How-To Guide

SAP Business One 8.82 and higher

Document Version: 1.0 – 2012-09-01

PUBLIC

How to Set Up and Manage Perpetual Inventory

System

All Countries

2

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Typographic Conventions

Typographic Conventions

Type Style

Description

Example

Words or characters quoted from the screen. These include field names, screen titles,

pushbuttons labels, menu names, menu paths, and menu options.

Textual cross-references to other documents.

Example

Emphasized words or expressions.

EXAMPLE

Technical names of system objects. These include report names, program names,

transaction codes, table names, and key concepts of a programming language when they

are surrounded by body text, for example, SELECT and INCLUDE.

Example

Output on the screen. This includes file and directory names and their paths, messages,

names of variables and parameters, source text, and names of installation, upgrade and

database tools.

Example

Exact user entry. These are words or characters that you enter in the system exactly as they

appear in the documentation.

<Example>

Variable user entry. Angle brackets indicate that you replace these words and characters

with appropriate entries to make entries in the system.

E X A M P L E

Keys on the keyboard, for example, F2 or EN T E R .

How to Set Up and Manage Perpetual Inventory System

Table of Contents

PUBLIC

© 2012 SAP AG. All rights reserved.

3

Table of Contents

Introduction ................................................................................................................................................................. 5

Defining Initial Settings ............................................................................................................................................. 6

Initializing a Perpetual Inventory System ........................................................................................................................... 6

Defining Primary G/L Accounts .......................................................................................................................................... 8

Defining an Opening Inventory Account ............................................................................................................................ 11

Defining Item Defaults ........................................................................................................................................................ 12

Defining Warehouses .......................................................................................................................................................... 13

Drop-Ship Warehouses ......................................................................................................................................... 15

Defining a Default Warehouse .............................................................................................................................. 15

Defining Item Groups .......................................................................................................................................................... 17

Perpetual Inventory System by Moving Average ................................................................................................ 20

Overview ............................................................................................................................................................................. 20

Defining Item Cost When Using Moving Average Valuation Method ............................................................................ 20

Examples of Journal Entry Structures When Using the Moving Average Valuation Method ...................................... 22

Sales Documents .................................................................................................................................................. 22

Purchasing Documents ........................................................................................................................................ 24

Special Scenarios for A/P Documents ............................................................................................................... 29

Inventory Transactions ........................................................................................................................................ 34

Perpetual Inventory System by Standard Price .................................................................................................. 38

Overview ............................................................................................................................................................................. 38

Defining Item Cost when Using the Standard Price Valuation Method ........................................................................ 38

Examples of Journal Entry Structures When Using the Standard Price Valuation Method........................................ 39

Sales Documents .................................................................................................................................................. 40

Purchasing Documents ........................................................................................................................................ 42

Special Scenarios for A/P Documents ................................................................................................................47

Inventory Transactions ......................................................................................................................................... 51

Perpetual Inventory System by FIFO .................................................................................................................... 56

Overview ............................................................................................................................................................................. 56

Defining Item Cost When Using FIFO Valuation Method ................................................................................................ 56

Examples of Journal Entry Structures When Using the FIFO Valuation Method .......................................................... 57

Sales Documents .................................................................................................................................................. 58

Purchasing Documents ........................................................................................................................................ 60

Special Scenarios for A/P Documents ............................................................................................................... 64

Inventory Transactions .........................................................................................................................................67

Handling Small Values ............................................................................................................................................. 72

Handling Small Values for All Valuation Methods ............................................................................................................ 72

4

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Table of Contents

Updating Valuation Methods .................................................................................................................................. 74

Revaluing the Inventory ........................................................................................................................................... 76

Printing Inventory Revaluation Documents ..................................................................................................................... 81

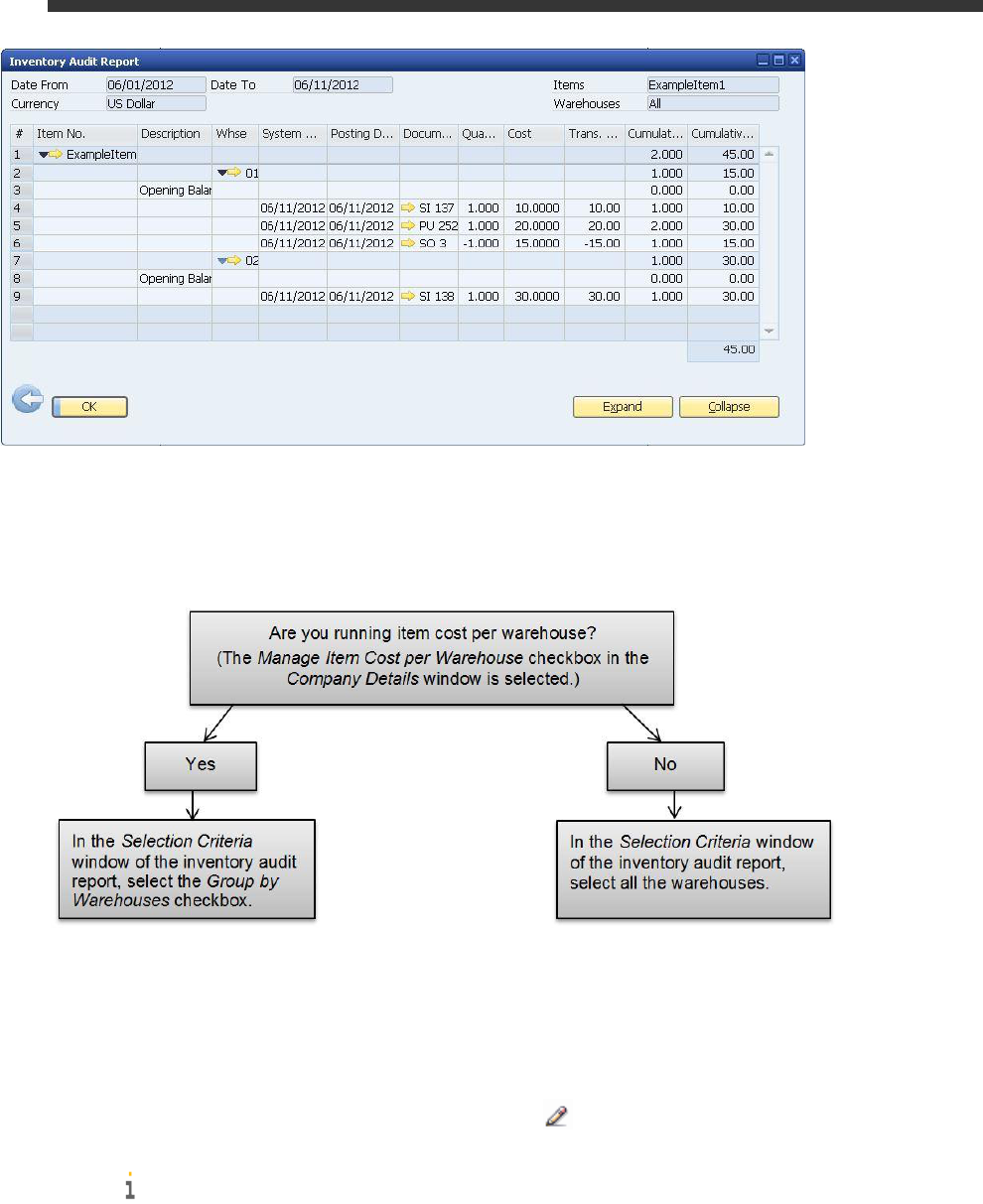

Working with Inventory Audit Reports ..................................................................................................................83

Generating Inventory Audit Reports ................................................................................................................................. 83

Examples of Inventory Audit Reports for Different Calculation Methods ..................................................................... 87

Moving Average ..................................................................................................................................................... 88

Standard Price ....................................................................................................................................................... 89

FIFO 90

Cost of Revaluation Document in Inventory Audit Report .............................................................................................. 91

Unexpected Results in Inventory Audit Report ................................................................................................................ 91

Difference Between Inventory Audit Report and Inventory Account Balance ................................................. 91

Number of Records Returned is Too Large......................................................................................................... 91

Unexpected Results Due to Particular Basic Initial Settings ............................................................................. 91

Working with Inventory Valuation Simulation Reports .......................................................................................95

Working with a Purchase Accounts Posting System .......................................................................................... 99

Defining Purchase Accounts ............................................................................................................................................. 99

Examples for Journal Entry Structures Used When Working with a Purchase Accounts Posting System .............. 100

Goods Receipt POs and A/P Invoices ................................................................................................................ 101

Closing a Goods Receipt PO ............................................................................................................................... 103

Goods Return ....................................................................................................................................................... 104

A/P Credit Memo................................................................................................................................................. 104

Landed Costs ....................................................................................................................................................... 105

Authorizations ......................................................................................................................................................... 107

Database Tables Reference ................................................................................................................................... 108

Copyrights, Trademarks, and Disclaimers .......................................................................................................... 109

How to Set Up and Manage Perpetual Inventory System

Introduction

PUBLIC

© 2012 SAP AG. All rights reserved.

5

Introduction

A perpetual inventory system reflects the value of inventory postings in terms of monetary transactions in the

accounting system. These monetary transactions are carried out only when items defined as inventory items are

received or released from stock.

You should determine a perpetual inventory system during basic initialization, before posting any transactions.

SAP Business One provides the following three valuation methods for calculating the inventory value:

Moving Average – Calculates the average cost for the item in each sales, purchasing, inventory, and production

transaction.

Standard Price – Calculates the inventory value by a fixed price, which is then used for all transactions.

FIFO (First In First Out) – With this method, goods purchased first (or produced first) are sold first, regardless of

the actual goods flow.

o Each inventory receipt transaction creates a layer of quantities linked to costs. A FIFO layer is defined as

the quantity of an item in a warehouse with a particular cost value.

o Each inventory release transaction uses quantities and their corresponding costs from the first open layer

or layers.

When you use a perpetual inventory system, SAP Business One lets you do the following:

Manage the three methods in the same company.

You can select a certain valuation method on the level of item and item group.

Update the valuation method of your items globally. For more information, see Updating Valuation Methods.

Update the calculated item cost for each item, if required. For information, see Revaluing the Inventory.

Note

The SAP Business One 8.8 family release includes enhancements and changes in inventory management

regarding the different valuation methods. The changes are described in this document; however, for

more examples, see the document Enhancements in Inventory Management in the documentation area of

SAP Business One Customer Portal at http://service.sap.com/smb/sbocustomer/documentation.

6

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

Defining Initial Settings

When you decide to use the perpetual inventory system, employees responsible for logistics and accounting must

analyze the accounting transactions carried out in the background for each inventory transaction. You need to

determine special G/L accounts for the inventory transactions. This influences the settings for warehouses and

item groups.

Initializing a Perpetual Inventory System

1. From the SAP Business One Main Menu, choose Administration System Initialization Company Details

Basic Initialization tab.

2. To initialize the perpetual inventory system, select the Use Perpetual Inventory checkbox.

Caution

This selection is irreversible after you create an inventory transaction.

3. In the Item Groups Valuation Method dropdown list, select an inventory valuation method.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

PUBLIC

© 2012 SAP AG. All rights reserved.

7

The default valuation method of new items is taken from their linked item groups, and the valuation method of

new item groups is the method selected in this field.

The cost calculated for the items is in local currency.

Note

You can change the selected valuation method in the Item Groups Valuation Method field at any time;

however, changes apply only to item groups added after the change, not to the ones added before.

4. To manage the cost of items for each warehouse individually, select the Manage Item Cost per Warehouse

checkbox. When this checkbox is deselected, calculating inventory price is combined for all warehouses.

Caution

This selection is irreversible after you create an inventory transaction.

Example

The following example shows the difference between managing the item cost per company and for each

warehouse individually. The moving average valuation method is used.

Transaction

Manage Item Cost per Company

Manage Item Cost per

Warehouse

Item Cost in

Warehouse 1

Item Cost in

Warehouse 2

Goods receipt PO 1

Quantity of 1

Price 10

Warehouse 1

10

10

0

Goods receipt PO 2

Quantity of 1

Price 30

Warehouse 2

20 = (10*1 + 30*1) / 2

10

30

To document your inventory transactions on the expenses side as well as to conduct a perpetual inventory

system, select the Use Purchase Accounts Posting System checkbox. When the checkbox is selected, each journal

entry includes additional rows reflecting the company's expenses. For more information, see Working with a

Purchase Accounts Posting System

Note

o Once you have recorded transactions, you cannot modify this setting.

o This checkbox is not relevant for the US and Canada localizations.

5. To allow items to be included in documents such as deliveries or A/R invoices, even when the item cost has

not been defined, select the Allow Stock Release Without Item Cost checkbox.

6. To save your changes, choose the Update button.

8

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

Defining Primary G/L Accounts

1. From the SAP Business One Main Menu, choose Administration Setup Financials G/L Account

Determination Inventory tab.

2. Define primary G/L accounts to be selected as defaults in new warehouses, item groups, and items master

data. The following table describes the usage of each account:

Type of Account

Description

Inventory Account

Reflects the actual inventory value recorded in any

inbound or outbound inventory transaction, goods

receipt and issue production.

Cost of Goods Sold Account

Used in A/R outbound or inbound transactions to

reflect the actual inventory value of goods sold. In the

case of based A/R returns, it always reflects the COGS

value from the base document.

Allocation Account

A clearing account used as an offsetting account to the

inventory account only on the A/P side (in goods

receipt POs, goods returns, and in A/P credit memos,

A/P invoices based on goods receipt POs). The

balance of this G/L account reflects the total amount

of open goods receipt POs and goods returns

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

PUBLIC

© 2012 SAP AG. All rights reserved.

9

Type of Account

Description

Variance Account (Price Difference Account)

Used only with a standard price valuation method. In

certain scenarios, if there are differences between the

standard price and the actual price in purchasing and

inventory documents, these differences are recorded

in the variance account.

Price Difference Account

Used in purchasing transactions to reflect price

differences between target A/P documents or non-

based returns and insufficient inventory levels or

inventory value. With inventory revaluation, this

account is used for debiting or crediting inventory

value of non-existing inventory quantity, if the current

on-hand quantity is either zero or less than the

quantity that is being revaluated by target A/P

document. Price difference amount is then fully or

proportionally posted to the price difference account.

Negative Inventory Adj. Acct

Used to reflect differences between the static price

and inbound or outbound transactions amounts in the

negative zone. This account replaces the price

difference and the exchange rate differences accounts

while relevant scenarios are done in the negative zone.

In such cases, the moving average or FIFO prices are

held static; SAP Business One saves and uses the last

price for the item before zeroing the stock. The

differences between these prices and inventory values

resulting from the addition of new documents are

posted to this account.

Note

This account is not relevant for the standard

price valuation method.

Caution

From an accounting perspective, we do not

recommend using negative inventory.

However, to use negative inventory, deselect

the Block Negative Inventory checkbox in

Administration System Initialization

Document Settings General tab.

Inventory Offset - Decr. Acct

Used to balance the inventory account in case of

outbound inventory transactions (goods issue,

inventory posting).

Inventory Offset - Incr. Acct

Used to balance the inventory account in case of

inbound inventory transactions (goods receipt,

inventory posting).

10

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

Type of Account

Description

Sales Returns Account

Reflects the actual inventory value recorded in A/R

return documents (excluding A/R credit memo based

on A/R reserve invoice).

Purchase Account / Purchase Returns Account / Cost

of Goods Purchased / Purchase Balance Account

When working with the purchase accounts posting

system, you should define the relevant default

accounts. For more information, see Working with a

Purchase Accounts Posting System.

Exchange Rate Differences Account

Used in purchasing transactions to reflect price

differences caused by changes in the exchange rate

between based A/P invoices and insufficient inventory

levels or values.

In certain scenarios, when you create a target

document based on a base document, a difference in

local currency occurs if the following conditions exist:

The item price is in a foreign currency.

The target document is connected to a different

exchange rate.

That difference is posted to this account.

This account is only used while item has a positive or

zero in-stock quantity (except when processing based

A/P returns and based A/P credit memos in moving

average price valuation method).

Goods Clearing Account

An offsetting account to the allocation and expense

clearing costs, used when closing goods receipt POs or

goods returns. In this case, no inventory entry is

registered, however, a journal entry is created

including this account.

G/L Decrease Account

Used as balancing account when the stock value is

decreased by a material revaluation transaction.

G/L Increase Account

Used as balancing account when the stock value is

increased by a material revaluation transaction.

WIP Inventory Account

An offsetting account to the inventory account used in

the production process; it reflects the value of a

production order during its various stages.

WIP Inventory Variance Account

This account contains the cost of the direct material,

direct labor, and factory overhead placed into the

products on the factory floor. A manufacturer must

disclose in its financial statements the cost of its work

in process as well as the cost of finished goods and on-

hand materials.

Expense Clearing Account

An offsetting account used as a clearing account for

freight charges influencing inventory value against the

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

PUBLIC

© 2012 SAP AG. All rights reserved.

11

Type of Account

Description

inventory account in A/P documents, side by side with

the allocation account (A/P reserve invoice excluded,

the Stock in transit account is used instead).

Stock In Transit Account

Clearing account used as an offsetting account to

the inventory account only in the A/P reserve

invoice and its targets documents). The balance of

this G/L account reflects the total amount of open

A/P reserve invoices.

For examples of usage of the accounts described above, see the following:

Examples of Journal Entry Structures When Using the Moving Average Valuation Method

Examples of Journal Entry Structures When Using the Standard Price Valuation Method

Examples of Journal Entry Structures When Using the FIFO Valuation Method

Note

The sum of the inventory account balance and the sales returns account balance reflects the total value of

the inventory.

Due to various user actions, the total balance of the inventory and sales returns accounts might be different

from the inventory audit report. Those differences can be caused by one of the following scenarios:

o The inventory account is involved in a manual journal entry.

o In a service type document, you use a specific account as the inventory or sales returns account, as well

as another account type (for example, as an allocation account), or as the G/L account.

3. On the Purchasing tab, define an expense and inventory account.

This account is used for items managed by the moving average valuation method to reflect specific amount

differences. Those differences are caused when you manually change prices in A/P credit memos that are based

on A/P invoices.

4. To update changes, choose the Update button.

Defining an Opening Inventory Account

You should create an opening inventory G/L account in the chart of accounts. This G/L account is used as

an offsetting account to the warehouse inventory account to which you enter initial quantities.

1. From the SAP Business One Main Menu, choose Inventory Inventory Transactions Inventory Opening

Balances, Inventory Tracking and Inventory Posting Initial Quantity tab.

2. Specify the selection criteria of items for which you would like to enter initial quantities, and choose the OK

button.

The Initial Quantity window opens.

12

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

3. In the Open Inventory Account field, specify an opening inventory account. The account is automatically

updated in the G/L Account field for all the items you selected. You can manually change the opening

inventory account for each item.

4. To save your changes, choose the Add button.

Note

The opening inventory account should be different from the inventory account. Otherwise, when you

enter an initial quantity, the same account is both credited and debited, producing a zero effect on the

account balance.

Defining Item Defaults

1. From the SAP Business One Main Menu, choose Administration System Initialization General Settings

Inventory tab.

2. In the Item Defaults area, specify the following information:

Field

Activity/Description

Default Warehouse

In the Default Warehouse dropdown list, choose a

default warehouse. This warehouse is used in all new

transactions. When modified, this setting is updated

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

PUBLIC

© 2012 SAP AG. All rights reserved.

13

Field

Activity/Description

immediately per company, for all users

Note

You can also set a default warehouse at the

item level and at the user level. For more

information, see Defining a Default

Warehouse

Set G/L Accounts By

When modified, this setting is updated immediately

per company, for all users.

In the Set G/L Accounts By dropdown list, choose the

method by which you would like to set the G/L

accounts connected to new item records only:

Warehouse

The G/L accounts defined in the Warehouses – Setup

window, located under Administration Setup

Inventory Warehouses Accounting tab.

Item Group

The G/L accounts defined in the Item Groups – Setup

window, located under Administration Setup

Inventory Item Groups Accounting tab.

Item Level

Select this method to define G/L accounts for each

item manually on the Inventory Data tab in the Item

Master Data window.

Note

The list of accounts can be displayed in the

warehouse table. To display the relevant

accounts, click (Form Settings). Those

G/L accounts are enabled only if you choose

the Item Level option.

Auto. Add All Warehouse to New Items

SAP Business One adds all the existing warehouses

to every new item and every new added warehouse to

all the existing items.

Defining Warehouses

To define a new warehouse, do the following:

1. From the SAP Business One Main Menu, choose Administration → Setup → Inventory → Warehouses.

The Warehouses – Setup window appears.

14

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

In the Warehouse Code field, enter the code of the new warehouse. In the Warehouse Name field, enter the name

of the warehouse.

2. On the General tab, view or define the following:

Note

Fields that are self-explanatory are not described in the table below.

Field/Checkbox

Activity/Description

Nettable

This checkbox is selected by default. It enables the

warehouse to be automatically involved in the MRP

process. If you deselect this checkbox and also

deselect the Drop Ship checkbox, you make this

warehouse a non-nettable warehouse.

Drop Ship

This checkbox is enabled only when the Nettable

checkbox is deselected.

Select this option to define the warehouse as a drop-

ship warehouse. A drop-ship warehouse is used when

the company does not manage inventory, but receives

commission for every order.

Note

You cannot change the setting of the Drop

Ship checkbox after a drop-ship warehouse is

recorded in an existing document.

3. On the Accounting tab, you can define the G/L accounts for the item group. The default G/L accounts are

taken from the G/L Account Determination window.

4. Choose the Add button.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

PUBLIC

© 2012 SAP AG. All rights reserved.

15

Drop-Ship Warehouses

Drop shipping entails transferring goods directly from your vendor to your customer without holding the items as

inventory in your warehouses. A drop-ship warehouse does not actually contain items; it is a ‘’virtual’’ warehouse.

The moment the goods ‘’enter’’ the drop-ship warehouse, you ship them to your customer. The system does not

record any inventory postings for documents using this type of warehouse.

To work with drop shipping in SAP Business One, you must create a drop-ship warehouse.

When you work with a perpetual inventory system, documents in which drop-ship warehouses are used create

journal entries that do not reflect the inventory value of the items received or released from a drop-ship

warehouse.

Note

If you manage an item in a drop-ship warehouse as well as in a regular warehouse, inventory postings

occur only when you create documents involving the regular warehouse.

Note

Drop-ship warehouses cannot be used for serial batch numbers and cannot be included in an MRP run.

Defining a Default Warehouse

You can set a default warehouse at three levels:

1. Item level – in the Item Master Data window

2. User level – in the User Defaults window

3. Company level – in the General Settings window (Administration → System Initialization → General Settings →

Inventory tab → Items subtab)

The system takes the default warehouse according to the order above; for a new transaction, the system takes

the default warehouse from the item level. If an item does not have a defined default warehouse at the item level, it

takes the default warehouse from the user level. If there is no default warehouse defined at the user level, it takes

the default warehouse defined in the general settings.

Defining a Default Warehouse in General Settings

For information about how to define the default warehouse in the general settings, see Defining Item Defaults.

Defining a Default Warehouse at User Level

From the SAP Business One Main Menu, choose Administration → Setup → General → User Defaults.

The User Defaults window appears.

16

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

For any new user defaults code, you can define a default warehouse in the Warehouse field, as shown in the

window above.

You can change this setting for an existing user defaults code at any time. However, the change applies to new

transactions only. If you create a document based on a document that was created before the change, the

warehouse from the base document is used.

Defining a Default Warehouse at Item Level

To choose a default warehouse for an item, do the following:

1. Open the Item Master Data window of the relevant item.

2. On the Inventory tab, select the row of the warehouse you would like to set as the default.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

PUBLIC

© 2012 SAP AG. All rights reserved.

17

Choose the Set Default Whse button.

The row of the default warehouse is now displayed in bold.

3. Choose the Update button.

You can change this setting at any time. However, the change applies to new transactions only. If you create a

document based on a document that was created before the change, the warehouse from the base document is

used.

Defining Item Groups

You can classify all or part of your inventory into item groups. For example, you can create groups that

correspond to your business areas and assign the items to a business area using the group, or you can classify

similar items to one general group. You can use the groups to format your reports and evaluations and to process

items together as a group.

Whenever you create an item that belongs to a group, the item draws the defaults set from the item group, for

example, the valuation method, the G/L account, the default warehouse and so on.

To create an item group:

1. From the Business One Main Menu, choose Administration → Setup → Inventory → Item Groups.

The Item Groups – Setup window appears.

18

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

2. In the Item Group Name field, enter the name of the group you want to create.

3. On the General tab, view or specify the following information:

Field/Checkbox

Activity/Description

Planning Method

MRP - Select this if you want this item group to be

planned by MRP.

None - Select this if you do not want this item

group to be planned by MRP.

Procurement

Make – Select this if you want MRP to generate

production order recommendations for this item

group.

Buy – Select this if you want MRP to generate

purchase order recommendations for the item

group.

Order Interval

Select one of the defined intervals or select Define New

to open the Order Interval - Setup window. In MRP

calculations, the system automatically groups the

recommended orders into interval periods and

arranges orders within the same period into the first

working day of that period.

Order Multiple

Enter the numeric value to define the size of the lots

for the MRP.

Minimum Order Qty

Enter the value to define the minimum lot size.

Lead Time

Enter the number of days to calculate the duration of

time from ordering a product to the time when the

product is received or produced.

Cycle Group

Select an inventory cycle for this group. The inventory

How to Set Up and Manage Perpetual Inventory System

Defining Initial Settings

PUBLIC

© 2012 SAP AG. All rights reserved.

19

Field/Checkbox

Activity/Description

cycles define and schedule inventory counts.

Alert

Activates alert notifications of inventory counts for this

group.

Default Valuation Method

Select the default valuation method for the item group.

Note

You can change the valuation method for a

group at any time. However, the change

applies only to the relevant items that you

create after the change, not retroactively

4. On the Accounting tab, define the G/L accounts for the item group, if necessary. The item group draws the

default G/L accounts from the Inventory tab of the G/L Account Determination window.

5. Choose the Add button.

20

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

Perpetual Inventory System by Moving Average

Overview

When managing a perpetual inventory system by moving average, an inventory receipt posting debits the

inventory account of each warehouse according to the price entered in the document. This price also updates the

item cost. An inventory release posting credits the inventory/sales returns account according to the item cost.

Note

Due to various user actions, the item cost per item, as displayed on the Inventory Data tab in the Item

Master Data window, might be different from the moving average price per item calculated by the

inventory valuation simulation report. For example, working with negative inventory could be a cause of

those differences.

Defining Item Cost When Using Moving Average Valuation Method

1. From the SAP Business One Main Menu, choose Inventory Item Master Data Inventory Data tab.

2. Create a new item.

3. From the Valuation Method dropdown list, choose Moving Average.

The default inventory valuation method of a new item is taken from its linked item group. For information about

the valuation method of a new item group, see Defining Item Groups.

Note

It is possible to change the valuation method of an item at any time, as long as the item is not linked to any

open documents (goods receipt PO, delivery, return and goods return) and its in-stock quantity is zero.

4. If in the Company Details window, the Manage Item Cost per Warehouse checkbox is selected, the item cost is

calculated separately for each warehouse and is displayed in the warehouse row in the table.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

21

If the button is deselected, a single item cost is managed for all the warehouses and is displayed above the

warehouses table.

22

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

5. Choose the Add button.

Note

You cannot enter the item cost into the Item Master Data window manually for an item with moving

average price valuation. Hence, the default cost of a newly created item without any transactions is zero.

You can set the item cost in two ways:

o Incoming inventory transaction – Any incoming inventory transaction sets the current moving

average price. If your initial settings allow negative inventory, an outgoing transaction takes the

current moving average price, which is zero, regardless of the item price entered in the document.

o Inventory revaluation – You can perform inventory revaluation for a new item to set its cost. For more

information, see Revaluing the Inventory.

Examples of Journal Entry Structures When Using the Moving

Average Valuation Method

The moving average valuation method takes the weighted average of all units available for sale to determine the

item cost. SAP Business One saves the cumulative quantity and the cumulative value of the item in stock. The

item cost is the quotient of the cumulative value divided by the cumulative quantity.

The moving average price is calculated as follows:

Prerequisites

The following prerequisites apply to all the described examples:

The business partner is tax exempted.

The initial settings were defined as follows:

o In the Company Details window, on the Basic Initialization tab:

o The Use Purchase Accounts Posting System is deselected.

o The Use Negative Amount for Reverse Transaction is selected.

o The G/L accounts set for the items are by warehouse. For more information, see Defining Item Defaults.

The G/L account code and name, ‘13400000-01-001-01', 'Inventory – Finished Goods' relates to the

release/receipt of items from/to warehouse 01.

There are sufficient in-stock quantities of all the items involved in the scenarios below.

Sales Documents

Delivery and Delivery Based on a Return

The following journal entry is created when you add a delivery:

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

23

The amounts in the Debit and Credit columns are calculated by multiplying the quantity of each item in the

delivery document by its item cost.

The item cost in the delivery based on a return is taken from the return document. It updates the moving average

price.

Return and Return Based on a Delivery

The following journal entry is created automatically when you add a return:

The amounts in the Debit and Credit columns are calculated by multiplying the quantity of each item in the

delivery document by its item cost.

A return based on a delivery creates a transaction with the item cost taken from the base document. It updates

the moving average price.

If the return is the first transaction for an item, the cost and transaction value are zero. However, the item cost can

be set to a positive value using the inventory revaluation document; then the newly set item cost is used in the first

transaction for this item.

A/R Invoice Based on a Delivery

When basing an A/R invoice on a delivery, no inventory posting is created; thus, only a regular journal entry is

created in the accounting system.

A/R Invoice

The following journal entry is created automatically when you add an A/R invoice that is not based on a delivery:

24

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

Note

This journal entry includes both the delivery’s inventory transaction and the invoice’s accounting

transaction.

A/R Credit Memo Based on a Return

When basing an A/R credit memo on a return, no inventory posting is created; thus, only a regular credit journal

entry is created in the accounting system.

A/R Credit Memo and A/R Credit Memo Based on an A/R Invoice

The following journal entry is created when you add an A/R credit memo:

The credit and debit amounts of both the sales returns and the cost-of-goods-sold accounts are calculated by

multiplying the quantity of each item in the document by its item cost.

Note

This scenario is not relevant for an A/R credit memo based on an A/R reserve invoice. A credit memo

based on an A/R invoice created a transaction with the item cost taken from the base document. It also

updates the moving average price.

Purchasing Documents

Goods Receipt PO

The following journal entry is created automatically when you add a goods receipt PO:

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

25

The Debit and Credit amounts are calculated by multiplying the quantity of each item in the document by the price

specified in the goods receipt PO.

The allocation account functions as a temporary alternative to the vendor's account, which is cleared only after

you create a corresponding A/P invoice or goods return document.

Goods Receipt PO with Freight

A goods receipt PO with freight behaves like any other goods receipt PO document. In addition, the freight amount

recorded in the journal entry is the global amount of additional expenses for the entire quantity. The expenses

clearing account is a clearing account recorded counter to the inventory account.

Goods Receipt PO Based on Goods Return

A goods receipt purchase order based on a goods return uses the cost price from the goods return document.

Goods Return and Goods Return with Freight

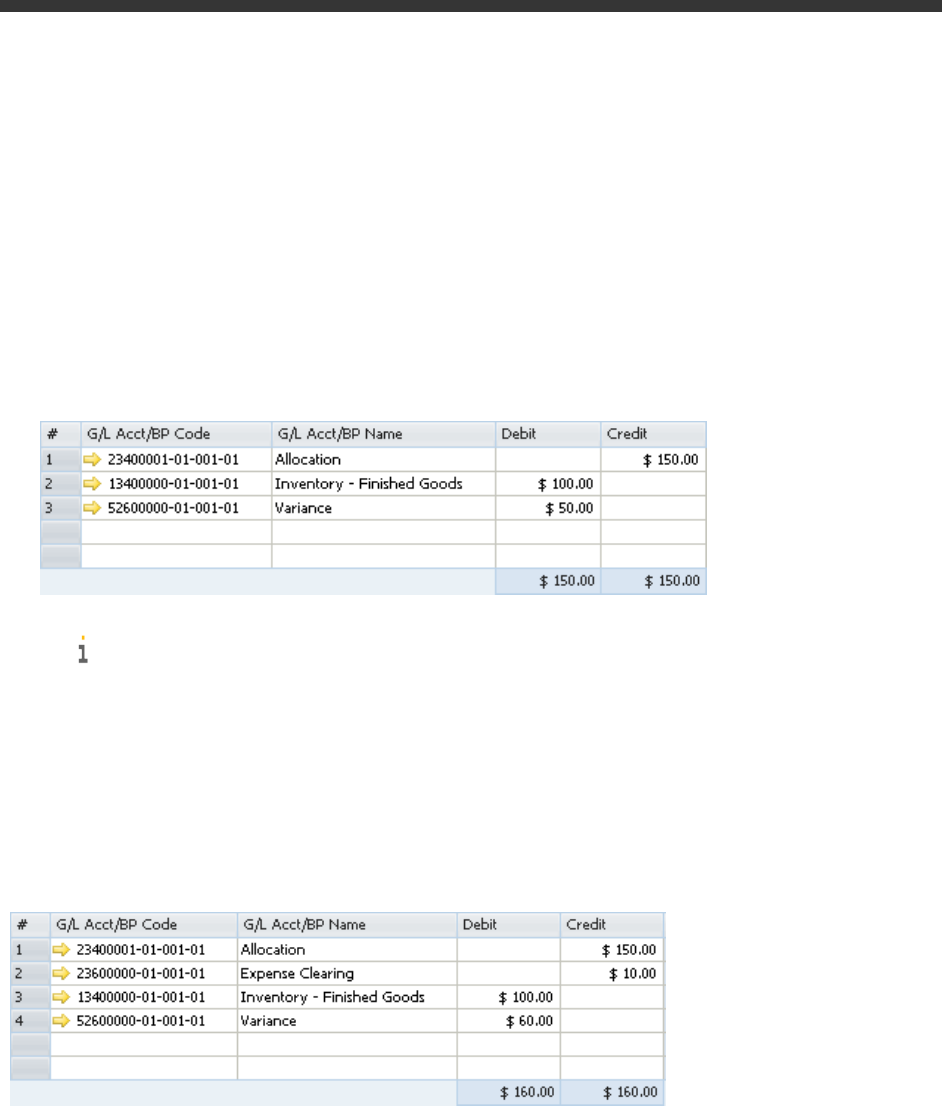

In the following example, the item cost is 100 and the item price in the document is 150. The following journal

entry is created automatically when you add a goods return:

26

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

The value of items returned in a non-based goods return is the current item cost calculated for the item and not

the unit price entered in the goods return document.

Goods Return Based on a Goods Receipt PO

Note

This journal entry is identical to the entry created by a goods receipt PO, only reversed.

The item is released from the inventory with the base document price.

Goods Return Based on a Goods Receipt PO with Freight

The item is released from the inventory with the base document price.

A/P Invoice Based on a Goods Receipt PO

When basing an A/P invoice on a goods receipt PO, the allocation costs account is debited, counter to the

vendor's account, which is credited:

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

27

Note

The allocation account functions as a clearing account. In this example, it is debited by the amount in

which it was credited in the goods receipt PO.

If the price is changed in the A/P invoice, the inventory account is affected and the moving average price is

updated.

A/P Invoice

The following journal entry is created automatically when you add an A/P invoice that is not based on a goods

receipt PO:

The amount of the debited inventory account is calculated by multiplying the quantity of each item by the price

specified in the A/P invoice.

A/P Invoice with Freight

An A/P invoice with freight behaves like any other A/P invoice. In addition, the expenses clearing account is not

recorded in this journal entry since the inventory account reflects the item prices, including freight. As mentioned

28

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

earlier, the expenses clearing account is a clearing account, and this journal entry recorded the final values for

affecting the inventory valuation. Therefore, no intermediate accounts are recorded here.

A/P Credit Memo Based on a Goods Return with or without Freight

In the following example, you base an A/P credit memo on a goods return. The item price in the goods return is 90

with a freight amount of 10, and the item cost is 80. The following journal entry is created automatically:

The price difference account is debited by the document total including freight charges minus the amount posted

to the inventory account in the goods return.

Note

The allocation account functions as a clearing account. In this example, it is debited by the amount in

which it was credited in the goods return.

A/P Credit Memo

In the following example, you create an A/P credit memo. The item price in the A/P credit memo is 70, and the

item cost is 100. The following journal entry is created automatically:

The amount of the debited inventory account is calculated by multiplying the quantity of each item in the

document by its item cost. The value of items returned is calculated from the current moving average price, not

the price entered in the document.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

29

A/P Credit Memo Based on an A/P Invoice

The following journal entry is created automatically when you add an A/P credit memo that is not based on a

goods return:

The item is released from the inventory with the base document price.

A/P Credit Memo with Freight and A/P Credit Memo Based on A/P

Invoice with Freight

The price difference account is debited by the document total including freight charges minus the amount posted

to the inventory account in the A/P invoice.

The item is released from the inventory with the base document price.

Special Scenarios for A/P Documents

A/P Invoice Based on a Goods Receipt PO – Exchange Rate

Differences

A difference in the local currency amount results from the following situation:

You create an A/P invoice for a foreign currency vendor based on a goods receipt PO.

In the invoice, the item price is defined with a foreign currency.

The A/P invoice is connected to a different exchange rate from the one defined for the goods receipt PO.

30

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

In the following example, the local currency for your company is US dollars. A goods receipt PO was created for

Foreign Vendor, whose currency is the euro. The goods receipt PO contains the following information:

The posting date is July 1st. The exchange rate for that day is 1.

1 unit of Item1 is managed by the moving average valuation method.

The item price in the document is EUR 100.

On July 11th, an A/P invoice was created for the vendor, based on the goods receipt PO from July 1st, and the

exchange rate on that day is 2.

There are four possible scenarios for this situation:

The quantity of the items copied from the goods receipt PO to the A/P invoice is less than or equal to their

quantity in stock.

In the example, the quantity in stock is 2. Since the actual inventory valuation changes in this situation, the

inventory account is affected accordingly.

The quantity in stock of the items copied from the goods receipt PO to the A/P invoice is zero.

Since there is no quantity in stock and the actual inventory valuation does not change in this situation; the

exchange rate differences account is affected accordingly.

The quantity in stock of the items copied from the goods receipt PO to the A/P invoice is negative.

In the example, the quantity in stock is (-2). Since the in-stock quantity is negative and the actual inventory

valuation does not change in this situation, the negative inventory adjustment account is affected accordingly

The quantity of the items copied from the goods receipt PO to the A/P invoice is greater than their quantity in

stock.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

31

In the example, the quantity in stock is 1. For this scenario, the quantity of the item in the documents is 2.

Since the actual inventory valuation changes only for the existing quantity in stock, the inventory account is

affected by the existing quantity and the exchange rate differences account is affected by the remaining

quantity.

Note

The above scenarios are also relevant for copying a goods return to an A/P credit memo.

A/P Invoice Based on a Goods Receipt PO – Price Differences

When copying a goods receipt PO to an A/P invoice, there might be a difference between the item prices

recorded in the goods receipt PO and their prices in the A/P invoice.

In the following example, a goods receipt PO was created for 1 unit of Item1, with a price of 100. In an A/P invoice

based on that goods receipt PO, the price was changed to 150.

There are four possible scenarios for this situation:

The quantity of the items copied from the goods receipt PO to the A/P invoice is less than or equal to their

quantity in stock.

In the example, the quantity in stock is 2. Since the actual inventory valuation changes in this situation, the

inventory account is affected accordingly

The quantity in stock of the items copied from the goods receipt PO to the A/P invoice is zero.

Since there is no quantity in stock and the actual inventory valuation does not change in this situation, the

price difference account is affected accordingly.

32

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

The quantity in stock of the items copied from the goods receipt PO to the A/P invoice is negative.

In the example, the quantity in stock is (-2). Since the in-stock quantity is negative and the actual inventory

valuation does not change in this situation, the negative inventory adjustment account is affected accordingly.

The quantity of the items copied from the goods receipt PO to the A/P invoice is greater than their quantity in

stock.

In the example, the quantity in stock is 1 and the quantity of the item in the documents is 2. Since the actual

inventory valuation changes only for the existing quantity in stock, the inventory account is affected by the

existing quantity and the price difference account is affected by the remaining quantity.

Note

The above scenarios are also relevant for copying a goods return to an A/P credit memo

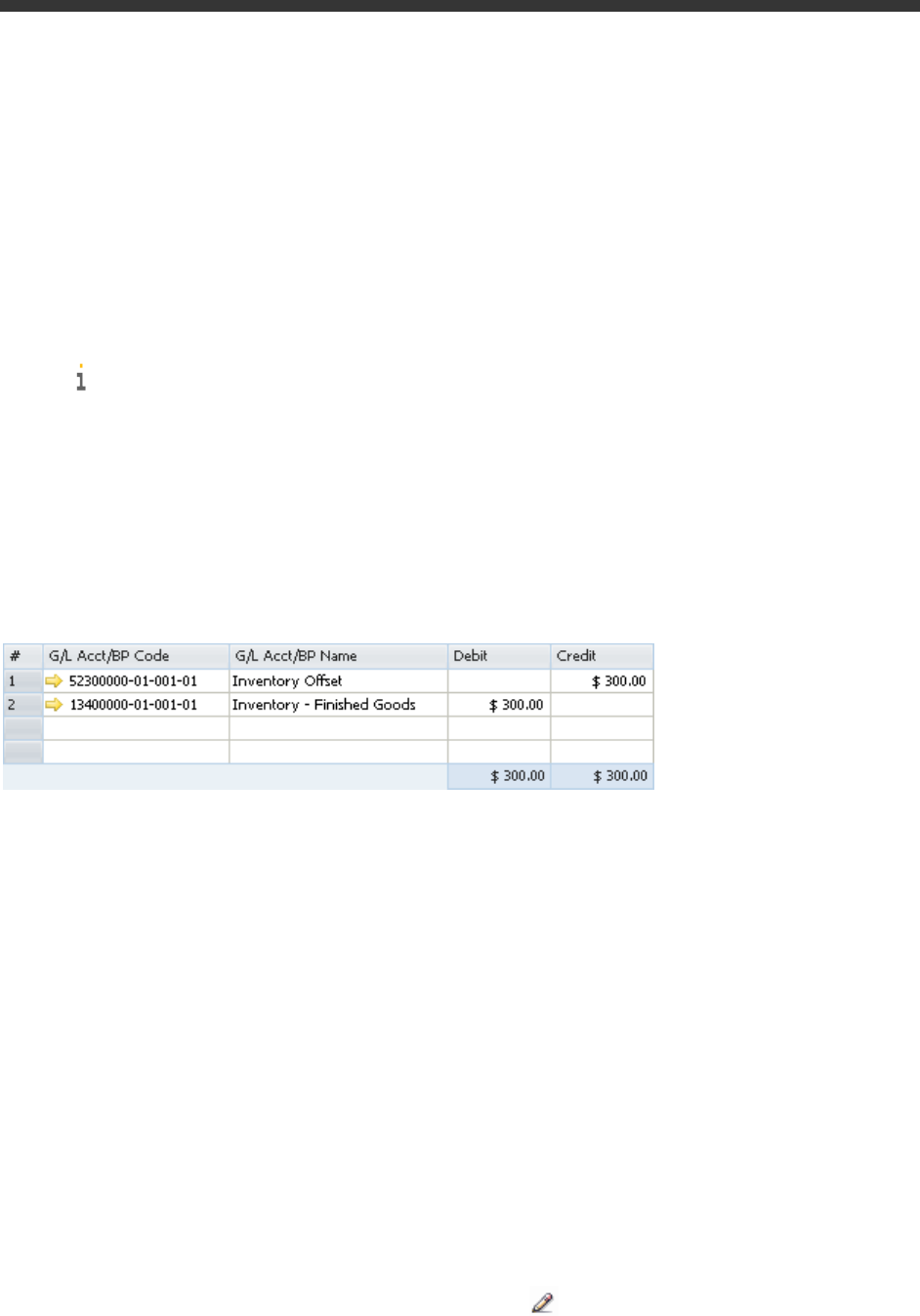

Closing a Goods Receipt PO or a Goods Return

When closing a goods receipt PO or a goods return, no inventory posting is registered; however, a journal

entry is created to clear the allocation costs account:

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

33

Note

o The above scenario is applied whether or not the goods return includes freight.

o When a goods receipt PO is closed, the amounts are the same as when a goods return is closed, but each

amount appears with a positive sign.

o To close a goods receipt PO or a goods return, use one of the following methods:

o Right-click the window and choose Close.

o From the Data menu, choose Close.

Closing a Goods Receipt PO with Freight

A/P Credit Memo Based on an A/P Invoice when Changing the

Freight Amount

In the following example, an A/P invoice was created for Item1 with a price of 100, and the freight amount in the

invoice is 10. An A/P credit memo was created based on that invoice, and the freight was changed to 20.

The expense and inventory account reflects the changes made in the freight amount.

Note

The expense and inventory account can be defined in the G/L Account Determination window on the

General subtab of the Purchasing tab.

34

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

Inventory Transactions

Goods Receipt

The Debit and Credit amounts are calculated by multiplying the quantity of each item in the document by the

prices specified in the goods receipt.

Goods Issue

The amount in the Debit and Credit columns is calculated by multiplying the quantity of each one of the items in

the goods issue by their item cost.

Inventory Transfer

If you had specified different inventory accounts for your different warehouses, the inventory transfer transaction

would have credited the inventory account of the release warehouse and debited the inventory account of the

receipt warehouse. The release/receipt price is set by the moving average price of the item in the release

warehouse.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

35

Note

If you manage the item cost per warehouse, inventory transfer changes the moving average price. The

item cost in the receiving warehouse is calculated as follows: (stock value of the item in receiving

warehouse + received value) / new quantity in the receiving warehouse.

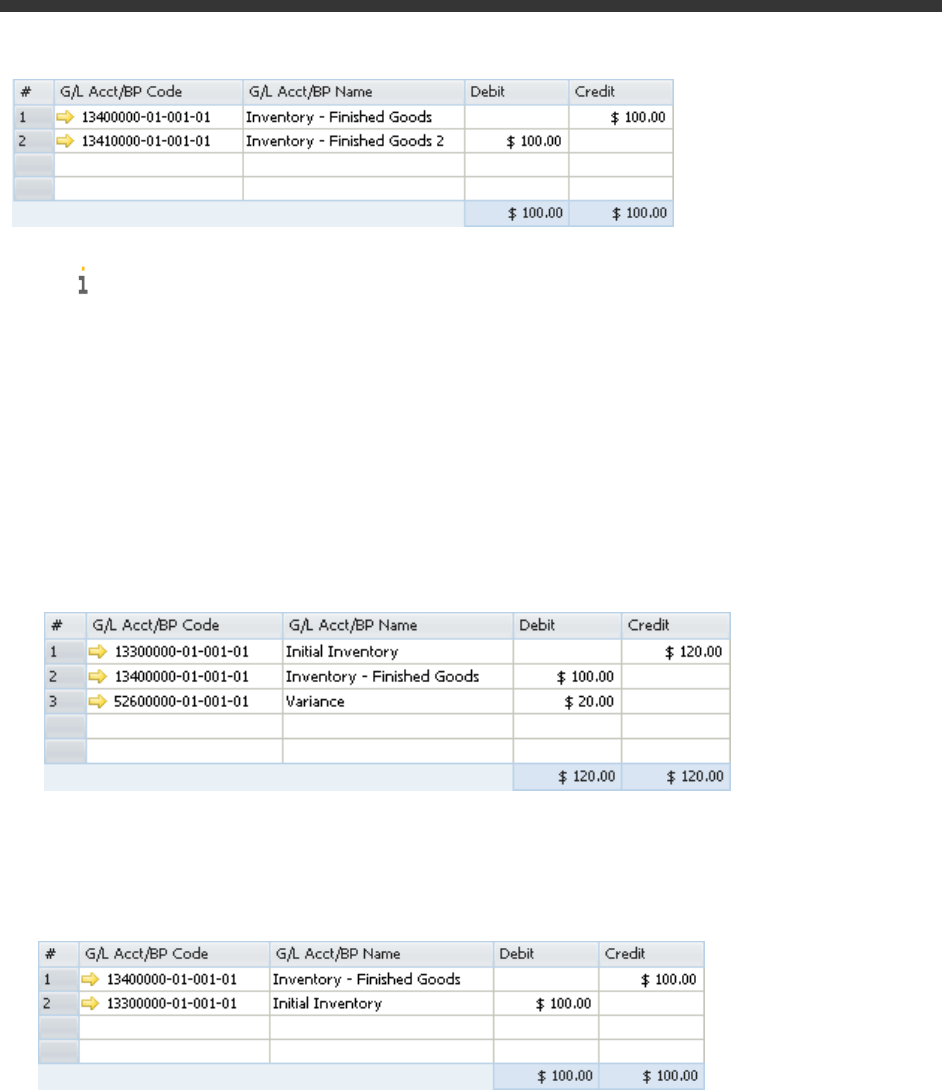

Entering Initial Quantities and Inventory Postings

A positive initial quantity creates the following journal entry:

The amount in the Credit and the Debit columns is calculated by multiplying the amounts of the Initial Quantity

and the Price fields of each item in the Initial Quantity window.

A negative initial quantity creates the following journal entry:

The price of the item is defined by its item cost.

Note

If the Allow Initial Quantities without Price checkbox is selected and no price is entered for the items, it is

not necessary to specify an opening inventory account. Notice that no monetary transaction is created in

the accounting system in this scenario.

If you would like to record initial quantities, including price, you must choose an opening inventory G/L

account manually.

A positive inventory posting where the counted quantity is greater than the existing In Whse quantity creates

the following journal entry:

36

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

A negative inventory posting where the counted quantity is less than the existing in-stock quantity (the In

Whse field) creates the following journal entry:

Landed Costs

For information about landed costs, see the online help for SAP Business One.

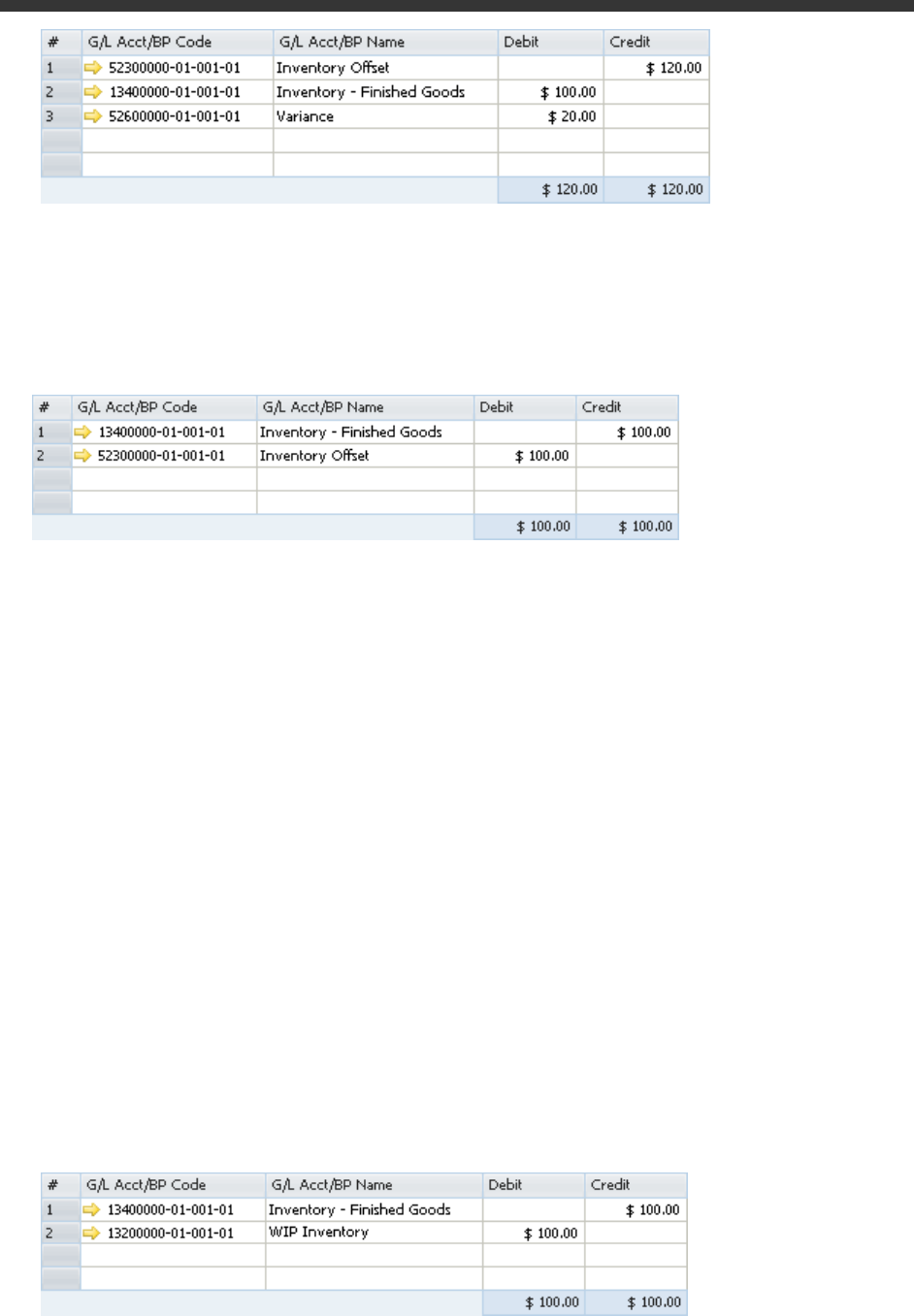

Production

In a production order for a production bill of materials item, the parent item price is calculated according to

the moving average prices of its child items. You cannot change this price.

In the following examples, both the parent and child items are defined with Moving Average as their inventory

valuation method.

The two methods for issuing items in production orders are manual and backflush. For more information, see

the online help for SAP Business One.

Manual

With this method, you should document the receipt of the parent item and the release of the child items.

o Issue for production

The amounts in the Debit and Credit columns are calculated by multiplying the quantity of each child item by

its item cost and summing the resulting product for all child items.

o Receipt from production

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Moving Average

PUBLIC

© 2012 SAP AG. All rights reserved.

37

The amounts in the Debit and Credit columns are calculated by multiplying the quantity of each child item

by its item cost and summing the resulting product for all child items.

Note

When you close a production order, if there is a difference between the actual component cost and the

actual product cost, an additional journal entry is recorded for the price difference:

For example, the parent item comprises 1 child item with a quantity of 2. The price of the child item is 50.

You issue a receipt for the product before issuing the child item. During the receipt from production, the

value in the Actual Product Cost field on the Summary tab of the Production Order window is 2 X 50=100.

Before you issue the child item, its cost is changed to 75. During the issue for production, the journal entry

created for the child item release was calculated as 2 X 75 = 150. This value is saved in the Actual

Component Cost field on the Summary tab of the Production Order window.

When the production order is closed, the difference between the costs [2 X (50 minus 75) = -50] is

recorded in the WIP inventory variance account, while the WIP inventory account is cleared.

Backflush

With this method, when the production order is completed, the inventory account of the parent item

warehouse is debited and the inventory account of the child warehouses is credited. The release/receipt price

is set by the moving average prices of the child items. With this method, there is no issue for production;

however, the above two journal entries are always created.

Working with Negative Inventory

The item quantity in stock can go negative on the company level if you are not running item cost per

warehouse (the Manage Cost per Warehouse checkbox is deselected), or on the warehouse level if you are

running item cost per warehouse (the Manage Item Cost per Warehouse checkbox is selected).

If the item quantity in stock is negative, SAP Business One uses the static price – the last price which was

used for the item before zeroing the stock. As long as the inventory level is negative, any transaction does not

update the moving average price.

In the journal entry, the difference between the document or transaction balance and the value posted to the

inventory account (in case of negative values) is posted to the negative inventory adjustment account.

The moving average item price cannot be changed through material revaluation, as long as the item is in the

negative zone.

38

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

Perpetual Inventory System by Standard Price

Overview

SAP Business One lets you work with the standard price method for calculating your inventory value.

A standard (fixed) price should be entered in each item record, thus influencing every inventory posting. An

inventory receipt created with a different price than the standard price set for the item debits the inventory

account according to the standard price. In addition, the difference between the standard price and the actual

receipt price is recorded in a variance or a price difference account. Inventory releases are recorded according to

the standard price.

Defining Item Cost when Using the Standard Price Valuation

Method

1. From the SAP Business One Main Menu, choose Inventory Item Master Data Inventory Data tab.

2. Create a new item.

3. From the Valuation Method dropdown list, choose Standard.

The default inventory valuation method of a new item is taken from its linked item group. For information, see

Defining Item Groups.

Note

As long as an item is not linked to any open documents and its In Stock quantity is zero, it is possible to

change its valuation method at any time.

4. In the Item Cost field, specify the standard price.

If you select the Manage Item Cost per Warehouse checkbox, the standard price is calculated separately in

each warehouse and is displayed in the warehouse row in the table.

In this case, after specifying a value in the Item Cost field, you can update this item cost to all warehouses.

Alternatively, you can set a different standard price manually for each warehouse.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

PUBLIC

© 2012 SAP AG. All rights reserved.

39

Note

It is recommended to specify or update standard price by means of a material revaluation document,

rather than using the Item Master Data window. The change log of item master data can be deleted at

some point and the information about item cost change can be lost. If the item cost is changed by

material revaluation, this information cannot be deleted.

Examples of Journal Entry Structures When Using the Standard

Price Valuation Method

The standard price valuation method uses a fixed price based on the defined cost for the item to valuate the

warehouse inventories.

Prerequisites

The following prerequisites apply for all the described examples:

The business partner is tax exempted.

The initial settings are defined as follows:

o In the Company Details window, on the Basic Initialization tab:

o The Use Purchase Accounts Posting System checkbox is deselected.

o The Use Negative Amount for Reverse Transaction is selected.

o The G/L accounts set for the items are by warehouse. For information, see Defining Item Defaults.

The item's standard price is 100.

The G/L account code and name, ‘13400000-01-001-01', 'Inventory – Finished Goods' relates to the

release/receipt of items from/to warehouse 01.

40

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

There are sufficient quantities in stock of all the items involved in the scenarios below.

Note

No journal entry reflecting the inventory value is created by a document containing items with Standard

as their inventory valuation method, but with no item cost defined for them.

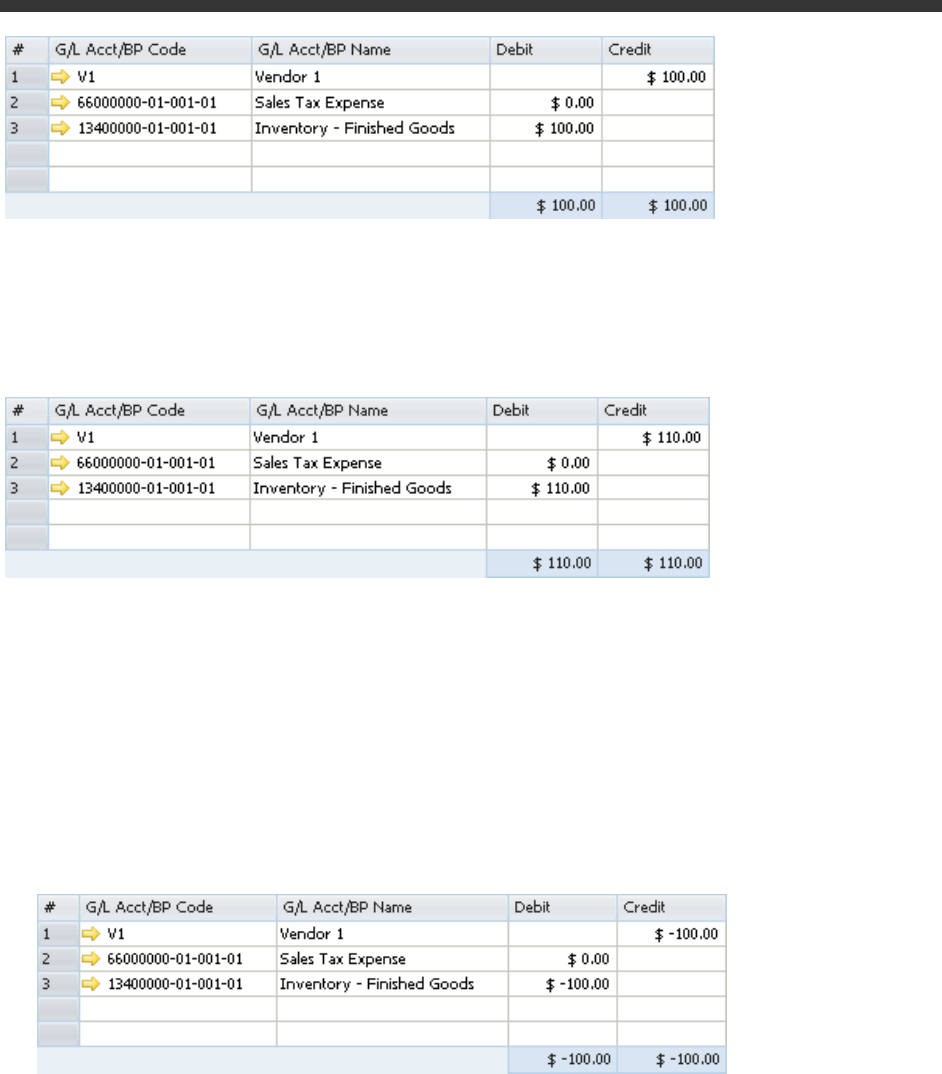

Sales Documents

Delivery and Delivery Based on a Return

The following journal entry is created automatically when you add a delivery:

The debit and credit amounts are calculated as a multiplication of each one of the items in the delivery by the

standard price of each item.

Return or Return Based on a Delivery

The following journal entry is created automatically when you add a return:

The debit and credit amounts are calculated as a multiplication of each item in the delivery by the standard price

of each item.

A/R Invoice Based on a Delivery

When basing an A/R invoice on a delivery, no inventory posting is created; thus, only a regular journal entry is

created in the accounting system.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

PUBLIC

© 2012 SAP AG. All rights reserved.

41

A/R Invoice

The following journal entry is created automatically when you add an A/R invoice that is not based on a delivery:

Note

This journal entry includes both the delivery's inventory transaction and the invoice's accounting

transaction.

A/R Credit Memo Based on a Return

When basing an A/R credit memo on a return, no inventory posting is created; thus, only a regular credit journal

entry is created in the accounting system.

A/R Credit Memo and A/R Credit Memo Based on an A/R Invoice

The following journal entry is created automatically when you add an A/R credit memo that is not based on a

return:

Note

This scenario is not relevant for an A/R credit memo based on an A/R reserve invoice

42

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

Purchasing Documents

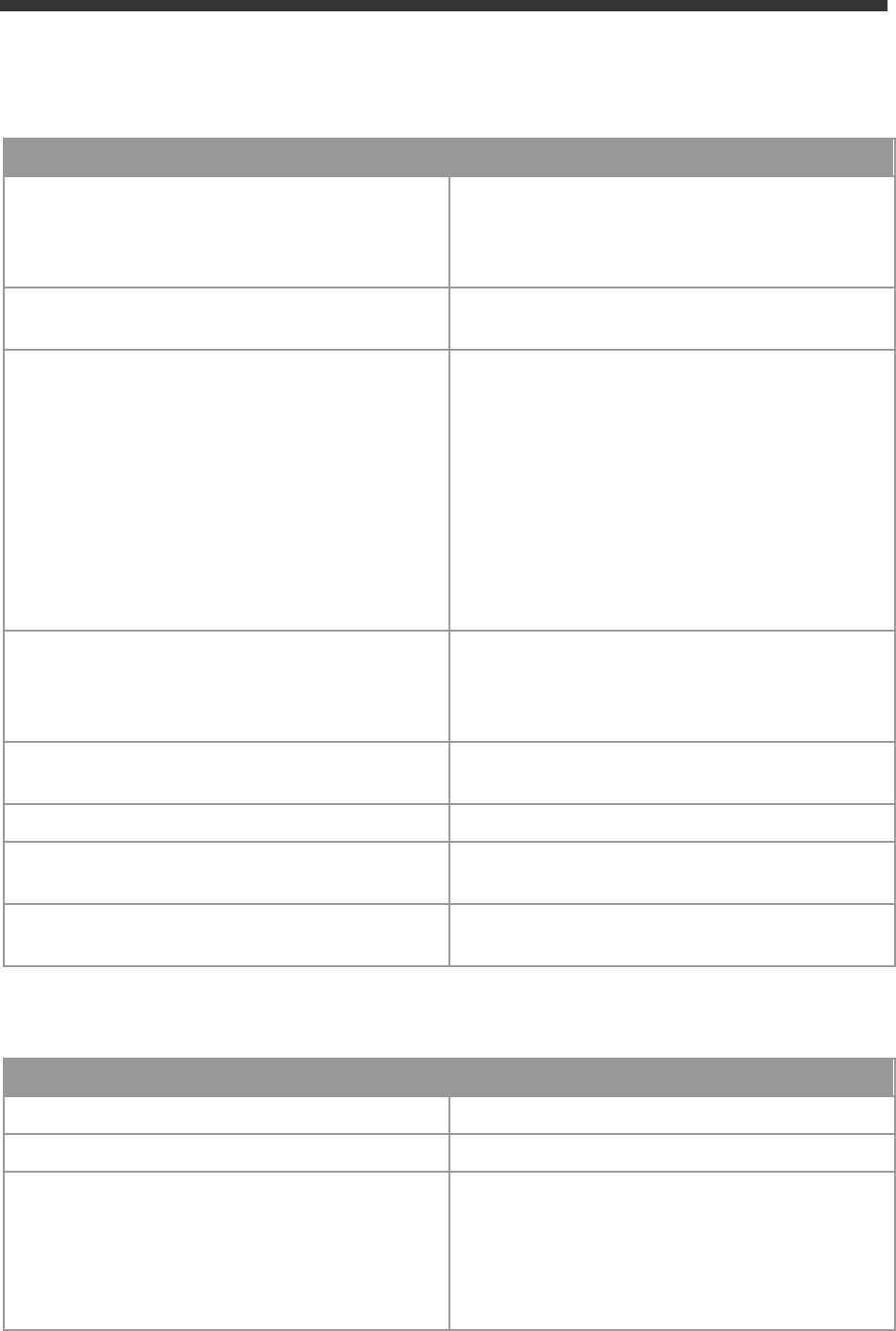

Goods Receipt PO

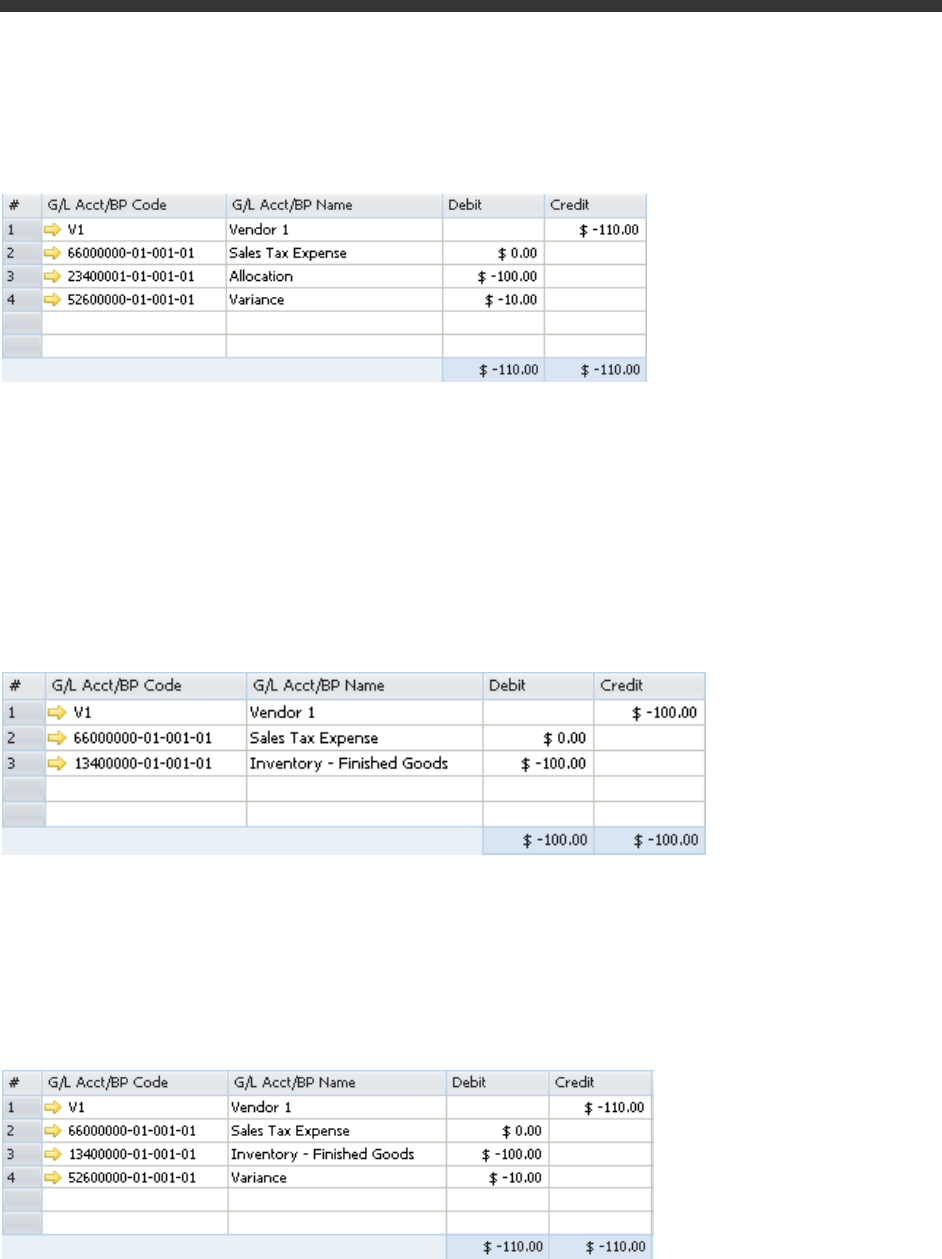

The following example displays a case in which the item's price, as recorded in the goods receipt PO, varies from

the item's standard price set in the Item Master Data window:

The price in the goods receipt PO is 150.

The standard price of the item is 100.

Note

The allocation account functions as a temporary alternative for the vendor's account, which is cleared

only after you create a corresponding A/P invoice.

Goods Receipt PO with Freight

This example relates to the same example as described above for the goods receipt PO:

The freight amount recorded in the journal entry is the global amount of additional expenses for the entire

quantity. The expenses clearing account is recorded counter to the inventory account.

Goods Return and Goods Return with Freight

In the following example, the item price, as recorded in the goods return, varies from the standard price of the set

in the Item Master Data window:

The item price in the goods return is 150.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

PUBLIC

© 2012 SAP AG. All rights reserved.

43

The standard price of the item is 100.

The debit and credit amounts are calculated by multiplying the quantity of each item in the document by its

current cost, and not the item price entered in the goods return document. Since the current cost is used, any

freight addition has no effect on the allocation and inventory accounts.

Goods Return Based on a Goods Receipt PO

This example relates to the same example as described above for the goods receipt PO.

The following journal entry is created automatically when you add a goods return according to above-described

scenario:

1.1.1.1 Goods Return Based on a Goods Receipt PO with Freight

This example relates to the same example as described for the goods receipt PO.

The following journal entry is created automatically when you add a goods return according to the scenario

described above for a goods receipt PO:

44

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

A/P Invoice Based on a Goods Receipt PO

When you base an A/P invoice on a goods receipt PO, the allocation account is debited counter to the vendor

account, which is credited:

The allocation account functions as a clearing account. In this example, it is debited by the amount in which it was

credited in the goods receipt PO.

A/P Invoice Based on a Goods Receipt PO with Freight

Note

In addition to the expense clearing account, the allocation account also acts as a clearing account. In this

example, these accounts are debited by the amounts in which they were credited in the goods receipt PO.

A/P Invoice

The following example displays a case in which the item's price, as recorded in the A/P invoice, varies from the

item's standard price.

The price in the A/P invoice is 150.

The standard price of the item is 100.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

PUBLIC

© 2012 SAP AG. All rights reserved.

45

The amount of the debited inventory account is calculated by multiplying the quantity of each item by the

standard price of the item. The amount of the debited variance account is calculated by multiplying the

quantity of each item by the difference between the price of the item in the A/P invoice and the standard price

of the item.

A/P Invoice with Freight

This example relates to the same example as described for the A/P invoice.

The expenses clearing account is not recorded in this journal entry since the inventory account reflects the item

prices, including freight. As mentioned earlier, the expenses clearing account is a clearing account, and this

journal entry recorded the final values for affecting the inventory valuation. Therefore, no intermediate accounts

are recorded here.

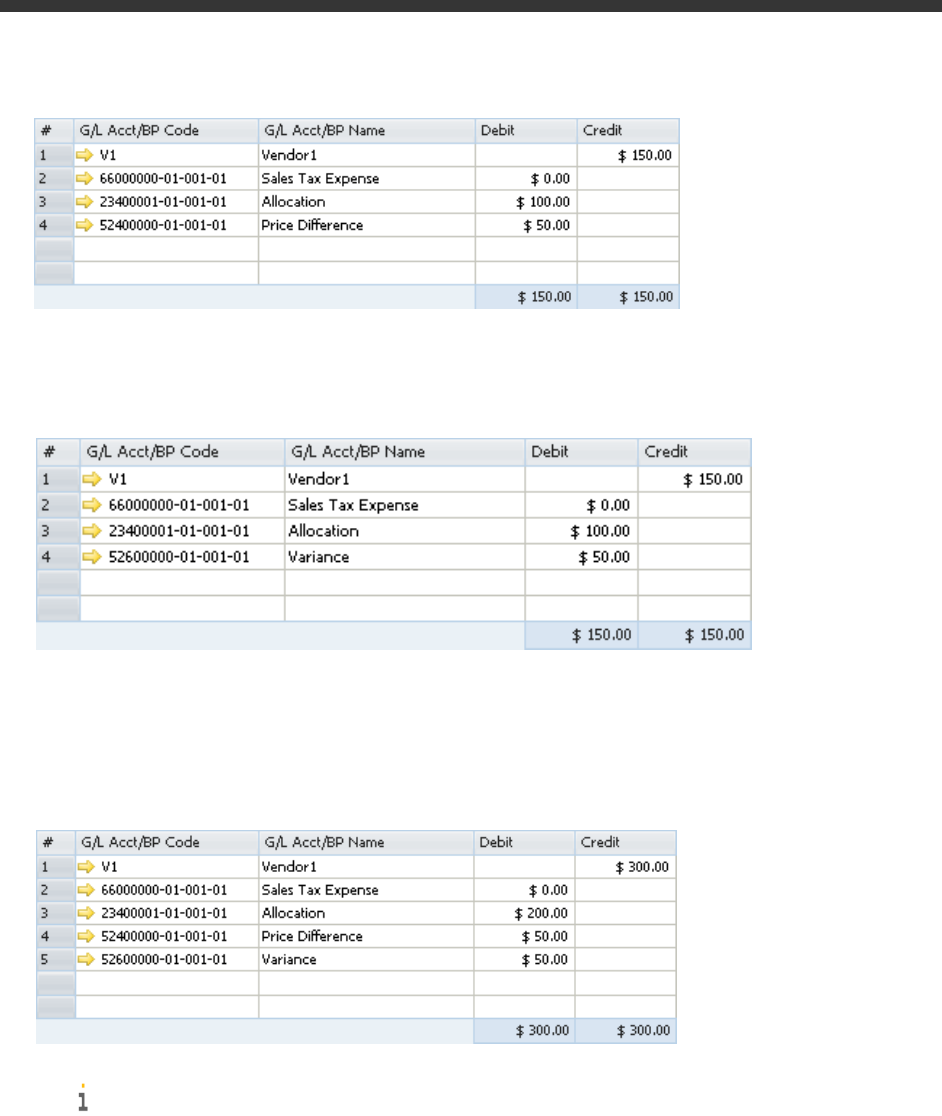

A/P Credit Memo Based on a Goods Return

When you base an A/P credit memo on a goods return, the journal entry created automatically is identical to the

one created by an A/P invoice based on a goods receipt PO, only reversed:

The allocation account functions as a clearing account. In this example, it is debited by the amount in which it was

credited in the goods returns.

46

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

A/P Credit Memo Based on a Goods Return with Freight

The variance account is credited or debited by the document total, including freight charges, minus the amount

that was posted to the inventory account in the goods return.

A/P Credit Memo and A/P Credit Memo Based on an A/P Invoice

The following journal entry is created automatically when you add an A/P credit memo that is not based on a

goods return:

A/P Credit Memo with Freight and A/P Credit Memo Based on A/P

Invoice with Freight

The expenses clearing account is not recorded in this journal entry since the inventory account reflects the item

prices, including freight. As mentioned earlier, the expenses clearing account is a clearing account, and this

journal entry recorded the final values for affecting the inventory valuation. Therefore, no intermediate G/L

accounts are recorded here.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

PUBLIC

© 2012 SAP AG. All rights reserved.

47

Special Scenarios for A/P Documents

A/P Invoice Based on a Goods Receipt PO – Exchange Rate

Differences

The following situation results in a difference in the local currency amount:

You create an A/P invoice for a foreign currency vendor based on a goods receipt PO.

In the invoice, the item price is defined with a foreign currency.

The A/P invoice is connected to an exchange rate different from the one defined for the goods receipt PO.

In the following example, the local currency for your company is US dollars. A goods receipt PO was created for

Foreign Vendor, whose currency is the euro. The goods receipt PO contains the following information:

The posting date is July 1st. The exchange rate for that day is 1.

1 unit of Item1 is managed by the standard price valuation method.

The item price in the document is EUR 100.

On July 11th, an A/P invoice was created for the vendor, based on the goods receipt PO from July 1st; the

exchange rate on that day is 2.

The four possible scenarios for this situation are as follows:

The quantity of the items copied from the goods receipt PO to the A/P invoice is less than or equal to their

quantity in stock.

In the example, the quantity in stock is 2. Since the actual inventory valuation changes in this situation, the

variance account is affected accordingly.

The in-stock quantity of the items copied from the goods receipt PO to the A/P invoice is zero.

Since there is no quantity in stock and the actual inventory valuation does not change in this situation, the

exchange rate differences account is affected accordingly.

The quantity in stock of the items copied from the goods receipt PO to the A/P invoice is negative.

48

PUBLIC

© 2012 SAP AG. All rights reserved.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

The exchange rate differences account is affected the same way as if the item’s quantity in stock is zero.

The quantity of the items copied from the goods receipt PO to the A/P invoice is greater than their quantity in

stock.

In the example, the quantity in stock is 1 and the quantity of the item in the documents is 2. Since the actual

inventory valuation changes only for the existing quantity in stock, the variance account is affected by the

existing quantity and the exchange rate differences account is affected by the remaining quantity.

Note

The above scenarios are also relevant for copying a goods return to an A/P credit memo.

A/P Invoice Based on a Goods Receipt PO – Price Differences

When copying a goods receipt PO to an A/P invoice, there might be a difference between the item prices

recorded in the goods receipt PO and their prices in the A/P invoice.

In the following example, a goods receipt PO was created for 1 unit of Item1 and its price was 100. In an A/P

invoice based on that goods receipt PO, the price was changed to 150.

There are four possible scenarios for this situation:

The quantity of the items copied from the goods receipt PO to the A/P invoice is less than or equal to the

quantity in stock.

In the example, the quantity in stock is 2. Since the actual inventory valuation changes in this situation, the

variance account is affected accordingly.

The quantity in stock of the items copied from the goods receipt PO to the A/P invoice is zero.

Since there is no quantity in stock and the actual inventory valuation does not change in this situation, the

price difference account is affected accordingly.

How to Set Up and Manage Perpetual Inventory System

Perpetual Inventory System by Standard Price

PUBLIC

© 2012 SAP AG. All rights reserved.

49