TRADITIONAL IRAs

Traditional IRAs are federally allowed accounts

taxpayers may set up to save for retirement.

Contributions to traditional IRAs provide for

federal income tax deductions, however tax-

payers may also make IRA contributions with-

out claiming deductions and when deductions

are not permitted.

Contributions must be made before a taxpayer

becomes 70 ½ years old, and minimum distri-

butions from an IRA are required once a tax-

payer reaches that age. A retired taxpayer

between 59 ½ and 70 ½ years of age may

choose whether or not to receive distributions.

For federal income tax purposes, contributions

to traditional IRAs lower taxable income and

grow tax-free until withdrawn.

ROTH IRAs

Roth IRAs are also federally allowed accounts

taxpayers may set up to save for retirement.

However, contributions to Roth IRAs are not

tax-deductible for federal income tax purposes,

and there is no age limit for making contribu-

tions.

Generally, Roth IRA withdrawals are not taxable

for federal income tax purposes, if the individ-

ual has had the retirement account for more

than five years and has reached 59 ½ years of

age.

What are Pennsylvania’s rules

regarding IRAs?

Following are the most commonly applicable

personal income tax rules with regard to tradi-

tional and Roth IRAs.

•

Contributions are not tax deductible.

•

Withdrawals are generally not taxable after a

taxpayer reaches retirement age and retires.

•

Payments employers make for the

benefit of employees directly to IRA trustees

or issuers may be excluded from

compensation.

•

IRA contributions made by, on behalf of or

attributable to an employee or self-

employed person – regardless of whether

the contributions were made directly or indi-

rectly; through a payroll deduction or a

salary reduction agreement; or otherwise –

may not be excluded or deducted from

income for PA personal income tax

purposes.

•

Income on assets held in an IRA is not

taxable.

•

Distributions can be considered income for

PA personal income tax purposes to the

extent distributions exceed the contributions

to the plan when distributions are made

before the IRA owner reaches 59 ½ years of

age.

•

The cost-recovery method is used to deter-

mine the portion of distributions to be

included in income.

Must all distributions from IRAs be

reported for PA personal income tax

purposes?

Yes. All IRA distributions should be reported on

PA Schedule W-2S, Wage Statement Summary,

whether or not some or all of the distributions

are taxable. If a taxpayer receives distributions

before he/she reaches 59 ½ years of age, some

of the distributions may be taxable. The cost-

recovery method is used to determine the por-

tion of distributions to be included in income.

REV-636 (PO+) 02-18

RETIREMENT

TRADITIONAL IRAs and

ROTH IRAs

Online Customer Service Center

www.revenue.pa.gov

Taxpayer Service & Information Center

Personal Taxes: 717-787-8201

Business Taxes: 717-787-1064

e-Business Center: 717-783-6277

1-888-PATAXES (728-2937)

Touch-tone service is required for this automated

24-hour toll-free line. Call to order forms or check the

status of a personal income tax account or property

tax/rent rebate.

Automated Forms Ordering Message Service

1-800-362-2050

Service for Taxpayers with Special Hearing and/or

Speaking Needs

1-800-447-3020

Call or visit your local

Department of Revenue district office, listed in the

government pages of local telephone directories.

www.revenue.pa.gov

CONTACT INFORMATION

Individual Retirement Accounts (IRAs) are

special accounts that offer tax advantages

to help taxpayers save for retirement.

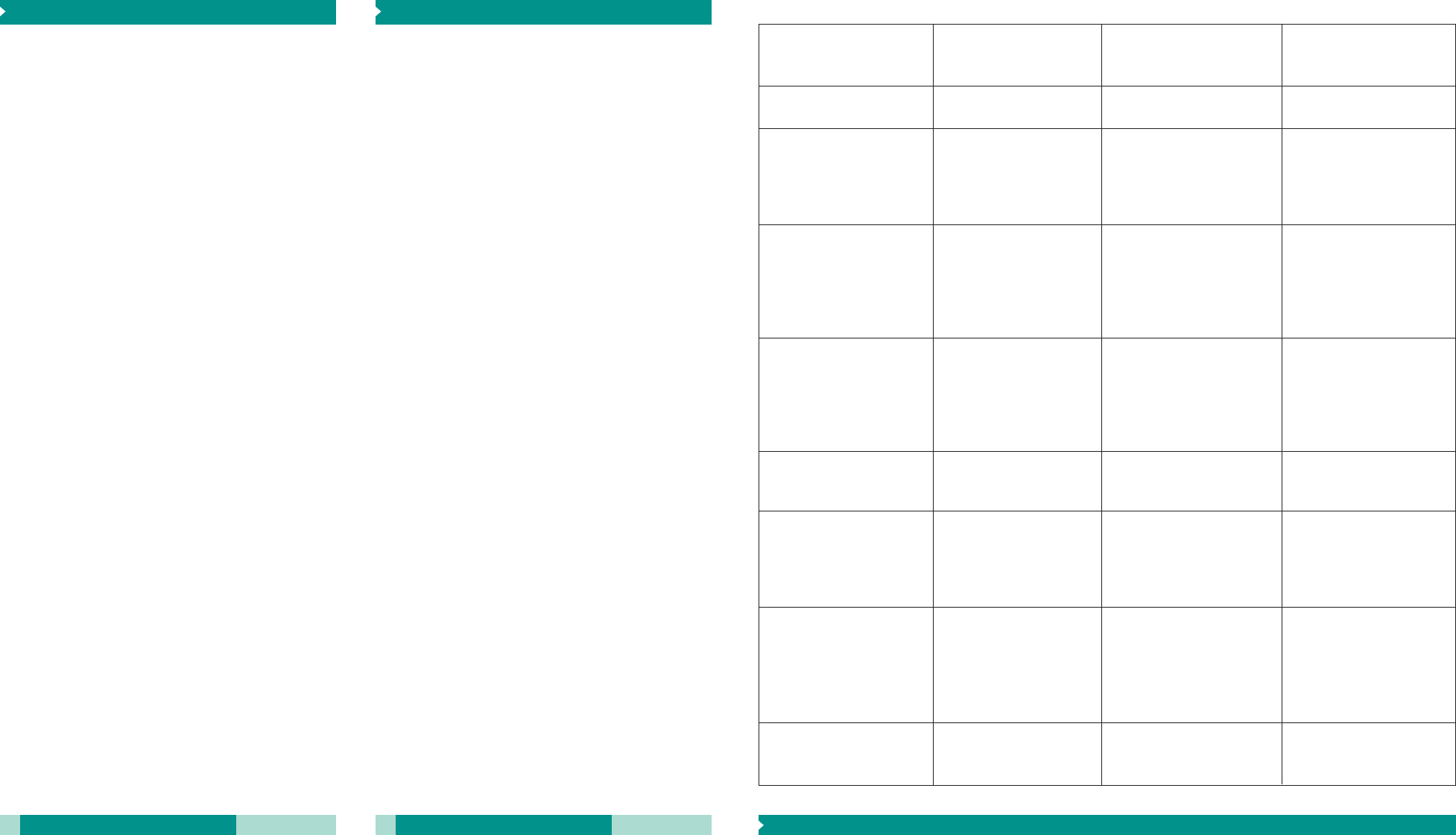

Eligibility All workers under age No age restrictions.

70 ½ at the end of the

year.

Contributions Made with pre-tax Made with after-tax

income. income.

Tax Benefits of Fully deductible if no Not deductible. If con-

Contributions employer retirement plan verting from IRA to Roth

exists. IRA, conversion is gener-

ally taxable for federal

income tax purposes.

Maximum Tax Year: Under Age 50: Same. If you have both

Contribution an IRA and a Roth

(per individual) 2014 $5,500 IRA, the total contribu-

2015 $5,500 tions cannot exceed

2016 $5,500 limits shown at left.

2017 $5,500

Tax Year: Over Age 50: Same. If you have

both an IRA and a

2014 $6,500 Roth IRA, the total

2015 $6,500 contributions cannot

2016 $6,500 exceed limits shown

2017 $6,500 at left.

Rollovers Same. No annual limit on

amount rolled over from

another qualified plan.

Conversion May convert from tradi-

tional IRA to Roth IRA, but

the conversion is generally

subject to federal income

tax.

Earnings/Withdrawals Generally not subject to Qualified distributions

federal income tax until after age 59 ½ are gener-

withdrawn. ally not subject to federal

income tax. Possible

penalty if not in account

for at least five years.

Distributions Before Generally taxable and Earnings generally taxable

Age 59 ½ subject to 10% early and subject to 10% early

withdrawal penalty. withdrawal penalty.

IRA Comparison Reference Traditional IRA Roth IRA

Are there differences between

Pennsylvania and federal tax rules on

roll-over contributions and plan

conversions?

Yes. For federal tax purposes, amounts rolled

over into Roth IRAs from traditional IRAs are

considered income. Similarly, the conversion of

a traditional IRA to a Roth IRA is generally tax-

able for federal income tax purposes.

For Pennsylvania personal income tax purposes,

the following rules apply:

•

Amounts rolled over into IRAs from non-IRA

individual retirement plans are generally

considered income in the distribution year to

the extent the distributions exceed contribu-

tions to the plan.

•

Amounts rolled over into an individual's IRA

from a federally qualified retirement plan

(other than an individual retirement plan)

are generally considered income for the dis-

tribution year to the extent the distributions

exceed contributions to the plan. However,

when a plan allows the distribution to be

paid directly to another federally qualified

retirement plan maintained for the same

owner’s benefit – as a direct trustee-to-

trustee transfer to the IRA – the distribution

is not considered taxable income. Similarly,

when the distribution is paid into the IRA no

later than the 60th day after the day on

which the IRA owner receives payment, the

distribution is not considered taxable

income.

•

The conversion of a traditional IRA to a Roth

IRA is generally not taxable. That is, monies

transferred from a traditional IRA to a Roth

IRA via conversion (whether by a trustee-to-

trustee transfer or a roll-over within 60

days) are generally not subject to

Pennsylvania personal income tax. However,

any amounts transferred from the traditional

IRA that are not put into the Roth IRA, be it

by federal income tax withholding or other-

wise, are subject to Pennsylvania personal

income tax. In such a situation, basis is allo-

cated pro-rata between the taxable distribu-

tion and the non-taxable conversion. If there

is a partial rollover/conversion, the basis in

the traditional IRA must be allocated pro-

rata between the traditional IRA and the

Roth IRA.

What are the PA rules with respect to IRA

distributions to charities or for other non-

retirement purposes?

Charity distributions and other non-retirement

distributions made before the IRA owner retires

from service are considered income for PA per-

sonal income tax purposes, to the extent distri-

butions exceed contributions to the plan.

The cost-recovery method is used to determine

the portion of distributions to be included in

income.

Is there additional information available

regarding PA personal income tax

treatment of IRAs?

Yes. Please refer to Personal Income Tax

Bulletin 2008-1 for additional IRA tax informa-

tion, including details regarding employer-

sponsored plans, investment accounts and

inherited IRAs. The bulletin is available online at

www.revenue.pa.gov

www.revenue.pa.gov

For information regarding Pennsylvania personal income tax rules, see Q&A on reverse.