Economy Profile

Canada

Canada

Doing Business

2020

Page 1

Economy Profile of

Canada

Doing Business 2020 Indicators

(in order of appearance in the document)

Starting a business

Procedures, time, cost and paid-in minimum capital to start a limited liability company

Dealing with construction permits

Procedures, time and cost to complete all formalities to build a warehouse and the quality control and safety

mechanisms in the construction permitting system

Getting electricity

Procedures, time and cost to get connected to the electrical grid, and the reliability of the electricity supply and

the transparency of tariffs

Registering property

Procedures, time and cost to transfer a property and the quality of the land administration system

Getting credit

Movable collateral laws and credit information systems

Protecting minority investors

Minority shareholders’ rights in related-party transactions and in corporate governance

Paying taxes

Payments, time, total tax and contribution rate for a firm to comply with all tax regulations as well as postfiling

processes

Trading across borders

Time and cost to export the product of comparative advantage and import auto parts

Enforcing contracts

Time and cost to resolve a commercial dispute and the quality of judicial processes

Resolving insolvency

Time, cost, outcome and recovery rate for a commercial insolvency and the strength of the legal framework for

insolvency

Employing workers

Flexibility in employment regulation and redundancy cost

Canada

Doing Business

2020

Page 2

About Doing Business

The

project provides objective measures of business regulations and their enforcement across 190 economies and selected cities at the subnational and

regional level.

Doing Business

The

project, launched in 2002, looks at domestic small and medium-size companies and measures the regulations applying to them through their life

cycle.

Doing Business

captures several important dimensions of the regulatory environment as it applies to local firms. It provides quantitative indicators on regulation for

starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across

borders, enforcing contracts and resolving insolvency.

also measures features of employing workers. Although

does not present rankings

of economies on the employing workers indicators or include the topic in the aggregate ease of doing business score or ranking on the ease of doing business, it does

present the data for these indicators.

Doing Business

Doing Business Doing Business

By gathering and analyzing comprehensive quantitative data to compare business regulation environments across economies and over time,

encourages

economies to compete towards more efficient regulation; offers measurable benchmarks for reform; and serves as a resource for academics, journalists, private sector

researchers and others interested in the business climate of each economy.

Doing Business

In addition,

offers detailed

, which exhaustively cover business regulation and reform in different cities and regions within a nation.

These studies provide data on the ease of doing business, rank each location, and recommend reforms to improve performance in each of the indicator areas. Selected

cities can compare their business regulations with other cities in the economy or region and with the 190 economies that

has ranked.

Doing Business

subnational studies

Doing Business

The first

study, published in 2003, covered 5 indicator sets and 133 economies. This year’s study covers 11 indicator sets and 190 economies. Most

indicator sets refer to a case scenario in the largest business city of each economy, except for 11 economies that have a population of more than 100 million as of 2013

(Bangladesh, Brazil, China, India, Indonesia, Japan, Mexico, Nigeria, Pakistan, the Russian Federation and the United States) where

also collected data

for the second largest business city. The data for these 11 economies are a population-weighted average for the 2 largest business cities. The project has benefited from

feedback from governments, academics, practitioners and reviewers. The initial goal remains: to provide an objective basis for understanding and improving the

regulatory environment for business around the world.

Doing Business

Doing Business

To learn more about

please visit

Doing Business

doingbusiness.org

Canada

Doing Business

2020

Page 3

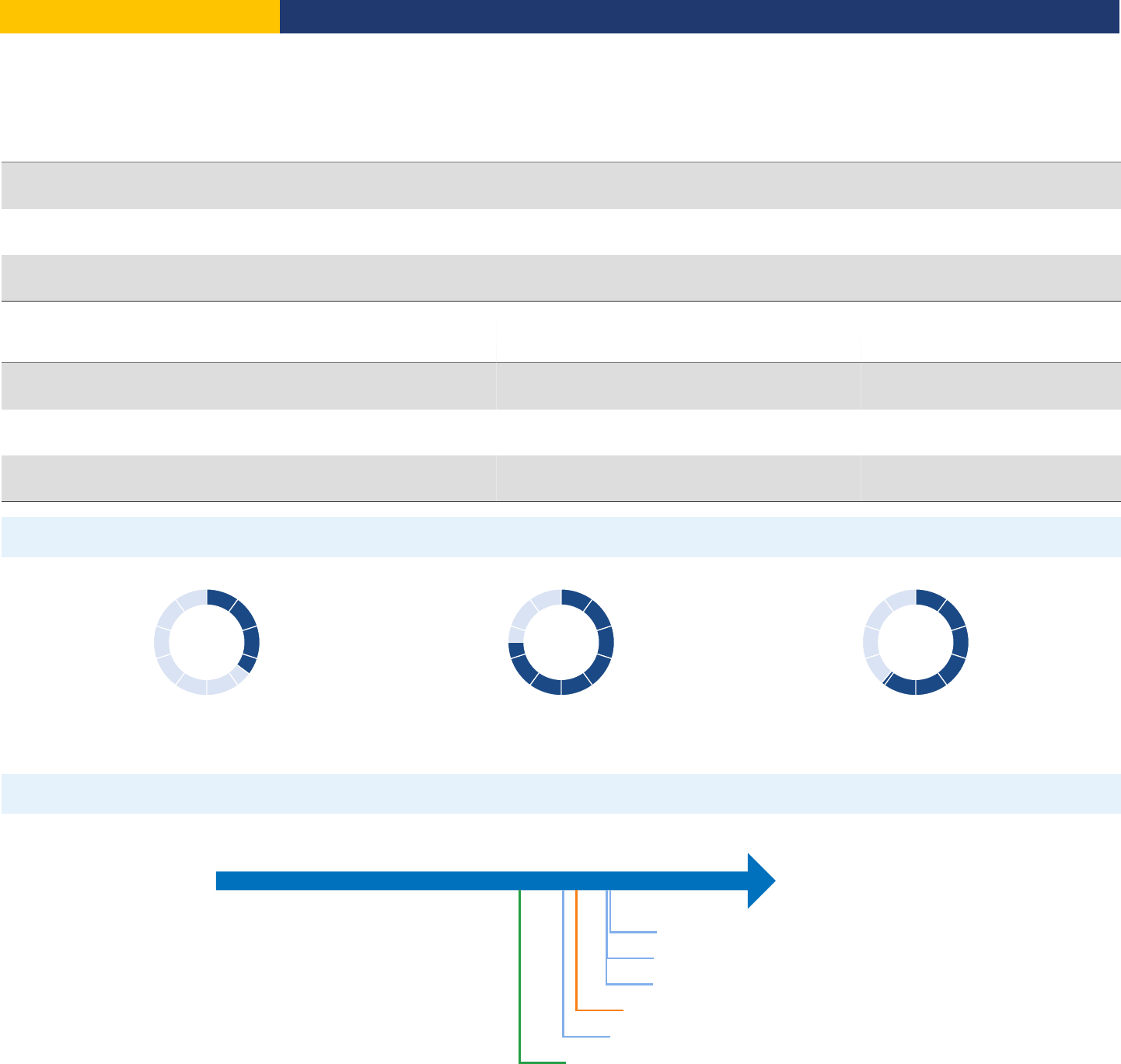

Ease of Doing Business in

Canada

Region

OECD high income

Income Category

High income

Population

37,058,856

City Covered

Toronto

23

DB RANK DB SCORE

79.6

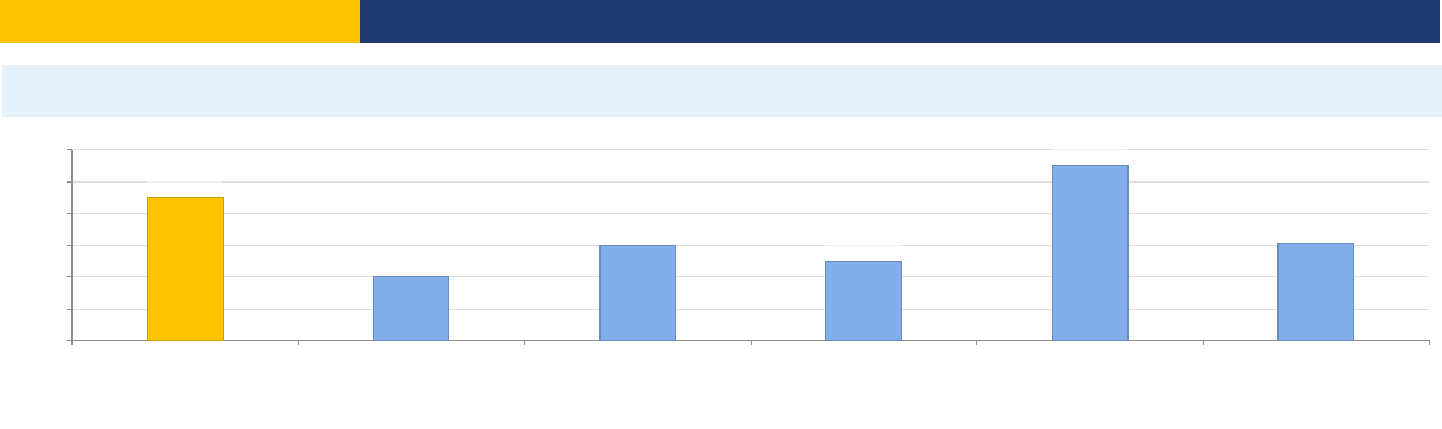

Rankings on Doing Business topics -

Canada

3

64

124

36

15

7

19

51

100

13

Starting

a

Business

Dealing

with

Construction

Permits

Getting

Electricity

Registering

Property

Getting

Credit

Protecting

Minority

Investors

Paying

Taxes

Trading

across

Borders

Enforcing

Contracts

Resolving

Insolvency

Topic Scores

98.2 73.0 63.8 77.8 85.0 84.0 88.1 88.4 57.1 81.0

(rank)

Starting a Business

3

Score of starting a business (0-100)

98.2

Procedures (number)

2

Time (days)

1.5

Cost (number)

0.3

Paid-in min. capital (% of income per capita)

0.0

(rank)

Dealing with Construction Permits

64

Score of dealing with construction permits (0-100)

73.0

Procedures (number)

12

Time (days)

249

Cost (% of warehouse value)

1.8

Building quality control index (0-15)

14.0

(rank)

Getting Electricity

124

Score of getting electricity (0-100)

63.8

Procedures (number)

7

Time (days)

137

Cost (% of income per capita)

116.9

Reliability of supply and transparency of tariff index (0-8)

6

(rank)

Registering Property

36

Score of registering property (0-100)

77.8

Procedures (number)

5

Time (days)

4

Cost (% of property value)

3.8

Quality of the land administration index (0-30)

21.5

(rank)

Getting Credit

15

Score of getting credit (0-100)

85.0

Strength of legal rights index (0-12)

9

Depth of credit information index (0-8)

8

Credit registry coverage (% of adults)

0.0

Credit bureau coverage (% of adults)

100.0

(rank)

Protecting Minority Investors

7

Score of protecting minority investors (0-100)

84.0

Extent of disclosure index (0-10)

8.0

Extent of director liability index (0-10)

9.0

Ease of shareholder suits index (0-10)

9.0

Extent of shareholder rights index (0-6)

4.0

Extent of ownership and control index (0-7)

6.0

Extent of corporate transparency index (0-7)

6.0

(rank)

Paying Taxes

19

Score of paying taxes (0-100)

88.1

Payments (number per year)

8

Time (hours per year)

131

Total tax and contribution rate (% of profit)

24.5

Postfiling index (0-100)

73.2

(rank)

Trading across Borders

51

Score of trading across borders (0-100)

88.4

Time to export

Documentary compliance (hours)

1

Border compliance (hours)

2

Cost to export

Documentary compliance (USD)

156

Border compliance (USD)

167

Time to export

Documentary compliance (hours)

1

Border compliance (hours)

2

Cost to export

Documentary compliance (USD)

163

Border compliance (USD)

172

(rank)

Enforcing Contracts

100

Score of enforcing contracts (0-100)

57.1

Time (days)

910

Cost (% of claim value)

22.3

Quality of judicial processes index (0-18)

11.0

(rank)

Resolving Insolvency

13

Score of resolving insolvency (0-100)

81.0

Recovery rate (cents on the dollar)

86.7

Time (years)

0.8

Cost (% of estate)

7.0

Outcome (0 as piecemeal sale and 1 as going

concern)

1

Strength of insolvency framework index (0-16)

11.0

Canada

Doing Business

2020

Page 4

Starting a Business

This topic measures the number of procedures, time, cost and paid-in minimum capital requirement for a small- to medium-sized limited liability company to start up and

formally operate in each economy’s largest business city.

To make the data comparable across 190 economies,

uses a standardized business that is 100% domestically owned, has start-up capital equivalent to

10 times the income per capita, engages in general industrial or commercial activities and employs between 10 and 50 people one month after the commencement of

operations, all of whom are domestic nationals. Starting a Business considers two types of local limited liability companies that are identical in all aspects, except that one

company is owned by 5 married women and the other by 5 married men. The ranking of economies on the ease of starting a business is determined by sorting their

scores for starting a business. These scores are the simple average of the scores for each of the component indicators.

Doing Business

The most recent round of data collection for the project was completed in May 2019.

.

See the methodology for more information

What the indicators measure

Procedures to legally start and formally operate a company

(number)

Preregistration (for example, name verification or reservation,

notarization)

•

Registration in the economy’s largest business city

•

Postregistration (for example, social security registration,

company seal)

•

Obtaining approval from spouse to start a business or to leave

the home to register the company

•

Obtaining any gender specific document for company

registration and operation or national identification card

•

Time required to complete each procedure (calendar days)

Does not include time spent gathering information

•

Each procedure starts on a separate day (2 procedures cannot

start on the same day)

•

Procedures fully completed online are recorded as ½ day

•

Procedure is considered completed once final document is

received

•

No prior contact with officials

•

Cost required to complete each procedure (% of income per

capita)

Official costs only, no bribes

•

No professional fees unless services required by law or

commonly used in practice

•

Paid-in minimum capital (% of income per capita)

•

Funds deposited in a bank or with third party before registration

or up to 3 months after incorporation

Case study assumptions

To make the data comparable across economies, several assumptions about the business and the

procedures are used. It is assumed that any required information is readily available and that the

entrepreneur will pay no bribes.

The business:

-Is a limited liability company (or its legal equivalent). If there is more than one type of limited

liability company in the economy, the limited liability form most common among domestic firms is

chosen. Information on the most common form is obtained from incorporation lawyers or the

statistical office.

-Operates in the economy’s largest business city. For 11 economies the data are also collected for

the second largest business city.

-Performs general industrial or commercial activities such as the production or sale to the public of

goods or services. The business does not perform foreign trade activities and does not handle

products subject to a special tax regime, for example, liquor or tobacco. It is not using heavily

polluting production processes.

-Does not qualify for investment incentives or any special benefits.

-Is 100% domestically owned.

-Has five business owners, none of whom is a legal entity. One business owner holds 30% of the

company shares, two owners have 20% of shares each, and two owners have 15% of shares

each.

-Is managed by one local director.

-Has between 10 and 50 employees one month after the commencement of operations, all of them

domestic nationals.

-Has start-up capital of 10 times income per capita.

-Has an estimated turnover of at least 100 times income per capita.

-Leases the commercial plant or offices and is not a proprietor of real estate.

-Has an annual lease for the office space equivalent to one income per capita.

-Is in an office space of approximately 929 square meters (10,000 square feet).

-Has a company deed that is 10 pages long.

The owners:

-Have reached the legal age of majority and are capable of making decisions as an adult. If there

is no legal age of majority, they are assumed to be 30 years old.

-Are in good health and have no criminal record.

-Are married, the marriage is monogamous and registered with the authorities.

-Where the answer differs according to the legal system applicable to the woman or man in

question (as may be the case in economies where there is legal plurality), the answer used will be

the one that applies to the majority of the population.

Canada

Doing Business

2020

Page 5

Starting a Business - Canada

Figure – Starting a Business in Canada – Score

Procedures

94.1

Time

99.0

Cost

99.8

Paid-in min. capital

100.0

Figure – Starting a Business in Canada and comparator economies – Ranking and Score

DB 2020 Starting a Business Score

0 100

98.2: Canada (Rank: 3)

93.1: France (Rank: 37)

91.6: United States (Rank: 55)

91.3: Regional Average (OECD high income)

86.1: Japan (Rank: 106)

83.7: Germany (Rank: 125)

Note: The ranking of economies on the ease of starting a business is determined by sorting their scores for starting a business. These scores are the simple average of

the scores for each of the component indicators.

Standardized Company

Legal form

Private Corporation

Paid-in minimum capital requirement

No minimum

City Covered

Toronto

Indicator

Canada

OECD high income

Best Regulatory Performance

Procedure – Men (number)

2

4.9

1 (2 Economies)

Time – Men (days)

1.5

9.2

0.5 (New Zealand)

Cost – Men (% of income per capita)

0.3

3.0

0.0 (2 Economies)

Procedure – Women (number)

2

4.9

1 (2 Economies)

Time – Women (days)

1.5

9.2

0.5 (New Zealand)

Cost – Women (% of income per capita)

0.3

3.0

0.0 (2 Economies)

Paid-in min. capital (% of income per capita)

0.0

7.6

0.0 (120 Economies)

Canada

Doing Business

2020

Page 6

Figure – Starting a Business in Canada – Procedure, Time and Cost

This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.

*

Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows the

time for women. For more information on methodology, see the

website (

). For details on the procedures

reflected here, see the summary below.

Doing Business

http://doingbusiness.org/en/methodology

Procedures (number)

1 2

0

0.2

0.4

0.6

0.8

1

1.2

1.4

Time (days)

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

Cost (% of income per capita)

Time (days) Cost (% of income per capita)

Canada

Doing Business

2020

Page 7

Details – Starting a Business in Canada – Procedure, Time and Cost

Takes place simultaneously with previous procedure.

No.

Procedures

Time to Complete

Associated Costs

1

File for federal incorporation and provincial registration via the online Electronic Filing

Centre

: Innovation, Science and Economic Development Canada

Agency

To file for incorporation electronically (via Online Filing Centre), the cost is CAD 200. There is no

fee for the provincial registration in Ontario. Electronic filing for incorporating a business is 1 day

and the Business Number is sent to the company within 5 days.

The following documents are required to file for federal incorporation and provincial registration:

1. Form 1: Articles of Incorporation

2. Form 2: Initial Registered Office Address and First Board of Directors

3. Provincial registration form.

While extra-provincial registration in Ontario, Newfoundland and Labrador, Nova Scotia and

Saskatchewan can be done at the same time when the documents for federal incorporation are

filed (via Joint Online Registration System), generally, a federal company that intends to conduct

business in other Canadian province would need to register in that province individually. See, for

example, Part 11 of the Business Corporations Act (British Columbia).

Four incorporation options available:

1. Incorporation of a numbered name corporation, e.g. 1234567 Canada Inc.

If the company is incorporating under a name, rather than a number, a name search report must

be obtained at a cost of CAD 13.8. The search report and articles must be filed within 90 days of

the production of the name search report.

2. Incorporation of a corporation with a name pre-approved by Corporations Canada (a NUANS®

search in electronic format is required to accompany the submission) or

3. Incorporation of a corporation where name approval is to be sought (a NUANS® search in

electronic format is required to accompany the submission);

4. Incorporation of a numbered name corporation that has been pre-reserved.

It is a same day service, if you submit the forms online prior to 1PM, the incorporation certificate

should be provided on the same day by 5PM.

Once a corporation is created, the corporation's information is transmitted to the Canada Revenue

Agency which then transmits back the Business Number with the corporate income tax account

number. This number can be accessed within a day from the online database of federal

corporations on Industry Canada's website.

1 day

CAD 200

2

Register for GST/HST

: Canada Revenue Agency

Agency

All private corporations with turnover of over 30,000 CAD of taxable supplies per quarter must

register for the VAT –referred to as Goods and Services Tax (GST)/Harmonized Sales Tax (HST) –

with Canada Revenue Agency (CRA). The company must register within 29 days after a sale is

made other than as a small supplier. In order to register with CRA, corporations must provide the

Name, phone number, and the Social Insurance Number (SIN) of at least one owner/director of

the business and the Business Address and Major Business Activity (MBA) when registering.

Registration can be done online at http://www.cra-arc.gc.ca/menu-eng.html - at no cost.

less than one day (online

procedure)

no charge

Canada

Doing Business

2020

Page 8

Dealing with Construction Permits

This topic tracks the procedures, time and cost to build a warehouse—including obtaining necessary the licenses and permits, submitting all required notifications,

requesting and receiving all necessary inspections and obtaining utility connections. In addition, the Dealing with Construction Permits indicator measures the building

quality control index, evaluating the quality of building regulations, the strength of quality control and safety mechanisms, liability and insurance regimes, and professional

certification requirements. The most recent round of data collection was completed in May 2019.

See the methodology for more information

What the indicators measure

Procedures to legally build a warehouse (number)

Submitting all relevant documents and obtaining all necessary

clearances, licenses, permits and certificates

•

Submitting all required notifications and receiving all necessary

inspections

•

Obtaining utility connections for water and sewerage

•

Registering and selling the warehouse after its completion

•

Time required to complete each procedure (calendar days)

Does not include time spent gathering information

•

Each procedure starts on a separate day—though procedures

that can be fully completed online are an exception to this rule

•

Procedure is considered completed once final document is

received

•

No prior contact with officials

•

Cost required to complete each procedure (% of income per

capita)

Official costs only, no bribes

•

Building quality control index (0-15)

Quality of building regulations (0-2)

•

Quality control before construction (0-1)

•

Quality control during construction (0-3)

•

Quality control after construction (0-3)

•

Liability and insurance regimes (0-2)

•

Professional certifications (0-4)

•

Case study assumptions

To make the data comparable across economies, several assumptions about the construction

company, the warehouse project and the utility connections are used.

The construction company (BuildCo):

- Is a limited liability company (or its legal equivalent) and operates in the economy’s largest

business city. For 11 economies the data are also collected for the second largest business city.

- Is 100% domestically and privately owned; has five owners, none of whom is a legal entity. Has a

licensed architect and a licensed engineer, both registered with the local association of architects

or engineers. BuildCo is not assumed to have any other employees who are technical or licensed

experts, such as geological or topographical experts.

- Owns the land on which the warehouse will be built and will sell the warehouse upon its

completion.

The warehouse:

- Will be used for general storage activities, such as storage of books or stationery.

- Will have two stories, both above ground, with a total constructed area of approximately 1,300.6

square meters (14,000 square feet). Each floor will be 3 meters (9 feet, 10 inches) high and will be

located on a land plot of approximately 929 square meters (10,000 square feet) that is 100%

owned by BuildCo, and the warehouse is valued at 50 times income per capita.

- Will have complete architectural and technical plans prepared by a licensed architect. If

preparation of the plans requires such steps as obtaining further documentation or getting prior

approvals from external agencies, these are counted as procedures.

- Will take 30 weeks to construct (excluding all delays due to administrative and regulatory

requirements).

The water and sewerage connections:

- Will be 150 meters (492 feet) from the existing water source and sewer tap. If there is no water

delivery infrastructure in the economy, a borehole will be dug. If there is no sewerage

infrastructure, a septic tank in the smallest size available will be installed or built.

- Will have an average water use of 662 liters (175 gallons) a day and an average wastewater flow

of 568 liters (150 gallons) a day. Will have a peak water use of 1,325 liters (350 gallons) a day and

a peak wastewater flow of 1,136 liters (300 gallons) a day.

- Will have a constant level of water demand and wastewater flow throughout the year; will be 1

inch in diameter for the water connection and 4 inches in diameter for the sewerage connection.

Canada

Doing Business

2020

Page 9

Dealing with Construction Permits - Canada

Figure – Dealing with Construction Permits in Canada – Score

Procedures

72.0

Time

35.7

Cost

90.9

Building quality control index

93.3

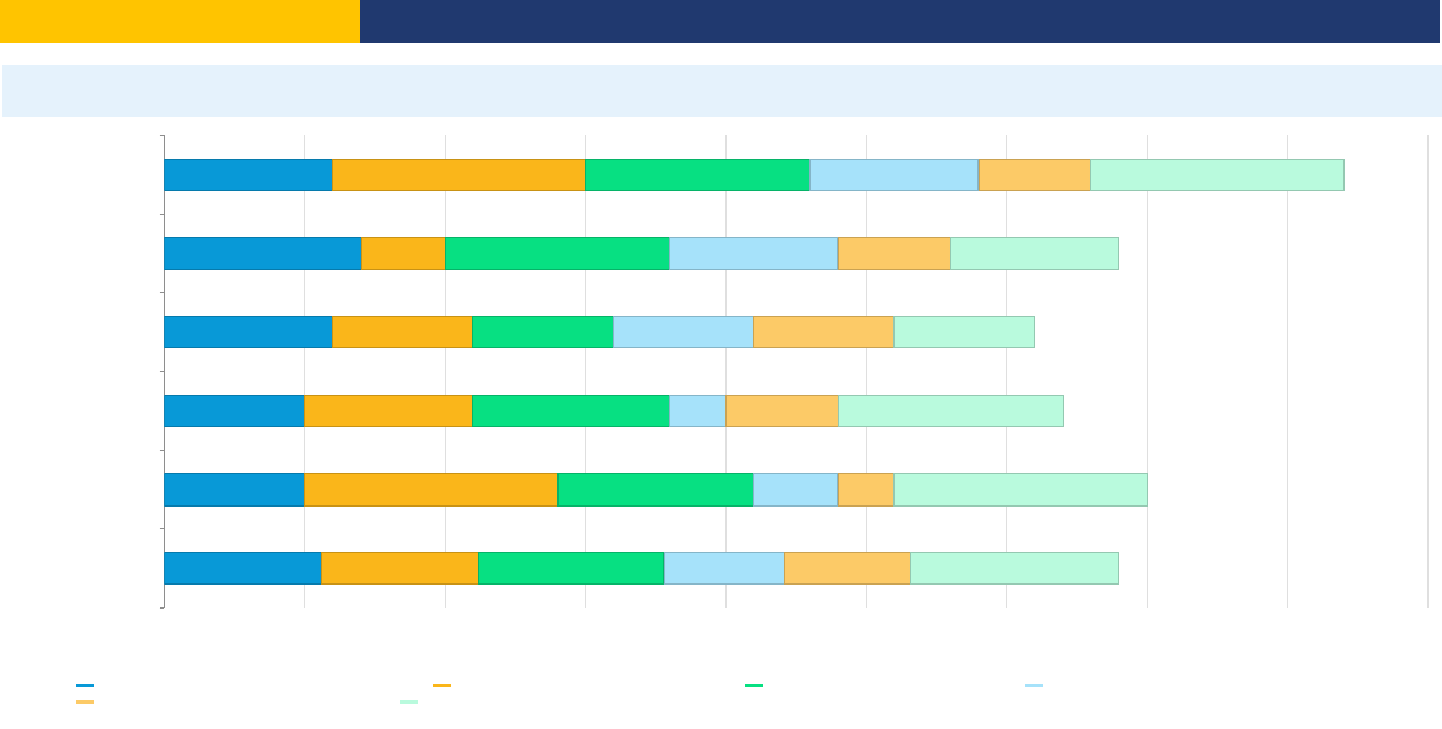

Figure – Dealing with Construction Permits in Canada and comparator economies – Ranking and Score

DB 2020 Dealing with Construction Permits Score

0 100

83.1: Japan (Rank: 18)

80.0: United States (Rank: 24)

78.2: Germany (Rank: 30)

75.6: Regional Average (OECD high income)

74.3: France (Rank: 52)

73.0: Canada (Rank: 64)

Note: The ranking of economies on the ease of dealing with construction permits is determined by sorting their scores for dealing with construction permits. These scores

are the simple average of the scores for each of the component indicators.

Standardized Warehouse

Estimated value of warehouse

CAD 2,951,819.90

City Covered

Toronto

Indicator

Canada

OECD high income

Best Regulatory Performance

Procedures (number)

12

12.7

None in 2018/19

Time (days)

249

152.3

None in 2018/19

Cost (% of warehouse value)

1.8

1.5

None in 2018/19

Building quality control index (0-15)

14.0

11.6

15.0 (6 Economies)

Canada

Doing Business

2020

Page 10

Figure – Dealing with Construction Permits in Canada – Procedure, Time and Cost

This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.

*

Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows the

time for women. For more information on methodology, see the

website (

). For details on the procedures

reflected here, see the summary below.

Doing Business

http://doingbusiness.org/en/methodology

Procedures (number)

1 * 2 3 4 5 6 7 8 9 10 11 12

0

50

100

150

200

Time (days)

0

0.2

0.4

0.6

0.8

1

1.2

Cost (% of warehouse value)

Time (days) Cost (% of warehouse value)

Canada

Doing Business

2020

Page 11

Figure – Dealing with Construction Permits in Canada and comparator economies – Measure of Quality

Canada France Germany Japan United

States

OECD

high

income

0

2

4

6

8

10

12

14

16

Index score

14.0

13.0

9.5

13.0

12.4

11.6

Details – Dealing with Construction Permits in Canada – Procedure, Time and Cost

No.

Procedures

Time to Complete

Associated Costs

1

Undergo preliminary project review with the Municipal Authority

: Toronto Municipal Authority

Agency

The Preliminary Project Review is a review of a proposal to determine its compliance with the

city’s zoning bylaw.

30 days

CAD 547

2

Apply and obtain a zoning certificate

: Chief Building Controller

Agency

Under Chapter 363-3.1 of the Toronto Municipal Code, a zoning certificate is mandatory prior to

requesting a building permit. The zoning certificate costs 25% of the total prescribed building

permit fee. Once the application has been received and payment is made, the application will be

circulated to city divisions and external agencies for detailed technical review and comments.

Within 30 days of payment of the application fee, a written notice will be provided to the applicant

with regards to the completeness or incompleteness of the application, and the applicant will be

assigned a STAR stream and application file number.

30 days

CAD 3,716

3

Obtain site plan approval from the Municipal Authority

: Toronto Municipal Authority

Agency

A pre-consultation with City Staff (Planning Department) is advised. This step will help save time

later on in the process. Several documents are needed in this application, including Site Plans,

Floor Plans, Elevations, and SWM Plan

Site Plan Control is legislated under Section 41 the Ontario Planning Act and allows the City to

review and control important aspects of a proposed project, for example, the site of buildings,

landscaping, pedestrian access, parking, exterior design and appearance, storm water

management and waste disposal.

The municipality forwards the site plan to the fire department for approval. On some occasions, a

City councilor will get involved in the review of the site plan and community consultation may be

requested by the planner. The process can take anywhere from 3 month to 9 months depending

on the complexity of the site plan, political interests, and on how often the applicant needs to

revise the plan to meet the City's desired revisions. Once approved, the City often has conditions

that need to be met before building permit can be obtained.

180 days

CAD 31,042

4

Obtain building permit

: Toronto Municipal Authority

Agency

The building permit is issued by the City of Toronto. BuildCo must post the building permit on the

construction site. In certain cases, the process of reviewing the building permit application can be

started by the City before the site plan is approved. The City can issue a temporary building permit

at that time. However, the final building permit cannot be issued before the site approval is

granted. The building permit and the site plan approval are granted by different municipal

departments. The site plan approval entails verifying planning compliance with the city bylaws (for

instance, if enough parking spaces are included in the plans). In contrast, the building permit

application review analyzes technical issues.

The Ontario Building Code requires that on top of including all design plans and plot information,

one must include a form ensuring energy efficiency, completed by the architect, mechanical

designer, and electrical designer.

This price includes the cost of the application intake, review, and inspection activities.

15 days

CAD 11,149

5

Request and receive foundation work inspection

: Toronto Municipal Authority

Agency

Building inspectors review projects during key stages of construction to ensure that work complies

with the building code and approved plans. Inspectors may visit several times, depending on the

project; they must be able to see the part of the work under inspection. Inspectors require a

minimum of 48 hours notice to book an inspection.

1 day

no charge

Canada

Doing Business

2020

Page 12

Takes place simultaneously with previous procedure.

6

Request and receive frame inspection

: Toronto Municipal Authority

Agency

To conduct a frame inspection, building inspectors review projects during key stages of

construction. This is required to ensure that the work complies with the building code and

approved plans. Inspectors may visit several times, depending on the project; they must be able to

see the part of the work under inspection. Inspectors require a minimum of 48 hours notice to

book an inspection.

1 day

no charge

7

Request and receive drainage inspection

: Toronto Municipal Authority

Agency

Building inspectors review projects during key stages of construction. This is required to ensure

that work complies with the building code and approved plans. Inspectors may visit several times,

depending on the project; they must be able to see the part of the work under inspection.

Inspectors require a minimum of 48 hours notice to book an inspection. Inspection is done upon

completion, before back filling and ready for testing.

1 day

no charge

8

Request and receive sanitary inspection

: Toronto Municipal Authority

Agency

Building inspectors review projects during key stages of construction. This is required to ensure

that work complies with the building code and approved plans. Inspectors may visit several times,

depending on the project; they must be able to see the part of the work under inspection.

Inspectors require a minimum of 48 hours notice to book an inspection. Inspection is done upon

completion, before back filling and ready for testing.

1 day

no charge

9

Request and receive plumbing inspection

: Toronto Municipal Authority

Agency

Building inspectors review projects during key stages of construction. This is required to ensure

that work complies with the building code and approved plans. Inspectors may visit several times,

depending on the project; they must be able to see the part of the work under inspection.

Inspectors require a minimum of 48 hours notice to book an inspection. Inspection is done upon

completion, before back filling and ready for testing.

1 day

no charge

10

Obtain water and sewer service connections

: Toronto Water: Water Renewal Division

Agency

This procedure can only be completed after the site plan approval has been granted. The City has

implemented a process in 2008 by which the connection work is carried out by any one of 8 listed

contractors. Once the application has been submitted, the City sends out a Request for

Quotations (RFQ) from the contractors. The desired contractor is chosen based on the list of

quotes and a deposit is collected.

Toronto Water estimates the costs by tendering the job to a roster of approved City of Toronto

contractors. The costs are later communicated to the applicant, who is required to pay all fees in

advance of construction. Once the work is complete, the actual costs will be determined.

14 days

CAD 7,500

11

Request and receive fire department inspection

: Fire Department, Toronto Municipal Authority

Agency

The fire department inspector conducts this inspection.

3 days

no charge

12

Receive final inspection and occupancy permit

: Toronto Municipal Authority

Agency

The building inspector conducts the final inspection.

1 day

no charge

Canada

Doing Business

2020

Page 13

Details – Dealing with Construction Permits in Canada – Measure of Quality

Answer

Score

Building quality control index (0-15)

14.0

Quality of building regulations index (0-2)

2.0

How accessible are building laws and regulations in your economy? (0-1)

Available online; Free

of charge.

1.0

Which requirements for obtaining a building permit are clearly specified in the building regulations or on any

accessible website, brochure or pamphlet? (0-1)

List of required

documents; Fees to

be paid; Required

preapprovals.

1.0

Quality control before construction index (0-1)

1.0

Which third-party entities are required by law to verify that the building plans are in compliance with existing

building regulations? (0-1)

Licensed architect;

Licensed engineer.

1.0

Quality control during construction index (0-3)

2.0

What types of inspections (if any) are required by law to be carried out during construction? (0-2)

Inspections at various

phases.

1.0

Do legally mandated inspections occur in practice during construction? (0-1)

Mandatory

inspections are

always done in

practice.

1.0

Quality control after construction index (0-3)

3.0

Is there a final inspection required by law to verify that the building was built in accordance with the approved

plans and regulations? (0-2)

Yes, final inspection

is done by

government agency.

2.0

Do legally mandated final inspections occur in practice? (0-1)

Final inspection

always occurs in

practice.

1.0

Liability and insurance regimes index (0-2)

2.0

Which parties (if any) are held liable by law for structural flaws or problems in the building once it is in use

(Latent Defect Liability or Decennial Liability)? (0-1)

Architect or engineer;

Construction

company; Owner or

investor.

1.0

Which parties (if any) are required by law to obtain an insurance policy to cover possible structural flaws or

problems in the building once it is in use (Latent Defect Liability Insurance or Decennial Insurance)? (0-1)

Architect or engineer;

Construction

company; Owner or

investor; Insurance is

commonly taken in

practice.

1.0

Professional certifications index (0-4)

4.0

What are the qualification requirements for the professional responsible for verifying that the architectural plans

or drawings are in compliance with existing building regulations? (0-2)

Minimum number of

years of experience;

University degree in

architecture or

engineering; Being a

registered architect or

engineer; Passing a

certification exam.

2.0

What are the qualification requirements for the professional who supervises the construction on the ground? (0-

2)

Minimum number of

years of experience;

University degree in

engineering,

construction or

construction

management; Being

a registered architect

or engineer; Passing

a certification exam.

2.0

Canada

Doing Business

2020

Page 14

Getting Electricity

This topic measures the procedures, time and cost required for a business to obtain a permanent electricity connection for a newly constructed warehouse. Additionally,

the reliability of supply and transparency of tariffs index measures reliability of supply, transparency of tariffs and the price of electricity. The most recent round of data

collection for the project was completed in May 2019.

.

See the methodology for more information

What the indicators measure

Procedures to obtain an electricity connection (number)

Submitting all relevant documents and obtaining all necessary

clearances and permits

•

Completing all required notifications and receiving all necessary

inspections

•

Obtaining external installation works and possibly purchasing

material for these works

•

Concluding any necessary supply contract and obtaining final

supply

•

Time required to complete each procedure (calendar days)

Is at least 1 calendar day

•

Each procedure starts on a separate day

•

Does not include time spent gathering information

•

Reflects the time spent in practice, with little follow-up and no

prior contact with officials

•

Cost required to complete each procedure (% of income per

capita)

Official costs only, no bribes

•

Value added tax excluded

•

The reliability of supply and transparency of tariffs index (0-8)

Duration and frequency of power outages (0–3)

•

Tools to monitor power outages (0–1)

•

Tools to restore power supply (0–1)

•

Regulatory monitoring of utilities’ performance (0–1)

•

Financial deterrents limiting outages (0–1)

•

Transparency and accessibility of tariffs (0–1)

•

Price of electricity (cents per kilowatt-hour)*

Price based on monthly bill for commercial warehouse in case

study

•

*Note:

measures the price of electricity, but it is

not included in the ease of doing business score nor in the ranking

on the ease of getting electricity.

Doing Business

Case study assumptions

To make the data comparable across economies, several assumptions about the warehouse, the

electricity connection and the monthly consumption are used.

The warehouse:

- Is owned by a local entrepreneur and is used for storage of goods.

- Is located in the economy’s largest business city. For 11 economies the data are also collected for

the second largest business city.

- Is located in an area where similar warehouses are typically located and is in an area with no

physical constraints. For example, the property is not near a railway.

- Is a new construction and is being connected to electricity for the first time.

- Has two stories with a total surface area of approximately 1,300.6 square meters (14,000 square

feet). The plot of land on which it is built is 929 square meters (10,000 square feet).

The electricity connection:

- Is a permanent one with a three-phase, four-wire Y connection with a subscribed capacity of 140-

kilo-volt-ampere (kVA) with a power factor of 1, when 1 kVA = 1 kilowatt (kW).

- Has a length of 150 meters. The connection is to either the low- or medium-voltage distribution

network and is either overhead or underground, whichever is more common in the area where the

warehouse is located and requires works that involve the crossing of a 10-meter road (such as by

excavation or overhead lines) but are all carried out on public land. There is no crossing of other

owners’ private property because the warehouse has access to a road.

- Does not require work to install the internal wiring of the warehouse. This has already been

completed up to and including the customer’s service panel or switchboard and the meter base.

The monthly consumption:

- It is assumed that the warehouse operates 30 days a month from 9:00 a.m. to 5:00 p.m. (8 hours

a day), with equipment utilized at 80% of capacity on average and that there are no electricity cuts

(assumed for simplicity reasons) and the monthly energy consumption is 26,880 kilowatt-hours

(kWh); hourly consumption is 112 kWh.

- If multiple electricity suppliers exist, the warehouse is served by the cheapest supplier.

- Tariffs effective in January of the current year are used for calculation of the price of electricity for

the warehouse. Although January has 31 days, for calculation purposes only 30 days are used.

Canada

Doing Business

2020

Page 15

Getting Electricity - Canada

Figure – Getting Electricity in Canada – Score

Procedures

33.3

Time

48.3

Cost

98.6

Reliability of supply and transparency of

tariff index

75.0

Figure – Getting Electricity in Canada and comparator economies – Ranking and Score

DB 2020 Getting Electricity Score

0 100

98.8: Germany (Rank: 5)

93.2: Japan (Rank: 14)

92.0: France (Rank: 17)

85.9: Regional Average (OECD high income)

82.2: United States (Rank: 64)

63.8: Canada (Rank: 124)

Note: The ranking of economies on the ease of getting electricity is determined by sorting their scores for getting electricity. These scores are the simple average of the

scores for all the component indicators except the price of electricity.

Figure – Getting Electricity in Canada – Procedure, Time and Cost

This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.

*

Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows the

time for women. For more information on methodology, see the

website (

). For details on the procedures

Doing Business

http://doingbusiness.org/en/methodology

Procedures (number)

1 2 3 4 * 5 * 6 7

0

20

40

60

80

100

120

Time (days)

0

10

20

30

40

50

60

70

80

Cost (% of income per capita)

Time (days) Cost (% of income per capita)

Standardized Connection

Name of utility

Toronto Hydro

Price of electricity (US cents per kWh)

12.3

City Covered

Toronto

Indicator

Canada

OECD high income

Best Regulatory Performance

Procedures (number)

7

4.4

3 (28 Economies)

Time (days)

137

74.8

18 (3 Economies)

Cost (% of income per capita)

116.9

61.0

0.0 (3 Economies)

Reliability of supply and transparency of tariff index (0-8)

6

7.4

8 (26 Economies)

Canada

Doing Business

2020

Page 16

reflected here, see the summary below.

Figure – Getting Electricity in Canada and comparator economies – Measure of Quality

Canada France Germany Japan United

States

OECD

high

income

0

1

2

3

4

5

6

7

8

9

Index score

6

8 8 8

7

7.4

Canada

Doing Business

2020

Page 17

Details – Getting Electricity in Canada – Procedure, Time and Cost

No.

Procedures

Time to Complete

Associated Costs

1

Submit application to Toronto Hydro and await comments on proposal

: Toronto Hydro

Agency

An application for an electrical connection can be submitted through a written request by letter or

email.

Required documents:

(1). Architectural, electrical, mechanical drawings (2). Survey plan and site plan (3).Locations of

other services, gas, telephone, water, cable (4) required in-service date, proposed service

entrance equipment, rated capacity and voltage rating, metering requirements and proposed load.

At this point Toronto Hydro requests for a preliminary design deposit based on ($10,000 per MVA

of load) which is put towards the cost of the job once it proceeds.

15 calendar days

CAD 1,400

2

Await completion and approval of project design

: Contractor

Agency

The customer's electrical consultant prepares the design of service entrance requirement. The

electrical design has to be approved by the Electrical Safety Authority. Usually the approval is

obtained by the electrical consultant/hired electrical design firm.

13 calendar days

CAD 2,125

3

Submit final design to Toronto Hydro and await offer to connect

: Toronto Hydro

Agency

The customer’s private consultants will provide Toronto Hydro with the final design drawings and

requirements. Toronto Hydro prepares an Offer to Connect, which includes the connection

charges and schedule of work. During this time Toronto Hydro will check for feeder capacity,

prepares the design scope and cost, and present the customer with an offer to connect.

The OTC outlines the cost of the project and the responsibilities of each party.

After the Offer to Connect is issued, the applicant must sign and comply with all the conditions in

the OTC before any further work can be completed, which includes payments.

An external inspection is performed by the utility to prepare the offer to connect and the technical

study. No one from the applicant's party is present during the inspection. Toronto Hydro submits

an Offer to Connect to the customer within 60 days of the request (all information required from

the customer must be submitted).

22 calendar days

CAD 0

4

Await completion of external works by Toronto Hydro

: Toronto Hydro

Agency

After the estimate has been issued a part of the external connection works are carried out by

Toronto Hydro. The works will most likely include the following: (a) Extend the overhead primary

feeder cables down the street by installing a new pole line up to the point that is in line with the

customer's building. (b) From an overhead feeder install a primary riser switch and fusing at the

pole. (c) Construct underground ducts from the base of the pole up to the customer’s property line.

(d) Install underground primary cable from the riser switch to the padmounted structure. (e) Install

padmounted transformer. (f) Make primary and secondary connection at padmounted transformer.

The connection fees paid to Toronto Hydro include: engineering design, labor, material,

equipment, overhead costs (including administration and inspection). The utility will obtain an

excavation permit for the part of the work which is their responsibility.

Toronto Hydro performs an economic evaluation on the "expansion" portion of the connection and

the forecasted revenue of connecting this customer. In this case, the customer will have to provide

a security deposit known as an Expansion Deposit. This expansion deposit will be returned to the

customer, if the customer reaches its demand of 140 kVA within the first five years (i.e. after each

year a portion of the expansion deposit will be given back relative to the demand realized). For the

case study, the customer will receive the full amount back after the first year of operation.

80 calendar days

CAD 44,363

5

Await completion of external works by contractor

: Contractor

Agency

While Toronto Hydro finishes its part of the connection works an electrical contractor proceeds

with his part of the works. The contractor's work includes: a) Install padmounted structure on

customer property. (b) Construct underground ducts from padmounted structure to join ducts

provided by Toronto Hydro at property line and construct ducts underground from padmounted

structure to Customer building. (c) Install secondary cable from padmounted transformer to

building.

14 calendar days

CAD 20,500

6

Await and receive inspection of internal wiring

: Electrical Safety Authority

Agency

An inspection of internal wiring is required and can be performed by the Electrical Safety Authority

at any time during rough in and final stages of the process so there are at least two inspections of

the internal wiring. The inspection would be performed by the Electrical Safety Authority, who in

turn would submit a "Turn On Notice" to Toronto Hydro. This allows Toronto Hydro to provide the

final connection of power to the facility in question.

1 calendar day

CAD 650

7

Await final inspection, meter installation and final connection

: Toronto Hydro

Agency

Once Toronto Hydro receives the connection authorization, the final inspection is performed during

meter installation and the final connection can be made. There is no separate supply contract to

be signed. The supply contract is signed at the same time as the connection contract in one

contract.

7 calendar days

CAD 0

Canada

Doing Business

2020

Page 18

Takes place simultaneously with previous procedure.

Canada

Doing Business

2020

Page 19

Details – Getting Electricity in Canada – Measure of Quality

Note:

If the duration and frequency of outages is 100 or less, the economy is eligible to score on the Reliability of supply and transparency of tariff index.

If the duration and frequency of outages is not available, or is over 100, the economy is not eligible to score on the index.

If the minimum outage time considered for SAIDI/SAIFI is over 5 minutes, the economy is not eligible to score on the index.

Answer

Reliability of supply and transparency of tariff index (0-8)

6

Total duration and frequency of outages per customer a year (0-3)

2

System average interruption duration index (SAIDI)

1.0

System average interruption frequency index (SAIFI)

1.5

What is the minimum outage time (in minutes) that the utility considers for the calculation of SAIDI/SAIFI

1.0

Mechanisms for monitoring outages (0-1)

1

Does the distribution utility use automated tools to monitor outages?

Yes

Mechanisms for restoring service (0-1)

1

Does the distribution utility use automated tools to restore service?

Yes

Regulatory monitoring (0-1)

1

Does a regulator—that is, an entity separate from the utility—monitor the utility’s performance on reliability of supply?

Yes

Financial deterrents aimed at limiting outages (0-1)

0

Does the utility either pay compensation to customers or face fines by the regulator (or both) if outages exceed a certain cap?

No

Communication of tariffs and tariff changes (0-1)

1

Are effective tariffs available online?

Yes

Link to the website, if available online

https://www.torontohydro.

com/for-business/rates

Are customers notified of a change in tariff ahead of the billing cycle?

Yes

Canada

Doing Business

2020

Page 20

Registering Property

This topic examines the steps, time and cost involved in registering property, assuming a standardized case of an entrepreneur who wants to purchase land and a

building that is already registered and free of title dispute. In addition, the topic also measures the quality of the land administration system in each economy. The quality

of land administration index has five dimensions: reliability of infrastructure, transparency of information, geographic coverage, land dispute resolution, and equal access

to property rights. The most recent round of data collection for the project was completed in May 2019.

.

See the methodology for more information

What the indicators measure

Procedures to legally transfer title on immovable property

(number)

Preregistration procedures (for example, checking for liens,

notarizing sales agreement, paying property transfer taxes)

•

Registration procedures in the economy's largest business city.

•

Postregistration procedures (for example, filling title with

municipality)

•

Time required to complete each procedure (calendar days)

Does not include time spent gathering information

•

Each procedure starts on a separate day - though procedures

that can be fully completed online are an exception to this rule

•

Procedure is considered completed once final document is

received

•

No prior contact with officials

•

Cost required to complete each procedure (% of property

value)

Official costs only (such as administrative fees, duties and

taxes).

•

Value Added Tax, Capital Gains Tax and illicit payments are

excluded

•

Quality of land administration index (0-30)

Reliability of infrastructure index (0-8)

•

Transparency of information index (0–6)

•

Geographic coverage index (0–8)

•

Land dispute resolution index (0–8)

•

Equal access to property rights index (-2–0)

•

Case study assumptions

To make the data comparable across economies, several assumptions about the parties to the

transaction, the property and the procedures are used.

The parties (buyer and seller):

- Are limited liability companies (or the legal equivalent).

- Are located in the periurban (that is, on the outskirts of the city but still within its official limits)

area of the economy’s largest business city. For 11 economies the data are also collected for the

second largest business city.

- Are 100% domestically and privately owned.

- Perform general commercial activities.

The property (fully owned by the seller):

- Has a value of 50 times income per capita, which equals the sale price.

- Is fully owned by the seller.

- Has no mortgages attached and has been under the same ownership for the past 10 years.

- Is registered in the land registry or cadastre, or both, and is free of title disputes.

- Is located in a periurban commercial zone (that is, on the outskirts of the city but still within its

official limits), and no rezoning is required.

- Consists of land and a building. The land area is 557.4 square meters (6,000 square feet). A two-

story warehouse of 929 square meters (10,000 square feet) is located on the land. The warehouse

is 10 years old, is in good condition, has no heating system and complies with all safety standards,

building codes and legal requirements. The property, consisting of land and building, will be

transferred in its entirety.

- Will not be subject to renovations or additional construction following the purchase.

- Has no trees, natural water sources, natural reserves or historical monuments of any kind.

- Will not be used for special purposes, and no special permits, such as for residential use,

industrial plants, waste storage or certain types of agricultural activities, are required.

- Has no occupants, and no other party holds a legal interest in it.

Canada

Doing Business

2020

Page 21

Registering Property - Canada

Figure – Registering Property in Canada – Score

Procedures

66.7

Time

98.6

Cost

74.4

Quality of the land administration index

71.7

Figure – Registering Property in Canada and comparator economies – Ranking and Score

DB 2020 Registering Property Score

0 100

77.8: Canada (Rank: 36)

77.0: Regional Average (OECD high income)

76.9: United States (Rank: 39)

75.6: Japan (Rank: 43)

66.6: Germany (Rank: 76)

63.3: France (Rank: 99)

Note: The ranking of economies on the ease of registering property is determined by sorting their scores for registering property. These scores are the simple average of

the scores for each of the component indicators.

Indicator

Canada

OECD high income

Best Regulatory Performance

Procedures (number)

5

4.7

1 (5 Economies)

Time (days)

4

23.6

1 (2 Economies)

Cost (% of property value)

3.8

4.2

0.0 (Saudi Arabia)

Quality of the land administration index (0-30)

21.5

23.2

None in 2018/19

Canada

Doing Business

2020

Page 22

Figure – Registering Property in Canada – Procedure, Time and Cost

This symbol is shown beside procedure numbers that take place simultaneously with the previous procedure.

*

Note: Online procedures account for 0.5 days in the total time calculation. For economies that have a different procedure list for men and women, the graph shows the

time for women. For more information on methodology, see the

website (

). For details on the procedures

reflected here, see the summary below.

Doing Business

http://doingbusiness.org/en/methodology

Procedures (number)

1 * 2 * 3 * 4 5

0

0.5

1

1.5

2

2.5

3

3.5

4

Time (days)

0

0.5

1

1.5

2

2.5

3

3.5

4

Cost (% of property value)

Time (days) Cost (% of property value)

Canada

Doing Business

2020

Page 23

Figure – Registering Property in Canada and comparator economies – Measure of Quality

Canada France Germany Japan United

States

OECD

high

income

0

5

10

15

20

25

30

Index score

21.5

24.0

23.0

25.5

17.6

23.2

Details – Registering Property in Canada – Procedure, Time and Cost

No.

Procedures

Time to Complete

Associated Costs

1

Obtain tax clearance and utility certificate from the Municipality

: Municipality

Agency

The parties must show reasonable evidence to the title insurance company that the property is

clear of tax obligations. A written tax clearance certificate should be obtained from the Municipality.

It can be obtained online, and the applicant will receive the certificate by email after two business

days. The certificate will need to show the latest tax receipts including the amount of current year

taxes and whether all taxes are paid to date. Verbal confirmation that real property taxes have

been paid will also suffice. To confirm verbally that the real property taxes have been paid, a Tax

Certificate must be requested and paid for, and in most cases, it commonly takes more than 1

business day to process. Real property taxes are required to be paid up to the date of the transfer

of the property.

At the same time, a utility clearance certificate is obtained online to confirm balance owing on a

utility account.

2 days

CAD 121.46; (CAD 68.65

Tax clearance certificate

CAD 52.81 Utility

clearance certificate)

2

Obtain a copy of parcel register and search for writs

: Land registry

Agency

A copy of Parcel Register and search for Writs filed against the seller are obtained online through

service providers.

Less than one day,

online

CAD 41.13; (CAD 30.05

(Parcel Register)

CAD 11.80 (Search for

Writs))

3

Obtain a status certificate for the selling corporation

: Provincial government

Agency

The buyer's solicitor obtains a Status Certificate from the provincial government or the federal

government.

1 day

CAD 40; (CAD 26 (the fee

of status certificate in case

of the province of Ontario)

CAD 14 (the service

provider fee, the fee differs

by providers))

4

Conduct title search

: Teraview

Agency

Depending on whether the property is located in a jurisdiction governed by the Land Titles Act or

the Registry Act or by electronic registration, in the absence of title insurance, a simple title search

will cost CAD 2,000, and more difficult searches can cost CAD 10,000 or more.

In terms of additional investigations: (a) an environmental report would cost between CAD 1,500

to CAD 3,000; (b) a building inspection would take 10 to 21 days and would cost CAD 2,500 to

CAD 10,000; and (c) a zoning review by a planning consultant would take between 1 day and 14

days and would cost between CAD 2,000 and CAD 10,000.

Title insurance can be obtained for CAD 0.75/CAD 1000 of the purchase price if the purchase

price is CAD 2,000,000 or more and for CAD 0.80/CAD 1000 of the purchase price if the purchase

price is less than CAD 2,000,000.

2 days

CAD 2,000

Canada

Doing Business

2020

Page 24

Takes place simultaneously with previous procedure.

5

Registration of the transfer of title

: Purchaser's solicitor or Land registry

Agency

After the agreement has been prepared and the transaction closed, the parties’ solicitors will

complete the registration for transfer of title. Electronic registration governs more than 90% of

properties in Toronto. In the electronic registration regime, the transfer is registered electronically

by an authorized licensee at the offices of the purchaser’s solicitor. Only authorized licensees

have access to the electronic registration system for security reasons.

The payment of registration fee and the Land Transfer Tax is done electronically if it is in the

electronic regime. Solicitor’s fees for their representation in the whole process are estimated at

CAD 6,000 (CAD 3,500 for the buyer’s solicitor and CAD 2,500 for the seller’s solicitor).

Notification of change of ownership to assessment department and utility companies can be done

the same day immediately after closing but should be arranged before closing to ensure continuity

of services.

Less than one day,

online

CAD 111,178.83; (CAD

76.55 (electronic

registration fee) +

Provincial Land Transfer

Tax + Municipal Land

Transfer Tax + CAD 79.5

(Municipal administrative

fee)

Provincial Land Transfer

Tax is calculated through a

progressive scale:

For a property valued

under CAD 55,000: 0.5%

From CAD 55,000, up to

and including CAD

250,000: 1.0%

From CAD 250,000, up to

and including CAD

400,000: 1.5%

Over CAD 400,000: 2.0%

Municipal Land Transfer

Tax for the City of Toronto

is calculated through the

following scheme plus an

administration fee of CAD

79.05

For a property valued

under CAD 55,000: 0.5%

From CAD 55,000, up to

and including CAD

250,000: 1.0%

From CAD 250,000, up to

and including CAD

400,000: 1.5%

Over CAD 400,000: 2.0%)

Canada

Doing Business

2020

Page 25

Details – Registering Property in Canada – Measure of Quality

Answer

Score

Quality of the land administration index (0-30)

21.5

Reliability of infrastructure index (0-8)

7.0

Type of land registration system in the economy:

Title Registration

System

What is the institution in charge of immovable property registration?

Toronto Land

Registry Office

In what format are past and newly issued land records kept at the immovable property registry of the largest

business city of the economy —in a paper format or in a computerized format (scanned or fully digital)?

Computer/Fully digital

2.0

Is there a comprehensive and functional electronic database for checking for encumbrances (liens, mortgages,

restrictions and the like)?

Yes

1.0

Institution in charge of the plans showing legal boundaries in the largest business city:

Toronto Land

Registry Office

In what format are past and newly issued cadastral plans kept at the mapping agency of the largest business

city of the economy—in a paper format or in a computerized format (scanned or fully digital)?

Computer/Scanned

1.0

Is there an electronic database for recording boundaries, checking plans and providing cadastral information

(geographic information system)?

Yes

1.0

Is the information recorded by the immovable property registration agency and the cadastral or mapping agency

kept in a single database, in different but linked databases or in separate databases?

Different databases

but linked

1.0

Do the immovable property registration agency and cadastral or mapping agency use the same identification

number for properties?

Yes

1.0

Transparency of information index (0–6)

3.0

Who is able to obtain information on land ownership at the agency in charge of immovable property registration

in the largest business city?

Freely accessible by

anyone

1.0

Is the list of documents that are required to complete any type of property transaction made publicly available–

and if so, how?

Yes, online

0.5

Link for online access:

https://www.teraview.

ca/wp-

content/uploads/2017

/12/ERPG-V12-2017-

Final-English-1.pdf

Is the applicable fee schedule for any type of property transaction at the agency in charge of immovable

property registration in the largest business city made publicly available–and if so, how?

Yes, online

0.5

Link for online access:

https://www.ontario.c

a/land-

registration/land-

services-fee-

changes-2018

https://www.teraview.

ca/en/mltt-calculator/

https://www.teraview.

ca/en/pltt-calculator/

https://www.teraview.

ca/en/teraview-

pricing/

Does the agency in charge of immovable property registration agency formally commit to deliver a legally

binding document that proves property ownership within a specific timeframe –and if so, how does it

communicate the service standard?

No

0.0

Link for online access:

Is there a specific and independent mechanism for filing complaints about a problem that occurred at the agency

in charge of immovable property registration?

No

0.0

Contact information:

Are there publicly available official statistics tracking the number of transactions at the immovable property

registration agency?

No

0.0

Canada

Doing Business

2020

Page 26

Number of property transfers in the largest business city in 2018:

Who is able to consult maps of land plots in the largest business city?

Freely accessible by

anyone

0.5

Is the applicable fee schedule for accessing maps of land plots made publicly available—and if so, how?

Yes, online

0.5

Link for online access:

http://www.teraview.c

a/en/teraview-pricing/

Does the cadastral/mapping agency formally specifies the timeframe to deliver an updated cadastral plan—and

if so, how does it communicate the service standard?

No

0.0

Link for online access:

Is there a specific and independent mechanism for filing complaints about a problem that occurred at the

cadastral or mapping agency?

No

0.0

Contact information:

Geographic coverage index (0–8)

6.0

Are all privately held land plots in the largest business city formally registered at the immovable property

registry?

Yes

2.0

Are all privately held land plots in the economy formally registered at the immovable property registry?

Yes

2.0

Are all privately held land plots in the largest business city mapped?

Yes

2.0

Are all privately held land plots in the economy mapped?

No

0.0

Land dispute resolution index (0–8)

5.5

Does the law require that all property sale transactions be registered at the immovable property registry to make

them opposable to third parties?

Yes

1.5

Legal basis:

The Land Titles Act

Is the system of immovable property registration subject to a state or private guarantee?

Yes

0.5

Type of guarantee:

Private guarantee

(Title insurance, etc.)

Legal basis:

The Land Titles Act

Is there a is a specific, out-of-court compensation mechanism to cover for losses incurred by parties who

engaged in good faith in a property transaction based on erroneous information certified by the immovable

property registry?

Yes

0.5

Legal basis:

By the Government of

Ontario

Does the legal system require a control of legality of the documents necessary for a property transaction (e.g.,

checking the compliance of contracts with requirements of the law)?

Yes

0.5

If yes, who is responsible for checking the legality of the documents?

Registrar; Notary;

Does the legal system require verification of the identity of the parties to a property transaction?

Yes

0.5

If yes, who is responsible for verifying the identity of the parties?

Registrar; Notary;

Lawyer;

Is there a national database to verify the accuracy of government issued identity documents?

No

0.0

What is the Court of first instance in charge of a case involving a standard land dispute between two local

businesses over tenure rights for a property worth 50 times gross national income (GNI) per capita and located

in the largest business city?

Superior Court of

Justice

How long does it take on average to obtain a decision from the first-instance court for such a case (without

appeal)?

Between 1 and 2

years

2.0

Are there publicly available statistics on the number of land disputes at the economy level in the first instance

court?

No

0.0

Number of land disputes in the economy in 2018:

Equal access to property rights index (-2–0)

0.0

Do unmarried men and unmarried women have equal ownership rights to property?

Yes

Canada

Doing Business

2020

Page 27

Do married men and married women have equal ownership rights to property?

Yes

0.0

Canada

Doing Business

2020

Page 28

Getting Credit

This topic explores two sets of issues—the strength of credit reporting systems and the effectiveness of collateral and bankruptcy laws in facilitating lending. The most

recent round of data collection for the project was completed in May 2019.

.

See the methodology for more information

What the indicators measure

Strength of legal rights index (0–12)

Rights of borrowers and lenders through collateral laws (0-10)

•

Protection of secured creditors’ rights through bankruptcy laws

(0-2)

•

Depth of credit information index (0–8)

Scope and accessibility of credit information distributed by

credit bureaus and credit registries (0-8)

•

Credit bureau coverage (% of adults)

Number of individuals and firms listed in largest credit bureau

as a percentage of adult population

•

Credit registry coverage (% of adults)

Number of individuals and firms listed in credit registry as a

percentage of adult population

•

Case study assumptions

assesses the sharing of credit information and the legal rights of borrowers and

lenders with respect to secured transactions through 2 sets of indicators. The depth of credit

information index measures rules and practices affecting the coverage, scope and accessibility of

credit information available through a credit registry or a credit bureau. The strength of legal rights

index measures the degree to which collateral and bankruptcy laws protect the rights of borrowers

and lenders and thus facilitate lending. For each economy it is first determined whether a unitary

secured transactions system exists. Then two case scenarios, case A and case B, are used to

determine how a nonpossessory security interest is created, publicized and enforced according to

the law. Special emphasis is given to how the collateral registry operates (if registration of security

interests is possible). The case scenarios involve a secured borrower, company ABC, and a

secured lender, BizBank.

Doing Business

In some economies the legal framework for secured transactions will allow only case A or case B

(not both) to apply. Both cases examine the same set of legal provisions relating to the use of

movable collateral.

Several assumptions about the secured borrower (ABC) and lender (BizBank) are used:

- ABC is a domestic limited liability company (or its legal equivalent).

- ABC has up to 50 employees.

- ABC has its headquarters and only base of operations in the economy’s largest business city. For

11 economies the data are also collected for the second largest business city.

- Both ABC and BizBank are 100% domestically owned.

The case scenarios also involve assumptions. In case A, as collateral for the loan, ABC grants

BizBank a nonpossessory security interest in one category of movable assets, for example, its

machinery or its inventory. ABC wants to keep both possession and ownership of the collateral. In

economies where the law does not allow nonpossessory security interests in movable property,

ABC and BizBank use a fiduciary transfer-of-title arrangement (or a similar substitute for

nonpossessory security interests).

In case B, ABC grants BizBank a business charge, enterprise charge, floating charge or any

charge that gives BizBank a security interest over ABC’s combined movable assets (or as much of

ABC’s movable assets as possible). ABC keeps ownership and possession of the assets.

Canada

Doing Business

2020

Page 29

Getting Credit - Canada

Figure – Getting Credit in Canada – Score