A Division of Empire State Development

Starting a

Business in

New York State -

A Guide to Owning and

Operating a Small Business

A Beginner’s Guide to

Starting a Small Business

in New York State

Welcome to Entrepreneurship

This guidebook was prepared to help you get started on the road to a successful entrepreneurship

and keep you pointed in the right direction. It gives you information about everything from

planning and financing a business to marketing, keeping records and understanding government

regulations. It also contains what you need to know about expanding an existing business. In

addition to providing a solid overview of small business ownership, this guidebook will serve as

a reference to the many programs and resources that are available to new business owners.

For the purposes of this publication, a small business is one that is a resident in this state,

independently owned and operated, not dominant in its field and employs 100 or fewer persons.

These businesses are a vital part of the economic picture in New York State and across the nation.

New York Business Express

At New York Business Express, you can learn about the licenses, permits and regulations to starting

a business in New York State. New York Business Express helps users to quickly learn about and

access resources for starting, running and growing a business in New York. The Business Wizard

leads users through a series of questions to create a Custom Business Checklist that helps determine

which New York State, as well as federal and local requirements apply to their business. The Incentive

Guide helps users to find out which New York State programs and incentives they may be eligible.

At the Business Index, users can quickly and easily access forms they may need.

The purpose of this guidebook is to provide general business information for anyone considering the start-

up or expansion of a small business in New York State. It is not intended to be an exhaustive discussion of

the laws of New York State, since legal requirements may change from time to time and the application of

specific laws to individual cases may vary.

This Guidebook was last updated in April 2019. If there are any inactive hyperlinks, contact [email protected]

Contents

CHAPTER 1: Foundations for Success 1

CHAPTER 2: Mapping a Strategy 7

CHAPTER 3: Financing Your Venture 12

CHAPTER 4: Selling Yourself 17

CHAPTER 5: Keeping the Books 24

CHAPTER 6: Government Regulations 31

Glossary 37

Appendix A: Entrepreneurship Assistance Centers 39

Appendix B: Small Business Development Center 40

Appendix C: Empire State Development Regional Offices 43

Appendix D: Government Agencies 44

Appendix E: Business Trade Associations 44

Appendix F: Chambers of Commerce 51

Appendix G: Alternative Lenders 56

The chapters follow the

sequence of decisions

and actions that most

entrepreneurs go through,

beginning with choosing and

organizing a business, which

is covered in Chapter 1.

Chapter 2 takes you step-by-

step through the development

of a complete business plan,

which is critical for success.

Once a plan is established, you

can begin to look at financing,

which is covered in Chapter 3.

Your continual success will

depend to a great extent on

marketing, which is discussed

in Chapter 4. In Chapter 5, you

will find a review of the records

you need to maintain to manage

your business and meet legal

requirements, while Chapter

6 is devoted to government

regulations, including licensing

and permits, sales tax, insurance

and obligations to employees.

The last few pages contain

information on resources

available to you from both

public and private sources.

You have always wanted to start your

own business. You’ve thought about

it, dreamt about it, discussed it with

family and friends, perhaps even

done some research on the subject.

Each year, thousands of New Yorkers

follow their dreams and tackle the

challenges of entrepreneurship and

enjoy the rewards and satisfaction of

having accomplished something by

themselves, of being able to shape

their own destiny and contributing

to their community. Many people

who take this road wonder why they

didn’t do it sooner. With the right

planning, determination and resources,

you can do it too. Whether you’re

thinking of starting a food truck,

brewery, graphic design, accounting

service, home improvement,

laundromat, or e-commerce

business, this guidebook will help

you build a foundation for success.

Do You Have What It

Takes To Succeed?

Studies show that most successful

entrepreneurs share some key traits.

They are usually organized, determined

people who have a strong sense of

responsibility, are not afraid to make

decisions or mistakes, work well with

other people and enjoy the art of selling.

Here’s a look at some of those traits.

Organizational ability:

Small business

owners must pay strict attention to

details, be self-disciplined and use

their time efficiently. They must be

able to pay attention to employees,

customers, sales and expenses — all

at the same time. They must be able

to pay bills and wages on time and

maintain a budget to avoid the roller

coaster of having surplus funds one

month and a shortage the next.

Determination: The most successful

small business owners not only want to

succeed, they are determined to do so.

They have the ability to adjust rapidly

to change, learn quickly, recognize and

correct mistakes, think creatively, be

enterprising and resourceful, handle

discouragement and develop favorable

solutions to everyday problems. They

also realize the importance of taking risks.

Sense of responsibility: Small business

owners are completely responsible

for what happens to their business.

Long after others have gone home,

they may have to stay on the job

tending to any number of details —

getting your bookkeeping in order,

going over inventory, rearranging

merchandise, meeting clients or

seeing that repairs are made.

Decisiveness: Small business owners

must make many decisions, and often

make them quickly. Some entrepreneurs

come by that ability naturally; others learn

through experience. The best decision-

makers consider all the choices open

to them, use that knowledge judiciously

and don’t second-guess themselves

once a decision has been made. They

realize that making mistakes is part

of the process, and they forge ahead

with new decisions despite setbacks.

People skills:

Small business owners must

get along with people, understand their

needs and inspire their confidence. They

realize that courtesy and understanding

are an important part of dealing with

customers, suppliers, lenders and others

who play a key role in their business.

Marketing: Marketing and selling are a

part of operating all businesses, from

manufacturing to the service trades.

While some people are naturally adept at

sales skills, others work hard to develop

a sixth sense for marketing know-how

and opportunities, taking advantage

of the many books, courses, seminars,

and online training available to them.

Do you wonder if you have the right quali-

ties to make it on your own in

business? Take the quiz, “A Readiness

Test”, (see Figure 1-1) to find out.

CHAPTER 1

Foundations For Success

Assessing Your Resources

Opening your own business is an

exciting journey that can provide

lifelong satisfaction. But it is also

one of life’s greatest challenges and

also entails making some choices

that will deeply affect you and the

people around you. That’s why it’s

important to get all the information

you can before you start.

Education and information: In

today’s increasingly global economy,

education is essential for the business

person. In addition to a good general

education, you may want to consider

taking specialized courses to enhance

your working knowledge of financial

and other pertinent matters. New York

State has many fine learning institutions,

including private and state universities,

local community colleges, vocational

schools, adult education centers and

job training programs that offer a

range of entrepreneurial development

and business programs, such as the

Entrepreneurship Assistance Centers

(EAC) and Business Mentor NY. EACs

provide new and aspiring entrepreneurs

with training and business counseling

services to develop basic business

management skills, refining business

concept, devising early-stage marketing

plans, and obtaining business financing.

To find an EAC in your area, visit

EAC’s webpage at https://esd.ny.gov/

entrepreneurial-assistance-program or

Appendix A on page 39.

Business Mentor NY is a web-based,

mentoring program, which assists

entrepreneurs and established small

businesses overcome challenges to grow

their business. To connect with a mentor,

visit Business Mentor NY at https://

businessmentor.ny.gov/. It is also helpful

to consult trade journals, consumer

magazines, web publications, forums,

and social media on a regular basis to

keep up with current news and trends in

your industry. In general, the more you

know about the business before you start

the greater your chances for success.

1

2

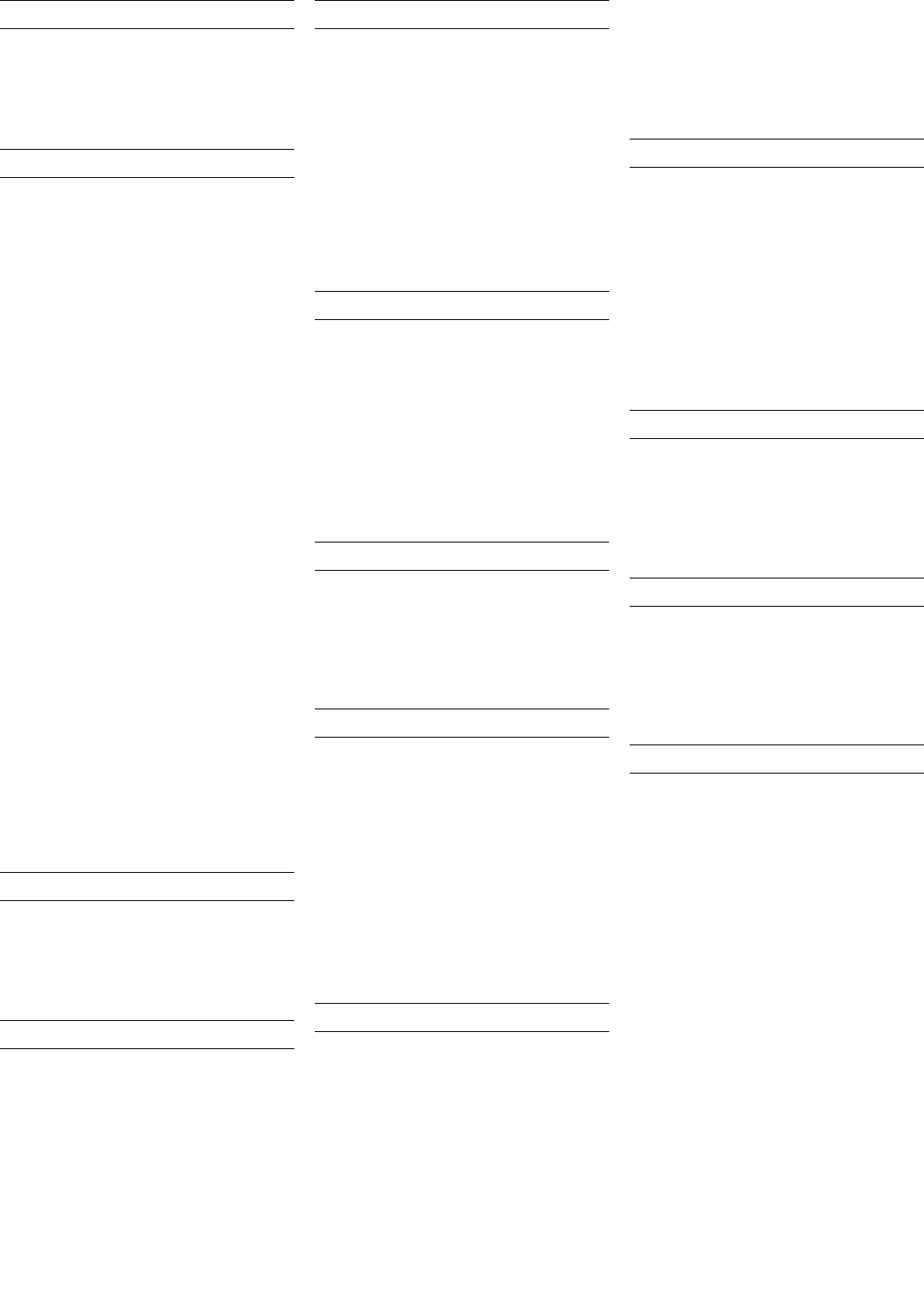

Figure 1.1

A Readiness Test

Take this quiz to find out if you have the right qualities to operate your own business. Under each question, check the answer that

comes closest to saying what you feel, then find your score using the key provided.

1. Are you a self-starter?

____ Yes. I like to do things on my own and have a lot of initiative.

____ To a point. I’ll contribute what I am expected to.

____ No. I don’t put myself out unless it’s absolutely necessary.

2. Do you enjoy working with other people?

____ Yes. I like people and can get along with anybody.

____ Sometimes. If people don’t bother me too much, I can get along with them.

____ No. Most people are difficult to work with and irritating.

3. Do you welcome responsibility?

____ Yes. I like to take charge of things and see them through from beginning to end.

____ Not really. But I can handle it if I have to.

____ No. I’d rather let someone else be in charge.

4. Are you a good organizer?

____ Yes. I always have a plan before I start a project, and usually get things lined up when others want to do something.

____ It depends. I do all right up until a point, but when things get too overwhelming, I tend to back off.

____ No. I like to take things as they come. I try not to plan too much in advance.

5. Are you a hard worker?

____ Yes. I do whatever it takes to get the job done. I don’t mind working hard for something I want.

____ Usually. I’ll work hard for a while, but when I’ve had enough, that’s it.

____ No. I prefer to work only when I have to.

6. Are you comfortable making decisions?

____ Yes. I can make up my mind in a hurry if I have to, and usually things turn out well.

____ I’m not sure. If I have plenty of time, I usually can, but if I have to make up my mind fast, later I always wonder if

I made the right choice.

____ No. I don’t like being the one to decide things. I’m afraid of making the wrong choices.

7. Do you finish what you start?

____ Yes. If I’m determined to do something, nothing can stop me.

____ Usually. I can finish what I start as long as it is going well and is interesting.

____ No. I have great ideas, but frequently I have trouble carrying them out.

8. Are you eager and energetic?

____ Yes. I’m a tireless worker who looks forward to new challenges and tasks.

____ For the most part. I have a reasonable amount of energy.

____ No. I run out of steam sooner than most of my friends do.

9. Do you like to sell?

____ Yes. When I sell something I believe in, I feel as though I have done the customer a service. I find it extremely

satisfying and consider myself very persuasive.

____ Sometimes. Selling is a tough job, but I’m willing to learn the skills if I must.

____ No. I don’t like asking someone to buy something from me. I believe a good product or service should sell itself.

Scoring: How many check marks are beside the first answer? ____

How many check marks are beside the second answer? ____

How many check marks are beside the third answer? ____

If you have more than five checks beside the first answer, you probably have what it takes to run a business.

If you have more than five checks beside the third answer, you may have difficulty making it on your own.

If your score falls somewhere in the middle, you may need some help to make your business successful.

3

Often, the most successful entrepreneurs

are people who have worked for years

for someone else in a particular line of

business and who finally decide they

know the ropes well enough to leave

their employer and start up a similar

operation.

Capital: Money invested in a business

is called capital. Before you start your

business, you must identify sources of

money for equipment, supplies and

day-to-day operating expenses, and

plan in advance to have it available

when you’ll need it. Successful

entrepreneurs plan their cash flow at

least a year ahead, and many carry out

their projections two to five years in

advance. Insufficient start-up money or

under-capitalization, is one of the major

reasons half of all small businesses fail

during the first two years.

Professional assistance: Building a

successful business means relying on

others for support and advice. There is

a wide range of resources, both public

and private, that can offer the support

you need. Government agencies such as

Empire State Development (ESD) and the

U.S. Small Business Administration (SBA)

can provide guidance on everything

from securing access to capital, business

mentoring, and government procurement,

to exporting products or services. To

learn about ESD’s programs and services,

visit https://esd.ny.gov/doing-business-

ny/small-business-hub or find an ESD

office in Appendix C on page 43. For

information on SBA’s programs, visit SBA

at www.sba.gov or find SBA’s regional

office in Appendix D on page 44.

Professional advisors can assist with

planning and save you money in the long

run. A lawyer, for instance, can help you

buy or sell a business, formulate a legal

structure for your business, negotiate with

your landlord or financial institution, write

a personnel policy and resolve conflicts

that may arise. An accountant can help

review your start-up costs, prepare and

analyze financial statements, prepare

loan applications, set up a bookkeeping

system, and prepare tax returns.

You may want to consult a lender

for information about how to secure

financing or manage your finances,

while an insurance agent can help you

determine what kinds of insurance

coverage you will need and the

best policy for your business.

For information on trends in your field,

comparative operating figures and the

latest marketing strategies, you may

find local or national business trade

associations helpful. Find contact

information at Appendix E on page 44.

Choosing Your Business

There are several options to consider

when deciding what kind of business

to undertake. You can sell a product or

a service or a combination of the two.

You can purchase a new business or an

existing one, and run it by yourself or

with a partner. Whatever you ultimately

decide, it is important to take the time to

examine all the choices.

GENERAL CONSIDERATIONS

It is wise to choose a field in which you

have some prior knowledge. If you go into

a business that is completely unfa miliar,

you will be competing with experienced

professionals who already know things

it may take you years to learn. There are

probably some businesses you can start

almost immediately, provided you have

sufficient capital, but others will require

that you complete months or even years

of training.

Prior experience is important, but do not

neglect your personal interests. Initially,

you are likely to be working 10 to 15

hours a day, five to seven days a week

to make your operation a success. With

the business taking up that much of your

life, it is important for your mental and

physical health that you like what you are

doing. Investigate the long-term outlook

for the industries that interest you. Look

for opportunities in businesses where

expansion can be expected. Surveys

by trade groups, government and other

reputable organizations are a good

place to find businesses that are ripe for

development. You can get this information

by contacting trade associations, U.S.

Census Bureau and libraries.

As you look at different businesses,

consider consumer needs you can

fill. You should make sure there is a

market for your products and services

before you commit. Stay away from

overcrowded fields. While many fields

may offer good opportunities in general,

too many businesses that offer the

same thing in the same area may be a

prescription for failure.

Survey the people who are likely to

be your customers to find out what

they want and how much they are

willing to pay. This may be as simple as

questioning friends and acquaintances or

conducting an informal focus group.

The amount of capital you have

available will also influence your decision.

You may find an attractive business

opportunity, but discover that you do not

have enough money to finance it. If that is

the case, it is best to continue looking for

another business opportunity. A business

is practical only if you have sufficient

capital to keep it going until the profits

are adequate to support the business.

New York State actively promotes

a healthy business climate, but each

community is different. Take your time

in choosing a location, particularly if

the community is new to you. Study

the long-term population and business

trends in the region, the town and the

neighborhood where you might locate.

Finally, get a feel for the business

and social climates in the community

where you will set up your operation.

Talk with local business people and

professionals, including bankers, lawyers

and real estate brokers. You may want to

consider joining a chamber of commerce

or business trade association. You can

find a local chamber of commerce in

Appendix F on page 51 and business

trade association in Appendix E on

page 44. These organizations can

help your business gain credibility

in the community; exposure through

networking opportunities, referrals

and online or printed publications;

accessibility to discounted services,

products, training and development

programs; and advocacy on issues

affecting the small business community.

BUSINESS OPTIONS

There are three basic ways to go into

business for yourself — start a business

from scratch, buy an existing business or

buy a franchise.

The New Business

Starting a new business can be the

least expensive way to begin, and it

allows the most freedom since it has no

history. The business name, its location,

its equipment and its employees are

all yours to choose. If you are selling

products, you have the option of starting

with an all new inventory, unaffected

by the purchasing decisions made by

4

others. In addition, you are not affected

by prior commitments to employees,

leases and other obligations that an

existing business frequently has.

On the other hand, it can be difficult to

raise money for a new business and the

risk is higher. Since you probably do not

have an established clientele, you can

expect your advertising expenses to

be higher than those of an established

business, and you may have to go through

a prolonged period of trial and error as

you develop your marketing strategies.

Because you will have no history of prior

operations, cash flow will be unpredictable

and, most likely, insufficient.

Buying a Business

By purchasing an established business,

you have a product or service that is

already familiar to your customers, making

the job of advertising easier and less

costly. You may gain already established

goodwill, which includes all the intangible

efforts that go into building a thriving

business, including good customer and

trade relations, management efficiency

and public acceptance. Cash flow

generally has been established and there

is usually an existing relationship with

lenders and suppliers.

When you research your potential

purchase, carefully consider any

disadvantages. Depending on the

previous history of the business,

goodwill may not exist. The building

or its location may contain hidden

liabilities, such as being situated three

blocks away from a similar operation.

If the business involves retailing,

wholesaling or manufacturing, there

may be “dead stock” or inventory

that is obsolete or damaged, turns

over slowly or does not sell at all.

Also beware of undisclosed reasons

for selling, such as concealed financial

obligations, deteriorating local

conditions, labor problems, zoning

changes, an expiring non-renewable

lease or limited growth potential.

You can find out about businesses

for sale by letting your interest be

known among members of the local

business community, checking the

classified advertising sections of

local newspapers, online, and trade

magazines or newsletters, and

consulting commercial specialists

and industrial real estate business

brokers, lawyers and accountants.

There are a few additional precautions to

take when you are looking to purchase

a business. Beware of “partner wanted”

opportunities. By law, every partner in

a general partnership is responsible

for the debts of the entire partnership,

so be very cautious about getting

involved. You will also want to avoid new

partners, which are generally poor risks.

Do not let yourself get rushed into

a deal. All propositions and agreements

should be in writing and drawn up or

reviewed by a lawyer who works for you

and has experience in business sales.

Consult your nearest Better Business

Bureau, which can help you avoid

professional swindlers, and have the

business you are buying investigated

by both a lawyer and an accountant.

If you do decide to proceed, know

your legal responsibilities. The sale

of a business, either in part or as a

whole, is called a bulk sales transaction.

Regardless of the size or cost of

the sale, you must comply with the

laws regulating such transactions.

If the seller of your potential business

has ever been required to collect

New York State sales tax during

business operations, he or she may

we sales taxes to the state. If you buy

the business without having followed

bulk sales procedures, you may

be responsible for any outstanding

sales tax liability owed by the seller.

For more detailed tax information

including bulk sales information, see

Chapter 6 section on “Taxes”.

Franchising

When you purchase a franchise, the

business will operate under the name

and system of the master company.

The types of franchises available vary

from tax-preparation services and

soft drink distributorships to fast food

restaurants and hotel chains. The sizes

vary from single-person operations to

large businesses employing hundreds of

people.

What you get as a franchisee depends

on the terms of your contract. Frequently,

you benefit from training opportunities as

well as a precise formula covering every

detail of operation, which is based on

the previous trial-and-error experience

of the franchiser.

The Franchise Opportunities Guide,

available from the International Franchise

Association (IFA), lists descriptions of

hundreds of different franchises by

category and also provides a checklist

for evaluating a franchise. To purchase

a copy, visit www.franchise.org or find

contact information for IFA in Appendix E

on page 44.

Under New York State law, franchisors

are required to register with the New York

State Office of the Attorney General. To

find out if a franchisor is registered in New

York State, contact the Attorney General’s

Investor Protection Bureau at (212) 416-

8236 or https://ag.ny.gov/franchisors-

franchisees.

In any business purchase, conduct a

thorough research before you buy.

Study the required franchise disclosure

document and proposed contracts

carefully. As always, consult with

an attorney and other professional

advisors before making a binding

commitment. Be sure that all promises

made by the seller(s) or salesperson(s)

are clearly written into the contract.

Analyze the earnings claims. They

must be in writing, describe the basis

and assumptions for the claim, state

the number and percentage of other

franchises whose actual experience

equals or exceeds the claim. They also

must be accompanied by an offer to

show substantiating material for the

claim, and include cautionary language

regarding the exceptions to the claims.

It is also advisable to talk with others who

have already invested in the business.

Seek out both those recommended by

the company and others who might offer

a different point of view. Comparison

shop for other franchises in the same

field and similar business opportunities

that are not franchised.

Always be sure the rights you are buying

are exclusive and that the product

involved sells elsewhere under similar

circumstances.

5

Legal Forms of Business

Organization

No matter what business you are in, you

will need some form of legal business

organization. There are four basic forms

— sole proprietorship, partnership,

limited liability company, and corporation.

Each has advantages and disadvantages,

including tax consequences.

SOLE PROPRIETORSHIP

In a sole proprietorship, you own

and control the business. You reap

the profits, take the losses and are

personally responsible for the debts and

other obligations of the business. As a

sole proprietor, you report your business

income and expenses on your individual

income tax return.

Setting up a sole proprietorship is the

easiest way to go into business. Legally,

all you have to do is obtain the licenses

and tax identification numbers that

the federal, state or local government

requires for your type of business. If the

business has a name other than your

own, you must register with your local

county clerk and file a Certificate of

Assumed Name, commonly referred to

as a Business Certificate, see Chapter 6

section on “Licenses & Permits”.

This is the fastest, cheapest way to get

into business, and many successful

operations have started as sole

proprietorships. As your business

expands, you can change to a

partnership, limited liability company or

corporation if it is more advantageous.

PARTNERSHIP

There are several options available to

business owners who want to set up

their business as a partnership.

A general partnership is a business

owned and operated by two or more

persons. Partners can contribute capital,

specialized knowledge, marketing or

management skills and other valuable

help. They also share the risk.

Generally, partners share equally in the

rights and responsibilities of managing

the business, and by law each partner

is responsible for all the debts and

obligations of the firm. This means you

are personally liable for the full amount

of the partnership’s debts — even if the

debts exceed your investment and you

did not personally consent to the debts.

Partnerships are easy to start, but they

can run into trouble if the day-to-day

stress of running a small business

leads to friction between the partners.

A written partnership agreement, which

should be drawn up by a lawyer, is your

best protection. In it you can spell out

such issues as the capital contributions of

each partner, duties and responsibilities

of each partner, changes in partnership

structure, dispute resolution methods and

financial management.

The partnership itself is not taxable.

Instead, you report the firm’s income

and expenses on federal and state

“information” tax returns and you are

taxed on your share of the profits or

losses at your individual income tax

rate. The deduction of losses from

your personal income tax statement

could be a tax advantage.

Limited Partnership

A limited partnership is a partnership

formed by two or more persons

having one or more general partners

and one or more limited partners.

Personal liability is joint and individual

for the general partners who are

responsible for the obligations of

the partnership. Limited partners are

liable to the extent of their capital

contribution to the partnership.

The life-span of the limited partnership

is for the period stipulated in the

Certificate of Limited Partnership; or

until a dissolution event occurs.

For purposes of taxation, a limited

partnership is not treated as a

separate taxable entity; business

income is taxed through each

partner’s personal tax return.

If you want to operate a limited

partnership, you must file a Certificate

of Limited Partnership (following the

execution of a partnership agreement)

with the New York State Department of

State (DOS), Division of Corporations.

To form a limited partnership, you file a

Certificate of Limited Partnership with

the DOS, Division of Corporations, pay

the appropriate filing fee and specific

statutory requirements. For more detailed

information, visit: https://www.dos.ny.gov/

corps/ or find contact information for

DOS at Appendix D on page 44.

Limited Liability Partnership

A Limited Liability Partnership (LLP)

is a partnership, without limited

partners, each of whose partners is a

professional authorized by law to render

a professional service. Professionals are

defined as those persons authorized by

law to render a professional service in

New York. This includes, among others,

physicians, attorneys, certified public

accountants, architects and veterinarians.

For a complete listing of professional

services, visit New York State Education

Department (ED) at www.op.nysed.

gov/prof/ or find contact information

for ED at Appendix D on page 44.

Typically under New York law, general

partners are liable for the debts and

obligations of each partner when

partnership assets are not adequate.

But partners of an LLP are liable

only for their own professionally

negligent or wrongful acts, not for

the negligence of their partners.

A general partnership may elect to

become a LLP by filing a registration

form with DOS, Division of Corporations

and paying the appropriate filing fee

and specific statutory requirements.

For more detailed information, visit

DOS at https://www.dos.ny.gov/corps/

or find contact information for DOS at

Appendix D on page 44.

LIMITED LIABILITY COMPANY

A limited liability company (LLC)

retains the management flexibility of a

partnership while offering some of the

advantages of a corporate structure.

In an LLC members retain the same

liability protection they would receive

by incorporating, but avoid the double

taxation that is required of most

corporations. This ability to manage

your own business and avoid personal

liability as well as taxation on both

profits and personal dividends makes

the LLC well worth considering.

To form a LLC, you must prepare

organizational documents and file

the Articles of Organization with the

DOS, Division of Corporations and

pay the appropriate filing fee and

specific statutory requirements.

For more detailed information, visit

DOS at https://www.dos.ny.gov/

corps/ or find contact information for

DOS at Appendix D on page 44.

6

New York State’s Limited Liability

Company Law and Partnership Law has

publication requirements for limited

partnerships, LLPs and LLCs. The

company must publish in two newspapers,

which are designated by the county clerk

of the county where the company is

located. After publication, the publisher

of the newspapers will provide the

company with an affidavit of publication

that will be submitted along with the

Certificate of Publication form to DOS,

Division of Corporations.

CORPORATION

A corporation is a business that may have

one or many owners, and which conducts

transactions as an individual entity. Many

corporations start out as one of the other

forms of business organization presented

here. All corporations are considered C

corporations unless a special election is

filed for S corporation status.

The decision to incorporate is sometimes

based on a need for additional capital

for expansion, which may be done by

selling shares of the company to outside

investors. A corporation is run by elected

officers rather than by the owners or

shareholders. To identify if a business is

incorporated, look for the abbreviations

Inc., Corp. or Ltd.

There are many advantages to forming a

corporation. These include protection of

the stockholders from personal liability;

easy transfer of ownership; a separate

legal existence that is stable and relatively

permanent; and greater ease in securing

capital from investors.

Disadvantages include limitations on

corporate activities; possible conflict

between company management and the

board of directors; and government

regulation and paperwork at local, state

and federal levels. Corporations also

may be subject to substantial taxes and

government filing fees.

To form a corporation, you file a Certificate

of Incorporation with the DOS, Division of

Corporations, pay the appropriate filing

fee and specific statutory requirements.

For more detailed information, visit DOS

at https://www.dos.ny.gov/corps/ or find

contact information for DOS at Appendix D

on page 44.

S Corporation

Businesses that want to incorporate

but wish to avoid the tax burden of a

corporation may form an S corporation.

The income and expenses of the

S corporation are distributed to

shareholders in proportion to their share

holdings, and profits or losses are taxed

at the shareholders’ individual tax rates.

In contrast, a C corporation’s profits are

taxed twice, on both corporate profits and

shareholders’ income.

To qualify for S corporation status, the

corporation must meet the following: be

a domestic and eligible corporation; have

only allowable shareholders (individuals,

certain trusts, and estates and not

partnerships, corporations or non-resident

aliens as shareholders); no more than 100

shareholders; and only one class of stock.

To apply for S corporation status, you

must first be a corporation. Then, the

corporation must elect S corporation

status for federal income tax purposes

by filing Form 2553, Election by a Small

Business Corporation with the Internal

Revenue Service (IRS).

For more detailed information, visit IRS

at https://www.irs.gov/uac/form-2553-

election-by-a-small-business-corporation.

A corporation which has elected S

corporation status for federal income tax

purposes may then elect S corporation

status for New York State income and

corporation franchise tax purposes.

This is done by completing Form CT-6,

Election by a Federal S Corporation to be

Treated As a New York S Corporation and

submitting it to the DTF.

For more detailed information, visit DTF

at https://www.tax.ny.gov/forms/corp_s_

forms.htm or find contact information for

DTF at Appendix D on page 44.

Professional Advice

Whichever form of business organization

you choose, be sure to seek professional

advice due to the complex nature of these

various forms of business organizations.

It is advisable to consult with an attorney

and an accountant to help you thoroughly

evaluate which option is best for you.

A lawyer can prepare the proper legal

papers and advise you on your legal

obligations, while an accountant can

describe the tax advantages and

disadvantages.

7

Now that you have decided to

follow your dream and open your

own business, you must outline

a strategy or business plan.

When prepared carefully and

thoughtfully, the business plan is a road

map that can pave the way for your

growth and success. It should include

such details as what your business is,

how you plan to run and finance it, how

much it has earned or lost (if it is an

established enterprise) and how much

you project will earn in the future.

A detailed plan is an excellent

evaluation tool that you can use to

spot any potential weaknesses in your

proposed business. It is always easier

and less costly to rewrite a plan than

to change the direction of a business

that is already up and running.

A written plan will also help to organize

and consolidate your ideas so that you

can sell yourself and your business more

effectively. Financial institutions and

investors want to see sound plans and

ideas before deciding to lend or invest

capital, particularly to a new business.

It pays to take the time to make sure

your plan reflects all of your ideas and

strategies. You may consider hiring

someone to develop your business

plan, but only you can write the best,

most effective plan for your own

business. There are many formats you

can use. Figure 2-1, “The Business Plan,

An Outline”, is only a suggestion.

EXECUTIVE SUMMARY

In the executive summary, you will

highlight the important points of the

other sections of your business plan

in as brief as possible manner. Since

the executive summary is the most

important section of your business

plan, this should be the last section

you complete.

COMPANY DESCRIPTION

Start with a thorough description of the

central activities and purpose of your

business. Describe the desired legal

structure of your business and list all

owners of the business. Briefly describe

your customers, the industry of your

business, and the location and hours of

operation of your business.

State your long-range goals and the

milestones you will have to pass to

achieve them. Then make a timetable

for accomplishing specific short-term

business objectives that will enable you

to reach your larger goal. As an example,

your long-range goal may be “to be

the largest manufacturer of gluten free

desserts in the Northeast.” First you

must decide on your definition of “largest

manufacturer.” It may mean the largest

gross sales, the largest number

of employees or the most diverse

product lines to meet the customer’s

needs. Perhaps it means all of these,

but to get there you must put into place

logical, carefully considered steps to

reach your goal.

Be realistic when making short-term

CHAPTER 2

Mapping a Strategy

objectives. If a reasonable estimate of

your first year’s gross profit is $100,000,

do not set yourself a $500,000 goal.

Give yourself achievable targets in a

limited time frame, and then write a plan

for meeting them. A successful business

not only looks forward, but reevaluates its

past. It is in your best interest to compare

your actual business performance to your

written goals on a continuing basis.

MARKETING ANALYSIS

Thoroughly investigate the fields that

interest you and make note of trends.

You should strive to offer a unique

product or service with potential for

a long life span. This means knowing

where the future lies in your industry

in such areas as potential competitors,

new technology, cultural change

and economic trends. Once you are

confident that you have an excellent

product or service that fills a specific

client need better than anyone else,

Figure 2.1

The Business Plan

AN OUTLINE

I. EXECUTIVE SUMMARY

A. Briefly describe your business name and location, product or service, target market,

competition, prior experience, management and personnel team, and financial position

II. COMPANY DESCRIPTION

A. What your business is

B. List business goals

C. Timetable of objectives to reach these goals

III. MARKET ANALYSIS

A. Describe trends in your industry

B. Who are your target customers

IV. PRODUCTS OR SERVICES

A. What are the benefits and features of your product or service

B. How your product or service pricing compares to your competition

V. ORGANIZATION & MANAGEMENT

A. What is the present and future forms of business organization

B. Organizational staffing chart, resumes, personnel policies and hiring practices

VI. SALES & MARKETING STRATEGIES

A. How will you reach your prospects

B. How will you distinguish your business from the competition

VII. FINANCIALS

A. Income statement - revenue and expenses of the business

B. Balance sheet statement - assets, liabilities and equity of the business

C. Cash Flow satement - the flow of cash in and out of the business

D. Key business ratios compared to averages

E. Break-even analysis

F. Copies of income tax returns if you are already in business

8

you must convey that message to your

customer. To do this successfully you

need answers to at least these five basic

questions: Who are your customers?

Where are they? What do they want?

When do they want it? Why should

they buy it from you? By knowing your

costumer well, you will be better able

to predict what they want in the future,

which is essential for long-term growth.

PRODUCTS OR SERVICES

Describe what your business will offer

in the way of products or services, as

well as any features that make your

product or service stand out from the

competition. Include a description of

your supplies and suppliers, equipment

for manufacturing and methods of

product or service distribution.

Describe the price of your product

or service, including how it compares

to your competitors.

ORGANIZATION & MANAGEMENT

Describe your desired legal structure

of your business in detail. Include

provisions for growth, such as the

addition of a partner, shareholders

or creation of a board of directors.

Provide a thorough review of your

abilities, including any particular

experiences or skills that will enable you

to run your business well. List anyone

else who will help you manage better,

such as an accountant, lawyer, insurance

agent, partner or employee. You should

include your own resume and those

of any partners or principal staff.

Describe procedures that demonstrate

that your business will be well-

structured and carefully monitored.

These may include organizational

staffing charts, in-house business

meeting schedules, cash flow analysis,

yearly reviews of staff and financial

statements, and procedures for use

of outside vendors and resources.

Personnel policies

Initially, you may plan to operate

without employees, either doing all

the work yourself, perhaps with the

help of a family member or contracting

some work to independent outside

contractors. This approach keeps things

simple, but statistically, businesses with

employees that grow in number tend

to last longer than those without them.

If you know you are going to hire

employees at some point, you should

include that in your business plan. Hiring

one or more employees forces you to

meet a variety of legal obligations, which

are discussed in Chapter 6. In addition,

you should have a personnel policy and

follow good hiring practices. Figure

2-2 contains some basic elements that

a personnel policy should contain.

Hiring practices

Begin your employee search by writing

detailed job descriptions. Once you

have defined what positions you

need to fill and what qualifications

are necessary to fill those positions,

you can begin your search.

Have a job application form available

for those candidates who do not

have a resume. Forms are available

at office supply stores and online.

Review applications as you receive

them and set up interviews with

those who appear best qualified.

During the interview give a brief

introduction about the job and the

company and specify what you expect

from your employees. Then let the

applicant do most of the talking. Ask

simple, specific questions, such as:

“What did you do at your last job?

What did you like or dislike about

it? What skills do you bring to this

job?” Do not ask about race, religion,

health, age, marital status, arrests not

followed by convictions and other

personal matters — it’s illegal to do so.

Compare the applicants in terms

of desired skills, work record, self-

motivation, willingness and ability to

learn, and ability to get along with

others. You may need to schedule a

second or even third interview to select

the best applicant. Before you offer the

position, contact references, especially

former employers, teachers, and others

who have worked with the applicant.

When you have made your decision,

offer the job to the person who is

your first choice. Complete the U.S.

Department of Homeland Security,

U.S. Citizenship and Immigration

Service (USCIS) Form I-9, “Employment

Eligibility Verification,” for all new hires.

You can obtain this form at this link

www.uscis.gov/i-9 or for information,

contact USCIS at (800) 375-5283.

A word of caution: Do not hire family

members and friends simply because

they need jobs. Make sure you need

an additional worker and that the

person you are considering has the

skills and experience you want.

Welcome your new employee by giving

a tour of the premises and introductions

to the other employees. Explain how

the business operates and who does

each job. Describe in detail what the

worker will be doing. Now is also a

good time to outline how and when

the employee will be evaluated.

Figure 2.2

Basic Elements of a Personnel Policy

Compensation: Find out what the prevailing wage rates are in your locale for

the type of workers you expect to be hiring. Remember, when you employ

people, you are in competition with other employers for the best help.

Fringe benefits: Although fringe benefits are not a legal requirement, a variety

of benefits such as health, dental, vision, commuter, and pension plans, tuition

reimbursement and life insurance can be a strong draw when competing for

new employees. Ask your insurance agent or accountant about them.

Working hours: Describe briefly the policy for working hours, including the

starting and quitting time, lunch schedules and days of the week employees

will be expected to work. Also establish policies for overtime. Consider

staffing options such as flex-time, job sharing and part-time employment

in addition to full-time positions. Such flexibility will increase the size of

your labor pool and may allow you to offer more or better service to your

customers.

Other policies: Other employee policies include vacation time, sick leave,

leave of absence with or without pay, paid holidays, hiring, termination,

promotions and evaluations and workplace harassment and discrimination.

9

Describe your employment policies in

detail. It’s a good idea to have these

in writing, perhaps in the form of an

employee manual, to help prevent

misunderstandings. Also make sure

your new employee knows who

to talk to when problems arise.

Do not forget to post New York State

minimum wage rates, as well as policies

regarding work hours and conditions

under New York State Department

of Labor’s (DOL) Employment Laws.

To learn about New York State posting

requirements, visit https://labor.ny.gov/

workerprotection/laborstandards/employer/

posters.shtm or call (888) 4-NYSDOL.

There are also mandatory federal

posting requirements regarding minimum

wage and other fair labor standards,

equal employee opportunity, and safety

and health protection.To learn about

federal posting requirements, visit https://

www.dol.gov/general/topics/posters.

There are many resources available

for locating potential applicants. You

can network with other business and

community people to find employees

who are looking for work. Depending

upon the type of position and level

of expertise required, post the job

description in online job boards, job

training programs, and schools. You can

also file with your local unemployment

office and job development program.

And there is always advertising in the

local newspaper.

The DOL’s New York State Job Bank

provides services to businesses

seeking to hire employees. For

information on NYS Job Bank,

visit http://newyork.us.jobs/ or call

(800) HIRE-992. DOL’s Business Services

can assist you in finding the right

employees and services such as, career

fairs, custom recruiting, skill matching,

human resources assistance, safety and

health assistance, and consultations with

the DOL staff.

To obtain information on DOL’s

Business Services, visit https://labor.

ny.gov/businessservices/landing.shtm

or call (888) 4-NYSDOL.

SALES & MARKETING STRATEGIES

You have an excellent product or

service that fills a specific client need

now you must convey that message

to your consumer. How are you going

to let them know about it? Accurate

target marketing may be the difference

between a business that fails and one

that flourishes, see Chapter 4 section

on “Target Your Market”.

Use this

information to develop your strategies

for

advertising and promotion. Be specific

about your plans. Include what types of

media you will use and how often. You

may also want to develop a system to

evaluate how effective your advertising

is, such as a weekly sales monitor or

customer survey.

Do not neglect to identify and keep

watch on the competition even before

you start your own business. You can

learn from their successes and mistakes.

And if you are to stay the proverbial “one

step ahead,” you must first know what

they are doing, and then do it better.

FINANCIALS

Until you have a business that is up

and running, you are not going to

have anything but projected financial

statements. Potential lenders or

investors will want to see these

when you try to borrow money or

attract capital for your business.

The income statement shows how

much money your business will

earn and spend. The balance sheet

statement shows your business overall

financial standing. The cash flow

statment shows the flow of money in

and out of your business. You will

find sample statements in Chapter 5.

Once your business is operational,

you should compare actual

statements with the projected

statements in your business plan.

Cash flow forecasting

As a new business that has no financial

history, the cash flow forecast is an

essential tool. Used correctly, it can

help keep you from going out of

business since it can tell you whether

you are solvent. The monthly cash

flow projection will let you know how

much cash you need at the end of

the month to meet your expenses.

You should try to estimate your monthly

cash flow at least 12 months in advance

and update it monthly with the real

figures. When there are significant

differences between real and projected

cash flow, try to figure out why, so that

your future projections will be more

accurate. Items to watch very carefully

in your cash flow analysis are credit

and accounts receivable (the money

people owe you). Be careful not to get

too much of your working capital tied

up in accounts receivable, since this

can rapidly deplete your cash pool and

the ability to pay your own creditors.

To calculate your financial status at

the end of each month, subtract total

expenditures from total cash available.

If the result is negative, you will have

to come up with more cash to meet

your expenses. Negative ending

positions are fairly typical in start-up

businesses and in businesses that

are growing rapidly. Plan for them by

making sure you have enough cash in

the bank to cover your expenses each

month. That may require borrowing or

attracting new permanent capital to

your business. Established ventures

with large seasonal variations often

depend on a revolving line of credit or

extended terms (payment due dates) to

handle a temporary shortage of cash.

Most business experts agree that you

should do your cash flow analysis and

cash flow projection monthly. It forces

you to be more realistic and disciplined

in your thinking and keeps your

attention focused on the bottom line.

Use Figure 2-3 as a guide for developing

your own cash flow projection. The

expenditure categories are only

suggestions. You can download

free cash flow projection templates

from the internet. There are also

accounting software programs

available that will do cash flow

statement, income statement, balance

sheet statement and much more.

Key business ratios

Key business ratios compare historical

or projected figures such as sales to

receivables, cost of sales to inventory,

sales to working capital and total current

assets to total current liabilities. Ratios

and percentages of particular expense

categories compared to gross sales

allow you to see how your business

compares to other similar businesses.

By comparing your ratios, either

historical or projected, with averages

for your type of business, you can see

if your operation is being efficiently

run and if your forecasts are realistic.

10

Figure 2-3

Sample Cash Flow Budgeting Form

Use of whole dollars

Estimate Actual Estimate Actual Estimate Actual

$ % $ % $ % $ % $ % $ %

1. cash on hand

(beginning of month)

2. cash receipts

(a) cash sales

(b) collections from credit accounts

(c) loan/other cash support (specify)

3. total cash receipts

(2a + 2b + 2c = 3)

4. total cash available (1+3)

5. cash paid out

purchases (merchandise)

business taxes, licenses

employer’s share Social Security

unemployment

rent

repairs and maintenance

gross employees’ salaries

insurance

professional fees

commissions

interest and bank charges

advertising

auto, truck

trade publications

office supplies

telephone

utilities

operating supplies

travel

laundry and uniform

entertainment

contract services

miscellaneous

subtotal

loan principle payment

with interest

capital purchases (specify)

other start-up costs

owners’ withdrawal

6. total cash paid out

7. cash position (4-6)

case assumpt ions. This type of analysis

can be valuable if you are thinking of

making a capital investment and want

a quick picture comparing the relative

merits of buying or leasing equipment

or property.

Break-even analysis

A break-even analysis shows the

point at which your business will be

breaking even, that is, neither making

a profit nor a loss. It is expressed

in dollars or number of sales. Once

you know your break-even point,

you have a goal and can devise a

specific plan on how to get there.

To do a break-even analysis you will

need to be familiar with certain financial

terminology. You already know that

break-even sales are the amount of

sales necessary to cover the exact

amount of all your business expenses.

In general, you will have two types of

expenses, fixed and variable. Fixed

costs (FC) are costs that remain constant

no matter your sales (S) volume.

These include overhead costs such as

rent, office and administrative costs,

salaries, benefits, utilities, as well as

such “hidden costs” as depreciation,

loan amortization and interest.

Variable costs (VC) are those costs

associated with sales. They include

the cost of goods sold, variable labor

costs and sales commissions.

The basic break-even formula is:

S = FC + VC. (S = break-even level

of sales in dollars; FC = fixed costs

in dollars; and VC = variable costs in

dollars.) While the concept is deceptively

simple, you should not neglect to

calculate and recalculate this figure on

a regular basis. Variable costs are just

that — they change often and can get

out of hand as sales volume grows.

Some of the figures you will use to

calculate your break-even analysis

will have to be estimates, particularly

in a new business. It is a good idea

to make your estimates conservative

by using somewhat pessimistic sales

and margin figures, and by slightly

overstating your expected costs.

When you calculate a projected break-

even level for a new business, you

will probably not know what your total

variable costs will be. You can use a

variation of the basic break-even formula

that is based on your anticipated gross

margin (GM, i.e. your gross profit on sales)

expressed as a percentage of sales:

S = FC/GM where GM = gross margin

expressed as a percentage of sales.

If you want to calculate how many units

you need to sell to break even, divide

the break-even in dollars by the unit

price, which gives you the number of

units you need to sell.

You can substitute different numbers to

quickly calculate their effects on your

business. One way to do this is to make

the best case, average case and worst

SOURCES OF ASSISTANCE

The State of New York has many

resources available to emerging

entrepreneurs. There are several

agencies that can provide information

to you on anything from writing a

business plan and obtaining capital

funding to finding good employees and

following appropriate legal business

practices. The following section is an

overview of these agencies along with

how to contact the office nearest you.

ENTREPRENEURSHIP

ASSISTANCE CENTERS

The Entrepreneurship Assistance Centers

(EAC) is an enterprise development

program currently operating 24 centers

strategically located in local communities

throughout New York State. EACs

are hosted by not-for-profit agencies,

community colleges, and Boards of

Cooperative Educational Services who

can support the intensive management

and technical guidance. EACs offer

one-on-one counseling and a 60+

hour training course supplemented

by concentrated technical assistance

and support services to help new

entrepreneurs complete business

plans and develop and expand a viable

business. In addition to learning general

management skills, participants learn

about working capital and cash flow

management, how to conduct break-even

analysis, hiring and managing employees,

and further developing marketing and

financial management skills.

To find an EAC in your area, visit

EAC’s webpage at https://esd.ny.gov/

entrepreneurialassistance-program or

Appendix A on page 39.

BUSINESS MENTOR NY

Business Mentor NY is the state’s first

large scale, web-based, mentoring

program focused on helping emerging

entrepreneurs and small business

owners overcome challenges to grow

their business. At Business Mentor

NY, you can obtain free counsel,

advice and support from volunteer

experienced entrepreneurs and

seasoned professionals. This online

facilitated matching system connects

you to mentors that can provide you

with guidance to address business

questions and difficulties, assist you

to build and grow your business, and

obtain knowledge and skills to keep

your business on track or take it to the

next level. At Business Mentor NY, you

can get answers to simple questions

or engage in longer-term mentorship

relationships. Mentorship is a powerful

tool that can help your business survive,

thrive and grow. To connect with a

mentor, visit Business Mentor NY at

https://businessmentor.ny.gov/.

NEW YORK SMALL BUSINESS

DEVELOPMENT CENTER

New York Small Business Development

Center (SBDC), administered by the

State University of New York and

funded by the U.S. Small Business

Administration, offers pro bono

counseling assistance for small

business entrepreneurs, both start-

ups and existing businesses. Services

include assistance on business

plan development, loan resource

identification, accounting, financial

planning, export information, cost

analysis and marketing as well as

targeted business training programs.

SBDC offices are conveniently located

throughout the state.

To find a SBDC in your area, visit

SBDC’s webpage at http://www.nyssbdc.

org/locations.html or Appendix B on

page 40.

U.S. SMALL BUSINESS

ADMINISTRATION

The U.S. Small Business Administration

(SBA) provides financial, technical

and management assistance to

help Americans start, run, and grow

their businesses. With a portfolio

of business loans, loan guarantees

and disaster loans in addition to

a venture capital portfolio, SBA is

the nation’s largest single financial

backer of small businesses.

For more information on SBA

programs and services, visit

www.sba.gov.

OTHER SOURCES

Business trade associations that may

be helpful as you develop your plans

include: The Business Council of

New York State, www.bcnys.org;

National Federation of Independent

Business (NFIB), www.nfib.com; and

Retail Council of New York State,

Inc., www.retailcouncilnys.com.

Your local chamber of commerce

also provides a multitude of

services that can help you grow

your business, from networking

opportunities to other services for

your business and employees.

You can find a local chamber of

commerce at this link www.officialusa.

com/stateguides/chambers/newyork.

html or in Appendix F on page 51.

Help is also available from SCORE, a

nonprofit association, where executives

volunteer their services to assist small

business owners find solutions to their

business problems. Their service is

offered free. You may contact SCORE at

www.score.org or call (800) 634-0245.

The New York State Department of

Labor can supply a wide range of

labor market information, such as

occupation, industry and regional

data. To obtain DOL information,

visit https://www.labor.ny.gov/home/

research.php or call (888) 4-NYSDOL.

The Census Bureau Economic

Statistics provides statistics about

U.S. businesses, including links to

data products, related programs

and other additional information.

For more information, visit

https://www.census.gov/econ/ or call

(301) 763-3321. Another useful tool is

the Census Business Builder, which

provides selected demographic and

economic data that is tailored to specific

types of users. For more information,

visit https://www.census.gov/data/data-

tools/cbb.html or call (800) 923-8282.

ACCESS RESOURCES

Make sure to take advantage of the

different types of assistance available

from various sources, which you

can find in the Appendix section

of this Guide, to help you map out

a detailed business strategy.

11

12

You’re on your way.

You’ve decided what kind of business

you plan to open and how you will go

about it. You’re familiar with the different

forms of business organization and have

drafted a convincing business plan.

Now you need to know the nuts and

bolts of how to finance your business.

The ability to raise money, also known as

capital, is essential not only for starting,

but for maintaining and expanding a

healthy business. No matter how good

your concept or your business plan, it

will fall flat without the proper financing,

the lifeblood of any enterprise.

Understanding Capital

Being knowledgeable and

well-prepared goes a long way toward

helping you secure the financial

resources you will need. It is essential

to have a clear understanding of the

different kinds of capital and their uses.

PERMANENT CAPITAL

Permanent capital, also known as equity

capital, is money you gather from your

own resources and personally put

into your business. It can also include

money contributed by partners and, if

you become incorporated, money that

comes from the sale of shares of stock

issued by your business. If you choose

to hold back some of your profit and put

it back into the business, it also becomes

permanent capital.

Permanent capital is just that — a

permanent part of the business.

This means it cannot be removed

from the business once it has been

invested, and there is no legal

obligation to pay a return on it or to

repay it. This money is always at risk,

because if the business fails, you

can lose part or all of the money.

Personal Resources

Before you begin your search for

capital, you will need to know how

much money your business will

require. To get an accurate answer

you should consider not only the costs

of starting, but also the costs of staying

in business. Many businesses take a

year or two to get up and running. This

means you will need enough funds to

cover the cost of materials, salaries,

rent, supplies and other items until

sales can meet these costs.

It’s common for many new business

owners to furnish a substantial amount

— from 25 to 50 percent — from their

own resources. Before coming up with a

figure, you should consider many things,

including your living expenses; your net

worth; how much permanent capital you

can furnish and how much you will need

to borrow; your first-year expenses;

your estimated break-even point; and

contingency plans if you need additional

funds. Remember to be honest. The

more candid you can be the better your

chances for success.

Do not use your credit cards to start

your business. You risk ruining your

personal credit if you are not able to

keep up with the payments. Using

your own money to finance your small

business is ideal. It is also the least

expensive and least obligatory method

of financing. You are responsible only

to yourself for what happens to the

money and you don’t have to ask for

permission to use it.

A good way to calculate the amount of

permanent capital you can contribute is to

fill out a “Personal Financial Statement”,

such as Figure 3-1. Besides tapping into

your own funds, you may also consider

approaching family and friends for

permanent capital. Other sources include

retirement income, the income of a

spouse, your income from a part-time or

full-time job, investment by partners and

sale of stock.

CHAPTER 3

Financing Your Venture

BORROWED CAPITAL

Although many new businesses begin

with permanent capital, very few

limit their financing to this alone. You

probably will want to borrow money

to invest in marketing, research,

additional fixed asset purchases such

as facility or machinery upgrading,

or other improvements aimed at

increasing productivity and controlling

costs.

No matter how you use this capital, the

bottom line is always the same — by

borrowing money to achieve specific

goals, you can often make your

business more profitable than if you

rely solely on personal savings.

CAPITAL NEEDS

As you try to decide how much capital

you will need, regardless of the kind of

capital you have to work with, permanent

or borrowed or a combination of the

two, it is helpful to know what all of

your startup costs will be. A startup

budget will help you determine this.

Startup costs consist of one-time costs

and regular monthly costs. One-time

costs will include some of the following

expenses: fixtures; equipment; licenses;

permits; initial inventory; website;

renovation; and consultants. Regular

monthly costs will include some of the

following expenses: rent, insurance;

supplies; utilities; payroll; taxes;

advertising; and loan payments.

A detailed startup budget is necessary

to help determine your capital need.

There are many sources of capital for

new and growing businesses. The

following sections briefly summarize

the most common sources, their

advantages and disadvantages and,

where appropriate how to contact those

sources. Not every option will apply to

you, but with knowledge, preparation

and determination you

can be confident of beginning your

search for capital on solid footing.

13

Lenders

There are many different types of

lenders and lending programs. After

personal savings, banks and alternative

lenders are the major source of capital

for entrepreneurs. Most lenders will

facilitate the financing of well-managed,

credit-worthy small businesses and strive

to give them the help they need.

When approaching a lender, be sure

you are well-prepared. You should have

a written business plan and a budget

that shows the type of business, credit

needed and anticipated reveneues and

expenses. If you need a loan for an

already established business, having

accurate, well-kept records will be to

your advantage. If you cannot afford

a full or part-time accountant, you can

maintain your own recordkeeping

through an accounting software program

or some type of computerized system.

Your lender is likely to be impressed

with a neat and complete set of records

that have a professional touch.

You must have realistic expectations

of your lender. In general, expect the

lender to be a valued advisor, in much

the same way as an attorney or an

accountant. Also expect your lender

to get to know your business and your

industry so he or she can make specific

recommendations on what kind of loan

is best suited for your company, how to

structure that loan and how to help you

chart the best financial course. Keep

in mind, however, that while lenders

serve as valued advisors, there are laws

prohibiting them from taking an active

management role. These are known as

“lender liability” laws, and basically state

that unless lenders are willing to accept

liability, they should not get involved

in making important management

decisions for a business.

When you approach a lender for

a loan, you should also begin to

establish business credit. You can do

this by co-signing as an individual for

a credit card in your business name,

as well as by establishing a checking

account in your business name. If

you are doing business under your

own name, set up an account in your

name and use it exclusively for your

business. If your business has its own

name, set up an account in the name

of the business.

When you open an account in the

name of a business, the bank will

probably want to see your Doing

Business As certificate which is

often referred as a DBA certificate or

Certificate of Assumed Name. You

receive this certificate when you

register your business name with the

county clerk. If you registered as a

Corporation, LLC or LLP, you will need

the Articles of Incorporation, Articles of

Organization or Certificate of Limited