www.trelliscompany.org2

About the Student Financial Wellness Survey

The Student Financial Wellness Survey (SFWS) is a self-reported, online survey that

documents the financial well-being and student success indicators of postsecondary

students across the nation. While not nationally representative, responses were weighted

to reflect the total student composition at the participating institutions. The SFWS was

designed and implemented by Trellis Research starting in 2018. Since then, 2.4 million

students have been surveyed at 231 institutions in 33 states.

The SFWS is a free national survey oered by Trellis Company that explores the

connections between student finances, academic success, and more. Interested

in participating in the Fall 2023 implementation of SFWS? Learn more here:

www.trelliscompany.org/SFWS-get-started

About Trellis Company

Trellis Company (trelliscompany.org) is a nonprofit 501(c)(3) corporation focused

on helping people leverage the power of post-secondary education and learning

to improve their quality of life and the communities where they live.

About Trellis Research

Trellis Research (trelliscompany.org/research) provides colleges and policymakers

insight into student success through the lens of higher education aordability.

With more than three decades of experience studying key issues such as student

debt, student loan counseling, and the financial barriers to attainment, our research

team explores the roles of personal finance, financial literacy, and financial aid in

higher education.

Interested in collaborations or need research expertise? Trellis Research welcomes

opportunities to inform policymakers and help organizations address their analytical

needs. For more information, please contact Trellis Research at Trellisresearch@

trelliscompany.org or visit us on Twitter (@TrellisResearch).

Newsletter Subscription

Interested in receiving our monthly newsletter, Trellis Research News: Data, Trends,

and Insights, via email? Subscribe here:

www.trelliscompany.org/research/data-trends-and-insights/

Recommended Citation

Fletcher, C., Cornett, A., Webster, J., and Ashton, B. (2023). Student Financial Wellness

Survey report: Fall 2022 semester results. Trellis Company.

Follow us on Twitter @TrellisResearch

www.trelliscompany.org 3

Table of Contents

Preface ............................................................................................................................................... 4

Acknowledgements ....................................................................................................................4

Executive Summary ....................................................................................................................5

Survey Overview...........................................................................................................................9

Distress Indicators Among College Students ................................................................10

Student Success Indicators .................................................................................................... 16

Students Who Are Parents ....................................................................................................18

Paying For College ....................................................................................................................20

Student Credit Card Use and Risky Borrowing .......................................................... 23

Financial Behavior, Knowledge, and Decision-Making .......................................... 26

Research to Practice ................................................................................................................. 29

Conclusion ....................................................................................................................................31

Appendix A: Detailed Methodology and Sample Characteristics ....................... 32

Appendix B: Survey Questions and Responses ........................................................... 39

Appendix C: Endnotes............................................................................................................. 54

www.trelliscompany.org4

Preface

Over 200,000 students have shared their responses to the Student Financial Wellness

Survey (SFWS) since Trellis Company (Trellis) started this survey in 2018. Trellis is

honored to amplify the voices of these students. This report shares the findings

from the Fall 2022 SFWS and reflects the responses of over 36,000 students.

Institutions across the country have used the results of their school reports to inform

their strategic planning, adjust their student support programs, and advocate for

increased resources to address student need. This work has grown as Trellis and

many other organizations have elevated the importance of addressing student

financial needs.

Participating in the SFWS is free, and each institution receives a customized report

of their results with a comparison group from similar institutions. This report details

aggregated findings from the Fall 2022 implementation.

• The Fall 2022 SFWS was implemented at 89 colleges and universities across

23 states. This includes 61 community colleges, 18 four-year public, and

10 four-year private institutions.

• Trellis surveyed 388,653 undergraduates and received responses from

36,446 students for a response rate of 9.4 percent.

• The responses were weighted to reflect the total composition of

participating institutions.

For more information about how to participate in future implementations of the

SFWS, please contact Trellis Research at Trellisresearch@trelliscompany.org.

Acknowledgements

We are appreciative of the institutions that participated in the SFWS; your work

supporting students in their educational pursuits is making a dierence.

To the students who took the time to participate in the survey—thank you so much.

It is our hope that the information learned from your participation will be used to

support students across the country as they work towards achieving their goals.

Comments and requests for additional information regarding this report or any of

Trellis’ other publications are welcome. Please direct questions to:

Je Webster

Director of Research

Trellis Company

Phone Number: (800) 252-9743, ext.4504

Email: Je.Webster@trelliscompany.org

www.trelliscompany.org/research

Twitter: @TrellisResearch

THIS REPORT SHARES

THE FINDINGS FROM

THE FALL 2022 SFWS

AND REFLECTS THE

RESPONSES OF OVER

36,000 STUDENTS.

www.trelliscompany.org 5

Executive Summary

This survey provides a snapshot of student wellbeing during the fall of 2022. Lingering

economic impacts of the COVID-19 pandemic and rising inflation meant that many

students struggled to make ends meet. Over 380,000 students were surveyed from

89 schools in 23 states and 36,446 students responded. This report is meant to amplify

the lived experience of these students. Understanding these experiences will allow

college administrators and policymakers to better serve students, enabling them to

reach their academic potential.

LINGERING ECONOMIC

IMPACTS OF THE

COVID-19 PANDEMIC AND

RISING INFLATION MEANT

THAT MANY STUDENTS

STRUGGLED TO MAKE

ENDS MEET.

SURVEY METRICS

Fall 2022 SFWS – Undergraduate Cohort

2-year Institutions 4-year Institutions Total

Survey Population 241,307 students 147,346 students 388,653 students

Responses 20,536 students 15,910 students 36,446 students

Response Rate 8.5% 10.8% 9.4%

Completion Rate 78% 79% 79%

Median Time Spent 14 minutes 13 minutes 14 minutes

What is new?

New questions:

• Added questions regarding academics and return on investment: Students were

asked if they have diculty concentrating on schoolwork because of their financial

situation, and they were asked if they felt the cost of college is a good investment

for their financial future.

• Added questions about parking and transportation issues: Students were asked

about the availability of parking on campus and about missing class due to lack of

reliable transportation.

• Added questions to learn more about the impact of childcare access: Parenting

students were asked if they had missed class due to lack of childcare, and what

they would do if they did lose access to their current childcare arrangements.

• Added a question about mental health services: Students were asked if their school

has mental health or counseling services available.

www.trelliscompany.org6

Deleted questions:

• Deleted questions about technology access: These questions had focused

on identifying technology gaps, which was paramount during the COVID-19

pandemic. It was found that the gaps are generally small.

• Deleted a question regarding receipt of federal stimulus funds: This question was

intended to be temporary, to capture federal stimulus fund disbursements during

the COVID-19 pandemic.

• Deleted a question regarding financial discussions with financial professionals:

To reduce survey burden, a question regarding financial professional interactions

was removed.

• Deleted a question about bank accounts: Since very few respondents reported

being unbanked, this question was removed to reduce survey burden.

www.trelliscompany.org 7

The Fall 2022 SFWS covers a range of topics related to the financial wellbeing of postsecondary students. The

following key findings section oers a high-level overview of some of the results from the survey. Each heading

corresponds to a longer section in the remainder of the report which includes more in-depth analysis

KEY FINDINGS: DISTRESS INDICATORS AMONG COLLEGE STUDENTS

• A majority of students reported they would have diculty finding $500 in cash or credit in case of an

emergency. While some of these students would turn to their savings or to family members for support,

others would be forced to borrow, use their credit cards, sell their possessions, or delay paying a bill.

• Overall, 10 percent of students experienced all three forms of basic needs insecurity in the past year:

food insecurity, housing insecurity, and homelessness.

• Higher percentages of respondents who experienced key indicators of distress were students of color, female

students, first-generation students, or enrolled part-time compared to all undergraduate respondents.

KEY FINDINGS: STUDENT SUCCESS INDICATORS

• Financial concerns impacted academics for some students, with 48 percent of respondents who had

experienced financial challenges while enrolled agreeing or strongly agreeing that they had diculty

concentrating on schoolwork because of their financial situation.

• Learners over 24 years old, first-generation students, students who saw themselves as workers who attend

school, or students who reported it was important they support their family financially while enrolled were

more likely to say they had diculty concentrating on schoolwork because of their financial situation

compared to their peers.

• Higher percentages of parenting students who would not be able to get $500 in an emergency, who ran

out of money, or who had experienced basic needs insecurities had missed classes due to childcare issues

compared to parenting students who did not experience those distress indicators.

KEY FINDINGS: STUDENTS WHO ARE PARENTS

• Twenty-two percent of respondents were parents to children, and these respondents were more likely

to be enrolled part-time, first-generation students, 25 years or older, female, or Black than their

non-parenting peers.

• More than 40 percent of parenting students reported receiving medical assistance and food assistance

during the year.

• Higher percentages of student parents reported they would have diculty finding $500 in an emergency,

ran out of money, sold belongings to make ends meet, or experienced housing security compared to

their non-parenting peers.

www.trelliscompany.org8

KEY FINDINGS: PAYING FOR COLLEGE

• Most respondents had completed the Free Application for Federal Student Aid (FAFSA). Among those who

did not complete the application, the most common reason was perceived ineligibility.

• While many students use savings or income to pay for college, it rarely is enough. Only two percent

of four-year respondents and five percent of two-year respondents reported using only one or both

of these resources.

• Thirty-seven percent of respondents reported receiving some form of family support to pay for college.

• Respondents who borrowed student loans reported experiencing key indicators of distress at higher rates

compared to all respondents.

KEY FINDINGS: STUDENT CREDIT CARD USE AND RISKY BORROWING

• While 77 percent of respondents who used a credit card in the past year reported paying their bill on time, only

39 percent agreed or strongly agreed that they fully pay o their balance each month, with the rest accruing

interest at potentially high rates.

• Respondents from four-year schools, white respondents, and non-first-generation respondents were more

likely to report that they fully pay o their credit card balance each month, compared to their peers.

• Respondents who had borrowed auto title loans and payday loans reported experiencing key distress

indicators at higher rates compared to all respondents.

KEY FINDINGS: FINANCIAL BEHAVIOR, KNOWLEDGE, AND DECISIONMAKING

• Respondents who reported following a budget were more likely to say they pay their bills on time, and

respondents who said they know where to find advice on financial decisions were more likely to report

having confidence in their ability to manage their finances.

• Seventy percent of respondents said they believed the cost of college was a good investment for their

financial future.

• Respondents who disagreed or strongly disagreed they always pay their bills on time reported experiencing

all key distress indicators at higher rates compared to all undergraduate respondents.

www.trelliscompany.org 9

Survey Overview

The SFWS is a self-reported, online survey that seeks to document the financial well-being

and student success indicators of postsecondary students across the country. The survey

was open beginning on October 24, 2022, and closed on November 14, 2022. Eighty-nine

(89) institutions participated in the survey—61 two-year institutions, 18 public four-years,

and 10 private not-for-profit four-years. While the pool of schools in the survey represents

a diverse group of institutions and students served, it should be considered a convenience

sample – albeit an extremely large one – as it is not strictly representative of the entire

nation. The response rate was 9.4 percent, so there may be response bias in the data.

Trellis tried to mitigate this risk by weighting the results by gender, age, and enrollment

intensity to better reflect the total population of the participating schools based on data

fields available for all students surveyed regardless of whether they responded or not.

Minimal dierences were found. When compared to all students surveyed, respondents

tended to be slightly older, more likely to attend full-time, and were more likely to identify

as female. While weighting the results by these indicators will make the results more

representative, there may be other factors beyond our control that may generate a bias in

the results. A detailed description of survey characteristics, comparison groups, tests for

representativeness, methodology, and other research notes can be found in Appendix A.

This report is divided into the following sections:

• Distress Indicators Among College Students

• Student Success Indicators

• Students Who Are Parents

• Paying For College

• Student Credit Card Use and Risky Borrowing

• Financial Behavior, Knowledge, and Decision-Making

WHEN COMPARED TO

ALL STUDENTS SURVEYED,

RESPONDENTS TENDED

TO BE SLIGHTLY OLDER,

MORE LIKELY TO ATTEND

FULL-TIME, AND WERE

MUCH MORE LIKELY TO

IDENTIFY AS FEMALE.

www.trelliscompany.org10

Distress Indicators Among

College Students

Paying for college can be stressful and challenging. With its steep, if brief, period of

investment, the long-term rewards of higher education can seem distant as students

become overwhelmed by associated costs. Unsurprisingly, a large majority of students

report financial diculties. This section shows the incidence of 10 indicators of financial

distress, sometimes breaking the results out by race/ethnicity, gender, first-generation

status, enrollment intensity, and school sectors. Many students say they would have

diculty meeting a $500 emergency, suggesting inadequate savings to cover unexpected

costs or financial shortfalls. Basic needs insecurity and mental health challenges can

have devastating impacts on students as well. Other indicators of distress – such as

selling one’s belongings to make ends meet or running out of money eight or more times

within a 10-month period – beset substantial portions of students. Such concerns can

impede learning, reduce happiness, and erode students’ social lives.

FINDINGS

• While a majority of respondents overall worried about paying current expenses and

having enough money to pay for school, students of color were more likely to report

this compared to white students. Black and Hispanic respondents were also more likely

to say they would have trouble finding $500 in cash or credit in case of an emergency

in the next month. (Q42, Q49-50)

• The use of savings or turning to family were the most common options for

respondents in need of $500 in a hypothetical emergency, but higher percentages

of four-year respondents would have these options available compared to two-year

respondents. Twelve percent of four-year respondents and 17 percent of two-year

respondents said they would be unable to find such an amount if faced with an

emergency. (Q43)

• Sometimes students face financial emergencies which deplete their reserves. While it

was fairly common to run out of money at least once, 20 percent of students ran out

of money eight or more times during the year. (Q44)

THE LONG-TERM

REWARDS OF HIGHER

EDUCATION CAN SEEM

DISTANT AS STUDENTS

BECOME OVERWHELMED

BY ASSOCIATED COSTS.

Trouble finding $500

69%Black

61%Hispanic

53%White

Worried about

current expenses

59%Black

55%Hispanic

51%White

Worried about

paying for college

63%Black

68%Hispanic

61%White

www.trelliscompany.org 11

Food Security

The Economic Research Service (ERS) of the United States Department of Agriculture

(USDA) defines food security as “access by all people at all times to enough food for

an active, healthy life.” Conversely, ERS describes food insecurity as “the limited or

uncertain availability of nutritionally adequate and safe foods, or limited or uncertain

ability to acquire acceptable foods in socially acceptable ways.”

1

Trellis assessed food security among surveyed students using the USDA short-form,

six-item scale. This scale identifies food-insecure individuals and households with high

sensitivity and specificity, and minimal bias.

2

• According to their survey responses, 46 percent of students had experienced food

insecurity within the 30 days before taking the survey. (Q81-86)

Q81-86: USDA Food Security Scale (30-Day)

54%

High or Marginal

Food Security

23%

Low

Food Security

23%

Very Low

Food Security

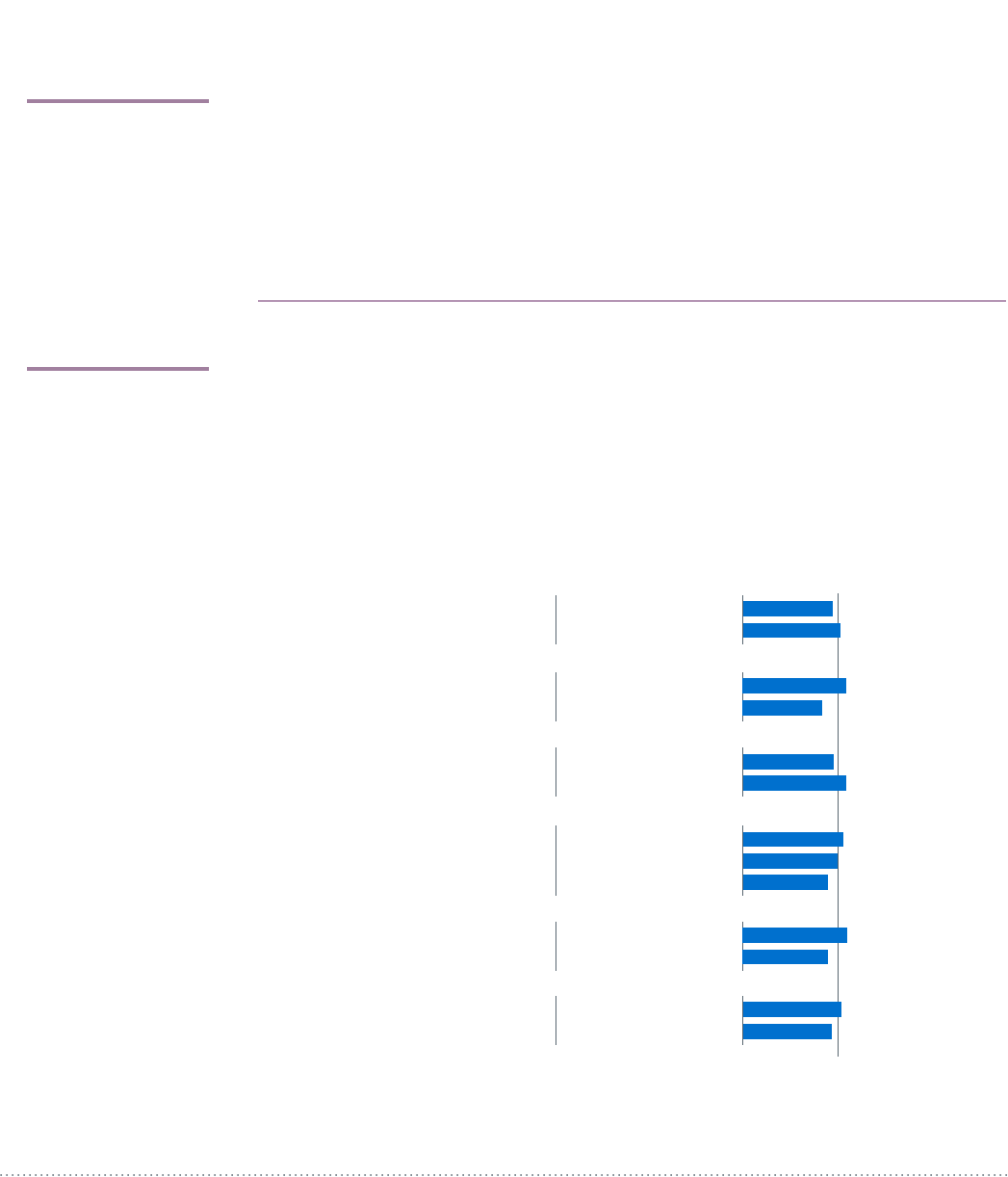

Percent of respondents who ran out of

money eight or more times during the year,

by characteristic

Black 33%

Hispanic

18%

White

17%

Female

Male

23%

14%

First Generation

Not First Generation

26%

16%

Average:

20%

Q43: Imagine that you had to pay a $500 cost

unexpectedly in the next month. In this situation, which

of the following resources would you turn to first?

My savings

31%

28%

A credit card

10%

11%

My parent(s) or other

family members

27%

18%

Delaying paying a bill

5%

7%

Selling my possessions

5%

6%

A loan

3%

3%

Reducing my spending

5%

6%

0%

0%

My friend(s)

My school

1%

1%

Other

2%

2%

I would not be able

to get $500

12%

17%

4-year Schools

2-year Schools

www.trelliscompany.org12

In response to this crisis, many institutions have established on-campus food

distribution centers, like food pantries, to better assist students who struggle to meet

their basic needs. However, research suggests that students are generally unaware of

these critical resources (see the Trellis brief, Hungry Minds, for more on this topic).

• Of the 89 colleges and universities that participated in the Fall 2022 implementation,

71 (80 percent) had at least one food pantry or closet available to students.

• Forty-six percent of those who responded “I don’t know” or “no” to the question

about the presence of an on-campus food pantry were food insecure. Further, only

19 percent of food insecure students reported visiting a pantry of any type (on- or

o-campus). (Q87-88)

Housing Security and Homelessness

The Student Financial Wellness Survey incorporates measures of housing security and

homelessness that are commonly used by other researchers studying basic needs security.

3

According to the United States Department of Housing and Urban Development

(HUD), housing insecurity encompasses a range of issues, “including diculty finding

aordable, safe, and/or quality housing, having unreliable or inconsistent housing, and

overall loss of housing.”

4

This may involve diculties in paying for rent and utilities,

needing to frequently move, living in overcrowded conditions, and more.

For many students, maintaining safe and stable housing during college is a significant

challenge. These obstacles can have a profound impact on students’ academic

performance, persistence, and ultimately, their ability to complete their studies and earn

a credential.

5

• Students at two-year institutions were more likely to report housing insecurity

(47 percent) than four-year respondents (40 percent). Overall, 44 percent were

housing insecure during the prior year. (Q90-95)

• Around one-fourth of surveyed students had diculties paying the full amount

of their utility bills (28 percent) and rent (25 percent). Fewer students reported

overcrowding (9 percent) or moving frequently (6 percent).

FOR MANY STUDENTS,

MAINTAINING SAFE AND

STABLE HOUSING DURING

COLLEGE IS A SIGNIFICANT

CHALLENGE.

60%

53%

Housing Secure

40%

47%

Housing Insecure

Q90-95: Housing Security Scale

4-year Schools 2-year Schools

www.trelliscompany.org 13

The most severe form of housing insecurity, homelessness is a significant obstacle to

students achieving their full academic potential. According to Federal Student Aid (FSA),

homelessness is defined as lacking “fixed, regular, and adequate housing.”

6

• While only five percent of students explicitly identified as unhoused, 15 percent

experienced homelessness at some point since starting college or within the last

year. (Q96-105)

• The most common expression of homelessness occurred when students

temporarily stayed with a friend or relative, or couch surfed while looking for

housing (11 percent). Four percent of students, respectively, did not have a home

or had been thrown out of their residence. Students were less likely to report

sleeping outdoors, staying in a shelter, or living in abandoned buildings.

0

3

6

9

12

15

Homelessness Scale Questions

Couch

surfing

10%

13%

Ever been

homeless

4%

6%

Didn’t have

a home

3%

5%

Thrown out

of home

3%

5%

Didn’t know

where would

sleep

2%

4%

Slept in

other closed

space

3%

4%

Evicted

from home

1%

2%

Stayed in

shelter

1%

2%

Stayed in

abandoned

building

0%

1%

Slept

outdoors

1% 1%

4-year Schools 2-year Schools

Overall Basic Needs Insecurity

College students often face one or more forms of basic needs insecurity (BNI) at the

same time, whether that be food insecurity, housing insecurity, or homelessness. Basic

needs security can also be fluid and change over time, meaning a student may be food

secure during the fall and spring semesters, but experience very low food security in the

summer (see the Trellis report “Studying on Empty” for more).

• Three in five students experienced food insecurity, housing insecurity, or homelessness

in the prior 12 months, not only jeopardizing their mental and physical health, but their

academic success.

• Food insecurity puts students at a higher risk of facing housing insecurity.

Thirty percent of students who responded to the survey were both food and

housing insecure.

• Overall, 10 percent of students experienced all three forms of basic needs insecurity

in the past year: food insecurity and housing insecurity and homelessness. The high

prevalence of basic needs insecurity among college students is deeply concerning

and demands urgent attention from policymakers, educators, and communities.

www.trelliscompany.org14

Mental Health Challenges

Not only are college students at an increased risk of experiencing basic needs

insecurity, but they are also more vulnerable to mental health challenges that can have

a significant impact on their academic performance, social lives, and physical wellbeing.

In fact, The Healthy Minds Study found that 60 percent of its respondents were likely

experiencing one or more mental health concerns in the 2020-2021 school year.

7

To assess potential mental health challenges among SFWS respondents, two validated

scales were used—the Patient Health Questionnaire-2 (PHQ-2) and the Generalized

Anxiety Disorder 2-item (GAD-2).

The PHQ-2 is a modified, short-form scale that measures the frequency of depressed

mood and the inability to feel pleasure over the past 14 days; the GAD-2 is a modified,

short-form instrument that screens for generalized anxiety disorder.

• Through their responses to the PHQ-2, nearly two in five students (36 percent)

indicated they were likely experiencing depression, a serious mood disorder.

• Sixty-nine percent of respondents had little interest or pleasure in doing things in

the prior 14 days to taking the survey. Nearly two-thirds (66 percent) of students

felt down, depressed, or hopeless in that same timeframe. (Q76-77)

• Anxiety is the leading mental health concern among students; in the Student

Financial Wellness Survey, 46 percent of respondents screened positive for

Generalized Anxiety Disorder.

• Eighty percent of students described feeling nervous, anxious, or on edge at least

several times in the 14 days prior to taking the survey. Almost a quarter

(23 percent) felt this way nearly every day. (Q78-79)

• Of the schools that took part in the survey, 88 percent either directly oered mental

health services (65 percent) or collaborated with an external organization to make

these services available to students (22 percent).

• While a significant portion of students knew of the mental health and counseling

services available to them (62 percent overall), those with mental health concerns

were often less aware of these resources. For instance, 40 percent of those likely

experiencing depression did not know their school had mental health services

available. (Q80)

0

10

20

30

40

50

60

70

80

No

77%

50%

Yes

2%

3%

21%

47%

I don’t know

Q80: Does your school have mental health or

counseling services available for students?

4-year Schools 2-year Schools

ANXIETY IS THE

LEADING MENTAL

HEALTH CONCERN

AMONG STUDENTS.

www.trelliscompany.org 15

Key Indicators of Distress

• Higher percentages of respondents who experienced key indicators of distress were

students of color, female students, first-generation students, or enrolled part-time

compared to all undergraduate respondents. While first-generation students made

up 36 percent of all undergraduate respondents, over half of those who would not

be able to get $500 in an emergency were first-generation students.

STUDENT CHARACTERISTICS BY DISTRESS INDICATOR

Those who… were… Non-White Female First Gen Part-time

All Undergraduate Respondents 53% 61% 36% 43%

Experienced Financial Diculty While Enrolled 54% 64% 39% 43%

Would Have Trouble Finding $500 in Emergency 56% 68% 42% 43%

Wouldn’t Be Able to Find $500 in Emergency

(from any resource)

61% 75% 51% 48%

Ran Out of Money 8 or More Times 58% 72% 47% 48%

Sold Belongings to Make Ends Meet 54% 68% 44% 44%

Indicated Major Depressive Disorder 54% 64% 39% 40%

Indicated Generalized Anxiety Disorder 51% 68% 38% 41%

Experienced Very Low Food Security 56% 67% 46% 42%

Experienced Housing Insecurity 54% 67% 43% 48%

Experienced Homelessness 57% 62% 47% 46%

www.trelliscompany.org16

Student Success

Indicators

Students need general good health, sucient energy, the ability to concentrate on

their studies, and the opportunity to attend classes if they are to excel in college. Stress

regarding finances and other mental health concerns can disrupt the patterns that lead

to high academic performance. In this edition of the SFWS, Trellis added questions

regarding the ability to concentrate on school and missed classes due to financial

pressures. This section examines the frequency of concentration diculties by several

student characteristics including race/ethnicity, age, and first-generation status, but

also by their reported level of importance placed on supporting families financially and

self-perception of being either a student or worker. Concentration and missed classes

can also be tied to Trellis’ ten indicators of financial distress.

FINDINGS

• Financial concerns impacted academics for some students, with with 48 percent

of respondents who had experienced financial challenges while enrolled agreeing

or strongly agreeing that they had diculty concentrating on schoolwork because

of their financial situation. Older students, first-generation students, students who

saw themselves as workers who attend school, and students who reported it was

important they support their family financially while enrolled were more likely to say

they had diculty concentrating on schoolwork because of their financial situation

compared to their peers. (Q4)

AS THE COST OF COLLEGE

CONTINUES TO RISE,

THE MOST VULNERABLE

STUDENT POPULATIONS

ARE FINDING THEMSELVES

REACHING FOR HIGH

INTEREST AND HIGH-RISK

SHORT-TERM LOANS.

Percent of respondents who reported diculty concentrating

on schoolwork because of their financial situation

Under 25

25 and older

46%

52%

Important

Not Important

Student Who Works

Worker Attending School

48%

55%

Average:

48%

Black

Hispanic

White

53%

50%

45%

Parent

Not a Parent

52%

47%

First Generation

Not First Generation

First Generation Status

55%

45%

Age Group

How Students Who Work

View Themselves

Race/Ethnicity

Parent Status

Importance of Supporting Family

Financially While in School

55%

42%

www.trelliscompany.org 17

• About a quarter of all respondents were parents, and a quarter of those parents

reported missing at least one class due to lack of childcare. Higher percentages of

students who experienced certain financial distress indicators (such as not being able

to get $500, running out of money, and experiencing basic needs insecurities) were

parents, compared to all undergraduate respondents, and higher percentages of the

parents with those indicators had missed classes due to childcare issues. Students

experiencing those financial distress indicators also reported missing classes due

to transportation issues at higher rates. Nearly all of the key distress indicators were

associated with higher levels of diculty concentrating on schoolwork due to the

student’s financial situation.

STUDENT CHARACTERISTICS BY DISTRESS INDICATOR

Those who… reported… Was a Parent

Missed

Classes –

Childcare*

Missed

Classes -

Transportation

Diculty

Concentrating**

All Undergraduate Respondents 22% 25% 13% 48%

Experienced Financial Diculty While

Enrolled

24% 28% 16% 48%

Would Have Trouble Finding $500

in Emergency

26% 29% 17% 57%

Wouldn’t Be Able to Find $500

in Emergency (from any resource)

38% 30% 21% 66%

Ran Out of Money 8 or More Times 36% 31% 21% 66%

Sold Belongings to Make Ends Meet 29% 34% 20% 61%

Indicated Major Depressive Disorder 19% 34% 19% 63%

Indicated Generalized Anxiety Disorder 19% 31% 17% 60%

Experienced Very Low Food Security 26% 34% 24% 71%

Experienced Housing Insecurity 31% 30% 19% 62%

Experienced Homelessness 27% 39% 28% 69%

*Of those who said they were a parent to a child or children.

**Of those who said they had experienced financial diculties or challenges while in college.

www.trelliscompany.org18

Students Who Are Parents

A sizable percentage of the respondents – 22 percent – reported being parents. The

responsibilities that come with parenthood can aect students’ available time to study

and disrupt concentration. The added costs of childcare can stress their already limited

resources

8

, forcing many to explore other non-traditional sources of funding including

public assistance and risky credit. Yet even with these non-traditional sources, finances

may be inadequate; parenting students still have a generally higher incidence of financial

distress indicators. Addressing the financial challenges of parenting students can help

institutions improve their student success rates.

FINDINGS

• Twenty-two percent of respondents reported being a parent, primary caregiver, or

legal guardian to children. Parenting students were more likely to attend two-year

institutions and enroll part-time. These students were also more likely to be the first

person in their family to attend college, be 25 years of age and older, female, or

identify as Black.

• Higher percentages of parenting students reported using every category of public

assistance compared to respondents without children. Nearly half of respondents

with children reported using medical assistance and food assistance in 2022.

• Student parents were more likely to have used a credit card during the year than

non-student parents (67 percent vs. 49 percent). Among the respondents who had

used a credit card, parenting students were less likely to say they always pay their bill

on time, and less likely to say they pay o the full balance each month, compared to

non-parenting students.

Q56-61: Percent of respondents who indicated use

of public assistance, by assistance type

Medical Assistance

43%

18%

Utility Assistance

13%

3%

Childcare Assistance

10%

1%

Housing Assistance

8%

2%

Unemployment Assistance

3%

2%

Food Assistance

41%

11%

Parent

Not a Parent

ADDRESSING THE

FINANCIAL CHALLENGES

OF PARENTING STUDENTS

CAN HELP INSTITUTIONS

IMPROVE THEIR STUDENT

SUCCESS RATES.

www.trelliscompany.org 19

• Higher percentages of student parents reported experiencing nearly all of the key

distress indicators compared to non-student parents. Respondents with children

were particularly likely to report diculty finding $500 in an emergency, running out

of money, selling belongings, or experiencing housing insecurity.

100

69%

81%

Agree/Strongly Agree

20%

9%

Disagree/Strongly Disagree

Q66: I always pay my credit card bill on time.*

(of those who borrowed on a credit card)

Parent

Not a Parent

*Responses indicating 'Neutral' are not shown

20%

47%

Agree/Strongly Agree

69%

38%

Disagree/Strongly Disagree

Q67: I fully pay o my credit card balance each month.*

(of those who borrowed on a credit card)

Parent

Not a Parent

*Responses indicating 'Neutral' are not shown

Indicator

All Undergrad

Respondents Student Parents Not Student Parents

Experienced Financial Diculty While Enrolled 73% 81% 71%

Would Have Trouble Finding $500 in Emergency 57% 69% 54%

Wouldn’t Be Able to Find $500 in Emergency

(from any resource)

15% 26% 12%

Ran Out of Money 8 or More Times 20% 33% 16%

Sold Belongings to Make Ends Meet 37% 48% 34%

Indicated Major Depressive Disorder 36% 30% 37%

Indicated Generalized Anxiety Disorder 46% 41% 48%

Experienced Very Low Food Security 23% 27% 22%

Experienced Housing Insecurity 44% 61% 39%

Experienced Homelessness 15% 18% 14%

www.trelliscompany.org20

Paying For College

Self-help has become a foundational element of higher education financing, but it is

rarely sucient. Through their personal savings and current employment, students

invest heavily in their own education, but typically must access other sources of financial

support from family, government programs, and through credit. Students rely on an array

of sources that can dierently influence their ability to concentrate on academics. The

need to accumulate numerous sources of aid—in particular, government programs—can

also create information barriers to college, as students attempt to navigate programs that

have their own set of eligibility rules, application processes, and program terms. Within

this context, the importance of completing a FAFSA is key as it can unlock resources for

which the student may be eligible. Reliance on certain types of aid, such as grants, loans,

and emergency aid can alter the prevalence of financial distress indicators as can the lack

of family financial support.

FINDINGS

Q36: Did any of the following contribute to your decision

to not complete the FAFSA? Please check all that apply*

*Of those who said they did complete the FAFSA

I did not think I would be

eligible for financial aid

50%

I could aord to go to school

without financial aid

22%

I did not want the possibility

of taking on debt

20%

The application form(s) were too much

work or too time-consuming

14%

I did not have enough information

about how to apply for financial aid

15%

I did not plan to continue my

degree/program

2%

Other reason(s) 36%

STUDENTS RELY ON AN

ARRAY OF SOURCES

THAT CAN DIFFERENTLY

INFLUENCE THEIR ABILITY

TO CONCENTRATE ON

ACADEMICS.

Q35: Did you receive any help in completing the FAFSA?

Check all that apply.*

I completed the FAFSA on my own

68%

75%

Another family member

4%

5%

Another on-campus oce

or resource

2%

3%

Other

8%

10%

University or college

financial aid oce

5%

7%

Community organization or college

access program (e.g. TRiO,

College Forward, etc.)

1%

2%

Parents

46%

30%

4-year Schools

2-year Schools

*Of those who said they did complete the FAFSA

• Most respondents had completed the Free Application for Federal Student Aid

(FAFSA). Eighty-one percent of respondents reported completing it while 16 percent

said they did not complete it and three percent were unsure.

www.trelliscompany.org 21

• Four-year respondents were more likely

to report that their parents completed

the FAFSA for them compared to

two-year respondents.

• Among all respondents who did not

complete the FAFSA, common reasons

included perceived ineligibility, not wanting

to take on debt, or a belief they could aord

school without financial aid. (Q34-36)

• While self-help is a common source of

funding to pay for college, it rarely is

enough; few students today can pay their

way through college using just their savings

and income. Only two percent of four-year

respondents and five percent of two-year

respondents reported using only current

income and/or personal savings to pay for

college. (Q24-32)

• Seventy-five percent of respondents

reported using grants, scholarships, student

loans, and/or parent loans to pay for school.

Forty-four percent of respondents who

reported using grants to pay for school

also reported borrowing student loans. In

fact, those using grants to pay for school

were more likely to borrow student loans

compared to those who did not use grants.

(Q24-25, Q27-28)

• Thirty-seven percent of respondents had

some form of family support to pay for

college, though it varied by dierent student

characteristics. (Q26)

Q24-32: Do you use any of the following methods to pay for college?

Respondents who answered 'Yes'

Self-Help

Personal savings

Current employment

60%

61%

61%

52%

Family Support

Support from my

parents and/or family

49%

32%

Student loan(s) my

parents took out

18%

4%

Grants

Pell Grants and/or

other grants

55%

59%

Scholarships

63%

38%

Military or

veteran benefits

7%

5%

Credit cards

Credit

Student loan(s) I have

taken out for myself

48%

26%

29%

30%

Student loan(s) my

parents took out

18%

4%

4-year Schools

2-year Schools

www.trelliscompany.org22

Percent of respondents who reporting having family support

to pay for college, by student characteristic

Average:

37%

Black

Hispanic

White

29%

36%

39%

Parent

Not a Parent

20%

49%

First Generation

Not First Generation

First Generation Status

32%

47%

Race/Ethnicity

Parent Status

Indicator

All Undergrad

Respondents Had Grant

Had Student

Loan

No Family

Support

Received

Emergency

Aid

Experienced Financial Diculty

While Enrolled

73% 79% 88% 75% 84%

Would Have Trouble Finding $500

in Emergency

57% 66% 70% 60% 66%

Wouldn’t Be Able to Find $500

in Emergency (from any resource)

15% 20% 21% 18% 18%

Ran Out of Money 8 or More Times 20% 24% 28% 22% 24%

Sold Belongings to Make Ends Meet 37% 42% 46% 39% 44%

Indicated Major Depressive Disorder 36% 37% 38% 35% 36%

Indicated Generalized Anxiety Disorder 46% 48% 50% 46% 47%

Experienced Very Low Food Security 23% 27% 32% 25% 28%

Experienced Housing Insecurity 44% 51% 57% 49% 54%

Experienced Homelessness 15% 17% 19% 17% 18%

• While somewhat higher percentages of respondents who used grants to pay for

school and those who received emergency aid from their institution had experienced

key distress indicators compared to all respondents, those who had borrowed

student loans reported even higher rates of distress.

www.trelliscompany.org 23

Student Credit Card Use

and Risky Borrowing

Postsecondary education is a personal investment that students make towards their career

and life ambitions. Because the financial returns on this investment can take years to

materialize, many turn to various forms of credit to spread out the payments over time.

But whereas educational loans typically are subsidized and come with various consumer

protections, other forms of credit like credit cards, auto title loans, and payday loans do

not. While students may use these riskier forms of credit out of a lack of awareness of

these risks, it’s more likely they have fewer alternatives to make ends meet. This section

documents the use of credit cards, auto title loans, and payday loans and how their use

is associated with indicators of financial distress.

FINDINGS

• Credit card use was much more common among students compared to pay day

loans and auto title loans. However, while 77 percent of respondents who used a

credit card in the past year reported paying their bill on time, 47 percent failed to pay

their full balance each month, accruing interest at potentially high rates. (Q62-64,

Q66-67)

0

10

20

30

40

50

60

53%

Credit Card

6%

Pay Day Loan

6%

Auto Title Loan

Q62-64: Since January 1, 2022, have you

used the following borrowing sources?

Respondents who answered 'Yes'

*Responses indicating 'Neutral' are not shown

0

10

20

30

40

50

60

70

80

77%

Agree/

Strongly Agree

12%

Disagree/

Strongly Disagree

Q66: I always pay my credit card bill on time.*

(of those who borrowed on a credit card)

*Responses indicating 'Neutral' are not shown

0

10

20

30

40

50

60

70

80

39%

Agree/

Strongly Agree

47%

Disagree/

Strongly Disagree

Q67: I fully pay o my credit card balance each month.*

(of those who borrowed on a credit card)

CREDIT CARD USE WAS

MUCH MORE COMMON

AMONG STUDENTS

COMPARED TO PAY DAY

LOANS AND AUTO

TITLE LOANS.

www.trelliscompany.org24

• Respondents from four-year schools, white respondents, and non-first-generation

respondents were more likely to report that they fully pay o their credit card balance

each month, compared to their peers.

• Respondents who had used a credit card did not dier much on key distress

indicators from all respondents overall. However, those who had borrowed auto

title loans and payday loans reported experiencing key distress indicators at higher

rates compared to all respondents. More than three-quarters of respondents who

had borrowed a payday loan said they had experienced financial diculties while

enrolled, would have trouble finding $500 in an emergency, and had experienced

housing insecurity.

Percent of respondents who report fully paying o

their credit card balance each month

Average:

39%

Black

Hispanic

White

37%

24%

43%

Four-year Schools

Two-year Schools

45%

35%

First Generation

Not First Generation

First Generation Status

31%

44%

Race/Ethnicity

School Sector

www.trelliscompany.org 25

Indicator

All Undergrad

Respondents

Used Credit

Card

Borrowed

Auto Title

Loan

Borrowed

Payday Loan

Experienced Financial Diculty While Enrolled 73% 78% 85% 92%

Would Have Trouble Finding $500 in Emergency 57% 58% 69% 86%

Wouldn’t Be Able to Find $500 in Emergency

(from any resource)

15% 14% 20% 33%

Ran Out of Money 8 or More Times 20% 21% 31% 51%

Sold Belongings to Make Ends Meet 37% 40% 53% 64%

Indicated Major Depressive Disorder 36% 35% 40% 42%

Indicated Generalized Anxiety Disorder 46% 47% 51% 53%

Experienced Very Low Food Security 23% 24% 35% 46%

Experienced Housing Insecurity 44% 50% 63% 80%

Experienced Homelessness 15% 15% 23% 27%

www.trelliscompany.org26

Financial Behavior,

Knowledge, and

Decision-Making

For many students, navigating the information barriers of college financing can be

confusing with its foreign terminology, complex legal documents, and daunting

implications. Students often confront these obstacles with underdeveloped financial

knowledge and limited experience. The decisions they make while in college help

form lasting financial behaviors. Trellis introduced a question about students’ perceived

return on investment which we analyze by dierent categories of students such as

attitudes about student debt, parental status, and school sector.

FINDINGS

• Many students reported positive financial behaviors. Seventy percent said they always

paid their bills on time and 48 percent followed a weekly or monthly budget. Those

who reported following a budget were more likely to say they pay their bills on time.

(Q46-47)

• Students who know where to find advice on financial decisions were more likely

to have confidence in their ability to manage their finances. Seventy percent of

respondents who said they have the ability to manage their finances said they knew

where to find the financial advice they need, compared to 39 percent who said they

don’t have the ability to manage their finances. (Q48, Q55)

STUDENTS WHO

KNOW WHERE TO FIND

ADVICE ON FINANCIAL

DECISIONS WERE

MORE LIKELY TO HAVE

CONFIDENCE IN THEIR

ABILITY TO MANAGE

THEIR FINANCES.

0

10

20

30

40

50

44%

Financial Aid

Advisor

Academic

Advisor

38%

23%

Faculty

Member

15%

Other

Sta

37%

I Have Not Spoken

With Any of These

Individuals

Q12-16: During my time at school, I have spoken with the following

individuals about my financial struggles. (Check all that apply)*

*Percentage indicate respondents who chose at least one of the above choices

79%

9%

Follows Budget

62%

21%

No Budget

Q46: Always pay their bills on time by Budget Status*

Agree/Strongly Agree Disagree/Strongly Disagree

*Responses indicating 'Neutral' are not shown

70%

39%

Agree/Strongly Agree

9%

35%

Disagree/Strongly Disagree

Q48: Ability to manage finances well*

Know Where to Find Don’t know Where

*Responses indicating 'Neutral' are not shown

www.trelliscompany.org 27

• Sixty percent of students said they would

seek financial support services, like financial

coaching, if oered by their institution.

While 37 percent of students had not

spoken with anyone at their institution

about their financial struggles, those who

did were most likely to speak with financial

aid advisors. However, many students

sought advice from ocials who were not

experts in financial aid programs, such as

academic advisors, faculty members, or

student aairs sta. (Q6, Q12-16)

• Black and Hispanic students were more

likely to say they would use financial

services oered by their institution

compared to white students. (Q6)

• Overall, 70 percent of respondents said

they believed the cost of college was a

good investment for their financial future.

However, some students were more likely

to believe this than others. Student loan

borrowers who said they did not have more

debt than they expected, were confident

about their ability to repay their loans,

and were confident about a future loan

forgiveness were more likely to agree that

college was a good investment. Additionally,

parenting students, students who felt their

school was aware of their financial situation,

students who were not worried about

paying for school, and community college

students were more likely to agree that

college was a good investment. (Q53)

• Respondents who disagreed or strongly

disagreed that they always pay their bills on

time reported experiencing all key distress

indicators at higher rates compared to all

undergraduate respondents.

Hispanic

73%

9%

Black

64%

11%

54%

17%

White

Q6: Students that would use professional financial support

services if oered by their school, by Race/Ethnicity*

Agree/Strongly Agree Disagree/Strongly Disagree

*Responses indicating 'Neutral' are not shown

Percent of respondents who agree or strongly agree the cost

of college is a good investment for their financial future

Aware

Not Aware

75%

66%

Average:

70%

Confident or Very Confident

Less Than Confident

Confidence About

Ability to Repay Loans

82%

64%

Not More Than Expected

More Than Expected

78%

66%

School Awareness of

Students’ Financial Situation

Worry About Paying

for School

Worry

No Worry

70%

77%

Have More Student Loan

Debt Than Expected

Confidence About Future

Loan Forgiveness

Confident or Very Confident

Less Than Confident

75%

68%

School Sector

Four-year Schools

Two-year Schools

66%

74%

Parenting Status

Parent

Not a Parent

79%

68%

www.trelliscompany.org28

Indicator

All Undergrad

Respondents

Financial

Knowledge

Scale – Zero

Correct

Financial

Knowledge

Scale – All

Correct

Doesn’t

Follow a

Budget

Doesn’t Pay

Bills on Time

Experienced Financial Diculty

While Enrolled

73%

68% 74% 76% 91%

Would Have Trouble Finding $500

in Emergency

57%

59% 52% 60% 85%

Wouldn’t Be Able to Find $500

in Emergency (from any resource)

15%

19% 11% 16% 36%

Ran Out of Money 8 or More Times 20%

21% 17% 23% 50%

Sold Belongings to Make Ends Meet 37%

36% 34% 35% 60%

Indicated Major Depressive Disorder 36%

39% 33% 40% 45%

Indicated Generalized Anxiety Disorder 46% 48%

43% 51% 56%

Experienced Very Low Food Security 23%

22% 21% 23% 44%

Experienced Housing Insecurity 44%

39% 45% 46% 79%

Experienced Homelessness 15%

12% 15% 14% 28%

www.trelliscompany.org 29

Research to Practice

The responses contained in this report provide deep insights into the financial lives of our students and can inform

campus policy, procedures, and programs. Based on the responses, Trellis has identified a few areas of focus for campus

leaders that are looking to address issues related to student financial wellness.

COST OF ATTENDANCE

Tuition and direct fees have received substantial attention over the past decade by Boards and campus

leadership as individuals look to slow the growth in the cost of college. Given the recent inflationary economic

climate and the large increases in costs for basic needs, students are feeling increased financial pressure.

Campus Change:

Campuses can conduct an extensive review of their cost of attendance and utilize numerous data sources

to present an accurate picture of current indirect costs.

INTEGRATED SUPPORT

Institutions are continuing to add student facing supports that address numerous barriers to student basic

needs and student success. Services like counseling support, benefit navigators, and rent assistance programs

all provide key and necessary services to students. All of these challenges are linked, and campuses will

benefit from finding unique connection points to provide various services to students including integrating

local social service agencies.

Campus Change:

Institutions should actively seek out partnerships with social service organizations that are providing basic

needs supports to individuals. This includes organizations like Head Start, WIC, Transit Agencies, and

regional food bank providers. Deepening these relationships will allow for better supporting students.

EMERGENCY FUNDING

The absence of federal funding has left a large void in the emergency funding landscape. Survey responses

show that many students face substantial barriers to access money in the case of an emergency, which can

result in derailing their educational experience.

Campus Change:

As we transition out of an environment of federal support for emergency aid, institutions can prioritize

fundraising for emergency aid programs and reallocate financial aid strategies to include reactive support

funding. Additionally, institutions can look to structure match savings programs that work to assist

students in developing an emergency fund similar to this work at Austin Community College.

PARENTING STUDENTS

Students that are parents are dicult to identify on campus but continue to make up a large percentage

of student bodies, especially at two-year institutions. These students face significant constraints related to

their time and finances as they purse their education. As childcare costs rise, these financial challenges will

continue to grow, making student success more dicult.

Campus Change:

Campuses are encouraged to appoint a student parent liaison that can assist with helping student parents

move through the institution. This individual can also be charged with the development of parent-friendly

policies and programs including childcare, course scheduling times, priority scheduling for student

parents, and creating communities to enhance a sense of belonging.

www.trelliscompany.org30

CREDIT CARD USAGE

While student loans dominate popular discussions about college financing, responses from students show

continued heavy use of credit cards to fund elements of their educational experience, especially indirect

costs. Campuses can provide on-going education related to credit cards and can continue to strengthen

student financial competency.

Campus Change:

Given the precarious funding structures that many students experience, campuses are encouraged to

make financial aid awards that provide as much clarity as possible over the life of the degree program.

Campuses are encouraged to review any awards that are declining in the amount over the student’s

enrollment on campus and to review eligibility requirements to promote continued enrollment.

WORKERS WHO ATTEND SCHOOL

One interesting finding is that those that are attending school while working often identify as an employee

first, and a student second. Given their dependency on current earnings, this has implications for how

institutions understand and promote student engagement.

Campus Change:

Campuses have an opportunity to work directly with area employers to more conveniently schedule

courses, provide seamless tuition reimbursement, and explore options for tuition subsidy programs

that assist with workforce development. Additionally, campuses should design policy, procedures, and

programs to support the whole person, recognizing that for many, the identity of student is secondary to

that of employee. This work includes developing explicit personas to better understand student barriers

to completion, including an appreciation of the whole cost of education which encompasses direct costs

(i.e., tuition and fees), indirect costs (i.e., room, board, transportation, supplies, technology), as well as

opportunity costs associated with forgoing full-time employment.

MULTIPLE SOURCES OF FUNDING

Survey responses continue to highlight that students piece together numerous funding sources to pay for

their postsecondary experience. Diversification, in this sense, injects additional risk with the loss of one

funding source potentially creating a significant barrier to continued enrollment.

Campus Change:

Given the precarious funding structures that many students experience, campuses are encouraged to

make financial aid awards that provide as much clarity as possible over the life of the degree program.

Campuses are encouraged to review any awards that are declining in the amount over the student’s

enrollment on campus and to review eligibility requirements to promote continued enrollment.

www.trelliscompany.org 31

Conclusion

College is a time of intense learning that can shape a person’s trajectory in the world.

Student financial wellness can impact this pathway in important ways. This report

documents how a broad cross section of students pays for college and how their

finances influence their ability to succeed. This edition of the SFWS explores how

students’ finances aect concentration on academics whether through pervasive

anxiety, worry about debt accumulation, missed classes due to transportation or

daycare issues, or securing one’s basic needs.

Research confirms the ecacy of student supports that reduce financial and information

barriers to student success, showing that these eorts improve not only academic

outcomes but even post-college earnings.

9

This study shows that students internally sense

this same connection, reporting higher expected return on investment from college when

their finances are secure and their institution understands their financial challenges. Trellis

identified key indicators of financial distress and used these indicators as a lens through

which to view how students pay for college, navigate parenthood as a student, rely on

credit, and develop financial behaviors and aptitudes.

Trellis views these findings as the first step in promoting student success. The deep

understanding that comes from this survey has helped colleges from across the country

develop initiatives to address the most destabilizing aspects of financial insecurity. This

report shares some of these promising practices. Trellis is committed to furthering this

iterative process of research and programmatic change as we help institutions grow

individual economic mobility and expand community prosperity.

THE DEEP

UNDERSTANDING

THAT COMES FROM

THIS SURVEY HAS

HELPED COLLEGES

FROM ACROSS THE

COUNTRY DEVELOP

INITIATIVES TO

ADDRESS THE MOST

DESTABILIZING

ASPECTS OF

FINANCIAL

INSECURITY.

www.trelliscompany.org32

Appendix A: Detailed Methodology

and Sample Characteristics

Participating Institutions in the Fall 2022 SFWS

The fall 2022 implementation of the SFWS captures the attitudes, perspectives, and self-reported financial behaviors of

more than 36,000 students from 89 colleges and universities in 23 states. While not nationally representative, student

respondents attended public universities, private colleges, and community colleges that range in size from nearly 70,000

students to fewer than 650. Student responses from all institutions were aggregated to provide a comparison group for

individual institutional findings by school sector.

Four-Year Public Institutions (18)

Angelo State University (TX)

Grambling State University (LA)

Mississippi Valley State University (MS)

Salisbury University (MD)

Sam Houston State University (TX)

Southern University and A&M College (LA)

State University of New York Oneonta (NY)

Sul Ross State University (TX)

Tarleton State University (TX)

Texas A&M University – Kingsville (TX)

Texas State University (TX)

University of Oklahoma (OK)

University of South Alabama (AL)

University of Texas at El Paso (TX)

University of Utah (UT)

University of West Alabama (AL)

University of Wyoming (WY)

Western Kentucky University (KY)

Four-Year Private Institutions (10)

Belmont University (TN)

College of Saint Mary (NE)

Herzing University (WI)

Houston Christian University (TX)

Lubbock Christian University (TX)

Midway University (KY)

Newberry College (SC)

Peirce College (PA)

St. Mary’s University (TX)

Vaughn College of Aeronautics and Technology (NY)

www.trelliscompany.org 33

Two-Year Institutions (61)

Allan Hancock College (CA)

Amarillo College (TX)

Asheville-Buncombe Technical Community College (NC)

Ashland Community and Technical College (KY)

Atlanta Metropolitan State College (GA)

Atlanta Technical College (GA)

Big Sandy Community and Technical College (KY)

Bluegrass Community and Technical College (KY)

Cape Fear Community College (NC)

Carteret Community College (NC)

Catawba Valley Community College (NC)

Central Carolina Community College (NC)

Central Piedmont Community College (NC)

College of the Albemarle (NC)

Dallas College (TX)

Davidson-Davie Community College (NC)

Delgado Community College (LA)

Elizabethtown Community and Technical College (KY)

Fayetteville Technical Community College (NC)

Gateway Community and Technical College (KY)

Grayson College (TX)

Haywood Community College (NC)

Hazard Community and Technical College (KY)

Henderson Community College (KY)

Hill College (TX)

Hopkinsville Community College (KY)

Howard College (TX)

Jeerson Community and Technical College (KY)

Lake Michigan College (MI)

Macomb Community College (MI)

Madisonville Community College (KY)

Martin Community College (NC)

Maysville Community and Technical College (KY)

McDowell Technical Community College (NC)

McLennan Community College (TX)

Monroe County Community College (MI)

Muskegon Community College (MI)

Navarro College (TX)

North Central Michigan College (MI)

Northeast Lakeview College (TX)

Northwest Vista College (TX)

Oakland Community College (MI)

Owensboro Community and Technical College (KY)

Palo Alto College (TX)

Panola College (TX)

Randolph Community College (NC)

Ranger College (TX)

Roanoke-Chowan Community College (NC)

Sandhills Community College (NC)

Seminole State College of Florida (FL)

Somerset Community College (KY)

Southcentral Kentucky Community and

Technical College (KY)

Southeast Kentucky Community and Technical College (KY)

Southern Maine Community College (ME)

Southwestern Oregon Community College (OR)

St. Philip’s College (TX)

Temple College (TX)

Tyler Junior College (TX)

Wayne Community College (NC)

West Kentucky Community and Technical College (KY)

Yakima Valley College (WA)

www.trelliscompany.org34

Methodology

The SFWS seeks to document the financial well-being and student success outcomes

of post-secondary students across the nation. Trellis hosted and delivered the online

survey in an attempt to understand more about the financial challenges and barriers

facing students, how students view their institutions’ awareness of those challenges

and barriers, and how the challenges and barriers alter how students view and attend

college. All participating institutions receive a school-level report of findings with

comparison response groups from their sector.

In order to host and deliver the survey to students, participating institutions provide

Trellis with the contact information and select demographics (to allow assessment of

representativeness) of study participants. Participants in the SFWS are asked to consent

to having additional select student-level records (e.g., number of credit hours, gender,

age) released by their institution for matching with their survey responses. Participating

institutions with enrollments above 10,000 students could choose to randomly sample

5,000 of their students or provide their entire population. Institutions with enrollments

lower than 10,000 included all students in the survey population.

To maximize student responses, Trellis contributed 50, $50 Amazon gift cards which were

randomly awarded to 50 study participants. Institutions were encouraged to supplement

the survey-wide incentive oered by Trellis with their own incentives where possible.

For survey-wide incentives provided by Trellis, Trellis randomly chose incentive winners,

contacted the incentive winners, and disbursed the incentives. For institutional incentives,

Trellis randomly chose incentive winners and provided institutions with contact

information to disburse the incentives. If a participant withdrew from the

survey before completion, they were still eligible for the incentive drawing.

Data were de-identified to create a dataset for analysis. In most instances, reports

primarily consist of descriptive statistics; however, additional exploratory data analysis

was conducted to identify trends among groups of respondents and answer the research

questions. Analyses conducted include chi-square tests and reliability tests to construct

and validate indexes contained within the survey instrument. All data are reported in

aggregate form only and reported data do not identify individual institutions outside of

confidential institution-level reports.

Sample Characteristics and Representativeness

Voluntary surveys—particularly those delivered online—are unlikely to achieve high

response rates. Lower response rates make surveys more susceptible to response bias,

i.e., the risk that those taking the survey don’t reflect the views of the total population.

The Student Financial Wellness Survey obtains data on both the total population and

responders. This allows for comparisons to determine if, based on these characteristics,

responders mirror the total population. The results are weighted using a post-stratification

weighting technique. Two-year institutions and four-year institutions were separately

weighted by gender, age, and enrollment intensity. Response bias in the sample

marginally aected the magnitude of the response frequencies presented for questions

in the survey but did not aect the overall findings and themes found from the study.

The tables in this appendix provide a comparison between the population of students

invited to participate and the sample of responders, and they present where there were

statistically significant dierences.

www.trelliscompany.org 35

Patterns of response were analyzed at the aggregate level in order to determine if

low quality responses (i.e., response patterns that indicate a lack of attention) were

skewing the data. On average, respondents chose a neutral response 17 percent of the

time where neutral was an option. The nature of the questions asked by the Student

Financial Wellness Survey result in neutral being a valid response in each case it was

made available. Additionally, many of the survey items with neutral response options

are part of indices or grouped questions for which consistent patterns of response

would be expected. Given the minimal impact and the potential of suppressing valid

responses, these responses were retained.

TESTS FOR REPRESENTATION BY STUDENT CHARACTERISTIC, UNWEIGHTED

All Undergraduates

Relationships between variables were tested for association using Pearson’s Chi-Square tests.

Race/Ethnicity

Statistical dierences between the population and sample (**Statistically significant result at

the p<.01 level). Hispanic students are overrepresented in the sample by a magnitude of one

percentage point and Black students are underrepresented in the sample by a magnitude of

one percentage point.

Gender

Statistical dierences between the population and sample (**Statistically significant result

at the p<.01 level). Female students are overrepresented in the sample by a magnitude of

16 percentage points.

Enrollment Intensity

(Full-time, Part-time)

Statistical dierences between the population and sample (**Statistically significant result

at the p<.01 level). Students enrolled full-time were overrepresented in the sample by a

magnitude of seven percentage points.

Credit Hours Earned

(Class Year)

No statistical dierences were observed between the population and sample.

Age

Statistical dierences between the population and sample (**Statistically significant

result at the p<.01 level). The average age of the sample is almost one year older than

the population.

GPA

Statistical dierences between the population and sample (**Statistically significant result

at the p<.01 level). The average GPA of the sample is 0.1 points higher than the population.

SURVEY METRICS

Fall 2022 SFWS – Undergraduate Cohort

2-year Institutions 4-year Institutions

Survey Population 241,307 students 147,346 students

Responses 20,536 students 15,910 students

Response Rate 8.5% 10.8%

Completion Rate 78% 79%

Median Time Spent 14 minutes 13 minutes

www.trelliscompany.org36

SURVEY CHARACTERISTICS FALL 2022 SFWS

Characteristic

Population

(N=388,653)

Respondents

(n=36,446)

Race/Ethnicity

American Indian/Alaskan Native 1% 1%

Asian, Hawaiian, or Other Pacific Islander 3% 4%

Black/African-American 17% 16%

Hispanic/Latinx 17% 18%

International 1% 1%

White 47% 47%

Multiple 3% 4%

Other 0% 0%

Race/Ethnicity Not Reported 11% 10%

Gender

Female 60% 76%

Male 39% 23%

Self-Identify/Not Reported 1% 1%

Enrollment Intensity

Full-time 55% 62%

Part-time 44% 38%

Class Year

1st (<30 credits earned) 47% 47%

2nd (30-59 credits earned) 24% 25%

3rd (60-89 credits earned) 15% 15%

4th (90-120 credits earned) 8% 9%

5th (120+ credits earned) 4% 4%

Age

Average Age 24.6 25.5

GPA

Average GPA 2.9 3.0

Scales: Net Promoter Score (Q22)

Trellis’ Student Financial Wellness Survey includes a customer satisfaction rating for

institutions to benchmark future work and to better understand how students perceive

their institution. Trellis collected the information with a scale that allows a Net Promoter

Score (NPS) to be calculated. NPS is a method, based in research, to benchmark customer

satisfaction ratings across dierent services, businesses, and products.

10

NPS uses a 0-10

scale. Those respondents who score 9-10 are promoters, 7-8 are passives, and 0-6 are

detractors. %Promoters - %Detractors = NPS. A positive NPS (>0) is generally considered

good, with highest performers usually between 50 and 80.

www.trelliscompany.org 37

Scales: United States Department of Agriculture (USDA) 30-Day Food Security

(Q84-89)

Trellis’ Student Financial Wellness Survey uses a six-question scale designed by the

United States Department of Agricultures (USDA) that measures food security within

the prior 30 days.

11

Many researchers of food security amongst college students use a