HB-2-3560

3.1 INTRODUCTION

This chapter provides an overview of the essential responsibilities for property

management. In general, the borrower is responsible for providing management acceptable to

the Agency both in terms of staff qualifications and management practices. The borrower must

ensure that property operations comply with the terms of all loan or grant documents; Agency

requirements; and applicable local, State, and Federal laws and ordinances. For many project

management responsibilities, the Agency must approve or concur in the management decisions

and policies of the borrower. This chapter is designed to identify those actions that require

Agency reaction to the borrower’s decision.

Section 1 of this chapter deals specifically with property management, including Agency

approval of the proposed management agent and management certification. It also describes the

Agency’s requirements regarding items that must be addressed in the borrower’s management

plan; and civil rights and accessibility requirements, self-evaluations, and transition plans.

Section 2 discusses the requirements for acceptable management entities and the

Agency’s procedures for reviewing and approving new management entities. It also outlines

the Agency’s procedures for removing unacceptable management entities.

Section 3 describes the program requirements regarding allowable management fees to be

paid out of project income and Agency procedures for assessing the reasonableness of the fees.

Section 4 addresses the required insurance coverage and real estate taxes for projects.

Section 5 discusses the project management requirements and procedures that differ for

Farm Labor Housing projects.

SECTION 1: PROJECT MANAGEMENT [7 CFR 3560.102]

3.2 OVERVIEW OF PROJECT MANAGEMENT RESPONSIBILITIES

Borrowers must provide management acceptable to the Agency as a condition of loan or

grant approval. The borrower requirements listed in this chapter may be complied with by the

borrower or a person designated in writing by the borrower. Acceptable management will be

documented in the management plan and management certification.

3.3 THE MANAGEMENT PLAN [7 CFR 3560.102(b)]

For each multi-family housing project, borrowers must develop and maintain a

management plan that establishes the systems and procedures that will be employed at the

project to ensure that project operations comply with Agency requirements. This plan is used by

the Agency to guide its oversight of project operations and its monitoring of project compliance.

The management plan should provide the Agency with information regarding site operations

only, not about management agent central office functions.

3-1

(07-19-24) PN 619

CHAPTER 3: PROPERTY MANAGEMENT

HB-2-3560

A management plan is initially submitted as part of the borrower’s application for

funding. It remains in effect until such time as the Agency requires modification of the plan, the

plan needs to be updated to reflect changes occurring in project operations, or the project is

transferred from one borrower to another.

A. New Projects

1.

Requirements for Submitting a Management Plan

For new projects, borrowers must submit a management plan that addresses the

required items identified in Attachment 3-A in sufficient detail to enable the Agency to

effectively monitor project performance.

If the Agency determines that a proposed management plan does not adequately

address the required items, the MFH Servicing Official will provide written notice to

the borrower indicating the deficiencies and specifying a time period for submission

of an acceptable plan.

No Agency loan will be closed, construction started, or transfer approved before the

Agency has an acceptable management plan from the borrower.

2.

Contents of a Management Plan

At a minimum, management plans for multi-family housing projects must address the

items presented in Attachment 3-A.

3.

Agency Review of a Proposed Management Plan

In reviewing a proposed management plan, the Agency must ensure that it does not

contain policies that violate Agency regulations and that it provides adequate details

regarding the items in Attachment 3-A for the Agency to effectively monitor project

compliance with program requirements.

B. Existing Projects

1.

General Requirements for Maintaining and Modifying a Management Plan

In accordance with the requirements of this chapter, the borrower must develop and

maintain a management plan acceptable to the Agency. A borrower’s failure to maintain

an acceptable plan is grounds for Agency termination of the management agent. This

management plan will remain the guiding management document, as long as it accurately

reflects project operations, and the borrower remains in compliance with Agency rules

and regulations.

Borrowers must submit an updated management plan to the Agency if project

operations change and are no longer consistent with the current management plan on file

with the Agency. The Agency should expect to see a modified management plan when:

• Project operations change to meet the needs of a changing tenant population; or

3-2

• Program requirements change; or

HB-2-3560

• Changes in subsidy levels or types occur (e.g., HUD Section 8 is converted to Rental

Assistance and/or units are reduced) or the property is converted to another allowable

use (e.g., changed from an elderly property to a family property).

When a housing project is transferred from one borrower to another, the transferee

must submit a new management plan that addresses the items listed in Attachment 3-A.

2.

Agency Request for and Review of a Modified Management Plan

If the Agency determines that project operations are in compliance with Agency

requirements; loan or grant agreements; or applicable local, State, and Federal laws but

are not consistent with the management plan, the Agency will notify the borrower of the

discrepancy in writing and indicate that the existing plan is no longer acceptable. Upon

receiving notice that project operations are not consistent with the current management

plan, borrowers must take one of the following actions within 60 days from the date of

the Agency’s letter:

• Revise the management plan to accurately reflect housing operations;

• Take actions to ensure that the management plan is followed; or

• Advise the Agency in writing of the action taken.

If the borrower submits a modified management plan, the Agency will review the

plan for the necessary changes and ensure that the plan adequately addresses the

requirements of the discrepancy. The Agency may visit the project or management

agent’s office to ensure that documented changes have occurred.

C. Three-Year Borrower Certification of Adequacy of Plan

When there have been no changes in a project’s operations, borrowers must submit a

certification to the Agency every 3 years stating that the project operations are consistent

with the current management plan and that the plan is adequate to ensure project

compliance with the loan documents and the applicable requirements of this part (see

Attachment 3-B).

D. Projects with Compliance Violations

1.

Agency Notification to the Borrower

If the Agency determines that there are compliance violations at a project, the

borrower must respond to the Agency notification and update the management plan in

accordance with the requirements below. If the borrower does not fulfill the

requirements of this section, the Agency will deem the management plan for the project

unacceptable, and the borrower/agent may be subject to termination of their management

agreement.

3-3

(07-19-24) PN 619

HB-2-3560

2.

Borrower Response to Agency Notification

Upon receiving notice of compliance violations at a project, borrowers must address

the violations in accordance with 7 CFR 3560.102(d) and update the management plan as

follows:

• Borrowers must submit to the Agency, within 60 days, revisions to the management

plan that establish the changes in project operation that will restore project

compliance; and

• If the borrower determines that changes to the management plan are not needed

because the compliance violations were due to a failure to follow the current

management plan, the borrower must certify to the Agency that the management plan

is adequate to ensure project compliance with the applicable requirements of this part.

Borrowers must submit a written description of the actions that will be taken,

including timeframes for restoring compliance with the current management plan and

Agency rules and regulations.

E. Continued Management Discrepancies

If the Agency discovers continued discrepancies between a project’s management

plan and project operations, the Agency retains the authority to terminate the current

management agreement and require the borrower to install a new management entity

acceptable to the Agency.

3.4 THE MANAGEMENT CERTIFICATION

As a condition of Agency approval of the management agent, including borrowers who

self-manage, the borrower and the management agent must execute a Form RD 3560-13,

“Management Certification”, and submit this to the Agency each time the borrower proposes a

new management agent and/or a management agreement is executed or renewed. The borrower

and the management agent must jointly submit the certification to the Agency to attest that:

• The borrower and management agent agree to operate the housing project in

accordance with the management plan;

• The borrower and management agent will comply with Agency requirements, loan

or grant agreements, applicable local, State, Tribal, and Federal laws and

ordinances, and contract obligations, will certify that no payments have been made

to anyone in return for awarding the management contract to the management

agent, and will agree that such payments will not be made in the future;

• The borrower and the management agent will comply with Agency notices or

other policy directives that relate to the management of the housing project;

• The management agreement between the borrower and the management agent

complies with the requirements described in this chapter;

3-4

HB-2-3560

• Allowable management fees are assessed and paid out of the housing projects’

general operating account. Borrowers and management agents will comply with

Agency requirements regarding management fees and allocation of management

costs between the management fee and the housing project financial accounts;

• The borrower and the management agent will not purchase goods and services from

entities that have identity-of-interest (IOI) relationships with the borrower or the

management agent until the IOI relationship has been disclosed to the Agency, not

denied by the Agency, it has been determined that the costs are as low as or lower

than open-market purchases, and there are no personal factors that influence the price

and decision-making; and

• The borrower and the management agent agree that all records related to the housing

project are the property of the housing project and that the Agency, OIG, or GAO

may inspect the housing records and the records of the borrower, management agent,

and suppliers of goods and services having an IOI with the borrower or with a

management agent acting as an agent of the borrower upon demand.

The management certification requires that the borrower and the management agent

identify any and all IOI relationships that would involve project funds.

For management agents proposing IOI firms to provide goods and services to Agency

properties, a fee schedule of these goods and services must be attached to Form RD 3560-31,

“Identity of Interest Disclosure/Qualification Certificate”. The Agency must approve the

borrower’s use of such firms prior to the borrower entering into any contractual relationships that

involve Agency funds with such entities.

After the borrower or management agent discloses an IOI relationship in Form RD

3560-31, the Agency will:

• Require the borrower, management entity, and supplier of goods and services to

provide documentation proving that use of IOI firms is in the best interest of the

housing project;

• Require that all suppliers of goods and services agree to certify in writing to the

Agency that the individual or organization proposed is qualified and licensed, if

appropriate;

• Require the borrower, management entity, and supplier of goods and services to agree

in writing to make available all records relating to the housing project to the Agency

or the Agency’s representative; and

• Deny the use of an IOI firm when the Agency determines that using the firm is not in

the best interest of the Federal Government or the tenants.

3-5

(07-19-24) PN 619

HB-2-3560

A. The Role of the Management Agreement

While the management certification replaces the need for the Agency to approve the

management agreement, it does not eliminate the need for the borrower and the

management agent to execute a management agreement. By executing the management

certification, the borrower and the agent are assuring Agency staff that an acceptable

agreement has been executed. Agency staff may review this agreement during the

supervisory visit.

Borrowers operating owner-managed projects are not required to execute a management

agreement.

B. Agency Approval of the Management Certification

A certification must be submitted for Agency approval prior to the initial approval of

the management agent. Subsequent certifications must be submitted for Agency approval

when any of the following occurs:

• An increase in the management fee is requested, if the increased management fee is

not in accordance with Attachment 3-F;

• A new management agent is proposed; or

• A management agreement expires, and a new agreement is executed or renewed.

The borrower must submit a new certification to the Agency for approval at least 45

days prior to the date of the proposed change. The Agency will return the approved or

denied certification within 60 days of receipt.

3.5 SELF-EVALUATIONS AND TRANSITION PLANS

On June 11, 1982, USDA issued 7 CFR 15b, which required all borrowers to conduct self-

evaluations of their facilities, policies and procedures for compliance with Section 504 of the

Rehabilitation Act of 1973 and the Uniform Federal Accessibility Standards (UFAS), within one year of

the USDA regulation. Information related to these compliance issues as they affect Section 514, Section

515, Section 516, and Section 521 housing may be found in answers to frequently asked questions in

Appendix 5. In the event that structural changes were necessary, recipients were required to develop

transition plans that set forth the steps necessary to complete such changes.

Borrowers may become liable for fines and penalties imposed by enforcement agencies,

loss of tax credits, or legal actions if found in non-compliance with civil rights laws. The

Agency does not impose these fines and penalties, but will follow regulatory, supervisory,

servicing procedures and loan eligibility requirements when non-compliance is found.

A. Borrowers Required to Conduct Self-Evaluations and Develop Transition Plans

The following borrowers must conduct self-evaluations and develop transition plans:

• Borrowers of projects ready for occupancy on or before June 10, 1982.

• Borrowers of projects ready for occupancy after June 10, 1982, who have been found

in non-compliance with Civil Rights law (as a remedial action).

3-6

HB-2-3560

• Borrowers who have had complaints filed against them, when the Agency determines

it necessary.

• Borrowers transferring ownership.

• Borrowers of projects receiving rehabilitation or equity loans, when the Agency

determines it necessary.

• Borrowers receiving loans for new construction after August 20, 2002. The Agency

will review the self-evaluation and any transition plan during the preoccupancy

conference.

• All State and local Government borrower entities. The Department of Justice issued

a regulation on July 26, 1991, which requires all State and local governments to

conduct self-evaluations, unless they had already done so to meet the requirements of

Section 504.

• Borrowers receiving loans after January 1, 2001, if a self-evaluation has not been

conducted within the last 3 years.

B. Standards Borrowers Must Meet

Regardless of when a project was ready for occupancy, all borrowers are required to

have policies and practices that do not discriminate against persons with disabilities.

The architectural accessibility standards borrowers must meet will depend on when the

project was ready for occupancy and what modifications are planned. In addition, many

State and local governments have their own accessibility standards that must be met.

The Agency does not have the authority to waive any accessibility requirements.

C. Self-Evaluation and Transition Plan Requirements

1.

Self-Evaluations

In accordance with 7 CFR 15b, self-evaluations must:

• With the assistance of interested persons, including persons with disabilities or

organizations representing disabled persons, evaluate their current policies and

practices and the effects thereof;

• After consultation with interested persons, including disabled persons or

organizations representing disabled persons, modify any policies and practices that do

not meet the requirements of this part;

• After consultation with interested persons, including disabled persons or

organizations representing disabled persons, take appropriate remedial steps to

eliminate the effects of any discrimination that resulted from adherence to these

policies and practices that do not meet the requirements of this part; and

3-7

(07-19-24) PN 619

HB-2-3560

• Maintain a record of the self-evaluation for at least three years. The record must be

made available for public inspection and be provided to the Agency upon request.

The self- evaluation record must contain:

◊ A list of the interested persons consulted;

◊ A description of areas examined, and any problems identified; and

◊ A description of any modifications made, and any remedial steps taken.

2.

Transition Plans

At a minimum, transition plans must:

• Identify physical obstacles in the borrower’s facilities that limit the accessibility

of their property to disabled persons;

• Describe in detail the methods that would be used to make the facilities accessible;

• Specify the schedule for taking the steps necessary to achieve full program

accessibility and if the time period of the transition plan is longer than one year,

identify steps that will be taken during each year of the transition period; and

• Identify the person responsible for implementation of the plan.

When structural changes are necessary, such changes must be made as expeditiously

as possible within three years.

3-8

HB-2-3560

SECTION 2: APPROVING, REMOVING, AND REVIEWING

THE MANAGEMENT AGENT [7 CFR 3560.102]

3.6 THE MANAGEMENT AGENT

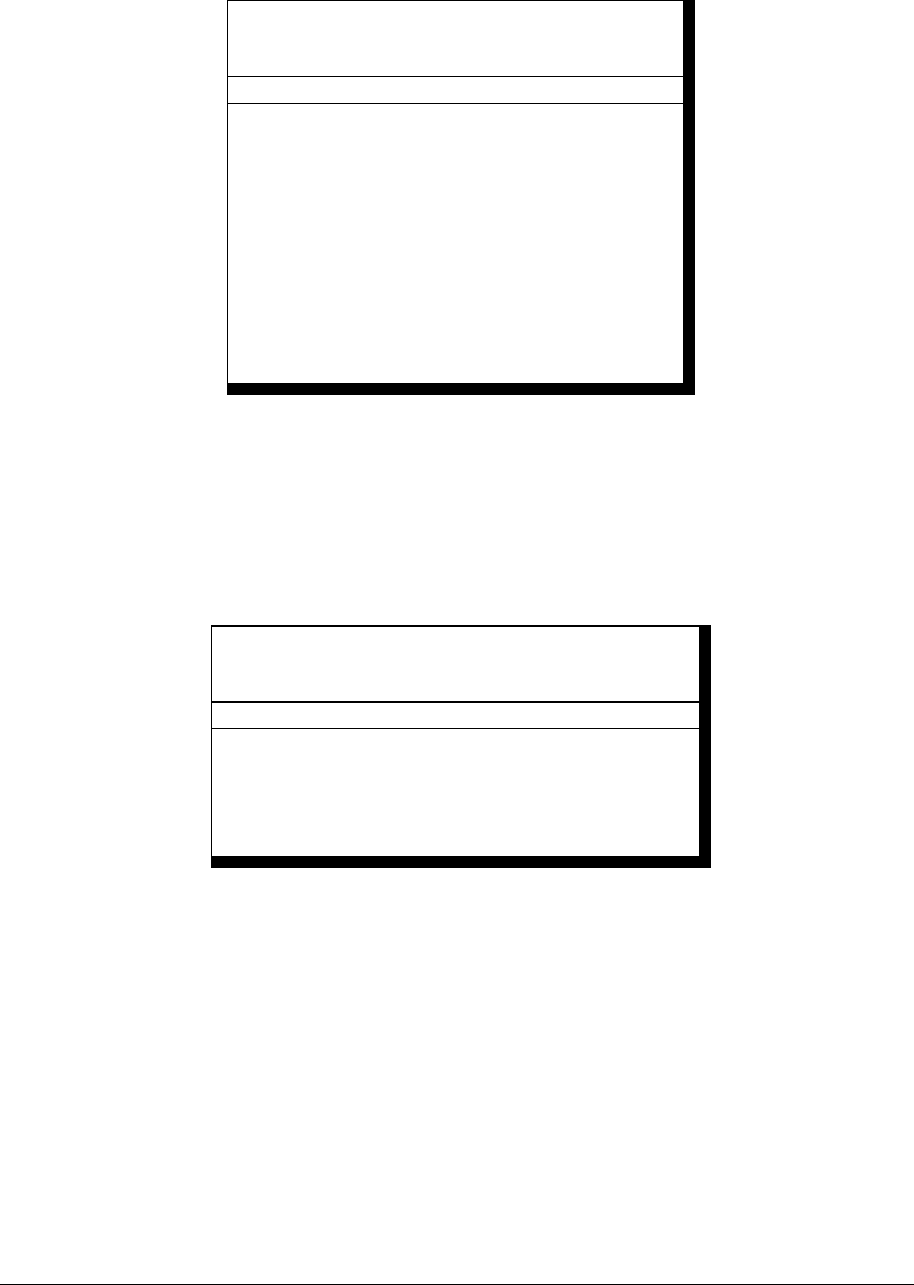

A. Acceptable Types of Management Entities

Exhibit 3-1 shows the three types of management entities.

1.

Borrower/Manager

In the borrower/manager relationship, the borrower and the management agent are the

same business entity. This is often referred to as “self-management or owner-managed”.

A project is not self-managed if some or all of the same individuals are involved in both

the borrower entity and the management agent, but the organizations are legally different

business entities.

For example, if the borrower is a limited partnership and the general partner of the

borrower entity serves as the management agent, the management agent is not a

borrower/manager because the management agent and the borrower are different business

entities. Instead, the management agent is an identity-of-interest management agent.

2.

Identity-of-Interest Management Agent

An IOI relationship exists when an individual, including the spouse, parent, child,

grandchild, or sibling, or other relation by blood or marriage, or entity that provides

goods, management, or other services to the project has a relationship with the project

borrower that is such that selection of the management agent and determination of the

management fee will not be determined through an arms-length transaction. Exhibit 3-2

further describes this relationship.

Failure to disclose such IOI relationships may subject the borrower, the management

agent, and other firms or employees among whom the IOI relationship exists to

suspension, debarment, or other remedies available to the Agency.

3-9

(07-19-24) PN 619

Exhibit 3-1

Three Types of Management Entities

Borrower/manager

IOI management agent

Independent fee management agent

In this Handbook, the term “management agent” applies to

all three forms of management entities, unless a specific

distinction is made because of policy or procedural

differences.

HB-2-3560

3.

Independent Fee Management Agent

An independent fee management agent is a management company or individual that

has no IOI relationship with the borrower and no financial interest or involvement in the

project, other than earning a fee for providing management services.

B. Approval of the Proposed Management Entity

A management entity will be deemed acceptable by the Agency provided that the

agent or staff member has a minimum of two years of experience and satisfactory

performance in directing and overseeing the management of similar Federally assisted

multi-family housing. Management services are a lower-tier transaction and subject to

debarment and suspension check by the Agency in accordance with 7 CFR 3017 and RD

Instruction 1940-M. Management entities found to have been disbarred are not eligible

for approval by the Agency.

In addition, the Agency may issue approval to a management agent if the agent’s

Form HUD 2530 shows that a small percentage of the properties it has managed are

either in default or have a mortgage delinquency and either one of the following can be

documented:

• The default or delinquency was due to circumstances beyond its control; or

3-10

Exhibit 3-2

Identity-of-Interest Relationships

An IOI relationship exists when:

The borrower entity, any principal of, or a general partner of the borrower

entity; or

Any officer or director of the borrower entity; or

Any person who directly or indirectly controls 10 percent or more of the

voting rights, or owns 10 percent or more of the borrower entity

is also

A borrower, general partner, officer, or director of the management agent

company or its subcontractor; or

A person who directly or indirectly controls 10 percent or more of the voting

rights or owns 10 percent or more of the management company or its

subcontractor.

As used above, “person” refers to any individual (spouse, parent, child,

grandchild, sibling, or other relation by blood or marriage), partnership, corporation,

or other business entity. Any ownership, control, or interest held or possessed by a

person’s spouse, parent, child, grandchild, or sibling or other relation by blood or

marriage is attributed to that person for this determination.

As used above, “subcontractor” refers to any individual or company that

contracts with the management agent to provide management services to the project.

HB-2-3560

• The agent is making satisfactory progress toward improving the problem property’s

operations.

The Agency reserves the right to deny approval of any proposed management entity

that does not meet such requirements. The Agency may issue a denial of a proposed

management agent if:

• The agent and/or its staff does not have two years of experience successfully

managing Section 514, Section 515, or Section 516 properties as relevant or other

assisted housing;

• If the agent’s Form HUD 2530, “Previous Participation Certification”, shows that a

substantial percentage of the properties it has managed are either in default or have a

mortgage delinquency; or

• If the agent’s Form HUD 2530, shows that a small percentage of the properties it

has managed are either in default or have a mortgage delinquency and the

management agent is not addressing the property’s or properties’ deficiencies.

To request approval of the management entity, the borrower/agent must submit the

following information to the Agency at least 45 days before the date the borrower

wishes the new agent to assume responsibility. In the case of emergency replacements

of management agents, the borrower/agent must submit the information needed for the

Agency to review and approve the new management agent as soon as the new agent is

identified. Borrowers must submit the following documents when requesting Agency

approval of an agent:

• Management Plan. The management plan establishes the systems and

procedures that will be employed to ensure that project operations comply with

Agency requirements. Form HUD 2530 Previous Participation Certification must

be included as an attachment to the management plan.

• Management Certification. Using Form RD-3560-13, the borrower and

management agent together certify that they will comply with Agency requirements

and contract obligations and will execute an acceptable management agent

agreement, and that no payments have been made to the borrower in return for

awarding the management contract to the agent nor will such payments be made in

the future.

• RD Forms 3560-30 Certification of No Identity of Interest or 3560-31 Disclosure

and Qualification of Identity of Interest, as applicable.

• Additional information required by the Agency. Agency staff may require

borrowers to submit additional information to clarify materials already submitted.

Materials requested may address:

◊ Determining the management agent’s acceptability;

3-11

(07-19-24) PN 619

HB-2-3560

◊ Monitoring the agent’s compliance with Agency requirements;

◊ Resolving project operating problems; and

◊ Justification of contractual relationship with IOI or third-party contractors. The

Agency must review all items listed above within 30 days of receipt. The review will

consist of the following:

• Review of Previous Participation Certification. If the management agent is new

to the Agency and manages properties assisted by HUD, local public housing

agencies, and State housing finance agencies, the servicing jurisdiction must obtain

references from the appropriate jurisdiction on the management agent’s past

performance. For instance, if the management agent has managed HUD properties,

then the Agency is required to contact the appropriate HUD Field Office and obtain

a reference or request that HUD provide a copy of the most recent Form HUD 2530.

• Review of the proposed management plan. This review ensures compliance

with the Agency’s submission requirements and determines if the proposed

systems and procedures:

◊ Are in compliance with Agency requirements;

◊ Can reasonably be implemented at the project; and

◊ Are reasonably tailored to the particulars of the project.

Within 30 days of receipt of information from the borrower/management agent, the

Agency will inform the borrower of its decision in writing.

If the Agency grants approval, the borrower may enter into a contract with the

management agent to begin no sooner than 45 days from the date of submission of the

approval package.

If the Agency issues a denial, the borrower will be provided with appeal rights. The

borrower may not enter into a formal agreement with the management agent being

reviewed by the Agency. If a borrower enters into an agreement with a management

agent or begins to self-manage prior to receiving Agency approval, the Agency will place

the borrower in non-monetary default status. The Agency will ask the borrower, if not in

a self-management arrangement, to immediately terminate the contract with the

management entity. Under emergency circumstances, with Agency consent, the

borrower may enter into a temporary agreement with a different management entity for

30 days.

C. Use of Management Entities without Agency Approval

If a borrower enters into an agreement or contract with a management entity that has

not been approved by the Agency, the Agency is authorized to immediately terminate the

borrower’s agreement or contract with that entity. This action is not appealable.

3-12

HB-2-3560

3.7 REMOVAL OF A MANAGEMENT AGENT

As permitted in the management certification, the Agency reserves the right to remove

the management agent for lack of performance or deliberate fraud against the project or the

Government. Some specific reasons for requiring removal of a management agent are listed in

Exhibit 3-3. Other reasons also may apply.

If the Agency determines that the management agent is in violation of the management

certification, the Agency will:

• Send a servicing letter, Handbook Letter 301 (3560), Servicing Letter #1, notifying

the borrower of the violation;

• State that the management agent must prove that there was no violation or that there

were mitigating circumstances, and the borrower must respond to the Agency within

30 days of the receipt of the servicing letter;

• If the borrower does not respond satisfactory within the prescribed time period with

either (1) documentation that the violation did not take place, or (2) a plan to address

the violation within a certain period of time that is acceptable to the Agency, the

Agency will send the borrower a second servicing letter, Handbook Letter 302

(3560), Servicing Letter #2; and

• If the borrower does not respond within the prescribed time period in the second

servicing letter, the Agency will send a third servicing letter, Handbook Letter 303

(3560), Servicing Letter #3 indicating that the management certification will be

terminated by a certain date. As of that date, no management fees may be paid to the

agent from project funds. If the information reveals that management fees were paid

to the agent subsequent to termination of the management certification, the borrower

will be required to reimburse the funds to the project operating account.

3-13

(07-19-24) PN 619

Exhibit 3-3

Specific Reasons for Requiring Removal of a Management Agent

Lack of performance:

Failure to adhere to the provisions of the management certification;

Repeated failure to adhere to the management plan; and

Non-compliance with applicable State and local laws.

Fraud against the project and/or Government:

Misappropriation of project funds;

Paying kickbacks to contractors, subcontractors, or service providers;

and

Deliberately requesting more Rental Assistance than that to which the

project is entitled.

HB-2-3560

If the borrower is required by the Agency to remove the management agent, they must do

so under the timeframe required by the Agency or file an official appeal, as described in

Chapter 1, stating why they believe the agent should not be removed. Failure on the part of the

borrower to comply with Agency demands to remove the agent may result in acceleration of the

loan and debarment from further participation in Agency programs.

3-14

HB-2-3560

HB 2 3560

SECTION 3: SETTING THE MANAGEMENT FEE [7 CFR 3560.102]

3.8 THE MANAGEMENT FEE

A. The Purpose of the Management Fee

The purpose of the management fee, which is an allowable expense paid from the

housing project’s general operating account, is to compensate the management agent

for services provided to the project when the fee is approved by the Agency as a

reasonable cost to the housing project and documented on the management

certification. These services are described in Attachment 3-D.

B. Types of Management Fees

There are two major types of fees that, when added together, make up the

overall management fee for a project:

• Base fee per occupied revenue producing unit; and

• Add-on fees.

The base fee per occupied revenue producing unit is the largest component of the

management fee. It must be quoted and calculated as a per-unit, per-month (PUPM) fee

for revenue producing units occupied during a given month. This requirement gives the

agent an incentive to maximize occupancy.

Add-on fees are quoted as dollar-per-unit amounts because they relate to

project conditions that are not a function of project occupancy.

1.

Occupied Unit Fee

Periodically, the Agency will review the base per occupied revenue unit fee.

Surveys may be conducted to collect management fee data from other assisted housing

sources such as local Housing and Urban Development field offices, State Housing

Finance Agencies, Housing Authorities, local housing organizations, and non-profits.

Each Region provides information about the organizations within its states, documents

contacts and provides a description of the fee structure used by the source organizations.

The description should include the amount of the management fee, how the

management fee was established, and a ‘bundle of services’ comparability synopsis.

To provide consistency, the states are divided into Regions. The Regions are

identified as follows:

MIDWEST: Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska

North Dakota, Ohio, South Dakota, Wisconsin;

NORTHEAST: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire,

New Jersey, New York, Pennsylvania, Rhode Island, Vermont, Virginia, West Virginia;

3-15

(07-19-24) PN 619

HB-2-3560

SOUTH: Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina

Oklahoma, Puerto Rico, South Carolina, Tennessee, Texas, Virgin Islands;

WEST: Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico

Oregon, Utah, Washington, Wyoming.

2.

Add-On Fees

Add-on fees are a flat PUPM fee paid to agents managing projects with long-term

project characteristics and conditions that require additional management effort

beyond the activities covered by the base fee portion of the management fee. The

add-on fee is applicable to all revenue producing units regardless of occupancy status.

See Exhibit 3-4 for types of add-on fees.

• The Agency has established a standard list of add-on fees that is applicable to all

states.

• Exhibit 3-4 project characteristics or conditions that warrant the use of add-on fees.

Add-on fees should not cover project characteristics or conditions that are already covered in the base fee.

Agents may not take add-on fees for management of properties with workout agreements except under limited

circumstances, and solely at the Agency’s discretion. If it is demonstrated that conditions at the property are

beyond the management agent’s control, the Agency may agree to allow the management agent to take add-ons

fees for the circumstances listed in Exhibit 3-4.

Exhibit 3-4

Agency Approved Add-On Fees

Type of Add-on Fees

PUPM

Management of properties with 15 units or less

$5

One project that has buildings located on different non-contiguous

parcels of land (i.e. across town or in another town)

$5

Management of properties in a *remote location

$5

Troubled or critical properties with workout plans and new

management only

$5

**Properties with Multiple Subsidies with annual reporting

requirements

$5

*Effective with FY2023 proposed budgets, “Remote Location” is defined as properties located within the USDA

Economic Research Service (ERS) Level 4 Frontier & Remote (FAR) Area codes. https://www.ers.usda.gov/data-

products/frontier-and-remote-area-codes/. The following states/territories do not have areas that meet the Level 4

FAR definition: Connecticut, Delaware, Indiana, Massachusetts, New Jersey, Ohio, Puerto Rico, Rhode Island,

South Carolina, and the Virgin Islands. Properties in Alaska or Hawaii that are authorized to take the “off-road”

management fee are not eligible to claim an additional add-on fee for remote location. If the property does not

suffer from difficulty retaining staff, obtaining services, or if management offices are located near the Level 4

FAR property, management should refrain from claiming this add-on fee. If a property is not located in a

Level 4 FAR area, and management can justify a remote location add-on fee, they may request an exception.

Reasonable justification must be submitted to the MFH servicing specialist for review. Justifications could include

extensive travel time, difficulty obtaining services or retaining staff, or required unique means of travel (4-wheel

3-16

HB-2-3560

HB 2 3560

drive, ferry, etc.). If there is a question as to whether the justification is reasonable, the servicing specialist should

consult with their team lead.

**Multiple Subsidies – properties with additional subsidy that have reporting requirements in addition to and

separate from those of Rural Development such as Low-Income Housing Tax Credits or project-based Section-8.

This does not include Section 538 loans. Regardless of the number of layered subsidies, the total add-on fee for this

category is $5.

The Occupied Unit Per Month State Maximum Management Fee available on

Attachment 3-F must be reflected on the proposed budgets and are effective January 1,

for the specified fiscal year.

The Agency’s decision regarding the amount of management fees set by the region

and the state is unappealable.

C. Services Paid from the Management Fee

The purpose of the management fee is to compensate the Agent for

providing oversight to the project including:

• Overseeing compliance with national, State, and local laws and regulations;

• Establishing strong project management policies and procedures; and

• Overseeing the implementation laws, regulations, policies, and procedures

through the supervision of onsite staff.

Charges covered by the management fee must be listed in the project’s Management Plan. A

breakdown of items that are to be paid from the management fee can be found in

Attachment 3-D.

D. Services Paid from Project Income

In general, project income is used to pay for project-related items. Examples

include the salary, benefits, and office expenses of onsite office staff and maintenance

expenses for the property and costs for processing project-specific transactions (e.g.,

tenant certifications). A specific breakdown of items that are to be paid from project

income as opposed to the management fee can be found in Attachment 3-E.

The borrower and management agent must obtain materials, supplies, utilities, and

services at a reasonable cost and seek the most advantageous terms for the project.

Generally, expenses charged to project operations, whether for management agent

services or other expenses, must be reasonable, typical, necessary and show a clear

benefit to the residents of the property. Services and expenses charged to the property

must show value added and be for authorized purposes. If such value is not apparent,

the service or expense should be examined.

3-17

(07-19-24) PN 619

HB-2-3560

Administrative expenses for project operations exceeding 23 percent, or those

typical for the area, of gross potential basic rents and revenues (i.e., referred to as

gross potential rents in industry publications) highlight a need for closer review for

unnecessary expenditures. Budget approval is required, and project resources may not

always permit an otherwise allowable expense to be incurred if it is not fiscally

prudent in the market.

Excessive administrative expenses can result in inadequate funds to meet other

essential project needs, including expenditures for repair and maintenance needed to

keep the project in sound physical condition. Actions that are improper or not fiscally

prudent may warrant budget denial and/or a demand for recovery action.

The borrower or management agent must credit any rebates, fees, proceeds, or

commissions generated by transactions using project funds to the project.

3-18

HB-2-3560

SECTION 4: INSURANCE, BONDING, AND TAXES [7 CFR 3560.105]

3.9 OVERVIEW

Insurance protects the asset against loss or damage. Borrowers without adequate

insurance coverage are financially responsible for:

• Property damage;

• Losses due to employee dishonesty or error; and

• Personal injuries that occur on the property.

Borrowers are responsible for acquiring and maintaining insurance on all dwellings and

buildings that are necessary for the operation of the project in accordance with their loan or grant

documents. Insurance must be in place at loan closing and must remain in place until the loan is

paid in full. Reevaluation of insurance coverage is necessary when new buildings are

constructed, or values increase or decrease materially. Any refund or rebate from the insurance

company must be credited to the project’s account.

The Agency is responsible for counseling the borrower regarding the Agency’s insurance

requirements. Through the Multi-Family Information System (MFIS), MFH Servicing Officials

will monitor insurance policy expiration and ensure borrower compliance. The Agency will

obtain insurance for the secured property if the borrower is unable or unwilling to do so. If a

borrower refuses to pay the insurance premium with their own funds or fails to arrange with the

agent for subsequent payment by premium note or otherwise, the Agency will pay the amount of

the insurance premium and charge the premium payment amount and all costs associated with

procurement of the required insurance to the borrower’s Agency account. The Agency considers

a borrower’s failure to maintain adequate insurance coverage or to pay taxes as non-monetary

default. Borrowers who fail to furnish property and hazard insurance coverage of any kind are

responsible for the debt in the event of loss.

3.10 PROPERTY INSURANCE

Property or “all-risk” insurance protects the physical asset against loss due to damage.

Types of property insurance are described below.

A. Hazard Insurance

1.

Loss or Damage Covered

Hazard insurance protects the property against fire and weather-related damage, as

well as damage from civil commotion, aircraft, or other vehicles. These policies may

also be known as fire and extended coverage, homeowners, all physical loss, or broad

form policies.

3-19

(07-19-24) PN 619

HB-2-3560

2.

Coverage Requirements

The minimum property insurance coverage per building is 100 percent of the

insurable value as reflected in the appraisal report, as referenced in Chapter 7 of HB-1-

3560. If no appraisal report is required, the Agency will perform the necessary

evaluations and determine and document the minimum insurance coverage requirements

in the file.

3.

Deductible

If a property’s insurance policy has a deductible, the deductible must be accounted for

in the reserve account, unless the deductible does not exceed:

• $1,000 on any project with an insurable value under $200,000; or

• One-half of 1 percent of the insurable value, up to $10,000 on a project with an

insurable value over $200,000.

Borrowers who wish to increase the deductible amount must deposit an

additional amount to the reserve account equal to the difference between the

Agency’s maximum deductible and the requested new deductible. The Borrower

will be required to maintain this additional amount so long as the higher

deductible is in force. This is commonly referred to as GAP insurance.

B. Flood Insurance

1.

Loss or Damage Covered

Flood insurance protects the property against flooding caused by natural disasters

such as hurricanes. This coverage is required only for those properties located in areas

identified as flood hazard areas.

2.

Coverage Requirements

Flood insurance is required for any property located in a Special Flood Hazard Area

(SFHA), as identified by the Federal Emergency Management Agency (FEMA). FEMA

Form 81-93, Standard Flood Hazard Determination is used to determine if a property is

in a SFHA and whether flood insurance is available under FEMA’s National Flood

Insurance Program. If the property is in a SFHA, the Agency will notify the borrower

using Form RD 3550-6, Notice of Special Flood Hazards, Flood Insurance Purchase

Requirements, and Availability of Federal Disaster Relief Assistance. The borrower

must sign and return Form RD 3550-6 prior to loan closing. If the borrower cannot

secure flood insurance through FEMA’s National Flood Insurance Program in a SFHA,

the property is not eligible for Federal financial assistance.

3.

Deductible

The Agency allows a maximum deductible of $5,000 per building.

C. Earthquake Insurance

1.

Loss or Damage Covered

3-20

HB-2-3560

c

Earthquake insurance covers property losses in the event of an earthquake.

Earthquake coverage is recommended in areas where earthquakes are prevalent; however,

it is very expensive and generally has a high deductible.

2.

Coverage Requirements

Although the Agency does not specifically require a project to be covered by

earthquake insurance, it recommends a Probable Maximum Loss (PML) seismic study for

all projects located in certain regions of the country where earthquakes are prevalent.

The coverage amount should be for 100 percent of the replacement cost of the project.

3.

Deductible

In the event that the borrower obtains earthquake coverage, the Agency is to be

named as a loss payee. The deductible should be no more than 10 percent of the

coverage amount.

D. Windstorm Insurance

1.

Required Coverage

The windstorm policy should include extended coverage for rental loss for at least 12

months, except for coverage provided by State insurance programs.

2.

Deductible

When windstorm coverage is excluded from the “all risk” policy, the deductible must

not exceed 5 percent of the total insured value.

E. Builder’s Risk Insurance

Builder’s risk insurance protects the property against loss or damage during

construction or reconstruction after an insured loss.

F. Elevator, Boiler, and Machinery Insurance

1.

Loss or Damage Covered

Elevator, boiler, and machinery coverage is required for any property that

operates elevators, steam boilers, turbines, engines, or other pressure vessels.

2.

Coverage Requirements

The Agency requires boiler and machinery insurance in any property that has

centralized heating, ventilating, and air-conditioning (HVAC) equipment in operation.

3-21

(07-19-24) PN 619

HB-2-3560

G. Sinkhole Insurance or Mine Subsidence Insurance

1.

Loss or Damage Covered

Sinkhole insurance or mine subsidence insurance is recommended for projects located

in areas prone to these geological phenomena.

2.

Coverage Requirements

The amount of coverage that the Agency recommends for properties located in areas

prone to these geological phenomena is 100 percent of the replacement cost of the

structure affected.

3.

Deductible

The deductible for sinkhole insurance or mine subsidence insurance should be similar

to what would be required for earthquake insurance.

H. Business Income or Rent Loss Insurance

1.

Loss or Damage Covered

Business income or rent loss coverage provides coverage for the loss of rental income

incurred due to a property loss during a 12-month period.

2.

Coverage Requirements

The Agency does not require but recommends that the project be insured against loss

of business income or rent in the event of a property loss that causes one or more units to

be uninhabitable for a period of time. Business income coverage may be obtained in one

of two forms:

• Actual loss sustained; or

• A fixed amount equal to the annualized amount of monthly gross potential rents.

I. Acceptable Exclusions

Acceptable exclusions from “all risk” insurance policies include:

• War or military action;

• Nuclear hazard;

• Volcanic eruptions;

• Fraudulent or dishonest acts committed by the insured;

3-22

HB-2-3560

• Dispersal, release, or escape of contaminants or pollution (biological or chemical

agents); and

• Terrorism.

J. Property Insurance Exemptions

Property insurance is not required if:

• The building is in such a state of disrepair that the cost of insurance would be

prohibitive;

• The building has a depreciated replacement value of $2,500 or less

K. Property Insurance Policy Requirements

The project’s property insurance policy must include the following:

• Name and location. The policy should contain the names of the borrowers who are

owners of the property being insured. The exact location of the property should be

described in the policy.

• Loss or damage covered. The policy must indicate that the buildings are insured

against loss or damage by fire, smoke, lightning, windstorms, hail, earthquake,

explosion, riot, civil commotion, aircraft, and vehicles.

• Effective date of insurance. If there are insurable buildings located on the property,

the policy’s effective date will be on or before loan closing or assumption, or before

the credit sale is closed, so that the policy will properly insure the borrower and the

mortgagees. When new buildings are erected or major improvements made to

existing buildings, such insurance will be made effective as of the date materials are

delivered to the property. The Agency will not advance loan funds for labor or

materials until the borrower has furnished adequate insurance to protect the interest of

the Agency.

• Term. The borrower must furnish insurance for a term of at least 1 year, with

evidence that a full year’s premium is paid. If the policy is the type that imposes an

assessment only after a loss has occurred, the borrower must provide documentation

from the insurance company that no assessment is owed. If the insurance policy is

automatically renewable, the renewal clause must meet Agency requirements.

• Loss payee. The Agency must be named loss co-payee on all properties where it

holds first lien position, which means if there is a damage or loss, the insurance draft

will be made payable to the Agency. Further, the Agency must be named as an

additional insured if its lien position is other than first.

3-23

(07-19-24) PN 619

HB-2-3560

• Mortgage clause. The standard mortgage clause adopted by the State or the Agency

Form RD 426-2, “Property Insurance Mortgage Clause (Without Contribution)”

must be attached to or printed in the insurance policy. Whenever a new mortgage

clause highlighting the Agency's interest is issued after the policy has been in force,

the new mortgage clause must be signed by an authorized agent or officer of the

company that issued the policy.

The mortgage clause is not required if:

◊ An authorized official of an insurance company provides a statement that all

insurance policies the company issues in the State, and in which Rural

Development has a mortgage interest, incorporate all of the provisions of Form

RD 426-2. This statement may be accepted in lieu of attaching the form to each

policy. If such a blanket letter is used, Rural Development must be named in the

loss payable clause after prior approval is obtained from the Agency.

◊ For all hazard and flood insurance policies the Agency will be named as co-payee.

◊ For builder’s risk policies the borrower must be named as the insured party, and

the policy must convert to full coverage when the project is completed.

3.11 FIDELITY COVERAGE

A. Loss or Damage Covered

Fidelity insurance protects the property against loss due to employee dishonesty.

The policy will provide coverage on all persons with access to project assets. Fidelity

coverage may also be known as Blanket Crime Coverage or Fidelity Bond.

B. Coverage Requirements

The fidelity insurance policy, at a minimum, must include an insuring agreement that

covers employee dishonesty. The minimum amount of fidelity coverage will be the

amount calculated by multiplying an exposure index by a coverage factor. When the

calculated amount is less than $10,000, minimum coverage of $10,000 must be provided.

This calculation is made as follows:

• Determine exposure index: Exposure index = 25 percent of the SUM of annual cash

receipts (rents, cash subsidy, security deposits and interest, etc.) and cash (cash

carryover, reserves, CDs, tax and insurance escrows, etc.). Round to next higher

$1,000.

• Determine coverage: Coverage = exposure index X coverage factor taken from the

coverage chart shown in Exhibit 3-5. Round to next higher $1,000.

3-24

HB-2-3560

Exhibit 3-5

Fidelity Coverage

Exposure Index

Coverage Factor

$100,000 or less

0.30

$100,000 to $200,000

0.28

$200,000 to $300,000

0.26

$300,000 to $400,000

0.24

$400,000 to $500,000

0.22

$500,000 to $600,000

0.20

$600,000 to $700,000

0.18

$700,000 to $800,000

0.16

$800,000 to $900,000

0.14

$900,000 to $1,000,000

0.12

$1,000,000 or more

0.10

C. Deductible

A deductible is designed to allow flexibility in balancing what the project can

prudently pay from its own assets, at a time of loss, against the economy of annual

premiums in its annual budget. The deductible levels shown in Exhibit 3-6 will meet

Agency requirements. Each year borrowers must review and adjust, if necessary, their

fidelity coverage.

Exhibit 3-6

Fidelity Coverage Deductible Levels

Fidelity Coverage

Deductible Level

Under $50,000

$1,000

Up to and including $100,000

$2,500

Up to and including $250,000

$5,000

Up to and including $500,000

$10,000

Up to and including $1,000,000

$15,000

D. Exemptions

Fidelity insurance is not required under the following circumstances:

• When a loan is made to an individual or a general partnership, and that individual or

general partner will be responsible for the project’s financial activities. Individuals

cannot bond against their own actions. For land trusts where the beneficiary is

responsible for project management, the beneficiary is treated as an individual.

• For the general partners of a limited partnership, unless one or more of its general

partners perform financial acts coming within the scope of the usual duties.

E. Policy Requirements

3-25

(07-19-24) PN 619

Fidelity coverage must be documented on a bond form acceptable to the Agency.

Fidelity coverage policies must state that the insurance company will provide protection

to the insured against the loss of money, securities, and property through any criminal or

dishonest acts by any employee acting alone or in collusion with others. The amount of

indemnity will not exceed the amount stated in the declaration of coverage.

The portion of the insurance premium to cover project site employees and general

partners is an eligible project expense. The premium paid by the management agent is

part of the agent’s management expense and cannot be claimed as a project expense.

When a project site employee is covered under the management agent’s fidelity policy,

the pro rata portion of the premium covering the employee should be reflected in the

management plan.

3.12 ERRORS AND OMISSIONS INSURANCE

Errors and omissions (E&O) coverage protects the borrower against loss resulting from

negligence, errors, or omissions committed by those persons covered under the

borrower’s fidelity insurance policy. Obtaining E&O insurance does not diminish or

limit the borrower’s documentary obligations and responsibilities.

3.13 LIABILITY INSURANCE

A. Loss or Damage Covered

This coverage insures against any personal injury that might occur in or on the

project’s common areas, common elements, commercial space, and public areas.

B. Coverage Requirements

The coverage must meet the requirements established below.

1.

Commercial General Liability

The insurer's limit of liability per occurrence for personal injury, bodily injury, or

property damage under the terms of coverage must be at least $1,000,000. Coverage may

also include borrower exposure to risks such as E&O and environmental damage, or

protection against discrimination claims.

2.

Umbrella Liability Insurance

The Agency recommends, but does not require, the borrower to obtain umbrella

liability insurance to provide coverage over and above the $1,000,000 provided for in the

commercial general liability policy. The Agency recommends that umbrella liability

insurance policies provide coverage as follows:

3-26

HB-2-3560

HB-2-3560

• For projects with buildings of 1 to 3 stories, $1,000,000;

• For projects with buildings of 4 to 10 stories, $5,000,000; and

• For projects with buildings of 11 to 20 stories, $10,000,000.

3.

Commercial Automobile Liability Insurance

The Agency recommends that the borrower purchase commercial automobile liability

insurance to cover all automobiles used for business purposes related to the project. The

recommended amount of coverage is $1,000,000 per occurrence.

C. Deductible

The Agency allows a deductible not to exceed $5,000 per occurrence.

3.14 WORKERS’ COMPENSATION

This insurance coverage, which is also known as employer’s liability coverage, is

required by the Agency.

3.15 POLICY RENEWALS

When renewing insurance policies, if the best policy the borrower can obtain contains a

deductible clause with amounts greater than those stated above, the borrower must submit to the

MFH Servicing Official:

• The insurance policy; and

• An explanation and documentation of the reasons why more adequate insurance

coverage was not available.

3.16 BLANKET POLICIES

Blanket insurance policies for several buildings or properties located on non-contiguous

sites are acceptable if the insurer provides proof that the secured property is as fully protected as

if a separate policy were issued.

Blanket crime insurance coverage or fidelity bonds are acceptable types of fidelity

coverage. At a minimum, a borrower must provide the Agency with an endorsement listing all

Agency properties and their locations covered under the policy or bond as evidence of required

fidelity insurance. The policy or bond may also include properties or operations other than

Agency-financed properties on separate endorsement listings.

Individuals or organizational borrowers must have fidelity coverage when they have

employees with access to Multi-Family Housing complex assets. A borrower who uses a

3-27

(07-19-24) PN 619

HB-2-3560

management agent with exclusive access to housing assets must require the agent to have fidelity

coverage on all principals and employees with access to the project. If project management

reverts to the borrower, the borrower must immediately obtain fidelity coverage.

3.17 AUTHORIZED INSURANCE PROVIDERS

Borrowers are responsible for selecting an insurance provider that meets Agency

requirements. The insurance provider must be licensed or authorized to do business in the

State or jurisdiction where the project is located. In making the determination that an insurance

company is reputable and financially sound, the Agency uses all relevant available information,

including financial statements, Best’s Insurance Reports, and information from State insurance

authorities.

The borrower and management agent are required to disclose any IOI relationships with

the insurance company.

3.18 BORROWER FAILURE TO MEET INSURANCE REQUIREMENTS

The MFH Servicing Official is responsible for taking all actions in connection with

insurance that are necessary to protect the security interest of the Agency. Any unusual

situation that may arise with respect to borrower procuring or maintaining insurance should be

referred to the Leadership Designee. The Leadership Designee may refer questions to the

Office of General Counsel (OGC).

A. Unacceptable Insurance Policy

When the borrower submits a policy or binder that does not meet Agency

requirements, Agency staff will return the policy/binder to the borrower with a letter

that provides the reasons for the policy's unacceptability and requires an acceptable

policy within 30 days of the date of the letter.

If acceptable coverage still is not obtained from an authorized provider and the

determination has been made to continue with the borrower, the MFH Servicing Official

will temporarily accept from the borrower the available insurance policy the Agency

determines most nearly conforms to established requirements. Whenever adequate

insurance becomes available, the Leadership Designee will require the borrower to

deliver to the Agency an acceptable insurance policy.

B. Expired Policies

When an expired insurance policy is not renewed, the MFH Servicing Official will

require the borrower to provide a new policy. The Agency will be shown in the loss

payable clause and in the mortgage clause in the proper order of priority. Insurance

coverage on each building usually will be the same as shown on the expired policy if it

meets or exceeds Agency requirements. If the coverage shown on the expired policy

does not meet Agency requirements, the borrower will obtain the proper coverage. If

the insurance agency or broker who issued the expired policy refuses to issue a new

policy, the MFH Servicing Official will have the borrower designate in writing another

insurance agency or broker from whom the insurance can be obtained.

3-28

HB

HB-2-3560

C. Force-Placed Insurance

If the borrower does not furnish acceptable insurance within the required timeframe

the MFH Servicing Official will begin the process of procuring the required insurance.

The costs of procuring the insurance and the premium amount will be added to the

borrower’s Agency account.

3.19 PROPERTY DAMAGE OR LOSS

Borrowers must notify the Agency and their insurance company agents of any loss or

damage to the insured property.

A. When Loss or Damage is Discovered

Upon being notified of loss or damage, the MFH Servicing Official will:

• If the Agency is listed as mortgagee in the insurance policy, collect the amount of the

loss and may also consent to the borrower using the funds to repair or replace

damaged or destroyed property or to apply the loss proceeds to their loan account or

to any prior liens that might exist in the order of their priority.

• If the Agency is not listed as mortgagee in the insurance policy, contact the borrower

to determine whether they have received the loss proceeds. If the borrower has

received the loss proceeds but has not yet paid for improvements to repair or replace

the property, or has not received the loss proceeds, the MFH Servicing Official will:

◊ Inform the borrower of their responsibility for repairing or replacing the damaged

or destroyed property or for authorized disposition of the loss proceeds; and

◊ Notify the insurance company in writing of the Agency’s interest in the security

property and request that the loss proceeds be made payable jointly to the Agency

and the borrower.

• In discussion with the borrower, determine if any units are uninhabitable. If units are

uninhabitable, the affected tenants may request a Letter of Priority Entitlement

(LOPE) from the Agency. Uninhabitable units must be reflected in MFIS.

• Request the borrower to provide a copy of the Insurance Adjuster’s worksheet

reflecting damages and estimated loss amounts to the Agency. For significant losses,

the scope of work/plans/specs should be submitted to the Program Support Staff

(PSS)/Architect for review. Transition plan items should be reviewed by

PSS/Architect before the work takes place to ensure it meets the applicable

accessibility standards.

• Insurance funds need to be tracked in MFIS Tracked Accounts.

3-29

(07-19-24) PN 619

B. Loss Drafts

A loss draft is payment from the insurance provider for property loss or damage.

Loss drafts for loans secured by a first mortgage, which in the opinion of the Agency

represents a satisfactory adjustment of the loss will be endorsed immediately without

recourse and deposited in a supervised bank account to be used in repairing or replacing

the damaged building, except when:

• The amount of the loss is $5,000 or less and the borrower will use the funds for

repairing or replacing an essential building. The loss draft may be endorsed without

recourse and given to the borrower upon satisfactory proof that the repairs or

replacements have been made.

• The essential buildings are not to be repaired or replaced and other suitable buildings

are not to be erected.

• A balance remains after all repairs, replacements, and other authorized disbursements

have been made, insurance funds can be applied as follows:

◊ To prior liens;

◊ As an extra payment to the borrower’s loan account; or

◊ To the borrower’s reserve account.

◊ Make other capital improvements to the property as approved by the

MFH Servicing Official.

• The indebtedness secured by the insured property has been paid in full or the draft is

in payment for loss of property on which the Agency has no claim. A loss draft that

includes the Agency as a joint payee may be endorsed without recourse and delivered

to the borrower.

Loss drafts for a loan that is not secured by an Agency first mortgage will be released

by the Agency only if the primary mortgagee agrees to the provisions set forth in the

previous part.

3.20 REAL ESTATE TAXES

Borrowers are responsible for paying real estate taxes each year. The annual

financial statements must include a certification that the property’s real estate taxes have

been paid. Failure to pay taxes and assessments by the due date will be considered a

non-monetary default.

When the Agency discovers that a borrower has failed to pay property taxes or local

assessments, the MFH Servicing Official will notify the borrower in writing to pay the

property’s taxes and that paying taxes are the borrower’s responsibility. The notification

letter will request proof of payment of taxes within 30 days. If the borrower fails to

submit proof of payment, the MFH Servicing Official will:

3-30

HB-2-3560

HB

• Determine if taxes have been paid;

• Pay delinquent taxes and any penalties;

• Charge the cost of bringing the taxes current to the borrower’s Agency account; and

• Require the borrower to establish an account to ensure that funds are available for

payment of taxes.

The MFH Servicing Official will begin servicing actions.

SECTION 5: PROJECT MANAGEMENT FOR LABOR HOUSING

3.21 PROJECT MANAGEMENT AND FEES

A. Off-Farm Labor Housing

Project management for off-farm labor housing will be in accordance with the

procedures established in this chapter for the Section 515 program. Borrowers are

required to submit a management plan and a management certification, and to receive

Agency approval on the proposed management agent and the management fee prior to

paying a management fee from project income. For off-farm labor housing operated on

a seasonal basis, the management plan must establish specific opening and closing dates.

B. On-Farm Labor Housing

Project management for On-Farm Labor Housing projects should follow the same

basic procedures as outlined in this chapter for the Section 515 program with the

following exceptions:

• On-Farm Labor Housing borrowers are expected to manage their own properties and

should not need to charge a fee for this service; and

• On-Farm Labor Housing borrowers are required to maintain a lease or employment

contract with each tenant specifying employment with the borrower as a condition for

continued occupancy.

3.22 INSURANCE REQUIREMENTS

A. Off-Farm Labor Housing

Off-farm labor housing must comply with the same insurance requirements as

specified for the Section 515 program in this chapter.

B. On-Farm Labor Housing

On-Farm Labor Housing borrowers must ensure that they provide hazard insurance

adequate to cover replacement of the property in case of loss. On-Farm Labor Housing

borrowers must comply with the same flood insurance requirements as specified earlier in

this chapter.

3-31

(07-19-24) PN 619

HB-2-3560

HB-2-3560

3.23 SPECIAL SERVICING REQUIREMENTS FOR SECTION 514 ON-FARM

LABOR HOUSING

A. Background.

Prior to January 17, 1993, owners of on-farm type LH were not allowed to charge rent or

utilities to eligible tenants residing in the housing if the requirement that the owner execute a

loan agreement had been waived. If there had been no waiver of the loan agreement

requirement, owners of on-farm type LH were allowed to charge rent and utilities for the unit.

Effective January 17, 1993, regulations required all owners of Section 514 on-farm type

LH to sign a loan agreement. By signing this agreement, the owners of on-farm LH reaffirmed

their obligation not to charge rent or utilities to eligible tenants. Owners who sign the

agreement must obtain the Government’s prior approval for charging rent, utilities, refundable

deposit charges or cleaning fees. Charges must be reasonable and approved in accordance with

the procedure. Borrowers not meeting these requirements will be requested to comply with

these requirements. Borrowers unwilling or unable to do so may be subject to the RHS

initiating appropriate servicing action to seek compliance.

B. Policy.

Agency staff are to ensure that owners of on-farm type LH financed under Section 514

are not charging for rent, utilities, refundable damage deposit charges, or cleaning fees to

residents, unless the rent, charges, and fees are approved by authorized officials.

Where violations are evident, the owner will be asked, in writing, to come into compliance.

Tenants must receive proper notification and an opportunity to comment on proposed rent

changes. Borrowers should arrange to request rent changes during periods when migrant

residents can be readily contacted. Making requests during the off-farm season when tenants

are not occupying the units does not excuse the borrower from the responsibility to make

effective notification to tenants. Tenants must also receive notice of any approved charges

authorized by the Agency prior to imposing charges. Borrowers imposing unauthorized charges

must be notified, in writing by the Agency, that they must roll back rates retroactively to the last

authorized level. The borrower must give tenants a rebate or credit for the unauthorized

charges.

Borrowers with known violations must be brought into compliance or subjected to

servicing actions which may include, but not be limited to, added Agency supervisory visits,

inspections, and reviews; acceleration; suspension; debarment; and referral to local, State, or

Federal officials for investigation and prosecution of violations of civil or criminal law.

C. Definition of Rent.

For administering the section 514 on-farm program, the term “rent” means any charge

made by a landlord to an eligible tenant household for the use and occupancy of the housing and

includes utilities (i.e., electricity, heat, water, waste disposal, etc.) or the requirement that the

tenant pay the utilities directly to the utility provider.

The term “rent” is also clarified to include any deductions or off-sets made to a tenant’s wages

for the use of a LH dwelling. Rent does not include bona-fide wage changes or reductions

unrelated to retaining rent-free housing benefits. Agency officials should seek to obtain and

document the following:

3-32

HB-2-3560

• A meeting with the tenants residing in the labor housing should be convened,

preferably without the borrower being in attendance in order to ensure objectivity.

Solicit the information set out in the Supervisory Visit On-Farm form in MFIS.

Letters to tenants in advance of the visit may also be used to solicit this information.

• If the borrower is unable to provide utility bills, contacting the utility company to

determine in whose name the utilities are registered. Compare the information

solicited by tenant interviews on utilities paid with the utility company data, where

possible.

• A review of the borrower’s farm and home plan and other financial records to

determine whether the borrower is deriving any income from the farm labor housing

units. Compare the information solicited by tenant interviews on rent and utility

payments with that disclosed by the borrower.

D. Servicing Actions.

Normal servicing letter and initial follow-up: If the borrower is not complying with

Agency regulations (including improperly charging rent, permitting unlicensed occupancy or

occupancy during a period for which the housing was not designed) the borrower should be sent

the first servicing letter identifying the compliance deficiencies. The letter should normally be

sent within 15 days of identification of the compliance deficiencies. Borrowers should normally

be requested to issue a response within 15 days of the date of such a letter. When rent change

violations are identified, the extent of the violations should be documented, including an

estimate of the amount of the improper charges involved and the documentation relied upon to

derive these estimates. Borrowers in violation should be requested to show evidence of any

reimbursement or crediting of improper charges to those residents affected. This includes

documentation of attempts to contact and reimburse former tenants for unauthorized charges.

Where documentation shows former tenants cannot be reached for reimbursement of

unauthorized charges, the borrower may remit the unauthorized charges to the Government for

processing as a miscellaneous payment for crediting to the Rural Housing Insurance Fund.

Within 30 days of sending any letter to the borrower citing unapproved rent charges, officials