Document No: EPR: 01

Version: 1.0

November, 2016

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Government of India

Ministry of Electronic and Information Technology (MeitY)

New Delhi –110003

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 2 of 34

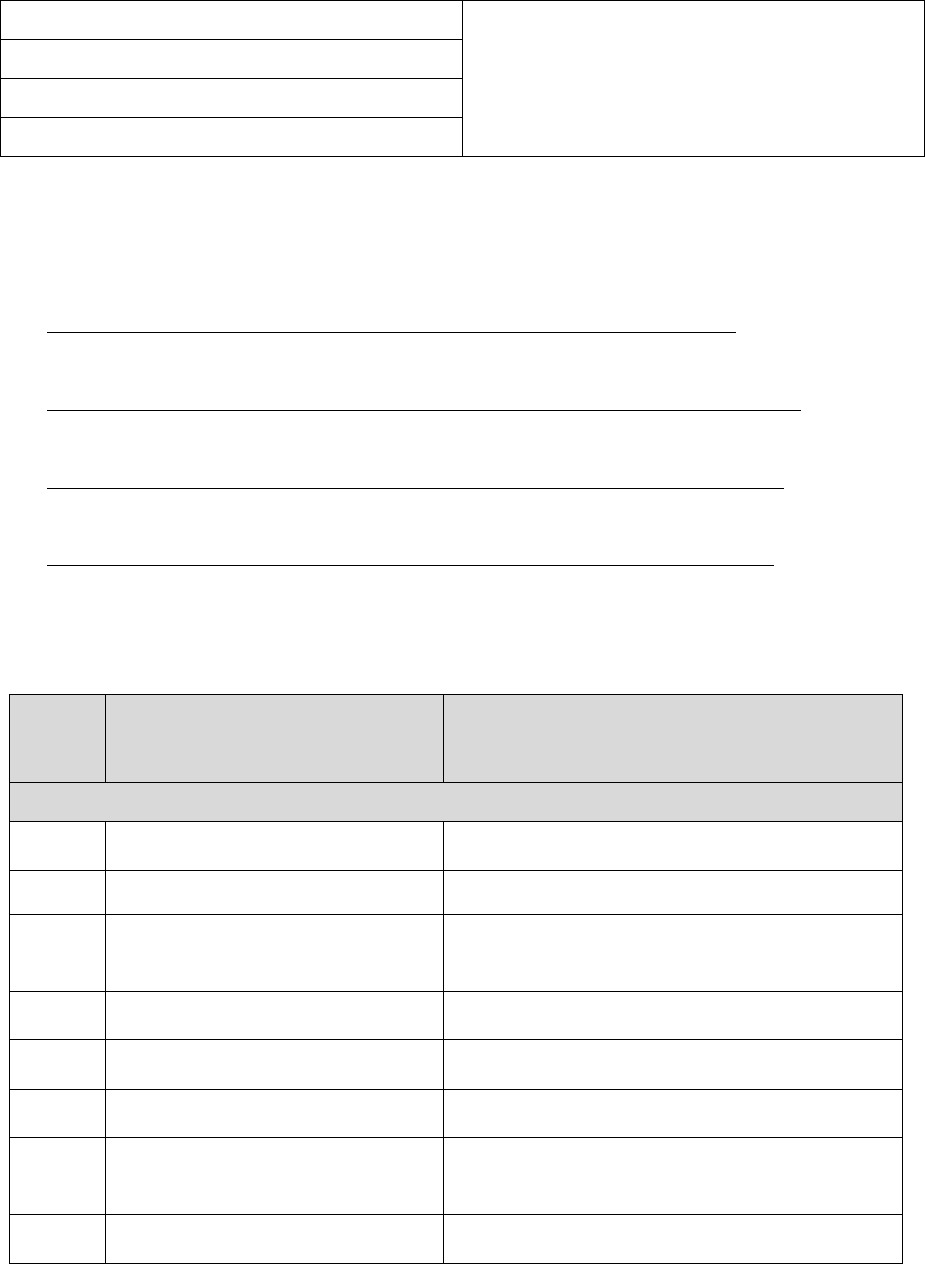

Metadata of Document Framework for Electronic Payments and Receipts

S. No.

Data elements

Values

1.

Title

Guidelines for Adoption of Electronic Payments and

Receipts (EPR)

2.

Title Alternative

EPR

3.

Document Identifier

EPR:01

4.

Document Version, month, year of

release

Version 1, Nov 2016

5.

Present Status

Approved by Secretary, Ministry of Electronics & IT

6.

Publisher

Ministry of Electronics and Information Technology

(MeitY), Government of India (GoI)

7.

Date of Publishing

Nov 2016

8.

Type of Standard Document

( Policy / Technical Specification/

Best Practice /Guidelines/

Framework/ Process)

Guidelines

9.

Enforcement Category

( Mandatory/ Recommended)

Recommended

10.

Creator

(An entity primarily responsible for making

the resource)

Ministry of Electronics and Information Technology

(MeitY), Government of India (GoI)

11.

Contributor

(An entity responsible for making

contributions to the resource)

Ministry of Electronics and Information Technology

(MeitY) and Controller General of Accounts (CGA)

12.

Brief Description

The Guidelines for Adoption of Electronic

Payments and Receipts (EPR) of Government of

India aims to harness the potential of electronic

cashless payments platforms for various Payments or

Receipts handled by Departments / Institutions.

13.

Target Audience

(Who would be referring / using the

document)

State Governments, Govt. of India Autonomous Bodies,

Central Public Sector Undertakings and Municipalities

14.

Owner of approved standard

MeitY, New Delhi

15.

Subject

( Major Area of Standardization )

Guidelines for Adoption of Electronic Payments and

Receipts (EPR)

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 3 of 34

S. No.

Data elements

Values

16.

Subject. Category

(Sub Area within major area )

Policy guidelines and implementation framework for

Electronic Payments and Receipts

17.

Coverage. Spatial

INDIA

18.

Format

PDF

19.

Language

(To be translated in other Indian languages

later)

English

20.

Rights. Copyrights

MeitY, New Delhi

21.

Source

(Reference to the other resources from which

present resource is derived)

NIL

22.

Relation

N/A

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 4 of 34

Table of Contents

1. PREAMBLE .................................................................................................................................................... 6

2. BACKGROUND ............................................................................................................................................. 6

3. OBJECTIVES ................................................................................................................................................. 7

4. POLICY STATEMENT ................................................................................................................................. 7

5. OVERVIEW OF PAYMENTS AND RECEIPTS IN GOVERNMENT MINISTRIES/

DEPARTMENTS..................................................................................................................................................... 8

5.1 CITIZENS TO GOVERNMENT (C2G) AND BUSINESS TO GOVERNMENT (B2G) PAYMENTS ......................... 8

5.2 GOVERNMENT TO CITIZENS (G2C) PAYMENTS ......................................................................................... 9

5.3 GOVERNMENT TO BUSINESSES (G2B) PAYMENTS .................................................................................... 9

5.4 GOVERNMENT TO EMPLOYEE (G2E) PAYMENTS ..................................................................................... 10

5.5 GOVERNMENT TO GOVERNMENT (G2G) PAYMENTS ................................................................................ 10

6. CATEGORIZATION OF SERVICES OFFERED BY DEPARTMENTS ON BASIS OF IT

READINESS WITH RESPECT TO PAYMENTS INTEGRATION ................................................................. 11

6.1 LEVEL 1: PAPER BASED RECORDS, MANUAL BILLING SYSTEM AND NO OPTIONS FOR ELECTRONIC

PAYMENTS ............................................................................................................................................................. 11

6.2 LEVEL 2: ELECTRONIC RECORDS AND IT ENABLED PROCESSES WITH NO PAYMENTS INTEGRATION ..... 11

6.3 LEVEL 3: ELECTRONIC RECORDS MANAGEMENT, IT ENABLED AND ELECTRONIC PAYMENTS ................ 11

7. GUIDELINES ON SERVICES WITH PAYMENTS FROM CITIZENS/ BUSINESSES TO

DEPARTMENT (C2G AND B2G) ........................................................................................................................ 12

7.1 LEVEL 1 SERVICES ................................................................................................................................. 12

7.2 LEVEL 2 SERVICES ................................................................................................................................. 14

7.3 LEVEL 3 SERVICES ................................................................................................................................. 16

8. GUIDELINES FOR PAYMENTS FROM GOVERNMENT DEPARTMENT TO CITIZENS/

BUSINESSES (G2C AND G2B) ............................................................................................................................ 19

9. GUIDELINES FOR PAYMENT/RECEIPTS FROM DEPARTMENT TO OTHER DEPARTMENTS

(G2G) ...................................................................................................................................................................... 20

10. GUIDELINES FOR PAYMENT FROM DEPARTMENT TO EMPLOYEES (G2E) ............................ 21

10.1 . GUIDELINES FOR GENERATING AWARENESS .......................................................................................... 21

11. IMPLEMENTATION METHODOLOGY ................................................................................................ 22

12. PROGRESS REVIEW AND REPORTING ............................................................................................... 24

13. REVIEW OF THE EPR FRAMEWORK .................................................................................................. 24

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 5 of 34

14. POINT OF CONTACT ................................................................................................................................ 24

15. ANNEXURES................................................................................................................................................ 25

ANNEXURE 1: ADOPTION OF PAYMENT AND RECEIPT SYSTEMS ........................................................................... 25

ANNEXURE 2: PAYMENTS AND RECEIPTS THROUGH BANK AND NON-BANK PAYMENT SERVICE PROVIDERS ...... 27

ANNEXURE 3: SUGGESTED GUIDELINES FOR ENCOURAGING DEPARTMENTS TO INCREASE USAGE OF ABOVE

MENTIONED CASHLESS OPTION THROUGH CSCS/BANK/THIRD PARTY AND PAYONLINE ...................................... 33

ANNEXURE 4 : GLOSSARY .....................................................................................................................................34

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 6 of 34

1. Preamble

Digital India program envisages transforming India into digital empowered society and knowledge

economy. The Digital India vision provides the intensified impetus for further momentum and progress

for e-Governance and would promote inclusive growth that covers electronic services, products,

devices, manufacturing and job opportunities. Governance and Services on demand is an important

component in Digital India program and includes programs to offer seamlessly integrated, real time

online services to citizens with platforms enabled for electronic & cashless financial transactions.

Departments are being encouraged and supported to fully leverage the Common and Support ICT

Infrastructure established by Government of India.

Ministry of Electronics and Information Technology (MeitY) has been tasked with evolving/ laying

down standards and policy guidelines, provide technical and handholding support, undertake capacity

building, R&D, etc. and further evolve the Digital India vision.

The aim is that all departments are in a position to collect and make payments in an electronic mode.

MeitY envisions that multiple payment channels should be available to enable electronic transactions,

provide ease of access, and competitive transaction charges for users.

2. Background

Ministry of Electronic and Information Technology (MeitY), Government of India envisages web-

enabled/mobile enabled anytime, anywhere access to information and services across the country,

especially in rural and remote parts of India. MeitY further envisages common e-Governance

infrastructure that will offer end-to-end transactional experience for a citizen, businesses as well as

internal government functions, which includes accessing various services through internet with payment

gateway interface for online payments.

Since 2008-09, Central Government Departments are already using Public Finance Management

Systems (PFMS) for plan/ non-plan schemes. With 139 Centrally Sponsored Schemes (CSS) and more

than 800 Central Sector Schemes (CS), along with State Plans and Additional Central Assistance

(ACA), the PFMS is managing funds in excess of Rs.3,00,000 crore annually.

1

In 2013, for the

payments of Government schemes directly to beneficiary, DBT module was also included in PFMS. In

1

Source: PFMS Portal : https://pfms.nic.in/Users/LoginDetails/Login.aspx?ReturnUrl=%2f

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 7 of 34

2015, for the payments and accounting, a dedicated module was launched and is being rolled out to pay

and accounts offices of Central Ministries.

The Apex Committee on Digital India Programme has recommended a targeted approach to implement

digital payments for citizens across all the e-Services of Government Ministries and Departments as per

following timelines.

Departments to provide for electronic payment system for all payments and receipts by 31

st

March,

2016

At least 90 percent of all the payments and receipts online by 31

st

December 2016.

Against this backdrop, MeitY has prepared this framework, intended for State Governments, Govt. of

India Autonomous Bodies, Central Public Sector Undertakings and Municipalities for expeditiously

implementing appropriate mechanism to enable electronic payments and receipts.

3. Objectives

The objective of this framework is to provide guidelines for Departments to:

i.Assess various services involving payments and receipts by types of services and level of electronic

payment enablement

ii.Provide actionable instructions for universal adoption of electronic payment modes for each type of

service through various payment channels

iii.Provide guidelines on engagement with various payment service providers

4. Policy Statement

Jan Dhan Yojana, the Aadhaar initiative of UIDAI and Mobile number (JAM), this Trinity of reforms is

one of the biggest pieces of reform ever attempted in India for direct subsidy transfer to poor citizens of

India. With financial inclusion as one of the key priorities of Government, using JAM, it is necessary

for Government Departments to adopt modes of electronic payments & receipts for its internal and

external transactions.

There exist a large number of options for enabling various payment channels and electronic modes for

payments/receipts. This framework is formulated with the aim of enabling 100 percent electronic

payment for all the external or internal transactions of the Departments.

The framework provides the guidelines for facilitating the Departments to expeditiously enable

electronic payments and receipts leveraging all the payment channels.

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 8 of 34

5. Overview of Payments and Receipts in Government Ministries/

Departments

The overall payments and receipts made by Departments can be categorized into seven parts:

Figure 1: Types of Payments and Receipts

5.1 Citizens to Government (C2G) and Business

2

to Government (B2G) Payments

Departments deliver various kinds of services to citizens and businesses and collect payments

against delivered services through any one or more of the following modes:

Cash

Paper based payments

Cheque to the department

Demand draft in favour of Departments

Challan to the department

Electronic payments

Online mode through

National Electronic Funds Transfer (NEFT)

2

The term Business in this document means Corporate, Vendor, Supplier, Contractor, Autonomous Bodies, PSUs,

NGOs and any other non-government body

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 9 of 34

Real Time Gross Settlements (RTGS) ( especially for B2G services)

Net Banking

PoS Terminal Based through Debit and Credit Cards

Mobile App Based ( NEFT/RTGS/Net banking)

IMPS/PPIs

Online payments of taxes and duties through Online portals of Center and States

Center

Online end to end portal for Central Board of Direct Taxes

Online end to end portal for Central Board of Excise and Customs

Other portals

State

Tax receipt portals at most of the states

5.2 Government to Citizens (G2C) Payments

As part of Government plan and non-plan schemes, Departments make payments to beneficiary of these

schemes under various heads. Central government Departments primarily use PFMS for making such

payments. Also, government hires external personnel to deliver services/support to the Departments and

makes payment against such services to personnel. Government uses following modes for the payments

to beneficiaries:

• Cash

• Paper Based ( Cheque )

• Direct Benefit Transfer to Citizen through NEFT/RTGS

• Aadhaar Enabled Payments (AEPS)

Central Government Departments use PFMS, eLekha and COMPACT for processing such payments

and state Departments use government/own portals for making such payments.

5.3 Government to Businesses (G2B) Payments

Under defined expenditure heads, Government Departments either procure goods/products or sub-

contract projects/services to external agencies/persons and make payments for such procurements and

projects using any of the following modes:

• Electronic based ( NEFT/RTGS) to businesses

• Paper based ( Cheque)

• Cash

In PFMS, the implementing agencies register as Program division and issue sanction orders, drawing

and disbursement officer generates the bills and Pay and Accounts Officer (PAO), approves the bills

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 10 of 34

and makes the payments. State government Departments use individual systems for making such

payments.

5.4 Government to Employee (G2E) Payments

Central Departments make salary, GPF and pension payments to employees through electronic means

primarily; Central Government officers use systems named as e-Lekha and COMPACT developed by

Controller General of Account (CGA). State Departments are presently using self-developed or

procured systems for making payments. Some payments like housing, loans, utility bills, petty

contingent charges or remuneration of casual nature are paid using cheque or cash.

5.5 Government to Government (G2G) Payments

Central Government Departments use Public Finance and Management (PFMS) for making payments

against plan and non-planned schemes. PFMS is mainly used for Central Sector and Central sponsored

schemes and their interfaces with state treasury.

For making G2G payments, State Government Departments use developed or procured systems for

making payments.

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 11 of 34

6. Categorization of Services offered by Departments on basis of IT

readiness with respect to Payments Integration

Departments collect and receive payments against services delivered/received to other Departments,

citizens and businesses. The services delivered by Departments are categorized under the three

progressive levels of IT as indicated below:

6.1 LEVEL 1: Paper Based Records, Manual Billing System and No options for electronic

payments

This level includes services in which:

Beneficiaries (citizens/business) in case of G2C payment and Payer in case of C2G payments

records are completely paper based

In case of C2G payments, bill generation process for services is manual

Payments and receipts are received ONLY through cash / cheque with no option of electronic

payments

6.2 LEVEL 2: Electronic Records and IT Enabled processes with No Payments Integration

This category includes services with:

Completely digitized records of G2C/B payment‟s beneficiaries (citizens/business) and payers in

case of C/B2G payments

The sanctioning and billing processes for services are automated, respective approvals are

implemented electronically and sanction orders/bills are generated electronically

Payments and receipts are paid /received ONLY through cash/cheque with no option of electronic

payments

6.3 LEVEL 3: Electronic Records Management, IT enabled and Electronic payments

This category includes services with:

Completely digitized records of G2C/B payment‟s beneficiaries (citizens/business) and payers in

case of C/B2G payments

The sanctioning and billing processes for services are automated, respective approvals are

implemented electronically and sanction orders/bills are generated electronically

For payments and receipts, there are ONE or more of the following options for electronic

payments/receipts and through:

For Over-the-counter payments/receipts: Card based/ IMPS/ Wallet based

For web based payments/receipts: Card based/ Net banking/ IMPS/ RTGS/ NEFT/ mWallets

For mobile based payments: Card based/ Net banking/ IMPS/ RTGS/ NEFT/ mWallets

7.Guidelines on Services with Payments from Citizens/ Businesses to Department (C2G and B2G)

These guidelines are applicable for Govt. of India Autonomous Bodies, Central Public Sector Undertakings, state government departments, district local

bodies delivering services/ products to citizen/businesses which results into departments making or receiving payments/fees/fines.

7.1LEVEL 1 Services

These guidelines for adoption of payments/receipts systems, channels and modes are mentioned in table 1 (below) are for Departments offering Level 1

services (as per categorization mentioned in section 6) for both Rate based Services

3

and Pre-generated bill based services

4

.

Table 1 : Guidelines for Adoption of Payment Systems, Channels and Modes for Level 1 Services

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

1

State

Government

Department,

municipalities,

Govt. of India

Autonomous

Bodies and

Central

Public Sector

Bill Based

Services

Department‟s own

Counter

Adoption of Payment Systems:

Departments are advised to adopt any one or more of the following systems for

receiving payments electronically:

Adopt systems offered by banks or third party payment service providers; refer

annexure 2 for list of Reserve Bank of India (RBI) approved Bank or Non-Bank

organizations

Use State Portal or any Portal developed by their IT Department to provide a

payment facility integrated with a payment gateway service provider. Refer

annexure 2.1.4

CSC Counters

Rate based

Services

Department‟s own

counters

CSC‟s counters

Third party‟s

counters

Common Service

3

Rate Based Services are services against which charges are pre-decided for delivery of services, for example sale and submission of government forms, application of

water bill connection etc.

4

Pre-Generated bill based services are services for which bill is generated on the basis of consumption of any services offered by government departments such as water

bill payments.

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 13 of 34

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

Undertakings

Center (CSC)

Counters

Adopt PayOnline for receiving payments; refer annexure 1.1 for detailed

guidelines.

Adoption of Payment Channels:

Departments are advised to also adopt multiple channels for receiving payments

electronically

For adoption of third party counter/portal as service delivery channel, refer

annexure 2 for list of Reserve Bank of India (RBI) approved Bank or Non-Bank

organizations

In addition to department‟s own counters and third party counters, Departments

may also adopt CSCs as service delivery channel and receive payments against

services offered through CSCs as channel, refer annexure 1.2 for details

Adoption of Payment modes

For each of the counter based services through own counter/ Third party counters /

CSC counters, department are advised to implement at least one of the following

options of electronic payment modes at the counter: Debit /Credit Card or IMPS or

PPI

Payments to businesses for delivering government services to citizens ( Indirect

receipts to citizens):

Any receipts from citizens which are received by businesses for delivering

government outsourced services to citizens should also be through electronic

modes. Businesses are advised to make following modes available to

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 14 of 34

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

citizens/businesses for receiving payment

For each of the counter based services through business/service provider‟s counters,

businesses are advised to implement at least one of the following options of

electronic payment modes : Debit /Credit Card or IMPS or PPI

7.2LEVEL 2 Services

These guidelines for adoption of payment receipt systems, channels and modes are mentioned in table 2 (below) are for Departments offering Level 2

services (as per categorization mentioned in section 6) for both Rate based Services

5

and Pre-generated bill based services

6

.

Table 2: Guidelines for Adoption of Payment Systems, Channels and Modes for Level 2 Services

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

1

State

Government

Department,

municipalities,

Govt. of India

Autonomous

Bill Based

Services

Department‟s own

Counter

Adoption of Payment Systems: Department are advised to adopt one or more of the

below mentioned payments systems

Integrate Department‟s Systems with a Payment Gateway Service Provider such

as PayGov or others for receiving payments electronically; refer annexure 2.1.4

Integrate with systems offered by banks or third party service providers; refer

CSC Counters

Rate based

Services

Department‟s own

counters

CSC‟s counters

5

Rate Based Services are services against which charges are pre-decided for delivery of services, for example sale and submission of government forms, application of

water bill connection etc.

6

Pre-Generated bill based services are services for which bill is generated on the basis of consumption of any services offered by government departments such as water

bill payments.

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 15 of 34

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

Bodies and

Central

Public Sector

Undertakings

Third party‟s

counters

annexure 2 for list of Reserve Bank of India (RBI) approved Bank or Non-Bank

organizations

Adoption of Payment Channels

Departments are advised to also adopt multiple channels for receiving payments

electronically

For adoption of third party counter/portal as service delivery channel, refer

annexure 2 for list of Reserve Bank of India (RBI) approved Bank or Non-Bank

organizations

In addition of department‟s own counters, Departments may also adopt CSCs as

service delivery channel and receive payments against such services. For

adoption of CSC as service delivery channel, refer annexure 1.2

Adoption of Payment mode

For each of the counter based services through department/CSC counters,

departments are advised to implement at least one of the following options of

electronic payment modes : Debit /Credit Card or IMPS or PPI

At the department/ CSC / Third party Portals, applicable Departments are advised

to implement at least one of the following options of electronic payment modes :

Debit /Credit Card or IMPS or PPI or Net banking or RTGS or NEFT

Payments to businesses for delivering government services to citizens ( Indirect

receipts to citizens):

Any receipts from citizens which are received by businesses for delivering

Common Service

Center (CSC)

Counters

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 16 of 34

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

government outsourced services to citizens are advised to also be through electronic

modes.

Businesses are advised to make following modes available to citizens/businesses

for receiving payment

At the Business/System provider‟s Portals, are advised to implement at least

one of the following options of electronic payment modes : Debit /Credit Card

or IMPS or PPI or Net banking or RTGS or NEFT

For each of the counter based services through business/service provider‟s

counters, businesses are advised to implement at least one of the following

options of electronic payment modes : Debit /Credit Card or IMPS or PPI

7.3LEVEL 3 Services

These guidelines for adoption of payment receipt systems, channels and modes are mentioned in table 3 (below) are for Departments offering Level 3

services (as per categorization mentioned in section 6) for both Rate based Services

7

and Pre-generated bill based services

8

.

Table 3: Guidelines for Adoption of Payment Systems, Channels and Modes for Level 3 Services

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

7

Rate Based Services are services against which charges are pre-decided for delivery of services, for example sale and submission of government forms, application of

water bill connection etc.

8

Pre-Generated bill based services are services for which bill is generated on the basis of consumption of any services offered by government departments such as water

bill payments.

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 17 of 34

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

1

State

Government

Department,

municipalities,

Govt. of India

Autonomous

Bodies and

Central

Public Sector

Undertakings

Bill Based

Services

Department‟s own

Counter

Adoption of Payment Systems:

Department‟s websites are advised to comply to the website guidelines mentioned

at http://guidelines.gov.in/ i.e. Guidelines for Indian Government Website (GIGW)

and are advised to get certified with „Website Quality Certification‟ by STQC

Departments are advised to adopt any one or more of the following systems for

receiving payments electronically:

Adopt PayOnline

9

for receiving payments electronically.

Adopt systems offered by banks or third party service providers; refer annexure

2 for list of Reserve Bank of India (RBI) approved Bank or Non-Bank

organizations.

Departments are advised to integrate with sufficient numbers of Bank and

Non-Bank Payment Service Providers in order to gain required reach for

citizens using electronic modes.

Adoption of Payment Channels

In addition of department‟s own counters, Departments may also adopt CSCs as

service delivery channel and receiving payments against such services. For

adoption of CSC as service delivery channel, refer annexure 1.2

Adoption of Payment modes

For each of the counter based services through department/CSC counters,

departments are advised to implement at least one of the following options of

CSC Counters

Rate based

Services

Department‟s own

counters

CSC‟s counters

Third party‟s

counters

Common Service

Center (CSC)

Counters

9

PayOnline is Under development by Department of Electronics and Information Technology, Ministry of Communication and IT

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 18 of 34

S/

N

Type of

Departments

Types of

Services

Channels

Guidelines for adoption of systems and Payments modes

electronic payment modes : Debit /Credit Card or IMPS or PPI

Payments to businesses for delivering government services to citizens ( Indirect

receipts to citizens):

Any receipts from citizens which are received by businesses for delivering

government outsourced services to citizens are advised to also be through electronic

modes.

Businesses are advised to make following modes available to citizens/businesses

for receiving payment

For each of the counter based services through business/service provider‟s

counters, businesses are advised to implement at least one of the following

options of electronic payment modes : Debit /Credit Card or IMPS or PPI

At the Business/System provider‟s Portals, are advised to implement at least

one of the following options of electronic payment modes : Debit /Credit Card

or IMPS or PPI or Net banking or RTGS or NEFT

EPR Framework

Version: 01 Page 19 of 34

8. Guidelines for Payments from Government Department to Citizens/

Businesses (G2C and G2B)

These guidelines are applicable for the all the Government Departments making payments to citizens

and businesses in cash/paper based (Cheque /DDs) modes

S/

N

Type of

Departments

Types of

Expenditures

Guidelines for adoption of systems and Payments modes

1

Govt. of India

Autonomous

Bodies and

Central Public

Sector

Undertakings

a. Payments to

Citizens/Busin

esses as per

planned

scheme

b. Payments to

Citizen/Busine

sses as per

services

provided to

Government

Payments to Citizens/Businesses :

Departments are advised to adopt electronic systems for

bill preparation, sanction payments and payment approvals

and integrated with electronic payment processing systems

for making payments to citizens and businesses

Payments are advised to be made directly into beneficiary

accounts except in exceptional cases, as envisaged by

department/organization specific guidelines

2

State

Government

Department,

ministry,

municipalities

or Any other

department

receiving

Government

payments

State Plan and

non-plan

payments

For State Funds:

State departments are advised to use state payments

systems developed and prescribed by State

Government for bill preparation, sanction payments and

payment approvals for making payments to citizens and

businesses

State Departments are advised to adopt electronic modes

for payments to citizens/businesses:

Directly credited into citizen‟s/business‟s account

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 20 of 34

9.Guidelines for Payment/Receipts from Department to Other Departments

(G2G)

These guidelines are applicable for the all the Government Departments making payments to other

Departments in either cash or paper based (cheque / DDs) modes.

S/

N

Type of

Departmen

ts

Types of

Expenditur

es

Guidelines for adoption of systems and Payments modes

1

Govt. of

India

Autonomou

s Bodies and

Central

Public

Sector

Undertaking

s

NA

Payments and Receipt to Other Government Departments:

Organizations / departments are advised to process all payments to

other government departments using electronic modes, with

exceptions as stated by respective organizations.

For Receipts:

Department may adopt PayOnline portal.

For receipt of funds ( e.g. Un-utilized funds) from state governments,

public sector entities or any other organizations/personnel,

Government Departments are advised to provision following modes:

RTGS/NEFT

mWallets

IMPS

Net banking or RTGS or NEFT

NA

2

State

Government

Department/

ministry

State Plan

and non-

plan

payments

Department are advised to adopt any one or more options of electronic

payments and receipts to Center, other State Government, public sector

organizations and private entities:

Department may adopt PayOnline portal.

For payments and receipts to/from other mentioned government

Departments, each government department are advised to enable

electronic modes of payments/receipts such as :

RTGS/NEFT

mWallets

IMPS

Net banking or RTGS or NEFT

Accounting of G2G payments and receipts may be done through

eTreasury system developed by NIC

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 21 of 34

10.Guidelines for Payment from Department to Employees (G2E)

These guidelines are applicable for the all the Government Departments making payments ( salary,

GPF, Pension, grant or any other funds) to full time, contractual, daily wage based staff in either

cash or paper based (Cheque / DDs) modes:

S/

N

Type of

Departments

Guidelines for adoption of systems and Payments modes

1

Govt. of

India

Autonomous

Bodies and

Central

Public Sector

Undertakings

Payments To Employees

Organizations/Departments are advised to process all payments to

employees including salary, LTA or any other compensation

component using electronic modes only.

Receipts from Employees:

Department may adopt PayOnline portal or any other

government/Autonomous body developed portal for receiving any

deposits such as fines, unutilized grants/funds etc.

2

State

Government

Department/

ministry

Payments To Employees

Each government department are advised to use enable electronic

modes of payments to employees:

RTGS/NEFT

mWallets

IMPS

Net banking or RTGS or NEFT

Government Departments may also use either eSalary system developed

by respective state‟s NIC Team or any state specific systems

Receipts from Employees:

Department may adopt PayOnline portal

Government Departments are advised to adopt electronic modes for

receiving any deposits such as fines, unutilized grants/funds etc.

10.1. Guidelines for Generating Awareness

Department are advised to take steps to build awareness on availability and usage of various

electronic Payment channels and modes. Department are advised to also take measures to

innovatively incentivize citizens making payments electronically. Guidelines for the same are

attached in Annexure 3.

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 22 of 34

11.Implementation Methodology

The implementation approach for the EPR framework can be defined as a two-step process. It

primarily addresses assessment of services offered by the Departments to internal and external

stakeholders, identification and adoption of delivery channels and usage of options for electronic

payments for payments and receipts from/to department:

Figure 2: Implementation Approach

Step 1: Assessment of the department‟s overall status of services offered to internal and external

stakeholders on the basis of IT enablement and existing payment channels. The services can be

categorized in to various levels on the basis of IT readiness levels and adoption of payment modes, as

indicated in table 4:

Level 1 - Service with paper based records, manual process and manual billing system

Level 2 - Digitized records and IT enabled processes and computerization of Billing systems,

with no options for electronic payments

Level 3 - Digitized records and IT enabled processes and computerization of Billing systems,

with multiple options for electronic payments with integration with Payment providers

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 23 of 34

Table 4: Assessment of Services Offered by Departments

Type of

Payments/

Receipts

Payer

Payee

Total

Number of

Services

Offered by

the

Department

Level 1 :

Paper

Based

Records,

Manual

Billing

System

Level 2 :

Computerization

of Billing

systems

completed

Level 3:

Integrations

with

Payment

providers.

Number of services

G2C

Department

Citizen

G2B

Department

Business

G2G

Department

Department

G2E

Department

Employee

C2G

Citizen

Department

B2G

Business

Department

E2G

Employee

Department

Step 2: For each of the service, department are advised to list already adopted payment modes as

illustrated and depicted in table 5.

Table 5 : Payment Details Integration

Name of

Service

Payment Channel

Level

Payment Modes

Department‟s

Counter/

CSCs/Online / Third

Party

Level 1/2/3

In case of level 1 and 2, Payment Mode are

advised to be specified as either cash or

cheque or both.

In case of level 3, type of payment modes

are advised to be specified which may

include NEFT, RTGS, IMPS, Card Based,

netbanking or others

EPR Framework

Version: 01 Page 24 of 34

12.Progress Review and Reporting

1. Baseline Reporting: The department shall nominate nodal officer and register with EPR Reporting

portal. Department shall ensure that nodal officer updates the baseline status of IT and payment

enablement „Assessment of IT Enablement and Electronic Payment Readiness of the Services Offered

by Departments‟.

Note: EPR portal shall be created and managed by MeitY. This portal shall have functionality to

update both the periodic status of IT and payment enablement and summary of cash and electronic

transactions.

2. Periodic Progress Reports: Further on, regular (monthly) department level progress review shall be

done and status updated in the portal EPR portal. MeitY shall periodically generate consolidated

progress report using EPR portal and extend support as required to the Departments.

3. Information Sharing with Payment Service Providers: Access to EPR Reporting portal shall be

given to RBI licensed list of payment service providers and banks enabling them to directly contact

respective department.

13.Review of the EPR Framework

The Government of India reserves the right to review and revise the EPR framework as necessary.

14.Point of Contact

Queries or comments related to the EPR Framework may be sent to the Director (eGovernance),

Ministry of Electronics and Information Technology (MeitY), Electronics Niketan, 6 CGO Complexes,

Lodhi Road, New Delhi – 110003. They can also be sent through e-mail to kbhatia@gov.in

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 25 of 34

15.Annexures

Annexure 1: Adoption of Payment and Receipt Systems

Annexure 1.1. : Guidelines for Adoption of PayOnline

MeitY is formulating a generic portal which will enable receipts of government payments. As per

guidelines, applicable Departments may adopt PAYONLINE by following guidelines mentioned on

following link: www.payonline.gov.in (the Portal is in beta stage and currently undergoing

development).

Objective of PAYONLINE:

To support all applicable (as per the guidelines) State Governments, Govt. of India Autonomous

Bodies, Central Public Sector Undertakings and Municipalities irrespective of functions in their

efforts for enabling electronic payments.

To support payments of both fixed fees and bill based payments for C2G and B2G payments.

To enable linkages to multiple payment providers thereby providing ease of payments to citizens

and businesses.

Procedural Guidelines of PayOnline:

The Departments would have to provide data including fee list, bill details, unique customer

identifier (Customer ID, Bill No. etc.) and other relevant details to enable payments through the

PAYONLINE.

PAYONLINE would prescribe common data formats for customer and fee list data exchange as

well as transaction level data which would apply to all Departments. This will ensure that the

details are recorded in a structured and identifiable manner.

PAYONLINE would define payment settlement and reconciliation processes for each department

for each type of services/payments being rendered.

PAYONLINE would define a common process for data updates in case of billing data, collection

formats /frequency; fee lists etc. are changed at the department level. This would ensure that there

is synchronization between the Departments and the stipulations concerning payments at the

Department level and ensure that the customer does not face any issues.

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 26 of 34

Annexure 1.2. : Guidelines for enablement of services through CSCs (Guidelines for integration

with CSCs already defined)

CSC has a prescribed set of procedures for integration governed by the „Guidelines for implementation

of the CSC scheme in States‟ prescribed as on May 2007. The guidelines can be accessed from the

following link: http://csc.gov.in/images/states_gudielines.pdf or are as enclosed in file:

CSC_states_gudieline

s.pdf

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 27 of 34

Annexure 2: Payments and Receipts through Bank and Non-Bank Payment Service

Providers

Annexure 2.1 RBI Licensed PSPs

Annexure 2.1.1. : RBI licensed Commercial Banks

10

List of Public Sector & Private Sector Banks

Public Sector Banks

Private-sector banks

State Bank and its associate

1. Axis Bank

1. State Bank of India

2. Bandhan Bank

2. State Bank of Bikaner & Jaipur

3. Catholic Syrian Bank

3. State Bank of Hyderabad

4. City Union Bank

4. State Bank of Patiala

5. Development Credit Bank

5. State Bank of Mysore

6. Dhanlaxmi Bank

6. State Bank of Travancore

7. Federal Bank

Nationalized banks

8. HDFC Bank

1. Allahabad Bank

9. ICICI Bank

2. Andhra Bank

10. IDFC Bank

3. Bank of Baroda

11. IndusInd Bank

4. Bank of India

12. ING Vysya Bank

(merged with Kotak Mahindra Bank in April 2015)

5. Bank of Maharashtra

13. Jammu and Kashmir Bank

6. Canara Bank

14. Karnataka Bank

7. Central Bank of India

15. Karur Vysya Bank

8. Corporation Bank

16. Kotak Mahindra Bank

9. Dena Bank

17. Lakshmi Vilas Bank

10. Indian Bank

18. Nainital Bank

11. Indian Overseas Bank

19. Sunitkeshrai Bank

12. Oriental Bank of Commerce

20. South Indian Bank

13. Punjab & Sind Bank

21. Tamilnadu Mercantile Bank

14. Punjab National Bank

22. Yes Bank

15. Syndicate Bank

22. Yes Bank

16. UCO Bank

17. Union Bank of India

18. United Bank of India

10

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/APB30091213F.pdf

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 28 of 34

19. Vijaya Bank

Other public sector banks

1. Bharatiya Mahila Bank

2. IDBI Bank

Besides the above there are also the following banking providers that (if CBS enabled) can be used by

Departments for enabling electronic payments:

Foreign Banks (RBI List available at :

https://www.rbi.org.in/commonman/Upload/English/Content/PDFs/71207.pdf)

State Co-operative Banks (RBI List available at:

https://www.rbi.org.in/Scripts/AboutUsDisplay.aspx?pg=StateCooperativeBanks.htm)

Urban Scheduled Co-operative Banks (RBI List available at :

https://www.rbi.org.in/commonman/upload/English/Content/pdfs/schedulecoop.pdf)

Regional Rural Banks (RBI List available at:

https://www.rbi.org.in/scripts/AboutUsDisplay.aspx?pg=RegionalRuralBanks.htm)

Annexure 2.1.2. : RBI authorized White label ATM providers

The below mentioned list provides the list of RBI authorized White Label ATM Operators

2

Sr. No.

Name of the Authorized Entity

Payment System Authorized

White Label ATM Operators

1

AGS Transact Technologies Ltd.

Installation and operation of WLAs

2

BTI Payments Pvt. Ltd.

Installation and operation of WLAs

3

Hitachi Payment Services Pvt. Ltd.

Installation and operation of WLAs known as

„Money Spot‟

4

Muthoot Finance Ltd.

Installation and operation of WLAs

5

RiddiSiddhi Bullions Limited -

Installation and operation of WLAs

6

SREI Infrastructure Finance Ltd.,

Installation and operation of WLAs

7

Tata Communications Payment

Solutions Ltd.

Installation and operation of WLAs

8

Vakrangee Limited

Installation and operation of WLAs

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 29 of 34

Annexure 2.1.3. : RBI Authorized Pre-paid Payment Instruments

The below mentioned list provides the list of RBI authorized Pre-paid Payment Instruments

11

Sr. No.

Name of the Authorized Entity

Payment System Authorized

Pre-paid Payment Instruments

1

Aircel Smart Money Limited

Prepaid Payment Instruments

2

Airtel M Commerce Services Ltd.

Pre-paid payment instruments known

as Stored Value Card Wallet (SCW)

„Airtel Money‟

3

Atom Technologies Limited

Pre-paid payment instruments known

as „Atom Wallet‟ and „Aquapay‟

4

Card Pro Solutions Pvt. Ltd.

Prepaid Payment Instruments

5

Citrus Payment Solutions Pvt. Ltd.

Pre-paid payment instruments known

as „Citrus Cash‟

6

Delhi Integrated Multi- Modal Transit

System Limited

Pre-paid Payment Instruments

7

DigitSecure India Private Limited

Pre-paid payment instruments e-

wallet known as „HotRemit'

8

Edenred (India) Private Limited – nee

Accor Services Pvt. Ltd.

Meal and gift paper vouchers, meal

and cafeteria cards, gift cards. The

products are mainly under the brand

name „Ticket/Ticket

Restaurant/Ticket Compliments‟

9

Eko India Financial Services Private

Limited

Pre-paid payment instruments

10

Fino Paytech Ltd. (Transfer of authorisation

from erstwhile Nokia Mobile Payment

Services India Pvt. Ltd.)

Pre-paid payment instruments

11

FX Mart Pvt. Ltd.

Pre-paid payment instruments known

as

„FX Money‟

12

GI Technology Private Limited

Pre-paid payment instruments Card

known as 'I Cash'

13

Idea Mobile Commerce Services Ltd.

Pre-paid payment instruments known

as „Idea Money‟

14

India Transact Services Limited,

Pre-paid payment instruments known

as „Ongo‟

15

Itz Cash Card Ltd.

Pre-paid payment instruments known

11

Source: RBI https://rbi.org.in/scripts/publicationsview.aspx?id=12043

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 30 of 34

as „Pay on web‟, „Mobile Wallet‟ and

„Itz Cash BSNL trust Card‟

16

MMP Mobi Wallet Payment Systems

Limited

Pre-paid payment instruments known

as „mRupee‟

17

Mpurse Services Pvt. Ltd.

Pre-paid payment instruments known

as „mpurse wallet‟

18

Muthoot Vehicle & Asset Finance Ltd.

Pre-paid payment instruments e-

wallet known as „Muthoot Money‟

and m-wallet known as „Muthoot

wallet‟

19

My Mobile Payments Limited

Pre-paid payment instruments known

as „MOM‟

20

One97 Communications Ltd.

Mobile based Pre-paid payment

instruments m- Wallet known as

„Paytm wallet‟

21

One Mobikwik Systems Private Limited

Prepaid Payment Instruments known

as „Mobikwik Wallet‟

22

Oxigen Services (India) Pvt. Ltd.

Pre-paid payment instruments known

as „Oxigen Wallets‟

23

Paul Fincap Pvt. Ltd.

Prepaid Payment Instruments

24

PayMate India Pvt. Limited

Pre-paid payment instruments known

as „Paymate Wallet‟

25

Pay Point India Network Private Limited

Pre-paid payment instruments known

as 'Pay Pointz'

26

Premium eBusiness Ventures Private

Limited

Pre-paid payment instruments

27

Pyro Telecommunications Ltd.

Pre-paid payment instruments m-

wallet known as „SpeedPay‟

28

QwikCilver Solutions Pvt. Ltd.

Pre-paid payment instruments, Co-

branded gift card known as „Issued

by QwikCilver‟

29

Reliance Payment Solution Limited

Pre-paid payment instruments known

as „Jio Money‟

30

Smart Payment Solutions Pvt. Ltd.

Pre-paid payment instruments known

as „PayCash‟

31

Sodexo SVC India Pvt. Ltd

Paper based vouches known as

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 31 of 34

Meal, Catering, Gift Gold, Gift

Exclusive and Gift Advantage.

Electronic based vouchers, gift passes

known as Meal Card, Premium E Gift

Exclusive E gift and Say Rewards

32

Spice Digital Ltd

Pre-paid payment instruments

33

Tech Mahindra Limited

Pre-paid payment instruments (m-

wallet) known as „MoboMoney‟

(Transfer of authorisation from erstwhile

CanvasM Technologies Ltd.)

34

Transaction Analysts (India) Private Ltd.

Pre-paid payment instruments known

as „Transaction Assured‟

35

UAE Exchange & Financial Services Ltd.

Pre-paid payment instruments m-

wallet known as „X-Pay

36

UTI Infrastructure Technology and Services

Ltd.

Pre-paid payment instruments known

as National Common Mobility Card

(NCMC)

35

Vodafone m-pesa Limited

Pre-paid payment instruments known

as „Vodafone M-pesa‟

(Transfer of authorisation of erstwhile

Mobile Commerce Solutions Ltd.)

36

Y-Cash Software Solutions Private Limited

Pre-paid payment instruments m-

wallet known as „Y-Pay Cash‟

37

ZipCash Card Services Pvt. Ltd.

Pre-paid payment instruments known

as 'ZipCash Coupons'

Annexure 2.1.4. : List of Non-Bank Entity as Payment Service Providers

RBI is empaneling Non-Bank entities such as Payment aggregators for receiving electronic payments

as Bharat Bill Payment operating units (BBPOUs). Applicable (as per the guidelines) Government

Departments are advised to refer following links for list of empaneled BBPOUs:

www.rbi.org.in and http://www.npci.org.in/BBPS-about-us.aspx

For the reference, list of major payment aggregators: Bill desk

Techprocess

CCAvenue

Times of Money/DirectPay

EBS

Citrus

Payu / PayuPaisa

Paytmpayment

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 32 of 34

ZaakPay

SBIePay

(Many Others)

Annexure 2.2. : Guidelines on Settlement of electronic Payments

RBI guidelines for settlement of payments for electronic payment transactions involving

intermediaries: https://www.rbi.org.in/scripts/NotificationUser.aspx?Mode=0&Id=5379

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 33 of 34

Annexure 3: Suggested guidelines for encouraging Departments to increase usage of above

mentioned cashless option through CSCs/Bank/Third Party and PayOnline

Departments should identify measures to encourage department‟s staff, Citizens/businesses for usage

of electronic modes of payments. The specific measures may include benefits to payee/payer for usage

of available electronic options. The specific measures may be identified by the respective department.

Annexure 6:

Guidelines for Adoption of Electronic Payments and Receipts (EPR)

Version: 01 Page 34 of 34

Annexure 4 : Glossary

Department - For the purposes of this document the term Department here refers to all Government

Departments, Ministries, Utility service Providing Agencies, Municipal bodies, Public Sector bodies at

the Central and State levels.

Payment Service Providers (PSPs) – These are Third Party entities, which offer online services to

Departments enabling acceptance of electronic payments by a variety of payment methods including

credit card, debit card, bank-based payments such as direct bank transfer, and real-time bank transfer

based on online banking. Typically, they use Software as a Service (SaaS) model and form a single

payment gateway for their clients (merchants) offering multiple payment options.

Payment Aggregator (PA) - Payment Aggregators are service providers through which electronic

PSPs or merchants can process their payment transactions. Aggregators allow merchants to accept

credit card and bank transfers without having to setup a merchant account with a bank or card

association. The aggregator provides the means for facilitating payment from the consumer via credit

and debit cards, stored value accounts or bank transfer to the merchant.

Billing System - For the purposes of this document Billing System refers to the “Systems and

Processes” used by Departments to generate due of external clients at a regularly defined frequency

(say monthly, quarterly, annually, etc.) or as a one-time transaction against goods or services.

Electronic Payment - A payment or transfer made using electronic medium either by the department

to external/internal entity or external/internal entity to department.