ECB-

PUBLIC

Business Description Document for the

ECMS

Eurosystem Collateral Management System

(ECMS)

7 January 2020 Version 1.0

– Contents

1

Contents

1 Overview 2

1.1 Introduction 2

1.2 Purpose and structure of this document 3

1.3 Features of the ECMS 4

2 Interaction with the ECMS 5

2.1 Technical connectivity 5

2.2 Roles and access rights 5

2.3 Operating hours 6

3 Counterparties 8

3.1 Account and pool structure 8

3.2 Collateral management 9

3.3 Monetary policy operations 15

3.4 Counterparty pool 18

4 Central Securities Depositories (CSDs) 22

4.1 Corporate Action events 22

4.2 Sending of invoices 23

5 Triparty agents (TPAs) 24

5.1 Triparty collateral management 24

5.2 Sending of invoices 25

Annex: CA events processed by the ECMS 26

List of figures and tables 28

List of abbreviations 29

– Overview

2

1 Overview

1.1 Introduction

In accordance with its statute, the Eurosystem provides credit only against adequate

collateral. Complex and robust systems are needed in order to handle Eurosystem

credit operations and to manage the eligible assets comprising this collateral in an

effective manner.

These tasks are currently performed by the individual systems of the Eurosystem

national central banks (NCBs), in accordance with the common provisions laid down in

the Eurosystem monetary policy framework.

1

This means that their current systems

share a common set of requirements.

In December 2017 the Governing Council of the European Central Bank (ECB)

approved the start of the realisation phase of the Eurosystem Collateral Management

System (ECMS) project, due to go live in November 2022.

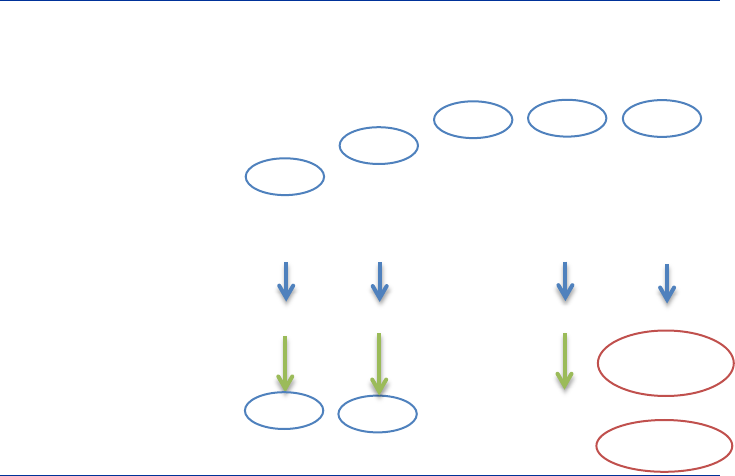

Figure 1: Current status and future situation after the ECMS go-live

The aim is to ensure a single collateral management system with a common

functionality, capable of managing the assets used as collateral in Eurosystem credit

operations for all euro area jurisdictions. After go-live, the ECMS will replace the

1

Guideline ECB/2014/60, usually referred to as the General Documentation Guideline or the GD.

– Overview

3

individual collateral management systems currently in use by NCBs.

2

The move to a

single system is expected to increase efficiency in terms of the mobilisation and

management of collateral.

The ECMS is being developed as part of the Vision 2020 initiative which also includes

major upgrades to the Eurosystem’s market infrastructure landscape. In this context

the Eurosystem has also developed the TARGET Instant Payment Settlement (TIPS)

service in 2018 and initiated a project to replace TARGET2 in November 2021 with a

new system

3

which will optimise liquidity management across all TARGET Services

(T2-T2S Consolidation).

The ECMS interacts with the Central Liquidity Management (CLM) module within T2 in

order to ensure the settlement of payments stemming from monetary policy

operations, corporate actions and fees, and for updating the credit line. The ECMS

interacts with TARGET-2 Securities (T2S) for the settlement of securities and the

management of the auto-collateralisation process. Furthermore, the ECMS takes

advantage of the support functionality common to all TARGET Services (common

components). The resulting synergies are expected to benefit NCBs and all other

ECMS players in their communities: counterparties, central securities depositories

(CSDs) and triparty agents (TPAs).

In line with the current framework,

4

the ECMS continues to support all domestic and

cross-border mobilisation channels for marketable assets (the Correspondent Central

Banking Model (CCBM), eligible links, CCBM with links and remote access), as well as

the cross-border mobilisation of credit claims.

Launching the ECMS will facilitate the implementation of harmonisation proposals

agreed both within the market - by the Advisory Group on Market Infrastructures for

Securities and Collateral (AMI-SeCo)

5

- and internal to the Eurosystem.

1.2 Purpose and structure of this document

This document aims to introduce the functions and features of the ECMS and to

provide support to ECMS actors when launching preparations for the go-live. Relevant

technical information, including details of workflows, will be provided to ECMS

stakeholders in due course.

Any functionalities only available to NCBs are not covered in this document.

This document is divided into several chapters, each focusing on the different

functionalities available to the main external actors (counterparties, CSDs and TPAs)

and on communication between the ECMS and those parties.

2

Some NCBs will continue to make use of their national systems for the management of some or all of

their credit claims.

3

T2 – composed of an RTGS module and the Central Liquidity Management (CLM) module.

4

Articles 149 to 151 of the General Documentation Guideline.

5

AMI-SeCo triparty collateral management standards, corporate actions standards and billing processes

standards

– Overview

4

1.3 Features of the ECMS

The ECMS replaces many of the tasks currently performed by the NCBs’ individual

collateral management systems.

The ECMS includes the following state-of-the-art features:

• Advanced graphical user interface for counterparties and A2A

communication based on the most recent standards (ISO 20022);

• User-to-Application (U2A) and Application-to-Application (A2A) connection

using the same gateway (ESMIG - Eurosystem Single Market Infrastructure

Gateway) and network service provider as the TARGET services;

• Direct connection to T2S for the settlement of marketable assets and

auto-collateralisation support;

• Standardised instruction messages for the mobilisation and demobilisation

of marketable assets, irrespective of the mobilisation channel used or the

location of the assets;

• Interaction with various NCB systems for the purposes of cross-border

mobilisation of marketable assets is replaced with interaction with a single

system and more simplified process;

• Standardised file format for the management of credit claims;

• Repurposing of excess collateral to automatically increase the credit line;

• Advanced collateral management functionality such as credit freezing and a

maximum credit line;

• Automated handling of corporate action (CA) events pertaining to

Eurosystem eligible marketable assets;

• Implementation of the single harmonised TPA model.

The existing relationships between NCBs and their communities remain unchanged,

in keeping with the principle of decentralisation. Counterparties will continue to liaise

with their usual NCB contacts in the event of any queries related to collateral

management or monetary policy operations. The legal relationship between the

counterparty and its NCB with respect to monetary policy operations, intraday credit

and/or collateral management is also unaffected.

– Interaction with the ECMS

5

2 Interaction with the ECMS

2.1 Technical connectivity

Users belonging to counterparties, Central Securities Depositories (CSDs) and

Triparty Agents (TPAs) interact with the ECMS (and all TARGET services) via the

Eurosystem Single Market Infrastructure Gateway (ESMIG). These counterparties,

CSDs and TPAs are defined in the ECMS as parties belonging to an NCB.

ESMIG is network-provider agnostic (i.e. it is not reliant on network-specific features)

and therefore allows participants to connect to all TARGET Services, including the

ECMS, via a single certified network service provider of their choice in

Application-to-Application (A2A) mode and/or User-to-Application (U2A) mode.

ESMIG provides central authentication, authorisation and user management features

to protect the connected systems/platforms against intrusion and unauthorised

access. It ensures that only trusted parties transmit inbound communication via a

secure channel.

6

A2A communication with the ECMS is based on ISO 20022 compliant messages.

7

The ECMS offers functionality for message subscription, with each NCB responsible

for configuring message subscriptions for its community.

A graphical user interface allows access to the ECMS via a desktop/laptop in U2A

mode. Individual users can log on to the ECMS with the same sign-on used for any of

the TARGET Services and common components and a single certificate.

2.2 Roles and access rights

ESMIG authenticates users, checks that they are authorised to address or use the

ECMS, and manages access rights. The allocation of users to predefined roles is

managed within the ECMS. Users are allowed to perform business functions based on

their assigned roles and depending on their data scope.

Each individual user is assigned one or more predefined roles by the party

administrator in each entity. A role consists of a set of privileges that determine what

functionality the user has access to within the ECMS. Each privilege relates to a

business function that the user can perform in either “read-only” or “take action” mode.

In U2A mode, the ECMS may be configured to require four-eye verification. The

ECMS provides functionality whereby counterparties may designate another entity to

interact with the ECMS on their behalf.

6

For further information on ESMIG please refer to the T2-T2S Consolidation Business Description

Document.

7

ESMIG only supports the ISO 20022 standard.

– Interaction with the ECMS

6

The ECMS also provides dedicated functionality for banking groups (defined as

groups of counterparties), which grants an entity designated as the manager of the

banking group access to aggregated information on the whole group and detailed

information on the pool position of each member of its group.

2.3 Operating hours

The ECMS operates from Monday to Friday on the opening days defined in the

Central Liquidity Management (CLM) calendar. The ECMS schedule is based on

Central European Time (CET) and Central European Summer Time (CEST). All times

stated in this document are based on these conventions.

Figure 2: Operational day

The ECMS operational day is divided as follows:

The start of day process implements the change of the ECMS business day as of

18:45.

Night-time

process

Night-time

process

Maintenance

window

Daytime

process

End of day

Start of day

18:00

18:45

19:00

00:30

02:30

07:00

– Interaction with the ECMS

7

The night-time process, from 19:00 to 07:00, is for carrying out processes such as

updating collateral positions and calculating accruals on outstanding credit or debit

operations. The settlement of open market operations and marginal lending on

request by sending the corresponding payments to CLM is also conducted during the

night-time process.

System processes are conducted during a Maintenance window from 00:30 to 02:30.

The daytime process starts at 07:00 and runs until 18:00.

8

During this period,

instructions sent by counterparties (e.g. the mobilisation and demobilisation of

marketable assets and credit claims, and requests for marginal lending) and

information provided by TPAs (e.g. reporting on flows) are processed. Other main

ECMS activities such as the processing of corporate actions events, the recording of

the results of open market operations, and the transmission of the updated credit line

to CLM also take place during the daytime process.

The end of day process, from 18:00 to 18:45, is used to close the ECMS business

day, for example by sending asset-related information to T2S and TPAs and

generating end of day reports.

This schedule might be subject to additional cut-offs for specific tasks, e.g. in cases

such as access to the marginal lending facility on the last day of a reserve

maintenance period.

8

The cut-off for incoming messages is 15 minutes before the Day-time process ends and the End of Day

starts (at 17:45) to ensure that no messages are blocked between CLM, T2S and ECMS. For the

reception of credit claim files the cut-off is set to 16:00.

– Counterparties

8

3 Counterparties

This section presents the functionality available to participants that act provider of

collateral towards the Eurosystem (i.e. as an eligible monetary policy counterparty). In

the ECMS such actors are identified by the role “counterparty”.

The ECMS functionality for counterparties is available in U2A through a modern

interface provided in the user’s browser, with some functions also available in A2A.

Counterparties can fully manage their pool in U2A mode and do not need an A2A

connection.

In the ECMS, each counterparty is assigned to the NCB with which it has entered into

a legal relationship concerning the granting of Eurosystem credit and the use of assets

as collateral (the refinancing NCB). This NCB is responsible for setting the

counterparty up within the ECMS and is the single point of contact for queries related

to collateral management or monetary policy operations.

3.1 Account and pool structure

Marketable assets and credit claims submitted as collateral by a counterparty are

allocated to internal accounts (ECMS counterparty asset accounts), which are created

within the ECMS by NCBs for their counterparties. The number of accounts allowed

per counterparty depends on the practices of each NCB and the types of collateral

mobilised. The same account cannot be used for both marketable assets and credit

claims.

Figure 3: Example of account and pool structure

Similarly, collateral pools are also created and configured in the ECMS by NCBs for

their counterparties (see section 3.4). A collateral pool provides a comprehensive

Counterparty

Pool A Pool B

Asset

Account 1

Asset

Account 2

Asset

Account 3

– Counterparties

9

overview of the current collateral position, credit position and credit line of the

counterparty. The number of pools allowed per counterparty is set at the discretion of

the relevant NCB.

While the ECMS supports multi-pooling functionality which allows counterparties to

hold collateral pools in the ECMS for purposes other than Eurosystem credit

operations, a single pool must be used for the collateralisation of Eurosystem credit

operations. Each ECMS counterparty asset account can only be linked to one

collateral pool. One collateral pool in the ECMS can however be linked to several

ECMS counterparty asset accounts.

Positions related to other types of collateral (for example triparty collateral or

externally managed collateral), are recorded at pool level.

Counterparty pools are linked to a main cash account (MCA) in CLM, which is used for

the settlement of monetary policy operations, payments related to cash as collateral

and corporate action payments. Counterparties authorised to access intraday credit

may choose to use any excess collateral in that pool to automatically increase the

credit line in that MCA.

Counterparties and NCBs (on behalf of their counterparties) can reallocate assets

between asset accounts, which may be linked to the same or to different pools. When

linked to different pools, the transfer can only be completed if the collateral remaining

in the original pool is sufficient to collateralise the outstanding credit (collateral

sufficiency check).

3.2 Collateral management

Mobilisation in the ECMS is the process by which a collateral position is included in an

ECMS counterparty asset account (or is added to an existing position). Demobilisation

results in an already existing collateral position being reduced or removed (if the total

amount is demobilised).

Demobilisations initiated at a counterparty’s request of can only be completed if

sufficient assets remain in the pool to collateralise the outstanding credit. If not, the

demobilisation instruction is put on hold until there is sufficient collateral. If the pool is

also used to collateralise the counterparty’s credit line in CLM, demobilisation also

depends on the successful decrease of the credit line.

The total collateral available to a counterparty in its pool is calculated as the sum of all

different collateral positions

9

linked to that pool (see section 4.4).

9

Calculated after valuation, application of haircuts and other risk management measures.

– Counterparties

10

3.2.1 Mobilisation and demobilisation of marketable assets

In the ECMS, the procedures related to the mobilisation and demobilisation of

marketable assets apply to all assets deposited in a CSD,

10

and can be triggered via

both A2A and U2A. The ECMS interacts with T2S for the settlement of marketable

asset instructions.

Figure 4: Mobilisation of marketable assets with the ECMS in place

Counterparties start the mobilisation process by sending the relevant instruction to

the ECMS. The counterparty interacts with the ECMS, using a single message

structure, irrespective of the location of the asset or the mobilisation channel used.

An instruction that passes the relevant business validation checks is transmitted by

the ECMS to T2S in the form of a settlement instruction. The ECMS automatically

determines the correct CSD account to be used in this settlement instruction using the

information provided by the counterparty. Counterparties remain responsible for

ensuring that a corresponding settlement instruction is available in T2S for matching.

The settlement instruction is sent to T2S as soon as the mobilisation request is

processed by the ECMS, regardless of its intended settlement date (current or in the

future). This allows matching in T2S ahead of the settlement date and facilitates

successful mobilisation on the intended settlement date.

The actual asset position is only updated in the ECMS Counterparty Asset Account

(and thus in the counterparty pool in the ECMS) after settlement has been confirmed

by T2S

For demobilisations, counterparties also initiate the process by sending the relevant

instruction to the ECMS. If the intended settlement date for the instruction is in the

future, the demobilisation is queued and processed when the settlement date is

10

While DECC are defined as non-marketable assets in the GD, they are mobilised in the ECMS via the

same procedures as marketable assets.

Counterparty

ECMS

T2S

2

2

1

1. Marketable Asset (De)mobilisation Instruction

2. Securities Settlement Transaction Instruction

ECMS interaction

Outside ECMS (potentially via CSD)

– Counterparties

11

reached (and following a collateral sufficiency check

11

), to avoid the premature

reduction of the collateral pool value.

A counterparty can cancel instructions related to mobilisation and demobilisation in the

ECMS as long as their status is not yet final and settlement has not yet been confirmed

by T2S.

12

The cancellation instruction, which can be sent via U2A or A2A, must

reference the previous instruction and will reverse any changes that may have been

made as a result of the original instruction.

The ECMS ensures that only eligible marketable assets published in the ECB Eligible

Asset list are mobilised in the ECMS.

13

Nevertheless, counterparties are still

responsible for ensuring that they only submit eligible assets and for complying with all

applicable risk control measures and rules for the use of eligible assets.

If a marketable asset becomes ineligible, the asset remains in the pool of the

counterparty until it is demobilised.

14

However, the collateral value of the position is

immediately set to zero.

3.2.2 Management of credit claims

The ECMS supports the management of credit claims mobilised on an individual basis

under both the General Framework and the Temporary Framework (Additional Credit

Claims (ACC)). When the respective NCB has an approved ACC framework, the

ECMS automatically allocates credit claims to the respective framework during the

eligibility assessment (provided that the counterparty has the necessary

authorisation).

Some NCBs will continue to make use of their national systems for the management of

some or all of their credit claims. Any credit claims mobilised as portfolios of credit

claims do not come under the scope of the ECMS and will continue to be managed by

NCBs outside the ECMS. The total value of all such credit claims is recorded in the

ECMS via the externally managed collateral functionality.

Credit claims mobilised on a cross-border basis are managed within the ECMS,

provided that at least one of the involved NCBs uses the credit claim functionality of

the ECMS.

The main mode of communication with the ECMS for credit claims management is in

A2A. Counterparties send credit claim files in xml format with an agreed structure and

11

If the collateral sufficiency check has a negative outcome, the demobilisation instruction is queued and

only processed after conditions for further processing are met.

12

If the instruction to be cancelled has already been matched in T2S, the counterparty will also need to

cancel the instruction they sent to T2S.

13

An exception concerns those assets whose eligibility status depends on the credit assessment issued by

the credit assessment provider chosen by the counterparty, in accordance with the rules of the

Eurosystem credit assessment framework. These assets are not included in the list of eligible assets but

can be mobilised in the ECMS.

14

In line with existing procedures, counterparties have to demobilise an asset within seven calendar days

of it becoming ineligible.

– Counterparties

12

content, or insert individual instructions via U2A. A credit claims file may contain

multiple instructions of different types

15

but with the same intended settlement date

(which may be in the future):

The process for the mobilisation of a credit claim is initiated with the registration of the

credit claim via the submission of detailed information to the ECMS.

16

The simple

registration of a credit claim does not necessarily mean that it can be used as

collateral as eligibility checks are only conducted upon mobilisation.

If the credit quality requirements of a credit claim are to be fulfilled via an assessment

provided by an authorised internal ratings-based system or, in the case of ACCs,

17

by

a Rating Tool (RT) system, the counterparty will also need to provide information on

the associated probability of default. Once a rating has been registered in the ECMS

for a specific obligor, this rating can be used for all new credit claims with the same

obligor.

When a counterparty requests the mobilisation of a registered credit claim, the ECMS

verifies whether the information provided by the counterparty allows the use of the

credit claim as collateral. If the credit claim passes the checks and is deemed to be

eligible, the credit claim position becomes available in the pool of the counterparty. If

more information is required from the NCB, the mobilisation remains on hold. If any

checks fail, the mobilisation instruction is rejected. Counterparties remain responsible

for ensuring that all information submitted is correct and that the credit claim fulfils all

Eurosystem eligibility criteria before it is submitted as collateral to the ECMS.

When information on a credit claim changes, the counterparty is responsible for the

timely resubmission to the ECMS of all credit claim attributes,

18

unless the

outstanding amount is the only item which needs to be updated. In this case, the full

set of information is not required. As long as information on a credit claim remains

unchanged, no action is needed on the part of the counterparty.

If new information (either provided by the counterparty or resulting from internal

processes of the ECMS) results in the credit claim becoming ineligible, the

counterparty will be asked to remove it from its pool within seven calendar days. Until

then, it remains in the pool, pledged to the NCB regardless of its eligibility status, but

its collateral value will be set to zero. Credit claims that reach their maturity date are

automatically removed from the pool.

After a credit claim file has been processed, the counterparty receives a report with the

status of all individual instructions (even if some of those instructions still require NCB

15

Credit claim registration/update, Credit claim outstanding amount update, Rating registration/update,

Credit claim mobilisation, Credit claim demobilisation.

16

These include: the loan type, maturity date, outstanding amount, governing law, information on the

structure of the interest rate and the identification of the obligors involved in the credit claim (i.e. debtor

and/or guarantor identifiers). According to the obligor nationality, NCBs stipulate which code

counterparties should use to identify an obligor (for example via its unique national identifier, Legal Entity

Identifier or national tax identifier).

17

See https://www.ecb.europa.eu/mopo/assets/standards/nonmarketable/html/index.en.html for further

information on additional credit claims.

18

Via a Credit Claim Update instruction or Rating Update instruction.

– Counterparties

13

validation), as well as an end of day report detailing all previously pending instructions

that were processed during that day.

3.2.3 Cash as collateral

The ECMS provides functionality for capturing cash from the counterparty’s MCA

account in CLM for use as collateral in the ECMS. Cash as collateral is managed at

the level of the pool rather than in individual counterparty accounts.

In the case of pools used to cover monetary policy operations, the mobilisation of cash

as collateral is only permitted if a margin call is pending and no additional eligible

collateral is available.

19

Once the collateral insufficiency is resolved, the ECMS will

automatically demobilise the cash as collateral.

The (de)mobilisation process can be initiated via U2A or A2A.

20

The amount of cash to

be mobilised does not need to be indicated when responding to a margin call, nor is it

required for demobilisations as the ECMS automatically demobilises the maximum

amount that will not create a collateral insufficiency if the amount is unspecified.

The ECMS sends a payment instruction to debit/credit the account of the counterparty

in CLM. Once settlement is confirmed by CLM, the cash position is updated in the

counterparty pool in the ECMS. The demobilisation of cash as collateral may be

subject to the successful decrease of the credit line in CLM.

Interest is accrued on a daily basis at the start of the day when the interest amount is

added (or subtracted as applicable) to the cash collateral balance.

3.2.4 Fixed-term deposits used as collateral

The ECMS provides functionality for the handling of fixed-term deposits used as

collateral. Following the settlement of such an operation, the ECMS automatically

creates a position in the collateral pool of the counterparty that represents the value of

that fixed-term deposit. The value of the fixed-term deposit position (including accrued

interest) is counted towards the total available collateral. Accrued interest on

fixed-term deposits is updated on a daily basis at the start of the day.

Upon maturity of the operation, the position is automatically demobilised from the pool

of the counterparty. If the collateral value is insufficient, a margin call can be issued.

19

For pools which are used to cover non-monetary policy operations, the NCB may also choose to allow

cash as collateral at any time.

20

If the margin call is not solved by 17:00, the ECMS automatically initiates the mobilisation of cash as

collateral. NCBs may also trigger the mobilisation of cash as collateral from cash due to be paid to the

counterparty (e.g. from the cash flow of a CA event).

– Counterparties

14

3.2.5 Triparty collateral management

If authorised to do so, counterparties can make use of triparty collateral management

services from triparty agents (TPAs) which have been positively assessed by the

Eurosystem to provide collateral. In the pool, this triparty collateral is segregated from

the marketable asset positions.

The ECMS does not provide functionality for counterparties to manage their triparty

transactions. TPAs communicate directly with the ECMS for the purposes of, inter alia,

initiating, increasing, decreasing or closing a triparty transaction. Interaction with TPAs

is explained further in section 6 below.

3.2.6 Externally managed collateral

A limited number of assets (e.g. some credit claims and ACCs) relevant for

Eurosystem credit operations continue to be managed in the local systems of NCBs

(externally managed collateral). NCBs report externally managed collateral to the

ECMS so that the collateral value is available in the pools of counterparties.

Counterparties should contact their NCB for further information on such collateral.

3.2.7 Statements of Holdings, Transactions and Pending Transactions

Statements of Holdings, Transactions and Pending Transactions related to marketable

assets and credit claims managed in the ECMS are available in both U2A and A2A

mode. Counterparties have the option of subscribing to these and other messages on

a daily, weekly, monthly or annual basis, which follow the ISO 20022 standard, and

which may also be sent to authorised third parties.

3.2.8 Corporate Action events

NCBs are responsible for managing any corporate action (CA) events related to

securities provided by their counterparties as collateral and which are in the

possession of the NCB at the time of the CA.

The ECMS automatically processes some categories of CA events, based on the

AMI-SeCo corporate actions standards. For elective CA events, counterparties can

provide their instructions via U2A (outgoing CA information would also then be

provided in U2A mode by the ECMS). In A2A mode, counterparties (or their authorised

third parties) should be prepared to process incoming and outgoing CA messages

from the ECMS based on ISO 20022 messaging.

– Counterparties

15

Each ECMS counterparty asset account is linked to an MCA in CLM into which all cash

payments in euro resulting from a CA on a mobilised asset will be credited.

21

In the

event of a CA reversal event, the ECMS may debit the MCA.

Due to the automated processing of CA events by the ECMS, counterparties do not

need to demobilise assets subject to a CA event from the collateral pool. However, for

some types of CA event,

22

the ECMS may block the marketable asset position to

prevent the position from being demobilised while the CA is ongoing.

A list of the types of CA events handled by the ECMS is annexed to this document.

3.3 Monetary policy operations

Table 1: Overview of characteristics of the Eurosystem monetary policy operations

(instruments falling within the scope of the ECMS are marked in green)

Category of monetary policy

operations

Types of instruments

Provision of liquidity Absorption of liquidity

Open

market

operations

Main refinancing

operations

Reverse transactions —

Longer-term

refinancing

operations

Reverse transactions —

Fine-tuning

operations

Reverse transactions Reverse transactions

Foreign exchange

swaps

Foreign exchange swaps

Collection of fixed-term

deposits

Structural

operations

Reverse transactions Reverse transactions

— Issuance of ECB debt

certificates

Outright purchases Outright sales

Standing

facilities

Marginal lending

facility

Reverse transactions —

Deposit facility — Deposits

21

For payments in other currencies, the ECMS is informed of the CA event, but related payments are

performed outside the ECMS.

22

Please refer to Standard 10 of the AMI-SeCo corporate actions standards.

– Counterparties

16

The ECMS provides functionality for the settlement of monetary policy operations

conducted through liquidity-providing reverse transactions (in euro and other

currencies

23

) and the collection of fixed-term deposits.

While foreign exchange swaps are also liquidity-providing instruments that may

require the provision of collateral, for the time being, they will continue to be handled in

dedicated NCB systems. Similarly, instrument types that do not require the provision of

collateral (for example outright purchases) are outside the scope of the ECMS.

The settlement of payments related to open market operations is performed by the

ECMS on the MCA used by the counterparty.

The value of all outstanding liquidity-providing reverse transactions managed in the

ECMS (including the accrued interest) is part of the counterparty’s pool and is counted

towards its total credit position (see section 4.4).

3.3.1 Settlement of open market operations

The open market operations covered by the ECMS are liquidity-providing reverse

transactions and the collection of fixed-term deposits.

It should be noted that although settlement of these open market operations is

performed via the ECMS, the collection of bids from counterparties is performed via

the local NCB applications. The announcement and allotment of those open market

operations is performed by the ECB.

The ECMS receives the allotment results from Eurosystem applications and sends the

respective payment instructions to the designated MCA in CLM. When the maturity

date is reached, the ECMS checks collateral sufficiency and automatically sends the

payments to CLM (for the outstanding amount and for the interest). Early repayments

are also managed by the ECMS.

23

The ECMS handles operations in other currencies, but only handles the respective payments if they are

to be made in euro.

– Counterparties

17

Figure 5: Settlement of a credit operation

Payments related to open market operations (both at settlement and maturity) in the

ECMS occur at the start of the business day (between 19:00 and 19:30 CET on the

previous calendar day).

The ECMS includes functionality to allow payments for the settlement of new

operations to be netted out against any maturing liquidity providing operations (e.g.

OMO and marginal lending), thus enabling a single payment in CLM for the netted

amount. This functionality should reduce the instances of failure due to the order of

payments, and improve collateral availability by foregoing the need to temporarily

collateralise both operations. The availability of this netting functionality depends on

the setup at each NCB.

3.3.2 Access to the Marginal Lending Facility

Counterparties meeting the required access conditions may request access to the

marginal lending facility directly in the ECMS, via U2A and A2A. The process is

initiated by the Counterparty inserting a request instruction in the ECMS

Counterparties are able to request marginal lending for immediate settlement or for

settlement at the next start of day, if the counterparty has a credit operation maturing

on the next business day (thus permitting the netting of the marginal lending with

maturing operations).

The ECMS is also informed of any access to the marginal lending facility which is

triggered automatically in CLM at the end of day due to a lack of funds. This will then

be included in the credit position of the counterparty.

2

3

1

Counterparty

ECMS

CLM

Eurosystem

applications

1. Allotment results

2. Payment instruction

3. Credit becomes available in the counterparty’s CLM account

ECMS interaction

Outside ECMS

– Counterparties

18

3.3.3 Calculation of accrued interest

The outstanding amount of monetary policy operations is calculated taking into

account the interest accrued on an operation since its settlement date. The ECMS

applies a last-day accrual approach, as shown in Table 2 below.

Table 2: Example of evolution of accrued interest for an open market operation

Date Principal Accrued interest

Settlement Date (Wednesday)

1,000,000 0

SD +1 (Thursday)

1,000,000 55.56

SD +2 (Friday)

1,000,000 111.11

SD +5 (Monday)

1,000,000 277.78

SD +6 (Tuesday)

1,000,000 333.33

SD +7 = Maturity Date (Wednesday)

1,000,000 388.89

For illustration purposes an MRO with a 2% interest rate is assumed. Only business days are shown.

The same calculation process for accrued interest applies to all outstanding open

market operations (including fixed-term deposits), marginal lending and cash as

collateral, using the respective interest rates.

3.4 Counterparty pool

The ECMS counterparty pool provides a comprehensive overview of the current

collateral position, credit position and credit line of the counterparty.

The difference between the total collateral available and the amount of outstanding

Eurosystem monetary policy operations determines the over/under-collateralisation of

the pool (this is referred to as the suggested credit line in the ECMS – see section

4.4.2). Some collateral or credit information may be displayed in the pool without

having a direct impact on the collateral or credit positions (for example, fixed-term

deposits which are not activated for use as collateral).

The ECMS provides information to the counterparty on its pool positions via U2A and

A2A, with an aggregated overview (e.g. the sum of all collateral and credit positions)

and transaction level information

on each position in each account linked to that pool. A

counterparty can also obtain the consolidated pool position of a banking group if

designated as the manager of that banking group (see section 3.2).

– Counterparties

19

Figure 6: Simplified view of a counterparty pool

3.4.1 Credit freezing

The ECMS offers credit freezing functionality. Credit freezing reserves a certain

amount of collateral value in the counterparty pool for a specific purpose, which is then

deducted when calculating the excess collateral available in the ECMS.

The types of credit freezing are defined by the Eurosystem. If authorised to do so, the

counterparty can request, via U2A and A2A, an increase or decrease of its credit

freezing position.

One particular function of credit freezing is that used in the CLM contingency

solution.

24

Counterparties can hold credit freezing positions in the ECMS which are

used to automatically provide initial liquidity to the contingency solution, if activated.

When the contingency solution is active, additional collateral can be mobilised and will

be used to automatically increase the liquidity available to the counterparty in the

contingency solution. Only when the contingency is solved and the counterparty has

reimbursed the liquidity granted, can the credit freezing position in the counterparty

pool be decreased.

3.4.2 Credit line management

Access to intraday credit in CLM is provided only against adequate collateral. The

ECMS is responsible for providing CLM with the value of the credit line in CLM based

on the collateral available in the ECMS for this purpose. The setup depends on the

counterparty having the necessary authorisation.

24

ECONS – Enhanced Contingency Solution.

Credit position

Collateral position

Open market operations

Marginal Lending

Credit Freezing

Credit Line

Marketable assets

Credit claims

Cash as collateral

Fixed-term deposits *

Triparty collateral

Externally managed collateral

Counterparty Pool

* When activated for use as collateral

– Counterparties

20

Only one pool per counterparty can be used to collateralise Eurosystem credit

operations, including the credit line in CLM.

The management of the credit line in ECMS makes use of three different but related

concepts for a credit line:

• The suggested credit line is the difference between the total collateral

available and the amount of outstanding Eurosystem monetary policy

operations, i.e. the over/under-collateralisation of the pool;

• The expected credit line is the last credit line value sent to CLM. In this

sense, it is of temporary relevance while the ECMS is waiting for

confirmation of the change of the credit line in CLM;

• The real credit line reflects the value of the credit line confirmed by CLM.

Whenever the suggested credit line becomes negative (under-collateralisation), the

ECMS issues a margin call to the counterparty, which is then responsible for bringing

additional collateral (eligible assets or cash) or reducing its credit to resolve the margin

call in a timely manner. The ECMS allows the NCB to debit the account of the

counterparty in the CLM to resolve a margin call which has not been solved by the

counterparty itself (thus triggering a mobilisation of cash as collateral – see section 0).

Figure 7: Example process of updates of a credit line and interaction with CLM

Initial State:

no Credit Line

has been set

up

A Credit Line

link is

configured

Maximum

Credit Line is

added

Collateral

decreases

Further

collateral

decrease

Collateral

demobilisation

instruction

Suggested Credit Line

1,000,000 1,000,000 1,000,000 900,000 700,000 600,000

Maximum Credit Line

N N 800,000 800,000 800,000 800,000

Pool credit line

configuration

N Y Y Y Y Y

Real Credit Line

N/A 0 1,000,000 800,000 800,000 700,000

Expected Credit Line

N/A 1,000,000 800,000 800,000 700,000 600,000

Instruction to modify

the credit line

No need to

update CLM

Credit Line in CLM

N/A 1,000,000 800,000 800,000 700,000 700,000

Reduction rejected

by CLM if credit line

is consumed

Real Credit Line

N/A 1,000,000 800,000 800,000 700,000 700,000

Demobilisation

instruction pending

The ECMS implements a “floating credit line” approach. This means that when the

suggested credit line in the ECMS increases, this increase can be automatically

repurposed to increase the credit line in CLM.

A counterparty wishing to do so may limit this automatic increase by configuring a

maximum credit line in the ECMS. NCBs are also able to limit the amount of the credit

– Counterparties

21

line for a counterparty. The counterparty will in this case not be able to set its maximum

credit line higher than the maximum defined by its NCB.

If a maximum credit line has been set, any increase in the suggested credit line over

the maximum will not be used to increase the credit line in CLM. This collateral

remains available for other purposes.

In some instances, the automatic increase of the credit line in CLM may be connected

to a timing parameter. In such cases, the increase is delayed by a few minutes to

enable batch processing and a reduction in the number of messages exchanged

between the two systems.

Conversely, in the absence of a maximum credit line, any decrease in the available

collateral will immediately trigger a reduction of the credit line (subject to CLM

confirmation). Some events (e.g. a request by the counterparty to demobilise an

asset) are thus dependent on the successful decrease of the credit line in CLM (see

sections 4.2 and 3.4.2).

Eurosystem credit operations are thus managed in an integrated manner, meaning

that credit obtained via monetary policy operations and the credit line in CLM are

automatically interconnected.

3.4.3 Pool projection

The ECMS provides pool projection functionality to counterparties (at the discretion of

the respective NCB). This functionality is available in U2A and provides a view of the

expected evolution of a counterparty’s collateral and operations, taking into account all

movements that are already known to the ECMS. Pool projection assists

counterparties in forecasting their liquidity needs and identifying in advance potential

under-collateralisation.

The valuation of marketable assets used in the projection is based on the latest

information (e.g. prices, pool factors, haircuts, etc.) available in the system. As such,

the realisation of the collateral value on a future date may differ from the previously

projected value, even in the absence of any mobilisations and demobilisations.

– Central Securities Depositories (CSDs)

22

4 Central Securities Depositories (CSDs)

This section presents the business processes available to Central Securities

Depositories (CSDs) in respect of securities accounts held for Eurosystem collateral

business. In the ECMS such actors are identified by the role “Central Securities

Depository (CSD)”.

Whenever multiple NCBs hold accounts in the same CSD, that CSD will be treated in

the ECMS as multiple distinct entities, one for each NCB holding an account.

It should be noted that for settlement instructions, the ECMS will interact directly with

T2S. As such, CSDs will not need to establish a direct connection with the ECMS for

settlement purposes.

Interaction with CSDs is in A2A mode and follows the ISO 20022 standard.

4.1 Corporate Action events

The ECMS supports the harmonised procedures laid down by the AMI-SeCo for all CA

events relevant to Eurosystem eligible debt instruments.

According to these standards, the issuer must inform the CSD of the details of a CA

upon its public announcement. The information reaches the end investor through the

relevant chain of CSDs and investment intermediaries.

Figure 8: Interaction between ECMS and CSDs

The ECMS processes incoming messages from CSDs and, when applicable, forwards

them to the respective counterparties. Similarly, in the case of elective CAs (where the

holder of the asset has a choice) the ECMS needs to be able to process incoming

instructions from counterparties before delivering the respective instruction to the CSD

where the asset is held.

After the ECMS informs the NCB of an upcoming CA event, the ECMS acts as an

intermediary, processing this information and conveying it to counterparties affected

ECMS interaction

Investor

CSD

ECMS

Counterparty

– Central Securities Depositories (CSDs)

23

by the CA event. In the event of an elective CA, the ECMS also informs the CSD of the

counterparty’s choices.

CSDs notify the ECMS of the calculated expected movements and the ECMS informs

counterparties of their entitlements via an additional process.

From the CSD perspective, the CA event is in principle completed in the ECMS once

they have sent a confirmation and performed the related payment or securities

movement (this information is also relayed to counterparties). When the CA event

involves a cash flow, the ECMS forwards the respective cash flow to the entitled

counterparties. In case of securities movements, the counterparty account is updated.

If necessary, the CSD can also reverse the cash payment or security movement.

If the CA event relates to a meeting, the ECMS provides dedicated messages for the

provision of information before and after the meeting has taken place.

For a complete list of CA events supported by the ECMS please refer to the Annex: CA

events processed by the ECMS. The AMI-SeCo corporate actions standards detail the

specific messages that need to be used.

4.2 Sending of invoices

In accordance with the AMI-SeCo billing processes standards, CSDs send their

invoices for the NCBs accounts related to collateral management business to the

ECMS via a standardised ISO 20022 message.

Invoices are expected no later than the eighth business day of the month.

– Triparty agents (TPAs)

24

5 Triparty agents (TPAs)

This section explains the business processes relevant to those participants providing

triparty collateral management services to counterparties and NCBs. In the ECMS

such parties are referred to as “triparty agents”. Interaction with TPAs will be in A2A

mode and follow the ISO 20022 standard.

Whenever counterparties of multiple NCBs have a direct relationship with the same

TPA, the TPA is treated in the ECMS as multiple distinct entities, one for each NCB.

5.1 Triparty collateral management

The ECMS implements a single model for triparty collateral management which is

harmonised among the different jurisdictions. Communication between the ECMS and

the systems of TPAs is implemented according to the AMI-SeCo triparty collateral

management standards.

Figure 9: Interaction between ECMS and TPAs

A counterparty’s triparty collateral position is updated in the ECMS, primarily on the

basis of reports provided by the TPA to the ECMS. These triparty collateral and

exposure reports can be divided into two broad categories: reports on flows and

reports on stocks.

Reports on flow are used by the TPA to inform the respective NCB of:

• an increase in the triparty transaction amount;

• an increase or decrease in the value of collateral held;

• the delta update on the list of allocated securities.

Reports on stock inform the NCB which securities have been allocated to triparty

transactions, together with valuation information.

The process to decrease a triparty transaction amount is initiated in the ECMS

following a request made by the TPA and requires the ECMS to confirm that the

ECMS interaction

Outside ECMS

TPA ECMS

Counterparty/

Collateral Giver

– Triparty agents (TPAs)

25

decrease can be completed. As long as such confirmation has not been provided, the

decrease remains pending and the ECMS will continue to attempt to decrease the

collateral value throughout the day. This process ensures that the collateral decrease

cannot create a collateral insufficiency in the pool of the counterparty. A TPA may

cancel a previously sent decrease request.

Some of the processes described in this document may also involve the

counterparty/collateral giver (i.e. increase/decrease of triparty transaction amount).

However, the ECMS is not involved in that part of the process.

If it proves necessary to remove a specific security from a triparty transaction, the

ECMS asks the TPA to do so (for example, if the NCB becomes aware that the asset is

not eligible for that counterparty).

On a daily basis, the ECMS provides the TPA with all information necessary for it to

ensure that only eligible securities are used as collateral and that the collateral pools

comply with the applicable risk control measures (i.e. collateral value after haircuts

and close links data).

25

5.2 Sending of invoices

In accordance with the AMI-SeCo billing processes standards, TPAs send their

invoices for the NCBs to the ECMS via a standardised ISO 20022 message.

Invoices are expected no later than the eighth business day of the month.

25

It is acknowledged that TPAs cannot ensure the application of the risk control measures related to

concentration limits.

– Annex: CA events processed by the ECMS

26

Annex: CA events processed by the

ECMS

ID Name

ACTV

Trading Status: Active

BIDS

Repurchase Offer / Issuer Bid/ Reverse Rights

BMET

Bond Holder Meeting

BPUT

Put Redemption

BRUP

Bankruptcy

CAPI

Capitalisation

CERT

Non-US TEFRA D Certification

CHAN

Change

CLSA

Class Action / Proposed Settlement

CMET

Court Meeting

CONS

Consent

CREV

Credit Event

DFLT

Bond Default

DLST

Trading Status: Delisted

DRAW

Drawing

DSCL

Disclosure

DTCH

Dutch Auction

EXOF

Exchange

EXTM

Maturity Extension

INCR

Increase in Value

INFO

Information

INTR

Interest Payment

LIQU

Liquidation Dividend / Liquidation Payment

MCAL

Full Call / Early Redemption

OTHR

Other Event

PARI

Pari-Passu

PCAL

Partial Redemption Without Pool Factor Reduction

PINK

Payment in Kind

– Annex: CA events processed by the ECMS

27

PLAC

Place of Incorporation

PPMT

Instalment Call

PRED

Partial Redemption With Pool Factor Reduction

REDM

Final Maturity

REDO

Redenomination

REMK

Remarketing Agreement

RHDI

Intermediate Securities Distribution

SUSP

Trading Status: Suspended

TEND

Tender / Acquisition / Takeover / Purchase Offer

TREC

Tax Reclaim

WTRC

Withholding Tax Relief Certification

WRTH

Worthless

– List of figures and tables

28

List of figures and tables

Figure 1: Current status and future situation after the ECMS go-live ........................ 2

Figure 2: Operational day .......................................................................................... 6

Figure 3: Example of account and pool structure ...................................................... 8

Figure 4: Mobilisation of marketable assets with the ECMS in place ...................... 10

Figure 5: Settlement of a credit operation ................................................................ 17

Figure 6: Simplified view of a counterparty pool ...................................................... 19

Figure 7: Example process of updates of a credit line and interaction with CLM .... 20

Figure 8: Interaction between ECMS and CSDs ..................................................... 22

Figure 9: Interaction between ECMS and TPAs ...................................................... 24

Table 1: Overview of characteristics of the Eurosystem monetary policy operations

(instruments falling within the scope of the ECMS are marked in green) ................. 15

Table 2: Example of evolution of accrued interest for an open market operation .... 18

– List of abbreviations

29

List of abbreviations

A2A

Application-to-Application

AMI-SeCo

Advisory Group on Market Infrastructures for Securities and

Collateral

CA

Corporate Action

CET

Central European Time

CLM

Central Liquidity Management

CSD

Central Securities Depository

ECB

European Central Bank

ECMS

Eurosystem Collateral Management System

ESMIG

Eurosystem Single Market Infrastructure Gateway

GD

General Documentation

NCB

National Central Bank

T2S

TARGET-2 Securities

TIPS

TARGET Instant Payment Settlement

TPA

Triparty Agent

U2A

User-to-Application