Support for this study was provided by Apple.

The conclusions and opinions expressed are exclusively those of the authors.

A Global Perspective on the

Apple App Store Ecosystem

An exploration of small businesses

within the App Store ecosystem

Jonathan Borck, Ph.D.

Juliee Caminade, Ph.D.

Markus von Wartburg, Ph.D.

June 2021

A Global Perspective on the Apple App Store Ecosystem

1

When the App Store launched in 2008, it offered approximately 500 apps for the iPhone

and iPod touch – an impressive number at the time but merely a fraction of what it offers

now. Since then, the App Store has grown to offer millions of apps to one billion App Store

customers worldwide, who have downloaded hundreds of billions of apps over the years.

i

Those apps are at the center of a massive ecosystem. Last year, we estimated that the

App Store ecosystem facilitated more than half a trillion dollars in billings and sales

worldwide in 2019.

ii

The number was even larger in 2020, as the role played by apps grew

during the coronavirus pandemic. As many users reduced their in-person interactions,

they turned to apps to make purchases and to stay connected, entertained, and healthy.

Most businesses, organizations, schools, and universities had to shi at once to digital

technologies, including mobile technologies, which enabled remote work and learning.

As online shopping and food and grocery orders soared, many small businesses had to

start or accelerate their digital transition. This report documents substantial growth in the

App Store ecosystem: We estimate that billings and sales facilitated by the App Store

increased by 24%, from $519 billion in 2019 to $643 billion in 2020. (See Part 1.)

In January 2021, Apple launched the App Store Small Business Program, through which

developers who earned less than $1 million per year on the App Store the prior year qualify

for a reduced commission rate of 15%. Moreover, the App Store ecosystem facilitates the

sales of a broader set of small businesses than those that monetize their apps directly

through the App Store – for example, small developers who sell digital goods and services

that are consumed on apps but purchased outside of the App Store; small developers who

sell in-app advertising; and small businesses (not just developers) that sell physical goods

and services through their own apps or through those of third-party platforms.

In this report, we focus on small businesses and the ways in which the App Store

supports their success. We look at small developers, those with less than $1 million in

earnings and fewer than one million downloads across all their apps in a given year (those

criteria are not the same as those of the Apple Small Business Program). Small developers

represented more than 90% of all developers on the App Store between 2015 and 2020.

Many of them have grown quickly, and some businesses for which iOS apps are central

to their business models have become large enough to become public companies or be

acquired by other companies. In addition, small businesses – even those without their

own apps – have benefied from the App Store ecosystem through digital platforms,

which connect them with consumers around the world through their apps. (See Part 2.)

The App Store aims to facilitate transactions between developers and users, and it

becomes more valuable when developers create new and innovative apps. To encourage

transactions and innovation, the App Store offers developers a global platform to

distribute their apps to one billion App Store customers worldwide, with built-in support

for various local payment methods. In addition, to help developers develop, distribute, and

market their apps, Apple offers a large set of developer tools, resources, and educational

and support programs. Through these tools and the platform it provides, the App Store

opens up meaningful opportunities for small developers. (See Part 3.)

Part 1

How large is the App Store

ecosystem? An update for

2020

Part 2

The success of small

businesses on the App

Store

Part 3

How the App Store

supports the success of

small developers

A Global Perspective on the Apple App Store Ecosystem

2

Part 1: How large is the App Store ecosystem? An update for 2020

Apple reported in 2020 that earnings it paid to developers summed up to about $39

billion worldwide in 2019. Such direct monetization through the App Store occurs through

paid downloads and through in-app purchases of digital content and services, using

Apple’s in-app payment system. However, direct monetization of apps significantly

underestimates the size of the App Store ecosystem. This is because developers can

choose to monetize their apps in different ways, including several that do not involve

transacting directly through the App Store. These other monetization strategies include

selling digital goods and services outside of the App Store that can be used within apps

on Apple devices (employed by, for example, multiplatform apps and reader apps such as

streaming, education, and enterprise apps), selling physical goods and services (employed

by, for example, grocery delivery apps), and offering ad-supported content (employed by,

for example, social networking apps). Therefore, our study focuses on third-party iPhone

and iPad apps, and account for billings generated through direct monetization via the App

Store, and for sales generated through monetization outside of the App Store.

1

We estimate that the App Store ecosystem facilitated $643 billion in billings and sales

worldwide in 2020.

2

$86 billion originated from billings and sales of digital goods and

services (13% of the total), $511 billion from sales of physical goods and services through

apps (80% of the total), and $46 billion from in-app advertising (7% of the total). About

90% of total billings and sales facilitated by the App Store ecosystem in 2020 occurred

outside of the App Store, meaning that Apple collected no commission on those sales.

(See Table 1.)

Table 1: Estimated Billings and Sales Facilitated by the Apple App Store Ecosystem

Worldwide, 2020*

Category

Billings and Sales

($ Billion) Annual Change

Digital Goods and Services** $86 +41%

Physical Goods and Services $511 +24%

In-App Advertising*** $46 +4%

Total $643 +24%

* Totals may not sum due to rounding.

** Estimated billings and sales from digital goods and services are not the same as total App Store billings. Our estimate also

includes the volume of sales from digital goods and services purchased elsewhere but used on apps on Apple devices, and,

conversely, subtracts billings from in-app purchases made via the App Store but used elsewhere. The estimate is based on a

combination of third-party sources and Apple data. See Appendix for methodology.

*** Estimate of all in-app advertising sales for iOS apps.

1 Apps developed by Apple, such as Apple Music, and mobile browser apps, such as Google Chrome, are

excluded from this analysis. Third-party apps featured within Apple TV are included in our analysis of video

streaming.

2 We use the term “billings” to refer specifically to payments generated by paid downloads and in-app purchases,

including subscriptions, that use the Apple in-app payment system, and the term “sales” to refer to money spent

by customers purchasing goods and services in general. We use the term “facilitated” to include the various

ways in which apps contribute to generating billings and sales.

A Global Perspective on the Apple App Store Ecosystem

3

While our analysis captures the major app monetization strategies in 2020, we do not

capture all of the ways in which the App Store ecosystem facilitates sales or all of the

benefits created by apps. A description of our methodology is included in the Appendix.

The App Store ecosystem across app categories and regions

The three largest streams of sales from physical goods and services facilitated by the App

Store ecosystem in 2020 originated from general retail ($383 billion), travel ($38 billion),

and food delivery and pickup ($36 billion), all of which are part of the substantial mobile

commerce (“m-commerce”) category.

Out of total global billings and sales facilitated by the App Store ecosystem in 2020, China

accounted for 47%, the US 27%, and Europe 12%. Compared to 2019, Europe’s fraction of

the global total increased slightly (up from 10%), while those of China and the US stayed

the same. Table 2 provides further country and regional breakdowns by app categories.

Appendix Tables 1 and 2 provide a similar breakdown for select countries in Europe, and

Japan, Korea, and Australia and New Zealand, respectively.

Table 2: Estimated Billings and Sales Facilitated by the Apple App Store Ecosystem by

Region and App Category, 2020*

US China Europe****

Rest of the

World

Total

($ Billion)

Digital Goods and Services** $33 $17 $9 $28 $86

Physical Goods and Services $115 $277 $60 $59 $511

M-Commerce

General Retail $74 $228 $44 $36 $383

Travel $10 $12 $7 $9 $38

Food Delivery and Pickup $10 $17 $4 $5 $36

Ride Hailing $13 $6 $3 $4 $26

Grocery $5 $11 $2 $4 $22

Digital Payment

$3 $3 - - $5

In-App Advertising*** $27 $6 $5 $8 $46

Total $175 $300 $74 $94 $643

* Totals may not sum due to rounding.

** Estimated billings and sales from digital goods and services are not the same as total App Store billings.

*** Estimate of all in-app advertising sales for iOS apps.

**** Europe includes countries in Western, Central, and Eastern Europe (including the UK and the Nordic Region). Russia is included

in the Rest of the World category.

The App Store ecosystem facilitated $643 billion in

billings and sales worldwide in 2020, a 24% increase

compared to 2019.

A Global Perspective on the Apple App Store Ecosystem

4

Comparison with 2019: The impact of the coronavirus pandemic on the App

Store ecosystem

In 2020, billings and sales facilitated by the App Store ecosystem rose by $124 billion, a

24% increase from 2019. However, this aggregate change masks important differences

across categories and geographies. (See Table 3.) The large changes observed this year in

many categories are consistent with our expectations, given the impact of the coronavirus

pandemic.

Compared to 2019, total billings and sales of digital goods and services increased by 41%.

The US and Europe saw the largest increases (+53% and +48%, respectively), followed

by China (+27%). Within digital goods and services, all categories increased globally, with

enterprise, video streaming, education, entertainment, and fitness seeing the largest

increases. Video and music streaming increased more in Europe compared to the US and

China, while education apps increased more in the US and Europe compared to China.

Apps have played a particularly central role during the coronavirus pandemic, as the

virus increased mobile usage.

iii

The pandemic drove an increase in remote work, online

schooling, gym closures, and home-based sources of entertainment such as video

streaming. Each of these, in turn, contributed to the changes observed in the billings

and sales of digital goods and services as most businesses, organizations, schools, and

universities had to shi quickly to digital technologies.

iv

As many people reduced their

in-person interactions with others, they turned to apps to make purchases and to stay

connected, entertained, and healthy.

v

Compared to 2019, the sales of physical goods and services facilitated by the App Store

ecosystem increased by 24%. As expected given the effect of the coronavirus pandemic,

this aggregate figure includes large increases in some categories and large decreases in

others. For example, sales facilitated by the App Store ecosystem in the travel and ride

hailing sectors decreased by more than 30%, as mobility and tourism decreased in most of

the world. Conversely, as online shopping soared and customers turned to online

orders of food and groceries, and as many stores pivoted to a digital format, sales

facilitated by the App Store ecosystem in the general retail, grocery, and food delivery and

pickup categories all increased significantly. Looking at regional trends, general retail

sales within apps increased by nearly 70% in the US and more than 100% in Europe.

Similarly, in-app food delivery and pickup and grocery increased by 30% and nearly 130%

in the US, and by more than 60% and 50% in Europe, respectively. In-app advertising

revenues increased slightly, by 4%.

In 2020, billings and sales of digital goods and

services facilitated by the App Store ecosystem

increased by more than 40%.

A Global Perspective on the Apple App Store Ecosystem

5

Table 3: Changes in Estimated Billings and Sales Facilitated by the Apple App Store

Ecosystem by Region and App Category, 2019 to 2020

US China Europe***

Rest of the

World

Total %

Change

Digital Goods and Services* +53% +27% +48% +37% +41%

Physical Goods and Services +23% +23% +53% +5% +24%

M-Commerce

General Retail +68% +30% +103% +35% +43%

Travel -37% -26% -33% -41% -34%

Food Delivery and Pickup +30% +4% +61% +23% +18%

Ride Hailing -41% -21% -13% -36% -34%

Grocery +128% +54% +53% +16% +56%

Digital Payment

+186% +10% - - +54%

In-App Advertising** +10% -9% -3% +0% +4%

Total % Change +26% +23% +47% +12% +24%

* Estimated billings and sales from digital goods and services are not the same as total App Store billings.

** Estimate of all in-app advertising sales for iOS apps. The source of our estimates for in-app advertising is Omdia. In 2021, Omdia

considerably remodeled their historical estimates and projections based on new data and feedback from industry players. To calculate the

changes in in-app advertising between 2019 and 2020, we rely on Omdia’s revised 2019 figures, rather than the figures that were reported in

our white paper last year.

*** Europe includes countries in Western, Central, and Eastern Europe (including the UK and Nordic Region). Russia is included in the Rest of

the World category.

Throughout 2020, the coronavirus pandemic dramatically affected our daily lives. This

study captures the many ways in which people have had to adjust their everyday activities,

working or studying from home, shopping online, or turning to video streaming and online

fitness during lockdowns, all of which affected the mobile economy and app usage. While

some of these trends may gradually return to pre-pandemic levels, as economies reopen

and in-person social interactions become more prevalent, we expect some of these

changes to persist, as they represent fundamental and possibly permanent shis in the

way individuals, businesses, and organizations use digital tools.

A Global Perspective on the Apple App Store Ecosystem

6

Part 2: The success of small businesses on the App Store

The App Store ecosystem includes businesses of all sizes. Some businesses are large

household names. Others are small, with just a few employees, or one self-employed

individual.

In this section, we focus on small businesses that have achieved substantial success on

the App Store. We consider various measures of success. First, we note that many small

developers (a type of small business) have grown quickly, some to the point that they are

no longer small. Second, we describe how some businesses for which iOS apps are central

to their business models have become large enough to become public companies or to

be acquired by other companies. Third, we discuss how small businesses, even those

without their own apps, have also benefited from digital platforms on the App Store, which

connect those businesses with consumers around the world through their apps.

The growth and success of small developers on the App Store (2015–2020)

The App Store supports hundreds of thousands of small developers. In fact, between 2015

and 2020, more than 90% of all developers on the App Store met our definition of “small.”

(See Definition.) Moreover, the number of small developers has grown, increasing by 40%

between 2015 and 2020.

Small developers have achieved substantial success on the App Store. We show this

through four analyses.

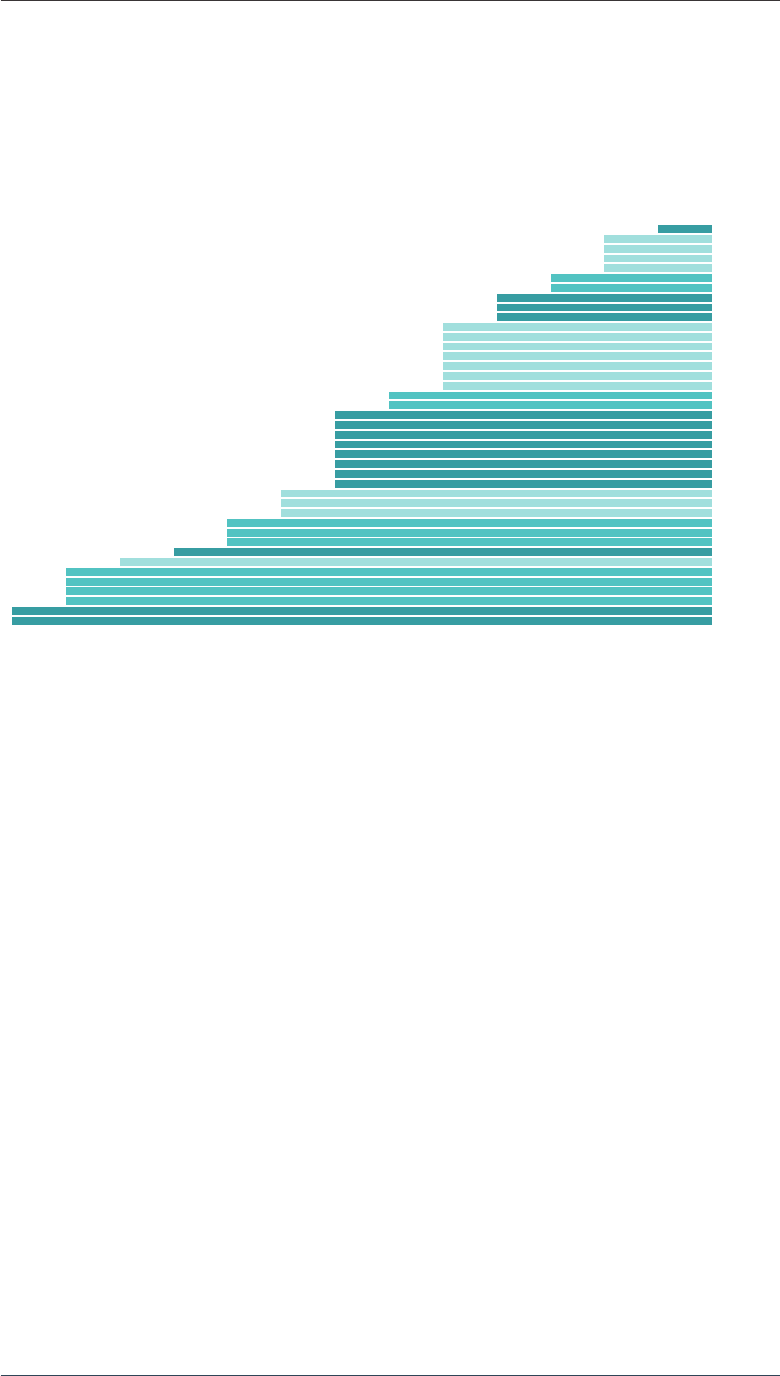

First, the App Store earnings of small developers grew substantially over the time period

we studied. We analyzed the group of developers who were small in 2015.

3

As shown in

Figure 1, the earnings for this group of developers nearly tripled between 2015 and 2020.

3 To limit the effect of a few large-scale successes driving the results, this analysis excludes developers that

earned $10 million or more in any subsequent year.

More than 90% of all developers on the App Store in

2015–2020 were small developers.

Definition

We consider a developer

to be a small developer in

a given year if it had fewer

than 1 million downloads

and less than $1 million in

earnings across all its apps

in that year (those criteria

are not the same as those

of the Apple Small Business

Program). We exclude from

our analyses developers who

never had more than 1,000

annual downloads between

2015 and 2020.

A Global Perspective on the Apple App Store Ecosystem

7

Figure 1: Small Developers in 2015: Growth in App Store Earnings

2015

1.3x

2016 2017

1.5x

2018

1.9x

2019

2.2x

2020

2.8x

Second, many small developers have experienced high download growth. We examined

the set of developers who were small and had at least 1,000 downloads in their first full

year on the App Store.

4

Among this group, more than one in five saw an increase in

downloads of at least 25% annually since their first full year on the App Store. These

developers may monetize their apps in a variety of ways, including several that do not

involve transacting directly through the App Store, or they may have other goals than

monetizing their apps. Download growth is a reasonable proxy for their success.

Third, many small developers who sell digital goods and services on the App Store have

experienced significant growth in App Store earnings. We examined the set of developers

who were small and had earnings of at least $1,000 in their first year on the App Store. We

find that one in four saw an increase in earnings of at least 25% annually since their first

full year on the App Store, and one in eight saw an increase of at least 100%.

Finally, some small developers grew enough to exceed our definition of small. We

identified the set of developers that had more than $1 million in earnings in 2020 and

summed up their App Store earnings in 2015. As shown in Figure 2, only 23% of developers

with at least $1 million in earnings in 2020 already earned more than $1 million in 2015. By

contrast, 42% were active in the App Store but earned less than $1 million in 2015, and 35%

were not active on the App Store in that year.

4 Our analyses of download and earning growth include developers whose apps were first released on the App

Store in 2014 or later.

Makaron (CN, 2018)

Winner of Apple’s 2018

“App of the Year” in the

China App Store, this app

from developer Versa

produces images, videos,

and more. Staff grew 5x

since launching. The

app has accumulated

nearly 8M downloads,

mostly in China, Japan,

and Southeast Asia. In

2 years, the company

valuation nearly tripled,

reaching $150M.

Butterfly iQ (US, 2018)

This app powers a single

whole-bodyultrasound

probe that works with

smartphone and tablet

apps. Within 2 years, the

company doubled its

workforce from 100 to 200.

Loopsie (IT, 2018)

This app transforms

photos into 3D images.

Founded by 3 university

friends, it now has 5

full-time employees. In

3 years, earnings grew

from $16K to $2M+.

Examples of apps that

have experienced

significant growth in

downloads and earnings

A Global Perspective on the Apple App Store Ecosystem

8

Figure 2: Where Were 2020’s Large Developers in 2015? (Earnings)

23% 18% 8% 16% 35%

Above $1M $100K to $1M $10K to $100K Below $10K No App in App Store

While our focus is on the growth of small developers, it is important to remember that

many small developers on the App Store who do not achieve the growth thresholds we

describe above still enjoy substantial and continued success. Apps from developers that

have experienced sustained success include:

Streaks (Australia, 2015) – This to-do list app to form good habits from

Crunchy Bagel won the Apple Design Award in 2016. The team of two built a

business that grew steadily over the past six years.

Cone (India, 2017) – Kushagra Agarwal created Cone, his first app, so he

could identify colors in daily life, before releasing it to the public. He later

created a filtering app to help the colorblind and a meditation app.

Aerlight (US, 2017) – This photo editor app began as the joint project

of two brothers. Its earnings have grown steadily and the app is now

supported by a team of six. The app has over 500,000 monthly users.

Notable successes: Going public or being acquired

A number of businesses for which iOS apps are central to their business models have

achieved other milestones of success: an IPO, in which shares of the private company

are offered to the public, oen aer substantial growth and with great fanfare; or an

acquisition, in which businesses are purchased by other companies that saw value in the

acquisition.

More than 75 businesses in the US and Europe for

which iOS apps are central to their business models

went public or were acquired since 2011.

“[The IPO]’s going to

allow us to accelerate

our growth into more

markets and scale our

mission…To realize that

kind of change, you have

to reach a lot of people,

and the App Store has

enabled us to do that.”

– Bumble

A Global Perspective on the Apple App Store Ecosystem

9

This group of publicly offered or acquired businesses includes the creators of a variety of

businesses, including:

˿ Snapchat, the social media app, which went public in 2017 at a $33 billion valuation

˿ Stitcher, the podcasting app, which was acquired in 2020 for $325 million

˿ Unity, the developer of a platform that allows developers to build mobile gaming

apps, which went public in 2020 at a $13.7 billion valuation

˿ Bumble, a dating app, which went public in 2021 at an $8.2 billion valuation

This group also includes companies with a diversity of business models and monetization

strategies, including:

˿ MyFitnessPal, a nutrition and exercise app, which monetizes via in-app advertising

(adding paid subscriptions aer it was acquired)

˿ Rovio, the developer of gaming app Angry Birds, which monetizes via both in-app

purchases and in-app advertising

˿ Deliveroo, a food delivery startup, which collects a commission on transactions for

physical goods and services

Using publicly available information, we identified a set of businesses in the US and

Europe for which iOS apps are central to their business models that have gone public or

been acquired since 2011. (See sidebar.)

IPOs: We identified 40 businesses in the US and Europe for which iOS apps are central

to their business models that went public since 2011. These companies had an aggregate

market valuation of more than $450 billion at the time of their IPOs. As shown in Table 4,

this group includes companies in categories such as gaming, social networks, and food

delivery and pickup.

Table 4: IPOs by Companies for Which iOS Apps Are Central to Their Business Models, US

and Europe

Category Number of IPOs

Aggregate Valuation at IPO

($ Billion)

US Europe Total

Games 3 8 11 $46

Social Network 7 0 7 $175

Food Delivery and Pickup 3 3 6 $66

Other 3 2 5 $38

App Developer Tools 4 1 5 $20

Ride Hailing 2 0 2 $106

Digital Marketplace 1 1 2 $7

Digital Payments 2 0 2 $1

Total 25 15 40 $459

Methodology

We obtained IPO and

acquisition data from

Crunchbase. We examined

IPOs and acquisitions

in relevant categories

between January 2011

and March 2021 for

which the business

headquarters were in the

US or Europe. For IPOs,

we focused on companies

listed on prominent

stock exchanges. For

acquisitions, we focused

on companies that were

acquired for more than

$250 million.

For each company

examined, we assessed

whether iOS apps

were central to its

business model at the

time it went public or

was acquired based

on contemporaneous

business documents and

media coverage. We looked

in particular for sources

that addressed whether

a substantial portion of

the company’s business

was tied to the App Store

at the time of the IPO or

acquisition.

See Appendix Tables 3 and

4 for the full list of the IPOs

and acquisitions included

in our analysis.

A Global Perspective on the Apple App Store Ecosystem

10

Acquisitions: We also identified 39 businesses in the US and Europe for which iOS apps

are central to their business models that were acquired since 2011. As shown in Table 5,

these companies were purchased for a total of more than $45 billion.

Table 5: Acquisitions of Companies for Which iOS Apps Are Central to

Their Business Models, US and Europe

Category Number of Acquisitions

Aggregate Price at Acquisition

($ Billion)

US Europe Total

Games 4 6 10 $8.6

App Developer Tools 6 2 8 $4.5

Other 4 2 6 $4.7

Enterprise 6 0 6 $4.3

Food Delivery and Pickup 3 0 3 $1.0

Social Network 2 0 2 $20.0

Utilities 2 0 2 $1.7

Retail 1 1 2 $1.0

Total 28 11 39 $45.8

Our analyses are conservative because they do not include many companies for which iOS

apps maer for their success but that also derive a substantial portion of their business

from channels and platforms outside of the App Store. For example, our lists do not

include:

˿ Airbnb, which went public in 2020 at a $47 billion valuation, and whose iOS app had

been downloaded 121 million times at the time of its IPO

˿ Trulia, which was acquired in 2014 for $3.5 billion, and whose iOS app had been

downloaded 12 million times at the time of its acquisition

˿ Etsy, which went public in 2015 at a $1.8 billion valuation, and whose iOS app had

been downloaded 20 million times at the time of its IPO

˿ Yelp, which went public in 2012 at an $898 million valuation, and whose iOS app had

been downloaded eight million times at the time of its IPO

vi

While our quantitative review focused on the US and Europe, IPOs and acquisitions of

companies for which iOS apps are central to their business models have taken place

across the world. (See sidebar for examples.)

MyFitnessPal (US)

Fitness

Acquired in 2015

for $475M

In-app advertising

NetMarble (KR)

Mobile games

IPO in 2017 at $11B

valuation

Digital goods and

services, in-app

advertising

MedPhone (BR)

Health care

Acquired in 2020

for $1.2M

Digital goods

and services

Examples of IPOs

and acquisitions of

companies for which

iOS apps are central to

their business models

Peak Games (TR)

Mobile games

Acquired in 2020

for $1.85B

Digital goods and

services, in-app

advertising

Bumble (US)

Online dating

IPO in 2021 at

$8.2B valuation

Digital goods and

services

Deliveroo (UK)

Food delivery

IPO in 2021 at

$10.5B valuation

Physical goods

and services

A Global Perspective on the Apple App Store Ecosystem

11

Digital platforms, apps, and small businesses

Small businesses can benefit from the App Store ecosystem even when they do not have

their own apps. In particular, with the growth of digital platforms worldwide, the apps

of many online marketplaces and other platforms have become central to connecting

millions of small businesses and entrepreneurs throughout the world with tens of millions

of consumers. Through digital platforms and their apps, small businesses can build an

online presence and can access digital tools that would be otherwise unavailable.

These platforms have developed in many different sectors, including:

˿ General retail, with marketplaces such as Taobao, eBay, Etsy, and Mercado Libre

˿ Travel, with Airbnb and VRBO, all of which connect hosts and guests worldwide

˿ Food delivery and pickup, with apps such as DoorDash, Deliveroo, Uber Eats, Grab,

and Meituan Waimai, which have allowed millions of restaurants to offer online

pickup and delivery options

˿ Grocery delivery, with apps such as Instacart and Cornershop

Hundreds of billions of dollars in sales are facilitated by the App Store ecosystem, much of

which happens through large digital platforms.

Table 6: Select List of Large Digital Platforms

Category Digital Platform Origin Country Estimated Number of Businesses*

Monthly Active

Users (Million)**

General Retail

Taobao China 10 million active storefronts 441.8

Amazon US 1.6 million active sellers worldwide 293.3

eBay US 20 million active sellers worldwide 113.9

Mercado Libre Argentina 12 million active sellers 99.9

Etsy US 4.4 million sellers 15.9

Travel

Airbnb US 4 million hosts 38.2

VRBO US 2 million homes 3.0

Food Delivery

and Pickup

Grab Singapore 2 million merchant partners 79.3

UberEats US 600,000+ restaurants 69.8

Meituan Waimai China 6.8 million restaurants 61.4

Doordash US 390,000 merchants in US, CA, and AU 22.3

Grubhub US 265,000 partner restaurants in US 10.2

Deliveroo UK 115,000 restaurants and grocers 7.3

Grocery

Instacart US 300 retailers, 3,000+ independent grocers 6.4

Cornershop Chile/Mexico 1,000+ stores in Latin America 1.6

* Sources: company documents or website, market research.

** Sources: App Annie and iiMedia. Includes all mobile users.

A Global Perspective on the Apple App Store Ecosystem

12

Digital platforms have also emerged in many other industries. Examples abound:

ClassPass in the fitness space, Getaround for car sharing, Rover for dog walking, Care for

child care and other services, Thumbtack for home services, Insight Timer for meditation

classes, and Talk Space for mental health consultations.

Digital platforms can also connect specialized audiences, such as the Danish app Too

Good to Go for reducing the food waste of restaurants and grocery stores, the French

app Ollca for online orders at local shops, and the US-based EatOkra and Oya for locating

Black-owned restaurants and women-owned businesses, respectively.

As the coronavirus pandemic swept through the world in early 2020, businesses and

entrepreneurs had to adjust quickly. Many were able to offer alternative ways to reach

customers through platform apps. For example, many restaurants and small shops in

Europe turned to platforms such as Deliveroo, Ollca, and Cajoo, allowing them to pivot to

mobile distribution strategies in a short amount of time.

Platforms have been central to connecting millions

of small businesses worldwide with tens of millions

of consumers through their apps.

A Global Perspective on the Apple App Store Ecosystem

13

Part 3: How the App Store supports the growth

of small developers

The App Store connects hundreds of thousands of small developers with one billion

App Store customers who are interested in their apps throughout the world. Like other

two-sided platforms, the App Store aims to facilitate transactions between developers and

users. The ecosystem becomes more valuable when developers create new, diverse, and

innovative apps, even when those apps are not directly monetized on the App Store. To

encourage transactions between users and developers, the App Store offers developers a

global platform to distribute their apps to one billion customers worldwide, with support

for various local payment methods. Additionally, to help developers develop and market

new apps, regardless of their business models, Apple offers a large set of tools and

resources, as well as educational programs and support.

Access to local storefronts around the world

The App Store is a global marketplace visited by more than half a billion people each

week through local storefronts in 175 countries, including 20 new storefronts in Europe,

Asia, Africa, and Oceania that opened in 2020.

vii

This global distribution platform allows

developers – including small developers with limited resources – to offer and seamlessly

distribute their apps (and app updates) to customers around the world. In addition, the

App Store assists developers in monetizing their apps globally, including with:

˿ Localized price tiers that are adjusted to each market or region and updated for

changes in taxes and foreign exchange rates

˿ Payment processing, to make it easy for users around the world to pay for apps and

make in-app purchases with local payment methods, including backup payment

methods and a billing grace period for digital subscriptions to prevent payment and

service interruptions and to help developers avoid losing customers

˿ Tax administration, to make it easier for developers to comply with local laws

The App Store’s curated local storefronts support many languages, almost 200 local

payment methods, and 45 local currencies, and help customers search and discover

relevant apps.

The App Store’s global distribution platform can offer small developers unique

opportunities to grow and expand their businesses; indeed, the large majority of small

developers take advantage and transact globally. In 2020, about 40% of all downloads of

Tangerine (EE/PT, 2020)

Created by 2 part-time

developers, this self-care

app was “App of the

Day” in 100+ countries.

The app has almost 6K

daily active users and is

expected to double its

earnings in 2021.

KidloLand (IN, 2012)

This award-winning

learning app with 6M+

downloads worldwide

provides learning

resources for young

children. Having started

with 5 employees and 3

songs, it now employs

40 people and offers 3K+

songs, games, and stories.

Examples of apps with

global reach

Chani (US, 2020)

This app combines

astrology, meditation,

and mindfulness. In

only 5 months, its

team grew from 4 to 15

employees, and had over

520K+ downloads in the

US, Canada, Europe,

Australia, and another

40+ countries.

About 40% of all downloads of apps from small

developers came from users outside of the

developers’ home countries.

A Global Perspective on the Apple App Store Ecosystem

14

apps from small developers came from users outside of the developers’ home countries.

Nearly 80% of small developers are active in multiple storefronts, and, on average,

developers that monetize their apps on the App Store on multiple storefronts have

earnings from users in more than 40 storefronts. There is a positive relationship between

the size of a small developer and the number of storefronts in which it is active, indicating

that for many small developers, global expansion provides an opportunity to grow their

businesses.

While some small developers take advantage of the App Store’s global distribution, others

choose to offer apps with a local or regional focus, and are primarily distributed in a few

countries. (See sidebars on pp. 13-14 for examples of both types.)

Access to payment methods

The App Store offers users the ability to pay for apps and make in-app purchases using

most credit and debit cards, and in certain countries or regions, Apple Pay and store

credit (from redeeming gi cards or adding funds to their Apple IDs). Apple also supports

other third-party payment methods (alternative payment methods) in 69 storefronts, and

continues to add support for new payment methods globally. Since 2015, 54 storefronts

have added such alternative payment methods. Of those storefronts, 48 added carrier

billing, whereby users can charge App Store purchases to their mobile phone carrier bills.

In total, the App Store now offers carrier billing for more than 100 mobile carriers around

the world.

The wide range of supported payment methods – coupled with the App Store’s assistance

with tax administration and remiance, local currency conversions, and monitoring of

fraudulent transactions – benefit developers who aim to monetize their apps globally but

may lack the resources and infrastructure to do so. Without the App Store’s integration

of these alternative payment methods, it would have been particularly difficult (or

prohibitive) for small developers to contract with numerous mobile carriers around the

world, or arrange for users to pay using popular alternative payment methods and digital

wallets such as TrueMoney in Thailand, KakaoPay in South Korea, and Alipay in China.

App Store billings from alternative payment methods are substantial and important for

developers seeking to reach a growing mass of global users. A share of these billings is

incremental, that is, they come from users who have not purchased anything from the

App Store in the past 12 months (“new-to-paid” or “reactivated”). In the last six years,

YAMAP (JP, 2013)

This Japanese app

for outdoor activities

provides information

about routes and trails

in Japan, especially for

mountain hikers. The app

is available in Japanese

and English, and 99% of

users are from Japan.

Example of local app

In the last six years, new payment methods (other

than credit and debit cards) have brought more than

60 million new-to-paid or reactivated customers in

their first year alone.

Developer quotes

“The App Store makes it

easy to launch the app

in different locations and

in different currencies

[…] It’s been a big help to

not have to worry about

different currencies

or different payment

methods.” – flowkey

"As a small company, we

didn’t have the resources

to go international by

ourselves, but Apple gave

us the tools we needed

for expansion. For

example, we would have

never guessed we would

be in Turkey, but the App

Store analytics gave us

a really clear sign that

we needed to go there —

and now people love us

there." – Makaron

A Global Perspective on the Apple App Store Ecosystem

15

new payment methods (other than credit and debit cards) have brought more than 60

million new-to-paid or reactivated customers in their first year of launch alone. This

improved ability for developers to monetize their apps globally benefits small developers

in particular because it would have been prohibitive for them to negotiate payment

agreements around the world in the absence of the App Store’s built-in payment support.

The addition of new customers and the improved monetization increase the value of the

App Store ecosystem to the benefit of users and developers.

Apple provides tools and technologies to help developers create and manage

apps and games

Apple continuously invests in ways to make it easier for developers to create and manage

new and innovative apps. For instance, Apple provides tools that are either free or

included in the Apple Developer Program membership for all developers so that they can

create, develop, test, publish, and upgrade apps.

˿ Apple provides an Integrated Development Platform – Xcode – for developers to

design, code, test, and debug apps. Apple continuously updates the platform.

˿ In 2014, Apple introduced Swi, a programming language designed to make it easier

for developers to create apps.

˿ Xcode includes all the technologies necessary for developers to add different

functionalities to their apps. These building blocks for apps (called soware

development kits, or SDKs, and application programming interfaces, or APIs) let

developers add new functionalities to their apps, oen with a simple click and drag.

Apple offers over 250,000 APIs, and, as Figure 6 illustrates, it has released new SDKs

every year since 2008, adding up to more than 40.

˿ Apple provides tools to easily test, debug, and publish apps. For example, since

2014, TestFlight allows developers to invite users to test initial versions of their apps.

˿ Apple also provides design guidelines and resources, including templates for

all necessary in-app components, to make it easier and less time-intensive for

developers to design apps.

These tools and technologies make it easier to create apps and games, and they make it

possible for anyone to try developing apps.

Apple’s tools and technologies make it easier to

create apps and games, and make it possible for

anyone to try developing them.

A Global Perspective on the Apple App Store Ecosystem

16

Apple also supports developers aer their app launch, with tools such as crash reporting,

performance metrics, phased rollouts, and ratings and reviews, allowing developers to

measure the performance of their apps.

Figure 3: Availability of Select Apple SDKs

2021 2020201920182017201620152014201320122010 201120092008

1. UIKit

2. Reachability

3. CoreLocation

4. GameKit

5. MapKit

6. StoreKit

7. EventKit

8. GLKit

9. PassKit

10. iMessage

11. SceneKit

12. iBeacon

13. SpriteKit

14. TextKit

15. PhotoKit

16. CloudKit

17. HealthKit

18. Apple Pay

19. HomeKit

20. CarPlay

21. WebKit

22. WatchKit

23. ResearchKit

24. ClockKit

25. MetalKit

26. CareKit

27. CallKit

28. Apple Speech

29. SiriKit

30. PushKit

31. ReplayKit

32. Core ML

33. ARKit

34. PDFKit

35. ClassKit

36. CreateML

37. PencilKit

38. RealityKit

39. MetricKit

40. VisionKit

41. WidgetKit

Apple SDKs offer certain advantages to developers over creating their own tools, or using

alternative third-party solutions:

˿ As opposed to coding functionalities themselves, using SDKs allows developers to

cut costs and reduce the technical skills needed to release an app. For example,

the developers of the Japanese hiking app YamaReco explained that they used

“SpriteKit on watchOS to draw trail maps” so they did not have to create a

“completely new library from scratch.”

˿ Compared to alternative third-party solutions, Apple SDKs automatically benefit

from system updates and bug fixes. This prevents developers from having to

deal with performance issues related to outdated third-party SDKs, such as apps

crashing or storing data improperly.

xii

Additionally, because these SDKs have been

developed by Apple, developers can trust that they are safe and free of malware, and

will protect users’ privacy.

Developers are indeed choosing to use these tools. For example, within the set of SDKs

tracked by App Annie, more than 75% of installed location and payment SDKs were

developed by Apple.

Some of Apple’s SDKs, such as MapKit, SiriKit, and CoreML, are used by a large number

of developers to add functionalities that can improve their apps. Many of them can be

integrated into an app in a single package. This allows developers to build apps in a flexible

Did you know?

Developing apps has

become significantly

cheaper over the last

decade.

viii

The limited number

of Apple devices and

operating systems

minimizes fragmentation,

making it easier and

less costly to develop

apps, since they need to

be designed for a small

number of devices and

operating system versions.

ix

Apple makes it easy for

developers to port their

iPhone and iPad apps

to other Apple devices,

such as Macs, Apple TVs,

and Apple Watches. For

instance, Xcode allows

developers to convert

iOS apps into Mac apps,

sometimes simply by

clicking a checkbox.

Some developers have

found that developing apps

on iOS takes approximately

30% less time than in

other platforms, such as

Android.

x

Studies have shown that

some third-party SDKs

are unsafe and exhibit

poor privacy practices,

such as exploiting the

app’s permissions, leaking

private information, and

tracking users.

xi

A Global Perspective on the Apple App Store Ecosystem

17

way, providing certain functionalities from the start while leing them add more services,

such as support for Siri, later on.

Other SDKs developed by Apple have allowed developers to build and create new apps

in entirely new product spaces. For example, HealthKit, released in 2014, allows more

than 6,000 approved apps to securely collect and manage health and fitness data,

while ensuring user data privacy. HealthKit allows developers to not have to build their

own health tracking system, which, as the developers of the exercise app Wakeout!

stated “would have been just another weight on our shoulders.” Since 2018, ClassKit

has allowed educators to manage student data, assign problems in different apps, and

track students’ progress. Developers have installed ClassKit more than 71,000 times. The

release of ARKit in 2016 has allowed developers to create new apps or improve existing

ones by adding augmented reality-based functionalities. This tool has become crucial for

many developers, such as those of the home design app Primer: AR Home Design, who

explained that “our app and our business would not exist without it. We don’t just use

ARKit … ARKit is the entire app.”

Many widely successful apps rely on the environment and tools that Apple provides.

Some of these rely on an extensive set of Apple SDKs, while others use particular tools to

provide key new functionalities for their apps.

Examples of successful apps relying on Apple SDKs

YamaReco (Japan, 2016) – Launched with two employees and two part-time

workers, this app helps hikers and mountain climbers check their route and

location, even without phone signal. It has nearly 300,000 downloads.

Wakeout! (Guatemala, 2017) – This app uses HealthKit to provide brief

workouts to users. It started with 80 exercises in 2017 and now offers 1,500.

In 2020, its users accomplished more than 1.6 million exercises.

Learn Math Facts (US, 2019) – This app, which has over 100,000 downloads

and is available in 10 languages, uses ClassKit, CoreML, and PencilKit to

help children learn math through quizzes.

Primer: AR Home Design (US, 2020) – This app uses ARKit to let users

visualize how different paints, wallpapers, and tiles would look in their

own spaces. In the first year, the team grew from three to eight, and over

500,000 users visualized a virtual swatch from over 5,000 AR products.

A Global Perspective on the Apple App Store Ecosystem

18

Initiatives to strengthen and grow the iOS community

Another way Apple invests in making it easier for developers to create and manage new

and innovative apps is by providing different educational and mentorship programs

around the world. Through those initiatives, Apple provides support for small developers,

entrepreneurs, and others interested in learning more about developing iOS apps, in

order to strengthen and grow the iOS developer community. We group Apple’s education

support into three broad categories, depending on when these initiatives impact the life

cycle of a developer: early support, education support, and entrepreneur support.

˿ Early support initiatives target those new to coding, and can function as an entry

point to iOS, and eventually the App Store, by connecting novice developers to the

broader iOS space.

- Coding education programs such as Everyone Can Code, Develop in Swi,

and the app Swi Playgrounds provide learners of all ages and levels, as well as

educators, with tools to learn to code in Swi.

- The WWDC Scholarship provides an opportunity for students in STEM programs

to aend the Apple Worldwide Developers Conference.

- The Student Mobile App Contest seeks to introduce college students in China

to the tools needed to launch new apps.

˿ Education support initiatives offer a comprehensive array of training modules on

topics such as coding, marketing and presenting, and navigating the app economy.

- The Developer Academy is one of Apple’s largest education initiatives to date.

Launched in 2013, the program is now active in Brazil, Indonesia, Italy, and

France, and will soon be in Korea.

5

As part of its new Racial Equity and Justice

Initiative, Apple selected Detroit for the first US academy, starting in 2021.

Students can enroll in either a 30-day program or a 10 to 12-month course.

- Apple-supported certifications, such as the App Development with Swi

certification, recognize advanced proficiency in Swi, Xcode, and other

important tools for iOS developers.

xiii

˿ Entrepreneur support initiatives include camps, labs, and workshops, to help

startups and developers in the App Store ecosystem launch or scale apps, learn

about new tools, and take advantage of expert mentorship.

- Apple Entrepreneur Camp targets underrepresented entrepreneurs with new

or existing apps. Currently focused on women-owned businesses and Black

founders and developers.

5 Brazil has 10 academies and three foundation programs; Indonesia has three academies and three foundation

programs; Italy has one academy and seven foundation programs; and France has four foundation programs.

Coding education

programs in numbers

1.9M students and

educators reached in 2020

9K institutions using Apple

curriculum

27 countries

15 languages

Thousands of WWDC

scholarships

1K teams from over 300

universities across China

registered for the Mobile

App Contest initiative in

2020

Apple Entrepreneur

Camp in numbers

2019: 100 participants,

13 countries, 42 women

companies

2021: first cohort of 13 Black

founders and developers

and their teams

Developer Academy in

numbers

Over 10K graduates

51 nationalities

6x more women in 7 years

431 WWDC Scholars

Over 1.5K apps

Over 160 startups

1K students/year to enroll

in the US

A Global Perspective on the Apple App Store Ecosystem

19

- App Accelerators in China (Shanghai) and India (Bengaluru) introduce

developers to the tools needed to launch apps across multiple Apple platforms

through labs and mentorships from Apple experts.

- Developer Workshops support entrepreneurs, small businesses, and developers

in general, with group and one-on-one sessions with Apple experts on specific

topics to help them improve their apps. Participants can learn about new

technologies, such as CoreML, App Clips, Widgets, and watchOS, as well

as business features, such as subscriptions and family sharing for in-app

purchases. Apple organizes these workshops around the world. For example, the

company joined France’s new Station F campus with a “mentorship office” for

entrepreneurs, where participants can readily access expert advice.

xiv

Another

example is in Japan, where Apple has multiple workshops, including one-on-one

sessions, to introduce developers to the subscription business model.

Many alumni from these initiatives have taken advantage of Apple’s support and used

Apple’s developer tools to successfully launch apps on the App Store, to create startups

that have expanded beyond the small business threshold, and to develop apps that have

been downloaded globally.

Alumni Highlights

flowkey (Germany, 2015) – Available in 12 languages, this app from an Apple

developer workshop participant helps users of all levels to learn and prac-

tice piano. Created by three friends, it now employs over 50 people. The app

has three million users and over 100,000 paying subscribers.

Rogervoice (France, 2015) – This app from a Station F participant provides

real-time transcription for phone conversations. Since launching, 50,000

users have called 290,000 contacts and spent four million minutes in calls.

The number of employees has increased from 10 to 50.

Lake (Slovenia, 2017) – This coloring app, downloaded eight million times,

features designs from artists worldwide, who participate in a revenue-

sharing model. Lake was part of the 2019 Entrepreneur Camp and WWDC

since launching. Employees almost doubled in the last three years.

Vectornator (Germany, 2017) – This graphic design app, created by a WWDC

Swi Student Challenge winner, now employs a team of 40, including four

WWDC Scholarship winners. In three years, it reached 30,000 ratings, about

400,000 monthly active users, and over four million downloads.

Noted. (UK, 2018) – This app from an Apple developer workshop participant

is a recording and note-taking tool. Each month, over 70,000 active users, of

whom about 1,000 are visually impaired, record 60,000 Apple Watch notes,

and take more than 35,000 notes. In two years, the app earned over $500,000.

Developer quotes

“Apple Entrepreneur

Camp was tremendous

– it reshaped the app,

the product and the

business and gave us

quite a substantial

push.” – Lake

“So I basically kicked off

then and went on as a

hobby project to...WWDC,

and from there we

founded the company.

I brought over some

people I met at WWDC,

which was pretty cool,

and took it from there. It

got some traction and

the company grew.”

– Vectornator

A Global Perspective on the Apple App Store Ecosystem

A1

Appendix

Appendix Table 1: Estimated Billings and Sales Facilitated by the Apple App Store

Ecosystem for Select European Countries and by App Categories, 2020*

UK Germany France Italy Spain

Digital Goods and Services** $2.6 $1.5 $1.1 $0.5 $0.3

Physical Goods and Services $26.4 $9.3 $6.3 $2.0 $2.1

M-Commerce

General Retail $20.2 $6.8 $4.7 $1.4 $1.5

Travel $2.0 $1.6 $0.7 $0.4 $0.4

Food Delivery and Pickup $1.9 $0.5 $0.4 $0.1 $0.1

Ride Hailing $1.3 $0.2 $0.3 $0.0 $0.1

Grocery $1.0 $0.2 $0.2 $0.0 $0.1

In-App Advertising*** $2.4 $0.4 $0.6 $0.4 $0.3

Total $31.4 $11.2 $7.9 $2.9 $2.7

* Totals may not sum due to rounding.

** Estimated billings and sales from digital goods and services are not the same as total App Store billings.

*** Estimate of all in-app advertising sales for iOS apps.

Appendix Table 2: Estimated Billings and Sales Facilitated by the Apple App Store

Ecosystem for Select Countries and Regions and by App Categories, 2020*

Japan**** Korea

Australia and

New Zealand

Digital Goods and Services** $14.4 $1.5 $1.5

Physical Goods and Services $16.4 $13.1 $5.4

M-Commerce

General Retail $10.6 $10.6 $2.4

Travel $2.3 $1.0 $1.0

Food Delivery and Pickup $1.2 $0.4 $0.8

Ride Hailing $0.5 $0.3 $0.7

Grocery $1.8 $0.8 $0.5

In-App Advertising*** $3.8 $0.4 $0.8

Total $34.6 $14.9 $7.7

* Totals may not sum due to rounding.

** Estimated billings and sales from digital goods and services are not the same as total App Store billings.

*** Estimate of all in-app advertising sales for iOS apps.

**** In estimating the portion of mobile sales that occurred in apps compared to mobile web browsers, we rely on estimates from

J.P. Morgan’s E-commerce Payments Trends Report. J.P. Morgan’s estimate for the share of in-app sales in Japan decreased

markedly between 2019 and 2020, reflecting changes in consumer m-commerce habits as Japan’s m-commerce grows and

matures. During this transition, a certain level of fluctuation in estimates are to be expected.

A Global Perspective on the Apple App Store Ecosystem

A2

Appendix Table 3: IPOs by Companies for Which iOS Apps Are Central to Their Business

Models, US and Europe

Games Social Network Food Delivery and Pickup

G5 Entertainment (2014) Facebook (2012) Deliveroo (2021)

GAN (2020) HearMeOut (2016) Delivery Hero (2017)

Hugo Games A/S (2015) Life360 (2019) DoorDash (2020)

IsCool Entertainment (2012) Pinterest (2019) Grubhub (2014)

Kahoot! (2019) Snap (2017) Just Eat (2014)

King.com (2014) The Meet Group, Inc. (2011) Olo (2021)

Nitro Games (2017) Twier (2013)

Roblox (2021)

Rovio Entertainment (2017)

Rush Street Interactive (2020)

Zynga (2011)

App Developer Tools Other Digital Marketplace

Agora.io (2020) Bumble (2021) ACV (2021)

Millennial Media (2012) DropCar (2018) Scout24 (2015)

Nektan USA (2014) Spotify (2018)

Square (2015) Sprout Social (2019)

Unity Technologies (2020) Storytel (2015)

Digital Payments Ride Hailing

Pushpay (2014) Ly (2019)

Shi4 Payments (2020) Uber (2019)

Appendix Table 4: Acquisitions of Companies for Which iOS Apps Are Central to Their

Business Models, US and Europe

Games App Developer Tools Enterprise

Big Fish (2014) AdColony (2021) AirWatch (2014)

Easybrain (2021) Adjust (2021) Epocrates (2013)

Glu Mobile (2021) Fyber (2021) Fiberlink (2013)

Goodgame Studios (2017) Kony (2019) MobileIron (2020)

Hutch (2020) MoPub (2013) PlanGrid (2018)

Machine Zone (2020) Paydiant (2015) Zenprise (2012)

Outfit7 (2017) Teads US (2017)

Peak Games (2020) Vungle (2019)

Small Giant Games (2018)

Storm8 (2020)

Other Food Delivery and Pickup Utilities

Grindr (2020) Bite Squad (2018) Check (2014)

iZele (2018) LevelUp (2018) Waze (2013)

MyFitnessPal (2015) Waitr (2018)

Nearpod (2021)

Shazam Entertainment (2017)

Stitcher (2020)

Retail Social Network

Dosh (2021) Instagram (2012)

Trendyol Group (2018) WhatsApp (2014)

A Global Perspective on the Apple App Store Ecosystem

A3

Methodological approach

To arrive at our results, we distinguish among three primary app monetization strategies

that developers use:

˿ The first monetization strategy is to sell and distribute digital goods and services.

Sales and distribution of digital goods and services can occur through the App

Store in the form of paid app downloads and in-app purchases, or through the sale

of digital content and subscriptions from multi-platform apps that allow for the

use and consumption of the app both in the App Store ecosystem and elsewhere.

Examples of apps using this monetization strategy include those for gaming, dating,

video and music streaming, fitness and health, and news and magazines.

˿ The second monetization strategy is to sell physical goods and services through

the app. Apps using this monetization strategy are m-commerce apps generally,

including apps for ride hailing, food delivery and pickup, grocery delivery and pickup,

general retail, and travel, as well as digital payment apps.

˿ The third monetization strategy is to sell in-app advertising. Examples of apps

using in-app advertising as their primary monetization strategy are social network

and short video sharing apps.

We employ different methodologies to estimate billings and sales facilitated by the App

Store ecosystem for each of these monetization strategies. In so doing, we rely on a variety

of data sources, including data from Apple, app analytics companies, market research

firms, and individual companies. To ensure the reliability and robustness of our estimates,

we validate and compare key inputs from different data sources.

6

Sales and distribution of digital goods and services

Apps used to sell and distribute digital goods and services fall into two subcategories:

˿ Certain app developers choose to monetize their iOS apps only through the App

Store, and those apps can only be used on the iOS platform.

7

Most billings from

these apps come from games, which involve a one-time payment or, more oen,

in-app payments that allow app users to remove ads, unlock bonus levels, or access

premium features.

8

This category also includes most photo-editing apps and dating

apps, as well as apps for short video and weather, among others.

˿ Other apps allow for the consumption of digital goods and services, both within the

App Store ecosystem and elsewhere. These so-called multi-platform apps allow

consumers to pay through either the App Store or another platform or device. In

6 This methodological approach is consistent with the one used in our 2019 Apple App Store ecosystem study.

7 Developers may also offer the same digital goods and services through apps on other platforms, such as

Android.

8 Our analysis does not include billings generated from the Apple Arcade gaming service. Apple Arcade provides

participating developers with an additional business model – distinct from the App Store – in which Apple

supports the development costs of Apple Arcade games. Many small and independent developers with games

in Apple Arcade also monetize with other free-to-play or paid games on the App Store.

A Global Perspective on the Apple App Store Ecosystem

A4

other words, consumers use non-device-specific subscriptions or purchases to

enjoy the digital goods and services provided. Multi-platform apps can be further

divided into consumer apps and enterprise apps.

- Consumer apps typically offer paid digital content – such as movies, music,

audiobooks, news, meditation courses, and fitness classes – that can be

consumed within the app. Moreover, they may offer paid digital services obtained

on the app, such as educational services, password management, job search,

and access to job platforms.

- Enterprise apps allow businesses and organizations to provide tools and

capabilities through smartphones and tablets. Those include communication

and collaboration apps, mobility management solutions, cloud-based business

apps, and file hosting services. These apps usually make money by selling

subscriptions to corporations and institutions outside of the App Store.

To distinguish between these two subcategories of apps, we manually review the

most popular apps in each App Store category, focusing on their business models and

monetization strategies. We use this information to ascertain (1) whether the app can be

used on mobile or computer browsers or on a different app platform; and (2) whether an

app on an Apple device can be used through a subscription or purchase made outside of

the App Store.

Methodology for iOS apps that sell only through the App Store

For iOS apps that sell digital goods and services only through the App Store, we count

total billings, which include Apple’s commission.

9

We use billings because they represent

the total amount customers pay.

Methodology for multi-platform apps

Background. For multi-platform apps, estimating the volume of sales facilitated by the

App Store is complex because subscriptions and purchases associated with them are not

device-specific. The lack of device specificity creates a dual challenge:

˿ First, consumers can pay to access multi-platform digital goods and services in

different ways, regardless of where they consume those goods and services. In

some cases, consumers pay through the App Store, but sometimes they do not.

˿ Second, multi-platform apps allow users to access content and services across

different devices, including non-Apple devices. For example, consumers can

stream videos through smart TVs, connected TV devices, video game consoles,

smartphones, tablets, web browsers, and across different platforms (Apple, Android,

etc.).

9 In 2020, Apple’s commission rate was 30% for the sale of digital goods and services; for subscriptions, it was

30% for the first year and 15% for any subsequent years.

A Global Perspective on the Apple App Store Ecosystem

A5

Because of these two characteristics of multi-platform apps, billings that flow through the

App Store are not necessarily a reliable indication of Apple users’ engagement with multi-

platform apps. Consequently, we must be deliberate about aributing the appropriate

share of billings and sales to the App Store ecosystem.

Example. To illustrate these challenges, consider the video streaming service Hulu. The

Hulu app is free to download, but a subscription is necessary to watch content on the

iPhone, iPad, and Apple TV apps. A Hulu subscription can be purchased in one of two

ways:

˿ Through the Hulu app on an Apple device, in which case the purchase happens

through the App Store. But a subscription purchased through the App Store can

also be used to watch Hulu on other platforms. Consequently, it would be incorrect

to aribute all of the App Store billings (the full subscription amount) to the App

Store ecosystem, because it would overstate the value of the Hulu product enjoyed

on Apple devices specifically.

˿ Outside of the app (on a Mac or PC via web browser, for example), in which case

the purchase does not happen through the App Store, and there are no App Store

billings. However, the subscription can be used to watch content on Hulu using

apps on Apple devices. Consequently, it would be incorrect to use the App Store

billings (which are zero) as an input to our App Store ecosystem results, because

it would understate the value of the Hulu product enjoyed through apps on Apple

devices.

Methodology. To address these challenges, we generally do not rely on App Store billings

for multi-platform apps. Instead, we rely on the proportion of use that occurs on apps in

the App Store ecosystem to estimate how much of the total sales of multi-platform apps

(App Store plus non-App Store) is facilitated by the App Store ecosystem.

Consider, for example, not just Hulu but the entire video streaming industry, a market

with more than $26 billion in total annual sales in the US in 2020.

xv

Users consume video

streaming content over a mix of smartphone apps, tablet apps, desktop browsers, smart

TVs, connected TV devices, and video game consoles. To estimate the volume of sales

facilitated by the App Store ecosystem, we first take the portion of hours streamed on

smartphone apps, tablet apps, and smart TVs of all types. We then apportion this share to

Apple devices specifically using the Apple market share for each device category.

Using this framework and approach, we estimate the volume of sales facilitated by the

Apple App Store ecosystem for several categories of apps offering similar types of goods

and services. The app categories for which we estimate sales facilitated by the App

Store are video and music streaming, e-books and audiobooks, news and magazines,

and enterprise. We use third-party research to account for the variation in users’ app

consumption habits across categories and countries. For example, consumers oen listen

to music and audiobooks through apps on mobile devices, while they are more likely

to stream videos on smart TVs. Those consumption habits may also vary by geography.

A Global Perspective on the Apple App Store Ecosystem

A6

Additionally, when the data is available, we take into account any variation in the

consumption paerns of iOS (and non-iOS) users by app type and geography.

For each app category, we estimate total sales by geography, relying on inputs from third-

party sources, typically market research firms.

xvi

We then apportion those sales using the

share of content consumed on apps on any platform by geography, based on information

collected from marketing surveys, company reports, or data on usage paerns.

xvii

Finally,

we apportion usage to Apple devices specifically using the Apple market share for each

device category in each geography.

xviii

We use a more tailored approach for enterprise apps for a number of reasons. First, usage

paerns are more heterogeneous for enterprise apps. Second, app-based usage and

desktop-based usage of enterprise products tend to be more integrated. Third, the pricing

of enterprise products is less transparent and more complex than for consumer apps.

With these complexities in mind, we individually estimate sales from 10 major apps or

families of apps – Microso Office 365, Google Workspace (i.e., enterprise versions of

Google productivity tools such as Gmail and Google Docs), Adobe (Acrobat), WPS Office,

Dropbox, Box, Baidu Drive, Webex, Zoom, and Slack. We also include an aggregate market-

level estimate for mobility management apps, which allow employees to securely access

business content.

Finally, for some categories of apps, we use billings from the App Store as a proxy for

sales facilitated by the App Store ecosystem. We do this for categories of apps, such as

meditation or fitness apps, for which consumers typically consume the content within

the app, but may purchase it outside of the App Store. This methodology likely results

in a conservative (or lower) estimate compared with an estimate relying on usage-based

apportionment.

Additional dimensions not included in our estimates

In addition to providing an outlet for users to consume digital goods and services, the App

Store has also made it generally easier for consumers to sign up for subscriptions through

what App Annie described as “the App Store’s simple, frictionless and secure payment

channel,” in particular for smaller apps.

xvix

Making it easier and more secure to sign up for

new subscriptions or make purchases may lead to incremental sales for app developers –

regardless of the platform chosen by users to consume the digital goods and services.

Sales of physical goods and services through the app

Many developers monetize their apps by selling physical products through their apps.

These include:

˿ Apps that let customers purchase physical goods and services. We broadly refer to

these as m-commerce apps. The group includes apps for general retail, ride hailing,

food delivery and pickup, grocery delivery and pickup, and travel.

A Global Perspective on the Apple App Store Ecosystem

A7

˿ Apps that enable digital payments or transfers, such as mobile point-of-sale apps

that rely on QR codes and peer-to-peer transfer apps.

M-commerce

Globally, mobile apps are an increasingly important e-commerce channel due to

their convenience. This growth has been most pronounced in China, the leader in

m-commerce.

10

Apps of retailers such as Amazon and Target allow consumers to browse

and purchase physical goods directly in the app, and offer in-store pickup or delivery. In

addition, mobile apps – including those for ride hailing, food delivery and pickup, grocery

delivery and pickup, and mobile pickup ordering – have been central to the creation or

expansion of certain business models.

Sales on m-commerce apps do not flow through the App Store.

11

We therefore use

third-party data to estimate the volume of sales of physical goods and services from

transactions on mobile apps.

12

We provide results for several categories of apps: general

retail, food delivery and pickup, travel, ride hailing, and grocery.

For each app category, we estimate the total volume of e-commerce or m-commerce

sales by geography, relying on estimates of third-party sources, typically market research

firms.

xx

We then apportion the volume of sales, if necessary, to purchases that occur via

smartphone and tablet apps. For example, for online food delivery and pickup, customers

may place orders via an app, a mobile browser, or a desktop browser. We estimate the

share of each app category’s sales that occurs via mobile apps, within each geography,

using information collected from marketing surveys or data on usage paerns.

xxi

Finally, we

apportion usage to Apple platforms based on the overall iOS market share.

13,xxii

Digital payments

Digital payment apps have become increasingly popular worldwide, although the

landscape differs substantially across countries. In China, currently the largest market for

digital payments, two QR code-based payment apps, Alipay and WeChat Pay, dominate

both online and brick-and-mortar points of sales. These apps charge merchants a fee on

purchases paid for with their apps. In the US, app-based payment systems are a relatively

nascent market,

xxiii

while peer-to-peer transfer apps such as Venmo and Cash App are

already popular and have grown significantly in recent years.

xxiv

10 In China, more than 80% of online retail is mobile. Additionally, most mobile commerce occurs through apps,

and to a lesser – but increasing – extent through “mini-programs” on platforms such as WeChat, Baidu, and

Alipay. See eMarketer; QuestMobile, “China Mobile Internet 2019 Half Year Report”; Aladdin, “2019 Mini-Programs

White Papers,” January 2, 2020..

11 Since the launch of the App Store, Apple’s policy has been not to charge a commission on sales of physical

goods and services or advertising.

12 The sales associated with purchases made on mobile browser apps are excluded.

13 Apportioning by iOS market share almost certainly results in a conservative estimate because owners of iOS

devices tend to spend relatively more than owners of Android devices. (See, e.g., Comscore.)

A Global Perspective on the Apple App Store Ecosystem

A8

We estimate the transaction fees collected by developers from customers or merchants

for payments and transfers occurring through apps on the iOS platform.

14

For QR code-

based payment apps in China, we start with an estimate of total payment volume

(TPV) from a third-party research firm.

xxv

We then estimate WeChat Pay and Alipay total

transaction fees using their published fee rates and deductible policies. For peer-to-peer

transfer apps in the US, we use the ratio of total transaction fees to TPV from Venmo and

Cash App to estimate the transaction fees collected by the apps. Finally, we apportion