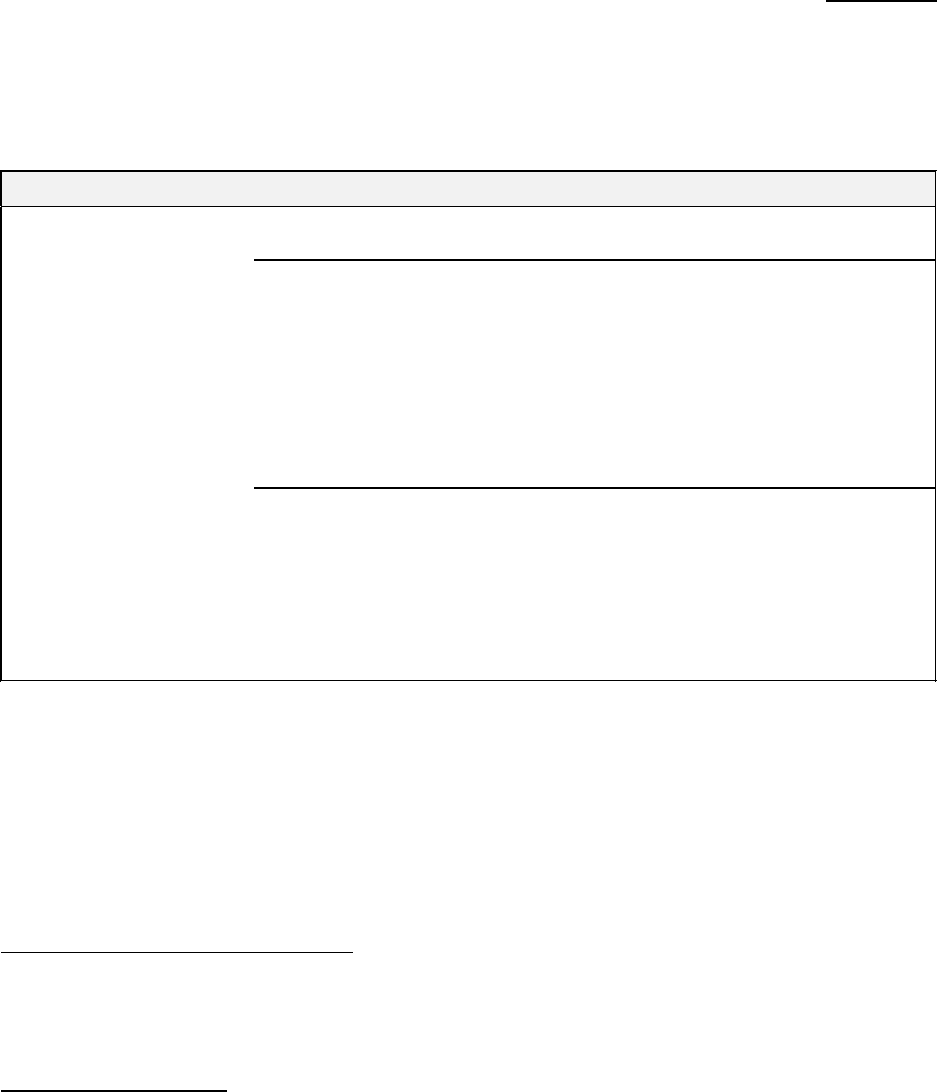

BOARD OF TRUSTEES

Carol Chaplin, Chair

Richard Jay, Vice Chair

Jennifer Cunningham, Treasurer

Adam Kramer, Secretary

Shaun Carey, Trustee

Joel Grace, Trustee

Kitty Jung, Trustee

Art Sperber, Trustee

Cortney Young, Trustee

PRESIDENT/CEO

Daren Griffin, A.A.E.

CHIEF LEGAL COUNSEL

Ian Whitlock

BOARD CLERK

Lori Kolacek

AGENDA

Board of Trustees Regular Meeting

Thursday, May 23, 2024 | 9:00 AM

Reno-Tahoe International Airport, Reno, NV

Administrative Offices, Second Floor

Notice of Public Meeting

Meetings are open to the public and notice is given pursuant to NRS 241.020.

This meeting will be livestreamed and may be viewed by the public at the following link:

Watch on Zoom: https://us02web.zoom.us/j/86188201516

Listen by Phone: Dial 1-669-900-6833

Webinar ID: 861 8820 1516

Accommodations

Members of the public who require special accommodations or assistance at the meeting are requested

to notify the Clerk by email at [email protected] or by phone at (775) 328-6402. Translated

materials and translation services are available upon request at no charge.

Public Comment

Anyone wishing to make public comment may do so in person at the Board meeting, or by emailing

comments to lkolac[email protected]. Comments received prior to 4:00 p.m. on the day before

the meeting will be given to the Board for review and included with the minutes of this meeting. To

make a public comment during the Zoom meeting, please make sure your computer or device has a

working microphone. Use the “Chat” feature to submit a request to speak. When the time comes to

make public comments, you will be invited to speak. Public comment is limited to three (3) minutes

per person. No action may be taken on a matter raised under general public comment.

Posting

This agenda has been posted at the following locations:

1. RTAA Admin Offices, 2001 E. Plumb

2. www.renoairport.com 3. https://notice.nv.gov/

Supporting Materials

Supporting documentation for this agenda is available at www.renoairport.com, and will be available

for review at the Board meeting. Please contact the Board Clerk at [email protected], or

(775) 328-6402 for further information.

RTAA Board of Trustees – May 23, 2024 Pg. 2

1. INTRODUCTORY ITEMS

1.1 Pledge of Allegiance

1.2 Roll Call

2. PUBLIC COMMENT

3. APPROVAL OF AGENDA (For Possible Action)

4. APPROVAL OF MINUTES

4.1 April 11, 2024, Board of Trustees meeting

4.2 April 23, 2024, Board of Trustees workshop

5. PRESIDENT/CEO REPORT

6. BOARD MEMBER REPORTS AND UPDATES

7. CONSENT ITEMS (All consent items may be approved together with a single motion, be

taken out of order, and/or be heard and discussed individually.)

7.1 Board Memo No. 05/2024-16 (For Possible Action): Review, discussion and potential

authorization for the President/CEO to execute a one-year contract for the Reno-Tahoe

Airport Authority employee workers’ compensation insurance coverage for Fiscal Year

2024-2025, with Starr Aviation, in the amount of $145,367

7.2 Board Memo No. 05/2024-17 (For Possible Action): Review, discussion and potential

authorization for the President/CEO to execute a five-year contract for the operation and

maintenance of the Baggage Handling System to Daifuku Services America Corporation in

accordance with requirements of the original manufacturer and the Transportation Security

Administration with the five-year total for all services in the amount of $8,231,595.73

7.3 Board Memo No. 05/2024-18 (For Possible Action): Review, discussion and potential

authorization for the President/CEO to execute a professional services agreement for design

services for the General Aviation East Apron and Taxilane Reconstruction Project at the

Reno-Tahoe International Airport, with Kimley-Horn and Associates, Inc, in the amount of

$437,080

8. INFORMATION / POSSIBLE ACTION ITEMS

8.1 (Non-Action Item): Public Hearing on adoption of the Reno-Tahoe Airport Authority’s

Fiscal Year 2024-25 Budget (July 1, 2024 through June 30, 2025)

(This is an opportunity for the public to comment on the Reno-Tahoe Airport Authority’s proposed

budget for the 2024-2025 fiscal year.)

RTAA Board of Trustees – May 23, 2024 Pg. 3

8.2 Board Memo No. 05/2024-19 (For Possible Action): Review, discussion and potential

adoption of the Reno-Tahoe Airport Authority’s Fiscal Year 2024-25 Budget (July 1, 2024

through June 30, 2025)

8.3 Board Memo No. 05/2024-20 (For Possible Action): Review, discussion and potential

adoption of Resolution No. 567 Amending Resolution No. 565, Establishing the Airport

Rates and Charges for Fiscal Year 2024-25 Pursuant to the Reno-Tahoe Airport Authority

Budget for Fiscal Year 2024-25

8.4 Board Memo No. 05/2024-21 (For Possible Action): Review, discussion and potential

approval of Investment Banking Pool of Underwriters Related to the Issuance of Airport

Revenue Bonds by the Reno-Tahoe Airport Authority for the MoreRNO Program of

Projects with BofA Securities Inc., Jefferies LLC, Samuel A. Ramirez & Co., Wells Fargo

Corporate & Investment Banking, Academy Securities Inc., Loop Capital Markets, RBC

Capital Markets LLC, and Stifel Nicolaus & Company Inc. and Underwriter Assignments

for the Initial Issuance of Bonds Anticipated in 2024

8.5 Board Memo No. 05/2024-22 (For Possible Action): Review, discussion and potential

approval of Resolution No. 568 Authorizing Declarations of Official Intent Under Internal

Revenue Code Regulations with Respect to Reimbursements from Bond Proceeds of

Advances Made for Payments Prior to Issuance and Related Matters

8.6 Board Memo No. 05/2024-23 (For Possible Action): Review, discussion and potential

adoption of Reno-Tahoe Airport Authority Fiscal Year 2024-25 Liability and Property

Insurance Program and Approval of Premiums in the Amount Not to Exceed $1,630,00

8.7 Board Memo No. 05/2024-24 (For Possible Action): Review, discussion and potential

adoption of Resolution No. 566 Amending Resolution No. 548 – A Resolution Adopting an

Update to Policy No. 600-007 on the Financial Incentives for Airlines and Dedicated Cargo

Carriers at the Reno-Tahoe International Airport

8.8 Board Memo No. 05/2024-25 (For Possible Action): Review, discussion and potential

authorization for the President/CEO to execute an Amendment No. 1, to the Professional

Services Agreement, for design services for 30 to 100% for the HQ Project at Reno-Tahoe

International Airport, with RS&H Company, in an amount of $6,326,407

8.9 (Non-Action Item): CEO's recommended changes to CSP and Management Guidelines

10. TRUSTEE COMMENTS AND REQUESTS

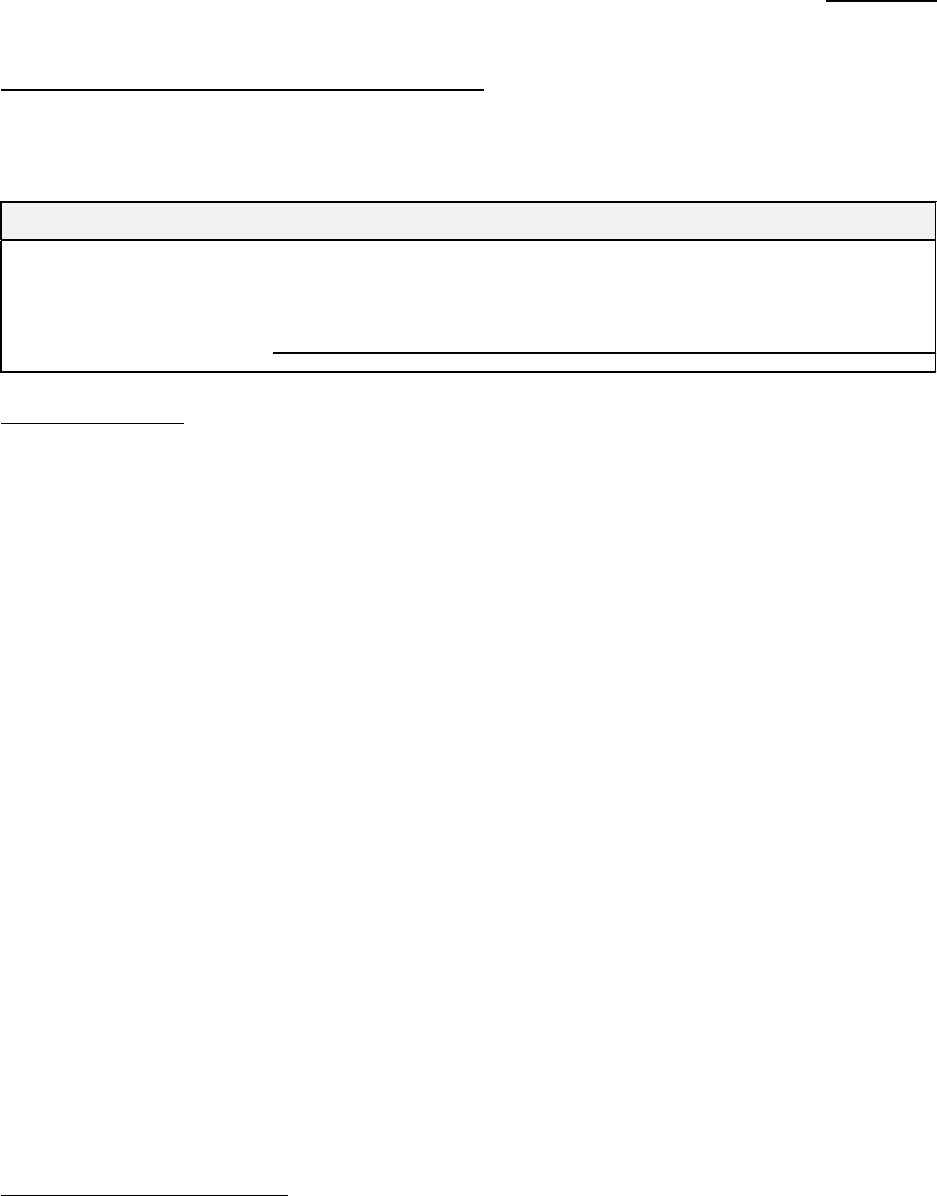

11. UPCOMING RTAA MEETINGS

DATE

MEETING

06/11/2024

Finance & Business Development Committee Meeting

Planning & Construction Committee Meeting

06/13/2024

Board of Trustees Regular Meeting

RTAA Board of Trustees – May 23, 2024 Pg. 4

07/09/2024

Finance & Business Development Committee Meeting

Planning & Construction Committee Meeting

07/11/2024

Board of Trustees Regular Meeting

08/06/2024

Finance & Business Development Committee Meeting

Planning & Construction Committee Meeting

08/08/2024

Board of Trustees Regular Meeting

12. PUBLIC COMMENT

13. ADJOURNMENT

BOARD OF TRUSTEES

Carol Chaplin, Chair

Richard Jay, Vice Chair

Jennifer Cunningham, Treasurer

Adam Kramer, Secretary

Shaun Carey, Trustee

Joel Grace, Trustee

Kitty Jung, Trustee

Art Sperber, Trustee

Cortney Young, Trustee

PRESIDENT/CEO

Daren Griffin, A.A.E.

CHIEF LEGAL COUNSEL

Ian Whitlock

BOARD CLERK

Lori Kolacek

--DRAFT--

MINUTES

Board of Trustees Regular Meeting

Thursday, April 11, 2024 | 9:00 AM

Reno-Tahoe International Airport, Reno, NV

Administrative Offices, Second Floor

1. INTRODUCTORY ITEMS

Chair Chaplin called the meeting to order at 9:01 a.m. Trustee Kramer led the pledge. Roll was

taken by the Clerk of the Board.

Trustees Present:

Shaun Carey, Carol Chaplin, Jennifer Cunningham, Joel Grace, Richard Jay, Kitty Jung,

Adam Kramer, Art Sperber, Cortney Young

2. PUBLIC COMMENT

Chair Chaplin called for public comment. There was none.

3. APPROVAL OF AGENDA (For Possible Action)

Motion: Move to approve the agenda as presented.

Moved by: Art Sperber

Seconded by: Richard Jay

Vote: Motion passed

4. APPROVAL OF MINUTES

4.1 February 8, 2024, Board of Trustees meeting

4.2 March 14, 2024, Board of Trustees meeting

Chair Cunningham asked if there were any corrections to the Minutes of February 8, 2024, and

March 14, 2024. Hearing none, the Minutes were approved as presented.

5. PRESIDENT/CEO REPORT

Dennis LeBaron, Facilities Project Manager II, gave a presentation on spring cleaning safety.

RTAA Board of Trustees – April 11, 2024 Pg. 2

CEO Griffin recapped events happening around the airport. He spoke about the Board’s

approval of Phase III with Conrac Solutions at last month’s Board meeting and thanked the team

for their efforts to complete the commercial close. He updated the Board on Air Service

developments and also reminded the Board about the 16

th

Annual RTAA Employee Art Show.

Lastly, he congratulated Aurora Ritter, Interim Chief Commercial Officer, for being the nominee

for this year’s Woman of Achievement recognition.

6. BOARD MEMBER REPORTS AND UPDATES

Trustee Jay announced that Mike Larragueta has been named the permanent CEO for the

RSCVA.

7. INFORMATION / POSSIBLE ACTION ITEMS

7.1 Board Memo No. 04/2024-13: (For Possible Action) Review, discussion and potential

approval of a Technical Services Agreement with ServiceTec International, Inc., for a

renewal of services, effective September 1, 2023, for $124,100 annually; an amendment

dated October 10, 2023, which increases support hours from 56 to 92 per week for $91,791

annually; an amendment dated March 1, 2024, to further extend support hours from 92 to

112 per week for annual total of $257,806; finally, a renewal of the agreement commencing

September 1, 2024, for an annual amount of $257,806

This item was previously heard by the Finance & Business Development Committee on April 9,

2024. No presentation was requested by the Board and no discussion took place. The following

action was taken:

Motion: Move to authorize the President/CEO to execute a Technical Services Agreement with

ServiceTec International, Inc for a renewal of services, effective September 1, 2023 for $124,100

annually; an amendment dated October 10, 2023 which increases support hours from 56 to 92

per week for $91,791 annually; an amendment dated March 1, 2024 to further extend support

hours from 92 to 112 per week for annual total of $257,806; finally, a renewal of the agreement

commencing September 1, 2024 for an annual amount of $257,806

Moved by: Jennifer Cunningham

Seconded by: Adam Kramer

Vote: Motion passed

7.2 Board Memo No. 04/2024-14: (For Possible Action) Review, discussion and potential

approval of a Professional Services Agreement for consulting services for federal lobbying

services, with Van Scoyoc Associates, in the amount of $6,000 per month through June 30,

2026, with options for two, 2-year extensions upon mutual agreement

This item was presented by Lindsay Anderson, Director of Government Affairs, and was first

heard by the Finance & Business Development Committee on April 9, 2024. After discussion,

the Board took the following action:

RTAA Board of Trustees – April 11, 2024 Pg. 3

Motion: Move to authorize the President/CEO to execute a Professional Services Agreement for

consulting services for federal lobbying with Van Scoyoc Associates (VSA) for the period of

May 1, 2024 through June 30, 2026, with two additional options to extend for two years each

Moved by: Kitty Jung

Seconded by: Joel Grace

Vote: Motion passed

7.3 Recommended Changes to the CSP & Management Guidelines (Non-Action Item)

Larry Harvey, Chief People, Culture & Equity Officer, walked the Board through the upcoming

changes to the CSP & Management Guidelines and the timeline for the process. These

guidelines will be revised to update outdated language, titles and procedures for performance

reviews. All revisions to these guidelines must be approved by the Board. In May, staff will

give a presentation on the specific revisions and, in June, bring the changes to the Board for

approval. He thanked Trustees Chaplin and Jung for their help in this process.

8. BOARD MEMBER COMMENTS AND REQUESTS

Chair Chaplin called for any Board member comments or requests. There were none.

9. UPCOMING RTAA MEETINGS

DATE

MEETING

04/23/2024

Board of Trustees Annual Budget Workshop

05/21/2024

Finance & Business Development Committee Meeting

Planning & Construction Committee Meeting

05/23/2024

Board of Trustees Regular Meeting

06/11/2024

Finance & Business Development Committee Meeting

Planning & Construction Committee Meeting

06/13/2024

Board of Trustees Regular Meeting

07/09/2024

Finance & Business Development Committee Meeting

Planning & Construction Committee Meeting

07/11/2024

Board of Trustees Regular Meeting

10. PUBLIC COMMENT

Chair Chaplin called for public comment. There was none.

11. ADJOURNMENT

Chair Chaplin adjourned the meeting at 9:30 a.m.

__________________________

Adam Kramer, Secretary

BOARD OF TRUSTEES

Carol Chaplin, Chair

Richard Jay, Vice Chair

Jennifer Cunningham, Treasurer

Adam Kramer, Secretary

Shaun Carey, Trustee

Joel Grace, Trustee

Kitty Jung, Trustee

Art Sperber, Trustee

Cortney Young, Trustee

PRESIDENT/CEO

Daren Griffin, A.A.E.

CHIEF LEGAL COUNSEL

Ian Whitlock

BOARD CLERK

Lori Kolacek

--DRAFT--

MINUTES

Board of Trustees Workshop

Tuesday, April 23, 2024 | 10:00 AM

-- Virtual Only --

1. INTRODUCTORY ITEMS

The meeting was called to order at 10:00 a.m.

Art Sperber was absent at the time of roll call. All other Trustees were present by Zoom.

2. PUBLIC COMMENT

Chair Chaplin called for public comment. There was none.

3. INFORMATION / POSSIBLE ACTION ITEMS

Board Memo No. 04/2024-15 (For Possible Action): Review, discussion and potential

authorization for the President/CEO to negotiate final terms and execute a settlement agreement

with Granite Construction Company, Inc., to resolve potential litigation related to the

reconstruction of Runway 17R/35L at the Reno-Tahoe International Airport pursuant to the

Contract Agreement dated April 8, 2020, between Granite Construction Company, Inc. and the

Reno-Tahoe Airport Authority

Chair Chaplin called for discussion on this item. Tom Luria, Associate General Counsel, noted

clerical errors included in the Board Memo and corrected those errors on the record. Those

changes are shown in the attached redlined Board Memo. After discussion, Chair Chaplin called

for a motion and the following vote was taken:

Motion: With the corrections mentioned by Mr. Luria, move to authorize the President/CEO to

negotiate final terms and execute a settlement agreement with Granite Construction Company,

Inc., to resolve potential litigation related to the reconstruction of Runway 17R/35L at the Reno-

Tahoe International Airport pursuant to the Contract Agreement dated April 8, 2020, between

Granite Construction Company, Inc. and the Reno-Tahoe Airport Authority.

Moved by: Adam Kramer

Seconded by: Richard Jay

Absent: Art Sperber

Vote: Motion passed

RTAA Board of Trustees – April 23, 2024 Pg. 2

[Trustee Sperber joined the meeting at 10:10 a.m.]

3.2 Board Workshop on the Preliminary Budget of the Reno-Tahoe Airport Authority for

the Fiscal Year Beginning July 1, 2024 (FY 2024-25) (Non-Action Item)

This item was presented by Alex Kovacs, Director of Finance.

4. PUBLIC COMMENT

Chair Chaplin called for public comments. There was none.

5. ADJOURNMENT

Chair Chaplin adjourned the meeting at 11:06.

_____________________________

Adam Kramer, Secretary

President/CEO Report

To: All Board Members

From: Daren Griffin, President/CEO

Date: May 2024

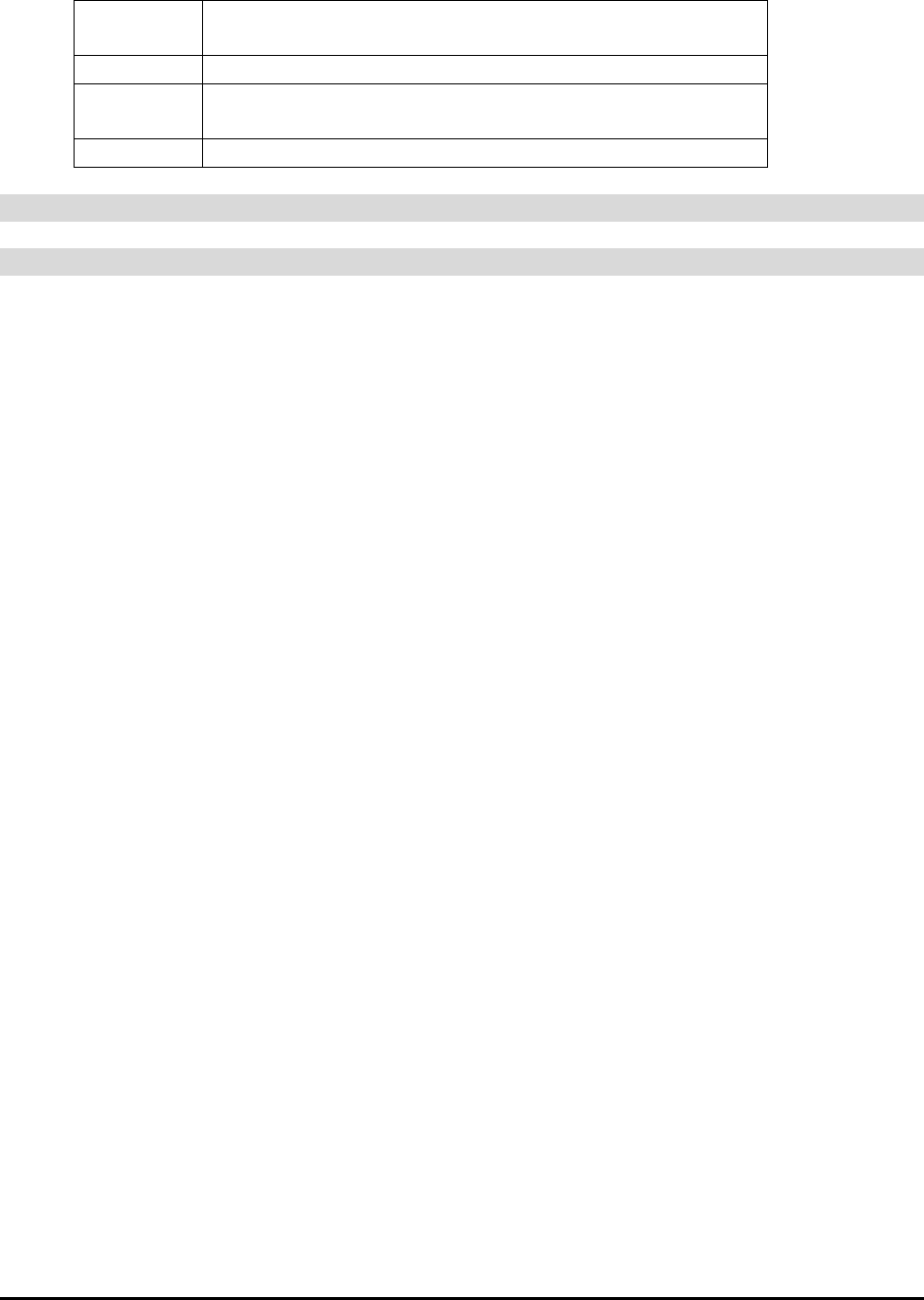

AIR SERVICE DEVELOPMENT

Airline Meetings

Staff will attend the Airport Council International JumpStart conference in Washington, D.C., during the

second half of May. Staff will hold pre-arranged one-on-one meetings with eight airlines. The airlines

include Southwest Airlines, Air Canada, United Airlines, JetBlue, Sun Country, Spirit Airlines, Frontier

Airlines, and American Airlines.

March 2024 RNO Passengers

Reno-Tahoe International Airport (RNO) served 395,906 passengers in March 2024, an increase of 4.1%

versus the same period last year. In March 2024, RNO was served by 11 airlines to 22 non-stop

destinations. The total seat capacity increased 9.4% and flights increased 6.1% when compared to March

2023.

Page 2 of 8

March 2024 RNO Cargo Volume

RNO handled 8,545,646 pounds of air cargo in March 2024, a decrease of 23.2% when compared to

March 2023.

Page 3 of 8

ECONOMIC DEVELOPMENT

Concessions

Gaming Industry Days

The RTAA held Gaming Industry Days on April 16-17, 2024, to share the upcoming gaming concession

opportunity and provide an update on MoreRNO. Six separate one-on-one meetings were held with

interested parties representing different gaming entities from casinos, manufactures, and gaming

operators. These meetings allowed staff to hear from interested parties on what, in their experience,

makes a successful gaming operation, and how the gaming program might be planned in New Gen A&B

to create a viable program while balancing the passenger experience. The meeting opportunity was

posted on the RTAA's website, advertised in the Reno Gazette Journal, Nevada Government eMarketplace

(NGEM), and shared directly with local casinos as well as members of the Association of Gaming

Equipment Manufacturers (AGEM). Staff is working on next steps including follow up meetings and an

upcoming public solicitation.

Properties

GTC Project

After the Board voted to proceed with Phase III of the project, Commercial Close was achieved on April

9, 2024, which entailed execution of various documents including the 30-year Ground Lease between

RTAA and RNO Conrac, LLC, the design-build construction contract, and various financial hedges that

locked in debt rates for the deal with JP Morgan Chase. Conrac Solutions and airport staff and

representatives have continued to work diligently to prepare the required documentation for Financial

Close, finalizing design, and submitting building permits for enabling projects. Conrac Solutions achieved

Financial Close on May 2, 2024.

RTS Land Development

Dermody Properties Development

Grading work continues on the Phase I site with slab pours following shortly after. The first wall tilt-up

for the buildings is scheduled for July 10, 2024.

RNO Land Development

Stellar Aviation

Stellar continues to focus on the construction of their second hangar to complete their Phase I project.

Stellar is coordinating with RTAA Staff for a grand opening event toward the end of May, possibly May

23rd.

Tolles Development

The Tolles Development project is proceeding according to schedule and should be complete by the end

of May or beginning of June. Preleasing continues to be strong. Tolles is coordinating with RTAA Staff for

a grand opening event towards the middle of June.

OPERATIONS & PUBLIC SAFETY

Department Event 03/2024 03/2023 03/2022

Joint Actions

Aircraft Alerts: ARFF, Ops, Police, Aircom

5

2

0

Medicals: ARFF, Ops, Police, Aircom

27

39

22

Operations

Inspections

146

12

65

Page 4 of 8

Wildlife Incidents

2

0

6

Police

TSA Checkpoint Incidents

19

24

16

Case Numbers Requested

11

9

11

Security

Alarm Responses

61

76

228

Inspections: Vehicle, Delivery, Employee

940

1082

1045

Badge Actions

1012

1006

805

ARFF

Inspections: Fuelers/Facilities

13/1

22/7

2/9

Landside

Public Parking – Total Revenue

$1,511,823.00

$1,483,506.00

$1,114,479.00

Public Parking – Total Transactions

40,578

39,318

37,474

Public Parking – Average $ Per Transaction

$37.26

$37.73

$29.74

Shuttle & Bus Trips Through GT

9,369

8,970

8,819

Transportation Network Company Trips

34,191

15,344

11,709

Taxi Trips Through GT

4,670

6,108

6,376

PLANNING & INFRASTRUCTURE

Engineering & Construction

Ticketing Hall

The Ticketing Hall Grand Opening ceremony occurred on April 12, 2024. The ribbon cutting ceremony

was well attended by former trustees, local agencies, design and construction teams, airline

representatives, tenants, and many guests. The elevator beacon tower was dedicated to General Herbert

XX. The 450-foot art wall was presented with Dixie Friend Gay discussing the inspiration of her artwork.

Loop Road Construction

Phase 2 of the Loop Road Construction began on April 15, 2024. The roadway section adjacent to the

ticketing hall and baggage claim was reopened and the roadway adjacent to the parking structure was

closed with single lanes available for the parking lot and rental car returns.

Planning & Environmental

Truckee Meadows Regional Planning Authority – RTAA Annual Report

As an affected entity, per Nevada Revised Statutes 278.0286, the RTAA is required to submit an annual

report to the Truckee Meadows Regional Planning Agency (TMRPA) which indicates how RTAA actions in

the previous year (Calendar Year 2023) have furthered or assisted in implementing the 2019 Truckee

Meadows Regional Plan. As required, Planning & Environmental staff provided a targeted narrative report

that addresses specific Regional Plan goals, capital improvement plan data, and public infrastructure data

by the April 1, 2024 deadline. In recent years, TMRPA staff have evolved the static PDF report into an

interactive website available here https://tmrpa.org/tmar/

The 2022 data is currently available, and the

newly reported 2023 data should be accessible in the coming months.

FAA Airport Capital Improvement Program (ACIP)

Planning & Environmental staff submitted the required annual update to the Federal Aviation

Administration’s (FAA) Five-Year Airport Capital Improvement Program (ACIP) for both the Reno-Tahoe

International Airport and the Reno-Stead Airport on May 3, 2024. Information submitted is incorporated by

the FAA Regional Airports Office into its regional ACIP. The Regional ACIPs are then incorporated into the

National ACIP. The National ACIP is the primary planning tool used by the FAA to identify and prioritize

nationwide airport capital improvement needs and to plan for the distribution of Airport Improvement

Program (AIP) funds over the next 3 to 5 years.

Page 5 of 8

Facilities & Maintenance

Electrical Feeds to Terminal Building

On April 30, Building Maintenance along with contractors IME & Vertiv completed connection and

balancing of the two main electrical feeds that serve our two concourses and the terminal building. This

will ensure that should we have an issue with one of the electrical main feeds serving the terminal, only

portions of the terminal or one concourse would be on generator power until full power could be switched

to the other main electrical feed.

Asphalt Shoulder Repair

The Airfield Maintenance teams have been using two recently purchased pieces of equipment to perform

asphalt crack repair and asphalt patching. The RTAA invested in a Rock Saw to grind the cracks and a 4-

Ton Hot Box to keep the asphalt at the correct temperature and deliver to the locations. Currently, the

work is on the asphalt shoulders of the runway and taxiways. The deficiencies were noted in the previous

year’s inspection by the FAA to begin addressing the issues. The airfield team has provided over 4,000

man-hours and have repaired over 3,000 lineal feet of crack repair and over 77 tons of asphalt repairs.

The work is considered pre-work that needs to be completed prior to the shoulders being slurry sealed and

extending the useful life of the pavement and reduce rehabilitation or replacement cost in the future.

For more project updates, please refer to the Monthly Project Status Reports which are posted with

Planning & Construction Committee meetings agendas. Click HERE

to view those agendas.

PEOPLE, CULTURE AND EQUITY

Time frame: 4/01/2024 through 4/30/2024

Open Positions

0

New Starts

6

Resignations/Terminations*

3

Promotions

2

*Termination refers to an employee leaving under

any circumstances, good or bad.

The Culture Club sponsored an “After Hours Social Meet Up” at the Reno Public Market. Participants

enjoyed the variety of food choices as well as cornhole, a trivia contest, and some amazing conversation.

People Operations staff assisted Battalion Chiefs with testing for an Engineer (Fire) to replace a vacancy.

The test consists of a written portion as well as a practical application segment that tests on various

functions and apparatuses. All candidates were internal.

All employees were scheduled to attend “Intro to DEI: Unconscious Bias” training as part of an

organization-wide initiative to focus on Diversity, Equity, and Inclusion. Conducted by Angie Taylor of

Guardian Quest, this program was highly interactive and impactful, and participant feedback has been

very positive.

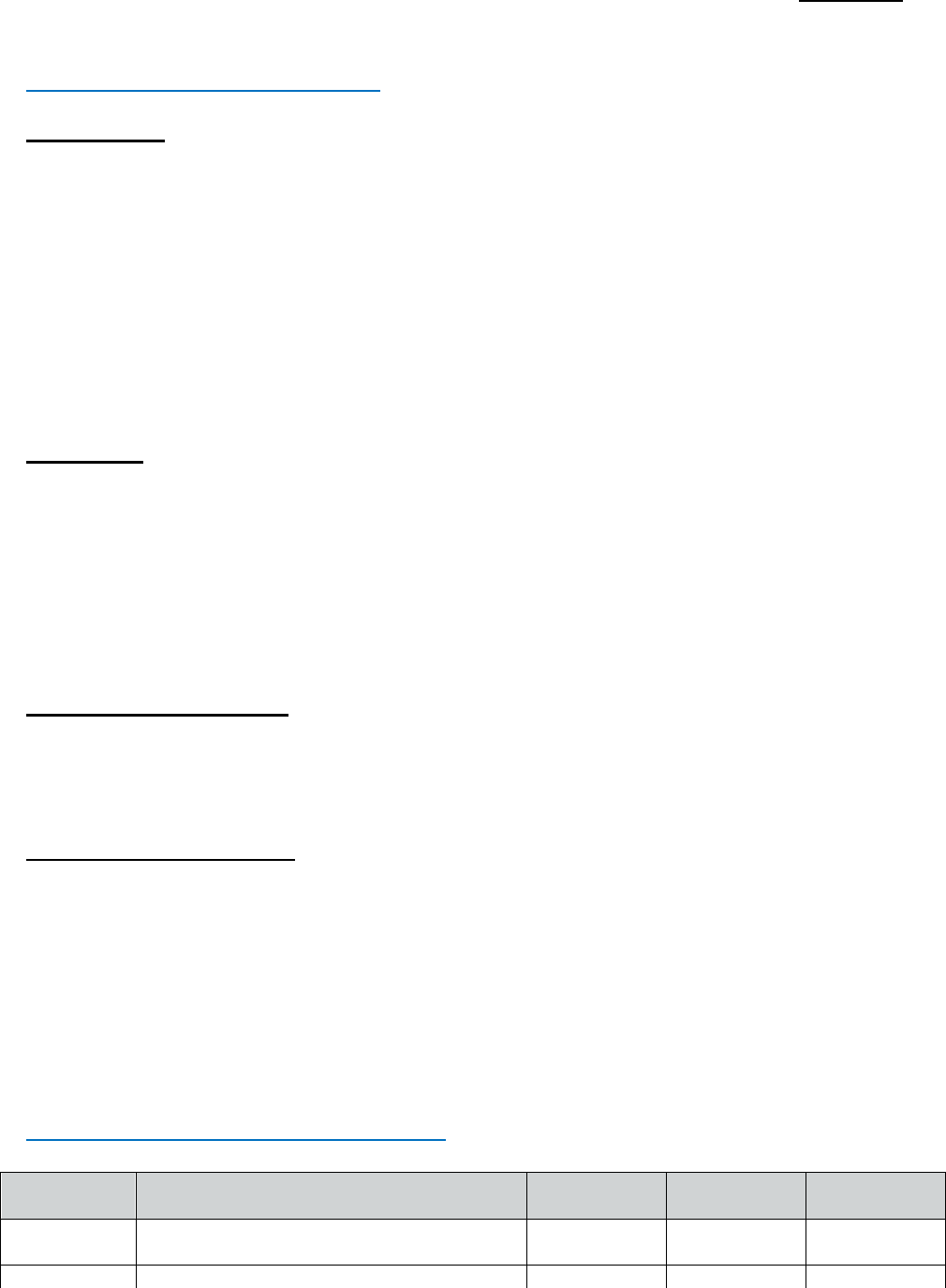

MARKETING & PUBLIC AFFAIRS

Marketing

A refreshed advertising campaign began in mid-April, shifting concentration to RTAA’s Air Service focus

nonstop destinations: Austin, Texas, and Atlanta, Georgia; while also seeding the market with ads for

Nashville, Tennessee, (see example below). These ads, along with complementary videos, are appearing

on Facebook, Instagram, X, Google and StackAdapt. We anticipate a slight increase in advertising spend

Page 6 of 8

will result in higher impression rates in the coming months. Additionally, we welcomed the RTAA’s new

Director of Marketing, April Conway, APR, MBA.

Notable metrics from March 16 – April 15 include:

• Paid Campaigns: Conversions (the total number of times a user completed a desired action after

clicking on an ad) decreased compared to the outstanding rates of last period, however held close to

desired benchmarks. Overall ad impressions held steady, increasing by 4.2% compared to last period

earning more than 877,000 impressions through digital media, programmatic and social media ads.

• Organic Social Media: Overall, social media content saw a 13.3% increase in impressions

compared to the previous period (with high-performing posts seen more than 70,000 times),

accompanied by a steady rise in followers across all platforms. Notably, Facebook, Instagram, X and

LinkedIn collectively totaled 39,500 followers, marking a 1% increase across platforms.

Page 7 of 8

During this period, posts across platforms saw significant audience engagement, particularly on

Facebook, which experienced a noteworthy 149% surge in interactions including likes, comments and

shares. This uptick can be attributed to timely and resonant content, such as April Fools’ Day posts

and updates on air service, the Ticketing Hall/MoreRNO, and feel-good posts.

• Website: The website saw decreases across the board, possibly indicating a slowdown in activity

compared to the spikes seen (due to winter weather and spring break bookings) in the previous

period. Specifically, traffic to the Arrivals and Departures page decreased by 51% compared to the

previous period.

On the other hand, during this period, traffic to the Parking page increased by 31.6%, likely driven by

spring break travelers seeking parking availability.

• Newsletter: A new campaign was launched in March to reengage individuals that have signed up

for the newsletter in the last 12 months. As projected, open rates have begun to level out at 52%,

from the original send, this month (benchmark open rate 38%). The April newsletter heavily featured

air service and the announcement of 90,000 more seats added this summer. Additionally, there were

features on the Ticketing Hall Grand Opening and McCarthy Construction. The majority of readers

clicked the link to the nonstop destinations page, showing continued interest in our nonstop flights.

Media and Public Outreach

The team issued a press release announcing the approval and financial close of the Ground

Transportation Center and a media alert introducing the newest concessions addition of Liberty Toast to

the C Concourse. Additionally, the team staffed interviews with President/CEO on Nevada Newsmakers,

Face the State and Airport Improvement Magazine to engage media in MoreRNO program updates.

Page 8 of 8

Government Affairs

FAA authorization was extended by Congress until May 10, but faces at least another short-term

extension of about a week. There has been a bipartisan, bicameral compromise on all germane topics,

but since this will likely be one of the last pieces of legislation done before the November election, all

sorts of amendments are being proposed that the Senate must process. RTAA has signaled to our

delegation that we are in support of the compromise provisions being proposed and urged them to pass

this measure as quickly as possible. The compromise language includes several helpful provisions for

RTAA.

The team continues to onboard Van Scoyoc Associates (VSA) as our federal lobbyist and has had several

productive meetings about how to uncover additional federal funding and policy opportunities.

We also hosted our lead transportation staff contact from Senator Cortez Masto’s office while he was in

town for a briefing and tour of the new ticketing hall and all MoreRNO projects.

Art

Staff has been busy working on the next 1% for public art projects in HQ, GTC and New Gen A&B. We

are energized by the community’s overwhelmingly positive reaction to

Repeated Refrains

in the ticketing

hall. Accolades continue to come in, most recently, at two Chamber events - Leadership Reno-Sparks and

the Business Expo. The Art Advisory Committee is scheduled to meet this summer in preparation for

multiple public art solicitations starting in late 2024.

The depARTures gallery has officially made the transition from Nevada Arts Council’s exhibition,

Find Your

Folklife

, to the 16

th

Annual Employee Art Show. 67 artists submitted 85 works that spanned a variety of

mediums including paintings, works on paper, photography, sculptures, mixed media and new this year,

quilts. The show will run through Aug. 12 with an awards reception taking place June 5. Big thanks to the

National Arts Program for sponsoring the exhibit. Next up – Burning Man and their community-driven

endeavors through the Burning Man Project including Burners Without Borders, Fly Ranch and the Global

Grants program.

RNO is again a host location for Artown 2024! Three performances will take place at the ski statue during

the month of July including High Desert Harmony, The Note-ables and for the first time, a dance

ensemble from the India Arts and Culture Center.

Board Memorandum

05/2024-16

In Preparation for the Regular Board Meeting on May 23, 2024

Subject: Authorization for the President/CEO to execute a one-year contract for the Reno-

Tahoe Airport Authority employee workers’ compensation insurance coverage for

Fiscal Year 2024-2025, with Starr Aviation, in the amount of $145,367

STAFF RECOMMENDATION

Staff recommends approval of the Proposed Motion stated below.

BACKGROUND

State law requires that each employer provide insurance coverage for on-the-job injuries. The

RTAA’s current fully insured workers’ compensation insurance policy provided through Starr

Aviation will expire on June 30, 2024.

The RTAA, through a competitive request for proposal process, has retained Arthur J. Gallagher

Risk Management Services, Inc. (AJG) as the Broker of Record.

AJG provides the following insurance broker services: (1) Obtain workers’ compensation

insurance coverage bids from insurance carriers authorized to do business in the State of Nevada;

(2) receive and analyze the received proposals; (3) evaluate the commitment and financial

stability of the proposers; (4) review proposals for accuracy and conformity to specified

coverages; (5) compare proposed policy language to the prior year and advise the Authority of

changes in policy form or coverage; (6) recommend policy coverage or language changes as

necessary; and (7) request modifications from the insurers upon RTAA concurrence.

DISCUSSION

In March 2024, AJG began marketing the RTAA FY 2024-2025 employee workers’

compensation insurance coverage. This effort successfully obtained the following quotes:

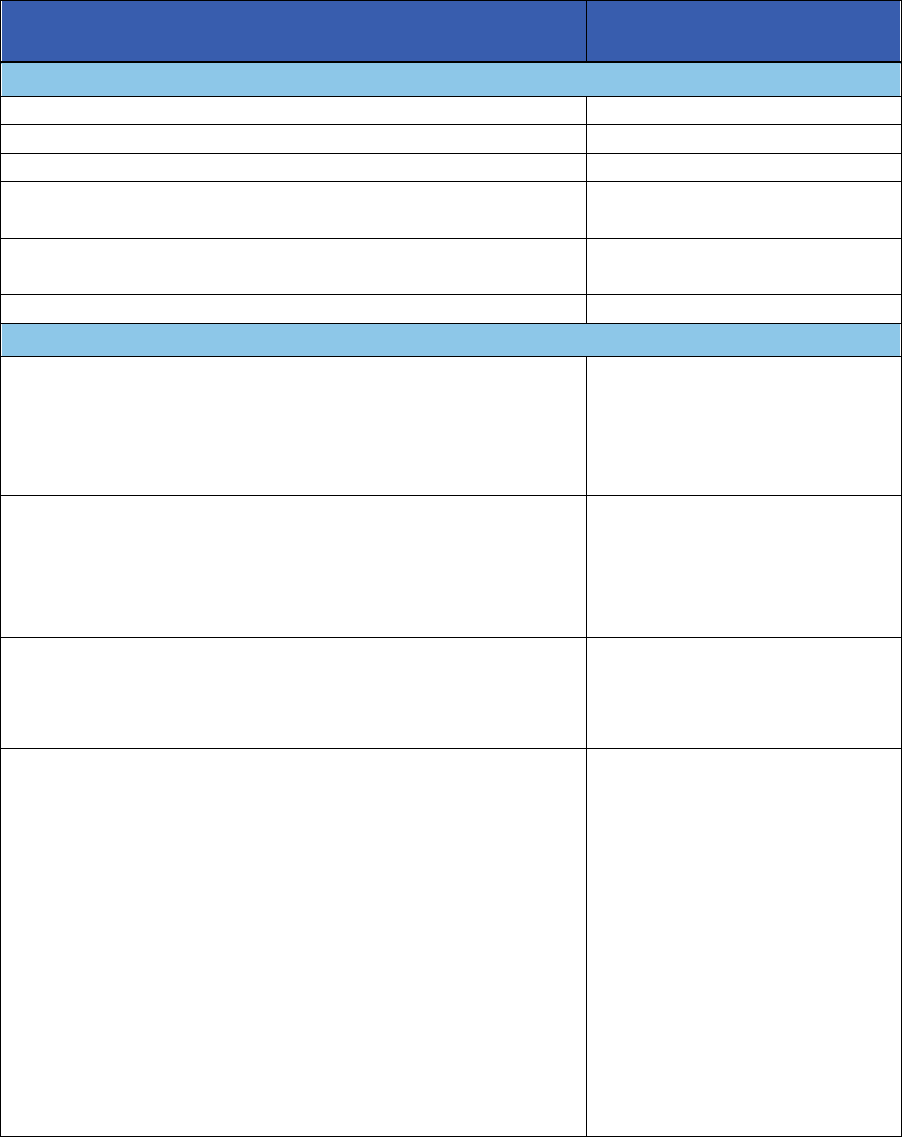

FY 2024-2025 Workers’ Compensation Insurance Bid Responses

Carrier

FY 2023-2024

Premium

FY 2024-2025

Premium Quote

Annual Dollar /

Percentage Difference

Starr Aviation

$177,213

$145,367

-$31,846 / -18.0%

Old Republic

N/A

$151,799

-$25,414 / -14.3%

Global Aerospace

N/A

Declined to quote

N/A

Beacon Aviation

N/A

Declined to quote

N/A

USAIG

N/A

Will be exiting the market

N/A

QBE Aviation

N/A

Has exited the market

N/A

AIG Aerospace

N/A

Has exited the market

N/A

Page 2 of 2

As indicated in the chart on the previous page, AJG received two quotes, including one from our

current carrier, Starr Aviation; while two carriers declined to submit a quote based on the

potential for high police and fire claim exposures due to Nevada’s generous heart & lung

statutes. The other three carriers will or have exited the market altogether.

The quote provided by Starr Aviation represents a sizeable decrease over the current premium

and is the most competitive. In addition, based on the RTAA’s continued success in safety and

loss control, Starr Aviation is offering a sliding scale dividend plan which could potentially

credit us back a portion of our premium based on claim costs. Therefore, staff is recommending

continuing the RTAA’s coverage with Starr Aviation.

Founded by Cornelius Vander Starr in 1919, Starr is one of the world’s fastest growing insurance

organizations, providing property, casualty and accident coverage insurance to almost every

imaginable business and industry in virtually every part of the world.

FISCAL IMPACT

The FY 2024-2025 premium quote from Starr Aviation totals $145,367, an 18% decrease from

FY 2023-2024. A portion of this decrease is due to the RTAA’s lower experience modification

(e-mod) factor (.75 to .72). This reduction indicates that RTAA claim costs are continuing to

trend lower than previous fiscal years when compared to organizations of comparable size and

function to the RTAA. This lower experience modification factor also reflects the on-going

efforts of the management team to keep claims costs down through safe work practices, and by

involving injured workers in the RTAA’s modified duty return to work program. In addition,

Starr Aviation has provided almost $13,000 in premium discounts and a dividend plan which

could potentially credit us back a portion of our premium based on FY 2024-2025 claim costs.

The FY 2024-2025 budget will be adjusted at mid-year to reflect this lower premium.

COMMITTEE COORDINATION

Finance & Business Development Committee

PROPOSED MOTION

“It is hereby moved that the Board of Trustees authorizes the President/CEO to execute a one-

year contract with Starr Aviation to provide workers’ compensation insurance for RTAA

employee on-the-job injuries for Fiscal Year 2024-2025, in the amount of $145,367.”

Board Memorandum

05/2024-17

In Preparation for the Regular Board Meeting on May 23, 2024

Subject: Authorization for the President/CEO to execute a five-year contract for the operation

and maintenance of the Baggage Handling System to Daifuku Services America

Corporation in accordance with requirements of the original manufacturer and the

Transportation Security Administration with the five-year total for all services in the

amount of $8,231,595.73

STAFF RECOMMENDATION

Staff recommends that the Board adopt the motion stated below.

BACKGROUND

The Reno-Tahoe Airport Authority (RTAA owns, maintains, and responsible for the functional

operation of the integrated in-line explosion detection and baggage handling system (BHS). The

system includes the ticket counter take-away belts, conveyors, sorting devices and baggage

carousels. Specifically, the system consists of 1.17 miles of conveyors, 441 Variable-Frequency

Drive (VFD) electric motors, motor control panels (MCP), integrated push type baggage diverters,

vertical sorter devices, one (1) Vaculex baggage vacuum lift assistance device, and a very

sophisticated Programmable Logic Control (PLC) computer system that controls the timing and

operations of the belt system. The value of the BHS system is in excess of $20,000,000 including

$401,458 in parts inventory.

In order to properly maintain the investment and to ensure maximum operational availability and

efficiency of such a complex integrated conveyor system, a contract with a maintenance service

provider has been required to perform the preventive maintenance and oversee the operation of the

in-line system. Additionally, the maintenance service provider is responsible for the housekeeping

duties for the BHS conveyor system in the Baggage Make-Up (BMU) matrices.

The contractor is required to be on site and managing the system on a twenty-four (24) hour per

day, seven (7) days per week schedule. The contractor oversees the operation utilizing the Central

Control Room (CCR) that houses the computer control stations for the conveyor systems and the

associated Closed-Circuit Television (CCTV) system that provides a visual tool for monitoring the

bags as they move through all three of the conveyor and screening matrices. They provide

manpower sufficient to respond to any baggage jams in the system having jams cleared within two

(2) minutes and are required to notify the RTAA Facilities and Maintenance Department (FMD)

within five (5) minutes if any system and/or component malfunction failures occur as well as

provide the FMD with a report of the anticipated repair time. A variety of daily, weekly, and

monthly reports detailing the operations, availability, and accuracy of the BHS is provided. The

Page 2 of 3

reports are used to establish the contractor’s ability to meet or exceed the performance

requirements of the system and the contractor’s monthly payment are subject to penalties if the

criteria are not met.

The contractor is required to survey the system and provide the RTAA with a detailed contingency

plan for any type of system or system component failure to ensure continuous and minimally

interrupted baggage delivery to the outbound pick-up carousels. The contractor trains on each type

of contingency scenario to ensure that their personnel are ready to react should such a failure occur.

The RTAA provides a variety of different types of BHS equipment components for the contractor’s

use in live, hands-on preventive maintenance training. The contractor is further required to

maintain training on the equipment should it be needed for integration into the BHS.

The contractor is responsible for procuring and maintaining minimum required stock levels of

BHS parts inventory. They are required to utilize the RTAA’s IBM Maximo Computerized

Maintenance Management System (CMMS) to monitor the preventive maintenance program, parts

inventory, and warranties of the system. The contractor maintains the computer database with all

pertinent information for the Preventive Maintenance (PM) work order tasks, parts inventory, and

BHS asset information. The RTAA has access to the BHS Maximo program to monitor the

contractor performance and preventive maintenance program’s status and compliance.

DISCUSSION

The Request for Proposals (RFP 23/24-14) was released and published on February 2, 2024, in the

Reno-Gazette Journal (RGJ) and posted on the RTAA’s website, and on the Nevada Government

eMarketplace (NGEM) website. Three prospective proposers attended the non-mandatory pre-

proposal meeting held on February 13, 2024. Four proposals were received and opened on March

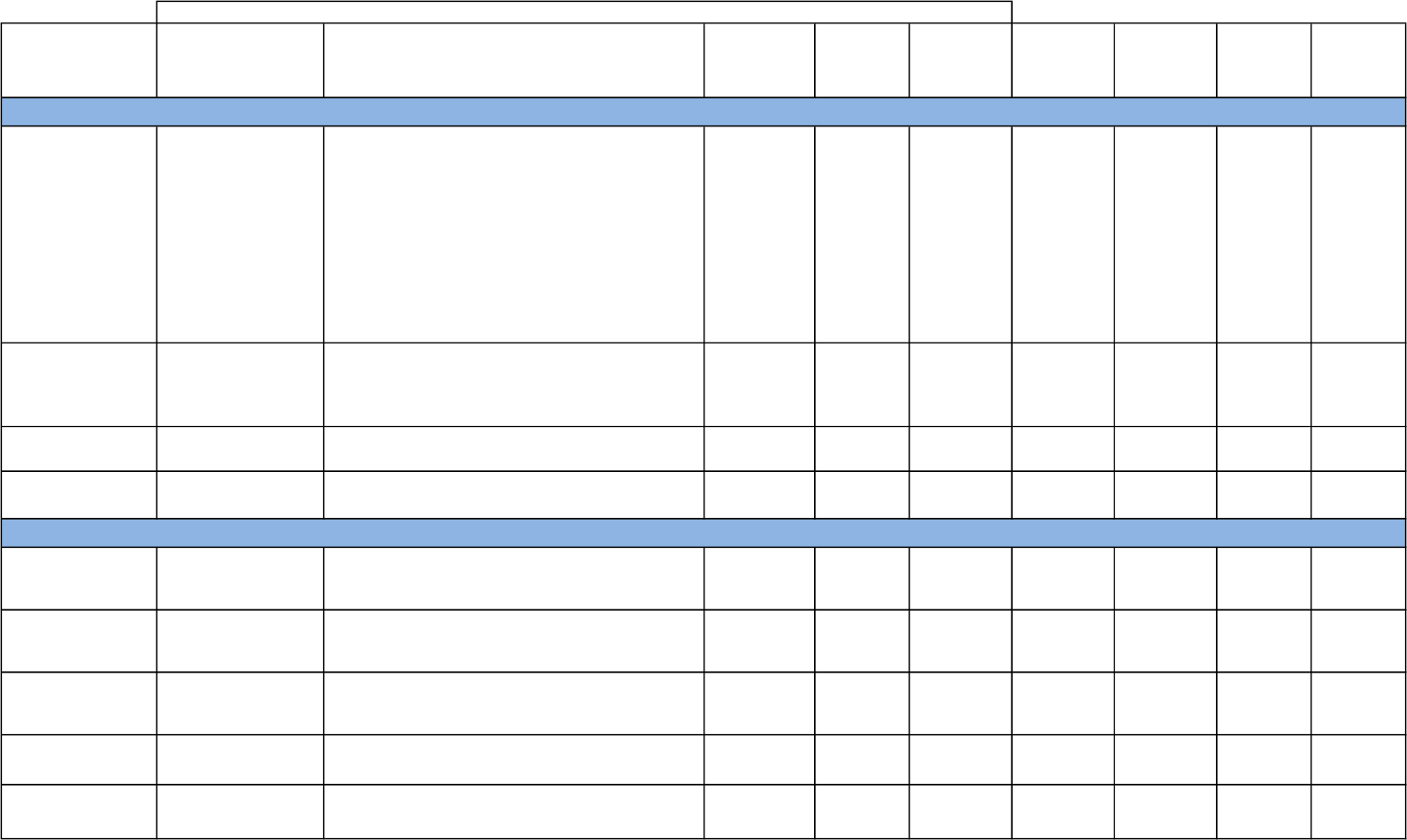

11, 2024. The following table outlines the annual maintenance costs submitted by each proposer:

Company

Year 1

Year 2

Year 3

Year 4

Year 5

Total

Daifuku

$1,504,141.26

$1,567,463.48

$1,634,058.74

$1,716,472.67

$1,809,459.58

$8,231,595.73

ERMC

$1,404,547.46

$1,394,238.83

$1,430,983.83

$1,475,564.52

$1,514,547.28

$7,219,881.93

JSM

$1,749,996.00

$1,802,496.00

$1,856,580.00

$1,912,284.00

$1,969,644.00

$9,291,000.00

Oshkosh

$1,876,900.00

$1841,763.00

$1,898,586.00

$1,959,557.00

$2,011,461.00

$9,588,267.00

A selection committee comprised of the Southwest Airline’s Station Manager, the United Airline’s

Station Manager, and RTAA staff evaluated all proposals received.

The evaluation criteria considered critical areas of the qualifications of the proposing firms,

including their proposed on-site operations, maintenance and management team, the firm’s

detailed work plan for meeting the program requirements, references, and finally, the contract

costs. The panel was unanimous in their evaluation of Daifuku Services America Corporation

being the best choice of the four proposals. The panel recommended a direct selection of DSAC

to the Board whose proposal was most advantageous to the RTAA.

Key advantages from the DSAC proposal:

Although price was not the only consideration, DSAC submitted the second lowest overall

cost proposal.

Page 3 of 3

DSAC has 30 years of experience in the operation and maintenance of complex airport

baggage handling systems.

DSAC has 20 locations in the United States for backup support.

Specific experience at other airports with similar systems include Detroit International, Los

Angeles International, Phoenix International, San Antonio International, Sacramento

International, and John Glenn International.

Strength of reference checks.

Excellent proposed procedures for daily operation, preventative maintenance, and handling

system emergencies.

Successful management of the RTAA BHS system for the last fifteen years meeting all

contractual requirements and expectations.

Excellent working relationship with the RTAA staff.

The request is to approve the full five-year contract agreement for a total of $8,231,595.73. Each

contract year’s pricing is inclusive of the required annual Brock Solutions software connection for

programmable logic control support and site visits. The five-year term agreement will expire June

30, 2029.

FISCAL IMPACT

Funding for the first year of this contract is included in the requested Fiscal Year 2024-25 Building

Maintenance’s Operating and Maintenance budget that will be presented for approval at the May

Board meeting. The first-year budgeted amount for the maintenance agreement is $1,504,141.26.

The first year’s maintenance agreement represents 65% of the total budget associated with the

BHS of $2,312,641 in Fiscal Year 2024-25. The overall budget also includes $65,000 for

replacement parts associated with the system. Subsequent years funding will be in the Building

Maintenance’s Operation and Maintenance budget.

The entire Baggage Handling System budget of $2,312,641 is 100% reimbursable from the airlines

through a per bag fee calculation as outlined in the current year Master Fee Resolution.

COMMITTEE COORDINATION

Finance & Business Development Committee

PROPOSED MOTION

“Move to authorize the President/CEO to execute a five-year contract for the operation and

maintenance of the Baggage Handling System to Daifuku Services America Corporation in

accordance with requirements of the original manufacturer and the Transportation Security

Administration the five-year total for all services in the amount of $8,231,595.73.”

Board Memorandum

05/2024-18

In Preparation for the Regular Board Meeting on May 23, 2024

Subject: Authorization for the President/CEO to execute a professional services agreement for

design services for the General Aviation East Apron and Taxilane Reconstruction

Project at the Reno-Tahoe International Airport, with Kimley-Horn and Associates,

Inc, in the amount of $437,080

STAFF RECOMMENDATION

Staff recommends that the Board adopt the motion stated below.

BACKGROUND

The Reno-Tahoe International Airport General Aviation East project area is located on the east

side of the airfield adjacent to Rock Boulevard. The General Aviation East project area is

developed and is approximately 9 acres. It is bordered to the west by Taxiway Charlie, north by

the fuel farm, south by East lighting Vault and east by Rock Boulevard.

The General Aviation East Apron is a non-exclusive use apron with taxilanes that were previously

under a long-term lease with a fixed base operator which has expired and reverted to the Airport

Authority. The apron has not been rehabilitated in over 20 years and has exceeded its useful life.

The Pavement Condition Index (PCI) for the pavement in this area ranges from 5 (failed) to 24

(serious) based on the 2022 Pavement Maintenance report. The pavement requires significant

maintenance to mitigate the pavement raveling and creating foreign object debris (FOD).

The General Aviation East Apron and Taxilane Reconstruction Project has been deemed necessary

to the General Aviation Airport Operations. There are over 60 general aviation tenants using the

area and lease nearby hanger space . Additionally, several business operate out of this area

including Grandview Aviation, which provides medical flights, Stellar Aviation, and JSX which

serves approximately 300 passengers weekly.

DISCUSSION

A Request for Qualifications (RFQ) for design services was publicly advertised on October 13,

2023, and Statements of Qualifications (SOQ) were received on November 16, 2023, from the

following firms:

• AtkinsRéalis

• Kimley Horn & Associates

Page 2 of 3

An evaluation committee comprised of RTAA staff reviewed the submittals and determined

Kimley-Horn as the most qualified firm for the project. The evaluation was based on the

qualifications and experience requirements stipulated in the RFQ of similar type projects.

Kimley-Horn has extensive experience in airfield pavement design projects at Commercial and

General Aviation airports across the United States. The Kimley-Horn design team also includes

sub-consultants MAPCA Surveying and Corestone (geotechnical engineer). Additionally, Kimley-

Horn conducts in-house electrical design, airfield analyst and pavement design as part of their core

services. Kimley-Horn proposes to meet the minimum Disadvantage Business Enterprise (DBE)

goal of 11.5% with Corestone and MAPCA both being DBEs. Members of Kimley-Horn’s design

team have performed multiple projects at the Reno Stead Airport in recent years.

The Professional Services Agreement for the project tasks include field survey, geotechnical

investigation, hydrology conditions, existing storm drain evaluation, construction phasing,

operational plan, client review, cost estimates, development of the design and bid packages.

Outreach will be conducted with the RTAA Stakeholders including the Commercial Business,

Planning, Engineering, Operations, Airfield Maintenance and the airportuser groups.

The stakeholder meetings will generate information to identify project constraints and operational

criteria to be utilized in the basis of design. The construction is expected to begin in early 2026.

The construction schedule and phasing plan will be developed during the design process.

Upon completion of the design, the construction documents will be issued for bids and submitted

to the FAA for approval. The construction contract will be brought separately for Board approval

at a later date and is expected to be funded under a new AIP grant. The AIP construction grant will

include construction, construction administration, construction management, and administration

services as well as project close out.

The table 1 is an estimate of the preliminary schedule:

Table 1 – Preliminary Schedule

Activity

Date

Board Approval

May 23, 2024

FAA AIP Grant Award

June 1, 2024

Notice to Proceed

June 2, 2024

Design

June 2 – December 1, 2024

Bid Package Complete

January 1, 2024

FISCAL IMPACT

The PSA for design services in the amount of $437,080 is funded by FAA AIP pending grant.

The FAA eligible share is $417,958 (93.75%) and the RTAA share is $27,864 (6.25%).

An Airport Improvement Program (AIP) Grant has been submitted to the FAA.

Page 3 of 3

Table 2 – Design Professional Services Estimate at Completion

Airside Design

Other Direct

Costs

Estimate At

Completion

$437,080

$8,742*

$445,822

* Other Direct Costs include but are not limited to: reimbursable agreement with the FAA,

administrative costs, advertising, printing, permits and miscellaneous fees.

The Estimate at Completion (EAC) is a preliminary estimate for budgetary purposes only.

COMMITTEE COORDINATION

Planning and Construction Committee

PROPOSED MOTION

“Move to authorize the President/CEO to execute Professional Services Agreement for design of

the General Aviation East Apron and Taxilane Reconstruction Project at Reno-Tahoe

International Airport (RNO), with Kimley-Horn and Associates, in the amount of $437,080.

Board Memorandum

05/2024-19

In Preparation for the Regular Board Meeting on May 23, 2024

Subject: Adoption of the Reno-Tahoe Airport Authority’s fiscal year (FY) 2024-25 Budget

(July 1, 2024, through June 30, 2025)

STAFF RECOMMENDATION

Staff recommends that the Board adopts the Fiscal Year 2024-25 budget of the Reno-Tahoe

Airport Authority (RTAA).

PURPOSE

The purpose of this action is to adopt the RTAA’s annual budget for FY 2024-25, representing the

period of July 1, 2024, through June 30, 2025. Pursuant to State law, the budget is to be considered

by the Board in a noticed public hearing. The notice was published in the Reno Gazette-Journal

on May 14, 2024. In accordance with State law, the Board must adopt the budget on or before June

1, 2024. Accompanying this memorandum is the RTAA’s proposed budget for FY 2024-25 for

consideration and adoption by the Board of Trustees.

BACKGROUND

The budget is RTAA’s annual fiscal plan of revenues and expenses to fund operations and the

annual capital improvement program for the Reno-Tahoe International Airport (RNO) and Reno-

Stead Airport (RTS) as owned and operated by RTAA.

On April 23, 2024, the Board held a workshop on the proposed budget. Staff presented an overview

of the proposed budget, including passenger traffic, landed weight, revenue, and operating expense

estimates for the upcoming fiscal year to begin on July 1, 2024. The presentation included

information on fixed assets and capital projects proposed for next fiscal year. The FY 2024-25

budget and airline rates and charges were also discussed with the Airline Airport Affairs

Committee as required by the RTAA’s airline agreement with signatory airlines.

DISCUSSION

Airline traffic at RNO has made a tremendous recovery following the COVID pandemic. We

celebrated new records of enplaned passengers in some months of FY 2023-24. However, the

updated FY 2023-24 traffic forecast has shown signs of a slowing growth trend with a reduction

in both landed weight and passenger traffic. Some of the carriers exited the Reno market

(Allegiant, Frontier, New Pacific), while new airlines started operating at RNO – Spirit, Sun

Country. The existing airlines are still facing operational challenges primarily caused by

Page 2 of 14

equipment shortages and safety concerns. As we look at the airline traffic for next fiscal year, we

are cautiously optimistic. Our airline partners are forecasting increased landed weight when

compared to the current year forecast and expecting the passenger traffic to stabilize next year.

RTAA staff is currently in consultation with airlines on the FY 2024-25 traffic forecast and will

continue to closely monitor airline traffic changes and the impact this may have on revenues.

FY 2024-25 is the second year of the new ten-year Airport-Airline Use and Lease Agreement

(AAULA or airline agreement) with Alaska Airlines, American Airlines, Delta Air Lines, Federal

Express (FedEx), Southwest Airlines, United Parcel Service (UPS), and United Airlines referred

to as Signatory Airlines. The AAULA defines the premises leased by Signatory Airlines and

provides the terms and conditions under which they operate at RNO. The airline agreement sets

forth the rate methodology by which Signatory Airlines pay for the facilities and services they use.

The MoreRNO capital program is expected to make significant progress in FY 2024-25 with the

continued design process of the New Gen A&B concourses, South Remain Overnight (RON) pad,

Central Utility Plant (CUP), and New Headquarters (HQ). Upon Board approval construction is

also expected to start next year on the South RON, CUP, and HQ. Funding for the MoreRNO

program is from federal grants, passenger facility charges (PFC), airline rates and charges, RTAA

cash, and airport revenue bonds. Staff is currently anticipating issuing bonds in August 2024.

RTAA has recently entered into a ground lease and a public-private partnership agreement with

ConRAC Solutions to build a new ground transportation center (GTC). The project will be funded

exclusively by customer facility charges (CFCs) paid by rental car customers. All CFCs are

managed by a third-party trustee and RTAA no longer receives those revenues from the rental car

companies. A $150,000 annual administrative fee will be paid to RTAA for the duration of the

agreement.

The proposed budget is balanced, includes necessary cost increases, higher revenues, and required

adjustments based on various contractual obligations. Working closely with the Executive Team

we are continuing to closely monitor airline traffic, revenues, and expenses and are prepared to

make necessary adjustments if the current forecast does not materialize.

FISCAL IMPACT

As discussed in the attached FY 2024-25 Budget of the Reno-Tahoe Airport Authority.

COMMITTEE COORDINATION

Finance and Business Development Committee

PROPOSED MOTION

“Move that the Board of Trustees adopts the budget of the Reno-Tahoe Airport Authority for Fiscal

Year 2024-25 as presented.”

Page 3 of 14

FY 2024-25 PROPOSED BUDGET

Summary

The FY 2024-25 proposed budget includes total revenues of $105.485 million to fund airport

operating expenses, debt service, equipment, and capital improvements. This section provides a

financial overview of the proposed FY 2024-25 budget and key metrics.

Key Metrics

The revenue forecast for next year assumes 2.415 million enplaned passengers, a 3.3% decrease

from the current year budget, and 1.9% increase from the updated forecast. The decrease in

enplaned passengers is due to the exit of some carriers from the RNO market, downsizing of

equipment by exiting carriers, and a lower load factor assumption.

Total Revenues

Total airport revenues, composed of operating and non-operating revenues, forecasted for FY

2024-25 are $105.485 million, a $2.373 million or 2.2% decrease from the FY 2023-24 adopted

budget. Total revenues also include federal stimulus funds.

FY 2022-23 FY 2023-24 FY 2023-24 FY 2024-25

Actual Budget Forecast Budget $ Change % Change

Operating Budget

Revenues 66,493,459$ 85,456,219$ 85,208,518$ 88,408,803$ 2,952,583$ 3.5%

Expenses (55,842,097) (65,144,750) (65,111,301) (68,668,035) (3,523,285) 5.4%

Revenues over Expenses 10,651,362 20,311,469 20,097,217 19,740,768 (570,702) (2.8%)

Other Sources (Uses)

Property, Plant and Equipment (1,667,829) (894,962) (920,911) (702,657) 192,305 (21.5%)

Debt Service (400,000) (1,110,519) (910,609) (1,915,560) (805,041) 72.5%

Federal Stimulus Funds 1,520,000 1,160,094 960,184 - (1,160,094) (100%)

Interest Income 2,899,224 1,976,400 2,778,700 2,696,900 720,500 36.5%

Other Non-Operating Revenue 300,994 298,400 300,000 302,900 4,500 1.5%

Total Other Sources (Uses) 2,652,389 1,429,413 2,207,364 381,583 (1,047,830) (73.3%)

Net Sources over Uses 13,303,751 21,740,882 22,304,581 20,122,350 (1,618,532) (7.4%)

Other Revenues:

Passenger Facility Charges 8,372,017 9,394,600 9,167,900 9,076,700 (317,900) (3.4%)

Customer Facility Charges 7,863,374 9,573,000 11,218,500 - (9,573,000) (100%)

Total Other Sources 16,235,391 18,967,600 20,386,400 9,076,700 (9,890,900) (52.1%)

Capital Budget 24,002,427 58,384,588 58,384,588 100,139,053 41,754,465 71.5%

Budget to Budget

Budget Category

FY 2022-23 FY 2023-24 FY 2023-24 FY 2024-25

Actual Budget Forecast Budget $ Change % Change

Enplaned Passengers 2,229,254 2,496,862 2,369,767 2,414,737 (82,125) (3.3%)

Sig. Cost Per Enplanement 6.33$ 9.65$ 10.17$ 10.93$ 1.28$ 13.3%

Landed Weight (000's) 3,100,328 3,506,091 $3,249,801 3,378,382 (127,709) (3.6%)

Landing Fee (Signatory) 3.79$ 3.99$ 4.26$ 4.19$ 0.20$ 5.0%

Landing Fee (Non-Signatory) 3.79$ 4.59$ 4.90$ 4.82$ 0.23$ 5.0%

T erminal Re nta l Rate ( Av g. ) 34.47$ 142.44$ 143.68$ 156.40$ 13.96$ 9.8%

Debt Service Coverage 53.49 27.92 34.79 16.47 (11.45) (41.0%)

Budget to Budget

Description

Page 4 of 14

Operating Revenues

Of the total revenues, $88.409 million are operating revenues derived from airline and non-airline

revenue sources. Operating revenues are forecasted to increase $2.953 million or 3.5% from the

FY 2023-24 adopted budget. Operating revenues are summarized in two major categories:

• Airline revenues – generated from landing fees and terminal building rents, are forecasted

to be $35.656 million, approximately 40% of the total operating revenues. The 4.2%

increase from the current fiscal year is primarily due to the increase in the cost of operating

and maintaining the Airfield and Terminal cost centers resulting in higher landing fees and

terminal rental rates. The addition of debt service related to the ticketing hall expansion

project also contributed to the rate increases.

• Non-airline revenues – generated from public parking, car rental, retail, food and

beverage, advertising, gaming, and other concessions represent $52.753 million, or

approximately 60% of total operating revenues. The 3.0% increase from the FY 2023-24

budget is primarily due to ground transportation and land rental revenues.

FY 2022-23 FY 2023-24 FY 2023-24 FY 2024-25

Actual Budget Forecast Budget $ Change

% Change

Operating Revenues:

Airline Revenues 17,989,194$ 34,223,253$ 34,211,506$ 35,655,792$ 1,432,539$ 4.2%

Non-Airline Revenues 48,504,266 51,232,966 50,997,012 52,753,011 1,520,044 3.0%

Total Operating Revenues 66,493,459 85,456,219 85,208,518 88,408,803 2,952,583 3.5%

Budget to Budget

Budget Category

Page 5 of 14

Airline Rates and Charges

Airline rates and charges primarily refer to landing fees, terminal rents, and baggage handling fees

established annually by RTAA. The rates and fees are calculated to recover budgeted costs to

operate and maintain the airfield, terminal facilities, and the baggage handling system (BHS). At

the end of the fiscal year, a true up is performed to account for the difference between actual costs

and the budgeted rates and charges in accordance with the airline agreement between RTAA and

seven signatory airlines.

Landing Fee Calculation

Landing fees are charged to passenger and cargo carriers for each aircraft landing based on the

aircraft’s maximum gross landed weight. RTAA currently recovers 100% of its costs of operating

and maintaining the airfield through landing fees. The Landing Fee rate is calculated by dividing

(i) the total requirement (net cost) of the airfield by (ii) the total landed weight of Signatory

Airlines. Non-signatory airlines pay a 15% premium for the landing fee rate compared to Signatory

Airlines. The forecasted total landed weight of 3.378 million thousand pounds is a 3.6% decrease

from the current year budget.

Demand for travel through RNO is expected to remain relatively strong in FY 2024-25 with landed

weight to exceed the current year updated traffic forecast. Landing fees are forecasted to increase

to $4.19 per thousand pounds for Signatory Airlines and $4.82 for non-signatory airlines. The new

rates represent a 5.0% increase from the current year budget due to higher costs associated with

operating and maintaining the airfield and the 3.6% reduction in the landed weight forecast for FY

2024-25. Also, federal stimulus funds have been fully committed to RTAA capital projects and

are no longer available to pay for operating expenses.

FY 2022-23 FY 2023-24 FY 2023-24 FY 2024-25

Actual Budget Forecast Budget $ Change % Change

Operating Expenses 12,964,388$ 14,463,446$ 14,298,462$ 14,175,962$ (287,483)$ (2.0%)

Operating Reserve 457,788 266,897 266,897 122,377 (144,521) (54.1%)

Fixed Assets/Equipment 511,398 240,407 255,559 238,004 (2,403) (1.0%)

Capital Projects 57,160 - - 516,180 516,180 100%

Amortization of Capital Items - 697,355 696,815 634,458 (62,897) (9.0%)

Less: Federal Stimulus (1,120,000) (300,000) (300,000) - 300,000 (100%)

Less: Non-Signatory Landing Fees - (1,672,489) (1,569,695) (1,283,952) 388,537 (23.2%)

Less: Airfield Revenues (1,133,856) (1,151,625) (1,268,915) (1,364,311) (212,685) 18.5%

Total Requirement (A) 11,736,878 12,543,990 12,379,123 13,038,718 494,728 3.9%

Total Landed Weight 3,100,328 3,506,091 3,249,801 3,378,382 (127,709) (3.6%)

Signatory Landed Weight (000s) (B) 2,795,471 3,141,595 2,907,820 3,111,919 (29,676) (0.9%)

Sig. Landing Fee Rate Per (000s) (A/B) 4.20$ 3.99$ 4.26$ 4.19$ 0.20$ 5.0%

Non-Signatory Landing Fee Rate (15%) 4.59$ 4.90$ 4.82$ 0.23$ 5.0%

Airfield Cost Center

Budget to Budget

Page 6 of 14

Terminal Rent Rate Calculation

Airline terminal rentals reflect recovery of terminal costs allocated to airline occupied facilities,

with total facility costs divided by airline rentable square footage. The average terminal rental rate

is calculated by applying the total required cost to operate and maintain terminal facilities, plus

debt service, capital improvement projects, and amortization of capital items, minus 50% of

Gaming Concession and In-Terminal Concession revenues, divided by the total airline rentable

terminal space. The proposed average terminal rental rate is $156.40, a 9.8% increase from the FY

2023-24 budget. This increase is due to the higher cost to maintain and operate the Terminal

building, and the introduction of debt service related to the ticketing hall expansion project.

Baggage Handling System (BHS) Fee Calculation

The baggage handling fee is meant to recover the operating, maintenance, and capital costs

allocated to the BHS cost center, which now include amortization of capital items. RTAA manages

the BHS through a service contract with a specialized vendor for the ongoing maintenance of the

system used by the airlines. RTAA establishes a rate per checked piece of luggage based on a net

cost recovery formula. The BHS signatory fee is forecasted to be $1.62 per bag and $1.78 per bag

for non-signatory airlines which pay a ten percent premium per the airline agreement. The new

FY 2022-23 FY 2023-24 FY 2023-24 FY 2024-25

Actual Budget Forecast Budget $ Change % Change

Operating Expenses 23,417,804$

27,730,434$ 27,838,835$ 29,447,538$ 1,717,104$ 6.2%

Debt Service - - - 1,665,560 1,665,560 100%

Other Debt Service - 250,425 250,425 - (250,425) (100%)

Debt Coverage -$ - - 166,556 166,556 100%

Operating Reserve 476,149 511,716 511,716 254,211 (257,505) (50.3%)

Fixed Assets/Equipment 502,906 342,333 348,279 282,945 (59,388) (17.3%)

Capital Projects 253,566 577,838 577,838 84,480 (493,358) (85.4%)

Amortization of Capital Items - 345,586 345,586 598,949 253,363 73.3%

Less: Gaming Concession (50%) - (699,100) (710,900) (724,400) (25,300) 3.6%

Less: In-Terminal Concessions - (4,421,517) (4,294,420) (4,636,712) (215,194) 4.9%

Less: Airline Reimbursements (364,192) (344,350) (361,600) (350,900) (6,550) 1.9%

Total Requirement 24,286,232 24,293,365 24,505,759 26,788,228 2,494,863 10.3%

Terminal Square Footage (SF) 262,114 170,553 170,553 171,275 722 0.4%

Average SF Terminal Rental Rate 92.66$ 142.44$ 143.68$ 156.40$ $13.96 9.8%

Signa tory Airline Allocated Cos t 11,698,900 17,545,300 17,698,100 19,377,800 1,832,500 10.4%

Less Revenue Sharing Transfer (7,347,400) - - - - -

Net Terminal Requirement 4,351,500 17,545,300 17,698,100 19,377,800 1,832,500 10.4%

Signa tory Airline Lea s e d SF 126,256 123,177 123,177 123,899 722 0.6%

Signa tory Airline T e rm ina l Rate SF 34.47$ 142.44$ 143.68$ 156.40$ 13.96$ 9.8%

Budget to Budget

Terminal Cost Center

FY 2022-23 FY 2023-24 FY 2023-24 FY 2024-25

Actual Budget Forecast Budget $ Change % Change

Operating Expenses 2,063,279$ 2,093,553$ 2,093,553$ 2,406,541$ 312,988$ 15.0%

Operating Reserve 36,666 38,633 38,633 20,775 (17,858) (46.2%)

Less: TSA Reimbursements (69,694) (45,240) (65,000) (45,900) (660) 1.5%

Less: Airline Reimbursements (148,548) (194,300) (169,300) (155,300) 39,000 (20.1%)

Total Requirement 1,881,704 1,892,646 1,897,886 2,226,116 333,470 17.6%

Signatory Airline Bags Processed 1,349,877 1,371,948 1,308,648 1,376,911 4,963 0.4%

Signatory Airline Rate per Bag 1.39$ 1.38$ 1.45$ 1.62$ 0.24$ 17.2%

Non-Signtory Airline Rate per Bag 1.53$ 1.52$ 1.52$ 1.78$ 0.26$ 17.1%

Budget to Budget

Baggage Handling System

Page 7 of 14

rate is a 17.2% increase when compared to the FY 2023-24 budget due to a new negotiated

maintenance agreement, utility cost increases, and the reduction in passenger traffic.

Revenue Sharing Calculation

The revenue share calculation with signatory airlines is based on funds remaining after satisfying

the RTAA’s financial obligations for the year, including a $3.0 million set aside for the general-

purpose fund. The revenue share is now distributed monthly on a per enplaned passenger basis to

Signatory Airlines and applied as a credit in the billing process. There are specific debt service

coverage (DSC) requirements used in the calculation – a minimum 1.4 DSC must be met before

revenue sharing with the airlines; between 1.4 – 1.5 DSC $2/enplanement will be shared, and

above 1.5 the excess revenues are shared 50/50 between RTAA and the Signatory Airlines.

Cost Per Enplaned Passenger (CPE) – Calculated as all rates and charges paid by the airlines to

operate at RNO, divided by the forecasted number of enplaned passengers. The signatory cost per

enplaned passenger is forecasted to be $10.93, a $1.28, or 13.3% increase from the current year

budget rate of $9.65.

Non-Airline Revenues

The non-airline operating revenues forecasted in the FY 2024-25 proposed budget include

concession fees (e.g., gaming, food & beverage, retail, advertising, etc.), parking, ground

transportation, auto rental, reimbursed services, building and land rents, and other rentals. These

revenues are estimated to be $52.753 million, reflecting an increase of $1.520 million or 3.0%

from the current budget year. This overall increase is primarily attributed to higher building and

land rental revenues, and the increase in operating activity for ground handling and support

services at RNO. Consumer Price Index (CPI) rental rate adjustments were also factored in the FY

2024-25 budget.

FY 2022-23 FY 2023-24 FY 2023-24 FY

2024-25

Actual Budget Forecast Budget $ Change % Change

Airline Revenue 25,664,461$ 34,057,053$ 34,045,006$ 35,704,192$ 1,647,139$ 4.8%

Non-Airline Revenue 48,481,132 51,226,466 51,010,512 52,753,011 1,526,544 3.0%

Total Revenue 74,145,593 85,283,519 85,055,518 88,457,203 3,173,683 3.7%

O&M Expense 55,010,334 64,015,150 64,040,701 67,005,134 2,989,984 4.7%

Total Debt Service 400,000 1,110,519 910,609 1,915,560 805,041 72.5%

O&M Reserve Requirement 1,167,557 1,202,130 1,202,130 592,789 (609,341) (50.7%)

Fixed Asset 1,667,829 894,962 920,911 702,657 (192,305) (21.5%)

Capital Project 310,727 1,671,088 1,671,088 1,964,500 293,412 17.6%

Amort of Capital Items 3,455,432 3,081,081 3,030,501 3,284,031 202,950 6.6%

Special Fund 504,916 489,385 497,651 507,095 17,710 3.6%

General Purpose Fund Requirement - 3,000,000 3,000,000 3,000,000 - -

Interest Income (1,546,090) (956,000) (1,818,900) (2,668,800) (1,712,800) 179%

Federal Stimulus (1,520,000) (1,160,094) (960,184) - 1,160,094 (100%)

Total Requirement 59,450,703 73,348,221 72,494,507 76,302,966 2,954,746 4.0%

Funds Remaining 14,694,890 11,935,298 12,561,011 12,154,236 218,938 1.8%

Revenue Share per Enplaned Passenger - 2.00$ 2.00$ 2.00$ - -

Signatory Airline Enplaned Passengers 2,008,315 2,212,819 2,110,723 2,220,824 8,005 0.4%

$2 per EP Revenue Share - 4,425,637 4,221,446 4,441,648 16,011 0.4%

Net Funds Remaining after Rev. Share 14,694,890 7,509,661 8,339,566 7,712,588 202,927 2.7%

Total Airline Revenue Sharing Credit 7,347,445 8,180,468 8,391,229 8,297,900 117,432 1.4%

Amount to RTAA General Purpose Fund 7,347,445 6,754,831 7,169,783 6,856,294 101,463 1.5%

Effective Revenue Share per EP 3.66$ 3.70$ 3.98$ 3.74$ 0.04$ 1.1%

Revenue Sharing

Budget to Budget

Page 8 of 14

RNO concession revenue from security services and ground handling services is expected to

increase significantly by 161.7% and 50.7%, respectively, driven by the increase in operational

activity. Ground transportation revenues are anticipated to increase by $321,900, or 32.9% due to

the increased activity expected for Transportation Network Companies (TNCs) and higher fees.

Other terminal rents, including ground handling office/storage space, are expected to increase by

$81,600, or 7.8% due to rate adjustments. Retail revenues are forecasted to experience an increase

of approximately $104,600 or 8.5% compared to the current year budget. The significant increase

in Reno Stead land rental revenue of $341,600, or 58.4%, is primarily driven by the annual option

payment from Dermody Properties.

Despite these increases, certain revenue streams face declines, notably auto rental and auto parking

revenues impacted by the decrease of passenger traffic and change in passenger behavior. The

decrease in auto rental revenue is driven by on-airport rentals expected to generate slightly less

revenue per enplaned passenger in FY 2024-25 and the exit of Payless from RNO, resulting in an

overall loss of approximately $921,200. This is partially offset by the peer-to-peer rental revenue

increase estimated at $304,200. Auto parking is expected to decrease by $106,900, or 0.6%, due

to less passenger traffic and reduced utilization of the public parking lot in favor of TNCs. Lastly,

RTAA will no longer receive federal funds for the Law Enforcement Officer (LEO) and Canine

program, resulting in a revenue loss of approximately $436,000 for FY 2024-25.

Non-Operating Revenues

The proposed budget includes non-operating revenues of $16.593 million to be received from

Passenger Facility Charges (PFCs), federal stimulus funds, investment interest, and aviation gas

tax. PFCs are estimated to decrease by $317,900 or 3.4% from the current year budget attributable

to reduced passenger traffic and a slight decrease in the proportion of passengers paying PFCs.

Furthermore, RTAA will no longer receive CFCs revenue directly, as it will be managed by a

third-party trustee. The forecasted Federal Stimulus funds of $5.000 million are designated to fund

RTAA Capital Improvement Projects in FY 2024-25.

FY 2022-23 FY 2023-24 FY 2023-24 FY 2024-25

Actual Budget Forecast Budget $ Change % Change

Non-Operating Revenues:

Passenger Facility Charges 8,372,017$ 9,394,600$ 9,167,900$ 9,076,700$ (317,900)$ (3.4%)

Customer Facility Charges 7,863,374 9,573,000 11,218,500 - (9,573,000) (100%)

Federal Stimulus 1,520,000 1,160,094 960,184 5,000,000 3,839,906 331%

Interest Income 2,899,224 1,976,400 2,778,700 2,696,900 720,500 36.5%

Other Non-Operating 300,994 298,400 300,000 302,900 4,500 1.5%

Total Non-Operating Revenues 20,955,609 22,402,494 24,425,284 17,076,500 (5,325,994) (23.8%)

Budget to Budget

Budget Category

Page 9 of 14

Operations and Maintenance (O&M) Expenses

The proposed budget for operating and maintenance (O&M) costs in FY 2024-25 amounts to

$68.668 million, a $3.523 million or 5.4% increase compared to the FY 2023-24 budget. The table

below outlines the RTAA's operating expenses, categorized by major expense groups.

Personnel Services – This expense category is estimated at $45.219 million, representing 65.9%

of the total O&M budget. It includes expenses related to salaries, wages, and benefits for the

RTAA's workforce consisting of 295.5 full-time equivalent (FTE) positions. The proposed FY

2024-25 personnel budget is an increase of $3.033 million, or 7.2% over the FY 2023-24 budget.

This increase is primarily attributed to the salary and wage increases per the existing bargaining

agreements and anticipated health insurance and other benefit increases. Increases in overtime pay,

shift differential, and standby pay also contributed to the higher budget. The proposed budget

includes two new positions, totaling 1.5 FTEs: an Environmental Program Manager (budgeted for

6 months) and the Chief Air Service Development Officer. Two additional FTEs were added as

part of the new MoreRNO team and will be charged to ongoing capital projects.

The unrepresented groups of Civil Service Plan (CSP) and Management employees are eligible

for a merit increase estimated at an average of 4.8% in base salary and an average of 5.6% in

performance-based incentives. The budget increase for merit and performance-based incentive

increase compared to FY 2023-24 is approximately $228,000. The International Brotherhood of