CSRF

Ver 1.5

1 of 5

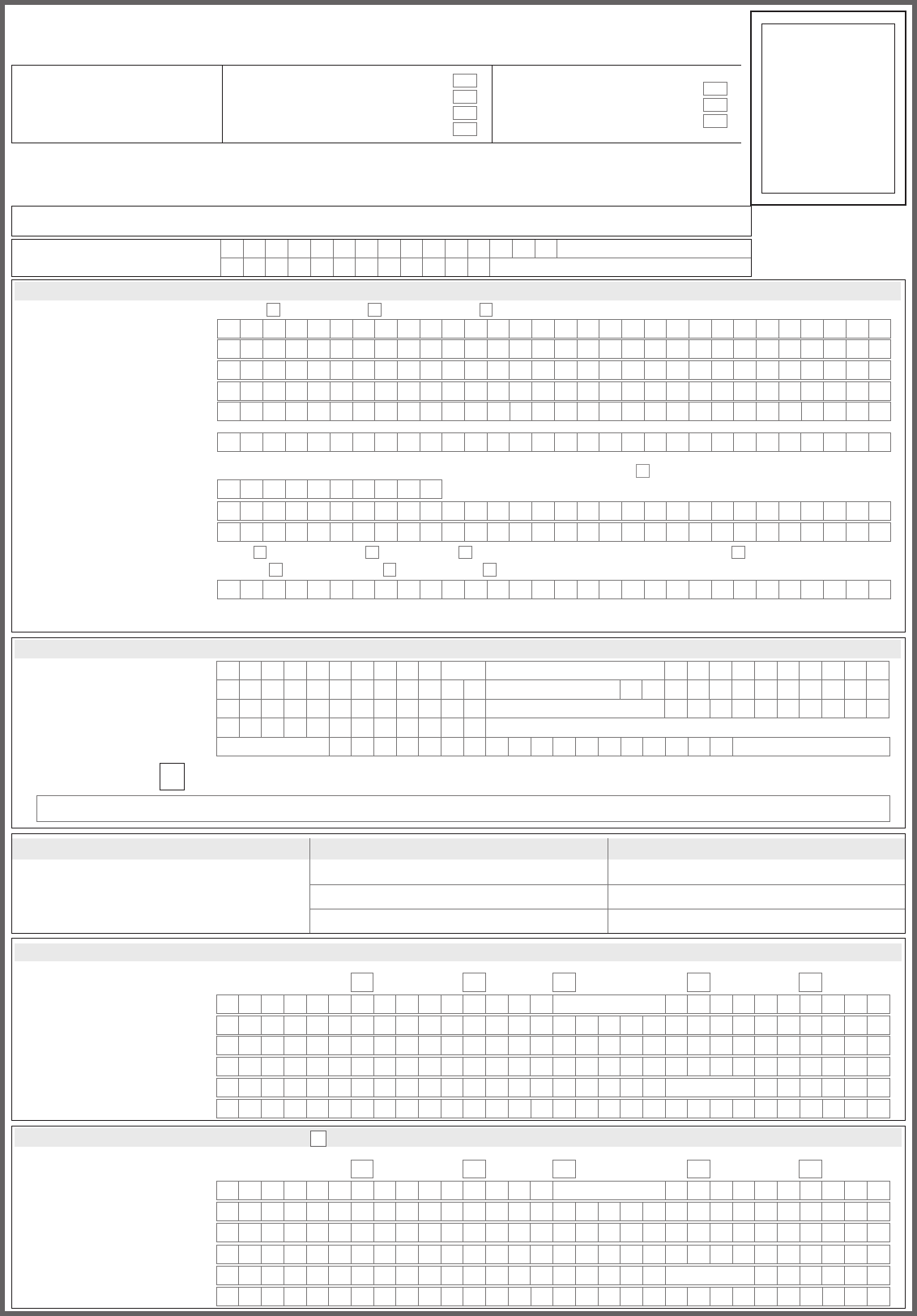

Afx

recent photograph of

3.5 cm × 2.5 cm size /

Passport size

NATIONAL PENSION SYSTEM (NPS) – SUBSCRIBER REGISTRATION FORM

Central Recordkeeping Agency (CRA) - NSDL e-Governance Infrastructure Limited

Please select your category

[ Please tick() ]

Central Govt.

Central Autonomous Body

All Citizen Model

NPS Lite (GDS)

State Govt.

State Autonomous Body

Corporate Sector

To,

National Pension System Trust.

Dear Sir/Madam,

I hereby request that an NPS account be opened in my name as per the particulars given below:

* indicates mandatory fields. Please fill the form in English and BLOCK letters with black ink pen. (Refer general guidelines at instructions page)

KYC Number, Retirement Adviser Code and Spouse Name fields are not applicable for Government & NPS Lite Subscribers

KYC Number (if applicable)

Generated from Central KYC Registry

Retirement Adviser Code (If applicable)

1. PERSONAL DETAILS: (Please refer to Sr. No.1 of the instructions)

Name of Applicant in full Shri Smt. Kumari

First Name*

Middle Name

Last Name

Subscriber’s Maiden Name (if any)

Father's Name* F i r s t M i d d l e L a s t

(Refer Sr. No. 1 of instructions)

Mother’s Name* F i r s t M i d d l e L a s t

(Refer Sr. No. 1 of instructions)

Father’s name will be printed on PRAN card. In case, mother’s name to be printed instead of father’s name

[ Please tick () ]

Date of Birth* d d / m m / y y y y

(Date of Birth should be supported by relevant documentary proof)

City of Birth*

Country of Birth*

Gender* [ Please tick () ]

Male Female Others

Nationality*

Indian

Marital Status*

Married Unmarried Others

Spouse Name* F i r s t M i d d l e L a s t

(Refer Sr. No. 1 of instructions)

Residential Status*

Indian

2. PROOF OF IDENTITY (Pol)* (Any one of the documents need to be provided along with the identification number)

Passport Passport Expiry Date d d / m m / y y y y

Voter ID Card PAN Card

Driving License Driving License Expiry Date d d / m m / y y y y

NREGA JOB Card

Others Name of the ID I D N u m b e r

Please refer Sr. No. 2 of the instructions.

UID (Aadhaar) (UIDI [ Aadhaar] number not required.)

As per the amendments made under Prevention of Money-Laundering (Maintenance of Records) Second Amendment Rules, 2019, PAN or Form 60 is mandatory under NPS.If you do not have PAN

at present, please ensure that these details are provided within six months of submission of this Subscriber Registration Form.

3. PROOF OF ADDRESS (PoA)*

Correspondence Address Permanent Address

[ Please tick (), as applicable ]

#Not more than 2 months old.

Please refer Sr. No. 2 of the instructions

Passport /Driving License/UID (Aadhaar)/Voter ID card/NREGA Job

Card/Ration Card/Others

Passport /Driving License/UID (Aadhaar)/Voter ID card/NREGA Job

Card/Ration Card/Others

Registered Lease/Sale agreement of residence/Municipal Tax

Receipt

Registered Lease/Sale agreement of residence/Municipal Tax

Receipt

#Latest Piped Gas/Water/Electricity/Telephone[Landline or postpaid

mobile] Bill

#Latest Piped Gas/Water/Electricity/Telephone[Landline or postpaid

mobile] Bill

4.1 CORRESPONDENCE ADDRESS DETAILS*

Address Type* Residential/Business Residential Business Registered Ofce Unspecied

Flat/Room/Door/Block no. Landmark

Premises/Building/Village

Road/Street/Lane

Area/Locality/Taluk

City/Town/District PIN Code

State/U.T. C o u n t r y

4.2 PERMANENT ADDRESS DETAILS* Tick () in the box in case the address is same as above.

Address Type* Residential/Business Residential Business Registered Ofce Unspecied

Flat/Room/Door/Block no. Landmark

Premises/Building/Village

Road/Street/Lane

Area/Locality/Taluk

City/Town/District PIN Code

State/U.T. C o u n t r y

CSRF

Ver 1.5

2 of 5

5. CONTACT DETAILS

Tel. (Off) (with STD code)

+

Tel. (Res): (with STD code)

+

Mobile* (Mandatory) + 9 1

(Mobile Number is required for communication and to get SMS alerts)

Email ID

6. OTHER DETAILS ( Please refer to Sr no. 3 of the instructions )

Occupation Details* [ please tick() ]

Private Sector Public Sector Government Sector Professional

Self Employed Homemaker Student Others (Please Specify)

Income Range (per annum) Upto 1 lac

1 lac to 5 lac

5 lac to 10 lac 10 lac to 25 lac 25 lac and above

Educational Qualifications

Below SSC

SSC HSC Graduate Masters

Professionals ( CA, CS, CMA, etc.)

Please Tick If Applicable Politically exposed person Related to Politically exposed Person (Please refer instruction no.3)

7. SUBSCRIBER BANK DETAILS* ( Please refer to Sr no. 4 of the instructions )

(All the bank details are mandatory except MICR Code.)

Account Type [ please tick() ] Savings A/c Current A/c

Bank A/c Number

Bank Name

Branch Name

Branch Address PIN Code

State/U.T. C o u n t r y

Bank MICR Code IFS Code

8. SUBSCRIBERS NOMINATION DETAILS* (Nomination details are mandatory. Please refer to Sr. No . 5 of the instructions)

Name of the Nominee (You can nominate up to a maximum of 3 nominees and if you desire so please ll in Annexure III (Additional Nomination Form) provided separately)

First Name Middle Name Last Name

Relationship with the Nominee

Date of Birth (In case of Minor) d d / m m / y y y y

Nominee’s Guardian Details (in case of a minor)

First Name Middle Name Last Name

9. NPS OPTION DETAILS (Please tick () as applicable)

I would like to subscribe for Tier II Account also YES NO

If Yes, please submit details in Annexure I.

(If you wish to activate Tier II account subsequently, you may submit separate application (Annexure S10) to the associated Nodal Ofce or to POP/POP-SP of your choice. The list of POP/

POP-SPs rendering services under NPS and Annexure S10 is available on CRA website)

I would like my PRAN to be printed in Hindi YES NO If Yes, please submit details on Annexure II

10. PENSION FUND (PF) SELECTION AND INVESTMENT OPTION* ( Please refer to Sr no. 6 of the instructions )

(i) PENSION FUND SELECTION (Tier I) : Please read below conditions before opting for the choice of Pension Funds:

1. Government Sector: The following Pension Funds (PFs) will act jointly as default PFs, if choice is not exercised by the government employee/subscriber

(a) LIC Pension Fund Limited (b) SBI Pension Funds Pvt. Limited (c) UTI Retirement Solutions Ltd. In case of Central Autonomous Bodies (CAB)/ State Government

(SG)/State Autonomous Bodies (SAB) employees, selection made under this section will be ignored, if choice to employees is not notied by the respective State

Govt/Ministry.

2. All Citizen Model: Subscribers under All Citizen model have the option to choose the available PFs as per their choice in the table below.

3. Corporate Model: Subscribers shall have the option to choose the available PFs as per the below table in consultation with their respective Employer.

4. NPS Lite: NPS Lite is a group choice model where subscriber has a choice of PF and investment option as available with Aggregator.

Name of the Pension Fund (Please select only one)

Please Tick ()

Default Choice of Pension Funds

LIC Pension Fund Limited

Available in Government sector, if employee/subscriber does not exercise

choice of PF

SBI Pension Funds Private Limited

UTI Retirement Solutions Limited

ICICI Prudential Pension Funds Management Company Limited

Kotak Mahindra Pension Fund Limited

HDFC Pension Management Company Limited

Aditya Birla Sun Life Pension Management Limited

* Selection of 01 Pension Fund is mandatory for All Citizen subscriber

(ii) INVESTMENT OPTION

(Please Tick () in the box given below showing your investment option).

Active Choice Auto Choice

Please note:

1. In case you select Active Choice ll up section (iii) below and if you select Auto Choice ll up section (iv) below.

2. In case you do not indicate any investment option, your funds will be invested in Auto Choice (LC 50).

3. In case you have opted for Auto Choice and ll up section (iii) below relating to Asset Allocation, the Asset Allocation instructions will be ignored and investment will

be made as per Auto Choice (LC 50).

CSRF

Ver 1.5

3 of 5

(iii) ACTIVE CHOICE – ASSET ALLOCATION (to be lled up only in case you have selected ‘Active Choice’ the investment option)

Asset Class

E

(Cannot

exceed 75%)

C

(Max up to

100%)

G

(Max up to

100%)

A

(Cannot

exceed 5%)

Total

Asset class E-Equity and related instruments; Asset class C-Corporate debt and related

instruments; Asset class G - Government Bonds and related instruments; Asset Class

A-Alternative Investment Funds including instruments like CMBS, MBS, REITS, AIFs, Invlts etc.

Specify % 100%

Choices in

Govt sector

Not available Available

Not

available

In case of Government employee/subscriber the Active choice of Asset Allocation is restricted to Asset

Class ‘G’ only

Please note:

1. Upto 50 years of age, the maximum permitted Equity Investment is 75% of the total asset allocation.

2. From 51 years and above, maximum permitted Equity Investment will be as per the equity allocation matrix provided in Annexure A. The tapering off of equity

allocation will be carried out as per the matrix on date of birth.

3. The total allocation across E, C, G and A asset classes must be equal to 100%. In case, the allocation is left blank and/or does not equal 100%, the application shall

be rejected.

(iv) AUTO CHOICE OPTION (to be lled up only in case you have selected the ‘Auto Choice’ investment option). In case, you do not indicate

a choice of LC, your funds will be invested as per LC 50.

Life Cycle (LC)

Funds

Please Tick ()

Only One

Choices in Govt

sector

Note: 1. LC 75- It is the Life cycle fund where the Cap to Equity investments is 75% of the total asset

2. LC 50- It is the Life cycle fund where the Cap to Equity investments is 50% of the total asset

3. LC 25- It is the Life cycle fund where the Cap to Equity investments is 25% of the total asset

4. Govt. employee can exercise Auto Choice of Asset Allocation for LC 25 & LC 50 only

LC 75 Not available

LC 50

Available

LC 25

11. DECLARATION ON FATCA* (Foreign Account Tax Compliance Act) COMPLIANCE (Please refer to Sr no. 7 of the instructions):

Section I *

US Person*

Yes No

Section II *

For the purposes of taxation, I am a resident in the following countries and my Tax Identication Number (TIN)/functional equivalent in each country is set

out below or I have indicated that a TIN/functional equivalent is unavailable (kindly ll details of all countries of tax residence if more than one):

Particulars Country (1) Country (2) Country (3)

Country/countries of tax residency

Address in the jurisdiction for Tax

Residence

Address Line 1

City/Town/Village

State

ZIP/Post Code

Tax Identication Number (TIN)/Functional equivalent Number

TIN/ Functional equivalent Number Issuing Country

Validity of documentary evidence provided (Wherever applicable)

dd / mm / yyyy dd / mm / yyyy dd / mm / yyyy

“I certify that:

a) It shall be my responsibility to educate myself and to comply at all times with all relevant laws relating to reporting under section 285BA of the Act read with the

Rules 114F to 114H of the Income tax Rules, 1962 thereunder and the information provided in the Form is in accordance with the aforesaid rules,

b) the information provided by me in the Form, its supporting Annexures as well as in the documentary evidence are, to the best of my knowledge and belief, true,

correct and complete and that I have not withheld any material information that may affect the assessment/categorization of the account as a Reportable account

or otherwise.

c) I permit/authorise the NPS Trust to collect, store, communicate and process information relating to the Account and all transactions therein, by the NPS Trust

and any of NPS intermediaries wherever situated including sharing, transfer and disclosure between them and to the authorities in and/or outside India of any

condential information for compliance with any law or regulation whether domestic or foreign.

d) I undertake the responsibility to declare and disclose within 30 days from the date of change, any changes that may take place in the information provided in

the Form, its supporting Annexures as well as in the documentary evidence provided by me or if any certication becomes incorrect and to provide fresh self-

certication along with documentary evidence,

e) I also agree that in case of my failure to disclose any material fact known to me, now or in future, the NPS Trust may report to any regulator and/or any authority

designated by the Government of India (GOI) /RBI/IRDA/PFRDA for the purpose or take any other action as may be deemed appropriate by the NPS Trust if the

deciency is not remedied by me within the stipulated period.

f) I hereby accept and acknowledge that the NPS Trust shall have the right and authority to carry out investigations from the information available in public domain

for conrming the information provided by me to the NPS Trust

g) I also agree to furnish such information and/or documents as the NPS Trust may require from time to time on account of any change in law either in India or

abroad in the subject matter herein.

h) I shall indemnify NPS Trust for any loss that may arise to the NPS Trust on account of providing incorrect or incomplete information.

Date d d / m m / y y y y

Place :

Signature/Thumb Impression* of Subscriber in black ink

(* LTI in case of male and RTI in case of females)

Name of subscriber

CSRF

Ver 1.5

4 of 5

12. DECLARATION BY SUBSCRIBER* ( Please refer to Sr no. 8 of the instructions )

Declaration & Authorization by all subscribers

I have read and understood the terms and conditions of the National Pension System and hereby agree to the same along with the PFRDA Act, regulations framed thereunder

and declare that the information and documents furnished by me are true and correct, to the best of my knowledge and belief. I undertake to inform immediately the Central

Record Keeping Agency/National Pension System Trust, of any change in the above information furnished by me. I do not hold any pre-existing account under NPS. I

understand that I shall be fully liable for submission of any false or incorrect information or documents.

I further agree to be bound by the terms and conditions of provision of services by CRA, from time to time and any amendment thereof as approved by PFRDA, whether

complete or partial without any new declaration being furnished by me. I shall be bound by the terms and conditions for the usage of I-PIN (to access CRA website and view

details) & T-PIN.

Declaration under the Prevention of Money Laundering Act, 2002

I hereby declare that the contribution paid by me/on my behalf has been derived from legally declared and assessed sources of income. I understand that NPS Trust has

the right to peruse my nancial prole or share the information, with other government authorities. I further agree that NPS Trust has the right to close my PRAN in case I am

found violating the provisions of any law relating to prevention of money laundering.

Date d d / m m / y y y y

Place :

Signature/Thumb Impression* of Subscriber in black ink

(* LTI in case of male and RTI in case of females)

13. DECLARATION BY EMPLOYER

Applicable to Government Subscribers only

(Subscribers Employment Details to be filled and attested by the Deptt. (All Details are Mandatory)

Date of Joining

d d / m m / y y y y

Date of Retirement

d d / m m / y y y y

Employee Code/ID (If applicable)

PPAN (If applicable)

Employee Code/ID and PPAN are optional. If you intend

to provide, mention any one.

Group of Employee (Tick as applicable) Group A Group B Group C Group D

Ofce

Department

Ministry

DDO Registration Number

DTO/PAO/CDDO/DTA/PrAO Registration Number

Basic Pay

Pay Scale

It is certified that the details provided in this subscriber registration form by ___________________________________ employed with us, including

the address and employment details provided above are as per the service record of the employee maintained by us. Also, it is further certified that

he/she has read entries/entries have been read over to him/her by us and got confirmed by him/her.

Signature of the Authorised person

(In the box above)

Rubber Stamp of the DDO

(In the box above)

Signature of the Authorised person

(In the box above)

Rubber Stamp of the DTO/PAO/CDDO/

DTA/PrAO (In the box above)

Designation of the Authorised Person

Name of the DDO

Deptt/Ministry

Designation of the Authorised Person

Name of DTO/PAO/CDDO/DTA/PrAO

Date d d / m m / y y y y

14. DECLARATION BY EMPLOYER/ CORPORATE

Applicable to Corporate Subscribers only

(Subscribers Employment Details to be lled and attested by Corporate (All Details are Mandatory))

Date of Joining

d d / m m / y y y y

Date of Retirement

d d / m m / y y y y

Employee Code/ID

Corporate Regd. Number (CHO No.) Allotted by CRA

CBO No. allotted by CRA

Certied that the details provided in this subscriber registration form by ___________________________________ employed with us, including the

employment details provided above are as per the service record of the employee maintained by us. Also, it is further certied that he / she has read the

entries / entries have been read over to him / her by us and got conrmed by him / her.

Date d d / m m / y y y y

Place

Signature of the Authorised person (In the box above)

Designation of the Authorised Person

Rubber Stamp of the Corporate (In the box above)

CSRF

Ver 1.5

5 of 5

15. DECLARATION BY THE AGGREGATOR

Applicable to NPS Lite Subscribers

Authorisation by Aggregator’s office (NL - AO)

Certified that the subscriber is registered with the aggregator and he/she has opted to join NPS. I hereby declare that the subscriber is eligible to join NPS

and the above declaration has been signed /thumb impressed before me by ...................................................after (s)he has read the entries/ entries have

been read over to her/him by me.

Signature of the Authorised person (In the box above) Rubber Stamp of the Aggregator (In the box above)

Name of the Aggregator

NPS Lite Account Office (NL-AO) Registration Number

NPS Lite - Collection Centre (NL - CC) Registration Number

Membership No. allotted by Aggregator (if any)

Place Date d d / m m / y y y y

16. TO BE FILLED BY POP-SP

Receipt No. (17 digits)

POP-SP Registration Number

Document accepted for date of Birth Proof:

Copy of PAN card submitted YES NO KYC Compliance YES NO

Documents Received: (Originals Veried) Self Certied (Attested) True Copies

Identity Verication : Done

Existing Customer:

I/we hereby certify/confirm that Shri/Smt/Kum ......................... is an existing KYC verified customer The above applicant is having an operative Bank/

Demat/Folio/.......................account (specify nature of the account) having account number/client ID.......................maintained at..............branch/office.

The KYC documents available with us for this customer/client matches the requirement for opening NPS account and are in compliance with PMLA

Rules. I / We further confirm that the Savings Bank a/c of Sh/Smt/Kum ...................... is not a ‘Basic Savings Bank Deposit Account (applicable in case

of Bank PoP)

To be filled by POP-SP

Name:

Designation: Place:

POP-SP Seal Signature of Authorized Signatory Date d d / m m / y y y y

[To be filled by CRA - Facilitation Centre (CRA-FC)]

Received by CRA-FC Registration Number

Received at Date d d / m m / y y y y

Acknowledgement Number (by CRA-FC)

PRAN Allotted

ACKNOWLEDGEMENT

Name of the Subscriber:

Contribution Amount Remitted: `

Date of Receipt of Application and Contribution Amount: d d / m m / y y y y

Stamp and Signature of the Employer/PoP:

CSRF

Ver 1.5

6 of 5

INSTRUCTIONS FOR FILLING THE SUBSCRIBER REGISTRATION FORM

General Guidelines

(a) Please ll the form in legible handwriting so as to avoid errors in your application processing. Please do not overwrite. Corrections should be made by cancelling and re-writing

and such corrections should be countersigned by the applicant. Each box, wherever provided, should contain only one character (alphabet / number / punctuation mark) leaving

a blank box after each word.

(b) In case, you mention the KYC number submission of proof for the same is necessary.

(c) Applications incomplete in any respect and/or not accompanied by required documents are liable to be rejected. The application is liable to be rejected if mandatory elds are

left blank or the application form is printed back to back

(d) The subscriber should not sign across the photograph. The photograph should not be stapled or clipped to the form. If there is any mark on the photograph such that it hinders

the clear visibility of the face of the subscriber, the application shall not be accepted.

(e) Copies of all the documents submitted by the applicant should be self-attested and accompanied by originals for verication by the nodal ofce.

(f) Name and Address of the applicant mentioned on the form, should match with the documentary proof submitted.

(g) The subscriber’s thumb’s impression should be veried by the designated ofcer of POP-SP / Nodal Ofce.

S.

No

Item

No.

Item Details Instructions

1 1

Personal Details

i. This Form is applicable only for Resident Indians. There is a separate Form for Non Resident Indians & Overseas Citizen of India.

ii. Currently, Foreign Nationals / Other Country Individuals (OCI) and Persons of Indian Origin (PIO) are not allowed to open PRAN.

iii. The applicant shall mention father’s name and mother’s name and shall select the option to be printed on PRAN Card.

Spouse Name

If married, spouse name is mandatory.

Father’s Name

i. Father’s name is mandatory.

ii. If Father’s name has more than 30 digits, you may ll Annexure II for the same.

Mother’s Name

i. Mother’s name is mandatory

ii. If Mother’s name has more than 30 digits, you may ll Annexure II for the same.

Date of Birth

Please ensure that the date of birth matches as indicated in the document provided in the support.

2 2, 3 & 4

Identity,

Correspondence &

Permanent address

details

S.No Proof of Identity (Copy of any one) S.No Proof of Address (Copy of any one)

1 Passport issued by Government of India. 1 Passport issued by Government of India

2 Ration card with photograph. 2 Ration card with photograph and residential address

3 Bank Pass book or certicate with Photograph. 3 Bank Pass book or certicate with photograph and residential

address

4 Certicate of the POP for an existing customer. 4 Certicate of the POP for an existing customer.

5 Voters Identity card with photograph and residential address. 5 Voters Identity card with photograph and residential address

6 Valid Driving license with photograph 6 Valid Driving license with photograph and residential address

7 Certicate of identity with photograph signed by a Member of

Parliament or Member of Legislative Assembly

7 Letter from any recognized public authority at the level of

Gazetted ofcer like District Magistrate, Divisional commissioner,

BDO, Tehsildar, Mandal Revenue Ofcer, Judicial Magistrate etc.

8 PAN Card issued by Income tax department 8 Certicate of address with photograph signed by a Member of

Parliament or Member of Legislative Assembly

9 Aadhar Card / letter issued by Unique Identication Authority

of India

9 Aadhar Card / letter issued by Unique Identication Authority of

India clearly showing the address

10 Job cards issued by NREGA duly signed by an ofcer of the

State Government

10 Job cards issued by NREGA duly signed by an ofcer of the

State Government

11 Identity card issued by Central/State government and its

Departments, Statutory/ Regulatory Authorities, Public Sector

Undertakings, Scheduled commercial Banks, Public Financial

Institutions, Colleges afliated to universities and Professional

Bodies such as ICAI, ICWAI, ICSI, Bar Council etc.

11 The identity card/document with address or letter of allotment

of accommodation issued by any of the following: Central/

State Government and its Departments, Statutory/Regulatory

Authorities, Public Sector Undertakings, Scheduled Commercial

Banks, Financial Institutions and listed companies for their

employees. Pension or Family Pension Payment Orders issued

by Govt. Departments or PSU containing address.

12 Photo. Identity Card issued by Defence, Paramilitary and

Police department’s

12

Latest Electricity/water/piped gas bill in the name of the Subscriber

/ Claimant and showing the address (less than 2 months old)

13 Ex-Service Man Card issued by Ministry of Defence to their

employees.

13 Latest Telephone bill (landline & postpaid mobile) in the name of

the Subscriber / Claimant and showing the address (less than 2

months old)

14 Photo Credit card. 14 Latest Property/house Tax receipt (not more than one year old)

15 Existing valid registered lease agreement of the house on stamp

paper ( in case of rented/leased accommodation)

Note:

(i) If the address on the document submitted for identity proof by the prospective customer is same as that declared by him/her in the account

opening form, the document may be accepted as a valid proof of both identity and address.

(ii) If the address indicated on the document submitted for identity proof differs from the current address mentioned in the account opening

form, a separate proof of address should be obtained. All future communications will be sent to correspondence address. If correspondence

& Permanent address are different, then proof for both have to be submitted.

(iii) The KYC documents may be submitted within a period of 30 days after generation of PRAN. (Only for Government Subscribers)

3 6

Politically Exposed

Person

Politically Exposed Persons’ (PEPs) are individuals who are or have been entrusted with prominent public functions in a foreign country, for

example heads of state or of the government, senior politicians, senior government, judicial or military ofcials, senior executives of state-

owned corporations, important political party ofcials.

4 7

Subscriber’s Bank

Details

For Tier I & Tier II account, bank details are mandatory and it should be supported by a documentary proof. Please attach a cancelled cheque

containing Subscriber Name, Bank Name, Bank Account Number and IFS Code. If cheque is not available or cheque is not preprinted with

Subscriber name, a copy of bank passbook or bank statement or bank certicate or letter from Bank mentioning Subscriber Name, Bank

Name, Bank Account No. and IFS Code should be submitted.

5 8

Subscriber’s

Nomination Details

Nomination details are mandatory. In case of more than one nominee, percentage share value for all the nominees must be integer. Decimals/

Fractional values shall not be accepted in the nomination(s). Sum of percentage share across all the nominees must be equal to 100. If sum

of percentage is not equal to 100, entire nomination will be rejected.

6 10

Pension Fund (PF)

Selection and

Investment Option

Government employee/subscribers can exercise choice of Pension Funds and allocate their investments either in Asset Class‘G’ under’

Actice Choice’ and in Life Cycle Funds - LC 50 or LC 25 under ‘Auto Choice’. In case a Government employee/subscribers does not exercises

the choices of Pension Fund, their contributions will be allocated among 03 Pension Funds namely (i) LIC Pension Fund Limited (ii) SBI

Pension Funds Pvt. Limited (iii) UTI Retirement Solutions Ltd.

7 11

Declaration by

subscriber on FATCA

Compliance

Clarication / Guidelines on lling details if applicant residence for tax purposes in jurisdiction(s) outside India

• Jurisdiction(s) of Tax Residence: Since US taxes the global income of its citizen, every US citizen of whatever nationality, is also a resident

for tax purpose in USA.

• Tax identication Number (TIN): TIN need not be reported if it has not been issued by the jurisdiction. However, if the said jurisdiction has

issued a high integrity number with an equivalent level of identication (a “Functional equivalent”), the same may be reported. Examples

of that type of number for individual include, a social security/insurance number, citizen/personal identication/services code/number and

resident registration number)

•

If applicant residence for tax purpose in jurisdiction(s) within India, Permanent Account Number (PAN) to be provided as Tax Identication Number (TIN)

• In case applicant is declaring US person status as ‘No’ but his/her Country of Birth is US, document evidencing Relinquishment of

Citizenship should be provided or reasons for not having relinquishment certicate is to be provided

8 12

Declaration by

Subscriber

Signature / Thumb impression should only be within the box provided in the form. Thumb impression, if used, should be attested by the

designated ofcer of POP/POP-SP/Nodal ofce with the ofcial seal and stamp. Left Thumb Impression in case of males and Right Thumb

Impression in case of females.

General Information for Subscribers

a) The Subscriber can obtain the status of his/her application from CRA and their designated nodal ofcer.

b) Subscribers are advised to retain the acknowledgement slip signed/ stamped by the designated nodal ofcer where they submit the application.

c) For more information / clarications, contact CRA:

Website: https://www.npscra.nsdl.co.in

Call: 022-4090 4242

Address: Central Recordkeeping Agency (CRA)

NSDL e-Governance Infrastructure Limited

1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel (W), Mumbai - 400013

Equity Allocation Matrix for Active Choice

Age (years) Max. Equity Allocation

Upto 50 75%

51 72.50%

52 70%

53 67.50%

54 65%

55 62.50%

56 60%

57 57.50%

58 55%

59 52.50%

60 & above 50%

Please note:

1. Upto 50 years of age, the maximum permitted Equity Investment is 75% of the total asset allocation.

2. From 51 years and above, maximum permitted Equity Investment will be as per the equity allocation matrix provided above. The tapering off of equity

allocation will be carried out as per the matrix on date of birth.

Annexure A to CSRF

Ver 1.5