1

MobilePaymentsgoViral:

M‐PESAinKenya

IgnacioMasandDanRadcliffe,Bill&MelindaGatesFoundation

1

March2010

Abstract

M‐PESAisasmall‐valueelectronicpaymentandstoreofvaluesystemthatisaccessible fromordinary

mobilephones.Ithasseenexceptionalgrowthsinceitsintroduction bymobilephoneoperator

SafaricominKenyainMarch2007:ithasalreadybeenadoptedby9millioncustomers(correspondingto

40%ofKenya’sadultpopulation)andprocessesmoretransactionsdomesticallythanWesternUnion

doesglobally.M‐PESA’smarketsuccesscanbeinterpretedastheinterplayofthreesetsoffactors:(i)

pre‐existingcountryconditionsthatmad eKenyaaconduciveenvironmentforasuccessfulmobile

moneydeployment;(ii) acleverservicedesignthatfacilitatedrapidadoptionandearlycapturingof

networkeffects;and(iii)abusinessexecutionstrategythathelpedM‐PESArapidlyreachacriticalmass

ofcustomers,therebyavoidingtheadversechicken‐and‐egg(two‐sidedmarket)problemsthatafflict

newpaymentsystems.

1. MPESAinaNutshell

2

M‐PESAwasdevelopedbymobilephoneoperatorVodafoneandlaunchedcommerciallybyitsKenyan

affiliateSafaricominMarch2007.M‐PESA(“M”formobileand“PESA”formoneyinSwahili)isan

electronicpaymentand storeofvaluesystemthatisaccessiblethroughmobilephones.Toaccessthe

service,customers

mustfirstregisteratanauthorizedM‐PESAretailoutlet.Theyarethenassignedan

individualelectronicmoneyaccountthatislinkedtotheirphonenumberandaccessiblethroughaSIM

card‐residentapplicationonthemobilephone.

3

Customerscandepositandwithdrawcashto/fromtheir

accountsbyexchan gingcashforelectronicvalueatanetworkofretailstores(oftenreferredtoas

agents).ThesestoresarepaidafeebySafaricomeachtimetheyexchangethesetwoformsofliquidity

onbehalfofcustomers.Oncecustomershave

moneyintheiraccounts,theycanusetheirphonesto

transferfundstootherM‐PESAusersandeventonon‐registeredusers,paybills,andpurchasemobile

airtimecredit.Alltransactio nsareauthorizedandrecordedinrealtimeusingsecureSMS,andare

cappedat$500.

1

IgnacioMasisDeputyDirectorandDanRadcliffeProgramOfficerintheBill&MelindaGatesFoundation’s

FinancialServicesforthePoor(FSP)team.

2

FormoredetailedaccountsoftheM‐PESAservice,seeHughesandLonie(2009)forahistoricalaccount,Masand

Morawczynski(2009)forafullerdescriptionoftheservice,andMasandNg’weno(2009)forthelatest

accomplishmentsofM‐PESA.

3

TheSubscriberIdentificationModule(SIM)cardisasmartcardfoundinsidemobilephonesthatarebasedonthe

GSMfamilyofprotocols.TheSIMcardcontainsencryptionkeys,securestheuser’sPINonentry,anddrivesthe

phone’smenu.TheShortMessagingService(SMS)isadatamessagingchannel

availableonGSMphones.

2

Customerregistrationanddepositsarefree.CustomersthenpayaflatfeeofaroundUS40¢

4

forperson‐

to‐person(P2P)transfersandbillpayments,US33¢forwithdrawals(fortransactions lessthanUS$33),

andUS1.3¢forbalanceinquiries.Individualcustomeraccountsaremaintainedinaserverthatisowned

andmanagedbyVodafone,butSafaricomdepositsthefullvalueofitscustomers’balances

onthe

systeminpooledaccountsintworegulatedbanks.Thus,SafaricomissuesandmanagestheM‐PESA

accounts,butthevalueintheaccountsisfullybackedbyhighlyliquiddepositsatcommercialbanks.

CustomersarenotpaidinterestonthebalanceintheirM‐PESA accounts.Instead,theforegone

interest

ispaidintoanot‐for‐profittrustfundcontrolledbySafaricom(thepurposeofthesefundshasnotyet

beendecided).

M‐PESAisusefulasaretailpaymentplatformbecauseithasextensivereachintolargesegmentsofthe

population.Exhibit1showsthesizeofvarious

retailchannelsinKenya.

5

Notethattherearenearlyfive

timesthenumberofM‐PESAoutletsthanthetotalnumberofPostBankbranches,postoffices,bank

branches,andautomatedtellermachines(ATMs)inthecountry.UsingexistingretailstoresasM‐PESA

cash‐in/cash‐outoutletsreducesdeploymentcostsandprovidesgreaterconvenience

andlowercostof

accesstousers.

Exhibit1:Outletsofferingfinanci alservicesinKenya

6

4

WeassumeanexchangerateofUS$1:75KenyanSchillings.

5

Kenyahasatotalpopulationofnearly40million,with78%livinginruralareasandaGDPpercapitaof$1,600.

19%ofadultshaveaccesstoaformalbankaccount.SeeFSDT(2009a)forfinancialaccessdataderivedfromthe

FinAccesssurvey,anationallyrepresentativesurveyof6,600

householdsconductedinearly2009.

6

DatafromthistablewaspulledfromtheCentralBankofKenya,KenyaPostOfficeSavingsBank,andSafaricom

websites.

440

800

840

1,510

16,900

100,000

1

10

100

1,000

10,000

100,000

PostBank

branches

Totalpost

offices

Bank

branches

ATMs M‐Pe sa

stores

Airtime

rese llers

3

ASnapshotofMPESAafterThreeYears

M‐PESAisgoingfromstrengthtostrength.AsshowninExhibit2,Safaricomreachedthe9million

customermarkinunderthreeyears.

Exhibit2:GrowthofM‐PESACustomerBase

ThelatestdevelopmentsandfiguresreportedbySaf a ricomasofJanuary2010are:

7

9.0millionregisteredcustomers,ofwhichthemajorityareactive.Thiscorrespondsto60%of

Safaricom’scustomerbase,23%oftheentirepopulation,and40%Kenyanadults.

8

16,900retailstoresatwhichM‐PESAuserscancash‐inandcash‐out,ofwhichnearlyhalfare

locatedoutsideurbancenters.

US$320millionpermonthinperson‐to‐person(P2P)transfers.Onanannualizedbasis,thisis

equaltoroughly10%ofKenyangrossdomestic

product(GDP).Althoughtransactionsper

customerhavebeenonarisingtrend,theyremainquitelow,probablystillundertwoP2P

transactionspermonth.

US$650millionpermonthincashdepositsandwithdrawaltransactionsatM‐PESAstores.The

averagetransactionsizeisaroundUS$33,butVodafonehas

statedthathalfthetransactions

areforavalueoflessthanUS$10.

US$7millioninmonthlyrevenue(basedonthesixmonthstoSeptember2009).Thisis equalto

8%ofSafaricomrevenues.

19%ofSafaricomairtimepurchasesareconductedthroughM‐PESA.

7

Seewww.safaricom.co.ke/fileadmin/template/main/images/MiscUploads/M‐PESA%20Statistics.pdfforkey

monthlystatisticsforM‐PESA.AdditionalfiguresaretakenfromSafaricom’spublishedhalf‐yearresultsforthe

periodendingSeptember2009andCentralBankofKenyareports.

8

The2009FinAccesssurvey(FSDT[2009a],p.16)confirmedthat40%ofadultshadusedM‐PESA.

4

Thereare27companiesusingM‐PESAforbulkdistribution ofpay ments.Safaricomitselfusedit

todistributedividendsonSafaricomstockto180,000individualshareholderswhooptedto

receivetheirdividends intotheirM‐PESAaccounts,outofatotalof700,000shareholders.

Sincethelaunchofthe

billpayfunctioninMarch2009,thereare75companiesusingM‐PESAto

collectpaymentsfromtheircustomers.Thebiggestuseristheelectricutilitycompany,which

nowhasroughly20%oftheironemillioncustomerspayingthroughM‐PESA.

Atleasttwobanks(FamilyBankandKenya

CommercialBank)areusingM‐PESAasamechanism

forcustomerstoeitherrepayloansorwithdrawfundsfromtheirbanksaccounts.

CustomerPerspectivesonMPESA

9

Asurveyof3,000M‐PESAusersandnon‐usersconductedinthefallof2008shedconsiderablelighton

theprofileofM‐PESA’searlyadoptersandcustomerusagepatterns.Thesurveyfoundthattheaverage

M‐PESAuseris,incomparisontonon‐users,twiceaslikelytohave

abankaccount(72percentversus36

percent),wealthier(65percenthigherexpenditurelevels),moreliterate,andbettereducated.Early

adoptersappeartobeexperiencedwithbankingpropositionsandfairly“techsavvy,”whichprobably

makesthemmoreacutelyawareoftheconvenienceofferedbyM‐PESA relativetothealternatives.

Exhibit3highlightshowcustomersusetheservice.Consistentwithitsbroadmarketpositioning,more

thanhalfthesampleuseitprimarilyforsendingandreceivingmoney.Interestingly,21percentofM‐

PESAusersreportusingM‐PESAforstoringmoney.However,thesurveyrevealedthatlessthan1

percentof

accountshadbalancesofoverKSh1,000(US$13),andagovernmentauditofM‐PESAin

August2009revealedthattheaveragebalanceonM‐PESAaccountswasonlyUS$2.70.

10

Thesurvey

alsofoundthat52percentofcustomersusetheserviceonamonthlybasis,suggestingthatcustomers

haveyettoincorporateM‐PESAintotheirdailylives.

Exhibit3:TheUsesofM‐PESA

9

ThedataandtablesfromthissectionarefromSuri,TavneetandWilliamJack(June2008),“Theperformanceand

ImpactofM‐PESA:PreliminaryEvidencefromaHouseholdSurvey.”UnpublishedPaper

10

Okoth,Jackson(2009).“RegulatorgivesM‐PESAacleanbillofhealth.”TheStandard,27January2009.

5

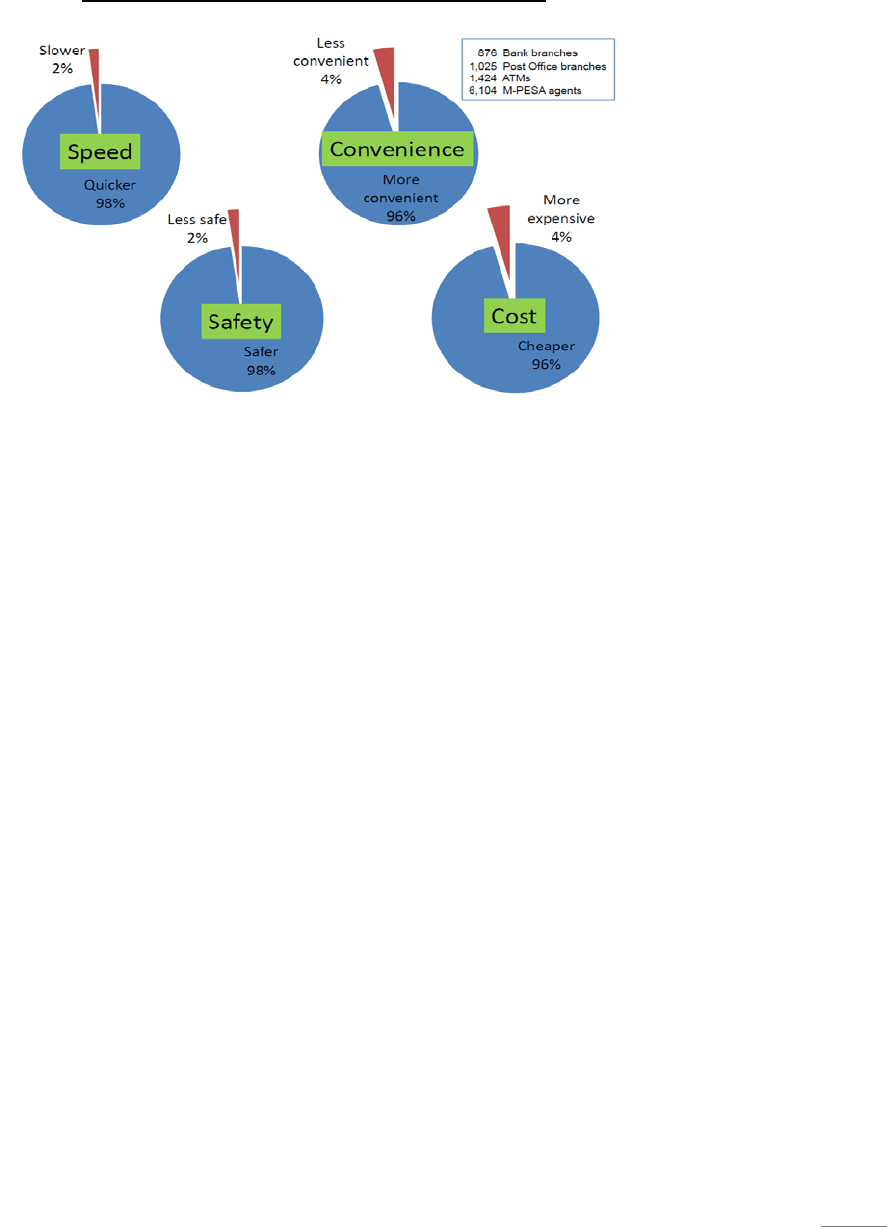

Thesurveyalsofoundthat98percentofusersreportbeinghappywiththeserviceand84percentclai m

thatlosingM‐PESAwouldhavealarge,negativeeffectonthem.Exhibit4belowillustrateshow

customerscompareM‐PESAwithalternativeservices.

Exhibit4:ComparingM‐PESAwiththeAlternatives

MPESA’sServiceEvolution

M‐PESA’soriginalcoreofferingwastheP2Ppayment–enablingcustomerstosendmoneytoanyone

withaccesstoamobilephone.Itopenedupamarketfortransactionswhichpreviouslywerehandled

largelyinformally–throughpersonaltrips,friends,andpublictransportnetworks.Thatisrepresented

bytheset

oftransactionslabeled‘personalnetworks’inthemiddleofExhibit5below.Many P2P

transactionscanbecharacterizedasscheduledpayments(suchassendingaportionofsalaryearnedat

theendofthemonthtor elativesbackhome),butmanyrepresentabasicformoffinance,where

peoplecan

drawonamuchbroadernetworkoffamilymembers,friends,andbusinessassociatesto

accessmoneyasandwhenrequired.Thus,M‐PESAnotonlyintroducesalargemeasureofconvenience

totransactionsthatwerealreadyoccur r ing,butitalsoenablesabasicformoffinancialprotectionfora

largenumber

ofusersbyenablinganetworkforinstant,‘ondemand’payments.

Inrecentmonths,SafaricomhasincreasinglyopenedupM‐PESAtoinstitutionalpayments–enabling

companiestopaysalariesandcollectbillpayments.Infuture,SafaricomenvisionsincreaseduseofM‐

PESAforin‐storepurchases.Thus,Safaricomintends

forM‐PESAtobecomeamorepervasiveretail

paymentsplatform,astrategyrepresentedbythedownwardarrowinExhibit5.

6

Exhibit5:PotentialRangeofTransactionsSupportedbyM‐PESA

ThechallengeremainsforM‐PESAtobecomeavehiclefordeliveryofabroaderrangeoffinancial

servicestothebulkoftheKenyanpopulation–representedbytheupwardarrowinExhibit5.Sofar,the

evidenceislimitedthatpeoplearewillingtousethebasicM‐

PESAaccountitselfasastoreofvalue.

Thereislikelytobeaneedtodevelopmoretargetedsavingsproductsthatbalancecustomers’

preferenceforliquidityandcommitment,andwhichconnectintoabroaderrangeoffinancial

institutions.ThisisthejourneyM‐PESA mustbeonforitto

deliveronitspromiseofaddressingthe

challengeoffinancialinclusioninKenya.Akeypreconditionisregulation:theCentralBankofKenyaisin

theprocessoffinalizingregulationsthatwillallownon‐bankoutletsandplatformssuchasM‐PESAasa

channelforformaldeposit‐taking.Beyond

that,Safaricomwillneedtodevelopappropriateservice,

commercialandtechnicalmodelsforM‐PESAtointerworkwiththesystemsofotherfinancialservice

providers.Wereturntothistopicintheconcludingsectionofthispaper.

ThebroadersignificanceofMPESA

BeforeexaminingwhyM‐PESAachievedsuchdramaticgrowth,wediscussbrieflythreetop‐linelessons

thathaveemergedfromM‐PESA’ssuccess:

First,M‐PESAhasdemonstratedthepromiseofleveragingmobiletechnologytoextendfinancial

servicestolargesegmentsofunbankedpoorpeople.Thisisfundamentallybecausethemobile

phone

isquicklybecomingaubiquitouslydeployedtechnology,evenamongpoorsegmentsofthepopulation.

MobilepenetrationinAfricahasincreasedfrom3percentin2002to48percenttoday,andisexpected

FORMAL FINANCIAL

PRODUCTS

Savings, credit, insurance

INFORMAL SERVICE

PROVIDERS

Pawnbroker,moneylender

‘On-demand’ payments

PERSONAL NETWORKS

‘Scheduled’ payments

REMOTE B2C/C2B

INSTITUTIONAL PAYMENTS

Salaries, bill pay, G2P,

online/e-commerce

IN-STORE MERCHANT PAYMENTS

For goods & services

‘JUST

PAYMENTS’

PUSHING &

PULLING MONEY

ACROSS TIME

M-PESA role

in promoting

fuller financial

inclusion?

M-PESA as

a fuller retail

payments

platform

7

toreach72percentby2014.

11

And,happily,themobiledevicemimicssomeofthekeyingredients

neededtoofferbankingservices.TheSIMcardinsideGSMphonescanbeusedtoauthenticateusers,

therebyavoidingthecostlyexer ciseofdistributingseparatebankcardstolow‐profitabilitypoor

customers.Themobilephonecanalsobeused

asapointofsale(POS)terminaltoinitiatefinancial

transactionsandsecurelycommunicatewiththeappropriateservertorequesttransaction

authorization,thusobviatingtheneedtodeploycostlydedicateddevicesinretailenvironments.

Second,M‐PESAhasdemonstratedtheimportanceofdesigningusage‐rathe rthanfloat‐based

revenuemodels

forreachingpoorcustomerswithfinancialservices.Becausebanksmakemostoftheir

moneybycollectingandreinvestingdeposits,theytendtodistinguishbe tweenprofitableand

unprofitablecustomersbasedonthelikelysizeoftheiraccountbal ancesandtheirabilitytoabsorb

credit.Banksthusfinditdifficulttoservepoor

customersbecausetherevenuefromreinvestingsmall‐

valuedepositsisunlikelytooffsetthecostofservingthesecustomers.Incontrast,mobileoperatorsin

developingcountrieshavedevelopedausage‐basedrevenuemod el, sellingprepaidairtimetopoor

customersinsmallincrements,suchthateachtransactionisprofitableona

stand‐alonebasis.Thisisthe

magicbehindtherapidpenetrationofprepaidairtimeintolow‐incomemarkets:acardboughtisprofit

booked,regardlessofwhoboughttheprepaidcard.Thisusage‐basedrevenuemodelisdirectlyaligned

withthemodelneededtosustainablyoffersmall‐valuecash‐in/cash‐out

transactionsatretailoutlets

andwouldmakepossibleatruemass‐marketapproach,withnoincentiveforproviderstodenyservice

basedonminimumbalancesorintensityofuse.

Third,M‐PESAhasdemonstratedtheimportanceofbuildingalow‐costtransactionalplatformwhich

enablescustomerstomeetabroad

rangeoftheirpaymentneeds.Onceacustomerisconnectedtoan

e‐paymentsystem,shecanusethiscapability tostoremoneyinasavingsaccount,sendandreceive

moneyfromfriendsandfamily,paybillsandmonthlyinsurancepremiums,receivepensionorsocial

welfarepayments,orreceiveloandisbursements

andrepaythemelectronically.Inshort,whena

customerisconnectedtoane‐paymentsystem,herrangeoffinancialpossibilitiesexpandsdramatically.

Puttingtheseelementstogether,M‐PESAhaspromptedarethinkontheoptimalsequencingoffinancial

inclusionstrategies.Wheremostfinancialinclusionmodelshaveemployed“credit‐led”

or“savings‐led”

approaches,theM‐PESAexperiencesuggeststhattheremaybeathirdapproach–focusfirston

buildingthepayment“rails”onwhichabroadersetoffinancialservicescanride.

AccountingforMPESA’sSuccess:ThreePerspectives

TherestofthispaperexploresM‐PESA’ssuccessfromthreeangles. First,weexaminetheenvironmental

factorsinKenyathatsetthesceneforasuccessfulmobilemoney development.Then,weexaminethe

servicedesignfeaturesthatfacilitatedtherapidado ptionandfrequentuse ofM‐PESA.And,finally,we

examinetheelementsinSafaricom’sexecutionstrategythathelpedM‐PESArapidlyrea chacriticalmass

ofcustomers.

11

WirelessIntelligence(www.wirelessintelligence.com)

8

Insodoing,wedrawextensivelyonasequenceoffourpaperswhichreaderscanrefertoformore

detailedaccountsoftheM‐PESAstory:HeyerandMas(2009)onthecountryfactorsthatledtoM‐

PESA’ssuccess,MasandMorawczynski(2009)onM‐PESA’sservicefeatures,Masand

Ng’weno(2010)

onSafaricom’sexecution,andMas(2009)ontheeconomicsunderpinningbranchless bankingsystems.

Beyondthecompellingmarketing,coldbusinesslogicandconsistentexecutionofM‐PESA,itssuccessis

avividexampleofhowgreatthingshappenwhenagroupofleadersfromdifferentorganizationsrally

aroundcommon

challengesandideas.ThestoryofM‐PESAstraddlesthesocialandthecommercial,the

publicandtheprivate,powerfulorganizationsanddeterminedindividuals:

TheIndividualsandInstitutionsBehindM‐PESA

TheideaofM‐PESAwasoriginallyconceivedbyaLondon‐basedteamwithinVodafone,ledbyNick

HughesandSusieLonie.Thisteambelievedthemobilephonecouldplayacentralroleinloweringthe

costofpoorpeopletoaccessfinancialservices.TheideawasseizedbytheSafa ricomteaminKenya,led

byCEOMichaelJosephandProductManagerPaulineVaughn.Theytoyedwiththeidea,convinced

themselvesofitspower,developeditthoroughlypriortothenationallaunch,andoversawa very

focusedexecution.

TheCentralBankofKenya(CBK),andinparticularitsPaymentsSys temgroupledbyGeraldNyoma,

deservesmuchcreditforbeingopentotheideaoflettingamobileoperatortaketheleadinproviding

paymentservicestothebulkofthepopulation.TheCBKhadrecentlybeenmadeawareoftheverylow

levelsofbankpenetrationinthecountrybythefirstFinAccess surveyin2006,andtheywere

determinedtoexploreallreasonableoptionsforcorrectingtheaccessimbalance.TheCBKworkedin

closepartnershipwithVodafoneandSafaricomtoassesstheopportunitiesandrisksinvolvedpriorto

thelaunchandasthesystemdeveloped.Theywereconsciousthatprematureregulationmightstifle

innovation,sotheychosetomonitorcloselyandlearn–andformalizetheregulations later.

Finally,theUK’sDepartmentforInternationalDevelopment(DfID)playedan instrumentalrole,firstby

fundingtheorganizationsthatmadetheFinAccesssurveypossible—theFinancialSectorDeepening

TrustinKenya,theFinMarkTrustinSouthAfrica—,andthenbyprovidingseedfundingtoVodafoneto

trialitsearliestexperimentswithM‐PESA.DfID’sroleinspotlightingtheneedformobilepaymentsand

fundingtheearlyriskdemonstratesgoodrolesfordonorfunding.

2. KenyaCountryFactors:UnmetNeeds,FavorableMarketConditions

ThegrowthofM‐PESAisatestamenttoSafaricom’svisionandexecutioncapacity.However,Safaricom

alsobenefitedfromlaunchingtheserviceinacountrywhichcontainedseveralenablingconditions fora

successfulmobilemoneydeployment,including:stronglatentdemandfordomesticremittances,poor

qualityofavailablefinancialservices,abanking

regulatorwhichpermittedSafaricomtoexperimentwith

differentbusinessmodelsanddistributi onchannels,andamobilecommunicationsmarket

characterizedbySafaricom’sdominantmarketpositionandlow commissionsonairtimesales.

9

StrongLatentDemandforDomesticRemittances

SafaricombasedtheinitiallaunchoftheM‐PESAserviceonthe‘sendmoneyhome’proposition,even

thoughitalsoallowstheusertobuyandsendairtime,storevalueand,morerecently,topaybills.

Demandfordomesticremittanceserviceswillbelargerwheremigrationresultsinsplittingof

families,

withthebread‐winnerheadingtourbancentersandtherestofthefamilystayingbackhome.Thisisthe

caseinKenya,where17percentofhouseholds dependonremittancesastheirprimaryincomesource.

12

InherstudyofM‐PESA,Ratan(2008)suggeststhatthelatentdemandfordomesticremittancesis

relatedtourbanizationratios.Morepropitiousmarketswillbethosewheretheprocessofrural‐urban

migrationissufficientlyrootedtoproducelargemigrationflows,butnotsoadvancedthatrural

communitiesare

hollowedout.Countrieswithmid‐rangeurbanizationratios(20percentto40percent),

especiallythosethatareurbanizingatarapidrate,arelikelytoexhibitstrongrural‐urbantiesrequiring

transferofvaluebetweenthem.ThisisthecaseinmanyAfricancountrieslikeKenyaandTanzania,

wherethe

urbanizationratiosare22percentand25percent,respectively.

13

InthePhilippinesandLatin

America,whereurbanizationratiosexceed50percent,remittancesaremorelikelytobetriggeredby

internationalratherthandomesticmigrationpatterns.

Whereentirenuclearfamiliesmove,remittanceswillbestrongerwherethereisculturalpressureto

retainconnectionwithone’sancestralvillage.InKenya,migrants’ties

withruralhomesarereinforced

byanethnic(ratherthannational)conceptionofcitizenship.Theselinksareexpressedthroughburial,

inheritance,cross‐generational,socialinsuranceandotherties,evenincaseswheremigrantsreside

moreorlesspermanentlyincities.

14

Inothersettings,a greateremphasisonnationalasopposedto

localorethnicidentitymayhavediminishedthesignificanceoftherural‘home’andhencedampened

domesticremittanceflows.

PoorQualityofExistingAlternatives

Latentdemandfore‐paymentsmustbelookedatinthecontextoftheaccessibilityandqualityofthe

alternatives.Iftherearemanygoodalternativestomobilepayments(asistypicallythecasein

developedcountries),itwillbedifficulttoconvinceuserstoswitchtothenewservice.In

thePhilippines,

forexample,theG‐CashandSmartMoneymobilepaymentservicesexperiencedlowtake‐upinpart

duetotheavailabilityofacompetitivealternativetomobilepayments–anextensiveandefficientsemi‐

formalretailnetworkofpawnshopswhichoffereddomesticremittanceservicesat3perce nt.

In

Kenya,themostcommonchannelforsendingmoneybeforeM‐PESAwasinformalbusandmatatu

(sharedtaxi)companies.Thesecompaniesarenotlicensedtotransfermoney,r esultinginconsiderable

riskthatthemoneywillnotreachitsfinaldestination.AndKenyaPost,Kenya’smajorformalremittance

12

FSD‐Kenya(2006)

13

CIAWorldFactBook(https://www.cia.gov/library/publications/the‐world‐factbook)

14

ForfulleranalysesoftheuseofmobilemoneyfordomesticremittancesinKenya,seeRatan(2008)and

Morawczynski(2008).

10

provider,isperceivedbycustomersascostly,slow,andpronetoliquidityshortagesatruraloutlets.

Meanwhile,Kenya’ssparsebankbranchinfrastructure(840branches)isfartoolimitedtocompetewith

M‐PESA’s16,900cash‐in/cash‐outoutlets.Exhibit6belowillustrateshowKenyanhouseholdssent

moneybeforeandafterM

‐PESA.Notethedramaticreductionintheuseofinformalbussystemsand

KenyaPosttotransfermoneybetween2006and2009.

Exhibit6:MoneyTransferBehaviorBeforeandAfterM‐PESA

15

Asnotedabove,M‐PESA’searlyadopterswereprimarilybankedcustomers,whichsuggeststhatM‐PESA

didnotacquireitsinitialcriticalmassthroughcompetitionwiththeformalsectorbutratherasa

complementtoformalservicesforclientswhowerewealthier,moreexposedtoformalfinancialservice

options,and

lessrisk‐averse.Asservicesmovedeeperintothemarket,unbankeduserswilllikelydrive

M‐PESA’sexpansion,duetothecompetitiveadvantagesofformalmobileoffersoverotheroptions.This

isonereasonwhyAfrica,withitshighpopulationofunbanked,isseenassuchapromisingmarketfor

mobilemoneydeployments.

ASupportiveBankingRegulator

Regulationofmobilemoneycanhelptosecuretrustinnewmobilemoneyschemes.Atthesametime,

regulationmayconstrainthesuccessofamobilemoneydeploymentbylimitingtheschemeoperator’s

degreesoffreedominstructuringthebusinessmodel,serviceproposition,anddistributionchannels.In

thecaseofM

‐PESA,SafaricomhadagoodworkingrelationshipwiththeCentralBankofKenya(CBK)

andwasgivenregulatoryspacetodesignM‐PESAinamannerthatfititsmarket.

TheCBKandSafaricomworkedoutamodelthatpro videdsufficientprudentialcomforttotheCBK.The

CBKinsistedthat

allcustomerfundsbedeposited inaregulatedfinancialinstitution,andreviewedthe

15

FSD‐Kenya(2006)andFSD‐Kenya(2009).

11

securityfeaturesofthetechnologyplatfo rm. Inturn,theCBKallowedSafaricomtooperateM‐PESAasa

paymentssystem,

outsidetheprovisionsofthebankinglaw.

16

Safaricomhashadtopayacertainpriceforthisarrangement.Forinstance,interestearnedon

depositedbalancesmustgotoanot‐for‐profittrustandcannotbeappropriatedbySafaricomorpassed

ontocustomers.Therearealsolimitsontransactionsizestoaddressanti‐moneylaunderingconcerns.

But,fundamentally,Safaricomwasabletodesigntheserviceasitsawfit,withouthavingtocontortits

businessmodeltofitwithinaprescribedregulatorymodel.

TheCBKhascontinuedtosupportM‐PESA’sdevelopment,eveninthefaceofpressurefrombanks.In

late2008,afteralobbying

attackfromthebankingindustryseekingtoshutdowntheservice,the

CentralBankdidanauditoftheM‐PESAserviceattherequestoftheMinistryofFinanceanddeclaredit

safeandinlinewiththecountry’sobjectivesforfinancialinclusion.

17

Sofar,theCentralBankappears

justifiedinitsconfidenceinM‐PESAastherehavebeennomajorreportsoffraud.Andsystem

downtime,althoughfrequent,hasnotbeen catastrophic.

ADominantMobileOperatorandLowAirtimeCommissions

Thechancesofamobilemoneyschemetakingrootdependalsoonthestrengthofthemobileoperator

withinitsmarket.Marketshareisanimportantassetbecauseitisassociatedwithalargercustomer

baseforcross‐sellingthemobilemoneyservice,alargernetworkofairtimeresellerswhichcan

be

convertedintocash‐in/cash‐outagents,strongerbrandrecognitionandtrustamongpotential

customers,andlargerbudgetstofinancetheheavyup‐frontmarketinvestmentneededtoscalea

deployment.Withamarketshareofaround80percent,Safaricomenjoyedeachofthesebenefitswhen

itlaunchedM‐PESA.

Amobilemoneydeploymentwillalsohavegreaterchanceofsuccessincountrieswherethe

commissionsmobileoperatorspayairtimeresellersarerelativelylow.Thisisbecauseifcommissionsare

toohigh,resellerswillnotbeattractedbythelowercommissionsoftheincipientcash‐in/cash‐out

business.InSafaricom’scase,

airtimecommissionstotal6percent,ofwhich5percentarepassedonto

theretailstore.A1‐2percentcommissiononacash‐in/outtransactionisplausiblyattractive–thestore

needonlybelievethatthecashbusinessmaybefivetimesasbigastheairtimebusinessin

volume

terms.Thisseemsreasonable,consideringthatthebulkofairtimesalesareoflowdenominations

(aroundUS25¢).

16

TheCentralBankofKenyaActwasamendedin2003togiveCBKbroadoversightmandateoverpayment

systems,buttheoperationalmodalitiesforitsregulatorypowersoverpaymentssystemshavenotbeen

implemented,pendingapprovalofanewNationalPaymentsSystemBillwhichhaslanguishedinParliament.

17

TheresultsofthesurveyareexplainedinOkoth(2009).

12

AReasonableBaseofBankingInfrastructure

Finally,theabilityofM‐PESAstorestoconvertcashtoe‐valueforcustomersdependsonhoweasilythey

canrebalancetheirliquidityportfolios.Thiswillbemoredifficulttoachieveifbankbranchpenetration

istoolow,asthiswillforcetheagentchanneltodevelopalternativecashtransport

mechanisms.Thus,

anagentnetworkwillneedtorely ona minimalbankingretailinfrastructure.(Thisqualifiesourearlier

pointthatlackofaccesstoformalservicesindicatesastrongmarketopportunity.Thereappearstobea

branchpenetration“sweetspot”formobilemoney,wherepenetrationisnotsohigh

thatithampers

demandformobilemoneyservices,butnotsolowthatagentsareunabletomanagetheirliquidity.)

KenyaisreasonablywellsuppliedwithruralliquiditypointsduetothebranchnetworksofEquityBank

andotherbanksandMFIs.Evenso,shortageofcashorelectronicvaluefor

M‐PESAagentsisaproblem

bothincountryandcity.Othercountriesfacemoreseriousliquidityconstraints,especiallyinruralareas,

whichislikelytobeamajorfactoraffectingthesuccessofmobileservicesinspecificcountry contexts.

3. MPESA’sServiceDesign:GettingPeopleontotheSystem

WhileM‐PESA’sexplosivegrowthwasfueledbycertaincountry‐specificenablingconditions,thesuccess

ofsuchaninnovativeservicehingedonthedesignoftheservice.Conductingfinancialtransactions

throughamobilephoneisnotanintuitiveideaformanypeople,andwalkingtoacornershopto

conductdeposits

andwithdrawalsmaynotatfirstseemnaturaltomany.Toovercomethisadoption

barrier,SafaricomhadtodesignM‐PESAinawaythat(i)helpedpeoplegraspimmediatelyhowthey

mightbenefitfromtheservice,(ii)removedallbarriersthatmightpreventpeoplefromexperimenting

withtheservice;

and(iii)fosteredtrustintheretailoutletswhowouldbetaskedwithpromotingthe

service,registeringcustomers,andfacilitatingcash‐in/cash‐outservices.

ASimpleMessageTargetingaBigPainPoint

M‐PESAwasoriginallyconceivedasawayforcustomerstorepaymicroloans.However,asSafaricom

market‐testedthemobilemoneyproposition,theyshiftedthecorepropositionfromloanrepaymentto

helpingpeoplemakeP2Ptransferstotheirfriendsandfamily.Fromitscommerciallaunch,M‐PESAhas

beenmarketedto

thepublicwithjustthreepowerfulwords:“sendmoneyhome.”Thismessagewas

welladaptedtotheKenyanphenomenonofsplitfamiliesdiscussedaboveandtappedintoamajorpain

pointformanyKenyans–therisksandhighcostassociatedwithsendingmoneyoverlongdistances.

Thisbasic“e‐

remittance”productbecamethemust‐have“killer”applicationthatcontinuestodrive

servicetake‐upandremainsthemain(thoughnotonly)marketingmessagethreeyearslater.Although

peoplehaveprovedcreativeinusingM‐PESA fortheirownspecialneeds,sendingmoneyhome

continuestobeone ofthemost

importantuses–thenumberofhouseholdsreceivingmoneyinKenya

hasincreasedfrom17percentto52percentsinceM‐PESAwasintr oduced.

18

18

FinAccessSurvey,FSDT(2009a),p16.

13

ASimpleUserInterface

ThesimplicityofM‐PESA’smessagehasbeenmatchedbythesimplicityofitsuserinterface.TheM‐PESA

userinterfaceisdrivenbyanapplicationthatrunsfromtheuser’smobilephone.Theservicecanbe

launchedrightfromthephone’smainmenu,makingiteasyforuserstofind.

Themenuloadsquickly

becauseitresidesonthephoneanddoesnotneedtobedownloadedfromthenetworkeachtimeitis

called.Themenupromptstheusertoprovidethenecessaryinformation,onepromptatatime.For

instance,foraP2Ptransfer,theuserwillbe

askedtoenterthedestinationphonenumber,theamount

ofthetransfer,andthepersonalidentificationnumber(PIN)ofthesender.Oncealltheinformationis

gathered,itisfedbacktothecustomerforfinalconfirmation.Oncethecustomerhits‘OK,’itissentto

theM‐PESAserverin

asingletextmessage.Consolidatingallinformationintoasinglemessagereduces

messagingcosts,aswellastheriskofthetransactionrequestbeinginterruptedhalf‐waythrough.A

finaladvantageisthattheapplicationcanusethesecuritykeysintheuser’sSIMcardtoencrypt

messagesend‐to‐

end,fromtheuser’shandsettoSafaricom’sM‐PESAserver.

RemovingAdoptionBarriers:FreetoRegister,FreetoDeposit,No

MinimumBalances

Safaricomdesignedtheschemetomakeitaseasyaspossibleforcustomerstotrythenewservice.

Theydesignedaquickandsimpleprocessforcustomerregistration,whichcanbedoneatanyM‐PESA

retailoutlet.Customerspaynothingtoregisterandtheclerkattheoutletdoesmost

oftheworkduring

theprocess.First,theclerkprovidesapaperregistrationform,wherethecustomerentershisorher

name,IDnumber(fromKenyanNationalID,Passport,MilitaryID,DiplomaticIDorAlienID),dateof

birth,occupation,andmobilephonenumber.TheclerkthencheckstheID

andinputsthecustomer’s

registrationinformationintoaspecialapplicationinhismobilephone.Ifthecustomer’sSIMcardisan

oldonethatisnotpreloadedwiththeM‐PESAapplication,theclerkreplacesit.Thecustomer’sphone

numberisnotchangedeveniftheSIMcardis.

Safaricomthen

sendsboththecustomerandoutletanSMSconfirmingthetransaction.TheSMSgives

customersafour‐digitstartkey(one‐timepassword),whichtheyusetoactivatetheiraccount.

CustomersenterthestartkeyandIDnumber,andtheyarethenaskedtoinput asecret PINoftheir

choice,whichcompletestheregistrationprocess.Inadditiontoleadingcustomersthroughthisprocess,

retailoutletsexplainhowtousetheapplicationandthetariffsassociatedwitheachservice.Suchagent

supportearlyintheprocessisparticularlyimportantinruralareas,whereasignificantpercentageofthe

potentialuserbase

isilliterateorunfamiliarwiththefunctioningoftheirmobilephone.

WhiletheminimumdepositamountisaroundUS$1.25,thereisnominimumbalancerequirement.

Customerscandepositmoneyforfree,sothereisnoimmediatebarriertotakinguptheservice.M‐

PESAchargescustomersonlyfor“doing

something”withtheirmoney,suchasmakingatransfer,

withdrawal,orprepaidairtimepurchase.

14

BeingAbletoSendMoneytoAnyone

M‐PESAcustomerscansendmoneytononM‐PESAcustomers,includinganypersonwithaGSMmobile

phoneinKenya,whethertheyaresubscribersofSafaricomorofanyoftheotherthreecompeting

networks(Zain,OrangeandYu).Underthisservice,moneyisdebitedfromthesender’saccount,and

therecipientgetsacodebySMSwhichitcanusetoclaimthemonetaryvalueatanyM‐PESAstore.

Thus,it’sanaccount‐to‐cashservice,withthereceiver’sexperiencebeingsi milartohowWesternUnion

workstoday.Thepricingonthisserviceisinteresting:customerspaya

higher(roughlytriple)P2Pcharge

whensendingmoneytoanon‐customer,butattheotherendcashingoutisfreeforanon‐customer,

whereasregisteredcustomerspayacash‐outfeeofatleastUS$0.30.Sowhy“penalize”thecustomer

ratherthanthenon‐customer?Safaricomunderstoodthat

thesenderhadpowerovertherecipient,so

itchosetoputpressureonthesendertorequiretherecipienttoregisterwithM‐PESA.Furthermore,

thenon‐customergotagreatfirstexperiencewithM‐PESAwhenhereceivedmoneyforfree,which

Safaricomhopedwouldconvincethemto

registerforM‐PESA.

BuildingTrustintheRetailNetwork

SafaricomrecognizedthatM‐PESAwouldnotachieverapidadoptionunlesscustomershadenoughtrust

intheM‐PESAretailnetworkthattheywerewillingtoconductcash‐in/cash‐outtransactionsthrough

thoseoutlets.Safaricomemployedseveralmeasurestobuildthattrust.

First,itcloselylinkedtheM‐PESAbrand

tocustomers’affinitywithandtrustinSafaricom’sstrong

corporatebrand.AsthemobileoperatorinKenyawithadominantshare(over80%atM‐PESA’slaunch

andscarcelylesstoday),Safaricomwasalreadyabroadlyrespectedandtrustedbrand,evenamonglow‐

incomecustomers.AsshowninExhibit7below,

M‐PESAretailoutletsarerequiredtopainttheirstore

“Safaricomgreen”whichnotonlybuildsgivescustomersconfidencethatthestoreisactingonbehalfof

Safaricom,butalsomakesiteasierforcustomerstolocatecash‐in/cash‐outpoints.

Exhibit7:ATypicalM‐PESARetailOutlet

15

Second,Safaricomensuredthatcustomerscanwalkintoanyretailauthorizedoutletandhavea

remarkablysimilarexperience.Thishashelpedtobuildtrustintheplatformandtheoutlets,andgives

customersaconsistentlypositiveviewoftheservice.Safaricommaintainsthiscontroloverthe

customerexperiencebyinvesting

heavilyinstoretrainingandon‐sitesupervision.Safaricomchoseto

centralizethesefunctionsinasinglethird‐partyvendor(TopImage)ratherthanrelyingonitschannel

intermediaries(e.g.masteragents)tocascadethesefunctionstoretailshops.ATopImage

representativevisitseachoutletatminimumonamonthly

basisandrateseachstoreonavarietyof

criteria,includingvisibilityofbrandingandthetariffposter;availabilityofcashandM‐PESAelectronic

valuetoaccommodatecustomertransactions;andthequalityofrecord‐keeping.

Third,customersreceiveinstantSMSconfirmationoftheirtransaction,helpingcustomerslearnby

experience

totrustthesystem.TheconfirmingSMSconstitutesanelectronicreceipt,whichcanbeused

indisputeresolution.Thereceiptconfirmingamoneytransferdetailsthenameandnumberofthe

recipientandtheamounttransferred.Thisallowsthesendertoconfirminstantlythatthemoneywas

senttothe

rightperson—themostcommonsourceoferror.

Fourth,Safaricomrequiresitsoutletstorecordallcash‐in/cash‐outtransactionsinapaper‐based,

Safaricom‐brandedlogbook.Foreachtransaction,thestoreclerkenterstheM‐PESAbalance,thedate,

agentID,transactionID,transactiontype(customerdepositorwithdrawal),value,

customerphone

number,customername,andthecustomer’snationalIDnumber.Customersarethenaskedtosignthe

logforeachtransaction,whichhelpsdiscouragefraudandalsogivesagentsawaytoofferfirst‐line

customercareforcustomersqueryingprevioustransactions.Eachentryinthelogiswrittenin

triplicate.

Thetopcopyiskeptbytheretailoutletforhisownrecords,asecondispassedontothestore’smaster

agent,andthethirdissenttoSafaricom.Recallthat allinformationcontainedintheagentlog(except

forthecustomersignature)iscapturedelectronicallybySafarico m

whenthetransactionismadeandis

availabletothemasteragentsviatheirwebmanagementsystem.Hence,themainpurposeoftheagent

logisnotforrecord‐keeping,buttoprovidecomforttocustomerswhoareusedtohavingtransactions

recordedonpaper.

SimpleandTransparentPricing

M‐PESApricingismadetransparentandpredictableforusers.Therearenocustomerchargesfor

theSMSsthatdelivertheservice,andinsteadfeesareappliedtotheactualcustomer‐initiated

transactions.Allcustomerfeesaresubtractedfromthecustomer’saccount,andoutletscannot

chargeanydirectfees.Thus,outlets

collecttheircommissionsfromSafaricom(throughtheirmaster

agents)ratherthanfromcustomers.Thisreducesthepotentialforagentabuses.Customerfeesare

uniformnationwide,andtheyareprominentlypostedinalloutletlocationsinthepostershownin

Exhibit8(

feesareinKenyanShillings(KSh),whichtradeatabout75shillingstotheUSdollar).

M‐PESAchosetospecifyitsfeesinfixedcurrencytermsratherthanasapercentageofthetransaction

.

Thismakesiteasierforcustomerstounderstandtheprecisecostofeachtransactionandhelps

16

themthinkofthefeeintermsofthetransaction’sabsolutevalue(e.g.,sendingmoneyto

grandmother).Italsohelpsthemcomparethetransactioncostagainstalternativeandusually

costliermoney‐transferarrangements(e.g.,thematatufareplustraveltime).

Exhibit8:M‐PESATariffStructure

Depositsarefreetocustomers.

WithdrawalsunderUS$33cost

around0.33¢.

Withdrawal

chargesare“banded”(i.e.,larger

transactionsincuralargercost)

soasnottodiscouragesmaller

transactions.ATMwithdrawals

usingM‐PESAareslightlymore

expensivethanataretailoutlet

(40¢versus33.3¢).

P2Ptransferscostaflatrateof

aroundUS40¢.Thisiswhere

Safaricommakesthebulkofits

revenue.Thus,forapurely

electronictransfer,customerspay

morethandoublethan

whatthey

payfortheaveragecash

transaction(17¢)–despitethe

costtoprovidebeinglowerfor

purelyelectronictransacti onsthan

thoseinvolvingcash.Thisreflectsa

notionofoptimalpricingthatis

lessbasedoncostandmoreon

customerwillingnesstopay:

enablingremotepaymentsisthe

biggest

customerpainpointwhich

M‐PESAaimstoaddress.M‐PESA

ischeaperthantheotheravailable

mechanismsformakingremotepayments,suchasmoneytransferbythebuscompanies,KenyaPost’s

PostapayorWesternUnion.

19

ItisnoteworthythatM‐PESAhasmaintainedthesamepricingfortransactionsinitsfirstthreeyears,

despitethesignificantinflationexperiencedduringtheperiod.Thishashelpedestablishcustomer

19

Inherfieldresearch,OlgaMorawczynskifindsthatsendingKSh1,000throughM‐PESAis27%cheaperthanthe

postoffice’sPostaPay,and68%cheaperthansendingitviaabuscompany.SeeMorawczynskiandPickens

(2009).

17

familiaritywiththeservice.However,Safaricomhaschangedthepricing fortwocustomerrequeststhat

donotinvolveafinancialtransaction:balanceinquiries(becausetheinitiallowpricegeneratedan

overlyburdensomevolumeofrequests)andPINchanges(becausecustomers werefarmorelikelyto

remembertheirPINifthefee

tochangeitwashigher).Thevolumeofbothtypesofrequestsdecreased

substantiallyafterthesepricechanges.Asnotedearlier,theSMSconfirmationofatransactioncontains

theavailablebalance,whichalsohelpscutdownonthenumberofbalanceinquiries.

LiquidityofLastResortatBankBranchesandATMs

Fromveryearlyon,M‐PESAsignedupbanksasagents,sothatanyM‐PESAcustomercouldwalkintothe

branchesofseveralbankstoconductcash‐in/cash‐outtransactions.Oneyearafteritslaunch,M‐PESA

wentfurtherandpartneredwithPesaPoint,oneofthelargestATMserviceproviders

inKenya.The

PesaPointnetworkincludesover110ATMsscatteredalloverthecountry,givingthemapresenceinall

eightprovinces.CustomerscannowretrievemoneyfromanyPesaPointATM.Todoso,theymustselect

“ATMwithdrawal”fromtheirM‐PESAmenu.Theythenreceiveaone‐time

ATMauthorizationcode,

whichtheyenterontheATMkeyboardtomakethewithdrawal.Nobankcardisneededforthis

transaction.ByaccessingthePesaPointATMnetwork,M‐PESAcustomerscannowmakewithdrawalsat

anytime,dayornight.

YetM‐PESA’sliquiditysystemisnotwithoutitschallenges.

Duetocashfloatconstraints,M‐PESAretail

outletscannotalwaysmeetrequestsforwithdrawals,especiallylargewithdrawals.Furthermore,the

agentcommissionstructurediscouragesoutletsfromhandlinglargetransactions.Asaresult,customers

aresometimesforcedtosplittheirtransactions overafewdays,takingmoneyoutinbitsrather

than

withdrawingalumpsum,addingbothcostandinconvenience.ItalsounderminescustomertrustinM‐

PESAasamechanismforhigh‐balance,long‐termsaving.UsingbankbranchesandATMstogive

customersasortofliquiditymechanismoflastresortbolsteredthecredibilityoftheM‐PESAsystem.

4. Execution:GettingtoCriticalMass,Quickly

Withastrongservicedesigninplace,Safaricomthensetaboutdevelopingitsexecutionplan.It

recognizedthatitwouldbedifficulttoscaleM‐PESAincrementallyasithadtoovercomethree

significanthurdlesthatarecommontoanynewelectronicpaymentsystem,namely:

Adversenetworkeffects:The

valuetothecustomerofapaymentsystemdependsonthe

numberofpeopleconnectedtoandactivelyusingit.Themorepeopleonthenetwork,the

moreusefulitbecomes.

20

Whilenetworkeffectscanhelpaschemegainmomentumonceit

20

Ithasbecomehabitualtoillustratenetworkeffectswithreferencetofaxmachines:thefirstsetofpeoplewho

boughtafaxmachinedidn’tfinditveryusefulastheycouldn’tsendfaxestomanypeople.Asmorepeople

boughtfaxmachines,everyone’sfaxesbecamemoreandmoreuseful.Network

effectsaresometimesreferredto

asdemand‐sideeconomiesofscale,toemphasizethatscaleaffectsthevalueoftheservicetoeachcustomer.

18

reachesacriticalmassofcustomers,theycanmakeitdifficulttoattractearlyadoptersinthe

earlyphasewhentherearefewusersonit.

Chicken‐and‐eggtrap:Inordertogrow,M‐PESA hadtoattractbothcustomersandstoresin

tandem.Itishardto

sellthepropositiontocustomerswhiletherearefewstorestoservethem,

andequallyhardtoconvincestorestosignupwhiletherearefewcustomerstobehad.Thus,

theschemeneededtodrivebothcustomerandstoreacquisitionaggressively.

Trust:Customershavetogainconfidencein

thereliabilityofanewsystem.Inthiscase,

customershadtobecomfortablewiththreeeleme ntsthatwerenewatthetimeinKenya:(i)a

paymentsystemthatwasoperatedbyamobileoperator,(ii)goingtonon‐bankretailoutletsto

meettheircash‐in/cash‐outneeds,and

(iii)accessingtheiraccountandinitiatingtransactions

throughtheirmobilephone.

Theseproblemsreinforceeachotherintheearly‐stagedevelopmentofapaymentssystem,creatinga

significanthurdletogrowth.Wesuspectthishurdlehelpsexplainwhymanyothermobilemoney

deploymentsremainsub‐scale.M‐PESAovercamethis

hurdlethroughveryforcefulexecutio nontwo

keyfronts:(i)Safaricommadesignificantup‐frontinvestmentsinbuildingastrongservicebrandforM‐

PESA;and(ii)Safaricomeffectivelyleverageditsextensivenetworkofairtimeresellerstobuilda

reliable,consistentretailnetworkthatservedcustomers’liquidityneeds.

AggressiveUpFrontInvestmentinPromotingtheMPESABrand

Fromthebeginning,Safaricomsoughttofostercustomertrustinthenewpay mentmechanismand

reliedonexistingcustomerstobetheprimemechanis mtodrawinnewcustomers.Thiswasallthe

moredifficultbecauseSafaricomwasintroducingnotonlyanewproduct,butanentirelynewproduct

categoryto

amarketthathadlittleexperiencewithformalfinancialservices.Theinternallaunchtarget

forM‐PESAwasabout1millioncustomerswithin oneyear,equalto17percentofSafaricom’scustomer

baseofabout6millioncustomersatthattime.

21

Nationallaunchatscale.Aftersmallpilotsinvolvinglessthan500customers,

22

M‐PESAlaunched

nationwide,increasingthelikelihoodthattheservicecouldreachacriticalmassofcustomersinashort

timeframe.Atlaunch,Safaricomhad750storesandhadmadesuretocoverallofKenya’s69district

headquarters.Itwasamassivelogisticalchallengethatledtoagreat

dealofcustomerandstore

confusionand,inthefirstmonthsafterlaunch,severaldays’delays toreachcustomerservicehotlines.

Userandstoreerrorswerefrequentsinceeveryonewasnewtotheservice.Butthegamblepaidoff.

Logisticalproblemssubsidedafterafewmonths,leavingstrongbrandrecognition

andtop‐of‐mind

awarenessamonglargesegmentsofthepopulation.Theserviceoutranfirst‐yeargrowthtargets,quickly

Thisdistinguishesitfromsupply‐sideeconomiesofscale,whichrefertosituationswhereaveragecostsper

customerfallasvolumeincreases.Davidson(2009)discussesimplicationsofnetworkeffectsformobilemoney.

21

SafaricomcompanyresultsfortheyearendingMarch2007.

22

Theearliestpilotprojectconductedin2004/05revolvedaroundmicroloanrepayments,andinvolvedthe

CommercialBankofAfrica,Vodafone,FauluKenyaandMicroSave,inadditiontoSafaricom.

19

turningnetworkeffectsintheirfavorasnewcustomersbegatmorecustomersandturnedM‐PESAinto

acompellingbusinesspropositionformorestores.

Anappropriatemarketingmix.Initialmarketing featuredandtargetedthewealthiercitydwellerwith

theneedto“sendmoneyhome”(seeExhibit9a).Thischoiceofthe

richerurbandwellerastheinitial

customercreatedanaspirationalimageforM‐PESAandavoidedtheimpressionthatitwasalow‐value

productaimedatthepoor.Overtime,themarketingmovedfromyoung,up‐marketurbandwellerswith

deskjobstomoreordinaryKenyansfromlower‐paid

professions.

WhileM‐PESA’slaunchwasassociatedwithsignificantup‐frontinvestmentinabove‐the‐linemarketing

viaTVandradio,

23

therewasalsointenseoutreachthroughroadshowsandtentsthattraveledaround

thecountrysigningpeopl eup,explainingtheproduct,anddemonstratinghowtouseit.Overtime,as

peoplebecamemorefamiliarwiththeproductandhowtouseit,itwasnolongernecessarytodothis

kindofhands‐onoutreach.TVandradiowerelargelyreplacedbytheomnipresentM‐PESAbrandingat

alloutlets,supportedwithafewlargebillboards.Newerads (like theoneinExhibit9b)featureageneral

emotionalappeal,withawiderrangeofservicesindicated.

Exhibit9a:EarlyM‐PESA

ademphasizingsendingmoney

fromurbantoruralareaslinkingintofamilyandsocialties

Exhibit9b:RecentM‐PESAadwith

moregeneralemotionalappeal

AScalableDistributionChannel

Safaricomunderstoodthattheprimaryroleofthemobilephoneistoenablethecreationofaretail

outlet‐basedchannelforcash‐to‐digitalvalueconversion.And,forthiscash‐to‐digitalconversiontobe

broadlyavailabletothebulkofthepopulation,ithadtodevelopachannelstructure

thatcouldsupport

23

Asurveyof1,210usersinlate2008revealedthat70%ofsurveyrespondentsclaimedtheyhadfirstheardabout

M‐PESAfromadvertisements,TVorradio.FSDT(2009b),p.6.

20

thousandsofM‐PESAstoresspreadacrossabroadgeography.Toachievethis,Safaricombuiltfour

elementsintoitschannelmanagementexecutionstrategy:(i)engaginginterm ediariestohelpmanage

theindividualstores,therebyreducingthenumberofdirectcontactsithadtodealwith;(ii)ensuring

thatoutletsweresufficientlyincentivized

toactivelypromotetheservice;(iii)maintainingtightcontrol

overthecustomerexperience;and(iv)developing severaldifferentmethodsforstorestore‐balance

theirstocksofcashande‐value.

Two‐tierchannelmanagementstructure.Safaricomcreatedatwo‐tierstructurewithindividualstores

(sub‐agents,inSafaricom’sparlance)

whodependedonmasteragents(referredtobySafaricomas

AgentHeadOffices[HO]).AgentHOsmaintainallcontactwithSafaricom,andperformtwokey

functions:(i)liquiditymanagement(buyingandsellingM‐PESAbalancefromSafaricomandmakingit

availabletoindividualstoresundertheirresponsibility),and(ii)distributingagent

commissions

(collectingthecommissionfromSafaricombasedontheoverallperformanceofthestoresunderthem

andremuneratingeachstore).IndividualstoresmaybedirectlyownedbyanagentHOormaybe

workingforoneundercontract.

Incentivizingstores.Retailoutletswillnotmaintainsufficientstocksofcashand

e‐moneyunlessthey

areadequatelycompensatedfordoingso.Hence,SafaricompayscommissionstoagentHOsforeach

cash‐in/cash‐outtransactionconductedbystoresundertheirresponsibility.Safaricomdoesnot

prescribethecommissionsplitbetweenagentHOsandstores,thoughmostagentHOspasson70

percentofcommissions

tothestore.

24

FordepositsunderUS$33,SafaricompaysUS13.3¢intotal

commissions,ofwhichUS7.4¢goestothestoreaftertax.Forwithdrawals,SafaricompaysUS20¢to

thechannel,ofwhichUS11.1¢goestothestore.So,assumingequalvolumesofdeposits and

withdrawals,thestoreearns

US9.2¢pertransaction.Assumingthestoreconducts60transactionsper

day,itearnsaroundUS$5.50–almosttwicetheprevailingdailywageforaclerkinKenya.

RecallthatSafaricomchargescustomersUS33.3¢onaround‐tripsavingstransaction(freedepositplus

US33.3¢withdrawal),whichisin

factequaltowhatthechannelgets(US13.3¢onthedeposit+US20¢

onthewithdrawal).So,assumingequalvolumesofdepositsandwithdrawals,Safaricomdoesn’tmake

anymoneyoncashtransactions.Itmerely“advances”commissionstothechannelwhencustomers

deposit,andrecoupsitwhencustomerswithdraw.

BychargingUS40¢onelectronicP2Ptransactions

(whicharealmostcostlesstoprovide),Safaricomoptedtogeneratethebulkofitsrevenuefromthe

serviceforwhichthereishighestcustomerwillingnesstopay‐remoteP2Ppayments.

Becausestorerevenuesaredependentonthenumberoftransactionstheyfaci litate,Safaricom

was

carefulnottofloodthemarketwithtoomanyoutlets,lestitdepressthenumberofcustomers per

agent.Instead,itmaintainedabalancedgrowthinthenumberofoutletsrelativetothenumberof

activecustomers,resultinginanincentivizedandcommittedagentbase.

Maintainingtightcontrolover

thecustomerexperience.Safaricomalsorecognizedthatcustomers

needtohaveagoodexperienceattheretailpoints,wherethebulkoftransactionstakeplace.Toensure

thatitmaintainedcontroloverthecustomerexperience,Safaricomdidnotrelyonthebroadbaseof

24

Safaricomwantsthesplittobe20%/80%,thuspassingmoreofthecommissiondowntotheretailoutlet.

21

agentHOstoperformallchannelmanagementfunctions.Instead(asmentionedabove),itconcentrated

theevaluation,training,andon‐sitesupervisionofstoresinasingleoutsourcingpartner,TopImage.

Thus,weseethatSafaricomdelegatedthemoreroutine,desk‐bound,non‐customer‐facingstore

supportactivities(e.g.liquiditymanagement,distribution

storecommissions)toalargerpoolofagent

HOs.Atthesametime,throughitscontractwithTop Image,itretaineddirect,centralizedcontrolover

thekeyelementsofthecustomerexperience(e.g.storeselection,training,supervision).

Developingmultiplestoreliquiditymanagementmethods.Byfarthebiggestchallenge

facedbyM‐PESAstoresismaintainingenoughliquidityintermsofbothcashande‐floattobeableto

meetcustomerrequestsforcash‐inandcash‐out.Iftheytaketoomanycashdeposits,storeswillfind

themselvesrunningoutofe‐float

withwhichtofacilitatefurtherdeposits.Iftheydotoomany

withdrawals,theywillaccumulatee‐floatbutwillrunoutofcash.Hence,theyf requentlyhaveto

rebalancetheirholdingsofcashversuse‐float.Thisiswhatwerefertoasliquiditymanagement.

TheM‐PESAchannelmanagement

structurewasconceivedtoofferstoresthreemethodsformanaging

liquidity.TwooftheseplacetheagentHOinacentralrole,withtheexpectationthattheagentHOwill

‘recycle’e‐floatbetweenlocationsexperiencingnetcashwithdrawals(i.e.accumulatinge‐float)and

locationswithnetcashdeposits(i.e.accumulating

cash).Wediscusseachofthesemethodsinturn:

1) AgentHOprovidesdirectcashsupporttostores‐Underthisoption,thestoreclerkcomestothe

agentHO’sheadofficetodeliveroroffloadcash,ortheagentHOsendscashrunnerstothestoreto

performthese

functions.

2) AgentHOandstoresusetheirrespectivebankaccounts‐Underthisoption,ifthestorehasexcess

cashandwantstobuyM‐PESAe‐floatfromtheagentHO,thestorewilldepositthecashintothe

accountoftheagentHOatthenearestbankbranchor

ATM.OncetheagentHOconfirmsreceiptof

thefundsintoitsaccount,theHOtransfersM‐PESAe‐floattothestore’sM‐PESAaccount.Ifthe

storewantstoselle‐floattogetcash,thestoretransfersM‐PESAe‐floattotheagentHO.Theagent

HOthendeposits(ortransfers)moneyintothestore’saccountatthebranchofthestore’sbank.

ThestorecanthenwithdrawthecashatthenearestbranchorATM.

3) StoresinteractdirectlywithabankthathasregisteredasanM‐PESA“superagent”‐Underthis

option,theagent

HOdoesnotgetinvolvedin liquiditymanagement.Instead, storesopenan

accountwithaparticipating“superagent”bank.Torebalancetheircash,storesdepositand

withdrawcashagainsttheirbankaccountatthenearestbranchorATMofthebank.Thestorethen

electronicallybuysandsellse‐floatinreal

timeagainsttheirbankaccount.Fromastore’s

perspective,onedrawbackofthebank‐basedsuperagentmechanismisthatitcanonlyuseitduring

bankingbusinesshours.Thispresentsaproblemforstoresintheeveningsandonweekends.

Thee‐float‐cashnexuswillremainthekeyconstraint

tothefurtherdevelopmentofM‐PESAsinceit

requiresthephysicalmovementofcasharoundthecountryandisthustheleastscalablepartofthe

system.

22

5. MPESA’sFutureEvolution

TheexperienceofM‐PESAdemonstrateshowpowerfulapaymentnetworkthatoffersconvenienceat

anaffordablecostcanbeonceacriticalmassofcustomersisreached.Italsoshowsthatachieving

criticalmassrequiresbothaservicedesignthatremovesasmanyadoptionbarriersaspossibleand

significantinvestment

inmarketing,branding,andagentnetworkmanagement.TheKenyanexperience

alsosuggeststhatseveralcountry‐levelenvironmentalfactorsneedtoaligntosetthescenefora

successfulmobilemoneydevelopment,includingthelabormarketprofile(demandforremittances

generatedbyrural‐urbanmigration),thequalityofavailablefinancialservices,

supportfromthebanking

regulator,andthestructureofthemobilecommunicationsmarket(dominantmobileoperatorandlow

airtimecommissions).

Yet,whileM‐PESAhasbeensuccessfulbeyondwhatanyonecouldhaveimaginedatitslaunch,the

modelstillhassubstantialroomtodevelopfurther.OurwishlistforM‐PESA

isthree‐fold:(i)the

mainstreamingofM‐PESA’sregulatorytreatment;(ii)pricingthatopensupamuchlargermarketof

micro‐transactions;and(iii)buildingofamuchmorerobustecosystemaroundM‐PESAthatenables

customerstoaccessabroaderrangeoffinancial services.Weaddr esseachof

thesebelow,before

offeringsomeconcludingthoughtsonhowM‐PESAoffersarekindledvisionforachievingfinancial

inclusionindevelopingcountries.

MainstreamingMPESA’sRegulatoryTreatment

M‐PESA’sregulatorytreatmentasapaymentsvehicleneedstobeformalizedsothatitcanbecome

regulatedinthemostappropriateway.Tothisend,theCBKhasbeentryingtogetanewpaymentslaw

enactedbyParliament,butthedrafthasnotyetbeenapproved.Theintentionis

forM‐PESAtobe

coveredinfuturebyregulationsemanatingfromthispaymentslaw.TheCBKisalsointheprocessof

finalizingagentbankingregulationswhichwouldallowcom mercialbankstouseretailoutletsasa

deliverychannelforfinancialservices.Banksarequitereasonablycomplainingthatthey

couldnot

replicatetheM‐PESAservicethemselvessincetheyarenotcurrentlyallowedtoundertakecustomer

transactionsthroughagentnetworksontheirown.Webelievethereshouldbealevelplayingfield,so

thatbothbanksandM‐PESAcanoperatesuchagentnetworks.

PricingthatEnablesSmallerPayments

M‐PESA’scurrentpricingmodelisnotconduciveforsmalltransactions.AUS$10P2Ptransferplus

withdrawal,forexample,costsaround7percentofthetransactionsize(US0.40¢forthetransferplus

US0.33¢forthewithdrawal).WeseetwoadvantagestoadjustingM‐PESA’scurrentpricingmodelto

makeitworkforsmaller‐denominationtransactions:

Itwouldmaketheserviceaccessibletoapoorersegmentofthepopulation,forwhompricingis

nowtoohighgiventheirtr ansactionalneeds.ThiswouldallowSafaricomtomaintaincustomer

growthoncesaturationstartstosetinatcurrentpricing.

23

ItwouldallowcustomerstouseM‐PESAfortheirdailytransactionneeds,andinparticularto

saveonadailybasiswhentheyarepaiddaily.

Areductionincustomerpricescouldcomeaboutinseveralways:

Forelectronictransactions,thecurrentP2PchargeofUS40¢

allowsforsubstantialscopefor

pricereductions.Butlet’sbecareful.Thereisacompellinglogicbehindthecurrentmodelof

extractingvaluefromremotepayments(forwhichthereissubstantialcustomerwillingnessto

pay),whilemaintainingtightpricingoncashtransactions(forwhichcustomersarelesswillingto

pay).But

wedobelievethereisroomfor‘tranching’theP2Pfeesothatthepriceworksfor

smaller(e.g.daily)transactions.

Forcashtransactions,onewaytoenablelowerfeeswouldbetocreateacategoryofstreet‐

levelsub‐agents,characterizedbylowercostsandcommissionsthanstore‐

basedagents.Sub‐

agentswouldbeakindof“e‐susucollector,”operatingwithsmallworkingcapitalbalan cesin

ordertoaggregatesmallcustomertransactions.Sub‐agentswouldusenormalM‐PESAretail

outletstorebalancetheircashandM‐PESAstoredvalue.Thekeyprinciplehereisthat

segmentationof

customersneedstogohand‐in‐handwithsegmentationofagents.

LinkingwithBanksandotherInstitutionalPartnerstoOfferaFuller

RangeofFinancialServices

WhilesomecustomersuseM‐PESAasasavingsdevice,itstillfallsshortofbeingausefulsavings

propositionformostpoorpeople.AccordingJanuary2009CBKauditofM‐PESA,theaveragebalanceon

M‐PESAaccountswasaroundUS$3.Thisispartlya“largenumber”problem:if

900,000peopleusedM‐

PESAtosave,thatwould“only”be10percentofusersandtheirsavingswouldbedilutedwithinan

“average”savingsbalance.Butthefundamentalproblemisthatthereisstillalo tofconversio nof

electronicvaluebackintocash,sayfollowingreceiptofa

domesticremittance.Weattributethistoa

combinationoffactors:

Lackofmarketing.SafaricomdoesnotwanttopubliclypromotethesavingsusageofM‐PESA

forfearofprovokingtheCentralBankintotighterregulationofM ‐PESA.

Customerpricing.Thereisaflatfeeof

aroundUS33¢forwithdrawalsunderUS$33,which

meansthatsmallwithdrawalscarryalargepercentfee.

Productdesign.M‐PESAworksverymuchlikeanelectroniccheckingaccount,anddoesnot

offerstructuredsavingproductswhichmayhelppeoplebuilddisciplinearoundsavings.

Inflation.M‐PESA

doesnotpayinterest.Inanenvironmentwith15percentinflation(duringits

firstfullyearofoperationin2008),thismaybetooonerousforsavings.

Trust.DepositsarenotsupervisedbytheCentralBank.Andunlikepayments,wheretrustcanbe

validatedexperientiallyinrealtime,savings

requirestrustoveralongerperiodoftime.

Privacy.Peoplemaywantmoreprivacyintheirsavingsbehaviorthananagentprovides.

24

Excessliquidity.16,000cash‐inpointsarealso16,000cash‐outpoints.TheubiquityofM‐PESA

agentsmaymakeittooeasyforcustomerstocash‐outtheirfunds,thuslimitingtheirabilityto

accumulatelargebalances.

RatherthanexpectingSafaricomtodevelopandmarketrichersavingsservices,

webelievethatM‐PESA

shouldsupportsavingspropositionsbylinkinginto banks.M‐PESAwouldthenbecomeamassive

transactionacquisitionnetworkforbanksratherthananalternativetothem.Safaricomisbeginningto

connectwithbanks.InSeptember2009,forexample,FamilyBankconnectedtoM‐PESAtoallow

their

customerstotransfermoneyfromM‐PESAtotheirFamilyBankaccount(usingM‐PESA’sbillpay

function).ThisisfollowingasuccessfulpilotofloanrepaymentsviaM‐PESA’sbillpayfunction.

M‐PESAwouldalsobenefitfromestablishingfurtherlinkageswithinstitutionsbeyondbanks,suchas

billers,

distributors,andemployers.BypromotingM‐PESA asamechanismfordistributingsalariesand

socialwelfarepayments,enablingpaymentsacrosssupplychains,andpayingbills,theneedforcash‐in

andcash‐outwouldbeminimized,and,asaresult,akeycomponentoftransactioncostscouldbe

reduced.Wealso

suspectsavingsbalanceswouldbehigherifpeoplereceivedpaymentsdirectlyinto

theiraccountratherthan incash,andiftheyhadmoreusefulthingstheycoulddowiththeir moneyin

electronicform.

Concludingthoughts:HowMPESAcanreinvigoratevisionsaround

financialinclusion

Imagineaworldwherebanksarenowh erenearwhereyoulive.Thenearestbranchis10kilometers

away,butittakesyoualmostanhourtogettherebyfootandbusbecauseyoudon’thaveyourown

wheels.Withwaitingtimesatthebranch,that’saround‐tripoftwo

hours–aquarterorsoofyour

workingdaygone.Andthebusfareisonly50cents,butthat’sonequarterofwhatyoumakeonagood

day.Soeachbankingtransactioncostsyoutheequivalentofalmosthalfaday’swages.Itwouldbelike

an

ATMchargingussomethinglike$50foreachtran saction, givenwhatweearn.

Then,imagineaworldwithoutcreditinstrumentsorelectronicpayments.No checks,nocards,no

moneyorders,nodirectdebits,nointernetbanking. Allyourtransactionsaredoneincashor,worse,by

barteringgoods.Allexchangesare

physical,person‐to‐person,hand‐to‐hand.Considerthehassleand

theriskofsendingmoneytodistantrelatives,businesspartners,orbanks.

Howwouldyouoperateinsuchaworld?Arecentbook,PortfoliosofthePoor

,hasdocumentedhow

poorpeoplecope.Howtheysaveto‘push’someexcessmoneyfromtodaytotomorrow,howthey

borrowto‘pull’tomorrow’smoneytofundsomeneededexpensetoday.Youstoresomecashinthe

hometomeetdailyneeds,youparkitwithatrustedfriendfor

emergencies,youbuyjewelrybecause

thatrepresentsafutureforyourchildren,youpileupsomebricksforthedaywhenyoucanbuildan

extraroominyourhouse.Youmakeregularcontributionstoasavingsgroupwithacircleoffriendsto

buildupapot,andone

dayitwillbeyourturntotak ethatpothometobuynewclothes.Youalso

25

borrowfromfriends,seekadvancesfromyouremployer,pawnsomeofyourjewelry,andgotothe

moneylender.

TheauthorsofPortfoliosofthePoor

documentsomepoorfamiliesacrossIndia,BangladeshandSouth

Africausingupto14differentmechanismstomanagetheirfinanciallives.Theyhavefewoptions,but

youneedtodeployallyouringenuitytousethemall,preciselybecausenoneareverygood.Someare

notverysafebecauseof

theirsheerphysicality.If you savebystoringyourgrainorbuyinggoa ts,when

yourvillagehitshardtimesyoumaynotbeabletofindreadybuyersforyourgrainorgoats.Forget

aboutgettingloansfromneighborsduringhardtimes.Thelocalmoneylenderrunsaquasi‐monopolyin

the

villagebecauseitistoocostlyforyoutogotoothermoneylendersinothervillages,andinanycase

theydon’tknowyouthere.Soyouenduppayingdearlyforaloan.

Weestimatethatover2billionpeopleneedtocopewithsuchcircumstances.Thelackof

goodfinancial

optionsisundoubtedlyoneofthereasonswhypoorpeople aretrappedinpoverty.Theycannotsustain

orevenaspiretohigherincomebecausetheyarenotabletoinvestinbetterfarmingtoolsandseedsto

enhancetheirproductivity,startamicroenterprise,oreventakethetimeto

searchforbetterpaying

employmentopportunities. Theirincomeisvolatile,oftenfluctuatingdaily,sowithoutreliablewaysof

pushingandpullingmoneybetweengooddaysandbaddaystheymayhavetofacethestarkdecisionto

pullthekidsoutofschoolorputlessfoodonthetable

duringbadpatches.Andwithoutgoodfinancial

toolstheymaynotbeabletocopewithshocksthatsetthembackperiodically.Mostoftheseshocksare

foreseeableifnotentirelypredictable:a drought,ill‐health,lifecycleeventssuchasmarriageanddeath.

Cashisthemainbarriertofinancialinclusion.

Aslongaspoorpeoplecanonlyexchangevaluein cash –

or,worse,physicalgoods—theywillremaintoocostlyforformalfinancialinstitutionstoaddressin

significantnumbers.Collectinglow‐valuecashdepositsandredeemingtheirsavingsbackintosmall

sumsofcashrequiresacostlyinfrastructurew hichfewbanks

arewillingtomakee xtensiveinlow‐

incomeorruralareas.Butoncepoorpeoplehaveaccesstocost‐effectiveelectronicmeansofpayments

suchasM‐PESA,theycould,inprinciple, beprofitablymarketablesubjectsbyarangeoffinancial

institutions.

M‐PESAitselfdoesnotconstitutefinancialinclusion.

Butitdoesgiveusglimpsesofacommercially

sound,affordableandeffectivewaytoofferfinancialservicestoall.

26

References

Camner,GunnarandEmilSjöblom(2009).CantheSuccessofM‐PESAberepeated?AReviewof

ImplementationsinKenyaandTanzania.ValuableBitsnote,July.

Collins,Daryl,Morduch,Jonathan,Rutherford,Stuart,Ruthven,Orlanda(2009)Portfolios of the Poor:

How the World’s Poor Live on $2 a Day, Princeton:PrincetonUniversityPress.

Davidson,Neil(2009).“TacticsforTippingMarkets:InfluencePerceptionsand

Expectations,”GSM

Association,MobileMoneyfortheUnbankedblog,November15.

FinancialSectorDeepeningTrust[FSDT](2009a).“FinAccessNationalSurvey2009:DynamicsofKenya’s

changingfinanciallandsca pe,” June.

FinancialSectorDeepeningTrust[FSDT](2009b).“ResearchonMobilePaymentsExperience:M‐PESAin

Kenya.”Unpublisheddraf t, December.

FinancialSectorDeepeningTrust

[FSDT](2007a).FinaccessKenya2006:ResultsofaFinancialSurveyon

AccesstoFinancialServicesinKenya.

FinancialSectorDeepeningTrust[FSDT](2007a).KeyfindingsoftheFinScopesurveyinTanzaniain

2006.

GSMAssociation(2009).“WirelessIntelligenceDatabase.”Availableatwww.wirelessintelligence.com

.

Heyer,AmrikandIgnacioMas(2009).“SeekingFertileGrou nds forMobileMoney.”Unpublishedpaper.

Hughes,NickandSusieLonie(2009).“M‐PESA:MobileMoneyfortheUnbanked.”Innovations,special

editionfortheMobileWorldCongress2009(Boston,MA:MITPress).

Isaacs,Leon(2008),IAMTNpresentation,MMTAconferenceJohannesburg,May.

Jack,BillyandTavneetSuri(2009).“MobileMoney:theEconomicsofM‐PESA.”Unpublishedpaper,

October.

Juma,Victor(2009).“FamilyBankoffersnewservicelinkingaccountstoM‐PESA.”BusinessDaily,18

December.

Kimenyi,MwangiandNjugunaNdung’u(2009).“ExpandingtheFinancialServicesFrontier:Lessonsfrom

MobilePhoneBankinginKenya.”(Washington,

DC:BrookingsInstitution),October.

Kinyanjui,Kui(2009).“Yulaunchesnewmobile cashtransferplatform.”BusinessDaily,16December.

Mas,IgnacioandOlgaMorawczynski(2009).“DesigningMobileMoneyServices:LessonsfromM‐PESA.”

Innovations,Vol.4,Issue2,Spring(Boston,MA:MITPress).

Mas,Ignacio(2009).“The EconomicsofBranchlessBanking”

Innovations,Volume4,Issue2(Boston,

MA:MITPress,Spring).

Mas,IgnacioandAmoloNg’weno(2010).“ThreekeystoM‐PESA’ssuccess:Branding, channel

managementandpricing,”unpublished,January.

27

Mas,Ignacio(2008).M‐PESAvs.G‐Cash:AccountingfortheirRelativeSuccess,andKeyLessonsforother

Countries.CGAP,unpublished,November.

Mas,Ignacio(2008).RealizingthePotentialofBranchlessBanking:ChallengesAhead,CGAPFocusNote

50(Washington,DC:CGAP,October)

Mas,IgnacioandSarahRotman(2008).GoingCashlessat

thePointofSale:HitsandMissesinDeveloped

Countries,CGAPFocusNote51(Washington,DC:CGAP,December).

Morawczynski,Olga(2008).SurvivingintheDualSystem:HowM‐PESAisFosteringUrban‐to‐Rural

RemittancesinaKenyanSlum.HCC8Conferenceproceedings,Pretoria.

Morawczynski,Olga(2009).Exploringtheusageand

impactoftransformation alm‐banking:Thecaseof

M‐PESAinKenya,mimeo.

Morawczynski,Olga&MarkPickens(2009).PoorPeopleUsingMobileFinancialServices:Observations

onCustomerUsageandImpactfromM‐PESA.C‐GapBrief

http://www.cgap.org/p/site/c/template.rc/1.9.36723/

Morawczynski,OlgaandGianlucaMiscione(2008).“Examiningtrustinmobilebanking transactions:

The

caseofM‐PESAinKenya.”In:“SocialDimensionsofInformationandCommunicationTechnologyPolicy:

Proceedingsofthe8thInternationalConferenceonHumanChoiceandComputersHCC8,”editedbyC

Avgerou,MSmithandPvandenBesselaar,InternationalFederationforInformationProcessingTC9,

Pretoria,SouthAfrica,September

25‐26,Volume282(Boston,MA:Springer),pp.287–298.

Okoth,Jackson(2009).“Re gulatorgivesM‐PESAacleanbillofheal th.”TheStandard,27January.

Okuttah,Mark(2009).“SafaricomchangesmethodofrecruitingM‐pesaagents.”BusinessDaily,23

December.

Ratan,A.L.(2008).UsingTechnology toDeliverFinancialServicesto

Low‐IncomeHouseholds:A

PreliminaryStudyofEquityBankandM‐PESACustomersinKenya.MicrosoftResearchTechnicalReport,

June.

Safaricom(2009).“M‐PESAKeyPerformanceStatistics”andvariousfinancialreportsavailableon

www.safaricom.co.ke

.

Suri,TavneetandBillyJack(2008).“TheperformanceandImpactofM‐PESA:PreliminaryEvidencefrom

aHouseholdSurvey.”Unpublishedpaper,June.