How global telcos can profit

from India’s wireless experience

By Bart Vogel and Sandeep Barasia

Global wireless companies

can reduce costs if they follow

three strategies from India’s

wireless playbook.

Copyright © 2011 Bain & Company, Inc. All rights reserved.

Content: Manjari Raman, Elaine Cummings

Layout: Global Design

Bart Vogel is a partner with Bain & Company in Sydney and co-leads Bain’s Asia-

Pacific Telecommunications, Media & Technology practice. Sandeep Barasia is

a partner with Bain & Company in New Delhi and a member of Bain’s Global

Telecommunications, Media & Technology practice.

1

How global telcos can profit from India’s wireless experience

Global wireless com-

panies can reduce costs

if they follow three

strategies from India’s

wireless playbook.

As many wireless telecommunications opera-

tors around the world reach saturation points

in consumer penetration, they fear hitting a

growth wall. These companies face mounting

competition, declining average revenue per

user (ARPU) and steeply rising costs. All these

factors put tremendous pressure on their mar-

gins. Increasingly, wireless companies must

hunt for ways to squeeze more from their

business model—but where and how?

To find answers they might consider dialing the

country code for India. Indian telcos continue

to thrive despite serving users at bare minimum

rates. Their ARPU is a fraction of comparable

telcos in developed countries (see Figure 1).

For example, in 2009, Indian wireless ARPU

averaged just $2.90 a month. Compare that

with about $50 a month in the US, a little over

$22 a month in Germany and nearly $58 in

Japan. Even in developing countries like Brazil

and Mexico, ARPU averages close to $13 and

$14 a month, respectively.

Yet, Indian wireless companies excel in eking

substantial returns from thin soil. Leading

Indian players like Reliance Communications

and Bharti Airtel (Airtel) enjoy EBITDA (earn-

ings before interest, taxes, depreciation and

amortization) margins of more than 30 percent.

These compare well with global competitors

such as AT&T, Verizon, Deutsche Telekom,

Vodafone Group and Telefónica, despite having

ARPUs of one-tenth or less of these giants

(see Figure 2). Only some of this wide variance

can be explained by scale and the relatively

lower wages of the Indian labor force. Much

more hinges on a unique business model.

Note: APRU mentioned is overall APRU (divided by 12 for monthly ARPU)

Source: Ovum (mobile regional and country forecast pack: 2010–15, May 2010)

0

20

40

$60 57.8

52.0

50.2

34.4

33.6

22.3

17.6

16.3

13.8

12.8

10.0

9.4

3.0 2.9

Japan France USA

UK

Korea

Germany Hong

Kong

Malaysia Mexico Brazil

China

Russia Pakistan India

Wireless ARPU (2009, monthly)

Figure 1: Indian wireless players have less than one-tenth the ARPU of telecom companies

in developed countries

2

How global telcos can profit from India’s wireless experience

How do India’s young telcos generate superior

returns and make calls so inexpensive for

consumers? The true secret of their success

lies in a rock-bottom cost model that aims to

achieve the most optimal economics at three

levels: First, Indian providers have learned how to

“manufacture” very low-cost minutes. Second,

they continually strive for high levels of net-

work utilization. All this amounts to a telecom

breakthrough in achieving high minutes of use

(MOU) rates while radically de-layering tradi-

tional telco operations. Third, they have a cus-

tomer acquisition and distribution model that

ignores the traditional norms created in more

mature markets. Let’s consider these factors

in detail.

Manufacturing very

low-cost minutes

India’s mammoth population of 1.17 billion

people creates a unique market, but it can

provide universal lessons. Its telcos’ huge scale

of mobile operations and integrated networks

help them achieve their high MOU totals. India

has one of the largest mobile subscriber bases

in the world. In 2010, the country had 752

million mobile subscribers, second only to

China’s 842 million—and more than double

the 305 million subscribers in the US, whose

total population is around 310 million.

India also has some of the highest minutes

of use per connection globally (see Figure 3):

nearly 4,000 MOU per year per connection

compared with nearly 2,500 in China and just

over 1,600 in Japan. India’s total annual min-

utes of usage are also very high at 3,000 billion

versus 1,450 billion MOUs for the US and 150

billion MOUs for Germany. One key reason for

high mobile usage: the low penetration and lack

of sophistication of fixed-line services in India

when mobile phones first arrived. Consumers

shifted their pent-up demand for communi-

cations to mobile phones. Culturally, Indian

consumers enjoy communicating frequently,

and at length, whether through conversations

or texting. Lower prices further encouraged

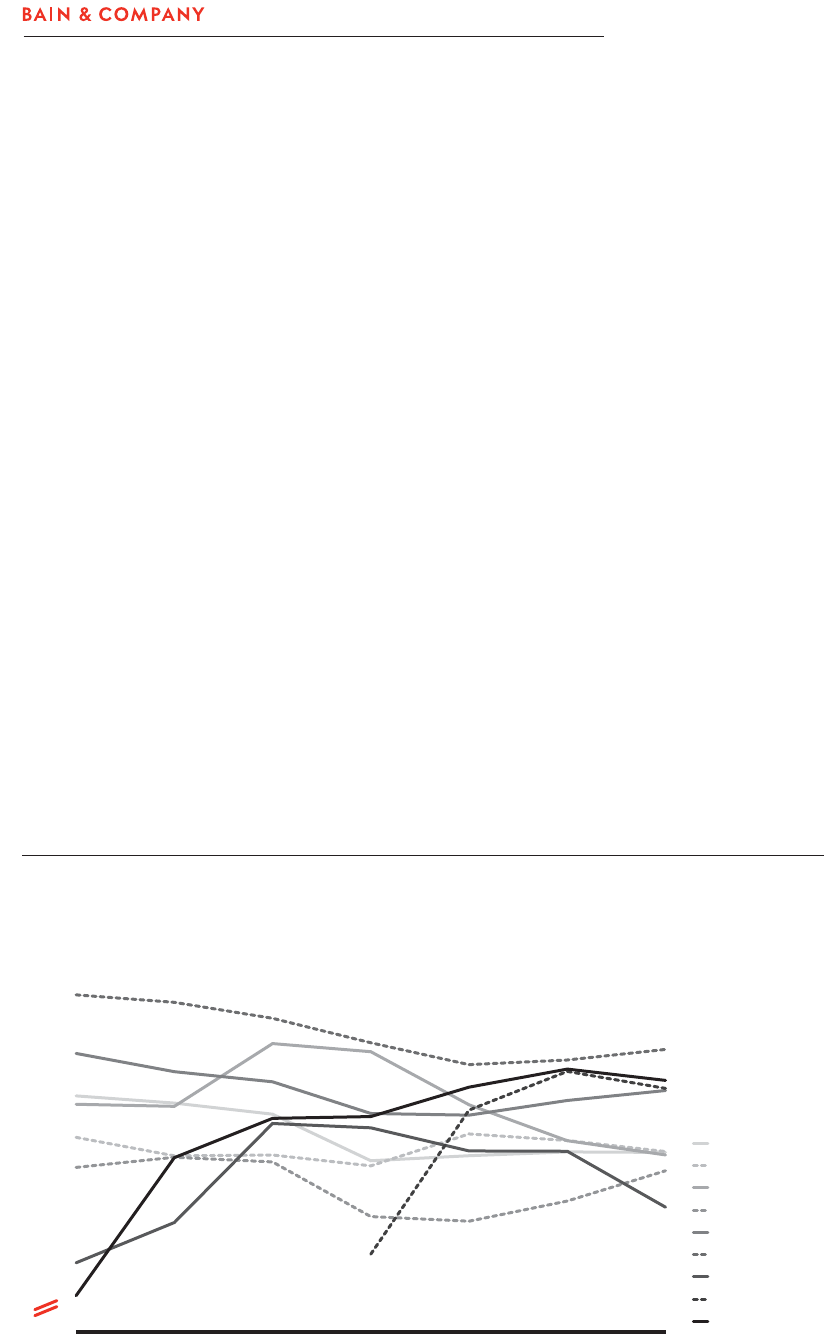

Note: FY05 for Indian telecom players implies year ending March 2005

Source: CapIQ company reports; analyst reports

EBITDA margins

0

20

25

30

35

40

45

50%

FY03 FY04 FY05 FY06 FY07 FY08 FY09

Bharti Airtel

Reliance

Idea Cellular

Telstra

Telefónica

Deutsche Telekom

Vodafone

AT&T

Verizon

Figure 2: Leading Indian wireless companies are as profitable as their European and

US peers

3

How global telcos can profit from India’s wireless experience

greater usage: as prices plummeted from an

average of 16 cents a minute in 1998 to just

0.70 cents a minute 10 years later, more Indians

consumed more mobile minutes.

To enable this volume, Indian telecommuni-

cations companies maintain large, integrated

networks. For instance, the top six wireless

companies in India, measured by subscriber

base, all operate across the breadth of the

country, handling more than 50 million sub-

scribers each.

Indian telcos do this very inexpensively by two

means: sharing passive infrastructure such as

the tower, shelter or generators and the wide

use of outsourcing. That outsourcing reduces

what in the rest of the world are the high fixed

costs of such backbone items as networks,

information technology (IT) maintenance and

services, data transmission and certain areas

of general and administrative expenses. That

approach of sharing passive infrastructure helps

amortize costs among a larger set of players.

The savings then translate into lower billing

rates that still deliver strong profits.

For instance, sharing or leasing towers can

save as much as 25 percent of tower costs as

tenancy increases from one operator to more.

These savings will increase further when the

telcos begin sharing active infrastructure like

antennae, feeder cables, nodes and transmis-

sion systems, too. While active infrastructure

sharing is still at a nascent stage—most com-

panies are still testing possibilities through

intra-circle roaming, whereby calls from one

operator use the network of another operator—

almost every telco in India is aggressively

pursuing passive sharing.

Many have teamed to spin off their passive

assets into separate entities. Tata Teleservices

sold its towers to Viom Networks (the erst-

while Quippo WTTIL). Bharti Infratel (Airtel),

Vodafone Essar and Aditya Birla Telecom Ltd.

(Idea) came together to set up a joint venture,

Indus Towers, to handle their passive assets.

Source: Ovum (Mobile Connections Forecast Pack, May 2010; mobile regional and country forecast pack: 2010–15, May 2010)

MOUs/connection (2010)

India

USA

Brazil

Mexico

France

Germany

UK

Hungary

Poland

Australia

China

Hong Kong

Japan

Korea

Singapore

UAE

South Africa

0

2,000

4,000

6,000

0

1,000

2,000

3,000B

Total MOUs (2010)

MOUs/connection Total MOUs

Figure 3: India ranks high in minutes of use (MOU) compared with other global markets

4

How global telcos can profit from India’s wireless experience

And Reliance Infratel and GTL Infrastructure

came close to striking an $11 billion deal to

create the world’s largest independent telecom

infrastructure company. The benefit: such

initiatives not only free up capital for invest-

ments, they help reduce interest costs.

Beyond sharing passive infrastructure, Indian

telcos improve operating efficiencies by exten-

sively outsourcing network development, oper-

ations and maintenance. Airtel works with

more than half a dozen partners—from IBM to

Ericsson—for functions such as network plan-

ning, IT and call center operations. Reliance’s

joint venture partner, Alcatel-Lucent, manages

the company’s CDMA and GSM mobile phone

networks. Vodafone partners with IBM and

Nokia on back-office IT operations and net-

work management. Indian telcos may have

pioneered such pervasive outsourcing, but

many global players are beginning to adopt

this tactic, too. Recently Maxis, a leading player

in Malaysia, announced a new network out-

sourcing deal with China’s Huawei.

Thanks, too, to outsourcing, new products and

services come to market at minimal costs—

and roll out faster. Tata Teleservices, for exam-

ple, recently signed a deal with Nokia Siemens

Networks to support the launch of its network

in India. In a deal worth $700 million, Airtel

similarly partnered with Nokia Siemens Networks

to roll out its networks in record time, as well

as to manage its radio and core network and

services in eight Indian telecom circles.

Pushing high levels of utilization

The success of Indian telcos hinges on match-

ing these very low costs with very high utiliza-

tion of networks (see Figure 4). The principle:

serve more with less. India’s companies typi-

cally operate their networks at full capacity

levels not seen in most other telcos. The goal

is to treat most expenses as variable costs and

track them against a minute of use. Despite

having limited spectrum compared with many

of their global peers, Indian telcos serve much

higher levels of subscribers and MOU. Indeed,

Source: TRAI; COAI; TEC; analyst reports

Capacity position by circles

(number of circles)

0

20

40

60

80

100%

Airtel

23

Vodafone

23

Idea

Above capacity

Well above capacity

At capacity

Excess capacity

Near capacity

23

Figure 4: Indian telcos achieve very high levels of utilization, often operating well

above capacity

5

How global telcos can profit from India’s wireless experience

some of the nation’s telcos are running 50

percent to 75 percent of their base transceiver

station (BTS) facilities at above, or well above,

capacity. While this approach can be ultra-

efficient, it can also significantly affect call

quality, especially for consumers at the top end

of the market who demand superior service.

To serve their burgeoning population of cus-

tomers, India’s telcos work hard to expand

capacity in high population centers through the

building of infrastructure, a process called cell

densification. Today, Airtel operates in 23 geo-

graphic circles that cover most of India. Of

these, more than 75 percent are above capacity.

Vodafone also operates in 23 circles. More than

50 percent are above capacity and another 35

percent are at capacity. Lower-frequency GSM

spectrum will further allow some leading compa-

nies to lower costs by renting out excess capacity.

However, this cell densification is leading to a

noticeable decline in call quality. Consumers

are now more discerning about issues like call

drops and network quality. Until recently, the

lack of mobile number portability protected

carriers from mass defections of customers to

competitors offering better service—but that

will change now. Mobile number portability

rolled out across India in early 2011.

Building a low-cost customer

acquisition and distribution model

Indian telcos bring thriftiness to their sales,

marketing and customer service strategies as

well. First, they focus predominantly on serving

prepaid customers (see Figure 5). The prepaid

business model creates substantial cost benefits.

They include the creation of lower billing and

collection expenses, and the critical ability to sell

more phones to more low-income consumers.

The last is essential to expanding scale.

To get phones into as many hands as possible

at the lowest cost, telcos rely heavily on India’s

many mom-and-pop shops, which offer prepaid

recharge coupons for several operators. Many

Source: Ovum (Mobile Connections Forecast Pack, May 2010; mobile regional and country forecast pack: 2010–15, May 2010)

Postpaid versus prepaid subscribers in India (in millions)

0

500

1,000

1,500M

2008

347

2009

525

2010

741

2011

924

2012

1,049

2013

1,135

2014

1,185

2015

1,217

Prepaid Postpaid Total subscribers

Figure 5: Prepaid subscribers dominate India’s mobile market

6

How global telcos can profit from India’s wireless experience

of these outlets also sell SIM cards directly to

customers and hence act as distributors for

the operators. That approach stresses high

volumes and low commissions to sales part-

ners. For instance, Indian telcos typically pay

4 percent to 5 percent commissions to partners

on prepaid recharges. Of that, a minuscule

1 percent to 1.5 percent goes to the distributor

and the remaining 2.5 percent to 3.5 percent

is paid to the retail outlet. To drive costs down

even further, Indian telcos also promote self-

service electronic recharging, rather than paper-

based methods, for prepaid phones. Today,

electronic recharges account for more than

80 percent of all sales.

The few telco-owned or franchised outlets in

existence are maintained mostly for servicing.

Vodafone Essar offers postpaid, prepaid, roaming

and value-added services through 1.2 million

retail outlets. But only a fraction of these,

1,150, are company owned and 6,500 consist

of franchises and exclusive dealer arrangements.

Indian telcos also team with unconventional

partners. For example, Airtel entered into an

alliance with IndianOil to gain access to 23,000

retail outlets at gas stations and cooking gas

distribution outlets. Other major Indian telcos,

such as Reliance Communications, also main-

tain a low ratio of owned outlets.

Another Indian telco practice is to keep sub-

scriber acquisition costs at the barest possible

minimum. Thus, most telcos have little stake

in the new handset market. That allows them

not only to maintain a very minimal device

inventory, but it frees them from making large

investments in the handset supply chain.

Instead, a thriving open handset market has

developed in India.

That is in direct contrast to those in developed

markets, where wireless companies often bear

the full burden of handset subsidies. These up-

front, fixed expenses can comprise as much as

one-third of subscriber acquisition costs. In

Western Europe, for example, handset subsidies

can total as much as 12 percent to 14 percent

of sales, on average. For GSM wireless com-

panies in India, handset subsidies are zero.

For CDMA service providers, they amount to

less than 3 percent of revenue.

Finally, to pump up user demand, India’s tel-

cos aggressively promote on-net and off-peak

calling, meaning they provide lower prices

for calls between customers within company

networks and during evening and overnight

hours. Not only do these policies redistribute

and increase usage, they bring down inter-

connect and termination fees between telcos.

Intra-circle roaming agreements also maximize

network usage. How India’s telcos manage

these call reallocation efforts reveals some

marketing ingenuity.

For instance, Vodafone offers 1,000 local min-

utes for a minimal cost to customers between

the hours of 10 PM and 8 AM. MTS offers 150

on-net calls. Similarly, Airtel bills in-network

calls at bargain rates compared with out-of-

network calls. And Reliance lets customers

make unlimited local and long-distance calls

if the consumer takes a prepaid CDMA con-

nection for Rs 599, or about $13.

What can a global company learn

from Indian wireless companies?

The business practices of Indian telcos are not

necessarily directly translatable to companies

elsewhere. But the principle of rigorously

identifying and justifying costs is. The stark

difference between the average annual cost

per connection of Indian wireless companies

($43) and that of global peers ($406) is mostly

explained by higher subscriber acquisition and

retention costs, network-related costs and

personnel costs (see Figure 6). Put another

way, a telco must go deep enough within its

operating model to understand what increases

cost in its business model—and then figure

out how to reduce them. As part of such an

analysis, a company also needs to understand

7

How global telcos can profit from India’s wireless experience

which costs must be controlled—and delivered

in-house—as well as determine those costs

that are variable with customers or with usage.

There are a lot of innovative ways to address

this task and finding the right ones may take

some trial and error. But Indian telcos’ cost

management expertise already provides most

wireless companies with at least five focus

areas to start controlling costs. Telcos every-

where can explore ways to:

• Maximize the opportunity to share passive

infrastructure in the short term and start

looking for opportunities to share active

infrastructure over time. As the India

experience shows, sharing infrastructure

can lead to huge savings on capital and

operating expenses, and also speed rollouts

of new products and features to customers.

In contrast, in many global markets, wire-

less companies pursued a more traditional

model of asset ownership, and competitive

pressures acted as cultural “deterrents” to

sharing infrastructure assets.

• Outsource network operations and main-

tenance services. Obviously, providers

must forge network outsourcing and infra-

structure-sharing agreements with care.

But the Indian experience shows that telcos

don’t have to own everything. Indeed,

outsourcing can take advantage of a spe-

cialized partner’s unique expertise and

lower costs as that partner achieves greater

economies of scale. That also allows telcos

to focus on what will truly differentiate

their service.

• Outsource or offshore select customer care

capabilities to global providers. A wireless

company can tap into the already developed

world-class expertise in efficient, scale-

delivery centers used by many of the world’s

leading telcos.

Note: Other telcos’ data is average of Vodafone (UK and Germany), Telstra, AT&T and Verizon

Source: Analyst reports; Bain analysis

Average annual cost per connection (US$)

Network related costs

G&A costs Selling and advertisement charges

Subscriber acquisition and retention costs Personnel costs Others

0

100

200

300

400

$500

Indian telcos

43

SARC

118

Personnel

costs

81

Network

related costs

77

G&A

44

Selling/

advertisement

18

26

Other

telcos

406

Other

costs

Figure 6: Global players stack up higher costs—especially for subscriber acquisition

and retention

8

How global telcos can profit from India’s wireless experience

• Lower customer acquisition costs. Telcos

can lower costs through sales strategies

that target prepaid subscribers and by

introducing self-service methods. The more

customers can do for themselves, the less

it costs a telco in staff services.

• Explore lower-cost distribution channels.

Indian telcos’ practices demonstrate that

low-cost channels such as convenience

stores can be just as good as company-

owned outlets for the sales of low-cost,

prepaid products. As part of this winnow-

ing of fixed costs, telcos should also zero

in on ways to simplify call plans and

standardize on fewer handsets to reduce

inventory costs.

Controlling costs is a critical element of busi-

ness strategy. But the essential strategic task

of any telco is to understand deeply the core

of what truly differentiates its products and

services—and then create ways to strengthen

that offering. It takes a different infrastructure

entirely to support a sophisticated smartphone

or tablet than it does to sell prepaid devices. Most

telcos are somewhere along a curve between

the need for high-end support and self-service.

Calibrating that point carefully, in order best

to serve the changing needs of its customers,

will remain an ongoing task for telcos on the

path of greater profitability.

The evolving landscape

The success of Indian telcos will inevitably

confront them with growth challenges. Several

looming trends make this inevitable: today’s

cost-conscious Indian telcos are being forced

to make significant payments for 3G licenses,

and they will need to develop resources for

the deployment of the technology’s inherent

value-added features. What’s more, with mobile

number portability now available in the market

Indian companies will need to invest more in

quality. In order to compete, they will find that

differentiation on customer experience will

increasingly become more important. Just as

inexorably, the subscriber growth rate will begin

to slow down as market saturation increases.

Already, the massive growth of dual SIM phones

and multiple SIM card ownership suggests

that discrete subscriber growth is much lower

than SIM card growth, and that subscriber

ARPU may get fragmented.

For companies in the Indian telco market,

these developments will represent wholly new

opportunities. We can expect that, as leaders

in cost-cutting innovations to serve a vast

population of very modest means, they will

continue what they do best: develop new meth-

ods for generating ever greater efficiencies

and effectiveness, all on a tight budget. But in

the interim, global players would do well to

read up on the early chapters of India’s wire-

less playbook. After all, any national telecom

industry that can add more than 220 million

phone connections, at such low ARPUs and

with such solid returns, in one year (2010),

must have made many right calls.

Bain’s business is helping make companies more valuable.

Founded in 1973 on the principle that consultants must measure their success in terms

of their clients’ financial results, Bain works with top management teams to beat competitors

and generate substantial, lasting financial impact. Our clients have historically outperformed

the stock market by 4:1.

Who we work with

Our clients are typically bold, ambitious business leaders. They have the talent, the will

and the open-mindedness required to succeed. They are not satisfied with the status quo.

What we do

We help companies find where to make their money, make more of it faster and sustain

its growth longer. We help management make the big decisions: on strategy, operations,

technology, mergers and acquisitions and organization. Where appropriate, we work with

them to make it happen.

How we do it

We realize that helping an organization change requires more than just a recommendation.

So we try to put ourselves in our clients’ shoes and focus on practical actions.

How global telcos can profit from India’s wireless experience

For more information, please visit www.bain.com