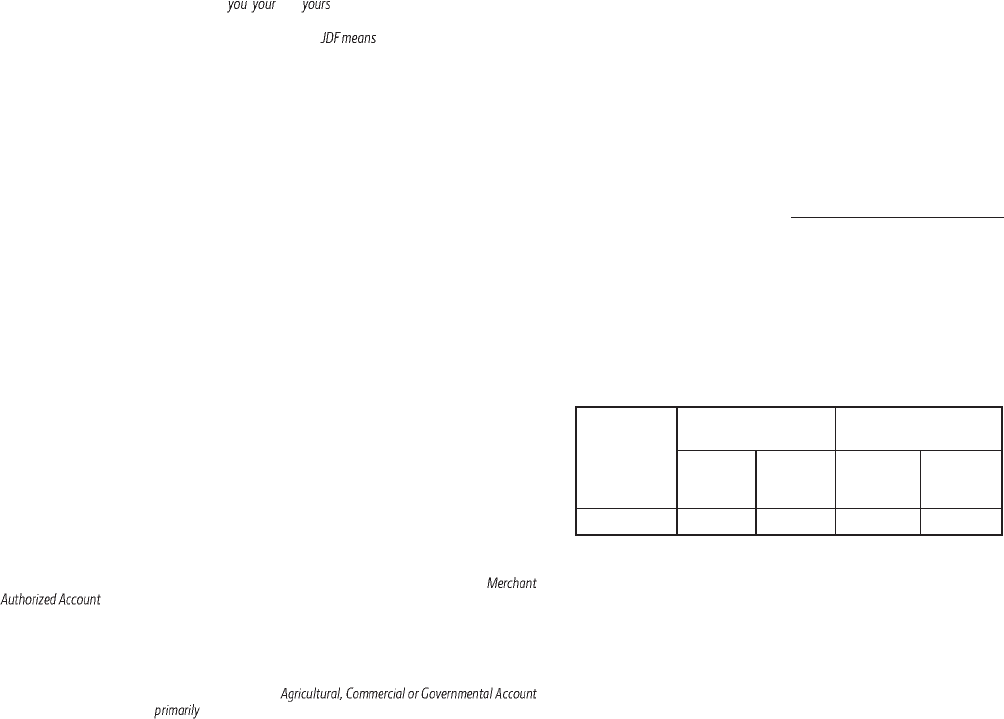

Preferred Merchant Authorized

Spreads

11.9% 13.9%

Rate increases and decreases that result from changes in the Base Rate will take effect on the first day of

the month, or the next succeeding business day if the first day is not a business day, after the Reference Day

on which the Base Rate changes.

Changes in your variable rates will apply to your existing balance as well as to future purchases under your

Account. An increase in your rate will increase the total Finance Charge accruing on your Account and the

balance on which your Minimum Required Payment is calculated.

Currently effective rates are shown below:

The above rates are correct as of the date of printing, March 30, 2012, but are subject to change

after that date.

FINANCE CHARGE CALCULATION. FINANCE CHARGES

will accrue on your Account Balance as follows:

JDF will add a FINANCE CHARGE, calculated as shown below, if your New Balance is not paid in full on or

before the Payment Due Date. To avoid additional Finance Charges on purchases, you must pay the New

Balance in full on or before the Payment Due Date.

The amount of your

FINANCE CHARGES

will be determined as follows:

JDF uses the daily periodic rates and corresponding

APRs

shown in this Agreement. The applicable periodic

rate is applied to the “Average Daily Balance” of your purchases, including current transactions, during the

current billing cycle.

To get the “Average Daily Balance,” JDF takes the beginning balance of your purchases each day, starting

with any Previous Balance outstanding on the first day of the monthly billing cycle, adds new purchases and

debits, and subtracts payments or credits. This determines the daily balance. Unless JDF elects to use a later

date, purchases are added to the daily balance as of the date of purchase.

JDF totals the daily balances for the billing cycle and divides the total by the number of days in the billing

cycle. This gives JDF the “Average Daily Balance,” which is shown on your monthly statement. Finance

Charges may accrue on Special Promotions Transactions at a different rate, as explained in the Special

Promotions section of this Agreement.

DEFAULT FINANCE CHARGE RATE.

If you are in default, you may no longer qualify for any reduced interest

rate Special Promotions and you agree that, at JDF’s option, the APR applicable to any outstanding reduced

interest rate Special Promotion(s), may be increased to the APR described in this agreement.

A MINIMUM FINANCE CHARGE

of One Dollar will be made when the result of the application of the

periodic rate(s) to the “Average Daily Balance,” is less than One Dollar.

MINIMUM REQUIRED PAYMENT.

Except as provided below, you agree to pay each month a combined

Minimum Required Payment equal to:

1. Any late payment fee due;

plus

2. Any additional fees due;

plus

3. Any amount past due;

plus

4. For Purchases on your Account:

(a)

Either

the greater of: $25, or 10% of your New Balance (less any Conversion Balance {balances

transferred to John Deere Financial from a merchant’s accounts receivable} and less any Special

Promotions Transaction(s) balances on which no payment is due) if it exceeds $25;

(b) Or your entire New Balance (less any Conversion Balance and Special Promotions Transaction(s)

balances on which no payment is due), if it is less than $25.

5. The amount of any Special Promotions transaction that is due;

6. For Conversion Balances:

(a)

Either

the greater of: $25, or 10% of your Conversion Balance, if that balance exceeds $25;

(b)

Or

your entire Conversion Balance, if it is less than $25.

Daily

Periodic Rate(s)

Annual

Percentage Rate(s)

Preferred

Regular

Purchases

Merchant

Authorized

Purchases

Preferred

Regular

Purchases

Merchant

Authorized

Purchases

Rate:

0.041507% 0.046986%

15.15% 17.15%

CR3910253 Litho in U.S.A. (12-03)

DUE-IN-FULL PROVISION FOR GOVERNMENTAL ACCOUNTS. If you are a local, state or federal

government agency or department, you agree to pay the entire balance of your account on the date

shown on your monthly statement.

SPECIAL PROMOTIONS.

For some transactions, special promotional financing terms, such as extended

free periods, incentive interest rates on certain purchases or for limited time periods or other promotions

may be available, at the discretion of JDF. These special terms will be disclosed by the merchant at the time

of purchase. Purchases you make during these special promotions will be separately identified on your

monthly statement and will become part of the balance on which your FINANCE CHARGE and Minimum

Requirement Payment are calculated at the time provided in the special promotions terms disclosure. These

transactions include:

NO-PAYMENTS/NO-INTEREST TRANSACTIONS. Unless otherwise disclosed, minimum monthly payments

will be deferred and Finance Charge will not accrue during any disclosed No-Payments/No-Interest

period described. Finance Charges will accrue at the APR applicable to your Account after the due date

of your No-Payments/No-Interest transaction, unless otherwise disclosed.

SPECIAL TERMS TRANSACTIONS. Unless otherwise disclosed, Finance Charge will accrue from the date

of purchase, which may be prior to your receipt of the merchandise, and throughout any special terms

period. A special terms transaction may include that no payment on that transaction will be due until

the end of the special terms period, which will be disclosed to you. Otherwise, payment will be due as

described in this Agreement. Accrued Finance Charge must still be paid by you if the entire special terms

balance is paid in full by the end of the special terms period. A reduced special terms finance charge

rate may apply to the transaction, which will be disclosed to you. Otherwise, the finance charge rate

will be the APR applicable to your Account. The entire balance of the special terms transaction, plus any

accrued finance charge, will be due in full by the disclosed due date.

SAME AS CASH TRANSACTIONS. Unless otherwise disclosed, minimum monthly payments will be

deferred and Finance Charge will accrue during any Same As Cash period. No Finance Charge will be due

until the end of the Same As Cash period and any accrued Finance Charge will be waived if the entire

Same As Cash balance is paid in full by the end of this Same As Cash period.

OTHER FEES and CHARGES.

LATE PAYMENT FEES. If within 20 days after the Payment Due Date, JDF has not received payment of at

least the current portion of your Minimum Required Payment (Minimum Required Payment plus unpaid late

payment fees and past due amounts), JDF will add to your Account a late payment fee of $39.

RETURNED PAYMENT FEE. If you send JDF a check or electronic payment authorization that is dishonored

upon first presentment, JDF will add to your Account a fee of $35.

COLLECTION COSTS. Upon default, you will pay for expenses incurred in connection with the enforcement

of our remedies, without limitation, repossession, repair and collections costs, any attorney’s fees plus

court costs and related fees including any bankruptcy fees and costs, to the extent permitted by applicable

law.

CREDIT BALANCES.

Any credit balance in excess of $5 on your account will be refunded within 30 business

days from JDF’s receipt of your written request. Otherwise, JDF will refund to you any credit balance

remaining on your account after six months. You agree that JDF may retain any credit balance if it is less

than $5 or if JDF does not know your address and it cannot be traced through the last address or telephone

number provided to JDF.

ACCEPTING PAYMENT.

You agree that JDF can accept late or partial payments, as well as payments marked

“paid in full” or with other restrictive endorsements, without losing any of its rights under this Agreement.

DISCLOSURE OF FINANCIAL INFORMATION.

You agree that JDF may report your performance under this

Agreement to credit reporting agencies and others who request a credit reference from JDF. You agree

that JDF may ask credit reporting agencies or others you list as a credit reference for consumer reports or

information regarding your credit history at any time for all legitimate purposes, including credit decisions

and the review and collection of your account. You authorize JDF to share information regarding your

Account with its corporate affiliates and other companies that offer products and services JDF believes

may be of interest to you.

JDF’s affiliates may use certain consumer report information as a factor in

establishing your eligibility for consumer credit. If you object to this, you must notify JDF by calling

John Deere Financial Customer Service at 1-800-356-9033, and providing your name, Social Security

number, address and account number; and certain information will not be provided

to those affiliates.

CLOSING YOUR ACCOUNT

. You may close your Account at any time by notifying JDF in writing. You agree

that JDF may close or suspend your Account to future purchases at any time without prior notice. You

agree that JDF may close or suspend your Account to future purchases if your Account has no activity for

12 or more months. You agree that, regardless of the closing or suspension of your Account, you remain

responsible for paying the amount you owe JDF according to the terms of this Agreement.

SECURITY INTEREST. You grant JDF a purchase money security interest in all merchandise purchased

through your Account,

and its proceeds, including insurance proceeds, but this provision does not apply if

you reside in NC and the APR on a purchase or transaction exceeds 15%. JDF’s security interest continues

until such merchandise is paid for in full by application of your payments in the manner described in this

Agreement.

PAYMENT APPLICATION.

You agree that your payments will be applied as JDF determines in its sole

discretion. You agree that JDF has this discretion and that JDF may exercise it to suit its own convenience

and interests, without further notice to you. You also agree that JDF may change how it applies payments

at any time without notice to you. You acknowledge that the exercise of this discretion by JDF may result in

cases in which the application of your payments to the Account creates higher Finance Charges than other

payment application methods and that this may include payments allocated to balances with lower APRs

before balances with higher APRs and/or to balances with longer promotional periods before balances with

shorter or no promotional periods.

You agree that your payments will be credited as of the date of receipt at the address on the payment

stub of your Monthly Statement if received by 11:00 a.m. Central Time Monday through Friday (otherwise

next business day); but if payment is not accompanied by the payment stub, is not sent in the envelope we

provided, includes other items, such as other checks, staples or paper clips, or is not received at that location,

credit may be delayed up to five days.

MERCHANT CHARGEBACKS.

JDF may charge back to a merchant who sold goods or services to you on your

Account, any part of your Account balance related to those purchases. In that event, this Agreement will

be deemed assigned to the merchant to the extent of the chargeback. You agree to such an assignment

and further agree to pay the merchant the amount of such chargeback in accordance with the terms of this

Agreement.

DEFAU LT.

You agree that you will be in default if: (a) you fail to pay the Minimum Required Payment within

20 days after the Payment Due Date; (b) the value of JDF’s security interest in any collateral is materially

impaired; (c) your ability to repay is materially reduced by your exceeding your credit limit, by a change in

your employment, by a change in your other obligations, by bankruptcy or insolvency proceedings involving

you, or (for community property state residents only) by a change in your marital status or domicile; (d)

you die or become incompetent; (e) you have provided JDF false or misleading information relating to your

credit application or Account; (f) you fail to perform any other of your obligations under the terms of this

Agreement as it may be amended; or (g) you are in default under any other agreement you have with JDF or

any of its affiliates.

You agree that, upon your default, JDF may close your Account to future purchases and that JDF may

demand immediate payment of your entire Account balance, after giving you any notice and opportunity

to cure the default required by applicable law. In addition, you agree that JDF shall have all the rights of a

secured creditor under the Uniform Commercial Code and other applicable law.

DELAY IN ENFORCEMENT.

You agree that JDF can delay enforcing its rights under this Agreement without

losing them.

ELECTRONIC DISCLOSURE.

You agree that any notices and disclosures related to your account can be

delivered to you in printed form or by electronic means if you provided an electronic mail address to JDF

when you applied for this Account or at a later date. Until JDF receives notice of a new electronic mail

address, JDF may continue to send such notices and disclosures to the electronic mail address you most

recently provided to JDF.

GOVERNING LAW.

This Agreement must be approved, and all charges and payments to your Account

processed by JDF at its office in Madison, Wisconsin. Therefore, this Agreement and your account will be

governed by the substantive law of the United States and to the extent state law applies to this Agreement

the substantive law of the State of Wisconsin; regardless of whether or not you reside in Wisconsin. The

law of your state of residence will apply to JDF’s recovery of any collateral located there.

This is the entire Agreement between you and JDF relating to your multi-use account and no oral changes

can be made.

Invalidity of any provision of this Agreement shall not affect the validity and enforceability of the remainder

of its terms.

CHANGING THIS AGREEMENT.

IMPORTANT: READ BEFORE SIGNING. THE TERMS OF THIS AGREEMENT

SHOULD BE READ CAREFULLY BECAUSE ONLY THOSE TERMS IN WRITING ARE ENFORCEABLE. NO OTHER

TERMS OR ORAL PROMISES NOT CONTAINED IN THIS WRITTEN CONTRACT MAY BE LEGALLY ENFORCED.

YOU MAY CHANGE THE TERMS OF THIS AGREEMENT ONLY BY ANOTHER WRITTEN AGREEMENT. You agree

that JDF may change this Agreement, including the Finance Charge Calculation and the APR, at any time,

by providing prior notice to you. To the extent that the law permits and JDF indicates in the notice, the

changes will apply to your existing Account balance as well as to future transactions.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT.

To help the

government fight the funding of terrorism and money laundering activities, Federal law requires all financial

institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, you will be asked for your name, address, date of

birth, and other information that will allow JDF to identify you. You may also be asked to show your driver’s

license or other identifying documents.

Your choice to limit marketing.

They include Deere & Company, Deere Credit, Inc., and John Deere Construction & Forestry Company.

insurance affiliates, from marketing their products or services to you based on your personal

information that they receive from JDF. This information may include your income, account history,

and credit score.

years from when you tell us your choice. Once that period expires, you will receive a renewal notice

that will allow you to continue to limit marketing offers from JDF affiliate Deere companies for at

least another 5 years.

To limit marketing offers, contact us (1-800-356-9033).

To ensure that John Deere Financial receives all of the information necessary

to process your application, please follow the guidelines below:

Requested Complete the Following Other Required Information:

Credit Limit:* Application Pages:

Up to

$250,000*

$250,001 –

$120,000*

$120,001 –

$300,000*

Over

$300,000*

Page 1

Page 1 and 2

Page 1 and 2

Page 1 and 2

None

If a Partnership, Corporation or LLC,

include most recent lender prepared

(or equivalent) personal balance sheets

with supporting schedules of the general

partners, president, owner or managing

member.

Lender-prepared (or equivalent) balance

sheets and supporting schedules from the

past two years. If a Partnership,

Corporation or LLC, include most recent

two years of lender prepared (or equivalent)

personal balance sheets with supporting

schedules of the general partners,

president, owner or managing member.

Documents listed above, plus the

most

recent two years’ tax returns. If a

Partnership, Corporation or LLC, include

most recent two years’ personal tax

returns of the general partners,

president, owner or managing member.

Questions?

Call 1-800-356-9033 for assistance from a

John Deere Financial Customer Service Representative.

After you have completed the application and gathered any additional

attachments, please take your information to any local John Deere Financial

dealer or merchant to apply in-person. Or, select from the following options:

NOTICE: Please detach and retain the terms and conditions page of the

application for your records. It is not necessary to fax or mail this page

to John Deere Financial.

When mailing your completed application to John Deere Financial, you may

opt to fold and seal the application using the postage-paid address panel or

seal the documents into your own envelope for added security. When mailing

balance sheets or other required information for credit lines over $120,000,

please use an envelope to ensure the safety of your documents.

Completing your application. Submitting your application.

Fax:

1-800-732-0251

Mail:

John Deere Financial

P.O. Box 5328

Madison, WI 53791-9605

*John Deere Financial reserves the right to request additional information if needed.

NOTE: The requested credit limit is the combination of Regular Limit and Special Terms Limit, if

applicable. See the terms and conditions for more information about the two types of credit limits.

parts and service, and larger seasonal supplies

like seed, fertilizer and crop protection products.

month after month.

payment options.

user-friendly phone and online capabilities.

and annual purchase summaries.

more than 7,000 locations nationwide.

- Visit MyJDFAccount.com to complete

an online application.

- Stop by a local merchant to complete

an in-store application.

- Call 1-800-356-9033 to have an

application mailed to you.

The multi-use account.

* Account use is governed by the multi-use account credit

agreement and is subject to credit approval. Merchant

participation may also be required. Some features are

available only on Preferred agricultural accounts.

10 ways John Deere Financial

goes to work for your operation.

Multi-use accounts are a service of John Deere Financial, f.s.b.

CR3910253 Litho in U.S.A. (12-03)

March 2012

Multi-use account Credit Application

Agricultural, Commercial and Governmental Use Account

JohnDeereFinancial.com/Advantage