2021 Global

Tourism Watch

Highlights Report

China

China GTW

– October 2021

Study Overview: China Market

2

Geographical Definition

for Qualified Trips

Outside of: East Asia

(e.g., China, Hong Kong,

Macau, Japan, South

Korea and Taiwan)

GTW Sample Distribution

Sample distribution: National

Recent visitors to Canada: 335

Other travellers: 1,865

Total sample size: 2,200

The target population are residents aged 18 years and older who have taken a long-haul

pleasure trip, where they had stayed at least 4 nights with a minimum of 1 night in paid

accommodation in the past 3 years, or plan to take such a trip in the next 2 years.

Timing of Fieldwork

2021

Oct

Note: this study is conducted

annually. Significant differences

from the last wave in November

2020 are identified with .

/

China GTW

– October 2021

Market Overview

3

It is important to consider the results in light of the COVID-19 situation at the time

of data collection (October 2021).

COVID-19 situation in China

Since the outbreak of COVID-19 in early 2020, China has imposed a strict “zero

Covid” policy to prevent the spread of the virus and keep cases as close to zero

as possible.

1

There were sporadic COVID-19 outbreaks which led to city or

regional lockdowns.

Outbound travel situation

As part of the “zero Covid” policy, Chinese travel agents were banned from selling

packages and group tours as of late January 2020.

2

Travel outside China for non-

essential reasons was strongly discouraged and the availability of international

flights was drastically reduced. Those choosing to travel internationally faced a

minimum 14-day hotel quarantine upon return. As a result, domestic tourism has

flourished. Macau is the only destination outside of mainland China which Chinese

citizens can travel to for leisure with no quarantine on arrival or return.

3

Plans to

reopen the Hong Kong-mainland border for quarantine-free travel were put on

hold indefinitely with the arrival of the Omicron variant in December 2021.

4

In

2021, there were 8.5 million Chinese outbound travellers, which is less than 5% of

the 2019 total.

5

Canada’s borders re-opened to non-resident visitors who were fully vaccinated

with a Health Canada approved vaccine on September 7, 2021. The list of

approved vaccines was expanded in November 2021 to include two vaccines

widely available in China. All visitors still required a pre-entry COVID-19 molecular

test, but quarantine requirements were eliminated for vaccinated travellers.

6

Travel Indicators

Prior to the COVID-19 pandemic, China was a growth

market with high levels of long-haul travel and future travel

intention.

Long-haul travel past 3 years

92%

Intend to travel long-haul next 2 years

74%

Ever visited Canada

27%

/ Significantly higher/lower than 2020 GTW wave.

Intend to visit Canada next 2 years

48%

1

China Briefing 2021/2022.

2

Dragon Trail International, October 2021.

3

China Travel News, September 2021.

4

Dragon Trail International, October 2021.

5

DFNI, January 2022.

6

Government of Canada, September 2021.

China GTW

– October 2021

KEY HIGHLIGHTS

4

Insight Implication

While there is pent-up demand for travel among Chinese travellers, relatively few say

they feel safe travelling. Although significantly more Chinese travellers say they feel safe

travelling in 2021 compared to 2020, the proportion remains relatively low.

To best meet the opportunity of Chinese travellers’ renewed interest in travel and

encourage them to visit Canada once restrictions are relaxed and international travel

is an option again, it will be important for messaging to illustrate that Canada is a safe

destination.

COVID-19 concerns related to caseloads, travel insurance, medical care, and the

possibility of being stranded are generally subsiding, but concerns about health and

safety measures and quarantine requirements (both at the destination and upon return

to China) persist. Vaccination levels in a country and vaccine passport requirements are

also moderately important considerations for Chinese travellers.

Once Chinese travellers are able to travel internationally, it will be important to

communicate Canada’s current health and safety regulations, entry requirements for

fully vaccinated travellers (including acceptance of Chinese vaccines), and lack of

quarantine requirements.

Travel is the top spending priority for the next year, and Chinese travellers are

planning to spend slightly more on long-haul travel post-COVID-19 than they did pre-

COVID-19. Anticipated spending on long-haul travel is considerably higher than anticipated

spending on domestic travel and short-haul travel.

The current prioritization of spending on travel, along with the high anticipated spend

on long-haul travel post-COVID-19, presents a strong opportunity for Canada once

Chinese travellers are able to travel internationally.

Interest in several outdoor activities has dropped in general, but remains consistently

high for a trip to Canada. In particular, interest in seeing the Northern lights is one of the

top activities Chinese travellers would base a trip around, and growing in popularity for a trip

to Canada.

While outdoor activities are still popular for a trip to Canada, interest in some activities

is waning. Unique activities such as viewing the Northern lights on a trip to Canada

may be a strong lure for Chinese travellers.

Interest in visiting Canada during the spring season outpaces historical visitation

during those months. Additionally, spring is the preferred season to take part in many

popular vacation activities, while others hold three- or four-season appeal.

There is an opportunity to disperse Chinese visitation into the spring by promoting

activities that are popular outside of the busy summer months.

Travel agents and tour operators play a pivotal role in supporting travel from China to

Canada. Almost all potential Chinese visitors indicate that they are likely to use a travel

agent to research or book a trip to Canada.

Building and maintaining relationships with the Chinese travel trade is important to

boosting visitation to Canada.

5

COVID-19

Considerations

China GTW

– October 2021

Attitudes Toward Travel and Transportation Modes

6

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

COV13. Thinking of your next holiday, as government restrictions allow, how much do you agree

or disagree with the following statements?

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

COV16. As government restrictions allow, how likely are you to use the following modes of

transportation?

Attitudes Toward Travel Transportation Modes

/ Significantly higher/lower than 2020 GTW wave.

/ Significantly higher/lower than 2020 GTW wave.

► Significantly more Chinese travellers say they are eager to travel again (76%, up from 68% in 2020), yet just 45% say they feel safe travelling now (up from 39% in

2020). Chinese travellers have a strong preference to visit new destinations over familiar ones.

► Despite ongoing COVID-19 restrictions, Chinese travellers are also growing more comfortable with using most forms of transportation. Comfort levels are higher

for domestic air travel than international air travel.

27%

21%

8%

8%

7%

6%

43%

34%

27%

26%

22%

20%

70%

54%

35%

34%

29%

26%

Domestic air

travel

International air

travel

Bus travel (coach,

tour, shuttle,

other)

Rental car

Cruise

Ferry

Definitely Very likely

26%

25%

15%

11%

53%

51%

50%

34%

79%

76%

64%

45%

I will visit new

destinations that I

have never visited

before

I miss travel – I

can't wait to get

out and travel

again

I will visit

destinations that I

know well or have

visited before

I feel safe

travelling now

Strongly agree Somewhat agree

China GTW

– October 2021

Most Important Considerations in Selecting Travel Destination

7

+

New statement in 2021 GTW – no trending.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

NEWQ3. When thinking about taking a holiday trip outside of your country, which of the following are the most important considerations in selecting your travel destination? (Select up to 3 options)

/ Significantly higher/lower than 2020 GTW wave.

► When selecting a destination, health and safety measures remain the top concern for Chinese travellers. Vaccination levels in a country and the requirement for

proof of vaccination/vaccine passports are also moderately high on Chinese travellers’ list of considerations when selecting a travel destination. Concerns about

COVID-19 caseloads, travel insurance, medical care, and the possibility of being stranded are generally subsiding.

► Despite the requirement for a minimum 14-day hotel quarantine upon re-entry to China, Chinese travellers are more concerned about quarantine requirements at a

destination than upon return to China.

46%

34%

29%

27%

25%

25%

18%

17%

15%

14%

14%

12%

0%

2%

Health and safety measures in a country

+Proportion of the population that has been vaccinated in a

country

Quarantine requirements upon entry into a country

The number of COVID-19 cases increasing in a country

+Requirement of vaccine passport or proof of vaccination

upon entry into a country

Quarantine requirements upon re-entry into my own country

The possibility of infecting others upon my arrival or return

The number of COVID-19 cases being higher in a country,

compared to my own country

Availability of insurance to cover medical costs

Availability of proper medical attention in a country

The possibility of being stranded in a country if transportation

options become unavailable

Availability of insurance to cover trip interruption or change

costs

Other

None of the above

8

Key Performance

Indicators

China GTW

– October 2021

32%

26%

20%

10%

9%

8%

7%

5%

5%

4%

4%

3%

China

Japan

South Korea

Thailand

Singapore

France

Australia

Canada

United States

United Kingdom

New Zealand

Malaysia

Unaided Long-Haul Destination Consideration (Next 2 Years)

9

1

Responses as mentioned by respondents (e.g., percentage who said “Canada” specifically).

2

Roll-up of brand mentions by country (e.g., percentage who said “Canada” or any destination in Canada).

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

S8. You mentioned that you are likely to take a long-haul holiday trip outside of East Asia (e.g., China, Hong Kong, Macau, Japan, South Korea and Taiwan) in the next 2 years. Which destinations

are you seriously considering? (Please list up to 3 destinations)

/ Significantly higher/lower than 2020 GTW wave.

Top 12 Destination Brands

1

Top 12 Destination Countries

2

4%

Don’t

know

26%

Not

planning

to travel

Unaided consideration represents the top-of-mind presence of destinations in the consumer mindset and requires travellers to think of destinations without

being prompted.

► Canada is tied with the United States as the #8 top-of-mind country that Chinese travellers are considering visiting in the next 2 years. Due to travel restrictions in

place at the time of data collection, it is not surprising that mentions of China are up significantly compared to 2020. While down from 2020 levels, 26% of Chinese

travellers still indicate they are not planning to travel.

24%

23%

18%

11%

10%

9%

9%

6%

6%

5%

4%

4%

Hong Kong

Japan

South Korea

Macau

Thailand

Singapore

Taiwan

Australia

France

Canada

United States

United Kingdom

5.0% – Canada

0.1% – Ottawa

0.1% – Victoria

China GTW

– October 2021

Aided Destination Consideration (Next 2 Years)

10

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

BVC1. You may have already mentioned this before, but which destinations would you seriously consider visiting in the next 2 years? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

Aided consideration represents the proportion of travellers who say they would seriously consider visiting a destination, when prompted with a list of

potential destinations. For these travellers, Canada may not be top-of-mind as a destination, but they are considering a visit in the next 2 years.

► Canada continues to rank first on aided consideration, just ahead of France. Aided consideration for some top competitors, New Zealand and Australia, has

dropped significantly since 2020.

35%

32%

28%

27%

26%

25%

24%

23%

22%

20%

17%

16%

15%

11%

5%

Canada

France

New Zealand

Australia

Italy

Switzerland

United Kingdom

Russia

Germany

United States

Sweden

Netherlands

Spain

Belgium

India

China GTW

– October 2021

Knowledge of Holiday Opportunities

11

Base: Long-haul pleasure travellers (past 3 years or next 2 years) evaluating each destination

MP3. How would you rate your level of knowledge of holiday opportunities in each of the following destinations?

/ Significantly higher/lower than 2020 GTW wave.

► Canada remains in the middle of the pack on destination knowledge among long-haul competitors – in a three-way tie with Russia and Germany for the 7

th

spot

and trailing the #1 ranked France by a considerable margin.

8%

9%

8%

11%

8%

11%

8%

9%

9%

9%

7%

7%

6%

3%

3%

32%

24%

26%

22%

24%

21%

24%

23%

22%

21%

19%

20%

16%

17%

11%

40%

33%

33%

33%

32%

32%

31%

31%

31%

30%

26%

26%

22%

21%

14%

France (n=472)

Australia (n=472)

New Zealand (n=471)

United States (n=471)

United Kingdom (n=471)

Switzerland (n=471)

Germany (n=472)

Russia (n=471)

Canada (n=2200)

Italy (n=471)

Sweden (n=471)

Netherlands (n=471)

Spain (n=472)

Belgium (n=472)

India (n=472)

Excellent Very good

China GTW

– October 2021

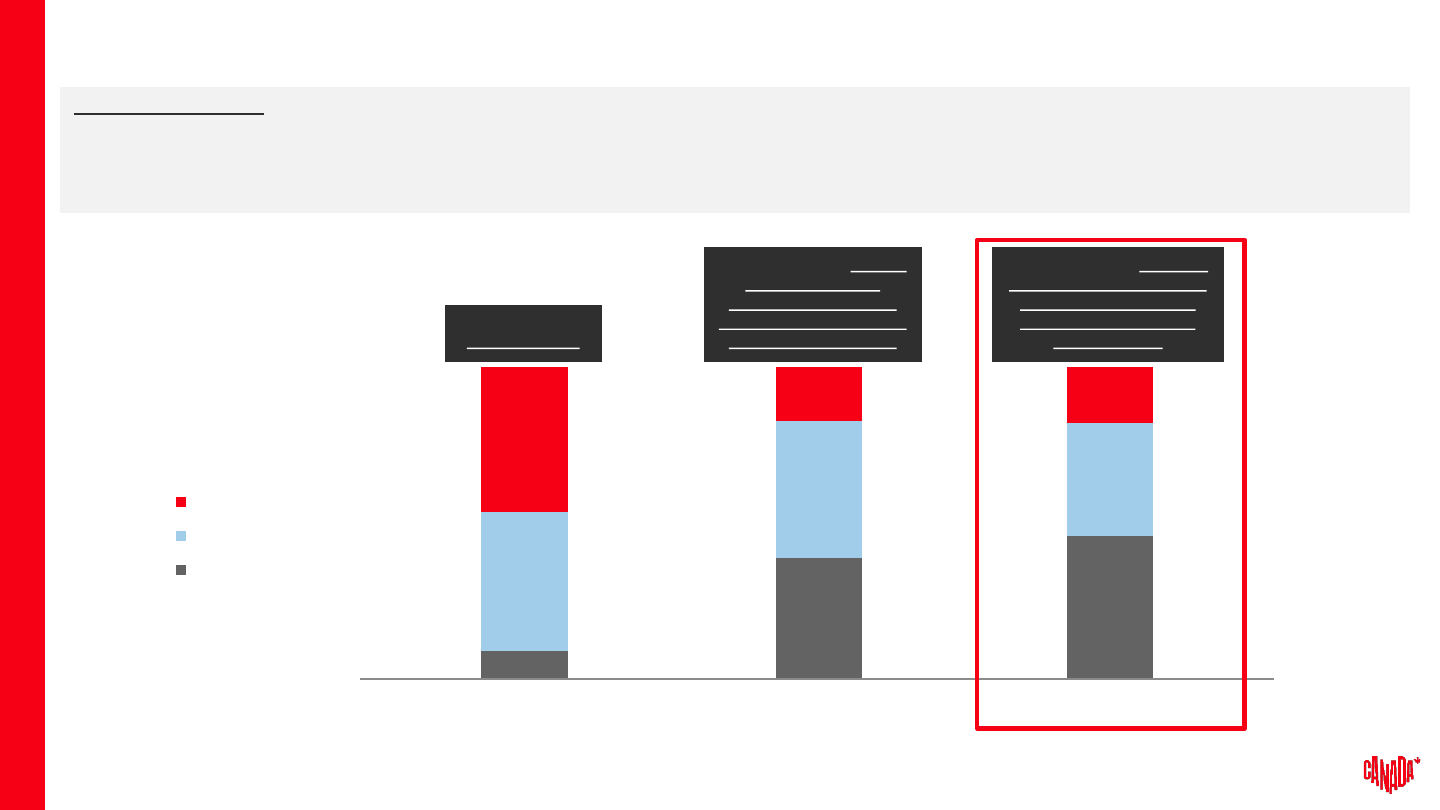

Stage in the Purchase Cycle by Market

12

Base: Long-haul pleasure travellers (past 3 years or next 2 years) – note all respondents evaluated Canada plus 2 randomly selected countries from the competitive set

MP1. Which of the following best describes your current situation when thinking about each of the following destinations for a holiday trip?

There is a purchasing or decision-making cycle associated with long-haul travel; consumers move through progressive stages from not knowing anything

about a destination to booking a trip. NET Active Planning represents the final four stages, or lower funnel, of this path-to-purchase cycle.

► Between 9% and 26% of Chinese travellers are in the lower funnel stages of the purchase cycle for Canada’s top competitor long-haul destinations. Canada is

ranked 7

th

overall, tied with four other destinations. 21% of Chinese travellers report that they are in the NET active planning stages for a trip to Canada, down

significantly from 2020. This suggests that several destinations are under serious consideration by Chinese travellers and Canada may face a challenge

converting interested travellers into visitors.

► Compared to 2020, more Chinese travellers say that they are seriously considering visiting Canada in the next 2 years, while fewer are planning an itinerary, which

may be related to the travel restrictions facing Chinese travellers at the time of data collection.

15%

17%

21%

26%

13%

8%

Canada (n=2200)

Have never thought of taking a trip to this destination

Not interested in visiting/returning in the foreseeable

future

Dreaming about visiting/returning someday

Seriously considering visiting/returning in the next 2

years

Am currently making transportation and

accommodation arrangements

Have already booked my transportation and

accommodations

Have started to gather some travel information for a

trip to this destination (from friends, internet, etc.)

Am planning the itinerary for a trip to this destination

NET Active

Planning

21%

/ Significantly higher/lower than 2020 GTW wave.

China GTW

– October 2021

NET Promoter Score (NPS)

13

Base: Long-haul pleasure travellers (past 3 years or next 2 years) who have visited each destination

MP11. Whether you have visited or not, how likely are you to recommend each of the following holiday destinations to a friend, family member or colleague?

The Net Promoter Score (NPS) measures the likelihood of travellers to recommend a destination. It is an important measure for advocacy, since a high

NPS score suggests that those who have visited Canada are more likely to encourage others to visit. Results are gathered among travellers who have

ever visited the destination and data has been normalized to indicate relative NPS scores across all competitors.

► Compared to competitive destinations, Canada is ranked 4

th

overall on NPS. This marked a slight drop from the 3

rd

spot in 2020.

France

Italy

Germany

Canada

New Zealand

Switzerland

Russia

Australia

Sweden

Netherlands

United Kingdom

Spain

Belgium

United States

India

Normalized Data

Travel Spending and

Canada Travel Intent

14

China GTW

– October 2021

Spending Priorities for the Next Year

+

15

+

New question in 2021 GTW – no trending.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

AT. In the next 12 months, which of following will you prioritize spending money on? (Select up to 3 options)

► Travel is the top immediate spending priority for Chinese travellers in 2021, far ahead of secondary priorities such as savings and electronics.

76%

53%

29%

27%

23%

16%

7%

4%

2%

Travel

Longer-term savings

Electronics

Buying a car

Home renovations or decorating

Purchasing a home

Paying down debt

Other

None of the above

China GTW

– October 2021

Travel Spending Intentions (in Next 12 Months)

16

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

S2. How would you describe your spending intentions on the following items in the next 12 months compared to the last 12 months? Will you spend …?

/ Significantly higher/lower than 2020 GTW wave.

Travel Market Outlook is the difference between the proportion who say they will spend more on travel in the next 12 months than they did in the last 12

months, minus the proportion who say will spend less on travel in the next 12 months than in the last 12 months.

► Chinese travellers foresee spending more on all types of travel in the next year than they did in the past year.

► While the long-haul travel outlook is still negative and far below 2019 (+24), it is significantly improved from 2020 (-44).

46%

36%

18%

9%

45%

46%

A little more

About the same

A little less

39%

44%

17%

+38 -22 -28

Leisure Travel

Within China

Leisure Travel Within

East Asia (e.g.,

China, Hong Kong,

Macau, Japan, South

Korea and Taiwan)

Leisure Travel Outside

East Asia (e.g., China,

Hong Kong, Macau,

Japan, South Korea

and Taiwan)

Travel Market Outlook

China GTW

– October 2021

Travel Spending

+

17

+

New questions in 2021 GTW – no trending.

Base: Long-haul pleasure travellers who travelled in 2019 (n=1692 Domestic / n=1423 Short-haul / n=1312 Long-haul)

TP2_INT. Thinking about the holiday trips you took in 2019, approximately how much did your immediate household spend in total on trips to each destination? A rough estimate is fine but if you

cannot remember please select don’t know. (PRE-COVID)

Base: Long-haul pleasure travellers who expect to travel post-COVID-19 (n=1677 Domestic / n=1413 Short-haul / n=1361 Long-haul)

TP2B_INT. Thinking about the vacation trips you plan to take when COVID-19 is no longer a consideration, approximately how much does your immediate household intend to spend in total on trips

to each destination? A rough estimate is fine but if it’s too hard to predict please select don’t know. (POST-COVID)

► Although travel is a spending priority and the outlook for spending on travel has improved compared to 2020, Chinese travellers don’t anticipate much change in

their spending on travel post-COVID-19 compared to pre-COVID-19, regardless of the destination.

► Long-haul travel is projected to see modest growth in spending, and anticipated spending on long-haul travel ($5,320) is considerably higher than anticipated

spending on domestic travel ($2,735) and short-haul travel ($3,951).

PRE-COVID POST-COVID

NET CHANGE

POST-COVID

MINUS

PRE-COVID

Travelling within China

$2781 $2735

-$46

(-2%)

Travelling within East Asia (e.g., China, Hong Kong, Macau, Japan, South Korea and Taiwan)

$4022 $3951

-$71

(-2%)

Travelling outside East Asia (e.g., China, Hong Kong, Macau, Japan, South Korea and Taiwan)

$5279 $5320

+$41

(+1%)

Mean Annual Household Spend on Vacation Trips

China GTW

– October 2021

Likelihood of Visiting Canada in Next 2 Years

18

Note: Not interested is comprised of those saying not very likely, not at all likely, or indicating no intention to visit Canada.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

MP6. Realistically, how likely are you to take a holiday trip to Canada in the next 2 years?

/ Significantly higher/lower than 2020 GTW wave.

► Among all Chinese travellers, the likelihood of visiting Canada in the next two years is up significantly from 2020.

► Intent to visit Canada in the next two years is highest among those aged 55+ and lowest among those aged 18-34.

► Chinese travellers are more likely to be considering a longer trip of 4+ nights than a shorter trip of 1-3 nights when visiting Canada in the next 2 years.

48%

40%

20%

26%

14%

45%

26%

22%

7%

Definitely

Very likely

Somewhat likely

Not interested

Likelihood of Taking a Trip of:

4+ nights

1 to 3 nights

Likely

(definitely/very

likely) to visit

Canada in next

2 years

China GTW

– October 2021

Potential Market Size For Canada

19

1

Includes respondents likely to visit Canada for a trip of 1 to 3 nights, or a trip of 4 nights or more.

Base: Target market for Canada = long-haul pleasure travellers (past 3 years or next 2 years) (n=2200); Immediate potential for Canada = dream to purchase stages for P2P for Canada (n=1552)

MP1. Which of the following best describes your current situation when thinking about each of the following destinations for a holiday trip?

MP6. Realistically, how likely are you to take a holiday trip to Canada in the next 2 years?

Target Market for Canada

Those in the dream to

purchase stages of the path

to purchase for Canada

Size of the Potential Market to Canada (Next 2 Years)

Size of the target

market

Immediate Potential

for Canada

Will definitely/very likely visit

Canada in the next 2 years

1

Immediate potential

Total potential long-

haul pleasure travellers

aged 18 years or more

/ Significantly higher/lower than 2020 GTW wave.

Study data is used to estimate the size of the potential market for Canada in two ways – the target market (proportion of all Chinese travellers in the dream

to purchase stages of the purchase cycle for Canada) and the immediate potential market (intention among the target market to visit in the next two

years).

► The proportion of Chinese travellers considering Canada remained stable in 2021, but within that group the intention to visit in the next two years increased

significantly, resulting in an immediate potential market size of 9.6 million.

9,551,000

20,120,000

68%

13,762,000

69%

China GTW

– October 2021

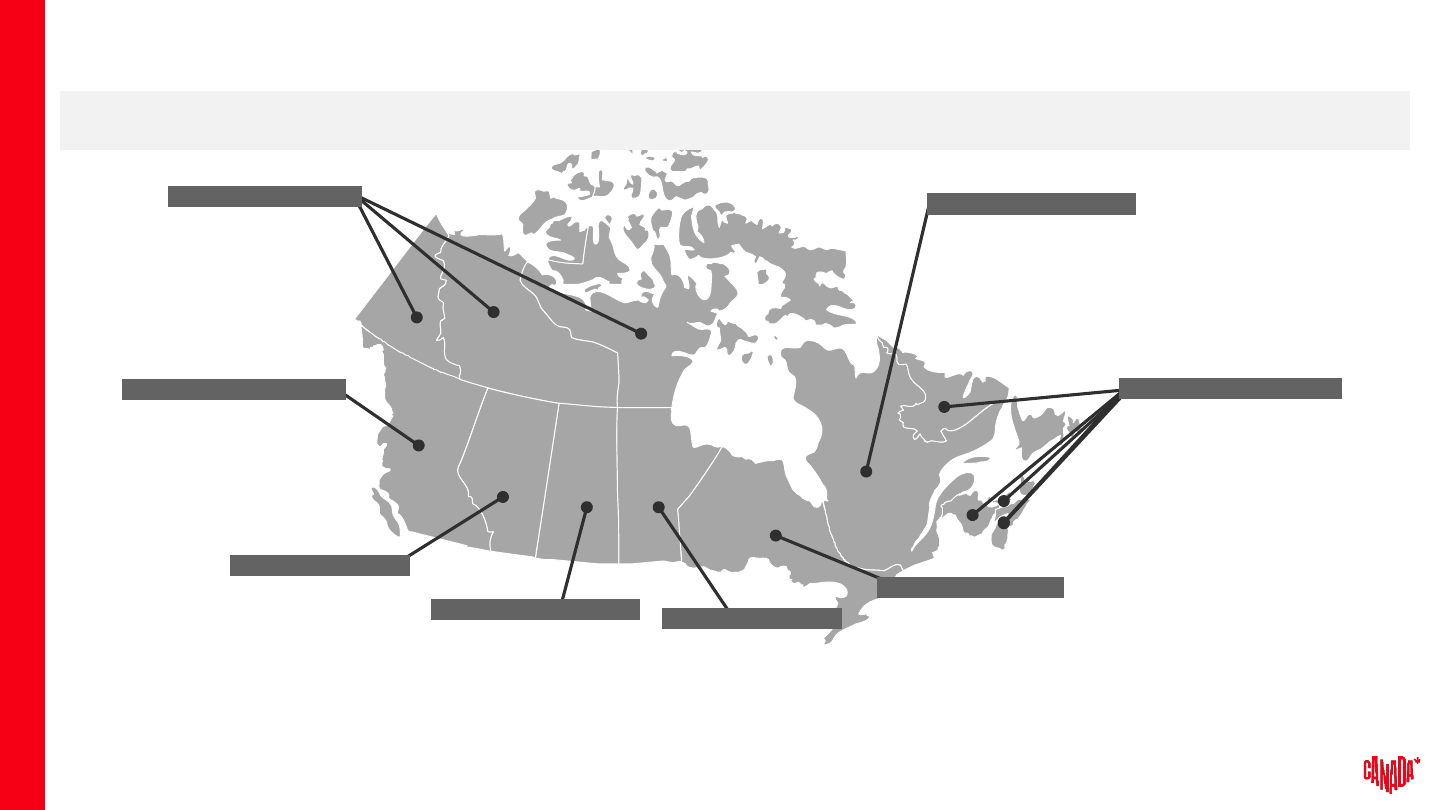

Potential Market Size for the Regions

20

+

Saskatchewan and Manitoba were combined in 2020 GTW wave – no trending.

Base: Those in the dream to purchase stages of the path to purchase for Canada and definitely/very likely to take a trip to Canada (n=1106)

MP7. If you were to take a holiday trip to Canada in the next 2 years, which of the following Canadian travel destinations are you likely to visit? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

Key:

% likely to visit region

Immediate potential (000s)

Immediate Potential for Canada: 9,551,000

► Ontario and BC continue to stand out as the provinces most likely to attract the largest share of Chinese travellers. However, compared to 2020 interest in BC

declined in 2021, as did interest in the Atlantic region. By contrast, interest in visiting Alberta and the North is on the rise.

NORTH

16%

1,547

BC

53%

5,052

AB

40%

3,859

SK

+

25%

2,378

ON

66%

6,294

QC

40%

3,811

ATL

32%

3,047

MB

+

26%

2,521

China GTW

– October 2021

Canadian Destinations Likely to Visit

21

+

Saskatchewan and Manitoba were combined in 2020 GTW wave – no trending.

Base: Those in the dream to purchase stages of the path to purchase for Canada and definitely/very likely to take a trip to Canada (n=1106)

MP7. If you were to take a vacation trip to Canada in the next 2 years, which of the following Canadian travel destinations are you likely to visit? (Select all that apply)

MP7a-i. Within [province/region], which travel destinations are you likely to visit? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

► The declining interest in BC and the Atlantic region is fueled by declining interest in many top destinations in those regions. Meanwhile, the growing interest in

Alberta is driven by increased interest in mountain destinations.

40%

Alberta

29%

Rocky Mtns.

19%

Calgary

19%

Banff

18%

Edmonton

17%

Jasper

5%

Other – AB

16%

North

8%

Dawson City

7%

Inuvik

6%

Iqaluit

5%

Yellowknife

5%

Whitehorse

7%

Other – North

53%

British Columbia

43%

Vancouver

35%

Rocky Mtns.

33%

Victoria

11%

Whistler

11%

Okanagan

4%

Other – BC

25%

Saskatchewan

+

21%

Saskatoon

16%

Regina

13%

Other

– SK

26%

Manitoba

+

22%

Churchill

19%

Winnipeg

11%

Other

– MB

66%

Ontario

52%

Niagara

Falls

52%

Toronto

43%

Ottawa

9%

Other

– ON

32%

Atlantic

16%

Saint John

12%

St. John’s

11%

Halifax

11%

Charlottetown

9%

Fredericton

9%

Cape Breton

15%

Other – PE

12%

Other – NL

8%

Other – NS

7%

Other – NB

40%

Quebec

31%

Québec

City

26%

Montréal

17%

Mont

Tremblant

9%

Other

– QC

China GTW

– October 2021

China Seasonal Demand for Canada

22

+

Source: 2019 Statistics Canada Frontier Border Counts.

* ‘Don’t know’ responses excluded from seasonal demand chart.

Base: Those in the dream to purchase stages of the path to purchase for Canada, excluding ‘Don’t know’ (n=1470)

PC3. What time of year would you consider taking a holiday trip to Canada in the next 2 years? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

6%

Don’t know*

► July and August are the most popular months for Chinese travellers considering a visit to Canada, and also historically the peak months for visitor arrivals from

China.

► However, demand appears to be shifting away from the peak summer period, while interest in visiting in early spring (March-April) is growing. This presents an

opportunity to potentially disperse some Chinese visitation into the spring months, given that demand outpaces historical visitation during these months.

6%

14%

24%

28%

20%

9%

14%

10%

19%

28%

20%

9%

Jan-Feb Mar-Apr May-Jun Jul-Aug Sep-Oct Nov-Dec

2021 China Traveller Demand

2019 Actual Arrivals+

23

Impressions of

Canada

China GTW

– October 2021

Impressions of Canada as a Holiday Destination

24

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

MP5_NEW. We are interested in your general impressions about destinations, even if you have never been there. Please select all the destination you think apply to the statement. Select None of

these if you think none of the destinations apply.

/ Significantly higher/lower than 2020 GTW wave.

► Canada is best known among Chinese travellers for beautiful scenery and landscapes, offering unique experiences, and as a place to see wildlife. However, the

proportion of Chinese travellers associating Canada with these top attributes, as well as several other attributes, declined in 2021.

53%

50%

48%

47%

47%

47%

45%

44%

44%

43%

43%

43%

42%

Has beautiful outdoor scenery and

landscapes

Is a place where I can experience things that

I can't experience at home

Is a great place to see wildlife in its natural

habitat

Is a great place for touring around to multiple

destinations

Is easy to travel to from where I live

Its cities have a lot of great attractions to see

and do

Combines the best of both outdoor activities

and city experiences

Is a place to spend quality time with friends

and/or family

Is a place that allows me to de-stress

Has great outdoor activities I would

participate in

Is a place I would be proud to tell people I

have visited

Its cities are great for exploring and soaking

in the atmosphere

Has a unique culture that I would want to

experience on a vacation

42%

42%

41%

41%

41%

41%

40%

40%

40%

38%

36%

35%

8%

Is a safe place to visit

Is a great place for regular vacations that

avoid surprises

Offers adventures that everyone can enjoy

Offers adventures that challenge me

Has great dining and food experiences

Offers good value for money

Is a place to form lifelong memories

Has people that are friendly and welcoming

Has great shopping

Has vibrant art scene

Is a place that inspires me

Has great historical & cultural experiences

None of these

China GTW

– October 2021

Key Barriers for Visiting Canada

25

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

MP9. Which of the following factors might discourage you from visiting Canada? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

► Similar to 2020, health risks and safety concerns continue to stand out as the top deterrent for potential Chinese travellers to visit Canada in 2021, although both

have declined as COVID-19 vaccines became more globally available.

► Concerns about a language barrier, unfavourable winter driving conditions, and lack of knowledge about Canada are on the rise.

49%

41%

29%

17%

17%

15%

14%

13%

13%

12%

11%

10%

9%

9%

9%

8%

7%

7%

5%

4%

4%

Health risks

Safety concerns

Poor weather

Not enough time to take a vacation

Delays and hassles at airports and borders

Language barrier/don't speak my language

Too far/flight too long

Cost

Poor value for money

Too many crowds at the places I want to visit in Canada

Unfavourable conditions for driving during winter

Unable to take vacation during months when I want to visit Canada

Destinations and attractions too far apart

Don't know enough about it

Visa requirements

There is no reason to visit anytime soon

There are other places I would rather visit

Doesn't have the cultural experiences I'm looking for

Have been to all the places I wanted to go in Canada

Unfavourable exchange rate

Nothing would prevent me from travelling to Canada

26

Vacation Interests

China GTW

– October 2021

Activities Interested in While on Holiday

27

+

New statement in 2021 GTW – no trending.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

MP10. In general, what activities or places are you interested in while on vacation? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

► Along with trying local food and drink, Chinese travellers have a strong preference for nature-based holiday activities.

► While interest in seeing the Northern lights and shopping is up relative to 2020, general interest in a wide variety of other vacation activities, including both nature

and city-based activities, has decreased compared to 2020.

52%

50%

49%

44%

42%

42%

41%

41%

40%

38%

36%

34%

33%

30%

30%

30%

29%

29%

Trying local food and drink

+Oceanside beaches

Natural attractions like mountains or

waterfalls

Historical, archaeological or world

heritage sites

Northern lights

+Lakeside beaches

Amusement or theme parks

Nature parks

Viewing wildlife or marine life

Exploring Indigenous culture, traditions or

history

Snowshoeing or cross country skiing

Camping

Food and drink festivals or events

Fine dining

Shopping for items to remember my trip

Art galleries or museums

Spring blossoms

City green spaces like parks or gardens

28%

28%

28%

27%

26%

24%

24%

24%

24%

24%

22%

21%

21%

20%

20%

20%

19%

18%

17%

Live shows

Culinary tours or cooking classes

Cultural or traditional festivals

Hiking or walking in nature

Downhill skiing or snowboarding

Nightlife

Fishing or hunting

Shopping for clothes/shoes

Kayaking, canoeing or paddle boarding

Fall colours

Ziplining

Shopping for luxury items

Breweries or wineries

Guided nature tours

Agricultural or country farm tours

Winter festivals

Music festivals

Guided city tours

Movie festivals

17%

16%

16%

16%

15%

15%

14%

14%

14%

13%

13%

13%

13%

12%

11%

11%

9%

1%

Self-guided driving tours/road trips

Scuba diving

Sporting events

Golfing

Mountain biking

Exploring places most tourists won't go to

Guided boat tours

Guided airplane or helicopter tours

Casual biking

Travelling to remote destinations

Cruises

Road cycling

Guided train tours

Spa or wellness centres

Rodeos

Comedy festivals

Renting a recreational vehicle (RV)

None of the above

China GTW

– October 2021

Activities to Base an Entire Trip Around

28

+

New statement in 2021 GTW – no trending.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) answering (n=2183)

MP12. Among these activities, are there any that are important enough that you would base an entire trip around that activity? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

► Interest in planning a trip around seeing the Northern lights is very high and has increased relative to 2020, which presents a key opportunity for Canada. Other

natural attractions like mountains and waterfalls are the top activity Chinese travellers would base a trip around, though interest is down relative to 2020.

36%

31%

26%

25%

25%

23%

21%

19%

19%

15%

14%

14%

14%

13%

12%

12%

12%

12%

Natural attractions like mountains or

waterfalls

Northern lights

Trying local food and drink

Historical, archaeological or world

heritage sites

Viewing wildlife or marine life

Nature parks

Amusement or theme parks

+Oceanside beaches

Exploring Indigenous culture, traditions or

history

Fine dining

Food and drink festivals or events

Cultural or traditional festivals

Art galleries or museums

Live shows

Fall colours

Spring blossoms

City green spaces like parks or gardens

Camping

12%

11%

11%

11%

11%

10%

10%

10%

10%

10%

9%

9%

9%

8%

8%

7%

7%

7%

Shopping for items to remember my trip

+Lakeside beaches

Shopping for clothes/shoes

Guided nature tours

Shopping for luxury items

Nightlife

Breweries or wineries

Downhill skiing or snowboarding

Snowshoeing or cross country skiing

Winter festivals

Culinary tours or cooking classes

Fishing or hunting

Self-guided driving tours/road trips

Music festivals

Hiking or walking in nature

Guided city tours

Sporting events

Agricultural or country farm tours

7%

7%

6%

6%

6%

6%

5%

5%

5%

4%

4%

4%

4%

4%

3%

3%

3%

3%

1%

Kayaking, canoeing or paddle boarding

Movie festivals

Guided airplane or helicopter tours

Guided train tours

Exploring places most tourists won't go to

Guided boat tours

Casual biking

Rodeos

Golfing

Spa or wellness centres

Scuba diving

Travelling to remote destinations

Ziplining

Renting a recreational vehicle (RV)

Comedy festivals

Mountain biking

Cruises

Road cycling

None of the above

China GTW

– October 2021

Time of Year Would Participate in Activities While on Holiday

+

29

>50% of respondents who are interested in the

activity would participate in this season

40-49% of respondents who are interested in the

activity would participate in this season

+

New question in 2021 GTW – no trending.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) interested in activity

MP10A. Thinking about activities or places you are interested in while on vacation, when would you typically take part in these activities? (Select all that apply) Note that the seasons refer to the

destination’s seasons.

► Spring is the preferred season to take part in many of the listed vacation activities, followed by summer. Other activities such as trying local food and drink hold

three season appeal. There are also several activities, especially city-oriented activities, which are popular year-round.

Summer

Fall Winter Spring

Trying local food and

drink

58% 54% 39% 63%

+ Oceanside beaches

81% 20% 12% 31%

Natural attractions like

mountains or waterfalls

50% 39% 18% 48%

Historical, archaeological

or world heritage sites

33% 52% 24% 60%

Northern lights

23% 19% 73% 17%

+ Lakeside beaches

77% 26% 12% 37%

Amusement or theme

parks

46% 46% 22% 66%

Nature parks

36% 49% 23% 70%

Viewing wildlife or

marine life

51% 35% 18% 57%

Exploring Indigenous

culture, traditions or

history

50% 58% 42% 65%

Snowshoeing or cross

country skiing

n/a n/a 100% n/a

Camping

51% 43% 15% 54%

Food and drink festivals

or events

57% 45% 32% 51%

Fine dining

48% 56% 43% 61%

Shopping for items to

remember my trip

52% 48% 41% 63%

Art galleries or museums

43% 52% 45% 67%

Spring blossoms

n/a n/a n/a 100%

City green spaces like

parks or gardens

43% 43% 23% 74%

Summer

Fall Winter Spring

Live shows

42% 47% 31% 55%

Culinary tours or cooking

classes

39% 40% 35% 58%

Cultural or traditional

festivals

42% 44% 35% 57%

Hiking or walking in

nature

34% 48% 20% 69%

Downhill skiing or

snowboarding

n/a n/a 100% n/a

Nightlife

71% 36% 23% 45%

Fishing or hunting

52% 35% 24% 52%

Shopping for

clothes/shoes

48% 43% 39% 57%

Kayaking, canoeing or

paddle boarding

70% 23% 13% 37%

Fall colours

n/a 100% n/a n/a

Ziplining

41% 35% 30% 49%

Shopping for luxury

items

49% 53% 46% 64%

Breweries or wineries

40% 48% 38% 48%

Guided nature tours

30% 49% 30% 62%

Agricultural or country

farm tours

27% 41% 23% 60%

Winter festivals

n/a n/a 100% n/a

Music festivals

54% 38% 23% 51%

Guided city tours

44% 41% 36% 64%

Summer

Fall Winter Spring

Movie festivals

47% 43% 42% 62%

Self

-guided driving

tours/road trips

27% 55% 23% 69%

Scuba diving

73% 20% 13% 30%

Sporting events

48% 36% 30% 56%

Golfing

40% 31% 28% 60%

Mountain biking

38% 34% 23% 59%

Exploring places most

tourists won't go to

33% 41% 42% 51%

Guided boat tours

47% 34% 33% 53%

Guided airplane or

helicopter tours

34% 37% 34% 55%

Casual biking

33% 45% 21% 64%

Travelling to remote

destinations

38% 46% 29% 62%

Cruises

29% 35% 26% 63%

Road cycling

31% 33% 25% 66%

Guided train tours

34% 34% 39% 60%

Spa or wellness centres

44% 34% 47% 46%

Rodeos

43% 33% 24% 53%

Comedy festivals

44% 38% 35% 56%

Renting a recreational

vehicle (RV)

38% 29% 30% 56%

China GTW

– October 2021

Sustainable Travel

30

1

Data can be found on page 32.

+ Base: Asked among those in the dream to purchase stages of the path to purchase for Canada (n=1552)

Base: Long-haul pleasure travellers (past 3 years or next 2 years) (n=2200)

PC31. Sustainable travel refers to “travel that minimises any negative impact on the destination’s environment, economy and society, while making positive contributions to the local people and

conserving the destination’s natural and cultural heritage”. Please indicate your level of agreement with each of the following statements …

/ Significantly higher/lower than 2020 GTW wave.

► Just over three-quarters of Chinese travellers say they are thinking about their personal impact on travel destinations, with just slightly fewer saying they would pay

more for socially responsible and environmentally-friendly options.

► A majority of those interested in taking a trip to Canada consider it to be an environmentally-friendly and socially responsible travel destination, though these

positive impressions have dropped compared to 2020.

► However, a much smaller number mention the availability of eco-friendly (18%) or socially responsible (18%) travel options as factors influencing their choice of

Canada as a travel destination.

1

29%

22%

29%

22%

19%

21%

20%

18%

55%

59%

51%

55%

57%

51%

50%

47%

84%

82%

80%

77%

76%

72%

70%

65%

I select travel destinations that have invested in reducing

their environmental impact

I select travel destinations that have invested in socially

responsible tourism practices

+I consider Canada to be an environmentally-friendly travel

destination

+I consider Canada to be a socially responsible travel

destination

I consider the impact that I personally have on the

destinations I visit

For an equivalent experience, I am willing to pay a higher

price for a socially responsible travel option over one that is

not

For an equivalent experience, I am willing to pay a higher

price for an environmentally-friendly travel option over one

that is not

I purposely avoid visiting crowded destinations

Strongly agree Somewhat agree

31

Key Characteristics of

Future Trips to Canada

China GTW

– October 2021

Factors Influencing Destination Choice

32

+

New statement in 2021 GTW – no trending.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) considering Canada (n=840)

FT3. Which of the following would factor into your choice to travel to Canada? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

► The top factors that influence Chinese travellers to choose Canada as a holiday destination include destination safety, the availability of interesting culinary

activities, and the availability of interesting outdoor experiences.

► Several of the top factors have decreased in importance as reasons to choose Canada since 2020.

31%

29%

28%

28%

27%

26%

26%

24%

23%

20%

Is a safe place to visit

Offers culinary activities I am

interested in (e.g. food or winery

tour)

Offers outdoor experiences I am

interested in

Offers cultural experiences I am

interested in

Opportunity to relax, unwind, and

decompress

Seeing a great trip itinerary

Offers city experiences I am

interested in

Has adequate health and safety

policies in place

Is a great family destination

Is a place where I could gain a

new perspective on my world

18%

18%

18%

18%

18%

17%

17%

17%

17%

+Is a destination that offers

socially responsible travel options

that support the local community

Is somewhere I have always

wanted to visit

Offers travel activities I am

interested in (e.g. cruise, train, or

RV trips)

Offers sports or outdoor activities

I wanted to do (e.g. ski, golf)

Is a destination that offers eco-

friendly travel activities

Offers great opportunities to

share my trip on social media

Is a place where I could pursue

my personal passions

My friends or family recommend it

I saw an article or video on a

news or lifestyle website

16%

16%

15%

15%

13%

13%

13%

8%

<1%

I saw a picture or a post from

someone in my personal social

network

I saw it on a channel I subscribe

to or a personality I follow on

social media

Is recommended by a travel agent

or tour operator

If it fits my travel budget

Seeing a great deal

I saw it on a television program

I want to visit with my friends or

family

Have visited before and wanted to

return

Other

China GTW

– October 2021

Main Purpose and Travel Party of Future Trip

33

Base: Long-haul pleasure travellers (past 3 years or next 2 years) considering Canada (n=840)

FT2. If you took a trip to Canada, what would be the main purpose of this trip?

Base: Long-haul pleasure travellers (past 3 years or next 2 years) considering Canada (n=840)

FT5. Who would you travel with on a trip to Canada? (Select all that apply)

Purpose of Trip Travel Party

/ Significantly higher/lower than 2020 GTW wave.

/ Significantly higher/lower than 2020 GTW wave.

► Holiday trips will drive Chinese travel to Canada in the next 2 years, with personal events (e.g. family reunion, wedding) playing a smaller role.

► Chinese travel parties visiting Canada will be largely be made up of immediate family – primarily couples trips or family trips with children.

Would

travel with

spouse/

partner only

33%

85%

23%

16%

12%

11%

1%

Holiday

Personal event

(e.g., family reunion, wedding)

Combined business/personal reasons

Visit family and friends

Education/learning a language

Other

80%

35%

19%

15%

9%

7%

5%

4%

1%

0%

Spouse or partner

Child (under 18 years old)

Friend(s)

Parent(s)

Alone/solo

Child (18 years old or older)

Other family members

Business

associate/collegues

Grandparent(s)

Other

China GTW

– October 2021

Length of Future Trip

34

Base: Long-haul pleasure travellers (past 3 years or next 2 years) considering Canada (n=840)

FT4. How many nights do you think you would spend on a trip to Canada?

/ Significantly higher/lower than 2020 GTW wave.

► Chinese travellers typically would like to spend at least four nights in Canada. The strongest preference is for a stay of 4-6 nights, although this number has fallen

since 2020.

<1%

12%

55%

30%

3%

1 night

2-3 nights

4-6 nights

7-13 nights

14+ night

China GTW

– October 2021

Trip Type and Accommodation for Future Trip

35

Base: Long-haul pleasure travellers (past 3 years or next 2 years) considering Canada (n=840)

FT9. What type of trip do you think you would be most likely to book likely to book for a trip to

Canada? (Select one)

+

New statement in 2021 GTW – no trending.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) considering Canada (n=840)

FT10. Which types of accommodation would you consider staying at during a trip to Canada?

(Select all that apply)

Trip Type Type of Accommodation

/ Significantly higher/lower than 2020 GTW wave.

/ Significantly higher/lower than 2020 GTW wave.

► Chinese travellers are split on the type of trip they would prefer on a visit to Canada. Fully guided tours, partially guided options, and all-inclusive packages are all

similarly popular choices for a trip to Canada.

► Chinese travellers have a strong interest in unique accommodation options. Resorts and mid-priced accommodations are also popular, but interest is decreasing.

40%

36%

34%

32%

30%

29%

27%

27%

16%

14%

13%

12%

8%

<1%

+Unique accommodation (e.g. treehouse, tiny

homes, eco-domes, etc.)

Resort

Mid-priced hotel/motel

Bed & Breakfast (B&B)

Luxury hotel

+Glamping (e.g. camping with comfortable amenities

and, in some cases, resort-style services or catering)

Budget hotel/motel

Guest ranch, farm or lodge

Rented house, apartment or condominium

Camping or trailer/RV park

Own cottage or second home

Hostel, university or school dormitory

Home of friends or relatives

Other

28%

27%

25%

15%

3%

1%

1%

<1%

Fully escorted or guided group tour to several

destinations

All-inclusive or semi-inclusive resort stay

(including beach, ski, nature, country or golf

resort)

Independent touring trip with some guided day

or overnight excursions

Fully independent touring trip (i.e. visiting

several destinations on your own)

Trip to a single city or place

Cruise

A visit to friends or relatives

Don’t know

China GTW

– October 2021

Activities Interested in on Future Trip to Canada

36

+

New statement in 2021 GTW – no trending.

Base: Long-haul pleasure travellers (past 3 years or next 2 years) considering Canada (n=840)

FT11. What activities would you be interested in participating in during a trip to Canada? (Select all that apply)

/ Significantly higher/lower than 2020 GTW wave.

► Chinese travellers’ interest in viewing the Northern lights in Canada increased significantly in 2021 and is now the #5 activity of interest for a trip to Canada. This

presents a strong opportunity for Canada, as viewing the Northern lights is also one of the top activities that they would base a trip around. While there is still a

strong preference among Chinese travellers for nature-based activities on a trip to Canada, interest in some of those top activities has dropped relative to 2020.

54%

51%

49%

47%

46%

43%

43%

43%

41%

40%

39%

37%

36%

36%

36%

36%

35%

32%

32%

+Oceanside beaches

Trying local food and drink

+Lakeside beaches

Natural attractions like mountains or

waterfalls

Northern lights

Amusement or theme parks

Viewing wildlife or marine life

Nature parks

Historical, archaeological or world

heritage sites

Exploring vibrant multicultural cities

Exploring Indigenous culture, traditions or

history

Camping

Snowshoeing or cross country skiing

City green spaces like parks or gardens

Food and drink festivals or events

Shopping for items to remember my trip

Spring blossoms

Fine dining

Cultural or traditional festivals

32%

32%

30%

30%

30%

30%

29%

29%

29%

28%

28%

27%

27%

25%

25%

25%

25%

23%

23%

Downhill skiing or snowboarding

Culinary tours or cooking classes

Fall colours

Guided nature tours

Fishing or hunting

Art galleries or museums

Hiking or walking in nature

Kayaking, canoeing or paddle boarding

Agricultural or country farm tours

Live shows

Exploring French culture, traditions or

history

Breweries or wineries

Nightlife

Guided city tours

Winter festivals

Shopping for clothes/shoes

Ziplining

Guided train tours

Shopping for luxury items

23%

22%

22%

21%

21%

20%

19%

18%

17%

17%

17%

17%

17%

16%

15%

15%

13%

13%

1%

Movie festivals

Guided boat tours

Guided airplane or helicopter tours

Music festivals

Scuba diving

Sporting events

Exploring places most tourists won't go to

Self-guided driving tours/road trips

Mountain biking

Casual biking

Travelling to remote destinations

Golfing

Road cycling

Spa or wellness centres

Cruises

Comedy festivals

Renting a recreational vehicle (RV)

Rodeos

None of the above

China GTW

– October 2021

32%

51%

14%

3%

0%

Definitely

Very likely

Somewhat likely

Not very likely

Not at all likely

Travel Agent Usage for Future

37

Base: Long-haul pleasure travellers (past 3 years or next 2 years) considering Canada (n=840)

FT6. Travel agents offer personalized service to help individuals, groups, and business travellers plan and organize their travel schedules, from purchasing tour packages to booking flights and

hotels. Examples of travel agents include CITS, CYTS, or Utour, they do not include online booking engines like Ctrip, Qunar, Fliggy or TUNIU. How likely are you to use a travel agent or tour

operator to help you research or book a trip to [destination]?

Definitely/

Very Likely/

Somewhat

Likely

/ Significantly higher/lower than 2020 GTW wave.

97%

► Travel agents and tour operators play a pivotal role in supporting travel from China to Canada, with almost all potential Chinese visitors indicating that they are

likely to use a travel agent to research or book a trip to Canada. Of note, the proportion saying they will definitely use an agent has jumped to 32%, up from 26% in

2020, which may be related to the travel restrictions facing Chinese travellers at the time of data collection.