China’s Middle-Class Consumers: Online Shopping Habits

In recent years, both the uptake and frequency of online shopping and overseas online

shopping by China’s middle-class consumers have been climbing significantly. According

to a survey on the mainland middle class carried out by the

Hong Kong Trade

Development Council (HKTDC)

[1], these consumers shop online about 5.25 times a

month on average, with 73% of the respondents shopping online at least once a week.

Smartphone apps are used to place orders online much more than computer browsers,

which suggests that consumers have already developed the habit of using smartphones

to create their “mobile lifestyle platform”. 53% of the respondents remarked that sharing

on social media could trigger their impulse to buy, while only 15% said they would not be

persuaded by the promotional gimmicks used by shopping websites to buy goods outside

their purchase plans.

Uptake and Frequency of Online Shopping and Overseas Online Shopping Both Up

China’s online shopping market is growing in leaps and bounds. According to figures

released by the

National Bureau of Statistics

, nationwide online retail sales rose from

RMB1,303 billion in 2012 to RMB5,155.6 billion in 2016. Its share of total retail sales of

consumer goods climbed from 6.2% in 2012 to 15.5% in 2016.

At the focus groups, participants made the following remarks:

“Online shopping offers more and more choices.

Tmall

offers more and more international

top brands,

jd.com

has also launched overseas online shopping. There are also

Amazon

,

vip.com

… as well as all kinds of “overseas purchasing platforms”, you can basically buy

products from all over the world.”

“There are many designer brand fashions online, including

D2C

,

Shangpinhui

etc.

Taobao

has also created ‘Quality by China’ launching independent designer fashions with unique

characteristics. Shoppers can buy clothes which are not often found in shopping malls

which can save them the embarrassment of wearing the same clothes as other people.”

To these consumers, the internet has already evolved from a “tool” to a “lifestyle”. This is

due not only to the proliferation of various kinds of mobile phone apps, but also to the

mature development of online payment systems such as

Alipay

,

WeChat Pay

and

JD

Baitiao

. All these apps have set the internet free from desktop computers and created a

“mobile lifestyle platform” for smartphone users.

According to findings of the

HKTDC

survey, both the uptake and frequency of local online

shopping and overseas online shopping by mainland middle-class and upper-class

consumers have risen markedly in the past few years. Respondents shopped online an

average of 63 times a year, or 5.25 times a month, a much higher frequency than the

monthly average of 1.43 times found in the 2013 survey. 73% of the respondents said

that they shop online at least once a week, with female respondents shopping online 66

2 Aug 2017

1

times a year on average and male respondents 60 times. Respondents used overseas

online shopping outlets 1.5 times a month on average, with 63% of the respondents

shopping on them twice a month or once every two to three months. The higher the

household income, the higher the frequency of overseas online shopping.

Both the consumer focus groups and questionnaire survey show that the “online lifestyle”

is already commonplace among consumers on the mainland. Many daily activities, such

as eating, drinking, entertainment, travelling and shopping, can be carried out via mobile

apps, while consumer attitude has also shifted from “skeptical” to “ready to try”, to

“getting used to it”. Consumers tend to find shopping online stress-free because it allows

them to pick and choose at their own pace and in a relaxed manner. Business operators

are finding that designing their webpages so as to attract consumers attracted by this

aspect of online shopping is becoming an increasingly demanding task.

China’s Middle-Class Consumers: Online Shopping Habits

2

Smartphones Create Mobile Lifestyle Platforms

It was found at the focus group discussions that the “palm-top lifestyle” has already

become the norm for many consumers. Through various mobile apps and shopping

platforms, it has become increasingly convenient for consumers to buy all kinds of

products and services. Middle-class consumers are increasingly opting for online shopping

to purchase medium-end to high-end products as it offers convenience as well as door-

to-door delivery.

At the focus groups, participants made the following comments:

“Nowadays many apps compare prices and recommend discounts to users.”

“Many food ordering apps allow users to order food even from faraway restaurants.

Although it takes a bit more time, it offers many more choices.”

“To dine out at a restaurant, one can make reservation by apps. You can hang around in

the neighbourhood before going to the restaurant at the appointed time.”

“In the past when (I) rented apartments (I) often came across undesirable units asking

for high rents and yet the environment was rather poor. Later on (I) used home leasing

apps which would screen the units before putting them online. This has not only spared

(me) the pain of going through an intermediary, but also saved (me) more than

RMB1,000 in rent a year through getting ‘red packets’ by posting likes.”

The survey finds that the use of smartphone apps to place online orders has far

surpassed that of computer browsers. 60% of the respondents said they usually use their

smartphone apps to place orders for shopping, compared to 21% who use computer

browsers. Female respondents use smartphone apps to shop online more often than their

male counterparts.

China’s Middle-Class Consumers: Online Shopping Habits

3

Online Special Offers and Promotions Appeal to Consumers

According to the findings of the questionnaire survey, when consumers make purchases

at shopping sites, they are easily lured by special offers to buy products outside their

intended purchases. 48% of respondents said that in order to take advantage of coupons

offered by shopping sites or price cuts on designated products, they would choose other

products in addition to their intended purchases. 42% said they would buy products

outside their planned purchases in order to bring their total order up to the amount

entitled to free delivery. The survey also found that only 15% of the respondents

indicated that they would not be lured by promotional gimmicks offered by shopping

sites.

China’s Middle-Class Consumers: Online Shopping Habits

4

The survey shows that female consumers are more easily encouraged to buy products

outside their planned purchases by the promotional gimmicks of online stores. 48% of

female respondents would buy products outside their planned purchases in order to

qualify for free delivery, a percentage markedly higher than the 36% of their male

counterparts. 38% of female respondents are attracted by “guess what you like” products

offered by shopping sites while only 32% of the male respondents respond to such

promotions. However, it is interesting to note that just 18% of the male respondents said

they would only buy the brands and products that they had planned to do – only 11% of

their female counterparts would do similar.

China’s Middle-Class Consumers: Online Shopping Habits

5

High-income households are more likely to be lured by online data analysis and targeted

product promotions. 50% of those with a monthly household income of over RMB40,000

agree that they would be attracted by “guess what you like” products offered on shopping

sites, while 39% said they would be attracted by products similar to their planned

purchases. Both of those figures are higher than the overall average. However, only 35%

of the respondents with a monthly household income of over RMB40,000 said that they

would buy products outside their planned purchases in order to qualify for free delivery.

Penchant for Trying New Mobile Apps

According to the survey, consumers like to try new mobile apps on their smartphone. In

the last six months, the respondents installed an average of 11.6 mobile apps on their

smartphone. However, they don’t necessarily keep those apps very long. Of those 11.6

apps, on average only 7.4 apps still remain, a retention rate of merely 63%. Men tend to

install new mobile apps more often than women. In the six months preceding the survey,

male respondents installed an average of 12.5 new mobile apps on their smartphone,

while the figure for females was 10.8. There was no apparent difference in mobile app

retention rates between the two genders.

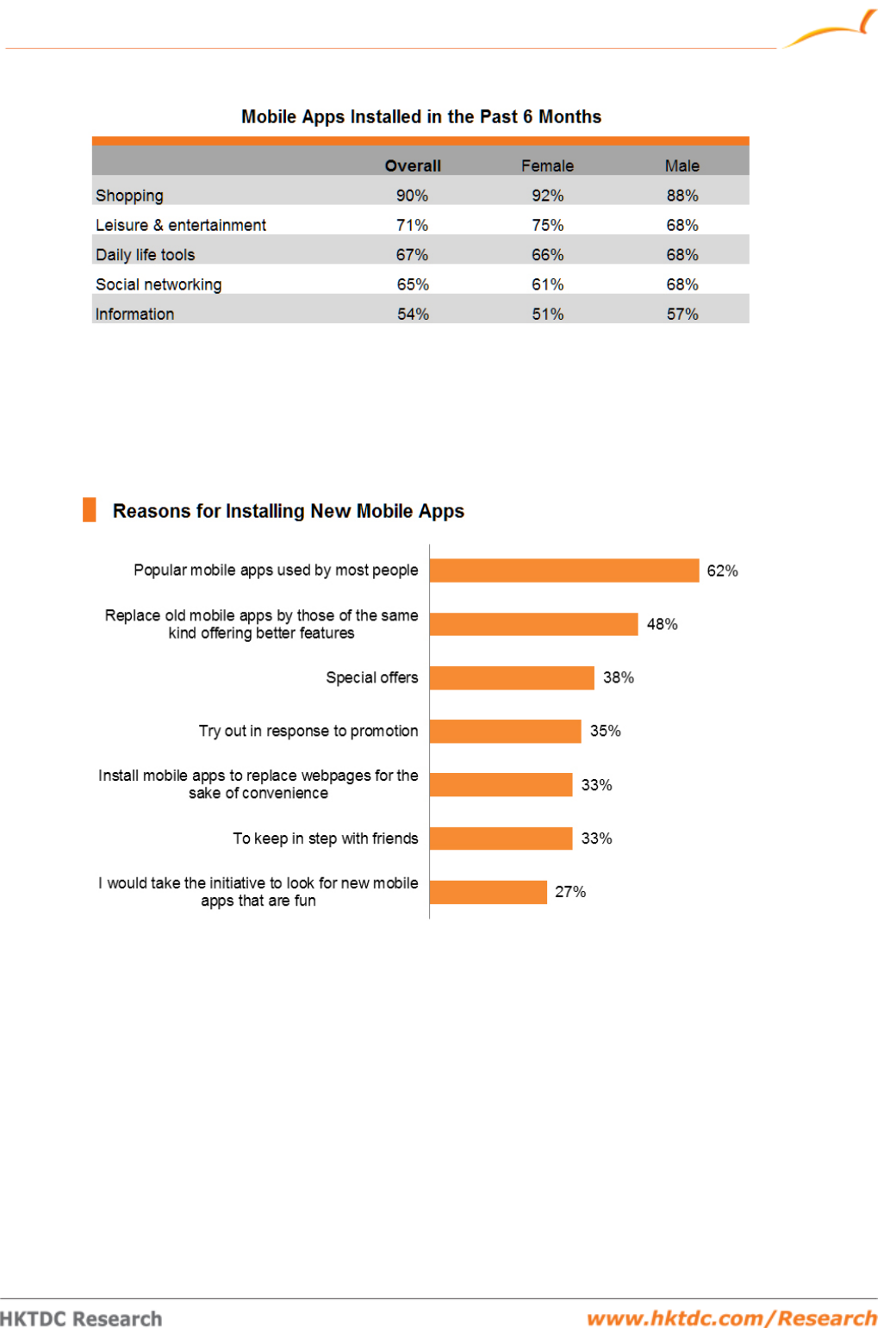

Among the different mobile apps, shopping apps have the highest installation rate,

topping the list at 90%, followed by leisure and entertainment apps at 71%. Female

respondents favoured shopping and leisure and entertainment apps while male

respondents leant more towards social networking and information apps.

China’s Middle-Class Consumers: Online Shopping Habits

6

The most important reason given for installing a new app is that it is popular and widely

used. 62% of respondents put this as their primary motive. Female respondents are more

likely to install new mobile apps to take advantage of special offers, while replacing old

apps with better versions is more often given as a reason for installation by males.

WeChat

Moments the Main Connection among Friends

The “mobile lifestyle platform” is the force driving

WeChat Moments

to becoming the

main channel used by mainland middle class to connect with friends. The survey finds

that although 66% of respondents would still share and exchange latest ideas and life

experiences with friends in the form of “face-to-face gathering”, only 15% said this is the

most frequently-used method of communication with friends. 77% said

WeChat Moments

was their most frequently-used form of communication.

China’s Middle-Class Consumers: Online Shopping Habits

7

According to the consumer focus group discussions, exchanging and sharing latest ideas

and life experiences via

WeChat Moments

is the most efficient way of disseminating

information. Respondents made comments such as:

“Moments is the best channel for me to discover new restaurants because (the

information) is shared by people (I) know after they have tried, so there is no bluffing.”

As the information shared on

WeChat Moments

comes from friends, it is considered more

reliable. It travels fast and reaches target audiences. Such information sharing

encourages and attracts people to modulate their behaviour and, in turn, can change and

stimulate their consumption mentality very effectively. This is particularly the case in

some inner circle

WeChat

groups with a high frequency of communication, where

exchanges between people can be non-stop. Information on what products and services

are good or bad can be passed around very quickly, increasing the pressure to buy - or

indeed the resistance against buying.

Sharing on Social Media Can Trigger Impulse to Buy

Social media allows middle-class consumers to express their choices better and position

themselves so that friends around can understand them more easily. According to the

survey, 66% of respondents agreed with the statement that “I would share my views or

daily life experiences so that my friends can understand me better”. The proportion of

respondents with a monthly household income of over RMB40,000 agreeing with this

statement is as high as 73%.

53% of the respondents agreed that “the information shared by friends can trigger my

impulse to buy”. The percentages of female respondents and those on high monthly

incomes agreeing with that statement are even higher, at 58% and 62% respectively. In

view of this, making good use of social media in promotion and disseminating the right

information to target customer groups is a promotion and brand- building strategy that

should not be overlooked.

China’s Middle-Class Consumers: Online Shopping Habits

8

Physical Store Increasingly Being Used as Marketing and Customer Touch Point

How to integrate online and offline sales channels has become a marketing strategy

demanding the attention of industry players. When asked which forms of O2O have been

used in making purchases, 58% of respondents said that they had tried

“choosing/experiencing at physical store first before buying online”, while 55% said they

had tried “choosing the right product online and experiencing it at physical stores before

China’s Middle-Class Consumers: Online Shopping Habits

9

going back online to buy”. This suggests that most of the respondents using these O2O

forms will eventually make their purchases online.

It was found at the focus groups that consumers have developed the habit of visiting

physical stores even after shopping online. If no discounts are offered at the physical

store, they will look and try out products there but will mostly not buy there. Then they

will go online to search and buy products that offer discounts, products available in

overseas purchasing, or similar products. In view of this, “advertising and brand

promotion” is becoming an increasingly important role for physical branded stores.

China’s Middle-Class Consumers: Online Shopping Habits

10

This has important repercussions for the nature of such physical stores. In order to

attract consumers to visit them more frequently, they must pay more attention to their

business format. For instance, “shops using special themes” and “supermarkets focusing

on a particular sector” are the most popular business formats, both of which managed to

attract 53% of the survey’s respondents to visit them more frequently.

As the internet lifestyle continues to be a growing trend, offline experiential stores must

perform the functions of establishing brand image, advancing brand promotion and

providing services in addition to conducting sales. With middle-class consumers becoming

increasingly choosy, ordinary shops are finding that they can no longer satisfy their

requirements. Business operators should devote effort into turning their bricks-and-

mortar stores into venues offering unique experiences with characteristics and a story to

tell. The development and design of physical stores should place emphasis on special

features and target specific consumer groups.

Online shopping sites are set to become important sales channels. However, the strategy

they adopt in order to attract target customers is totally different to that employed by

conventional physical shops. As online products become increasingly diverse, strategies

such as targeted promotions aimed at specific customer groups, effective analysis of

product demands, active interaction with social networking groups, as well as detailed

product information, can help to offer better services to target customers.

Appendix

China’s Middle-Class Consumers: Online Shopping Habits

11

Background

With its high spending power and penchant for consumption, the mainland middle class is

the main target of Hong Kong manufacturers and traders eyeing the mainland market.

HKTDC Research

has carried out several studies on mainland middle-class consumers in

the past for the purpose of tracking and understanding their spending patterns, mentality

and changes in lifestyles in order to provide points of reference for Hong Kong companies

wishing to tap the mainland market.

Apart from trying to discover the general characteristics of middle-class consumption

behaviour, the present survey also explores the impact China’s 13th Five-Year Plan has

on middle-class consumption and way of life. One of the policy directions of the Plan is

promoting new consumption patterns, which includes encouraging the consumption of

green, fashionable and quality products, encouraging the development of custom-made

services to meet the demand for personalisation, expanding service consumption, and

advancing online/offline integration. Moreover, to take into account the post-80s

consumers, who grew up in times when China experienced substantial economic growth

and whose upbringing is very different from that of their parents, efforts were made in

this survey to reflect their consumption characteristics.

Methodology

The survey was carried out in January 2017 in eight mainland cities where a total of

2,000 consumers were polled by online questionnaire. Before conducting the

questionnaire survey, six consumer focus group discussions were held in Shanghai,

Wuhan and Chengdu (two in each city). The objective of the focus group discussions is to

further understand the spending mentality of mainland consumers by way of qualitative

analysis.

China’s Middle-Class Consumers: Online Shopping Habits

12

China’s Middle-Class Consumers: Online Shopping Habits

13

China’s Middle-Class Consumers: Online Shopping Habits

14

[1] See Appendix for details of the survey.

Find this page at

http://economists-pick-research.hktdc.com/business-news/article/Research-Articles/China-s-Middle-Class-

Consumers-Online-Shopping-Habits/rp/en/1/1X000000/1X0AAU8A.htm

Copyright©2017 Hong Kong Trade Development Council. Reproduction in whole or in part without prior

permission is prohibited. While every effort has been made to ensure accuracy, the Hong Kong Trade

Development Council is not responsible for any errors. Views expressed in this report are not necessarily

those of the Hong Kong Trade Development Council.

China’s Middle-Class Consumers: Online Shopping Habits

15